The Bread and Circus economy: Lessons from the Great Depression Part 33. The McDonald’s and paper-mill education economy funded by a too big to fail bank.

The current struggle to add jobs brings up bigger implications for the flailing housing market. The recent report on jobs reflects the underlying reality that the recession is still ongoing for many Americans. The recession officially ended in summer of 2009 but this is really only because of the expansion of GDP that was juiced by large investment banks leveraging cheap money from the Federal Reserve. Some of this money trickled into the housing market but here we are facing a double-dip in housing and a possible double-dip for the economy. The quality of jobs being added is also a hindrance to potential home price growth. The 54,000 added jobs fell well short of the 150,000 baseline figure just to keep steady with demographic growth. Then you have places like McDonald’s going on hiring sprees but how is this good for home values? The Great Recession is looking a lot of like the Great Depression in duration even though official GDP figures reflect a different story.

This is part 32 in our Lessons from the Great Depression series:

28. The Gospel of Economic Prosperity

29.  New home sales fell 80 percent from 1929 to 1932 and fell 82 percent from 2005 to 2011.

30.  Economic déjà vu from the 1937-38 recession

31. When government and financial institutions become one.

32. Housing prices continue to fall as other costs eat up disposable income.

The question of jobs

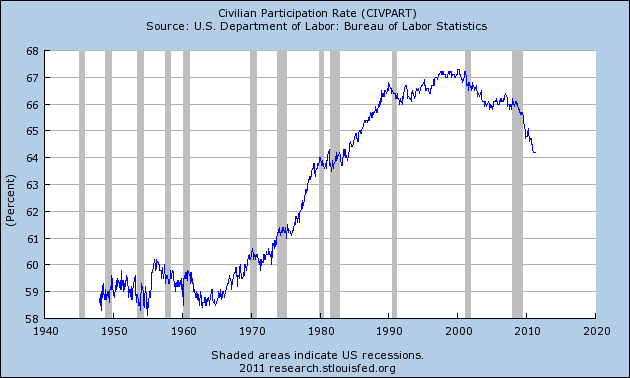

One of the better measures of employment health is the civilian participation rate. The above chart reflects the more than a decade long trend of doing more with fewer workers. This might seem good in terms of productivity but technology and banking thievery have allowed more workers to be shelved in the market. This might be good for the bottom line of a banking CEO but this reduces the number of households with adequate income to support the housing market. This is why home prices have now reached a new nominal post-bubble low:

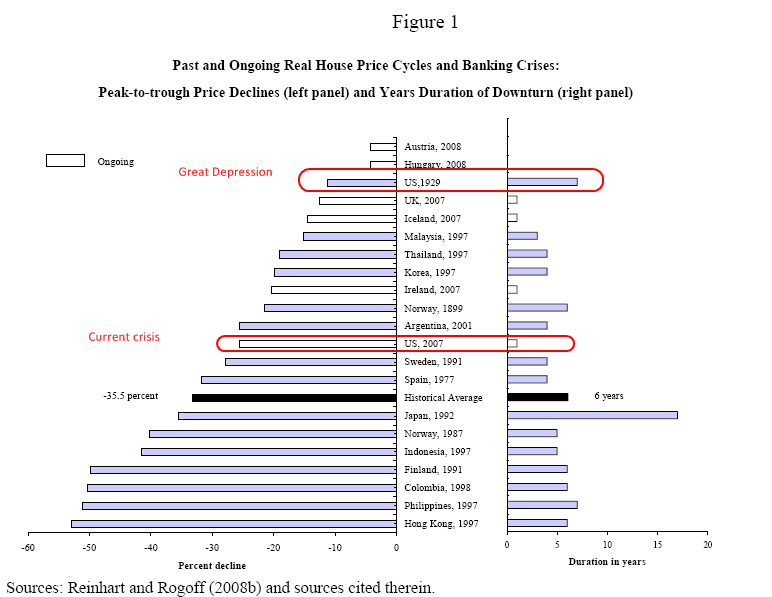

By far this is the deepest housing crash on record. Home prices are falling lower even in the face of record low mortgage rates and the Federal Reserve eating up over $1 trillion in mortgage backed securities that the market wants nothing to do with. Again the question should be about jobs but also the quality of jobs being added. Simply adding tens of thousands of people working at McDonald’s or Wal-Mart does little for the growth in U.S. housing. So this pushes home values into the worse housing crash ever:

Source:Â Economy.com

One of the big issues of the Great Depression was creating jobs. People may forget that even after massive government intervention the unemployment rate remained in double digits for the entire 1930s. Government spending directly on hiring people did help but it was not the answer to the panic and market collapse of the 1920s. The 1920s was an era of graft and spectacular market speculation.  It was a bubble market like the 1990s tech bubble or the 2000s real estate bubble. It seems that our economy is one of continuous bubbles when Wall Street is allowed to reign supreme. Only after World War II did we see long-term sustained growth for many Americans, not only the financial elite who were kept in check by adequate market enforcement.

When do we get back to normal?

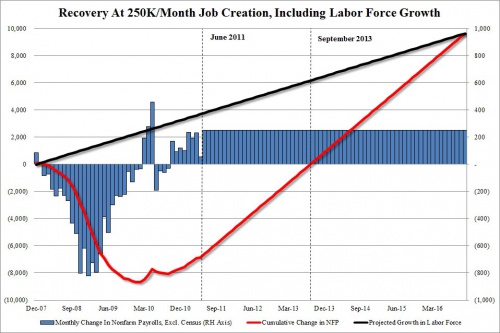

The question of back to normal for most people is one in which the unemployment rate is low. What use is it if a certain company is making billions of dollars in profits but employs people overseas while enjoying the laws and government structure of the U.S.? This is a new market in which unemployment is absurdly high yet profits are still decent for companies as they gouge local employees and off shore jobs to the cheapest markets possible to exploit workers abroad. Again, how is this good for housing values? Next, just to get back to pre-recession unemployment we would have to add 250,000 jobs for many months straight:

Source:Â Zero Hedge

66 months it would take. Does that even seem plausible with the current number of jobs being added? The Great Depression struggled for over a decade to add jobs. We are now four years away from the start of this recent recession and here we are with an official 9.1 percent unemployment rate. Much of the support was through trillions of dollars channeled into the financial system but also government investment into projects. What industries are hiring right now? If we look at the BLS report closely we see a good amount in service sector jobs (i.e., McDonald’s) and health care (i.e., hello old baby boomers). This is the big part of our growth. Both of those groups cannot support the over 6 million homes in the shadow inventory.

