The Subtle Nationalization of the Banks and Housing Market – How the Taxpayers Support the Banks through Pseudo Nationalization. We Own the Financial Junk and the Banks Collect the Profits. The Stunning SIGTARP Report.

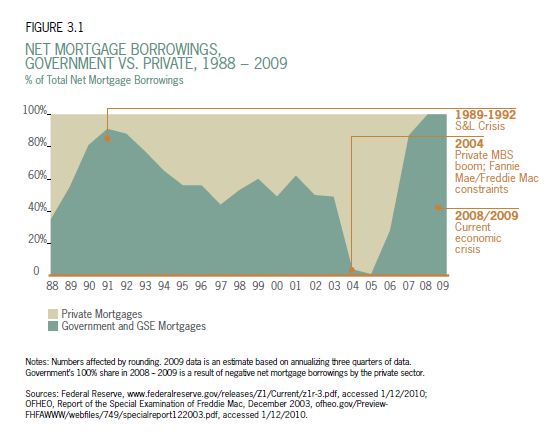

I was amazed at how many people got all worked up when the idea of nationalizing the banks came up. These people fail to pay attention to the fact that we’ve already nationalized Fannie Mae and Freddie Mac and these two giants essentially hold up the entire edifice of the secondary mortgage market. But no one in their right mind is buying those risky mortgage backed securities anymore right? Well we have a program for that too with the Federal Reserve nearing its stated buying cap of $1.25 trillion in mortgage backed securities. In other words, we’ve already nationalized the mortgage market except unlike nationalization, we get the worst junk pushed to taxpayers while the banks enjoy record profits and nothing really fundamentally changes.

The SIGTARP report, an insightful and disturbing 224 page read put out early on Saturday by Special Inspector General Neil Barofsky shows us the wicked web of bailouts we have undertaken. For the record, I think Mr. Barofsky is one of the good guys and has done a superb job just like Elizabeth Warren for fighting for sensible protections in our Wild West financial system. They’ve laid out the path but those at the helm seem happy to ignore the recommendations. I will go through some of the important items in the report but one key finding is that we are going into housing bubble 2.0 and we need to gear up for a second leg down if something should give way (like the economy not adding any jobs for example).

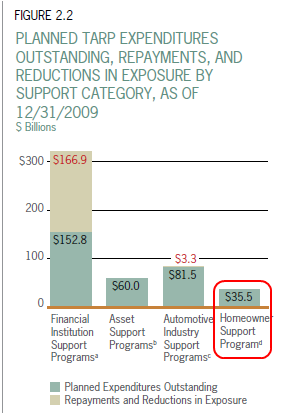

The first chart shows how little money was actually allocated to supporting homeowners. Remember way back in the panic sky is falling moments of the bailout? The banks essentially held our economy hostage and stated that if we didn’t give them $700 billion that the entire financial system would implode. Well thankfully the banks are a-okay now, but since that time we’ve seen over 5 million foreclosure filings and now have an underemployment rate of over 17 percent but hey, banks are back to record profits and the chart above shows you why. The bulk of TARP 1.0 went to financial institutions. The repayments are a joke since banks are trying to get out from the thumb of the government and are back to their speculative ways on Wall Street. The amount set aside for homeowners was a pittance of the entire funding yet this was the hook to sell the American people. Sorry, it was a clandestine nationalization of the banks except the only difference here is the banks maintained full control and all their profits while shifting the bad stuff to the taxpayer.

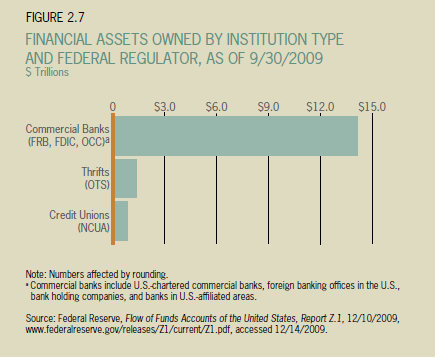

I think few understand the size and scope of our banking system and how little actually supports it:

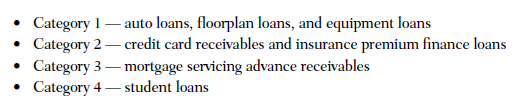

Commercial banks hold approximately $14 trillion in assets yet we have the FDIC that is basically insolvent backing up this entire industry. On top of that, we now insure accounts up to $250,000 each but if the system is insolvent, where is the money coming from? Bailout-ville, that is where. The Federal Reserve in fighting the massive amounts of debt in the banking system needed a dumping ground. As it turns out, mortgages were only one piece of the massive debt salami. The Fed needed other ways to shift toxic loans onto the taxpayer since the system was clogged with poor performing loans from the heyday of the bubble:

Just look at the chart above. TALF was setup to essentially create “liquidity†in other debt markets. Auto loans, credit card debt, and pretty much anything that is considered debt had found a new place to land. And you wonder why banks are back to record breaking profits.

