The California and Texas Connection: California Exports Its Poor to Texas Due to High Cost of Living.

California is a high cost of living state. That goes without saying. Yet the level of affordability oscillates up and down with the whims of the bubble economy. As of today the state faces a rental Armageddon trend where many families simply cannot afford to purchase a gorgeous, sturdy, and well-designed home (just kidding, most can’t buy a 700 square foot funky looking crap shack). Whenever people even hint at the expensive nature of California the yelling begins with “then move out!†or “buying always makes sense!†which seems interesting since the housing market really got out of control in many metro areas starting in the late 1990s as Wall Street injected its casino antics into the industry. And many of those that protest the loudest are usually Taco Tuesday baby boomers living in granite countertop paradise that wouldn’t have a chance affording their home today if they had to pay current prices. But in reality, many are moving out. From 2000 to 2015 more people left California than moved in from other states. The biggest destination is Texas.

The Grand Migration

The math on the grand migration out of California is interesting. Here is the data from 2005 to 2015:

-2.5 million people living close to the poverty line left the state

-1.7 million moved in from other states near the poverty line

This equates to a net loss of 800,000 people.

-Net gain of about 20,000 residents earning $100,000 or more

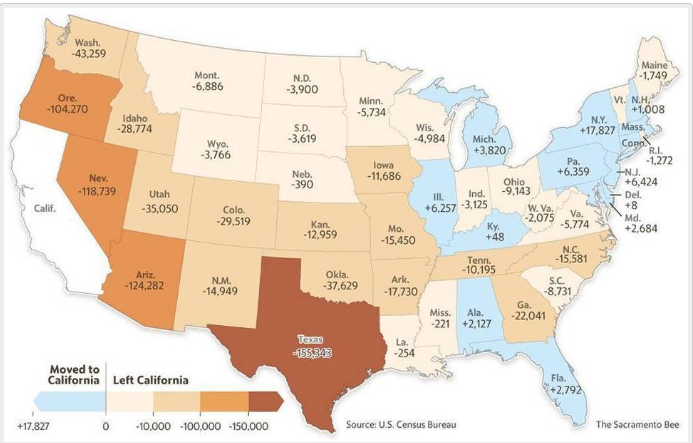

The exodus is very clear on a map:

“(SacBee) Not surprisingly, the state’s exodus of poor people is notable in Los Angeles and San Francisco counties, which combined experienced a net loss of 250,000 such residents from 2005 through 2015.

The leading destination for those leaving California is Texas, with about 293,000 economically disadvantaged residents leaving and about 137,000 coming for a net loss of 156,000 from 2005 through 2015. Next up are states surrounding California; in order, Arizona, Nevada and Oregon.â€

It should be no shock that the biggest line item on any household budget is housing (rent or a mortgage payment). And in Los Angeles, you have a ridiculous number of people paying nearly half of their income just on rent or a mortgage payment. That is a big problem especially when you want to plan for other expenses or want to put something away for retirement.

The map above is rather clear in how the trend is unfolding. While those lower income families have no chance of owning a place in California or the rent is eating away at their income, in Texas these families have a chance not only to save some money but to potentially own a home. I’ve talked with older families here in California where that opportunity once existed (not too long ago) so this is their frame of reference and many are angry that their adult “children†cannot afford a home without them gifting a giant down payment (which cuts into their Taco Tuesday outings and ability to booze it up on happy hour). So the current environment is really new.

You also have the option of doing mega commutes:

“The choices facing millions of low-income workers trying to rent in California’s urban centers are stark, Hershey and others said. They can commute from far-away locales.

“People are having to move so far away from their jobs – driving two or three hours,†Hershey said.â€

I know of many that take on these mega commutes into LA and OC just for work. The fact that you are wasting away days of your life in a car is difficult to stomach and isn’t good for your overall health. So the choice for many especially those with lower incomes is to leave the state. The data is very clear. People do vote with their feet.

So the question many have to wrestle with is what is that crap shack worth to you? For a large number leaving the state is an option, for some it is mega commutes, and for others it is to mortgage yourself to the hilt.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

218 Responses to “The California and Texas Connection: California Exports Its Poor to Texas Due to High Cost of Living.”

Isn’t there already a housing bubble in Austin?

We looked at buying a small place in Austin as an investment…this was 4 years ago. Prices were pretty high then for what you got, but the real kicker was the property taxes…In Texas, you are assessed different percentages by county…so Travis Co. was like 3% on the purchase price. People don’t talk about it very much, but since they are known for low business and sales tax thats what gets the headlines….until you buy property! They always make up the tax somewhere!.

Made the investment really not worth it for us. At least CA has that advantage over TX!

Doesn’t matter as much if it’s a higher property tax % is if the cost basis is much lower. Ultimately, it’s how much in $s you pay out, not some %.

Hey what do you know… a tax system which effectively counterbalanced a non-local rent skimmer… which increased the odds that an actual end user purchased a property. No groovy Prop 13 gravy there.

+1 in being all for any system that discourages purchasing by anyone other than someone who actually intends to live in their property. Competing against every wannabe landlord and flipper sucks ass.

Yellen bucks have permeated the real estate market nationally. Dallas and Austin are among the many recipients of this asset reflation program.

So, what I understand from this article is that the poor run away from the socialists republic of CA (liberal paradise) and move to a red state to vote for the same liberals who ruined the previous state. They did that in Colorado, too. It never occurs to them that they are the problem, they try to run away from their problem and keep ending in the same problem – something like many illegals do when they run from the south.

The poor people from the other socialists paradise of Venezuela can not run anywhere. There, the lack of critical thinking and bad decisions at the voting box caught up with them – they run out of other people money.

When they go to a red state they continue mooching on the federal taxpayers money and the liberals from CA say that the red states receive more than they pay in taxes. However, those mooching still vote liberals even if they are in a red state. I doubt the ranchers from TX who vote conservative wait on the taxpayers to pay for their living expenses.

Now, you can start throwing eggs and tomatoes my way!!!!….I am used to that.

The only reason I can think of to move to flyover country where there’s no jobs, is to buy some arable land cheaply and homestead. You’d better have some experience or be prepared for a few rough years. Plus you have to come out to flyover land with an RV you can live in or be prepared to buy/build housing. If you come out with an RV you can build a sort of shelter over it to mitigate the extreme temperature swings seasonally and also daily.

Get a few acres preferably 10-20, with some source of water, raise almost all of your own food, and have some online presence for a trickle of money to you can bring in maybe 10 grand a year, and it may beat living under a bridge in California if you’ve been pushed off of the grid here.

~”

The only reason I can think of to move to flyover country where there’s no jobs, is to buy some arable land cheaply and homestead. You’d better have some experience or be prepared for a few rough years. Plus you have to come out to flyover land with an RV you can live in or be prepared to buy/build housing. If you come out with an RV you can build a sort of shelter over it to mitigate the extreme temperature swings seasonally and also daily.

Get a few acres preferably 10-20, with some source of water, raise almost all of your own food, and have some online presence for a trickle of money to you can bring in maybe 10 grand a year, and it may beat living under a bridge in California if you’ve been pushed off of the grid here.”~

You need to get out of San Jose and see the rest of the country, aka “flyover country”. It is huge, and there are all sorts of climates, economic conditions and social situations.

But before you do, you need to know this: It takes money to live anywhere. You will still have to buy fuel for your vehicle, pay taxes and spend money like crazy on all kinds of things to be able to perform that idealistic “living off the land”. The ROI is years away even if you can swing it.

To afford this “back to nature” wetdream, you will either a) be independently wealthy or b) have a job in the local community. Take Tennessee for example. There are tons of lots for sale back there for “dirt cheap”. Why? Because there is no work there. Beautiful, scenery, lovely weather, no effin’ jobs.

I have a good friend who moved his family from San Diego to Tennessee a couple of years ago. He worked in SD as a Toyota certified Master Mechanic. In Tenn. all he could find was doing counter work at Autozone for minimum wage. Get the picture?

