Broke, young, and unable to afford a home: The crisis for young American home buyers and household formation.

Making homes unaffordable to younger Americans is more problematic than simply altering the living habits of upcoming generations. Housing formation in the United States is entering uncharted territory based on demographic shifts and also the new reality that younger Americans will be less affluent than their parents. This is why we have millions of younger Americans living at home with parents. Some may not view this as an issue but in the past, construction was a big part of GDP and you will have a hard time justifying new housing construction if people are simply living at home or are only able to afford a rental. The student debt crisis goes hand and hand with the unaffordable nature of housing for young Americans. It also doesn’t help that Wall Street is crowding out regular buyers in the market. With a growing population and investors eating up the low supply of housing, many young Americans are essentially in the position to move back home or to rent. Buying is a remote possibility for many Americans and this has put a clamp on new housing formation.

Household formation

In stable markets you would expect that housing starts and household formation would track closely to one another. Builders can predict (to a certain degree) how many homes to build for upcoming families based on demographics. Yet this becomes difficult to predict when a large portion of those coming up are simply unable to afford a property. In the early 2000s toxic mortgages and no due diligence allowed anyone with a desire to buy to do so. So of course, when we look at household formation early in the decade we find that formation was far outstripping housing starts. If the bank is offering you crazy amounts of money for a nice place why would you say no? The bank is looking out for my interest right? At least that with greed mixed in led to the biggest housing bubble of all-time.

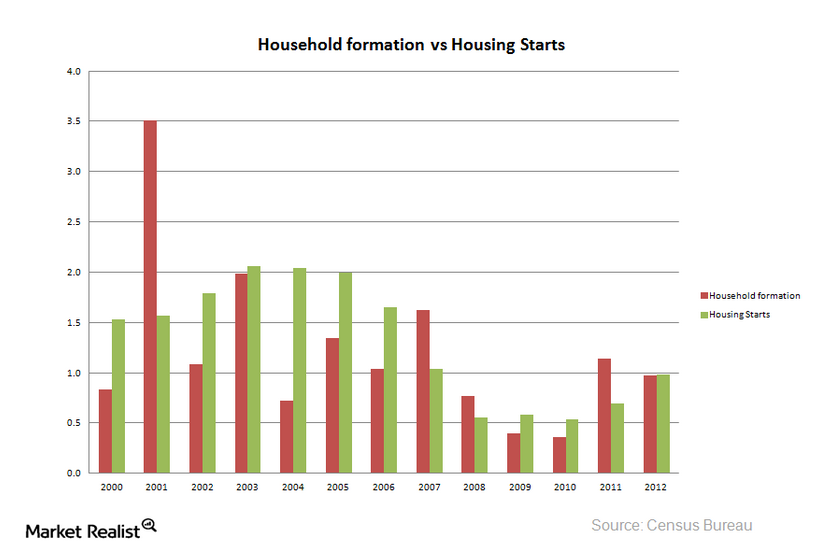

Here is a chart of both household formation and housing starts:

You’ll notice that between 2001 and 2002 builders got the message quickly and started building. In 2003 they nailed it in terms of demand and supply. However, from 2004 to 2006 there was a glut of overbuilding. In 2007 a tipping point occurred. Household formation was still high since the bubble didn’t pop late in the year but builders were already tapped out. From 2008 to 2010 household formation and building collapsed. In 2011 things have rebounded and in 2012 an equilibrium was struck. 2013 is the year investors devoured the market completely. Yet we need to remember that from 2008 to the present, the dominant market mover came in the form of investors. Driving up prices with no real increase in income forced many young Americans back home with mom and dad:

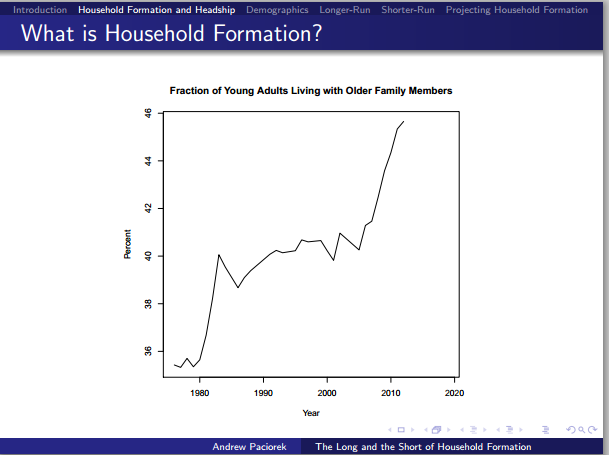

We have a dramatically high number of adults living at home seemingly during an economic recovery. Remember the recession has been officially over for nearly half a decade. Why do we continue to see a massive number of young adults living at home?

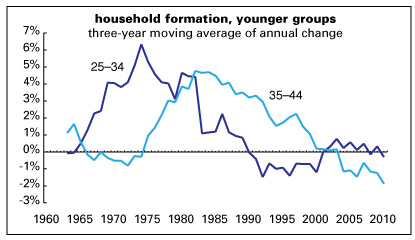

What is interesting is that this trend for the young is not new. It actually has been on-going for many years:

The trend is rather clear for those in the 25-34 age group and the 35-44 age group. What is going on is that more Americans are going to college but at the same time are also accumulating high levels of debt for jobs that essentially pay what they did decades ago adjusting for inflation (and less in many cases). Why is this important? Well even one generation ago, if someone picked the wrong major they at least were off in the market with little to no student debt. Today, pick the wrong major and you still have a good portion of your income going to student debt payments. This matters when your income is low.

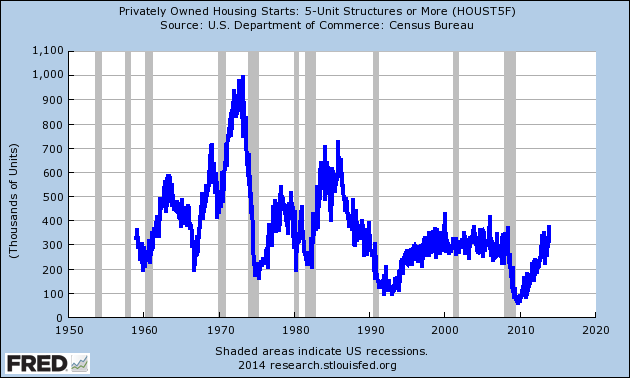

Builders realize that the nation is becoming one where more people will be renters out of economic necessity so multi-unit housing starts (i.e., apartments) are now going back up:

This is a fairly smart move for builders. Household formation will resume but it is highly doubtful that these people will be in the market for the more expensive McMansions given their incomes. Also, many are having a hard time contenting with the hot money flowing out of Wall Street into residential real estate.

