Bargain hunting in Beverly Hills and the 90210 zip code – A place for under $500,000 in the 90210? When the housing crash hits aspirational neighborhoods.

It isn’t often that you can go bargain hunting for a place to live in Beverly Hills. The famous 90210 zip code in Los Angeles is not immune to the global real estate correction. Prices are falling simply because that is the natural outcome of a bubble bursting. The immense shadow inventory and lack of real income growth is causing downside pressure in uncommon markets. In L.A. you have an interesting phenomenon of aspirational millionaires. These are folks who drive leased foreign cars, get a phone number with a 310 area code, and claim to live in prime locations. Yet when you look at their balance sheet they are living paycheck to paycheck and have a net worth closer to zero if not negative. Today we find a place in the 90210 zip code that will allow an aspirational to claim that he or she lives in the 90210 zip code.

90210 under $500,000

You might find it surprising that we have found a place in the 90210 zip code for under $500,000:

9803 PORTOLA DR, Beverly Hills, CA 90210

Listed   05/17/11

Beds     1

Full Baths            1

Partial Baths      0

Property Type  SFR

Sq. Ft.  732

$/Sq. Ft.              $675

Lot Size 8,650 Sq. Ft.

Year Built            1923

This place isn’t exactly a giant property. 732 square feet isn’t exactly the palatial mansion with pillars in the front you might be thinking about when you consider Beverly Hills but I doubt this will be a problem for someone that ports their phone number to the 310 area code simply to say they are part of the Westside of Los Angeles.  The above home is 1 bedroom and 1 bathroom which is probably all you can get out of 732 square feet.

I’m surprised this place has a built date going back so far, even prior to the Great Depression. Let us take a look at the description:

“Cute doll house. country living feel. 2 story 1bedroom 1 bath fixer. Just off Benedict Canyon Rd. Lots of privacy. Bank of America Home Loans prequalification required on all offers. Free appraisal and credit report if buyer finances through Bank of America. Please allow 2-3 business days for seller response. Buyer must verify all info and rely on their own findings. See private remarks for showing instructions.â€

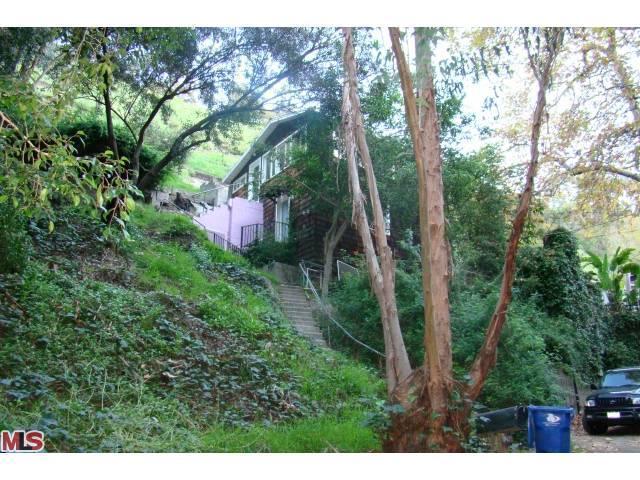

Cute doll house? 2 story? We can see that from this photo:

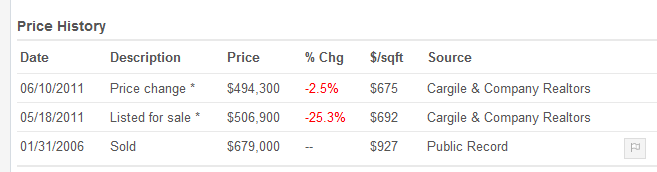

Even though this place carries the 90210 zip code it is part of the Beverly Crest neighborhood. For folks outside of the Los Angeles area, this makes a big difference and you will see this when commenters start posting about the nuances of the 90210. But if you want to have that 90210 zip code for under $500,000 this is the place. The current list price is $494,300. This is nice cut from the previous sales price back in 2006:

The last sale occurred in 2006 for $679,000. A 27 percent price cut in the 90210. You can have the 310 area code, the 90210 zip code, and if you find a 1990s used Mercedes you might fool someone that you are a Hollywood actor. Not everything that glitters is gold especially in Southern California.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

40 Responses to “Bargain hunting in Beverly Hills and the 90210 zip code – A place for under $500,000 in the 90210? When the housing crash hits aspirational neighborhoods.”

