Move inland or leverage your life: The gentrification of the California middle class pushes many to use ARMs to leverage into homes they cannot afford.

I am convinced that Californians enjoy having a sordid affair with real estate. The amount of justifications that get thrown around during booms and busts would be enough to fill a diagnostic manual for any aspiring psychologist. It is fairly well accepted that mortgage rates will only move in one direction from this point forward. So why would anyone lock into an artificially low rate via an ARM that is set to adjust in a short timeframe? Many Californians are opting for ARMs to compete with big money investors over the tiny crumbs of inventory out in the market. After all, home prices will be up in 5, 7, or 10 years and by that time you’ll be playing the equity ladder game once again, right? The usage of ARMs is surging for the non-investor share of buyers. A big reason is that California is largely unaffordable for the masses.

Affordability reaches bubble level lows

What is amazing is that some people have somehow confused the definition of prime. Manhattan Beach is not Redondo Beach or Torrance. That should be rather clear. Just because you are near to the coast does not suddenly mean an area is crazy valuable or the next Newport Beach. Think of places like Beverly Hills or San Marino that are not near the coast but legitimately are prime. Or think of other places where this rule does not apply (i.e., Oxnard and Thousand Oaks comes to mind).

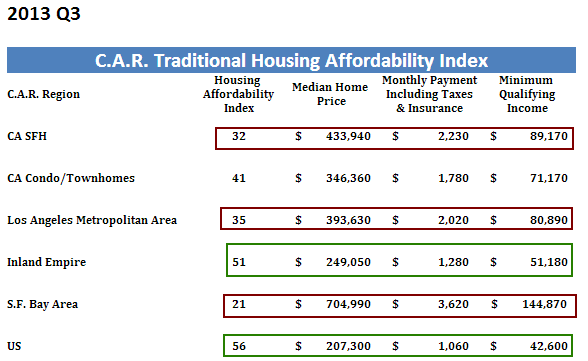

The bottom line is that affordability is very low for many parts of California again:

Source:Â CAR

Only 32 percent of households can actually afford to purchase a median priced home in the state. However, affordability across the US is still high and this also applies to the Inland Empire. The L.A. region is once again very unaffordable although pales in comparison to San Francisco.

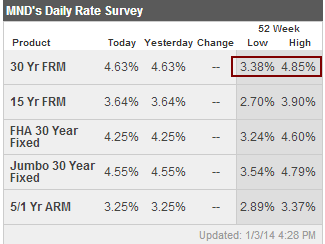

The affordability calculations largely rest on the 30-year fixed mortgage rate. As we know, this has undergone a big change recently:

A move from 3.38 to the current 4.63 percent market rate is a big move. Big enough that it has slowed down the market dramatically starting in the second half of 2013. In fact, the Southern California median home price hasn’t moved much from where it was in June of 2013. Of course momentum keeps on trucking and those families needing to buy are leveraging into properties with those trusty ARMs.

ARM usage increases

ARM usage in Southern California has doubled in the last year:

“(LA Times) When Michael Shuken recently bought his family’s first home, a four-bedroom in Mar Vista, his adjustable-rate mortgage helped them stay on the pricey Westside.

For now, his interest-only loan costs him about 35% less per month than a 30-year fixed mortgage, he said. But he’ll have a much bigger monthly bill in 10 years, when the loan terms require him to start paying off principal at potentially high rates.

“What is going to happen if I can’t restructure my loan and extend it? Are interest rates going to be 7%, 8%?” the 43-year-old commercial real estate broker said. “The home is big enough for me to grow into. The question is, will I be able to?”

Employed in commercial real estate and diving in with an interest-only loan. Talk about putting all your eggs in one basket. People do realize that since the housing crisis hit over 5.4 million people have seen their homes repossessed? No one likes to brag about making a bad purchase at a peak but my goodness will we hear about those that lucked out and timed a short-term trough as if that was the only time prices would be affordable ever in the existence of California (have we not already established that California loves to boom and bust?). Many of these folks forget about opportunity cost. What if you put that $200,000 down payment in the stock market? If you did this last year, it would now be up to $260,000 merely by investing in the broad market. However you slice the pie, it is market timing. By the way, you don’t get that equity until you sell. You know how that story goes with the baby boomers hanging onto properties even if it means they eat Puppy Chow before letting go of those granite countertops.

It is fascinating to see the market slowly shift as sales downgrade and the average Joe is now diving in with ARMs throwing caution to the wind. Others are squeezing in with small down payments because most people in glamorous California live life with the all hat and no cattle philosophy. Leverage is the name of the game once again in California and new car leases are once again humming along. This time it is different. No really. That is why investors with big money are now slowly stepping back. Buy now or be priced out forever! Based on affordability, the middle class is already priced out and those wanting to play are using risky leverage products trying to compete with investors.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

96 Responses to “Move inland or leverage your life: The gentrification of the California middle class pushes many to use ARMs to leverage into homes they cannot afford.”

Thank you Dr. HB for your pearls of wisdom once again. The real estate game in California has become very high stakes. Wall Street is already bundling, slicing and dicing their latest real estate swindle in RBS (Rental Backed Securities). Sound familiar? They need boom and bust periods in order to have something to sell. Then the gov’t. (us) picks up the pieces. Privatize Profits and Socialize the Losses. Wash, Rinse and Repeat. Very sad.

http://Www.westsideremeltdown.blogspot.com

Housing Inflation, Housing Inflation, Housing Inflation

The Main Topic I have been and will be talking about to CNBC, Bloomberg, Wall Street Journal and others. There is a disconnect from Main Street Media and economist on this issue because they don’t get the plight of main street America

Here is my 2014 Housing Prediction on Bloomberg Financial when I go into this problem of Housing Inflation

http://loganmohtashami.com/2014/01/01/my-interview-with-bloomberg-financial-on-my-2014-housing-predictions/

Another great yet disturbing post from Dr Housing Bubble. Here are some additional charts to support the good Doctor’s point. http://confoundedinterest.wordpress.com/2014/01/04/housing-unaffordability-and-the-return-of-the-arms-race-only-32-of-californians-can-afford-to-purchase-a-median-price-home/

Not only has ARM usage began to climb up, HELOC’s are starting to rise again as well as reverse mortgage applications. It sure looks like we’re in a bubble development phase. yet again.

If you sector out areas that are decent to live in, affordability goes far below 32%. The real factor today is the very low amount of inventory. I see nothing on the horizon that indicates inventory will be rising.

Perhaps the high prices are what keeps people in California. If people are underwater they stay put. If they don’t sell there is little inventory and the people that want to live in CA end up paying the higher prices.

A financial bust including a stock market tumble may end this dynamic-will probably happen as the Fed tries to end QE or tries to continue it!