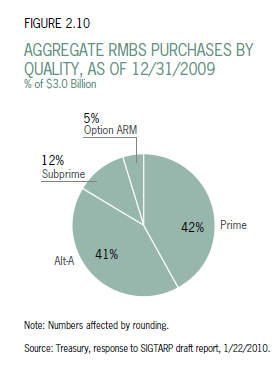

But you would imagine that with taxpayer money, that at least there is some vetting going around right? Not exactly. As we have gone into painful detail, Alt-A and option ARMs are absolute toxic financial instruments and really serve no purpose in a market backed by taxpayer money. If you want to put your own money at risk go for it. But even this junk has made its way into taxpayer connected bailouts:

In other words, we are looking at a nationalization of the system by crony Wall Street yet no power has shifted as would be typical in a nationalization process. People are so afraid of the word nationalization that they would prefer a worse option in what we currently have. In this toxic soup, this is where programs like HAMP have made their way:

“Of that $15.4 million, approximately $12.1 million represents incentive payments to servicers and $3.2 million represents payments to investors. Borrower incentive payments begin only after one year of participation in the program.â€

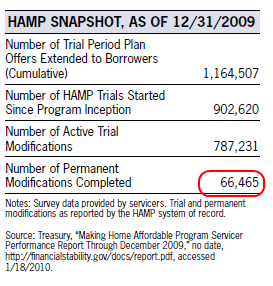

Why is HAMP a failure? Because it was developed by the bankers to pay them out first before actually thinking about whether the program would actually succeed. Already $15.4 million has gone to banks for a failure of a program. And here are the sad stats:

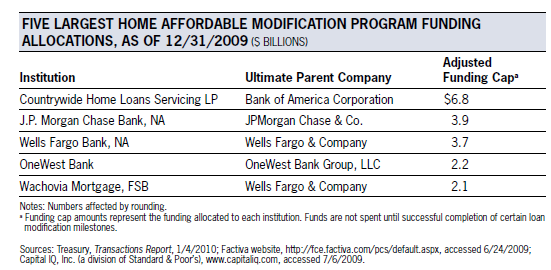

“To date, the largest allocation of incentive payments went to Countrywide Home Loans Servicing LP, now owned by Bank of America, which is eligible to receive up to $6.8 billion in TARP funds.â€

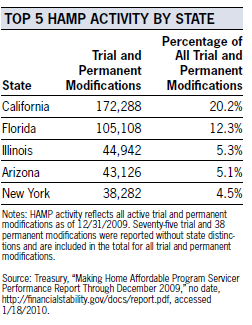

Good times. So not only do banks have all the taxpayer support in the world, they now get incentives to push a program that is largely a failure. I wonder what Mr. Barofsky thought when he put this thing together. Unfortunately the previous and current administrations seem to be in cahoots with Wall Street. Here we have a report clearly showing the mess we are in yet what action will come from this? Even Mr. Barofsky mentions we are at risk for bubble 2.0! Doesn’t matter, after nearly a year of HAMP we have 66,465 permanent loan modifications. Last year we had 4,000,000 foreclosure filings. That is like spitting into the ocean. As you would expect, most of the trial modifications come from California:

Yet there is another program with more incentives to banks called the Home Affordable Foreclosure Alternative (HAFA) program. Ironically, both HAMP and HAFA are against affordable housing since they artificially keep prices high by keeping inventory off the market through kicking down the road measures. What is HAFA?

“On November 30, 2009, Treasury released guidance regarding the Home Affordable Foreclosure Alternatives (“HAFAâ€) program (previously referred to as the SS/DIL program). Where a mortgage modification is not practical, HAFA creates financial incentives for borrowers, servicers, and investors to avoid a foreclosure by utilizing a short sale or a deed-in-lieu of foreclosure. According to Treasury, these options generally provide borrowers, investors, and communities with a better outcome than a typical foreclosure sale.â€

Now here are the basic elements of the program:

• Borrower Relocation Assistance — A $1,500 incentive payment to the borrower.

