An expensive lesson in debt. Why many future potential home buyers will carry an albatross of student loan debt and push home prices lower. 25 percent of young California graduates underutilized in the labor force.

The current tax debate reveals something deeply troubling about our current economy and psychology of current leaders. They want it all but don’t want to pay for it. At least pay for it today since it seems that current leaders are very eager to saddle future generations with massive amounts of back breaking debt instead of confronting the grim reality of a nation fueled by incredibly large amounts of debt. One aspect of the housing market not discussed in the media is the extraordinary amount of student loan debt out in our country and how this will impact future buyers. As I noted in a previous article student loan debt has now surpassed all outstanding credit card debt in our nation which is an incredible milestone in itself. Even this week, we heard head Fed honcho Ben Bernanke give one solution to the economic crisis on 60 Minutes where he discussed that “education†was the key to improving our economy. Like anything in life there is an ultimate cost to everything. At what point does formal education become overpriced? How much debt is too much? Many younger Americans are saddling themselves with so much debt that they will not be able to borrow enough to buy a home (at least not at current prices). In California, a college degree isn’t exactly a path into this “employment†miracle Bernanke talked about. Let us look at employment utilization for Californians by degree level.

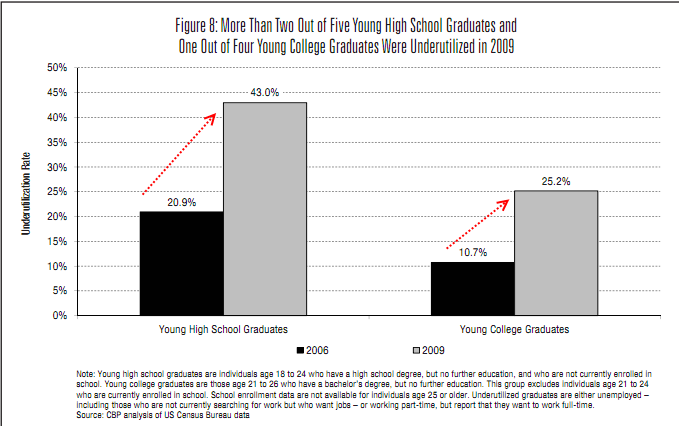

This chart is rather startling:

Source:Â California Budget Project

The current headline unemployment rate in California is 12.4 percent. Yet the underemployment rate is over 23 percent. It is without a doubt that those with more education do better in the economy. But how much better are they doing if they come out of school with $20,000, $50,000, or even $100,000 in debt? In fact, there is a student with $200,000 in debt that started her own website to help her pay it down:

“(DailyNews) A recent college graduate has come up with a student loan debt solution: Pleading for help online.

Northeastern University grad Kelli Space, 23, owes $200,000. The New Jersey resident has set up a website entitled TwoHundredThou.com on which she tells her story and asks visitors to make a payment, any payment, to help bail her out.

“Monthly payments just for the private loans are currently $891 until Nov 2011 when they increase to $1600 per month for the following 20 years,” she wrote in an effort to elicit funds.

But the response has been lukewarm, to say the least.

To date, she’s received $1,811.28 in donations and still owes $198,188.72, according to her website.â€

That amount of debt is more than the median U.S. home price! Just like housing, we have made it all too easy to borrow incredible amounts of money for students to go to college. But unlike a toxic mortgage, students cannot walk away from their massive student loan payments. This is actually creating a generation of Americans that will work to pay for their large amounts of college debt and have little left over for anything else except buying a Subway sub and a bottle of Coke. Examining the above chart, we see that young high school graduates are entering a very unforgiving economy. 43 percent are underutilized in the employment force versus 20 percent in 2006. Yet the rate for young college graduates is even more startling. In 2009 young college graduates were underutilized in the work force by over 25 percent! These are the potential future buyers of California homes yet we somehow expect prices to remain inflated?

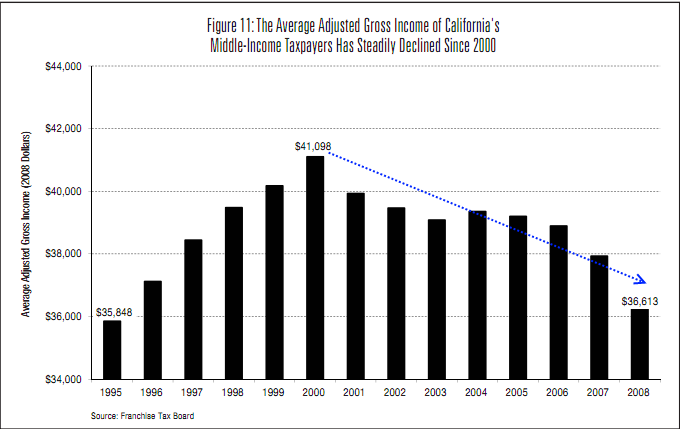

The average wage for California tax payers have also fallen steadily for over a decade:

Keep in mind the above is for individuals and not households. You might be asking yourself how is it that home prices surged to dizzying heights all the while average income was steadily dropping? Good question. Of course when you don’t check for income and offer maximum leverage loans anyone and everyone can borrow and inflate a bubble. This is what happened yet now that the air is being let out, we are confronting a decade of falling wages and a market that simply has more workers than jobs.

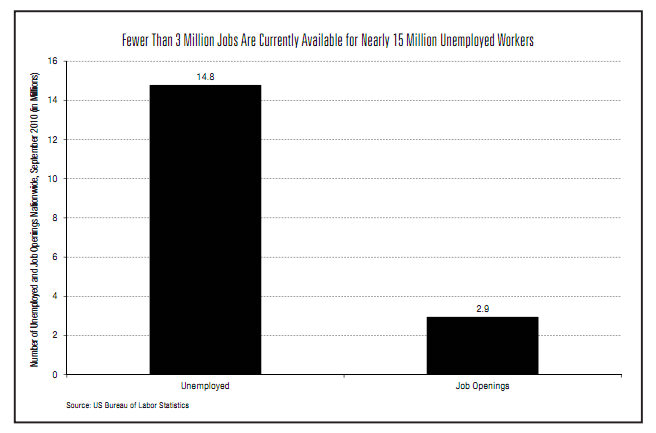

Take a look at this rather simple but very telling chart:

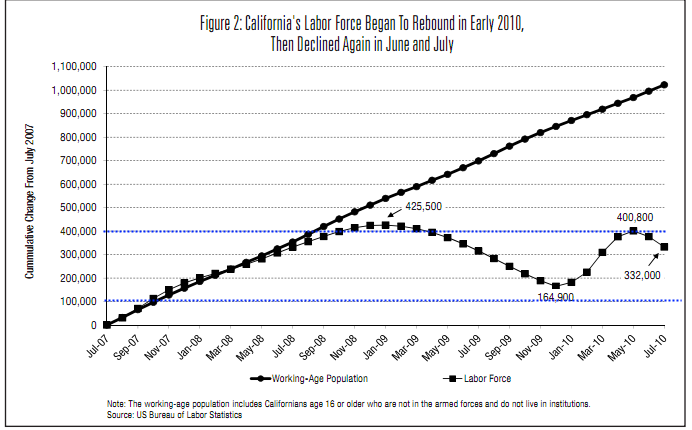

We have 15 million unemployed Americans but only have 3 million job openings. You don’t need a doctorate to realize that is a recipe for disaster. The California employment market is trending lower yet again:

We saw an early jump this year but once all the gimmicks, home buyer tax credits, delays, smoke screens, and other shenanigans disappeared we were left with an economy that is flooded with debt in mortgages, auto loans, credit card debt, and student loan debt. I look at the California housing market closely and when I talk with recent college graduates, they have little desire to buy a home because many enter a sticker shock scenario when their student loan debt payments begin. As you know, students start paying their student loan debt 6 months after they graduate typically. Just imagine entering a market with few jobs and incredible amounts of debt. Why would this generation want to add an additional layer of debt with mortgages? They don’t and the longer this crisis goes on the more this generation will avoid paying high prices for housing. Not because they don’t want to own but because their debt burden is already high before they start their professional career.

