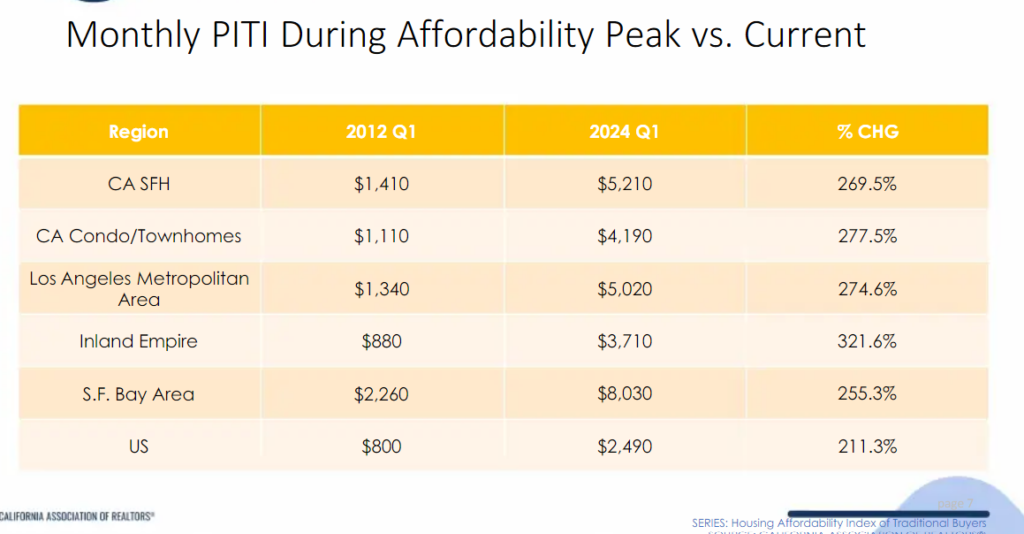

California Home Prices on a Roller Coaster: Monthly Payment for a California House: $1,410 in 2012 and $5,210 in 2024.

It’s been nearly a year since we last posted and we missed you all, and the California housing market has been anything but dull. The landscape has shifted significantly, influenced by a confluence of economic pressures, demographic trends, and policy decisions. As we delve into the current state of California real estate, we’ll examine key factors driving these changes and provide a detailed analysis supported by recent data and trends.

The State of the Market

Inventory and Pricing

The California real estate market is in unaffordable territory last seen right before the Great Recession. Rising mortgage rates, driven by the Federal Reserve’s aggressive rate hikes, have cooled some buyers but not by much. The result? Higher prices driven by stretching out the monthly payments like a balloon. Take a look at this:

The standard monthly payment for a California home is now at $5,210 a month, up from $1,410 back in 2012. But certainly, incomes have kept pace over these past 12 years, right? Not exactly:

Median Household Income CA

2012: $58,328

2023: $85,300

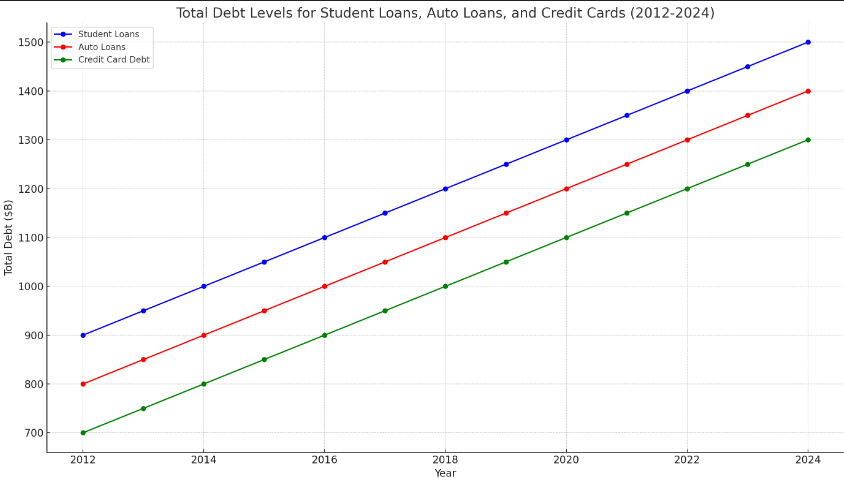

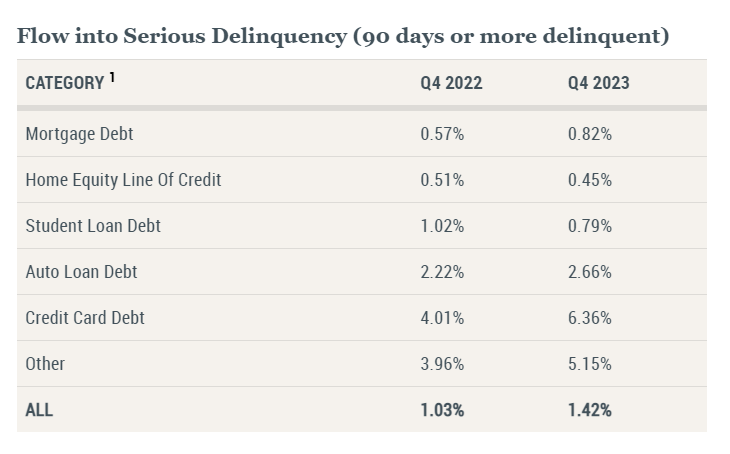

During this period, the monthly payment is up 269.5% yet household income is up 46%. So how is this even possible? First, 2012 was the bottom of the crash and affordability was strong at that point. Now, people are maxing out debt on all fronts (student loans, auto debt, credit card debt, and mortgage debt). Signs are flashing red as everything is up:

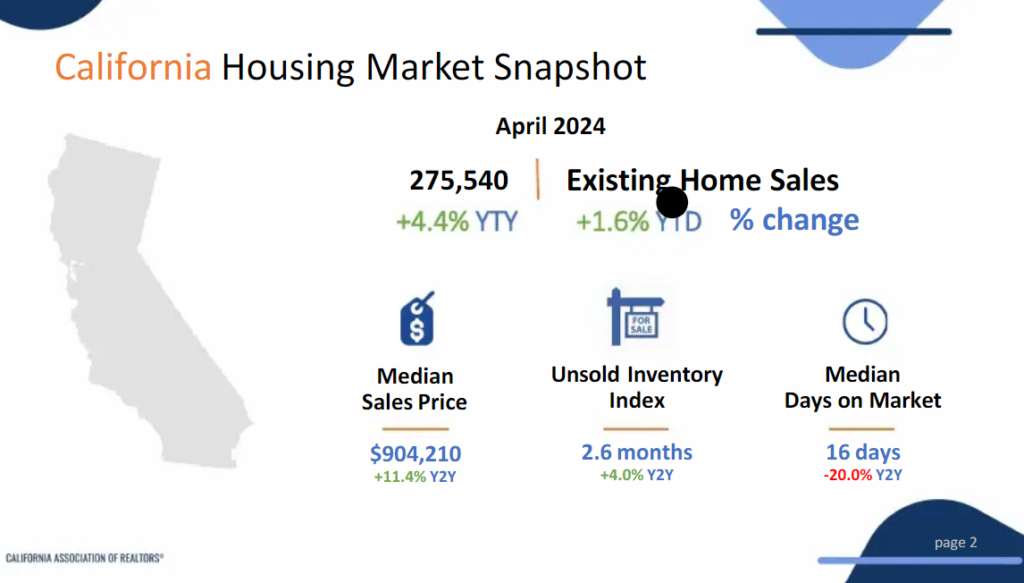

The typical home in California is now over $900,000 yet the typical household income is $85,300 (a typical family will need at least $200,000 in annual income to afford a home – in other words, your typical California family cannot afford a typical home). So sales volume is very low and people are maxing out their monthly payment. It is musical chairs territory. “Hey, should have bought and now I have six-figures in equity!” You do not have that equity until you sell which requires another person believing in this narrative. A bit of mania is in the market now but even with that, the numbers just do not work for what people earn.