Great deal for Beverly Hills Zip, actually. You could do worst than buying hte cheapest property in the nicest neighborhood!

My thoughts exactly. But you better have at least another $50K to deal with the nightmarish maintenance issues that come with a 90 year old home.

Question for other patients of the good Doctor:

I recently found a place which is both cheap ($140k) and rentable, and thought I would buy it to produce some cash flow. I went to my bank’s website (TD) and found that the origination charges on such a small loan were ridiculous – for 100k I’d be expected to pay out 7% upfront for the variety of fees they charge.

Obviously, it would only be worth buying something so small if it was an all-cash deal (which reminds me of the number of cash deals we’ve been seeing). So, two things: is this normal? Are there other places which charge lower fees?

All those fees are negotiable. A good mortgage broker is all you need.

About 8 months ago, I wrote an article about why areas like Bel Air, Newport, and Beverly Hills were going to take steep hits when they started to correct. Basically, my thinking was that not only would banks want to take these steep loses later (perhaps when the stock market had recovered), but that also, people in these areas would be able to make payments for longer regardless of economic conditions.

On several different occasions, I received negative feedback by people that believed that buying in an area like this would always be a better bet than to buy “a piece of crap” in the Inland Empire.

My question to the readers is simple; due to the amount of speculation and the sheer access to capital that is available in these upper tier areas, do you believe that areas like Newport, Bel Air, and Beverly Hills will reach their bubble level prices before areas similar to the the Inland Empire?

Here is what I see in Newport/Laguna. This is based on friends and acquaintances buying, so pretty small sample size. The market here dropped about 30% from bubble highs. This spring, there was a delay it seems in the spring buying, but it has picked up, inventory is lower than I would expect based on the # of distressed homeowners I know of;prices are creeping up a bit from my observations maybe down now 25%. Most of the buyers I know are putting down very large downs – 30/40% and using 5/1 ARMs and 30 Yr fixed. Taking multi million dollar loans. I am stunned to see the prices they are paying for these properties. They are down 20% from peak, but still 70/80% higher than 2001/2002 pricing. It is incredible how people who can be such smart business guys, can think getting 20% off of a bubble price is a great deal. There seems to be very little awareness of just how much of an artificial increase in prices there has been, and people are diving in still – just amazing. So, lots of leverage in the $3M+ market; I believe this is keeping the higher end from total collapse right now. Again, just one persons observation.

Buying a home with a mortgage only makes sense if you are convinced you will be there for a significant period of time. Even if/when prices fall back within range of local incomes, who can say they will be able to keep a job for 10 years in that location? Housing is a liability for career development, especially for the middle class. Let’s be honest – middle class, middle management, salary men & women have little control over their fortunes as their VPs count beans and lay people off at a whim to ensure their quarterly bonuses.

Why in the world would anyone lock themselves into a long term depreciating asset? Is the American Dream still that powerful? The world has changed, but we’re slow to realize it in CA.

My wife and I recently bought into the Inland Empire…on the edge (about 1 mile from the LA County line). For a lot less than the Beverly Hills shack shown above, we got a 4 bedroom, 3 bath house built in the mid ’90’s w/ a 3 car garage and a one-of-a-kind swimming pool in a gated community. In the last 2-3 months, sales in that area for comps has been about what we paid for ours, but the prices are definitely 2002-2003 era. Both my wife and I are satisfied with the house and the community. We’ll pay the loan off before we consider moving again.

A lot can be said about location, but frankly, this house above is a terrible buy. There does not appear to be a garage, the house looks ancient, and it’s only got one bedroom. So, the only type of person that you’ll be able to sell it to is an upwardly mobile professional who is single and not considering marriage and children anytime soon. And it’s not going to be some old guy, ’cause he’s not going to want to hoof it up those stairs every day.

