All cash buyers slowly pulling back in California real estate: What happens when one third of your buyers begin moving cash elsewhere?

The cash buying and investor segment of the market has been the major catalyst for the current run in real estate. Record low inventory coupled by low rates brought on one of the best year-over-year returns for real estate. The investor crowd can easily pullback as quickly as it dove in head first. We are already seeing some signs that investment buying is starting to slow. In real estate, things historically turn very slowly. The reason for this is because real estate is not a very liquid investment. However, we’ve never had this much hot money in the market. Inventory had been on a steady rise starting early in the year but recently, it appears that inventory is creeping back into its cave. In California those with golden real estate handcuffs are pulling back for possibly better days in 2014. What is surprising is that rentals and homes for sale both have seen decreases in inventory. Cash sales were up by 3 times the normal volume from 2001 and nearly twice the historical average going back to 1998. This average is skewed because it starts around the time of the massive real estate mania. So what happens when the cash crowd starts pulling back?

The volume of cash buying

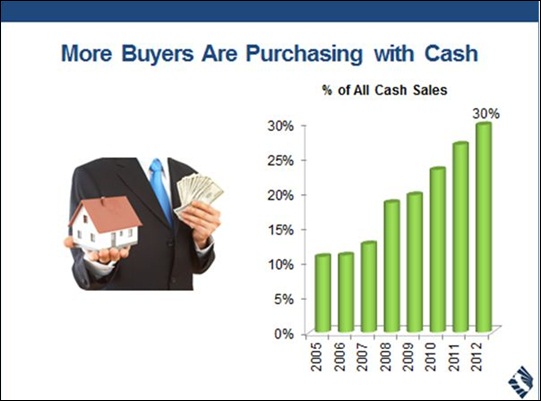

In economics you usually look at historical precedents and try to forecast the future as best as you can. Yet we have never had a situation where investor buying has been so big. Take a look at the volume of cash buying in California:

In 2001 8.8 percent of all sales went to cash buyers. In 2012 it was 30 percent. This is not a normal market. This is a giant market with big speculation. There are multiple cross currents. Some think that baby boomers will somehow retire and start selling in droves. We’ve argued that in California many will be treating their grandfathered in homes under Prop 13 like granite plated sarcophaguses. These people are not going anywhere. Many couldn’t afford their home today if they had to purchase it based on their earned income. In fact, part of the pullback in inventory has come from this crowd. Many are seeing that they had to cut prices to move properties and would rather pull inventory off the market. Maybe in 2014 they will hit the real estate lottery. This is one line of thought but where will they move? My thought is that inventory will remain tight into next year. Foreclosures are now a tiny piece of the sales market, making up only 6 percent of all sales (versus 56 percent in February of 2009).

Cash buying is slowing

Both sales volume and cash buying is pulling back. Take a look at this:

Cash buying volume (Southern California)

February 2013:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 36.9 percent (peak all-time)

September 2013:Â Â Â Â Â Â Â Â Â Â Â Â 28.5 percent

October 2013:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 27.5 percent

Sales:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Down 4.4 percent year-over-year

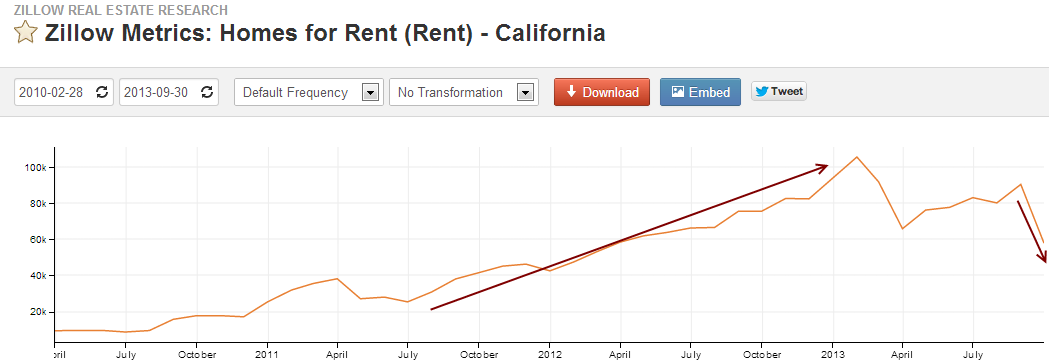

Something is changing here. The hot market of seeing prices going up 30 percent year-over-year was simply unsustainable. But how much of the rise in prices came from speculators and flippers simply hoping to sell into momentum of a tight market? It was interesting to hear that many were saying that these people were buying these homes to rent out yet the single family rental volume has virtually disappeared meaning these homes aren’t being put on the market as rentals:

Source:Â Quandl, Zillow

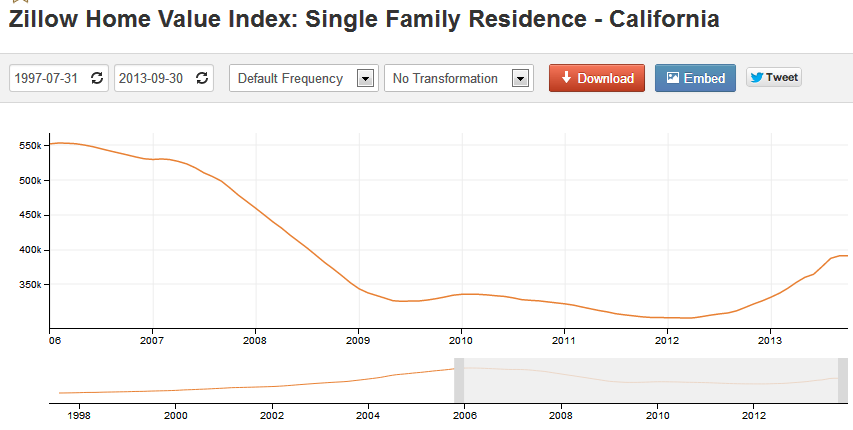

A shift occurred earlier in the year as well. It was clear that from 2009 to early 2013 more rental units were being put on the market but that has changed dramatically recently. Some investors are likely planning to exit the game taking profits off the table. The returns are fairly weak in rents for California properties. Keep in mind that we’ve been in a strong move up since the bottom:

The bottom hit in 2011 and 2012. Since then, prices have rebounded strongly over the last year. Investors are the most fickle group of them all. It’ll be interesting to see what happens as those year-over-year gains start declining and sales fall (headlines will be filled with this just like headlines have been filled over the last year about the raging market). If anyone thinks that psychology isn’t a part of housing is out to lunch. The real estate market especially in California is driven by mania, euphoria, and bust. Those arguing we are going to see calm rational behavior after this run are simply ignoring the last couple of decades of history.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

121 Responses to “All cash buyers slowly pulling back in California real estate: What happens when one third of your buyers begin moving cash elsewhere?”

What percentage of the total housing market is owned by investors? Compared to the stock market in 2013, housing looks like the worse investment. You’d think the money follows the trend (Wall Street), so that would create inventory as investors rotate back to conventional investments. I just wonder how investors react to a fall in property values, in theory. Do they try to “stick it out” until a recovery or cut prices in order to move an illiquid investment. If the Chinese aren’t on the other side to buy, how strong is demand?

The home ownership rate for California was 54.5% in 2012, so 45.5% of the housing stock was owned by investors. Investors owned a majority of the housing stock in LA county. Investors are always a big part of the California market.

I agree that RE out here is a bad “investment”. Right now, you’d be paying the price for a nicer place to live and good schools. I recently just sold my house and moving in with the inlaws until we find a new place. Not sure if I should wait a year or not.. we have our names down over at the Great Park. Housing seems quite inflated but I have noticed that homes aren’t selling at a fast pace they were earlier this year. Hmmm.. decisions decisions.

Cash buyers will be back when California RE prices start dropping again. After the Dodd-Frank Qualified Mortgage provision kicks in on 1/10/14, there will be fewer potential home buyers able to qualify for home loans. Dodd-Frank will also make it difficult for sellers to offer owner-carry mortgages, and, of course, for buyers who need HELOCs in order to close on a home. Home sale numbers will drop, so house prices will drop, too. Also, there are more people moving out of California than there are people moving in.

