Is California built out? Privately owned housing starts remain all-time record lows. Affordability continues to crush home buying but signs of lower prices loom.

One of the major signs of a tipping point in real estate includes rising inventory, falling sales, and a resistance to higher home prices. California has reached this level. Affordability is a major challenge with only one out of three families able to afford the median priced home in the state. What is interesting is that for regular home buyers, the modest rise in interest rates essentially slammed the breaks on the price rise momentum. Home prices in California have remained in a tight range since June of 2013. Sales have fallen and the year is starting off with a nice little return of inventory to the market. This is good news for potential buyers assuming they even have incomes to support current home prices (which the affordability measures show they cannot without added leverage). Investors continue to be major players here but they have showed some slight pullback as the easy gains are now harder to find. Beyond the coast, California has plenty of land to build but we see building permits at near all-time lows. Is California built out?

California builders not taking the chance

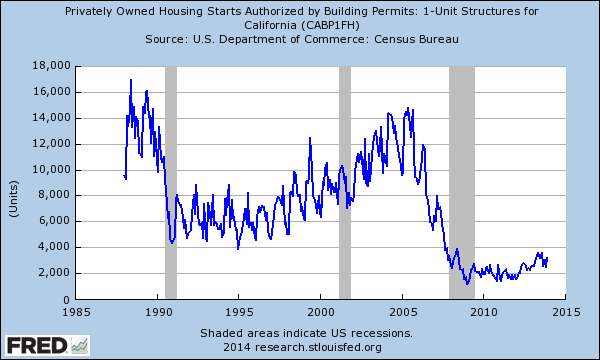

The difference between the massive run-up in price from 2013 versus say that which occurred in 2005, 2006, and 2007 is that builders are betting on this price rise as an anomaly. For example during the boom days we were seeing privately owned housing start permits hitting a range of 12,000 to 14,000 as measured by the US Department of Commerce. Today it is near the 3,000 range. This is a big difference. If these price increases were organic, as in regular families buying homes based on incomes you would see more builders building out in places like Riverside and San Bernardino. Yet they are not.

Take a look at permits being issued on privately owned 1-unit structures:

Privately owned housing starts have fallen 78 percent since 2005. Are we not adding more people? Didn’t home prices surge by 20 to 30 percent in California in various markets? The problem with the current boom is that it is based on manipulated supply, artificially low rates, and massive demand from investors. Take one or two of these items away and the market slows down. It has and we have proof with the modest rise in interest rates from last summer. Now we are seeing what happens when some investors begin to pullback.

The affordability question in California

The problem with having a boom and bust market in California is that it forces a winner versus loser situation on families merely looking for homes. Instead of having housing as a small part of the economy and focusing on more important job creating sectors in places like California, housing has become the modern day gold rush. People try to get rich quick and see real estate as the perfect vehicle. These dramatic shifts do not bode well and you see this with massive amounts of young adults living at home or with roommates with little prospect of purchasing a home.

There are a few major changes occurring in the market that are worth exploring:

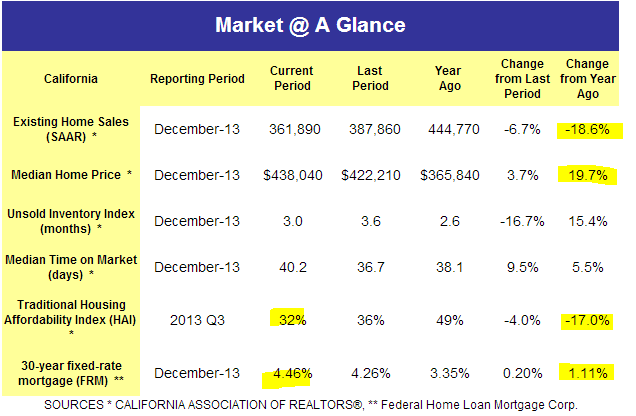

Let us go line by line here on the highlighted points.

Existing home sales: Existing home sales are falling strongly. A 20 percent year-over-year drop when prices are up tells you something is changing.

Median home price: A near 20 percent year-over-year gain in home prices with no real income gains is telling. Speculation is at play here. This time it isn’t small time players going in with NINJA loans but big Wall Street banks leveraging the Fed’s low rate environment to snag real property.

Traditional housing affordability: This has dropped by 17 percent in one year largely because of price gains and interest rate moves. Only 32 percent of families in California can actually afford a median priced home.

30-year fixed rate mortgage: A 4.46 percent mortgage is still a steal. But this is a 33 percent move up from the lows reached last year. Since many Californians live by an “all hat and no cattle†philosophy many now cannot afford to buy (hence the drop in existing sales as investors also wane).

Investors have had a good run at it since 2008. Yet their game is one of margin and gains are now harder to make. You need additional suckers to unload to. Regular households are largely unable to save a good portion of money and even households with good incomes have bad spending habits. Just look at the number of leased foreign cars on the freeways. The stock market is also modestly correcting but you see how quickly things can change because people assume the current situation is normal. Nothing is normal about 20 percent annual price increases when incomes remain stagnant.

2014 is likely to be the year of a tipping point. You still see delusional SoCal sellers thinking peak prices are back once again. Some are getting fools to bite but it seems like the supply of fools is shrinking as well. The fact that builders are not out building also tells you something in spite of the big spike in home prices.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

79 Responses to “Is California built out? Privately owned housing starts remain all-time record lows. Affordability continues to crush home buying but signs of lower prices loom.”

People can Afford housing, it’s plain and simple. But people are willing to do anything to own if given a loan by the bankers.

how many of you know people who rent a room to a friend or to a sibling or family member ??

This is particularly true for Southern California and Bay Area. Then they kid themselves by saying that it’s only temporary, “just for year they say” so people will own even if they have to rent out rooms or the garage

Right now just the fact that housing went up and inventory is low – with rents even higher than 5-6 years ago, and people making less money, except the few in googleLAND or some Healthcare field… something has got to give… with more taxes to pay each year… ugrrr

“Then they kid themselves by saying that it’s only temporary, “just for year they say†so people will own even if they have to rent out rooms or the garage”

Perhaps that’s one of those “intangibles” that renters don’t know what they’re missing out on?!

