The broke first time home buyer: 66 percent of first time buyers purchase homes with low down payment mortgages.

There is a reason why new home sales still remain in a slump. New home sales cater to an economy where most family income is rising to support the cost of higher priced homes. In many markets, new homes cater to first time buyers. But the first time home buyer market is mired in problems. In more expensive metro areas you have younger people simply unable to afford rents let alone the cost of a crap shack. In many other parts of the US families are simply dealing with an economy that isn’t seeing across the board wage increases. Low interest rates have to remain to keep the monthly payment static. At least that is what the Fed is hoping for. There was some recent data showing that first time home buyers continue to make up a small portion of all sales. Contrary to some false narrative, many first time home buyers are coming in with low down payments, not suitcases of cash. And for the most part, this is being driven because Americans overall don’t have much in savings and barely enough to cover a dinner at Taco Tuesday with a side order of guacamole if you are being a big spender.

Low down payments and low percentage of all sales

The first point we should look at is that the percent of first time home buyers is still near historical lows. First time home buyers as you would expect come from younger families. Younger Americans came of age during the epic tech bubble and the even more dramatic housing/debt bubble. Across a span of 20 years wages have remained stagnant yet the cost of debt financed items has ballooned (i.e., housing, college tuition, and even glamorous cars). But with housing, much of the growth is dependent on government backed low rate loans.

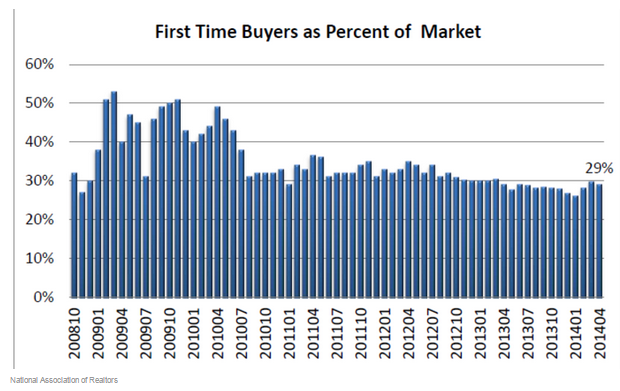

Take a look at the percentage of first time home buyers:

First time home buyers make up 29 percent of all sales. Compare this to 2009 and 2010 where it was around the 50 percent mark (the bust made prices more affordable for a short window before investors pushed prices higher). Investors crowded out regular buyers and have pushed this first time home buyer figure lower. Many American families are on the razor’s edge of monthly payments. Any tiny deviation on interest rates and they are priced out.

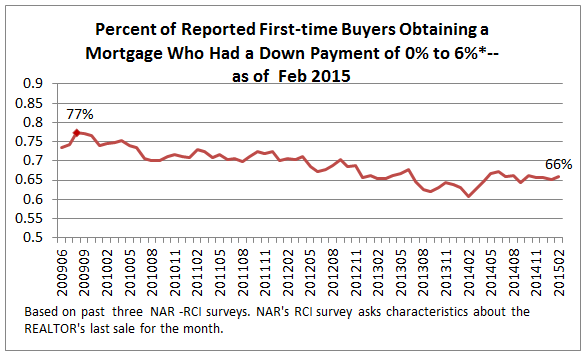

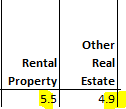

Here is a chart of the percent of first time home buyers entering the market with low down payments:

66 percent of first time home buyers are entering the market with low down payment loans. In 2009 when the chart begins, it was 77 percent. It would be nice to show more historical data because low down payments were nowhere close to being this common (outside of the housing bubble). Is this good or bad? Well in reality, it just means that many recent post-bubble buyers are still in tenuous situations and negative equity is one tiny recession away. That is why higher down payments, say in the 20 percent range serve more as an insurance policy. Then again, most Americans are close to being broke.

Where is the wealth?

The most comprehensive data on household wealth comes from the Census. I think people over estimate the wealth of families in this country. Take a look at the percent of households that hold any of these asset classes:

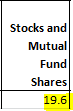

Only 19.6 percent of households own stocks and mutual funds outright. But they have it in 401ks or retirement plans, right? Let us see:

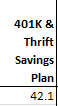

Okay, well 42.1 percent have a 401k or thrift savings plan. Keep in mind a paid off crap shack is not going to throw off any income in retirement. This is why we see many Taco Tuesday baby boomers in million dollar pads in Pasadena or Culver City shopping at Wal-Mart. That million dollar pad is only going to pay you once you unlock the equity. And many now are stuck with their adult kids moving back home. But how about those that own rental property?

Only 5.5 percent own rental property. Outside of the big investors, rental property isn’t all that common because you actually need to save a good chunk of money to buy investment property. All of the above data should show that most families have a very tough time even saving a small amount for the down payment of their own home. Which leads us to our final data point.