Agreed. Also what smart investor would invest in something that has a smaller pooo of potential buyers? Who wants to be stuck with that? Lower prices or not I don’t think the new Dodd Frank provisions will spur on investors since at some point they would need to sell to get their cash out. The dumb money little retail investor will be burned. As usual.

While I agree with most of your points, you are factually incorrect on your population guestimate. California continues to gain population, however at a much lower rate than recent history. http://blogs.sacbee.com/capitolalertlatest/2013/05/california-population-growth-remains-low.html – however, it should be noted that our population is no longer domestic in flow but is births and foreign immigration.

True. According to http://www.howmoneywalks.com, California domestic:

Wealth Migration 1992-2010

Lost $45.27 billion in annual AGI*

Gained Wealth From:

$3.16 billion New York

$2.24 billion Illinois

$1.93 billion New Jersey

$1.41 billion Massachusetts

$1.19 billion Michigan

Lost Wealth To:

$9.59 billion Nevada

$7.96 billion Arizona

$6.08 billion Oregon

$6.02 billion Texas

$5.33 billion Washington

Population Migration 1985-2010

Lost 566,682 people

Gained Population From:

51,904 New York

35,452 Massachusetts

30,150 New Jersey

29,144 Illinois

25,521 Michigan

Lost Population To:

202,848 Nevada

171,575 Arizona

136,055 Texas

135,353 Oregon

113,150 Washington

*AGI – adjusted gross income as defined by the IRS. For most people AGI is the starting point in calculating their taxable income. AGI gained (lost) since loading this page is calculated based on the average rate of AGI gain (loss) between 1992 and 2010.

For the last 6-8 weeks this was a growing complaint from agents, that the cash rich investor was leaving and looking at Florida.

Orange County CA.

March of 2013, 2/3 rd of the buyers Median to Median were already priced out of the market and then rates rose.

In fact you can add California to the list because after rates rose 2/3 rd of the state can’t buy a home median income to median prices

A reason why mortgage purchase applications took a dive from 14% positive YOY to now down -5% on the 4 week moving average

http://loganmohtashami.com/2013/10/24/mortgage-purchase-applications-falling-slope/

I need cash buyers in California area for the Saint Louis, Mo. area. Are you one? If not can you refer me to some I have a few properties on my hands that I need to liquidate.

There is an upper limit on real estate returns as there is an affordability ceiling

There is no such limit on stocks so money will continue to flow there as long as debasement continues.

Dollars and other currencies are also chasing bitcoin higher- dollars flowing from one bubble to the next. http://smaulgld.com/the-case-against-bitcoin-a-faith-basedemotion-backed-currency/

Could this be the tipping point now that the hot money is going elsewhere? We still haven’t seen what should have been a full correction from 2007. Just more government tricks to keep the party going. Don’t be too surprised if you see the market drop faster than it went up. California boom and bust is now worse than Las Vegas. It is not a real housing market anymore, just pure speculation.

http://www.westsideremeltdown.blogspot.com

You are right on

Agreed that a full correction to long term trend was not realized in SoCal. It was in some other parts of the country. It would be one thing to play for arbitrage in the recent SoCal RE market, but quite another to compete with the specuvesters on a home as a working class individual.

It’s a rainy and cold day here today, even at the beach. It’s funny how these types of days aren’t the ones you ever hear or read about in the popular spin regarding life in L.A.

Joe, those cold rainy days at the beach are nice because they are rare here. Lighting the fireplace, having some drinks and listening to the rain is not a bad thing every once in a while.

Weekend should be nice and sunny in the mid 70s. Monday will be close to 80s at the beach…not bad for December 2! The California Dream is just too strong for many of the kids from the Midwest or Northeast to resist.

Overcrowded beaches and a long commute… Soooo dreamy!

Emphasis on “kids.” Once they have their own and try to settle down and realized how distorted the California economy is, they’ll most likely head elsewhere.

KR, the people who can’t make it here and wash out will be replaced by another eager crop of transplants. The door never stops revolving.

Investors are slowing down simply because buyers are wising up…the ubiquitous “granite and stainless upgrade” flips of early 2013 are now sitting stagnant on the market because many potential buyers are recognizing the bubble this time around. Those who don’t recognize it will be eaten up…just like in the last frenzy.

It was the 100 basis point increase in mortgage rates that slammed the brakes on the housing bubble.

Many “all cash” buyers refinance into regular mortgages. So “all cash” buyers are sensitive to changes in interest rates as well.

What about the Chinese all cash buyers parking their money in real estate?

They will be eaten up and spit out like rotten egg foo young. They should have learned a lesson from Japan about rotten real estate, obviously they learned nothing and will receive huge punishment as their “investments” slide down the drain.

Political corruption back home drives such purchases.

Meaning that economic returns are hardly important to them.

Unlike the Japanese of years ago, this is TRUE flight capital. It’s NOT opportunistic at all.

It’s looking for a ‘hide’ for its owners — who’ve managed to get their winnings out of Red China — in spite of intense capital controls.

Such capital controls did not, do not, exist for Japanese buyers.

A true apples and pears comparison, then.

They are driving big market segments in CA, like Irvine and the 56 corridor in San Diego. Money from China, ill-gotten or not, has been flowing into what they consider a safe-haven – SoCal RE. Lots of benefits to this move – get some money out of the Chinese govt’s reach, diversify, bragging rights of owning US RE, access to excellent public schools.

So Americans want cheap prices, buy Chinese made junk, money flows into China, Chinese get rich, also China prints money, also Chinese corruption dwarfs that of Wall St, lining the pockets of govt officials and anyone with insider access, and with all this money now the Chinese turn around and buy up US Pacific Rim RE from Vancouver to SD, creating ethnoburbs, essentially colonizing parts of CA.

Problem is there are 1.3 billion Chinese so even if you consider only the top 5% you are talking about 65 million people. Sorry to say lots of legs left in Chinese buying. If things get better in China that means they are making more $$ to re-direct into CA RE. If things get worse in China the fear-factor rises and they accelerate getting their money out of the country and into safe-havens. Either way the purchase of US RE continues. Sorry.

Falconator-multipling 5% times 1.3 billion is easy. How you then assume that those people want or can afford not just real estate, but cali real estate or pacific rim real estate, is another story. Do you even know what the average annual wage is in china? Its garbage. Do you know what the top 5% even make a year there? Or do you just assume the top 5% everywhere has money? Can the top 5% of americans can barely afford the neighb

Sorry-iphone issue. I was saying that in the US only about 7% of people n 17% of households make over 100k a year. The areas the chinese are buying are very expensive spots. I seriously doubt anywhere even close to 5% could afford those types of homes, especially because the chinese person would be purchasing their second home far from their first home. Also, many here seems to think the chinese want the US/cali real estate. Read a little more and you’ll see many actually are trying to go to singapore and then many others are trying to get into europe as many countries (portugal, greece, etc) are offering visas or pathways to citizenships like the US is. I couldnt tell you how many chinese will buy in the future in cali, but there are stats for 2012, etc that even the good doctor mentioned in previous articles with real numbers. I think we would all be better served to stick to hard facts and not rhetoric or false extrapolations of data.

http://www.chinagaze.com/2013/08/18/hurun-wealth-report-2013-on-chinese-millionaires-released/

So in 2012, china had a whopping total of about 105,000 millionaires (defined as a million pounds or US1.65mil dollars. Youd think youd have to be a millionaire or close thereto if you are buying a second home in a country thousands of miles away for $600k-millions. 105,000 is a tad less than 65 million people.

I suck n so does adding comments with an iphone. Meant 1.05 million millionaires total

And if China successfully rebalances and continues to liberalize their economy?

If the PBOC has been stating honest intentions regarding policies that help set the stage to allow RMB to appreciate against the dollar, it could make those USD denominated assets look a lot less appealing to hold on to.

Would you still be sorry?

Do you really know what Chinese nationals are really thinking? I don’t.

http://www.bloomberg.com/news/2013-11-20/pboc-says-no-longer-in-china-s-favor-to-boost-record-reserves.html

The players are sure to be in the top 1% not 5%.

However, for such buyers, purchase money is virtually unlimited versus upper middle class Californians.

This is ONE WAY money that has defied capital controls and will NOT back off. Even a drop of 70% would not EVER cause a Red Chinese citizen to sell off.

