4 current trends in the housing market: Rents holding steady nationwide, young home buyers, bidding war trends, and going after strategic defaulters.

The big motivation for large real estate investors was the yield they could potentially receive from purchasing real estate in depressed markets. Early adopters entered the market in 2008 and 2009 and by 2010 the market was flood by big money investors. Today we are seeing a saturation in terms of investors and yields are not worth the time for many large funds. For example, rents in Arizona and Nevada are down from where they were in 2010 in spite of the rapid rise in housing values. It could be because there is a saturation of rentals in these markets or simply because incomes are weak in these areas. One thing is certain and some investors are losing their appetite for rental real estate. Another interesting trend involves higher inventory and subsequently and ease in the volume of bidding wars. What are some of the trends in the current housing market?

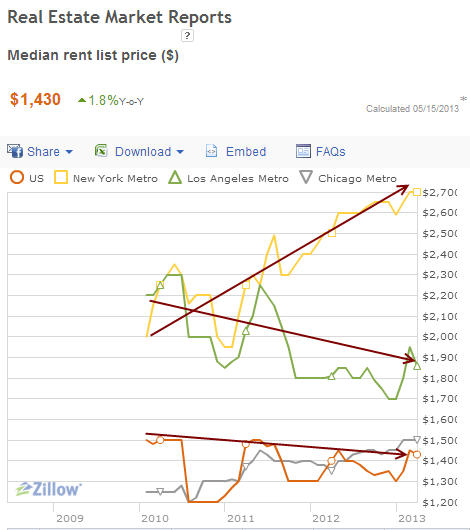

Rental analysis

One interesting trend is the large rise in rents for New York since 2010. Los Angeles rents appear to be steady or falling somewhat according to the median list price. The rental trend in Los Angeles appears the same as it does for the nation.

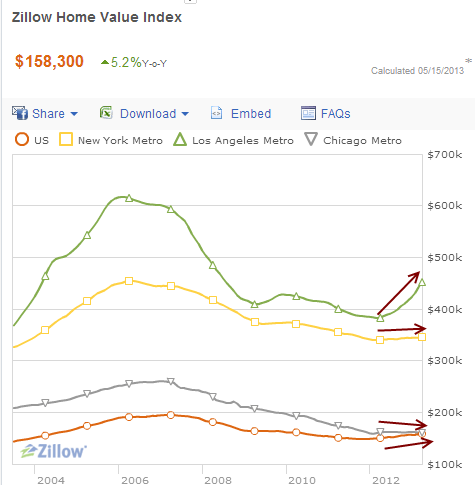

What is interesting is when comparing housing values:

Los Angeles is one of the markets that has turned around quickly. The trend isn’t evenly distributed as the chart above highlights. The big jump in New York rents is interesting since home values according to the above seem to be fairly stable. Unlike Arizona and Nevada with falling rents and incredible jumps in home values, New York would seem to justify a move up in prices when looking at rents.

The young and in debt

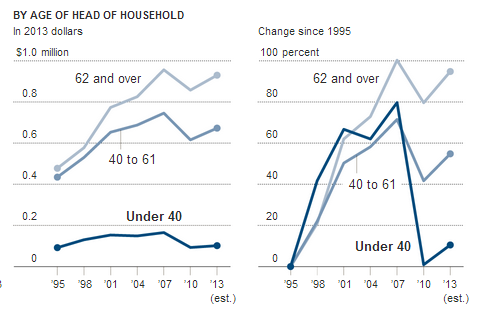

Americans overall receive a large portion of their reported net worth through real estate equity. Since many young Americans bought near or at the peak, they never really had the chance to accumulate any equity growth. Many also bought with FHA insured mortgages or low down payment loans stretching their budgets. Because of this, net worth for older households has largely recovered from the peak but for younger households, they are still down by a whopping 40 percent from the peak:

Source:Â New York Times

The main reason? Negative equity. The debt still remains connected to peak housing values and while stocks are near record levels, real estate values nationwide still have a long way to go to reach those previous peaks.