The projections are clear, household formation will stabilize but housing will unlikely be a giant player in making our economy boom again:

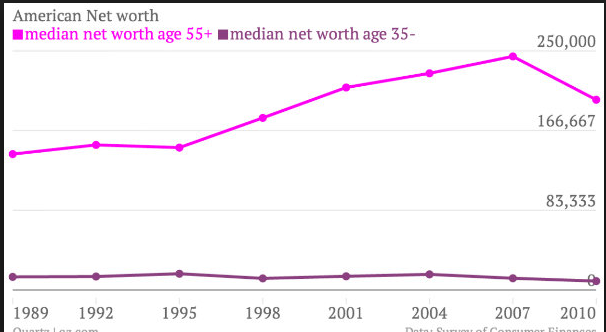

So it becomes apparent. After all, if you were a builder what motivation would you have to try to capture the attention of an audience with a median net worth of close to zero dollars. Older Americans, many who already own, are not in the market for new homes:

Then you wonder why we have millions of young Americans living with mom and dad and deep in student debt.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

99 Responses to “Broke, young, and unable to afford a home: The crisis for young American home buyers and household formation.”

[sarcasm] No problem, Mom and dad have, like, trillions saved in the stock market. They’ll just buy the kids a MacMansion with pocket change. [/sarcasm]

Really?

“Really?”

ffftttttttttt…….right over your head.

not likely… (over my head that is)

So Mike, I guess you must believe that the stock market can never correct to the point that it will wipe out the parents’ “trillions” or that most young people, who are fortunate enough to have a well-paying job, actually want a McMansion?

What planet do you live on?

What most people don’t realize is that when the fed keeps interest rates low it is not doing any buyer any favors because low interest rates drives price up artificially. So when interest rates go up you end up owning an overpriced property that you won’t get your price or appreciation when you try and sell. It is a bad time to buy when interest rates are low. If you study the market that your buying in it becomes obvious you are over paying. Itty is all based on the payment you can afford. The banks think they are fooling us. They want us to default so they can steal our homes even though they have no skin in the game with fractional reserve banking.

I’ve watched THE RICH KIDS OF BEVERLY HILLS it seems kids are doing just fine.

Oh crap,

Two possibilities seem to come to mind. Another, smaller, housing crash. Or, the reemergence of poor quality loans to poor quality applicants backed by the poor American tax payer. Somehow, especially with that POS Mel Watt heading the FHFA, I suspect the latter is the more likely.

As most of us all know, this isn’t a normal economy. It’s a Fed dominated command economy. Looks more and more like the Soviet system, minus the “shared wealth” principle.

Good analogy, DJ

If the market would have been allowed to correct from the bubble, it would have stabilized years ago. But whenever you have government intervention, it just prolongs the pain and does not allow it to correct naturally.

what do you mean without the shared wealth ? the Fed and the banksters have shared all of my wealth and now I have none. lol sorry, I have to laugh it beats crying.

In my opinion it is more of a fascist economy. Anyone here remember the definitions of the isms?

Market Pricing plus Private Ownership = Capitalism

Command Pricing plus Public Ownership = Communism

Market Pricing plus Public Ownership = Socialism

Command Pricing plus Private Ownership = Fascism

These were the definitions in my Economics 101 class in college (Solomon, 1974). I still have the book. Strange how these things get lost in time.

This is a perfect illustration showing the fundamental differences between right and left wing governments. The farther and farther governments move away from the political center toward extremism, the more alike they actually become. If we were to draw a graph it would have to be a circle, with centrism on the top and left/right wing extremism merging together at the bottom. Other than one system believing in public ownership (at least in theory) and the other believing in private ownership, there’s little difference. Both systems are inherently corrupt and both abuse citizens’ rights and steal their money.

But I won’t digress any farther from the topic at hand: the current real estate market.

This is largely the result of young people being unable to delay gratification.

Of course, I need the latest phone, a computer that is less than 2 years old, a status German car (leased of course), designer jeans, golf every weekend, and vacations to some exotic place every year.

My wife and I decided to save for a house. No eating out at restaurants (food cost is typically less than 1/3 of the price you pay for a meal out), no cable TV, driving an older Honda Civic, and vacations of camping. After 2 years, we could afford to buy in a decent area. Many of our friends, (who make substantially more than we do), ask how we could do that.

When we explained, the typical response was

“Well, I couldn’t live like that!”

“This is largely the result of young people being unable to delay gratification.”

or,

“What is going on is that more Americans are going to college but at the same time are also accumulating high levels of debt for jobs that essentially pay what they did decades ago adjusting for inflation (and less in many cases).”

Myself, I go for the A.P.C. jeans argument.

Lol great that’s funny! I’m assuming you’re being sarcastic. I was thinking the same thing. But after reading his entire comment he does make a point about saving planning and orchestrating the plan. I too went from having a nice little golden nest egg of course was all stolen by the bankers that robbed me the day I closed escrow. All because of just bad timing. If I had just sold the house in 2006 and taken my little nest egg I would be fine right now, I mean really fine. Instead I get to start over like I’m 12 years old when I started working the first time 40 years ago and since the bank stole everything I worked for my entire life I’m now left to start over at 52 in the same place I was when I was 12 only without the tight skin.

Lynn, what exactly happened? Is there something that we should be watching out for during closing?

The trend is pretty clear….the std of living is steadily headed downward for most people in the US.

How will the upcoming generation buy a house and then support their children’s education as well? More will become life-long renters and a smaller percentage will get a college education.

Assuming that the long term trend of the housing price level doesn’t move down. Big assumption.

Overpriced housing is not only problematic for young Americans….it’s KILLING our economy as well. Americans are leveraged soooo much for over-priced housing or are paying HUGE rents and have no money left over to support the consumer economy.

Fake housing inflation is ruining our economy.

How is the Fed propping up the Housing markets? Do I really need to answer that? Deflate interest rates and inflate housing prices. It’s a simple formula. The Fed became THE market and is financing over priced housing in hopes of keeping it overpriced, to save the banks.

But we will never have any REAL recovery until we allow interest rates to rise, until we allow defaults and bankruptcies to run wild and destroy all debt, destroy over leveraged and indebted companies and individuals.

Time to wake up.

Housing demand has been crashed and Mortgage Interest rates is at what….4.35%.

Homes are overpriced everywhere so that Americans can’t even afford mortgage rates of 4.35%. How will they afford to buy when rates go over 5%, 6%?????

Home prices need to be cut in half, that’s how.

Look at the jobs number that came out today. What a joke.

Agreed on every point with two modest exceptions.

1) The Fed has a role although we don’t know if the way things have played out for housing have been by design or accident. Politics and government policy has a large role in staving off liquidation that the market demands. On one hand we have artificial demand through monetary policy and artificial supply constraint through government policy. Some folks with much at stake may take solace in this, I’m not so sure it’s more than a halftime show.

2) Housing isn’t unaffordable in all parts of the country.

@Anon wrote: “2) Housing isn’t unaffordable in all parts of the country”

You are correct!