In other notable markets, no-one has ever seen Red Chinese/ Hong Kong’ers exit the market, — or even slow down.

The money creation within Red China is totally off the hook. It’s MANY times the money creation seen in the West. Only a trickle of said monies are able to jump the capital controls and make purchases in California.

I suspect that ONE of the mechanisms used is the gold trade. It’s possible to buy serious quantities of gold in Hong Kong at good rates. Then it’s not much trouble to scoot to Australia/ Canada/ other and cash in the gold. As long as the value is down around $1,000,000 it’s luggable.

Think Macao. The amount of cash sloshing around that colony is astounding. Even North Korea launders its counterfeits there!

My theory is that they’ll go the way of the Japanese investor from the 80s.

No, it’s a different impulse.

To make such purchases, ANY Red Chinese citizen has to violate CAPITAL CONTROL laws.

This is ONE WAY MONEY. Period, stop.

Good point. I just wonder if $500k invested in an Irvine condo is where they will want to keep their money, long term.

Yep. There is still all those Chinese cash buyers lining up in Irvine and Beijing expos to purchase CA real estate. Spend 500,000 and get citizenship. Hide money from your govt too. Incentives are still here for overseas money, even at inflated prices.

By eliminating all tax deductions for investors that invest in single unit homes we can eliminate the boom bust cycles in single family homes. http://www.keepourhomesusa.wordpress.com

I have been reading this awesome blog over 2 years now and this is my first comment here. ( English is my 2nd language)

I live in FL and bought a single family home in mid 2009 for $160k (thanks to the first time home buyer’s tax credit of $8k back in the day it convinced me to act quick) However prices went down another $20k to $30k in my neighborhood till 2012.

Most of my neighbors paid close to $300k if not more than $300k for same house as I live right now.

My next door neighbor paid over $300k for his house in 2005 and left his home shortly after I bought mine. He probably couldn’t sleep after hearing what I paid for my house so he packed up one day and left to rent out another place to live. I think that is another stupid move?.

His house and many other houses in my neighborhood has been empty since 2008. ( I heard last month in a meeting that HOA sold and rented a few of them before banks can take it)

Anyways, those empty ( shadow inventory) houses has No sale sign, over grown backyard, bee nest and wasps all over the house.

I am hearing that Banks can delay foreclose process up to 10 years, it is funny cos I am actually witnessing it. People are complaining that inventory is low.. no sh.. inventory is low because banks are making it look that way.

I could sell my house for around $200k and buy a bigger home to live for a long time but I wont! I have equity in my house but after paying Realtor & other fees there is no cash left …that’s why many homeowners are not selling their current homes yet.

I checked out a few houses last month, and I have seen prices jumped over %25 for new build homes in my neighborhood. (I live in West Palm beach, FL). New home builders are asking %25 more than what were selling for over a year ago. I hear&read from main media that it is time to buy again, rates are down, low inventory, prices going up full off bs bs bs

I am not going to pay over %30 mark up. This is not sustainable at all. I see a lot of cash buyers snatching up places and lots of baby boomers selling their houses up north then only to pay full if not over asking price down here.I think RE prices will go up till 2020 then bubble will burst once again.

I will be ready to sell my home as soon as I see $300k in front of sale price. I will be waiting on the sideline with cash in my pocket to buy low again.

I moved from San Diego to Naples, Fla and had to settle with a 15% loss on the former property. But my new house, $725k, had comps of $1.1 mil at the time of the bubble. My point is that for your own life, you sometimes just have to realize the loss and move on. The loss is still there; you just have yet to realize it (financially, not intellectually.).

Considering what the crooks in CONgress and the Federal Reserve are doing to the dollar, along with China’s recent announcement concerning the dollar, a person would have to be mentally retarded to put their money into ANY long-term investments involving US dollars. And anybody who buys into this latest real estate bubble will deserve whatever happens to them, just like the suckers who jumped into the last one. At least, it looks like SOME of the sheeple are wising up. Maybe there’s still a tiny ray of hope. I’m not counting my chickens, however.

You’re uncomprehending: buying California real estate establishes SHORTS against the dollar.

If you believe the US Dollar is going to be trashed — then you WANT real estate — the PHYSICAL instead of financial assets.

Think it through.

Further, you get to mortgage your real estate — which is a SHORT against the dollar.

Real estate is MOST appealing to those who want to be short the dollar… which includes America’s hedge funds. That’s their play. They’re not interested in collecting rents.

The equity markets are rising because the debts on the corporate balance sheets are being DEBASED. Said debasement does not impair the assets. The net result is that everyone and his brother is piling in to the stock market.

The fool is anyone holding onto straight cash or debt securities. Both get absolutely trashed during massive money printing.

c.f. Weimar Germany, Argentina, Russia, et. al.

This is spot on, Bert.

Funny how folks usually talk about the hedge funds’ inability to manage rentals. ” they are nor interested in collecting rents”.

Blert-you really seem to have all the answers and are very confident in you abilities to tell us the motivations behind every hedge fund and every rich Chinese person. Its funny bc I thought hedge funds might have different reasons for purchasing certain assets and I also swore they had to consistently make money or they would likely lose clients who are paying them very high fees. Is buying real estate only to short the dollar enough of a return for a hedge fund, understanding a hedge funds business model and their competition including other funds, someone just purchasing an index fund, etc? That sounds more like capital preservation, not capital appreciation. Don’t many funds bounce from asset class to asset class in order to keep producing above market returns? You think funds that lose money in rents will stick around in housing if there are more favorable places to invest, regardless of what is happening to the dollar? What happens if the currency war stops/slows down and the dollar actually goes up in value? What happens if housing goes even flat PLUS rent returns are not as expected? Your analysis makes so many assumptions about the future that it becomes ridiculous. Last time I checked, things change all the time, often on a dime. Glad to see you have the next few years/decade mapped out, when billionaire investors admit they don’t. Glad to see you are 100% positive that we are Japan and will never ever end QE (the reason the dollar is down). Also, hedge funds aren’t always so smart. In fact, they are pretty stupid so far this year…

http://blogs.wsj.com/moneybeat/2013/08/21/hedge-funds-severely-underperforming-this-year/

All I know is that I don’t know the future, nor the motivations of every person. What you write is opinion, not fact; don’t forget it.

Lastly please provide some stats that the top 1% of Chinese are wealthy enough to purchase real estate in prime areas around the world. You realize the top 1% in the US make under $400k a year, right?

My apologies for all the comments this weekend; I’m with family since thanksgiving. ;). Also, I’m growing weary of all these comments with zero support other than the cockiness of the author that he knows better because he says so.

FTB … as a retired former broker let me clue you in:

Hedge funds think in packs far more than you might believe.

Further, not all hedge funds are of equal weight.

The result is massive group think — and momentum following.

As for my life long track record… it’s not worth announcing… you’d never believe it.

It’s pretty solid, though.

In today’s markets there is only one massively accepted truth: the Fedsury is printing money like mad — and the historical results from such antics are of one direction only.

ALL of the biggest recent super-killings have been made by working trades that swing on government policy/ folly.

True enough, there will always be contrary opinions — it’s just that the outliers just can’t raise the money — (sell their concept to the boobs) — like the biggest boys. This is why group think and pack behavior is so much the norm in all financial history.

It is all about supply and demand. The population in So Cal continues to grow. And, not many new homes have been built for quite some time. And, not many new homes are planned in the near term. So you have increased demand for housing with a decreased housing supply. Econ 101 says you get a price jump. And that is what happened. The all cash part of the story is not what is important. And, prices will continue to rise until either the So Cal population drops, and that is not in the cards, or a large number of new homes is added … and that is also not in the cards. So, renters, the dumb thing to do is wait for prices to come down. They are not.

How’s the sand down there?

“It is all about supply and demand. ”

Well, not ALL of it. If the world were as black and white as Econ 101 as applied to residential home sales, then all the low-income immigrants from Latin America would have long ago spiked real estate values everywhere they have settled, including in such places like San Bernardino, Riverside, and the Central Valley. But there’s no housing boom going on in those places. So your model doesn’t work there.

Believe it or not, the So Cal population is relatively flat. One year in the past decade was actually negative in terms of growth. Another interesting statistic is that U.S.-born Californians are net emigrating while foreign-born Californians are net immigrating, primarily from China and Central America. Take from that what you will.