I’ve observed that in the various areas of the country I’ve lived in, people tend to kid themselves on a lot of things. We’re all guilty of it to some degree. What has amazed me is the degree to which people in SoCal will generally kid themselves. I swear that this place – especially L.A. – is in a reality bubble that eclipses the scope of any particular housing bubble. Here, housing bubbles are but one component of many.

This will be an interesting time. Obama just got his man Mel Watt in at FHFA. We’ve been living under holdover Bush administration housing policies since 2008. If the market tanks, Obama will get the blame and the GOP can pin it on Watt. Watt’s predecessor wouldn’t allow massive write-downs on underwater mortgages, which was the #1 remedy needed for the market to unwind. So, the Fed flooded money into a housing market with an artificial floor on prices. Now, the Fed is stuck with trillions in mortgage-backed securities that will fall in value if the mortgages behind them are written down. Oh, the inexorable force has met the immovable object. The only think the fed can do is print more virtual money. But, can Obama string it out till he leaves office in January 2017? Gosh, that’s a long time. Blert, where are you? Someone shine the Blert signal in the sky!

Ontario is building the New Model Colony, to the tune of 30,000 homes. Rancho, Fontana, and Chino all have large swaths of land left for housing. I don’t think it is built out yet.

There are plenty of wonderful folks in the 909, but truth be told, I’d much rather live in Phoenix, Las Vegas, Tucson, etc. if I could transfer my job/secure a job in those locations. Similar weather, smaller commutes, more to do, prettier views, lower cost of living, better quality of life, and in many cases buy a far better house in a far better neighborhood for far less than 909 prices. Nothing personal, JMHO.

The same thing occurs to me, and apparently to many others as we have outbound numbers to show for it. The only reasons I can see that tips the balance of the equation in favor of the 909 would be a) family or b) niche business/job prospects. Outside of those things, why pay more for less in the 909? Everytime I drive back into the L.A. region from Vegas or Phoenix, the feeling in the environment goes from relative calm to friction. Just the sheer abundance of passive aggressive SoCal drivers is observation enough.

To each their own, but I have to disagree. I am at the beach all the time for various reasons on weekend and at only 45 min to HB and others, it’s something the other places can’t provide. The rest of your statements I agree with, but I’ll pay extra for accessibility to the ocean. I can also snowboard 45 min away, very happy in Corona in the IE. Would I live in OC? Sure. Still waiting to see what happens this year but with enough for 20% down, I’ll wait it out and continue saving. Think house prices in the IE will move lower, OC, well I’ll wait and see.

Drinks, I’m right there with you. If you can’t live in the prime or near prime areas of socal, pack up the U-Haul and get the eff out of here. Your quality of life will be MUCH greater in other areas of the country. Many people feel obligated to stay because they have “family” here. I sure hope the family is helping out with housing and daycare for the working stiffs.

Good call on Tucson, that’s a hidden gem. Definitely on my list if I ever leave LA.

Arizona politics are waaay too red for me, and vegas is too damn hot, I’ll stay in the 909 and be very happy to do so, I live cheap and can get out of here anytime I want a break.

The western Inland Empire will likely be a great buy when Bubble 2.0 pops. Major logistical centers in the Ontario area. You can enjoy all the amenities of LA and the OC in less than an hours drive non rush hour. However a lot of the local income seems dependent on bubble industries, especially in the high end. I’m personally looking for a 15-20% haircut in North Upland which would put us a little under the 2010 trough. Considering the enormous efforts of the FED are tapering off and the current run up is solely based upon it (and still an illusion based on low volume) I think I might hit my buying target in 2015. I’d definitely are that option over Vegas or Arizona living. South OC beaches an hour away, 15 minutes to Mt Baldy snowboarding and the occasional night out in Hollywood combined with a 4/3 at 400k or less and I can stop reading Bubble sites for the first time in 9 years 🙂

Tuscon, Phoenix, Vegas?

Aren’t these cities mostly bland Spielbergian nightmares? Filled with the “idyllic” planned communities one sees in such 1980s homages to suburban living as Poltergeist or E.T.? “Cities” with no sidewalks, just miles and miles of curving suburban streets and cul-de-sacs and identical mega-mansions? No walkable retail districts, just pristine but dull mega-malls and big box stores.

It’s why I’d hate to live in Thousand Oaks or Simi Valley (where Spielberg shot some of his films). I much prefer the walkability of a Santa Monica or Pasadena or Hollywood.

Good stuff guys… it all depends what you are looking for? I lived in the 909, prices took off, so I relocated to Atlanta… watched things get too hot for what you got there and did a new build in Phoenix East Valley in 2010. Hit that about right, my home price has increased sharply.

West Phoenix, not for me. Tucson, is North Mexico, ( some might find that ok), but now Phoenix is getting over heated too. But lots to do here. Driving around the city is stress free most of the time. ( minus the west side inbound on I-10)

Most of my neighbors are from the north, we are too conservative here for most of California… we don’t like giving our money away. So if you are Liberal, stay away, we won’t agree with you on much… or move to the west side or Tucson, they are pretty similar.

Son of Landlord, you can get that creepy, master planned stucco box community in any city in this country. If you are ever in Tucson, check out the foothills. These are generally one off houses nestled in the foothills. Lots of nature since the houses aren’t right on top of each other and views you will not believe…Tucson is surrounded by mountain ranges on three sides. It is mind blowing what you can get there for the money compared to your standard LA crap box.

I have to chuckle at some of these replies. “Only 45 minutes to the beach with no traffic.” This just reaffirms my belief that the allure of socal is just too strong for many…which works out quite well for me.

LB, Why does the allure of the beach make you chuckle? Is it surprising that some would rather be surfing or playing beach volleyball as opposed to barbecuing in the desert or sitting on the couch in a large home? Everyone has different priorities and interests so the smugness of your reply is rather shortsighted.