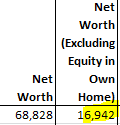

Low net worth excluding home equity

The median net worth of families in the US is very low (and even lower minus home equity):

The typical American family has $68,000 to their name. But in reality, they have $16,942 at their quick access since most of the net worth figure is made up by home equity. I know people like to make up anecdotal stories that their Taco Tuesday habit is merely a carryover from their Beach Boys days. But when we look at hard data like the all encompassing Census figures, most are living month to month. And these figures include all households. The first time home buyer figures are a reflection of even tighter budgets for groups like Millennials, many that have no desire of buying homes (big boost to renting) or McMansions (a hit to new home building). Low down payments are merely a reflection of stagnant wage growth and the continuation of pretending to be middle class with mountains of debt. Wealth is having assets that throw income your way.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

72 Responses to “The broke first time home buyer: 66 percent of first time buyers purchase homes with low down payment mortgages.”

This is a bleak picture. And yet house prices continue to go up. When will the madness end?

Tech company mergers and acquisitions. They are now talking about M&A. Well, I’m no expert — but it means they’re maxed out. I remember Network Solutions couldn’t grow it’s business in the 2000’s so it started to acquire as many companies as possible to show growth. The dotcom era blew up shortly thereafter.

http://www.businessinsider.com/get-ready-for-a-major-boom-in-technology-mergers-2015-4

When interest rates go up

The scars from the 2006-2008 housing bust are not forgotten so it maybe a long time before home ownership regains its priority status in America especially in lieu of the other changes that have occurred in our hollowed out economy. While polls still show many believe owning a home is a ‘good investment’ it would be interesting to see how that differs across age and income levels, i.e do people who can actually afford to buy a house have a more or less favorable view of housing as a “good investment” compared to those who can only ‘aspire’ to buy one. People who went through the housing bust and saw how fast their home equity could disappear or who lost their jobs in the Great Recession may never regain the confidence they once had about taking on debt to buy an illiquid asset like housing even if it is cheaper than renting!

That last sentence is the killer: Pure truth.

what? ‘wealth is having assets that throw your income away?’ you kidding me? this is america, it is and always has been about ownership. wow, say it ain’t so. is this blog just a huge troll site to convince the masses to never buy in to RE?

fact is, land is the only thing that is constantly appreciating; the structures themselves do not/depreciate over time. owning land is what generates wealth, ask any farmer or any developer – these ‘crap shacks’ are selling for such absurd amounts because of the land they sit on and their proximity to other parcels of land that have been developed more fully

seriously?

nevermind, i read the last sentence in context; in the case of people taking out huge mortgages they cannot afford with low downpayments – yes, of course, who wouldn’t agree with what is being said there

but wealth (aka passive income) IS owning assets, and for many undisciplined people a mortgage is the only way they can begin building it. that’s why it is and always has been about comparable rents + ability to pay + the game wall st. is currently playing

my take: at first it was mortgage backed securities because everyone thought, well people will cut off their limbs to save their equity in their houses – these things are as safe as treasury bonds. then things got out of control too quickly because real estate goes through bubbles and manias

now, it’s rental backed securities because people need a place to live and the assumption that people won’t scale down in their quality of life when times get tough. moreover rises in rents are controlled in many places so there’s less systemic risk that things get out of hand and people begin moving out/opting out of their lease agreements en masse – these things are as safe as treasury bonds

someone commented in this post or last that you shouldn’t be afraid to buy in this market and in looking at the underlying factors i have to agree: i don’t see RBS taking down this investor market any time soon; what we’re seeing here is true demand meeting true lack of inventory. kids these days can’t afford shit. but ask yourself if they really have to or not: they’re going to be handed a house when their parents pass away anyway, which is why this generation of kids (‘millennials’) are so in to festivals and drugs and slacking off — hard

take away their safety net and watch them scramble. but who would do that? it would compromise the economy + take away what little demand there is left for the goods in the rest of the economy. big rock + bigger rock on both sides. imo all we can do is wait for another war or stagflation to grind on

at one point in history Detroit land prices were fetching top dollar…..

If first time buyers have no dough in the game…here we go again! All my delusional friends love this hyper-inflated housing market in So Ca, whereas I think it’s an inflated rigged market, ripe for a wash.rise.repeat of freeloading and bailouts. We may not have a mortgage, but we’re bitter we had to overpay from these negative interest rates and the inverse effect on housing prices.

In 1984 we bought a nice 2,000 sq ft new construction PUD home, and our 10% down was the minimum. We saved our arses off and did without. What ever happened to delayed gratification? Maybe I’m old school. The govt, the banksters, don’t get me started…

Don’t abandon your approach. This well end badly and cask will be king once again.

