California budget and housing are interlinked – California home sales spike but prices remain near the trough. Why California housing values cannot increase without income and employment growth.

On Friday the Governor gave a grim overview of the problems faced by California. The California budget is facing a $19.1 billion short fall ensuring a long and drawn out summer of politics and financial hocus pocus. The Governor even made a brief comparison to Greece for all of those who can’t connect the dots and figure out that having too much debt is a bad thing. Too much debt is what built the California housing bubble. Alt-A and option ARMs still languish out in the market. Even the boogeyman of toxic loans is being dwarfed by the problems in prime mortgages. Fannie Mae and Freddie Mac keep issuing quarterly losses and going back to the government well.

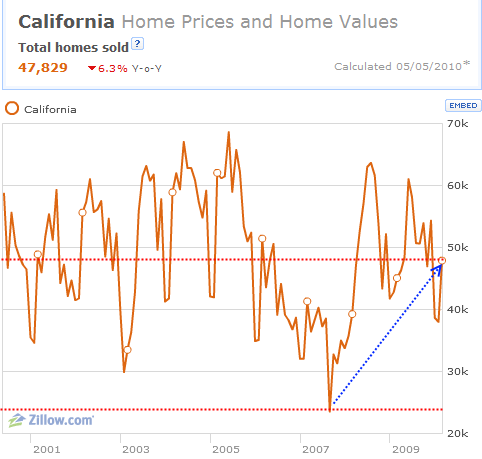

People look at the jump in home sales last year for California and attribute this to a recovery:

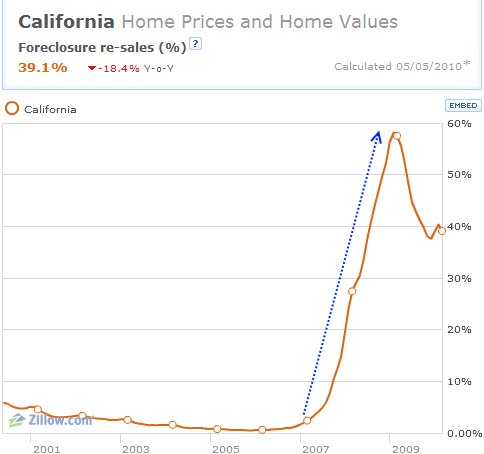

Without a doubt, we are no longer scraping the bottom that we faced back in 2007. Yet this in no way reflects a healthy market. For 2007 and 2008 nearly half of all California home sales were foreclosure resales. Even today, 40 percent of all California homes sold in the last month were foreclosure resales. This is not the makeup of a healthy market. The jump in sales came because of a few artificial stimulants:

–HAMP and banks holding off inventory

-$8,000 government tax credit

-Federal Reserve keeping mortgage rates low by buying up $1.25 trillion in mortgage backed securities

-Crash in home prices

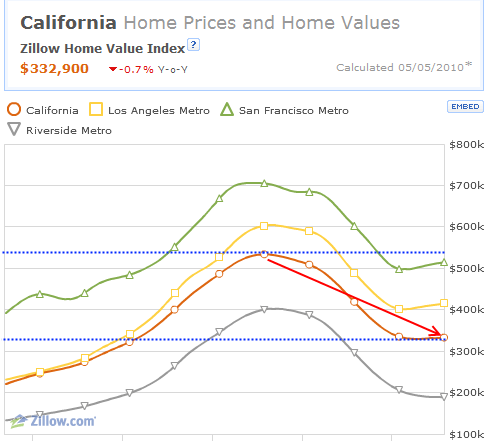

And home prices are still at the bottom on aggregate:

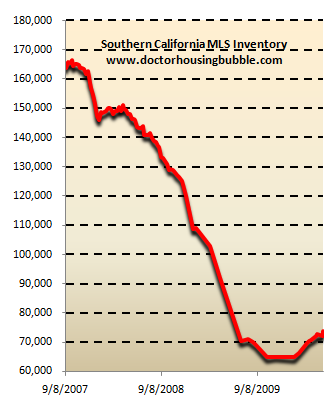

So why hasn’t the massive jump in sales caused prices to rise accordingly? Because lower prices are the direct reason for more sales (plus the large amount of foreclosure resales). Yet many of the temporary gimmicks have seen their day. For example, inventory is now making its way onto the MLS at a steady pace:

Inventory keeps moving up from the bottom although we know that banks have enormous amounts of mortgages that are problematic. One third of California mortgages are underwater. That gives us approximately 1.7 million homes that are underwater in California. Foreclosure resales are not a healthy part of the market. Just look at this chart:

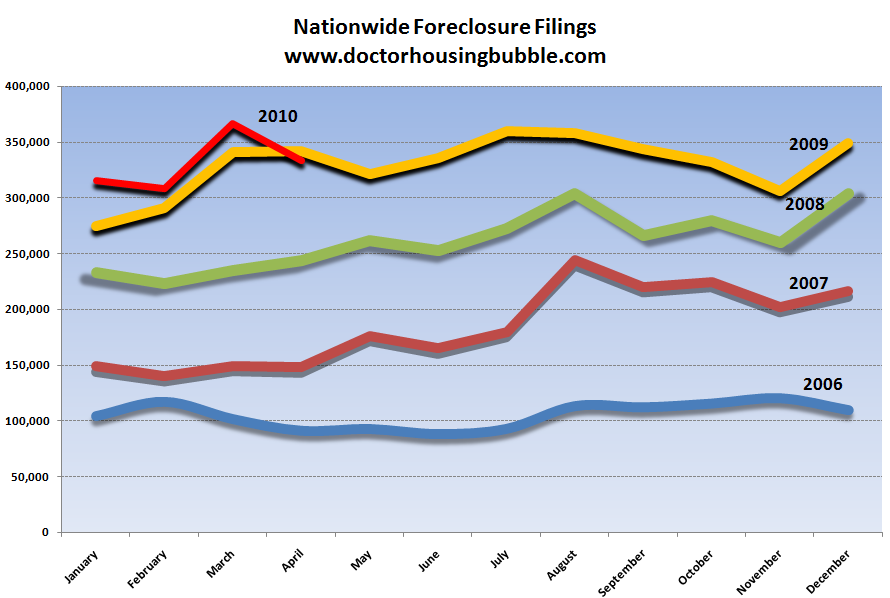

We have no historical comparison for this. Foreclosures are always part of any housing market but they are usually a tiny number of homes. Even today after trillions in banking bailouts we are still seeing record amounts of foreclosures. Nationwide the number is still elevated:

We are heading for 3.5 to 4 million foreclosure filings this year and this is all occurring with every imaginable government program as well. Why hasn’t it worked? Because the economy is still in the dumps for most Americans. What use is it having a low interest rate if you lost a job or had your wages cut back? A principal reduction does little if you have no work. I’ve been arguing for a few years that the bailouts were focusing on the wrong issue first. Instead of focusing on banks and Wall Street, we should have focused on solidifying the employment market for most Americans. The two are absolutely interlinked. In California, the last ten years have been all about real estate.

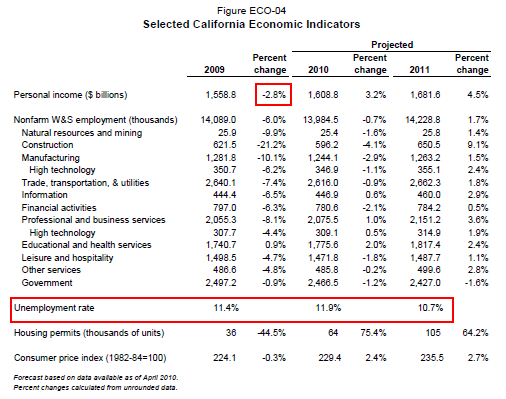

The Governor’s budget always optimistic in projections, has double-digit unemployment until the end of 2011:

How does this bode well for housing? People keep wondering why home prices are stagnant or falling in many areas. This is occurring because home prices can only sustain what local incomes can support. That was the flaw of the housing bubble in the first place. The large mortgages allowed one giant game of musical chairs where home prices simply kept going up but in reality, incomes had no way of supporting growing home prices. Even today in many cities in California you have mini housing bubbles. People buy with the same expectations they had during the decade long bubble. That has worked in the last year but with every government support measure in place. As I talk with people today I would summarize the situation as cautious. The vast majority of Americans don’t follow the housing market that closely. Even those in the housing industry trying to pump up prices have hard times justifying prices. “Prices will go up because real estate always goes up.â€Â I’m not sure if they’re trying to convince me or each other.

