California Budget Solution – Ignore It. $3 Billion Financial Gap by December. State Budget Deficit Already in the Billions. Tax Revenues Collapse and Unemployment and Underemployment at 23 Percent.

Many of those calling for a housing bottom seem to ignore the state budget problems that are already showing up in California’s finances. State revenues are collapsing. This is important to focus on because it will leave the state with a few options in remedying the deficit. It can either raise taxes or cut spending further. Both are bad for the overall housing market. And housing prices have not boomed like some have claimed. 475,000 notice of defaults will be sent out in 2009, a record breaking number. California is battling gaps in revenue even though it has some of the highest taxes in the country.

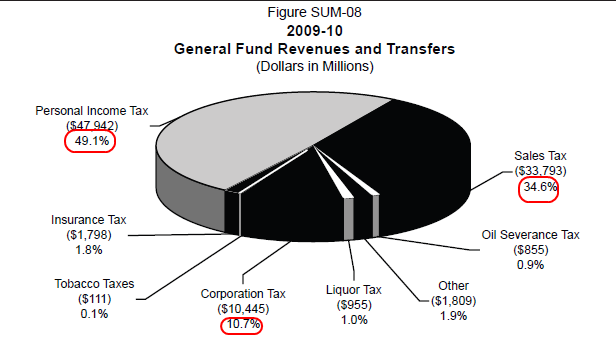

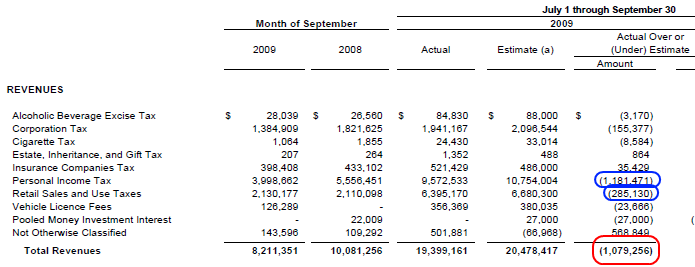

Let us first take a look at the California balance sheet:

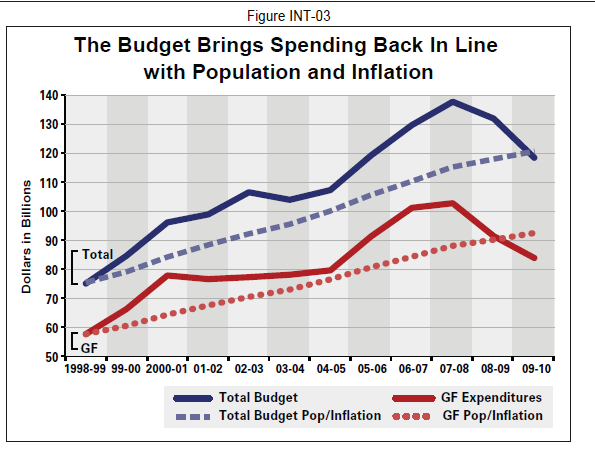

Nearly 50 percent of the revenue for the state comes from personal income tax. Another 34 percent comes from sales taxes. Over 84 percent of all revenue comes from sources that are affected heavily by economic downturns. Those in Sacramento have decided to simply ignore the problem until we reach another situation where we are printing IOUs. Yet even with the current cuts in spending we are still over historical trends:

The above chart shows how the total budget exploded during the boom times. With the bubble, there were billions in profits that should have never been there. You had high school graduates pushing Alt-A and option ARMs receiving commissions of $10,000 to $20,000 for falsifying documents on a loan that ultimately will implode. The state enjoyed collecting those high tax revenues and turned a blind eye to the practice. Plus, many of these people blew all their money and the state then collected more money on sales taxes. Each home that sold had a new higher appraisal. How many industries do you think really had no chance of viability without the housing bubble? We are now finding out.

