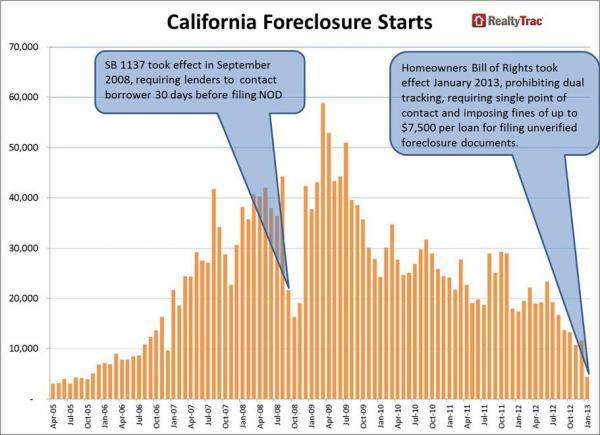

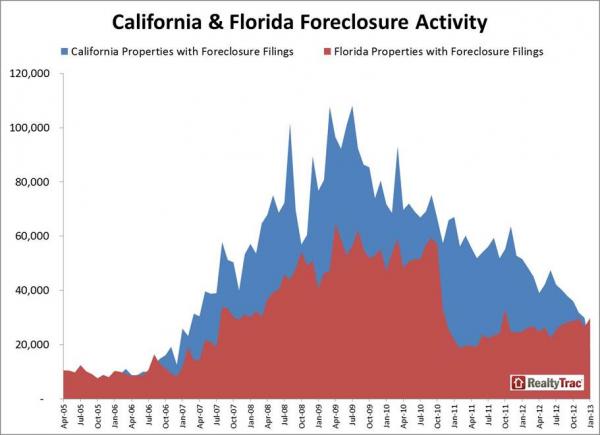

California Homeowners Bill of Rights pushes foreclosure starts down to levels last seen in 2005. Florida takes foreclosure activity title away from California

When it comes to buying a home, the average buyer is at the mercy of what is available on the market. Typical buyers do not have access to REO portfolios or early knowledge of short sales that will turn out to be screaming deals. The current market is one where inventory is scarce like water in Death Valley but access to debt is plentiful. The amount of all cash buyers has been a big factor as well driving up prices on what little good inventory is out there. California also recently enacted the Homeowners Bill of Rights which will slow down an already slow foreclosure process. Because of this, foreclosure starts in California are down to levels last seen in 2005 when the market was raging in a furious mania. We are seeing a very different market today being driven by a low interest rate environment and an insatiable investor appetite. Let us first look at the impact of the Homeowners Bill of Rights.

A giant drop in foreclosure starts

Foreclosure starts dropped off a cliff in January because of California’s enacted new Homeowners Bill of Rights:

This is the lowest level of foreclosure starts since 2005. The process has already been slowed since banks have figured out that there is more profit in holding inventory off the market then actually putting it out for sale. Keep in mind that very little of this is helping your average American homeowner. Even here in California, I get e-mails from couples being out-bid on properties by all cash investors courtesy of the low rate easy money environment. I’m also noticing the level of credit card offers I’ve been receiving over the last year is nearly on par to what it was in 2005 and 2006. Money (debt) is cheap if you can get your hands on it but the problem is you are competing against billions of dollars of hot money flowing out of Wall Street and foreign hands into targeted markets. With such little inventory, this external pressure has turned the market into a feeding frenzy.