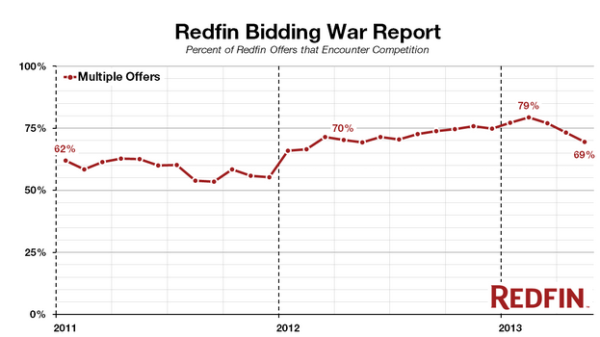

Bidding wars easing up

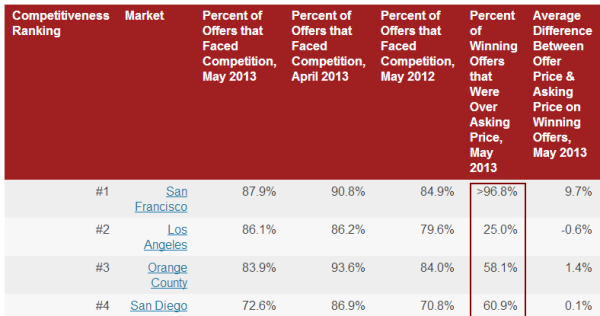

Redfin has an interesting report on bidding wars. Of course the most competitive markets seem to be in California. Take a look at the bidding war trend:

Source:Â Redfin

The main reason for this? The largest monthly inventory increase in three years might help to ease off some of the insanity in the current market.  This might offer some wiggle room around the country but the heat is still on in manic California:

Look how crazy the San Francisco market is in terms of competition. In May, over 96 percent of winning bids were over asking price! Orange County and San Diego had very high numbers here as well. So if you are out there in this mania and are losing out, this is probably why.

Going after strategic defaulters

A large number of people strategically defaulted during the height of the bust and many thought they were off free and clear. Now that prices are up, banks are looking into those strategic defaults from the past:

“(WaPo) [Freddie Mac spokesman Brad German] said Freddie Mac is targeting “strategic defaulters,†which the agency defines as “someone who had the means but chose to go into default, that there were no extenuating circumstances that affected their ability to pay. If you’re choosing not to pay off your mortgage, but you’re paying other bills, we would consider that strategic default.â€

In 2011, Fannie and Freddie flagged 12 percent of 298,327 properties they had foreclosed on — more than 35,000 — for deficiency judgments in an attempt to collect $2.1 billion in unpaid mortgage debt, according to an inspector general’s report released in October from the Federal Housing Finance Agency.â€

Americans seemed to be shocked that data was being collected on them while they post their entire lives chronicled by the minute on Facebook voluntarily. So it should be no surprise that our GSEs were also tracking those strategic defaulters. Now that times are good and equity is back up, you might be receiving a letter if you strategically walked away from your mortgage and had assets in other investment vehicles.

The trends suggest that rents are tight because incomes are tight. You also see that bidding wars might be reaching an apex in terms of manic fever in some markets. In the end, the momentum is still on the upside but for how long? Can the Fed continue to purchase MBS and risk inflating that $3.3 trillion balance sheet even further? The fact that inventory is rising is a good sign for most Americans.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

41 Responses to “4 current trends in the housing market: Rents holding steady nationwide, young home buyers, bidding war trends, and going after strategic defaulters.”

@Dr. HB wrote: “..Los Angeles rents appear to be steady or falling somewhat according to the median list price. The rental trend in Los Angeles appears the same as it does for the nation…”

Answer: Probably because banks are now allowed to rent out foreclosures, as of April 5, 2012: http://www.federalreserve.gov/bankinforeg/srletters/sr1205.htm

“In light of the current extraordinary conditions in housing markets, the policy statement indicates that banking organizations may rent one- to four-family residential OREO properties without having to demonstrate continuous active marketing of the properties, provided suitable policies and procedures are followed.”

This policy change by the Federal Reserve effectively allows banks to become the biggest landlords in the country and it also allows the banks to carefully regulate how much inventory gets put on to the market. So banks can trickle out foreclosures to maximize their selling price.