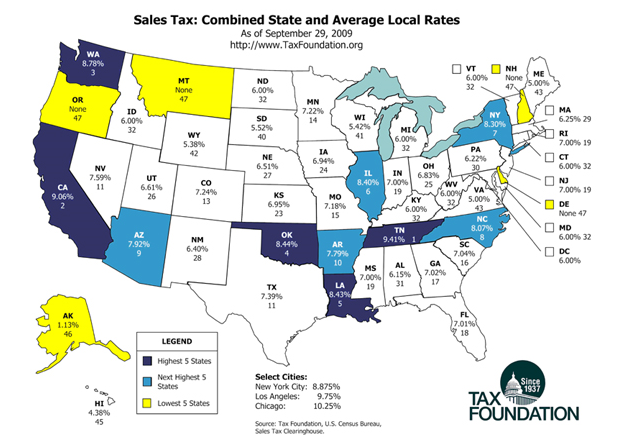

California has boosted its sales tax in the past year to bridge the gap. Has this helped? Of course not. California already has one of the highest state sales taxes in the country:

We have one of the highest sales taxes and also, one of the highest personal income tax burdens. Los Angeles has a sales tax of 9.75 percent. This is stunning. I had to buy some household goods a few weeks ago and couldn’t believe the $50 in sales tax being paid out. That $50 could have been spent at a meal at a restaurant.

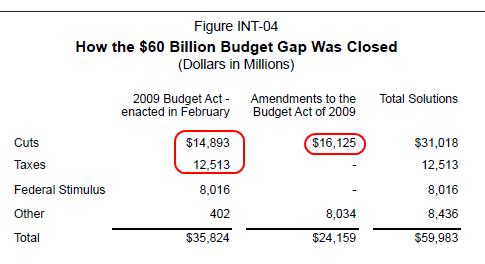

People then ask if employment gains didn’t plug the $60 billion in budget gaps, then what did? Taxes and cuts:

$30 billion of the budget was fixed with cuts, $12 billion in taxes, and $8 billion with Federal Stimulus. If you think this has fixed the problem, it has not. The above proposal came out in July and we are already off with the current estimate:

This is the latest report that came out in October and reflects revenue for the state up to September 30th. So where did the biggest falls come from? Personal income taxes and sales taxes. Last year in September, the state collected $5.5 billion in personal income taxes. This year, that number is $3.9 billion. Keep in mind that in September of 2008 things were already bad. The housing bubble had already popped and unemployment was already high. Yet what you see above is a state that is having a tough time collecting revenues from typical income streams.

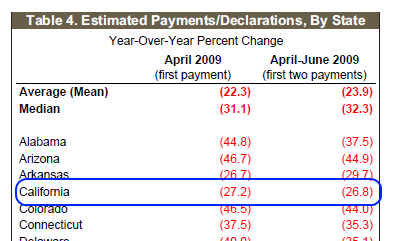

The California housing market still has much more pain to face based on the above. The above data is merely a proxy for the real economy. California revenues are declining because unemployment is high and people are being more cautious with their money. Another good indicator is estimated tax payments. The wealthiest Californians pay a large portion of personal income taxes to the state. Unlike most people, they do not pay the state via withholdings. It comes from estimated taxes:

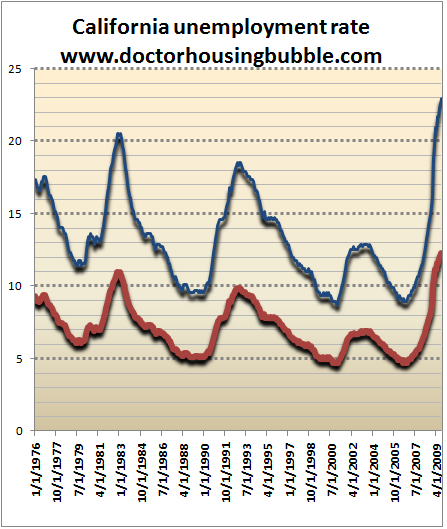

Look at it this way, if your best client is suddenly not buying as much of your goods, would you be worried? Of course. Many of these people make money from the stock market and ironically, unlike many average Californians, have enough losses in 2008 to carry over for a few years with creative accounting. But more importantly in terms of home buying, unemployment and underemployment is at 23 percent:

Someone that is unemployed is not paying personal income taxes. Someone that is unemployed does not have the same disposable income as someone with a job. There goes your personal income tax and sales tax. Your two biggest income streams are still near the bottom. In addition, people have seen their pay cut. Take for example someone that was used to selling $600,000 homes and receiving a commission on that. Now, they might need to sell three $200,000 homes for the same amount. Bottom line is a large part of the above revenue stream was temporary and is never coming back. The U.S. Treasury and Federal Reserve are trying to revive parts of the housing bubble with the $8,000 tax credit (a 4 year old got a credit and millions of dollars are under fraud investigation), Fed buying GSE MBS to buy down mortgage rates, and allowing banks to do whatever they wish with the foreclosure process. Yet prices are not booming back. Have sales increased? Yes. But the question is how sustainable is this path without the real economy? Those arguing for a bottom are so one sighted about their analysis that they miss all of the above! The state is still showing symptoms of a patient in intensive care. Revenues are falling not because the economy is healthy, but because it is poor. Yet the current solution to the problem is flood the housing market with money? Two years and nothing yet. Who is really being helped here?

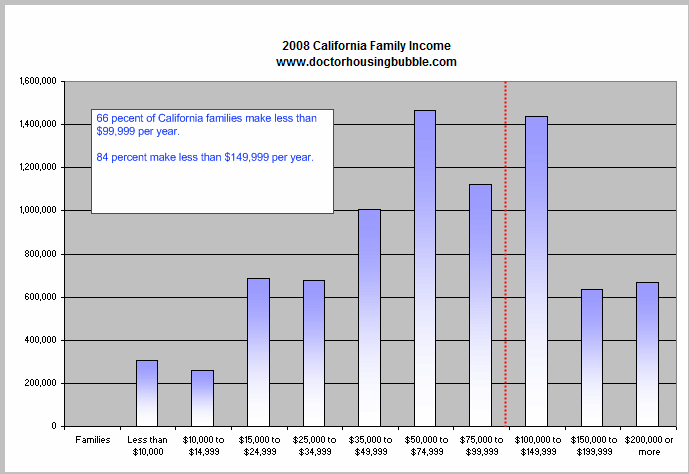

And spare us the notion that everyone is making $250,000 a year (by the way, that is what you would need to safely buy the once median price home of $600,000). In fact, this warrants putting a chart together:

So if this is the income distribution, how in the world did the median home price in the state approach the $600,000 mark? When you can make things up on mortgages like Alt-A loans and option ARMs, you can leverage yourself to whatever your heart desires. If income is being made up, then there is no restraint on the bubble. The only restraint is how much the criminal mortgage broker is willing to put on the gross income line.

California’s Future?

A recent survey shows that people are planning on spending less this holiday season. This does not bode well for the sales tax California depends on. And even though the stock market is up, like we have mentioned, many wealthy individuals have creative accountants that can game the system so the state shouldn’t expect a 60 percent bounce in revenues from this group even though the market has gone up this much. Why? Because job hiring is still missing on the radar screen.

Some are viewing housing as the proxy to a recovery. They see sales stabilizing and moving up and prices pulling back from the cliff and all of a sudden project this data onto the overall economy. Yet they fail to realize the incredible subsidies that are floating in the housing market. The $8,000 tax credit, historically low interest rates brought on by the Fed, a glut of low priced homes, investors desiring to be the next Rich Dad, and this notion that housing gave us the go-go 2000s so it will also lead us out. That is the problem. This obsession with housing. Why not give tax credits for job creation? Or what about lowering interest rates on SBA loans so people can start businesses? Of course, the housing shills only care about and focus on housing with their one track mind.

They fail to see that housing will not lead us out of this recession. It has to come from other industries. California has a fleet of delusional realtors and brokers just itching to get back to 2005. They fail to see that 23 percent of people are unemployed and underemployed or that the state is back in a billion dollar budget deficit. Rome is burning but they continue to play on their housing fiddle.

We will be dealing with another budget deficit soon. This is in the cards. And it is only a matter of time that the federal government raises taxes. This is inevitable. You can’t run trillion dollar deficits and expect the U.S. dollar to remain strong. So we know where this is heading. So much money spent on the banks and housing. What a waste. We could have spent the money on targeted job creation and housing would have fixed itself on its own. Instead, we have handed out approximately $13 trillion to the banks and Wall Street through giveaways and backstops.