I personally just this year became a political refugee in AZ after selling the house in SoCal. I just could not take the loss of my civil liberties at the hands of the altruist-collectivists in the Legislature and Governor Moonbeam. As a TTBB I bought a 10 yr old travel trailer for less than $10k, spent $16k installing solar and lithium batteries and now I can live just about anywhere for next to nothing, while traveling this great land you call…flyover country. Enjoy your time in Kalifornia.

Raising your own food is overrated. What percentage of your budget is food? Homesteading is almost a synonym for grinding poverty. Knowing that in advance can save a lot of trouble.

Alex,

How many times do I have to post data that shows how wrong your closed-minded view is? My county’s unemployment is running at 2.9%. Please watch/listen to video in link:

http://www.kbzk.com/story/34934803/job-service-works-to-match-employers-with-employees-in-gallatin-county

Cheers.

As a RN, I moved from Seattle/Tacoma to Northern Idaho. With 35 years of experience, I was at the top of the salary schedule for staff nurses at my old hospital. I was able to obtain employment in my chosen specialty, on day shift, at a hospital in Spokane. I took a 5 cent an hour cut in pay. While my commute is 25 miles longer, it only takes about 15 more minutes due to less traffic congestion. We did very well selling our residence in Tacoma and purchasing in lower cost Idaho.

You say there are no jobs in flyover country. But I see physicians, lawyers, marketers, computer people, service industry jobs, farmers, loggers, ranchers and miners. We even have colleges and college professors. We do not have the ocean ports, the railroads are very big here. Burlington Northern has a big freight yard in my little town. Oddly enough, my decades long insurance agent (who I thought was based in Bellevue, WA) telecommutes from Sandpoint, ID.

Life does exist outside of the coastal areas.

I would have thought Texas provides far fewer welfare state giveaways to poor brown people than the socialist nirvana of California. Are you suggesting the poor brown people are such idealists that they move away from their welfare paradise just to export their ideology by voting blue in a red state? Good thing that TX is so gerrymandered after the Tom DeLay years that no Democratic vote will make any difference there until all the good white folk are swamped by the Latino demographic tsunami in another decade or two.

I would imagine smart Democrat ideologues who wanted to influence national voting trends would move to purple states where their votes could have disproportionate effect. Of course anti-slavery folks (the bleeding heart liberals of the 19th century) tried that once by moving en masse to Kansas in the 1850s – a similarly polarized time in American politics. Read about Bleeding Kansas and the run up to the Civil War to see how well that turned out.

The Sacramento Bee didn’t bother to mention how many poor illegals and refugees from other countries moved into California? Don’t believe everything that you read in The Sacramento Bee–it’s basically a Democrat propaganda site full of fake news.

Your opinions are not facts. The problem is not the poor, the problem is the demand for real estate is bought up by the ultra-rich and the poor do not have the income to stay. That’s pretty common sense. Also, more people are on welfare in the red states than the blue states by a wide margin. That’s a fact. IMO, these low IQ people vote against their benefit all the time because they are fed a bone of hate and divide, and they eat it up because they don’t have the necessary intelligence to see what they are doing. It’s hilarious to see them complain about Obamacare leaving. I, for one, have no problem reducing welfare and govt support because it would take away the dependence from meth taking, uneducated hillbillies prevalent in the South.

your post is racist

This just in: facts are racist.

Liberals are the most racist people you can find. If you are not a liberal, you are a “deplorable”. This is not my opinion, by the way. I heard it from another racist politician. The liberals are tolerant only with their own “tolerant”; otherwise they become intolerant. Freedom of speech is ONLY if you agree with them – ask Merkel – if you don’t agree with the socialist Merkel you should be put in jail because any criticism is called “hate speech” and they took care to have a law against that. In US, they don’t put you in jail for “hate speech” yet, but if you tried to criticize the TPTB or contributed to the wrong politician, the IRS will call you and put you in jail. It was more round about than in Germany. And just when we were supposed to have out own Merkel, Trump happened.

Let me guess, you also believe college tuition and healthcare cost are being driven higher by the “ultra-rich”

This is the equivalent of how the North American indians were unable to fight off progress. We just plowed through without any disregard who was living there. Now that land parcels became the standard homesteads allowed new owners to essentially have the right to kick anyone out that crossed their border. In addition, it has made not only us an enemy of the indians but enemies between each owner.

MR. SOUTHWEST is not only racist, but he’s also ignorant. Over one third of the US welfare recipients live in California (aka Commiefornia).

California is a welfare queen.

http://www.cnsnews.com/commentary/terence-p-jeffrey/354-percent-109631000-welfare

http://www.nationalreview.com/article/302148/california-americas-welfare-queen-nash-keune

Flyover, I’m not a liberal so feel free to bash them all you want. The answer is not bashing the poor for circumstances brought on to them by politicians and the ultra-rich that keep them divided.

Samantha, you are ignorant, and I’m not surprised at all by this.

First of all, your sources are National Review and CNS News. LMAO.

This is partly the reason why you stay ignorant. Perhaps get sources from a more objective media, and to be fair, MSNBC, CNN, and others are just as bad. But since you rely on them so much, let’s just see what your CNS says about the states with the most federal aid out of respect to population.

http://www.cnsnews.com/news/article/michael-w-chapman/top-10-states-rely-most-federal-aid

The 10 states receiving the most in federal aid as a percentage of their general revenue, in order, were:

Mississippi, 42.9% federal aid as percentage of general revenue

Louisiana, 41.9%

Tennessee, 39.5%

South Dakota, 39.0%

Missouri, 38.2%

Montana, 37.4%

Georgia, 37.3%

New Mexico, 36.6%

Alabama, 36.1%

Maine, 35.3%

Only an idiot would say a state with one of the biggest populations turn around and say the problem is welfare in the state because it has the highest net total. The south is by far more dependent on welfare. Sorry to burst your fantasy that has been brainwashed your entire life. You’re not special, only a mere genetic mutation.

“… they run out of other people money.”

While true by itself, commentator readily forgets that US has run out other people’s money decades ago and has been lending trillions since then.

The only difference is that US is able to have loans in dollars, i.e. home currency with value which FED can directly devalue at will. And have been doing so much that FED stopped publishing the actual amount of devaluation.

“There’s no inflation if we don’t publish the inflation numbers”-ideology.

Can you imagine being in such a state of despair that you really contemplate moving to Texas?

That being said, a guy I know of (friend of boss) moved to the South, turns out he’s a rabid Jesus-freak so I guess he and the South deserve each other.

Dude your comments can be so deluded it seems you’ve lost all sense of olfactory objectiveness from the soylent cal crap patty crumbs you’ve been subsisting off of. The main thing my colleagues in Texas aren’t saying is that they feel priced out forever which counts for far more than your snooty cal crap bottom feeder insults do.

I for one prefer to live where there are jobs, and where meth and opioids are not a way of life. Not to mention the kooky religiosity that’s the norm out in the boonies.

But, as mentioned, if you buy arable land out where it’s cheap, and can do something online for “cash money” you could make it OK.

Alex, then why haven’t you found a well paying job there yet? You have the skills and intelligence, yet you’ve consigned yourself to living in some “artist’s space” and scraping by.

Not a dig. I know you have a certain philosophy, but I think your biggest enemy may be yourself.

Alex, “kooky religiosity”? California is the birthplace or headquarters of many kooky cults and religions. New Age, crystals and shamans, neo-paganism, Scientology, Jim Jones, Heaven’s Gate, the Manson Family.

But of course, when you say “kooky,” that’s your bigoted term for Christian, isn’t it?

I for one prefer to live where there are jobs, and where meth and opioids are not a way of life.

Right. No meth or opiods in Los Angeles, Portland, Seattle, Miami, Washington, New York, or any coastal city. No crack, heroin, Valium, pot, Prozac, or any other kind of drug. I guess that’s why the coastal cities have no gangstas or organized crime.

That’s bullshit because half of the time you’re saying tech jobs pay next to nothing up in cal crap highlandia where cracked out bums were formally high flying technocrats.

