Real Homes of Genius: Tracking the California housing bubble through the eyes of a 900 square foot Burbank home. 42 percent price decline in a city still in a real estate bubble.

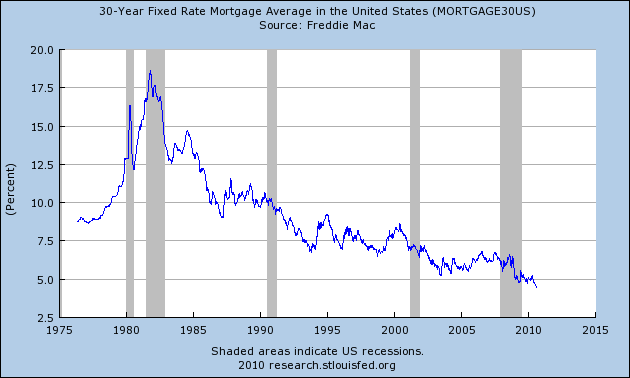

I was talking with a colleague here in Southern California and he was perplexed that the housing market hasn’t recovered given all the money being thrown at it. His perspective on California is so niche specific that he is unable to see the housing forest unless we cut away some of the propaganda filled trees. On Wednesday the Federal Reserve echoed what we have been saying about the weak economy. They promised to keep rates low to “help†the economy but ironically it was the work of mastermind Alan Greenspan on keeping rates artificially lowered that helped spur the housing bubble in the first place. If it isn’t apparent to you already, the Fed has failed in helping the economy even after they have used their podium to funnel trillions of U.S. taxpayer dollars to their buddy banks. Yet they want to keep rates low for what? So more people can buy over priced homes? Apparently that is the logic filtering around a handful of niche California cities.

A friend wanted to get some information on Burbank so I decided to dig up some data on the area and take a look at one single home in the area that highlights the mania that is Southern California housing. Today we salute you Burbank with our Real Homes of Genius Award.

The bubble is still alive in Burbank

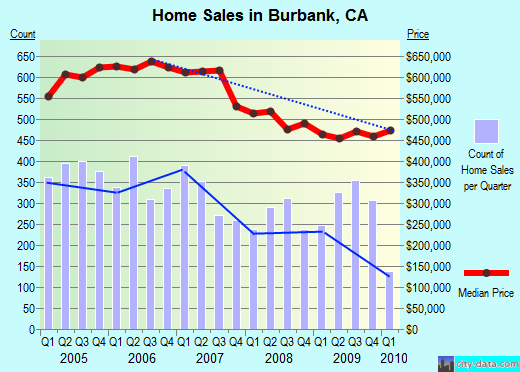

Home prices for Burbank peaked back in 2006 where a median priced home would have cost you close to $650,000. Burbank is a nice area with a population close to 110,000. However, like any large city you have to be select in what neighborhood you choose. Interestingly enough more people work in Burbank than live in the city. This speaks to the economic diversity of the area. Walt Disney, NBC, ABC, and other media outlets have headquarters in the city. Yet the chart above shows the absolute mania that occurred in this city during the boom (and prices are still elevated).

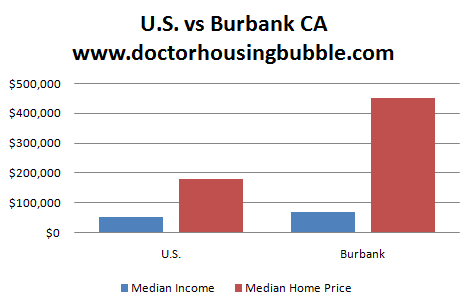

Many outside of the area are probably thinking that those who live in the city must make loads of money to support a $450,000 median home price for such a large area. Funny that because of the housing bubble, $450,000 seems “reasonable†in a decent L.A. city but it is not. Let us take a closer look:

Source:Â Census

So while it is true that household income in Burbank is higher by 30 percent than the nationwide median, home prices in Burbank are higher by a multiple of 2.5! If home prices tracked local area incomes home prices in Burbank would be closer to $230,000 (a far cry from the current $450,000 overall). Indeed home prices in general are still in a housing bubble for Burbank. This has to do with the amount of creative financing that occurred during the housing bubble. Many still believe that home prices will recover in some of these areas even though they are still too high to begin with.

Let us examine our home for today:

701 S LAKE ST, Burbank, CA 91502

Beds:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 2

Baths:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 1

Square feet:Â Â Â Â Â Â 919

Built:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 1939

List Price:Â Â Â Â Â Â Â Â Â Â Â Â $361,900

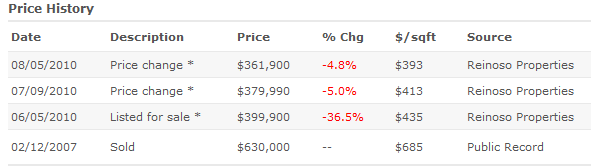

This home is a MLS listed foreclosure. For some, the current price will seem inflated. Yet only when we look at the sales history do we realize how far we have come in the California housing bubble:

The last sales date was back in early 2007 when the home sold for a stunning $630,000! A home in Burbank with approximately 900 square feet sold for over $600,000. This is 10 times the annual median household income for the area. What I usually recommend is that folks aim at taking on a mortgage with an upper-bound of three times their annual household income. So for example, with this place what would someone need to purchase it and be comfortably within this range?

