The Bay Area housing market hits a snag thanks to absurd prices: San Francisco home sales are down by 12 percent year-over-year.

Anyone that thinks SoCal housing is nutty need only look at the Bay Area for how crazy things can actually get when it comes to real estate. The Bay Area has seen some of the wildest real estate speculation and mania that we have ever witnessed in California and that says a lot. We are professionals for chasing fads and spending well beyond any reasonable budget. So it should come as no surprise that the Bay Area housing market is now facing a wall. In general home sales are hitting a big slowdown and house horny buyers are not willing to pay $1.3 million for a crap shack if there is no other lemming in line that will pay more just a few months later. So long as this narrative plays out, the one that proclaims prices keep going up, then the mania will continue. We even see it in the comments here via examples. “Just look at this place†and of course it is some junky World War II built place but the price is astronomical. The underlying message is “see, there are still plenty of suckers that will buy therefore prices will go up.â€Â The Bay Area is now seeing that the pool of lemmings is drying up.

Bay Area home sales take a big dip

It should come as no surprise that home sales are the leading indicator for future price action. First home sales dip, then prices if the dip is significant. This is typical in markets where home prices get out of control and enter into bubble like territory. Just because people are paying cash or are going with decent down payments doesn’t mean prices can’t correct.

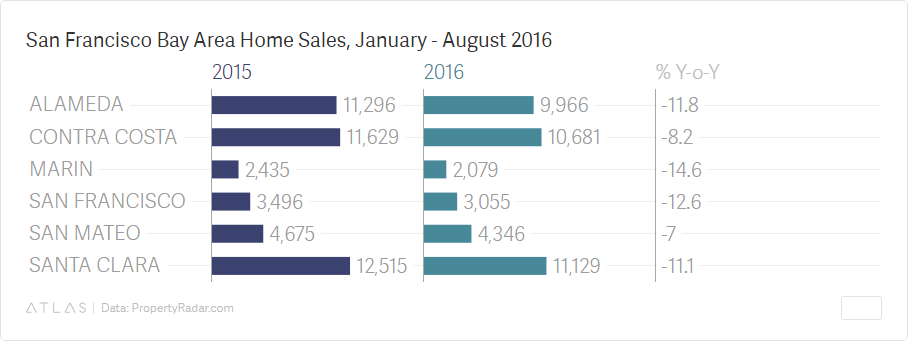

First, take a look at what is happening in the Bay Area:

Something is definitely going on here across the board in the surrounding six counties:

-Alameda down 11%

-Contra Costa down 8%

-Marin County down 14%

-San Francisco down 12%

-San Mateo down 7%

-Santa Clara down 11%

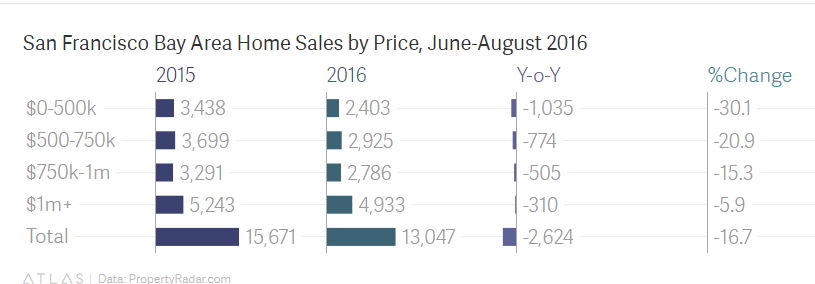

And the median price dipped by 2.2% during this period as well. And this isn’t simply because of the crazy high priced outlier homes. This is because virtually every segment of the market is priced at a nutty level:

In other words, sales are down across all areas of the market. Here is what you get in the “deal†price range in San Francisco:

419 Lakeview Ave, San Francisco, CA 94112

2 beds, 1 bath 840 square feet

Of course this targets the hipster audience with this line:

“The house is near to restaurants, shopping, including Whole Foods, MUNI Balboa Park BART station, Balboa Park & swimming pool, Stonestown Galleria, schools, colleges, & more.â€

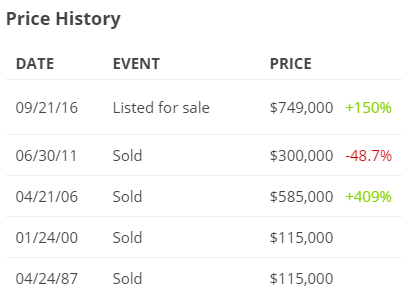

And of course this is a bubble. The place last sold in 2011 for $300,000:

Yet somehow, in 5 short years it is now “worth†the current asking price of $749,000. Yes, nothing crazy going on here. But the big slowdown in home sales in the Bay Area tells you some people are waking up or their wallets simply can’t handle the nutty prices.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

107 Responses to “The Bay Area housing market hits a snag thanks to absurd prices: San Francisco home sales are down by 12 percent year-over-year.”

thanks for sharing

The canary in the coal mine.