Since 1997, the average annualized appreciation in home prices in the SoCal (excluding the Inland Empire and desert areas) has been about 7% per year. Now, if these golden handcuffers were to cash out and move to somewhere else the most they can expect to earn on their excess cash parked in a savings account, money market or certificate of deposit is about 0%. Hence, these people ain’t going nowhere.

Either the Federal Reserve are maniacal madmen or accidental geniuses, but by setting the Federal feds rate at zero percent (ZIRP) they have found an additional way to keep help keep inventory artificially low. Setting the Federal funds rate at 0% means than savings accounts, money market accounts, certificate of depots and adjustable rate mortgages (ARMs) are all artificially low. No homeowner sitting in a full paid off home in SoCal is going to put their home up for sale until interest rates on savings accounts, MM and CDs go back up to 5% to 7%. That isn’t going to happen until the Federal Reserve allows the Federal funds rate to rise.

most would be happy with 4-5% rates… its funny we think this is a market. The housing market has been libored also……Hopium sells well in california and the fed has supplied it. People will sell, buying RE today in Calif. has issues, expect youar water bill to rise 20%…reality is a bitch, soon the bitch will be back…enjoy the hopium while it lasts..

Encouraging investors to invest in single family homes with tax incentives and other financial ploys during a recession is shortsighted, and could lead to another sell off. The single family home market should only include the families that want to live in the home. Prices should reflect their purchasing power not the greater purchasing power of investors. Investors have many opportunities to invest in multi-unit housing. All tax incentives in the tax code for investor to invest in single family homes should be eliminated. If an investor does buy a single family home in an area that allows multi-unit housing they will quickly build multi-unit housing on the land which will increase housing supply.

We should control the high appreciation/inflation cycle, to control the creation of economic bubbles, and the excessive creation of debt (money) with the “2% Appreciation/inflation Taxation Policy”.

History has showed us that the Fed does not have the correct tools to control high appreciation/inflation rates. In the last 50 years prices have increase 1000%. If the 2% Appreciation/Inflation Taxation Policy had been enacted prices may have increases only 100%. Our wages would have maintained their purchasing power with affordable raises, and our manufacturer ing capabilities would have remained in the USA. Our production jobs would not have been outsourced to other countries. Our wages and product would have remained competitive in the world market place.

Consider this, If we could create an economy that allowed people to stay house, employed, and productive, taxes would not have to be collected or increased to pay for a larger government “safety net.”

The 2% Policy would work like this: If asset and real estate prices were increasing more than 2% a year the tax on savings and money investment would decrease based on the appreciation/true inflation rate. At the same time the tax deduction would decrease based on the appreciation/true inflation rate. This tax policy change would automatically change the tax code as our economy changes from the recession cycle to the high appreciation/inflation cycle. This change in the income tax code would reduce the stimuli in the tax code for people to create excessive amounts of debt (money), which creates high inflation and appreciation rates. Money (debt) would become more valuable because of the lower tax rate on money investment and savings. After annual appreciation/ inflation rates returned to 2% the tax rates would return to the way it was to maintain demand.

Interesting idea.

Why not tax all income at the same rate regardless of how it came to be. Lower taxes on ordinary income and raise taxes on dividends and capitol gains. I do like your idea of a capitol gains inflation write off so that you do not punish folks who sell a house and appear to have a gain but really are being punished by inflation.

Hmmm this might work. I think this might get people back to investing in real investments versus flipping tulip bulbs back and forth. I am sure there is a flaw in my logic but I think this would move us in the right direction…

Of course this would never happen because the only way to keep the party going is to continue asset bubble inflation at the cost of productivity and competiveness…

Chris, You must be a tax preparer. Could we stop using the progressive income tax code as a means of driving social engineering? Enough already, the code is already 70,000 pages long!

Amen Roscoe. Taxing income is ridiculous in the first place. Why should I pay more tax just because I choose to work and others don’t?

Regardless of whether you like progressive income taxation or not, the tax code is not bloated due to social engineering. It’s bloated with loopholes to buy the votes of various constituencies from the national level all the way down to the Congressional district level.

Insane is all I can say.

http://www.redfin.com/CA/Manhattan-Beach/104-The-Strand-90266/home/6712526

What a dump. 8 million… the world’s gone insane

I have a really good, secure, well paid job. Nice down payment, no debt. I live in NorCal central Valley and still I can not afford to buy in a half decent area.

Just as a comparison, the type of rich you need to live on the Strand. I know – I lived there for over a decade (but in a rental) only a few paces from this house.

http://blogs.laweekly.com/informer/2013/12/jordan_belfort_victims.php?page=3

You are paying for the dirt plain and simple. I jog on the Strand through Hermosa and Manhattan, it is absolutely mindblowing how many old houses are being bulldozed and subsequent McMansions are being built. This is exactly what will happen here. The rich are doing VERY well!

What is your definition of “the rich”?

This one was also for the dirt.

http://www.redfin.com/CA/Manhattan-Beach/2316-The-Strand-90266/home/6711069

What,

People never call themselves rich, whether they have $10 or $100M to their name. And in either of those cases (and everywhere in between) they consider the rich those hated few who can easily afford that which they covet.

Daniel…

For the dirt?

That seems hard to believe.

BTW, is there a height limit on strand real estate residences?

The CCC effect in obvious here: even the very wealthy can’t develop virgin coastal ground.

If you can afford an 8M dollar piece of dirt, you are very rich!

There is a problem when we can’t define specific words that we use all the time. Statistics can be easily manipulated when we continually change the definition to suit our needs. Tax the rich, rich Chinese, the rich are getting richer, etc. has different connotations when we actually set a definition of “the rich”. I would argue that a family making 250k a year with a net worth of a million would be considered the rich by some and not by others. The amount of Americans making 250k a year with net worth of one million is much larger than the amount making 2.5 million a year with net worth of 10 million. What happens is that we take the total amount of 250k and up and call these the rich and then extrapolate that there are a lot of rich out there who have the ability to pay 8 million for a very small piece of dirt. The amount of “the rich†drops dramatically when our definition requires a higher income and net worth.

Yup, 8M only for the dirt. It’s the last beach bungalow still standing on the Strand.

And yes, there are height restrictions in Manhattan Beach.

Not only is it $8,000,000 for the dirt, but people are falling all over themselves to buy it!

Dr B has good access to data. There are several things I’d like to know, and I hope he’ll reply with the numbers for all of us, not just me.

1) What percentage of SoCal houses are sold by private parties and what percentage by banks and other institutions? (Compare to National)

2) What percentage of loans in the last year were ARMs and what percentage conventional ? (Again compare SoCal to National.)