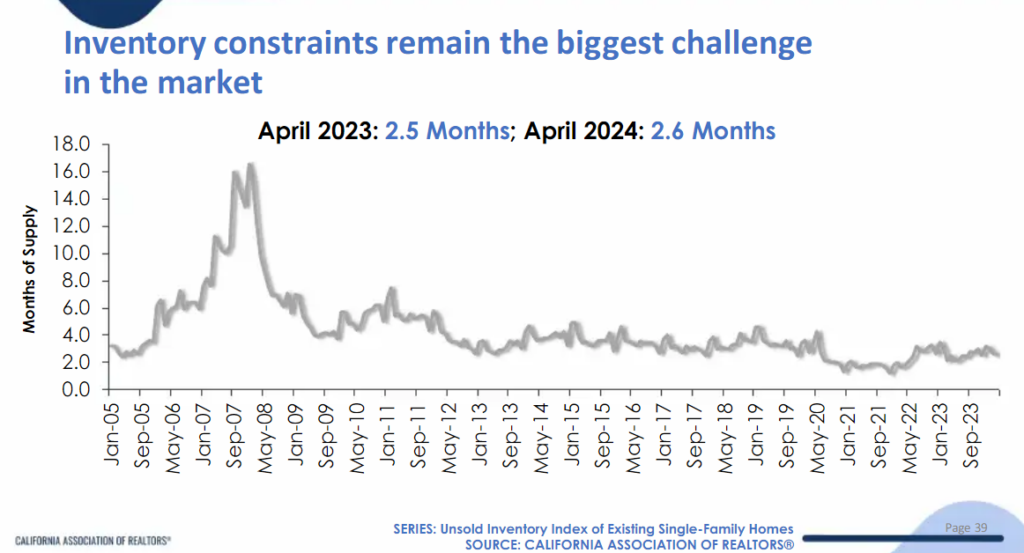

The story on the price front is one of low inventory levels:

You have people that bought and are staying put. So if you want to buy, you get the house obsessed crowd that is going to stretch to extreme levels only thinking that “now or never” is the motto to buy real estate. But the reality is, very few can afford homes and people are leveraging every piece to get in.

Just look at total debt levels:

Student loan debt is above $1.5 trillion, auto debt above $1.4 trillion, and credit card debt above $1.3 trillion. In other words, people are maxing it out. And no surprise, problems started happening last year and continue today:

All of this to say, the debt needs to keep floating in to keep this party going. Nothing to see here folks!

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

138 Responses to “California Home Prices on a Roller Coaster: Monthly Payment for a California House: $1,410 in 2012 and $5,210 in 2024.”

Everyone makes the mistake of assuming that Californians are buying the houses that are selling now. I keep seeing houses go to wealthy recent arrivals from abroad. (Like the house next to my Daughter’s house). We are getting a new upper class with the local helots doomed to servitude.

Same deal next to my parents. Was there for a family reunion recently and these people complained about the kids being too loud. Oh no! Kids playing together outside! Dang, we used to blow things up in the front yard when I was a kid and nobody every complained. Maybe don’t buy a house in an American suburb next time, you morons!

There are not enough wealthy individuals arriving on our shores to buy up the hyped up Housing stock to keep prices from collapsing. Wishful thinking.

I said nothing about maintaining housing prices. I was discussing who is buying currently at these prices. There are a lot of countries whose elites and upper middle class want to have some kind of base here particularly for the younger members of their families. Nothing beats a good exit strategy.

The future of housing prices is dependent on the value of the dollar, and employment in the middle class and higher income groups. A big drop in middle class employment will tank the market. Low wage employees can barely make rent here. They just count for rental income for the other group.

You also should see my last post of June 23. That was a national study of vulnerable housing markets. Note that wealthy Orange Co is listed as having a much lower probability of housing price crashes than the markets in the Central Valley. I’m in Orange County, not San Joaquin Co. I’m sure what I’m seeing isn’t applicable to San Joaquin Co.

They don’t even have to arrive on our shores. That’s one problem. California should take the Mexico approach.

The average Californian can’t afford a million dollar house with their median income and we know it isn’t the typical illegal immigrant that’s buying.

I’m not saying there won’t be a crash. Eventually, there always is, but Irvine has basically become New Hong Kong, in case you did not notice.

Welcome back!!!

All of this is due to money printing to paper over massive deficits, war spending and close to a trillion per year the government has to pay in interest. War spending increases the GDP but the average person does not benefit from it. They just suffer the consequences of the money printing. Increasing the minimum wage does not help anyone; those at the bottom will suffer the most from the inflation it creates because they don’t have any asset to offset the inflation.

The fight against “fossil fuels” in the absence of any other RELIABLE energy source ruins the economy, but maybe that is the goal. Trying to cover up the implosion in the real economy via money printing does not fool anyone with their eyes open and understanding of the real economy. They will fool the sheep for the next election.

They will try to levitate this “economy” till the election time at a tremendous cost long term. After that, I believe they will leave all pieces to fall to the ground. What they do is totally unsustainable long term.

If Trump wins the next election… he’s gonna get screwed so hard. The Trump name will be associated with the largest crash/depression in history. Look how Covid almost destroyed his legacy of prosperity. You will know with certainty the next crash will be in 2026-2027 just before 2028 election.

You’re going to be a very rich man now that you’ve found a working crystal ball.

Welcome back, finally another post after a long hiatus. Sadly the market has gone even more insane since then. Guess there’s no hope out there and maybe this time is different….fundamentals don’t matter anymore and this is the new norm..

I think the other bubble is overlooked. Incomes haven’t risen enough from 2012 but the stock market is a bubble that is likely bigger.

Bitcoin: Up 2000X since 2012.

NVDA: Up 300X since 2012.

QQQ (a NASDAQ index fund): Up 8X since 2012.

If I was a smart and brave techie back in 2012 like M (I think he was in diapers then) and invested 100K in this current equities bubble, I’d be set to buy a house.

If I went all in with Bitcoin back then, I’d likely be a billionaire and I could buy 50 of any houses I wanted. Houses would seem so cheap.

If I was cautious and invested 100K in NVDA, I’d have a measly 30M so I could buy at least 10 houses.

If I was very conservative and invested in QQQ, I’d only have 800K so I could buy one house.

What are the morals of this story?

1) The equity bubble must pop to pop for the housing bubble to pop.

2) Given the wage increases showing a 1.5X increase, working for a living is for suckers.

3) Be born rich with a trust fund in equities.

Don’t worry, in 2008 both popped. However, after losing half their wealth and seeing housing prices drop 10% per year, everyone was too chicken to buy by 2012.

THIS! This is the only explanation for why housing is nuts. I wasn’t ballsy enough and only got like 20-30% returns per year on my 401k. But anyone that put $5k-10k in NVDA, TSLA or a dozen other tech funds made a killing. I have friends who’ve been out of work in the entertainment industry who own three homes…. Yep they put like $10k in NVDA in 2009 and held it. They survived off that multi million dollar NVDA return and now rent out one of their properties for additional income with 2% mortgages. They are sitting on $4 million if they are still holding NVDA. But my guess is they sold and have a cool million they are living off of. This is very common in big cities. Half the population are idle wealthy that work when their net worth drops below a certain amount. It explains the disparity in local incomes and home prices.

I always have a few additional thoughts after I post.

2012 was the best time to buy. Housing prices had cratered to 2002 lows and the stock market was just starting to recover. Wages and employment were starting to increase after 4 years of layoffs, foreclosures, and van living.

It was actually cheaper to buy a house than to rent in 2012 (refer to Wolf Richter’s excellent chart of Case Shiller home prices vs Owners Equivalent of Rent). People were still afraid after losing 10% per year on their houses for 4 years and watching their co-workers foreclose. The good Dr had many postings from people predicting further losses during that time (“Housing to Tank Hard Soon”). Fear was the predominant emotion.