CD, I get beat up all the time on this blog when I mention “desirable” beach cities in socal. If people are willing to drive an hour just to go to the beach on a regular basis, imagine what people will do to own a house close to the beach. With all that’s wrong with California, the weather and the beach seems to compensate for a quite a bit to many. That is all.

So Arizona politics are waaay too red for shellz? Yeah whatever, shellz deserves to be taxed even more than blue Cali does now to pay for their hordes of illegals and their freaking bullet train to nowhere. People like shellz in the 909 should be paying hella more for water they do now since they live in a desert with no water. Also shellz should pay more for electricity too since a lot of their power comes from the Palo Verde Nuclear Power Plant in Arizona and also from the Hoover Dam which is on the Arizona border!

@PapaNow, you are right. California is not built out. At the current home listing prices, interest rates and incomes, California has run out of potential buyers. The bidding wars of 2013 when 40 buyers bid on one crappy overpriced fixer-upper tear-down home was killed off by the 100 basis point interest increase.

Also, the U-3 unemployment rate for SoCal is 10%, and the U-6 underemployment rate is 20%. The U-3 rate for California is higher than most other states’ U-6 rate. And this rate has not changed much in the last two years.

Congress voted to reduce unemployment benefits and SNAP (food stamps) benefits. GDP is coming in weaker than expected. The Federal Reserve is scaling back quantitative easing (but will continue ZIRP). Real estate sales volume is collapsing. The stock markets are at an all time high as is margin buying (this usually proceeds a recession).

Recessions happen about every 57 months. The Great Recession ended 54 months ago.

Based on all the above, 2014 smells like the next recession.

Housing to Tank Hard in 2014!!

Hey Jim, another commenter once asked you what your rationale was for your prediction. You responded but I can’t find that post. Would you mind posting again why you think housing will tank this year?

I do not recall the specifics of my previous response but the underlining themes were:

– stock buying at record margin levels even beyond 2007

– interest rates will rise and the paltry 5% returns on blackstones housing program will not be attractive.

– investors will dump their properties faster than they bought

-mortgage apps are crumbling to decade lows

– when the selling starts there will be no one to buy

– market sentiment is at extreme optimism levels

– So small losses will become huge losses faster. Some firms are leveraged 5-1. A 20% correction would equal a 100% loss!

-Fed has started to taper the. The QE was the only reason home prices went up. WIthout QE they will Tank Harder than in 2008. This is because all of the investors that came in and bid properties back up in 2012 will be getting destroyed this time. So there will be no one to the rescue. Housing is going to down massively for a long time.

Thanks, Jim. Seeing your list reminded me that it was the level of margin debt that you pointed to before.

Jim Taylor said:

I do not recall the specifics of my previous response but the underlining themes were:

– stock buying at record margin levels even beyond 2007

[Hedge funds have utterly ruined this metric. Leverage swings no longer show up in the NYSE stats. Because of massive hedge fund liquidations, actual leverage in the (equities) market is way down. You just can’t use stock margin credit figures at all, anymore.]

– interest rates will rise and the paltry 5% returns on blackstones housing program will not be attractive.

[This is a horrific error in judgment. The Big Boys are taking a, de facto, preferred equity position in real estate and land. The cap rate on income producing land has been 3% going back centuries. A 4-5% current return looks epic compared to US Treasuries. Rents can be adjusted upwards against the destruction of the currency. Paper wealth takes it straight to the gut.

So what you have is 4% real returns vs -4% real returns!]

– investors will dump their properties faster than they bought

[The deal structure makes this wildly improbable. There’s enough liquidity coming through the pipe to soak up all of the bread and butter properties entering the market. Any price reversion within the higher priced stuff means absolutely nothing to this crowd. The inventory explosion is not in their segment, BTW. Absolutely no-one is manufacturing bread-and-butter homes at their price points. It’s impossible to do so. They knew that going in. Duh!]

-mortgage apps are crumbling to decade lows

[ This is a direct consequence of the rentier class providing their own financing. Refi’s are dead. Duh.]

– when the selling starts there will be no one to buy

[It’s impossible to sell and then live on the street. There is no lower cost habitation available – unless you’re moving back in with mom. Bread-and-butter homes will find institutional buyers at these prices – since no-one can replace them at their cost of acquisition.]

– market sentiment is at extreme optimism levels

[I presume you mean the stock market. I don’t see extreme optimism in California real estate. Disbelief is more like it.]

– So small losses will become huge losses faster. Some firms are leveraged 5-1. A 20% correction would equal a 100% loss!

[Both their leverage and their tactics are huge presumptions, and doubtful.]

-Fed has started to taper the. The QE was the only reason home prices went up. Without QE they will Tank Harder than in 2008. This is because all of the investors that came in and bid properties back up in 2012 will be getting destroyed this time. So there will be no one to the rescue. Housing is going to down massively for a long time.

[ The taper is still goosing the markets on a staggering basis. This is not even projected to end until late this year – if it’s not reversed. Such reversals have already happened twice, and on a dime, too.

It’s impossible for real estate to tank harder than 2008. It was at that time that the mortgage origination machinery seized up – entirely. You can’t top that. The only deals closing were those in the pipeline.

As long as the Fed is buying mortgage paper with a printing press, the mortgage engine will be humming.

Flight capital from Emerging/ Submerging Markets is now in the offing. This is reflected in the dire currency shifts of the rupee, and others. A piece of this action will go to Palo Alto, and such.

A grindingly slow real price retreat is the single most probable market trend. (All bets are off if atomic war breaks out.) Nominal prices are unlikely to shift much. Anyone holding large cash positions continues to get screwed – all currencies are being debased at the same time. Perfect.