You still believe that what is good for Wall Street and Banks is good for the average American? Well the data above shows us it is certainly not good for California.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

45 Responses to “California Budget Solution – Ignore It. $3 Billion Financial Gap by December. State Budget Deficit Already in the Billions. Tax Revenues Collapse and Unemployment and Underemployment at 23 Percent.”

Don’t worry, SF area is #1 for a real estate comeback. The Ra Ra Real Estate Propoganda machine is oiled and running.

http://customsites.yahoo.com/financiallyfit/finance/article-108002-2984-2-5-cities-positioned-for-a-housing-recovery

“One reason for the sharp comeback is that much of the area’s excess inventory will have been sold. It’s already dropped by nearly in half over the past year.â€

Too bad the premise of their argument is based on the manipulated inventory. Foreclosures have INCREASED over 2007 and 2008 this year as the good doctor has proven.

So, the banks get $13,000,000,000,000 and the home purchasers get $8,000 each. The weird thing is that a lot of home buyers will be happy because they think $8,000 is a lot. This is one way to keep people happy in a democracy.

Totally agree. And where would house prices be if interest rates were at historic norms, considering most people just care about their monthly payment?

$8K throughout most of Southern California is NOTHING. I don’t get the excitement???!

I’m still seeing articles here and there claiming that the housing market will start to recover next year.

For example:

“By August 2010, First American CoreLogic projects 12-month appreciation for national home prices will be 4.6% and that California and Florida, two states hit hardest by the housing downturn, will see gains in excess of 7%.”

http://www.housingwire.com/2009/10/23/12-month-price-appreciation-to-reach-46-in-2010-first-american/

How on earth can anyone think that we will we see “gains in excess of 7%” in California of all places? What do they know that we don’t? I’m guessing that American CoreLogic has some sort of stake in the real estate market.

So, California gets 50% of their revenues from the state income tax. Texas and Florida, both large states with equally difficult demographics, have no state income taxes at all. Florida is in a bit of fiscal difficulty and Texas isn’t, not really.

What the hell is wrong with California?

Everything you say is correct, Dr. HB, but what do you mean when you say $13T should have been spent on ‘job creation?’ Surely, the government cannot and does not ‘create’ jobs with money they make up or take from somebody else. That just moves jobs from one part of the economy to another – just what’s happening now with current ‘stimulus’ spending. Funny how all government words have to be put in quotes, isn’t it?

“$8K throughout most of Southern California is NOTHING. I don’t get the excitement???!”

Yea I know, the truth is if you are in a position where saving 8k is difficult for you, which many people are, you are also in a position in which you are priced out of the southern CA housing market anyway! 8k toward a house, what a complete joke!

> Los Angeles has a sales tax of 9.75 percent. This is stunning.

Haha – you ain’t see nothing yet. 9.75%? In Europe, they have VAT of 15 to 25% (often with reduced rates for food, to unburden the poorer people some of this regressive tax). California could increase their sales tax, but only after they have a new constitution. A VAT would even be better, but demands federal action, like the VAT in Europe needs EU-wide rules.

Dr. HB, what would you suggest California should do? I agree with your main point that the current course is unsustainable, but what should they do?

$13T in tax cuts would have had far more immediate impact on the economy and job creation than paying off the Wall Street Cronies most involved in creating this disaster.

(at the direction of the government, of course, in the name of fairness and equality for all in housing, regardless of income.)

What happened to the state’s IOU’s?

They were a possibility for Sovereign money in California, the abolishment of debt and interest on state money and an opportunity to emulate the North Dakota State banking system.

Again, what happened?

Local budgets are going to be hit hard over the next few years by unfunded pension liabilities for public workers. Example: Alameda, CA, a small city of under 100,000. will have $25,000,000.in unfunded pension benefits over the next 10 years. There is no idea where that money will come from. That is what happens when you pay nearly $100,000. in salary,medical, and retirement benefits for someone to cut the grass at the local ballfields. see

http://www.pensiontsunami.com

Jo,

Of course the Government can create jobs. If the Government borrows into existence a trillion dollars (and the Fed prints it into existence) and spends it on infrastructure, it will create jobs.

This is especially true when the choice was spending that trillion infrastructure or giving it to banks or first time home buyers or something just as stupid.