Actually, the real story is that zoning regulations mean that it’s IMPOSSIBLE to increase residential density in most areas of So Cal — especially the hot markets.

This legal quagmire is not likely to be unwound for at least a generation. Too many are making cake as a result of such artificial scarcity.

For those living in other markets, it’s impossible to comprehend what these restrictions are doing to prospective construction. Simply put, ‘greenfield’ construction is no longer possible. One HAS to pay up to rehab/ tear down if you want to have a nice home in a nice area.

Check out Santa Monica.

Not true. I didn’t live in SM, but close enough near Century City. During the time I lived in that part of LA, a lot of small 4-5 unit apartment complexes were torn down to make room for 20+ unit condos. Santa Monica used to be almost 100% SFR’s, but over the years, many of those small houses were torn down to make room for condo buildings.

Inventory did increase by quite a bit in LA over the last 10 years. Does anyone else remember how downtown was a no-man’s-land? How many condos have been built? 1000’s or tens of 1000’s? How many new homes built out in Calabasas or Santa Clarita or OC? How much of the population growth of SoCal took place in areas like Riverside or Claremont and not central LA?

You’re looking at grandfathered zoning.

The California Coastal Commission has put the kibosh on new, higher densities up and down the coast — and most elites want to live within that restricted zone.

Not surprisingly, this is the belt with the highest price appreciation.

Anyone thinking about California real estate should Google around about this restricting body — which is over run with Greens. They’re forced to live with pre-existing permissions — yet are trying to terminate the higher densities whenever possible.

Marin County is another classic example of legislated scarcity. Even George Lucas has had to fight city hall. Because of insider knowledge, I’ve heard NO END of astounding tales about development obstruction there. In these cases city hall is typically fighting multi-millionaires — and high powered attorneys. These fights do not make the paper, the Independent Journal. (Hey, I used to deliver that rag!)

You know I often wonder if someday we will look back on all of this and find that we were no different than our ancestors believing that rain was the Gods crying and thunder was the sound of angry Gods. To assume that market supply and demand or any other antiquated hocus pocus has anything to do with our perception of the housing “market†is no different than believing that Santa Clause brings gifts that elves made up in the North Pole. I hate to break it to you but Santa is really your dad dressed up in a silly looking costume. The government/banks are the market. So, if you tell me supply is the banks and demand is the government than ok but anything else is just a bunch of silly superstition. Chinese, cash, mortgage, interest, investment, etc. are just parts of the giant myth we call the housing market…

“We’ve argued that in California many will be treating their grandfathered in homes under Prop 13 like granite plated sarcophaguses.”

I LOVE that statement. Thanks Dr B.!!

Some of the saddest cases I know are people who sold out here and moved to “cheaper” areas hoping to live better. Unless they had a great job lined up at the other end (like my Brother who moved from more expensive Oregon to less expensive Fargo, ND and a job with one of America’s oldest and best known corporations) I have seen that they often wish they could come back but can’t, or do come back but to rentals in the less fancy parts of the I.E. It’s amazing how fast cash can slip through your fingers when you don’t have steady income to support your lifestyle, and with financial repression in full bloom, forget about living off the interest on the difference between the sale of your modest tract house in Socal and your house in that “charming” prairie town!

On the contrary, I know quite a few people who sold their CA house, paid cash for a house in a lower cost of living state, freeing up $ for other investments, travel, time to spend with loved ones, etc. Best decision they ever made. Of course everyone is different.

Like you, I do know some unhappy folks that relocated; what sets them apart is that they seem to have a “California Forever” mindset. They don’t embrace the place/customs/food they relocate to; they live in the past, comparing everything to California. They enjoy telling locals how great California is, how the place they relocated to should be more like California, Disneyland and the Beach, frequently name dropping a celebrity they went to high school with or have met, etc. They secretly believe Californians are better looking, smarter, etc. Then they wonder why locals, coworkers in their new state are “unfriendly”, “backward”. Not like open minded, accepting, friendly Californians! California is like an ex girlfriend they just can’t quit. She was beautiful, but she emptied their wallet, she was unfaithful, sometimes abusive, but they can’t move on, they forget why the relationship soured in the first place, in hindsight she’ll always be Perfect.

My experience is that it is against your best interests to tell people that you are from California. Our reputation precedes us.

I moved to Florida in 2012 and just went back to Torrance/Redondo for the first time since then. There is no way in the world that I would move back.

Joe R – I can validate your statement about leaving the costly for the cheap (but ‘charming’). I sold a Bay Area house in ’05 for a substantial gain after ten years of ownership, and moved to Northern CO on the edge of the plains. Unable to find a good job all this time, and probably retired now, I would love to return to the coast – but can’t. As much as the home price issue is the loss of legacy Prop 13 tax basis. I am stuck here now, watching as I type the outdoor tem dropping through the mid-teens on the way to maybe -10 overnight…

Housing to tank hard in 2014. Just watch. Top is in place. Price reductions occuring. Tank Tank Tank just like Frank the Tank

Care to provide evidence to back up this assertion? Need a little more than, “it’s going to tank”

NYSE margin is now at an all time high. Last two times it hit these levels were 2000 and 2007. Investor sentiment is reading 15% bears. If 85% are bullish and already bought who are they going to sell to now? Interest rates are artificially low. The Fed will loose control of the bond market and rates will rocket up. In turn housing prices will TANK HARD in 2014 :):):):P

You’re hilarious.

The Federal Reserve is the only buyer of bonds now. Who in the world wants to buy bonds at the highest prices in the history of the market? The Federal Reserve is fast approaching $4 trillion in bond purchases since 2008. The Federal Reserve will never let the bond market crash otherwise the entire house of cards will collapse. As Bernanke once said, I have the printing press. The only problem is that that hyperinflation is hitting stock market and housing again.

De facto, the Fedsury is MONETIZING the US Treasury market — replacing bonds with cash in the bank.

This has reached such extremes that the market is running into ‘failures to deliver’ — in Treasuries!!!!

By monetizing the Treasuries the bond crowd is being FORCED into non-Treasuries: corporates, even munis.

The bond crowd is massively dominated by the insurance industry. Until this latest quirk, US Treasuries were the single largest segment for the industry to invest in. Now, all across America, pension funds are blowing up because of Financial Repression.

The Fed is NOT going to go whole hog on junk bonds, period, stop. So the bond market break is going to happen in THAT sector — which is traditional, BTW. The weaker firms lead the way to Chapter 11 or 7.

It’s lousy business conditions that trigger corporate bond defaults. Bad management can pull that off in ANY season. Check the record.

Once junk bonds start defaulting, it will trigger a staggering ramp in perceived risk — and even the better credits will be hammered. This can happen — ought to happen — even as the Treasury market is firm.

The losses then absorbed will super-cool the economy — as THAT bond crowd — in this era — is now composed of investors not prepared to take such losses. They only went down this road because the Fed induced them to do so. (Yes, it’s official policy.)

Financial Repression is causing all of those expecting money rents (interest) to lose out — to see their wealth shaved as time passes. This non-receipt of interest has HUGE impacts on where these savers can spend their interest income — as in they can’t spend what they now are not getting.

THIS is why wealth is being concentrated in the hyper-elite class. On balance, they’re the ones getting the cheapened debt leverage — everyone else is on the other side of the equation.

Bernanke and Yellen haven’t figured that out quite yet.

This theft from Main Street is why the economy can’t get out of first gear. The kind of person that would be an Angel Investor simply is not getting cash flow out of his portfolio. So there’s no pixie dust to boot up new small businesses. And, of course, job growth is almost exclusive to small businesses. The big firms, on balance, shed jobs — replacing people with capital. (computers, machines, devices large and small)

Small businesses return large profits on capital invested — because said capital is leveraged with human capital.

Massive money printing DESTROYS human capital. That’s what chronically high unemployment triggers. Careers don’t get started, training is delayed, the work force ages, — intangible wealth is destroyed.

The Fed, the experts, the academics don’t see it. Such losers are not part of their own crowd.

The Real Estate markets are manipulated. California is in a bust condition, The banks are holding foreclosures off the market. Businesses are hording cash. Governments are broke. Empire, Real Estate and Economies everywhere are in a devolutionary cycle. Concentration of wealth is at an all time high which indicates collapse in all markets is inevitable. Business will always continue but look for the black and grey markets to grow while conventional businesses suffer and fade. Corruption will continue to grow and real estate will slowly continue to decline.