The overpriced areas are:

1.) SoCal (Los Angeles, Orange and San Diego counties)

2.) the Bay Area

3.) Seattle

4.) the eastern megalopolis of Northern Virginia (Washington D.C.) through Boston, MA

Literally, 90% of the U.S. is very affordable. In the midwest and south, housing can be had for $150K in the large cities. Go to the smaller towns, houses in the $75K price range are normal. And these are places with low unemployment, low crime and good schools. The pay is not so spectacular but a person flipping burgers at Burger King, McDonalds or working at Wal*Mart can buy a starter SFR in these areas.

Blofeld, it’s true that houses in Seattle are expensive, but why do you say they’re over-priced?

Seattle is said to have a strong economy. Lots of high-tech. You got Microsoft. And Amazon is expanding in Seattle.

It seems to me that Seattle’s wages are better able to support high home prices, unlike the wage to home price ratio in Los Angeles.

@Son of a landlord,

I’m using the 32 percent rule. This states that mortgage principal, interest, insurance, taxes and heating (PITH) should be limited to 32 percent of a household’s gross (before tax) income.

Applying this metric to Seattle, median home price $430K, median household income $65K, we see that (assuming a 10% cash down payment), that Seattle’s monthly housing costs are pegged at 42% to 45% of median household income. This is 1/3 to 1/2 above the 32% rule. Granted SoCal is much worse at 50% for monthly PITH.

Contrast this with Des Moines, Iowa : median household income of $42K and a median home price of $110K. The monthly PITH is about 23% which is way below the 32% rule.

Also Dallas, TX: median household income of $55K and a median home price of $250K. The monthly PITH is about 25%. This too is well below the 32% rule.

Anyhow, Seattle definitely falls into the overpriced category when computing monthly PITH against median household income.

Good analogy, Mr Jones

Housing To Tank Hard in 2014!!

Thanks for checking in Jim.

How was your weekend Jim? 🙂

Another thing to factor in is the un- and under-employment for many “older” young folk, 30-45 who should be saving for retirement. They aren’t doing that. Something’s gotta give. I can see Mcmansions bought and divided up for 2-3 or more families, pooling of money in families, etc. typical 3rd world stuff. It might actually be good for family cohesion and Americans can learn again why family is good to have, but it might mean less cohesion to other indentifiers such as “I’m an American”. I think people will open their eyes, look around at who they can trust and it’s family, not corporations, not government. A different USofA.

I find myself in an enviable position compared to my fellow 20-somethings, yet am still unable to afford a home in San Diego. I am 25 years old, have $90,000 in savings towards a home, absolutely no debt, 800+ credit, and a $100,000+ job with generous benefits and retirement. I don’t mention these stats to brag, just to give an idea of where I am at in life. I am very fortunate and thankful for what I have.

I keep constant tabs on the San Diego market, yet can’t justify these insane prices for even a townhome in a respectable area. Starter homes go for $400k+ and condos $350k+. How can I be in this position and unable to justify purchasing when my fellow young professionals are likely nowhere near my savings? Something is seriously wrong with this market, and I am more than happy to wait it out. I have learned from older coworkers who found themselves massively upside down on homes purchased during the bubble, and don’t aim to repeat their unlucky mistakes.

What’s wrong with this market is that most of your cohorts only think in terms of monthly payments whereas you think of the larger picture.

Sure is frustrating to live in a world where the status quo sells moral hazard to the uninitiated.

You come across as someone with solid principles and an eye for the bigger picture. Keep trusting your instinct.

Good for you, Kristopher

Just practice the old saying, “Don’t let your money burn a hole in your pocket”. You should be reading Robert Kiyosoki with his “Rich Dad Poor Dad” series. Buy rental properties that make sense or don’t buy anything. At your age, don’t focus on a home, focus on investments

Good for you! Smart thinking. Keep up the good work. Nice to hear something good for a change. I think you are doing the right thing.

Kristopher, when you say that you are unable to afford a home in San Diego. Are you saying banks won’t lend you money for a loan or are you just uncomfortable borrowing 300 or 400K for a starter home? If the facts you state are correct, you shouldn’t have any problem getting a loan. You are seeing first hand that “starting off” in coastal California can be extremely difficult. You are very young and doing quite well for yourself. If you really are uncomfortable buying, rent and save for a few more years. It’s likely your best option unless you absolutely need to own or are paying top dollar rent. Good luck.

Kristopher, you are definitely doing something right. I applaud you for waiting out this hysteria we’re seeing. When the market corrects itself you will be in an even more fantastic position.

Hang in there. I have 3 years and 150k on you, but I’m in the same boat, just on a different coast.

By me, it’s 600k for a starter home. I could move further from my job and get a 450k starter home, but I question if adding an hour to my commute each day is worth my sanity.

Lord Blankfein- to answer on the OPs behalf:

1) It’s not that I can’t get the money from the bank. It’s the thought of spending such an incredible amount of money on something I wouldn’t be proud of. Frankly, I feel I deserve better. I find it unfair that in my 20’s, I’d be out-earning my 50 year old neighbors, but due to timing, they bought their house for 1/5th the price.

2) I’m fine in a 1 bedroom apartment. Without kids, we really don’t need the space (it’s hard enough to keep an apartment clean!)

3) It’s a major financial burden. I have a lot of freedom right now. I’d go from extremely comfortable to house-poor. Not sure what the property tax situation is on the west coast, but by me, we’re talking 15k-20k/yr for that 600k house.

4) Knowing that I can buy a 4 bedroom 3,000 square foot home elsewhere in the country for 250k is making me consider saving up half a million, moving, buying the 250k home outright and well, doing a semi-retirement by 40. Sure I’ll still work- but not because I have to.

We are a young family with decent income, no debt, but completely priced out. We are 33 and have never purchased a home.

I would like to see some true first time buyer programs (none of this no home in three years since I last took my profit within the taxfree window stuff).

But as angry as I am, I see so many people a few years ahead of us trapped underwater in their homes. Everyone in society suffers under this market except for the bankers. And they wonder why true employment numbers are so bad, and why food stamps usage in CA is at all time highs.

“We are a young family with decent income, no debt, but completely priced out. We are 33 and have never purchased a home.”

Going out on a limb and guessing that you live in SoCal?

Yak Yak and Kristopher, you’re not alone…this problem spans all age groups. My wife and I are in our 50s, no debt, excellent credit, 150k in the bank for a down payment, yet still unable to buy a nice home in a nice neighborhood for a decent price anywhere in Ventura or L.A. Counties. We don’t want a mcmansion, just a nice small bungalow. But our upper price range of 500k buys us a shack in a crummy neighborhood in this current market. No thanks….