All is well. Nothing to see here. Everyone move along. Everything is just fine. Barack O., Janet Y., Jamie D., and Lloyd B. got this….

Lloyd Bentsen’s got it for sure – he died 10 years ago.

These are prime areas. Prices in prime areas never go down, so keep on buying!…The FED and the Democrats always will have your back!…They are your friends; they want to be in power because they love you and they are there to “serve” you.

If Trump doesn’t win, prices will go up forever.

Actually prices will continue to go up the TRUMP!

That’s pretty much the core issue of this site; that the middle class is getting it right up the trump.

No, the middle class will get Hillarized and it won’t be pleasant. The First and Second Amendments will be abolished, Obamacare will collapse, the borders will be wide open to illegals and jihadists, and American companies continue to move their operations to countries like Mexico and China.

Samantha what you’re talking about are the effects of capitalism, not any particular person in the White House. The only way to reverse things back to the wonderful 1950s like our parents or g’parents lived in, is to become more Socialist, as indeed we were in the 1950s – all the New Deal regulations and protections were in place, Unions were in place for almost a third of US jobs, taxes were sky-high on the rich, and due to the Red Scare, we were much more collectivist in mindset as well as in life – atomic bomb drills, no one questioned things like vaccination, etc.

Alex, correlation IS NOT causation. The US in the 50s was not great because of high taxes. It was great because it was in a monopoly position after the whole earth was scorched by war. They had monopoly prices/profits and for that reason the unions could thrive.

Under the present globalization (especially of the financial sector – TBTF banks) that is no longer possible. The election is clear: between a globalist (Hilary) and an egomaniac (Trump). Given the 2 choices given to us by the “SELECTION” (not ELECTION) committee, I prefer the second. The first choice is a continuation of the last 12 years.

If you like the course of US in the last 12 years please go ahead and vote for Clinton; nobody stops you. If you don’t like that, you don’t have too many good alternatives – just a bad one which is not the worst.

Alex: “The only way to reverse things back to the wonderful 1950s like our parents or g’parents lived in, is to become more Socialist”….like in Venezuela… you can go there – it has everything going for it: a president who “loves” the poor people and lots of natural resources (plenty of oil and nice beaches). You’ll feel right at home. Leave us here with the “crazies” like Trump.

As soon as realtors get tired of sellers unrealistic sales price, they will demand that it be lowered, regardless of how desperate they are for the commission, since it would be non-existent if the property never sells

Isn’t that what the article is about? Prices going down? Bubble self correcting?

This is what happened in the last crash. Desperate RE agents telling owners of houses it’s lower the price by $100k or the likelihood of a sale being vanishingly small. It was a race to the bottom there for a while.

Not in all areas. Inland cities in the Central Valley like Sacramento and in the Inland Empire like Riverside were hit hard. West LA, coastal San Diego, and San Francisco not so much.

We should start a proposition that would raise taxes for second homes and make it illegal for companies to own anything other than apartment complexes.

You should move to Russia.

He is Polish so Russia would move on him,….historically.

There does need to be limits set on ownership. People don’t realize monopolies are forming. What is troublesome are those monopolistic companies are not using U.S. companies. A Chinese company has bought theater chain AMC and Caremark. Thus they own more than 60% of movie theaters. AM Bev now owns 70 %and up to 80% of the market for beer in the u.s.. They own the Budweiser beer brand(that includes michalob…etc), and Cooks, and Miller beer, and corona, and at least 100 more.

I never thought I would see the day when coos and bud would be owned by the same company. So you can now call Budweiser and colors import beers lol

Disagree. Let the free market decide. However, the cost of consequences of speculation should be restored.

But thats the problem. The free market isnt deciding. The whole thing is being manipulated. Unfortunately we need a crash. I know it will hurt alot of people but better than this slow death.

Bingo. No bailouts when the market goes to the shithouse. You buy a rental when you can 2K a month and the market drops in 2 years and you’ve got a bunch of half-filled 9150’s homes that can’t fetch 1,200/month…that is on the inventor.

What “free” market is that? It’s completely manipulated.

I am very aware that the market has been heavily manipulated. And I am heavily against the current extraordinary Fed and government actions that contribute to such manipulation. At the same time, you can see the free market re-asserting itself (debt saturation, peaking sales and prices, etc.) despite all efforts to the contrary.