Florida has no state income tax but these thieves sure have scrambled to increase our property taxes to levels sure to have potential retirees looking elswhere.

One of these days a few foreign countries are going to see the marketing possibilities .

Why hasn’t Calif founded its own state bank (like North Dakota) and leveraged its 55 billion in funds in seven banks, per Ellen H Brown (six of whom refused to honor the state’s IOUs) and issue 0% loans for infrastructure renewal. Could it be that the Oligarchy wants to bring Calif as close to bankruptcy as is possible to buy its tangible assets at fire sale prices, only to lease them back to the taxpayers at egregious costs? Feudal Corporatism at last, ye vassals!

To ToddS: First American CoreLogic is, in fact, very much tied to the real estate market. It used to be called “First American Real Estate Solutions.” Their propaganda rates right up there with the nonsense provided by the NAR.

~

To Cleanthesbrule: One difference is property taxes . Prop 13 has cost California over $500 billion in revenue since its enactment thirty years ago.

~

To Jo: Of course the government can create jobs. That’s what happened in the days of the National Recovery Act. Those $13 trillion could have accomplished much more for the country if even just part of it had been spent on things we need, like infrastructure spending, instead of lavish bonuses and parties for the banksters.

~

I’m with our esteemed Doctor on this. We’d be lucky to have even a “jobless recovery.” What we seem to actually have is a “job loss recovery.” Wages can’t go up until unemployment comes down, and unemployment isn’t going to be coming down absent some kind of new or revived domestic industry. I don’t see any new or revived domestic industry on the horizon. Does anyone? All that seems to matter to Washington is the comfort of the moneyed class, which includes them and their “campaign contributors.”

.

This is stunning. I had to buy some household goods a few weeks ago and couldn’t believe the $50 in sales tax being paid out. That $50 could have been spent at a meal at a restaurant.

After disgust over California’s sales tax, I use the internet to bypass it.

Example: drugstore.com

No CA sales tax, free shipping for orders over $50, had a 15% off offer

I paid $40 for $55 worth of products (some were on sale); conservative estimate puts the cost at $65 if I buy local. No thanks, I’ll keep my money.

What’s good for Wallstreet? How about GREED

.

I’ve noticed that all of these housing bubble sites have lost the enthusiasm of it’s readers. Perhaps I’m speaking from my own experience. At the beginning of the year I was finally starting to think that years of waiting had paid off and started to see decent price reductions. Now, I’m frankly completely demoralized by the current market. There’s nothing decent on the MLS and the crappy foreclosures seem to have multiple offers. The economic situation is increasingly dire, however the government seems to want everyone to become debt slaves. I’m not sure what the solution is?

15% of californian households make more than $150k per year? That’s awesome

Comment by Jo

October 24th, 2009 at 8:26 pm

Everything you say is correct, Dr. HB, but what do you mean when you say $13T should have been spent on ‘job creation?’ Surely, the government cannot and does not ‘create’ jobs with money they make up or take from somebody else. That just moves jobs from one part of the economy to another – just what’s happening now with current ’stimulus’ spending.

___

You are wrong. Your politics are interefering with your thinking and you clearly do not understand the concepts of ‘crowd out’ or ‘substitution spending’ or even ‘additional spending’. You are merely repeating the far right-wing nonsense.

>>

By progressing with that nonsense, a police officer is not doing a job. A firefighter is not doing a job. An EMT is not doing a job. The road repair crews from the county highway department are not doing a job.

>>

In case you missed it, WE are the Government. Collectively WE have decided that WE want someone to police the streets, put out the fires, build and fix the roads etc etc etc. Collectively WE have decided that there are certain tasks, jobs and work that WE want done.

>>

As a group WE have decided that WE want this work done. And WE all chip in to pay for it — and we call it taxes.

>>

Fixing a pothole is fixing a pothole. Doesn’t matter if a county employee does it or if a private contractor is hired to do the work and he hires someone to work for him. Someone is doing the job.

>>

And the next time you visit one of dams or parks or drive on a road or go into a building all built by the WPA, just remember, none of those things are real. They don’t exist in your alternative universe since all the effort put into building them didn’t happen since what those people was not work, not a job and the buildings, roads, and dams were not ‘created.