Red Chinese holdings of US Treasuries / US Dollars have peaked — it’s now official policy.

From here on, their intent is to swap the paper for American land — especially Californian real estate.

The funds available are so VAST it’s beyond ordinary comprehension. These monies are going to come — come what may.

This is the natural out come of vast American money printing. Eventually, those aliens that hold US Dollars want to cash in their chips.

You’re talking about billions per month in real estate buying power — with NO selling — EVER.

This has been seen in Vancouver — where Hong Kong money has purchased the best parts of town — all of the hill — and displaced native Canadian millionaires — forever.

This is the phenomena that will be seen for the next generation in California. It’s NOT going to be a buying wave like the Japanese.

Do you know of any sales on crystal balls? Would really love to pick up a model similar to yours.

Your best crystal balls come from prior financial history.

When nations print money in a fury there has only ever been one outcome — flight from that currency — flight into real assets — take your pick.

This truth spans recorded financial history — across all cultures.

The very first money printers were the Chinese — because they invented paper in the first place. Said money printing blew up the national budget — and ended the dynasty.

As the centuries rolled by, this repeated.

Then the West picked up the gambit. The outcome is never different.

What’s different this time is that the entire planet is engaged in vast, vast money printing, Red China more than anyone else. (!)

You are right.

I am not Chinese, but marry to Chinese and am living in a Chinese community in SF Bayarea.

Many people are talking about Japanese in 80s. At that time, Japanese corporations and investing companies were buying real estate in the US while individual Chinese people are buying real estate in the USA for their family who will live in the US. They will not sell their house, but buy more houses if the price drops.

Most Chinese people’s life goal is that buying houses as many as they can. In south-east Asian countries, Chinese have been buying most of real estate, and now they control real estate, economics although Chinese population is less than 10%.

Not only people from mainland China, but also Chinese Americans especially first generation of immigrants living in SF Bayarea are buying their 2nd and 3rd houses.

I don’t think buying power of Chinese people stops.

Comparing China to Japan and using the Japanese history as a predictor of the Chinese ongoing impact on US Pacific Rim RE is really badly flawed. Two different countries with different values and operating procedures – far more corruption and $$ printing going on in China and more acceptance of corruption and funneling money out of the country. Also much more of a global economy now paving the way for Chinese immigration. Also more internal fear in China of the govt, which leads to more propensity to move money out into the US. And I save the best for last of course – I will spare you all caps but trust me I am screaming when I say are you kidding me, comparing a country with 125 million people (Japan) to a country with 1.3 billion? Okay I can’t resist, ARE YOU KIDDING ME???!!! BAD ANALOGY guys, you are way off.

I tend to read the current influx of money from China is primarily investment and VISA driven for those few Chinese actually able to afford the 500K+++ cost as well as the $1m house. I agree with FTB’s insight — the number of Chinese who can satisfy those financial thresholds — even if we include all of the industrialists who have been saving their pennies while polluting the environment, stealing African mineral and forest resources, and so on — we cannot assume all of them want to move or invest here. (And in any event even 1 million + millionaires is way, way, below the 5% you mentioned of China’s total population of something like 1.4 billion people.)

And as others have pointed out, immigration of wealthy Chinese is only one of several factors impacting prices locally in certain So Cal markets over the past year or two.

Let me note that, long-term, we can continue to expect to feel lots of pressure from Chinese who want to escape their horrible, polluted Communist country and move here. But the timing and extent of impact on property prices in So Cal is open to question.

You don’t have to assume anything, the evidence is right in front of you. Cupertino, milpitas, San gabe valley, San Marino, irvine, Carmel valley, penasquitos, 4s ranch, del sur- what more do you need to see? Look at the trending school enrollments in these areas as well – Asian explosion.

See my comment below on the fallacy that there are only 1 mil millionaires in china. Find the source of that claim and then find the admission it is a gross understatement.

Agreed the values of the Chinese and Japanese are different and how they invest, but maybe you should do 5 minutes of research before claiming everyone on here is wrong. I’ll refrain from all caps, but, neither the size if a country nor its population is the determining factor of the number of its millionaires. In 2012, America had the most millionaires in the world. Number two is…wait for it…wait for it….Japan. Now will china surpass china, most likely soon. But they haven’t yet despite all the rhetoric and despite their gigantic population differences. If population mattered, why isn’t brazil, India or Russia (3 of top 9 populations in the world) even on the list of top 10 countries with millionaires? The most millionaires are in the US, Japan, china, Germany, the UK, France, Canada, Switzerland, Italy and Australia. Will that change? Probably. Until that day happens though, lets stick with the facts please.

Property taxes due in 11 days.

I came across this article from the LA Times, it is from 2011. I predict the Cali-Exodus will continue as the middle class opts for quality of life. The end result for California will be like a third world nation, the very rich and the dirt poor. (Think Armageddon type movie). Middle class housing will tank because there will be no longer be a middle class who is willing to drive 1.5 hours one way to work, spend ridiculous $$ on gas, even if they are lucky enough to find and keep employment. We need to wake up the California lie. Businesses don’t want to operate in CA. Even the movie industry has had enough and is taking their business elsewhere. California’s economic fundamentals are there for all too see. Aerospace is on the decline. The military has closed many bases. What sector is going to produce the good paying jobs for the middle class? The number of people on government assistance grows in leaps and bounds. Sadly, all it will take to expose this truth will be an earthquake. Then California’s “held together by strings” situation will be exposed. Sad.

http://articles.latimes.com/2011/nov/27/local/la-me-california-move-20111127

“The real estate market especially in California is driven by mania, euphoria, and bust. Those arguing we are going to see calm rational behavior after this run are simply ignoring the last couple of decades of history.” Yes, people in California are noted for being crazy(not rational). The normal state of affairs here is lunacy. Acting sane(normal as some say) is just not the California way. How does a sane person figure out what a crazy person is going to do next? From my personal experience, it is close to impossible.

Doc, what do you suggest?

I visited my son in Texas… Austin area is very very slow with too-many-to-count houses on the market for sale or for rent. Plus, massive apartment complexes now blemmish the area offering super cheap rent. Tough on Landlords there who need to compete in that market. It’s crazy why so many houses have been dumped for sale this time of year, but that’s what it is.

The Houston area is still high demand esp West in Katy and now further west in beautiful master planned communities Fulshear since energy companies are moving there and hiring thousands of people from engineers to IT types. Those medical centers (like St Lukes, Methodist, etc) are building huge hospitals West to cater to the enormous population growth. Dallas and Ft Worth …not much going on there from what I see.

Going to be interesting to see how much of the Housing Bubble burst in various areas. Strong job growth provides a cushion but the Flipper and spec areas like Cali I am not so sure.

German daddy-I live 22 miles from downtown austin by lake travis. We are in a real estate boom currently. In fact, Austin was rated (unfortunately) as one of the top 10 bubble cities recently (along with LA and many other CA cities). People are selling because they can make money and there are lots of buyers. That’s what happens in a market that is going up where lots of people aren’t underwater or have golden handcuffs due to prop 13. Please read the below stats from September of this year. House sales are up over 30% since last September and the most since 2005 and the number of days houses stay on the market are down by a 1/3. It also states the number of homes on te market is actually down, btw.

http://www.kxan.com/news/local/austin/austin-housing-market-stays-hot

Dovetail that with this list below from 2012 of the top 100 largest cities in America. Besides Irvine, CA and New Orleans, Austin has had the greatest population growth since the last census in 2010 of all 100 cities. One would expect more homes to be built due to that growth, especially in an area where there is still land to grow. This land availability (supply) will limit home appreciation, but for now, things are on the up, not down.

http://en.wikipedia.org/wiki/List_of_United_States_cities_by_population

Re Chinese millionaires , it is conceded that the 1 million estimate is grossly low due to its failure to account for multiple asset classes, including private business investment. Citing the 1 million number is weak sauce and shows a lack research into the issue. BCG admits to the gross understatement of the figure.