Just like the absence of retail investors in the current stock bubble exposes the non-existent fundamentals of that ponzi, so does the absence of first time buyers in Housing Bubble 2.0. This “market” has SIGNIFICANTLY less organic activity than did Housing Bubble 1.0. Here we are with microscopic down payment options and their is STILL no first time buyer action. The moment the first REIT has a liquidation sale is gonna be a “Lehman Moment”. Until then I think you’ll see continued downward price action where people actually live, meaning the IE, the Valleys, and sub-prime LA proper. There are going to be people that need to sell at whatever price they can get. In the absence of specuvestors that price is trending lower in all but the luxury market. Median is down in many areas and if you look at the middle class track homes, they’re down just about everywhere outside of uber-prime.

NihilistZerO: I never went through any real estate transaction without a complete alien anal probe and 20% down.

Count me in as old school as well. I’ve never considered my house as a part of my “net worth”. It’s a place to live, a roof over my head, not an ATM to be tapped for cash and prizes. It is security against rent increases and the whims of the landlord.

Thankfully my current house is mortgage free and I have no debt. I’m a Baby Boomer, not rich, but I’m not living on Friskies and taking change to the Coinstar to pay for Taco Tuesdays.

The materialism and gluttony of my generation always repulsed me and still does.

Perhaps that Daily Mash article Galaxy Brain posted is true. “Menace to society” here, I guess.

@DweezilSFV

I’m actually about to put my money where my mouth is on my rental. I’m negotiating a buy option lease with the buy option occurring during year 3. The key point is price will be set by appraisal at time of purchase. I’m “shorting” this RE market in a very real way. I’m VERY confident in my decision and will be paying a little higher rent for the next 3 years for what I’m certain is a return to 2011 prices. Now I’m in the Eastern San Gabriel Valley and wouldn’t make this decision if I was in LA or OC prime as I’m less confident on the price action there. But the Valleys and the IE are already correcting and no correction in these areas since the 80’s has ever been less than a 25% downward action.

Interesting option NZO. I’m curious of two things:

Why would the seller agree to this? Risk doesn’t seem to equal reward unless the owner thinks it would be hard/lengthy to sell.

And two, have you had it appraised recently and did it equate to what your estimated value was?

@We’re Gonna be rich!

Hard sale because the house is a total fixer. He’s negative cash flow so higher rent eases his position. He’s in big his own cash but upside down because he bought peak. Luckily for me a drop in price to what I anticipate still leaves enough to cover the only mortgage on the property. He probably should have sold at the peak last summer as prices are down this year, but I have a feeling he thinks they’re going up. He lives out of state and isn’t coming back. If I’m right and he’s forced to take his loses, I’m really doing him a favor. He can get out of the negative cash flow position and by at what will surely be discounted prices where he’s at. As for current value I’d put this place 100k below comps as it is 37 years old, original everything with some moderate repairs needed. Needs a lot of work but the bones are great. 20% down on 2011 prices gets me just below rental parity. Ultimately the owner needs to be out of this property and he really should have sold last year. But much like the Boomers, he’s holding out in the belief there’s another leg up coming. Locking in a higher rent as well as moving the property at a higher price in 3 years is the carrot in a deal that can work for both of us. We just happen to disagree on how the final price figures in to that, but there’s no need for me to tell him that… 😉

Congrats NZ on jumping in to the market. Your timing is just like ours. I’m sure you will come out fine since you are a smart person. Best of luck!

@ILtoCorona

It’s pretty much a win-win for me. The house is a fixer so I’m already paying a relatively low rent. Locking in that rent for 3 or 4 years with the buy option in 2018/19 is a no brainer to me. There’s no way they can keep this cycle of the ponzi going that much longer. Even in the event prices don’t revert to 2011 I can probably afford late 2012 prices given the fixer upper discount. It’s a unique opportunity to take advantage of the landlords naivete. He could have minimized his losses if he sold in the past year, but he didn’t. The property manager told me he wanted to hold onto if for a few more years. That told me he was addicted to Hopium and believed prices would be higher in a few years. If this agreement goes through we’ll both have made our bets. I’m pretty sure my “short” position is going to turn out to be the right play.

“This “market†has SIGNIFICANTLY less organic activity than did Housing Bubble 1.0.”

I am not sure what your definition of “organic” is but I think you mean outside participants. I believe that 1.0 was no more organic than the current “market”. The “artificial” costing of money is what caused the 1.0 bubble as well as the 2.0 bubble. That goes for dot com 1.0 and 2.0 as well. I agree that there are way fewer direct participants in both 2.0’s hence, the recoverless recovery which is a wealth transfer of a shrinking pie. Never in history has there been a time with a wealth transfer of a shrinking pie that ended well. Guillotines were invented during a very similar time. Cake anyone?

@What?

As the Doctor has noted many times affordability was at historic levels during Bubble 1.0 because of NINJA loans. This created organic demand from first time buyers. As organic as fraud based mortgages can be considered anyway… My point, which you seem to agree with, is that now its a total ponzi circle jerk. The specuvestors are getting ready to splooge on each other and then it’s a run for the towels. I feel a lot of them are going to be left with baby-batter on their faces LOL!