3) Are there figures for the number of people who moved from coastal plain areas to the inland? I’d consider LA County other than the Mojave towns coastal, as well as most of Ventura County and all of Orange County. San Bernardino and Riverside Counties and Lancaster/Palmdale area as inland.

I know several people who have moved inland, at least one under duress , and one definitely to take advantage of the big cost differential. That person sold a large home in a nice area of North Orange County and bought an equally large and nice place not too far from Corona. As far as I know, he could afford his former home, but he will be retiring in the next few years, and the money he got was just too tempting.

Opportunistic moves can go in either direction. I’ve been mentioning the move up for our Daughter’s family here in Orange County, where they bought a much larger house on a large lot, and sold their town house and eliminated the Mello Roos they paid. They aren’t using an ARM… they got a conventional at around 4%. For $140K they got 900 more square feet of house and 7000 more square feet of lot. Would you buy a 900 square foot house on a 7000 square foot lot in suburban O.C. for $140000? Better question is could you? You could buy such a thing in Old Towne Orange for $500K.

I am pretty sure that the people who bought their town house overpaid for it. But that isn’t our problem. Our Daughter’s family qualified for the conventional loan on her Husband’s salary alone. They have close to 40% equity based on the sale price, and several similar houses on the same street sold for a lot more later in 2013. I know it isn’t fashionable on this blog to have a good feeling about Coastal SoCal real estate, but I don’t think it really matters if they lose $100K equity next year. They would’ve lost on their town house in that situation anyway. They need a place to live, and with the deductions they get, they couldn’t rent for what they pay now.

The secret is always to go in with a big down payment. When they were in college, and when they first went to work, they scrimped and saved, and we helped them some too. (In both cases, they came up with most of the money themselves.) You parents should encourage thrift, and also be willing to give some to the next generation so your kids won’t be forced to move to Hemet or Arizona. BTW neither my Wife nor I ever had a six figure income. My Son-In-law may come close in a good overtime year.

Fool me once, shame on you; fool me twice, shame on me…

…fool me three times shame on both of us!

Inventory is artificially low & prices are artificially high = seller’s market. Why buy now with interest rates poised to increase soon? Be patient, rent where you want to live, & wait for the dump & price crash.

Buy something fun like a used airplane or boat, those are buyer’s markets now.

Happy New Year!

…or an M Roadster — that’s where I put some idle cash last year. 0-60 in 4.9 seconds is addicting, and every time I take the car cover off it’s Christmas all over again.

Better watch out – with a Beemer play car in the garage you may get tagged as one of those hated hipsters around here. Anyway, I’ve always been more partial to the old “bread-van” coupes myself…

Hipsters don’t drive beemers, at least not ones made in the last couple of decades.

most people have little patience..this is no different than a stock driven up on mediocre fundamentals by hedgies, mm’s etc. Once the retail crowd is in, the drop will come fast and any stop will come much lower than you had set….housing is a market controlled, now no different than a libor, commodity etc…

Granted, it has been a long time since I lived in the South Bay, but Manhattan Beach was certainly prime when I lived there. Or did I misread the second paragraph?

(Redondo Beach and Torrance, on the other hand, while having nice areas, also had some very shady ones …)

I see Dr. HB quoted the infamous Manhattan Beach. People laughed at me when I claimed Manhattan Beach was in the rarified air of ULTRA desirable CA coastal RE. Here are some tidbits from wikipedia:

Manhattan Beach is a coastal city located in southwestern Los Angeles County, California, USA. It is an upscale community, and includes some of the most expensive real estate in California. The city is on the Pacific coast, south of El Segundo, and north of Hermosa Beach. Manhattan Beach is a hotspot for beach volleyball and surfing. Every August, the city hosts the Manhattan Beach Open Volleyball tournament and the International Surf Festival. It is one of the three Beach Cities in the South Bay. Within commuting distance to Hollywood and downtown Los Angeles, Manhattan Beach has attracted professional athletes and actors to take up residence there since the 1990s. Property in Manhattan Beach, especially near the waterfront, is very expensive.

So there we have it, Manhattan Beach really is different. Located on the beach, perfect weather, close to DTLA/Hollywood/LAX, very safe, awesome public schools, etc. That is why you pay a hefty premium for that ZIP. From what I read, MB had the most million dollar sales of any city in socal last year. Make no mistake, any new buyer in MB needs to be rich. If you are interested in this area and don’t want to pay the MB nosebleed price, look at Redondo Beach. The pickings are slim right now, but there were some unbelievable deals to be had a few years ago.

Speaking of Manhattan Beach, my great aunt recently passed away in MB. Her husband bought a piece of land near 8th Street, 3 blocks in from the strand for a few thousand dollars in the 1950’s. He built his own 3 bedroom 2 bath house and lived there ever since. After the passing of my great and and uncle, their children have not at all considered selling it, perhaps due to Prop 13. Instead, they rent it out for $4,500 per month.

No one disputes that Manhattan Beach has been and likely will continue to be a relatively expensive area to live in. Can we put this straw man back in the barn already?

What has been disputed is the relative value of said expense. It’s so subjective that there’s hardly any worth to discussion.

Here’s a prediction for 2014 – you might continue to make posts in an attempt to convince the rest of us how your 2009 boat ride was the best trip ever! The rest of us will continue to gaze on in disinterest, as we’ll be more concerned with the outlook for the future.

Joe, could you please tell the blog when the right time to buy is in socal? That is the million dollar question everybody wants answered. Is it when prices tank 50%? Rates are at 8%? UE rate is at 15%? MID goes away? Prop 13 goes away?

I generally hear “housing is going to tank” and “it’s not different this time” from the angry bears here…that’s a real valuable piece of information there. I’ve given everybody my pieces of advice for buying, what is yours…ball is in your court!

The fatal flaw here is the idea that there is a one size fits all answer.

“That is the million dollar question everybody wants answered.”

There we go again with the idea that everyone is looking for the same thing.

“angry bears”

Grouping and categorizing is cheap.

Generalization is cheap says the man who claims:

“Inventory is artificially low & prices are artificially high = seller’s market. Why buy now with interest rates poised to increase soon? Be patient, rent where you want to live, & wait for the dump & price crash.”

Dude, housing is very affordable in 90% of the country. There is absolutely NO guarantee you will get your “bargain” in desirable parts of CA. Do yourself a favor and sign a long term lease starting today and wait for the bargains. 🙂

I didn’t write that, you must have me confused with someone else of the same name.

I”m wondering about the Prop 13 aspect of all this institutional RE buying. Aren’t the property taxes being reset on these purchases, and as a consequence the Blackstone crowd and their investors will have a Cali high tax bill? Is there something in this deal that lets Blackstone off the hook for California property taxes? Anybody?