@Dr. HB wrote: “…The big jump in New York rents is interesting…”

Nothing interesting about NY rents. Quantitative easing is conducted by the New York Federal Reserve bank. People in NY are getting commissions based the the $85 billion per month of the Federal Reserve’s QE programs. If it weren’t for the QE being done by the NY Fed, New York City rents would be flat or declining like every one else.

High rents in NYC are also being driven by property taxes that have risen steeply for the past 10 years in parallel with public pension obligations. The wife and I live in a small co-op building; in 2002, the building’s quarterly tax bill was about 23K, now it’s about 100k. Our share of the tax bill (for a 745 sq ft 3rd floor one bedroom) is 1k per month.

Rental buildings are passing their increasing property taxes along in higher rents.

The rental market is further skewed by the still large number of rent stabilized units-everyone else has to pay a little more to carry the lottery winners.

Uncovered a game I haven’t seen posted on DHB yet. It starts with a bank foreclosure, asking $350K. Bought by Agent #1 for $350K. Agent #1 lists it for $500K within a month or two. Agent #2 buys it at $500K and immediately puts it back on the market for $500K.

Think about it. Who’s working together. How much did they make?

Also, in my message about the “game I haven’t seen posted on DHB yet”, Agent #2 gets to say it’s worth $500K (due to the recent sale, right?).

I think the only “game” I’ve seen are brokers who have investors in their pockets. They show up at a potential listing and it never actually hits the market in that first transaction, but later appears with new paint, kitchen countertops and flooring for 1-200k more.

Does anyone on this thread know when the Feds will stop subsidizing the banks and real estate industry? It appears the future is dim for our young adults in requiring homes. other than being an heir to a family estate. Very tough to compete with a bank and/or their investors.

“Does anyone on this thread know when the Feds will stop subsidizing the banks and real estate industry?”

The FED and Feds will never stop subsidizing the banks. However the RE industry will be thrown to the wolves when Bubble 2.0 pops. If only so the banks can go in and start the whole thing over again.

Yup. FED will always support housing. States are already in the red. You think a minimum 20% drop in tax revenues feels good when all your govt. pensioners (even DMV slugs get one!) are lining up for their 10 year vested retirement to death checks? Riots. Although most would have heart attacks on their way to the protest.

QE could end in 2015 if all goes well with unemployment (don’t bet on it). The Fed’s goal for unemployment is 6.5% vs. the May rate of 7.6% and April rate of 7.5%. Between now and then, the Feds have said they will taper QE from $85 billion per month. Again, that’s assuming unemployment rate declines. So far, even the suggestion of taper QE has rattled the market. Imagine if the Feds actually go through with it: R-E-C-E-S-S-I-O-N.

I assume they can only go after strategic defaulters in instances where the mortgage was recourse. It will be interesting to see how this plays out.

Very few SFH mortgages are recourse. I don’t think their is much there to be had. Even the article states “$2.1 billion in unpaid mortgage debt” which is less than a drop in the bucket. I’d suspect this is a small group of high net worth individuals with exotic mortgage products that happen to be recourse loans. Most of the squatters are gonna get off scott free, which they really should as they are just playing the F’d up system how it’s made.

SoCal is stagnating…ambitious young people (want to buy a home, be part of a community, maybe have kids, establish careers in living wage jobs) are leaving for locales with more affordable housing/better job market/better schools/quality of life/career opportunities where they can build a life…SoCal is saturated with boomers who bought property decades ago, parked until their jump off the mortal coil, retired govt types w/savory pensions, trust fund babies, adult children who live with Mom and Dad forever or in properties owned by relatives, lifetime renters, and low income dependent on govt bennies. Perhaps the constant dining out, shopping, remodeling might boost the hospitality/retail/construction sector, creating more sub $15/hr jobs to the SoCal economy. Whoopee!

Oh, forget about it. Weather trumps everything. No worries, Surf and Shop!

@ we dont make those drinks…

I think you are painting SoCal with a wide brush. I have lived in LA my whole life ( I am 53) and there is a hardly a person I know who is in any of your categories, except the lifetime renters. And many of those life time renters are in rent control. Even the landlords of those apartment buildings in Santa Monica cant bribe the tenants to move. Before I purchased a home, I lived in Santa Monica, near 10th and Wilshire and my neighbors were in a 2 bedroom 1 bath apartment paying $600 a month! The landlord said he would give them $15K to move out and they laughed at him. Those are lifetime renters!. If they took his offer he would have rented it out for $2,000 a month.