This is another issue missed by analysis on the housing market. Many bought homes before the bubble hit. They bought at a time when home prices were more reasonable. It was also the case that many locked in jobs during these good times. So I can understand why many in this group will believe that prices will go up but who are they going to sell to? The only real viable pool if they want prices to remain high is those that bought at the right time and got jobs during better days. But guess what? That pool is diminishing because of the ticking of time and each month that goes forward we have a new younger generation of Californians with starkly different expectations. They will buy only what they can afford and with a tough labor market and larger student loan debt levels, they won’t be paying top price for many homes in the Golden State. I’ve seen a few delusional folks usually tied to the housing industry calling for the reemergence of toxic loans to goose the housing market again but that game is over.

I am the first to agree that an education is absolutely vital moving forward. But not all degrees are created equal. Also, the public education system should charge based on potential earnings. For example, there is demand for nursing and many community colleges offer these programs. But many times these programs have waitlists that span years because of the demand but also the cost to run these programs. Many nurses earn a good income. So why not charge a higher fee and increase the number of students? The state generates revenue and also puts students into jobs that are in demand. On the flip side, why would the government back student loans for those pursuing degrees in online gaming at for-profit schools? There is a giant bubble in education but more because of how loans are structured and the government seal of approval. Some will argue that students should go to public school. Well guess what? Prices are shooting up:

From 2003 the cost to attend the University of California has gone up by over 100 percent. This at a time when the average income has fallen. Given the notion that education is vital, is it any wonder why students will go into debt to gain a four year degree? And the above price is cheap relative to private school tuition and for-profit paper mills.

Future young Californians are having a very different mindset from those that lived their lives in two decades of bubbles. Those that remember the 1970s will recall that there can be prolonged levels of slumps. Will these future generations be hungry to over leverage and buy over priced housing? I doubt it. And even if they wanted to the labor market and their current debt will put a ceiling on what they can buy.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

84 Responses to “An expensive lesson in debt. Why many future potential home buyers will carry an albatross of student loan debt and push home prices lower. 25 percent of young California graduates underutilized in the labor force.”

“Even this week, we heard head Fed honcho Ben Bernanke give one solution to the economic crisis on 60 Minutes where he discussed that “education†was the key to improving our economy.”

Somehow I doubt that Ben means “reading DHB and other well-researched sources of information” when he says education, but I wish he did.

The current state of universities in this country makes me sick to my stomach, and for all Ben’s bullshit so far I’m hard-pressed not to think he’s a crony for Big Education too.

There is no doubt that true education is important; learning to apply problem solving abilities and develop proficiency in high-level work is hugely useful. In fact, if our educational system as a whole really had its head on straight then maybe more people would have been taught about the very effects we’re seeing today in our economy. More people could be educated in how to live and thrive in our increasingly global society, and taught to make wise decisions on their own behalf that do not half to detract from the decisions of others or require subsidies. Unfortunately, this feels less and less to be what ‘higher education’ is about. I am hard pressed to think of many schools that are not puffing up tuition, watering down their educational merit, and fund-raising out the yin-yang. At some point the phrase “value of an education” just became marketing for an industry that seems eager to milk potential fools for all it can get — via inescapable loans, no less!

All of it breaks my heart, because I’d love to be back in school right now yet between escalating prices and the insular, self-absorbed attitudes of much of academia’s leadership, I can’t stomach the idea. Quit my job to qualify for your program requirements, and assume more debt to emerge in a climate where I may not find work? Uh… I’ll pass for now.

A much better way to become gainfully employed is to join the military out of high school. Getting paid to have a steady job with benefits while gaining the discipline most high school graduates lack is a much better option than racking up school loans with the hope that there will be a job for you when you graduate. And when you are getting close to “graduating” from the military, you can assess your employment options and either keep your current job or take one in the civilian sector. Not all military jobs and/or branches put you in the line of fire. I served in the military and got my college degree. The training and experience I gained in the military was much more useful from both a marketability and maturity standpoint. I currently make well over $100k and none of it is due to the college degree I earned.

PB,

You make over $100k and yet defaulted on your home loan. All the benefits you enjoyed from your (apparently) brief period in the military were taxpayer funded, as was your strategic default. I’m sure the military and note-holders would’ve liked to have gotten a better returns on their investments but PB had other plans.

Couple of points…the money I earned in the military was for services rendered, therefore the taxpayers got the return on their investment. I was in for eight years so it’s not like I got the training and bailed. As far as the taxpayers paying for my default, you can speak to your elected officials about that. It was their decision to have the taxpayers foot the bill for non-performing loans. If you want to say that I screwed the bank, so be it. But to say that I cost taxpayers money is not accurate.

And don’t think for a second that a six-figure salary makes carrying a $3500 mortgage reasonable. I know that based on the traditional ratio of ~ 30% of gross income being a safe amount to pay for housing we were okay. But that ratio is way out of date in my opinion. After health insurance and taxes, we take home a little over $7k a month. That 30% now becomes 50%. Food and household goods for a family of four is around $1000 a month. Utilities are another $500. Two cars, gas and insurance is another $1000 a month (long commute). So that leaves $1000 a month for miscellaneous items such as clothes, new brakes, plumbing problem at the house, youth sports, and some occasional fun. You can get strapped pretty quick in CA. I’m not claiming poverty by any means, but if you bought a house in 2006, you’re probably in the same boat as I was. The biggest mistake I made was looking around at what others were paying vs. what they were earning and thought “if they can do it, we can do it”. It was dumb, I admit that openly. But not as foolish as it would have been to stay in financial prison that was our bubble house. I still look around at what others are making and spending, but my thought now is, “how much longer can they sustain this?”

Those who serve in the military are providing a service to the country and are being paid in return for the service. What they do with the money they are paid is their business.

Ohhh, someone got served!

That is a point, Partyboy, trouble is,

#1- The military doesn’t always pay you enough to cover all your schooling

#2- You can ASK to be assigned to a certain area, but no matter what blithe assurances your recruiter gives you, you have no guarantee that you’ll end up in the assignment or training you wanted (and with the shortage of boot/guns on the ground they have right now, unless you have valuable prior training, you’ll most likely end up being shot at). I personally know several folks who went into the army with promises of valuable career training, only to come out and find their military experience got them no more than a crappily paid entry level job…that they could have gotten before spending all that time in the military.

and #3- You’re making a bet with Uncle Sam. He’s betting you’ll die before you cash out- you’re betting you won’t. And with so many veterans coming home with traumatic brain injuries and PTSD to a system that is completely failing to help them, it’s not a bet to make lightly. (My husband and I have a an agreement- if any kid of ours wants to go into the military, we’ll bargain to have them wait until they have a masters in something the military NEEDS (math, science, languages) so they’ll be valued as more than stuffing for an infantry suit by the system when they go in. A still a high-stakes bet- but a hedged bet in that case.)