Price floors rarely work in the long-run but this is what the government and Wall Street have tried to do with the housing market. How can you keep prices inflated if incomes are falling? Keep in mind the data only reflects those who are working because if you are unemployed, your real income is actually zero. This is now becoming one of the longest downturns in U.S. history:

Home prices are now lower so this is an ongoing issue here. Yet we have seen markets fall much harder as well. U.S. home prices as measured by the Case-Shiller are down over 30 percent. Will our bottom be at 40 or 50 percent? I think this question will be answered not on the housing front but on the employment front. Many areas in the country now have ridiculously low housing prices like Arizona, Nevada, and Michigan. But there is reason for that and that involves lack of jobs. Investors have swarmed Nevada and Arizona but most of the selling after the fact has been to other eager investors. The underlying market is weak for those who actually live in those areas. The low prices simply reflect this new reality. To think prices will zoom back up is naïve at best but many of these people are coming in with cash so at least they are not borrowing government loans to speculate in their endeavors.

The end of worker protection

Source:Â Vote Now

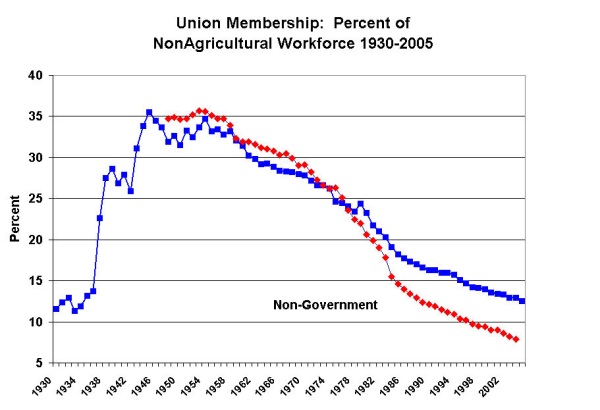

Some of the strongest growth our country has ever experienced came with a large portion of our economy being supported by unions. From 1945 to 1960 over 30 percent of non-agricultural workers worked under a union. No doubt there are serious issues with unions but here you have some protection for workers. Keep in mind prior to the Great Depression you have extreme worker exploitation and massive income inequality. Six or seven day work weeks, child labor, and unsafe working conditions and this was argued as being part of the “free market†so those that argue it today fail to parallel this massive predatory market with how the current de-regulated Wall Street ran roughshod on the American public. But guess what? The union apparatus is virtually non-existent today so you can’t blame that for our current demise.

The voice of the working and middle class American has been drowned out and ironically many keep voting for laws and regulations that keep the gig going for the predators. For example, last week extremely favorable regulations passed for the paper-mill for-profit colleges and guess what happened to their stock values?

“(Fast Company) It’s a heartening example of government working for you–if “you” means a team of lobbyists. Shares of Apollo Group (Phoenix U), the Washington Post Co (Kaplan U), and other publicly traded for-profit colleges rose sharply yesterday as the Department of Education released new regulations for the sector, significantly softened from a draft version published last July.

The original idea behind the “gainful employment” rules was to impose a little basic accountability on the kinds of colleges that advertise on the bus, by the crude measure of whether their graduates are able to pay back their student loans. Besides the obvious public interest, the federal government has significant skin in the game here: it underwrites these loans, to the tune of almost three quarters of a trillion dollars. And for-profit students, who make up only 12% of all college students, account for 46% of loan defaults.

Under the new rules, colleges with pretty crappy results will remain eligible for federal student aid. As long as at least 35% of grads are paying back their loans, the college is A-OK. It even counts if the former students are on an interest-only payment plan, which can keep students indebted for 25 years or more. No colleges will be kicked out of the program until at least 2016, and there’s a three-strikes rule, meaning they must fail three out of four years. Only 5% of for-profits are predicted to be put out of business by the new rules, compared to 55% that would have been in a marginal “yellow zone” under the draft rules.â€

So there you have it folks. I would argue that instead of loaning money to these toxic institutions why not funnel the money into infrastructure jobs or aiding local state schools to re-train workers in a variety of job fields? Instead of funneling money into the banking system where they speculate in global stock markets and help other nations why not use that money to fund small businesses that have to be here in the U.S. and create jobs here? Wall Street likes to talk about the free market but they are nothing more than corporate socialists with welfare queen attitudes. With very little worker protection, a mainstream media controlled by corporate powers, you can expect any information like this to make it to the airwaves. So expect home values to fall lower and the working conditions of Americans to falter for years to come unless something drastically changes. The profits at big banks and American Idol ratings with no mass protests tell me people enjoy believing in this fantasy story as their economic prospects are washed away. Keep the bread and circus flowing.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

79 Responses to “The Bread and Circus economy: Lessons from the Great Depression Part 33. The McDonald’s and paper-mill education economy funded by a too big to fail bank.”

DHB:

“The profits at big banks and American Idol ratings with no mass protests tell me people enjoy believing in this fantasy story as their economic prospects are washed away. Keep the bread and circus flowing.”

THE REALITY DETACHED AMERICAN:

http://www.youtube.com/watch?v=WCxBDDk4Y-M

~Misstrial

Agreed. Ron Paul seem like he’s from outer space because he tells it like it is. Most of us are unfazed by the hemmorhaging of our very existence going on right before our eyes. And a lot of these jokers are squibbiling over some statistic that they read somewhere that is slightly different than one Doc quotes. I’m too old to expect anything better. Even the energy crisis of the 70’s–I vowed that things would change in my life. They did, they got far worse.

I think you meant to type: American Idle……

lol idle not idol how funny!!!!!

Stop commenting, surfaddict. You’re terrible.

Nice link. Thanks for posting that.