Deep budget cuts ripple through an economy. The pain will come months after the cuts take place. You start seeing a class division in California take place. The housing markets that have taken the worst hits have been in lower to middle class areas. These areas have seen local governments decimated. So wealthier areas get smaller and more selective since there are fewer places to hide. But to think that people can go into a tiny niche and forget the rest of the state is the same logic of what occurs in places like Brazil where the wealthy focus on their own well being while the rest of society is left to fight for scraps. Yet is this what we want? America is built on a foundation of a solid middle class and that has been eroding for years. Growth came after World War II from the ability for average families to purchase a home that was affordable with a 30 year fixed mortgage and our ability to produce goods for the world and ourselves.

In the last decade, California has witnessed what happens when you give Wall Street free access to impose its will on the market. Wall Street devised the most obnoxious toxic mortgage waste and had an army of mortgage brokers and agents doing their dirty work for years. These people convinced themselves that they were doing “the right thing†because after all, it was the borrower who signed the mortgage. I’m sure the giant commissions helped. Would they be doing this “right thing†if they got $8 an hour for helping homeowners purchase a home? Of course not. Yet many of these people now realize how expendable they are to Wall Street. Investment banks are back to betting on the next hot thing with bailout money and churning out giant profits creating bubbles in other sectors.

“It is difficult to get a man to understand something, when his salary depends upon his not understanding it!”

I find it appropriate to quote Upton Sinclair who had a run with California politics before and during the Great Depression. We have to create an economy that depends on building and producing things. Right now what we have is an economy that allows Wall Street to siphon off true value and funnels it to a very few at the top (even if it requires bailouts). Then you have a crony government sector that basically does Wall Street’s bidding when it comes to writing laws. Is it any wonder that many Americans in recent polls are now favoring a system that goes beyond two parties?

I doubt we’ll see any stability in California housing for years. In some markets, purchasing a home is putting a bet on the housing bubble returning. Other markets have prices getting closer to more reasonable fundamentals. But until we start seeing solid employment growth for one year, then all of the supposed gains are merely an illusion.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

29 Responses to “California budget and housing are interlinked – California home sales spike but prices remain near the trough. Why California housing values cannot increase without income and employment growth.”

Great article as usual!

Seems to me prices have to go down some more in many areas of California, not just due to salary/unemployment but all those toxic alt-a/option arm resets we’re going to see for the next two years.

STOP FIAT MONEY !

The “more for me” mentality is alive and well.

In Alameda, Ca. a teacher was complaining that they got “only” a 4% raise, not the usual 4%,plus an additional 3% cost of living raise,like they usually get. Their solution- add a parcel tax of nearly $1,000. to each house, and a parcel tax of up to $9,000. to each apt. house, and commercial building.(Parcel tax can be used to raise salaries, and retirement- a bond issue can not.

Average teacher salary in CA. is $70,430.per NEA, highest in the nation.

Apparently, once you have the entitlement mentality, nothing is ever enough.

Thanks once again Dr. HB, for teasing out the facts, among the desperate attempts to keep the housing charade alive… Just the last few suckers at the party, before it finally collapses, like it has every other time in history. Even the high-end in West Los Angeles can’t deny it much longer. In the last 2 years ,YOY, even fabled Beverly Hills 90210 has declined 39% in Price Per Square Foot, to almost $500. Throw in Brentwood. West Hollywood and Santa Monica also with big declines.

The writing is on the wall, for those who choose to see it.

http://www.westsideremeltdown.blogspot.com

Fed up taxpayer, Ditto !

Just wait until these folks “expect” to get their pensions for life.

They were the ones who benefited most from Prop 13. Union career allowed them to stay in same house and pay artificially low property taxes,….. and NOW they want to change the system. Incredible arrogance.

I’d recommend that they each personally forgo the Fed $500K cap gain exclusion on the appreciation of SFR. Instead that tax should go to State coffers.

