You can’t afford to live in California: Only 30 percent of families can afford to purchase a home in California. Over 80 percent of California unaffordable on a teacher’s salary.

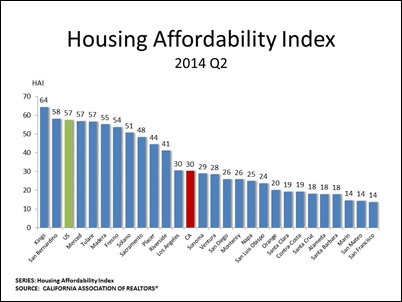

The Housing Affordability Index (HAI) is once again flashing red for California. Los Angeles and Orange counties are two of the most expensive markets to rent relative to what people earn in the area. The The HAI is showing that once again, California is incredibly overpriced. Only 30 percent of families can afford the typical home in the state. I thought it would be useful to look at data showing the typical non-investor buyer in California. These are people after all, that are putting their money in the game. It should be obvious that the middle class is being priced out of the state. As we enter the last month of the year, the housing market will likely end on a rather dull note. Those that qualify to buy understand the large commitment it will take to purchase a home in the current market. Locking in at this point is no easy decision. But for many, there is no decision to make because the majority of large markets in the state are simply unaffordable. This continues to explain the large number of people living with parents deep into their 30s and even 40s but also the decline in sales volume.

The typical California home buyer

The California Association of Realtors put out an interesting report looking at data on 2013. Keep in mind this survey was based on 1,400 respondents so this isn’t a definitive figure on who bought homes in the last year. It simply helps to give you a sense as to who was buying last year.

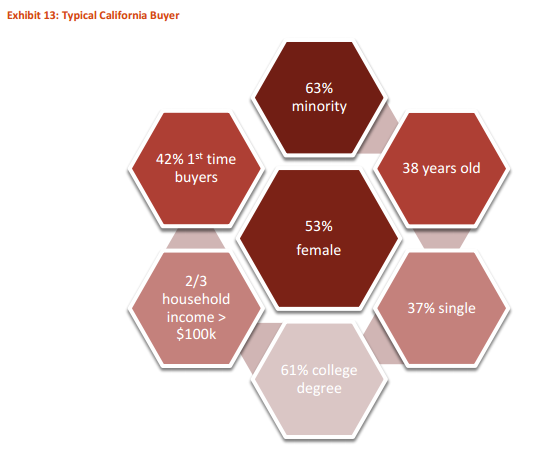

The figures are listed below:

Source: Â C.A.R.

This is interesting data. 2/3 of buyers had a household income of $100,000 or more. So yes, having a high income absolutely matters when it comes to buying a home. The typical age of a buyer is 38 and 42 percent were first time buyers. Keep in mind this survey did not look at investors who were a large force in California since 2008.

37 percent were single buyers and 63 percent were minorities. 61 percent of home buyers had a college degree. Then if we look at affordability, we find that many are stretching their budgets to buy:

Only 30 percent of families can afford to buy in California. Where are things affordable? San Bernardino, Merced, Fresno, Sacramento, and Riverside. Los Angeles, Ventura, San Diego, and Orange are not affordable. San Francisco is the least affordable market but no surprise on that one.

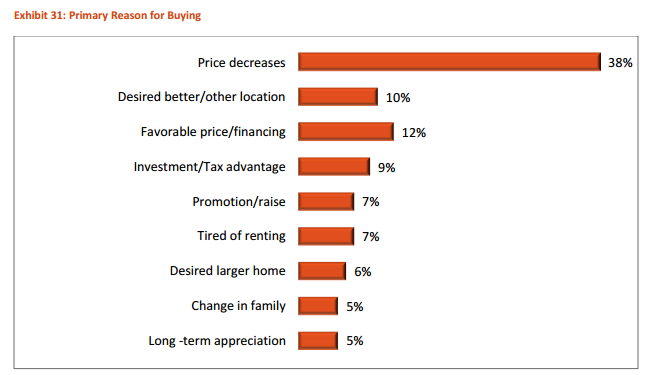

With that said, it was interesting to see what motivated people to buy in 2013:

The bulk of people buying bought because of price decreases. This would make sense given the HAI. You’ll also notice that favorable price/financing and investment/tax advantage make the top of the list. All of these ultimately are perks to your bottom line but drive the point home that people are trying to buy a home when pricing is perceived as moving lower or a deal is forth coming. And for many, it made sense to buy in 2013 when prices decreased. Of course some were caught up in the mania trying to out compete investors and this drove prices to their current levels. Sales volume has fallen because very few families can afford to buy.

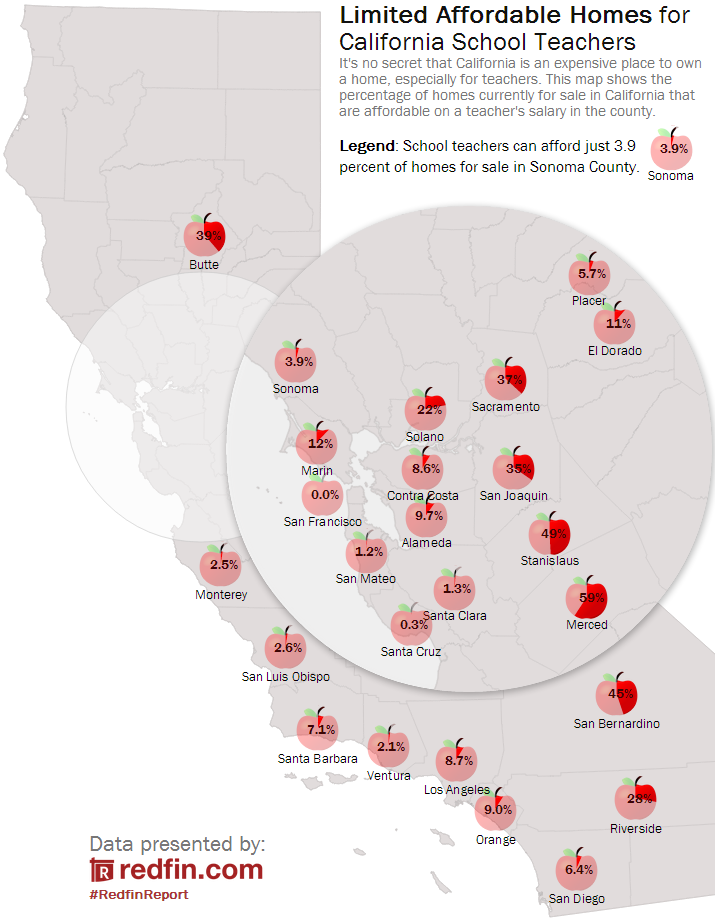

Redfin looked at a typical teacher’s salary and tried to see where they could buy in California:

Source: Redfin

According to the report, 83 percent of homes are unaffordable on a teacher’s salary. For a state that would like to put teacher’s first, it obviously doesn’t care about them having affordable housing. Of course you’ll notice that Riverside, San Bernardino, Merced, and Sacramento remain affordable.

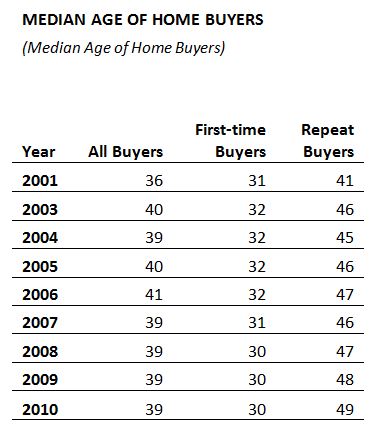

I was also curious to see the age of current buyers (outside of investors):

There is likely more recent data but what you find is that overall, the age of buyers has gone up especially for repeat buyers. Comparing this data to the more recent CAR data, you realize that your current home buyer is actually getting closer to 40 in age. For some the goal is to buy a home in a good area to raise a family. At 40 biology might make it tougher but then again, 37 percent of buyers were single.

All of this has long-term implications for the market. You have many people doubling up in rentals or living at home with parents. Sales volume is weak and inventory is still paltry. If you want to own today, your menu of options is limited and prices still remain elevated.