Wow, you’ve lived in LA your whole life and the majority of people you know are high wage earners who recently bought houses? Congratulations! I am impressed!

Not sure what your point about those living in rent control accomplishes; is this a demographic stimulating the economy in a unique way? People refusing to move even when offered thousands, hunkered down until they pass because its cheap and they couldn’t afford to live a ‘hood without govt intervention? Hmmm…seems like another form of govt bennies to me, kinda like adults who live with Dad/Mom forever because they couldn’t afford to live in the ‘hood they know and love without some “assistance” from “Daddy”, but heck, what do I know?

I’m sure SoCal will be fine for decades; LA is awash with dusty liberal Bohemian Bourgeois delighted to pay ever increasing taxes /fees to fund the retiring govt pensioners, and supplement the rapidly swelling masses dependent on welfare, WIC, CalFresh, Section 8, MediCal, etc. Job market sucks for majority of younger generation seeking living wage career jobs providing enough income to buy a house in a decent neighborhood, start a family, etc., but SoCal weather and yummy tacos trump everything else, right?

Hey..

I argue the ambitious still come here and stay here to raise families as long as they keep moving up in their careers. A lot of people pooh pooh hipsters buying in Los Feliz and attempting to establish roots, terrible schools, crime and all. Gentrification is happening across LA.

And, aren’t you underestimating the economic vibrancy of LA (assuming you’re not talking about IE when referencing stagnation in SoCal)?

Easy to laugh at entertainment industry, for example, but LA is #1 in the world, with nearly 1 in 6 people making a living in the creative industries.

Sure, the middle class is being squeezed out of LA, but the 10 percenters don’t feel like they’re stagnating just because they have a 3/2 on 5,000 square feet lot versus 3,500 sq. feet on an acre.

There is no middle class in New York. LA is becoming more and more like New York.

Theyre gonna give daddy the rainman suite. Who didnt love the big T from Swingers?! That came out back in 96 so Los Felix, Hollywood, etc have definitely been gentrifying for a while already. I’m curious to see whats happening recently in terms of purchasers of single family homes as that woud be the key stat to look at. You local guys would know better than me, but if there is room to squeeze people out within 40 mins of LA i would think eventually they will be squeezed. however, keep in mind that this process can take a super long time or wouldn’t the Bronx, Harlem (even Newark) by NYC would have all experienced this decades ago?

What is the economic vibrancy of LA exactly? Not being a jerk; just don’t know what that means. Most people I know in LA don’t make a lot of money, Hollywood related or not, and the super heavy majority rent, rather than own. Do you mean girls that live off daddy’s credit card and make and sell like 5 pieces of jewelry from their apt? The guy who is so proud that in 2 years, he’s done 3 national TV ad campaigns, for 25k each, plus checks ranging from a few hundred bucks just at first and then 8 cents soon enough? The club promoter? The dude that sells oranges on highland?

Studio and big corp guys and their attorneys do alright, but not until a decent way up the ladder, and that’s getting tougher. Agents? How many of those are there and tons got laid off and barely any make full agent anymore. Actors? Besides the tippy top, most make dogsht.

Also, if you want to predict the future it would seem movies are going the way of music. More decentralized, less dependent on a main source of funding and less people getting rich. Also studios are being built in many other places besides LA. Basically less for LA, IMO, going forward. Ditto in Silicon Valley. That monopoly is slowly being eaten away as well. Think corporate and individual taxes. The world got tougher and more competitive and tax shopping will factor more and more into peoples decisions going forward. When us non Cali’s come, we almost invariably rent at first. We LOVE your weather and your tacos, but the rest is aite/its everywhere these days (especially if you grew up near beaches on the east coast so they aren’t a super ooh, ahhh like Midwesterners may feel) and some of us have a hard time personality wise as people are not the same as where we grew up. To each his own and I’m not saying who’s right or wrong, but its oil and water for many who come. We like to say LA is a great place to visit, but most go back home or somewhere else without ever purchasing that SFH, even if they could afford it, just like you might about NYC.