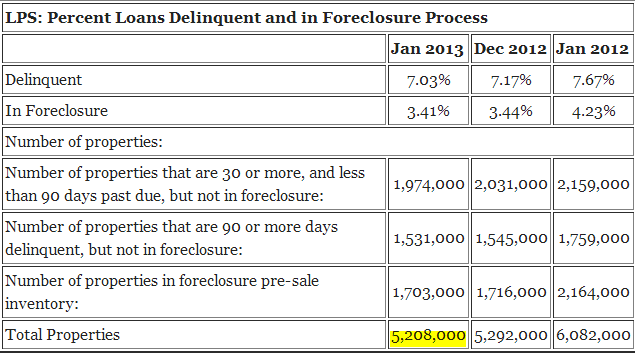

Distressed inventory is still high:

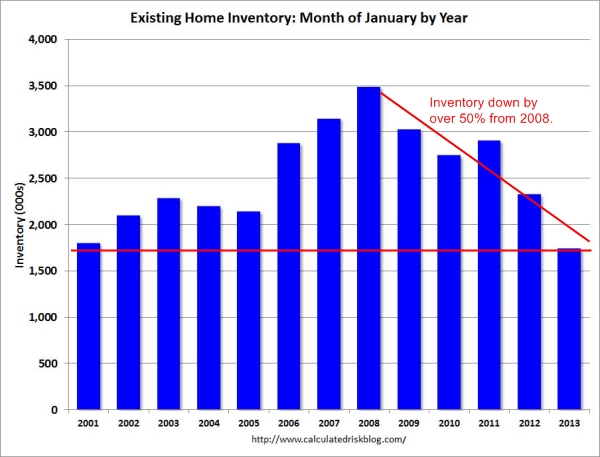

5.2 million properties are in some form of distress. 1.7 million of these properties are foreclosed. What is telling of course is that total overall inventory is at decade lows:

The difference between the peak inventory in 2008 at 3.5 million and our low at nearly 1.7 to 1.8 million is 1.7 or 1.8 million properties (essentially what is sitting in the distressed pipeline). But what you are seeing especially in certain niche markets is that most of the inventory has disappeared. We are seeing annual declines of 50, 60, or 70 percent.

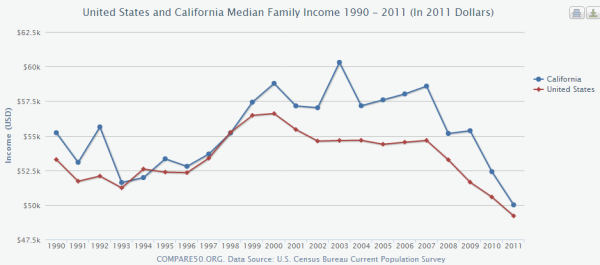

You would think that the underlying fundamentals would drive this up but they are not:

Adjusting for inflation household incomes are back to levels last seen in the 1990s and California is no exception. We also find out that last month incomes saw their biggest one month drop in 20 years:

“(USA Today) WASHINGTON — Personal income growth plunged 3.6% in January, the biggest one-month drop in 20 years, the Commerce Department said Friday. And consumer spending rose just 0.2% with most of it going toward higher heating bills and filling up the gas tank.

The income drop was offset by Americans’ savings a hefty 2.6% rise in December. But most of that gain, analysts said, reflected a rush by companies to pay dividends and bonuses before income taxes increased on top earners at the start of 2013.â€

This doesn’t really add any evidence to an organic recovery in the housing market. One thing we can be happy about here in California is that we are no longer the king of foreclosures:

Florida has once again regained the title of having the most foreclosure activity on a raw number basis even with less people than California. A big part of this of course is coming from the new legislation enacted in California which ironically, is going to be another reason on the growing list of items as to why California inventory is so incredibly low.

I have seen some reports showing that inventory is picking up nationwide but this doesn’t seem to be the case in California, at least not yet. For example, 2 years ago Pasadena had 489 listings while today it is down to 216 (a drop of 56 percent). Culver City went from 124 2 years ago to 26 today (79 percent drop) according to Movoto market trends.

This trend is obviously unsupportable. If we keep heading in this direction there will be zero homes for sale come the end of the year. Welcome to the unintended consequences of massive market intervention.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

43 Responses to “California Homeowners Bill of Rights pushes foreclosure starts down to levels last seen in 2005. Florida takes foreclosure activity title away from California”

I believe a similar dynamic is occurring here in Portland, albeit on a much smaller scale. The legislature passed a similar bill a few months ago, and most of the RE agents have no inventory to show prospective buyers – what a weird market that kind of law tends to create.