What we are seeing is a significant stalling of activity in marginal markets. Take a look at this property:

8133 Rancho Arroyo St, Paramount, CA 90723

4 beds, 3 baths, 1658 square feet

“Nice House, Located on desired area, by the border of Downey, Cul-the-sac Street, private and quiet neighborhood. House is in good conditions. Please See Remarks.â€

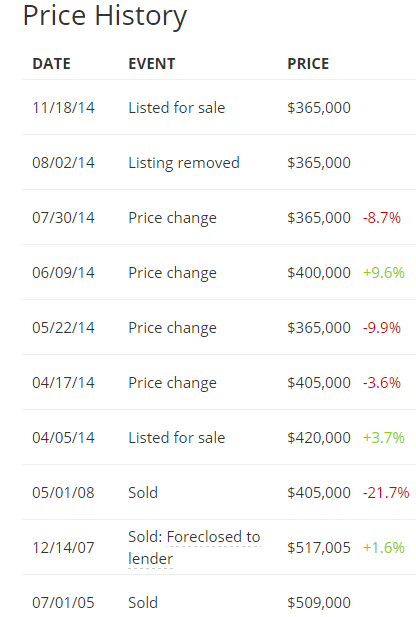

This is a good sized home. The current list price is $365,000. But take a look at the pricing history here:

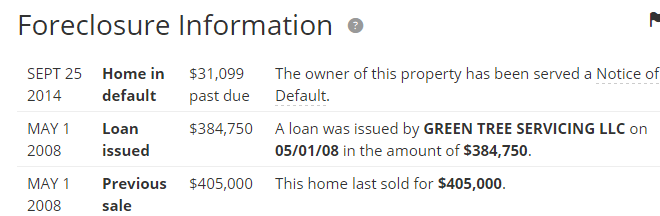

They were asking $420,000 in April of this year. Then there was some funny pricing action in May and June. They’ve been holding that $365,000 mark for some time now. Time is now not on their side. Not a great yield as a rental so investors probably have no interest here. So you are left with people looking to live here. They need to qualify. It looks like this place is in foreclosure:

The Paramount market is working class and just like the last correction, marginal areas get hit first when sales volume falls. Affordability absolutely matters. That is why California is becoming a renter dominated state.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

139 Responses to “You can’t afford to live in California: Only 30 percent of families can afford to purchase a home in California. Over 80 percent of California unaffordable on a teacher’s salary.”

>>This continues to explain the large number of people living with parents deep into their 30s and even 40s but also the decline in sales volume.

And this cannot go on. Sooner or later Prop 13 has to go. No tears over who gets left out in the cold. Interesting name calling etc. that this blog stirs up. We’re all being played. But nobody’s going to try to fix this in earnest until we hit rock bottom. Can’t see that happening until 2020. The next election will be interesting though as the last four have opened old wounds and poured the salt in.

i read an article recently that said 80 plus year old parents are moving in with their kids. doubling up goes both ways

Prop. 13 — I have two aunts who live in $2 mil homes in Los Angeles. Both pay less than $2k a year in property taxes and those decades of savings do nothing to contribute to the economy. Their money goes into saving accounts for their well to do children who will end up in the same home upon their deaths.

Their kids, my cousins will enjoy the lower property taxes until it the homes leave their family.

not a $2m “home” until they sell it

Please explain how abolishing prop 13 “fixes” whatever you Think the problem is.

My taxes go up every year, how much should I be paying? My parents bought 10 years before I did….our property tax is within 1% of each other.

I am a teacher and this article is why Housing Must Tank Hard in 2014!

Jim its November….years almost over…… Housing didn’t tank…..so do you feel like a dummy yet? How’s that whole ‘the sky is falling’ routine working out for you? I bought a rental in hemet for 125k 12 months ago, now all the homes nearby are selling for 160-180k. Until hemet homes hit 320-350k we are not in a bubble. Homes are still affordable all over parts of so cal. How long have you been repeating your silly mantra?? When are u going to throw in the towel? Housing won’t tank til 2018-2020, by that time subprime will be in full swing and 100% LTV ninja loans will be back

If I remember correctly he was calling for the tank way back in ‘THe Ides of March’. How’d that prediction work out?

I think housing is about 10% over value, it won’t tank but a nice correcetion where it’s not pretty fit able for flippers but yet affordable for home buyers to raise a family

For all the housing hedonists of California, any drop in their precious property values seems to be construed as “Tanking.” It guess it’s easy to get panicked when you know your property is vastly overvalued and your paper-wealth can evaporate in days. CA Housing is basically tanking and they shills are merely rallying.

Right on, Jim.

Hemet. Oh, the humanity!

No one who has chosen to live in Hemet can call anyone else a dummy. This is kind of a universally accepted rule.

i think $125K in Hemet is already a bubble and $160K-$180K is pure insanity, I’ve been there.

Last year right around this time I purchased two homes, one in Hemet and one in San Jacinto. The Hemet home was a light fixer, $56 sqft. The SJ home, $60 sqft. I was actually going to back out on the SJ home because it was a true fixer and as usual, rents are low in these areas, but I bought it anyway. I actually stopped buying beginning in 2013. But decided to take one last stab later that year. Right now I’m not looking at anything.

I agree – prop 13’s time has come to an end. I know so many people in Sacramento, mostly retired State workers, who are living it up in their huge houses they bought 40 yrs ago, on a taxpayer funded pension and health benefits. They love to boast how they only pay $200 a year in property tax. Why haven’t these government blood suckers downsized? Why are they allowed to pay $200 a year in property tax, while the younger generation pays 10-30 times that amount?

Paying these pensions to retired State workers, and lets face it, we all know State workers are far from overworked, its gotta end some day as its completely unsustainable. Calpers is so underfunded its scary and nobody wants to talk about it because nobody wants to lose their government handouts.

I support police and firefighters – people who put their life on the line and have stressful work environments, deserve some sort of retirement. BUT I know plenty of retired cops, YOUNG – in their early 50’s – pulling $100k pensions, and going back to work part-time, or even full time for another government law enforcement agency of some kind. The taxpayer is funding all of this and the bank account is seriously overdrawn.

If the baby boomers lost Prop 13, they would be forced to downsize and their homes going up for sale would flood the market – ie: push prices to where they should be to enable a young person on a middle class wage to purchase their own home.

Yep, well said Calgirl, they do like to brag about how good they have it that’s for sure.

i know a state worker who inherited her grandmother’s house and her car payment is more than her yearly property tax

I roam the streets of LA un-armed, and you call armed police “life on-the-line” I think you got it backwards.

Have you heard of the DROP program? You will love that. Im sorry but cops and firefighters are overpaid. WHy do you think there are 5000 applicants for every fire fighting jobs in CA? Why do you think that nepotism is so high in these jobs? There are fire departments that have over a quarter of the new hires being some relative of some sort. Its almost as bad as the long beach shoremen. When you have pensions over 6 figures, ability to retire at 50, ability to double dip your income/retirement, ability to raise your pensions higher than your salary using overtime/vacation pays during the last years before retirement, have full medical coverage, all the while working 3-4 days a week, ETC ETC ETC, then something has to give. THey are called public servants, but it seems like the public is serving their income/retirement.

And please stop with the “they risk their lives for us” comments. Nearly all cops never need to shoot their guns throughout their whole career and firefighters are mostly doing health emergency calls. When was the last fire you saw in your neighborhood? I see firefighters at Costco picking out their next lunch/dinner plans 100x more than I see them fighting fires. Construction workers, sanitation works, farmers, fishermen, pilots, miners, etc, etc, etc have way more risk on their jobs than a cop or fireman.

Looks like the cry for lower prices have been for some time now, all I see is listed homes still at the top of their market. The folks sitting rather take the house off the market unless they get at least even.

RE agents continue to list homes high and hope they will drop after 90 days, in many cases this has not worked. Sellers look at houses also and have figured out if they sell below what they paid they won’t be able to buy back in, hence they sit or remove the listing.

Old saying those who sale anything lose in the end, I believe from my many visits to new models and resale open houses over this past 10 months, new home sales agents and open house agents say the same thing, sellers will give only so much, but not going back to 2008 prices. they can in most part afford the taxes and payment so know need to panic?

For all the anti-prop 13 people, have you considered that you could very well benefit from prop 13 someday? California already has among the highest taxes in the country. And you want to give the government even more money? That’s insane, to put it nicely. Let government workers fund their own retirement, just like most people do in the private sector. Too bad if the pensions are underfunded; that shouldn’t be the problem of the taxpayer.

Overspending is the problem here (on pensions and everything else), and throwing more money (via repealing prop 13) at the same government that overspent to begin with is clearly not going to solve the problem. The government will continue to overspend, and the only thing that will change is that you and I will lose out on the benefits of prop 13.