• Servicer Incentive — A $1,000 incentive payment for the servicer.

• Investor Reimbursement for Subordinate Lien Releases — For every $3 an investor pays to secure release of a subordinate lien, such as a second mortgage or a home equity line of credit, the investor is reimbursed $1, up to a reimbursement limit of $1,000 per transaction.

More money to banks! Keep in mind that when banks dealt with foreclosures in the past or short sales, the incentive was for them to go ahead and do these things simply because they make economic sense. But now, they need a $1,000 incentive to do anything since in crony Wall Street handouts are simply another line item on the balance sheet. The Federal Reserve is loving this massive give away because they assume the public is buying this free market enterprise nonsense.

Yet now that banks are in better shape and making record profits, surely they are lending out money to fund home purchases right?

The above chart should have the title “How we Nationalized the Housing Market Without Telling You.â€Â As you can see, virtually 100 percent of the mortgage market is now backed by the government. But I keep hearing about banks making loans and home sales rebounding? Of course you are. They’re not lending their money silly, they’re lending out YOUR money and going back to the other people’s money (OPM) world that actually created this mess in the first place. A mortgage pusher at a big bank will try to squeeze you into a government backed mortgage like trying to put an elephant in a two piece bikini. What do they care? What does the bank care? It is the taxpayer’s money anyway.

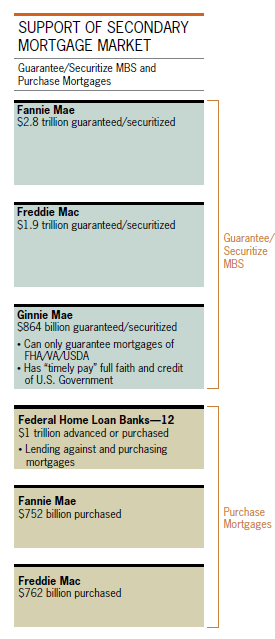

If we break down the actual secondary market, you can see how subtle this nationalization really played out:

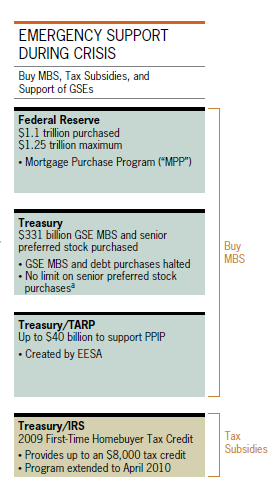

Fannie Mae and Freddie Mac guarantee and securitize $4.7 trillion in mortgages through mortgage backed securities. FHA insured loans, the current day superstar are now being funneled through Ginnie Mae and they are now securitizing roughly $864 billion in mortgages. Yet that is only one piece of the puzzle. These MBS are then sold to investors. Who in their right mind is buying this in today’s highly risky market?

Just envision a snake eating its own tail. Walk through this for a second. A person purchases a home with a FHA insured loan at a too big to fail bank. That loan is then bundled with other FHA loans and securitized by Ginnie Mae. Most rational investors knowing the current market is weak like a stool with two legs isn’t touching the loan. Step in the Federal Reserve to buy those mortgage bundles. In fact, the Fed has now purchased over 95 percent of their stated $1.25 trillion in MBS. In other words, we are selling, bundling, and buying our own mortgages. We are essentially creating bubble 2.0 since the actual market is looking for rates to go up and prices to go down. Just look at the chart above. If the Fed stopped buying, interest rates will go up (we’ll soon find out). Next, we are giving a tax credit to buyers who are already getting a big break by subsidized taxpayer backed loans. Now instead of all these gimmicks and funky mechanisms of funneling money to Wall Street, can you imagine if the same amount of time and conniving was spent on figuring out how to get Americans back to work?