By 2014, the stock market had recovered, and people were seeing their house value start to increase again. The Fed was still busy slowly lowering rates which made it more attractive to buy which started to blow up this current housing and stock bubble. The Fed kept lowering rates past 2017 which was the year price levels exceeded the peak of the last bubble in 2006.

I continue to read this excellent blog and watch Wolf’s chart for when Case Shiller home prices and Owners Equivalent Of Rent intersect again like they did in 2012.

No matter the fear level or how much blood is in the streets, that will be the time to buy again. If house prices fall 20% and rents increase 20%, then it will intersect again (or some combination of this to equal 40%)

Good luck and I hope I have the cash and income to jump in at this point.

If the Fed lowers rates, the housing bubble will continue to inflate and inflation will worsen. It seems like FOMO is still the driver of this bubble and making it cheaper, will just start crazy bidding wars again (for everything). It is much cheaper to rent than to buy now. People need to realize this and unemotionally wait.

“if I did this” and “if I did that”… “i’d be…” That’s meaningless. It can be said about anything. No crystal balls.

I don’t *think* the housing market will really drop much unless employment does. Housing has defied all logic in my eyes. I thought the pandemic/lockdowns would have an effect. Wrong. Then I thought the doubling of interest rates would cause a drop. Not really. A terrible unemployment rate? I won’t be surprised if I’m wrong about housing dropping in that situation too.

Oh, also add “4) Inherit a bunch of money from relatives like M”. Most of us said he was doomed after buying at the onset of a pandemic, but that all worked out fantastic for our favorite permabear turned permabull.

I feel bullish lately, but who cares!

Turtle,

You were correct about the correlations you made by looking only at 2 variables. In economics they say ” if X then Y,…., all other things being equal”. The problem with that is the complexity of the system – “all other things are not equal, and they influence one each other”. The financial and economic system these days is so complex, sometimes used even for military goals (nobody really has any information about those) that it makes long term prediction nearly impossible even for top people with access to secret information. They have to adjust constantly in light of new information.

For this reason, I said many times in the past, that long term, it is more important to be in the market than timing the market. Long term all prices go up due to money printing.

San Diego is about to join the $1,000,000 median home value club (congrats, owners). But San Diego’s median household income is $100,000K. That is woefully inadequate for buying a standard single family home.

In my big metro Texas ‘burb, our median home value has reached $400K which is still below the national median and the median household income is $115K. Now that is some good math! Welcome, California refugees, but please stop honking so much.

Texas real estate taxes are pretty high though. No prop 13 keeps prices reasonable. Taxes in that $400k Texas home can be higher than the average $2 million dollar home in CA if the owner is older.

Actually, the average property tax paid in Texas is lower than the average property tax paid in California. And when you’re retired, you can fill out a form to make it $0/year for the rest of your life. Texas has a cap too. It doesn’t screw the next generation like Prop 13, but it’s there. Well, actually Prop 13 doesn’t screw the next generation when they’re inheriting million dollar homes. What a scam.

California used to be great. Now it’s just great for visiting. if you know where to visit.

I was a regular on this site during the last downturn in 2006-2011. When I bought my home near end of 2011, everyone on this site was still so negative and made me feel miserable after closing. Now I’m sitting on a $1 million dollar home that’s half way to be paid off completely. This site has always been to negative to be trusted. Even when thing were turning around in 2012 over a decade ago the negativity made it impossible to visit. You will probably be right this time around again… but admit you are a permabear. Atleast calculated risk called a bottom correctly.

We helped our daughter buy a bigger house in 2013. She now has as much equity in her home as we do (and we are completely paid off). I was never a permabear, but I do think that Real Estate is not the only thing to own. I am currently contemplating selling some out of state rental real estate, but the tax consequences may cost me too much.

Housing prices go down in a down economy and up in an up economy. And the local situation is more important than the national for any given property. Plus the dollar isn’t a fixed commodity so you constantly have to inflation adjust all values. Especially with Biden and his minions in charge.

Yeah, the best time to buy a house is when you are able to pay for one you like, whether it’s “high” or “low”. Timing doesn’t matter because nobody knows what will happen next. The thing is to get in when you are able and not wait for some magical discount. Almost everyone who could buy but didn’t has been left behind with the people that could never afford anything.

Congratulations on being 100% debt free. And, for buying in 2012! Perfect.

It’s a little ironic that DHB has gone dormant during the most MASSIVE bubble in history – the current real estate bubble. $900k as the median home price in California -this is MAXIMUM INSANITY. Who can afford that? I know – this housing bubble has dragged on way too long, and has defied all laws of rationality and reason. It’s like a magician making an elephant levitate. The current housing market is insanity on steroids – there is nothing rational about it. Normally, higher unrest rates make home prices decline. This has not happened in the current market. Anyway, I’m glad the sleeping bear has a woken up – maybe in time to see the fireworks. The levitating elephant will soon fall to the ground. Don’t get caught under it.

Soon? How do you know? People here have been saying that for 10 years.

“Normally, higher unrest rates make home prices decline. This has not happened in the current market.”

I agree, it looks pretty odd, but that doesn’t mean things are going to fall apart. Truly nobody can call it without a crystal ball and if they “did”, I’d say coincident.

Get on with your lives folks. Move somewhere better if you have to. Not every place is insane like California, New York, Toronto, etc…

There are freaking 2,800 square foot BRAND NEW homes on acre lots, next to a beautifully landscaped and inexpensive toll road that gets you downtown in 25 minutes for $500K. Nothing insane about that, just a sweet opportunity for smart people who are willing to escape a disaster of a state.

Where? Utah and Boise used to be those things, by now they have gone completely insane. Almost rivaling California prices, yet often the houses aren’t as good and the wages are even worse.

The situation I spoke of still exists in parts of Texas. I’ve seen it with my own eyes and it’s 2020+ construction so the homes are nice (pretty much only “luxury” is being built now) and I’m talking the bigger counties where the wages for professionals and tradesmen are better than CA when cost of living is factored in. I *assume* it still exists in parts of the Midwest and South also, because Texas is no longer the best bargain. But maybe I’m wrong and Texas is still the magical go-to place. It’s just that now some native Texans are leaving for Oklahoma because “too expensive”. 😉

Houses will tank hard soon.

Or not. As you all are tired of hearing: My crystal ball fell off the shelf and broke during the 1994 Northridge quake. I used to think that I”ve seen it all before but the last few years have proved that I ain’t seen nothing.

In a recession, things move quickly. People panic and foreclose, flooding the market.

In boom times, like now, it takes awhile for leveraged people to realize they are running out of money and that hope is not a strategy.

“My crystal ball fell off the shelf and broke during the 1994 Northridge quake”

LOL, I wish mine had fallen off so early.

CA housing market is actually lagging other markets in appreciation of real estate the last year or so. Nationally home prices in the northeast and southwest have had larger gains.

What you don’t get is:

1. How many homes are paid off and simply off market

2. How many people simply rate/term refi’d at 2.75 making their mortgage lower than rent while also having more space

3. Lower supply can sync with lower demand

4. Prop 13 is a hell of a drug

5. Buyers from 2009-2019 rented out their former residence when buying their next (aka me)

6. We have entered Neo-Feudalism

7. There’s simply no land left to build detached homes without exorbitant commutes and/or extreme heat defeating the purpose of living in California.

Erik, I agree with you, but all is not lost.

Addressing your concerns:

What you don’t get is:

1. How many homes are paid off and simply off market

Yes, these people have the ultimate optimism and are spending like drunken sailors driving up the economy GDP and stock market with all of their excess cash from the stock market gains and GREAT Trump giveaway during the pandemic. His cronies made billions from all of the taxpayer money he handed out in PPP forgiven loans. They are enjoying their primary home just like it has always been and other less fortunate people who didn’t get PPP loans are trying to catch up.

2. How many people simply rate/term refi’d at 2.75 making their mortgage lower than rent while also having more space

Yes, these people have the ultimate optimism and are spending like drunken sailors driving up the economy GDP and stock market with all of their excess cash. They are enjoying their primary home just like it has always been. Thank Trump and Biden in 2020 and 2021 for this inflation causing event. Biden is reigning this in now. Trump was an idiot(but he and his cronies raked in billions) and Biden reacted too late.