Dittos on Prop 13. Govt pensions (and spending in general) are too high. We must slash current govt health & pension benefits, even if cities, counties, and the state must file for bankruptcy to do it. Bankruptcy will allow govt entities to void past union contracts and pay 50 cents on the dollar, or whatever. Happens all the time in the private sector.

Right now, we’re creating a bloated class of overpaid and corrupt govt workers. Yet another way in which we’re increasingly resembling a Third World nation.

Third World nations have practically no private sector middle class, and no economic mobility. Instead, they have a ruling class of super-rich kleptocrats, and a public sector middle class, and the only ways to join those classes are through nepotism or cronyism.

Here’s a scarier thought. Those overpaid bloated government workforces can vote too. Do you think they are going to vote out their gravy train? Not likely. Those living on the government trough will continue to vote for more money and benefits. This includes crony capitalist companies, government workers and those on one dole or another.

When do you think there will be more of them taking than there is of us paying for them?

fensterlips, I realize that govt workers vote in large numbers. That’s why I suggested state and municipal bankruptcies as the eventual solution to bloated govt worker pensions & benefits.

The day will come when govts can no longer fund govt employee benefits. Additional taxes or borrowing will no longer bring in the needed revenue. Too many tax cheats as taxes increase. Too many productive people leaving the state. Bankruptcies will be forced upon cities and the state when their checks start bouncing.

Govt workers can vote themselves all the money they want, but they’ll be paid with bounced checks, worthless I.O.U.’s, or port-bankruptcy pennies on the dollar.

It’s true that overspending is a problem, so why in the hell would we think that can be fixed by forcing non-property owners to subsidize property owners? That’s what prop 13 has resulted in. Instead of property taxes having a proportional share of the burden, all other taxes were raised higher in order to make up for the difference.

We are all still getting fucked in the form of higher taxes in other areas. Prop 13 didn’t fix the overspending problem, it simply pushed the burden of the problem onto other areas disproportionally.

Prop 13 has failed at reducing overspending. What it has succeeded at is to create an imbalance that results in a less efficient real estate marketplace.

Simple and short-mindedness with a heaping amount of self-serving fuck everyone else because I got into the party is preventing many from acknowledging the paradox.

It’s contributing to its own eventual undoing. As entry into property ownership becomes a less attractive partly due to prop 13 distorting pricing mechanisms, we continue to have fewer property owners as a proportion of the voting bloc. Politicians that today use support for prop 13 as a campaign slogan will turn on a dime and betray this allegiance in a heartbeat as soon as it becomes expedient to do so. Those who think it’s going to be a long time before that happens are being foolhardy. We have no idea how long this can continue to go on but what we do know is history proves time and again that you can’t trust politicians and change often happens when you least expect it.

Why do you think your rental or lease rates for real estate won’t be affected if Prop 13 is reduced or eliminated? You must think greedy landlords are rolling in dough. All costs pass down the food chain to the end consumer. Greedy businessmen can’t stay in business a long time without a cartel or collusion because competitors will eat their lunch.

There is a market distortion as a result of Prop 13 but the big winners are commercial lanlords that have not sold their properties since 1978 – they sell the company instead. Very devious, very clever but legal. BTW, lose the F bombs. They don’t help your case.

@A: Do you honestly think that a repeal of Prop 13 will mean that the government will lower your other taxes? Repealing Prop 13 will not lower your taxes at all. You can be assured that all other taxes will remain static or increase, just as always, if Prop 13 were repealed. A repeal would simply mean that you would never realize the benefit of Prop 13.

To reiterate mine and others’ point, the government problem in question is overspending. Raising taxes will not fix this problem. Why you would want to eliminate a tax benefit that will probably benefit you someday is beyond me.

“Why do you think your rental or lease rates for real estate won’t be affected if Prop 13 is reduced or eliminated? You must think greedy landlords are rolling in dough. All costs pass down the food chain to the end consumer.”

First of all, you assume I’m a renter. Secondly, I never said I thought prop 13’s eventual elimination will lead to reduced rental rates. Third, I don’t think most landlords are rolling in dough, because in fact, I think many of them are barely scraping by. Finally, you’re misguided if you’re claiming that all costs pass down to the consumer. Costs are shared between producer and consumer. The difference is between the producer’s profit and the value the consumer receives, depending on the circumstances, sometimes more or less so on one side or another. Both sides need the other just as badly and are forced to play ball when supply and demand factors present. The exception to this rule are cartels. We don’t have landlord cartels in this country at the present moment. Landlords don’t do business in a vacuum, they have competitive forces like any other business.

“Do you honestly think that a repeal of Prop 13 will mean that the government will lower your other taxes? Repealing Prop 13 will not lower your taxes at all. You can be assured that all other taxes will remain static or increase, just as always, if Prop 13 were repealed. A repeal would simply mean that you would never realize the benefit of Prop 13.”

No, I don’t think the repeal will lead to lower other taxes. I think the repeal will lead to fewer other taxes being raised even further than they would, absent the repeal. Furthermore, I don’t think we’re going to get the spending under control in California anytime soon. It will not be until things get spectacularly desperate that the politicians and their supportive public will be forced into taking the drastic measures necessary to fix this problem.

“To reiterate mine and others’ point, the government problem in question is overspending. Raising taxes will not fix this problem. Why you would want to eliminate a tax benefit that will probably benefit you someday is beyond me.”

I completely concur that raising taxes will not fix the problem but the benefit from prop 13 is largely illusory because it’s been mitigated by higher taxes in other areas that affect us all. The small amount that it’s not illusory is due to the fact that non-property owners and later property owners disproportionally share in the overall tax burden. If taxes are indeed going to be raised, there needs to be an equitable distribution. It’s not about what presently or may benefit me in the future, it’s about I the individual having the moral fortitude to not expect others to bear my costs.

“BTW, lose the F bombs. They don’t help your case.”

No, I don’t tell you what to do and if you can’t handle some word, too fucking bad. The case is the case, regardless.

For all the pro-billionaire tax people, have you considered that you could very well become a billionaire someday?

No, and as long as prop 13 is on the books, 85% and growing of californians will never benefit from prop 13, and if they do, it won’t be for very long, because prop 13 results in reduced property taxes over time, resulting in school districts decaying into demilitarized zones.

Becoming a billionaire is extremely unlikely to happen. Becoming a homeowner is a likely possibility. Your argument is an apples to oranges comparison and is of trivial relevance.

Replying to “A”…

“Finally, you’re misguided if you’re claiming that all costs pass down to the consumer.”

You are mistaken. All costs are past down to the consumer. You will learn this one day if/when you become a business owner.

The problem with people who believe otherwise is that they don’t see the forest from the trees. You think just because a business can and usually does “eat” the higher costs initially, that they always will. But that is never the case in the long run. Eventually the finished good or service with go up to make up for the past losses, and then some, in anticipation of future losses (cost increases).

“Costs are shared between producer and consumer. The difference is between the producer’s profit and the value the consumer receives, depending on the circumstances, sometimes more or less so on one side or another. Both sides need the other just as badly and are forced to play ball when supply and demand factors present.”

Costs are shared by no one other than the consumer because consumers buy the finished product, not the producer. Just because the profit went down for a period of time doesn’t mean it won’t go back up. Even if profits stay permanently depressed, eventually through ever increasing costs you will be forced to increase prices, or go out of business. If you go out of business, then those who are still in business will experience a higher demand, and what does a higher demand entail? Higher prices. Now tell me the consumer doesn’t pay.

“We don’t have landlord cartels in this country at the present moment.”

Actually we do, it’s called the government, state and federal.

“Landlords don’t do business in a vacuum, they have competitive forces like any other business.”

Not when you’re Blackstone who gets massive loans from a bank that was supposed have failed, but didn’t because it got bailed out be the Fed (aka, US Citizens): Deutsche Bank.

“We don’t have landlord cartels in this country at the present moment.”

Sure we don’t.

“if Prop 13 were repealed. A repeal would simply mean that you would never realize the benefit of Prop 13.”

As if the rain does not make the soil wet (the only difference is that water just falls from the sky, nothing else).

If Prop 13 were repealed then the obvious effect would be that property values would go down.

“You are mistaken. All costs are past down to the consumer. You will learn this one day if/when you become a business owner.”

Well pal, I’m going on being a landlord for many years and have been a small business owner. The day came a long time ago.