Seeing the same thing here on the oregon coast, one thing i have noted is that many houses on the listing show no furniture in them. As a buyer of real estate i have never seen the % so high. These houses are not REO, but have no furniture, leaving me to question what’s going on. Many realtors are fixing up friends and relatives, by telling buyers like myself that the house is already sold when in fact it hasn’t been. Thus keeping offers off the market. This has happened to us several times, only to find that the house sold a few months later for less than we would have offered. Even realtors tell me of this also.

Same thing happening to me here in LA. Saw a property in Eagle Rock go down in price from 300’s to 240K (!!) and could not get an offer in while willing to pay in 300’s…and just last week another short sale that got listed only to get a full mailbox and no return calls from realtor. I put in an offer immediately and was told it was pending while listed 200K below surrounding home prices. I will be watching as it goes through and will probably start filing FBI reports. This is BS.

The “Bills of Rights” above has 2 elements, the slowing foreclosure activity I’ve seen (occupancy field rep) hasn’t been due to the consumer protection provisions, many which actually help servicers too due to the clear, defined legal processes. I have seen plenty of homes that are in distress and abandon (including PDX which I visited last weekend) that would be marketable but for chain-of-title issues. As states and courts (like the above CA $7500 fine for filing unverified foreclosure documents, or in OR where MERS can’t be used for a non-judicial foreclosure) have clamped down it has become too risky and expensive for servicers to “recreate” proper title unless debtors co-operate in short sales or deed-in-lieu. Example: debtor dies and is deeply underwater with their mortgage, servicer doesn’t have clear chain-of-title due to securitization/MERS, heirs don’t want the property and don’t co-operate, so the house is sitting vacant and rotting. Stalemate.

BLS wrote: “…Example: debtor dies and is deeply underwater with their mortgage, servicer doesn’t have clear chain-of-title due to securitization/MERS …”

This is one of purposes behind the Federal Reserves’ MBS purchases, i.e. QE3, of $40 billion per month. If the real estate market where healthy there would be no reason to do QE3. But there are many mortgages with broken titles and improper paperwork. QE3 allows the Fed to fix the broken chain of custody.

Well, that’s just wonderful – paging Paul Volcker. He knew what to do with the distressed inventory of all of the failed S &L’s – get them off the books ASAP.

I can still remember back in 2002 when my mortgage broker told me that Wall Street had started making mortgage loans and that they were getting extremely loose with standards. First thing that I thought was,” When these thieves get into a market, it always ends badly for the average guy in there with them.”

Well, here we are again except instead of being the enablers with the cheap money, they are now the buyers. But I bet the end result will still be the same. They will get out when the getting is good and leave the mess behind them.

It isn’t easy to buy stolen property when competing with people who get to buy it first with money they stole from me.

+1

So what should the ave a hole like me do who has been on the sideline in so cal who only qual for FHA

Joe you, like me, can’t do a damn thing about it. The only option is to wait about three more years and save all the money you can so when it all comes apart and interest rates double down from current levels so prices drop. We have been priced out.

If you lived in your car you would be home by now. (bumpersticker)

What a manipulated market! Things will not end well is what history teaches us when market forces are flummoxed by manipulators. Anyone who has lived through “price controls” (or similar such as interest rate controls) can tell you what happens when market forces kick in again. Flippers and speculators are having a hayday! I feel sorry for their victims.

I love living in my house for free. I asked them, in writing, to verify and validate the debt. Many, many letters later they still could not, under the law. I asked them to foreclose on me so we would then see the real “standing party” or alleged Plaintiff. They filed the foreclosure complaint. I filed a motion for dismissal based on the fraudulent note and assignment in answer to their foreclosure complaint. TA-DA! No answer, no motion on the banks part. So I love the incompetence of the banks. This worked because I did the QUALIFED WRITTEN REQUEST and kept insisting they were not verifying the debt, there weren’t, and asked them over and over to “prove it”. This gave me the information I used against them in my motion for dismissal based on their fraudulent submission to the court. Got it? IF they refile, the question is “are you lying about these new docs or were you lying about the old docs submitted in the case you let die”? See?