Yes, why is this VERY obvious question never addressed in articles (and this blog)?

Blackstone avoided the pricey Los Angeles / Orange County areas. Blackstone bought in the Inland Empire, price range somewhere around $125K to $200K. So property taxes would be in the $1,250 to $2,500 range, or about one month’s worth of rent.

“Based on affordability, the middle class is already priced out and those wanting to play are using risky leverage products trying to compete with investors.”

We need to stop lamenting the demise of the middle class because they are going away for generations and generations to come thanks to the global adoption of capitalism and free/open markets, which mean that the labor pool has expanded like never before and median American wages (when compared against inflation in housing, education, energy insurance, etc.) are on a flat-to-down trajectory for another 30 years.

Our losses (labor wealth) is the world’s gain. Global players Apple, WalMart, Monsanto, P&G, etc. rejoice.

As others have mentioned on this board before…the notion of a middle class in societies is rarely realized in human history. Our 40-year run is over. The baby boomers got lucky and that’s that.

So, the American middle class is Dead. Buried. Headstone etchings already fading. Get over it.

Meanwhile, America still offers the best protections for wealth (and opportunities for the wealthy to increase their wealth) in the entire world. So, the wealthy will continue to come here and buy up all our “desirable” Cal real estate. This is a trend in the very early innings of it’s game.

My predictions for 2014:

* Jim Taylor will stop posting by June as no tanking will have occurred

* Median prices nation-wide and Cal will rise 6% yoy based purely on momentum, continued restrained SFR inventory and the greatest fools rush in to take advantage of “historically low interest rates” before they’re gone forever

* O-Care will not ruin the American economy (yet those buy into this thesis won’t have the intellectual courage to admit they were wrong)

* American economy gets back to 3% growth

* Unemployment at 6.5%

* 30-year rates pierce 5% end up just shy of 5% (I’ll say 4.9%)

* Tapering continues and the major stock market indices have a rocky year…ending up 2014 mostly flat

* The 90% continue to lose ground, but do nothing consequential to “redress grievances” with their gvmt since they are zombots to their duopolistic parties.

I agree with a lot of what you observe. Some of my conclusions are the same, a few slightly different:

* the vast majority of So Cal real estate is not for the 1%. So, pricing for this segment should be impacted by the “decline” of the middle class at some point. The rich Chinese don’t want to live in inland Torrance.

* o-care won’t ruin the economy but it is definitely a drag. To go back to January 2’s forum, all of those “greedy employers”–you know, mom and pop shops for the most part–will somehow find that it doesn’t make fiscal sense to go above 49 employees and 29 hours worked per week.

* is anyone normal buying a house for their family to live in?! I think this population is relatively commensurate with the amount of inventory available. Not including 1%ers.

* stock market does fine and is up in 2014 as taper is drawn out for months and months and corporate profits rise.

* Obama starts a war on income inequality while ignoring the fact that it is worse now than under bush. This accomplishes the creation of greater income inequality as mom and pop shopowner figure out again how to do more with less thanks to new regulations.

What the heck is a “mom and pop”? Is that some sort of LLC?

😛

Yeah, I am going quaint. It is that shrinking sliver of folks like me who started their own business and have to balance the books after every progression of baloney that comes from the gov’t. I grew up with friends whose dads owned restaurants, machine shops, etc… Much fewer around nowadays. For me in this generation, I realize that you have to do everything you can to minimize your exposure to taxes, regulations, etc… Nobody is in the mood to go put a big bet on growth when the majority of the profits would be taxed/regulated away.

Dfresh-you constant love of obamacare is absurd. It was a big lie and maybe under your myopic view it didnt hurt you as your drive around in your M roadster, but its hurting tons of wallets across the US already. and just wait til people realize their deductibles and copays are enormous when they actually get sick in 2014-2016, that’s when the real sht hits the fan. If you sold/forced a product to customers under the lies of obamacare you would be sued for fraud. If Obama was CEO and obamacare was a public company, he would have a class action securities law suit against him as well bc the stock of obamacare would have tanked by now. We live in a consumer society whether you like it or not, so more money toward healthcare means less money for other stuff. Period. We just got worse healthcare, longer lines for more money…but hey poor people are insured (even though they could go to free to the ER (btw read the new study from Oregon this week showing ER usage is going up under obamacrea, not down) so I know I feel better. Economy will suffer because of obamacare plain and simple. It may take a year, but its coming.

American economy gets back to 3% growth is another useless stat. Even if its 3% growth today its not the same GDP of even two years ago. We have added soft IP bs into GDP and now pushed healthcare into into Q4 in 2013…that’s what caused it to surge. Yippee! Unemployment going down? No sht. I would hope so. If you keep adding fake hires each week due to populaton growth, then count part time jobs added, but don’t count long term unemployed, part time workers AND cut unemployment benefits, unemployment tend sto go down. Basically no positive fundamental changes. Just more bs improvement in fake stats. I know I feel grrrrrreeeeaaatt! (Say like Tony the Tiger from frosted flakes commerical please)

Ding ding ding!

My deductible went from $150 to $3500 for in network. My employer did throw in a HRA but it was quite a shock to see that high of a number.

Just to add to the stories on the Internet about numerous companies cutting their health plans or pushing people onto obamacare (sometimes with a stipend from the employer to cover some costs which you know won’t go up over time, but ocare will), my friend’s wife who works at JetBlue said right before Xmas, the company got rid of healthcare for all its temp workers and increased premiums by 40% for full time workers . Eventually most companies will just move people onto the exchanges/obamacare where healthcare products are inferior but expensive bc they are over comprehensive and include useless costs for too many people. That will be great! Can’t wait to have even less doctors and longer lines! The future looks bright! It would be nice for more Obama supporters to be intellectually honest and admit you got duped. His stances towards the middle class have been awful and he certainly not a champion of the constitution or believes in a right to privacy. I can’t think of one thing he’s done that been positive. I know. I know. Its bush’s fault and congress still. We’ll probably here its bush’s/congress’s fault again if Hilary wins the next presidency and things aren’t going well. To be clear, I’m not pro-bush. I just rate a president by the merits, not political party, and Obama is plain poo.

obama hasn’t made one decision…congress and senate do…Obama is a puppet for bankers…nothing more…whom is making the money off of obamacare. follow the trail…

You lost me at “…global adoption of capitalism and freexopen markets… ”

Their is nothing genuinely capitalistic or free and open about the global March toward fascism. Your permanent bull thesis has failed in every asset class and in every economy it has ever been tried. Jim has for all intents and purposes been proven correct as housing tanked in late 2013. The reported median means NOTHING with this historically miniscule volume. No transactions = a tanked market. And while Obamacare won’t destroy the economy it will still filter $ OUT of local economies, and as they say all REady is local. Fact = number of underwater homes is still at record high and that’s comparing it to the current median which is a fantasy number. You are correct about a dwindling middle class, however 19% of the top 20% need the middle and bottom to consume. Consider that when predicting that wide swaths of SoCal will continue in appreciation. I’m quite sure the 1%ers will keep those lovely gated community McMansions sky high. The rest of these properties will respond to market forces sooner or later, just as EVERY OTHER ASSET IN THE HISTORY OF TIME HAS.