3. Lower supply can sync with lower demand

Only at a higher price. If rent is half of what it would cost for a mortgage, it is understandable and extremely rational. Buying an overpriced house is irrational.

4. Prop 13 is a hell of a drug

It is. My elderly mother was paying 1.5K per year for a 1M house in property taxes. However, she was so grateful that CA didn’t kick her out of her house while earning 20K per year in Social Security.

5. Buyers from 2009-2019 rented out their former residence when buying their next (aka me)

If you bought in 2012 when no one was buying and extremely depressed prices, you did well and pulled up the economy from the disaster. Most of the buyers during that time were corporate (BlackRock, etc) because nobody saw the value.

6. We have entered Neo-Feudalism

We’ve been entering that for a very long time. Over 40 years.

7. There’s simply no land left to build detached homes without exorbitant commutes and/or extreme heat defeating the purpose of living in California.

Yes, Demand is greater for ideal living conditions. This was true when my parents purchased a house in the 1960’s in S. CA. They overpaid at 40K. That will continue to be true because they don’t make more land.

“There’s simply no land left to build detached homes without exorbitant commutes and/or extreme heat defeating the purpose of living in California.”

Exactly, there’s literally no point in heading east for a place like Riverside County. It’s hot as any place. It’s more expensive than most places. It’s polluted. It has California income tax. It’s a dreadful drive to a decent job. Better off in Phoenix or Las Vegas.

But most people are smarter than that have headed to Texas where we have green lawns.

Welcome back Dr. Housingbubble. It is crazy looking in the rearview mirror at what CA housing has done in the past 20 or so years. Buying in 2011/2012 was an absolute gift. A simple spreadsheet showed the monthly payment to own was cheaper than renting, the fog of war still blinded many people from buying. I was lucky enough to buy in 2012 and encouraged people to do so for many years on this blog based purely on the numbers. Would I buy today? No, not unless I had significant cash and/or proceeds from a prior sale. I honestly don’t think we will ever return to a normal housing market in places like socal, but time will tell.

Hey people!!!!!

Good mood and good luck to everyone!!!!!

If anyone uses a blog (or mood on the block) to make a housing decision…well that is on you. :).

Excellent study on social behavior though

A decade of housing bubble articles and housing has done nothing but to go up, and up, and up. Kinda reminds me of Bitcoin. More FUD that you or AI can count. Yet, Bitcoin is still here and trending nonchalant above 60k. Some 7-8 years ago when I bought my first Bitcoin, peers thought I was crazy and they said I will lose all my money. It’s gambling!! They said it will never go to 5k. They said it will never go to 10k, they said it will never go to 20k. And so the years go by and M kept buying the dips. Today, I am a millionaire on paper. Stocks, RE and lotta crypto. During the next dip the bears will cheer (just like they did when I bought my first house in Q1 2020. Everyone and their mom were bearish and forecasted a depression like future where M bought the top). Fast forward and it was the best time to buy (the house price doubled in 4 years). Fast forward and I bought a second SFH (my first rental). Again, people said I bought the top. But they didn’t think that interest rates might 3x. Today, buying the same rental would cost me a lot more money if I were to finance it. And prices remained stable.

Meanwhile the S&P500 put in another ATH. Things are great for people who invested in assets like Bitcoin, stocks and RE. The haters never mention that. I lost family and friends over this (people get jealous and just can’t take the pain of losing anymore while people like me made it). A lotta people get left behind and rent forever hoping that a crash somehow improves their life’s. No, son, a crash doesn’t help you. During a crash, people like me buy two or more houses and bid the price up. A recession just means the 10y comes down. Lower mortgage rates = higher demand. The only way prices may sustainably trend down is if we get massive unemployment and inventory skyrockets (or an alien invasion).

Good luck everyone. It’s brutal out there for most. The train of affordable housing has left the station and won’t come back to the US. Welcome to reality.

Btw., this year they approved Bitcoin ETFs in the US and the SEC also approved an Ethereum ETF in the US. Trump is also very crypto friendly. Sry boomer, crypto ain’t going to zero. This is just the beginning.

Hello M,

Don’t you love that some of us Millennials are now old enough to say things like “son” now? I’m old enough to be a grandfather!

I agree that only *massive* unemployment (or alien invasion) is the only thing that *might* bring down prices. Everything short of full scale war on our soil has happened.

You could be right that the train of affordable housing has left the US permanently. Sky high housing has been normal in much of the rest of the developed world. I know a plumber in Dallas who bought a home in Oklahoma because “Texas is too expensive” and plumbers do earn more than the median income. He drives down every Monday to spend the work week with is brother.

I disagree about crypto not being gambling, though. 🙂

Cheers, my friend!

Hi friend!

lol, yeah I got a kick out of writing “son”. Man, time flies, many, many years of posting here. Feels just like yesterday that I was a perma bear. Been a moderate bull since buying our first home in 2020 now. And 2025 is just around the corner. And we just whitenesses the radical left trying to assassinate yet another republican president. What a time to be alive. Of course they will make up all kinds of cover up lies. Like they did with Biden. “He’s sharp” “world leaders call him for advice” “no, he can still complete a sentence and be by himself without supervision” “great job Joe! You answered all the questions”.

Newport Beach’s PIMCO is predicting tough times for regional banks due to commercial real estate loans on their books. Larger banks have been selling off these assets and PIMCO has been buying discounted loan assets for the last 18 months. Banks are facing about $440 billion in maturing property debt this year. Larger banks reduced their commercial real estate lending after 2008 leaving more in the hands of regional institutions. REITs (e.g. Starwood) are limiting withdrawals as many are seeing an uptick in withdrawal requests (e.g. Blackstone).

(Source: an article from Bloomberg in OCR)

Around here, there appears to be a trend of converting commercial retail real estate to multi-unit housing. Is it a case of one bubble bursting and another one forming?

You have to be absolutely insane to do what the Fed has done since 2008. No real economic growth, just massive money printing and interest rate manipulation to artificially increase asset values and inequality levels. Our country is not recognizable anymore. Funny thing is that most of those so called “houses” are build with cheap materials like plywood, drywall, shingles and etc. Total insanity!

And only one spring on the garage door. Or no drip pan under the water heater. It’s funny how new “luxury” construction sells for so much more than equivalent sized not-too-much-older homes. Great sales people in those model homes.

You have to be absolutely insane to do what the Fed has done since 2008. No real economic growth, just massive money printing and interest rate manipulation to artificially increase asset values and inequality levels. Our country is not recognizable anymore. Funny thing is that most of those so called “houses” are build with cheap materials like plywood, drywall, shingles and etc. Total insanity!

The OC Register published a study of large employer’s decline or growth by state. The study found declines in over half the states. Top three: NY down 344, Ohio down 229 and CA down 222. It’s a no-brainer who the biggest gainer was: Texas at +1505! Florida, Arizona and NC were next with +836, +367 and +326. Mr Lansner notes that although only 1.6% of businesses are in this category in CA, they control 41% of the jobs in CA, had 52% of job creation and paid 56% of the total wages.

NY and CA are particularly bad places to do business. Watch out for more bad news in this area.

Very interesting. It’s cool to see NC on that list. That’s a new “go to” place. Now that Denver is out, folks are going to NC. Nice mountains.

There’s no way in hell I would ever move my companies to California. Been there and it is insane. I love Texas. They leave me freaking a lone in all ways.

I forgot to mention that the definition of a large employer was 100 or more employees.

100 is “small business” by most definitions. I was thinking 500 or 1000. Sheesh.

I also forgot to mention that the study was over 4 years ending March 2023.

A study was done on 555 counties nationwide including 35 in CA. The survey measured “vulnerability gaps” in housing prices: how well a market could withstand a housing price crash. California had six of the top ten counties for risk including #1 San Joaquin and #2 Merced. The others were all in the Central Valley. Some counties in CA were relatively low risk, e.g. Santa Clara Co. at #363 and Imperial Co. at #359 (one is a very desirable wealthy county near SF and the other never had big price rises). Marin and Orange Counties were the only other ones in the bottom half for risk (#278 and higher). Others like Santa Cruz and San Diego were above #200. The median risk number for CA was #70 vs #310 for the rest of the country.