>>

And oh yes, don’t call a police officer if your house is robbed and don’t call a fire department if it catches on fire. Those are NOT jobs.

>>

Problem is there are not enough jobs. The US has, at minimum, 28,600,000 excess workers – and has had aa excess of workers for years as demonstrated by the falling incomes. So WE (as in all of us) can put those people to work by paying them to fix the roads, teach kids to read and do all sorts of other things that WE as a society think need to be done (and no private business wants to do except at prices the majority can not afford because of the need for profits on top of costs) or we can have them starve and also not get the roads fixed, not get the reading classes taught etc etc etc.

>>

You sound like Mish Shedlock. I like Mish – he is ever so much fun. On the other hand when Mish went on vacation, he went camping. He did NOT stay in the privately owned campgrounds up here. He stayed in the US National Park Campground at 1/2 the cost and just as nice as the private ones. (And the lower cost makes it more accessible to more people since WE have decided that all of us should be able to experience certain natural wilderness areas as part of our heritage.) And all the campgrounds -public and private -were packed this year since it is a cheap vacation. They have been overflowing for 10+ years. And no one has opened or is opening a new private campground even though the current campgrounds turn people away week after week. (High cost, low profit business.) The National Park will be expanding one of the campgrounds with the stimulus money. And the the people hired to build it don’t care who is the owner – they just care that they are getting paid.

>>>

So if you are going to talk the libertarian wacky talk, then walk the walk. Do not use the roads, Do not use the public schools. Do not use the electric power generated by a publicly paid for dam. Do not use the police or fire. Do not use the libraries. Do not use the water supply. After all none of the poeple who created those structures or who are doing the tasks to supply those services are really doing ‘work’ or a ‘job.’ (Oh yeah….and you can’t sue for divorce or to collect money owed to you because the court personnel and judge are not really doing work or a job.)

>>

And if you think that private business is going to step up and provide roads, schools, courts and all the other services at a cost that is affordable for all (a major societal value), you are in fantasy land. The problem is that there is too much money chasing too few low risk/low effort/high return projects — and that caused bubbles in farm land, stocks, dot.com, real estate etc etc etc. So WE have decided that some of that money can be channeled into providing goods and services that WE all use. (And if the upper .01% don’t like it, then they need to move somewhere where they won;t pay taxes – like Sudan. Of course if they move there they will be quickly robbed of the money and probably killed since it is the collective actions of WE/US that makes a country stable and safe.)

@cleansthebrule – I know this isn’t very PC and I know other states have illegal alien (NOT immigration) problems, but my day to day experience in Cali tells me the dollars spent has to be staggering. 1. Wife was a public school teacher and easily 65% of her students were children of illegal aliens. By definition, that amounts to 65% of the budget for THAT school. The entire state may not be @ 65% but I know it is significant. 2. When my newborn had some complications, we were the only English speaking parents (with private insurance) in the neo natal ICU of 9 patients. Even after insurance, the bill we received was significant. What was going to happen with the other 8 patients? $35 aspirin on your bill here we come! 3. Friends and family in other civil service positions (cops, firemen, etc.) estimate that 30 – 60% of their time is dealing with illegal aliens. This is in varying areas (San Diego, Mammoth Lakes, Orange Co.) so its not like I choose to live in Little Tiajuana. I am an American that does not want he or his family to be burdened under oppressive taxes. Add to this the fleecing of the country by our own very special politicians, bankers and corporate leaders and we’re in the mess Dr. HB is describing.

@Jo – I agree with you about the “job creation” and I agree with Dr. HB that a lot of the spending is money down the toilet. Not sure about the costs (less than 13T) but as an example nuclear power plants in the Mojave and other non densly populated areas would stimulate jobs and have a long term benefit. How about someone that really wants to “reform” actually tells the truth? Like telling 55 year olds that their expected S.S. benefits will only be 88% of what they expected, 45 year olds that it will be 70%, etc. That this is part of what will be necessary to keep the country solvent. This needs to take place throughout numerous pension plans, social service nets, etc. We have allowed ourselves to be a nation of “I cannot make a difference” individuals with our heads down that cannot kick the realities down the road for much longer. Not sure what will wake the public up at this point. We need leadership, not sound bites!