My Dad is a Taco Tuesday boomer.. who also owns several paid-off homes and is flipping another because he can’t figure out a safer investment.

While personally being on the short end of the stick in the housing game, I’m seeing the same investment mentality play out in certain car-collecting circles. Porsches from the ’60-90’s have literally shot through the roof alongside this v2.0 housing bubble, in a way reminding me of the baseball card craze 25 years ago. It’s a clic that can only feed on itself for so long; sooner or later two or three major players move on, dump a lot of inventory in the process, and everyone else starts to freak out.

We’re in a new age: the epicenter of liquidity is now Red China — Beijing in particular — with a major offshoot in Hong Kong.

This is the first time in a century that America was not the pivot point for global liquidity.

The mania in Red China is epic by any standards — and is the true source for the strange and weird price moves in all non- Red Chinese financial markets.

Such bubble end when the party runs out of collateral… itself largely a product of group/ collective faith in financial instruments.

Bank drafts backed by bonded commodities were the liquidity pump for the first Western financial bubble in Holland: tulip bulbs.

Right now the Red Chinese are having to re-rig their secured lending markets right in the cyclone of a new world record bubble.

Do NOT be surprised if the end result is a Chinese political revolution.

Such an event would merely be history (Chinese history at that) repeating itself.

What happens is that the elites fall out among themselves as the bubble implodes.

“Every kingdom divided against itself is brought to desolation;

and every house divided against itself shall not stand.”

Lucid post. Although I don’t know about the speculative comments regarding revolution in China, it certainly goes to the heart of the current boom. The massive wealth transfer from the West to the East (mostly China), is partly responsible for this ‘boom for the few.’

Unfortunately, every time the ‘boom & bust’ cycle of capitalism busts, the market is never allowed to correct itself and properly allocate the malinvestments and resources to where they would otherwise be or not be. Instead, the malinvestments keep getting propped up by more liquidity and therefore transfers ‘booms’ from one sector, to another sector, and so on as the new way of “recovery.” As soon as the interest rates go up, it will most certainly impact the markets and prices will start to reflect that.

Also, another variable to note: a commenter noted that Detroit was once considered prized real estate. With the historic drought in California, this may provide another tipping point as it will certainly take its toll on the economy if it continues. An inflated McMansion or a crap shack in Echo Park/ Silver Lake is as worthless if there’s no water, as a diamond in the desert.

You haven’t seen a truly punked First Time Homebuyer market yet.

Based upon trends, it’s reasonable to see FTH collapse down to one fifth of current tempos.

0-care taxation has scarcely begun its erosive effect, which will take years to unfold.

All the while 0-care’s defenders will be in fulsome denial that their love interest is causing a (full blown) real estate depression.

&&&&&

Real estate runs on money, not population growth.

So when the money bowl is taken away — and given to the medical, pharma, insurance, attorney cartel — well, that’s that.

Those fellows will be the only ones in a position to buy a home — in the main.

&&&&&

The belief that 0-care can be mandated by the government without having any impact on the rest of the economy will die hard. Indeed, for True Believers it will never die.

For some idea of how chaotic the real estate market can get: check out Argentina and Venezuela. Those polities can’t quite connect A to B, either.

This is natural when your economic-religious convictions don’t permit such a recognition.

I feel compelled to point out that your supposition is that having money directed at Healthcare, rather than Real Estate is bad. My opinion is that we already have TOO MUCH money going to Real Estate… whether it goes to O-care or new cars, I don’t care. Let’s just cut off the insane Real Estate inflation.

Most modern money starts its existence as a real estate loan.

Health spending does not create liquidity/ make new money for the economy.

This is an EPIC change that has yet to be comprehended — even by the ‘sophisticates.’

Please help me with this. Doesn’t O-care only impact 20% of Americans at all? And, aren’t these people the very one’s long priced out of southern california real estate?

@Derrick, technically 85% of the population was covered under some form of health insurance before Obamacare. However, the 15% that were not covered, many of them have very very serious and expensive illnesses.

On paper, Obamacare should not change the healthcare costs for the 85% that were covered before O-care. In practice, that is not the case.

My regular doctor office co-pay went from $10 to $40 per visit when O-care kicked in. My emergency care co-pay went from $40 to $500 per visit under O-care. Medication prescriptions went from $5 to $40. I paid nothing for my employer provided health insurance before ACA. Today I have a $75 per month insurance coverage co-pay deducted from my paycheck.

Luckily, I am healthy so the affects to me are small. However, I have co-workers who are being murdered financially by the changes wrought by the Affordable Care Act (Obamacare).

0-care entirely re-wrote the health care industry — from top to bottom…

Consequently it effects everybody — with astounding follow on effects that reach around the world. (A permanent non-expansion of the money supply.)