Assume a 10% down payment:Â $36,190

Mortgage:Â Â Â Â Â Â Â Â Â Â $325,710

Household income required:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $108,570

The income required to buy this small 900 square foot home is 50 percent higher than the median household income for the Burbank area. This is why many cities in California have a long way to adjust before the bubble is over. And if you noticed this week, the Fed desperately came out saying they will continue to buy mortgage backed securities to keep interest rates low. Why? Because no one else in their right mind would touch this toxic financial waste. In essence, the Fed is laundering the junk banks are taking in so banks can continue looting the real wealth of Americans. By the way, Americans have lost close to $6 trillion in residential real estate since the bubble burst. Of course, most of this was bubble wealth but it is amazing that after that, banks are now back to making giant sums of money by speculating on Wall Street. And what do you get? A low mortgage rate if you want to buy a home with an inflated value even though most Americans are struggling with keeping wages stable or with actually finding work.

Did you realize that the 30 year fixed mortgage is at a historical low?

So why are Americans not going hog wild and creating another housing bubble? Because the job market is in the toilet! For over a decade (and three years since the crisis started) we have listened to the bubble happy advice of Wall Street. This has led to a destruction of real wealth and a creation of a tiny gambling group that basically enjoys dressing up in striped suits and pretending to go to work by gambling the hard earned dollars from working and middle class Americans. The result is an unemployment rate that is incredibly high if we look at broad measures and home prices that are disconnected from market fundamentals.

People ask for a solution and there is only two ways this can be solved in a sane fashion. Either home prices go down in many areas to reflect current incomes of area families or wages suddenly shoot up to make home prices affordable. I don’t see income going up by 50 percent in Burbank over the next few years do you?

Today we salute you Burbank with our Real Homes of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

75 Responses to “Real Homes of Genius: Tracking the California housing bubble through the eyes of a 900 square foot Burbank home. 42 percent price decline in a city still in a real estate bubble.”

Lake street is a POOR example of Burbank. Lake St is the “ethnic” part of the city. English is not even spoken on Lake Street. The prime ares of Burbank, near Chandler & the studios are still worth the 600+ grand in my opinion. LA has become so segregated, that anglos have only pockets in LA county to live in to be amongst themselves. Burbank is one of those “pockets” and hence the high prices paid. Live one mile west in N. Hollywood and the price for a home is half merely one mile away. But you have to be very comfortable around an ethnicly diverse community, which we all know means graffiti, crime & street vending.

Jeez Homer, do you keep your white hood handy so you can join your Kluxer brothers on short notice? I’m white, blond, blue-eyed and no lefty, but your comment is wildly offensive.

Chris:

The poster was merely pointing out the obvious and indicating the differential between various communities within Burbank.

No reason to whip out the KKK vitriol.

Like it or not, real estate values are highest and crime stats are lowest for communities where caucasians are in the majority.

google FBI Crime Statistics and Communities and you’ll get your answer.

One of the reasons why the cost of real estate has gone up in Irvine and other south OC communities is because schools are safe and one can go for an evening walk in one’s own neighborhood without fear of being shot at or having your kid beat up at school.

If you go on to city data forum, inquiring posters ask all the time as to neighborhood/city composition and which are the safest with the best schools. These attributes are the drivers of real estate costs/values in California and really, the entire nation.

To pretend that self-segregation doesn’t exist is to have your head in the sand.

If you want to have house prices lowered all you have to have is all of the tens of thousands of square miles in L.A. and OC cleared of illegals and gangbangers and the crime associated with them being here. Just think of all of the residential property areas in the Basin that could be fit for safe habitation thus bringing down the cost of real estate.

As a lifelong Angeleno, I have to admit that Homer is right. Nobody wants it to be that way, but it is.

EASY FOR YOU TO COMMENT FROM O.C. WHERE THE POPULATION IS MOSTLY WHITE ENGLISH SPEAKING. WE HAD TO MOVE FROM BURBANK BECAUSE VERY FEW ENGLISH SPEAKING RESIDENCE REMAIN. WHEN I NOW VIISIT BURBANK I FEEL AS IF I AM IN A FOREIGN COUNTRY. I LIVED THERE FOR 33 YEARS! YOU HAVE NO IDEA WHAT ITS LIKE TO BE FORCED OUT OF YOUR OWN HOME TOWN.