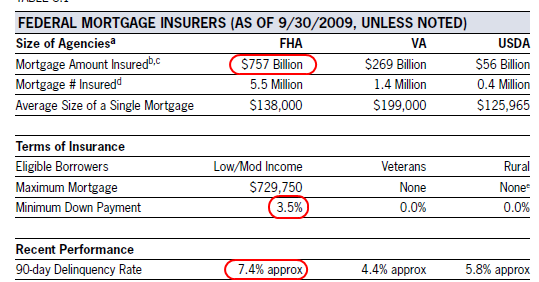

And for those that think FHA isn’t the new game in town, look at the below:

FHA was never intended to be a primary mortgage insurer. Last year, they basically became the market. In Southern California 4 out of 10 loans were FHA insured. Banks are back to loving this easy money gravy train since they can go back to their commission and fee loving ways but look at that 90-day delinquency rate. 7.4 percent of the entire pool is 90 days or more late (it has gotten worse). In fact, we are going to have an FHA bailout either in 2010 or 2011. But at this point, calling it a bailout is a joke since the entire mortgage system (refer to above chart) is now nationalized so either way, we are paying one way or another. Yet banks are still making ill-gotten profits and no real regulation enforcement has occurred.

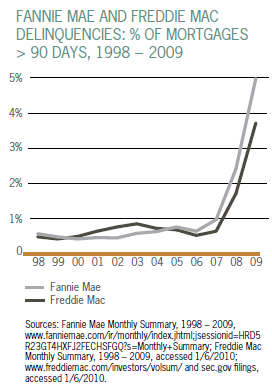

But Fannie Mae and Freddie Mac must have better performance than the FHA right?

The above chart is absolutely troubling. Keep in mind that Fannie Mae and Freddie Mac are behemoths. So a 5 percent delinquency rate is unheard of. And that chart is going exponential because of course all the bailout funding has gone to crony Wall Street while Americans keep losing their jobs and consequently are unable to pay their mortgage thus pushing Wall Street to go for more taxpayer bailouts.

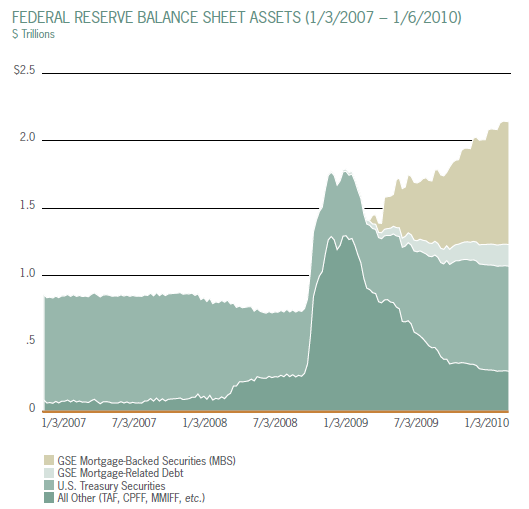

The Federal Reserve has become the dumping ground for many toxic loans. That is why calls for an audit have been fought tooth and nail from Wall Street and Ben Bernanke. If there is nothing to hide, why not let the public take a look since it is their taxpayer dollars propping up this zombie financial system. Their balance sheet has exploded since the crisis hit:

And just look at how much is made up of GSE mortgage debt. Notice how it explodes with the nationalization of Fannie Mae and Freddie Mac. What does this all mean? The entire financial and housing system is nationalized and banks like JP Morgan, Bank of American, and Wells Fargo might as well include their employee count under the federal government. The only difference however is that the government has zero control here and Wall Street is basically writing policy going forward. Don’t be naïve to think they are looking out for you. Look at the current housing market. Look at our current employment issues. What significant change has come from the bailouts? Aside from keeping banks intact so they can dish out record bonuses, nothing.

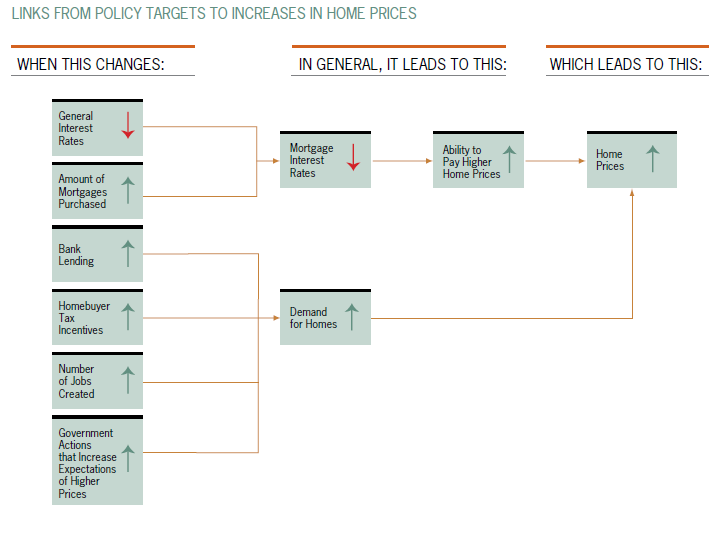

The report shows essentially what we’ve been talking about how all these bailouts are keeping home prices inflated even though the market is trying to lower prices:

The above chart is a perfect example of why it is total mistake to buy a home in many overpriced cities. The Fed is nearing the end of the MBS buyback program and interest rates will go up after that. The tax credit? Are we going to make this permanent? If not, then prices will come down even further. What about FHA and their problems? Well it looks like premiums will go up and possibly, the down payment. If not now, surely after we bail them out since clearly they are unable to provide adequate underwriting. And banks aren’t lending a penny of their own money since they know the real deal. They are simply a conduit to funnel government backed money to consumers while collecting their high cost middleman fee. If the Fed is at a zero bound, why don’t we just directly borrow from the U.S. Treasury for our mortgages? What is the difference since every mortgage is basically backed by the government. Heck, we can link up to the IRS and fill out an online mortgage application that automatically checks two years of W2s. That one step is more underwriting than the industry has done in the last decade.

So what does SIGTARP tell us? The entire banking and housing market is nationalized except where a nationalized system would bring on real changes and reform, we are basically going about banking in the same old way while the American public finances the joyride of Wall Street. And what does this mean for home prices? Very little of course. Think about it. Remove yourself from the nonsense echo chamber of the housing industry. Prices are depressed because the economy is depressed. People pay for their mortgages by working. Without work or weak wages, there is only so much home you can afford. So either home prices go down to reflect the current wage structure of a local economy or wages increase to reflect bubble like prices. Dean Baker from the Center for Economic and Policy Research in Washington who called the housing bubble early on, is discussing that home prices after adjusting for inflation are still overpriced by 15 to 20 percent. Welcome to bubble 2.0 folks.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

29 Responses to “The Subtle Nationalization of the Banks and Housing Market – How the Taxpayers Support the Banks through Pseudo Nationalization. We Own the Financial Junk and the Banks Collect the Profits. The Stunning SIGTARP Report.”

First of all I have to say that this administration should be ashamed of what they have done to the American people. It is criminal what has been going on behind the scene with the banks and the Federal Reserve and why should they not be accountable to the american people? The american people cannot even find out who owns their mortgage yet the pre-tender lender’s are showing up in court and taking peoples house in foreclosure at a record pace with no proof of standing and the majority of Judges are just approving them to do it without showing proof of standing and if that person does not have the benefit of a good real estate attorney they are thrown in the street.The mortgage modification program is a joke with banks not wanting to approve these modification’s as the record shows for if the Pre-Tender Lender not the real creditor-investor of the mortgage note mind you they foreclose on the American Taxpayer & they can get paid again for what is completely fraudulant and illegal behavior and they should be held accountable for the fraud on the taxpayer and the courts and the ironic part of it all is the people that are being thrown out of there homes are the ones that have to pay these guys for decades to come. I hope there is a day that these same people are faced with what they have done to the people of this country and are punished for their crimes of greed and corruption. I challenge any Pre-tender lender to come into court and tell the Judge exactly who is the owner of the note and produce that evidence and give a full accounting of where that money is and went and also how much was paid behind the scenes.

Thanks again Doc!

The large banks have been de facto nationalized. In DFW there are a large number of banks and many new ones opening. Funny thing about that though – on Friday afternoons – the lines at the bank are nonexistent. Perhaps it is due to electronic banking and direct deposits. Perhaps it is due to 17% un/under employment. Mortgage lending here is also mostly FHA.

One new and particularly troubling item that I have noticed lately is the “reverse mortgage” being pushed on seniors. Even sensible, financially experienced seniors appear to be susceptible to the allure of “easy money”. It appears to be yet another way to push the Home Equity/ATM cash machine to its limit. So – we may wind up with lots of seniors who gets foreclosed on also. Greed has no boundaries.

Best Regards

Word on the street is that Lloyd Blankfein is going to give himself a 100 million dollar bonus for all his wonderful work last year. It’s almost like Dr. Evil with his pinky to his mouth, laughing and shouting “100 million dollars!”.