I’d like to know…who decreed that this place is actually a “great buy?” I wouldn’t pay $100,000 for this dump! What do I care about a 90210 zip code?

Yeah, but it’s the Inland Empire! I wouldn’t live there for all the money in the world…

Spoken like a true LA snob who enjoys heavy traffic/crumbling infrastructure and inceasing crime. The inland empire is not just Riverside and Corona. Temecula has beautiful rolling hills and up and coming wineries literally minutes from your doorstep. The temps may be hot in the summer, but once 5 p.m. rolls around, the ocean air comes over the hills and cools off the area for absolutely glorious evenings. Air quality is excellent and we are literally no more than 40 min away from the ocean. All this for no more than 125.00/sq ft. You can keep LA. Great place for 20s and 30 somethings. A decaying craphole with some pockets of shangrila for more money that most can afford.

And you couldn’t pay me to live anywhere west of Pasadena…unless we’re maybe talking Ventura or Santa Barbara.

The Inland Empire definitely blows, no doubt about it. It’s the Valley of the Dirt People. Basically Jersey, except not quite as bad. I’d live in the San Fernando Valley before I lived anywhere in the IE.

It’s okay to face reality and accept it: for those who can’t cut it in LA or the OC…there’s the IE. BTW all the ghetto riff raff from the LA and OC ghettos and barrios is continuing to be priced and forced out, and where are they going? San Bernadino, Riverside, Corona, Chino, NorCo, Temecula, etc. The 909 and 951. Enjoy our continued detritus!

NIMROD: Take a look at the sex offender registry on the link and compare the valley to Temecula. Get back to me on your thoughts as I think the approprate term for this is that you just got PWNED. I sleep well at night, will you?

http://www.meganslaw.ca.gov/search_main.aspx?searchtype=city&lang=ENGLISH

Dear Jason,

Well done for your answer and my thoughts exactly!!!

Westsiders: Why Buy? Why Rent?

Why Rent? Eventually you get old. My cousin (lived in LA for 45years before dying. He was a VP at a cadillac dealer. Lived lavishly LIke all good Angelenos. Travelled, Dined, etc. Always rented. Now he’s dead. His wife has been going strong now into her 90’s. Savings long-since gone. But becuase there is no property owned, she is basically screwed. There is nowhere for her to live. Anyway, it does pay, eventually, to own a place to live. Like with leasing a car, it makes sense for some people, but if you own the car for more than 10 years, propbably you want to buy. If only they had bought a place any time during his 4 decades in LA… They would have had this “forced savings” despite his proclivity to indulge, and she would be better off. Instead, my family supports her….

Santa Monica has decent 2B/2b condos now in the 500’s. 1500SF. At current rates, this is comparable to rent. (ballpark) But imagine in 10 years. The market may drop another 10% in Santa Monica, as rates drift upwards…. but unless you are a market-timing expert… this year is a reasonable time to jump in to something like that. Rents go up, rates go up too, and inflation is a-coming eventually…

Why buy? Market still falling. Free-fall may be just beginning in the prime west-side.

Property tax and maintennance – yuck! Stuck in the place – what if I lose my job or want to move! Many places are still much chepaer to Rent than Own. Reality is only just beginning to set in, however, there are tempting “Deals”.

You are correct that buying a house is a long term, forced savings plan.

I know several widows, whose husbands died. In most cases, their ONLY asset is their house, usually owned free and clear. Bought years ago, they are now worth $500,000 to $1,000,000. each.

They can cash out, move if necessary, and still be in good shape, financially.

Another friend of my is a lifelong renter, and at age 78, has no place to call home.

She is living in a room, from a relative who took her in.

If it were not for that, she would be on the street.

Here’s a thought, pay $500k-to $750k over 30 years to pay a house off, or just buy a $500K life insurance policy, a lot cheaper.