Ah, a spokeswoman from from the Aryan sisterhood? I know you have a lot of pride in your race and all…but do you speak for all of us?

“Everyone knows” that whites hold the vast majority of wealth in this country and build that wealth by taking advant…er..’giving opportunities’ to darkies in third world countries and spending/buying/marrying their wealth to keep it within their own communities.

Maybe we should just build fences around our cities and control access with armed guards? If being surrounded by other ‘pure’ whites is so important that you want to live in a concentration camp and limit access to housecleaners and gardeners, why don’t you just admit it and move to northern Idaho where you can build the real estate utopia of your dreams?

^cariqunyil:

Your posted conclusions are bizarre and untrue.

You need to break away from your screen and go out and get some fresh air.

I also rec that you google “cargo cults” – seems like you share similar traits of greed, suspicion, animosity, and envy.

Try to get a life. I know its a small one, but try to get one anyway.

What a hoot!!! An ignorant woman posts a racebaiting, ignorant diatribe about how “If you want to have house prices lowered all you have to have is all of the tens of thousands of square miles in L.A. and OC cleared of illegals and gangbangers and the crime associated with them being here.”

…but I’m the one who’s out of touch with reality???

Misstrial, the real estate bubble did not happen because gangbangers and illegals “took over” LA and OC. Why don’t you lay off the Stormfront KKKool-Aid and backread Dr. HB’s well researched articles about how prices went up because of lax underwriting standards, asset reallocation from overpriced stocks, Federal Reserve monetary policy, and a collective delusions of grandeur by overinflated egos who lived beyond their means. Race had nothing to do with it.

The kind of “self-aggregation” that you so lovingly refer to is far more apparent when you look at those qualities…not race.

Why is it ‘offensive’ for a white ‘anglo’

to want to live in a community and

neighborhood that is comfortable and ethnically

similar? Why are you prejudices against

this? We all like to live where we feel comfortable

MR OC

I am sick and tired of having to dance around being honest about a certain race (Black, oops I mean “African Americans”).

Now I know not all Blacks fit into this category. But lets be honest here. Low income, welfare recipients, and Section eight housing recipients typically fit this profile. When these types infect an area, real estate values plummet. THAT IS A FACT!

I lived in a neighborhood like this for about a year. WHAT A NIGHTMARE! I thank God daily I was able to get out.!!!

I would live in a tent in the woods in Northern Idaho and attempt to live off of the land before I would EVER consider mving in to an “Ethnically diverse” neighborhood again!

cariqunyil:

Just so that you know, you’ve ID’ed your age with your use of the term “what a hoot.”

This would mean you are most likely in your 60’s, since no one younger uses that term. Which causes me to wonder if you are one of those aged 1960’s radicals….lol

No one needs to tell me about how the housing bubble started. I have been posting and reading the housing blogs since 2005, beginning with Ben Jones’ Blog: the Housing Bubble Blog. DHB since 2006 and Piggington et al.

Check me out on Patrick.net – a poster since 2007 and a reader since early 2006.

But anyway, back to Burbank….to use the race card in alleging that buyers are racist who wish to purchase a home in a safe neighborhood with excellent schools is to test the limits of rational credulity. I believe the race card has been maxed out.

~Misstrial

M,

No one has to “dance around” the fact that they are white and only want to live around whites, or that they think white neighborhoods are better than ethnically mixed neighborhoods. DHB isn’t censoring you for posting your true thoughts. Why live in fear like a cockroach afraid of light? You’ve admitted you don’t like people different from you, that non-whites are unpleasant or repulsive to you…so be proud of it, celebrate it, and stand by it!

But don’t pretend you’re not a racist. The very *definition* of Racism is a belief that your own ethnic group is better than others. Look it up in the online dictionary of your choice, if you don’t believe me. Misstrial (regardless of how long she has posted or what ethnicity of the white person she is married to…Hispanics are not a “race”, they are an ethnicity composed of different races) and you are not fooling anyone. Since, you “call it like it is”, I will too. The axe swings both ways. The only difference is that I wouldn’t be afraid to say what I think in public in front of anyone…and not merely hide behind an anonymous blog post, whereas I’m sure both of you would never say what you think in public because you can’t take the heat of being publicly identified as modern-day racists.

Incidentally, I have posted on this blog since 2007 myself, just not frequently.

I think by “ethnically diverse”, you mean “colored people you don’t like”. Check out San Marino, which is nearly 50/50 Anglo/Asian. Ethnically diverse, but still the top school district in the state, and $2 million median list price for homes.

But to segway back on topic: Dr HB wrote about the disparity between Burbank median income and median home price. That doesn’t hold a candle to San Marino. According to Wikipedia, San Marino has a $2 million median list price for homes, but the median income is about $150k, for a price/income ratio of 13.33! The kicker: San Marino has no apartments or condos.