FWIW I moved to Indiana precisely to get away from people like you.

Hey man congratulations on getting out!!!

Alex sounds like his religion is socialism/communism and a rabid Marxist freak. He deserves to live with the illegals and H-1b visa holders in the turd world shyt hole city of San Jose.

Funny, seems like mostly people want to stay near-ish to California. But some people want to get as far away as possible and choose Maine.

The big mistake … people pretend that their home is just a roof over their head. They think your home is not an investment. That causes them to make the mistake of not buying a home because they do not see it as an investment. If they correctly saw their home as an investment, they would have done what done whatever hey needed to do to get into a home. As long as they treat it as a roof over their head, they make the mistake of yelling bubble for every strong market and they sit it out.

Owning one’s primary residence is an investment but it also provides a service, it puts a roof over the head of your and your family. There is value in that beyond the actual cash price.

Typo:

If they correctly saw their home as an investment, they would have done whatever they needed to do to get into a home.

It would be the biggest mistake to buy during the bubble peak (now). Buying a house is the worst investment unless you buy after the crash. A house is a money pit. It pays no bills and cost much more to rent. Plus you have high transaction costs and cost for repairs.

I’m building a house with a homebuilder, done this fall, well aware that prices are very frothy. 240K for a 100K household in a suburb of Atlanta (Doraville) close to international cuisine and transit works out for me. I’m well aware that prices could crash, but I’m happy to secure the lot and customize the house.

Besides, it will recover if it does crash, and if it crashes, I can lower my payment with lower rates. You have to look at each situation and not make blanket statements.

“and cost much more to rent”

Not on my planet. Renting is about 1/3 the cost. The best part is when something breaks and i call the old landlord and say “the water heater just stopped working and we need that fixed…chop chop” While he was there i mentioned that with all the rain we’ve had i noticed a few leaks in the garage and told him this place needs a new roof…..he grumbled a little and rolled his eyes.

I told him sorry i spoiled your Sunday when he interrupted the movie i was watching to tell me it was fixed.

And the fucking lawn? that’s his problem too, I’m certainly not going to be cutting that shit.

Enjoy your overpriced over hyped bank rental…..that’s all you’re really doing, renting from a bank…..WHICH IS CHARGING YOU TWICE THE PURCHASE PRICE FOR THAT PRIVILEGE. And then you rent the land from the state.

Mumbojumbo, I meant to say it cost much more to buy than to rent. I agree with everything you said about the advantages of renting versus buying. Unless the market drops by like 50% I am not buying.

Real estate has been a Boom or Bust scenario for decades now. It is stupid to buy at or near the peak. When house prices drop below the average metrics like house price to household income, price to household debt levels, etc, that is the time to buy.

jtroll everybody… here every post for your enjoyment… but the house can’t afford free drinks, so you gotta buy your own… jt won’t vouch for your tab… but has no problem with trying to make you feel like an asshole for being careful with your money

I’m convinced that JT is just trolling this board. His posts may as well be taken straight out of the RE propaganda playbook.

Not a troll. Because of the FED, I am long term bullish on real estate. But, I do recognize eventually there will be a big price drop when the recession hits. When will that happen? No one knows. Rest assured, the price drop will happen and those that bought before that drop will take serious damage. But, when that price drop happens, the FED will be fighting it. They always do. So, even if you get unlucky and buy just before the drop, if you wait 10 or so years, time will bail you out of your mistake and life goes on. You see, the FED has your back and their goal is to generate inflation which make a real estate investment golden over the long term.

That same inflation also increases the cost of ownership. It’s funny how nobody has got time to wait for jumping in, yet no problem waiting 10 years if not more to be made whole again on a bubble top buy mistake.

It is normal for a buyer to worry that they bought the bubble top. Statistically, about 15% of buyers will buy the top. Those buyers can have a 10 year wait to break even. When you buy, you keep your fingers crossed hoping that you did not buy the top. It takes about two years before you know if you made a mistake or not.

So what you’re saying is that we need to buy now and wait two years to find out if we’re not priced out forever. Absolutely fucking genius plan Sherlock.

No mistake sitting out an obvious bubble market, regardless of what any real estate industry shills may say to the contrary. A house is just a place to live. While it may also be an investment for some, a house can also be a burden to others. Home prices don’t always go up, particularly when central banks have turned global housing markets into a worldwide casino.

There are a number of Texas markets where renting is probably a better option than buying.

Yeah, we’re renting a close-in house in Portland in one of the best school districts, and it would cost about $800 more per month, plus $135K down, to buy the house we’re in.

We’d love to finally “settle” and buy a place, but I can wait to see what happens.

The waiting is the hardest part. Where do you put your money while waiting for the bubble to burst? CD’s paying 0.2% interest, Bonds paying 1%? Both are losing money to inflation. Housing and Stocks are both on a bubble but are both giving the best return.

You aren’t looking very hard for better CD rates, Bob. I just set one up for 1.6% 2 years. Not great but not even close to 0.2%

Not the first I’ve read this and the claim is not backed up with data unless one only looks at those bank whores JP Morgan Chase or Wells Fargo

Bob, inflation can not last too long because the bond market (3x the size of the stock market) will implode. What is going to happen to the derivative market (555 Trillion dollars) then?!…. Even a small increase in interest will detonate this “weapon of mass destruction” (the derivative market) – to quote Warren Buffet.

Given what I know and what you know, I believe that cash will be king very soon regardless of what the FED say or want. At this point, the FED is cornered – doom on them and us either way – if they raise the rate or if they leave it like it is. I believe that we’ll see 2 more increases this year and 4 more next year. Just watch the fireworks!…

After the bubble busts, then will see again dramatic moves by the FED. For now they increase because they are way behind the curve and the longer they wait the more dramatic the collapse. At this point in the game they just try to find the course of action for the least damage, but they don’t have any good options. The time to raise the rates was in 2012 when they were trying to reelect Obama.

Inflation? Dude, you can leave the money in the bank there is no inflation. Groceries, electronics, clothes….everything gets cheaper. Sure we are in a stock and housing bubble but the crash will take care of that.

Dweezilsfv, do you mind sharing which CD that is? Dumb question….are there CD’s you cannot trust?

Waiting is hard = Nothing pays like patience.

Waiting = independent thinking

We need a return to a savings rate that is worth relying on if not investing. These micro interest rate changes by the FED don’t appear to be spilling over to small banks. CD’s seem to be the only item that has a better return.

I have a feeling that this continuous rise in the market maybe signaling the end to growth for now unless there is some magical item Trump administration is going to propose.

Flipping homes might be a harder thing to come by for investors and realtors.

Back to monthly income streams which will likely be rent, interest on savings/CD’s and Dividdends if any IMO.

Johnnie-

Ally’s and Barclays have great cd rates. FDIC insured.

@ Johnny: Capitol One 360 [formerly ING]. Another is Ally Bank and various credit unions. Here in Tucson, that’s Hughes Federal Credit.

Bankrate.com is a decent site, but there are several.

They don’t “pretend”. That’s exactly what it is and why they should buy if they think it’s what they need.

Buying a personal residence as an “investment” is real estate talk for cheerleading a house horny couple into buying the biggest house they can [barely] afford with the biggest loan possible.

That’s speculation, not investment.

The only time I have ever read anything that suggested that believing a house is just a roof over one’s head results in people not buying is your claim right here. What an absurd statement.

I don’t think I am the only one who has purchased a house or condo without “investment” as a motivator. Roof over my head, locked in payments, no threat of eviction unless I don’t pay the mortgage, autonomy and independence from a landlord.

In other words value and stability. “Investment” never even entered into the motivation. And it’s never prompted me to buy either.

Homes are only ‘investments’ as long as they are appreciating in value! Once the other shoe drops, they are like boat anchors and take those who dwell within down like the Titanic!

Actually houses are investments, and like any other investment, they can go up or go down. Over the long term, odds are in your favor that they go up, but nothing is certain in this world.