Good point about forced savings. The problem with forced savings is that if the long-run average annual housing price increase is 3-4% then it’s not nearly as smart a financial move as many other investments. For example, I invest in relatively low-risk alternative cash flow investments and with some effort you can find 10%+ stabilized cash flow with the potential for equity build as well. If you do a quick calculation on the amount of money that someone leaves on the table for that spread alone, especially compounded, you would be surprised to find that after 30-40 years we’re literally talking about MILLIONS of dollars, even for a modest house payment in the $500-$2,000 range. Not only would that build a huge amount of wealth for future generations but it would also EASILY pay for rent and expenses for a spouse once someone dies.

Of course, I realize that some people don’t know where to find opportunities, don’t have the time to find them, and there will always be those who don’t have the discipline to save the money and invest it if it’s not “forced”. But, for the right people, this could literally mean the difference between building wealth for future generations of their family and not. The biggest hurdle for those who actually have the discipline and motivation is actually financial advisors, who are essentially hired salespeople for stocks and bonds – and NOTHING else. Which is why hard work via networking is the key to finding great opportunities and the key to building wealth and cash flow…

Good luck to everyone,

Investor J

http://www.meetup.com/investing-363/events/22180081/

http://www.meetup.com/FIBICashFlowInvestors/events/22180611/

You still have to pay taxes on the place. A $1M home will likely run you about $10k per year. It’s cheaper than rent, but there is also insurance, repairs, etc. If you are buying to lease the property out, I don’t think you make much money on the deal until Prop 13 starts to kick in vs. inflation. I wouldn’t be surprised if Prop 13 was repealed before then.

There’s a coming inter-generational battle as the populace realizes that appeasing the Boomers and WW II generation is harming the next generation. The next generation simply can’t afford the real estate prices that the boomers need to retire. Shoot, even the boomers can’t afford the houses they live in, but they get a pass with Prop 13 letting them pay taxes on a $90k residence but walk off with $800k when they sell it.

http://www.redfin.com/CA/Laguna-Beach/1253-Starlit-Dr-92651/home/4895780

At some point society SHOULD swing back to support the next generation, permitting Gen X and Gen Y to raise families. That is, if the Boomers will pass the baton and allow RE prices to fall.

Going by the photos above, that is a long climb to get to the house from the street-unless they have a driveway/garage next to the door? Doubt they would have that in a 1br. If you get older, that climb itself can be a pain.

Hello Caboy that area, like other areas, such as Laurel Canyon and Beverly Glen have some very odd small homes. Some of the lots were carved out of the hillside and a small house was built into the side of the mountain. Some have a garage at street level and then a 1 bedroom or 2 bedroom home on top and a 60 degree upward sloping backyard. I have a friend who lives in Beverly Glen between Mulholland and Sunset and it really is a strange place to live. Hillside homes and cars going 50 mph right outside the front door… I have lived in LA my whole life but would never live in those areas.

I see you found another house with a garbage can picture! Good job, LOL!

How the hell do you get 732 sq ft in two stories? Not to mention the house looks like it might fall off the hill in a major earthquake. Half a million dollars was a lot of money not too long ago (think late 90s). What the eff happened in the last ten years.

“Half a million dollars was a lot of money not too long ago (think late 90s). What the eff happened in the last ten years.”

This exact thing really kills me. It’s not like most people are making more money now than they were then – how in the hell did $500K become a middling middle class home in many areas. Most of the people I know living in those homes in my area paid around $250-300K in the late 1990s and still make a salary commensurate with that home price (i.e. $125K family gross). How in the hell did all these $300K homes become worth $500K+ when almost no one in the community can afford that price or the prop taxes on a legit $500K home purchase (CA’s sneaky Prop 13 helps but this is going on in places outside CA too). Some nitwit speculator paid up on a couple houses so now 1000+ homes all reset higher in everyone’s mind. That’s a whole lot of bigger fools with bank enablers required for liquidity.

Crazy stuff. The reality is this – those $500K homes are really $325K and those $850K homes are really $550K. 30-35% haircut to get to normalcy on price/income. That’s about what’s required in areas that haven’t exploded like AZ/NV/Inland Empire/Detroit etc…Some decent capitulation in FL from what I saw but plenty of older communities with seasoned mortgages trying to hold the line when the newer gated community down the street offers much better value (as long as the community and golf club don’t fold over).