By “ethnically diverse” I doubt he meant 50:50 White:Asian. Does that really need to be said?

In communities like San Marino, the only thing bouying house prices is “prestige” and speculation. Having an address in San Marino will not guarantee you a higher paying job, a better life for your kids, or even ‘safety’…why not live in a regular ‘ethnically diverse’ city and stay out of debt, spend time with your children, and make friends with your neighbors and participate in your community? It might mean interacting with ‘people you don’t like’ and for some of us, that is a fate worse than death.

The current President came from a neighborhood in Chicago that is described by USAToday.com as:

“But he settled here, in a prominent neighborhood on Chicago’s South Side that has a history of influential residents. In many ways, the Democratic presidential candidate is the epitome of the place he calls home: a mix of black and white residents who are wealthy, well-educated and liberal-leaning.

Ringed by communities where people are poorer and more likely to have a high school diploma and not a college degree, the neighborhood where the Obamas live is an urban island of intellectual and financial prosperity, although it too has residents living below the poverty line.”

I think folks like to live around others who are like them financially, similar education levels, and those who share similar ideals. btw, the First Daughters do not attend D.C. public schools, but Sidwell Friends School (a private religious school operated by the Quakers) – the same one that Chelsea Clinton attended.

What is that sayin’: “Do as I say but not as I do….”

I have no problem with diversity – my spouse is 100 percent hispanic 🙂

The reason San Marino has such a low income to house price ratio is that the majority of Chinese business owner there run a “cash” business as much as possible. They’ll only report income that can be traced, such as credit card transactions. The rest they keep “under the mattress”.

So the income for most of the Chinese residents is is way above $150k, that’s just the portion they report to the IRS.

The White people that are still there are old retirees with mortgages paid off, and receiving a $150k pension…not bad.

Homer,

I thought I told you to keep your mouth shut. Every time, you open your mouth you say something stupid or in this case racist.

D’oh!

Another good one from the Doc… As stuff continues to drop drop drip slowly slowly sellers will get more and more nervous, realtors will say wow it’s never been a better time, people we know will continue to say how come prices are still high where I live- blah blah blah. 2013 is quite a ways away- I don’t think people realize how long that is in real estate, if indeed 2013 will end up being the bottom. This house or something similar in 2013? (BTW what an ugly little thing).. I’ll say $220- do I hear less even? Sub $200??

Something needs to give. Now if the dollar collapses, I think we have a shot-because now US wages will be on par or better with third world countries. Either that or we need to get at least somewhat protectionist and look after our own. Until then, something is gotta give.

You are right to mention about the studios in Burbank and that as many people work in Burbank as live there. That is one reason that people pay so much for a house, to be able to walk, bike, or take the Burbank City(not MTA) bus to work and go home for lunch. There is a monetary price to pay for this convenience. The alternative, is to spend 90minutes going home on the 210 to go east to more affordable housing. Also, Burbank is a lot cheaper than West Hollywood for some of the people that work at Disney. Burbank has its own school system, Police, and court and with all the studios, the government is doing fine with no business tax like L.A. . Burbank looks like a paradise island in the middle of the third world city of Los Angeles with their problems. Burbank also has an Airport where it only takes a few minutes to come and go, not to mention trains and a subway next door. In other words, it is ideal for many businesses and their employees. Universal Studios Hollywood park is next door, along with Griffith Park. People who like the entertainment industry find Burbank to be very affordable. Over half the people in the city are renters. People who own houses and buy houses are in another economic situation. Not to mention the immigrants that have a lot of cash and those that are part of the “underground economy.”

I know 3 people in their late 50’s who have been out of work for over a year.

One now says he is retired, one is still looking, and one, although not retired, has stopped looking.

This is not like any recession in our lifetime. The end result will be unlike anything in our lifetime.

@Mike

Yes, it’s very bleak out there for sure, I agree that it’s going to get worse and many of the jobs that are gone will not be coming back. I know more than a few people that have been out of work or underemployed for almost a year now. It just sucks.

I would be curious to read a similar analysis, by Dr. Housing Bubble, on the San Diego real estate market. I believe that market is also in a bubble similar to Burbank. It’s very difficult to find a house under $400K that is “move in ready.” Most under that price range are “fixers”. Investors tend to buy them, give them paint and carpet and try to flip for $50K – $100K more then they paid. These houses aren’t in La Jolla, they are locatedin La Mesa and Santee. These are OK areas but hardly “upscale” towns full of people making over $100K a year.

Would be interested in your take on investor owned properties being held for rental in Calif bubble markets. It has become fashionable to buy rental properties in Calif with negative cash flow based on rising asset prices and tax considerations. For instance I am renting a home sold in 2005 for $505K and the rent is $1575 which includes HOA fee of $138. My guess is there is lots of negative cash flow investment properties along the coast that could be added to inventory levels if Calif RE doesn’t quickly return to prior appreciation levels.