AnnS–

Well said.

I don’t believe tax cuts would have helped anything, we’ve had tax cuts for years and we ended up here, so tax cuts don’t work. We need to go back to the tax structure before the Regan tax cuts when it was more profitable for companies to put money back into their companies and employees instead of giving it all away to their CEOs.

Anns, I am absolutly with you. This libertarian nonsence talk has gone to the end of the road but still not dead yet.

AnnS –

Thank you for bothering to type out that long and insightful response. Unfortunately, I’m sure it will not compute with the mindset of the libertarian uptopians. It is as much a religion as any actual religion, with Ayn Rand as their feel-good prophet of choice. They won’t listen.

But nice try, anyway!

This does not have anything specifically to do with housing, but it does have something to do with taxes, and the state desperate to make up massive shortfalls. Here in Los Angeles, they have raised fees at every parking meter, and have a a swarm of meter attendants to give out parking tickets five seconds after the meter goes red. I’ve gotten two of those. Yes, all parking tickets are theoretically avoidable, but they are doing everything they can to give out as many as possible each day. I have not gotten a traffic ticket yet, but every day I see at least three people on the side of the road being given one of them. And I can only imagine how much they cost now. $300 and up?

This is not coincidence, it is the state’s and city’s effort to find ways to take people’s money to make up for deficits. Tax increases are greatly unpopular, but these kinds of fees and costs are less obvious, and don’t get politicians thrown out of office. But if you figure that it is now almost impossible to escape from at least one traffic ticket and two parking tickets a year, at $400 total, that is equivalent to an additional 5% tax for most people. To bring this around to our topic, it seems to me that this is another way that we are all paying for the massive bailouts, the scams. the loss of jobs and hence state revenue, stemming from the housing bubble.

To say that no jobs were created with the $13 trillion that was spent is obviously an exaggeration. But a couple of million jobs have been lost since the stimulus started, so it would be very generous to say that one million jobs were created or saved since that time. If we assume that 1 million jobs were saved, and we divide that number into 13 trillion, we get $13,000,000 per job saved. Yes, it’s great to have teachers, cops, etc, but at 13 million dollars per year per job, I think it is slightly expensive. Remember, 90% of the stimulus can be spent the first year, which is what is happening in California. So, most of these people will be out of a job after 7/1/10, when the new fiscal year starts. Yes, Dr. HB’s phrasing was slightly misleading, but his point is well taken. We are spending to much money to create to few temporary jobs. The money could have been spent much more efficiently.

Let’s talk specific ways for the state of California to save money.

Let me offer the California Energy Commission. They have a half a billion annual budget and do NOTHING to produce energy for the citizens. Abolish them and cut the CARB budget in half for another $350 million a year savings.

ANNS

WOW!!! You really said that well!!

Post more.

When one looks at the serious fiscal trouble that our nation is facing, there are some immediate points that the blogger should consider.

1. Currency valuation in dollars is difficult to compare from one year to another due to inflation.

2. California housing costs have had some significant increases in Consumer Price Index over and above a normal inflation rate.

3. Might the absence of a “gold standard” currency be adversely impacting us all?

YEP

If the government were serious about helping people and stabilizing the housing market, they’d increase funding for Section 8. In Sacramento County, they opened up the waiting list in 2008. They had 50,000 qualified applicants for 10,000 places — so they held a lottery! The waiting list is years long — and you can’t even get on it. In Marin County, the waiting list is 7 years long. Meanwhile, underemployed people are being evicted and rents are falling. These people need the help more than potential home buyers (and we know how expensive and farud-riddled that $8,000 tax credit is turning out to be).

http://www.reuters.com/article/gc03/idUSTRE59Q03Q20091027

Awesome! We need more of this.

The last graph was very interesting “California Family Incomeâ€. It strikingly visualizes the fact that the middle class is on extinction. The group of 75K –100K is smaller than groups on left and right, significantly smaller. One would expect a Gauss bell shaped distribution of income, in the worst case some flattening in the middle range, not that dip. This is amazing! To me this show tectonic processes in motion in the American society, which will lead us to the third world with very few very rich and wide spread poverty.