I agree, I served in the Navy for ten years and joined when my life had no direction. Working for a very large corporation now and interacting with both mid and senior level management I can say that I would hire an ex-military person with an honorable discharge, over any college grad any day! The management skills I learned in the military were invaluable and have made me stand out as a leader in every job I have had since. Today’s college grads are pretty much worthless in leadership roles. Yet because we have this stigma in the US if you didn’t go to college you are not as good as the guy who did, the senior management college grads must defend that high priced education their parents paid for by only placing other college grads in management positions. My management training was conducted while in extremely hostile situations and mistakes meant people could possibly die. The military makes sense right now, see the world, gain leadership and management skills and after you have succeeded in the military you will laugh at the issues college grads struggle with in the corporate world every day at work…I know I do.

Maybe high schools can include “who moved my cheese” into the summer reading list?

I love this book!

The biggest loser in the U.S. housing market will be the baby boomers who are relying on selling their homes to fund their retirement. They are in for a very rude awakening when they put their homes on the market because the younger generation will have neither the income nor the credit capacity to buy their home.

JK, the younger generation wil end up with the bill for the government deficit. The feds will continue to spend for us with out having us pay for it now. Party on.

DEBT!!!DEBT!!!DEBT!!!

Is this all that this country has left? Because if it is, we are not just bankrupt, but done. We need to figure out a way to lower the cost of living in this country, while at the same time, begin to make widgets the rest of the world wants and can afford.

Basically, most of us here have figured out that debt has allowed college education, homes, food, almost everything to skyrocket in cost. That time has to end, esp. since wages have not increased relative to the 70s-80s and because debt is no way to run an entire economy.

Sure, debt has its place and can grease the wheels, but when it becomes as big an influence as it has in this country and the world, it is time for the JUBILEE!!!!

And no, I don’t have $550K in mortgage, student loan, CC, and car debt. Just have $2K on the Visa. That is all and it will be taken care of in January!

We need to figure out a way to lower the cost of living in this country, while at the same time, begin to make widgets the rest of the world wants and can afford….Forget that free trade brainwashing crap, we to start making widgets for our own internal consumption. Tariffs ! OMG I said the “T” word

I completely agree. Protectionism is a very effective way to protect the economy. The propaganda against protectionism is run by the same people who brought us NAFTA, CAFTA and GATT. The idea of these programs is to “level the playing field” so that people in Europe and America have to compete for jobs against slave, or almost slave labor in third world countries. While this brings us incredibly inexpensive products, the price is really rampant unemployment, falling wages, and slow and steady inflation. All bad. Meanwhile in the “developing” nations people are having to work 14 hour days 7 days a week for a couple of bucks a day. The level paying field argument works for Exxon, GE, and all the big boys but it sucks for the other 99% of the world population.

Tariffs might work out for the best, but keep in mind the cost of imports of energy and other things will go up as other nations retaliate. Protectionism isn’t a sure-fire solution.

Protectionist tariffs worsened the Great Depression, because all governments started a race to enact higher and higher ones against each other. This killed exports across the board, which lead to massive layoffs for each country. Research Smoot-Hawley. Like tax cuts, tariffs seem like a good idea until you see the side effects.

“The new tariff raised rates an average of 59 percent on 25,000 items, the highest in history up to that time. World leaders hoping to stimulate their own economies through relaxed trade were shocked. Many retaliated with high tariffs of their own, thus sparking an international trade war that dramatically shrunk world trade and made the Depression much worse.”

http://www.suite101.com/content/president-hoover-worsens-the-great-depression-a150260

…..Protectionist tariffs worsened the Great Depression, because all governments started a race to enact higher and higher ones against each other. This killed exports across the board, which lead to massive layoffs for each country…RUBBISH !! More Free Trade propaganda. Imports and exports COMBINED were only three percent of the US economy at the time. Remember the words of Abrahan Lincoln : If we purchase a ton of steel rails from England for twenty dollars, then we have the rails and England the money. But if we buy a ton of steel rails from an American for twenty-fivÂe dollars, then America has the rails and the money both.”

And we have only ourselves to blame. The Government and Banks figured out a long time ago that Americans would just accept more and more debt to get the THINGS they think they need. So, why not just keep pushing up prices, offering more credit and watch the debt junkies trample each other to get it. Just look at Black Friday and you know the answer to your question, we are done! Most Americans don’t have a clue yet as to what the real issues are that are slowly destroying their country. I see hints of hope here and there but over all we may never be able to kick this debt habit which is what the Banks and our Government are betting on IT, after all our whole economy is based on it.

I can envision a scenario where students with very high levels of debt as well as being underemployed will default on their loans and live their lives in an all cash economy. Since student loans can not be discharged in bankruptcy they will live like that for many years. They may even get use to it and never use credit. These people will not buy homes. If this pool of people becomes large enough there will be a crisis because retailers and others who sell products and services want people to use credit and they will see this issue as hurting their profits. At this point a “student loan crisis†will appear and the government will be petitioned to solve it. Well let’s see what happens, I’ve read that the laws may change to match payments to income level and then discharged the loan after 20 years if a balance remains.

They can get a home in Detroit for free – however withtout street lighting, police, fire services and garbage collection. They could also just move to Mali. Weather is better and you are allowed to carry there.

You would be a fool to send your kid to a private college now.

Go to a community college for 2 years- should leave there with no debt, then transfer to a public, state college. With the money you saved in the first 2 years, you can pay for the last 2 .

The BEST gift you can give your kid is a college graduation with NO debt. !!!

No Jim, the best thing you can do is send your kid to a private school and you pay for it. I did that and it has been the best (but painful) decision I have made. He graduated in May, in four years, and is working full time, great salary, benefits, etc. I have not heard of one kid that graduated in his class at high school that went to a JC and has come close to graduating. btw, he is the only kid that lives on his own and not at his parents house.

Going to Jc has nothing to do with finishing college

Education is one of the most important keys to an individual’s development, not to mention a cornerstone of any good society, (look at the difference in quality-of-life in more educated cities over less educated cities to see what I mean). That said, I’ve always felt there was a tremendous overemphasis on the one-size-fits-all solution that is a four year degree. I think there should be more emphasis on figuring out where a kid’s natural aptitude lies. Vocational school is really the way to go for most people. FWIW, I’m 36, make over 110K annually + bonuses, have no debt and super low overhead, and I only just recently went back and finished my Junior College AA just to do it (I was two credits from completing it for the last ten years). I’m not bragging: I work my butt off in a specialized field that I genuinely find interesting, and in which I strive to be one the best. It’s worked out pretty well for me.

After having worked in a University for a while in my younger days, I quickly discovered that academia is little more than a massive wealth vacuum, holding a gun to the head of what would otherwise be an almost entirely disinclined student body: get your ticket punched or else live a marginal existence. It’s a brilliant business model. A LOT of the kids I interacted with back then really weren’t college-material, vacillating from one major to another and garbage-trapping the curriculum.

Outside of hard sciences, University education is almost like rent-seeking on information that is already readily available for the more motivated autodidact, and usually for free or very cheap – and sans some professor’s agenda. If you want to go for your own enrichment, that’s a whole different story.