Following your theory about the average reasonable house price being around 3 times the average household income for a given area, I looked in the 90232 zip code in Culver City which is close to where I live. This is what I found out:

– the average household income in 90232 is $74,546 according to http://homes.point2.com/Neighborhood/US/California/Los-Angeles-County/Culver-City-Demographics.aspx. This data is from 2007 so the actual data today is probably lower or at least equivalent.

– the average home price in 90232 was $713,000 in June 2010 according to zillow.com.

The last 10 years of home prices in this zip code are as follow:

– September 2000: $351,000 average

– September 2001: $380,000 average

– September 2002: $452,000 average

– September 2003: $549,000 average

– September 2004: $636,000 average

– September 2005: $820,000 average

– September 2006: $784,000 average

– September 2007: $773,000 average

– September 2008: $705,000 average

– September 2009: $681,000 average

– June 2010: $713,000 average

So in terms of affordability, the average family should be able to afford: $74,546 times 3 = $223,638 plus down payment so roughly a $250,000 home average. This is well below the 2000 average price and definitely below the current average price. Culver City has become a high demand area over the past 10 years with a brand new downtown area and good public schools driving the prices up and attracting people with a lot of money (probably making more average than the average 90232 resident). But still, even if the average family who wants to move to Culver City makes $120,000/year, that would mean an average price of $400,000 for a home roughly.

Any way you look at it, this area is greatly overpriced if looked at from the income perspective. Another way to look at it would be that at the current price, you would need to make ($713,000 – 10%)/3 = $213,900/year!!

Anyway, I was not trying to make a point here, just applying your theory to an area I am considering moving to potentially. Sounds like I need to wait!!

Just give it time. The price of homes will come down much more than their current asking prices. I’m personally waiting until next spring before I even start looking.

The situation doesn’t appear much different up here in the wine country. In Sonoma County, where I live, the median household income is 61k, while the median home price is at around 360k. And the last time I checked, home prices were actually rising, although perhaps it has changed in the last few months. Our bubble wasn’t as big, though, as I’m pretty sure the median price went to only a paltry $500k. 😉

How the hell are people affording these things? Are irresponsible loans still floating around (I think they must be)? Do they just dump more than half their income into their monthly payment or something? How do you afford maintenance? Do you just let your house rot after you buy it and never go on vacation ever again? What fun is that?

Bennett,

Be patient in Sonoma. The NODs and foreclosures are still very steady. You can watch it at my Sonoma Canary post. Also, I subscribe to ZipRealty for Sonoma and it’s amazing how many new properties get listed EVERY DAY. A random survey from those properties reveals a total bloodbath, but it’s also clear that it has a long way to drop.

Cheers!

Tyrone,

Thank you so much. I’ve been looking for a house for some time, but my gut instinct told me to wait it out for a while. After running across a few websites (with this one being the most helpful) and doing some research, it seems that I was right. The north bay, in general, seems to have a long ways to go.

What’s especially weird is that I keep hearing that I am one of the “healthy, fortunate” ones who could most stand to profit in the future. My credit is not spotless, but I did not buy a house during the boom, rent, and have literally no debt, but also no lines of credit (long story short- I lived off of cash teaching English internationally for a while). It’s odd to hear friends, home owners, say they’re “envious” of my position.

Just yesterday I completed negotiations on a $650K purchase in Moorpark, CA. It took me 3 months to find a home here! They say it is a buyers market, but frankly I don’t see it. 50% of what is out there is short-sale or foreclosure, and you can’t even look at it seriously. I know my RE Agent didn’t want me to. The sellers out there need to get real too. This was the 3rd home we made an offer on. The other two that turned us down with a 98% offer of their asking price didn’t have any other offers either. The banks let people continue to live in these homes without paying a mortgage.. The banks will give people 3-5K just to clean out the contents of the homes so they are suitable for showing/closings. Even though I found a home, this was such a frustrating process, I’ll never, ever buy re-sale again!!!!

You read this blog and you were still willing to overpay for a house. Puzzling.

To each his/her own. Good luck.

Ssssh!

You’re making too much sense for someone who has a closed mind.

People reject evidence which disagrees with their deeply-held beliefs.

Your real estate agent didn’t want you to look at short sale or foreclosure?! *head explodes*

As someone who has been following Moorpark home prices for 7 years and waiting for a buying opportunity I must say your decision is understandable but depressing. Upper tier home prices in Moorpark have fallen by about 25% from peak, but need to come down another 10-15% to catch up with the low/mid tier. As is the case in many other areas, however, upper income sellers have the resources to try and wait out the inevitable. Unfortunately you have capitulated before the sellers and given just a little bit more hope/ammo to the rest of the unrealistically hopeful homeowners.