So what was the “solution” last time to restore the US economy after FDR failed with all his government growth programs from 1933 to his death in 1945?

We got into a world war that sacrificed 400,000 young American men, killed millions of soldiers and civilians world wide, burned down whole cities and the productive factories of Germany, Japan and Europe.

When it was over, only American cities and factories were intact.

Presto– American jobs were created and American products were desired world wide.

We are now competing with world wide productivity. The playing field is level. At the same time, our current ballooning federal bureaucracy limits our manufacturing base and entrepreneurial spirit, causing us to contract job production instead of creating new opportunities.

California is classic: raise the sales tax, put pressure on job producers, regulate the heck out of everyone, grow government, protect public unions at the expense of small business, bankrupt the state.

You got to be kidding. Bureacracy limits te manufacturing base????? You must have heard about offshoring-where they pay a Chinese worker 1/10th or less of what they pay an American worker. On top of that, the Chinese govt manipulates their currency. Yet the American govt will not protect the people-just the corporations who pay them off and fund their elections.

When government employment grows faster than the public sector then we have a much bigger problem than off shore cheap labor. These government workers get nice salaries, full benefits and large pension, to produce NOTHING! I listen to people wine about US companies moving off shore, why do you suppose they move? Cheap labor is not the real reason. Less government regulations is the real reason. How can I pay my employees a decent wage when complying with government regs eat up 43% of my profits? Let’s say I make a product that sells for $100 in the stores. Before all this BS regulation, it costs me $25 to make it but now it costs me $35.75 to make. I know what you’re thinking, I don’t make the spread from $35.75 to $100. No, before the all the regs, I’d sell it to a wholesaler for $40, they’d sell it to the retailer for $64. Now take 43% out of this equation. I have to make it in China, just to survive. Even with cheap labor, my cost is still $25, but I can still keep living on my own and so can all my wholesalers and their employees.

Govt employment is actually declining the last couple of jobs reports. China slaps a 15% tax on all imports and top off that add another 40% or so on the low value of the yan. That 40% or so alone will bring back a ton of jobs-if we fight-it is illegal as per the WTO.

What regulations are you talking about-5 day work weeks? or that employees in America actually go home to their families? Many Chinese workers live in dormitories and go back and visit their family a few times a year. is that what Americans need to do? Nixon a republican actually slapped an import tax on imports when the blance of trade widened . What a novel concept.

No man, it’s definitely not regulation. Regulation might be annoying, but so is dealing with a thousands mile supply chain and managing operations in another country with all the legal and other issues that go along with that. It’s wages. China has so many people that even producing in other poor countries is relatively expensive when considered against China. Philippines, Cambodia, Viet Nam – all traditionally poor countries cannot compete price wise with China. If they can’t, how they hell are we gonna do it?

Hey David, let me ask you a few questions. Do you have potable water? Or do you pump from a well? Did you drive to work to produce your ‘things’, or did you trench and lay the blacktop? Did you take a crap and flush the toilet? OR did you dig a hole and hope to god it didn’t pollute your drinking water source? SO, the next time you say govt workers don’t produce a damn thing I hope I you shut the f* up because I am tired of your type whining about my job. I probably don’t need your ‘things’ either!

What are you saying. You mean it’s not true that Americans are superior to the rest of the world? That we are not smarter, harder working, and better in every way and that we don’t deserve to have a drastically greater standard of living than the rest of the world. They’re not better–they just hate our freedoms.

Sadly, I think it’s about time to wake up from the American dream and realize we are in a fight to the death with the rest of the world. They’ve had enough of our fiat currency and regime change military intervention. I travel the world–there isn’t a nation on earth that doesn’t want us wiped out. We better get our excrement organized…

Interesting:

“So what was the “solution†last time to restore the US economy after FDR failed with all his government growth programs from 1933 to his death in 1945?”

Well, that “failed” Social Security program, the one the corporate whores raid for corporate welfare, like tax breaks for off-shoring US jobs and unearned “bonuses” for failed policies, it sure is popular with the people that paid for it…and would be solvent for another 100 years if corporate whores kept their filthy hands off of it.

“We got into a world war that sacrificed 400,000 young American men, killed millions of soldiers and civilians world wide, burned down whole cities and the productive factories of Germany, Japan and Europe.” FDR invaded Poland? Or Russia, I forget…he bombed some island in Polynesia, right?”

“When it was over, only American cities and factories were intact.” True enough: how wise it was of FDR to found a nation on a different continent and out-of-reach of the war zone…. well over one hundred years before he was born…what foresight!

“Presto– American jobs were created and American products were desired world wide.” True enough…how wise of FDR to create American products the world desired….after being so wise as to found a nation where it’s factories went unharmed…

“We are now competing with world wide productivity. The playing field is level.”

NOW THE VEIL COMES OFF, eh koblog? Nowhere is it written American workers must be subjected to “competing” with goods made in third world nations by starving third world workers, or in nations with centralized planning to hold down labor’s share of productivity.

In point of fact, it is expressly against what America’s founders thought best for America: Tariffs on imported goods to protect the American standard of living.

Your premise is not only faulty, is reeks. Just because Clinton carried Poppy Bush’s NAFTA bucket to the well and back, and declared “Now the playing field is even between Mexican, Canadian and US workers” doesn’t mean American workers have to swallow his snake oil. Or yours.

“At the same time, our current ballooning federal bureaucracy limits our manufacturing base and entrepreneurial spirit, causing us to contract job production instead of creating new opportunities.” Absolute gibberish: you should have your mouth washed out with soap for your filthy lies.

“California is classic: raise the sales tax, put pressure on job producers, regulate the heck out of everyone, grow government, protect public unions at the expense of small business, bankrupt the state.” You mean that state ranked 9th in the world’s economy? Just because Wall Street thugs and their willing US Senate and Congress accomplices committed housing mortgage fraud on a scale that boggles the mind and trapped buyers in a real estate bubble they willingly created, does not mean it took up all our cranium space, we still detect BS when we smell it, koblog.