Sorry Prince. It just really upsets me with whats happening. I should be fine but I worry about other people and the future.

@Cromwelluk

I fully understand the concern about future generations. A thriving, sustainable housing market must be affordable to first time buyers corresponding local incomes. The best way to ensure this is to restore the costs and consequences to risky investments and speculation. I do believe that the smart investors are getting out as the amateurish ones are jumping in.

Like they did in Vancouver, we should have a 15% foreign buyer tax in California.

You made an easy decimal point error, it should be 150%

Totally. Lets make a rule that cake has no calories

You knew this would happen at some point! You can’t have prices continue to increase, while overall affordability continues to decline, and even the monied buyers back away because prices are too high! And, you wonder at what point people will begin to panic and start putting their homes on the market trying to capitalize on their appreciation!

LA home sales drop to the lowest level in 4 years

http://la.curbed.com/2016/10/10/13236738/home-sales-drop-los-angeles-county-prices

This plateau is different.

In San Jose area houses still go pending within a week or two max. People are still buying even though I have no idea who can afford. Engineer with 150K salary qualifies for $800 max house. There are no prices like this for a house. You can buy a condo for 800K here. 🙂

Let’s assume that engineer is getting $150k and not $80k or $90k or so. Let’s also assume they don’t have $150k in student loans, which frankly isn’t an unreasonable amount in *my* book, based on the idea that it’s worth it to borrow a year’s income to *get* to that income*, and then figuring an $800k place is $8k a month by Alex Math and $4k a month by Today’s Real Estate Math, he’s gotta cough up $4k a month that’s $48k a year. That’s before insurance, maintenance, car payment, and INCOME TAX – that last is gonna be about 30% so call that $50k all on its lonesome.

Then the wife Mr. Engineer was fixed up with by family at age 8 is flown over, and proceeds to pop out kids … at least she stays home, cooks up Indian food cheaply, does the laundry, and doesn’t ask questions (at least not in English!).

I guess it’s possible, but it’s a squeeze.

*looking back at my college days, I can see now it was a matter of “go big or go home”. I was big on the Boomer-era bullshit of working while in school, and instead if I was going to college I should have borrowed out the yanger.

Alex, why would we assume that “the engineer is getting $150k” when you told us that most folks in San Jose make ten dollars or less an hour?

Another misunderstanding of the difference between median and average.

Here’s my classic rundown on the San Jose economy: Half of the population is homeless or nearly so (living on their parents’ or kids’ couch, in a garage, in an old van or RV etc.) and make an average of $0 a year. The other half make $100k working for the police, the courts, the gov’t in general, largely toward keeping the first half cycling through the penal system. Result: An average income of $50k a year. Oh, and we have a few techies making some money, but at 5% or so of the total economy, they’re not much of an influence.

Really sounds great! Please keep your rat race! I traded that for breathtaking views of mountains and a lake; a home and 2.5 acres, a boat in the small marina 2 miles away, deer, wild turkeys, bear, and other wildlife wandering across my property almost daily; endless outdoor recreation opportunities; and an eclectic set of communities with a combination of small town, hip vibe, with all the conveniences! You just have to decide what is important!

@Jeff

I think Alex’s comments reflect the two economic realities we have in this country today. When I watched the debate, and listened to them pander to the middle class, I had to wonder, what they were considering middle class, and what the masses were considering middle class. To our millionaire congress/senate/presidents, middle class is $250k a year, when reality shows is much different;

http://www.pewresearch.org/fact-tank/2016/05/11/are-you-in-the-american-middle-class/

I live in the South Bay, so there is some truth to what Alex is saying. My buddy is a software engineer in his early 30’s making 6 figures and he lives in 700sq ft apartment that he rents for about $2600. He says after all his expenses the most he can save is about 10K a year, and that’s if he’s disciplined with his money. He just cant save enough to catch up to the pace of home appreciation in the area. Imagine with a wife who doesn’t work and a couple of kids.

@Hugh Mungus,

I don’t know all the specifics about your buddy, but saving only 10K per year sounds low. First of all, he is paying too much for rent. You can easily find a 1 bedroom in the South Bay for $1800/month…as simple as that he just saved an additional 10K per year. Being disciplined is all relative. If somebody is truly serious about saving for a downpayment in ultra competitive coastal CA, you need to take extreme measures. No cable, no expensive gym memberships, bring your lunch to work, minimize going out and partying, no fancy new cars, hold off on the travel plans, etc. This lifestyle isn’t for everybody, but that’s what it takes to come up with a hefty down payment.

Home prices will rise and home prices will fall, and in Californicate I recall this cycle was about every 8 or 9 years. Is anyone surprised?