I’m glad I live in Orange County!!!

Holy sh***

It’s #joeover

That debate qualifies as elderly abuse. Put this nut in a home. He’s unfit to go to the bathroom without supervision.

Trump 2024!

No housing crash, sorry bears. Buying a house during Q1 2020 was the best investment. Well, almost. The best investment was buying bitcoin. But buying a house in Q1 2020 when everyone here called the top and forecasted a depression was the second best investment.

ARM rates are starting to reset. Not sure what % of loans originated before interest rate increase were ARM, probably 10%-20%.

ARMs aren’t resetting en masse until fall 2025 at a minimum and the majority in 2026. Simple historical rate charts and reports will tell you this.

If inflation rears its head again and the Fed can’t cut I do believe that pain will come for ARM holders but that day is not here yet.

Missed you this past crazy year. Please post more

I’ve lived in CA for 30 years and lived through the last big housing bubble. Hubby and I are ready to retire and shopping a few spots in Northern CA and Central Coast. What we see in the listings is a lot of speculative purchases 20-21-22 now rushing to the exits and trying to sell at double the purchase price from just a couple of years ago. Nearly all of those listings are getting major price cuts.

Unlike the last bubble, I don’t think this one is owners cashing out their equity for shopping trips and toys, or strippers buying six houses on stated income. What I do think is the Airbnb bubble bursting is having and effect as many cities are now restricting vacation rentals. There was also a lot of home buying by banks and PE funds, and they are likely to get hammered as prices drop. There’s a limit to the number of people who can buy a million dollar home.

I don’t necessarily see drops in the major metropolitan areas, we’re tracking prices in Orange County since we’re prepping to sell and the good properties are going for ask, the properties that need work are taking haircuts on price.

My vote is that there is a speculative bubble that started in 2020 – if you look at the S&P CoreLogic Case-Shiller, starting in June 2020 there is a super steep climb in prices through June 2022. That’s an unnatural spike in price, even steeper than the last bubble. You don’t suddenly exceed supply like that in two years, that’s speculation.

Welcome back, Dr.!

If rates are lowered enough, will that not release the trapped low interest rate mortgage holders from their prison, and allow them to sell their homes and buy another? This would dramatically increase supply. Would it result in a price decline, especially if they were ditching their single family home for a condo or even an assisted living residence?

That would increase supply but also increase demand (since homeowner selling would want to buy).

First the dementia-Joe debate disaster for the radical left and now a failed assassination attempt? That 20y old kid clearly got help from the B-team “secret service”. And they still didn’t manage to get the job done. Bill Maher: “it’s over. Election is lost”.

No housing crash

Stocks and crypto in a bull market

What happened to the popcorn guy “realist”? For years he/she/they posted “got popcorn” and pasted some weird ass website links about the housing market crashing. Years. That can’t be healthy to your physical and mental health.

What happens when interest rates come down? Next leg up for the housing market?

What we experience here has happened all over the world. Big money is invested in the RE market, renter nation, unaffordable housing for the masses. People who bought before Covid hit the jackpot. Those that waited and hoped for a crash have fucked up….royally.

Interest rates can’t come down because inflation can’t come down under the current conditions. Housing prices in big metro area California are stuck due to stuck inflation and interest rates. The government could subsidize housing interest by printing the money to do so but it would quickly lead to price increases for everything else. If the Democrats lose the election, Trump would lower inflation by lowering energy costs by unshackling oil and gas. That is the only current practical way to lower energy costs which affect all other costs (e.g. food costs…farmers need fuel to grow crops). Inflation is always caused by government (don’t believe lyin’ Biden).

Look up Richard Cantillon and his money circulation theory. Right now, the rich can benefit from inflation by quickly transferring earnings in dollars to assets, while the low man on the totem pole always arrives too late to get any bargains.

Real Estate may not be the ideal asset because it can’t be moved around and is subject to taxes, but it worked well in 1920s Germany as a store of value. Diversify for safety.

I think inflation is near 3% now. That’s not far off from normal. I don’t know why what the Fed has done these last years has worked. I thought I’d be playing with a 15% CD but they seem to have pulled off the “soft landing”. I’m wrong more than I’m right so no more predictions for me without a disclaimer!

Turtle,

The inflation is lower because the House is in Republican hands, which put a brake on big spending. Inflation = too much money injected into the economy by the government. If KH wins AND gets control of Congress, watch out.

>>> clearly got help from the B-team “secret service”

I’m not a conspiracy guy but it seems 99.9% impossible that the Secret Service, with how they spend months in advance evaluating a location, could miss the line of site between a shed next door and the podium.

I’ll tell you a story about commiefornia. During the Covid-BS pushed by the radical left, the CA insurance commissioner had the brilliant idea of regulating the insurance market to protect homeowner. Sounds lovely to the average liberal that doesn’t understand eco 101. What have now is the most f-up home owner insurance market you can think of.

Before government got involved:

Wildfires drive up costs. Inflation drives up costs. Insurance companies raise rates. We all pay more.

After government got involved:

Wildfires drive up costs. Inflation drives up costs. Insurance companies were legally not allowed to increase rates. Insurance companies leave the market.

Result: insurance companies don’t accept new clients in CA.

Problem: most home owners finance their home and are legally required to have home owners insurance. But you can’t get insurance anymore.

Solution: government issues a state mandated insurance pool the famous CA FAIR PLAN.

What a great plan. Problem is that while membership for the fair plan skyrockets (because you can’t get insurance through a traditional insurance company anymore), the fair plan costs you 3-4 times more what you paid before. And you get this great fair plan solution with LESS coverage than what you had before.

Commiefornia at its finest. More bureaucracy, much higher costs, less coverage and no free market (no competition).

Just imagine America if someone like Newsom (CA governor) would be our president. ????

I think it was taken from the blueprint of Obamacare. Every time the government gets involved to run something, you pay more and get less. Too bad some people never learn.

No kidding! My insurance just increased by 20% (again). I’m self-employed and it’s up to $2,700 per month for a household of four with a deductible of $10,000. It doesn’t even cover a flu shot. Most things cost less when paying cash and the free Good RX card usually beats insurance pricing. I am glad that more people are covered but the whole system needs to be torn down and rebuilt.

Reading this lovely story to my kids tonight. That’s at least a few among Gen Alpha who might think twice having observed this type of idiocy reign the world over. How could anyone but the most short sighted person think that such trajectories are to to be embraced. Esau sold his inheritance for a bowl of soup. Reminds me of that.

M,

This is also happening in coastal FL and TX. Private insurers are cancelling high risk home policies. There is no government backup but lenders will charge you a very expensive premium for a policy to cover any mortgage balance. In case of disaster, the lenders get paid and you get nothing.

Today’s OC Register has an article (from Bloomberg) about the difference between average homes and luxury homes in today’s market.Transactions for previously-owned homes have dropped for four straight months (through this June). But sales have risen for homes costing more than 1 million dollars according to the National Association of Realtors. A luxury home agent in Sarasota noted that no one is asking for financing for quite some time. “They all come in with cash.” Toll Brothers is experiencing a wave of luxury home demand, and are expecting even more demand this year. At the end of first quarter, 45% of high end buyers paid in cash, which is the largest share in over a decade. Higher costs and land shortages near major centers are making affordable homes a more risky investment for builders. A deeper pool of people with the ability to buy for cash is partly due to 39% of US homes not having a mortgage. That makes long-time California homeowners like me able to move without taking out a loan if we so desire. Too bad about the under 40 folks.

New highs recorded in May. For years. years!! They told us the RE market will crash. How many more years/decades until crash??