The cliche is to say that our banking industry is turning into something very much like the Japanese cronyism of the last twenty years, which is true, but, I don’t think any of those bankers ever gave themselves what may be the GDP of a small third world country for a years “work”. They, at least, know how to be discreet.

The only question this excellent article leaves unanswered is “how long can government keep this up?”

How long can this continue before the value of the US$ is completely wrecked? The Fed creates and controls money. The govt needs rates to stay very low. Between nationalization, QE and all the other nonsense, the system has gotten massively out of balance.

Not that subtle. LOL.

We really do need more help for people so they are not thrown out of their homes and forced to live in Potters slums.

I am greatly disappointed in the president, who I voted for.

He appointed Summers as his economic adviser, who made millions on Wall Street. What do you think he will recommend? “We can’t let Wall Street fail!!”

Geitner is a buddy of Wall St., and will undoubtedly work there after leaving the administration.

The Dems. stand to loose big time this Novermber. Both parties are going to prop this economy up any way they can, until after the elections.

Don’t expect “Change”. It ain’t gonna happen.

Do you really think the Fed will stop buying MBS this spring? I wouldnt count on it, they will either extend the program or find a way to do it in secret.

This market is a joke. Fed will have a 3.85 trillion dollar budget in 2010 with a 1.5 trillion deficit, how can this not prop up the markets? Doc, your blog is great at pointing out all of the criminal thinks happening and it appears it will continue to happen well into the future. Your calling of a bottom or another slide is probably not going to happen with all this manipulation – the Gov is going to make this market appreciate no matter what it has to do. You can state all statistics you want – from unemployment to interest rates, but they will do whatever it takes to keep the market propped up. Any correction you blog about is going to be a long time into the future, probably long after your blog is gone.

“So either home prices go down to reflect the current wage structure of a local economy or wages increase to reflect bubble like prices.”

Or wages go up and home prices continue to fall. I submit that neither of Dr.’s proposed situations represents a sustainable balance.

Flippers, now qualify for FHA…

Oh yeah, one more reason property prices will rise even further

“FHA and Fannie: Pushing Foreclosure Sales ”

http://www.cnbc.com/id/35184396rther

Kim Thomas wrote: ” I challenge any Pre-tender lender to come into court and tell the Judge exactly who is the owner of the note”…. Considering Fed’s fancy for MBSs, I’d say there’s a good chance our government now owns many of these homes. And, yes, they as the investor will probably refuse 500,000 modifications between now and 2012, will pursue foreclosures and then tax the sh*t out of these people until their losses are made whole. Everyone wins, except the middle class.

Wow, what a fantastic article. When I look at the 600+K, 900sq/ft crackerbox in Campbell, CA, I can only laugh to know my tax dollars are helping kep 400k on that ridiculous price.

Wasn’t Obama’s mantra for getting elected, “Hope for Change – in your pocket”. Them dollarcrats took a large chunk and walked without nary a whimper from the beaten american people. Geithner cheated on his taxes, AND was head of the FED New York….oh yea, the FED has the best interest of the country at heart HA HA HA! Look in history and *any* President that has tried to abolish the Central Bank has either been assassinated or attempted to be assassinated.

JFK at least had the balls to print U.S. Treasury money…..they buried his ass like 4 months after that. Every President barring Reagan in the last 30 years has belonged hook, line, and sinker to the “secret societies” like The Trilateral Commission, The Bilderbergs, and the Council on Foreign Relations. These are a PRIVATE elite group of people who control nations through wealth and/or political influence.

Mel Gibson don’t have shit on the REAL conspiracy story going on behind the scenes. If you are smart enough to see it, you are smart enough to know there isn’t one damn thing you can do because the majority of people are happy with network programming and a full belly.

Doc:

Even under Dumb George with folks like Barney Frank and Chris Dodd running the financial services committees we were headed in this general direction, But with Obama as President and his main out of office experience as being a shill for Acorn, which is clearly Marxist in its approach to who should own housing… well, we are well down the part towards collectivization of housing in the US. and it has strong support among the Dems in addition to the President’s obvious position on the matter.

Our only hope is we see a resurgence of the Reps in the form of folks like Scott Brown in the Fall to stem the tide towards a Leninist/Stalinist form of the possibly soon to be late US of A.