When home prices fall, will any of the gloom-and-doomers go out and buy a home….

I doubt it.

Well gee, if organic buyers were given the same access to pricing, inventory and credit as investors were during the last downturn, things might have been different. Otherwise, we’re forced to pay a premium that contributes to bubble pricing.

I sold at the peak in the last bubble, was looking to buy around 2012 but didnt see any properties that were attractive – most required all cash, far away from my job, lots of fixing, etc. Market never got a true “reset” in my neck of the woods.

That said, now that its clear this bubble is starting to burst, had I bought back then I likely wouldnt have been able to sell now for a fat profit. You really have to be in choice areas with a booming job market and a somewhat constrained supply to see things get really bubbly and cash in. Its been eye opening to me as someone who follows RE closely, made good money and would like to do so again in the future.

Sure, some us “gloom-and-doomers” do exactly that. I sold my East Bay house in Feb 2006, rented till July 2012, and then bought a house outright with the proceeds from the previous bubble, which was easy to recognize as a bubble as it peaked. Recognized it how? By way-above-trend price increases coupled with sales volume peaking in Oct 2005, that was the signal that it was time to sell the previous bubble phase. It’s not mysterious: volume leads price. This bubble phase too shall pass. Many thanks to Dr Housing Bubble for tracking it all so well.

When the bubble will bust, they will blame it on Trump. The FED does not have anything with this bubble. It is all Trump’s fault.

Congratulations. Between extended family, friends, business associates and clients I know of not a single one who sold their home at the market peak, rented til the market bottomed and then bought again. Not one. You are one in a million. Maybe one in two million.

The fact is virtually all doomers/gloomers do not time the market and either end up frozen on the sidelines or buying without regard to market timing.

Trying to time any type of market (RE, stocks, etc) is almost impossible. As I have mentioned many times, 2006 really was different compared to today. Loans to buy houses were given out like candy. The cost of buying was much higher than renting the same place. The ensuing result was obvious, especially in places like Vegas, Phoenix, IE where prices went down 60+%. Coastal CA was very different, values went down from 15 to 30%.

Fast forward to 2016. Rents have skyrocketed, population has increased, very little building has taken place and multibillion corporations became landlords on large scale. Owning a home is stability, especially if you have a family. Very few people are going to roll the dice and give up this stability to MAYBE save a few bucks. If you can afford your home and enjoy living there, selling won’t be an option for the vast majority. Coastal CA really is different. It has become a global destination for the wealthy and supply/demand issues will keep prices elevated. I would bet my money on this.

Funny that Sam Zell sold prior to the last downturn. Now, he’s selling the properties (that he most likely got through easy and cheap credit during the previous downturn) off again. Heck those other landlord hedge funds are selling, not buying, their portfolio. Timing the market maybe be wishful thinking, but it’s not impossible to see when prices are not warranted by fundamentals.

As the last downturn showed, owning a house is not a slam dunk proposition. Paying too much can lead to financial and social instability. Many owners took loans out on their “paper equity” and became upside down. And the market is far from stable when its values depend on record low interest rates and government subsidies.

@Trump, yes you are right

Rents in OC hit all time high! Is it different this time?

http://www.ocregister.com/articles/month-732219-county-rents.html

Average apartment rent rates from article:

Orange County $1,781

Los Angeles $1,676

Inland Empire $1,239

Not that bad. Or you can pay $800,000 for some poorly built home. And how much of a down payment do you need to be competitive? 10 percent or maybe 20 percent? That is $80,000 or $160,000. And you still have a big 30-year mortgage.

Is it different this time? It is always different for dummies.

You are comparing a 1 bedroom apartment to an 800K home.

Let’s just stop right there…

For their mortgage to reach rental parity, the buyer would have to put down 160K (20%). And that’s without counting property taxes ($833 monthly), insurance, HOA (if applicable), melo-roos (if applicable), and maintenance costs. These housing costs would consume ~40% of the gross household incomes in OC. No bubble in rental and housing prices to see here folks.

This is my favorite quote from the article:

“But there’s still some sticker shock after realizing how much it costs for a unit with underground parking, a pool, gym, business center and weekly cooking demonstrations, said Rashelle McCarroll, 26, who moved there in May after four years exploring the West in a 37-foot travel trailer.”

Yes, I would assume a pool, gym, business center, & weekly cooking classes might add to the cost of a apartment. But these things are necessities, I mean who could live without them?

Cheap and easy credit being allowed land prices to re-inflate. Forced to pay a premium for land, developers were forced to build luxury housing to cover their initial investments. Not only did it drive up new apartment prices, but it drove up the rents of existing apartments as well. Thus, the hand of artificial inflation is being felt throughout even if it is drowned out in the official inflation numbers.

