California Budget Revisited: The Budget Cuts trickling into the Real Economy. Unemployment, Finance, Housing, Revenues, and Taxes. Game Show Employment and Realtors Say no to Paying Taxes Early.

Many look to California for guidance on where the future is heading. In this current economy, it would seem that some are looking for other economic leaders. A $26 billion budget deficit, a housing market that is still wobbling around, and employment that seems to continue to get worse. The current California economy, unlike many states in the nation, still seems solidly in a recession. Yet on a nationwide level, there does seem to be faint hopes that things are getting worse at a slightly slower clip. Unemployment isn’t flying off a cliff but jobs are still being lost. The housing market on a nationwide basis seems to have hit a sales bottom (although prices still seem to be heading lower).  Yet California has unique struggles that will make it a late bloomer in coming out of the recession.

If you haven’t already noticed, part of the budget balancing act contained earlier withholdings. California Realtors are gearing up to fight this because many are independent contractors and get a 1099 tax form instead of the more typical W-2. Most who get paid via the W-2 pay taxes on a rolling monthly basis. Yet many that operate under the 1099 pay quarterly estimates of their taxes. In many cases, this creates massive fluctuations with revenues. But you have to love the argument coming out from Realtors:

“(OC Register) The Vote May be TODAY! Please call your Assembly member NOW!” an association “Red Alert” to members said after the measure emerged from conference committee in June. “C.A.R. OPPOSES (this) proposal to force independent contractors to make interest-free loans to the state!”

Unlike wage earners, who get taxes deducted from their paychecks, independent contractors aren’t subject to any withholdings. But contractors, who get a 1099 tax form instead of a W-2, are required to make estimated tax payments every three months.

Some state officials proposed that those paying independent contractors be required to withhold 3% of their income and send it to the state. The plan would accelerate tax payments and generate more cash for California’s coffers, they maintain.”

You have got to love this one. Where were Realtors when brokers were giving out no money down loans and Alt-A junk to the public? Where were Realtors when the $700 billion taxpayer bailout rescued banks? I didn’t hear much opposition about that tax credit for home buyers which amounts to a free taxpayer subsidy to those who buy homes. Now they are opposed to paying taxes earlier? This isn’t even a tax hike. This is a typical case of cognitive dissonance in action.

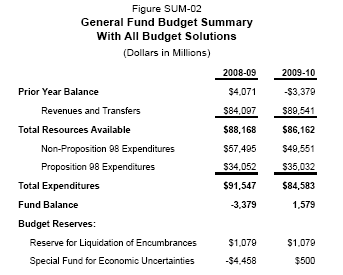

Some seem to think that we are already out of the woods with the July budget:

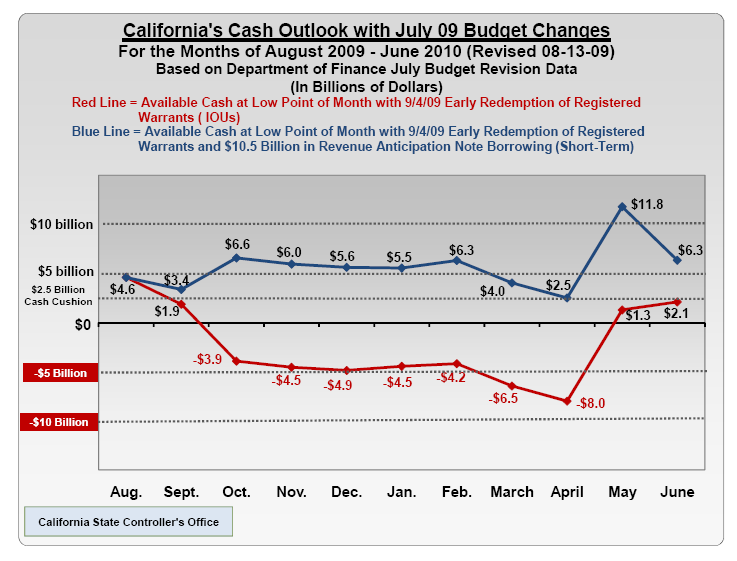

For what it is worth, the state is still issuing IOUs. They are however ahead of schedule and are planning to phase out the program come September 4. Even with all the massive cuts in programs and no new revenue streams the state is going to need to borrow some $10.5 billion for the fiscal year. The chart above depicts that situation. Without the borrowing, we would be in the red in a couple of days. And much of the expectation is things will stay at this level:

Keep in mind that the above cuts of approximately $15 billion and the $10.5 billion in borrowing balance the budget for part of the last fiscal year and the 2009-10 year. But the underlying basis is the worst has already occurred. Given the current cuts, it is assured that the economy will face additional pain at least into the next fiscal year. Many have only recently started furloughs which means less disposable income for the economy.

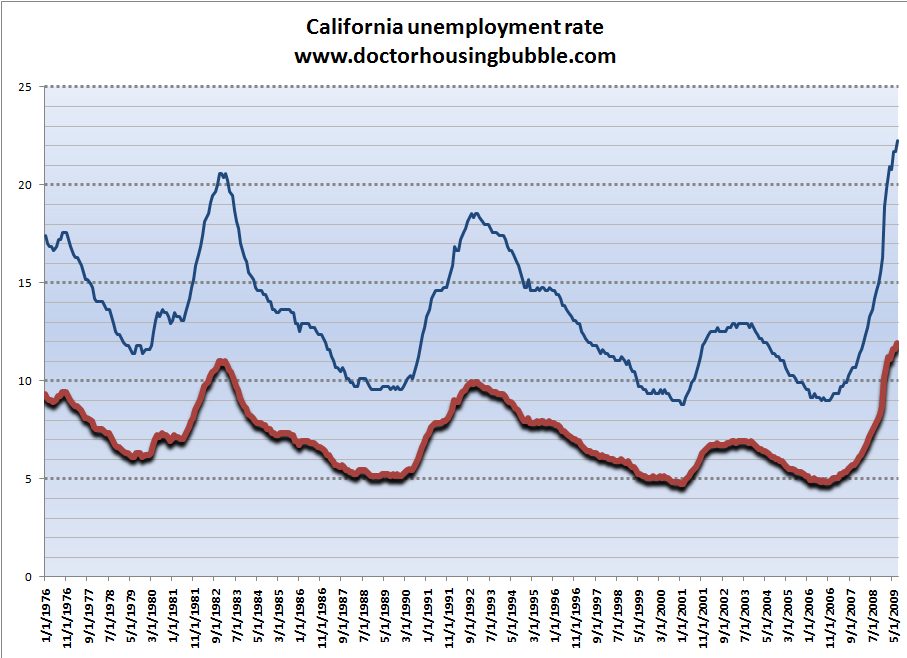

The current unemployment rate of 11.9 percent underscores the actual underemployment rate of 22 percent:

And people are doing what they can. The economy has actually pushed many unemployed to seek a new avenue of income. Game shows:

“(USA Today) Before the economy soured, Pomerantz says, few prospective contestants skewed older, college-educated and unemployed. Now its 10%, she says.

Catch 21 players can win a maximum of $50,000 – apparently enough of a draw these days to lure auditioners atypical of the “average Joes” who usually want on. Casting for a third season run of about 200 shows, “it’s absolutely clear we are seeing a lot of professionals who have lost their jobs or are looking for a way to supplement income,” says producer Scott Sternberg.”