I don’t understand why they insist on staying in California. There is a great big wonderful country out there where jobs DO exist and housing IS affordable. The growth in Texas and the Carolinas says it all. Climate is moderate. Income is good and housing does not consume most of your household budget. I got smart and left CA in 1994. I live in Charlotte NC where I make even more money in a thriving environment and my house cost 2/3 less than it would in CA. Add to that a great social environment with professional sports, theater, arts, restaurants and great weekend getaways to the mountains or the beaches. Was it hard to leave? Yes, for a few months. Was it worth it? Absolutely.

Linda, I can’t agree with you more. Not sure why people insist on living here, the quality of life is not that great other than the weather. We are actually Los Angeles native living on the Westside, we are so out of here when we retire. We sold our home over 5 years ago and are thrilled to be renters until we leave. The cost of owning and renting here make no sense and the jobs here pay a lot less than other cities. LA is so crowded, you have to plan your day around traffic and the so many people who live here. Los Angeles has drawn so much foreign money, who pay all cash of course. The neighborhoods have changed, not for the better and we would never buy on the Westside because of that and who has taken over. Yes, our roots are here, not much family anymore because they were smart like you and got out to have a quality of life in a place that makes sense.

You’re totally right, the jobs in LA pay A LOT less than they do in other cities. I think the expectation is that rich parents help out so you don’t need to pay workers the same. I know a woman, maybe 40, who’s been generously supplemented by her mother for the past 6 years so she can live in the Beach Cities. She has a job but makes only 45K where she would make double that at least anywhere else.

While I would be the first to agree that living in L.A. can be a bigger PITA than many are able or willing to admit, I’m not so sure about the idea that the jobs here pay less on a general scale.

My experience is that L.A. salaries are higher than their counterparts in most other areas of the country. Since the cost of living here is higher, it is necessary to attract and keep talent. The issue I have is that the higher salaries don’t always make up for the higher cost of living when a comprehensive cost comparison is made – especially considering a high skilled and in-demand career in some of the southern cities. Perhaps that is what you both are referring to? Cost of living adjusted salaries in L.A. are lower?

Weather in Texas is “moderate”? Maybe compared to Hades! A friend moved from Nor Cal to Austin, TX a few years ago and they experienced over 100 days straight of temps OVER 100 degrees! Thanks but no thanks. The meme about weather being comparable in any way to CA is silly. Go ahead, move to TX and enjoy the cheap houses. And make sure you love being indoors a lot sitting next to an air conditioner and paying electric bills!

The easily answer is most of us Californians would rather die before living in the South. Its a bunch of racists gun loving psychopaths that impede us from having a true western style democracy. Personally I’d love to see yall secede. As far as the analysis of the current situation I totally agree it only ends in violence, death, and revolution. We need to make rules that make it less lucrative for wall street and Joe Smoe to rent out houses. We also need to make it easier to build for cheaper and possibly bring back some form homesteading. Everyone deserves to own something, not just the ultra wealthy. The situation is getting fairly dire and if we don’t do something soon it will end badly for everyone including the wealthy.

DG, I see you drank the California Kool-Aid. Many people are losers (sorry for being mean), they don’t deserve to own anything. I personally love seeing the “elite” liberals in this state foam at the mouth of how everybody deserves a shot in life. At the end of the day, they drive their fancy hybrid cars to their fancy McMansion in one of the wealthy enclaves. Hell is going to freeze over before they surrender that lifestyle.

“Do as I say, not as I do.”

Have you ever lived in the South? I split time between SoCal and East Tennessee and have e good time in both locations.

DG can die in that mess of a state which is a bankrupt, lacks enough water for everyone, is overrun with millions of illegals, and is controlled by leftist elitist pigs who tax Californians on everything. The only ones who will have guns when the leftists are done are the millions of gang members and thugs who inhabit California’s ghetto cities.

Leftist ignorant fools like DG are impeding themselves from having a true western style democracy. The rest of the country would love to see yall secede.

@DG, the south ain’t what it used to be. Maybe 50 years ago it was how you described it. I lived in the south and midwest as a child. Last year I traveled on business to Dallas, Omaha, Chicago, Memphis and Atlanta. And what amazed me is how much the U.S. has homogenized. Except for weather, traffic and housing prices, most of the U.S. has largely become interchangeable and indistinguishable from one another.

The south is whatever you make it out to be. If you go there with an attitude like yours, I would not be surprised if you have a bad experience. If you go to the south with your eyes open and your respect for the people there evident, you will see the legendary southern hospitality and meet some of the kindest and most forthright people ever. The south can be very charming. Just check your attitude at the door.

“We also need to make it easier to build for cheaper”, DG you must be a climate change denier. In the Bay Area we have environmental restrictions which also has the secondary benefit of keeping out the “wrong type” of people that are so prevalent in SoCal. The enlighten people of The City and those around, have always had severe restrictions on building, unlike the common folk in SoCal who will build anything on the precious open spaces with the endangered species. We used the environmental laws to cut off sending water from our Delta to you poor folks in SoCal. The City is also a great financial center on the west coast. There is no way that we will allow our bought and paid for politicians to change our life style. Sorry if my truth upsets anyone.

CA is changing, rapidly, for this very reason. There are very distinct groups living in CA.

#1) The legacy folk. Been here for generations. Passing the house down, and or “golden handcuffs”.

#2) Rich immigrants. While L.A. is not the only game in town for the rich of the world, it’s weather and safety are appealing.

#3) Poor immigrants. Beds in the living room, just happy to be here. Central L.A. is becoming denser.

#4) Professional renters. Good jobs, good college degree, probably recruited by a company. They like Silverlake, Echo Park, or just living “close” to the beach in Santa Monica. Maybe they are happy in life, maybe they will become a commuter or maybe relocate to NC or TX.

#5) Commuters. The 210 was just finished, the 10 and 60 have been widened, and the 91 and 215 are in the process of widening. More and more people drive to the IE for affordable homes (like me). Why? I dunno, you just get used to it and do it, it’s that simple. I lived in various nice LA County areas and the suburbs appeal more to a Midwesterner. But people on here will tell you both ways about commuting and there’s days I like it, and days I hate it.

#6) Current and ex gangbangers moving farther and farther inland.

Very nice break-down.

What you describe is post-2000. Prior to that, many of the SFR’s in “newly desirable” areas on my side of the hill (West LA, CC, Venice, South Bay, DT LA and environs, etc.) could be had $250-$400k range.

#4 is wrong. LA has for years not had strong post-college recruiting. Which companies in central LA pay well? I found LA employers, both large and small, to be the cheapest anywhere especially when it comes to young workers. The Silverlake Echo Park set is mostly trust-funded or living dime to dime.

Why don’t people just move? The answer to that question is old. From the Declaration of Independence 4/17/1776:

“and accordingly all experience hath shewn, that mankind are more disposed to suffer, while evils are sufferable, than to right themselves by abolishing the forms to which they are accustomed.”

If Linda had stretched her budget to purchase ANYWHERE west of the 405 she’d be fabulously wealthy today.

You have to sell to lock in the profit. With that reality assumed, she’d be “fabulously wealthy” and living in NC.