That’s probably what those who bought during this bubble cycle are hoping for. And that the Fed and government have repealed the laws of economics.

Notable key words in the OC Register article: asking, apartment, summer

Notably missing from the OC Register article: any details as to Reis data metrics

Here’s a current report which claims rents are falling: https://www.abodo.com/blog/october-2016-national-apartment-report/

I see a repeating pattern here. The moral of this story is buy low and about five years later, sell high for nearly a half Mil profit. Buy low in 2000 for 115K and sell 6 years later for 585K (470K profit.) Buy it a again 5 years later for 300K and sell it again in 5 years for 749K for another 450K profit. How to become a millionaire on the same house. 🙂

I thought this time was different….

I think this was my point. I’ve seen it all before and it is happening again. A house is a good net egg, forced savings, and a hedge against inflation. But just like stocks, you can’t be forced to sell at a low. I can honestly say that if I bought a house in LA at any time before the past year, I would make money selling it today. If I buy a house today, I may have to wait 10 years to make money on it. Or maybe next year before the next down cycle. A house is, and should be, a long term investment. Anyone who has held a house for 10 years will tell you that it probably has been the best investment they ever made.

A house is, and should be, a long term investment.

No, it should not be a longterm investment. It should not be an investment at all. It might be for some, but that’s not what it SHOULD be.

A house SHOULD be a home. A place where you feel safe and comfortable. An oasis against the world. Something you buy for shelter and security and enjoyment.

This being so, you SHOULD buy what you can afford, in a place you want to live. Then ignore the real estate market. You have your little castle.

luckily I bought in the downturn in 2010. I paid $15,000 over the asking price. My house value actually went down in 2011 before it started to rise in 2012/13. Now I’m up about $300,000.

everybody loves to talk about buying when the market it low, but the problem is you never quite know where the bottom is. You still have to be aware that prices can still go down after what you thought was the bottom. Are people willing to be “underwater” the first couple of years of buying un till prices start to rebound?

Hindsight is beautiful. Would you buy your place again for the current market rate?

to VPN,

It was a fixer upper when I bought it and I put some work into it and improved some things. Still some work that needs to be done, but as a whole I would buy it again. however I do acknowledge that I would not be able to afford it again as a single income person, I would need a dual income.

Well, speaking as a Southern California product who lives in the Bay Area, prices are not only nuts here but what you get for that price isn’t that much of a good deal. Traffic is at least as bad as there, the average person working their 60-80 hours a week isn’t going to the beach any more often than someone in Los Angeles is, and the creative people are bailing out and heading to Los Angeles, away from the computer-case-grey “tech-bro” culture that’s taking over up here.

Great minds think alike! Here is my post from yesterday with additional info.

https://anthonybsanders.wordpress.com/2016/10/17/zuckerburg-san-francisco-area-home-sales-plummet-12-yoy-largest-quarterly-decline-in-homeownership-since-2005/

So if prices go down, what’s to keep people from fighting over lower prices, only to drive them up again?

Last time, people didn’t “fight” for properties until after prices fell close to 30% and the Fed and go ernment embarked on the greatest debt disbursement in history. Is there further room for credit binging and rate cuts when both are already at historical levels?

That’s a interesting question. Here’s my logic…

In the last bubble everyone who wanted a home got one due to relaxed lending and subprime mortgages. There wasn’t so much pent up demand when the crash occurred in 2007 as we have now. Currently we have a large number of would-be buyers sitting on the fence waiting for a price reduction. I think a small reduction would be enough to move these buyers and kickstart bidding wars. A massive increase in inventory or a moderate increase in mortgage rates would help keep prices down.

We are waiting on the sidelines for the next dip, but everyone we’ve met up here in Portland think it’s smart to buy now or “be priced out forever,” and I know several families who have purchased recently.

Prices fell 30% in many areas before an artificial bottom was established thanks largely to Fed and government actions. If prices fell despite the ongoing extraordinary subsidies and bailouts, what’s to stop the fall? As greedy as buyers are when prices go up, they’ll be equally fearful on the way down.

It’s hard to fight for houses, driving prices up, in the midst of a Depression. You’ve lost your job, you don’t know – if you have a nest egg at all – how much of your nest egg will be eaten up by inflation, you’ve got parents, kids, other relatives or friends who can move in with you or live in the street, etc. How short people’s memories are!

Jane, if you remember last time around the crash began when credit markets froze up. So even if you wanted a house, a bank wouldn’t lend you the money for the prices that were being asked, even as prices fell. It was almost like accountability returned for a brief second.

But here we are again, with minimal down payments and taxpayers back-stopping ridiculous mortgages that a bank would never write if they had to hold onto the loan themselves.