Love the tone, Doc. I can sense your frustrations are growing like mine at folks that seem to be forgetting (recent) history of booms and busts or are bragging about their purchases the past few years when last time I checked profits are only determined when you sell your home (by choice or if forced). I said it a few posts ago and others have said it as well-the bulls voices will only get stronger until pop goes the weasel. Bears/renters-be prepared to grow even more frustrated, but just keep telling yourself this time is no different and know its just a matter of time.

In regards to Manhattan Beach, of course its a solid beach area. So. Number one you dont have to be “rich” to live there unless we’re talking right by the beach. You can get a “million dollar+ home” with an ARM today and certainly not be rich, moreso well-off (which can change on a dime). Just like Joe6pack, these MB buyers are buying all the house they can “afford” too and guess what, they can default too, especially if they are relying on stock market gains in their asset/mortgage calculations (which many people are these days). Go ask all the lawyers that were fired in the last crash how they could easily live in manhattan beach before the crash, but not after. MB is better off than other areas so it has a higher floor. That’s all. It can go down just as fast as it went up since the last crash and to the low or even lower than where it was before (i mean interest rates are pretty darn low and that is factored into the home, no?) if interest rates ever do go up a bunch (no one knows how high it will go or when). To think otherwise, is asinine, IMO.

Two other quick thoughts. On looking at rental parity and claiming its the magic answer for when to buy. I call bullsht. Its a calculation made at a stagnant moment in time. Maybe it makes you feel better that day about your purchase, but rental parity can change even 6 months after your purchase. What matters is prediction of FUTURE rents vs all-in future costs of ownership (including lack of mobility and sales coats). Not saying thats even remotely easy to predict, but that’s really what matters. Beating rent for one year or two with a mortgage payment doesnt automatically make it a good long-term buy.

Lastly, for the folks here that keep relying on our govts measures of GDP, inflation and unemployment (even though they keep changing all three it feels like every year or so), here’s more hidden inflation for you (to add to my previous comments on hidden inflation in toilet paper, paper towels and diapers):

“Shrink a product and customers will notice, Chobani recently found out when it downsized some of its yogurts early last month. Following the move, many fans logged onto Facebook and Twitter to complain of yogurts that shrank to 5.3 ounces from 6 ounces – a roughly 12-percent decrease. Although Chobani shrank the contents of these cups, the company decided against decreasing the individual cup’s price, McGuinness said.”

“What matters is prediction of FUTURE rents vs all-in future costs of ownership (including lack of mobility and sales coats). Not saying thats even remotely easy to predict, but that’s really what matters. Beating rent for one year or two with a mortgage payment doesnt automatically make it a good long-term buy.”

This. Rents float, purchase principal is fixed (unless you get struck by principal reduction lightning). Defining rental parity as if it’s a simple and undynamic formula is a marketing tactic often done by those with a lot of skin in the game. Highly leveraged mortgage holders, flippers, real estate agents, mortgage bankers, and newspaper article real estate pundits are but a few that immediately come to mind.

“Shrink a product and customers will notice, Chobani recently found out when it downsized some of its yogurts early last month. Following the move, many fans logged onto Facebook and Twitter to complain of yogurts that shrank to 5.3 ounces from 6 ounces – a roughly 12-percent decrease. Although Chobani shrank the contents of these cups, the company decided against decreasing the individual cup’s price, McGuinness said.â€

The Consumerist often posts about the grocery and discount store shrink ray. It goes beyond volume. Cheaper ingredients and inputs into products are another way that inflation can fly under the radar. The same products today that were once durable and long lasting but are now basically throw away imported junk at a relative real price level. Now that’s inflation, it’s just that folks don’t tend to make the connection. No such thing as a free ride.

I remember reading an article in Time magazine somewhere around 1977. The article was about how the Soviet Union was doing everything possible to hide the inflation at the consumer level, by making packages smaller but charging the same price.

Basically it was about how low the Communists were for lying to their people and it was so note worthy it was picked up by the U.S. press.

And here we are today…….Sad but true..

Housing TO Tank Hard in 2014

It will not TANK but will slow down.

check this out! He is good with his predictions so far

http://www.marketoracle.co.uk/Article43843.html

We are doomed.

Get ready for the CPI to reflect “renter offsets”. If rent becomes too expensive, you take in a boarder or get a roommate. In this way, if rents rise 20%, the CPI will show the rate of increase as much much less than the actual.

Just another take on the current CPI method of “offsets” that they currently use. For example, if people eat steak, but steak increases too much, people tend to adjust their behavior so switch their eating habits to say tuna fish instead of steak. So the number crunchers just stop calculating the cost of steak period and instead begin calculating the cost of tuna fish.

Just as if the cost to rent a house or apartment becomes so high, people will change their behavior and they will take in more renters or roommates.

They have it all down to a science.

http://www.zillow.com/homedetails/4546-Verdugo-Rd-Los-Angeles-CA-90065/20850355_zpid/

I bought a home in September 2012 $372k loan (a home path loan at 4.25%, with 3.5% down, but they ‘gave’ me $10k for closing, NO MIP) I paid $372k for the house. I renovated the house myself, it cost about $37k to renovate ( new dual pane windows, new bathroom, all new pipes, refreshed kitchen, r-30 in the attic, new roof on 2 car garage, refinish hardwood floors, painted the house, etc)

Redfin/zillow thinks my place is worth anywhere between $565-$700k.

If I sold now for $600k….after about $48k for realtor, and other costs and getting my investment back of $45k and paying off the $365k mortgage… I would have a cool $147k…..

But to rent a place now that has a separate 2 car garage and a huge fenced back yard for my 30 dwarf fruit trees, raised veggie beds, 4 chickens, 2 cats, hammock, children’s play area, back covered patio and 1400ft2 of living space (3 bedrooms). We also have a very good elementary school, in walking distance. IF I could find something similar it would cost another $1000/month to rent than my current payment, including taxes…

NOW a huge assumption: 3 years, housing prices are down 30% from now and interest rates are 6.5%.

A similar home costs $420k, a 30% drop from current prices. If I spent an extra $36k over the next 3 years to rent a similar home now (extra $1000/month) I would have $111k to put down…

My new mortgage for $309k ($420k-$111k) @ 6.5% would be $1953/month, my current payment is $1830….. ACTUALLY $2500/MONTH after taxes.