“Costs are shared by no one other than the consumer because consumers buy the finished product, not the producer. Just because the profit went down for a period of time doesn’t mean it won’t go back up. Even if profits stay permanently depressed, eventually through ever increasing costs you will be forced to increase prices, or go out of business. If you go out of business, then those who are still in business will experience a higher demand, and what does a higher demand entail? Higher prices. Now tell me the consumer doesn’t pay.”

What’s missing is that input costs discount the net profit and said discount is a cost to the producer. That’s elementary.

>“We don’t have landlord cartels in this country at the present moment.â€

“Actually we do, it’s called the government, state and federal.”

That doesn’t make any sense.

>“Landlords don’t do business in a vacuum, they have competitive forces like any other >business.â€

“Not when you’re Blackstone who gets massive loans from a bank that was supposed have failed, but didn’t because it got bailed out be the Fed (aka, US Citizens): Deutsche Bank.”

Those are subsidized inputs on the supply side. Blackstone still has competitors in the marketplace where the demand pool exists. I would know as I’m one of them.

>“We don’t have landlord cartels in this country at the present moment.â€

“Sure we don’t.”

Care to cite any examples?

>“if Prop 13 were repealed. A repeal would simply mean that you would never realize the >benefit of Prop 13.â€

“As if the rain does not make the soil wet (the only difference is that water just falls from the sky, nothing else).

If Prop 13 were repealed then the obvious effect would be that property values would go down.”

You’re quoting someone else as I did not write that. I completely agree that the obvious effect of Prop 13’s eventual dismantling will be downward pressure to property values.

Actually 365k is price not high compared to the 700k I see most listing in Los angeles

You are correct. Compared to other SoCal prices @ $700K, $365K sounds like a bargain until you realize that in the non-bubble areas of the U.S., $365K will get you a sprawling equestrian estate. An in non-bubble exburbs, $365K will get you a small farm or small ranch.

Also, $365K requires an annual income of $85K in order to safely afford the house (this includes property taxes and insurance but not maintenance, upkeep nor utilities). Median household income in the Los Angeles-Long Beach-Glendale region is about $53K.

So, $365K is definitely not a bargain. Also, Paramount is working class which means one step above ghetto/barrio and one or two steps below middle class.

Cue non-native Californians saying that you must be special to live in California…….now!

Just “Special Ed”

I know it sounds very stressful but if us younger would just not buy those houses at all and keep moving house every year for the best deal…you would see things changing.

Unfortunately too many do think that to have kids you must buy a house and you have to have a cool house to keep with the Jones.

It is not my problem but most of this people will have to live on a SS check because they have no extra retirement plan and they do not plan to have one. So good luck with that. I keep beefing up my 401k, IRAs etc. because I think in the end California will be in the next 10 to 15 years Japan 2.0…so in real terms the house price will either be flat or slowly declining.

The big boom train has passed and it has arrived to the station already. For the millenials, in real terms housing will be a lousy investment. So if people think that the house will fund their retirements 20 years down the road I do think they are greatly mistaken IMHO.

I sort of do something similar….I simply set a ceiling on what I’m willing to pay in the Bay Area. I make solid money, mid-30’s, very little debit (should be done with car and college loans next year or so).

I set myself a top end of $1,000/month if living with a room (or girlfriend) and $1,300 if looking for a studio or 1bedroom for myself. Right now I’m doing the former and rent a house on Alameda Island with a yard, off street parking, close to bus/BART.

I really like the condo’s coming on-line in Berkeley, Emeryville and Uptown Oakland…But I’m not going to pay 300-500 for a condo with $300 HOA’s.

You’re upset by $500 a month HOA dues? This condo’s HOA dues are $1450 a month (sic): https://www.redfin.com/CA/Los-Angeles/10445-Wilshire-Blvd-90024/unit-202/home/6826631

My condo is in another building, in Santa Monica. Its HOA dues of $706 a month. And mine has the smallest square footage in the building, which means it pays the lowest HOA dues. The penthouse in this building pays over $2000 a month.

My dues were under $600 when I moved in. And yes, I look forward to buying a house so I can ditch the HOA dues.

To SOAL I’m pretty sure he meant $300,000 to $500,000

Prop 13 has little to do with the problems we face, and it’s not going anywhere anyway. Anyone who’s been paying attention knows that CA RE only went full retard when the FED created Housing Bubble 1.0. Housing Bubble 2.0 is and always has been an echo bubble designed by the FED to move residential RE inventory from the banks to private hands. This has been accomplished and the inevitable bust began this summer, sales volume is our leading indicator the same as last time. Once some small amount of market forces are allowed to act and you can purchase a home Prop 13 will be your friend. We’re all frustrated. Watching over a decade of economic insanity will do that. But the FED is out of options and the invisible hand will be swift and hard upon the backside of the specuvestors. Be patient everyone 🙂

Agree 100% that this echo bubble offloaded alot of RE to private parties for cold hard cash. Also agree that prop 13 probably isn’t a problem but people look to repeal it to fix the bubble, when there are better ways (just pop it!). Prop 13 really just magnifies the inequities of this bubble. Not a Cali resident so no dog in the hunt for me, thankfully!

FAIL

Direct correlation between Prop 13 passage and transfer of wealth from individuals to corporations and the under-funding of our public schools.

California’s per-pupil spending was about the same as the national average until about 1985. Now we rank 49th in the nation for per-pupil spending.

When When Prop. 13 passed, commercial property paid 40% of the property taxes in California and residential property paid 60%. Now, homeowners pay 72% and commercial properties only pay 28% of the property taxes in California.

Dfresh, you do realize that if you repeal prop 13 all the commercial properties will see their value lowered as a direct result of the higher tax rate removing profitability? The effective tax rate will rise but the revenue would likely rise modestly at best. This math applies to the residential market as well. And as unfair as it is that some people benefit disproportionally from Prop 13, if you take money out of their hands and put it into the educational bureaucracy you’re effectively advocating trickle down economics for CA. What was once a $1000 a year in the hands of 50 taxpayers is now 50K in the salary of one state worker. While the taxpayers would likely spread that money out among pizza shops and malls that one (likely overpaid or unnecessary) state worker is consolidating that money and preparing for his cushy retirement.

That’s a “FAIL” if I ever saw one.

“What was once a $1000 a year in the hands of 50 taxpayers is now 50K in the salary of one state worker.”

What about the value added in the form of educating pupils? Isn’t the idea that there’s a future return in the form of an educated populace that’s more productive than one that’s non-educated? I’m seriously asking these questions, not trying to prove a point.

RE: A

What evidence have you seen that increased spending has raised the quality of education in CA? If it was really about “education” as opposed to the salaries of the education bureaucracy we would make it easier to fire non-performing teachers, expel non-performing students and deport illegals. Then you’d have an efficient education system made up of students and teachers who want/deserve to be there. The fact is class sizes are DECREASING because no one with any sense is having kids in this shit economy. Take away the Mexican national kids and you’d have a pretty high per capita spending ratio.

“…Take away the Mexican national kids and you’d have a pretty high per capita spending ratio.”

Not only that, you’d have generally higher-performing students, regardless of how little or how much money you throw at them. There aren’t many students in Irvine schools performing poorly. There are also not many illegals there (including kids of illegals). Is this a coincidence? As the saying goes, you can’t fix stupid.

NZ: I can’t refute any of your points. I’m not much up to speed on the details around education spending but what you’re putting forth seems well reasoned enough. I suppose my questions were about confirming what would happen in an efficient system absent the issues you raise. What’s the answer to these issues? From what I can tell, the establishment status quo is looking to continue to import an underclass of latino workers as a way to add growth or am I missing something? Aren’t their children going to require education that needs to be paid for by the beneficiaries of said growth?

NZ: I can’t refute any of your points. I’m not much up to speed on the details around education spending but what you’re putting forth seems well reasoned enough. I suppose my questions were about confirming what would happen in an efficient system absent the issues you raise. What’s the answer to these issues? From what I can tell, the establishment status quo is looking to continue to import an underclass of latino workers as a way to add growth or am I missing something? Aren’t their children going to require education that needs to be paid for by the beneficiaries of said growth?

What you are missing, presumably by willful ignorance, is that the “status quo” wants illegals here for one or both of two reasons: 1) cheap labor; and/or 2) votes. The illegals are simply pawns, and are otherwise undesirable to the “status quo” on either side of the aisle.

Whether they deserve an “education” is probably irrelevant, considering the schools that these children attend in significant numbers are generally rated extremely poorly (read: they aren’t getting an education at school anyway). Check out the GreatSchools ratings for schools in Anaheim and Santa Ana. I would never even think of sending my child to most public schools in these cities. And thankfully, due in part to intelligent life choices, we won’t have to. We do, however, gladly collect rent from the poor souls who happen to live in one such city.