This jt guy is such a clown. It’s consumption if you’re consuming it and investment if you’re renting it out. Two completely different scenarios.

JT, have you heard about the 7mio people who lost their homes during bubble 1.0? That happened here in America. You think these 7 milo might disagree with you that buying an overpriced house during a bubble is an investment? In fact, they probably believe it’s the fastest way to poverty.

JT – Houses are not an investment.

Many studies have shown that over 30 years it is better to rent and invest the saving into the stock market.

Also, if you have to sell a home for a loss, you cannot write the loss off as an investment loss.

I live in flyover land. My house has appreciated on average, over the 18 years I have lived in it at 1.7% YOY. That is less in inflation and way less than the DOW. The house has appreciated 45k but my expenses over this time is 50k. (new roof, painting, carpet). If I sold now I would actually have a net loss.

Billman, the problem is you can not tell if we are in a bubble or not. Only after a bubble bursts can you say it was a bubble. If you think we are in a bubble, then you should not buy. However, two years from now, if prices are even higher, then you will know today was not a bubble.

My opinion … I don’t think we are in a bubble, but eventually be in one.

JT, it makes zero sense what you said: “However, two years from now, if prices are even higher, then you will know today was not a bubble.”

I think you have no clue what you are talking about.

The very def. of a bubble is inflated prices until it pops: A housing bubble is a run-up in housing prices fueled by demand, speculation and exuberance. … Speculators enter the market, further driving demand. At some point, demand decreases or stagnates at the same time supply increases, resulting in a sharp drop in prices — and the bubble bursts.

so, the bubble might go on for a a couple of years until it pops. 2009-2012 was a good time to buy but than the market was manipulated and artificially propped up with cheap money. When the party ends it all crashes down to 2009-2012 price levels or even lower.

Fact. Billman. Nearly everyone who purchased a home in coastal areas of Los Angeles or Orange County has a profit. The majority have a huge profit, big enough to fund a retirement. Unfortunately, many missed out. And, the many are determined prices will crash again and this time they will get in. Possibility you missed a once in a lifetime opportunity. Your kids might get a shot at the next crash.

These realtor/investors and hedge funds can only spin this show on for so long. Whatever JT is saying is likely propaganda being forced on us until the shoe does finally fall off. Almost a signal of what is yet to come IMO.

JT, you just make up stuff and call it facts. You are the Trump at housingbubble.com…..truth by proclamation/alternative facts. Your statements are just propaganda. Maybe, when you start providing some data/web links to prove your so called “facts” we start taking you seriously.

The vast majority of the “economically disadvantaged” will be forced to be life long renters, even in places like Texas. Buying a home isn’t a priority. Making your next rent payment and putting food on the table is likely much more important. Even with the poor migration from CA, the population here keeps increasing and the forces of supply and demand are seen first hand.

A RE market crash will come one of these days. And Jim Taylor will be right. I would put money on the fact that most people simply can’t put their lives on hold for the long term in hopes of buying at the bottom. There are no signs of tanking in sight!

Good ol’ LB. Can’t see the trees from the forest due to tunnel vision.

Claims that subprime and exotic loans play little or no part of the current cycle — Yet Quicken Loans and other FHA brokers run commercials daily.

Claims that prices are up because of high demand and low supply — yet organic demand is at multi-decades low, and there is plenty of inventory of over-priced residences.

Mocks renters — and yet ignores the multitudes of HELOC’s or reverse mortgages that make homeowners lifetime debtors.

Ignores the fact that prices and rents have hit a wall and actually falling in several over-priced markets — What, is the So Cal market truly different this time?

And for some reason, he’s still on this board preaching instead of actually buying properties.

“Claims that subprime and exotic loans play little or no part of the current cycle — Yet Quicken Loans and other FHA brokers run commercials daily.”

Subprime and exotic loans are not a factor in desirable parts of CA. The all cash and large downs have been proven time again. Where is your proof on subprime and exotic loans?

Claims that prices are up because of high demand and low supply — yet organic demand is at multi-decades low, and there is plenty of inventory of over-priced residences.

Again, supply and demand is probably the biggest factor when buying in desirable parts of CA. Anybody who refutes this simply doesn’t get it. And no, I don’t need to explain anything here.

Mocks renters — and yet ignores the multitudes of HELOC’s or reverse mortgages that make homeowners lifetime debtors.

I mock renters? That’s crazy talk.

Ignores the fact that prices and rents have hit a wall and actually falling in several over-priced markets — What, is the So Cal market truly different this time?

Is that a fact or your opinion? Home prices in desirable parts of CA are still rising and so are rents. Those are well documented facts.

And for some reason, he’s still on this board preaching instead of actually buying properties.

Just like you, I am interested in RE. I have said many times I am not a buyer at current prices. Give me a 15-20% correction and I’m in. Please keep the personal attacks and mockery to yourself.

There have been quite a few posts here about how sub-prime mortgages are once again contributing to the rise in housing prices. It was my understanding that non of the major banks are giving out what I consider sub-prime mortgages. I know BofA and Wells Fargo advertised a 3% down last year, but you had to have decent credit and qualifying income. Is any reputable financial institution actually giving out mortgages these days to people with bad credit and no proof of qualifying income?

Lord B.,

Look at what happens to the RE (rentals and RE prices) in New York (Manhattan) in the most prime area of the nation – they are in free fall. Google it and you’ll find tens of articles on the subject in all media (left and right). Are those people poorer than those on West LA?

At this point in the cycle all people are leveraged to their eyeballs – poor and rich alike. I can argue that the rich are even more leveraged than the poor for the simple reason that it was easier for them to borrow than the poor. If they have the debt on the house or their commercial property it matters less. If the banks don’t want to refinance the commercial property because the banking system freezes, will they try to sell the house? I don’t know. But leveraged people will become desperate and desperate people have poor choices. It is a fact that most rich people are very leveraged at this point.

It’s well established by now that rents are falling in the biggest metros.

“Subprime and exotic loans are not a factor in desirable parts of CA. The all cash and large downs have been proven time again. Where is your proof on subprime and exotic loans?”

Huh, no. Not letting you change the narrative from general real estate to just “desirable parts” of CA. Proof? Too afraid to look it up for yourself? “FHA loans made up 22% of all mortgages for single-family home purchases in fiscal 2016, up from 17.8% in fiscal 2014 but below the 34.5% peak in 2010, FHA figures show.”

http://www.usatoday.com/story/money/2017/03/12/concerns-riskier-mortgages-sprouting/98954348/

“Again, supply and demand is probably the biggest factor when buying in desirable parts of CA. Anybody who refutes this simply doesn’t get it. And no, I don’t need to explain anything here.”

There you go with “desirable parts” shtick. You do need to explain your sudden fascination with “desirable” areas.

“I mock renters? That’s crazy talk.”

In the worst way….with bad generalities and conclusions. Pride goeth before the fall.

“Is that a fact or your opinion? Home prices in desirable parts of CA are still rising and so are rents. Those are well documented facts.”

Trying keeping up with the real news once in a while, and not just the happy, go lucky headlines.

“Just like you, I am interested in RE. I have said many times I am not a buyer at current prices. Give me a 15-20% correction and I’m in.”

Huh? Are you a bear all of sudden? You’ve jumped both sides of the fence. If “desirable areas” are solid, why expect a 15-20% correction? Unless you’ve changed your position again and don’t care about “desirable” neighborhoods.

“Please keep the personal attacks and mockery to yourself.”

You consider me calling you out on your statements a personal affront?

We are not talking about “the biggest metros.” We are talking about LA/OC in particular and there have been recent article in both the LA Times and OC Register that rents are at an all time high and are expected to increase again this year. And look at all the anecdotal evidence of bloggers here complaining about their high rents. Why is this so hard to comprehend.

Los Angeles is one of the biggest metros. It’s always a good blast how you run toward the coastline whenever the sun starts to shine truth on your narrative. For every LAT OC Register shill piece you offer there’s a multiple of other sources showing that rents are coming down even in Los Angeles. If you really thought rents were on the up and will continue to go up in any sort of meaningful way then you’d be busy buying that beach close rental now getting started on the road to riches even sooner rather than here trying to convince the doubters.

