Baby boomers moving back home with mom and dad from the silent generation? 2 million adults live with parents in California and those 50 to 64 moving in with parents has surged.

House horny Californians try to avoid the overarching statistics starring them directly in the face. Many Californians are all hat and no cattle. We already know that many Millenials are moving back home with mom and dad because they simply cannot afford to rent or buy a home in the golden state. The golden sarcophagus with nice granite countertops is getting a little more crowded for baby boomers. A recent analysis actually found that many baby boomers as well had to move back in with mom and dad. No, they are not trying to save for a down payment or take care of mom and dad. The vast majority are moving in because of economic hardship. So much for the theory of pent up demand. The buyers of the last few years came from Wall Street, cash investors, foreign buyers, and house lusting people leveraging every penny they have to buy a home. So it is no surprise that more than 2 million adults are now living back home in the rooms they once occupied as teenagers. I actually dug up Census data and highlight why the flood of buyers is not materializing. This also points to more locked up housing units as boomers move in with those from the silent generation. Just more evidence highlighting the transformation of California into a feudal state and largely a rental focused market.

Boomers moving back home

The story about adults living at home is no surprise. I caught a clip of Conan O’Brien joking about older Californians moving back home with their parents. So I dug up the latest data on this trend and found some interesting information:

“(LA Times) For seven years through 2012, the number of Californians aged 50 to 64 who live in their parents’ homes swelled 67.6% to about 194,000, according to the UCLA Center for Health Policy Research and the Insight Center for Community Economic Development.

The jump is almost exclusively the result of financial hardship caused by the recession rather than for other reasons, such as the need to care for aging parents, said Steven P. Wallace, a UCLA professor of public health who crunched the data.â€

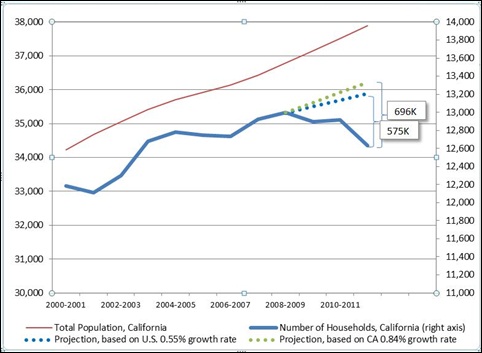

This is an incredibly big jump that was hidden in the midst of Millenials moving back home. In total, more than 2.3 million adult children in California are living at home with their parents since the Great Recession hit, a 63 percent increase. This is why household formation in California has been so pathetic. First, take a look at a projection from the California Association of Realtors (CAR) put out two years ago in 2012:

Source: CAR

You can see the “pent up demand†argument here. According to more normal times, you would expect household formation to grow with population growth. This simply did not happen. Given the wickedly low sales volume in the state, having 575,000 or 696,000 additional households would certainly add to demand assuming people could actually afford to buy at current prices (which they can’t). The buyers have largely come from the investor crowd.

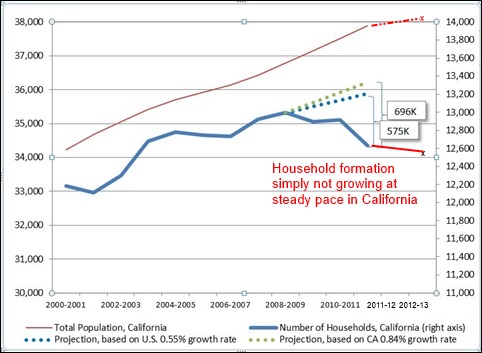

So what did happen? I went ahead and pulled up recent Census data and this is how the chart would look like today:

California’s population is now over 38.3 million but look at household formation. Household formation actually fell over this period of time! Why? Because these folks moving back home are largely doing it because of financial struggles, they are not trying to save cash to out compete some house horny home shoppers:

“The numbers are pretty amazing,” Wallace said. “It’s an age group that you normally think of as pretty financially stable. They’re mid-career. They may be thinking ahead toward retirement. They’ve got a nest egg going. And then all of a sudden you see this huge push back into their parents’ homes.”

Many more young adults live with their parents than those in their 50s and early 60s live with theirs. Among 18- to 29-year-olds, 1.6 million Californians have taken up residence in their childhood bedrooms, according to the data.â€

It is fairly clear that this is the primary reason why household formation in the state stinks. Now with investors pulling back, you are seeing inventory pick right back up and sales plunge. Lemmings continue to buy houses but what is new? You are starting to see more data showing how incredibly overvalued some areas of California have become. More and more people are simply stretching their budgets and pouring more of their net income to housing costs.

In some cases, even higher rents are pushing people back home:

“As with Rohr, those in their 50s move in only as a last resort. Many have exhausted savings. Some have jobs but can’t shoulder soaring rents in areas such as Los Angeles or San Francisco.â€

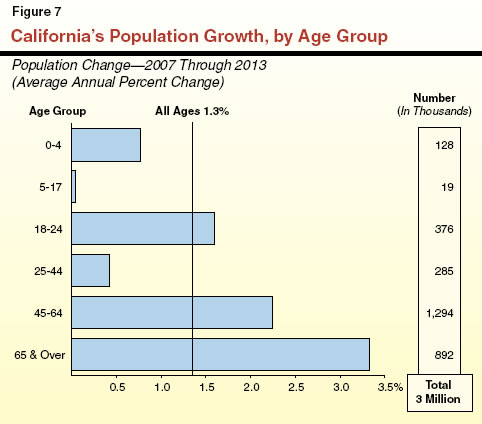

This is not a positive trend especially since the fastest growing group in California is the baby boomer group:

Many of these boomers realize that there is no way their kids are going to have the funds to keep this party going (some are “gifting†funds to their kids but this is not the majority for the state). Some think that these boomers will unlock equity and fund their kids. Hah! Most are trying to pay the bills and many are seeing their kids move back home. The study found an astonishing 42 percent of those living at home work (as in 58 percent have no jobs). Forget about buying, these folks can’t even afford rent:

“(CS Monitor) There were 433,000 older adults, age 65 and over, who housed approximately 589,000 of those adult children,” the researchers said in the report released by the UCLA Center for Health Policy Research. Those figures were generated from federal census statistics, said the report’s lead author, Steven P. Wallace.

Of those adult children living with older parents, researchers found that only about 42 percent were employed, putting a significant strain on the parents to provide not only housing, but also necessities like food, medical care, and transportation for them. To do so for just one adult child, the study found, costs the average couple about 2 1/2 times more per year than they would pay just to take care of themselves.â€

Giant pools of stashed hidden cash? For some but certainly not the larger trend here. If that were the case we would be seeing sales volume surge, wages going up, and a flood of buyers in the overall market. That simply is not happening. The trend is clear and what is left of the middle class in California is getting priced out. I’m sure some will talk about how Newport Coast or Malibu will always be prime but that has always been the case. It isn’t like middle class Californians were targeting these beach cities to begin with. Yet looking at the bigger picture, these macro trends don’t point to a pent up demand of households ready to buy.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

123 Responses to “Baby boomers moving back home with mom and dad from the silent generation? 2 million adults live with parents in California and those 50 to 64 moving in with parents has surged.”