0-care is primarily funded by a massive tax increase upon the young, healthy, with the incomes suitable to purchase their first home.

It is not ducked because the ’employer pays for the health plan’ logic.

Every employee always pays for all benefits — even if Congress deems such outlays to be outside the nominal W-2 income reported.

This latter fact eludes about 97% of the population — especially college professors.

That’s one thing to keep in mind: all professors live in an economic cocoon… often their entire lives. This permits them to engage in fantastical pipe dreams about how the real world works.

This goes double if they are economics professors.

It’s not without significance that professors are — collectively — horrific investors.

One need only peek at Larry Summer’s ‘management’ of the Harvard Endowment Fund!!!!!!!

@ Ernst,

You had amazing health insurance costs! Almost free. Good for you but does that make sense when millions could not afford anything but catastrophic care?

Maybe you and I look at healthcare differently. I view it as one of the “rights” of citizenship…not CARE, but ACCESS to AFFORDABLE health insurance. “Life, Liberty and the Pursuit of Happiness” and all that. We’re Americans. Health (and sometimes wealth) is a role of the dice, yet every American (in my view), deserves access to affordable healthcare insurance.

I pay 50/50 with my employer and nothing has changed (coverage/price) since OCare. Ours is a 250 person privately held LLC.

All the Domesday sirens of insurance rates going through the roof (your case and colleagues included in the overall stats), the news that I read is that insurance rates have gone up the slowest amount in many, many years. I”m no expert but the facts seem to contradict the doomesday people.

Meanwhile, millions have insurance who didn’t have before. Isn’t that a good thing?

Derrick, my health insurance only covers catastrophic — and that’s all I want. I pay for my own dental, eye exams, annual check-ups. A few hundred to a few thousand dollars a year.

Why SHOULD people have a “right” to free, basic health care? Why shouldn’t they pay for their own mammograms, birth control, prostrate exams, teeth fillings, etc? Isn’t that why people work for a living — to pay for their own food, clothing, shelter, and yes, health care?

Americans have this bizarre notion that THEIR money is for FUN, like an allowance. Their money is for movies, CDs, restaurants, etc. But the basics should be paid for by government. That’s it’s unfair for their fun money to be diverted to teeth fillings.

We see this bizarre notion in school food programs. When I was a kid in the 1970s, we brought our own lunches to school, in brown paper bags or lunch boxes. Today, schools provide free lunches — and free breakfasts and after-school dinners. There’s even talk of keeping school feeding programs open all summer, so “the children won’t starve.”

HUH? Isn’t it the parents’ job to feed their own kids? From their own paychecks? Are modern parents so dysfunctional that they can’t even be trusted to do such basic chores?

I consider it normal — NORMAL — to pay for one’s own, basic health care. Insurance should be for unusually expensive items that people normally can’t afford — like if your house burns down, or you’re hit with an illness that can cost hundreds of thousands of dollars.

FREE health care for all? Bizarre.

@ Ernst,

Where did I write free health care? I wrote access to affordable health insurance. Big difference.

Son of L.,

Excellent comment full of common sense. Finding people with common sense is so rare these days. I never asked the government to take care of me or my children although I came to this country and started from scratch.

What’s the connection between real estate and Obamacare? Sounds like you’re just ranting.

A permanent, and epic, shift in the creation of money for the American economy.

0-care is MASSIVELY deflationary.

One hint that’s already floating across the broad sheet: the rise in the US dollar.

These two phenomena are linked. This fact eludes about 99.99% of the investing public at this time.

By current law and procedure, the mortgage market within the US of A will begin to contract.

Existing mortgages will amortize or default – deflationary.

New mortgages will not be laid on by priced out not-going-to-buy-but-want-to young marrieds.

Ergo, the mortgage market will shrink. This will begin but slowly — and then build and build.

At some point, the crisis, Congress will jump in with both feet to reverse 0-care — before the entire economy implodes for lack of liquidity.

Modern money starts out during credit/debt creation. The home mortgage is BY FAR the dominant source of said new money.

Said money is killed off when the mortgage is paid off — or defaulted on.

Blert, you are 100% correct in your assesment of O-care impact on RE prices. I always though so, because it is obvious for all who understand the money system. The rest live in a paralel universe and their critical thinking doesn’t help them to connect the dots between cause and effect. Or they may be too blinded by ideology.

@Nine Yarder, the connection between real estate and health care is $$$. The average American tries to match income and expenses. Since we know that incomes are stagnant, when expenses go up (health care) that means some other expense needs to be cut (deflationary to that service/industry that is cut).

‘The typical American family has $68,000 to their name’ – (including home equity)… I’m guessing that might be up slightly since if I’m correct in thinking it’s Census 2010, and tickup in some house price reflation since in many areas?