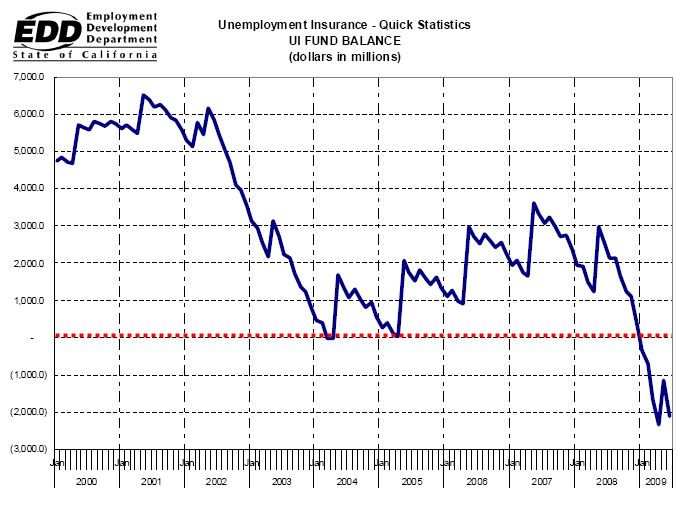

People are simply trying to make ends meet. And with 812,000 Californians receiving unemployment insurance, there are many simply trying to figure out how to handle the current downturn in the economy. The unemployment insurance fund has been in the red since the start of the year:

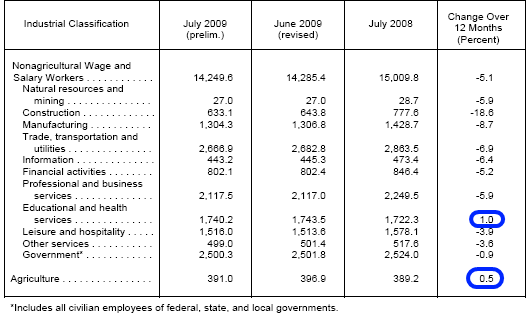

And the loss of jobs has occurred in practically every industry:

The only two sectors that are slightly positive on a 12 month basis are education, health services and agriculture. But even healthcare, the last place to cut is having to scale back:

“(LA Times) One of the state’s largest employers, healthcare giant Kaiser Permanente, said it would eliminate more than 1,800 positions as it struggles with drooping membership, uncertain healthcare reform and shriveling Medicare reimbursement rates.

Job reductions will occur within the next few months, the Oakland-based nonprofit said Tuesday. Many of the purged positions — just under 2% of Kaiser employees — are temporary, on-call or short-hour. Most Kaiser medical centers in California will be affected.”

The real question many should ask is what industry is going to bring us out of this recession? Also, we are assured additional financial losses with the Alt-A and option ARM products. There is now speculation that banks will be doing lease-back options to current owners. That is, renting the home back to the distressed borrower at market level rents with a future purchase option. But how many people will jump on to this program? Are banks capable of being landlords? I hold my own reservations here. Remember Hope Now? This was going to supposedly help tens of thousands and helped out a handful of people. With about 1,000 properties going back to banks each day, they will have to decide quickly what they plan on doing.

California relied much too heavily on real estate and is now paying the price. To assume real estate will lead us out again ignores the amount of distress property still coming down the pipeline. 2010 should offer us a better glimpse of where we are heading. And now, we are only starting to see the impacts of the major budget cuts. Many are just starting school. Bigger class sizes and a public college system unable to meet the demand of the recently unemployed. And those that can go to college, are now facing higher fees (10 percent at CSU and 9.4 percent at the UC). Even community colleges hiked up their fees from $20 to $26. Less money for consumption. Cash for clunkers ends today. At a certain point, the gimmicks start running out.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

16 Responses to “California Budget Revisited: The Budget Cuts trickling into the Real Economy. Unemployment, Finance, Housing, Revenues, and Taxes. Game Show Employment and Realtors Say no to Paying Taxes Early.”

If you take a look at the Mortgage Insider link at my name, you’ll see seven Orange County homes (out of almost a hundred) that the banks actually discounted and allowed to sell on time and at auction instead of the typical delay/modify/take as REO options.