“But with Obama as President and his main out of office experience as being a shill for Acorn, which is clearly Marxist in its approach to who should own housing…”

Dude, get a clue. You got any links to prove this?

Great article. I believe the numbers are still understated. Here is a good article by

Greg Hunter. These numbers transcend scary.

Fannie, Freddie and Gold

15 January 2010 33 Comments

By Greg Hunter

On Christmas Eve of 2009, the Treasury decided to lift the caps on how much bailout money failed mortgage giants Fannie Mae and Freddie Mac would receive to stay in business. The caps represented a maximum taxpayer exposure of $400 billion for both companies. Now, taxpayers will be on the hook for an “unlimited†amount for, at least, the next three years. How much is “unlimited?†Well, for starters, Fannie and Freddie guarantee more than $5 trillion in mortgage backed securities. Add that to the combined debt of nearly $3 trillion for both companies, and you get $8 trillion of taxpayer liability. When I first heard that the caps would be lifted for just three years, I asked myself “Why three years?†The chart below gave me the answer. Take a look at the 2010 mark. You see that wave of mortgage resets for all those different kinds of mortgages? They peak and fall off about mid 2012.

You know the reset mess won’t be over at that precise point. It will take about six months or so for all the defaults to shake out. That’s just about three years, which is the exact same amount of time the caps on Freddie and Fannie will be lifted to bail them out of infinity. I am confident Treasury Secretary Geithner has seen the same chart. He knows those bars represent millions of mortgages. Not everybody will default because their mortgage resets, but many will not be able to afford the higher payments and lose their home.

Also, Fannie and Freddie are going to have to keep providing hundreds of billions of dollars in new mortgage financing because, if they don’t, the real estate market will probably collapse. With all the sour mortgages, securities, and new mortgage exposure, there is no telling how much this will cost the taxpayers. I don’t think it is a stretch to say it will end up being many trillions of dollars. Once again, there was a huge tax bill hung on the country, on Christmas Eve no less, and the mainstream media is nowhere to be found. Where is CBS, NBC, ABC, and CNN? What just happened to the budget deficit is bigger than the $700 billion TARP bailout, the $787 billion stimulus bill, and the $180 billion bailout of AIG, COMBINED. As a matter of fact, lifting the caps on Fannie and Freddie will cost many times more than all those COMBINED! I guess that is just not a story in mainstream media land.

On Christmas Eve 2009, an $8 trillion addition to the federal debt was made by a single bureaucrat. This move by the Treasury is a budget buster and will guarantee some very big inflation. Gold will react to higher inflation with higher prices. There was only one other time in the last 10 years that there was such a clear signal precious metals were in for a ride. It was March 2006, and brand new Fed Chief, Ben Bernanke, decided to call an end to the M3 report. (a statistic that shows the broadest measure of all money in the system). The Fed effectively said it was not going to tell the world exactly how much money it was creating. You might as well have walked into the gold trading pits with a starting pistol because, after the M3 died, gold just about doubled in less than four years. Just look at the chart below:

Now, with the elimination of the caps on mortgage giants Fannie and Freddie, you will have gold off to the races again because the government will print money to pay off debt. And if we have another financial meltdown, like 2008, gold will take a moon shot. What makes me say that? It is H.R. 4173, which is the Reform and Consumer Protection Act of 2009. This legislation is supposed to protect the little guy, but it also protects the banks with a provision in the bill to rescue them from financial ruin in the future. The Fed will have pre-authorization to give reckless banks as much as $4 trillion to, once again, bailout the incompetent. The bill has a long way to go before it is signed into law. Still, I’d say the odds are pretty good there will be another crisis; otherwise, Wall Street would not have paid their lobbyists to push a pre-authorized bailout.

My advice to you is to brace yourself for the impact of inflation. The actions of the Treasury and Wall Street have guaranteed it.

Chris from NH,

Turn off the Faux News son. Your quip was straight from the Beckerhead script. Try thinking for yourself and you won’t sound like a FoxBot.

Doctor, The Federal Reserve is a private corporation and they are the central bank. They are the lender of last resort. They are printing money out of thin air and it is NOT taxpayer money. Funds from the Federal Government and Treasury are taxpayer money. About $10 trillion of the bailout is from the Federal Reserve. TARP and other programs are less than a $1 trillion.