No Desmo, Jim is correct.

I graduated from a public university, have always had a job at the top companies in my field (for past five years I’ve been out of school) and I have no debt. I paid for part of my education myself so I had taken out some student loans, but they were minor and I’ve paid them back. Additionally, my parents were able to keep funding their retirement instead of pouring their life savings into my education. In turn, I won’t have the huge burden of helping support them in their later years, most likely while I am rasing my own family. I hope you’re son won’t either.

Furthermore, private colleges are far from the only path to a good career, especially in areas like health care where you can start off with a community college degree in nursing and get your employers to fund the rest of your degrees. However, I am in business and know that you can reach the upper levels of management without a private school degree, despite whatever rhetoric you’ve heard and/or believe.

The number one priority should be a debt free education without draining the parents’ retirement savings.

“Going to a JC has nothing to do finishing college?” Here are some stats:

America’s nearly 1,200 community colleges are the workhorses of higher education, allowing open access to all who desire to learn. Of all students in college, about 45 percent attend these institutions, which were designed for a fast, two-year time of study to earn an associate degree.

High unemployment and the cost of four-year colleges have spurred record enrollment at these schools – but they’re failing to graduate students in high numbers and on time. About half will drop out before their second year. Only 25 percent finish in three years. Those who do graduate take an average of five years to complete their degrees.

Anybody saying “this is what I did and it worked, 10,15,20, years or so ago” better wake up, no college degree don’t bother even applying.

Great article. This is what I have been trying to say to my friends and family for some time now. My parents, like many other empty nesters, are still live in the 2000sq feet suburban home they bought 20 years ago and they are convinced that they’ll be able to sell it for around 600K (zillow estimate) when they finally decide to sell. The question I always ask them is, “to whom?”

I agree with you, doctor, that the younger generation is starting to have a different attitude towards homeownership. Already, my siblings and I understand the absurdity of paying 600K for a modest house in a middle class suburb.

Another important point I want to add is that more people are pursuing advanced degrees and professional degrees these days. In this economy, many of the high paying professions require advanced degrees, and that means even more student loan debt.

Dr. H, you hit the nail on the head about student loans.

We live in Central Florida, right in a bubble area. My wife and both my daughters recently completed college.

After raising the children, my wife went back to school and took about 18 months to complete her bachelors in business, and got a better paying job almost immediately. She has $12K in student loans, and should have that paid off in about 2 years.

My oldest daughter completed her bachelors and masters in education, and was pursued by several schools before taking a middle school teaching job. Even with scholarships, she has $25K in student loans, and plans to have that paid off in about 4 years.

My second daughter completed her bachelors in English last year, and found a great position where she actually has 2 manager’s fighting over her talents for their respective departments. She was also on scholarship, but lived in the casa while attending a pretty good state school. She was judicious with her money, and I paid a couple thousand out of pocket, so she graduated with zero debt.

We also have a son in high school, and have been saving in the Florida prepaid plan for his college. I know I’ll have to open my wallet when the time comes, but I don’t want him to start out with a crushing student loan.

My wife and my daughters could have gone many more thousands into debt, and the student loan folks were begging us to borrow more money. We have met many recent grads with staggering student loans, that even with a good paying job will require decades to pay back.

In the article you noted, Ms. Space has $200K in student debt. Well, she went out of state to a very expensive school, and went to Ireland for 3 months, then got a degree in sociology. Were the no adults around to ask her just how was she going to pay back $200K with a degree that doesn’t really figure into a good paying job?

As a taxpayer, I don’t mind providing help for folks trying to educate and improve themselves, but I’ll be damned if I’m going to have any sympathy for kids who take a 4 year vacation then cry boo-hoo.

Don’t worry when the Bond market goes tits up, they will rework the tax code.

INCOME TAX will be reapportioned so that you tax burden is inversely proportional to your indebtedness to federally guaranteed loan programs.

Up to your eyeballs in student loans, Fannie mortgages…no problem Income Taxed at 3.5%.

Debt free and earning an hourly wage or salary…..ding ding ding say goodbye to 50% or more. Your not using it for anything so give it back to Ben.

Debt free and filthy rich living off capital gains, just hire an attorney (eye balls deep in debt) to fill out all the schedules for exemptions and pay nothing.

I registered this fall at our local community college to take a class in macroeconomics for personal enrichment. After registration fees, books, and so forth, I figured the $400 I’d pay for the class would be a better investment than my former preferred form of entertainment which was drinking beer and watching dvds.

The cost, per unit, was $27.

That same class, in Texas, would’ve run me $117 per unit.

Needless to say, I’d probably still be drinking beer and watching dvds if I lived in Texas.

So maybe it’s not all that bad here in California.

You’re correct…that is a cheap price per unit. They’ll raise the price soon.

Many years ago, most people learned to read, right and had basic math skills by the age 14 or the 8th grade. Even high school was an option then. At this point you could choose to work on the family farm or apprentice yourself to a business. Want to be a brick layer? A carpenter? A blacksmith? An Auto mechanic? A plumber? An IT pro? etc……. For many jobs and well paying ones no “formal” education is necessary. In fact you can become a small business owner and earn your degree from the University of Hard Knocks. Most graduates are well educated and very successful.

There was even a day when you could become an engineer by working and learning under the guidance of a qualified licensed engineer. One of my dad’s best friends was the chief engineer for McDonald Douglass for years with only a high school education.

There are many, many examples of people doing quite well with no “formal” education. Most trades, and even engineering is a trade, do not require all the education that we seem to think is necessary. Most trades (I do want my doctor well trained), require a certain aptitude and skill set, but not a $100,000.00 education.

Partyboy got paid to learn, a much better way to go.

Though I did not join the military I was willing to get dirty, sweat, have my hand covered with bleeding blisters for a month and be a human forklift until I proved I was willing to do whatever it took to be a part of the “crew”. I learned quickly and was soon running the crew instead of playing human forklift. Soon thereafter I was the owner of a multi-million $$$ company.

Bottom line folks is a $100,000.00 “education” is way overrated. The american educational system is a joke and is in need of a MAJOR overhaul. I would say get rid of public education completely ( I know that will never happen), but at least get rid of the D of E and return control of the schools back to the citizens.

What happened to auto shop? metal shop? plastics shop? wood shop? etc…. I knew a lot of people who did not excel in the regular classroom, but excelled in the shop. We have replace the shop classes with politically correct social engineering CRAP that has nothing to do with education.

I’m somewhat skeptical about your post. There may have been a day when engineers didn’t require formal college educations, but that day was long long. At my engineering firm, I have a bunch of coworkers nearing retirement age and some past retirement age, and all of them have advanced degrees (most have PhDs).

Can a person learn engineering without going to college? Yes. But is it easier to learn on your own? Hell no. The EASIEST path to becoming a competent engineer is to go through an established curriculum at a school with a respected engineering program. You don’t need to go to an expensive, out of state liberal arts school — most states have public universities with decent engineering programs.

RE: the engineer at McD-D with only a high school education.