I agree that the decline will happen for years. I’m also concerned that we could see a big drop as the financial sector unravels. Looking at Greece and the $1 Trillion bailout for the PIIGS, we could see in a couple of years sovereign defaults. When that happens, it’ll be like Argentina in 2001 when they defaulted. No one lent them any money, who’s going to buy a home in the US if they have to put the entire price of that home down in one time while we suffer from hyperinflation. I love it when people go long with their predictions, I don’t think that our current financial system will last another three years.

employment income growth along with overall high employment has been a positive part of demand in the RE market model the past 40 years but that model is no longer valid. Mortgage debt in the U.S. was around 2 1/2 trillion in 2002 by 2008 it had grown to close to 11 trillion and it took 40 years to generate the first 2 1/2 trillion in debt! What has happened since is that the forward value equity of the RE market has been extracted through refinancing,2nd and 3rd loans and various homeowner equity lines during this critical 6 year period. The prior RE model depended on move up buyers with equity to make large down payments and cash remodel but instead equity was borrowed from the future and used to fund various consumer driven speculation and spending.

So what we have today instead of future growth is a large debt overhang that needs to be paid down or forgiven before the RE market can return to its prior state. There is not enough equity left in the market to create the sales velocity necessary to return the market to its prior state even with a return to higher employment levels this is why the government via the GSE’s are creating a different financing market based on income/debt levels rather then down payment size. Its an attempt to generate a new model that will duplicate the prior RE sales velocity.

Great summary, Ron.

Rather than a move up society and mentality, it’s time to switch to SAVE UP and live within your means.

A word comes to mind… austerity — the new “in” word for this decade.

Cheers!

One of my favorite all time quotes. I couldn’t agree more with you about the middle class. When historians of whatever society ends up replacing us as the next super power look back at our downfall the blame will lie heavily on Reagan as he is the one who started this process of destroying the middle class. You can’t have a thriving nation without a strong middle class.

If you overlay a CA employment graph with a CA housing price graph, you will see a very high correlation. I’ve done this for the time period of 1960 to 2010. An unemployment level below about 7% seems to kick in prices rising. Anything over 7% starts prices decling. At over 12%, we’re in deep doo doo for a while.

Hi All

I feel very good when I visit this blog. Even my wife knows that the reason behind us not buying the home is DHB and sometimes she says in a loud voice “STOP READING BUBBLE BLOG” (she don’t know the exact name). Guys every chart indicates that house price will fall but when ?? We are loosing it and having arguments everyday. My wife want to buy whatever is out there and do not want to sign one year lease. In Cerritos inventory is shrinking like there is no tomorrow. I saw two houses 1110 Sq feet going for 565k and 545k. The Euro is down so I feel little safe with my $$$ but very nervous. My fear is that they will keep the interest rate low for long time and keep the prices up.

“They were the ones who benefited most from Prop 13. Union career allowed them to stay in same house and pay artificially low property taxes,….. and NOW they want to change the system. Incredible arrogance. ”

I”m tired of Leftist whining about Prop 13. Prop 13 benefits little old ladies and grandparents living on a fixed income in the house they’ve paid off. It prevents them from having to sell because the tax man has re-assessed their house and decided they need to start paying $1500 a month in property taxes. In other states with no shield from property tax hikes, retirees were being forced out of their houses simply because they couldn’t make their tax payments.

“Repeal Prop 13” is the battle cry of those who hate their parents and grandparents. Besides, with all the buying and selling that went on over the past 10 years in this state, tons of properties have been re-assessed at much higher values. What did Sacramento do with their property tax windfalls? Did they fix the deficits we’ve been running the past (almost) decade? No. They piddled it all away on one thing or another when they were seeing record property tax revenues.

Patrick.net has an article from Barron’s today basically begging Bernanke to raise rates to squash the bubble that is reappearing in commercial real estate in some markets. (I don’t know if you allow links so didn’t provide).

My whole thing has been that bubbles NEVER come back but at the same time NEVER before has a government put so much energy into reigniting a bubble so the result is unknown.

I think they may very well get it going again in some markets but then what? It will collapse again but the next time the economic turmoil will be 10 fold.

In addition, in trying so hard to reflate an unsustainable bubble they are basically sacrificing the value of the dollar. Yes, there are few hints of inflation but mark my words one of the major casualties in the fallout of this bubble blowing is cash savers and anyone who has future income dependent upon the CPIndex (anyone who will be getting social security).