“Hedge funds have utterly ruined this metric. Leverage swings no longer show up in the NYSE stats. Because of massive hedge fund liquidations, actual leverage in the (equities) market is way down. You just can’t use stock margin credit figures at all, anymore.â€

Now where did I hear this before??? Oh yea, PE ratios don’t matter anymore as a market metric during the dot com boom… How did that work. There is no new era. There never was and never will be. Leverage is the most important metric in our market. I think you need to spend another weekend and read your friend Keen’s book again…

“This is a horrific error in judgment. The Big Boys are taking a, de facto, preferred equity position in real estate and land. The cap rate on income producing land has been 3% going back centuries. A 4-5% current return looks epic compared to US Treasuries. Rents can be adjusted upwards against the destruction of the currency. Paper wealth takes it straight to the gut. So what you have is 4% real returns vs -4% real returns!â€

I think you have a number of assumptions that have not shown to be true. The biggest being “Rents can be adjusted upwards against the destruction of the currencyâ€. This is only possible in the long run if wages can be simultaneously adjusted upwards against the destruction of the currency. With the huge slack in the US labor markets (aka worker participation not the phony unemployment number) there is no real upward pressure in wages. Even if you increase minimum wage the amount of income will not increase in nominal dollars as jobs will continue to be outsourced…

“The deal structure makes this wildly improbable. There’s enough liquidity coming through the pipe to soak up all of the bread and butter properties entering the market. Any price reversion within the higher priced stuff means absolutely nothing to this crowd. The inventory explosion is not in their segment, BTW. Absolutely no-one is manufacturing bread-and-butter homes at their price points. It’s impossible to do so. They knew that going in. Duh!â€

I know for a fact that this is untrue. One only needs to look at the last housing crash. I actually was invested in commercial REITs when the crash happened. I was in the process of cashing out during the crisis and the fund was frozen. The fund manager then was in the process of selling off underlying assets to pay for the net redemptions. There is no real difference here. When the fund is under performing the manager will sell off underlying assets at a loss if necessary… Duh!

“This is a direct consequence of the rentier class providing their own financing. Refi’s are dead. Duhâ€

This makes no sense. This is a result of increased interest rate along with increased price which is a double whammy on the mortgage market. Why would you refinance to a higher rate? How can someone buy a SFR when affordability has gone through the floor?

“It’s impossible to sell and then live on the street. There is no lower cost habitation available – unless you’re moving back in with mom. Bread-and-butter homes will find institutional buyers at these prices – since no-one can replace them at their cost of acquisitionâ€

You are making assumptions again. You assume that the owner is not a corpse’s relatives or a fund manager or an individual investor that has not been able to keep renters in the property and get it to pencil out. There have been many times in the past where real estate was not a great investment. You could also have changes in tax laws that make it even a less attractive investment. My friend’s dad who was a Beverly Hills doctor back in the day owned two commercial properties out right but had little to no income from them and with the change in the tax laws and Northridge quake he finally lost both to Uncle Sam. BTW one of the properties was on the third street promenade. It was not always a prime area for those new to the area..

“I presume you mean the stock market. I don’t see extreme optimism in California real estate. Disbelief is more like itâ€

See little “r†robert…

“Both their leverage and their tactics are huge presumptions, and doubtfulâ€

Remember who we are talking about. These guys are leveraged to the hilt until they can offload these “investmentsâ€. To think that these guys have changed their game is what is doubtful…

Now the next comment left me absolutely dumbfounded. How can anyone make such a ridiculous idiotic statement?

“It’s impossible for real estate to tank harder than 2008. It was at that time that the mortgage origination machinery seized up – entirely. You can’t top that.â€

The failure was not the seizing up of the mortgage origination, it was the failure of the underlying assets to perform! My God how could you not see that they would have continued forever if the bubble didn’t burst? You act as if it was the originators decision to stop making bad loans on properties not that the assets were extremely overvalues because of the growth in public debt. You really need to go spend another weekend reading Keen because I am convinced that you still don’t understand his thesis…

I would never try to predict how much and when a bubble asset will correct but I am convinced of two things. One is that it will correct. The other is that this is NOT a new era…

Water Tank! As the pipe is going to run dry in a few years and we won’t want to live here unless we find another source of water.

Is California’s water shortage a direct problem for anyone other than farmers?

Farmers use most of the state’s water. If there’s a water shortage, only they’ll get less water, because the politicians won’t let the cities go thirsty.

So a water shortage will simply mean …

* less food produced,

* less agriculture tax revenue for the state,

* higher state deficits,

* higher taxes to pay for those deficits,

* higher food prices.

Not good for the economy. But it won’t mean less water for urban areas.

Son of …

The single most likely event is the wholesale curtailment of rice farming. One has a hard time wrapping ones mind around how much water rice farming takes. It’s many multiples of most other crops.

California has many, many, rice fields that can just be shut down. Uncle Sugar will pick up the pain.

Right there, all by itself, the water situation is almost rectified.

Almond and walnut trees have to be sustained. They’re a priority, for obvious reasons.

Similar logic holds for asparagus. It’s just too valuable to lose, being a perennial.

Tomatoes and grapes are on the bubble. One can save vines with modest water — while stinking up the grape harvest. I’d say this is a certainty.

Likewise, the tomato harvest is likely to be throttled.

Expect onions to take a hit, too.

An amazing snow pack should make the rest of the nation at hazard for massive flooding come this Spring. Perfect.

Thanks for checking in Jim.

“Is California built out?”

Land is still in relatively large supply, but water is not. We are moving water around this entire state via an antiquated water delivery system, which was actually state of art several decades ago thanks to some foresighted planners. But since then, our infrastructure has not kept up with our population. The politicians in Sactown and DC have squandered everything over the past 25 years. Instead of investing in more water storage, building dams, canals, etc, our state leaders have decided that they’d rather become the welfare capital of the USA, and spend money on social programs and paying for things like Calpers pensions. Now we are at a crossroads. Not only do we not have water to grow, we don’t even have enough to maintain the status quo. And what are our dear leaders in Sacramento doing? Trying to shove a boondoggle HSR bullet train down our throats which is vastly over budget, and doesn’t even begin to solve our transportation problems in the slightest. Sorry if I’m off on a rant here, but people in CA need to wake up. State gov’t is not serving the needs of the constituents and taxpayers. They are serving themselves, their political parties, their narrow minded money donors, and their militant fringe groups. They are not solving problems on behalf of the general population like they once did. Instead, they are trying to preserve their jobs and their benefits and their pensions. I don’t blame people wanting to leave this state. The political dysfunction is disgusting. So, in answer to your question Doc…yes, CA is “built out” so long as we keep these boobs in office.