I live in epicenter of mainland Chinese enclaves in San Diego, one of my partners does biz in china 3-4 times/yr and another partner is married to a Chinese immigrant. I am right in the middle of the issue and there is no slowdown of Chinese buying. They are coming with money and targeting certain areas, bidding up prices and colonizing. So please don’t try and tell me what is going on in my own neighborhood.

Good luck to those who are waiting for a crash, you’re going to need it.

Falconator-I left a partial response that disappeared, so my apologies if I now have two responses.

lets assume millionaire stats for china are off and its not 1.3 million. Please tell us what number it is and how one chooses 5% to get to 65 million. Even if the stats are 50% off, we’re still under 2 million. Also, please tell us how many of these millionaires can actually afford CA prices as being a millionaire would not make you rich enough; youd need to be a multi millionaire and not just on paper, youd need to be liquid. Then please tell me how many millionaires are actually buying real estate vs gold, stocks, etc. Then please tell me how many are not buying in Vancouver, NYC, London, Singapore and Western Europe. Then please tell me how many of these millionaires are currently buying. Remember the approx 1.3+ millionaires number is total; not new millionaires. Therefore, many of these folks already purchased real estate from around 2001-2011 so even though some may want another home, many already have them so aren’t looking for another. You say the rest of us need to do more research yet your response only says BCG admits the number of millionaires is misstated. Where is your research other than that?

Ever think maybe because you live in an area with a lot of Chinese already (many of which have lived in those places for years and many of which are actually american-Chinese) perhaps you are extrapolating that everywhere else is the same? If I moved to Chinatown in SF, my hunch is I’d feel the Chinese are taking over CA as well. Minorities moving to specific locations has been going on FOREVER in this country, especially with those that don’t speak English. Also, we tend to notice and overexaggerate things when we are looking for them, especially when folks stand out more from the average white guy.

The rest of your post is more rhetoric. We all have close friends or family members doing business in china and know people married to Chinese natives. Congrats. Tells us nothing.

We all agree that the chinese are coming with money and influencing certain parts of the market. The issue is how many people and how big of a market are they influencing. To think that the chinese buying alone will keep property values up forever is asinine, especially bc although real estate is hyper local, its all kinda related. If everything goes to sht around your Chinese enclaves, the Chinese enclaves go down too. Maybe not the same amount as other areas, but down.

Sorry no time to hold your hand if you cannot perform even the most basic research. The Chinese millionaire data comes from surveys conducted by BCG and Gmk and Hurun. Do you even know who Rupert Hoogewert is? Do some basic research to confirm that all surveys acknowledge that the Chinese millionaire figure published is a gross underestimate due to hidden wealth. It’s so well known that the fact you spout the published figure without the caveat shows your lack of commitment to the full story.

As for boots on the ground evidence, if you want to argue that places like Cupertino, Milpitas, San Gabe valley, san Marino, Irvine, Carmel Valley, Penasquitos, west Ranco Bernardo and Miramar Ranch have not experienced explosive Chinese inflow, well good luck. Anyone who lives in these areas will confirm it. You can look at Schooldigger and see the explosive trend of Asian students in local elementary schools.

People like me that are living in the middle of it all and with direct access to the very people that are making the moves will all say the same thing. Frankly I could care less if you keep your head in the sand and ignore the substantial impact.

Again good luck to everyone who is waiting for the big crash in the desireable zip codes, you are going to need it.

Falconator-if you actually read what I wrote, I said lets assume another 50% increase off the official numbers. Of course stats are never 100% accurate, nor did I say they were. I would think most people would think 50% off would be a gross misstatement. Would you like to say its 100% off to feel better? I still don’t know how you go from 1.3 million to 65 million…..because you refuse to cite one article. Its a big Internet. You clearly have time as you keep responding. If you’d like to show me the light, I’m game. I have no preconceived notion. If its more Chinese so be it. All I want is facts, unlike you who keeps citing rhetoric post after post.

According to the Hurun report, which you just told me to read with contributions from your hogwart buddy from Harry potter:

http://www.hurun.net/usen/NewsShow.aspx?nid=488

The very people you told me to look up, on page 1, state the number of millionaires in china increased only 3% in 2012, the slowest rate in 5 years, and that there were 1.05 millionaires there (as defined by a million pounds/1.6 million). In other words, the exact number I stated in previous posts. The disclaimer in the report notes it includes real estate holdings (aka their currently overinflated first bubble home likely in shanghai or Beijing) and their stocks (also currently inflated).

Maybe we can put this to rest already? Your starting to bore me.

Sorry, falconator, I just reread your post. Are you saying I shouldn’t be looking at hurun and your boy Rupert or I should? Now I’m confused. Just cite one link that shows even a guess of what the number of Chinese millionaires is. Grossly understated is a loose term. One thing I can tell you is that 100% would be beyond a gross understatement in any normal person eyes. Do you realize what % of a gross understatement is from 1.3 million to your 65 million number?!

Another aspect to look at is multi-generational wealth, not just one person who is a millionaire. When you combine 3 semi successful generations under one roof, you can have impressive buying power. I don’t want to speculate, but there will be plenty of theses cases when you have 1.3 B people. I’m pretty familiar with the Asian communities in OC and multi-generational living is very common.

I was selling my place in Carmel Valley back in 2012, and I was brutally burned by not having a home situated to Chinese tastes. Funny how we have to redefine our idea of what adds value to a property.

They’re waiting for Godot.

This is an EPIC tide.

IIRC, the native Americans wondered when the Europeans would loose their lust for American real estate.

How’d that turn out?

Blert-what a great analogy! I am now 100% convinced that Cali real estate or any real estate in the world that the chinese move to will never go down again. California’s population of over 38 million is saved! If I was one of you CA real estate owners, I’d take out a huge HELOC because you’re all going to be rich forever with your houses going up every year due to millions upon millions of newly minted millionaire Chinese coming. Time to dump your 401ks and start pooling money for more homes, add some granite and resell to the endless chinese buyer. who cares what you pay bc the chinese are all dumb, loaded with cash and only care about schools and shorting the dollar, so you’re sure to make a profit! Happy days for all!

FTB

My favorite is how blert opines that Chinese buyers are moving their capital in order to save its value, yet they wouldn’t care about losing 70% of the value.

So, they care, but they don’t care. Um, okay.

For starters, the absolute insanity of Beijing real estate prices must be considered.

By such standards, California is going cheap.

The above bearish opinions were expressed decades ago — in Vancouver and in Australia — endlessly. The flood of Chinese real estate purchases has utterly failed to abate.

Instead, for those in the right locations, fortunes are made selling out.

If you’re not in the hot spot… no luck.

It’s the manic at the margin — the guy willing to pay top dollar — that sets the market clearing price. Right now, in the hottest California markets that buyer comes from China.

If you think California is insane, check out what the uber wealthy Russians are willing to pay in New York City — or in the south of France. The figures are through the roof.

Such exclusive areas are so price ‘sticky’ that they just don’t trade ‘down.’ The buyers are not even using bank finance/ mortgages.

So long as the Fedsury is willing to print into existence $ 1,000,000,000,000 per year… there’s going to be hot money looking for a home.

All of the above does not mean that the Inland Empire is going to participate, far from it. Those areas not on the hot list will go nowhere.

In the meantime, the traditional middle class is being utterly hollowed out. In a world of vast money printing — they don’t get to touch it first. Consequently, they’re lagging behind.

The skew in the statistics caused by high end purchases from foreigners is going to gloss over the damage done to the average Joe.

Given enough money printing / hyperinflation of the currency causes so much economic distress that rents collapse and mortgage origination to cease. Rental property goes into a SEVERE bear market. Without the ability to lay on a mortgage, sellers find that no one will take their rental properties at anything like former values. Taking back a purchase money mortgage is NOT what any seller wants during such times.

When enough renters have lost their jobs, gross rental income evaporates. When this happens, one can expect the government to block evictions — en masse. This guts the rentier class.

So, by the end, all is chaos.

Blert-after reading this comment, I actually think we’re on the same page. I totally agree with what you are saying with what funds have done (group think) and that money printing worldwide means buy real estate, stocks, collectibles, art, etc (still odd that gold and silver aren’t participating as much)-basically not cash. I also agree Asians are buying property in CA, etc and other physical assets. I guess i just look at that as kinda past/current and was writing from a more future time (admittingy unknown) where the money printing party ends, a black swan event happens, China doesn’t do as good as expected perhaps due to their need for worldwide demand which could collapse, etc and we have a worldwide correction, which I would think (am not 100% positive of course) would mean even CA home prices would go down and not the Chinese millionaires, hedge funds or govt/fed will be able to, or want to, stop it.