Building single family homes is not an answer to housing affordability in major metro areas. Mr Lansner of the OC Register has an article on the subject today.In CA, new houses in the top six metro areas are 22% more than the cost of the average resale house. However, the size of the new houses is 27% larger. So on a per square ft basis they are cheaper by 9%. This trend is the same nationally although the prices are lower. Nationally, new houses are 15% higher and 16% larger. Builders are building larger homes in part because the lots they are buying are more expensive, and they need pricier houses to make a profit.

The ten markets with the biggest imbalance are Columbus, St Louis, Kansas City, Philadelphia, Detroit, Milwaukee, Cleveland, San Jose, New York and Miami.

I’m starting to see rental communities where the homes are miniature single family things with no garages, maybe 10 feet apart. They look like apartment communities made up of fancy sheds crammed together. It’s either small rentals or big new “luxury” construction. The “starter home” of yesteryear seems to have died off around here.

If Kamala wins, prepare for massive price hikes and massive shortages for everything. Based on her stated desire for price controls (typical of communist regimes), shortages for everything will follow – food, housing, etc.

I was born and raised under a communist regime. The only way they know to control the inflation caused by too much money printing is to control prices. The end result is mass poverty. I don’t know if Kamala or her advisers ever took an ECON 101 course. If they did and they still propose this, means they are evil to the core.

Price controls led to massive shortages EVERYWHERE it was tried regardless of the culture or country. If you think rents are high now, you haven’t seen anything yet. All young people will be homeless or housed in Projects like in Bronx, NY.

Kamabla wins and we don’t have a country left. We will be a communist nation with open borders, high taxes, wealth destruction and no path to retirement. Any person with brains left must vote for Donald to save our country.

Flyover,

You already live under a Centrally Controlled Regime. The Fed kow-towed to Trump’s temper tantrum in 2019 and printed more money, bought more MBS, lowered interest rates and cut taxes for the elite. This helped the politburo (like Trump) to gain immense wealth.

At least under Biden, or should I say Kamala?, the Fed has been returning control to the market with QT, and raised interest rates, somewhat, but not enough.

Vote for the market and not for a dictator who wants to control the market.

Also, based on Kamala stated policy, prepare to pay taxes on unrealized gains. If your house is paid off, in retirement, you’ll have to take a mortgage again to pay the taxes for the inflation the government created. So, they print more trillions and then they tax you for the inflation they created; the house is not going to be bigger than before. “You’ll own nothing and be happy” because Kamala won!…

This is the policy you vote for till you’ll be left homeless in retirement – but no more “bad orange man”. For some people, TDS is so strong that they vote against their own interest (policy).

No kidding, interest rates should be higher. Trump himself said so before he became a politician. Then he wanted 0% to save his own butt. So when Democrats blame Republicans for inflation and vice-versa, it’s a joke. They all caused it with their stupid money printing and ridiculously low interest rates. They’re all the same in the end. The only difference is who is more of a jerk and that would be Donald.

Get your re-fill of popcorn, the previews are starting, California Wants To Reward Illegal Aliens With Zero Down, No Payment Home Loans, HOUSING COLLAPSE COMING 🙂

Coming to a CA neighborhood near you soon, remember, Stolen Elections have Consequences Liberals….. Vote Trump or get dumped

munch munch munch :)))))))

Hard to believe I agree with realist on something. Vote Trump is right.

But wait, remember when you were “Millennial” and commented “50% – 70% crash!” 37 times per month? LOL

Republicans are a disaster. Yeah, Democrats are too – I know. But I’m done being a Republican. I voted for that lying jerk twice and after what seems an eternity I’m sick of hearing his BS and watching how he treats people. Harris has my vote just to be done with that fool. Not that my vote will hand Texas to her. LOL

And good luck tipping California red with yours, M!

Our votes mean nothing!!!

Lol, turtle is right. But that was prior to Covid. In Q1 2020 when I bought our first primary house I never mentioned anything about housing crash ever again.

I can’t believe it’s been 4 years already. Time flies. Kinda miss Covid and the money printing. Hoping the FED keeps lowering rates. I want risk assets to pump.

I doubt you are Texan tbh.

Voting for Kamala makes not much sense unless you want a radical leftist from California who is for open borders and higher taxes.

Yes, I literally voted for Harris because Trump treats people like garbage. And his nasty attitude has infected 99% of the Republican party. But he won anyway and my net worth went up noticeably the very next day so there’s my silver lining. I can’t say this will go as well for people people, though.

Realize that both parties are more alike than different. Just watch Trump run up the national debt even more. He won’t do anything meaningful on immigration. Where’s his beautiful wall? This time won’t be different. He’ll just piss people off and I guess that’s what people want – a good show. Well, they got it.

Yep, enjoy the show. It’s called Maga.

Popular vote goes to Trump. It’s a a vote against the cancel culture, the weaponization of the justice department (all those fake accusations and trials). Against woke/DEI, against man in women’s locker rooms. I could go and on. Finally we are back to common sense and put an end to all this nonsense the radical left has spread. Gone are the days of “Queers for Palestine”. LMAO.

The Democrats are talking about taxing unrealized gains. Would those apply only to stocks or to Real Estate, too? If also for RE, what would the impact be on RE prices?

If they tax for the difference between the 2 values (let’s say from one year to the next), will they also give a credit back when it goes down???!!!….Since the house is not sold to realize those gains, how would the people come up with the money for the new taxes? And if the government is printing money like always (faster, and faster) is that a REAL gain or just inflation money due to printing? After all, the house has the same size like before; it is not bigger.

A bill in California from Assemblyman David Alvarez (D) of San Diego to allow the housing density bonus law to apply to areas covered under the Coastal Act was derailed by a Senate committee headed by Senator Dave Min (D). He represents Irvine and a couple of areas inside the coastal zone. So rich liberals get to keep the protection from high density development just by owning property near the beach. I also heard that the state is allowing the clearing of the camps at Dockweiler State Beach, which is maintained by the County and patrolled by LAPD. Playa Del Rey residents are rejoicing.

Bought a house in December of 2023 for $800K. It was way undervalued in my opinion and has so much upside potential. The house next door sold for $950K the month before and it’s a smaller house and no detached 1200 SF garage like my house does (although the interior/exterior is more updated than mine). I put $300K down and my total monthly is $4200/month. I’m allocating another $150K to convert the detached garage to a two or three bedroom 2 bth apartment and converting 2 out of the 4 attached garage portion into a 500SF studio (with bath and kitchenette) with its own entrance from the outside. The combined rent for both of these newly created units should fetch around $4200/month easily. Deduct that income from my mortgage and did I just get a free house? Spend another $50K to $75K remodeling the interior of the main house and I could easily turn around and sell it for $1.4M. The house has already been reappraised at $1.05M without even touching it so far.

You CANNOT tell me there aren’t good deals just waiting to be capitalized on. This market is MORE than reasonable.

Newage,

Thankful for people like you and your posts! Wishing this blog would be more active and posts would get published quicker.

Congrats on your house and I absolutely love what you do there.

“ I’m allocating another $150K to convert the detached garage to a two or three bedroom 2 bth apartment and converting 2 out of the 4 attached garage portion into a 500SF studio (with bath and kitchenette) with its own entrance from the outside.”

I understand the house came with 1.2k sqft detached garage.

And you are saying it also had a 4 car attached garage??

That sounds like a rare find! Detached garages are already uncommon, but having a 4-car attached garage as well is even more unusual. Is this property on the larger side overall? It seems like it might be a bit outside of San Diego. I’m in North County SD, so I’m curious as a property like this is very desirable.

Doctor Housing Bubble in the next six months is going to need to change its name to Doctor Housing Armageddon, or Doctor Housing Meltdown, or maybe even, Shi* I was Rich and Now I’m Homeless. Something along those lines.

Shamus,

See my posts on “Golden Handcuffs”, and mortgage free households. I’m in the latter category, and my daughter is in the former category. She owes less than half of what she paid with very low interest and her equity in that house is about the same as my paid off house. The only thing a big price crash would do to us is allow my daughter to file for a lower tax on her house like I did in the 90s during the Bob Citron fiasco. My base for taxes is so old that I doubt the appraised value would drop enough for me to avail myself of that option.