It happens. My father, who is now nearing retirement, does have a bachelor’s in generic Engineering, but designs microwave equipment for folks with PHDs, who ironically often don’t know how to use said equipment properly. I also know an optical coatings engineer with a degree that might as well be nonexistent. It’s in art. =)

In my father’s case, I’m sure you could argue “I said no degree at all and he’s got a bachelor’s!” but his case as ridiculous as the McD-D guy. The guy has only a bachelor’s degree and designs microwave systems that use geometric triangulation to determine where radio signals come from. Among the obvious national customers, SETI apparently uses the equipment. And during a recreational visit to the radio observatory in Lake Tahoe, it was made abundantly clear that the scientists and SETI had no clue how to use it.

Of course this is anecdotal, but I hope you get my point.

Toshi, I agree with you. I work for an engineering company and you won’t even get in the door for an interview without a degree and in most cases an advanced degree. In college, engineers are taught all the basic tools for problem solving they will need while working (advanced math, hard sciences and engineering related courses). Getting a kid out of high school and training him would not be beneficial for the company…they would essentially be paying him to get trained and educated in the basics. The next time you are in an airplane, driving over or a large bridge or are in a highrise…ask yourself if you wanted the person responsible for its design just to have the “minimum” education and receive on the job traiing. Probably not.

My mom got into engineering with only a bachelors in mathematics. Now she later went on to get an engineering degree, but I don’t think she’d even get her foot in the door these days with a bachelors in math. It’s a darn shame.

I agree with this.

But I also think DHB’s point is that, even if it isn’t education isn’t the way to go, I don’t think you can argue against the notion that it is advertised as such to the general population and most of eat it up hook, line, and sinker. It’s billed as the cure-all, the new path to wealth, when in reality it’s nothing more than a scam. The real tragedy and danger here is that, unlike with the housing bubble, what people are mortgaging are their very lives and there is no way out. Bankruptcy will not save them from college debt.

A bubble is just a ball full of air with a pretty cover. It might look shiny while it’s around, but when it floats too high, it vanishes. It’s basically just a bag full of empty promises to a way up, which, if you look at the demographics right now, is something most of us could probably use right now.

If anything, it speaks to the condition of what we live in right now. They sell to us, again and again, false stories of easy money, snake oil, if you will. First, it was with the internet, then it was with our homes, now it is in education. And we ate up the lies like a Thanksgiving turkey because most of us thought life would turn out just a little bit better than it did. The fact that we’re so willing to do so, even after two busts in ten years, to me, just shows how desperate we are.

So do I blame the people who fall for the snake oil? No, I don’t. Being gullible is not a crime. But I don’t see how you can argue that the new snake oil is in education loans, and this snake oil is a lot more poisonous than the last one.

I am with you, not all need to sit in a class for years, many do not need higher education.

Being an apprentice is a time honored and proven way to have a trade.

Our problems are a massive influx of cheap labor that has given way to no longer respected skilled labor. Couple this with export of jobs and the china trade imbalance.

No wonder we don’t have jobs.

Its discerning to for me to knowingly be sold down the river by the governments involvement in this sell out of the american people. Whats even more crazy is the politicians that make this a complex issue its as plain as the nose on the face, what has to done.

Also a firm would not even be able to give a HS grad an IQ or aptitude test to screen for learning potential, because it would be biased..

Colleges are just a loose form of apprenticeship. They provide many advantages such as flexibility in learning various skills in more than one trade and networking with others who have good chance to become masters of their trade. The only real gripe about college education is that it’s become too expensive.

This is not to say college education is the only way to go. Surely, even in today’s environment, businesses often times pick up part time or full time workers without education and teach them the skills required to help run the business. A college education will never determine one’s capability to learn and thrive within any environment. That’s up to the person to validate oneself and carve his/her own path in the world. But it’s extremely rare to find in apprenticeship the kind of accessibility that colleges and universities can provide to an individual in terms of skills and people.

Like most things in life, the college education system could be implemented better. However, what should be controlled is not so much the institution as much as the loose lending policies lenders have for college students. They should cap student loans depending on their major and the industry those majors are tied to. The economic environment has changed, and so should lending policies.

A college is not a “loose” form of an apprenticeship. An apprentice gets PAID to work and produce. He (she) is paid commiserate with the training received to date. It may take one person more or less time than another to learn a specific trade, but they are paid while they learn.

How do you people think things got built before MIT/Purdue/Texas A&M etc existed? Man has been building, engineering and inventing for thousands of years without sitting in a lecture hall.

The fact that you can’t get in the door for an interview without a this or that degree is the reason the system needs to change. So, I have to go spend thousands of dollars for a piece of paper to get a job interview. I agree with the poster above who said start a small business with the $$$. Think of all the entrepreneurs we could create that way. America would lead the world once again in thought, innovation, invention and much more.

Want to stimulate the economy? Make it easier to start a business. Regulation feeds big business and stifles small business. Want to start an oil company? No chance. The big boys love the regulation because there is now way someone with an idea could ever raise the venture capital to get it started. But small businesses can still be started and can still grow even in a recession/depression. It takes a few dollars, an idea and a lot of sweat. It’s a 24/7 life.

Ok, enough ranting……

Traditionally, they got food and lodging in addition to lessons in the craft. In exchange, the apprentice offered free labor. Today, students don’t offer free labor. Instead, they pay the school to have it’s ‘masters’ teach the student the craft of their choice. It’s a modern day apprenticeship. Whether it is in money or services, an exchange is made in return for knowledge.

Since you’re so bitter about the whole thing, I’ll just leave it at that.

The only people who should go to college now are those who need a government license to perform a job that will be in demand, such as nurses, doctors, dentists, etc. Otherwise, any other training needed to do a job can be done much more cheaply. Student loans are forever. Give your kid 1/3 the money you would spend on their college and tell them to go start a business. If they fail, repeat the process. They fail again, hopefully by business 3 they will know that they’re doing.

Next every American should borrow the maximum they can service monthly and buy gold and silver. Don’t touch it under any circumstances. As the dollar loses value, the real amount of debt will decline, but the value of the precious metal horde will increase in value. Since less than 1 percent of Americans own gold, when the dollar becomes all but worthless, you will be in the wealthiest 1 percent of Americans. In a depression, the real value of gold and silver increase dramatically. Gold and silver miner’s share price increase at near exponential levels. Don’t believe it, look at Canaco Resources, a Canadian mining company that has gone up 12 times in the last 6 months!

And if everything the kid touches turns to dismal failure, buy him the presidency.

The US is in general a very efficient country but there are three areas of massive inefficiency that weigh very heavily on most citizens

1- The overpriced bloated college industry, which does not compete on cost as outlined above and is there for the enrichment and glory of faculty members

2- The overpriced and bloated medical industry which relies on massive lobbying to ensure there is no pricing pressure what so ever applied from the government who in many cases picks up the tab

3- The legal profession have set the game up to be able to inflict maximum damage to the economy which everyone picks up the tab for and lobbying means the rules are always fixed so the lawyers walk away with whatever they wish…

Its almost as if these three industries are run as a cartel and own the government between them. The US is the cheapest place in the world for most goods and services but waaaay the most expensive in these three areas …

Don’t forget the banking, Wall Street and insurance industry; they own the government as well. Try to get something through congress that goes against their wishes, huge fight, to do so requires almost complete economic collapse, see last 2 years.

I think that the FIRE-sector is just about 30% of GDP! That is a lot of lard for a society to carry around!!

While I agree there’s a credit bubble, I don’t agree that there’s no need for a college education.

Or to put it more accurately, there are many jobs that require or will require specific college degrees. We have to stop looking at things so individualistically, and look at the structure of society and how it is changing.