CA home prices may live and die more likely by hot money going forward, not incomes, IMO. If Wall Street and China do well, CA home prices go up. Otherwise you’re relying mostly on native CA folks and their ability to make $150k+ a year salaries.

Decimation of the middle class will not be confined to cities.

Welcome to the new feudal state.

Seems to me that all big cities go through a flux of incoming and outgoing people and companies. LA is not stagnant – read here the article in Forbes about LA becoming a silicon valley

http://www.forbes.com/sites/ciocentral/2012/08/28/why-los-angeles-is-emerging-as-the-next-silicon-valley/

more here http://www.siliconbeachstartups.org/

@QE

LA has a long way to go before it can be compared with silicon valley. While there is a decent tech presence out in west LA and in pockets here and there (e.g. Irvine, the valley, etc), most of the innovation is still being done up north. The opportunities are broader, and the general level of talent is higher. LA needs more prominent tech companies to be headquartered locally before enough momentum exists to create an environment similar to silicon valley. That, and a culture of high salaries, generous bonus structures and stock options that promise the same type of riches that are affording our northern neighbors million dollar homes and technological glory. Without these things, LA’s level of innovation will be modest and will ultimately depend on a few smart individuals who’d prefer to give up that life in exchange for life in LA. (Like me, who grew up here and just like it here)

The entertainment industry (specifically the movie studios) is now entering a free – fall zone, due to the decreasing sales of DVD’s, lost to streaming. Spielberg and Lucas basically admitted as much yesterday, they said that all of the studios (including their own) are going to lose almost all of their profits in the coming years because they’d relied so much on DVD sales to prop up their financials, in spite of spiraling costs and generally poor product output. The much – smaller cable programs are killing the larger studios, and that trend is only increasing – decentralization is going to happen to all industries, most of the cable shows so popular now are filmed and produced outside of CA. Hollywood will always exist in some form, due to the attractiveness of the locality, but as a giant profit generator it’s going the way of the dinosaur.

http://www.cinelinx.com/industry-news/item/4103-steven-spielberg-george-lucas-predict-implosion-of-the-film-industry.html

Many states are also deep – sixing the golden gooses of tax breaks to lure filmmakers to their states – CONN just got rid of theirs this week. States are finally figuring out that the tax breaks don’t justify the revenues brought in.

You’re dead on, man. That’s the same thing I see going on, and it sucks. I’m a 35 y-old USC Alum, so I’m not talking from some pinhole point of view, I feel I have a solid perspective of what’s going on in LA, and your description is right on.

CA is trending towards a place for the very poor and the very wealthy. CEO’s and public pensioners closely followed by welfare recipients.

The future will be bigger and more private police forces, more “gated” communities, etc…. as there’s fewer and fewer opportunities for the young to find decent employment and form families.

Dear doc, I’ve chanced upon a CNBC article today about BAC’s shameful policies of denying their borrowers from HAMP as well as accelerating the foreclosure process for distressed accounts. (http://www.cnbc.com/id/100818866) I am sure no one is surprised by these practices, but it has lead me to another curiosity.

In the past, we referred to extremely high NOD/foreclosure rates as signs of huge distress. This reality has lead us to conclude that not only were high home prices unsustainable, but the excess inventory as a result of foreclosures would cause banks to be insolvent AND make way for a crash in home prices. This is what has occurred during the initial crash back in 06~08, but now, it seems that any increasing trend in foreclosure activity may not mean the same.

Say we have a significant increase in foreclosures again, but the banks only accelerated the ones that they knew were already securitized and owned by external investment entities. It’d be a win/win for them. They generate revenue simply by providing services to process the foreclosure, maintain the property and then charge more fees on re-sell.

Furthermore, since these banks have minimized their liability on these properties, they have no reason to release the inventory at all. They can hold them as long as they like and release them in a way to maximize their margins on the sell. (Although, I am also curious if the bank sells the foreclosed home at a higher price, does the investor also take the profit?)