I know, its better to buy low with higher % rate…..

But if I were to hold the note for the full 30 years.

$372k @ 4.25% = $387k

or

$309K @ 6.5% = $394K

but in 3 years I would have already paid $62k in interest….( 4 years)

so it would be more like $325k vs $394k

Basically what I am saying if prices go down in proportion to interest rates going up, a home would not be any more affordable in(monthly payment)

as far as investing the profits now if I sold…

stock market? I think I missed the bus on that.

CD….

You’ve put a lot of thought into all of this, but are you overthinking it? If the home is a good fit for your family and everyone is settled in, stick with it. You will have enough time to invest in the stock market in the years ahead. Stock market is around fair value at this point, IMO, anyhow.

There are just too many unpredictable variables to say that there is one “good” answer. That is why I revert back to quality of life as my key quantifiable metric.

Never base your decision on home buying or selling because of Zillow estimate. I’m surprised they haven’t been sued by now. They have no idea or anybody else what a proerty is worth unless it is visibility appraise .

Your huge assumption doesn’t predict where rents may be in three years.

Moving inland is no panacea either. The high energy bills will eat you alive, and they are not tax deductible like mortgage payments or property taxes.

Solar takes care of that issue. Put in $20k and you’re scott free on electricity for 30-40 years. Gas is negligible not even worth mentioning. Water is an issue only if you have a huge lawn just dry scape. Don’t knock it till you’ve tried it.

“puppy chow” that some baby boomers eat. Now in one of the last pieces we discussed cat food. Now dog food is another matter. “Puppy chow, also known as Muddy Buddies or Sweet Minglers, is a form of chocolate-based confectionery eaten in the United States”. Let us get to the pet type of food. “Dog food does not have these same strict rules that human food has. Although most dog food contains the same basic components that are in people food” As we discussed before, food stamps are a blessing in California. You can own a home in California and still get food stamps. But some people probably prefer puppy chow even if the cost is the same with the food stamps. How about growing a garden in the back yard old timer, like your depression era father did? Some of these old folks got lazy from smoking too much weed and now they want to legalize the stuff. Get out and plant a vegetable garden in the back yard and grow your own food. Go fishing and hunting as well. Only lazy people eat the pet food.

“It is fairly well accepted that mortgage rates will only move in one direction from this point forward.”

… which is why I think mortgage rates will be flat to slightly down in the next year or two. Markets nearly always prove the crowd wrong! To get a 7-year ARM to reset at 7% would require a sustained burst of inflation, which would require soaking up the labor surplus and the subsequent triggering of higher wages.

If you think low wages and a sputtering economy are here to stay, then interest rates will likely stay flat — in which case a 7-year ARM is a good bet right now.

“What if you put that $200,000 down payment in the stock market? If you did this last year, it would now be up to $260,000 merely by investing in the broad market. However you slice the pie, it is market timing. ”

True, but then you have 15% capital gains tax which makes the $260K now $221K. Then there is rent of $3000/month (good luck finding as nice a place than a $1M house for $3K) for 24 months or $72K. After paying rent and capital gains, you would have $149K, or lost $51K from the original $200K.

I put $160K down on a place in mid 2011. Place at the time was worth $799K. My PITI, minus prop taxes (I get that back in my tax deductions) is about $3400/month. Over 24 months, that is $81,600. The place is now worth approx $950K, so I would figure on clearing $900K. No capital gains either. And forced savings of about $900/month in equity. After paying everything, including PITI, the increased equity in my place, I net $40K.

So losing $51K vs making $40K. A $91K swing difference in just two years. Yes, it is about timing, and I could have lost value out of the deal, but that would have been a 12% drop off the purchase price. Not likely from 2011 prices.

“Granted, it has been a long time since I lived in the South Bay, but Manhattan Beach was certainly prime when I lived there. Or did I misread the second paragraph?

(Redondo Beach and Torrance, on the other hand, while having nice areas, also had some very shady ones …)”

I live in RB. Used to be shady areas in the north…back around 1993 and before. While there is some small crime up there (used to live in that neighborhood), it is a very safe place.

“If you are interested in this area and don’t want to pay the MB nosebleed price, look at Redondo Beach. The pickings are slim right now, but there were some unbelievable deals to be had a few years ago.”

Good point. RB is about 35-45% cheaper than MB. For being across the street, that’s not a bad discount. Schools are just as good. City services are better in MB. But your point about slim pickings is true. Prices have climbed here too…not to many deals now, and very little inventory.

Hey bud, your math is off on the capital gains. It only taxes your PROFITS. So 9k in capital gains taxes on a 60k profit.

While I agree that a discount would seem reasonable, I’m not sure where you’re getting the 45% price discount for Redondo Beach versus Manhattan Beach. When I look for 2000+ sq. ft. homes across the entire South Bay (Beach Cities, El Segundo), the pricing is similar across all the towns. Please show me an equivalent 2000+ sq. ft. house for sale in each town with that kind of price disparity.

Trekker, South Bay dude is correct that a hefty premium exists for that MB ZIP. It’s hard to put an exact number on the premium. Take a look at Redfin and there is one SFR for sale in MB for under 1M…and that is a mixed use property (residential, commercial). South Redondo 90277 fetches a premium relative to North Redondo 90278. Tall and skinnies in N. Redondo are a dime a dozen in the 800K range, that same house in MB will likely go for 1.1 to 1.2M. I would never live in MB for a variety of reasons, but it’s great riding on their coattails located “right across the street.”

Lord Blankfein,

I’m in agreement that a premium exists, but it seems to me to be much less than people are claiming. If you separate house and lot mentally, it’s easier to see why. In any of the South Bay, the house construction cost for a reasonably nice house is about $300/sq. ft. That makes a 2000 sq. ft. house about $600,000. Your example of tall skinnys (or two or three on a lots) is just a way to reduce the lot cost.

Lets say we’re going to buy lots in Manhattan Beach, Redondo Beach, Torrance, and Hawthorne (Holly Glen). I’ll guess at lot costs being MB ($1,100,000), RB ($850,000), Torrance ($750,000), and Hawthorne ($200,000 exaggerating way, way low). That gives us total prices of MB ($1.7M), RB ($1.45M), Torrance ($1.35M), and Hawthorne ($800k).

The price difference across these areas is nothing to sneeze at, but none of them is approaching affordable.

Trekker

This is so short sighted, it’s difficult to know where to begin.

With either investment strategy, you have to sell in order to lock in the gain.

The securities investor can simply sell and do whatever with the liquid proceeds over original purchase price. Indeed, taxes are a cost of the gain.