Hit the nail on the head, with one exception: we’ve also painted overselves into a corner via excessive regulation. I can’t even wrap my mind around the national debate that would take place if we wanted to build a dam or otherwise, likely because of some rare rat species that could possibly be wiped out in the process. It happens every single time.

Good points, TJ. New solutions needed and can be found for some of these problems – water: individual/community cisterns if dams aren’t politically feasible, alternative transportation arrangements via facebook groups etc. We’ve got to think outside the box to take Cali back for its citizens and make it work. Cali can break new ground to solve problems

That’s like saying “America is built out”…. just look out the window of your next flight and wonder why everyone wants to live on top of each other? Bad, short term thinking by city planners?

But I grew up in the Midwest, you could see the neighbors driving home in the distance… just right, just no job and way too cold….

Instead of the multi billion dollar bullet train that few people would use, how about some water reclamation plants and desalinization plants? Oh I know, the environmentalists want a limited water supply to keep the housing and population down and to make their real estate investments expensive. They want the Hispanics to move to AZ, and TX. They are just racists.

On the sidelines in San Diego for nearly 6 years… all indications suggested the market was going to pop back in spring 2012. Was working through other challenges, therefore, failed to make my move ascertively. Did NOT expect the +28-35% increase in home prices in 18 months. I am in the 30% that CAN afford a house, however, I shall remain sidelined until the next window of opportunity. In the meantime, I’m up over 200% in biotech stock (SD market), therefore, not regretting NOT buying, but look forward to the day I own… until then, I’ll just enjoy my rental a block from the ocean, and continue to deposit/invest the difference of rent vs mortgage in other areas!

Totally agree with you.

It’s not really a question of whether you can afford the current prices or not. It’s the question of whether you think these prices are ridiculous or not.

There has to be adequate price discovery, i.e. a not-totally-distorted market where we could see what prices really are for homes.

I love hearing the hegemonic masses talking about “building equity.” I mean, WTF? Even if prices don’t crash, they certainly won’t rise by a whole lot in the future and what are you going to do with that “equity”?

A) You will pay 1.25, if not greater, in property tax.

B) You will spend a lot of money on interest rather than principal that first decade. C) Lose 10% on any housing transaction on repairs and broker fees.

D) Plunk down that hard earned “equity” on an even more expensive and over-valued move-up house.

People really are too emotional about real estate to understand that it’s a place to live and not an investment vehicle.

Without that, I have no desire to buy a house as I can plunk down all this money and not be able to find a buyer two years down the road when interest rates are back to even just 6%.

mR, sounds like you have the right attitude regarding buying. Most people can’t save anything so any opportunity to buy (whether good or bad) is taken advantage of. I think prices have topped out in this rally and potential buyers who can save money for that elusive down payment will be rewarded. You mentioned investing in some high flying biotech companies. Be VERY careful if you plan on using these funds as a down payment. I’m sure you are well aware that price movement in high flyers can go both ways very quickly, have your stop losses set. Keep saving and keep your ear to the ground, people like you will be rewarded.

Houses are worth what buyers are willing and able to pay, so lets hope those buyers shrivel up in the near future. House price liberation for younger people, please.

Banks.. now you’re recapitalized (via QE) and offloaded loads of iffy assets back to market during the reflation….. how about allowing market to normalise. Think of all that fresh lending to be had, at volume, on lower house prices, to younger people…. on houses currently owned outright by older owners and investors at hyperinflated values.

Cash buyers and outright owners are of little use to the banks, not paying any interest to the banks. The banks need to get debt on those houses, in huge volume to younger people, and if substantially lower house prices the way to do it, then why not do it.

This is for the UK back in an earlier recession (in my view house prices are just as inflated in UK now), but I can imagine US banks compiling similar reports……

>> In 1993 the banks had been circulating market intelligence briefs on various types of industries and business. A big dealer in Tamworth had been throwing one at a ****** Bank employee and she stole a copy for him 11 pages long. MARKET INTELLIGENCE BRIEF. AUGUST 1993. This report has been designed for use by the staff of the ****** **** Bank Group and is strictly confidential. It effectively said that the time has come to squeeze and pull the rug on all but the cash rich. Anyone with no security was doomed. <<

A $100K mortgage is $193,255 to be repaid to the bank over 30 years at 5%. They can book an immediate big profit, loads of times over, selling houses at lower prices. Do it in volume banks and make yourself big money, whilst liberating the market for younger professionals. Get some debt on all those houses owned outright, and the equity rich.

The banks don’t need any instruction on what to do, this is exactly what the whole “recession” was all about. Give the banks time to get bad loans off the books. They have had time to get more reputable people in the houses who won’t walk when their houses lose value and they’re stuck paying far more than the house is worth. Granted, they are far from having released all the inventory that should really be out there, but I have the sense that they have come far enough to move to the next phase of the plan, and that as Jim Taylor says, housing will tank hard in 2014 — not a total collapse, but 30%-40% in many areas ( not luxury areas ).

“A $100K mortgage is $193,255 to be repaid to the bank over 30 years at 5%. They can book an immediate big profit, loads of times over, selling houses at lower prices. Do it in volume banks and make yourself big money, whilst liberating the market for younger professionals. Get some debt on all those houses owned outright, and the equity rich.”

You have just revealed the next phase of the plan. Home prices drop; more people are given loans; but they won’t be able to pay those either, because of the job-loss cancer and deindustrialization. It will just be another form of euphoria that looks like “realism” this time, but really isn’t.

That doesn’t matter to the banks. What matters is being able to put down on paper that they are going to earn such-and-such an amount of interest over 30 years, and thus take some of the junkiness out of their paper… The whole cycle repeats just at a lower level. Then they can do it again — a drop, loans, foreclosures, another drop.

This process, in a somewhat different form, has been called in Germany “kalte Enteignung,” or “ice-cold dispossession.” We are being reduced to slaves building pyramids for Pharaoh, and they will take and take until the men are disposable labor, croaking in the heat and dust and then easily replaced by the next, and the women prostitutes. Throwaway cogs and bodies for a vampiric, faceless elite.