I was Rep, then Dem, now I’m going independent. Don’t care if they don’t count my vote, at least I’m not going to give it to these crooks. They’ve all been bought by the banks, and now the court just opened the spigots to unlimited corporate investment. Got a kick out of a spoof I heard on the radio today, a lobbying firm is running for congress! Now we can be represented by the best company money can buy! What a hoot!

We have a revolving door between the government and financial institutions. It is the same people who run both – they just keep changing titles. It’s getting to a point where the only difference between the government and the financial institutions is the moniker.

Polo: read the mission statement for Acorn… and their underlying actions/programs… Marx/Engels would be hard pressed to have done better distilling their Manifesto

Steel: get your head out of your butt… this is serious stuff. Banks nationalized and now housing.. or are you a government worker who is saying ‘what recession?’, ‘what bailout?’, ‘what foreclosures?’

Just got foreclosed on. Here’s the short story. My house had depreciated substantially over the years. It was under water by about 40k last summer. The amount I was on the hook for was 162.5K. I’ve never refi’d or heloc’d. Been in the house for alomost 5 years. I tried to work with the mortgage company several times to restructure the mortgage to reflect the true market value of the house. I couldn’t even rent the damn thing for anything close to what the mortgage payment is ($1300 per month). They would not work with me saying it was not an option, etc. I have an interest only loan with an Option ARM due this year. When the ARM kicks in my monthly payment will go up to about 1800 per month. So I quit paying the mortgage. Five months of not paying earned me a forclosure notice. the banksters are now scheduled to sell my house on the court house steps with the bidding starting at 120k. So they’re willing to short sell it to someone else, but refused to work with me. Criminal. I hope they all burn.

Sorry to hear that Lucy. But in the long run you will most likely be better off not over-paying for an over-priced commodity. And considering it was an interest only loan, (I’m assuming you didn’t have a huge down-payment) you probably didn’t pay a lot more than you would have if you rented. You’ll take a ding on your credit, but you can chalk it up to experience, and I’ll bet you won’t make that mistake again.

@ Lucy There are loads of a-holes out there that would call you names and say you are a loser for defaulting on your loan, I think you did the SMART thing. At this point I would live in the house until the sheriff comes a knocking. Don’t think if you move out it will hasten the turnover because I see homes empty all over my neighborhood in Lake Forest that the banks have and no one is living in them. The system doens’t do “principal reductions” unless you give the house back, and in THAT case, they just bundle them together and sell them dirt cheap to their crony buddies!!! It’s another reason why homes are being held back.

Maybe…just maybe, one day the PEOPLE of the U.S. will stand up for the PEOPLE and not just blindly back wall St. and government. Your 100% right, all the scammers that used liar loans including the politicians who stripped Glass/Steagall should be tried and sentenced…..but that will never happen as you can PLAINLY see on any elitist controlled media outlet.

Follow the money….follow the money….it NEVER leads to us, they only TAKE our money.

@ WP…yup, there goes that attitude. “Too bad, so sorry you got DEFRAUDED, but you should have known, now that you are broke and your credit is ruined, maybe you can live a better life.”

F that. Millions of americans were defrauded, but again, lets blame the people suffering and not the ones inflicting it. It’s horsecrap. The division is happening in this country….the gene pool may find itself short of quite a few people before it’s all over.

Who knows…maybe we should have another civil war…this time it will be for the emancipation of COMMON SENSE! North side is for common sense (hopefully people like you and I), south side is for perpetual debt slavery through FRAUD (wall st. banksters, government). The sad thing is…no Abraham Lincoln are anyone even CLOSE to his character in government to cause the civil war, so therefore, keep running on that hamster wheel slave. It’s squeeky again too, grease the bearings with the blood of illegal immigrants again.

On a recent NPR Planet Money podcast, they talked to someone in the mortgage industry who receives calls from those with distressed properties. A few years ago, people were calling, trying to do anything to keep their homes from being foreclosed on. It was a fairly quick process. She said the banks now are waiting up to a year to get the process going, and that many calls she receives now are from people who want their foreclosures to be processed, so they can get out of the house and stop being responsible for property taxes. The banks are clearly dragging their heals… This sure gives credence to everything I read on doctorhousingbubble.com.

He is a good speaker. He will not change anything. Unbelievably the opposition is so weak. I doubt, the opposition party also involved in this big scam. It is the newer version of corruption without mistake.

Leave a Reply