I know that high end rentals are uncommon in Moorpark and if you need a house and just can’t wait then I can’t really blame you. But still, I wish potential buyers would hold firm for a while longer.

Love the guy pumping Burbank. I lived there for two years and it was hot as hell, and parts of Burbank might as well be Mexico.

White morons to start calling you racist in 5,4,3,2…

Robin, in the Magnolia Park district, there are plenty of trees and it has been cool(81 yesterday). But I do hear that apartments can be hot in summer. The homes were made in the time before air conditioners so they were constructed with crawl spaces and the English Tudors have high pitched roofs, all for air flow. The Magnolia Park district is a lot cooler than Texas. Yes, we do have our Mexicans like Texas, and the city does have a selection of other ethnic groups that you can pick from as well. The homes built in 1926 have thick walls of real lath and plaster and redwood studs and planks. The floors are oak. You don’t get this type of house construction out east on the 210.

$360,000 with 10% down leaves you with a $324k note, or about $1800 a month ($600/month for every $100k on the note at 5% interest).

Any takers for this 900 sq ft beauty at $1800 a month?

If all of the above are true, then why were modest Burbank homes in the flats on sidestreets along Chandler and Magnolia in the $225-275k range as recently as 2001?

I’m stunned at the level of denial amoungst the housing crash NIMBY’s.

Over the next 5-8 years, you WILL see these homes fall back into the $250-350K range……at the same time you see the same homes in NoHo drop into the mid $100’s.

I’ve tracked CA real estate price patterns since 1960. The highest correlation to price movement is employment levels. Any unemployment level about 7% will cause the CA real estate prices to level-off and head downward. At 12% or more, CA real estate is deep in the woods. And probably headed for another leg down.

Thanks, CAE. Objectivity in the midst of a lot of speculation.

There are some noises in the news about many, many openings not being filled because of the unemployment benefits and too many middle-skilled workers. They don’t want to work for lower wages because they can do nothing and collect more money from unemployment than working. They are not qualified for higher-skilled work. They are stuck. That’s why the government kept extending the new welfare. You can actually live with $1900 a month if you don’t pay your mortgage. So as long as the banks stay afloat, they don’t need to foreclose these houses, the unemployment benefit continues, everything seems to be fine. Actually, it is not. Something is going to give. We go out to eat a lot. Red Robin used to be packed and had 20-minute waiting list on Friday/Saturday nights, even during the recession 2008 to 2009. Now, however, we can walk right in and there are still plenty of spaces to choose from. The situation is deteriorating. It is very visible in the main street. On the wall street, the stocks swing back and forth going nowhere, because no one is certain what is going to happen. Now the fed is more certain the economy is going down. As long as Bernanke is the head of the fed, we will go down like Japan, slowly and surely. There is no bust of the bubble, so there is no boom for a long time. However, if there is a bond market crisis, we might just get a bust we need for the housing market. People here who have been waiting for a long period will finally be able to find a decent place with a reasonable price.

Red Robin is a chain that offers diners unlimited french fries.

You heard that right. Unlimited french fries.

So, it would appear that people who thought buying real estate for any price was a GREAT idea also thought that eatting at a chain restaurant that offers UNLIMITED fries was also a pretty swell idea!

Dumb, fat and stupid.

Jeez cambridge. Its just a burger and some fries. Calm down!

Thank you Doc … I appreciate the time and Effort you put in to bring us this Info. I felt so stupid until I found this spot where all my fears and concerns have been confirmed. I was about to waste our life savings on a property that was priced far too high. I live in Ventura county and hoped you could help us out with a story or two about our neck of the woods. Thanks Doc.

“What I usually recommend is that folks aim at taking on a mortgage with an upper-bound of three times their annual household income. ”

This is good rule. It also means that I’m not going to buy anything for a long time. 50% off from prices and it’s getting near affordable. Single income housenholds are in very difficult situation currently.

Renting is expensive but if I want to do something about it, it takes a month. Paying mortgage takes what? 30 years? And you pay to the bank that loan doubled as interest and “expenses”. (Flipping is often possible but won’t change the relationship between you and your bank: Bank owns you. Via your mortgage.)

I’ve worked in Burbank for nearly 5 years, at Cartoon Network, right next to the Police Station. I used to walk the neighborhood above Magnolia for my lunch breaks, some nice homes up there but, incredibly over-priced. My salary was roughly $65K, and there was NO way I could afford those homes back then, and even now. I live in West Covina, and made the 1 hour commute one way, each day.

Redfin sold statistics show that there were two nearby homes sold in the last three months with a average price of $230/sq foot

Why don’t you write an article about Vancouver, Canada? You can’t even get a decent 2 bedroom condo for much less than 500K, and the salaries are lower there.