Hello Doc.

I have several aging boomer friends who are over 55 years and after being laid off from their full time good paying jobs have now been unemployed for a very long time.

There are many articles about the dwindling employment opportunities for the older folks…

http://www.apnorc.org/news-media/Pages/News+Media/for-jobless-over-a-challenging-search-for-work.aspx

http://www.economicpopulist.org/content/long-term-unemployed-baby-boomers-2013-5345

As if incomes matter…

They do to the 1%. The 1% are really raking it in:

http://money.cnn.com/2014/05/01/news/economy/richest-1-income-oecd/index.html

i work for the state of calif and they are always hiring older people who are on their second or third careers

Housing in Santa Cruz County is hotter than ever! Multiple offers on everything under $750,000. Will we see this start to change?

Ne-vah!!!

you need to get a hobby. You’re one-hit wonder!

Marco? Marco? Don’t you mean one trick pony? In the end, arn’t we all one trick ponies? I think the fact that I changed my trick might confuse some but hey what’s really the difference at this point? How-zing to go up fo-eh-vah!!!

Doc – you are not taking into consideration the following:

“35% of households in OC making over $150k is a lot of households. Most have families and they “have to live somewhere,†which means “ownership†because of the “American Dream.†Call them outdated cliches if you wish, but they are part of the American mindset and culture. What? and others are the outliers tilting at windmills. You want hh making $150k/year to rent? Good luck with that PR campaign.”

YES!!! I think $150,000 could buy in OC if we start my 1,000,000 year loan at -5% interest rate program then we will unlock all that pent up demand.

“Besides, yes, there the 1% is a large and growing global class, and, guess what, prime SoCal offers one of the best lifestyles in the world for the rich to buy! And, and, wait for it, SoCal is actually a bargain compared to other global destinations. Haters just don’t get it.”

Completely agree!!! Rich “Red” Chinese will buy fo-eh-vah!!!!

“From 1981 to 2012, the share of income that the top 1% of Americans take in has more than doubled, according to a new report from the Organisation for Economic Co-operation and Development. The rich now earn about 20% of all pre-tax income in the United States, up from 8% in 1981.”

Exactly!!! These 1% are eyeing all those 1200 sf cracker boxes in Torrance to get a piece of the dream! Couldn’t agree more!!!!

“The report called the increase “spectacular,†and noted that the share of income going to the super rich — the top 0.1% of U.S. earners — has more than quadrupled over the 30 years since 1980.”

Exactly!!! See above comment…

There’s just so many haters shittin’ on our housing parade! It really is about their hatin’ and nothing to do with their point of view. Why debate about the issue at hand when we can deflect the debate to be about those bringing up the issues?

I’m really worried about our golden goose being impacted by common sense and intuition. We need to keep up the good fight and let everyone know on these housing hater blogs that it’s always a good time to buy and that it really is different this time.

Perhaps if we keep a rotating roster of smoke and mirror hat tricks going, it will be enough to keep future recruits distracted by the show and therefore they won’t notice the man behind the curtain. How about the first performance starting with an opening act of rich Chinese to buy what Americans won’t, for act two – buckets of money floating around, an intermission of prime will always be top shelf, followed by a final scene of hurry before being priced out forever.

You had me until “common sense”. WTF is “common sense”? I would feel much safer if you replace those two scary words with calming words like “unicorns” and “rainbows”.

I’d like to ask the earlier iteration of What? a question:

Why are 4 out of the 5 most unaffordable large metro areas in America and 5 out of the 5 most unaffordable small metro areas in California?

…poorly expressed. In America, why are 4 of 5 most unaffordable large metro areas and 5 of 5 most unaffordable small metro areas in California?

I will ask the old What? if I ever see him again. Until then, I see housing to go up 1,000,000% over the next few years!!!

Guffaws aside, with the major forces impacting housing affordability macro in nature, still no explanation for why the most unaffordable small and large metro areas are in California. “California is a boom/bust state” is expert analysis, no doubt, but there has to be something more to consider besides unicorns and hopium (member that one?).

A house that I was looking at buying last year sold for $490k here in La Mesa (San Diego suburb). It was new construction, but very basic finishes. Seemed like an okay deal but I passed on it. The guy who bought it just listed it for $675k and honestly it seems like a “good deal” compared to what else is out there at that price.

If this isn’t a bubble then I don’t know what is.

It is progress!!! See!!! You lost big!!! Now go find the nearest broker (funny how that word rhymes with broker aka more broke) and buy now or fo-eh-vah be priced out of the how-zing dream!!!

Housing is really about banking. When you buy a house, you need a loan from a bank. That loan becomes a bank asset. Real estate crisis is really a banking crisis in which that loan is defaulted, and the bank asset is going down. When Fed came in to buy that loan asset at face value, then the bank is fully compensated, plus the bank didn’t have to mark to market for their asset. So bank crisis is over. If the loan asset is at face value backed by the Fed, there is no need for the bank to fire sale anything. If nobody will sell at discount, how can the house go down?

Income only comes in to play when you are getting a loan, and service a loan. Banks are not interested in giving anyone a loan now, that’s why you need to go through a colonoscopy to find that hidden gold in order to get a loan.

I bought a house through auction last year due to my job change. What happened was that the bank sent out people to cut grass and maintain the water pipes regularly. Most people in the neighborhood do not know the house was bank-owned. The bank didn’t care if you buy in cash or a loan, and it didn’t care about a quick closing either. It takes as long as it takes for the bank to do their thing. You cannot get anyone breathing to talk to you.

There will be no next banking crisis in a long time.

Geek alert – For “fun”, I wanted to know what % of income renters are paying nationally and for my market, Portland, OR.

Based on a median of the bottom 40% of US households income paying the average rent takes 60% of median household income.

In Portland which has average household income, a median of the bottom 40% of households pay 115% of post tax income on rent/utilities.

I assume renters are generally in the bottom 40% of household income earners and that matches w/ 35.5% in US live in non-owner occupied housing.

Average rent in US = $9,192/yr; multiply 20% to rent for utilities, etc. (average total cost of rent/utilities = $11,030) and take off 10% from income from median bottom 40% income for SS, medicare, sales taxes, etc. assuming this set pays little to no Federal / state / property taxes (median bottom 40% household income = $18,535) . This means median of bottom 40% of households pay 60% of their after tax income on rent/utilities.

Average rent in PDX = $17,688; multiply 20% to rent for utilities, etc. (average total cost of rent/utilities = $21,225) and take off 10% from income from median bottom 40% incomee for SS, medicare, sales taxes, etc. assuming this set pays little to no Federal / state / property taxes (median bottom 40% household income = $18,535). In Portland which has average household income, means median of bottom 40% of households pay 115% of post tax income on rent/utilities.