May I ask you what the circumstances are that lead you to living in your house for free?

I just love answering this question from people who still don’t get it! Why am I “living in my house for free”?

Let’s see, in December 2007 when I was current on my mortgage, my loan servicer screwed up my account. I called GMAC Mortgage, and they failed to correct the problem.

In January 2008 when GMAC declared my account in default claiming that I was 34-days late on my payment, I again attempted to work with GMAC Mortgage, but they claimed they didn’t know me and refused to work with me.

In February 2008 when they sent me a Debt Validation Notice claiming that I owed a debt to Mortgage Electronic Registration Systems on a note dated December 23, 2005 I said “AHA. There’s the problem. I signed my note in May 2006 with WMC Mortgage Company” So I tried to work with them. What did they do?

They declared default. Then a few days later, they returned my payments that was sitting in their account. So what did I do? I tried to work with them! Yes, I did. I tried a forbearance agreement. The main sticking point was my refusal to admit default. I wouldn’t do it. I insisted that they admit to their screw-ups. They refused. So I sued them. After the fact they alleged that I couldn’t pay, but my robust bank statements told a different story.

I sued them. They did not foreclose on me. I sued them because it was the right thing to do. Unlike you, I believe that ALL parties to a contract MUST live up to their contractual obligations, not just the little guy who had no say in the contract terms and conditions. What did they do? They rescinded the default and then told the judge “I don’t know why she is suing us. We rescinded the default. No harm, no foul.”

The judge agreed with them. “No harm, no foul.” Two years of my life ruined. My security clearance gone. When the fight started, I was depositing over $23,000 per month in my account so the $3444 mortgage was not hard. They drove me into insolvency, but the judge saw “No harm.”

Five years later I am still fighting for my home. I’ve survived Bank of America and their fraud. They sold my home on September 24, 2012, I sued them on September 27, 2012, and I had my home back on October 4, 2012.

Yeah, I did. So what happened next? U.S. Bank eight SWAT officers to my home, and these officers posted a “Notice of Trustee” sign to my door, at gunpoint. So I sued U.S Bank. I got a restraining order against them. I got a Preliminary Injunction against them. I charged their lawyers with several crimes and got a California judge to agree to set a trial for the civil portion, as well as started working with state officials to bring criminal charges. What did they do?

One day after Chris Dorner went on his killing spree, their lawyers went to a small courthouse with limited e-filing capability and accused me and my husband of being “angry Blacks” and got a restraining order against us. They failed to inform us of the TRO. They failed to inform us of the hearing. I found out anyway.

This new judge ruled that sufficient cause exists for a hearing. Really pissed them off. They wanted the Order. I want them in jail. What you consider “living in a house for free”, I consider “working my butt off for my country.”

Five out of five judges side with me, yet they are still trying to sell my home next week. After all is said and done, I now have a copy of the loan I signed on June 1, 2006 — the loan I was always willing to pay. Unfortunately for them, they fought me for 60+ months trying to enforce a December 23, 2005 note and the Statute of Limitations has expired to enforce any note.

Given that ALL of this could have been avoided back in Jan 2008 if they had said “You are right. You did sign your note in 2006,” WHY SHOULD I PAY THEM A DIME NOW? They owe me for five years of abuse.

Does that help clear your muddled brain?

Yikes Karen. That’s awful. When I asked that question I wasn’t being antagonistic. I’ve heard of many different scenarios where each party is or can be at fault. It’s an awful situation with the market right now and you have been dealt with unfairly to the nines. It’s criminal. I’m a new Dad with a 4 month and trying to purchase my first home and can’t. I’m frustrated with the Fed, the banks, the investors/flippers the RE landscape and all the people that over reached as well. We have saved up just over a 100k and live in the Studio City/North Hollywood area. We want a home with long term appreciation because we will stay in it. We want a home. I wish you the absolute best in your fight and hope the perpetrators in your situation rot.

you could start a business helping other people keep their overmortgaged homes for free. Charge a commission, this could be very, very, big.