The capital gains exclusion is only a net benefit when you profit on the sale of a primary and purchase another of like kind at a discounted price level. For most, this means renting between peak and dip. Unless that is part of the plan, talk and unrealized market value gain is cheap. There’s no free ride either way.

Thanks, Doc! Income matters and this has been the weakness of the U.S. economy:

http://www.informationclearinghouse.info/article37295.htm

The rich get richer and the poor get poorer.

I am a fortunate one who loaded up on option ARMS and subprime financed fixers near the beach. I have a number of these properties, and when I was buying, everyone said “buy now or get priced out for ever”. So, I bought and bought, and just as they said, people who did not buy did get priced out forever. As long as the FED keeps printing, and they will in order to avoid a US sovereign debt crisis, prices should continue to march upward. There may be short term dips that last a year or two, but in the long run, much higher. 20 years from now, you will be amazed how high coastal real estate is.

Thanks for letting us know that we’ve finally reached forever. I must have missed that in the news.

When people discuss who/what defines “rich” nowadays gives me pause. What is wealth, really? Money and acquisitions? Wealth measured by a culture, value of knowledge, education and life experience, love, compassion, dignity, respect, morality, etc. is a far different thing.

I suppose QE is creating “wealth” for certain segments of the population. But for all the “wealth” being created, I think the US and perhaps much of the world is sliding into cultural bankruptcy.

Nicely done.

I’d also like to know what is the definition of “the economy.” Yeah, I know how the Econ 101 book defines it. It says that “the economy” is the GDP. But the GDP is a piss poor measure of wealth, as it doesn’t take into consideration public or private debt (and certainly not off-balance sheet debt.) But all we hear from central planners is “do it for the sake of the economy.” Sure, they can juice the GDP figure by increasing debt and government spending. But this is akin to an individual who takes a $5000 cash advance on a credit card, while proclaiming that they earned $5000 more dollars this year of income. When are we going to start measuring “the economy” with a balance sheet instead of an income statement? A high GDP means nothing if everyone is in debt up to their eyeballs.

Actually blert’s friend Steve Keen measures GDP as income plus change in debt. Most economists believe that debt cancels out at the total economy because one man’s debt is another man’s savings. This is actually not true but this explains why most economists do not include debt in their analysis. This is why the outgoing Fed chairman would state during the debt crisis that there was too much savings when we were in the single digit savings rate…

When The Bernank says the savings rate is too low, what he is really saying is that there is untapped wealth which he can further extract from the people (i.e. more blood from a turnip.) QE is wealth confiscation…it is designed to make people part with their money. So, in a sense your saying “one man’s debt is another man’s savings” is true. QE improves the balance sheets of the banks and cronies, while it erodes the balance sheet of the taxpayers, the middle class, and the working poor.

Interesting article from ZeroHedge today on lending.

http://www.zerohedge.com/news/2014-01-06/guest-post-debunking-real-estate-myths-%E2%80%93-part-2-overly-stringent-underwriting

Once upon a time there was an occupation known as loan officers. They evaluated a borrower’s credit history, ability to pay, collateral and other factors in order to make lending decisions. Today, the title of loan officer may still exist but they are nothing more than children playing with a toy, the one that inserts pegs of different shapes into holes of the same shape. The mortgage version of this toy has only round holes. Round pegs will fit into this hole with ease. Good luck if your pegs are not round. A round peg borrower is a W-2 household, or one with a few years of steady tax returns. A so-so credit score in the low 700s is more than adequate. Even a 580 score is enough to get you an FHA loan. Do you have any idea how irresponsible you have to be in order to have a credit score that low? Speaking of the FHA, borrowers now may become eligible for an FHA loan just one year after a short sale, foreclosure or bankruptcy as long as they can show they experienced financial hardship due to extenuating circumstances, such as unemployment. You have to read this HUD instruction to believe it. FHA also allows co-signers, including blending the family members’ income credit to arrive at an acceptable ratio and to cover the down payment as a gift. How much easier can it get?

Sigh. If it is so ‘easy’ to get a mortgage, somebody show me how it’s done. With a stable income (though 1099-based) and near-perfect credit I can’t seem to qualify for anything. I guess I’m out of luck cause my family doesn’t have money to kick in for a down payment or to co-sign.

Heathen- Consider yourself one of the chosen few. You are forced to live life as you earn it, and avoid the shackles of debt. Congratulations.

3.5% down FHA or 5% down conventional.

1099 income is fine, but, they will qualify off the Federal tax returns.

Freedie Mac (conventional) also allows co-signers “non occupying co-borrowers”.

You are correct on the Back To Work FHA program allowing only 1 yr seasoning for fc, ss, bk, etc.. but there are certain requirements that need to be reached with mounds of documentation to substantiate everything. I only know 1 or 2 lenders (I am a loan officer) that have closed these types of files.

I dunno if this occurred to the rest of you but after this year’s winter, there will certainly MORE people migrating to SoCal, not less. With the uncertainty of what future winters will be like, due to global climate changes it’s very clear where everyone wants to be.

I doubt few people in other states who have good paying stable jobs will give those jobs to roll the dice in high cost California; there are other things in their lives that take priority over weather. I believe most of who might move to California will be youthful idealists and low skilled poor with little to lose. A few will succeed, settle into living wage jobs; however the vast majority of California Dreamers will likely get stuck in low wage jobs, live in crowded marginal neighborhoods and/or wind up on govt bennies. Welcome to California, swimming pools and movie stars.

Spot on. There will be no mass migration from back east to California because of a little harsh winter weather. There will be some young hipsters who will move to SF area to work in tech related jobs, others who will move to the LA area to be near the entertainment industry, and then still others who will move to San Diego to be near the beach. There will be some Asians (mostly from China) who will buy in certain upscale areas like Irvine in OC and in the SF Bay Area. The majority of new immigrants to California will continue to be from Mexico and Central/South America. Most of California will continue to look more and more like south of the border.

Sorry….but anyone with a semi-decent job in the fly-over regions will not be moving to California due to harsh winters. I have family in the midwest and east coast. There is no way in hell these people are giving up their 3000 sq ft SFRs on tree-lined 15,000 sq ft lots that they paid $150K for for a 900 sq ft condo in the valley. Not…going…to…happen…

No, they will be moving to Arizona, Texas (no income tax) and Florida (also no income tax) …

Does it occur to anyone else that smug propaganda such as this is part of what’s turning people off about SoCal and the state of California in general?