_____

The Daily Mash

People who don’t care about houses ‘a threat to society’

07-04-15

GIVING up on owning property could lead to dangerous behaviour like reading books or being interested in world events, it has been claimed.

After it emerged that only four in 10 renters was still attempting to save for a house, property experts warned of a dangerous new breed of human that wants to discuss things other than the purchase and decoration of homes.

Estate agent Martin Bishop said: “Imagine being at a dinner party where nobody owns a house.

“You try to start a conversation about the price of a three bed in a neighboring zipcode, or how you’ve been knocking through walls to create a spacious feeling, but you’re met with dead-eyed stares.

“They want to talk about films, war things happening abroad, animals – a bewildering and scary array of topics that will make you feel thick.

continues

http://www.thedailymash.co.uk/news/society/people-who-dont-care-about-houses-a-threat-to-society-2015040797085

When I go to dinner parties I don’t hear renters discussing the Eifman Ballet, or art films down at the Nuart theater. It’s more like “Breaking Bad” or some “You Tube sensation” making more money than JayZ by opening up Disney toy boxes.

I am astonished at this “owning a home is a bad idea” meme. It almost seems like a “marketing campaign” to manufacture consent and create a capitulation amongst the populace into renting forever.

Imagine yourself at 70-years-old and having to pay rent that is rising 3.6% year-after-year-after-year rather than living near rent free by owning a home. (taxes and insurance notwithstanding). Do you realize that paying 3.6% more each year will double your rent in 20-years? Will you pay check match that increase?

Granted prices are ridiculous and they will always be – renting just perpetuates high prices due to the investment grade a property offers for the those owners who rent – but giving up on the hope of securing shelter and living in the moment is a really bad idea.

When one pays off their home, it’s like getting a HUGE raise. I offer this as a business model: I built a guest house in the back yard and had the renters contribute to my mortgage bill till they finally covered the whole amount after yearly rent increases. (It took 15-years) I added usual payment as well to pay down the interest. The house will be paid of in months. If you can’t build a house, add a room with a second door facing outside and rent it for $600 a month it will make owning a home a lot easier.

I hope this helps.

The expenses on a paid-for house go up, too. Property taxes on single family houses will skyrocket to pay for the underfunded pensions of government workers and municipal employees. Utilities on an apartment are less than houses and will have smaller increases. If you add one big home repair to the formula (roof, furnace, etc) that increases expenses astronomically.

SCAQTony: Granted prices are ridiculous and they will always be

That’s your view – which I think is wrong – prices can crash… again.

I have no interest in paying stupid high prices, nor in people farming.

i don’t think the Doc is discouraging homeownership altogether. It is unwise to overpay for a home. Overpaying is likely if you live in a handful of overheated and overhyped markets right now.

I don’t think the general meme is to not own a home. However, I think that this is a healthy dose of reality check to caution ourselves amid the ‘irrational exuberance’ that pervades the current zeitgeist. Quite the opposite, I would say that in the circles I’ve been in, it seems like everyone is consumed with the idea of owning a home at all costs, because everyone else around them is buying it, and prices are going up so you better lock in. I see many of the poor husbands get sapped out of their last dime throwing it to real estate.

However, if the history of finance capital and central banking is any indicia, there will always be a boom and a bust. One person’s pain is another’s gain. When liquidity is created and pumped to “stimulate the economy” the first entities that get it are the banks and corporations, not the average Joes. The speculators get it and want to spend, and so they spend (look at the Blackstone Group and how it has profited heavily from the current rental boom development). Thus, the current “housing recovery” is largely driven by more Wall St. speculation. I do not pretend to have any predictive value in my analysis of when this will pop, only that what goes up, must inevitably come down. The gravity of the come down remains to be seen (i.e., whether this housing bubble 2.0 is relegated to mostly the U.S., or whether it’s a global phenomenon which portends more doom – China I’m looking in your direction). The cyclical aspect to life is perfectly captured with physics – for every action, there is an equal and opposite reaction. The key is to save enough to position yourself to purchase property when things go down. My parents saved for 20 years before they bought their home back in 2004. Delayed gratification seems to be lost on most in my circle who have very much succumbed to the herd.

@SCAQTony, no one posting here is really against buying a home. I have had several properties over the years. What people are against is overpriced homes relative to income levels. Here in LA/OC, we’re looking at a home price vs median income multiplier of 12:1. That really makes no sense. In the non-bubble parts of California and the U.S., the multiplier is 5:1, and in some areas, as low as 3:1, which given interest rates of 4% is reasonable.

The current Case-Shiller LA index is in a nosebleed territory of 226. Boston and NYC with Case-Shillers of 175 are almost sane compared to Los Angeles. Then again so is Denver with a CS of 158, Chicago with a CS index of 127, and Dallas with a CS of 143.

Middle class will never have an opportunity to leave decently anymore. The economy in this country, particularly in Los Angeles area, makes it impossible for a middle class to nearly survive. Homes are not dwells any more. They businesses. Thank you investors for continuing destroying the (part) of this economy. It is not going to get better, only worse.