The answer to the illegal immigrant issues, education and otherwise, is deportation. It will not matter that your fruit resultantly costs a few pennies more. Punish any company that hires illegals, discontinue any benefits that they currently receive and change the law stating one is a citizen if born here to illegal parents. Magically, these people will self-deport. None of this will happen, of course, and the country will probably continue to further decay (due to this and a variety of other issues) and join the ranks of the once great societies such as the Greeks, Romans, etc. Oh well; it was fun while it lasted!

“The illegals are simply pawns, and are otherwise undesirable to the “status quo†on either side of the aisle.”

No shit Sherlock :-/

That doesn’t change the fact that they contribute to the overall shitiness of the schools they attend. The real issue for Mexico is the conquistador decedents, European Mexicans who control the Oligarchy, make that country such a sewer than so many wish to come here. The Zapatista Rebels had it right they took back the land and I don’t see many of them making the trek north.

All these stupid pro-illegal Mexicans can never tell me why there own country is so fucked up or better yet what they plan to do to fix it. Their to busy complaining about Whitey.

“What you are missing, presumably by willful ignorance, is that the “status quo†wants illegals here for one or both of two reasons: 1) cheap labor; and/or 2) votes. The illegals are simply pawns, and are otherwise undesirable to the “status quo†on either side of the aisle.”

I understand this full-on, your presumption of willful ignorance on my part is incorrect. I think you have my perspective pegged wrongly.

“Whether they deserve an “education†is probably irrelevant, considering the schools that these children attend in significant numbers are generally rated extremely poorly (read: they aren’t getting an education at school anyway). Check out the GreatSchools ratings for schools in Anaheim and Santa Ana. I would never even think of sending my child to most public schools in these cities.”

I’m not implying that they “deserve” anything. I’m asking about the future implications to all of us if there are to be uneducated masses residing here as a result of not spending the money on educating them.

I don’t doubt for a minute that the schools are shitty but that’s a different issue than the question of whether we actually spend to educate or not. You’re muddying the waters.

“And thankfully, due in part to intelligent life choices, we won’t have to. We do, however, gladly collect rent from the poor souls who happen to live in one such city.”

Was being born into a better situation than the illegals an “intelligent life choice” that you made? And then you follow-up with how you’re willing to profit from the problem? Come on, man, life is not that black and white.

“It will not matter that your fruit resultantly costs a few pennies more.”

I wonder if it’s really that simple. It seems that the status quo are desperate for growth and this seems to be in their toolbox. Could it be that they perceive deflation as such a threat that they’re willing to undertake these drastic measures to prevent it?

“I’m not implying that they “deserve†anything. I’m asking about the future implications to all of us if there are to be uneducated masses residing here as a result of not spending the money on educating them.â€

I’m asserting that the future implications are the same, whether they attend a better school or worse school, or even no school. These are not people that care about bettering themselves beyond mooching off of others, generally speaking. Spending money on “educating†them is a lost cause, and will make no difference. There are always exceptions to the rule, but that doesn’t make the rule invalid. This is just my opinion based on my observations and experience living in Southern California- anecdotal, I know.

“Was being born into a better situation than the illegals an “intelligent life choice†that you made? And then you follow-up with how you’re willing to profit from the problem? Come on, man, life is not that black and white.â€

I explicitly stated that we are successful, IN PART, because of intelligent life choices. I readily acknowledge that I had the good fortune to have been born in the U.S. and was not born to dirt poor parents. Neither me nor my wife had anything close to rich parents, however. Also, we do not rent to illegals, and therefore we are not profiting from the illegal problem. I was effectively stating that the folks who rent from us are unfortunate to have to live in a certain area/city. It’s all relative, though, and there are many, many places that are much worse.

“I wonder if it’s really that simple. It seems that the status quo are desperate for growth and this seems to be in their toolbox. Could it be that they perceive deflation as such a threat that they’re willing to undertake these drastic measures to prevent it?â€

What drastic measures? Procuring cheap labor? It’s been done for millennia!

“I’m asserting that the future implications are the same, whether they attend a better school or worse school, or even no school.”

Ok, got it.

“I explicitly stated that we are successful, IN PART, because of intelligent life choices. I readily acknowledge that I had the good fortune to have been born in the U.S. and was not born to dirt poor parents. Neither me nor my wife had anything close to rich parents, however. Also, we do not rent to illegals, and therefore we are not profiting from the illegal problem. I was effectively stating that the folks who rent from us are unfortunate to have to live in a certain area/city. It’s all relative, though, and there are many, many places that are much worse.”

I stand corrected.

“What drastic measures? Procuring cheap labor? It’s been done for millennia!”

The executive action that Obama just undertook seems drastic to me.

The RE market is messed up for sure, and so highly manipulated by the forces that need it to “work” for them.

Example: In 2005 we sold a gorgeous 2800 sq ft home we had built in 2002. I knew we’d not see these prices again, the house was too big for us and we wanted to move out of the city so up for sale it went. The dude who “bought” it was a pest control spray technician, salary couldn’t have been over $40k a year, but be borrowed 97% of it – $580,000 on an IO 3 yr ARM. 4 yrs later he stops making payments, NOD issued. Then it takes another 4 years of postponed foreclosure sale dates to finally foreclose (July 2013).

Then it sits empty until suddenly it sells in June this year. Never listed on the MLS. Guess what, it just sold again for $80k higher than it did 5 mths ago. Again never listed on the MLS. What is this? Who is the bank handing it off to? They could have resold that property in a heartbeat after spending $300 to send in a cleaning crew. Instead they have played some underhanded secret trading houses game. I can’t work out what was happening.

Wonder what happened to the pest control guy 🙂

The pest control guy lived free for 4 years, while we paid rent. Ruing his credit, but I found out my 800 plus credit score does or put food on the table.

Seems to me that the bank is not the only major pest in this story.

hmm, Redfin looks to be very weak on proofreading/editing, no way 12% of teachers can afford to buy in the extremely expensive. Marin Co….makes me wonder how accurate the rest of the chart is. Also FWIW teaching is no longer the steady stable job it used to be, layoffs are very common so many teachers would be leery of taking a mortgage on in any case (my GF is a teacher in Sonoma Co. where 3.9% of the houses are affordable to her per the chart, has been laid off several times in the last few years…also FWIW we have 40 (yes forty, not a typo) school districts in the county which is totally insane but that is another story)

WAAAAAHHH WAHHHHHH I hate prop 13. Bunch of babies. When he shoe is on the other foot you will sing the praises of prop 13 and brag about how little you pay compared to current homebuyers.

Labeling the opposition in the debate as whiners or complainers is not going to save prop 13. Those sour reactions help to demonstrate that the prop 13 camp will be its own worst enemy when it eventually comes down to brass tacks on deconstructing it. The clock is ticking down on this issue and the desperation to maintain the status quo is rather sorry.

Prop 13 will hit commercial property way before it tries to tackle residential.

You’re probably right. Residential investors would do well to pay attention to what happens to commercial so they can best position for when the time comes on the residential side.

Interesting that DHB singles out CA teachers in his observation of unaffordability as I believe they are one group that often CAN still afford to buy a home here.

A few points:

The average teacher salary is ~$69K, but there is a wide pay disparity between entry level and senior teacher salaries. I am friendly with several High School teachers with 20+ years experience and their salaries approach $100K.

In this day and age shouldn’t we assume that household income for a teacher also includes their working spouse. Do that and the total income for a household including a mid-career CA teacher will likely be $150K+. While I grant that this still would not make $1M prime real estate affordable, it does put the ~$500K smaller homes in the suburbs in reach.

Just as an aside, if you’re interested in what CA teachers (and other public employees) make it is most illuminating to check out transparentcalifornia.com . This is an indexed list of the salaries and pensions of most CA public sector workers. Punch in the name of your favorite teacher (or better yet, retired cop) and prepare to seethe. Recently I was looking at a somewhat overpriced home that had been sitting without price reduction for a few months. A bit of quick research yielded the name of the seller, and a visit to this site showed she was a retired teaching administrator pulling down a $100K/yr, cost of living adjusted, pension. People like that never need to sell and will never budge on price. Needless to say I dropped that house from my watch list like a hot rock.