When you look at loan losses to the banks, the data looks like this:

11622 DANIEL AVE: $229,464

23405 DEVONSHIRE DR: $283,086

1121 S CLIFPARK CIR 3C: $143,436

7877 LA CARATA CIR: $243,581

4294 VIA VERDE: $88,227

29 GRAPE ARBOR: $184,452

130 MELROSE DR: $159,978

TOTAL LOSSES TO BANKS: $1,332,224

AVERAGE LOSS PER LOAN: $190,318

You need less than 5,300 loans like these to go bad to lose a billion dollars (in addition to completely wiping out the equity and credit-scores of all those families.) Just amazing.

Now, we all know that the Great Deleveraging / Rebalancing that is occurring now in the housing market will, eventually, cost the banks (and/or taxpayers) a fortune (though we don’t know how much that final bill will be). We also know that, even if they had sufficient human resources to deal with it, if the banks were expediently foreclosing on all defaulting loans and offloading the properties at market prices – that they would have to report giant losses just like those above on their balance sheets in a single fiscal year and, at least in terms of the impact of accounting, quickly cease to exist.

So the point of whatever the banks are doing is trying to buy time in the hopes they can delay and pace their losses to absorb them over a longer period of time that may allow them to survive. You’ve really got nothing to lose if your choices are “die now” or “die another day, or possibly live.”

Whether it’s “extend-and-pretend” loan modifications, a lack of diligence or timeliness with regards to Notices of Default or Notices of Trustee Sales or repeat extensions or delays of such sales, shadow inventory of unlisted REOs, rent-back agreements with current tenants, or whatever tactic pops up next – the strategy is the same: avoid, at almost any cost, having to write-off a flood of large losses in a short period of time.

I don’t know if the banks will perform well in the roles of landlords – I doubt it. Surely they do not wish to be in that position and would prefer to dispose of these toxic assets and resume their focus on providing strictly financial services. Their plan must be to return to that condition as soon as possible, but judging from their actions, it simply isn’t feasible at the moment.

I work at Kaiser in Anaheim. We went digital with medical records about 2 years ago, and digital with x-rays about 1 years ago. The only people getting laid off here are the people that used to shuffle paper before we went digital. So most of them should have been gone long ago. We had 60 people that used to file and store x-rays, and we didn’t even have x-rays to file for the last year!

@Indy- Good reporting, thanks! I only differ with you on one small point and that is the description of what is occurring now as the “great deleveraging” (maybe in housing but not in the macro economic sense). It’s what SHOULD be occurring right now but is NOT. The bubble blowers have a few more tricks up their sleeves to mystify and awe the sheeple before the “great implosion” (what happens when a “great deleveraging” goes nuclear).

You don’t need a crystal ball or an MBA to see what lies ahead, just read this article from the WSJ. http://online.wsj.com/article/SB125113686930654371.html?mod=igoogle_wsj_gadgv1& Rising delinquencies and plummeting loan cure rates will lead to epic foreclosures which will lead to the next phase of the financial crisis. It’s all the stuff that Dr. HB has been preaching. There will be no more gov bazookas (thankfully) and this thing will come crashing down. It won’t be pretty but also cannot be avoided.

Be brave Comrades!

The current news that the Obama administration raises deficit forecast to $9 trillion also means that the White House has been way off with its economic projections. The effects of obama bailout on different sectors can be felt but not on a large scale. I think that’s the best option the current administration have to pull thru with the economic crisis.

I am sorry missed last doc’s article and this seams little off topic now, but can somebody tell me what is all the action on this house in Redondo Beach about?

http://www.realtor.com/realestateandhomes-detail/2706-Mathews-Ave_Redondo-Beach_CA_90278_1111010389

Currently is sitting on MLS, but no sign on the place. It has been declared few times “pending sale†and then a month later gets listed again. Last 2 times I remember with the same price of $380K. This price is by far cheapest SFR in North Redondo. Is it possible that some knife catcher is getting the bait and then the deal is falling apart when it gets to the bank for approval, because of down payment, lack of sufficient income..? If they (realturds) are not able to sale at this price I wonder what is selling at all? Probably close to nothing? Does somebody has any info?

I second blutown’s thanks, Indy.