Jus saying, seems like a pretty high % and there must be a hell of a lot of subsidies (SS, welfare, section 8, etc.) to allow these folks to make their rent payments…and probably doesn’t bode well for further rent increases or the economy in general???

Even if I take the bottom 60% of income earners…

In Portland which has average national household income, median of bottom 60% of households pay 77% of post tax income on rent/utilities.

Average rent in PDX = $17,688; multiply 20% to rent for utilities, etc. (average total cost of rent/utilities = $21,225) and take off 10% from income from median bottom 60% household income for SS, medicare, sales taxes, etc. assuming this set pays little to no Federal / state / property taxes (median bottom 60% household income = $27,700).

Chris, how do you draw the conclusion that rents are “high”? What is the right level of rent according to you?

I don’t know about Portland, but in LA we are not living in a communist utopia, and rents are determined by the amount of stock available and the ability of the ***marginal *** renter to pay. Even if rents are “high” they can remain so due to lack of new construction because of zoning, NIMBYs, and other reasons. People adapt to this by taking roommates, doing Airbnb, eating out less and so on. There are also people who prefer eating out, going to concerts, drinking microbrews and ironic hipster fedoras over their autonomy. Those people live with their parents. Whatever. Note that just because we find something unpleasant doesn’t mean it can’t go on, or get worse for that matter.

Notorious, I would say that rents are high based on the amount of “for lease” signs I see each day. Have you driven around Hollywood lately? They are building apartments at an astonishing rate, although they are all $2500 “luxury” apartments. Any building you drive past has a vacancy sign. The new buildings that are finished clearly have high vacancies. Look at the balconies. They can keep asking those prices and hiring a staff of four for their “leasing offices” to post ads online all day, but eventually they are going to start competing with each other and lowering prices.

Its high times for the sign twirler companies.

Honestly when the rates do come down and these things start to fill up our surface street congestion is going to be even more ridiculous.

Low-income households can live in some pretty nasty, low-grade rental properties that come in well under $9K-$11K per year. They group up and split rent in some sort of shared or rotating fashion or cycle in and out of the domiciles of relatives who “own” their homes.

Just drive through the poorer areas of Portland and study the landscape…really study it. Stop into an apartment complex (one that will never be in the local apartment finder) and ask the rental agent about rates and payment options. You’ll be surprised at how things are configured vs. more middle class complexes. In my salad days I used to live in the vicinity of poor people (not in Portland, mind you). They are amazing! They are infinitely adaptable and expend immense amounts of energy just making it day-to-day. I always wondered why they didn’t apply their craftiness to more gainful endeavors, but oh well.

If you’re looking at Portland, why include sales tax? But that’s nitpicking. I can’t tell from your numbers if you’re looking at the MSA, or just the city itself. The city runs higher because, a) it’s the city, and b) the rental stock in many ‘hoods skews more towards SFH, and most of the new apt. construction is higher end.

As notorious and Chris D. note, the prices in Portland are sustained by supply/demand, and adaption. Portland didn’t build much in apt. stock during last decades housing boom, and what’s being built now in the city is mostly high-end like the south waterfront.

At current asking prices I suspect more rentals would go unfilled except that people make adaptions to make it work, whether that’s groups of 25 y.o. packing 4 people into a 3 BR, or a family bringing in extended family or even an unrelated renter to make the numbers work.

But on the whole, sure, if you look at what households (particularly traditional families) make, the continuing surge in rental prices is making vast swaths of Portland a stretch these days if you want to make a go as a traditional middle-class household trying to rent.

Hollywood is a special case owing to a failed development plan. All the new (ish) nightclubs have made H’wood even more disgusting than before, and this as you correctly note is coupled with a lot of new units which are aimed at higher earners predicated on the idea that the area would become more desirable, not less. Oops. I can’t comment on Portland. BTW, don’t know if you know this, but these developments are constrained in their ability to complete on price via covenants in their loan packages which limit concessions and decreases in target rent. (because these often trigger a vicious cycle – poor ppl beget more poor ppl, and there goes the neighborhood.)

But even if we were talking Brentwood, It would be a mistake to believe that things will “return to normal”. Thanks to globalization, our non – rich will more greatly resemble the developing world non rich. That means large housholds devoting their entire collective income to subsistance. This is what we get for demanding that T-shirts should cost $8 and hence buying Chinese made stuff at Walmart. The effects of globalization have only just begun, and my bet is that in 30 years these will look like the good old days.

WTF is up with all the math? Have we not all learned by now that math has been proven scientifically false? Math, gravity, physics, etc. have gone the way of alchemy and we have replaced them with new sciences like unicorn fartology, rainbowology, this time is differentology, etc… Come on, you are sounding like my grandpa. “Math”, “percentage”, “economy”, what quaint concepts… Horse, buggy, buggy whip kinda makes me chuckle…

yeah, totally old school…just thought showing rents are high (one time) is better than stating my opinion rents are high. That discussion can now be set aside. Now we can get back to our MSM discussion of markets growing to the sky absent any income growth…nowhere is this more evident than rent based on income/savings vs. housing prices based on credit/leverage…

Oxnard is beach front property. It is cheaper than the $5million estates in liberal Malibu and Newport. We are just simple working folk in Oxnard, with a beach view and ranchero music. Remember Cinco de Mayo this weekend. The locos seem to keep the outsiders out from bidding up the prices here.

There are 2 completely different ‘nards. There’s a world of difference, in both price and lifestyle, between the waterfront homes right on the beach or with their own private docks in Channel Islands harbor and the barrios near the center of the city and out toward the 101. I do think the latter serves to scare some folks away from even the nicer parts of Oxnard, though. Where else in CA can you get waterfront with a private dock for under $1M or beachfront on the sand for under 2?

If I were more into sailing and watersports I’d have seriously considered one of the homes in the harbor.

We like our little Mexico Newport the way it is. Mariachi bands are very popular.

Oxnard, aka: Compton by the sea. lol

More like “Tijuana del Norte”

After my professional baseball venture ended, I played in a Ventura County fast pitch A league. Many night games in Oxnard and surrounding area. Yes me and the wife couldn’t get to the parking lot soon enough and leave?

DUDE – ZIP IT!!! You are letting everyone in on my retirement villa plans!

And right down the road a piece there is the even better ocean front deal in Port Hueneme. You can have an ocean view 2 bedroom condo for under $300K and a whole house less than 1 mile from the sand for under $500K. Take that Manhattan, Newport, Huntington, et al

Pseudonymous Carlos is an unrepentant bigot. Just like Donald Sterling, some day you’ll come out of the dark and the hammer will come down on you.

Look who is writing and threatening violence, with a hammer no less. You must be in construction. It is party weekend, take another toke and settle down.