Why couldn’t they just let us have a normal nasty recession where the idiots were punished and the prudent rewarded? We would be well on our way to a healthy recovery by now but instead we are headed towards oblivion going a thousand miles an hour and very few but the well connected will know when to jump.

I’m in the same boat as js.

Forced by all sides of family into drinking the kool-aid. pretty much a ultimatum of buying by end-of-year or getting the boot.

I’ll probably end-up buying and making a ruckus when prices plummet over the next few years.

i can’t believe why people can’t come out of the coma of the bubble…

let the market crash once hard and lets start the recovery instead of delaying the inevitable.

@ Doc: Like always nice thought provoking post. Can we post links?

@ PRCalDude and Mark Wax:

For the record I love my grandparents… Maybe the teachers are the ones benefiting or maybe it is the little old ladies and grandparents that might loose their place due to tax increases like the law was originally intended.

After looking at several tax records I doubt that they are ones truly benefiting from prop 13. Here is my opinion: the people that are truly benefiting are NOT the little old lady which might loose her house or avg. teachers. Here is one of many examples that I have com across. There is a redfin place (1) is trying to sell for $3,695,000 yet their tax record for 2008 was $3,421. Lets assume that this place is worth half the asking price or $1,800,000. According to lansner blog for May 14 (2) the median OC property price was $435,000. Assuming a tax rate of 1.15% the median property is paying close to $5,000 in taxes. Here is my question. Is it fair that someone that owns a multimillion dollar property (e.g. $1,800,000) pay the same or less in property taxes as someone that purchased the median home in Orange County for $435,000 ? Was this the purpose of prop 13?

NOTE: Links can be posted if allowed.

News today about the fallout of the loan mod program is very encouraging. It looks like more foreclosures. Yeah, banks are not releasing the inventory because they have the trading revenue to keep them float. I wonder if there is stock market crash in the near future what will happen to the trading revenue. If the trading revenue is down, they will have to liquidate the assets – foreclosed properties.

Another thing I am concerned about is the state budget crisis and what it will do to the K-12. California is already at the bottom of the national list. That’s why places like Cerritos still demand high $$ for housing because of its top notch high school (based on the test scores at least).

js,

In case you haven’t seen it…

Suzanne Researched This

But something tells me that you have seen it.

Good luck!!!

Fannie, Freddie, and FHA are the new sub-prime lenders. They continue the subprime madness with high debt to income ratios. “Dumb-money” buyers contiue to play along. Incomes are stagnant and most people living in the “real economy” can’t bank on significant income growth. High debt to income ratios (>30%) are very reckless in this economy. Middle class homebuyers need to wake up and realize that “house poor” is a bad idea going forward. The expanding federal gov debts will reach a tipping point and Washington will be unable to afford to maintain the bubble structure. Bailouts will be a thing of the past and self reliance will be the virtue of the future.

js and inthesameboat,

Sounds like you guys are getting it from every angle. If you do decide to buy, just tell everybody that is pressuring you that they won’t hear the end of it if prices collapse. I’ve seen a few divorces that were mostly due to buying an expensive house at the peak and getting financially wiped out when prices plummeted. The wait for prudent times strategy should always work in a normal market; however, this market is far from normal. Given the economic situation, the powers that be have decided housing is too big to fail and will do everything to prop it up. No, it’s not fair…but life never is.

PROP 13 was intended to allow people to stay in their homes without being forced out by huge tax increases…and it worked. However, PROP 13 also applies to business and commercial properties and that is corporate welfare. PROP 13 also punishes the new and upcoming generation. While a homeowner who has lived in a place for years may only pay 1 or 2 thousand dollars in taxes, the new buyers/owners/neighbors can pay 10 to 20 thousand. Yet, if a fire breaks out or police services are needed, the person paying 1 thousand gets 100% equal service. The same is said for schools.

Part of the incredible imbalance of tax collection is due to the corrupted nature of PROP 13. Change 13 to tax commercial property correctly, leave the homeowners with their status.