California isn’t in trouble because of “public unions” unless you mean Prison Guard Union. They are in trouble because of elected and appointed state government idiots that based future spending on bubble trends. Not to mention the $15 billion Arnold’s good friend Ken Lay defrauded California out of…Bush’s good buddy too, now that I mention it.

Only fools think US labor should compete with Chinese labor: wheretf do you think the “professional class” in the US gets it’s money from? Chinese laborers??

It’s not just paper mills like U. of Phoenix.

http://www.law.com/jsp/nlj/legaltimes/PubArticleLT.jsp?id=1202495481202&Law_school_sued_over_false_employment_statistics&slreturn=1&hbxlogin=1

You fail to appreciate the value of receiving UI benefots and attending an online university while reinventing a career in the wak of the housing crash. Residential construction professionals get real sick of being in the back of the bus and the first ones thrown under the bus. This time, I have had enough of this. UoP is my ticket out of Marxist-deluded social re-engineering hell. On-ground campus enrollment kills UI benefits and serves no purpose for adults. CONSIDER YOUR INFLUENCE. I enjoy your work. Keep it coming.

Thanks

This is actually the most interesting comment of the bunch. Attending a physical school causes one to lose benefits vs attending an online school?

There is nothing irrational. There is always a reason why things happen. But ‘rational behavior’ is the norm.

Autocracy:

Government by a single person having unlimited power; despotism.

The beast of Manhattan cares only for itself. They are in complete control and have no interest whatsoever in Americans on the other side of the Hudson River, beyond keeping the rest of us alive so they can maintain their parasitic lifeblood. At one point, the host may die, but for now, we are just getting weaker and our standard of living will be in perpetual decline, while gouldmen will zip around in the private jets looking for fresh blood.

Don’t forget, these guys shorted the housing buble they helped create with CDO’s. Then when they drained all the blood from AIG, they got the Treasury to bailout themselves and their cronies around the world. Should we expect things to get back to normal after this bump in the road? Hell no. They proved to themselves and anyone with the ability to see what is in front of their face that they have Autocratic power over this nation and the world, and they will devour anyone.

2 I looked, and behold, a Golden Horse, and he who sat on it had a CDO; and a crown was given to him, and he went out conquering and to conquer. And he drained the Treasury into his own and appointed his own into that position and teh 12 Federal Reserve banks. And from there he consumed the host until there was nothing left but dry bones.

Why would anyone in their right mind think that things will get better as long as we have these parasites sucking us dry?

I see your point, Manhattan, but there is one thing you haven’t considered. Basically, it is impossible to store wealth on a macro level. If you have a house (without mortgage), you can sell it and take the sale proceeds and buy other stuff, or you can just barter the house for stuff.

But what if you are a huge landlord with millions of homes and apartment buildings and try to sell? Price crashes.

Ditto US Treasury Bonds. Gold. ETC.

These guys think they have wealth, but they really don’t. They only have money coming in as long as America exists. Once their mismanagement of the economy pushes us from recession to depression, they won’t have squat.

I strongly recomend that everyone hook up a rain barrel to their down spouts, and and use the collected rain water to plant a garden. The way they are debasing the dollar, I’d hate to see anyone, especially with children, have to choose between feeding their family other basic necessities.

Bread Circuses and Wedding. Keep the masses looking the other way. Now one cares as long as the camera shows them looking for a few minutes. Then off to the divorce races they go.

Same is true in housing, off the the foreclosure courts they go. People care about getting in but have no clue what it takes to remain in their keeping up with the jones fantasy.

The last paragraph is interesting. If Bush was still in office the population would be going nuts. This current guy practically gets a free pass. In the past, whichever party in power really took some heat for economies much better off than this current one.

Go figure…………..

Really? Free Pass? All I hear about is how this is all Obama’s fault. Son, this has been going on since JFK was shot and we ramped up the Vietnam war, created the ‘Great Society’, appeared to have gone to the moon a bunch of times, and spent the next 40 years trying to outspend the Soviets on death machines,and thought up every possible way to destroy the future so we could party now.

Actually even before JFK–Eisenhower warned us of the Military Industrial Complex, Jefferson warned us of the banking cartels. Jesus turned over the tables of the money changers. Don’t think one of these mafia parties or the other will fix this.

You may hear it on forums, and blogs but you never ever hear it from the mainstream press. Its always either “unexpectedly” bad news or bush’s fault, but never Obama himself.

At this point I’d rather have any republican because at least the press would keep him honest every single day. And thats saying alot because McCain was a real dud.

Please don’t forget that there was a Coup attempt against FDR, which is part of the historical record, and hushed up in the MSM. Foiled by one guy, who didn’t want to go along with the Elites.

Anyone who thinks that this is a Red or Blue issue is seriously mistaken. BOTH parties are owned by the Banks. Attempting to hash this out as a party issue is simply a distraction from that critical point. And is to the Banks’ benefit.

Dudes, seriously, the debt is not Obama’s fault. That’s just partisan nonsense.

Think of the national debt like an irresponsible neighbor or cousin – you might have someone like this in your family. It’s like this: they spend way too much, more than their income for years but people still keep extending them credit, so they keep spending. At some point, the monthly interest and principal payments are so high that they can’t keep up their standard of living, so they borrow more. Then they get to the point where their income doesn’t even cover basic necessities so they borrow more. Finally, they reach a point where you have such high interest/principal payments that your only option is to borrow more and more.

This last phase is where we are at in America. Obama’s just the last guy in line. He didn’t cause the problem but he’s in a situation where past leaders, mainly Republican, did nothing about the debt, making it worse, which led him to borrow more just to keep the ship floating for a little while longer. With the Bush tax cuts and low employment #’s, there was just no way for USG to collect enough tax revenue to close the deficit. Just mathematically impossible. Americans want low taxes and high services, politicians gave them to us. The tax rate on high income earners and cap gains is too low to fund the government we want. The American economy, tax structure, and governmental structure is optimized to function properly only when things are going crazy good – low single digit unemployment and high single digit GDP growth. We’re not set up for anything less than optimal which is why we’re always blowing bubbles.

80% of the wealth in this country is held by the top 20% income earners. If the federal government taxed that wealth (houses, planes, boats, art, etc) every year it would generate trillions of dollars in additional revenue. The money could be used to pay down debt and rebuild infrastructure. This would kick start our economy.