At the low end, homeowners are even more leveraged than they were during the bubble:

http://www.marketwatch.com/story/at-the-low-end-homeowners-are-even-more-leveraged-than-they-were-during-the-bubble-2016-10-17

Housing starts tumble 9% as sturdy recovery remains elusive:

http://www.marketwatch.com/story/housing-starts-tumble-9-as-sturdy-recovery-remains-elusive-2016-10-19

People are thinking, they can buy a place and AirBNB one room. Not a bad idea really, but for that $100/night you will likely be picking people up and dropping them off at the airport or train station, doing laundry daily, getting up and cooking their breakfast, etc. All in all it probably doesn’t pay any better than driving for Uber and we all know Uber drivers are realizing less than minimum wage.

The Bay area is down because the offshore Chinese buying frenzy has slowed, at least as for as SFR’s. I see a lot more houses on the market in East Bay, but people are still buying. Too many job openings and you need a place to live. Houses are sitting for sale 50 miles out in the Tracy/Manteca area, but the commute is a killer. Amazon is bulding like mad in Tracy, and jobs go begging, but you can’t buy a house on what they pay.

$10 an hour to run around an Amazon warehouse in Tracy? Ooh, sign me up!

Markets are always local and sometimes block to block. Narrow down your choice based on never strapping yourself down on a house payment. If you truly say that you have to do without something to afford to buy it, than it means you can’t afford it.

There is no such thing as prices will go up even more, so buy now or else RE agent smoke and mirrors talk.

Catastrophic events, major down turn such as tech sector collapses, of course a person may say I will never own a home, for the most part I have to chance it and buy now. My advice as a long term investor in Ca, Co, AZ. Most of No Ca. is very suspect and I would pass and Orange County south to SD is also a bad investment going forward. Inland Empire is drive to buy country but nice homes can be bought. Ventura county if you search can be good. Santa Clarita another drive to buy, but good solid area with good buys if you do your homework.

Denver is completely over valued a disaster waiting to happen, never ever over pay for a house in Denver metro. Colorado Springs, better than Denver but still a concern for the future. Boulder county is strange laws and HOA, taxes can be a problem and downturns hit quickly. Fort Collins another feast or famine, stay away.

Phoenix has pockets of greats buys from Goodyear to West Peoria. Gilbert is still very good but stay away from Queen Creek.

If you have a solid down payment and good income and afford 600k to 800k you can really hit the jackpot in No Scottsdale, the area is very cold market and ripe for the pickings, property taxes are among the lowest in AZ and city services are second to none. if you can afford more than $800k I would pass at the present time.

ANTHEM to the north has homes that are large and priced right, the problem, water is a major concern, and fees for services are prohibited in cost, I would pass on it.

I found this completely unhelpful. Thank you.

So…..you came here looking for help??? Yikes.

I found your response completely hilarious. Thank you.

Marduksons… This is so funny because I told wife I think I should respond> “this site is not a helpline”, I have been on this blog for a numbers of years now and didn’t want to get into to it like I have many times, just wanted to give a perceptive look at the markets I have visited since we retired ,lot of time on hands we travel a lot now. take care

Actually I come here to count how many times on any particular day someone here posts that this day is the beginning of the next RE crash.

I grew up in Westchester and recall when the first Playa Vista condos were being built on the old Howard Hughes airport, how ridiculous I thought it would be to live there and pay some outrageous amount for a modern 1 bedroom condo.

Even though I still live on the westside I had no interest to go see Playa Vista. Last week that changed when I met friends for dinner in Playa Vista and although it is a yuppie heaven in which I would never want to live, I was impressed with the layout of the streets and shops and living areas.

Gotta admit though, $600K or $700K for a 1 bedroom condo is ridiculous. But obviously with those asking prices, lots of people have that ridiculous amount of money to spend, let alone the $2M needed to buy a home that looks like a condo in a crowded area

http://playavista.com/live-here/#for-sale

QEA:

One of my coworkers got into the first phase of Playa Vista. We had a discussion about its future…nobody can argue that it’s expensive, crowded, etc. For newer developments west of the 405 that is close to EVERYTHING, there is little alternative. What you are seeing is pure supply and demand at work.

The same goes for the Three Sixty South Bay development in Hawthorne (Aviation and El Segundo Blvd). These are new condos/townhouses selling in the 600K to 800K range. The caveat is you have a Hawthorne address. The place is really not ideally located either (very close to the 405, LA Air Force Base, not walkable to anything, etc). Yet they have no problem selling these things! There is demand for this type of product.

http://threesixtyhomes.com

I recall a few articles back, someone posted that actress Lena Headey was real estate savvy, because rather than buy an expensive house despite her huge salary, she settled for a $750,000 fixer upper in Sherman Oaks.