What happens to the people that walk away form their mortgages or settle a $300,000.00 loan for 3,000.00 with their company. Does all this info just get washed away in the future so they can go out and do it again?

Well, it depends.

Here is a link to a great site regarding this concern:

http://www.irvinehousingblog.com/blog/comments/foreclosure-101-non-judicial-foreclosure-176-garden-gate-ln-irvine

Scroll on down to about halfway and you’ll see a paragraph titled, “Balck Hole of Payment Default.”

Next, here is a link to the same site only this time a really fabulous atty gives a general and in a few instances, specific info on short sales and foreclosures and the consequences thereof:

http://www.irvinehousingblog.com/blog/comments/the-financial-implications-of-short-sales-and-foreclosures

hth

~Misstrial

caboy,

Something has and still is giving away and that is the American middle-class. By the time you might think a property will have an affordable price tag, you won’t have a good paying job or no job at all. Or it will take $75 for a loaf of bread or $100K to purchase a honda civic.

It would be interesting to actually see when was the last time a city in CA had a median price of 3 times the median yearly income. I’m guessing it was a while back. Especially in popular cities. But the old reality was economic growth and credit growth. Those days are over in CA for quite a while yet. So more down is where it will be going.

I’ve wanted to buy a house in SoCal for the last 5 years, cash in hand, but am coming to the realization that this will probably never happen.

The government is hell-bent at keeping house prices inflated AT ALL COSTS, and the only thing that will ever drive median house prices in SoCal down to 3.5X median income is a complete collapse of the U.S. financial system.

Forget 3.5X, Southern Californians. Ain’t gonna happen.

Time to start looking East, young man…

The funny thing about the “white Burbank” comments is that the white people that live there are the trashiest white people in LA county. I don’t even play golf at De Bell anymore because the behavior of the locals is off the charts rude. White people at De Bell will tee off while you are standing in the fairway waiting for the green to clear in front of you. I have seen several groups play there under the obvious influence of crystal meth or some other stimulant. You simply don’t see that in other places.

In the last mini-bubble (1986-early 1990), the price in Burbank

moved from 3.3x to 4.6x medium household income. In the

first quarter of 2007, it stood at 10.6x.

The government can fuel the banks to the tune of another

trillion or more in mortgage debt so that they eat none of

the short-sale loses… but in order for the market to stop

correcting you need affordability with responsible lending.

This can only happen when prices are back at 3.3x or lower.

Lots more job (unless they’re the high paying kind that allow

people to purchase RE) are meaningless, now. Affordability

is the only floor the housing market can settle to at anytime,

in anyplace. Because of government action, that deflationary

cycle is many years from completion. Japan’s history is our

best view of the future. It’s taken 20 years for real estate

to drop 70%. In that process the number of Japanese living

below the poverty level has grown from 5.5 to 15.5%. This

is the future of America. It’s a mathematical certainity.

Forced out, Burbank is no place to retire, but great if you work at the studios. Mike, the golf course often times has the studio people who sometimes think a lot of themselves because they make so much money. The block I live on in Magnolia Park is all white and some gay folk and primarily people in the media and entertainment industry. La Cresenta and La Canada-Flintridge is only 20 minutes away for activities.

A lot of people who work in the entertainment industry have family money to help them out buying a house in Burbank.

I’m convinced the fed will never raise interest rates. Never or for a very long time. Get ready for even lower rates than we have now.

Thank you Homer, you said what is obvious to anyone who is not in a coma.

To improve life and living standerds in California. we desperatly need to enforce our immigration laws and end birthright citizenship to children born from illegal aliens.

It is time we all realize that living standards in California will not improve until we demand the end of illegal immigration.

Personally I spend a fortune to keep my family away from the Mexican invasion. And it is a crime what the Libs. and Obama are doing to further depress American wages and our standard of living by refusing to secure our border and require work place enforcment to keep illegals out of the work force, especially in this time of outragously high unemployment. Wake up America and demand the end to the Mexican invasion!

Ah, Burbank, my home town! My folks still live in the hillside house that they purchased in 1963 for $23K! (One house on the block recently sold for $650K, and it’s smaller than ours.) When I was a kid in the early 70’s, our street was crawling with kids and young families. Now, almost all of the houses on the street are owned by retired people. There are no kids, except for grandkids occasionally. I only make about $70K a year, so the only way that I could hope to live in a tiny house in Burbank is to kill Mom and Dad! :):)

In my experience, Lake Street means gang activity. And yet it’s very close to the extremely coveted expensive Rancho District, where you can have horses. Go figure.

My dad bought our old house in Pasadena in 1964 for $50,000, now it’s valued at well over $1 Million. We sold it in 1976 for $100,000. I used to have a daydream about moving back into the old ‘hood, but obviously that isn’t going to happen!

Steve Sailer, were did you get the info that a lot of people in the entertainment industry get money from their families to help them buy a house?