The full spectrum of technical jobs no longer has strong demand – a lot will be outsourced to poorer, worse paid countries. Demand for finance jobs will stay strong, due to neoliberal policies that make our economy global. Demand for war technology and people to invade countries and topple governments – should rise. Following invasions, the demand for economists will surge.

Doc – I have been saying this for a LONG TIME. Housing prices which are currently sky high, are DOOMED to CRASH. The FUNDAMENTALS for housing in the U.S. are HORRIBLE. You bring up some good points in this article. College kids who graduate and are drowning in debt are a major reason why housing prices WILL COME DOWN. A massive OVERSUPPLY OF HOMES is another. HIGH UNEMPLOYMENT is another. A HORRIBLE ECONOMY is another reason. AGEING BABY BOOMERS who will move in with their children, downsize, move into nursing homes, or die is yet another reason why home prices will crash. HIGHER INTEREST rates, which are certainly coming to the U.S., will anaihilate home prices.

Housing remains insanely high in some areas (like California) and reasonably priced in other areas. Most people do not realize how artificially and insanely high home prices are because of government intervention. With millions of college graduates

who will be drowning in debt, into an economy in shambles, housing is going to fall off of a cliff! Mark my words, Doctor Housing Bubble!

Query, using an analogy…familiar with a buy vs. rent calculator for home.

I wonder if there is a similiar equation for “earn Phd vs. hiring Phd?”

Which is cheaper: earn my Phd in a field of science or simply hire one of the many unemployed Phd scientists currently out there?

What I’m really interested in, is how has that “earn vs. hire” chart looked over the last 30 years? I would imagine that at some point in time it was cheaper for me to earn my Phd compared to hiring one…but at some point it feels like it’s switched and now it’s cheaper if I hire one…especially from China or India.

What structural changes brought this about?

Thank you.

In the long run, it is still cheaper to earn your own PhD. Whether earning your own PhD is cost-effective or not depends on how much starter you are than the PhD’s you eventually hire. There’s a lot of smart people overseas, but from personal experience working with contractors on the other side of the ocean, I found operations ran more smoothly and products were of higher quality with workers in the US. For operations that don’t require mass production and cheap labor, I’d stick with home grown PhD’s.

My husband agrees with your views regarding US workers v. overseas workers.

He says that the amount of lying and overstating/exaggeration that goes on by foreign workers is appalling.

~Misstrial

Earning a PhD in science is a pretty good deal. You get paid a stipend so the only cost is the opportunity cost of making 22k/ year for 5 years instead of whatever you would have made with just your BS during that time.

But then there’s the risk of graduating without having produced any important publications. Then you might it hard to land a scientist-level job in industry and you will be overqualified for all the BS-level jobs.

We don’t all want to be sheep, er, home owners. I’m forty-six and proud that I never bought into the marriage, kids, home, American Dream crap. My life is less stressful than my cohorts around me, and, yes I have enough money to live on 🙂

While I do admire your independent thinking and courage to execute, let me just say that the most rewarding and enjoyable thing I’ve ever done was being a parent. Sure, it’s stressful as all hell sometimes and costs me money, but I’d never trade it and can die happily with the decision at any time. This comes from a guy who has also not owned a home (income is not an issue – I worked in mtg markets and am in investments and saw this going to hell from 2004 and on, fighting off wife’s nesting instinct for the better part of the decade).

Long-term care insurers are raising rates (MetLife & John Hancock), so plan on buying long-term care insurance by age 50 so that your rates don’t go up by a factor of 2.

Also this:

http://www.ocregister.com/news/peterson-279347-home-orange.html

~Misstrial

I’m going to make a huge point about our educational system – no matter what you end up doing for a job, you will exchange and store the benefits of your labor in money. Yet we do not have any kind of mandatory personal finance classes in high school curriculum, even in colleges, that teach issues/costs/management of personal finances. This includes cash/financing/leasing evaluation, current consumption vs. savings, how to budget, real costs of debt, or anything else. Could there be a more significant sign of failure to address any/all practical issues?

By the way, I also support mandatory high school classes in first aid/field medic training. Very useful stuff for everyone to know, and saving a life is about as noble a thing as we can do. I’d also like to see every citizen trained in the responsible use of firearms and general self-defense/awareness. Both of these make for a much stronger population.

Get a little more practical on all sides.

BTW – educating people used to be handled via a chaulk board and someone conveying knowledge. That’s relatively cheap to provide and no one needs a world class architectural marvel and student gym complex in which to execute on this. Educational institutions have squandered the tuition spiral facilitated by student loans and lack of real cost/benefit evaluation from prospective students and parents (back to point 1 – no teaching/tools to evaluate the decision).

First Aid/CPR is taught in high schools in Health class.

This class is required for a diploma or GED.

It is also a required class to pass in order to graduate early via the CHSPE exam.

~Misstrial

“Yet we do not have any kind of mandatory personal finance classes in high school curriculum, ”

Oh, you’re sure about that for all school districts? My stepson had personal finance in a mandatory senior class that was supposed to “prepare” him for real life, and after he graduated he joined in the military and promptly went into debt. They can sleep through that class as well as any other.

Misstrail – I had CPR/aid class too. I had something beyond that in mind which I thought was clear from my post.

Carol – point wasn’t that it isn’t offered anywhere but that it isn’t a mandatory focus everywhere like math/reading/science (yet its more important than many of those topics for making your way in the world). As for kids sleeping through class, lead a horse to water – this is a more practical class than most and putting it on their level with cars/college costs can help them relate. At the end of the day, it’s often enough to know that one should think about it rather than remembering details. Can always open the book again before putting on a few hundred thousand in debt. Sorry about your son, another key topic of mine is parental responsibility and at the end of the day personal responsibility, he lives his life as he sees fit and will reap the harvest of what he plants himself.

ding ding ding….!!! financial education in high school, risk / reward analysis.. We lack that in our school system. If you have to incur high student debt.. fine.. spend it on a good medical school, become a doctor, dentist, professional engineer, advance degree that actually do something. Know what the risk / reward scenarios are. I have nothing against psychology majors.. but if you are going to spend $200k in loans to get a BS in psychology, you better have other income streams to pay that off.

My parents paid for my college education (with some contribution on my side – lived at home, worked part time, etc), but they also made it clear that my major has to be in engineering, medical, hard sciences.

Because of their kindness, I am going to pass this on to my kids as well

As for the folks who say a degree is not important, I agree partially. There are plenty of folks who do not have degrees who has succeeded. But there are plenty more without degrees who have not. A proper college degree gives you more options, and more leverage, at an earlier stage, in a job env that is becoming highly competitive. (I am sure anyone applying for engineering positions will agree… there are some companies that are now even looking at the schools where the engineering degree comes from.. I know of one company that preferred UC (ex, UCSD, UCLA) engineer degree majors over State (SDSU, SJSU) engineer degree majors. Talk about bias… – but it’s happening, they perceive that the quality of engineers is higher)

-Andy

Well, student loan is like any other debt which is accumulated very quickly with the high interest rates on the private student loans. The core of the problem is the wage stagnation in this country. People are not being paid enough as simply as that. Productivity in this country is always rising and wages are not. Such an economic irregularity cannot hold for too long. So, people acquire debt such as mortgage and student loans, however, they do not get paid sufficient amount of income to pay it back. Most employed people have not gotten a rise in the last 3 years and also overal in the last decade, income have not gone up at all, when adjusted for overal cost of living increase(higher education cost, higher health care cost etc.) So all of this is a direct result of bunch a CEO and CFO figuring out that they can get away with the low paid labor and giving themselves outrageous high salaries. Now, all that short runner practice bear fruits in the defaults everywhere: home loans and student loans. Banks, of course are part of the problem, since they refuse to give a decent current market rate on this debt: refuse to refinance to a current market rate. There will be no positive outcome in all this until: people get paid sufficient amount of income according to their skills and productivity levels and until banks rewite current debt with the current market rates.