—

“I don’t know if the banks will perform well in the roles of landlords – I doubt it. Surely they do not wish to be in that position and would prefer to dispose of these toxic assets and resume their focus on providing strictly financial services.”

—

Given the numbers, it is a practical impossibility as certain as the impossibility for the Feds to re-invent the healthcare system out of whole cloth.

Everything is OK…until it isn’t. Alt-A cure rate down to 4.3%? Prime to 6%. In spite of the shock and awe of the last two years (GW–that was for the enemies, not the US population) we are still seeing things that could not have been imagined a few years ago. What have we become? How can this end well? We’ve all been shot by Goldfinger Paulson’s nuclear bazooka and Ben’s helicopter has finished us off with a blast of agent Greenspan.

Looking for a part time jobs? or got unpaid internships? why don’t you try a blood donation. I think this is a very big help for college students who needs an extra money and make up to $50/hour for blood donation. As we all know, Blood bank shortages kill tons of people all the time and it is time to spread the word about blood donation and give blood, you will never know when YOU might need blood. This is really beg help even it is just a part time or just once in while, the bottom line of this is to saved lives.

If you are thinking to be a blood donor and looking for specific blood banks and directory you can check it here at bloodbanker.com/banks.

Here’s a must read from this week’s James Howard Kunstler blog if for no other reason his caustic wit: http://kunstler.com/blog/2009/08/financial-crisis-called-off.html#more

A survey by the California Association of Realtors found that sales of California real estate have actually increased from the end of 2008 to the beginning of 2009. Survey respondents indicated that attractive prices and low mortgage rates were the leading factors motivating them to buy. The glut of bank-owned properties on the market has kept California’s housing inventory stocked, giving buyers many options. First-timers are leading the market spurred on by record low interest rates and the greatest affordability. Using the internet and area papers, you can soon get an idea of the market worth for different types of homes in the area. Identifying the right market & finding the best property holds the key to success. In fact there is a tool through which you can research, compare & identify best places to invest. Look into http://www.smartzip.com/s/sz/info/offer for more information.

Gee, a survey by CAR found that now is a great time to buy? Neat!

–

I think Luke Mahony should have to donate blood after making us read that pile of crap.

I think DrHB does himself a great disservice using game show casting to bolster his argument of Californians having a hard time making ends meet. It’s an almost ridiculous argument, and opens the gates as far as credibility goes. It makes me wonder what other exaggerations are in his reporting.

Case Shiller is up (even seasonally adjusted) in So Cal for the first time in 3+ years. What are we doing about it here? Are we admitting it, but saying is flawed, or are we just ignoring it altogether? I want to know so I can be one with the pervailing doom of this blog.

Ah yes, everyone WANTS to put all the RE problems behind because distress sales are skewing the numbers. It would be interesting to compare organic sales YOY from say 2005 through 2009. Distress sales are usually “one and done” and choke off the real estate chain. The high end is almost dead, so we are eating away from the top and the bottom. We still haven’t addressed all the people living underwater in their “zombie” houses.

The Westside will soon be filled with zombie listings. House’s that can’t sell until they end up back at the bank.

http://www.westsideremeltdown.blogspot.com

Whatever is going to happen in the next few years, it will not be unaffected by the 80 million Baby Boomers that are retiring. Already the retirement apartments are affected; in the past year most have given up all vacancies and there are long waiting lists. (I know, because I’m looking for one in the Sac. area). Only 15 percent of Baby Boomers are expected to inherit money, and millions have not prepared for retirement. That means a heavy reliance on Social Security, and lots of renters. We may find the homeless rate skyrocket.

On the housingbubbleblog (Ben Jones) there is an interesting article on the Chinese sending their sons to the U.S. for college, and marrying U.S. citizens in order to buy “cheap” houses in the U.S. (primarily California).

Since China is sitting on billions of U.S. dollars, this makes a lot of sense, and may prop up prices in So.Cal. for a while longer.

Leave a Reply