It sounds like she is doing better than most of us in CA, she has an nice house in a nice community. In fact I totally agree that moving out of CA is smart idea. I plan to move to the north-west (Seattle/Tacoma) in 4 years when my daughter is done with school (family issues can keep you from moving). With the high salary I make living in San Jose I will be able to afford to pay cash for a home in Seattle. Stay in CA=debt salve for life, move= not give all of my money to the banks.

Anon,

Fact is, she left a lot of money on the table by moving to NC. And, she wasn’t complaining about the CA lifestyle.

Oh, and Anon, she’d be making a killing as an absentee landlord, too. See, you don’t have to sell to lock in profits.

Linda,

I must also agree with LAnative and many of the threads to your post. Although I’m not in this category personally, having bought in La Canada in 1980, if I were starting out today, or starting over, I would likely leave. My kids left CA and headed east during the last bubble. They now live in nice places and enjoy them, I must admit. They encourage me to move with them but I fell I’m too old now. Maybe if I we’re 15-20 years younger though…

But at the same time, I feel for families who are shut out of the market here. The current conditions are very worrisome, even for long-time owners because it is clearly contributes to destabilizing the region, affecting us all eventually. I know some crow here about buying in “prime”areas and tell others if they can’t handle it, then move out, but in truth, not everyone is in a position where they can make that choice, and it isn’t always their own fault. We don’t really know what’s going on in in peoples lives behind closed doors.

I agree with everyone here. I am a thirtysomething physician who is living at home with parents due to being priced out of the market despite a relatively high income. There is no question that there is something seriously wrong with the market. My lifestyle as a physician who has spent 14+ years in school is comparable to someone who never even finished high school (ie living with parents). The question is what should we do? I am of the opinion that the fed will never allow housing prices to come down to a reasonable level vs incomes because this would mean a collapse of the banking system and huge revaluation of their assets. I think a more likely outcome is inflation of the dollar to maintain nominal asset values. I think the best option for those of us who are saving for a home would be to buy gold and silver rather than saving in dollar. This should help us to preserve our purchasing power until after the coming inflation when interest rates rise and housing and income become less divorced. What do you guys think? And thank you to the gentleman who puts together this website. It is very therapeutic to read knowing that I am not the only one in the same boat.

Gold and silver are not good investment vehicles. I myself have an amount in a total stock market index fund to keep up with the market, but haven’t put too much in because I took a bath in the last downturn. I am, regretfully, in a lot of cash, not because I think it’s a good investment, but because I’m scared of losing another 100K or so if the market tanks again. I’m just trying to take it easy and keep optimistic, looking for a home and willing to take a bit less house to have my mind at ease. My opinion you are young and restless, but you’ll have to wait it out probably. I try to relax and hang loose, but it’s certainly hard

“I am of the opinion that the fed will never allow housing prices to come down to a reasonable level”

This assumes that the Fed has the interests of home “owners” in mind.

Following is the Fed’s dual mandate as set forth by Congress:

“The Board of Governors of the Federal Reserve System and the Federal Open Market Committee shall maintain long run growth of the monetary and credit aggregates commensurate with the economy’s long run potential to increase production, so as to promote effectively the goals of maximum employment, stable prices and moderate long-term interest rates.”

Interpret at will.

@Preethi wrote: “…the fed will never allow housing prices to come down to a reasonable level vs incomes because this would mean a collapse of the banking system…”

You are technically correct on a short timeline, say the next two to four years. The major reason the Fed is winding down QE (quantitative easing) this year is because they are running out of garbage mortgages to monetize. The Fed will continue with ZIRP (zero interest rate policy) for the next few years because this allows zombie banks to continue to pretend they are still alive and function when in fact they are deader than a doornail.

The Federal Reserve has been recommending the mass importation of cheap foreign workers to cap labor prices. More likely, IMO, is debt fueled deflation.

http://www.computerworld.com/s/article/9132438/Greenspan_H_1B_cap_would_make_U.S._workers_privileged_elite_

how ironic, North Carolina is where I planned to move in 2006 when I was planning on selling all of my real estate cashing out and moving somewhere more affordable. Unfortunately my beloved dog and only child got cancer in 2006 so we decided to postpone selling until we got him through his treatment and just by pure luck that’s when everything crashed and we couldn’t sell and of course lost everything I’ve worked for like I said in my previous comment since I was 12 years old.

Lynn, everyone of your posts sounds like a country song. I’m sorry you lost your ass in RE 7 years ago, but at some point you have to move on and try to rebuild. Yeah, banksters screwed everyone, the gov’t bailed them out, yada, yada. I get it. It was unethical, immoral, and perhaps even illegal what they did. But they did not put a gun to your head and make you apply for the mortgage, you did that all by yourself. You signed up for the debt. You took the risk. If you had sold at the top and cashed out your equity a year sooner like you wanted to, then you probably would have been on here bragging about it for the next 7 years instead of drowning in your sorrows. Well, there’s an old saying, if you live by the sword, then you die by the sword. You took a risk, and you lost…big whoop…it happens everyday in America to many people in all walks of life. I’ve lost my ass of many business deals. It feels bad at the time, but you gotta put it behind you. Sorry if what I’m saying is harsh, but it is true.

In a previous post, Lynn said she’d owned “several” houses in the Las Vegas area. In another post, she claimed to have owned two houses. Of course, by “owned,” she means that she’d bought the houses, but the bank paid for them. They held the mortgage.

Since Lynn owned multiple properties, it’s plain that she was flipping. An aspiring Donald Trump. Maybe she’d seen some late night TV huckster who’d convinced her to “flip to be rich!”

A lot of small-time Trump wannabes got burned when the housing bubble burst, but it was their fault.

Pay attention to the documents you’re signing. Never buy more house than you can afford. Play it safe. Don’t get greedy. Don’t look for the fast buck. Be a tortoise, not a hare.

PS. correction, I didn’t lose anything it was stolen in the Giant bankster equity stealing Ponzi scheme.

Are you talking about the fact that the value of your housing declined which resulted in your equity being reduced? Was this equity that you saved for and put into the home? Was it appreciation equity that you borrowed against and then had trouble repaying? Was there some specific malfeasance that brokers and banks perpetrated against you specifically?

If it’s not the last, then you also had a hand in your financial loss. I invest in stocks and of course there is manipulation in the stock market, but at the end of the day, it’s me who decided to invest as I understood the risks at the time. All investment carries risk, and it’s up to the investor to do his/her due diligence to protect themselves.

LAer, don’t waste your time trying to reason with Lynn. She’s been on here for years with her sob story. I think she said she lost multiple properties bought near the peak and doesn’t want to take any of the blame herself. It was all the evil bankster’s fault. Buying a house near the peak of the last bubble was anything but a safe, boring investment. I feel sorry for people who lost one house due to bad timing and other unfortunate circumstances. Many people had delusions of grandeur and went “all in” in the housing market buying multiple properties. When you had years of 20% plus appreciation and loans were being handed out like candy…only bad things could have resulted in the end.