“An ongoing criminal enterpriseâ€: Why America’s housing disaster is back and wreaking terrorâ€

http://www.salon.com/2014/11/18/an_ongoing_criminal_enterprise_why_americas_housing_disaster

Cry me a river of liquidity eh, for these ‘victim’ borrowers. Many of them over borrowed, overpaid, and outbid good money. Tends to be very little sympathy for those of us who have stuck it honest and true – saved vs year-on-year rising prices, then reflation via QE and zirp and Wall St and global QE.

>Ninety-five percent of borrowers never show up to defend their foreclosures.

Of course teachers can’t afford a house on one salary- Who Can?

Average teacher salaries in Ca. are just under $70K, and a few districts average over

$80K Cost of living raises are not counted as “real raises” by this group.

Medical benefits are far better than anything in the private sector, and retirement plans are gold plated.. Not bad for 9 months work.

And yet these government employees whine and complain non stop about how they are underpaid and overworked. But you notice- after 3 years on the job, none of them quit.

You are dead wrong on medical benefits for teachers, they are different for every school district and range from good to absolutely worthless to the point you can do better buying your own insurance….get your facts straight before you post. The pension is far from gold plated and CA teachers do not collect SS benefits. The work year is 9-10 months but the work week is way over 40 hours for a good teacher that does a lot of prep work. There are worthless slugs in the teaching profession like any other but most earn their money doing a difficult job and work hard. I have dated a couple of teachers over the years and in every case my pay and benefits as a technician for a Fortune 100 company were far better as was my job security.

I don’t post often, but I must echo what Bluto just stated. My wife was a former physics high school teacher, who decided that we worked way too much for way too little and received little to no respect from students, administrators, and parents. In fact, most of the time the parents blamed the teachers for their child’s failures and the administrators undercut the teachers at every turn to appease angry parents.

She finally decided to leave the teaching profession and immediately tripled her salary working for the Applied Physics Lab at Johns Hopkins. Later, she decided to pursue her PhD in Astrophysics (where I met her) and she’s never looked back. Teachers, especially STEM teachers, are significantly underpaid relative what their credentials would command in the actual market place (most likely Master’s degrees.. depending on time in the field).

I’m somewhat taken aback that people would suggest that teachers are overpaid, and the 9 month of work is a joke. Teachers are expected to develop curricula, take extra courses, pursue a Master’s degree in their “free time.” There is no such thing as a 8 hour day in teaching and there is no such thing as a 9 month work year. These are fantasies perpetuated by people who’s only interest is in slashing the state budget by punishing state workers. I’ve never met a teacher who wasn’t worth every penny that they make–anecdotal, I know. In the case of STEM, the teachers typically leave within 4-5 years, because they can double or triple their wages, get way better benefits and retirement plans.

Anyway, I just had to echo Bluto’s comments.

Roger, it’s time to turn off FAUX news.

My family has benefitted a lot from Prop13. In 1975, my family inherited a house in Santa Monica, North of Montana Avenue. The house was valued at about $60K at that time, but the property taxes were around $4K. We even considered selling the house and moving elsewhere since we were living on 1 income household. Then Prop 13 rolled into town in 1978 and the property taxes rolled back to about $1,000 per year… [something along those lines]. Today, the house is still in the family, it is a tear-down valued at $2.5million and the property taxes have only risen to $1,900 per year!. Not sure if I will say Prop13 is fair or unfair. if Jerry’s kids (Sacto) move forward on collecting more taxes, they will eradicate Prop13 on commercial properties first. Insofar as SFH, Prop13 tax rates (for SFH) may see faster hikes in percentages but it wont be eradicated for a LONG time.

Prop 13 reminds me of the argument that Piketty makes that we are becoming more like a 19th century society around issues of inheritance. If that’s true, I wouldn’t expect Prop 13 to be rolled back anytime soon, sans a guillotine scenario.

People say the want the market to crash again.. what happens to people who do own. How do i react if my condo goes from being worth 200k to being worth 50k? or even less? not like the 150k i still owe on my morgage gos poof. it just means i am tramped an can never sell or leave.

What you do is this: buy more properties. Value all the properties you own as a whole and it essentially reduces your loss on the main one if the investment property values rise.

That’s one of the intangibles of owning.

“People say the want the market to crash again.. what happens to people who do own. ”

Hopefully they lose their shirts.

It’s the least they should get considering the repeated bailouts they’ve continually received are a direct result of cutting aid or directly taxing those who don’t.

What sort of question is that?!

Blargh: >Hopefully they lose their shirts. It’s the least they should get considering the repeated bailouts they’ve continually received are a direct result of cutting aid or directly taxing those who don’t.

______

Damn right. Bow Chicka Wow Wow.

“Hopefully they lose their shirts. It’s the least they should get considering the repeated bailouts they’ve continually received are a direct result of cutting aid or directly taxing those who don’t.”

So those who purchased responsibly and have not received any “bailout” should be punished? Because you haven’t reaped any benefit you wish for others to lose out. You make no argument of note and simply wish ill upon those who have made wise decisions.

If the housing market crashes, you can bet your ass that many homeowners will be looking to buy additional properties. Don’t believe the hype that all homeowners are tapped out and living paycheck to paycheck. I sure hope you Tank Harders are preparing yourself for when the next buying opportunity presents itself, you are going to have lots of competition.

Housing to tank hard in 2017. 🙂

That’s interesting, Lord Changemind, as that wasn’t your narrative before the last “tank.”

On the prop 13 issue, my wife and I also have benefited from it, as we never bounced from home to home, so after 30 years, our taxes are lower than our neighbors that bought in the last 10 years, but as a person that will be on a limited (retired income) in the next 10 years, to see prop 13 repealed for owner occupied homes, would be political suicide and really stupid for the voters to pass. I have no problem with my rental properties losing some of the prop 13 protection, as they are not O/O properties and income properties should pay more in, as they have increased rents over time. Just that change alone would make a huge increase in property tax revenue without throwing out the entire benefits of prop 13 for owner occupants.

I have never supported the current property tax system. If you have a couple of years of zero income and can’t pay the tax, then the city or county can enforce a tax lien, confiscate your property and sell it to collect the tax. The mere act of holding property should not be taxable.

I would much rather see property taxes replaced by a local income tax to pay for police, fire and schools. Seniors with low fixed incomes would pay less tax and not worry about losing their homes to the taxman.

That’s a good idea but what about locales with only old people on fixed incomes? What’s to keep people from gaming it? The benefit taxing authorities have with properties is that you can’t move the property and the transaction infrastructure is more difficult to defraud than sales or income.

I always looked at property tax the same way you do, it shouldn’t be taxed because then you never truly own it in a sense. Looking at it in terms of property ownership being one of the fundamental natural rights, that is life, liberty, and property, it makes sense.

But I’ve started to come around the idea of a a land value tax. The reason that I can see that a land tax makes sense is that much of that land value is created from the surrounding supporting infrastructure, great schools, etc. Much of that increase in land value isn’t a result of the property owner producing, it comes from the surrounding community. In that sense, without a land tax we encourage the speculation of people just squatting on property as it sucks up what otherwise could be productive capital, without producing anything on it (hence houses on million dollar properties that are tear downs).

Something I’m still grappling with.

Beware of the confirmational bias. You want lower prices, you want a correction so every stat is used to support your case. Many guard against this but I see many here that may be susceptible.

The charts DHB has been putting out shows the market oscillations damping. It seems to be quieting down. Remember we had this conversation in the 80’s after a hellatious runup and a nice dose of inflation. I suspect there are more than a couple people waiting for those prices to come back too.

Look hard and drive your best deal on what you can afford within your work geography and go for the long haul. Make it work without no down or IO ARM loans.

“Look hard and drive your best deal on what you can afford within your work geography and go for the long haul.”

People already know and observe this basic advice. The problem is that people increasingly can’t afford what’s within their work geography and the long haul is getting less practical to plan for in what’s becoming more of a mobility demanding job market.

You’re absolutely right. Somehow we muddle along and make do. I think a large correction, as exciting as it would be for the “have nots” and “have littles” would be so destructive that it’s hard to wish for this – no matter the opportunities. It seems to me the 2003 to 2007 bubble was caused by misguided government policy and banks all too willing to go along and rake in dough.

I look at other crazy expensive locales – think NY, SF, Hong Kong, Tokyo, London, Paris, etc. People are forced to make do and live in smaller places that are further out and less desireable.

I dont see any reason it can be different here.

“Somehow we muddle along and make do.”

“People are forced to make do and live in smaller places that are further out and less desireable.”