Not trying to be an alarmist because its certainly not my area of expertise, but the whole fukishima/tepco issue seems like it may have come to the Pacific coast already or is coming soon. There have been more articles brewing as of very recent as well as YouTube videos of radiation on the pacific coast. Also, the currents from Japan may kill our seafood on the pacific too (of course we’ll lie like Japan too as the fishing/food/restaurant industry will demand silence. You may not need that earthquake in CA if radiation is all over the beaches to effect home prices. I’m not saying this will happen nor can one determine its impact, but its probability of damage is increasing and the damage will be pacific coast based mostly. Real scary. The scariest thing about life these days, IMO and a few friends, is just the utter uncertainty in the world and how it feels like the mainstream media and TPTB have no fear of lying to our faces about almost everything that actually matters/impacts our lives, even when the truth is the opposite and they know the Internet provides alternative info. Scary world. Of course, we’ll complain and do nothing, but still scary.

The Fuku story is a very scary one! I have been following it for the past 2 yrs. Lot’s of good info on enenews.com

Just as big, if not bigger, is the calamity that the tsunami has inflicted upon the oceanic biota.

The typical radiation — so many months after the disaster — idiocy of TEPCO — is eclipsed by the debris that is, apparently, killing off fish near and far.

It’s a known fact that most pelagic fish can’t get past netting — even if the net effect is driven by mere tsunami debris. There are countless tails of astonishing mats of tsunami detritus at all points of the compass — millions of tons. The stuff is NOT sinking.

I am coming to believe that only active measures will do. If nature could’ve washed this junk all away, it would’ve done so by now.

The bill should be handed to Tokyo, for Japan authorized those insanely sited atomic plants.

They were begging for trouble.

I don’t think that you can EVER site an atomic plant adjacent to such flaming tsunami coasts.

Likewise, Japan should make some effort to STOP urbanization of low terrain adjacent to its north-east coast. It’s a rotten place to concentrate people and assets.

We see the same insanity along the American Gulf and Atlantic coasts: development is permitted exactly where it’s long been established that nothing can survive the next big blow. A storm that’s never more than a generation away — at the best.

We don’t have to put houses EVERYWHERE. Save something for nature. Sheesh.

Debris? Disagree. The radiation that is posioning our ocean and food chain in the largest man made disaster in history is far more important than debris. How about radioactive particles in the atmoshphere, land and sea that have a half life of a few hundred thousand years?

How about cores that are still in the process of melting down and spewing out radioactivity on a daily basis into the sea and air. This is a global event that is (for the most part) being swept under the rug. This is exponentially worse than Chernobyl and that disaster had 10’s of thousands of people helping to stabilize it. The world needs to combine all of it’s resources and top experts to get this thing under control, but alas, that wont happen. Not Good.

bmd…

I can see from your post that you’re not any kind of chemistry student — let alone a graduate.

1) LONG half-lives = NO THREAT

Most stuff has a half-life of infinity… it’s not radio active at all. Then you have Uranium 238. It’s half-life is staggering: 4.5 Billion years! You can swallow the stuff and not suffer atomic effects. (But don’t even try — it would go down like a heavy Barium brew.)

2) ULTRA short half-lives = NO THREAT

Some radionuclides decay so fast it’s hard to time them. (Cloud chambers are used.) They’ll never ever reach you.

Others last fractions of a second.

In the case at hand, a GE boiling water atomic reactor system, Nitrogen 16 is created in the steam loop during ordinary operating conditions.

http://en.wikipedia.org/wiki/Boiling_water_reactor#Disadvantages

N16 has a half-life of 7.1 seconds. It was because of this that TEPCO operators balked at venting the Daiichi reactors when they had the chance — when it would’ve helped.

Its prompt decay products, C12 or O16, are stable.

This was an EPIC failure to react correctly. It HAD to be transparent that a tsunami of astounding scale was headed straight to the plant: the quake had already vaulted the plant’s personnel clean into the air — over five feet into the air. They were on tsunami coast.

Yet, the operators were fixated on not releasing ANY radio activity into the environment; even though Nitrogen 16 was HARMLESS. In a single minute, a half-life of 7.1 seconds would have faded the Nitrogen 16 8.5 half-lives! Thats (0.5)exp(8.5-1) ==> 0.7815% of the starting quantity — itself a modest amount.

Further, the GE design has allowances for venting that were/ are supposed to trap radionuclides.

….

No matter: What was ESSENTIAL was to get the pressure down from operating level ASAP so that the maximum cooling of the residual atomic heat could begin.

TEPCO failed to even dream of this essential need. Had the operator vented the reactors down to zero pressure make-up water could’ve been injected at speed to keep the hot elements flooded. Dropping the pressure would drastically lower the temperature of the core. Steam can carry away a staggering amount of heat. Indeed, once the rods were scrammed, the heat generated fell to a trivial fraction of normal. The diesel sets could have pulled the core down hundreds of degrees — as ocean water would’ve been injected. (One forty year old reactor was originally scheduled to be scrapped out only ninety-days into the future. It’s value was nil under the dire circumstances.)

Instead, TEPCO operators froze at the controls — like a deer in the headlights — which officialdom has tried to obscure. They just sat and watched — waiting for the doom.

…

Back to your original scream: the radionuclides of concern are items like Sr-90 and Iodine 131. They are well absorbed into the body, and are hot enough to really cause trauma. They are not so hot as to decay before they contaminate the environment.

Even Tritium (H3) is of concern. But, at least you can flush it from your body fast enough to avoid horrific damage. (Think water) The Iodine and Strontium stick around too well. (Strontium acts like Calcium and goes into your bones — think marrow troubles.) (Iodine give your thyroid nightmares if it’s radioactive. This is why the government has stockpiled KI pills.)(Potassium Iodide salt.)

Anything with a half-life measured in more than a thousand years is — typically — of no concern at all. It’s such a feeble emitter that it does not create dire straits.

Please, scan Wiki and get better informed.

…

Lastly, the huge radio activity numbers early in actually mean nothing. They evidence the fast decaying isotopes that were never a concern for us distant Americans in the first place.

The isotopes of worry are hardly even going to show up in those alarmist statistics! The pernicious Iodine and Strontium get lost in the storm of data. These are the nasties that kill far, wide and long. They never register with impressive stats.

In contrast, the tsunami debris seems more than capable of destroying the Pacific Ocean food chain. Everywhere we turn, the reports are coming back of truly terrible shrinkage in every pellagic species. Bleak starvation for many a person might be directly ahead.

This effect is only compounded by fears of Iodine and Strontium contamination. Because of their power, it’s easy to pick out single, solitary, atomic decays. There are 6 x 10^^23 atoms in a single gram-mole of any element.

600,000,000,000,000,000,000,000 =

Six hundred-thousand-trillion-trillion in 12 grams of Carbon.

This is why it’s possible to get such absurd precision in all things atomic.

Always keep that in mind when you hear of nuclear radiation. The figures typically are counting deep down into the trillions of trillions.

Leave a Reply