The problem is the same one as with housing. The cost is out of line with people’s incomes. Now with housing you could blame that on people not being paid enough or on houses costing 400k but it’s really just two sides of the same coin. With people making what they actually do that housing cost is ridiculous. Education is the exact same way. With what people actually earn an 100k education is ridiculous. In fact with what people actually earn even the cost of the public UC system in CA is too high. I mean if a working professional who budgets carefully can not afford to go to college at night without minimal or no debt, then the cost is getting too high for the reality of people’s wages.

Much ado about nothing. Congress will eventually pass a “Fresh Start Act”, forgiving all student loans, in exchange for some pet project of the opposition; perhaps a govt 20K down payment subsidy specifically for first time homebuyers who are illegal aliens that complete college. This will juice the housing market, especially CA. Fed will print money to fund everything, problem solved. FICO scores improve, new credit cards and mortgages will be issued, etc. Erase debt like waking up from a bad dream. It’s been done before, it’ll be done again. Move along folks, nothing new to see here.

There is an interesting possibility on the student loan debt from a gender standpoint.

A young woman could in fact decide to default completely and find some guy to live with while she participates in the cash economy. A guy could do this also, but it is harder for guys to partner up unless they are decent wage earners.

If she remains unmarried and unemployed, what are they going to do, throw her in jail?

Absurd. I have never seen the civil courts show bias to a Defendant in a collections case on the basis of gender or orientation.

btw, males in financial arrears tend to move back home with the parents, thus saving on costs for shelter.

~Misstrial

At some point the definition of education began to change. Four year colleges began to offer courses in ‘softer’ subjects that had no clear job trajectory or, if it purported to, one that would pay very little. People began to believe that a major in Women’s Studies was equal to one in Chemistry. It could be argued that both are useful things to study but society continues to value the hard skills of a chemist over those of whatever one learns in a Women’s Studies class. Paying the same for both types of majors is just not a wise economic decision.

People also make poor choices. A simple equation, say, ‘Cost of Education+Income lost during Education</=Increase in Earning Capacity x Number of Years of Productive Life' should give someone a ballpark idea of whether more education is a good idea. If it doesn't provide added value you should recognize that fact up front and if your love of learning still wins out then you must realize that you are going to be paying for a luxury item.

A third point is that many people have never paid up front for anything. If you finance everything you own you start to see everything as a series of payments. You can finance your house, car, education, clothing, vacation, even put your basic necessities on a credit card. They only look at the payment, not the total cost. This numbs you to the true cost and value of your purchase and we have raise an entire generation who know of nothing else. My children used to roll their eyes when I would tell the Depression Era stories I heard from my grandparents but now they listen. At least we're discussing the fact that a country can have massive economic fluctuations during a lifetime. You live, you learn.

The definition of education changed during the 1960’s and accelerated during the 1970’s.

By the 1980’s, these soft studies were firmly entrenched in academia for politically correct reasons, and the University of California (my alma mater) and the CSU system *required* that students enroll in these courses for “diversity training” in order to matriculate.

These course requirements added about 6-12 months of additional time to complete and is the primary reason why students need about 5 years instead of four, to graduate with a Bachelor’s.

The Baby Boomers, who had only known prosperity, thought that the U.S. would always remain prosperous and that esoteric educational programs would continue to have economic value. These courses of study would include Black Studies, Chicano Studies, Asian Studies, Art History, Philosophy, Latin, Greek, the Romance languages, etc.

~Misstrial

I don’t think the definition of education has changed the way you think it has. Woman’s Studies may be a new major, on the other hand Philosophy has been a major for pretty much forever. What are the job prospects for a newly minted Philosophy major, pray tell?

I also don’t think the Chemistry field is as good as you think it is either. Once upon a time, Chemistry was a decent field to go into (when America had manufacturing and thus a true need for chemists!). Now you can’t do very much with it without a PhD and even then it is extremely competitive (many students competing for a few jobs). It’s an extremely tough major followed by an extremely brutal job market. You really have to have a passion for it. You might do somewhat better in Biochemistry though.

What is a good field to go into? Well there are still some real jobs like engineering, nursing etc.. Other than that: go into the FIRE economy if you want real money, because that’s where all the wealth of society seems to end up!

UE with College Degree, your wrong. The nation and most States (think Cali) are totally broke. Your scenario must have been done years ago. Let the guvmint try it again, it won’t work. And even if your scenario happens, who the hell is going to be buying homes. Answer. Nobody, and that includes foreigners. Look at Asia, Europe, etc. Most of those continents are in trouble. India and China are experiencing contractions today (it’s just not publicized). Either two things happen. One is prices for homes will decrease to reflect wages which will include college costs. Two, wages increase to supply the needed cash to purchase a home and college education. My bets are on number 1 happening, and it is happening now, just slowly due to all the guvmint meddling in the markets. With a new congress in January, one can almost see the writing on the law that Obama and crew are in for two years of heart burn and frustration. Obama’s social enginerring programs are going to come to a grinding halt. And do not expect a bailout of fed money for Cali either. Cali is going be hit really, really hard.

This blog entry is basically about me and my wife. We both just turned 30 and together have approximately $100k in student loan debt. That’s for 2 bachelor degrees and 1 MBA from Pepperdine. Our decisions to get those degrees were predicated on the assumption that lucrative careers would offset the cost of education. For us, even though we make good money and weren’t laid off, the ROI hasn’t been fully realized. Our buying power is not what we’d like it to be which means we have to hold off and wait. Good thing about getting the MBA is that I have enough tools at my disposal to make good financial decisions. So here’s to waiting and saving. Two novel concepts most people cannot grasp.

There was a time, not so long ago, when people didn’t even need a high school diploma to make good financial decisions, and there was a time before that when people who had not even graduated 8th grade wrote great books, conducted business and attained middle class status, and not only built some of the most productive and innovative industries ever to exist, but discovered and codified the bodies of knowledge that we spend minor fortune to study now.

I grew up in a nabe that was mostly blue collar and lower-level white collar. My friend’s father, a meter reader at the gas co., taught her to compound interest and balance her checkbook, as well as make simple household and appliance repairs. Saving money and staying out of debt was a given, and so was accepting responsibility for your actions.

Now, people borrow $40, 000 or more to win degrees in subjects that have no application or relevance at all from schools that have no admission standards at all- you had to have better basic skills to make it out of 8th grade back in the 60s than you do to get through many private and online colleges now.

And did anybody ever tell these people: you will not be able to pay back $100K debt or more on the kind of job you will get with a degree in sociology, or fine art, or Romance Literature?

What on earth were these people thinking? Did this woman even THINK about how she would ever pay back $200,000 in student loans? She took summer course, did a work-study in Ireland – did she not think about at least getting a job in the summers to help pay for her schooling? I feel sorry for these folks, but really, why didn’t they use some common sense? I guess they don’t teach that in college.