I now come across this: https://www.dwell.com/article/lena-headeys-off-camera-castle-b7a192b4

Headey didn’t remodel the house. She tore it down and built a new house.

Broden, formerly a construction project manager at Marmol Radziner, uncovered asbestos ceilings, water damage, and a serious mold infestation, which prompted taking the structure down to the studs and rebuilding.

Headey is even considering becoming a house flipper.

Now that she has a real home to return to between shoots, Lena says she thinks it might be fun to try her hand at flipping houses — not so much for economic gain, but to counter the McMansions that seem to be proliferating overnight. “They’re ruining neighborhoods that are unique and visually pleasing,†she says.

Or, she could just be talking, without any serious plans to follow through.

A newly constructed house in Sherman Oaks. (I assume the work was reported to the taxing authorities?) Wonder how high that jacked up her property taxes.

Taking a house down to the studs is not the same as tearing it down. Tearing it down is essentially bulldozing it. Taking a house down to the studs is essentially removing all drywall, flooring, kitchens, bathrooms. This is common practice for flippers. A group of unskilled laborers with basic hand tools should be able to do this in a couple of days. This also makes plumbing and electrical work much easier.

I wish rehabbers would think, and not be so reflexive about gutting a place back to the studs. Often, the place is in good enough condition that only a partial gut is necessary, one that saves the beautiful mill work and plaster work these places often have. Several wonderful old 20s vintage apartment buildings in my Chicago neighborhood were DE-habbed by tasteless developers in the 00s, with some sad results. I cry every time I walk by a former rental of mine, that was so beautiful before it was converted to condo. All that would have been necessary was to gut the kitchens and enough wall to facilitate the electrical and plumbing, and weatherize the shell of the building. But many developers totally re-arrange the floor plans, replacing an excellent floor plan with one that often makes no sense at all and destroys the interior architecture of the unit- I see units with what used to be a bathroom window, in an awkward place in the living area, and bathrooms that open directly into the main living area, with no improvement in the flow or usable space of the unit; and wonder what the rehabber was thinking.

houses are selling fast in the Bay Area… This is the strongest job market in the country…

Yeah so no Tank here folks.

wake me up when we go on recession and people are losing their jobs. No Job no buying… easy until then who cares about these charts

Totally agree 100%, not only is there no slowdown whatsoever, the market is gainly steam daily. I am not a fan of this course but it is the reality of what is happening. This market will keep booming for a while. Jim Taylor will continue his trend of being on the wrong side of history and an awful economic forecaster.

Not in my neighborhood

I feel like maybe 25% of my posts don’t make it onto the forum, am I too much of a bear? I try not to use uncouth language as well.

Anyhow, I am not seeing any sort of a slowdown whatsoever despite living 1.5hrs. from SF. Granted, it is completely different than SF and not as ‘gentrified’ but that even speaks more to my point…we are on a completely different trajectory than SF. They are supposedly contracting and the inland markets are seeing anything with a pitched roof sell instantly to foaming at the mouth house horny zombies.

There is zero slowdown on any level. I don’t think this is the ‘it’s happening’ moment at all. There is no paradigm shift in the markets I invest in. I am still not buying though because obviously nothing pencils, however this marketing is booming.

You could put a comp shingle roof on dog excrement and it would sell pre-market. (Will this last sentence prevent you from posting my comment oh secret hand??)

Certainly we won’t see a real drop until the next recession hits around Q2 2017. After Hillary gets installed, the Fed will let the market tank to get the recession over early before the 2020 re-installment of Hillary.

REMEMBER, housing corrects very slowly! It peaked in 2006 during the last double, and bottomed out around 2011 or 2012! That is 5-6 years!

I live in the South Bay Area (West of San Jose) and I can tell you houses are definitely sitting on the market longer than they did in the recent past. Also seeing prices reduced on many properties as they sit on the market. One look on Redfin with that filter will show you how many are starting to roll back. With tech still doing well, the rollback may not be massive without a major economy event, but still, I am glad I didn’t listen to friends who told me earlier this year to “buy or be priced out forever”.

Its definitely starting to act different in the city, seeing more properties on the market longer and a lot of new listings that look more like lets get out on the top. Also seeing more parking enforcement boots in action on cars on daily walk.

Friend bought at the absolute top in Sacramento last month….market is softening there also….

It amazes me some of the asking prices I see for outdated crapshacks with only one bathroom in the quasi-ghettos of LA with bars on the windows. But decent properties with semi-realistic prices are still moving quickly. I guess some people just have to scratch that itch. I expect things to slow down some as we enter the holiday season. A RE agent recently told me that the luxury home market in LA has really slowed down as of late.