The problem is that big business is always the recipient of government subsidies, and while Wall Street gets a bail-out and a hand-out, Main Street gets hung out to dry. We don’t have a taxation problem – we have a spending problem. Small business is the backbone of this countries economy, and takes the brunt of any tax increase. If you want to see economic growth the worst thing you can do is raise taxes. Check out the Laffer Curve when you have a free moment. It is used to illustrate the concept of taxable income elasticity (that taxable income will change in response to changes in the rate of taxation).

The laffer curve predicts that only at extremely high levels of income taxation (70% plus)– levels nowhere near what our top marginal rates are or ever have been considered does tax revenue fall because of the referenced elasticity.

Do you really believe that an increase in taxes will stimulate the economy? If we were paying 70% tax rate I’d shut down my business and get a government job. Americans and in particular small business owners in California are taxed to the hilt. It’s ridiculous.

@ Kirkus: You do understand that even when the top marginal tax rate was 91 percent only the very very rich paid 91 percent in income taxes yeah? And they were still very very rich as most of their gains are not from income. The middle and working class would not ever pay that amount. It’s progressive.

@ Gael :

I’m curious since you mention a top tier tax rate of 91% – if it were up to you what tax rates do you propose? As a small business owner I have to tell you I’m not going to work very hard if I’m walking into a tax rate that high.

Kirkus you truly can nont be that ignorant of income distribution in the US to write such bullhockey as “Doyou really believe that an increase in taxes will stimulate the economy? If we were paying 70% tax rate I’d shut down my business and get a government job. Americans and in particular small business owners in California are taxed to the hilt. It’s ridiculous.

If you are a small business owner who would have hit the top marginal rate of 70% (Nixon) or 91% (Eisenhower) then you are NETTING as your PERSONAL income a MINIMUM about $6,000,000 – 10,000,000 in to day’s dollars!

“Personal income” is not the same as what a business grosses or even what the business nets (if not a sole proprietorhsio, partnership or sub Chpt S corporation.) It is what the owner takes home as his personal paycheck.

Try to be less clueless. It is embarrassing.

@AnnS:

In case you were wondering, I do understand the concept of marginal tax rates and the difference between taxes on personal income and gross business income. But thank you for sharing.

The question remains – do you think that raising taxes will stimulate the economy? If so how?

I look forward to your response!

Sorry guys, you’re both in the wrong river. in 1913 the banks took over the government and even called themselves the Federal Reserve. Forget about the Potomac–our problems are at the mouth of the Hudson.

I agree. The big Banks are now above the law and can do whatever they want without consequences. Whenever someone threatens them, they just threaten to take down the stock market and the economy. The politicians always back off.

Our Democratic Republic and Rule of Law no longer matter. And most Americans don’t seem to care as long as their income isn’t impacted. Only when that changes do people seems to care. And are still left wondering “why”.

Matt:

Sounds like you should make a move to Venezuela or Cuba. Hugo loves the idea of plunder. Have you ever heard of rights to life, liberty and property?

Already the bottom 51% pays zero in income taxes. The top earners pay a disproportionate share as is. Your answer is bring in the guns of government to steal more of our productive citizen’s lives? How much slavery is enough for you? What level of taxation is high enough to satisfy you?

And once the golden goose is fully fleeced, where do you get your next meal ticket?

Go read Animal Farm, friend. Or better yet, Atlas Shrugged.

Yes, Ayn Rand has the answers!

http://www.angryflower.com/atlass.gif

Nice logical jump from taxation of the rich to Cuba and Chavez… Ayn Rand helped brink the disjunction.

Aka…commies destroy wealth and economies by redistribution and destroying innovative competitive markets and thus creating a slave state. Any higher levels taxation of the rich is unjust because it is unequal and squashes freedom and the inate drive in all humans to better their position in society.

So, those that are able to pay more are kept from feeding competitive markets and those people getting buy near the poverty line, who have very little income to pay taxes, are parasites feeding of the rich who support society?

Ayn and the “idividualists,” those self made men and women, usually benefited from some form of public education, health, and infrastructure on their rise to penurious self-agrandizing-philosophies.

Greenspan used to hang out with Rand – IMO a couple of douchebags whose bad breath is still stinking up the housing market and the tax code.

Matt’s point was that the tax revenue created by taxing the rich say at levels similar to those during the Eisenhower (Commie) administration could be used to rebuild infrastructure. Ike did it.

Better roads, schools, and health care just might help small businesses in many ways. The small business climate can be improved just from the decreased tax burden if small businesses are taxed less and the uber wealthy are taxed at a higher rate, but also through the government supporting workers costs that make current employers unable to keep workers on full time or pay a decent wage due to workers comp, health care, and other margin crushing employee costs.

While it’s true that the top 1 percent of wage earners paid 38 percent of the federal income taxes in 2008 (the most recent year for which data is available), income tax is less than half of federal taxes and only one fifth of taxes at all levels of government.

It always irks me when people provide the “50% pay no taxes!” line as justification for their argument (usually to raise taxes on the poor). Sure, maybe many of us pay no federal income tax, but federal income tax only makes up about 20% of the whole tax pie. And who carries the other 80%? Hint: it ain’t the rich.

And Phil Johnson FLUNKS the reading comprehension with the false statement that “Already the bottom 51% pays zero in income taxes. The top earners pay a disproportionate share as is.”

18,000 of the top 1% households paid ZERO income tax.

The top 400 households in the US paid an avearge of 17% opf their income in income taxes – and zip zero nada as a practical matter in payroll taxes.

The bottom 51% most certainly do pay income taxes – the median amount they pay is pretty much the same as their share of all income in the US. It jsut happens that they only get around 2 – 10% of all income in the US. (2% is the bottom 20% and 10% if around the middle 20% or the 40th to 60th percentile.)

Since the top 2% get 50% of the income and the top 1% control around 85% of all wealth, that doesn’t leave much for the other 98 -99%. So yeah, if you get most of the income in the US, you get to pay most of the income taxes.