Given this, I feel that maybe it’s check-mate by the Fed/banks at least in terms of real estate, but maybe you or some other members here have insight that I have probably missed. There are certain things that banks cannot control, such as ensuring that everyone can afford extremely expensive homes. This sort of gives us an effective cap on home prices, where homes prices will drop at some point when we exceed that cap for a limited amount of time, but perhaps given what is within their control, they can still keep the cap high enough for decades to come, with the only hope of ‘affordable’ housing to come when either we find ourselves in another era of economic prosperity or if the banks have figured out a vehicle of profit from lower priced homes.

Any thoughts anyone?

I think you about covered it.They have successfully transferred the real wealth, i.e the assets that back the debt instruments they bundled and sold, and will manipulate the market as they want.

My thought; you have in your third paragraph summed up my supposition that the banks have turned real estate into the used car market. Along with their investors controlling a large portion of the foreclosed properties (lease side of auto industry) the banks get to hold the repossessed asset and sell it again effectively running a profit churn.

Regarding the health of housing market and the fed:

1) The fed has to print 1 trillion a year just to prevent deflation. If you have to print that much money to just tread water, the economy is not strong enough for a sustained housing recovery.

2) If the economy does recover enough to generate greater than 2% inflation, the fed has said it will raise the interest rate. The housing recovery will not continue without lower interest rates.

This is the real catch with the fed’s support of housing. Also note that while the fed has been committed to ZIRP (zero-interst-rate-policy), it has stated it may stop buying mortgage backed securities.

Regarding lack of inventory, this is a short term problem:

a) The principal reason the inventory is short is less listings, not more buying as both drive inventory. This is hugely important as the latter would have implied a “naturally” hot market.

b) Catch-and-Release. Flippers and investors will ultimately have to sell back many of these houses. Only some will be kept for renting.

c) Builders will become overly optimistic over the next 12 to 18 months until the real lack of buyers become apparent. Note that the joblessness rate remains quite high and even as it goes lower, it takes years till people are stable enough to be able to purchase a house.

d) Pent-up sellers. We hear all the talk about pent up buyers, but there are many more pent-up sellers. While investors may be able to play it cool for a while, watch the pent-up sellers panic as they feel a market top approaching and passing. Also watch them panic as the interest rates take a modest hike up.

e) Foreclosures. Of course, delinquencies are still going on and going strong. The California Homeowners Bill of Rights and the misguided AG Carmela Harris have pushed back the foreclosures, but they will go through.

Regarding California being a special place to live, where climate is king:

a) The schools and services in this state are awful, not to mention air quality, traffic and taxes. If you don’t believe me, try living in about 30 other states that, though more cloudy, far outshine California in other ways.

b) If it was such a special place, why isn’t there exponential population growth?

c) If it was such a special place, why is unemployment so high?

d) If it was such a special place, why aren’t the wages super high?

Ultimately, housing is sold to people with good jobs and available services; the climate plays little role here.

We are probably at the echo-top of close to the echo-top here in the South Land. Hundreds of real estate bubbles have unraveled over the centuries and immediate “recovery” is pretty much never part of the cycle.

+1, AK47. I don’t think CA homers realize that almost everyone else in the world views CA as great almost universally for only weather (and some, beaches), and barely anyone with a stable income can just afford to uproot their life, move to CA and find great jobs where they can afford a SFH just because they want sun and no humidity. Having 20-25 year olds coming on daddy’s credit card for 1-4 years while they try to be big Hollywood stars doesn’t build an economy as they rent and also never claim CA residency so they actually make things worse. Neither do those out of staters who go to college here, but then leave soon enough after graduation bc there are no jobs here, besides in retail at the mall for 10/hour. All these folks use the roads and other infrastructure, while paying no CA income or property tax, they just pay CA sales tax when not buying stuff online. CA has to pray that a ton of companies HQ-ed in Silicon Valley go public every year, like Facebook (hence your one year of budget surplus) or the entertainment industry expands further and with better high paying jobs. I think most smart folks would not want to rely on that as safe bets. What’s more reliable is that taxes will have to go up to pay for more infrastructure, pension obligations and the working poor under the poverty line. Someone from CA please feel free to rebutt.