Red China is printing/ has printed so much new money/ credit that I fear for that nation.

China has done this before, and before, and before, and….

And EVERY time it has ended this or that dynasty… this financial abuse is at the absolute heart of the dynastic end game. (Some dynasties were destroyed by invasion, otherwise this is it. Printing fiat money is simply an irresistible political-financial narcotic. — Take a look at Washington right now — it’s the exact same story.)

The only reason that America might squeak through is that her international peers are even weaker still. At least America has the real goods — and Red China has our electronic cyphers!

As the Great Depression showed, being the world’s export powerhouse is actually a financially rotten place to be: creditor to the world!

Your counter-parties are getting real goods — and you’re taking back their IOUs. It’s really that simple. Weimar Germany burned the USA BIG TIME. America was by FAR its biggest international creditor — in every way pre-peating the role of Red China, today.

So when the merry-go-round slowed down, it was America that got hammered the most. We got stuck with worthless IOUs — while our exports stayed overseas — and our export engine blew a gasket. Smoot-Haley proved to make things incredibly worse. Crippling your debtors merely destroys every creditor American! They never saw it coming. So much for the best and the brightest.

Todays Chinese big shots realize that they dare not cut America off — yet they can’t abide piling on beyond our credit limit. Hence, they’re pouring all of their trading proceeds into every other asset they can touch. At this scale, that means everything on the planet.

The ONLY corrective is politically toxic to the Mandarins: they HAVE to increase real wages to the proles in Red China. They HAVE to decrease their own personal, relative, power. You can see why this makes them gag.

IF and only IF real wages rise, China can square their accounts. The average Wang will be able to finally afford to live in new construction and all the rest. It’s the same road that America went down one century ago.

(The $5 wage (Ford Motor) started in 1912, ten years prior, the average Joe earned $0.75 per DAY! Even in 1910, auto assemblers were getting $1.50 per day. That was real fat money. Gold was $20.33/ troy oz.)

Higher (Ford Motor) wages did not end the world. They simply permitted Ford to pick and choose the VERY best employees. The impact was so great that his rivals HAD to bump their wages up, too. The next thing you new, there was a blue collar middle class.

Red Chinese mandarins have to stop going for market share and shift over to profit margins. There is no alternative.

Well, there’s always another revolution, I guess. Sloppy, though.

The demographics of Red China must drive the labor pool down harshly in the decades ahead. It’s all for the best, for the alternative is atomic warfare. In such an event, having a large population counts for absolutely nothing. Quite the reverse, in fact.

The zany idea that Red China is permitting North Korea, et. al. to ramp up atomics is passing strange. No-one can be a bigger loser than Red China should atomic warfare break out. Her population is tightly packed. Her culture would be flat-lined — utterly. She could never get her rice paddies back into production before essentially the entire population starved to death. Unlike American farmland, paddies take enormous amounts of labor to even bring into production. (Check out the photos — posted everywhere.)

The mandarins are terrified of the above possibilities — which is exactly why they’ve gone totally overboard with bank lending and empty cities.

Damned if the did, damned if they didn’t: going for market share instead of profits has utterly done them in. Such is Communism!

San Marino is full of Asians because of rich Chinese moving in? Somehow I doubt it.

I grew up in Manhattan Beach but went to high school in Torrance, near Palos Verdes, and my school was packed with Asians. I don’t remember any of these people being fresh-off-the-boat Chinese, maybe some were, and I admit I didn’t ask questions of them, but it was probably very few, if any.

And where do you get the idea that the San Gabriel Valley is filling up with Chinese elite trying to park their money? The San Marino Valley had a large Asian population well before people began believing the hoax that China was some Unstoppable Superpower that is the Future of the World.

The idea that all these wealthy Chinese are going to prop up the grotesque housing bubble is just mania. Are you going to invest in bitcoins too? All signs of pure desperation. China is a communist country and the vast, vast majority of people there are poor, okay? As for the minority with money, there are other places that would suit them besides Los Angeles — Paris, London, French resort towns, New York, etc. So you have a small pool of buyers spread very thin. The Chinese are not going to prop up every bubble area worldwide any more than the “elite” are going to succeed with their ridiculous vampiric Ponzi scheme. All it is is people in power trying to stay in power and they are going to fail.

I’ve got one for ya –

Good luck to those who are waiting for this time to be different, you’re going to need it.

Strangely, for most living Americans this time IS guaranteed to be different: because the Fedsury is hyperinflating the currency.

America has done it before: the Confederacy and the Revolutionaries.

“Not worth a Continental (dollar) !”

“Opie, those are Confederate Dollars. They’re worthless!”

FYI, the Confederacy was such a loose union that no central taxing power was granted to the Davis administration. Instead, he was compelled to just start printing fiat currency. By the end Confederate officers were paying $500 for $200 riding boots — because the bills were to hand and the merchant couldn’t make change!

The hyperinflation during the Revolution destroyed Thomas Jefferson, financially. He’d taken back purchase money mortgages from his buyer-buddies. They paid him off in what had become worthless Continental dollars. None of his pals was willing to pay off in silver coin equivalents to the original deals.

The zany dynamics of hyperinflation have to be studied at some length. The best are academic papers — commonly drafted by experts paid by the Federal Reserve, itself. (!)

There are four types of commonly understood money:

1) Silver and gold coinage, specie. Counted by the ‘tale.’ No re-assay, re-weighting needed.

2) Warehouse receipts — in bond. Can be any bondable commodity: any bullion, pepper, tea, booze, salt, etc. This type of script, once endorsed three times by men of known, great wealth became the money fount for the tulip craze in Holland. Also triggered a MASSIVE real estate boom in the Lowlands — polders drained, etc. The bonding refers to the commodity being under lock and key — by a third party — typically the State.

3) Commercial debts — This is still the PRIMARY source of American money. It is created every time a commercial bank issues credit — in any form. Since the 2008 crisis these debts are being liquidated — per the relevant promissory notes/ credit card terms, etc. As these debts are liquidated the national money supply collapses. This figure is tracked by the Fed — religiously. When it ramps we call it INFLATION.

4) Federal debts — this is government driven — i.e. POLITICALLY driven debt generation. Unlike commercial lending it normally takes the form of ANTI-rational borrowing. That is, it’s staggeringly wasteful indebtedness. When it ramps we must call it HYPERINFLATION.

The terms Inflation and Hyperinflation come from EFFECTS not causes. They are driven by two TOTALLY different forms of money creation. That’s why the inflation of forty years ago caused ramping wages: the created money was spread throughout the economy.

In contrast, when the created money is coming from ONE SPIGOT ONLY, and without economic efficiency your get fiat currency as a political-financial narcotic. Unlike commercial bankers, government money printers NEVER back off the throttle.

This is most typical of wartime — or perhaps immediate post-wartime. Either way, the printed money is effectively blown to the wind — on POLITICAL priorities. In effect, it’s a WEALTH TAX.

So, every single time it operates to strangle the natural economy in favor of politics. And it ALWAYS melts down. The only question is just how destructive things have to get before the entire system has to be re-set.

For the Revolutionaries — the re-set meant the Constitutional Convention.

For the Confederates — the re-set meant that the Union crew took over the whole show.

So, you’re claiming that there will or won’t be a disruptive correction as a result?

Joe…

In a time of vast money printing – – globally — you’re NEVER going to see a nominal decline in real estate prices.

Instead, the US Dollar, itself, will decline in purchasing power. If you’re unlucky enough to not be at the Fedsury trough, then you’re entirely out of luck.

You’ll be fighting an uphill battle all the way, like the Red Queen, running like a maniac just to stay in place.

Political rigidities indicate that Yellen & Co are NOT going to turn off the spigot. Indeed, Yellen is a money printing dove who didn’t see all of the stuff I found to be as obvious as hands in front of my face. The bubble, all of it, I foresaw it over ten years ago. It was too obvious. Naturally enough, I was a lonely voice. All the experts knew better. Such is the vanity of academe… and Bernanke and Yellen have never been anything but academics — and Fed officials. They have no grounding at all in the real economy. Just open your eyes and ears. They’re clueless.