The bottom 65% (incomes under $65K) don’t exacly have a whole lot left after paying necessities – the top 1% – and especially the top 1/10th and 1/100ths of 1% – have more than they can spend and lots and lots left after covering the necessities to stay alive.

Try reading – and grasping – the annual data reported by the US Treasury which breaks out the amount of taxes paid by income groups.

Matt, spending levels are far beyond what can be made up by taxing the rich. Far, far beyond. Even if we went beyond confiscatory tax levels to outright confiscation.

http://www.youtube.com/watch?v=661pi6K-8WQ

That has always been the case. Hence never the issue. The issue is what is being spent on. Not how much.

That is pure delusion. First, it wouldn’t even come close. Second, it would result in massive capital flight and tax evasion.

Government ALWAYS takes in roughly the same amount of GDP, year in and year out. TFRA 1986 eliminated numerous deductions and tax shelters. Nobody ever paid 90% or 70% or even 50% of their income in taxes. At that point, it’s not worth it to work. You’ll take a lower-paying job or negotiate some untaxed benefit, move offshore, live off savings for a couple of years, file for disability benefits, whatever.

The USG’s annual revenue is more than sufficient to provide for a civilized nation. Tax increases are not needed and not effective.

Incisive analysis as usual. My preference for the beginning of a solution is not more regulations, which usually punish the smaller institutions and reward the bigger ones, is to stop making government-guaranteed student loans. Government has no business being in the lending business. Also, Fannie and Freddie should have been abolished years ago – or never instituted to begin with. Isn’t that where moral hazard begins?

Matt, Joe the plumber would have something to say about your “spreading the wealth around” idea. It’s not the top 20% we should be concerned abou, though. It’s the top 1% who are raping the rest of us. But, then again, they are burdened by their dispropotional wealth to pay a disproportionate share of taxes. It’s simply not fair for these dedicated “job creaters” to be deprived of their hard-earned largess.

I call B.S. At minimum you are deluded. It is the top 1% who are destroying American jobs. One retired Tech CEO (Intel) lamented in hindsight his participation in funding billions in overseas infrastructure for tech manufacturing stating that we could never catch up on that mistake and build the factories here in the states to create American jobs. The decisions to outsource our jobs are not made on the factory line but in the top management and board offices. Additionally I am sure that if you research it you will see that the majority of taxable income of the US is paid by the bottom 80% of workers.

I think that’s valid. Globalization’s just another word for nothing left to lose…

IRS records are public. Take some time to devoure them to discover that your statement is very much so incorrect.

Surf-a-dick (there’s gobs and gobs of them in SoCal) is a typical OC repugnantcan. Somehow, someway, these intellectual giants think business and jobs are created without demand from PEOPLE. Without the holy, mighty slav….um Plantation owner, ahem, er I mean Business owner, we would all just hold our own nads and bemoan what a terrible world it is. Thank Jesus for all these wonderful Wall St. executives that create wealth and jobs from nothing to provide for those of us too stupid and ignorant to even make our own food.

Your ignorance is boundless:

http://www.ntu.org/tax-basics/who-pays-income-taxes.html

The free market will inevitably determine our fate. And one of the main reasons for the shift in the American economy in the last 20 years is cheap oil. Globalization has been fueled by cheap oil, which has cost Americans millions of jobs. The rising cost of oil will be the great equalizer in that we will be forced to revert back to a more localized economy based on the simple fact that goods will no longer be available from China for cheap because the transportation cost will be prohibitive. Cheap oil has simply replaced labor.

What Kirkus says is basically true. David Ricardo’s “Iron Law of Wages” can be replaced with an Iron Law of per unit production and distribution costs. The higher the cost of the transportation portion of distribution, the greater the advantage of shorter distances. But that won’t help the U.S. as much as it will help Mexico, since unrealistic wage expectations of unskilled labor in the U.S. will drive most of the jobs recovered from China by rising oil prices to Mexico. Mexico also has the ability to subsidize oil prices due to their relative proportion of domestic production of oil vs the U.S. Our government’s response to this dilemma has been currency destruction. That may help some domestic industries, and some of the currently unemployed people, but it will absolutely kill those of us who have been saving for retirement for quite a while, and had expected a comfortable (though by no means luxurious) retirement. The Dollar is only hanging in there because the Euro and the Yen are further down the path of destruction. We’ll see what happens to gold and silver: “Truth or Bubble?”

Joe

I understand the cheap oil to expensive oil angle, but it won’t do the housing situation much good. As oil continues to increase, and jobs move closer to the markets for those goods, will it still make sense to drive an hour to work?

All of our cities are designed around the concept of cheap oil. You get rid of cheap oil, we’ll have to rebuild our cities. This might be good for buliders and architects, but horrilbe for suburban home owners, and owners of high mileage cars.

Also, farm product costs are tied pretty closely to oil prices, so look for food prices to skyrocket in an expensive oil environment. Better learn how to garden, if you don’t already know how.

‘All of our cities are designed around the concept of cheap oil. You get rid of cheap oil, we’ll have to rebuild our cities. This might be good for buliders and architects, but horrilbe for suburban home owners, and owners of high mileage cars.’

That’s correct – and what’s going to happen is the ‘2 hour commute’ will simply go away. It will be too cost prohibitive. Public transit will have to pick up some of the slack for transporting us to jobs, but electric cars will not necessarily be a long term solution.

I suspect that suburban towns will either build infrastructure and survive – or they’ll become ghost towns. With $7.00/gallon gas it’s not much of a stretch.

But how does this all relate to housing? Wages and our cost of living are closely intertwined with oil prices. As oil prices rise it puts more stress and pressure on the economy – and in turn the job loss and wage reductions will hurt home values …. How can you afford to buy a house if you dont have food on the table ?

$7.00/gal gas is nowhere near enough to cause people to move en masse. $8.00/gal might be enough to convince people that they’d rather have a 3rd car than drive the SUV to work every day, but that is all it would do. The 2-hr commutes would go away, but they are a rarity.

If we are lucky, high gas prices might accelerate something that should have happened a while ago. Let people who can work at home, work at home.