Prop 13 is nothing more than the “me me me” generation that wants services, but wants the cost passed on to someone else. While I’m a homeowner and appreciate having prop 13, I would give it up in a heartbeat if landlords and corporations were made to share their burden of taxes…and they are not.

Everyone wants to kick the can down the road….everyone. The problem is with the propaganda. PROP 13 saves homes! That is a bold face lie, and just allows the rich to avoid paying their fair share while getting market value for the property.

It’s too bad they can’t amend that proposition, but people are too ignorant and/or stupid, so they would rather have collapse than actually THINK.

I am surprised the way they are releasing these properties. It is a perfect statergy but who is coordinating the property release in the market between different banks. I am seeing few properties come in the market and get sold before the next batch come in. I can only talk about Cerritos and can tell you that there is a panic amongst the buyers. I also noticed that American people are not paying attentiion and did not react to 1 Tri. dollar bailout over the weekend (We are too busy in watching Lakers game). How can someone make such a important decsion over the weekend without any discussion ? Bailout for everyone but not for hard working people like me. My 4 yr old always ask me when I will buy her a dog ? She is not very happy listening to same answer “WHEN WE BY THE HOUSE”. I am not shure when that will happen ?

regarding “If you overlay a CA employment graph with a CA housing price graph”

Where do I get a CA employment graph and a CA housing price graph?

And such historians should look back further than that, and then weave the threads together across decades. The process of destroying the US middle class has been going on continuously across many administrations: from at least LBJ’s “Great Society” push that shifted the warfare / welfare state into gear, which hasn’t even slightly paused since; to Nixon’s closing of the gold window in 1971, which resulted in no significant increase in real wages at any time since; to Bush 1; then Clinton (his administration’s economic numbers were a scam, with the exception of a single year of minor surplus due to capital gains receipts during the Dot Com bubble – read Bob Rubin’s book “In an Uncertain World” in which Rubin plainly admits that the Clinton budget numbers were garbage without “unprecedented borrowing from Social Security” thrown in); Bush 2 (who took that “unprecedented borrowing from Social Security to new heights); Obama; and whomever will be next.

Throw off the self-indoctrination and self-imposed ideological blinders, and it becomes obvious that the Democorp Party = the Republicorp Party = “user interface” for a crime syndicate of, by, and for the elites.

@redfinsurfer ” Is it fair that someone that owns a multimillion dollar property (e.g. $1,800,000) pay the same or less in property taxes as someone that purchased the median home in Orange County for $435,000 ? Was this the purpose of prop 13?”

I don’t care. All I care about is that my parents and grandparents aren’t re-assessed and taxed at higher rates because of the ridiculous bubble in prices. Both have paid off their homes and the latter are retired and on a fixed income.

You’ve failed to mention how Prop 13 doesn’t protect them (it does). They’ve always sounded grateful to have that law.

For the record, I think paying taxes based on your purchase price of your home is awfully fair.

@swiller

“PROP 13 was intended to allow people to stay in their homes without being forced out by huge tax increases…and it worked.”

There it is. Full stop.

“Yet, if a fire breaks out or police services are needed, the person paying 1 thousand gets 100% equal service.”

State property taxes don’t go to fund municipal services. Municipalities raise their own taxes or just increase fees for other services.

” PROP 13 also punishes the new and upcoming generation.”

I’d argue that what punished the upcoming generation in this state was ethnically cleansing it with Mexicans. Pleasant dreams:

http://www.lewis.ucla.edu/special/metroamerica/ladiversity.htm

You don’t sound like a native of this state.

Re: 5/16: Thank you, PRCalDude. Too many people are (ignorantly) using Prop 13 as a bludgeon in their larger agendas of fomenting intergenerational warfare.

~

I was surprised to see–for the first time since I started reading DHB in late ’06–that red foreclosure line fall below the yellow one. I.e., the first time since early 2006 that foreclosures weren’t more than ever before.

~

Then I realized that if banks aren’t foreclosing but letting people live rent free, the line should in fact be up there above the yellow one. I.e., the downturn is only an artifact of a deeper economic/housing sickness.

~

rose

regarding “If you overlay a CA employment graph with a CA housing price graph”

Where do I get a CA employment graph and a CA housing price graph?

All the money is going to the Corporations and Top 1%, That’s the REAL problem with this country.

Leave a Reply