“We are being reduced to slaves building pyramids for Pharaoh, and they will take and take until the men are disposable labor, croaking in the heat and dust and then easily replaced by the next, and the women prostitutes. Throwaway cogs and bodies for a vampiric, faceless elite”

Yup. Wages lower, jobs more scarce, park millions into EBT lifestyle. Media glorifies young women who behave like crass whores, celebrates men who embrace traditional “feminine” behaviors; demonizes men who enjoy traditional “male” interests (football, guns, etc.) as unenlightened neanderthals, etc. Non stop reporting about racial issues; keep different races wary of each other (like they do in prisons) so people won’t figure out the truth that we are all far more alike than we are different. It’s become pervasive. JMHO. Sorry, end of rant. Back to housing.

Can anyone explain why the rent at Bay Area has gone up so high?

2000 for a 1-bd room apartment?

I think the high rent also contribute to the low inventory since people would rather to rent out the house instead of sell them.

“Can anyone explain why the rent at Bay Area has gone up so high?

2000 for a 1-bd room apartment?”

Google.

Because someone paid too much and landlords figured they could get that too…. It takes one person to set the price point for a whole area… and in some cases Country….. ( Americans screwed up prices in Costa Rica, Belize etc,) now the locals can’t afford to buy in their own Country, the land owners will set on their land since it’s free and clear for years…. It’s a sad fact.

CC, rent is high for many reasons in desirable parts of Ca. It has gone higher in the last few years due to a manipulated housing market…not because we are in such great economic times. Many qualified people who want to buy, can’t because there is simply no inventory out there. The sparse inventory is being fought over by investors, cash buyers, large downs, etc. This is driving up prices. Landlords know renters are between a rock and hard place and are sticking them with large rent increases. Landlords know that people are willing to cough up an $100/month rather than move and find a cheaper rental. This is exactly the reason I have been crowing about “rental parity” for years. If you are close to rental parity, it generally makes sense to buy.

Prices are about to go down, so no, it doesn’t make sense to buy, unless you want to have massive negative equity like a Spaniard.

Out of California, are you a fortune teller? Do you have a crystal ball? How did that fortune telling work out the past few years?

Nobody on this blog has any idea what will happen in the future regarding home prices, rents, etc. If you can buy at or below rental parity and plan on “owning” for the next ten years…you should really think about buying. Ask anybody in the past how buying at or below rental parity has worked out for them, I would imagine quite well.

Lord Blankfein, you are quit right, it is very foggy out there. But there has been reports of icebergs. But full speed ahead, as we know California real estate keeps going up as the real estate lobby tells me and this RMS ship is unsinkable. But if we do hit a iceberg in this fog, there is not enough lifeboats for everybody, so the crew will jump in them and take them all. The banksters and Wall Street investors always are the winners. “You know the rule of the sea. It’s every man for himself now”. Better to sell a year before the event, than afterwards.

I don’t know about you captain but I am already in the lifeboat. Not as comfortable as the dining hall but it is not as bad as others make it out to be…

An interesting observation from an actual flipper. Last year we remodeled and sold close to 100 homes in the IE. I can tell you first hand that distresses properties are now very difficult to come by. 14 months ago nearly 50 percent of active inventory were distressed sales. Now it’s down to less than 5 percent of the active market. Our average hold was 110 days, and since most of our purchases were short sales or REO, that means that each of our flips sold twice last year. It follows that the number of sales will be declining as the flipping diminishes. The number of “end users” market share is actually increasing.

Another interesting observation I see is that the current median price for “available” listed inventory is priced nearly 30 percent higher than Current (30 day) sold inventory. Historically that difference is less than 10 percent. There is still less than 60 day supply of available inventory, but less than a 30 day supply for homes priced below the median sold price.

Condos are now capturing a much larger share of the market than a year ago and prices are still moving up. Even though there was 25 percent increase in SFR value, we saw condos appreciate over 50 percent in value last year.

As the condo owners get “unburied” they sell and move up. We see “move up” as the next boom (bubble?).

We don’t see the market as “tanking” but returning to more normalized as the builders like us exit flipping. Raw land values have more than doubled in the last year. Higher land cost means more expensive poduct type… Look for the us builders to produce “move up” market homes at a cautious but steady pace. I can tell you this is what our company is doing.

It’s very hard to argue with your insights as a flipper but one question.

How are the number of “endusers” going up if:

-The homeownership rate continues to drop, a lot.

-The population of CA is dropping slightly or staying stable at best.

-There is a boom of rental units (not SFH, but apartment buildings.

It’s very hard to argue with your insights as a flipper but one question.

How are the number of “endusers†going up if:

-The homeownership rate continues to drop, a lot.

I think the reason homeownership rates have dropped is because during the boom many homebuyers that bought, really had no business buying a home… Liar loans, Zoroastrian down, subprime ect.

-The population of CA is dropping slightly or staying stable at best.

My point was that it a growing market share of move up buyers, that is moving from one house to another, therefore not adding or taking away from available Housing stock.

-There is a boom of rental units (not SFH, but apartment buildings.

This is more a factor of supply and demand. people that were displaced (Foreclosure or short sale) are now renting, Which created a shortage of rental properties. Therefore rents go up , and when rents go up … Apartments buildings get built to satisfy demand Until the cycle of oversupply …and then rents go down!

I don’t think buyer demand will shrivel up in the prime areas of So Cal anytime. Watch the documentary “Death by China” on Netflix and you’ll see there’s so much wealth being created there, thanks to US consumer spending habits, and they need safe investments for their money.

Unfortunately, So Cal real estate is a top target for Chinese buyers and will continue to be for quite a while. Hang around at most open homes on the Westside of LA and you’ll see what I mean. I’m assuming it’s the same in prime areas of the OC as well in other prime US cities.

“and will continue to be for quite a while”

Are you clairvoyant or just guessing?

Gotta love these crystal ball prognostications.

I went to a dozen or so open houses in Santa Monica last year. I didn’t see any Chinese couples, not a single one.