Making do includes abandoning the locale and contributing elsewhere. Not necessarily the best outcome for the locale and those with something to lose at stake.

“I think a large correction, as exciting as it would be for the “have nots†and “have littles†would be so destructive that it’s hard to wish for this – no matter the opportunities.”

Someone with little has little to lose from the so-called “destruction” because it disproportionately impacts those with more to lose. If over time, we are to gain more whom have little to lose, the few with more to lose will have even disproportionately more at stake and their concerns will increasingly be discounted. Better for those with something to lose to take their medicine earlier rather than later.

“I look at other crazy expensive locales – think NY, SF, Hong Kong, Tokyo, London, Paris,…”

“I dont see any reason it can be different here.”

That’s interesting because the common refrain is that it REALLY is different here. A commenter in one of the other threads made a case for how NY floor rents differ from LA and why. That commenter also had detailed points for differences in the London market relative to markets in the states. Seems to me that correlations between large metropolises across the globe only tell part of the story.

Totally agree A.

“so destructive that it’s hard to wish for this” = yet another call of the Vested Interests who are counting their House Price Hyperinflation wealth of “Be careful what you wish for”

And, “People are forced to make do and live in smaller places that are further out and less desirable” = make do with something in a dive of an area, blocking systematic renewal and blocking healthy capitalism in my opinion. From my position, the complacent “Be careful what you wish for” do not understand the extent of the unfairness – or they are deliberately blind and greedy to it all.

“I think a large correction, as exciting as it would be for the “have nots†and “have littles†would be so destructive that it’s hard to wish for this – no matter the opportunities. It seems to me the 2003 to 2007 bubble was caused by misguided government policy and banks all too willing to go along and rake in dough.”

It’s not hard not to wish for if you consider the long term consequences of keeping the ongoing asset bubble inflated, which is still government-sponsored. You’re passing on the burden of subsidizing the privileged few to future generations. As power and money continues to be heavily concentrated with the dwindling few at top, the middle class will gradually disappear. History shows that such circumstances are a recipe for social unrest and economic stagnation.

Howard Jarvis meant well, but the pundits were right, they predicted many years down the road prop 13 would become a major issue where repeal of the law could happen?

Don’t you all worry 3% down mortgages is what this housing slump in sales needs.

Now students with 30k debt can finally afford their home!

Forward comrade!

The Feds might just bail out all the millennials by simply forgiving all their student loan debts. Next they will hand out new mortgage loans like candy because they are entitled to it. Requirements will be lowered to 550 credit score with 1% down and it will be a 50 year loan to keep monthly payment affordable while keeping home prices propped up. The game has to keep going and we need players to play.

Carrington is already doing scores as low as 550.

RE: student loans – http://www.washingtonpost.com/news/get-there/wp/2014/11/19/wells-fargo-and-discover-to-offer-student-loan-modifications/

@KEn…You are very right KEn they the gov’t has to keep the game going, by all means they will think of so called creative ways to achieve this.

One thing is for sure, many locations in America either never came out of recession or on the brink, the gov’t has all hands on deck to ensure all looks good going forward, and do what banks have to do to make loans very attractive even though the risk is high,

Are we still talking about housing?

What else is there to talk about???!!!!…..

Everything is fine with the economy, growth every quarter, green shoots everywhere, it is Spring time!!!!….:-)))

Stock market is reaching new hights, the RINOs joined the democrats to makes things all rosy, what’s not to like????!!!!…..:-)

Don’t you love this economy and housing market?

It all boils down to the law of supply and demand, of course.

Re is still flying high, and stated loans are back.

Not much downside in sight, folks have loads of money I guess, I sure do see a lot of lambo’s too on the road.

Money is awash in some locations, we live in a affluent area but still you would think caution should abound it doesn’t here.

In our development 3 homes have at least 250k of upgrades being done. I asked a neighbor just last week did he think it was wise to invest major money in his home his reply ” it is all relevant Robert, if I don’t recoup the upgrades I don’t recoup, I will make it up elsewhere?”

I remember in 2007 or so that 17% of CA households could afford the median house price. I’m not sure how this compares to the current 30% from the Housing Affordability Index, but it seems we have a way to go yet before it tanks. The ninja loans, interest only and other gimmicks aren’t as prominent yet either. I take Zero Hedge articles with a big grain of salt but supposedly there are far more buyers than sellers of subprime debt. Higher prices/lower yields and more supply soon to follow?

63% are minority, e.g. Mexican. This is great. Come to Oxnard(the new Newport Beach) and get a bargain.

Comments to the effect of “someday you’ll want the benefits” assumes that we’ll all be able to buy a house. The Doc’s research suggests that 70% simply cannot do this. So what benefit is there to be had by the majority? Prop 13 represents unfair advantage for the upper end of the economic pyramid. Precisely the folks who typically don’t pay their fair share.

Feel free to call me a Commie. It’s the same argument the 1% quote. Someday you’ll be rich and you’ll want to get out of paying your fair share too. Climbing that high is a long shot.

More importantly, as others have pointed out, this lost tax revenue gets replaced by higher taxes in other forms, so the 70% are getting hit twice.

The whining comments are beyond tired. It’s simply pointing out unfair practices that benefit those who need it least. So bash away at the have-not’s all you want. This will get fixed. You may not like the means.

Just for reference, it’s not just the have-nots whining. I’ve lived in my house for 25 years and my property taxes are half those of new arrivals AND I think it’s totally unfair and would be happy to see Prop 13 go away. I’ve been in California long enough to see the changes resulting from 13 and they’re not for the better.

It is the westside wannabees that are whining. There is plenty of beach front housing in Oxnard, the new Newport coast for an affordable price. You get the view without the attitude.

California is in similar case as IL in its public financing, and, ultimately, doing things to raise more revenues, like repealing Prop 13, will not help. Furthermore, raising more taxes will only trigger more public spending, and, still worse, more public borrowing of larger amounts of money.

There is only one permanent corrective to the tax & spend death spiral, and that is to put spendthrift politicians, bureaucrats, and public employees on a cash diet. We in the most financially-challenged states all need to start thinking right now just what sacrifices in services and amenities we will accept in order to accomplish this, and we need to summon the political will to force our leaders to reduce spending steeply, and put permanent caps on future spending.

A lot of things will have to go. No more new highways in the middle of nowhere, no more school buildings designed by Starchitects and built at a cost of 3X per square foot that a more utilitarian building would cost, no more automatic raises for public employees. We need referendums to put caps on politician’s salaries, which is going to be tough because now they can vote themselves raises, leading the way to raises for everyone.

We need most of all to thoroughly rejigger public retirement programs. As matters stand at the moment, most public employees vest after only 20 years or even less, and can retire at 50. It would make a massive difference if the minimum retirement age, barring disability, were 60 and employees were required to contribute a larger share to the fund. It is also suggested that defined benefit plans be ended and replaced with defined contribution plans.

However, this all would take a lot of will and a lot of WORK on the part of citizens, in petition gathering, meetings, and all the other work you must do to make substantive changes in public policy when you are a nobody.

“California is in similar case as IL in its public financing, and, ultimately, doing things to raise more revenues, like repealing Prop 13, will not help. Furthermore, raising more taxes will only trigger more public spending, and, still worse, more public borrowing of larger amounts of money.”

The similarities stop at this – home prices correlate to incomes far more in the Chicago area than they do in LA/SF/SD. So you have two states with similar budget issues but the one without an artificial property tax governor has more reasonable home prices. That’s not to say that the property tax issue is the only reason for the disparity but it bears noting in the context of identifying correlations.

Austerity does not work. It was tried in the U.K. and other Euro nations and it failed. Spending cuts reduces money and demand in the economy, decreasing taxable income, resulting in larger government deficits.

See http://ideas.time.com/2013/04/18/why-austerity-is-a-dangerous-idea/

>Austerity suggests that you can have your cake and eat it too

_____

What a lot of nonsense. UK hasn’t had austerity for decades. We’re running £100 Billion+ annual + the wealth of older vested interests in property/stocks has only widened the divide.

They’ve got the cake and so have those who bid prices up with debt. They want to sell us crumbs at excessively high prices. (Those who control the supply, control the demand).

Austerity then fresh lending on lower asset values, so new market entrants can get a share/position.

Fact of the matter is VI want the cake, want to eat it too, and then want productive workers savings towards buying a slice of a future cake… year after year, decade after decade.