Slim:

The answer is simple: divorcing Boomers. This social instability created churn in the marketplace and created demand for excess housing due to breakups of traditional family social units.

Each and every time boomers divorced between the mid-1970’s to the present, they wrapped the costs of the divorce into the price of the home.

You can throw in move-ups and upgrading to a McMansion during this time too, however divorce was the big reason.

The above plus the realtor’s 6 percent commission, loan pay offs for existing auto loans, moving costs, and 20 percent down for separate residences was added to the “value” of the home, since (omygoodness) being a renter was an anathema to Boomers akin to being an illegal alien today.

Thus, a 3/2 ranch-style house that was sold for $25k in 1974 spiraled ever upwards to become, depending on the zip, a $420k dump in 2005.

Everything, or as much as possible, was passed off onto the buyer.

I am very blessed in that an old realtor told me that this was the *main* reason for skyrocketing housing costs. Look at any housing price chart and you will see how housing costs went up markedly during the Boomer demographic.

http://www.zoyzoy.com/realestate/caseshiller.php?msa=31100

~Misstrial

Am I screwed?

I have two houses in the IE. One is in Norco. Paid 120K in 1986 (2100 sq ft) and in a good location. Paid off 20 years ago. The second is in a good Lake Arrowhead location, lake view, dock, 10 minute walk from house to dock. Owe about 110. Prices on the street range from 500 to 1.7 million. I only paid 370.

What do you think?

Gene,

Sounds like you got decimated by the real estate market for sure:) Luckily, you caught the last nice wave of appreciation. Good luck seeing those kinds of returns again for the next 15 years.

There’s a good location in Norco?

If you want to see a map of home price increases and decreases, there’s a great article in the WSJ today:

http://blogs.wsj.com/developments/2011/06/28/mapping-home-value-drops-by-zip-code/

It gives you a visual of what people have been talking about in LA, by zip code. As well as an option for the other big cities.

T/Y Questor!

~Misstrial

Looking at that, it looks like Central LA (So. Central?!) is due for some gentrification.

Great article, Dr. HB. And that dump is definitely overpriced at the current asking price. No doubt one bad rainshower away from a hillside landslide that takes the dump out.

And so true about the aspiration douchebag types…got one such buffoon in the office, just moved into a crummy 90212 1 bedroom apartment in the slums of Beverly Hills, just a couple houses from the border into “gross” LA, has a used Porsche Cayman and is just so pathetically, tragically wannabe hip. 40-something moron trying too hard. We all feel so much pity for the guy, at least we would if he wasn’t so annoying and pathetic.

Not to criticize, but you forgot to mention canyon fires.

~Misstrial

Not a snob. Just don’t want to live in a place full of rednecks.

Yes, “snob”. Every place has good and bad and when you lump a whole area together and everyone in it you are not only a snob but ignorant.

I agree with this! Often the “snobs” are the most unbearable while those they look down upon are refreshingly sweet nice and sincere! PS I have “redneck” gardener. He always jokes about his red neck making him a red neck. Plus he’s as white as can be a believer….but he’s so sweet and laughs easy and I really like him a lot, “red neck” or not.

Looks like a Mill Valley cottage – just add redwood trees and some LSD. About the same price too.

It’s interesting to click on westside houses for sale and see how dramatically the prices have veered up, then down, then up again since the late 80’s/early 90’s bubble, like this one:

http://www.redfin.com/CA/Santa-Monica/1020-Wilson-Pl-90405/home/6776286

$345K in ’92 down to $202K only 2 years later.

There are examples all over the place like this one. Until the govt stops intervening and the market finds its natural price points, I just don’t see how anyone can say prices won’t come down again. All the same arguments from the late 80’s are being trotted out again, but why is this bubble rational while the last one wasn’t? And what about all the claims in the mid-2000’s that prices would never come down again?

How about this wacky one? $233K in 1995, then over 1 million in 2007, and now $796K? What in the world is going on?

http://www.redfin.com/CA/Santa-Monica/1509-Pearl-St-90405/home/6775535

I believe that an old Hollywood actress died here….might be why the price is so low…..

Leave a Reply