I absolutely give up with some of you guys. I could tell you the sky is blue and the sun rises in the east and you would still find ways to argue against it.

Keep your ear to the ground and your powder dry, you never know when the next opportunity may present itself.

“I absolutely give up with some of you guys. I could tell you the sky is blue and the sun rises in the east and you would still find ways to argue against it.”

It must be a crushing blow to find out that some people are allergic to your mis-information and flip-flopping.

I don’t know what passes for sightings of tanks but I see a hell of a lot more homeless around these days in Cal. This picture is getting uglier to look at.

According to people I know who have told me, there are lots more homeless *everywhere*. Hawaii, Nevada, you name it. There’s something going on that’s akin to “enclosure” which forced the peasants off of the land in England, giving rise to the original proletariat. It used to be that if you worked, you could afford to live under some kind of a roof. Maybe in a rooming house, but indoors, somehow. That informal social contract has been broken. A lot of homeless people work. In fact, the homeless people who are easily identifiable as homeless are just the tip of the iceberg – most homeless people take great care to not look homeless, because they have jobs to hold onto (sleep in their cars or in shelters or in homeless camps) and can’t afford to look homeless.

Looking homeless is a big hassle, because now you can’t go into many stores, people won’t let you use their restroom or even give you a cup of water (there are no drinking fountains in my town, San Jose, and with drinking water costing $8 a gallon, much of the panhandling downtown especially on hot days is to buy water) so it’s best to stay “stealth”.

The ones you notice are the very bottom rung, the most beaten down, those who have given up hope.

And yet instead of the needed socialist revolution, we’ve voted in Cheeto Hitler. Go figure. It might be a bumpy ride, kids.

Alex,

Since you are so bent for a socialist revolution and at the same time you want to move to Israel, I wish you good luck on both. You may have a socialist revolution in Israel.

Since I lived decades under collectivists/socialist and I understand what those people from Venezuela go through, could you please spare US with your bolshevik bent? I would take the “Cheto” anytime rather than Chavez. You might want to move to Venezuela. They are as collectivists/socialist/bolsheviks as you like them. Please go ahead and have a taste of what you wish. If the government has the power to provide everything, it has the power to take everything – not only your food but your freedom and safety, too.

You talk based on theory and propaganda. I am talking from experience. My experience is not unique to me; it was the experience of hundreds of millions of people who lived under collectivists governments, regardless of the culture or continent and is spelled TYRANNY. The poverty and tyranny go hand in hand.

That’s true alex, it is taking place all over, but it didn’t come to be overnight and you know what else?… If cal crap patty land is the special snowflake exception so many try their little hearts out to make it be, it wouldn’t also be happening there at the same time! So you tell me broski, what’s the primary difference between your pasture full of petrified cal crap patties and the other side of the fence? Higher prices, that’s what.

Flyover – I’m going to have the best of both in that Israel was founded as a Socialist country, and in the whole country the most pessimistic counts show maybe, *maybe* 1000 homeless people in the whole country, with a population of 8 million. Compare and contrast any city in the US with a population of *one* million, will have about 10,000 homeless people.

Alex, in Israel they don’t have that many homeless because they have the same policy like “Cheeto” – they built a wall against illegals (apparently it works for them), they don’t allow any illegals in the country and they have a very strong vetting process for all who come legally – any difference from what Trump says????!!!!….for that, they are accused of being fascists and this week they already had a document at UN accusing them of that. Also, they like others to pay for their defense and imperial wars (US is paying for most of that). I don’t agree with Trump for paying for Israel’s wars – see, I don’t agree with Trump in everything.

Also, in regards to your comments about Russia: I didn’t come from Russia and my parents, grandparents and I had to suffer greatly because of Russian imperialism in Easter Europe. Also, Russia NEVER had a democracy regardless of who was in power (czar, communists or oligarchs). What they call democracy was always a sham. I am not a racist like you accused me and I don’t have anything against any race. I would have preferred Ben Carson as president instead of Hilary or Trump (one is black and the other 2 are whites). Not like Carson was perfect, but in my humble opinion better that Hilary, Trump, Obama or McCain. See, I don’t care about the % of melanin, but about the person’s character – some have more flaws than others.

“And yet instead of the needed socialist revolution, we’ve voted in Cheeto Hitler.”

Obama was the socialist revolution, and all those homeless people showed up on his watch.

I have commented here once in 2011 and stated that house prices will increase slowly but no crash in the near horizon… nobody believed me because everyone here was talking about interest rate going up, shadow inventory popping up, why buy now, prices will drop again etc since then I sold my house in 2015 that I bought in 2009 (made $$$) and then I bought another house in 2015 with %20 down and price already increased another %25.

Here is my prediction for the housing market. House prices will keep going up slowly till 2020 to 2024 then we might see a %20-30 drop but it won’t be like 2008 all over again. (Baby Boomers are still in charge of key government positions and won’t let another big crash happen in the next 8 years)

If you are buying a place to live then just do it instead of waiting like you have been doing since 2007! Yes houses are expensive so everything else.

If in the Fed and government threw everything, including the kitchen sink, at the RE market to stop its fall in 2010-2011, pray tell what other measures would they have up their sleeves to stop another fall despite ongoing record cheap and easy money? Be specific.

We are not in 2011 anymore so past is the past what Fed did or didn’t do is irrelevant right now. We cannot change what happened in the past but we can control NOW.

You have been waiting for a market crash since 2011 and it is not happening so wait longer and blame Fed for easy QE?? Fed will never make a rational decision because it is the right thing to do! Please give me a break.

Fed is Private and it is interest doesn’t lie with average Joe. Fed will pop this bubble ( pre-planned-orchestrated) again when the time comes till then praying hoping is not going to help you at all.

Plans are in place for the next crash in FED vault. Do you think Ben Bernanke and other Fed members didn’t know about the upcoming crash? You are too naive if you think Fed didn’t planned the crash landing in 2008. Ben Bernanke and other members knew it years before and pre-planned all the actions for the benefit of Ultra-Elite. I am confident that today Janet Yellen just like her predecessor Alan Greenspan is setting the stage for the next orchestrated crash in front of our eyes.

@TR

You’re preaching to the choir in your response. But I ask you again, what can the Fed and government do to counter the next downturn, as you expect them to?

TR,

So, according to you, in 2009-2011 the FED did NOT want to rebound the RE, but this time they will…!!!!!….classic mistake of thinking that the FED is omnipotent.

Boom and bust is what the FED practiced for over 100 years. They harvest the wealth produced by the peasants in both situations. Nothing new. When they buy, they like to buy for pennies on the dollar. They can not do that in this market of stratospheric prices.

I fully agree with you when you say Boom and bust is what the FED practiced (more like Pre-planned-orchestrated) for over 100 years.

What brings you back this way?

I never left. I just don’t like to comment for every post or don’t have time for it . I will probably comment again around 2020ish when the next bubble pops

How convenient for you.

TR, You were right once 5 years ago. Quit while you are ahead.

I was right in 2009 then 2011 then again 2015 I will be right again around 2020ish

You did your homework, TR; the big crash was largely due to stated income loans and speculation, neither of which is present. Orange County affordability is 23% which is worrysome, but I believe that: Baby Boomers have been in their homes for awhile and can make their payments. The percentage buying $700,000 homes are 30 somethings earning $140,000 per year, again not a problem – so, in your opinion, do you see a bubble that I am missing?

“You did your homework, TR; the big crash was largely due to stated income loans and speculation, neither of which is present.”

More erroneous statements. The crash, like previous busts, occurred because high prices were sustained by cheap and easy credit, regardless of the qualifications of the borrower. This is proven by the fact that 1) the majority of bad loans were prime, and not subprime, and 2) prices in countries with no subprime lending crashed as well. Cheap and easy credit has led to today’s speculation where 30% of homes were purchased by investors in 2016.