If you are right, it might turn out to be a good time to buy some more houses like in 2009 to 2013.

lol so we are seeing a crash in the next 6months? Lmao

This time fo realz tho, amiright?

Curious to what the reason is for the upcoming RE collapse. Zombie outbreak? Alien invasion?

Last week’s Sunday OC Register had an article on “Golden Handcuffs”. Almost 60 % of homeowners have outstanding mortgages that are locked in below 4%. Moving to a new house that requires equivalent financing would cost a current homeowner at least 2.5 percentage points more than their current mortgage. That is why there has been a substantial drop in moves in the last year, even though surveys have shown an increase in people who would like to move. So as interest rates drop, the sector of the public that will be first to buy are first-time buyers who have saved cash and have no “Golden Handcuff” mortgage to hold them back. (The article gave an example of this.) Even so, prices are expected to rise as interest rates fall.

I checked the Minneapolis Fed inflation calculator to see what percentage the original price of a house I know of went up since 2013. The inflation calculator said it should be 135% of the original price in 2013 based on inflation alone. The stated value for this house today on Realtor.com is up 227%. Part of that might be improvements that were added, but even so, inflation alone does not explain the increase. SoCal real estate has been a pretty good investment in the last 10 years.

And Jerome just dropped interest rates. Houses are now more affordable and thus will become even more expensive. Interest rates should be around 15% to fix things. And so I can get my 15% CD! 5% has been kind of fun but Jerome is ruining that for me now.

Believe it or not, I don’t think homes are going to go up as a result of the rate drops. Rate drops make it easier for buyers to buy but also make it easier for the long overdue sellers to sell and trade up. Inventory has ticked up to 4.2 months, highest since mid 2020 so this is playing out in real time. Higher inventory makes it harder for prices to rise and if it hits over 6 months then prices will certainly drop. I don’t think it will get that high as the first time buyer demand is likely to hit an equilibrium before inventory gets to the dreaded 6 month mark. Good time to buy without a doubt seeing how wages are increasing, rates are dropping, selection is healthy.

Plenty of housing bubble content forming in the Dallas Texas area, Florida, and now spreading to Utah, Colorado, etc. California is just around the corner.

Look at the historical Mortgage application charts, red lights are flashing. The Fed had to cut to try and spur the consumer. We are now sitting around the 2008 Financial Crisis timeframe. The Fed started cutting rates but it did not stop the crash from occurring. Credit card debt is at an all time high, Car sales are dreadful, Home sales are extremely low and inventory is building. Foreclosures in Texas are hitting hard now. It’s not the rates, it’s the Homeowners insurance and property taxes that popped the bubble this time around. Contagion is spreading rapidly. California is in for a massive downturn. The fire insurance fiasco will be devastating here in Cali. Many homes in fire zones might as well be worthless if the rate escalation doesn’t get resolved.

There was a guy in Laguna Hills who was very conscious of the fire hazard, and with his engineering background, he built a fireproof house. I remember going down the street to watch the fire from an open schoolyard back in the 90s when it happened. The fire was more than 10 miles from us but we had a clear view.

https://basc.pnnl.gov/images/home-survived-laguna-beach-fire-october-1993-which-claimed-more-400-neighboring-homes-thanks

His neighbors were somewhat jealous of him I think, because he sold the home and bought a larger property with a better ocean view and built another masterpiece with the same innovations as I recall.

“Foreclosures in Texas are hitting hard now”

Well, that’s new to me!

Columnist Lansner of the OC Register has an article about mortgage-free households. California has the lowest percentage of any state of households that own a house without a mortgage (18%). Only DC is lower (10%). Nationally, the average is 26%. California has renter households at 43% which ls lower than only DC and NY.

No-mortgage houses cost their owner an average of $834 a month for insurance taxes and repairs according to the article. That is #7 in the US and it has been growing faster in the last 4 years than any other state except Colorado. I looked up the average household retirement income for California and it is a little under $35000/year. So housing expenses are a little under 30% of the average retirement income here if you have a paid-off mortgage! If you want a good retirement in CA you’d better not be just average!

Joe R,

Thanks for forwarding Lanser! I agree with you in most cases.

However, based on my S CA experience, The 18% with paid off mortgages are likely Boomers and GenX who took out 30 year mortgages on CA’s overpriced housing markets before 1990. They were the conservative frugal ones locked into ultra-low Prop 13 taxes who are spending a little to update their 30 year old avocado green kitchens and shag carpets and with higher services, can add up to the ultra-low $800/month expenses. They are paying $800/month and their neighbor with the same tract house is paying 5K/month in rent. They are feeling wealthy sleeping in their fully owned $2M tract houses.

The other side of CA has refi’d/HELOC’d at 3% their $2M in cash they have been sleeping on to buy their YOLO Porsches, yachts, RVs to achieve their retirement dream. Huge debt but with high stock market gains and FINALLY better than .01% savings account interest during the last administration’s disaster. They are spending like drunken sailors to achieve their dreams.

It is not stable and something is bound to fall but at 3% mortgages, the party continues.

BE,

I thought I implied that the 18% were older when I gave the data on retirement income. My post was also about CA vs the nation. Since this is about the whole state, not just the LA/OC/SD/SF/SJ metro areas, values of houses already paid for won’t be anywhere near $2 million on the average (mean or median).

Well if you own a house free and clear in CA then I’d bet you didn’t pull that off by being average.

Also, reverse mortgages are going to sky rocket since you can’t take the house with you to the grave and the US population are too self centered to leave anything behind to heirs.

New Age,

Thanks to Prop 13, people who paid off or still have a mortgage at less than 3% are living the dream.

Why would you sell? Your heirs might sell if you pass away into the great CA sunset. They likely will move in to your house and inherit the Prop 13 tax rate.

Private insurance rates might wreck this but it would be still much cheaper than renting.

That’s interesting, because homeowners in California are already in a much better financial position that those who rent, typically. As of 2023, 16% of California’s population is 65 or older, so that would about cover the 18% with paid off mortgages. I would have thought that more people would have paid their houses off, even if not intentionally.

Sorry kids, we gotta reverse mortgage this thang!

A book has just been released on Amazon that explains much of what is happening in the housing crisis. Some of it is about the special case of California. The book title is Housing Hardship: Decoding the Crisis in Real Estate

An article in today’s OC Register is on the popularity of smaller multifamily rental properties with OC investors. The article gives examples. A 60-year old 8 unit property in Anaheim traded hands for $2.6 million. Two small apartment properties with 10 units in Santa Ana sold for a total of $2.8 million. All of the units sold in less than a month and were more than 50 years old. All have some off-street parking available. Even if single family units aren’t selling under the current conditions, the rental properties are a hot commodity for wealthy people who want to generate income.

Additionally, the good Dr wrote about this 10 years ago.

He called the homes Golden Sarcophagi.

http://www.doctorhousingbubble.com/feudalfornia-golden-sarcophagus-california-house-home-affordability-real-estate-prices-renters/

Bob,

What are your thoughts on unrealized gain taxes proposed by Kamala and the Democrats. With the rampant inflation and the proposed taxes coming, how anyone retire anymore?!!?…

Flyover,

I think it is terrible idea. There isn’t any good way to assess assets without rampant cheating. That’s why Trump is now a felon. He got caught cheating.

Giving away 25K for house down payments is also inflationary for house prices.

Tariffs will be horrible for inflation. Prices will just go up.

We could have avoided rampant inflation in 2019 but Trump threatened to fire the Fed when they tried to remove QE and raise rates.

Neither candidate is a fiscal conservative. Trump has the dubious honor of deficit spending more than any President in US history which is a main reason inflation rose a year later. Too much free PPP money was handed out.

IMHO, the best way to fix the deficit is to repeal the Trump tax cuts for the wealthy and raise tax rates. Like they were in the 1950’s and 1960’s when America was great. Remove all loopholes also.

Now that America voted against wokeness, DEI, mass immigration of illegals and support for Hamas, we can finally start being a country again. There is hope.