Seems builders learned their lesson from the last bust prior to which they overbuilt. Lennar is building more multi family homes. Economist, real estate companies and housing recovery cheerleaders have been slow to catch on to the trend of lower household formation. Without jobs and too much student loan debt households may form but they may be renters or in an extension of current living quarters http://smaulgld.com/waiting-for-household-formation/

high income,no debt and living at home. forget buying a house,travel and see the world.

Couldn’t agree more. I love to travel and see new things. I have no envy for friends who own homes. It ties you down.

When I was a kid, I knew another kid whose family took a year off and drove around Mexico visiting historical sites. He and his siblings were all under 6 years of age at the time. Having kids is no excuse for not having adventures. Don’t buy into the average upper-middle class American myth of what life is supposed to be.

There have been boom and busts in California real estate, too:

* 1860’s drought

* boom followed, which went bust around 1890

* Depression hit California, too

* late 80’s, following S&L and Japanese bust & departure of defense/aerospace

* 2007-2009

In every case, RE wealth was transferred from weak hands into strong hands.

The fact is that the “recovery” since 2009 has seen the same thing…a transition of real estate wealth from weak to strong hands.

Whatever the “next” event is, it sure won’t provide anyone without outsized capital to be able take advantage. Personal experience is the near impossibility to take advantage of the 2007-2009 bust — REO’s were rigged, short-sales were rigged.

Yes and no. The early 90’s real estate market in L.A. was fair game for buyers. However, 2007-2009 was not. The collusion was ridiculous and in many cases illegal.

Good point.

Spot on about picking that wrong major in college and how worthless it is in today’s job market — especially how much of a waste of money it is when the student loan debt racked up to get a degree in basket weaving is considered.

The University I went to has tripled their tuition rates since 1994. Difference is that back then you could still get a good paying job with a decent Business degree. Not so much the case today from what I see.

First home I ever bought was in 1998 and it wasn’t that easy then… from what I remember the interest rate was around 8% with 20% down and that was considered a good rate at the time. I didn’t have any student debt out of college because I had some scholarships that helped out a little and worked for a company that partially reimbursed college tuition depending on the grades made.

Today it’s much easier to get a FHA loan with only 3.5% down hovering around in the 5% APR.

Personally, I think today’s younger Gen Y’s have different priorities. I have some college kids in one of my rentals and each one of them has access to $35K to $50K in their student loan accounts to burn through. Not too motivated to get jobs unless the jobs are in the fields they are getting their degrees in and I can tell you, the degrees they are working towards aren’t going to help them out too much once they finish up. (Needless to say — finding jobs in their fields of study while they work towards their degree is pretty much impossible.)

No shortage of kids I come across in their 20’s with nice cars, computers, tablets, smart phones, big screen TV’s, etc, etc.. basically spending everything they make on things that will be worth far less / worthless in less than 5 years. When I review their rental applications, they have good credit scores but are saddled with debt and their debt to income ratios are pathetic.

Then when I go out… I see them out and about in places that charge $8+ for drinks, etc., etc. looking good doing it.

Where I’m from, we have a saying for that: Big Hat, No Cattle. Basically what I see is a whole generation growing up with Big Hats and no cattle.

I’m not so much into the “Unable to afford” a home statement… it’s more like “Incapable of Saving Money to buy a home” for me. Along with nice cars, smart phones, cable TV — comes monthly fees such as higher car insurance, cable, cell phone bills, etc. Much different priorities then the 90’s, that’s for sure.

The Kids in their 20’s that I come across would rather rent in nice areas, drive nice cars and have the newest gadgets than save money and buy homes they could afford.

Even if they could save up 3.5% to put down, they won’t buy homes they can afford if they are in areas that aren’t considered cool and would rather rent in the “place to live” areas. Just ask one of my tenants that drives a Lexus that could easily afford to buy in another area of the city but would rather pay rent to live in the “happening” area. Or ask the other girl in her late 20’s with a sports car and a SUV that has every closet of the 4 bedroom house she leases from me jammed with clothes and shoes that cost who knows how much.

Tough call on this one with what’s really going on. Mortgage payments on my first home purchased with that 8% rate is just a little less then what it would be today for that same home with today’s value, 3.5% down and a 5% interest rate.

Yes — I still own it, paid off and rent it out to a nice couple with good jobs that drive nicer cars than I do. They could easily “afford” to buy it with the jobs they have if it wasn’t for their student loans they have to pay and the car payments that go along with driving those nice cars.

Regardless, I don’t think I’ll have any problems renting out my homes in decent areas for a very, very long time. When I put one up available at a fair rental price, no shortage of applications that come in within days — with many of them that could easily afford to buy if it wasn’t for all of their “accessories” that they have to pay for.

Sort of, but think about it like this. The basic cost of the things you need nowadays are pretty high compared to income – phone service, insurance, debt payments, transportation, rent, and food. The costs of renting in a good area vs. a crappy area are often not very different in major metro areas. If you lived a Spartan lifestyle, you might be able to wring a couple hundred dollars out of your budget a month. This means brown-bagging it, no entertainment, no dating, cooking all meals at home. For working people short on time and energy this is hard, and the monetary savings are often not worth it. If you saved $2500 a year living like this and you had to save up $35K for a down payment on a $1 million house, it would take over a decade. I’d be doing the same thing as your tennants if I were faced with the same situation.

LAer, if somebody is only saving $2500 per year, buying a 1M house should be the last thing on their minds. There are all types in this city. There are savers and spenders. First impressions are everything for many people, so having a fancy leased lifestyle is not out of the ordinary here. Fancy leased luxury cars, fancy clothes, every electronic gadget known to man, vacations, expensive nights out, spa days, $100/month gym membership, etc, etc. As much as I hate these people, I realize that I need them. Their spending habits are keeping the economy going, businesses open and tax coffers filled. They will also pay nosebleed high rent to live in certain parts of town which benefits me immensely. And if given the opportunity, they will purchase a home in one of desirable areas…adding fuel to the supply and demand equation and keeping prices inflated. I need these people just like you do.

“If you lived a Spartan lifestyle, you might be able to wring a couple hundred dollars out of your budget a month”

LAer, what I understand from your comment and few others is that you don’t want to live a Spartan life. That is good. Everyday, everyone, from morning to night makes decisions. The outcome in life is the cumulative effect of these decisions. The difference between people is that some have a goal and work towards it. Some are happy with the decisions they make and some they don’t like the outcome of their own decisions. Then, they complain about life being unfair because it does revolve according to their desire.

Nobody is forcing anyone to live in LA or SoCal. It is a personal decision. Like every other place on earth, it has advantages and disadvantages. You can’t have one without the other.