No one can’t talk about Argentina or Venezuela. The economies are so different and impossible to compare.

THANK YOU INVESTORS – AT LEAST WHEN YOU CONTINUE DESTROYING THE REAL STATE, CONSIDER REMODELING THE KITCHENS A LITTLE BIT DIFFERENT.

I LOVE your South American accent – you sound a bit like Gloria, the sexy Columbian wife on Modern Family 🙂

Maybe you ARE her, posting here from LA, using your real instead of stage name?

Jason,

IT is Colombian NOT ColUmbian…. Please…

The United States is fast becoming like corrupt countries Argentina or Venezuela where everyone is poor except for rich leftist dictators and their leftist cronies.

That is because we have too many leftists in leadership.

Like all those leftists running congress, and the Koch brothers.

Scary statistics! The biggest concern is, as these statistics show, the average family is living on the edge now, what happens when the next economic downturn/crisis hits or the individual family has a real emergency or crisis? Despite all that has happened in the last 10 years, it seems everyone is still wearing those ‘rose-colored’ glasses!

This picture is more bleak than you present. These numbers are percentages of sales. Sales are still in the toilet. The population continues to grow albeit at a rapidly decelerating pace. The majority of data these days has little to do with reality and more to do with propaganda. I wonder what the real numbers would be in a real context. That would be first time home buyers as a percentage of population over time. There really is no housing market at this point nor is there a stock market nor bond market nor commodity market. There is no “law” of supply and demand. These mythical creatures have been retired along with alchemy, scientology and Keebler elves…

For all this talk of drought, earthquake, economic recession, and limited inventory, there sure is A LOT OF MONEY in L.A.

Out of curiosity, today I searched on Redfin for all houses with a MINIMUM list price of $3 million. A LOT of houses came up.

Seems there’s a poor selection of houses listed at under $700,000. But if you have several million to spend, there’s a lot of inventory to choose from.

@son of a landlord,

In the Los Angeles area, only 28% can afford a median priced home, in Orange County the number is 21%. So the way this works out is thus:

In the LA/OC area:

20% are rich

10% are middle class

70% are working class/poor

In a healthy economic area (i.e. the Midwest)

15% are rich

70% are middle class

15% are working class/poor

*Note: this is a normal distribution (Bell Curve)

Your last 2 sentences tell a lot. In LA, regular people (i.e. middle class with 2 incomes) either own a house and are afraid to move up due to increased property taxes creates NO move-up market and a small supply of crapshacks (people selling to leave the LA area). $700,000 is obviously the maximum first time buyers can “qualify” for. And we have lots of $3,000,000 listings trying to dump to a small pool of buyers. Mortgage Backed Securities or Rental Backed Securities going sour on Wall Street is all that is left for the real estate “market” to turn south in a hurry. We really don’t have “markets” anymore just “govt” manipulated bubbles. And ALL bubbles eventually crash. Total crapshoot. I guess you have to ask yourself “do you feel lucky?’

Caveat Emptor. (buyer beware)

http://www.westsideremeltdown.blogspot.com

“Out of curiosity, today I searched on Redfin for all houses with a MINIMUM list price of $3 million. A LOT of houses came up.

Seems there’s a poor selection of houses listed at under $700,000. But if you have several million to spend, there’s a lot of inventory to choose from.”

That is the reason I said many times that if you want a normal life in SoCal you need 5 mil. plus. When I said that, many said that I don’t know what I am talking about. But I know what I am saying because I lived there. If someone wants the life of a slave, yes, you can live in SoCal with less than 5 mil. There are many from south of the border who live there with less than that. However, your standard of living will be like theirs.

Throughout history people have been renting out rooms, doubling up, tripling up, to pay for unaffordable housing in urban centers. The “regular Joe” has RARELY been able to afford property in developed urban centers. If you love LA, just buy a home and start renting out rooms, build tenement over your garage, guest house, whatever.

“Throughout history people have been renting out rooms, doubling up, tripling up, to pay for unaffordable housing in urban centers.”

LA as a whole is not an urban center. Perhaps places like downtown LA, Santa Monica promenade area, Beverly Hills, and other niche areas can be considered urban centers; real estate in those and other such areas will always command a premium. However, LA County is a very large place. Even larger if you consider OC as part of the general LA area. As many people (including myself) believe, there is not enough demand to justify prices throughout LA and OC on a sustained basis. It’s probably just a matter of time before housing becomes more affordable. And if that never happens, you might see more migration out of So Cal. But that would lead to lower prices, too. So no matter what, prices will likely be decreasing at some point.