“Orange County affordability is 23% which is worrysome, but I believe that: Baby Boomers have been in their homes for awhile and can make their payments.”

Until they take out HELOC’s and reverse mortgages.

“The percentage buying $700,000 homes are 30 somethings earning $140,000 per year, again not a problem – so, in your opinion, do you see a bubble that I am missing?”

What percentage are you referring to? If your claims that very few subprime loans existed, then these 30-somethings would have to come up with a $140K down payment — highly unlikely for many in that demographic. Conversely, private home ownership is at decades low. This means that investors, speculators, and flippers made up a large portion of the buyers during the current cycle.

Huh? We are a couple in our 30s making north of that with a huge downpayment. But we still are not buying the crap on the market. Just because we can doesn’t make it wise to do so.

Jack your right on this; the big crash was largely due to stated income loans and speculation, neither of which is present. It is harder to get a loan today then 10 years ago

I don’t see a bubble today I do see a price correction in 5-7 years.

@TR

“Home flipping hits 10-year high in 2016”

http://www.housingwire.com/articles/39523-home-flipping-hits-10-year-high-in-2016

What were you were saying….?

Even people in the South Bay face “mega commutes” into L.A. My parents’ neighbor recently chose to take an early retirement because his commute, after being constant for 20 years, essentially doubled during the last 10.

He’s putting his 3/2 on the market soon and hopes to get 800k, if anyone is looking! Last I heard, his roof fascia had to be replaced due to termites. Don’t recall seeing or hearing any construction, though. Maybe the new paint reverses termite damage?

If he’d stick it out a little longer there’s going to be trains from anywhere to everywhere and air conditioned bike lanes so no more worrying about commuting. It’ll be even more sweet for homeowners because we’re going to get all the money to pay for it from the poors who aren’t leaving the state. Winning! No tank in sight!

I know from experience that there are certain aspects of life that can be better over there, but it is certainly no paradise.

Day-to-day suburban life is comparable anywhere, but the humidity and mosquitoes over there are ridiculous. The threat of a hurricane is also more prevailing than earthquakes.

And most people are nice, but there is a segment of the population in Texas that has a serious attitude and ego problem.

Can confirm all of this. After having a child in a one bedroom San Francisco apartment, moved to suburban area of DFW. After having a second child who just wanted to be outside but would get eaten alive by mosquitoes in less than 5 minutes, we moved back to a Bay Area suburb. The living is similar, just a lot less killer bugs. I will say for the most part, people are much nicer in Texas, and way less shady characters, but I enjoy outdoor activities and it seemed like there were only about 30 total days out of the year where you wouldn’t be miserable in Texas for such recreation.

Crazy thing is, we made enough appreciation in two years on our house in Texas to afford us 20% downpayment for a wonderful house back in California. Reverse migration worked out well for us as we are in a home we will be completely happy living in for the next 30 years. We tried to look for rentals, but they would have all been more per month (after of course we put down almost $100,000 on our house).

But Texas is great, California is great, Tacos and happy hours are great.

Even in 2012 this blog focused on how overpriced the market was. Los Angeles will always be pricey but that is because people like it here, be proud of that. I will choose to buy when my salary allows it. If my salary goes up or if housing goes down. I will also keep a close eye on the Case-Shiller Los Angeles Home Price Index. Either way I am not going to be a slave to my debts. Debt is good, abusing debt is bad. I am a millennial who uses debt, have never paid interest on any credit card ever.

Housing has become like oil in 2007. I remember a liberal teacher telling the class “George Bush caused this gas crisis and gas will never go below $4 a gallon.” I love looking back on stuff like that. But just like Oil, something big will happen that some will see but most will not. Those who say housing will not go down again are just plain stupid. Back then it was George Bush and Oil today it is Trump and Housing. It is so funny how history will always repeat itself because people forget it. A lot of people will get burned but the world will keep turning.

After Trump is in office for a while people will start to blame him for high housing prices (it makes no sense but people will do it). They will claim he is using his presidency to make the trump name larger and more powerful. Lets set the date for 2.7.2018.

Buy now or forever get priced out! Seriously buy buy buy people, they weren’t making more oil and they sure as hell ain’t making more land. Well… until they start building vertical at least.

For eight years the FED gave us a monstrous bubble because they were suppose to make the statists/globalists/collectivists look good. They kept rates at zero with only a symbolic raise of 0.25 for the whole presidency of Obama.

Now that Trump is in power, regardless of the hard data, they raised the rates every quarter till the whole bubble will busts. Then, blame it on Trump, obviously. The GDP is decreasing every quarter, the wages are going down and the FED is raising rates; of course, “all data dependent”…:-))). Next quarter, I expect a new raise. Just wait for about 6 months to see the effect. I am not surprised. I expected this. What surprises me is how shameless they do it. They put lots of trust in the deep state made up of traitors.

Hey, follow JT advice and buy now the best investment of your lifetime.

I don’t believe that the Fed is raising rates because of Trump. More likely because they foresee the end of the credit cycle followed by the inevitable recession. They’re terrified of being unable to lower already historically low rates any further during a downturn. Unfortunately, they’re several years behind schedule.

If and when the Republican majority is voted out of power, it will be because they, like previous Democrat majorities, would have done nothing to address the concerns of main street. To my displeasure, Trump is flip-flopping and praising the job numbers produced by this unsustainable economy.

I agree with that. What I meant was that the FED was supposed to raise rates a lot long time ago. They didn’t do it to make the collectivists look good and enrich their buddies. Another point I was trying to make is that the raise or lack of it is not “data dependent” as they claim. And it is not because of “noise in GDP”. What, 0.9% raise instead of 1.2%? …and raise the rate when the GDP goes down?…just a sham!…

From my point of view they can raise it to 10%. I am ready and prepared to take advantage when they do.

This is very snarky, but why are all of these poor people leaving the liberal utopia of CA where you can eat bonbons while on welfare checks?

Bob, they are like locusts. They elect stupid politicians, destroy one area and then they move to the next. The cycle repeats till there is no green in site.

Seen it – it’s actually pretty hard to get onto welfare and food stamps in California because they know there are jobs out there you can. Out in flyover country, welfare and food stamps are very easy to get, and to stay on, because there are no jobs and nothing to do. It’s pay for a bit of food of face a monstrous crime rate.

I guess that’s why hardly anyone in California gets welfare or food stamps or EBT cards.

That’s exactly what the “haves” stereotyped the migrant workers in Steinbeck’s “Grapes Of Wrath”. A bunch of dirty locusts who wanted to work but couldn’t make enough money with a job to survive. They eventually voted in FDR who made the whole country a liberal utopia. At least until Reagan. The cycle repeats.

We had FDR after the last Depression who promised to help the locusts with social programs (SS, Medicare) and infrastructure programs with the New Deal. Germany had Hitler who didn’t promise social programs but promised to make Germany Great Again by funding jobs through a military build-up which led to a great war and the ultimate destruction of Hitler and Germany. The cycle repeats in the US differently this time. I hope the results aren’t the same.

Perhaps you should look up facts as opposed to your opinion. The states with the highest amount of welfare recipients are Oregon, Louisiana, Tennessee, and West Virginia. These are the people dragging down our country but lack of intelligence and wanting so bad for the answer to be someone that doesn’t look like you because that’s what you were told without research leads to comments such as your own.

How many poor people in those states vs. California? California might only be one state, with some very rich people — but it has way more poor folk.

He must have been blinded by the serene vista of the Golden State Advantage!!! https://www.ebt.ca.gov/caebtclient/login.jsp

Excuse me… Golden State ADVANTAGE!!! This moronic state is so hilarious even the poors can be subliminally fed the Cali dreamin’ imagery in the checkout line every time they whip out their card at the Southgate Market or 99 ranch! If only there was a subway to the vista!

In other words, the liberal policies of CA create jobs and make people who want to work want to move there? This is causing an issue because the demand for housing outstrips the number of people who want to live there and have jobs with livable wages.. This isn’t what the Republicans are telling me. They claim states like Kansas are utopias that offer jobs because they offer lower corporate taxes and individual taxes. People, Kansas is not doing well. Trump thinks the same. We are all doomed.