Overwhelmingly, I saw thirtysomething American couples. Many white couples. Many mixed couples (always a white husband, Asian or Latina wife).

I thought it interesting that almost everyone I saw looked thirtysomething. Some with small kids or babies, some without.

Roubini says that things are like 1914, war clouds, China and Japan(US) will have a go at it. Roubini: Many Davos Speakers Think It’s Like 1914 … Right Before WW1 Broke Out.

World War 1 never really ended. As I said once before on here, every military/territorial/religious/economic conflict from 1914 up to today can be traced directly back to WW1 and the various treaties that ended it. Historians will look back at the century between 1914 and 2014 as one of non-stop conflict between ’empires’. A war of empires ruled by monarchies turned into a war of empires based on ideologies and then into a war of empires based on their economies. The shooting hasn’t been constant for that 100 years, but it all goes back to 1914, or should I say that 1914 is when all of the other issues finally found their excuse to resort to violence at the same time. This is just things heating up again.

@ACF, 2/3 of the wealthy Chinese have already pulled their money out and left China. And the Chinese government is clamping down on capital flight and corruption. So the wave of wealthy Chinese buyers is pretty much over and done with at this point.

California is on a real estate cycle of 7 to 12 years up 7 to 12 years down it is the same cycle since World War 2 irrelevant of any changes or bills or loss or events in Washington DC or Sacramento because California is roughly 15 percent of the United States economy and the 7th or 8th largest economy in the world that’s a fact taking that fact into account the bottom of the market was June 2011 the top of the market was roughly 2005 2006 the previous bottom of the market was roughly 1995 the previous high off the market was 1988 89 this is the same cycle that will happen now based on the bottom mean June 2011 the top of the cycle on the way up will be approximately 2018 to 2022 take it as fax if you don’t buy now and you don’t sell then you’re more than stupid because the California real estate cycle give everyone thought in California to have cycles to make a profit if you consume you can invest from age 18 270 if you include your kids when you’re young or old that’s roughly three to four cycles got it now what are my credentials 700 to 800 real estate transactions all based on market timing average internal rate of return aka I RR 27 percent a month from 1999 to 2008 average cost of goods during that. 8.7 cents on the dollar from 2009 to 2014 my average cost of goods for six thousand acres 2.7 cents on the dollar that should yield roughly 3000 to 6000 percent return based on these numbers and my calculus of Fortune esters and Mike’s parents from 1976 to know I think that everyone should be buying property from 2009 to 2015 then start selling these properties 2017 to 2022 good luck everyone thank you

Good take, California is all about cycles, has been that way since the 50’s boom years. My parents had a home in Northridge, 1976 was worth about 60k, agent said that is about it. Seven months later cycle hit and sold for 95k full price.

Like I always said, Cal is a country to itself and they only answer to themselves, they really don’t care what goes on, especially east of Denver.

As the reason, there is always somebody still California dreaming. When ever they play the Rose Bowl those Big Ten players are in awe, if they make it to the pros they want a LA lifestyle. They have no interest in Iowa, or Nebraska let alone those other Midwest or Mideast states.

Of course once you actually move to California you figure out way most want to leave, but that is another subject.

Not true, miss STL. once people get to CA a lot of people get fed up and leave.

ahhhhh no.

Was there any part of those cycles that saw a price hike of 25% in one year? Doubtful.

If you do want to point to cycles, one could also argue that we are still in the up-cycle that started in 1999 as prices are still about 35% inflated versus average historical pricing.

Hard to draw any firm conclusions because:

A) Prices are jumping erraticaly.

B) Volumes are extremely low.

C) Interest rates have been gradually droping last 40 years and have hit a bottom and may actually come up a little (doubt they will go past 6% on a 30yr).

@irrgenius, the correct answer is: Recessions.

After every recession since WW2, home prices and rents have plunged in SoCal. Recessions happen about every 5 years and typically last one year. The only exception would be the recession of 2001.

2001 is the only recession where rents and home prices did not plunge. Then again the government changed the mortgage rules in 2002 and allowed banks to self-regulate themselves, and we all know what happened next.

Ok, here is my version of the blert rambling rant…

It appears that the FOMC is now scheduling the “taper†of QE 3’s bond buying bonanza. A cautionary note is that this is a slowing of the growth of the Fed’s balance sheet not a decrease of the Fed’s balance sheet. Hence the balance sheet will continue to grow for the rest of 2014.

Why would the Fed believe that taking MBS’s and treasuries from the big banks and replacing them with cash reserves at the Fed is a good thing? One reason is that the Fed believes that GDP = Money Supply X Velocity. Since GDP is the economic measure of happiness then we need it to go up not down.

The Fed believes that when Velocity slows down or if Money Supply goes down then the GDP goes down. Since the Fed can not control Velocity, the only option would be to increase money supply to increase GDP. There are two major tools for the Fed to increase money supply.

One tool is to lower interest rates therefore increasing the quantity of debt AKA Money Supply in the market. If interest rates are already zero or less in real terms then that tool is no longer available.

The second tool is buying bonds to increase the Money Supply. The idea is to increase the reserves at the large banks and in theory increase the ability of the banks to lend based on the increased reserves.

I believe we are witness to several flaws in the theory. The most obvious flaw to anyone who has worked in retail or distribution knows that supply does not create demand especially in a contracting market. The fact is that the higher supply will most likely have an impact on your turnover aka velocity. So increasing money in a contracting market will most likely decrease velocity.

The next flaw is the belief that lowering price will automatically increase demand/supply. A factory is not going to buy a new machine because financing is cheaper when there is little to no demand for more production.

According to blert’s friend Steve Keen another problem is that the Fed is ignoring the real cause of the slowdown which was the slowdown in the increase of public debt. Keen believes that GDP = income + change in debt. This would mean that with decreasing or flat incomes the only way for GDP to continue to increase would be to continually increase debt. I believe anyone with a pulse would see the problem with this equation. Assuming that debt needs to be paid off by fixed or falling incomes, there will come a time when the payment will make it impossible to continue to grow debt regardless of the interest rate or the term. The payments for prior consumption will eventually consume all income. This is the reason why all Ponzi schemas fail.