Beware of the unintended consequences of any policy. Sounds great to tax big houses, boats, planes……, but remember someone gets paid to build them. Can you say move the jobs offshore??

The problem is federally guaranteed student loans. Again the unintended consequences of “federal” student aid/ loans etc… is these loans/aid etc. are supporting all sorts of schools and raising the cost of education. If the federal $$$$ disappeared tomorrow the cost of education would drop overnight and every school would have to deliver on its promises or be out of business.

All these schools government/”private” are sustained by tax-payer $$$. There is nothing “private” about these schools the second they accept one $$ from the governmint. ALL schools gov’t sponsered & “private” are simply leaches sucking money that doesn’t even exist from taxpayers of the future. There never has been nor will there ever be a FREE LUNCH/EDUCATION/HOUSING/……….. Everything comes with a cost.

Capitalism works. Crony special interest, fascism will fail. The USA is not a capitalist county. If it were Angelo Mozilo would be broke (and in jail or worse), B O A, Citibamk, Wells Fargo, GM ….. and Goldman Sachs would not exist or would be in a completely different form.

In a truly free market all those banks would have failed. The mortgages they held and were selling as AAA rated packages would have been sold for pennies on the dollar to the lowest bidder and a good chunk of America would have been turned into renters overnight or the purchaser might have worked out new loan terms based on the price he paid for the mortgage who knows? The FREE market never had a chance to work. That way Angelo Mozilo could retire to a Malibu mansion and GS et all could continue to rape the economy.

Amazing, that sounds just like the country I live in.

If Mazilo isn’t the epitome of the founding father’s nightmare…

And none of the Manhattan players ever went to jail, did they? So the moral hazard was fixed how?

Jobs are already being moved offshore. And “guest workers” are being brought in to fill the well paying ones at a lower rate. Might as well tax the hell out of the top income brackets to pay for the cost of moving production offshore and lowering wages here.

And no, totally Free Markets always fail. They either lead to Monopolies (and unfree markets) or crony capitalism. Please spare us the Libertarian nonsense. Libertarianism can’t work, has never worked, and will never work.

In fact, this entire mess was caused by Ronald Reagan and his “revolution” under the Free Market banner. With self-professed Libertarian Alan Greenspan leading the charge. It’s been a disaster, and we’ll be better off if we can bury that nonsense once and for all.

Has never worked? Really? Your examples, please?

The idea that Alan Greenspan is a libertarian is giggle inducing, regardless of what he may claim.

If you’re going to blame Reagan for something, the bailout precedent set during the S&L Crisis would make far more sense. We got in this sorry state because the consequences of failure were removed from those engaging in massive risk using other people’s money. No matter what, they walk away rich. That is a formula for scheme leading to ruin.

+1

They are still teaching EMH as truth in business schools. The markets are God. They will weed out the weak, innefficient, poor businesses and all knowledge will be reflected instantly in market pricing.

Horse pucky…

@epobirs:

Just take a look at the American experience. Less to no regulation, such as in the 1800’s have led to the monopolies of that time period. Which had to be broken up by State intervention. I take it you haven’t studied the history of that time period. And we see the similar pattern introduced under Reagan. You might recall that Reagan was waving the banner of “Free Markets” during his election.

Yes, try and distance yourself from the Poster Boy of the Libertarian movement, Alan Greenspan. That’s understandable, given the economic and social disasters that the Libertarian banner has given us.

Now, please give us an example where it has worked. And here’s a question for you. How many disasters does it take before you get a clue? The definition of insanity is trying the same thing over and over again, and expecting a different result. With that definition, Libertarians are simply insane. Even if you ignore the logical fallacies built in to the philosophy..

Yes, but should we build them in the first place. A large yacht is a lot of resources to spend on one person. The rest of us are poorer for it. I’d rather see those jobs translated over into industries that benefit a lot of people, rather than have merchants all competing to please the aristocracy.

Most I know have lost hope in our “leaders”. Corruption, incompetence. Many seem like sociopaths with little/no conscience. Smiling puppets doing the bidding of the Masters who got them appointed/elected, not what’s best for the people. Goldilocks economy! Housing bubble…a myth! No Tech Bubble! Summer of Recovery! Money on the sidelines, ready to be put to work! Max out the 401K! Main Street is back! Shovel ready jobs! Politician rolls eyes; illegal immigration is of little concern for most Americans! Years and billions later, Bin Laden is dead! A week after the “sea burial”, most have lost interest. Big thud. Media blitz quickly shifts to Dancing with the Stars and AI finales, time to vote! Brad and Angelina on the Red Carpet! Masses feeling powerless and numb; tune out, it’s easier. I don’t feel great about the future of our country.

haha, just now the guest on CNN, “Your Money” his name is Richard Florida …. says NOW is the time to buy. BTW, All the stress that individuals cope with today in the form of money woes will eventually show itself in sickness, cancer and heart attacks. What this means is that doctors and others and those who cater to the sick will be the largest growing sector of the economy, IMO. When everybody has tumors from their cell phones, and skin cancer, like me, and any number of physical ailments brought on by money woes, it will be the health care industry where they all wind up. so I guess if you’re planning on going to one of those on-line universities, make sure you come out of as a surgeon LOL, and then you will have it made.

I don’t know. Surgeons actually perform some function and have giant loans to pay off. The lenders are the ones that make the dough. You’ll find them at the country club bragging about their handicap and the hot new flight attendant on their Lear jet.

Real change will begin when debt repudiation moves from the individual into sovereign nations, states and institutions. It’s just a matter of time before interest rates crush the weak hands and they simply toss them in and fold. This is the domino effect the bankers and Wall Street fear most. There is no reason to believe that worldwide unsustainable debt can be serviced another 10 to 20 years without signifigant haircuts.

My uneducated guess is that the first sovereign debt domino will fall in the Eurozone. Regardless, the trend will spread like a plague….just as we’ve seen with individual strategic mortgage defaults. Growing levels of rioting and violence will bring it all to a head eventually.

Zigzag

You are correct. Greece will be the first to fall – a major debt haircut is in the offing, though denied by all involved. While a relatively small economy, it will have a domino effect on others in the EU – likely Portugal, Spain, Ireland and Italy. And the contagion will spread. Both Japan and the U.S. are are so saddled with debt, and unsustainable nanny-state “entitlement” programs, that they (we) will fall as well.