Let’s just ahead and get this out of the way…

NAR: Existing-Home Sales Rise in October, First Year-Over-Year Increase since October 2013

*******Existing-home sales in the West declined 5.0 percent to an annual rate of 1.14 million in October, and remain 3.4 percent below a year ago. The median price in the West was $296,800, which is 5.0 percent above October 2013.

I’m all for ending Prop 13 for commercial and rental property. It makes no sense. As well as ending the mortgage tax deduction on non owner-occupied 2nd homes and income property. But prop 13 should remain in some form for owner occupied homes. The RE market in S. Cali is too volatile to reassess values every year. Due to the bounces in value too many people could be forced out of their homes. On the other side, Prop 13 keeps many neighborhoods of LA ghetto. People remain in homes they can not afford or maintain and therefore live in poorly maintained properties instead of selling to new homeowners or investors who will gentrify and improve the neighborhood. Maybe there should be some kind of minimum floor or base for Prop 13? It is ridiculous for someone to pay thousands less in property taxes, but still expect the same public services as their neighbors that pay thousands more. This might also motivate some entrenched homeowners to sell and thus establish a healthier RE market.

If we end Prop 13, LA will no longer be able to use property owners as the piggy bank when they need money for all kinds of BS like Ipads for inner city kids and other special assessment taxes. Why should property owners pay for education, don’t renters send their kids to school as well?

Exactly. As I posted above, financing education is another reason I oppose all property taxes. The solution is to eliminate property taxes and replace them with a local income or consumption tax. Everyone, homeowners and renters, would help pay for K thru 12. And retirees on low fixed incomes will never face a tax hike based on home valuation, which was the purpose of Prop 13 to begin with.

A great idea in theory but in practice it would be seriously disruptive. The thing about property tax is that you can’t hide or move the property in order to avoid the tax while reaping a benefit.

@A — True, you can’t hide property but you can hide the ownership. There’s a huge loophole in Prop 13 that corporate LLC’s have been exploiting to avoid reassessment of property values when the property is sold.

“However, the change of ownership of an LLC … does not constitute a change of ownership of the real estate owned by the entity, unless a single individual or entity acquires more than 50% of the membership interest in the LLC. Thus, an entity vested in title to real estate may strategically divide the sale of its membership interests to successfully transfer ownership of a property for all purposes, except the vesting, outside of the porous radar of Prop 13. To the benefit of buyers of property vested in corporations, LLCs and partnerships, this strategic maneuvering deprives communities of millions in tax revenue.”

To residents of the U.S., California seems out-of-sight. To a foreign business person from China or other international destination, California real estate is still a deal … today’s news stat that $1 million plus home sales are up 15%, is testament to monied buyers driving the real estate landscape there. Everyone else is just hanging on! Can’t imagine this will end well for most. Add to that the almost daily news .. today the Regents approved a 5%/ year increase in each of the next 5 years for tuition at the University of California system, an earlier LA Times article that LA needed over a $1 billion to fix streets, and another LA Times article about the age of water mains, and the list goes on and on. Add all that unfunded liability to the already unaffordable housing and high cost of living … it would seem that a perfect storm is brewing somewhere out over the ocean there!

Prop 13, and other Vested Interest subsidies, creates and builds up a force of negative economic feedback – in my opinion.

Including with the winners telling productive younger workers to, “Be careful what you wish for” (re wanting lower house prices in low/mid/high prime areas) – and -“‘Go and live in a dive somewhere there is no economic opportunity whilst we kick back and count our house prices and ponzi specuvestors propping it up forever more.”

Cyprus study below, tiny Cyprus… but in my view we’re experience similar, in prime parts of the world (swathes of California + London etc). We’ve got Wall St Hedge Fun money buying at high prices (pulling back now) – to residents who are living in Singapore in Local Gov subsidised housing specuvesting to buy in California and London at super high prices. Just have to wait for the music to stop.

_____

Lessons from Cyprus economic crash

Sunday 2nd November 2014

COUNTRIES can learn lessons from Cyprus’ economic crash and subsequent bailout package in terms of preventing future financial crises, according to a report from Imperial College London last Friday.

[..] {Cyprus} In the lead up to the crash, the Government had also introduced financially unsustainable policies that contributed to the crisis. For example, from 2008 the Government increased social security spending on a range of initiatives such as non-means-tested housing subsidies, which were aimed at helping the elderly on lower incomes cope with rising costs, but also had the unintended consequence of helping those who were better off. Over a period of four years, the debt to GDP ratio rose from 48 per cent to 78 per cent. This caused an unsustainable increase in government deficits in a short period of time.

[..] Demand for real estate from domestic and international buyers from countries such as the UK and Russia rapidly grew, leading to increases in house prices, following the country’s entry in the EU in 2004. {continues}

[..] The researchers say that the housing boom and bust cycle experienced by Cyprus should be a cause for concern in countries such as the UK, where house prices are currently increasing, due to demand from foreign investors. According to the estate agent Savills, £7 billion of international money was spent on premium London homes in 2013, with just 20 per cent of that spent by UK citizens. Two thirds of the properties bought by international buyers were as investments.

[..]LESSONS TO BE LEARNT

Michaelides believes that there are a number of lessons that governments all over the world can take away from Cyprus’s economic crash, both in terms of preventing future crashes and managing them appropriately if they do occur.

“In order to prevent crises of this magnitude standard macroeconomic policy advice applies: keep government deficits under control; ensure strong corporate governance in large banking sectors; beware of volatile capital flows such as large deposits being paid into bank accounts and then being quickly removed, and of rapid increases in house prices,†he said.

http://www.news.cyprus-property-buyers.com/2014/11/02/lessons-cyprus-economic-crash/id=0040745

http://www.cityam.com/1415191528/rising-london-house-prices-what-capital-can-learn-about-mortgages-cypruss-2013-economic

“Including with the winners telling productive younger workers to, “Be careful what you wish for†(re wanting lower house prices in low/mid/high prime areas) – and -“‘Go and live in a dive somewhere there is no economic opportunity whilst we kick back and count our house prices and ponzi specuvestors propping it up forever more.â€

Brain, I think you really get down to the real motivation. Those who placed their bets on housing will say anything to justify preservation of the current status quo. How easy it is for entrenched interests to tell others that they should just buck up and accept sub-optimal results. What they don’t admit out loud is how they are the ones best served by this scenario. They are worried, and they should be, because no party lasts forever. They are being foolhardy to their own detriment. They want to kick the can on the instability that these situations cause which leads to worse outcomes later.

As you say, A, no party last forever…. yet so much financial repression and intervention to protect vested-interests.

I’m currently rewatching the old 1960s ‘The Fugitive’ series (love that show… last episode I watched had him in desperate situation in Sherman Oaks) – law/order/prosperity/work hard-and-save-to-reward ethic… the cars, the cut and style of women’s clothes…. of course some hardship but opportunity always there, into long wave (with some set backs along the way) time of prosperity.

______

The Peter Pan Generation And America’s Giant Savings Deficit

by Jim Quinn • November 20, 2014

…I don’t blame those in their 20’s and 30’s for not having retirement savings. Anyone who entered the workforce around the year 2000 has good reason to not trust the system or their elders. There have been two stock market collapses and every asset class is now extremely overvalued due to the criminal machinations of the Federal Reserve. There are far less good paying jobs. Real wages keep declining. They were convinced by their elders to load up on student loan debt, leaving them as debt serfs. The Wall Street/Federal Reserve scheme to boost home prices and repair their insolvent balance sheets has successfully kept young people from ever being able to afford a home.

http://davidstockmanscontracorner.com/the-peter-pan-generation-and-americas-giant-savings-deficit/

It’s only a deal to them until they find out the substantial amount of property taxes they have to pay annually on their purchase. Trust me, I’m one of those foreign buyers. I regret very much about buying… It’s not as a good deal as I was made to believe it as. The annual property taxes, HOAs and their crappy quality of construction materials, the age of the home and everything else, made home buying really a scam to scam Chinese people who had no idea about property tax, because this is like a few hundred bucks in China, and it’s also extremely low in Hong Kong and Singapore… Anyway, most foreigners, once they are informed of this, they told me they didn’t want to buy, and they are my friends and family who are in China and Hong Kong.

If you didn’t know about property taxes before you bought… well then… you’re stupid.

Sorry to say.

I know a number of people in affluent areas of South Pasadena and Pasadena who can no longer afford to live in the condos they bought due to rising HOA fees and assessments.

@Gracie I find your story interesting. I’ve wondered about scams relating to Chinese purchasing in California.