Personally nothing would make me happier than to see home prices plummet. Because I am one of the people who DIDN’T buy a home at the height of the bubble, and I am still hanging onto my modest savings waiting for home prices to get to the point where the average person with an average income could actually afford to buy a home. Why should it take 2 incomes and a huge 25-year mortgage for someone to get a home? It is totally ridiculous. You used to be able to buy a home for what it costs now to buy a car. Why should the government try to keep home prices artificially high, so that people can think they are wealthy because they own a home that is worth half a million dollars?

You can get a MBA from Aspen University for $3600. That is correct. Educamatiion is CHEAP!!!

My junior college’s $95000/yr Human Resources SPHR has one of these!!!I’m telling you, there is a lot of reasons Kahleeforneeha is swirling in the toilet bowl!!! Wheeeee!

Oh hooray, a diploma mill degree, you can always use it for toilet paper.

Global bond rout deepens on US fiscal worries

The bond rout raises concerns that the US authorities may be losing control over events. Telegraph

Agreement in Washington on a fresh fiscal package has set off dramatic rise in yields of US Treasuries and bonds across the world, threatening to short-circuit any benefits of stimulus. The bond rout raises concerns that the US authorities may be losing control over events.

The yield on 10-year Treasuries – the benchmark price of money worldwide and the key driver of US mortgages rates – has rocketed to 3.3pc, up 35 basis points since President Barack Obama agreed on Monday to compromise with Senate Republicans on tax cuts.

The Treasury sell-off has ricocheted through the global system, triggering bond sell-offs in Asia, Europe and Latin America. Japan’s finance ministry braced as borrowing costs on seven-year debt jumped by a sixth in one trading session, while German Bunds punched through 3pc.

The White House deal with Congress will renew the Bush tax cuts for rich and poor alike for two years, as well as adding a further a 2pc cut in payroll taxes and an extension of unemployment aid.

David Bloom, currency chief at HSBC, said it is hard to disentangle whether investors are shunning bonds because they expect US stimulus to boost growth next year, or whether they are losing patience with profligacy in Washington.

“If this is all about growth, that’s brilliant. But if yields are rising because people think Amirca’s fiscal situation is unsustainable, then its armaggedon,” he said.

I do not wish to rehash all my previous points on other posts, but I will say this, if young people ~<35±2y/o don't put down their foot now and make older generations pay for what they bought and want; mom, dad, and grandparents will suck us dry just so they can ride their proverbial Harley into the sunset, listening to rock and roll; all on our credit card.

The toothpaste is out of the tube now. There’s over 2B people that work for $10/day and they’ve got all the production facilities as well now. The great rebalancing has begun. US wages and consumption life style is going to condemn many people to lives of abject servitude.

Perhaps it’s time to rethink how we educate ourselves. A liberal arts degree is a wonderful thing. It allows a person to explore all the knowledge of the world – languages, art, science, history, philosophy – all beautiful and worthwhile things. What it is not is preparation for a job. For learning to add value it needs to teach a skill that employers will pay to have. I propose different tiers of education, keeping in mind that half of the population is by definition below average:

High school => 2 year college => trade school

High school => 4 year college => professional school

High school => 4 year college => MA => PhD

The lie that we tell ourselves is that all Americans are above average and should go to college so we can create companies and business that will be manned by the rest of the world. We shouldn’t be pushing everyone into a college program where the first year is remedial work teaching what should have been learned in high school and the next 6 years are spent trying to find their ‘passion’. Do parents ever ask the question “And what can you do with THAT degree” anymore? If you’re going to attend a 4 year college and major in Botany you need to know that you still need to get training in a job skill. Telling a future employer that college taught you how to write and think and use Word won’t make you anymore valuable to him than a smart high school grad would be. He won’t care that you can name all the plants in the office.

Simple but very real fact: A college degree today = High school degree in the 1950’s.

You CAN with a lot of concentration and willingness to petition early or late classes get your AA in 2-2.5 years (heck, you can start taking classes at the JC here in CA at 15, the kid next door has done that, and is now nearly done with her AA as she graduates from High school!). The JC’s ARE impacted, and filled with a lot of returning adult students, as well as kids who are really just trying to figure out which vocational certificate program to get, so it takes concentration to stay focused. BUT it is the best start for the buck.

But I really feel a lot of Universities and Lenders are preying on our students- the Universities have no real interest in keeping costs down as long as kids can/will borrow the money, and after the real estate and credit card markets have slowed, I get the feeling that lenders see un-defaultable student loans as the best profit vehicle going. I volunteer at a Boys and Girls Club, and I am really worried to see the full court press private colleges are putting on some of my students. They send glossy brochures showing kids strolling across grassy commons, chatting in dorms, etc. and have my students starry eyed with visions of dorms, dances and “College Life”. (sigh) What the brochures DON’T show is that at 25k to 35k TUITION per year (not including dorms, books, food) the working class kids like them are not only going to be 100k+ in debt when they graduate (with a fairly useless liberal arts degree) BUT even with that beast of a debt, they’ll STILL be waiting tables and doing dishes AT those dances instead of dancing and flirting out on the dance floor just to make enough to cover food and books. These schools are selling a lifestyle to my low income kids whose parents are mostly inner city or newly immigrate people who aren’t savvy enough to realize their kids are being sold an over priced bill of goods. Our JC/Cal State/UC’s are great schools where you can still graduate with minimum debt, and any parent who doesn’t insist their in-state student apply there first is a either rich or a flat-out fool. Save your fancy-schmancy private school aspirations and money for graduate school.

The poster above may be correct in saying that a BA today is worth a high school diploma years ago. All too often, college ends up being a place where kids with rich parents (or who are willing to go deeply into debt) re-learn what they should have learned in high school. But not always. I’ve got an older co-worker struggling to learn a new computer program for his job, who said that his son is learning the same program at his high school! So I am always skeptical of these people who talk about how great things were in the past and how it’s all going to hell in a handbasket now. There may be some truth to it, but I take it with a large grain of salt.

I am also amused to see people constantly denigrate liberal arts degrees, and say the only way to get a job is with math, engineering, and hard sciences. I have a BA degree in Communication, a popular degree to claim is a “joke major,” but I don’t regret it at all. I learned public speaking skills, which I took for granted until I went to grad school and saw how few people (even those who were very intelligent) were able to present their ideas effectively. You’ve got an engineering degree but you can’t speak to a room of 12 people without your voice quavering? Talk about worthless on the job market!

My communication program also had some very interesting classes about mass media, advertising, and marketing, which proved immensely valuable to me later in life by preventing me for falling for marketing b.s. (like “real estate always goes up”!). I also had classes that talked about how to spot logical fallacies in arguments, which have also proved to be very helpful throughout the rest of my life. Yeah, I could have learned this stuff on my own, but as a 19-year old I probably wouldn’t have. I was also so shy that I probably wouldn’t have taken up public speaking on my own, and never found out that I’m good at it.

Finally, liberal arts force one to look at the world creatively. All these hard science majors arent’ going to be worth squat if the people holding them lack the imagination to come up with new ideas, products, and processes.

In Europe you go straight to study medicine from High School if your grades are high enough, an American high school diploma is not accepted by Universities in Germany and the UK.

Leave a Reply