“In other words, the liberal policies of CA create jobs”

The liberal policies of CA send the jobs outside the state. They are definitely not what create jobs. You may ask any private employer and you will hear the same thing. It is the weather attracting capital required for jobs and very rich people who want to enjoy that weather. They come DESPITE the liberal policies.

Fucking up governing a state is not a partisan issue. California has plenty of problems and appropriately addressing housing demand is one of them. Its not secret and it is definitely the fault of the in power politicians which are Democrats.

You can also find plenty of examples of mismanaged states held by Republicans. Finding a way to fuck over your populace is not bound by one ideology.

California is not known for its welcoming business environment, though I am certain there are exceptions. The nice thing about tech work is it doesn’t butt up against environmental regs since all we do is sit at computers all day.

Seen it all before Bob – Yep. Kansas Governor Brownback has had a hard time cleaning up the big spending spree that the two prior Democratic Governors left in their wake. Specifically Kathleen Sebelius. He is doing his best to balance the Kansas budget again

by having to cut all the over spending that was created by the Sebelius government. Nobody likes the person who has do to dirty deeds even though they are required to keep house from burning down.

Nobody realizes she hid pension deficits and etc. Parkinson almost went to jail because of her.

“Kansas failed to adequately disclose its multi-billion-dollar pension liability in bond offering documents, leaving investors with an incomplete picture of the state’s finances and its ability to repay the bonds amid competing strains on the state budget,†While the troubles brewed under Democratic Gov. Kathleen Sebelius and bounced to Parkinson, Kansas began reforming matters in 2011 following the election of Republican Gov. Sam Brownback.

Owning a home is not a Right. It is a Privilege.

Tell that to the government, which continues to encourage ownership by the economically unqualified and over-speculation by investors through cheap and easy credit.

^^^^ This. Perfect, concise and true.

And tax incentives…

Toyota moving jobs out of Torrance to Texas certainly contributed to the exodus.

Are we heading toward another subprime mortgage crisis:

http://www.cnn.com/2017/03/14/opinions/risk-of-another-housing-crisis-poole/index.html

The bigger issue will the debt crisis in many sectors of the economy, including corporate, financial, tech, Wall Street, etc., and not just subprime. The world is awash with debt that continually needs to be sustained by cheap and easy credit. Higher interest rates will hurt far more than the subprime segment.

bingo. Debt is not a problem as long as it is servicable (P&I or at least interest payments are paid).

Housing prices are supported by wages and thus disposable income. Low interest rates mean the same monthly payment can leverage a bigger loan. Higher interest rates mean lower leveraging.

TR is predicting slow increases in housing thus he is predicting wage growth too. If interest rates rise faster than wage growth….housing will stagnate though. Wages have risen the past 5 years and so has housing.

But…..if the FED can get inflation up to 4% then housing and wages could rise in tandem.

@Ru82

“Housing prices are supported by wages and thus disposable income. Low interest rates mean the same monthly payment can leverage a bigger loan. Higher interest rates mean lower leveraging.”

Wages have been relatively flat while prices have grown exponentially. The two have been almost mutually exclusive during the current and previous “boom”. Thus, RE price growth have been supported primarily by exponential debt growth (over-speculation).

“TR is predicting slow increases in housing thus he is predicting wage growth too. If interest rates rise faster than wage growth….housing will stagnate though. Wages have risen the past 5 years and so has housing.”

Accrediting price growth to wage growth has been a bad bet for somewhere close to 20 years.

“But…..if the FED can get inflation up to 4% then housing and wages could rise in tandem.”

The primary type of inflation the Fed has been generating is lifting asset prices. It cannot create the new innovative industries required to replace jobs displaced by globalization and technology. Thus, the widening wealth gap between the elite .0001%, which owns the assets, and the 99.999% (you and me). Asset inflation != wage growth

Prince of Heck: It cannot create the new innovative industries …

Something innovative is always new. Thus, it is redundant to say “new innovative.”

You should instead just say “new industries” or “innovative industries”.

@SOL

I graduated from the Redundant School of Redundancy for the Chronically Redundant.

Hi,

Reading these comments and articles. Texas always seems to be the place that people mention about moving to. Occasionally I read about Portland. Can I ask why not Florida, or New England and Dakota? Im from the UK and genuinely interested.

Thanks

Portland and Seattle have much in common with California cities like Los Angeles, San Francisco, and San Diego.

* All those cities are on the West Coast.

* Even if not all of them are actually on the Pacific Ocean, all of them are waterfront. In the case of Seattle, Puget Sound. In the case of Portland, the Willamette River.

* All of them have beautiful, varied, outdoor recreational spots.

* All of them have a mild climate.

* All are culturally and politically liberal elitist. By which I mean, it’s the kind of place that artsy, hipster, yuppie, liberal sophisticates like. (San Diego is more conservative, but not compared to places like the Deep South.)

Thus, white middle class and upper middle class liberals, if they can’t afford California, they often feel comfortable in Portland or Seattle.

Like Alex in San Jose, many of these Californians are prejudiced against “flyover country” conservatives.

As for Texas, Arizona, and Nevada, these states share Southern California’s desert climate. (Though I hear Texas is more humid.) So in that sense, it’s like L.A., in terms fo climate, only cheaper. And you can find pockets of liberalism in these places.

“Prejudice” means to “pre-judge”. Trust me, I did not pre-judge flyover types, I lived out there for several years and they really are mouth-breathing loons.

IF you are a white conservative Christian, they are no problem. If you are anything else be prepared for grief. The funniest is, if you are Jewish they *will* eventually ask about your horns.

Texas is very cheap in some areas and has tons of jobs, often time people can cash in their equity in CA and buy a home in Texas for cash or close to cash as possible so they have a very small mortgage. There are cities in Texas that are very expensive but you can get a lot of Real Estate there for and get buy on a small income.

Portland is very nice, coastal, lots of rain, weather is different than Texas, it is closer to Bay Area/North Ca Weather. Portland has gotten a lot more expensive in recent years but it is beautiful there, except that hipster crowd that caters to homeless and crime. IF you leave Los Angeles to run away from the crowded, dirty, and infested with crime areas, you don’t really want to end up in Portland with the same issues.

Florida is also very beautiful, the Weather there is great but you have to get used to it. Many people do move to Florida because most of them are from the East coast. It’s very hard to leave CA if you are from here and go to the other side of the Country. At least in Portland/Texas you are on a 2 hour flight away. Florida is another world compared to CA.

I love New England but weather is rough in the winter. I been to Boston, New Hamps, Maine, all over. I love it but I would only live there if I had the type of money that would allow me the flexibility to leave and live elsewhere during the winters. If you love small towns, New England can be amazing.

I never been to the Dakota’s but you probably do a lot of fishing there. I would probably move to Indiana/ East Michigan before I moved to the Dakota’s.

Remember the biggest thing is being able to get a job wherever you move to. Texas/Florida I think those places offer more job opportunities than smaller states.

The people move everywhere, not just TX. Depends on many factors and which ones are more important to you: climate, cost of land, jobs, family or friends, taxes, political climate of the state, natural beauty, etc. Sometimes is a combination of factors with each person having a different ranking for those factors.

Portland has rain all the time, is super crowded (at least on freeways) and it is a poorer sister of Seattle and with more drugs. Seattle is more sober and way wealthier; just as rainy and with bad traffic. It has more class among the big cities (which are not to my liking, I like smaller towns). There are way more job opportunities and good pay in Seattle pretty much for any field (comparative to Portland). In Portland you pay income tax and in Seattle you don’t. In Portland you don’t pay sales tax and you do pay in Seattle.

In TX, the property taxes are very high but RE prices are lower. You don’t pay state income tax. The weather is very bad for the most part. Wages are lower than Seattle. WA state has far more natural beauty and VERY diverse in terms of climate and geography, comparative to TX. Still, the beauty is in the eyes of the beholder.