Better take another look at the Oxnard waterfront prices. They have shot up in the last 2 years or so. The investors discovered Oxnard and worked it over. This is not just the housing problems of different generations. It a story of a country that has been completely stolen from its people. We have 2 Americas, the 1 to 10% , the psychopathic rich, and the rest of us. They have the money, they make the laws, they buy anyone and anything they want. As long as the vast majority of Americans do nothing it will get worse and worse. Read Thomas Piketty’s book, “Capital in the Twenty First Century”. It’s a brilliant book by this brilliant French scholar. We are a mess and it will get worse and worse until we finally vote the creeps out of office and make big policy changes. That is not going to happen any time soon. The so called intellectual congressman Paul Ryan is currently doing a ‘study” to prove there is really no poverty in the United States. What hope have got we with leaders like this? We live in a country with no care for children, no care for the elderly and a huge growing poverty rate. Have fun. I am thinking of returning to Mexico. I am old now and so sick of of watching the American people drown in junk food and cable TV. It will get worse. Many of you haven’t seen anything yet. And we haven’t even mention the homeless elderly who have no parents to go home too and no kids to take them in either.

Bobi, do you really think that somebody at the 10% income bracket has any say as to how the country is governed? The people calling the shots are all in the top 0.1% bracket – the people with the bucks to grease the system. “The psychopathic rich” as you call it are not the people in the 1% to 10% bracket…

The top 10% starts at $145,000 a year for household income. So do you consider a neighboring family where two parents both work full time with each making about 70-80 thousand each to be the “psychopathic rich”?

Last fall our cat went missing so we went around our neighborhood passing out fliers.

Our neighborhood is roughly 3 blocks wedged between busier streets. I would estimate about 200 homes.

While we didn’t even speak to half of those people personally, 3 different times, people we did speak to brought up that their 30 something kid was living at home with them. We weren’t asking any kinds of questions about that, just asking if they saw our cat.

I wonder how many more didn’t offer up that same information. Oh, and I would say about ten homes appeared totally unoccupied.

The key to polling is in framing the tone of the question to shape the answer.

Since you told them about your cat, that voluntarily left your home, you are inclined to receive unsolicited responses from other individuals suffering from the anxiety of having a house guest who is not inclined for whatever reason to leave of their own volition.

Had you rather stated that you had lost your “dog” the unsolicited responses would have been more likely to emphasize the relative success of or achievements made by their successful offspring.

What you have experienced is the age old truism of humanity; Dog People are cool, Cat People are weird and people that go “both ways” are the Devil incarnate and bringing about the end times.

True dat.

There are plenty of cool cat people. Here’s one.

But I don’t think that’s what we are here to discuss.

http://yourcatwasdelicious.tumblr.com/post/20785358234/johnny-cash

Mr. Observer I have to rescind my bias for dogs over cats.

http://jalopnik.com/cat-rescues-child-from-dog-attack-in-driveway-makes-be-1576282099

This one spectacular example has redeemed his entire Phylum.

I have quite a few people I work with who are in their 30’s and live at home with mom and dad. I’m sorta shocked really. At first I thought it was a temporary arrangement but years later guess what, they are still there and they have NO intention of moving out to either rent or buy.

The thing that amazes me the most, is these women all earn damn good salaries, but they tell me the are BROKE. Have no savings, have car payments, credit card debt and some of them even complain they have bad credit. How the hell do you have bad credit if you don’t have any living expenses????

These people should be able to stand on their own 2 feet but I guess they figure they’ll just wait for mom and dad to croak it, then they’ll get the house.

Calgirl: Good for them. Hopefully they’re just telling you they’re totally broke. My sister has just turned 30 and she’s a top-flight Corporate Lawyer (Associate). She still lives with her Mom. Why not? She’s single and quite depressing to rent alone, and wants to save some money. Also in this instance, she contributes more for her upkeep than it costs my mother to house her. It’s also called enjoying living with family.

If my sister wasn’t living there, I may become frustrated towards my own Mom. She would be hogging a family sized 4 bedroom family home all to herself. Just as I’m annoyed that these US ‘boomerangs’ as we call them in the UK, are returning to their elderly parents homes, who still have spare bedrooms for them. They should downsize! Get some property on the market instead of hogging family homes. I can’t get as sympathetic as the Doc to the extra cost on some older parents of allowing older adult children to return home, when they’re mostly owners of assets which are now worth fortunes.

Even if the women are telling you the truth, just goes to show housing isn’t everything to all people, that demand for housing is a very flexible thing. Hopefully when the frenzy buying dies down, we’ll find a chasm in the price-point remaining buyers are willing to buy in at.

@Calgirl,

I know people who fit this profile:

Starbucks, twice a day, $10/day

Lunch at restaurant, $10 to $20/day

Dinner at restaurant, $15 to $25/day

Mercedes/Lexus/BMW lease + insurance + maintenance, $1000/month

Gross income needed for this: $3000/month or $36K per year minimum.

Living with the parents cannot override living large. People can live with mommy and daddy, pull in $50K a year and still be flat broke.

Add to that list: Compulsive shopping and hoarding. One of the “stay at home grown ups” at my work, she has over $40,000 of brand new clothing, shoes and bags in her “suite”. Stacked to the ceiling in every possible place. Most still have tags on them. She said she gets bored so she shops.

Its one thing to live at home with mom and dad if you are working towards your own financial goals. Its another to stay there forever and mooch and spend everything you make. I’m sorry but its time to grow up and stand on your own 2 feet. You shouldn’t be making $75,000 a year and be dead broke with crap credit when you have no living expenses.

Log onto OkCupid, Plenty of Fish, or Match dot com and read the profiles. Everybody is a freaking ‘foodie’; ‘loves to travel’ or describes themselves as ‘well traveled’ as if that’s some sort of asset; everybody has a picture of themselves at Machu Picchu as well as Euro destinations; etc…

I only look at the women’s profiles. There are tons of 30-year-olds who are just now going to university, tons of women who have useless degrees (bachelor in history or psychology) that have screwed around throughout their twenties, sporadically showing up at minimum wages jobs between European backpacking or the like, and every last one is looking for a ‘smart, ambitious, and successful man’ that they can continue their princess complex with.

i am 47 no nagging wife no problem kids. i live with my parents and help with the bills. one big happy family sharing limited family resources. my condo in downtown long beach is in escrow and i will pay off the parents mortgage with the cash.

Ben… in my case I been married a long time but I have a one in a million Irish wife, she has to be great, to be married to a tough minded Italian.

We know of many couples who say, why did I get married and have kids. You enjoy your parents for as long as you have them friend.

When they are gone you can look back and say it was the right choice in your case, good for you.

Consolidating housing costs across generations isn’t an inherently bad thing. Culturally it’s taboo here, but there are many parts of the world where multigenerational housing is normative–and not because “those people are backwards” (or lazy or cheap or moochers). It was not uncommon even here pre-WWII, and it could be so again.

If people live with parents to avoid diving into an inflated market, more power to them. If they pile into houses in order to pay a ridiculous mortgage, not so wise.