In life it is a assumed that based on your own decisions you have more advantages than disadvantages where you live. I moved many times in my life, including SoCal. I am happy for every decision I made, because it was the best at the time given the circumstances – the ratio of advantages and disadvantages. Many other bloggers did the same and they found that there is life after SoCal and in most of the cases a better one.

You made a decision to stay, others to leave. I don’t see you happy and I see them happy. Yes, I understand that bankers are crooks, the FED manipulates, etc. Guess what? They always did that. That being a given, how exposed do you want to be to their schemes? Only you can answer that.

Something most of the people don’t understand when they are young is the power of compounding which generates an exponential curve. It is not a straight line. What you see as small increments, by discipline and in time (plus calculated and informed leverage) generates fortunes. What you see a small snow ball at the top of the mountain is an avalanche down below.

It is the same in life with the cumulative effect of your decisions – good or bad.

“Even if they could save up 3.5% to put down, they won’t buy homes they can afford if they are in areas that aren’t considered cool and would rather rent in the “place to live†areas. Just ask one of my tenants that drives a Lexus that could easily afford to buy in another area of the city but would rather pay rent to live in the “happening†area. Or ask the other girl in her late 20′s with a sports car and a SUV that has every closet of the 4 bedroom house she leases from me jammed with clothes and shoes that cost who knows how much. ”

So combine the fact that young people don’t want to own and also can’t afford to own. Now, consider that interest rates have no where to go but up. What is going to happen to demand for SFH?

If you are looking to buy, why do it now if demand and prices are only going to decrease.

Joe – there are plenty of 20 something year olds that can afford to buy if they were not racked in debt living the big hat, no cattle life. It’s a very large demographic and for every “kid” living at home with Mom and Dad, there is a kid with a good job. I know plenty of 20 somethings pulling in over 6 figures a year and a couple of them only have HS degrees.

What happens when rates go up? Prices may adjust down but the mortgage payment is going to be the same. Will demand go down or will buyers with plenty of cash buy them up if the cash flow numbers make sense? 2010 there was no demand and I was buying up everything they were giving away… an amazing opportunity that does not come around very often.

Either way I’m certainly not complaining… as some others have mentioned it just means we have a big pipeline of renters for life to fill our properties.

However way it works, I can pretty much guarantee you in 10 years that values will be higher and so will rents. Getting a 30 year mortgage today will have pretty much the same payment 10 years from now and at least you’ll have some equity to show for it.

10 years goes by pretty fast…

Boomers taking out their slingshots sitting in glass houses! Born lucky, children of the Greatest Generation, American industrial dominance at its apex, cheap education, cheap home prices…they choose to “turn on, tune in, drop out,” make speed the #1 prescription drug of all time, invent meth, disco dance (with those great-looking “designer jeans LOL”), and become America’s first, true consumer-driven/conspicuous consumption generation. You started it, Boomers! How ironic, boomers, the first-ever generation anathema to delaying gratification, now pointing their fingers.

Thanks for the isolated anecdotes of financial responsibility while the sad facts fly in their faces*:

60% have less than $100,000 in retirement savings

43% have saved less than $25,000

36% have saved less than $10,000

* 2013 poll, workers age 55+

Don’t forget, it’s Boomer politicians responsible for the gigantic debt they’re passing onto the rest of us. Thanks, Boomers!

Here’s what someone age 22, just after collage, who pulled down median wage in 1975, which was $11,800 (equivalent to $45k today) COULD have done:

This prudent boomer put 5% of his salary away. By 1990, the median was $29,000, he kept putting away 5%. Assuming blend of large-company stocks (60%) and government bonds (40%), he would have earned an average 11.3% annually, At that rate, he would have had $600,488 in his retirement savings at age 60.

Go ahead with those isolated anecdotes! Facts are a B*&%#, aren’t they?

DFresh: > it’s Boomer politicians responsible for the gigantic debt they’re passing onto the rest of us. <<

A lot of the debt racked up by Boomers was spent on YOU … on Xer's and Millennials.

These younger generations, whining about the "Boomer's debt," didn't any of you receive 12 YEARS of FREE education? Plus FREE school lunches, and in some cases, FREE breakfasts and after-school snacks? Who paid for that? Booomers!

Didn't any of you receive police and fire protection, sanitation, libraries, the military … and all the other things government debt pays for? Some of you, I'm sure, even got food stamps and other entitlement assistance.

For that matter, who told you to take out subsidized (by Boomer taxes) student college loans?

Who invented all the electronic gadgets and computers you love so much? Boomers like Bill Gates and Steve Jobs. Some kids in Los Angeles are even being given FREE iPads by the LAUSD (paid for, to a large extent, by Boomer taxes).

If you're in your early 20s, you've already consumed a lot of tax money (debt) paid for by Boomers. So quit whining about the debt — a lot of it went to subsidize YOU. Now it's time to start giving back.

People live in apartments so they can move where the jobs are. Jobs are number one. Household formation amongst the young is for prior generations and immigrants. The Google generation wants to have fun and as little responsibility as possible. For the losers that live with Mom they are “Peter Pan” types and never want to grow up. Party on folks.

I don’t fit any of the stereotypes that are being discussed but I will say one thing about priorities. Many other parents of young children in my circles do not

For the most part this only applies to expensive areas. I most areas of the country you can buy a great newer home for HALF what it costs to rent a 2 bedroom apartment in West LA.

250k New home in Texas would run about $1500 month and you get some tax incentives.

Many 2BR apartments are around $3000 and a brand new place will far exceed that.

So I think everyone complaining about affordability is really not willing to compromise. And if that is the case then the real issue isn’t affordability it’s expectations. As LA is priced right every time a house sells because someone thought that was a fair price.

And all the talk about a consumer economy is true, but the entire us doesn’t rely on SoCal to drive consumerism. There is life outside of the area and they buy a lot more stuff as they have a much bigger home to put everything.

Well, I guess I’m living in an Orange County 1950s mentality time warp bubble. My early 30s Daughter and a big bunch of her Orange County friends own houses here, often bought with some assistance from middle class parents, but also with a lot of saved money. The houses were bought between 2008 and 2012, and in the case of my Daughter and her Husband, they sold the starter home already and moved up.

I do know some of the other group also. Those neighborhood kids who didn’t go to college or trade school. Some moved out of state and some went into drugs and alcohol. (One died and one is climbing out of addiction.) Just goes to show that hard work pays off.

In the prior post Joe R wrote the following:

“Well, at the bottom, the 30 year fixed was about 3.3% and now it’s about 4.4%. So I figure the 95% chance range for interest rates this year would be between 3.7% and 5.0%. My guess is as good as yours. By the way what’s yours?â€

This got me thinking about interest rates.

First I looked at the components of interest;

1 anticipated inflation/deflation

2 the cost of money (demand/supply)

3 risk of the loan (default)

4 interest rate risk (rates could go up or down in the future)

I would argue that the cost of money is zero or close to it based on Fed policy. I would argue that loan risk is not represented in the current interest rate because of the government backstop plus asset bubble euphoria. This leaves us with the two flavors of inflation/deflation, principle value change and interest rate change.