I hope that helps.

Good Question

The answer is probably because the climate and culture are more comparable and familiar

It is a big difference in climate between CA and TX.

Thanks for all the information everyone. I know it probably seems abit unusual about someone from the UK being interested in California property. Its just I see alot of similiar problems in the UK.

you all come on over to Kerrville and me and Kinky Friedman will put an extra slab of genuine free range grass fed organic beef in the stoker for you all.

To the guy that mentioned property tax in Texas…it’s true, they are very high here, but remember you are basing that tax on a house that costs 1/2 the price or less of a California home so the net result is not that much different……Oh and we have no…Zero…nadda state income tax here. What is California’s state tax now? Yea, it’s not even close. Not to mention it costs me about $75 to register my new car. Is Cal still basing it off price? lol what a ripoff. The worst thing about Texas is the weather. Period.

Good point, and a good reason the WORKING poor are leaving Clownifornia for places like Texas. They see better cost of living, more job opportunities, and less future liabilities that they will be paying for (i.e., all the parasites, both at the bottom and those on the top in government). The people making 100K+ that moved to Cali are chasing the bucks but will often find the cost of living and taxes will chew up the gains versus what they made in their previous state. They’ll likely leave after this current bubble bursts unless they’re one of the few lucky ones that makes out from an IPO or realizes its a bubble and doesnt scale up their lifestyle.

It’s not just housing costs. In 2000, the legislature in Calif passed SB400, doubling CALPERS Pensions which now is costing taxpayers not only salaries with pensions but an an additional 8 Billion a year and climbing. We have now a privileged class to support that will raise state income tax to a huge amount. Texas has no state income tax. CALPERS is the reason we have no state funds to fix Oroville Dam and much more. Then we have the High Speed Train debacle. California has some weird priorities and most is abuse by Public Employee Unions.

Those public pension plans are amazingly unfunded and ready to implode across the nation. Dallas police had a run on theirs and wants the taxpayer to bail it out.

Such is what happens when you promise a 7% return and have 1% for a decade.

This is going to get real ugly, Stan. And not just in CA

The Fed’s prolonged ZIRP policies played no small part in this fiasco. Robbing from the middle class to reward the speculator class in a the casino-style economy.

you will never guess what those loyal servants of the great state of CA do when they get that fat check……They move to a low tax state and funnel all that CALPERS cash to other coffers. I would love to see an audit that shows the % of disbursement checks that go out of state.

The public employees should not have union. Period.

There is no reason for the government employees to be unionized. If they don’t work for profit there is no incentive for the government to abuse the employees or to provide unsafe work environment.

The public employee union is a gang to use the force of the state and rape the taxpayers because they can. All taxpayers should be against public employee unions and all politicians who support them.

Why people think we’re in a bubble, is beyond me. Can’t it just be an expensive, desirable city?

And why people think there are no jobs in flyover country, is also beyond me. It’s not the glorious life that some people portray it as, but it’s also not the trailer trash festival that other people say it is. It’s just a regular old place to live

Thank you. East and West Coast snobbery. CA native and never subscribed to the idea that only liberal elites mattered.

Realist, lets be realistic. It is a price increase if a city displays increases in price due to higher incomes and more better jobs. What we witness is a RE bubble in ALL industrialized countries due to actions of central banks and do not have anything to do with income increases or people feeling better off financially.

The actions which caused this bubble will cause a reverse (bust) when removed. That will make it plain for all to see that it was a bubble. I feel it even in flyover country – percentage wise the same as in SoCal but in absolute values on a smaller scale. There is too much CURRENCY/DEBT chasing the same RE.

It’s not just beyond you. 7mio foreclosed people had no idea they were buying into a bubble. Every game has losers. If you don’t see the loser, you might be it.

Is it 300% more desirable than it was in 2010? There isn’t 300% more weather but there is more crowding and traffic congestion.

The wild card is Yellen and the Fed. They are mostly Democrats, and they could try to spoil the Trump party by raising rates too much just to cause an economic problem before the midterms. The Democrats will do anything to get back into power, even if it means hurting American with too many interest rate increases. If the Fed goes too far with rate increases, it will hurt your 401K and your real estate values. The Democrats are not to be trusted.

“The Democrats will do anything to get back into power, even if it means hurting American with too many interest rate increases. If the Fed goes too far with rate increases, it will hurt your 401K and your real estate values. The Democrats are not to be trusted.”

A crash does not hurt, it offers opportunity. It brings back a more realistic price level. That’s great for all Americans. We need 10% interest rates and an economic crash.

“The wild card is Yellen and the Fed. They are mostly Democrats, and they could try to spoil the Trump party by raising rates too much just to cause an economic problem before the midterms.”

What the Government needs is a big bout of inflation of the 1970s wage inflation sort, not just asset bubbles. So they can pay debts like those state pension liabilities with cheap dollars. Yellen’s interest rate increases may attract foreign yield chasers which will bring in more dollars from abroad. Trump’s proposal to lower the tax rates on US corporations to repatriate foreign earnings will also bring in dollars from abroad. This money will help finance Trump’s infrastructure and wall programs. [SIABB: Trump’s wall is more like a Maginot line than anything Hitlerian!] Most of Trump’s spending will be in flyover territory, of course and presumably will drive up wages… That is if all this actually works and we don’t have a deflationary backlash again.

Isn’t this the plan? La La land loves their low wage help … gardeners, housekeepers, nannies, etc. but the rest are becoming a nuisance. Heck, having to roust those homeless camps and providing socialist state welfare is getting expensive! California only wants you if you have a spare $1 million or more to buy a home, you can afford a Tesla, are chic, or have memberships to the spa! It is so wonderful to be a socialist liberal when you have more money than sense, can tell the world how poorly the huddled masses are treated … just as long as they don’t try to set up a squatters camp in your neighborhood … actually having them leave and go somewhere else is even a better idea!

At least in Texas, where it seems fatty foods are their drug of choice, at least in the rural parts, they are closer to Dr. Nowzardan, from My 600lb life-

https://www.tlc.com/tv-shows/my-600-lb-life/

Born and raised on So. Cal. beaches in the 60’s – 70’s. Moved away years ago for my career but was a frequent visitor to check in on parents. While the weather is great, I can’t comprehend why anyone would intentionally stay in the arm-pit that the L.A. area has become! Having said that, please don’t migrate to those undiscovered places, one of which I found and spoil it too! I like my 2.5 acres, my boat, my lake, and the absolute stunning scenery, my little brewpub, my coffee house … ! Oh, on second thought, California is a lovely place, all kinds of amenities …. stay there!

Again with the lake! You’re like JT with his beach houses.

So serene, but I don’t know if I would like it too much. I’ve never lived anywhere but Socal, although I have traveled throughout the southwest states, but I just can’t imagine being anywhere but here. Weather is a BIG deal. I can’t stand the winter of the north and north east. Been to Texas and Florida a few times, there’s no way I can permanently live in that humidity. I heard the Northwest rains a lot, what a bummer. The plain has no natural features and I’d put myself at risk of tornado. So all that left for me CA, NV, and Arizona. When CA goes underwater I’d relocate to Nevada or Arizona, but for now I’m enjoying the year round 70 degrees. I’m 10 minutes away from the beach and 1 hour from ski resorts. I can eat any ethnic food and have access to all sorts of goods because everything is imported to the Port of Long Beach. Labor and materials are so much cheaper that I was able to build extension and renovate for a fraction what it would cost elsewhere. No religious nuts neighbors. In California with so much to do we don’t have time worrying about neighbors.

No jobs in flyover country. We are all gun toting religious fanatic rednecks. It is terrible, stay in California. We do not want you here to share in our ignorant misery. All of us are on meth, none of us is has an education. No one travels. Hang tight to your stereotypes. As one person I know said about living in Utah after moving from Sacramento, “We traded gang banger neighbors for Mormons.” Tough life here.

You forgot to say that we live in trailer parks and we don’t have teeth. There. I completed the picture for you.