The demand for our debt is even now almost nonexistent. China wants no more of it. Japan? I don’t think so. Lately, the Federal Reserve has been buying nearly 70% of it – so what happens when QE2 runs out at the end of this month? Rising rates due to lack of demand and higher risk.

It’s getting spooky out there.

Hold on to your has, boys, it’s going to be a bumpy ride.

The United States can not go bankrupt. Unlike Greece, Portugal, Ireland, etc. we did not sign away our sovereignty and turn over the fiat currency to the control of other nations. We might have to print money. That is all that will happen.

If there is default, it will be because Congress decided to do it, and not because we needed to do it.

Fools

The American Dream By The Provocateur Network

http://www.youtube.com/watch?v=ZPWH5TlbloU

60 minutes US Government Immorality Will Lead to Bankruptcy

http://www.youtube.com/watch?v=DUTXuNZXLVg

For Profit Educators Pigs at the Trough

http://americansresistance.blogspot.com/2011/06/for-profit-educators-pigs-at-trough.html

Superlative post.

Too good an analysis for WSJ or The Economist.

Forget guns & butter, it’s commodities and bonuses in this clown car circus.

Manhattan & Hermosa Beach have not corrected at all. TRW is long gone, its parking lot is only 15% filled. Aerospace shrunk up decades ago, maybe it is the TV studio pumping up the prices? This week’s Sleazy Reader and Beatch Reporter have hundreds of ads for $2M , $5M+, crackerboxes. If you rely on these rags for information, I think you are in the dark.

Hey Surf,

I’ve been gone from NGC for over a year. I have not heard about layoffs but I think they went through a peak at former TRW. We had a bunch of programs gearing up for production bur I think a design cycle had crested. Not sure how much it has shrank but I heard a couple thousand got trashed (out of 11,000~12,000). Felt it was creeping over toward the design side. I got out… struggling but back into design now. Hopefully new company will find a decent niche in commercial 5G phones or 4G phone market.

Still the world economy is a mess…

The 800k+ market is always a bit different… my guess is there is 36 months of inventory… see how strong the hands are. Part of the extend and pretend strategy is lowering holding cost. So, a lot of those things got rolled into 10yr I/O loans. The holders are in slow bleed mode possibly holding recourse loans. Hence they are going to rent them out for a long time.

As a barely middle class guy you have to be real careful with the recourse stuff. Those guys will bleed you forever if they can. A friend that went underwater is trying for an Obama loan mod. The process is long and difficult because they are current. A lot of spending restrictions on them.

This could drag this process out for a long long time. Easily 20 years.

Not sure what that will do to us. The other effects are Japan like… they are having some kind of social malaise over there. Declining population, low initiative… the long term effects of too much socialism for too long.

All the kings horses and all the kings men….

We are done, it’s just a matter of time before it all implodes, and it’s gonna be worldwide. Worldwide suicide

“It’s the same everyday and the wave won’t break

Tell you to pray, while the devil’s on their shoulder

The whole world,… world over.

It’s a worldwide suicide.

The whole world,… world over.

It’s a worldwide suicide.”

Worldwide Suicide by Pearl Jam

The biggest problem is that we are supporting so many salesboys. The cost of sales, advertising, packaging and marketing far exceeds the cost of production of all products. Even though Chinese, Vietnamese or Mexicans are making less than a tent of American salaries, the price of their products is not ten times lower. The problem is the sales and marketeering trash sucking up the difference. American workers cannot survive on the salaries of third world countries as long as costs of housing, food, clothing and fuel are so inflated. To cure the problem of high costs you have to reduce the amount of overhead liek salesboys, university trained economists who missed the crash, banksters and stockbrokers who get bailed from their mistakes, house flippers and real estate and other “investors” who expect to live without working. Also people who have inherited money are a drain on the economy. A person should live from their own effort, not who their grandma had sex with.

Middlemen, skimmers, RE and Stock Rah Rah cheerleaders, and Ne’er-do-wells are not a value add to society. Cut em out of the chain.

It’s good to see more people focusing on the banks.

Well, on the for profit colleges. I had a bunch of kids working for me at Northrop. Mostly technicians and promoted a couple to test engineering positions. From what I could tell these kids had wracked up 100,000$ or more in student loan debt. Lots of green folks. The degrees they had were in electrical engineering from Devry University. Back to them in a moment…

I also worked with the FLM for the technicians who was from Devry. He was very positive about their program. I told him we had to screen very carefully from the place. He didn’t understand why. So, we gave the kids that came in basic skill tests. I think maybe 50% passed the test. We asked them real basic stuff for EEs or techs like calculating a current in a simple circuit or a voltage divider. These were questions for recent graduates.

We did get a bunch of halfway decent people from Devry but you had to screen carefully. You can see the school does provide some information, it had little to no standards about performance of students. Basically they let anyone stay as long as the money was flowing in.

Back to the kids with 100K in debt… I don’t know what the heck will happen to these guys. They are clearly inferior to engineering graduates from any decent school and the knowledge base just wasn’t there for an engineering job. The group had engineering title but was really a tech job. I couldn’t attract any engineering talent to the group and it was difficult for me to escape and I had many years of design experience and a real degree. The repubs and debt slavery act made this a big mess. oye.

You obviously know what you are talking about with engineering but when you are communicating with an outside audience it is best to leave the jargon, acronyms and initials out. To whit, what are you talking about when you say FLM? Sadly this seems to be a real problem with the modern generation posting on the internet. If you say something that your audience cannot decipher you in essence have failed to communicate and will end up not being taken seriously.

Seriously Delinquent Homeowners Undermine Hopes Of A Market Recovery

http://www.businessinsider.com/keith-jurow-strategic-default-2011-5

Someone just bought a house in the Bixby Knolls area east of Atlantic 3 bed room 2 bath home for 850,000 a young japanese family looking for an investment. This home was purchased for 300k in 1995. Why are these areas still not seeing the reality of all of this? Insanity.

Leave a Reply