America is losing the wide spread upward mobility that once allowed for the creation of individual households. Without that ability, this country is slowly returning to the days of the ruling class and then everyone else.

I believe the post-WWII expansion, which was a direct result of being the only non-broken country in the world combined with socialist-level taxing of the rich, was a historical aberration and not the norm.

“normative” – The word of the week. Please use the word in a sentence. I walked into a trendy coffee shop on the Santa Monica Hamenade (guttural H) and everyone turned and gave me a “normative” glare…

No living expenses – don’t be too sure of that. They could be raging meth / heroin / coke whores.

And they might be waiting for mommy and daddy to croak and get the house, or they could be waiting (forever) for their Prince Charming to sweep them off their feet into the prince’s magic castle. However just like the fairy tale, the dream is just that – pure fantasy and fiction.

Have you every seen a crack/meth/coke whore smoke an entire SFR? It ain’t pretty!

I knew a lot of these people in LA. They had OK jobs but drove great cars and had expensive clothes. I guess you can afford those things if you don’t have to pay for housing, utilities, and food. Their take home was $2-3K month, and I don’t doubt they were in massive debt.

These single people with good jobs who live at home with their parents all have a BMW, trendy clothes, and hang out at all the right places. Children basically in grown up bodies. I work with a few of them and they all live paycheck to pay check with nothing in the bank. Idiots basically.

Or, the question might be, where are all of the poor Boomers going to live if Mom and Dad are dead? Which, you know, is probably a majority of them over 60, since that would make Mom and Dad at least 82ish or so, right?

This is going to be a sad story you’ll be reading about for the next few decades as The Boomers die off with no savings and now no jobs. The NYT just ran an article about older New Yorkers getting kicked out of their rentals http://www.nytimes.com/2014/04/30/nyregion/older-new-yorkers-face-acute-pain-in-finding-homes.html?hpw&rref=nyregion The best solution most could come up with, besides massive elder living complexes built by the government? Move to Florida, old lady.

I think that is why we are seeing condos being bought up by investors in places like Alabama. Also all the news about trailer park investment activity. They are trying to beat the boomers to it.

@Mike M., these adult children are waiting for mommy and daddy (in some cases grandma and grandpa) to kick the bucket. At least that is what I am seeing in Culver City. I assume Pasadena, Torrance, Burbank, and Glendale are seeing the same thing as their demographics mirrors that of Culver City. The income levels in Northridge, Sherman Oaks, Studio City and Encino are significantly highly so they may be different.

CA gains 356k residents?

Unemployment falls to 6.3% 288k jobs added, keep waiting folks for the housing to tank so you can buy a house? Rates are at historic lows, many underwater people want a offer, buy now ?

If you believe those numbers/stats you’re an even bigger moron than we though, lil bobby.

So I’m to believe you that the stock market is going down to 3,000 and houses if you wait long enough will be in your league what $80ft?

I don’t like name calling, let just say you are naïve and not well informed, I do know of a diploma mill in Fla. where you can get a degree in economics. You need to learn capitalist cycles and their trends every 10 or so years?

I’ve read the job numbers are so good because Santa and the Easter Bunny are hiring like crazy. High wage jobs too!

We are turning into Italy with the children coming home to live with mama.

What’s your point?

Don’t worry DFresh. We are okay as long as we don’t turn into Portugal…

Careful Maria, I’m a full blown Sicilian and if my mother (god bless her soul) was alive and my blessed wife was gone, yes I’m running home to Mama (are the Ravioli’s and hot bread ready Mom!!

that ok,smart parents charge rent from their “Adult” kids bank that money for them and in a short matter of time they have a down payment for them to go out on their own.problem solved.

Not so sure. Mamãe has a nice ring to it.

I agree that the job cuts that target Baby Boomers are harming the California housing market. Consequently, the ex-employees are moving back in with their parents. Employers covet “fresh young blood” to boost their short-term profit margins. Please refer to the winter, 2014 issue of The Social Contract. The PDF version of the article titled “Shattering the American Dream” provides an update. A NASA-funded research project notes how the elites utilize the government as a means to enrich themselves, to the detriment of the society as large.

From a March 14, 2014 article in the U.K. Guardian, “The (NASA-funded) research project is based on a new cross-disciplinary ‘Human And Nature DYnamical’ (HANDY) model, led by applied mathematician Safa Motesharri of the US National Science Foundation-supported National Socio-Environmental Synthesis Center, in association with a team of natural and social scientists. The study based on the HANDY model has been accepted for publication in the peer-reviewed Elsevier journal, Ecological Economics.” See: Ecological Economics 101 (2014) 90–102 which is available for a no-cost download from the Elsevier.com website. http://www.sciencedirect.com/science/article/pii/S0921800914000615 This article appears in the May, 2014 issue of Ecological Economics.

The abuse of immigration policies by U.S. elites such as William Gates, III (now worth $76,000,000,000.00 ) that cause unprecedented economic harm to the American middle class is an example of the harmful conduct highlighted in the HANDY model.

zzzzzzzzzzzzzzzzzzzzz leave it to a PhD (Parents have Dough, Big “P”, little “h”, big “D”) to put me right to sleep. So… are you saying that how-zing will go up fo-eh-vah?

What?, didn’t you used to make ‘normative’ comments on here?

What’s wrong with having family live with you instead of selling your place…. especially if you have low property taxes locked in and have the place paid for? Why take a big tax hit on the gain if you and your grown and broke kids would prefer to live together?

I hate to think this, but we might be returning to conditions that make multi-generation households necessary. Remember that, prior to the cheap-fuel driven prosperity of the mid-20th century, such households were the rule, not the exception. And, while I personally prefer to live alone, it might be nice for people who like it to get the benefit of family members to share expenses with and help out in caring for each other in times of sickness or unemployment.

We need to understand that life as most middle class Americans have known it since 1920 or so, is a byproduct of exceptional affluence, and may not be possible for most people in an era of depleting resources and economic contraction.

Refreshing viewpoint! In Europe, it used to be the norm for the children to stay with the parents until they married and for the last child to get married, to remain in the parents house and take care of the parents with their spouse. This could very well be a trend here in California as well because of hardship. I just don’t see any magic bullet to repair the corruption that is withholding empty homes from being sold at whatever price just to get them off the books. Instead we see banks running the show and since there is zero interest on funds they receive from the Fed, they can afford to just sit on empty properties and slowly release them to the market to maximize their profits. Meanwhile, the average American is forced to move in with their parents. You gotta do what you gotta do.

It’s not just grown and broke kids–the super affluent are doing this, too. Why waste 3 mill on an overpriced built-like-crap home when you can move into your aging parents’ roomy well-built mansion with Prop 13 taxes? People are adapting and developing new ways of living. This will only continue unless the system changes.

Prop 13 provides every incentive for old people to live in their homes for as long as possible. It makes much more sense for children to sell their 1995 tax base house and move in with their parents and their 1946 tax base house, than vice-versa. Prop 13 distorts a lot of economics in CA.