On inflation, the fed can say what it wants, but we all know its a lie and we’re all getting nickeled and dimed to death, leaving less money for housing and/or retirement. Just like unemployment and now GDP, they just keep changing the definitions of the metrics to get the numbers they want. Raise your hand if you believe life gets more expensive by only about 1-2% per year. Last time I checked, gas, healthcare, housing, food (packacking is the same size, but the food within the box seems to be less each year), education, taxes, public transportation, etc have all gone up (aka inflated) while salaries have not inflated. Also, services are worse/less to boot. But hey, the fed says inflation is under control so I know I feel better at night. 😉

Btw, if you read non-biased studies, most are predicting that the Midwest and south will see the most growth going forward in terms of companies and higher wages, and the trend will be for hardworkers to leave the expensive coasts as most intelligent folks view life as more than chilling in the sun.

Most importantly, if you are going to remain in CA, become a little more political and start voting in folks that will actually help the economy, instead of just who’s the democrat running in the election. Start pushing fiscally conservative, socially liberal politicians at the very least from the local level, so in a few years they’ll be ready for the big, important positions.

AK, I was with you until the last part of your post.

Regarding California being a special place to live, where climate is king:

a) The schools and services in this state are awful, not to mention air quality, traffic and taxes. If you don’t believe me, try living in about 30 other states that, though more cloudy, far outshine California in other ways.

The schools in California might be bad from a state level; however, they are very good or excellent in the desirable areas (i.e. Irvine, Manhattan Beach, etc). I have found the services in the desirable areas pretty good too (good streets, plenty of cops, nice well kept landscape, etc). The air quality is pretty good by the beach. If you live close to work, traffic isn’t much of an issue. The daily trek from the IE to LA is another story.

b) If it was such a special place, why isn’t there exponential population growth?

I don’t need to tell you this, but there is no more buildable land is most desirable areas. The state’s population has almost doubled in the last 25 years. There is much more competition for people who want to own in these areas.

c) If it was such a special place, why is unemployment so high?

State level unemployment is high, but you can’t compare Merced with Manhattan Beach. Unemployment is very low in the desirable areas. These are generally educated people who were spared the Great Recession.

d) If it was such a special place, why aren’t the wages super high?

Again, the wages are high for the top 10 to 15%. This is a society of haves and have nots here. If you are in the have camp, life is pretty good! I would venture to guess that anybody buying today in the premium areas has a very healthy salary.

Califorina is huge and could easily be broken up into five different states. Using a broad brush for the whole state isn’t fair, but it definitely skews facts and numbers. I have a feeling that the premium areas will do just fine in the future, there is just too much entrenched money and too many people wanting to own a piece of the pie. Just my 2 cents of course.

LB,

I agree with you, parts of California are nice and have good services. Most of it, however, is so-so and nothing special. 10-15 percent might be doing well in California, but my stents in NYC and Connecticut lead me to believe that they are not doing as well as the 10 to 15% in those states. Again, I am not sure if California is special. Besides, homeownership, even in CA, extends beyond 10 to 15% of the population.

My posting doesn’t focus on Manhattan Beach, CA but mostly the middle-class, and this is what they really are, cities like Burbank, Pasadena, Santa Clarita Vally, etc.

Again, I reiterate there is nothing intrinsically special about California as a whole and it will be subject to the same ebbs and flows of real estate as anywhere else in the world.

AK

I have decided to share an idea after being a long time reader of this blog and also being a long time CA resident.

A lot of this mess CA has gotten into this last year is due to investment firms and others buying large quantities of real estate. This has driven up prices to levels that are out of reach for most young workers (under 30). The homes which they should be pursuing as an entry level home are now just a dream.

I think the government should implement a “multiple house” tax which would help stifle the large quantity purchases.

For example, if you are buying your only home then you play the market as it is now. If you are looking for a second home (investment, vacation, or whatever) then you play the market the same as now but pay a one time 10% (of sale price) gov’t tax for multiple home ownership. Then for your 3rd home that could increase to 15%. Then for home #4-10 it could increase to 25%. The percentages are just for example but I think this will help bring money into the gov’t and also help prevent the younger generations from being shut out of the American Dream.