Now if we can’t increase GDP by lowering interest rates or buying bonds what other options do we have? There is the concept of “wealth effectâ€. The idea goes something like the public will increase consumption if we are able to increase the value of assets that are held by the public. This is actually a justification for the encouragement of asset bubbles by the Fed and Treasury. This is such a silly notion that I refuse to refute it and will let it stand on its own…

So, how do you rate QE 3’s success?

Did you watch the video from Ray Dalio? He explains this much easier to understand.

I wonder how cutting of state supplied water to 25 million Californians and over 100 thousand acres of farmland will affect those real estate values? The one thing we can count on is change. Live wherever makes you happy and won’t make you a debt slave.

Apartments use less water than SFH. The environmentalists want us to go Euro and live on top of each other in condos and apartments. The environmentalists will use this water emergency to put a stop, temporary of course, to further SFH construction.

I think you are right; everybody must wholly embrace the green agenda; only haters ask questions. If we do not embrace the philosophy, more toll roads, DMV fees, surcharges, a vehicle miles per driven tax, soaring water/electric bills, etc. may leave people no choice but to accept/adapt. Remember, it’s for the greater good.

Perhaps this is what life in large urban US cities will be like in fifty years…

http://abcnews.go.com/blogs/headlines/2013/02/shocking-photos-of-cramped-hong-kong-apartments/

Maybe a wealthy famous actor will fly in on a private jet, make a speech about global warming (and how more laws should be passed to make life for Average Joe commuting fifty miles to a job in his 2002 Honda trying to make his rent/feed his family even more expensive/difficult) to a worshipful crowd, then jet off to one of his multiple estates scattered around the world. It’s all good!

“Mr. Green,” meet “Juanita.” I think you already know “Lee.”

We saw a lot of builders go bust in the recent crash. Indymac was handing out construction loans like candy. I think builders are cautious for this very reason.

2014 should be interesting. Interest rates might drift down for a while as the emerging market crisis deepens.

In terms of the recent influx of people in Ca. We’ve seen this before. There is a lot of private equity flowing into the state. If retail sales weaken we will see pressure on advertising. This will tighten the noose on the hot money since so many startups and social media companies are based on ad sales. We will see this play out over the next 6 months. For those of you who lived here back in 2000 you know how quickly things can turn in this state.

This time is different because we have magic. We did not have magic in 2000…

“Not true, miss STL. once people get to CA a lot of people get fed up and leave.”

Really? I don’t miss STL one bit. My family is back there, and they want to move out here too. My cousins from STL all moved out more than 2 decades ago. Not missing it either.

What could you possibly miss back there, except the 1-2 nice weeks of fall? The rest of the time, the weather is too hot or too cold. People aren’t great either. It’s a pretty boring and dying city, long term.

Cardinal games at Busch Stadium, real Italian food, St Charles, Kirkwood, Westport plaza parties, Creve Coeur, nice people, managable traffic and the normal cost of living.

“nice people, managable traffic and the normal cost of living”

This

Rents in Palo Alto have gone up $1000 for a 1BR unit over the last three years, from $1800 to $2800, this year’s increase alone– $400. Yes, it’s Google and Facebook, and limited supply of housing driving up prices here on the Peninsula. The last window to buy here was 2009/2010, they were trying to give away a new 2BR/3BA townhomes with a stones’s throw of 101 for $799K, recently saw one listed for $1.3MM. Cash buyers are probably 2 out of 3, either stock options or money from China.

What will slow this NorCal market? A market correction where Google and Facebook drop 30% or more, or a slowdown in the flight of money from China.

Aren’t we just one stock market crash away from the California housing bubble bursting again? http://smaulgld.com/how-a-stock-market-crash-will-end-the-economic-recovery/ A stock market crash would lead to layoffs in SF and Silicon Valley and the bust will happen again. The question is whether the Fed will be able to pick up the pieces

Hey, come on up to Seattle or Portland…….have plenty of cheap real estate, nice people, and zero traffic issues…..;-)

The problem no one in CA wants to talk about…Fukushima radiation!

The government is covering up the 3 total melt-downs, just like when the reactors exploded and dosed the whole US.

Highly radioactive water is pouring from the plants unabated and will not be stopped.

Who’s going to want to raise a family in the coastal areas when endless radiation starts pouring in? The plume is nearing the coast now and will not stop for 100’s of years.

Good luck selling your home once everyone figures it out.

Follow the news enenews.com

I don’t understand why more people are not talking about this. Every time I think about the power plant, it makes me want to leave here as soon as possible. Minus the power plant, I love it here because of nice weather.

Another great post by the good Doctor. Here are some additional charts to emphasize his point. http://confoundedinterest.wordpress.com/2014/02/03/california-housing-starts-pale-in-comparison-to-texas-nevada-still-in-the-tank/

Good article from the Burning Platform with excerpts

http://www.theburningplatform.com/2014/02/02/warped-distorted-manipulated-flipped-housing-market/

…The report from RealtyTrac last week proves beyond the shadow of a doubt the supposed housing market recovery is a complete and utter fraud. The corporate mainstream media did their usual spin job on the report by focusing on the fact foreclosure starts in 2013 were the lowest since 2007. Focusing on this meaningless fact (because the Too Big To Trust Wall Street Criminal Banks have delayed foreclosure starts as part of their conspiracy to keep prices rising) is supposed to convince the willfully ignorant masses the housing market is back to normal. It’s always the best time to buy!!!

The talking heads reading their teleprompter propaganda machines failed to mention that distressed sales (short sales & foreclosure sales) rose to a three year high of 16.2% of all U.S. residential sales, up from 14.5% in 2012. The economy has been supposedly advancing for over four years and sales of distressed homes are at 16.2% and rising. The bubble headed bimbos on CNBC don’t find it worthwhile to mention that prior to 2007 the normal percentage of distressed home sales was less than 3%. Yeah, we’re back to normal alright. We are five years into a supposed economic recovery and distressed home sales account for 1 out of 6 all home sales and is still 500% higher than normal. …..

Leave a Reply