Can Prop 13 benefits can be extended by putting the property into a trust?

I’ve been Googling for info about on the other units in my condo building. I know that one boomer woman inherited her unit from her late mother. I’ve since learned from Googling that “her” unit is actually owned by a trust named after her mother.

There’s another unit in my building whose former elderly owners died, which is also owned by a trust in their name. I don’t know if the current residents are relatives of the late owners or renters, but they have different last names.

I am a daughter of the parent that lives in a “golden sarcophagus” in a San Ramon Bay Area Prop 13 home. My dad bought in 1983 and house is paid off. Good layout one story for my 70 something parents. Why would they sell? Why would anyone sell? Housing costs are set for life. A similar house would cost 600-700 k. For a 35 year old house? This trend is not ending, but move back home? Hell no! What we see here is kids that move back home want to live a caviar lifestyle on a McDonald’s budget. $50,000 cars, Louis Vuitton handbags, glitter nails. Accustomed to living a certain way, then they realize it’s hard out there to maintain how you “want” to live. Move back home and you can have all those things. Some may have genuine hardships, but it’s hard to support that argument as I watch your Audi whip by. And their appearance to others is way more important than saving. Whether or not they intent to buy a house. At this rate, they’re going to be shacked up with mom and dad for a long time. Neither groups are contributing to upward mobility within the housing market. Don’t bet on their participation any time soon.

son of a landlord, Prop 13 tax benefits are inheritable, with some limitations.

Very good post

The nuclear family as the primary family formation is quite old in American history. From colonial times on, young marrieds moved from their parents’ households to their own. In some cases a surviving grandparent would move in with the children in old age. Even those who came from cultures where extended families were more common adapted to the American way within a generation, and that is still true today. Economic depression forces people to “double-up,” but it’s an emergency measure, not the preferred one. If you read social histories of the Depression, for instance, you find that families moved in together to save money, rather than maintaining existing extended families.

It’s all part a larger process that can be called the monopolization of the land. It’s an unfortunate feature of our particular system. It causes successful areas to become victims of their own success. I think a strong case can be made that the same thing happened in many rust belt areas, Detroit in particular. People make the mistake of pointing to the most obvious issue in Detroit today but that isn’t what caused it’s downfall. At one time Detroit was rich and built lots of grand things. What do you think happened when everything was Grand? Price got pushed up as the land became monopolized. Normal business becomes uneconomic and moves on. Slowly at first and then more and more while the population that leaves is replaced by immigrants and other people seeking a chance at what appears to be a place of opportunity. They lack the perspective to see that it’s no longer a place where one can move up. It’s a multi-decade process that ends with the greedy old people dying in their mansions as everything has turned to crap around them. This is the only future for most of the bay area and most of L.A. You can clearly see it occurring if you look at it objectively. Most people are too caught up in the greed of the moment to understand the process they are part of.

Yeah, but it’s like perfect outside here today and the clean air is a cherry on top – it never gets too hot here like those places. And like everyone surfs and skis on the same day because the traffic makes it so easy to get around, besides you can always find a super fast bus route as a backup plan. Plus there are so many eatin’ places where you can get Mexican or Asian food because you can’t find that anywhere else – I mean, just ask the rich, they know how culturally utopian this prime SoCal lifestyle is. Competitive industry will always be here because everyone totally wants to live here and this place is different because we’re like the envy of the whole world, so stop being a hater and buy a house here to be a part of it all. Who cares about stuff like salaries and incomes… as if.

Looking at things objectively is for tilting at windmills, brah.

Yes! Embrace the darkness my friend!!!

Haters say, “unfordable,” and lovers say, “awesome.”

Four out of the five largest metro areas in America are awesome, and five of five small metro areas are awesome. Why else would people “overpay” if the places weren’t awesome?

Interesting because I wonder about this too. It’s not just price for space but when places get so costly, there is inevitably the local government looking to junk fee and sales tax you to death. Look at sales tax and fees in LA county and Bay Area counties vs. the rest of the state. It’s crazy.

House horny? Really?

Heh. I love it.

“delusional real estate horny juices”

I chuckle every time “house horny” or some variation of, pops up.

Oh, and how-zing fo-ev-ah?

fo-eh-vah!

Interesting article from yesterdays LA Times:

In the past I have commented that Baldwin Hills and Baldwin Vista are areas seeing migration of Westsiders like myself that want to pay half of the Culver City / WLA home prices but be close to the beach.

http://www.latimes.com/business/la-fi-property-report-20140501,0,255322.story#ixzz30UXrlicg

“…Priced out of much of Los Angeles, young professionals are zeroing on several neighborhoods around USC and to the west, as the expanding Expo light rail line delivers new residents to the area. Communities such as Jefferson Park, Leimert Park and West Adams are attracting buyers — and investors — seeking their relative affordability, location between the Westside and downtown Los Angeles, and the rail link between the two…”

“…Real estate professionals are taking notice. Agent Dino Buiatti is opening a West Adams office in June and plans to staff it with 30 agents.”…In the next five, 10, 15 years, the whole neighborhood is going to change,” he said. “There is a lot of money being poured in…”

I am not saying it is a good time to buy, so housing bears you can relax – but if you want to be near the Westside in a safe neighborhood, here is an example of these rising neighborhoods (3bed, 2ba for around $500K).

http://www.trulia.com/property/3153833293-3519-S-Cochran-Ave-Los-Angeles-CA-90016

safe neighborhood? you have got to be kidding!

HI Pammy

If you look at LA Times crime maps or other such websites you will see the crime between LaBrea and LaCienega and between Jefferson on the North and Kenneth Hahn park on the south is almost nonexistent except for breaking into cars along LaBrea and LaCienega. Crime in Baldwin Hills is less than Beverly District and Fairfax district. Have you driven through the area at night? see for yourself. Keep in mind East of Crenshaw and North of Jefferson are higher crime areas.

http://maps.latimes.com/neighborhoods/neighborhood/baldwin-hillscrenshaw/crime/

@pammy, safety is relative term as far as real estate goes. 90016 is relatively safe compared to South Gate, Lynwood, Paramount, Riverside, Bell, Bell Gardens, Hawaiian Gardens, Pacoima, Canoga Park, Inglewood, Hawthorne, Gardena, Panorama City, Van Nuys, et al.

Now, compared to Manhattan Beach, Pacific Palisades, Dana Point, Irvine, Rancho Palos Verdes, Hermosa Beach, San Juan Capistrano, etc. that is an entirely different matter.

I meant very good post for Laura and Teresa, don’t want to give the impression I’m backing down to the haters, can’t let them know, I’ve got a soft spot and very forgiving.

If you don’t agree with something, simply label those with an opposing viewpoint as a “hater.” It’s so much easier than actually staying focused on details pertinent to the discussion.

Don’t forget to end random non-questions with a question mark?

Point well taken, have a safe weekend!