The elite, connected and powers that be would never agree to such nonsense. They could care less if the younger generations are being shut out of the American dream. Their job is to keep the large portion of wealth in few hands. It’s been like that for a looooong time and that ain’t changing anytime soon!

And the rich and connected with their lawyers would use trusts, straw men, etc to purchase multiple homes, while the average guy who wants a home as a residence and a small 2nd vaca home/condo will get screwed. The govts more likely attempt at this would be to cap the amout one can take for mortgage interest deductions….which will basically screw individuals because they use mortgages, but not investors that use cash. I think its best for the govt to just stay the f out of everything. Even with best intentions (which is rare, regardless of the spin), govt is inefficient and clueless about the true consequences of a lot of their actions as they forget market forces eventually triumph. Think small govt. also, young people aren’t priced out of homes. They are priced out of buying homes in the worlds most exclusive and expensive cities, such as LA and San Fran (and most of coastal cali). Go rent there or buy somewhere else. There are 49 other states with more affordable houses and many have more jobs and lower standards of living. Took me 39 years to buy the house I wanted after living it up as a renter in NYC and LA. Hint for the younger generation-life ain’t fair and then you die. Do your best to enjoy it, but don’t expect any help along the way.

Helpin Young Generations, your idea will be easily broken by folks buying houses under each of family members’ name. It will not help the situation but only enrich the government. Chinese government is doing similar thing to tax the public, and cause a lot of fake devorces for tax pervention as side effect.

More Government “help” from the Government that brought the monstrosities known as Fannie and Freddie. Smart!!

Texas is the promised land. There is a 10AM Amtrak leaving every Tue and Thur. All Aboard. Of course, you will have to run your A/C like you live in the I.E. The body adjusts to the heat. Just stay out of the mid day sun.

I know that there is a lot to complain about in SoCal, but what is the alternative? Figure it out. If you decide that SoCal has more factors, stay, otherwise leave. If you decide to stay, accept that SoCal has changed(super multi-cultural) and stop the complaining, because the train has left the station.

Austin is one of the most over-valued RE markets in the country. 30+% of all purchases are all cash, and they are definitely flippers or rent-seekers. For rent-seekers, about 8K rental apartments (yep, you read that right) are coming online in 2014. Expect a serious glut of rental houses coming on the market by then. Another little know fact–Austin has LESS technology jobs now than it did in 2000, despite all the hype about Facebook opening an office here. There sure are lots of service jobs, though…

“rent-seekers” does not mean what you think it means. It has nothing to do with rental housing:

http://www.auburn.edu/~johnspm/gloss/rent-seeking_behavior

Rent-seeking behavior

The expenditure of resources in order to bring about an uncompensated transfer of goods or services from another person or persons to one’s self as the result of a “favorable†decision on some public policy. The term seems to have been coined (or at least popularized in contemporary political economy) by the economist Gordon Tullock. Examples of rent-seeking behavior would include all of the various ways by which individuals or groups lobby government for taxing, spending and regulatory policies that confer financial benefits or other special advantages upon them at the expense of the taxpayers or of consumers or of other groups or individuals with which the beneficiaries may be in economic competition.

Etherist, I meant rent-seekers literally, not in the figurative meaning. That literally, there are people buying houses seeking income from rent.

Cowboyboy wrote: “I know that there is a lot to complain about in SoCal, but what is the alternative? Figure it out. ”

Jeez, dude, I don’t know. Worldwide, people woke up this morning, living and building productive, emotionally fulfilling lives outside of SoCal. Or are they all just faking it; there’s really is no truly satisfying alternative to life in super multi-cultural SoCal?

Cowboybob wrote: “If you decide to stay, accept that SoCal has changed(super multi-cultural) and stop the complaining, because the train has left the station.”

I’m confused; SoCal is uniquely super multi-cultural? Everywhere else is racially/culturally homogenous, or simple multi-cultural? Which train has left the station? The Tue or Thur. 10AM Amtrak?

Back in 1991 when the RE market crashed in CA, San Diego had lots of nice homes selling very cheaply. Why? Because there just were not any good paying jobs to he had. There were less people and better weather back then as well. So it aint about the weather. Ultimately, mortgage loans have to be paid through employment.

Leave a Reply