The ONLY bet that can be played right now is that the magnum folly will continue — until the brainiacs run entirely out of road.

Take a look at the insanity of Venezuela and Zimbabwe… Argentina… Red China…

The term is: stuck on stupid. America — the Fed is composed of the same kind of people: vain, clueless, humans. They’d rather go on than be ‘wrong.’

The famous Weimar hyperinflation only ended because the critical official behind the policy up and DIED. His replacement terminated his insanities — and the replacement currency INSTANTLY stopped hyperinflating! Really, just as fast as you could snap your fingers.

For our trend to be snapped, Yellen would have to have a Road to Damascus moment. So keep your eyes pealed for radiance from the heavens.

This is the slowest time of year for RE sales/transactions. But, nothing has really changed. Foreclosures are still trickling onto the market. As long as supply stays very low, it keeps the bid up. Those underwater cant sell and the banks are very slow to foreclose. So a hard drop in RE prices would mean that a lot of would-be buyers would dry up.

This is from July 2012, but telling non the less about where I’m looking for my retirement place:

One of the largest pool building companies in the San Diego area abruptly closed its doors in early June (2012). Mission Valley Pools & Spas, a Pool & Spa News Top Builder, is said to have left projects incomplete… Though some are surprised that a firm of Mission Valley’s size would close this far into the recession, some in the area say it’s remained an uphill battle.“Last year (2011) was a lot tougher for us than any other year we’ve had,†said Rob Ault, president of Pacific Sun Pool & Spa, also a Pool & Spa News Top Builder in San Diego. “I have to assume it was the same for the other companies in this town.â€

I had to sell my Carmel Valley house to get out of Cali. Unfortunately, I had built a pool. Generally speaking, native Chinese don’t like pools. Darn, should’ve invested in granite and stainless steel.

@itwasntme:

I’m not sure what you are saying about pool builders is relevant. Having a pool built in your back yard is nothing but a luxury, most people don’t have pools and do just fine. During challenging economic times, people forego the big ticket luxury items. Kind of like the RV business. With less disposable income and high gas prices today, owning one of those behemoths doesn’t make any economic sense.

People will have to get used to the idea of having to get by with less.

You have a good point, but the company had been in business for years, and management weren’t flakes.

Regarding the Chinese, go to the Costco in Torrance and tell me there are not a lot of them are living in the South Bay area.

Can’t say the total number of Chinese, but per a 5 second search on Wikipedia, the number of Chinese Americans in Torrance is about 7,000 total, which is a hair under 5% of the total population on Torrance.

http://en.wikipedia.org/wiki/List_of_U.S._cities_with_significant_Chinese-American_populations

I read this blog mostly for the humor factor in the illogical “conclusions” some of you make. Gems like “there are lots of for sale signs on my block therefore…whatever”. But now and then a post is made with actual facts — Thank You! Some actual facts! Shees, the way some people on this blog come up with opinions without bothering to look up facts is ridiculous – glad to see at least a few of you can do a simple census data check.

I didn’t say they were living in Torrance.

Daniel and falconator-I think perhaps we may agree more than it seems so let me rephrase. I 100% agree that there are tons and tons of Chinese folks currently purchasing homes in CA, most of which are purchasing in the same neighborhoods, including the ones you are mentioning. I also agree 100% that any stat I mentioned is inaccurate and understates the number of Chinese millionaires and the number of Chinese in Torrance (or those going to the costco in Torrance) as well as where falconator lives. Many Chinese would not be surveyed as millionaires for a variety of reasons and i think census stats might be for Chinese-Americans so I don’t think they would include Chinese folks who aren’t citizens maybe (?) as well as anyone who just avoided the census and census errors in general. I would then hope you guys would say not all chinese millionaires are rich enough to buy homes, not all want to, not are all buying in CA, etc as well as some Chinese people living in the communities mentioned are not rich enough to own or don’t want to (so they rent), some are children (too young to own), some are old and live with relatives or a small number in nursing homes maybe (?). Since we are discussing the current housing market we wouldnt want to focus on previous millionaires or i guess any chinese person regardless of income, we’d want to focus on the impact of current/future Chinese homebuyers only. I think we would agree on all of that. I also think we can agree that good places to start at least are actual statistics/facts.

I guess maybe where we perhaps disagree on is if the Chinese (or for this blogs ultimate purpose the Chinese plus everything else like any non-Chinese buyers like funds, Americans, whomever as well as our opinions on QE (infinity?), is CA actually currently underpriced compared to other places or in general, etc) are enough to keep CA home prices going up forever. Of course I sometimes start thinking maybe things are different this time, but then I, personally, say nah. Its gonna go down. Can’t say when, can’t say exactly how hard, but, IMO, down. Perhaps this is where you say, yes, this time is different. To each his own.

Dude, those are Koreans. I’m half Korean so i know. Hence the kimchi, oxtails and fresh whole snappers lately. But Chinese are trickling in the South Bay sure enough. Go to open houses in Torrance and PV. Ask the local busy RE agents.

The article pointed out something that has been puzzling me for a while. We are not seeing very many investor owned rentals around here (Reno). Some, but not as many as you would think if these all cash buyers are investing. ????

Maybe they are mostly flipping…. I really don’t see what is happening to these investor properties.

Reno does not appeal to Chinese buyers. It’s the weather.

Reno is a ‘warehousing’ town for Northern California — its manufacturing sector, its construction sector. Both are absolutely punked vs the boom.

Unlike California, Reno has ENDLESS raw land just down the road suitable for development. This means that price increases can’t even get into first gear.

They must have missed or forgotten about all that endless raw land during the last run up in prices.

Good thing this time is different!

Reno didn’t float on Chinese real estate purchases.

It leveraged the perception that Northern California was a one way bet.

I predicted that market would end up as a train wreck — in 2003 — while visiting family in Reno.

Just too obvious, it was.

Reno lost so many jobs during the last 5 years – not many renters for the amount of rentals. Asian rich are not interested in Podunk anyway.

The economy is not improving we are just changing the way we measure the economy to make it look like it is improving.

http://www.counterpunch.org/2013/07/31/economic-recovery-by-statistical-manipulation/

The “Red Chineseâ€, “Mexicansâ€, “Specuvestersâ€, etc. are not the enemy. The Federal Reserve, Federal Government and Mega Banks are the enemy. Isn’t funny how everyone takes the bait on government sponsored stories in the media on how some outsider is causing the problems. As a fifth generation Californian, I can tell you that there have been Chinese, Mexicans, and land speculators here way before anyone on this blog got here. My family came here in the 1800’s as land developers/speculators. This is not new. The Federal Reserve manipulating interest rates is new…

For FTB:

Re “grossly” understating # of Chinese millionaires:

http://www.bloomberg.com/news/2011-05-31/china-s-millionaires-jump-past-one-million-on-savings-growth.html

http://www.bloomberg.com/news/2010-08-12/china-s-wealthy-have-as-much-as-1-1-trillion-in-hidden-income-study-says.html

http://www.newsweek.com/gray-wealth-chinas-super-rich-71237

I could post links all day but you get the idea. You can keep your head in the sand if you like.

BTW the surveys all use yuan as the basis so when they come up with a # of millionaires in China they are actually talking about people with $1.6 mil USD or more Massive difference of 60%.

And who said only Chinese worth $1.6 mil or more are the only players in US real estate? What about those worth $1.5? $1.3? $1.1? $900K? etc.

I am also comfortable based on the acknowledged vastness of unreported underground hidden wealth that these surveys do not include that the top 5% of Chinese have enough assets and/or earning power to be players in the US real estate market. That’s 65 million people.

Now please post some data that shows that the Chinese are not buying a significant amount of RE in the areas I list and thus moving the market.

Falconator-very quickly and lets please move on. I hope this doesnt come out as a double comment again. I already stated the stats were inaccurate and estimated about a 100% misstatement, that one report said US$1.6 million, I also cited a 1.3ish? millionaire num, etc. Lets just use $1.2 trillion in hidden wealth. The articles say its slanted towards the top, but lets just divide that by US$1million and its 1.2 million people. So we’re still closer to 2.5 million. I mean we can go 3 million. 4? Not sure, where you think is right, but 65 million feels a bit high, IMO.