Guys,C’mon.

a) There’s four hundred years of data showing housing follows wages. Wages aren’t increasing.

b) This has been a bad economy for main street and ultimately main street will have to buy the houses.

c) The economy is heavily distorted by the feds. If the housing market has stalled out at 4.3% interest rates, who in their right mind is gonna buy something unless they absolutely have to? Do you think you can resell it when rates = 6.5%?

d) You guys see nothing wrong with prices changing 25%? How can that be organic or sustainable.

e) Demographics are bad, especially for tax and spend California, which crushes the middle class and the working affluent.

f) This economic expansion (or actually contraction last quarter) is getting long in the tooth and, whether we see it or not, a recession is coming soon.

g) We just had a massive bubble collapse. This is likely an echo bubble do to misallocation of capital.

h) In places like LA, half of the foreclosures from 2007-2010 have not made it down the pipeline. This is Zillow / Dataquick data.

g) China is about to have its version of US 1929 or Japan 1990. Take your pick; it won’t be pretty, and from the price of lumbar to stopping real estate money laundering, it will affect the US housing market.

Or, you can be oblivious to all these facts and pretend this is all normal. It ain’t.

ak –

“a) There’s four hundred years of data showing housing follows wages. Wages aren’t increasing.â€

In the new, new, new, new normal wages don’t matter because there is a lot of monies out there like gazillions of monies.

“b) This has been a bad economy for main street and ultimately main street will have to buy the houses.â€

In the new, new, new, new normal the 1% will trade SFR’s like baseball cards. No need for 99% wages.

“c) The economy is heavily distorted by the feds. If the housing market has stalled out at 4.3% interest rates, who in their right mind is gonna buy something unless they absolutely have to? Do you think you can resell it when rates = 6.5%?â€

Feds? What does the FBI have to do with the e-con-oh-my that I don’t know about?

“d) You guys see nothing wrong with prices changing 25%? How can that be organic or sustainable.â€

In the new, new, new, new normal there is no need for organic or sustainable we are moving to purely GMO production…

“e) Demographics are bad, especially for tax and spend California, which crushes the middle class and the working affluent.â€

In the new, new, new, new normal there will be no need for the wasteful middle class. We import cheep labor to take care of the aging 1%.

“f) This economic expansion (or actually contraction last quarter) is getting long in the tooth and, whether we see it or not, a recession is coming soon.â€

I have been assured by CNBC, CNN, NPR, etc. that we are in a slow recovery and remember that the tortoise always beats the hare.

“g) We just had a massive bubble collapse. This is likely an echo bubble do to misallocation of capital.â€

I actually studied economics and the classical economists do not believe in bubbles so until they are replaced there are no bubbles.

“h) In places like LA, half of the foreclosures from 2007-2010 have not made it down the pipeline. This is Zillow / Dataquick data.â€

In the new, new, new, new normal there will be no more foreclosures. We will only need to pass legislation to outlaw them, problem solved.

“g) China is about to have its version of US 1929 or Japan 1990. Take your pick; it won’t be pretty, and from the price of lumbar to stopping real estate money laundering, it will affect the US housing market.â€

There is soooooo much monies in “Red†China that they will ne-vah stop buying “prime†real estate.

“Or, you can be oblivious to all these facts and pretend this is all normal. It ain’t.â€

One man’s facts are another man’s fiction. There was a time when the majority of people believed that the world was a sphere. Well, Tom Friedman the great e-con-oh-mist has proved that the world is flat as a pancake. Many scientific facts are being proved wrong so don’t hold on too tight to your facts.

ak

“a) There’s four hundred years of data showing housing follows wages. Wages aren’t increasing.â€

Wages are increasing for the 1%. In a county of 10,000,000 people, that’s 1 million people to drive middle-class households to gentrify places like Mar Vista and Culver City. Not to mention the global elite, mostly from Asia, who find the confines of SoCal much to their liking.

“b) This has been a bad economy for main street and ultimately main street will have to buy the houses.â€

Main street doesn’t matter the the prime areas the readers here are horniest for. It’s all about the 1 million people doing well in LA, the investors wanting a piece of the demand and foreigners looking for a place to park their expatriated dollars.

“c) The economy is heavily distorted by the feds. If the housing market has stalled out at 4.3% interest rates, who in their right mind is gonna buy something unless they absolutely have to? Do you think you can resell it when rates = 6.5%?â€

People buy because the aren’t housing blog nerds and just make a call based on their immediate needs. Do you KNOW that rates are going to 6.5%? When will that be, exactly? Will people have paid down enough equity during that time for it not to matter?

with prices changing 25%? How can that be organic or sustainable.â€

What is “organic” appreciation? Please provide the formula. And, who actually believes that 25% yoy is in the cards?

“e) Demographics are bad, especially for tax and spend California, which crushes the middle class and the working affluent.â€

Agree on bad demographics, but what is “working affluent?”

“f) This economic expansion (or actually contraction last quarter) is getting long in the tooth and, whether we see it or not, a recession is coming soon.â€

Boohoo! Hissss! We should keep money under the mattress or invested in guns, gold bars and canned food until after the next recession, right? When will that be again?

“g) We just had a massive bubble collapse. This is likely an echo bubble do to misallocation of capital.â€

Actually, we’ve had a few asset bubbles (precious metals, bonds, real estate, tech stocks, S&P stocks) over the past 14 years. If history is any guide, there will be more bubbles to come. Compared to the U.S., Canada’s real estate bubble is on roids. Who knows exactly when these bubbles begin and end? You?

“h) In places like LA, half of the foreclosures from 2007-2010 have not made it down the pipeline. This is Zillow / Dataquick data.â€

Remember the eminent “sub-prime tsunami”? Ankle slapper more like it.

“g) China is about to have its version of US 1929 or Japan 1990. Take your pick; it won’t be pretty, and from the price of lumbar to stopping real estate money laundering, it will affect the US housing market.â€

Please, please, please, when? I wanna short Alibaba.

“Or, you can be oblivious to all these facts and pretend this is all normal. It ain’t.â€

Puh-leaze, ak, there are more opinions, and worse, prognostications here to shake a redwood-sized stick at.

DFresh:

Point A) Yes. That’s four hundred years of data. The point about data is that it trumps the sophist.

Point B) About 150,000,000 units in the US, and yes they have to be occupied by real people as the carry cost for an empty house is 4-5%. So, yes, housing is where the rubber hits the road regarding the real economy.

Point C) Rates ain’t going any lower. In fact, 6.5%, while not unrealistic, is not necessary. Even 5-5.5% will have amazing harm. Tell me, how much purchasing power is lost for every one percent rise in mortgage rates?

Point D) You didn’t reply to this.