If luxury includes as low as $800k to 1.2 mil, then I’m seeing the exact same thing in LA. Of course, these aren’t really luxury properties at all, unless you consider it a luxury to live in a tiny home in a decent neighborhood.

Regardless, the inventory in this range remains low, but it doesn’t move much. It’s the same properties for sale, week after week, with the occasional good one moving almost instantly.

This is subjective, but I think we’re getting to the point where some people are holding out for something better down the line. It’s one thing to be priced-out entirely. It’s another thing to be able to afford something but refuse to buy because of how little one gets for their money, relative to 4 years ago. Dumpy condos cost as much in LA as a starter home with a yard did in 2012.

I know a lot of homeowners in the neighborhoods we like in LA. I used to assume they all did much better than us, until I figured out that a lot of them actually don’t. They just bought at a much more favorable time, whether that 2011, 2012, or much earlier.

These are people my age, so I’m not talking about a generational difference. But the reality is that many of them could probably not afford to buy their own homes at market prices today. I’m talking about 4 years, not 25. That seems very bubble-ish to me.

If it looks like a bubble, smells like a bubble, and talks like a bubble….you know the rest. This cycle is about investors borrowing hundreds of billions to chase yields via real estate acquisitions and pricing out organic buyers will smaller lines of credit.

Tony I think you’ve nailed it pretty well in terms of, “holding out for better.” For those people pressured for time, they’re pulling the trigger on the best of a bad bunch, but the rest of us are waiting. I’m focused on shopping in South Bay and when it takes 800K+ just to buy a house that has a lot, 1M+ for a decent sized home — there’s no point in pulling the trigger on a house that I don’t absolute love. The houses I see listed are usually 750K+ and then need an easy 50-75k in materials alone for upgrading.

The pool of buyers who can afford the 20% down and then money to fix are shrinking by the month. Which explains why I now saw this article on Redfin — https://www.redfin.com/blog/2016/10/the-low-down-on-new-low-down-payment-mortgage-programs.html

There’s an increasing amount of mortgage products coming out that will offer as low as 3% down (non-FHA). In Wells Fargo’s case, they’ll consider applicants with FICO as low as 620. Anything they can do to keep this bubble up.

I seriously doubt anyone will qualify for 3% down with a 620 fico. I assume it’s a advertising ploy and a way to get people in the door. The 680 score mentioned in the article sounds more realistic. The way I see it, if you only put 3% down what’s to stop you from just walking away if the market tanks again?

I’m seeing the same thing in the greater Long Beach Area. Most the inventory above 750k sits and sits. Many have price reductions. A few properties in good condition sell quickly but many have languished all summer. For example, I noticed a 4bedroom/3 bath 2200+ sq foot house in Cerritos list in May at $899k and finally sell last month at $775k.

I’m not sure why this is happening. As Tony states it could be folks are waiting for a better deal. Most likely this is the case with some. Maybe I’m underestimating house buyers, but I think most of “the sheeple” will buy with whatever loan the bank will give them. So if that’s true, there is less of a pool of buyers in the upper ranges. Did the Chinese stop coming? Are job losses mounting? Is it becoming difficult to move-up with equity from a less expensive house?

I don’t know… but things are definitely softening

If you buy a home for $500K and put 3% down, your monthly PITI (Incl. PMI) would be close to $3,500 a month, or $42,000 a year. Considering your housing costs are supposed to be 33% of your gross annual income, you should be grossing $126K+ a year to comfortably afford this arrangement. IMO, if you make 126K+ a year and your credit score is below 690 and you don’t have more then 3% to put down, you probably have made some very poor financial choices throughout your life and buying a home may not be for you.

I just bought a house this summer. I really did not want to, but we had our nest egg saved up and with a growing family and kids, we bought our small 3 bed, 2 bath house in NELA. I know the market is going to dip, but when you have a family and you need a home, we just couldn’t wait. Our 1 bedroom apartment in the city was getting a bit too small to house our 4 plus family!

If you plan to stay there longterm, I think you’ll do all right. The home’s value may dip, or even fall, in the future. But it will come back up, and surpass what you paid for it.

JJ…Good post, I pulled up 6 homes that closed from 800k to $1.1m. 4 of the 6 put down 5%, 1 at 3%, the other was all cash. Last year this would not have happened.

Oh no! I guess this may rule out a correction coming soon?

http://www.fanniemae.com/portal/about-us/media/corporate-news/2016/6467.html

Thank you, nice read.

Prices remain high

It’s all a big lie

Leave a Reply