It. Is. Unsustainable. As you so clearly state Greater SoCal has 10 million plus residents. If someone wants to argue Manhattan Beach, Newport Beach, Santa Monica, Laguna, etc will retain value I get the argument. But to apply that to the whole of SoCal, especially place like the IE and deep SFV, is just silly. There are not enough people who can buy at these prices. That’s why sales suck. There’s also not enough renters to support the prices many specuvestors paid. That’s why their cap rates suck. As I said a few pages ago, the rubber band is stretched and something has to give. Taking SoCal as a whole we have NEVER had a run up that corrected via higher wages. It’s ALWAYS been price reductions. I have yet to read any coherent argument why this time will be different.

@ NZ

There are 10 million residence in LA County, not in SoCal, which is a region that comprises 10 counties. So, yeah, 10 million “plus”

And misguided, retrograde view of Southern Calfornia…it is a patchwork of cities, making it a patchwork of urban centers. Culver City is an urban center by the modern definition (no more land to build on, own police/fire/schools, industry, etc.)…just because it doesn’t look like Prague doesn’t mean it’s not an urban center.

Funny how all these long-time posters whose arguments are considered so smart continue to be wrong or push out the time of the crash…now it’s in 3 years. Brilliant. Meanwhile, Lord Blankein will be up 25% on his house, paid off 15% and having had a nice tax write-off all these years, in addition to the advantages pride of ownership. But, he was dumb to buy, right? haha.

And you have these posters saying that LA will run out of water for homes. Right. That’s the hyperbole that lives here.

@Derrik

“Nice tax write-off” is a joke. I’m lucky enough to have a high income, and am now subject to limitations on deductions, including property taxes and mortgage interest. With California taking up to 13% of my income, I wouldn’t get a penny of mortgage interest or property tax deductions, since my deductions are considered too high.

Thank God I didn’t buy a big place when my office relocated (still in SoCal) in 2007. Honestly, renting is Way cheaper for me.

This should be a Real Home of Genius … S.F. hoarder home “worst ever seen” by cops, filled with Black Widows, rats, poo and an actual corpse. One week later? On the market for 2.5: http://www.dailymail.co.uk/news/article-3035421/Mummified-corpse-not-included-Urine-soaked-home-hoarder-kept-dead-mother-s-body-five-years-sold-auction-2-5-MILLION.html

They don’t have the cash flow or the self-discipline to save up a down payment. This never ends well.

Interest rates will not have much of an effect AS folks who are in or are buying get 30 year fixed rateS.

My coworkers laugh at me for not purchasing a home in San Diego. Just today two of them were having a conversation about utilities being $800/month around this time of year. I commented that that is what my portion of rent is every month after splitting with my girlfriend to live in a 1 bed blocks from the beach. They just laughed and said they have made $200k+ in equity for doing nothing but buying and that I am a fool.

Meanwhile I save $3000 a month and max out my 401k every year. Both of them where in shock to hear I max out my 401k and say that is insane! I’m 26 going on 27 and have $110k saved and plan on continuing to save and wait to buy in a few years. Hopefully things will cool off by then.

you can borrow 50% of your 401k for 15 years at about 4.5% interest and use it as a down payment in the future when you are ready to buy

Kristopher – I like your attitude. I know it’s a US cultural thing (and now European) to brag about earnings/savings/housing wealth, but I’m keeping my financial position opaque to everyone… no one would know I have some position from my rental situation or car I drive. I’ve given away over 1/3rd of my savings position to sister and two brothers in recent years, helping to put them in position to buy humble homes when market changes.

I have some concern about what occurs if and when the market softens.

“If you’ve got it, flaunt it” was a US ditty composed in boom times of the 1920s… it doesn’t suit depressed circumstances.

*I need to qualify that by adding they (my sister and two brothers) will all still need significant mortgages to buy (in any prime area), even if we do get the sort of real estate price correction I’m expecting.

We are in good hands with the Democratic Party running the state. We are a one party state. Long live the revolution.

FOLKS WHO HAVE NO IDEA?

Neighbor ask, ” lot of for sale signs been up sine Jan. why don’t agents put up sold signs”. Just shake my head, do I have the heart to tell him nothing has sold or do I pretend that the agents forgot to put up sold?

I live in Westchester, CA 90045. When houses in this area go up for sale, they typically sell quickly. Original houses (built around 1950) are usually single story, 1500 sq ft (like ours). They are invariably torn down and a 2-1/2 story moderate mansion is built.

We bought our house in 1980, it is paid for, and we have no plans to move or draw equity from it.

Folks, the new homebuilder stocks are going to have another spectacular crash. The price of lumber is in a freefall:

http://investmentresearchdynamics.com/sot-ep-16-jamesturk-the-gold-in-london-is-pretty-much-gone/

Your link was to an article about gold (which I have no position in / little understanding of).

I think this is the link you mean to post… I have not checked the lumber price against any source… reading the connected Houston story in a moment..

http://investmentresearchdynamics.com/new-home-sales-lumber-and-houston-are-crashing/

Leave a Reply