I am a visual artist in the entertainment industry, and most of the people that I know don’t have any type of finacial support or family money, myself included. To be honest though most people in the entertainment industry don’t have children either.

Steve I know you do a great deal or research, but where did you get this info?

Three words to turn all this real estate navel-gazing into an afterthought; eight point oh. A tent will sound pretty good then.

I can see from several of these threads that the melting pot is starting to curdle with a few lumps. We are becoming micro-balkans. When the collapse occurs in a few years it will be like Pitciarn and Mangareva, probably not so much cannibalism as long as there are food stamps, but who knows? We like those vampire movies so much, maybe we’ll become like Manhattan-drinking the blood of the American middle class.

If only folks had bought houses that were sustainable, instead of trying to be like HGTV–cheaply built, giant Easter-Island head monuments to a confused and ignorant culture. We have to look ahead. We have no faith, or families are geogrphically fragments, the only thing that holds us together are the fleeting sucesses of our sports franchises, which of course all but one end up losers every season.

Still, real or imagined, the elevated prices are indeed partly because there are lots of homes, but few that people with wealth want to live in. We can skip the PC here, because we’re just talking about what’s going on, and like Harry Truman may have said: “I never did give them hell. I just told the truth, and they thought it was hell. “

@Mistrial–my favorite username on DHB.

🙂 Not sure if you are referring to Yours Truly, but my username is Misstrial.

Which is a play on mistrial – fun in themselves depending if you are counsel for the plaintiff or defendant.

Cheers 🙂

~Misstrial

A couple things noticeable in the charts.

1 – Like credit cards, HELOCs, 5% down payments, 72 month auto loans, you have an entire generation that only knows of 7% or lower mortgage rates

Can you imagine the horror and shock, not to mention pricing damamge, that would occur if (or when) mortgage rates go above 7%?

You’ll think the world has ended.

Yet, for my generation, that would have been considered a pretty fair deal.

All white enclaves, gang lands, black neighbroohood talk aside – The question continues to be how much of disposable income are Americans willing to dedicate to housing?

And with this come the dirty little secret of couples having combined incomes allowing them to qualify for more house than they need. Dirty word – need.

And so they qualify – until one of them loses a job or cannot work, then they can’t.

Not to dispute the doc, but the 70K family income sounds a little low for the typical, 2 wage earner, home buying family. So it is some sort of blended statistic and not truly representative of your typical home buying “couple”.

But again, the question will be, considering the ever rising costs for all other neccesities of life, how much are Americans really willing to commit to housing. And I throw in autos to that question as well, since I for one am amazed at how that charade continues.

Holy Refi, Batman.

No kidding. I was so jealous when my neighbor refied in the 80’s at 7.5% and I was stuck at 12. Rates this low for this long only mean one thing: The economy is dieing and all the adrenalin and life-support will just keep the patient in vegetative state. The good thing about depressions is that we all come together again for our mutual survival. Many will turn back to God. Whatever the scientific merit, faith helps us survive.

I agree that the Greenspan Bridge to the future was a disaster and that is what allowed prices to get to the instanity they did, but that real or perceived comfort and safedty are contributing to the high prices.

Yeah, I’m so disgusted that I want to leave SOCA. I kept hanging around thinking that prices would go down, but our stupid government won’t allow that to happen. I’m to the point where I will never again vote. I see no point in it. The Congress is bought and paid for. Those bastards don’t care about responsible people. I saw William K. Black on Max Keiser the other night, and he made it clear that there has never been this kind of thievery ever in the history of the United States. The crooks who ruined our economy continue to get bonuses while the rest of us lose jobs and homes. Sickening.

Hey, I hear there will be a new day tomarro! A new start, and it’st Free! So wake up early and take a walk outside – if you hate what you see and the way you feel, then Move! Vote with your heart and your feet. Find a small town where folks know one another and care about each other. Life is too short to live for things beyond our control! Set your sails and steer a course in a new dirrection,… It may take longer than you planned to reach your destination so enjoy the ride or curse the wind it’s your choice how you spend your precious Life. Will you get any younger while you wait for things to change? Don’t become a slave to the things you want, enjoy the freedom of having little to worry about loosing and be thankfully for the gift of choice! Come on People, Don’t let the Media divide us against each other!

Listening to a talk radio show the other day and this guy working with a loan modification outfit called regarding the dismal re-fi results. Though he seemed to have trouble getting to it, finally came around and said… “the people had lied about income” nuff said.

Housing prices are still inflated in almost all but the poorest neighborhoods(south central LA, east LA etc.). It will take years maybe a decade or more before we have any sense of normalcy in housing prices. This is of course assuming that we don’t get hit with the big earthquake that is long overdue.

In the meanwhile, unemployment will remain high unless we can create the next breakthrough industry(the last one being the internet, computer tech etc.)

Leave a Reply