Point E) We agree that demographics are bad. My definition of working affluent is $70,000 to $500,000 a year. Rich enough where one doesn’t qualify for California handouts, poor enough where the taxation / regulations hurt. Ask the 4000 employees from Toyota who used to work in Torrance.

f) Denying economic cycles exist is nonsense. You know this one is true and it scares all of us.

g) Look at collapsing home owner rate, lack of first time buyers, boomerang kids, ruined credit, non-completed foreclosures and tell me the recent real estate pop didn’t have deep lingering effects. Looks at how Japan popped and where it is today. But if you want to believe bubbles are sustainable and “it’s different this time,” go ahead.

h) Non-completed foreclosures are foreclosures nonetheless. Again, if you don’t want to admit there are a surfeit of unsustainable “owners,” be my guest. I think you are wrong about this though. There is a lot of near-inventory that exists. People talk about pent-up demand. They forget that applier to pent-up sellers as well.

I) Okay, China isn’t in trouble. That’s why the rich are scrambling to set their money overseas. Okay, maybe I misunderstood the multiple deep PMI misses over the last four months. Maybe I also misunderstood about price declines in anything but Tier 1 cities for housing in China. Maybe this was all fiction and in the miraculous, Central-Planned Chinese economy things only go up and there are no booms and busts.

Again, housing follows wages. When they diverge, they converge sooner rather than later. DFresh, you should probably list your house now while the downward slump hasn’t really started.

DFresh: “Wages are increasing for the 1%. In a county of 10,000,000 people, that’s 1 million people…”

As others are sure to note, 1% of 10,000,000 is only 100,000.

And I don’t think any of the 1% would want to gentrify Mar Vista or Culver City. They’d most likely already have enough to buy in Pacific Palisades or Brentwood.

“If you don’t agree with something, simply label those with an opposing viewpoint as a “hater.”

ONLY a “hater”?….What about “racist” or “fascist” or “tea bagger “????……

….Please!….give out the whole list….

I’m so excited to share this link. When cnbc is starting to question the market you know there are real issues…

https://homes.yahoo.com/news/whats-wrong-housing-150000401.html

A lot of delusional sellers out there. Here’s a Culver City house asking for $1.2 million: http://www.redfin.com/CA/Culver-City/10835-Lindblade-St-90230/home/6724678

Really? 1.2 million — for Culver City?

Here’s a Mar Vista house, only a FEW BLOCKS FROM THE 405 — asking for just under $1.5 million: http://www.redfin.com/CA/Los-Angeles/3517-Purdue-Ave-90066/home/6749908

According to the description, this house is in “a quiet oasis, just minutes from access to the I-405 and I-10 freeways,”

If it’s only minutes from two major freeways, it’s not in much of an oasis.

landlord…In the San Jose market, these barns would be considered undervalued?

As most know CA. is a entity of its own. Nothing has made since there since the mass movement of the 40’s to 60’s after that it was whatever the market would and could bear.

Nobody should price their homes let’s say in places like Topeka or Peoria (were they thought during the boom it would play) on the CA. market.

If one most live in the Golden State, for a multitude of reasons or you have a endless supply of resources then enjoy the climate, don’t listen to the local news, stay away from freeways, always valet the Bentley?

Hi Sonoflandlord. I dont think we should look at this as delusional sellers, we should think about how much money there is out there. Maybe those houses wont sell for exact listing price, but they will sell. It boggles the mind how much money people have.

My wife and I went to mall last night at both ends very, very high end steak houses. In-between avg restaurants mostly empty, the high end you must have a reservation you just don’t walk in?

Lots of money still waiting to enter the market, if only the banks would stop hoarding their billions in cash and loan it out?

ak….your points are noted and we can go back and forth on them, but the worry for me is (c). Interest rates in some locations are now under 4%, yet few takers.

When I was in the car business many folks sat down and just discuss how much payment they could afford, even the terms didn’t bother them just the final monthly figure.

You would think a 30 year loan at 3.99 to 4.25 would entice a buyer, it looks like and this is true of any business, when the public shuts off as my father would say, “you could give it away and they still don’t come around?”

Robert says: “When I was in the car business….”

Why am I not surprised?

Fred….My I ask for the record how did you make a living sir, this capitalist society we both live in you know, the smoke and mirrors of everyday I want to sell you something from life insurance to elect me and I will uphold the constitution and make life easier for you and the loved ones?

Come on Fred, I employed many people in my two business and sold many cars and appliances if I didn’t someone else would, a sales person is no better or worse then the company or professional trying to pry money out of your pocket.

BTW, Fred… the next time you visit your local doctor you know that person who went 10 years to school to make you well and “not profit from it” because they took a oath???

Marcus Welby MD was only on TV Fred, it is not the real world.

Fred – you took the bait hook, line and sinker. Don’t feel too bad we all have made the same mistake…

“The numbers are pretty amazing,†Wallace said. “It’s an age group that you normally think of as pretty financially stable.”

NEGATIVE.

As any observer of this blog would note, according to the boomers posting like crazy here, booster are the boostrappenist, prudentist of all the generations!

Out in Hawaii, lots of people in their 30’s-50’s live with their parents. Much less social stigma amongst asians and with the housing price to income gap even larger here than in coastal SoCal if they dont do it they would have to move to the mainland for work. The cost of living is just too high.

All this “living with the parents” stuff and no one is discussing rent. Don’t tell me you’re letting the kids back in and not charging them rent? WTH? No wonder the kids are moving back in. You have to put up with someone b**tching at you to pick up your clothes and clean the dishes but hey, the cost of living is great. Ah! The good old times. All of the income becomes disposable so I can spend it on new BMW’s and fancy restaurants.

Forty Five years ago when I had to move in with the folks for a while they welcomed me with open arms and a rental agreement. Only 50% of my income for a place to stay and some food. What a deal. No money? You can work it off. There’s the paint. Needless to say, I found my own place and a better deal in short order. I can see that an eviction notice, however, would be dicey if it ever came to pass.

We are all a bunch of soft suckers giving the deal of a lifetime to under-performing, lovable offspring.

All we needed were banks and crappy land use policies as a catalyst.

What a witches brew we have here.

Whistling Dixie is a popular tune in mainland China these days.

Story starts around 18:00 minutes.

http://www.bon.tv/China-Price-Watch/

Love it the word “we all” like in sports when the fans say “we all won” really, and when we’re you on this team?

What I do not understand is: why are the restaurants full and shopping malls overflowing with consumers spending? If wages are so bad and housing costs so high, why hasn’t this impacted retail and food service dramatically?

I went to the Roseville Galleria yesterday – JC Penney – to buy some summer work clothes. Had to drive around for 20 mins to find a park. Once inside, the mall was full of people. We ate out at a steakhouse last night, early dinner too – 5pm, and we still had to wait 30 mins for a table.

????? I mean the living-off-your-home-equity days are over. There’s only so much they can max out on their credit cards and for how long?

People figure “If I’m going to live in this crappy apartment/get foreclosed on my underwater McMansion, I might as well have a steak.”

Median yearly retirement savings is about $3000 per year for a 50 year old. For a 30 year old, median yearly retirement savings is about $1000 per year.

So the answer is: spend now, worry later

Leave a Reply