LFG Trump

M,

It will be a circus. The clown car is being filled with pedophiles, drunks and left-wingers who think banning fluoride and polio vaccines will solve all problems.

This is a better drama than anything offered on Netflix. I can’t stop laughing at the idiocracy.

This is going to be a fun 4 years and after,, the Republicans will never be trusted again.

It doesn’t work that way.Many people don’t care much for politics or don’t even remember what was said or promised. It’s simple with voting, if the majority of people don’t like their current situation they vote for the other side.

I read the article you linked to and it certainly doesn’t apply to me. We are free and clear with the mortgage and have diversified retirement account savings. I have current income to pay the bills, and unless we have a collapse of the dollar and sky high taxes (not impossible if the current administration is kept in place), I think I’m going to be OK.

An article in OC Register is about California Association of Realtors standard purchase agreements. A contingency for backing out when an affordable insurance policy cannot be obtained. This was being advised even before it was added to the standard agreement. Towns where the only insurance available is California FAIR plan are seeing fewer people looking for homes even in wealthy areas such as Woodside CA. Agents say that insurance contingencies are the least likely to be waived to make a bid more competitive. Another article is about the increase in people moving to disaster-prone areas. High housing costs in crowded areas such as the Bay area or big East Coast cities are driving people into more fire-prone or flood prone areas, especially in the South. We’ll wait and see what the insurance crisis does to this exodus in the next couple of years.

Well…. we got an answer to this post on Jan 7th. People with insurance cancelled were burned out of their homes all over LA County. This is going to be a dry (La Nina) year after the El Nino years we had that grew a lot of brush.

TRUMP LFG!!!! Golden age. Crypto pumping, Bitcoin made new ATH. Forget RE, but crypto. Thank me later. 2025 will be the year!

The OC Register had an article on the most expensive big and mid-sized cities for renting a single-family house. The study had over 700 cities in it and divided them between big (>250000 population) and mid (100000-250000). The most expensive was mid-sized Huntington Beach at $5724/Mo. The only big cities that made that particular list that weren’t in CA were Boston (#5) and Miami (#9). SF was #1 for big cities at $5409/Mo. All ten of the top mid-sized cities were in CA. Eight of them were in Southern CA. Five of the top rent cost big cities were in SoCal.

I’ve been preaching for year to join me on the crypto train. Look what you did. You missed out on generational wealth. Meanwhile you are saving money to buy a house while inflation is eating up your savings. When will you learn? Your 8-5 job is not gna cut it. You won’t afford a house and Prices are not gna crash. Any dip in RE gets eaten up by the blackrocks of this world and people like me who sit on liquid funds. The only way to beat the system Is through investments that return significantly more than the inflation rate. You Should have bought Bitcoin.

Congratulations M. Here is a virtual high five. I too was preaching on here for over the last decade warning everybody about inflation. Owning a home is a giant hedge against inflation (fixed rate mortgage and Prop 13 protection). People had every opportunity under the sun to buy. For people who sat on the sidelines are likely in panic mode now. RE prices and rental prices went through the roof. Mortgage rates went up and we were greeted by the worst inflation in almost half a century. Crypto should do very well under Trump, then again the entire market should do well. Good job again!

Thanks Bob! Buying a house despite all the naysayers wasn’t easy but likely one of the best decisions I’ve ever made. And yes, Trump will pump the markets to Valhalla.

Thank you Lord Blankfein!!!

I predict BTC will be around 20K again by July.

This rampant euphoria is ridiculous when promises are coming from a liar who promised everything to everyone to get elected.

There is a sucker born every minute. Don’t be one.

I will enjoy this circus and will stay conservative in my investments. I will be laughing all the way at all of the fools.

If Bitcoin would be at 20k by July I would be pretty much wiped out. Almost no chance of that happening. Bitcoin is more likely going to be at 120k.

M, this is all gonna end badly. Trump is gonna pump Bitcoin and stocks to the stratosphere for 2-3 years… a then we are going to have the most epic devastating crash in the history of modern civilization.

Trump inherited a Jenga tower that’s gonna collapse with one wrong move.

FartCoin is doing well! That should be a warning to all crypto holders.

The Circus will begin in January!!! I am so excited by the array of convicted felons and depraved lunatics who Trump appointed to run this great country! It now has become more exciting than any Netflix drama/horror.. You will be entertained and horrified as this drama unfolds. One of the arguments is that a surge in Crypto indicates no faith in the government and disaster ahead. I believe that. I am just T-Billing, Chilling, and Thrilling with my popcorn.

Ain’t that the truth. America is better than any movie right now. The news channels are gonna love the next four years.

Convicted felon has no meaning. You can still be great president. If nearly half the country dislikes someone, all it takes is fabricating charges and pursuing them in a region where public opinion is already against Trump. Crooked judge plus a jury that votes Biden/kamala and u have your verdict. It’s all made up. The American people saw right through that and elected him. If anything, this scheme gave him a booster.

It’s true. Democrats lost the election when they started prosecuting him for this that and who knows what. It was silly looking. I used to think Democrats were evil and Republicans were dumb. Now I think Republicans are evil and Democrats are dumb. They’ll need Oprah to run next time.

I’ll buy Bitcoin if it drops below $40K, just for fun. It will probably tank soon after.

Since this is a Housing Bubble Blog, I think Trump can’t do much for housing despite all of his promises.

If he listens to his voters, they want mortgage rates to go back to 3% or house prices to plummet.

If he listens to his taxpayer voters, he doesn’t want houses to plummet like 2008 and cause a massive taxpayer bailout of Freddie and Fannie with massive foreclosures.

If he listens to his voters, he doesn’t want more inflation which lowering rates will create.

He is between a rock and a hard place with ALL of his promises. You gotta lie about everything to get elected and then you do what you want to make yourself the big bucks.

Time to make ore popcorn.

Trump doesn’t have to do anything for housing. I am good. I got my house that doubled in value since Covid. And I got a rental. People shouldn’t blame the president for their inability to buy a house. Instead, they should reflect on their own choices, like relying on housing crash websites and YouTube videos. Affordable housing has been accessible for much of your life. Try buying a house in Europe or Canada. I heard Ukraine still has affordable housing though.

There’s still at least one affordable place in the US:

Tulsa, Oklahoma

Oklahoma is where the “Texas is too expensive” people are going.

Anybody been to Tulsa?

Trump was on TV with Karen Bass. He kept pushing her to let the burned-out people in LA city start to clear debris themselves. She kept dodging with the old “safety” excuse. What it all boils down to is that the elected city officials get donations from demolition companies to do over-priced cleanups that take 18 months, and he called her on it. Anyone can buy a Hazmat suit and wear breathing protection that you can buy at a hardware store. If you aren’t super-rich, contracting your own demolition is definitely the way to go. Plus you can sift the debris for valuables. See this post about Altadena (which doesn’t have a mayor!).

https://www.facebook.com/groups/SierraMadreRoseFloat/posts/10162019170972319/

There was an article in the OC Register about a man who tried to convert his condo garage into an ADU, but ran into a roadblock from the HOA. The HOA position was that the ADU law only applies to single family housing, not condos with HOA covenants. This legal opinion isn’t universally accepted but a court challenge would drain the already strapped condo owner’s budget. He wanted to build the ADU to supplement his declining income. His former lawyer thinks that if enough condo owners got together, that this legal opinion could be overturned , in part due to a 2019 law passed by the legislature.

I am turning. F orange man.

He doesn’t know what he’s doing.

He’s crashing everything. Get him out

He doesn’t understand how tariffs work. He sides with dictators since he wants to be one. He lies on all the waste and abuse his doge minions supposedly found.

Blue wave during mid terms

i recently bought a house. i went along with the doom and gloom for more than a decade… waiting for some kind of crash or reset. in that process i wasted tons of time and money renting.

dont wait. the housing crash may come one day. but that may be a loooong time.

do yourself and buy. the values will always rise and dollar decline. thats the way this system is set up.

buy. do go in to the noise and fears.

dont do what i did and waste time.

Leave a Reply