I’ve talked to some that say unemployment will actually get worse before it gets any better, perhaps reaching 15% or more nationally. Employers are scrimping, not spending, and they’re just laying a heavier burden on their existing staff to do 2 peoples’ jobs.

Word of advise Tommy: Go ahead and read the article before informing us of your off-topic “‘immediate’ points that ‘the blogger’ should consider.” Otherwise, STFU, go back to paying your football players, and leave the thinking to the adults.

AnnS, I’m glad you have your fans, but honestly- why do you assume that anyone who complains about the Stimulus or other examples of wasteful government spending hates any government spending. ‘Oh you don’t want to borrow a trillion+ to “create jobs”- you must hate driving on roads and paying the fire department!!’

Honestly, where do you get this stuff from?

Here’s an idea- how about all of you who want to see government spending go through the roof on crap like the so-called “Stimulus” open your checkbook and make a donation to the US Treasury. I’d rather not have to borrow that, thanks very much. You seem to be really into it- so why not donate? How about the government as the new liberal 501c3? I prefer to donate to organizations that are actually efficient with their money, but go ahead and make yours to the Feds today! At whatever million+ it seems to create a “Stimulus” job you might get somewhere say in the next 100 years.

sincerely,

A Conservative Who Loves And Gladly Does Not Mind His Tax Dollars Going To The National Parks (just please stop borrowing those dollars, ok?)

Another brilliant piece on NAR, shadow inventory and media spin:

http://seekingalpha.com/article/168713-fantasy-housing-numbers-a-prelude-to-the-next-u-s-crash?ref=patrick.net

Your article was good, till the end.

You stated .. “we could have spent”

hello….people, sheeple, Gov., writers

Leave the money in peoples pockets to spend as they see fit.

Leave the money is businesses pocket to spend as they see fit.

Anybody who thinks THEY should be in charge of spending someone else’s money needs to rethink that. Anyone who thinks they should be in charge of others lives need to rethink that.

My husband is also an “LA Architect” – 12 years at the same firm in downtown. I am a professor at a community college (full time for the last 11 years). We are supposedly very qualified potential 1st time buyers (no debt & $$ enough for a decent down payment) but the math just does not add up ?? We are also very frustrated with what we see on the market. And it does not help when most of our friends and family think we are crazy to still be waiting! We just do not want to participate in such an irrational debt game!

You’re husband is an architect? I have several friends who are out of work architects. Got any jobs for them?

Pez–

You’re plainly rambling. Apparently conservatism is a poor judge of parody.

I have been following the Doctor for about 6 months now. I totally agree – we are no where near the bottom yet on housing in CA, especially for properties in the mid and upper end.

What I’m wondering is: How long can banks hold onto the “shadow inventory” before it implodes? It seems to me we should be able to estimate how long this waiting game will last.

At some point, they will have to pay property tax, HOA, etc for all of these properties to keep the deception of low inventory going.

At some point the hit to their balance sheet will start to be painful from the on-going expenses, such that they will be forced to walk away, or let local governments take over the property and sell them at auction due to the tax liens.

Either way, I see prices going down due to the huge backlog of loan defaults. Whether banks foreclose, or they are eventually sold to pay for property tax – the effect is the same – at some point there will be a lot more inventory on the market at much lower prices.

I see AnnS is going off the rails again because Mish used a public campground. We all do it, honey. It’s not a political affirmation. It’s a vacation.

It is a “Buyer’s Marketâ€, but the best bargains are selling quickly. For the first time in several years, we are seeing “multiple offers†on the well-priced properties. Remember now is the time to buy that home you always wanted with prices where they are today,one of your best ways is to work with a realestate agent who has the knowledge and expertise to help you along the process. There is a tool which can erase all the confusion related to home buying. It’s a tool which Identifies properties with the most value, establishes the right price range to pay, projects long-term cash flow and appreciation & assesses how to maximize after-tax returns. For more information look into http://www.smartzip.com/info/score

Jake, is it? Just shut the f@#$ up already–we’ve had enough of your ridiculous spamming. As a matter of fact, maybe it’s time you went out and found a real job, if for nothing else to experience the pain of actually working for a living, rather than benefiting from the misery of others.

Leave a Reply