I believe we are really talking inflation/deflation when we are “guessing†what the interest rate will be in the short run.

Now QE3 has really changed all dynamics on what we would expect. The belief is that interest rates would go up if QE3 is tapered. But in the short run what we see is the opposite. The taper is impacting investor sentiment and causing investors to sell more risky equities and buy less risky treasuries. This then pushes the yield lower on the 10 year treasury. This is really counter intuitive but that appears to be what is happening right now.

I guess what we might be seeing is a change in anticipated inflation and that the market sees the taper as counter inflationary. If the cost of money is zero, then maybe folks are moving out of equities and back into dollar denominated investments. This along with the constrained supply of treasuries might explain what we are seeing. The lower deficit also plays a roll as well because that impacts the supply of new treasuries.

To make things worse we have global markets where capitol moves across national boundaries with relative ease. There are a good number of investors who have taken dollars and converted them to foreign currencies to deposit in foreign investments with better returns. The problem is that the taper is causing upward pressure on the dollar which the foreign banks encouraged but a repercussion is that investors are bringing their investments back to dollars.

The fact that there are so many moving parts to interest rates; I am not convinced that anyone can really predict the rate in the short term. I know most would say over the long term rates will go up for a myriad of reasons of which most do not apply in today’s short run world. So your guess really is as good as mine…

Agreed. Good post. Very thought provoking.

The interest prediction subject reminds me of an old story about Texas. There was a saying in Texas that the only people who predicted the weather in Texas were newcomers and damn fools.

A dude rode into a Texas town and entered a saloon. He walked up to the bar and said ” I do believe it’s going to rain”. A grizzled old-timer came up to him and said “you know son, there are only two kinds of people in Texas who predict the weather”. “Tell me, who are they?” said the stranger. “Newcomers… and damn fools!” After the laughter and demand for drinks at the stranger’s expense had died down, the fellow put his hand to his chin, gave a puzzled look and said “you know, you’re right… that’s the only two kinds of people there ARE in Texas!”

This is Bush’s fault! This, and tooth decay among cocker spaniels, plus the solar vortex which is causing a rash of unseasonably warm temperatures across America and Bulgaria.

I completely agree… I think…

These median SFR median figures indicate the California SFR price growth has plateaued since 1990. Given the state of wages, state and national debt, global economic forces, etc., it would seem that 2% CAGR will be the high end for decades to come. Buy if you must, but don’t expect your home to be an “investment vehicle” that will beat stocks, bonds, etc., unless you hit the gentrification lottery.

1970 = $24,640

1980 = $99,550 (15% CAGR)

1990 = $193,770 (7% CAGR)

2000 = $241,350 (2.2% CAGR)

2012 = $319,340 (2.4% CAGR)

DFresh, you are taking the median figure for the whole state. When you take it for the “desirable” areas, housing has been a fantastic investment vehicle since 2000. I do agree that going forward, large gains won’t be there. As the old saying goes, “you gotta live somewhere.” The desirable areas will do just fine in the future.

We keep looking for simple answers to complex problems.

Here’s my opinion on what we are looking at:

– State passes land use laws constraining supply driving up prices and reducing

available stock

– Fed gives discounts in the form of mortgage interest deductions

– State gives discount in the form of Prop 13

– Baby Boomers competing with each other and trading up in the market drive

building of bigger and fancier homes

– Fed drives up college tuition with Fed Student loans and grants

– Millennials believe our “get a degree, any degree” mantra and get degrees.

Their expectations are high.

– Millennials have been told how wonderful they are for years and now are trying

to “cash the check”. They want a great job, a big house and a fancy car or 2

– The Millennials don’t want to buy a house in the IE or Poway. They want no less

than 2000 square feet in Irvine, Santa Monica or Costa Mesa.

Now the whole thing is jammed up tight. Millennials want a lot of house they can’t afford while trying to pay off a student loan that is constraining their house and lifestyle desires. The job market is sluggish and wage growth is weak further constraining house buying opportunities. The degree choices could be further hindering career opportunities. Government manipulation has driven up home prices. Prop 13 gives you a lower tax burden at 1.5% total over the 3-4% paid elsewhere. The coastal areas near job centers are built out and the Coastal Commission as well as local Building Authorities are unlikely to make it easier to build or remodel. The low rates have pushed up housing prices in the last couple years. Meanwhile look to what Millennials have said on this blog about not being able to afford ” a decent house” in Santa Monica or San Diego. My first house wasn’t a decent house nor in a nice neighborhood and we had to sacrifice and take in roomers. We made it happen. I do think it’s harder today for the reasons outlined but there are a lot more entitled whiners too.

While I generally appreciate the thought and research that goes into your posts, this one feels a bit flawed.

I think one of the strengths you have when talking about the housing market is that you’ve spent a lot of time looking at the data. When you start relying on ‘student loan bubble’ rhetoric as a foundation for an article, you’re relying largely on the hype that makes the major media. The student loan situation is more complex than the media would have you think – I’d agree higher and more frequent borrowing are symptoms of related economic problems, but I think it’s a strain to suggest that student loans are the main reasons people can’t buy a house in many markets.

Someone with the current ‘mean’ (though I think even this requires some qualification) student debt of 27,000 would be paying $155/month or possibly less. Considering that’s what many households pay for cable/internet, and smaller than car payments, I’d caution that ‘loan bubble’ talk is at least in part a distraction from the core housing cost problem.

Is it one more straw on the camel’s back? Certainly. Grad students may have larger loan burdens, but that’s a more complex problem and a much smaller subset of the population.

In markets where median purchase price is 4x (much less the 7-8x of LA) what households make, that’s the core problem.

Since I spent longer on that issue than intended, I’ll just add that your final argument on ’35- net worth’ also feels undeveloped. Particularly with the scale of the graph the suggestion is that 35- net worth has always hovered around zero. I agree there’s something there but I think you need to dig a bit deeper.

Theyll be plenty of affordable housing in 6-10 years when US starts going toward debt default

The required cuts in spending will take away lots of income for those dependant on govt spending or subsidies (50%+ of US)

That should drop housing 30-50% in a hurry

I know this comment is too late but most of you believe that old people are all well off. Then I saw the title to this blog I immediately thought why not 0 old, broke and unable to buy a house or pay the rent. Most old people are women alone and most are poor. Why this continuing misinformation that the older generation is super well off. Not true although maybe on the westside but many live in nice homes that they cannot afford to keep up or fix up. We were hit very hard by the crash. Even harder than most young folks. We too cannot find jobs and never will no matter how much experience we have. I lived in Pac Pal but lost everything – no fault of my own and struggle struggle every day. Not what I had in mind. However it angers me that the misinformed attack us with their misinformation.

Leave a Reply