So no way to get clear title? What is your exit strategy?

Very sad to think of the families and their pets put in turmoil, tossed and turned so that the greed of banking industry can tuck in to bed those who think the house on earth is the only one they ever have to occupy…

With rising property prices, all pay higher property taxes. CA just increased the sales tax 1/2 %. All workers had FICA go up 2%. I just checked “GasBuddy” for Van Nuys. The lowest price i see is $4.15/gal. Will retiring baby boomers and others now say, “We missed the last price bubble, let’s not miss this one.” What’s next? Something has to give.

“Welcome to the unintended consequences of massive market intervention.” Keeping inventories artificially low is exactly what the Fed, in collusion with the banks, wants to happen. Just like they manipulated the market on the way up flooding the market with unqualified “homeowners”, they are now limiting the offer to push prices higher.

Bernanke is merely a handmaiden for the big boys.

Oh boy. People camping out, trying to “snag their dream homes”.

http://abclocal.go.com/kabc/story?section=news/local/orange_county&id=9013331

And to think we once made fun of the USSR for their food lines …

Nobody know where the top of the market is, and nobody knows where the bottom is. My guess is we have a new full blown short term bubble, only to be followed by the next disaster of some sort (pick any card in my hand) that will cause another collapse. Something else to ponder; 700,000 is the new million. Because of artificially low rates your payment is about the same on the million dollar home versus what it would be if rates were at a historical average rate of 7%. My bet is to stay liquid and wait a while…

Here in the central valley of California I have noticed a large number of long term vacant homes. Nothing is happening with them their just sitting vacant many for two years or more already. But also several of the homes that were bought up by investors and put up for rent have gone unoccupied for several months due to the fact that their asking too much for the rent. But I think also less people are losing their homes to foreclosure and rental properties are staying vacant.

We’re in OC and have been looking at rentals. All but one have been vacant. A few have been on the market for 3 or 4 months. Have been told by agents that the owners are waiting for applicants with good credit. Husband looked at one yesterday in a good neighbourhood but the house was a complete dump. Asking premium rent. Apparently the owners are dentists who inherited the house and will not upgrade or fix anything. Husband said the place was putrid and kitchen etc original. Owners have rejected many applications due to poor credit and lowballing. We have great credit and wouldn’t rent it even if it was $1500 month less. Don’t know who will ever rent it. Owners seemingly will wait forever for someone to pay their asking. Has been on the market for many months.

Also encountering owners how will not get back to agents, taking a week to get back to them about simple questions. We asked one if they would repaint the house (they have just bought it with cash and was a foreclosure). They said they would do the downstairs only. Would not do the upstairs or the bannister. Problem is that is where all the drawings and scribbles are. There are massive amounts of pen scribbles all over the bannister and huge faces on one of the bedroom walls. All I hear is ‘stick it scum’, not the kind of relationship we’re looking for with a landlord.

It’s all getting demoralizing really.

“All but one have been vacant”? So lots of vacant rentals on the market? Maybe all the investors who bought to rent out at a profit are going to realize the rental market is flooded in OC. The crowd of buyers at this summer’s For Sale houses won’t include those investors like last summer. Smaller crowd, lower sales price for houses this summer (let’s see if it happens)

I have seen a lot of this up in the SF Bay Area (where I currently live despite my moniker). Empty properties with unrealistic rents. Bad condition, bad neighborhood, lack of transportation/services access charging double, triple what a fair rental price would be. I guess landlords don’t want to be locked in long-term to what they feel are “low” rents since they feel the employment situation & economy will pick up any day now.

Just got a new place up here that is live/work zoned and month to month lease at a comfortable rent with some utilities included – feels great to only have to give 30 days notice and be gone if I want. It was hard to find because most rentals up here are at least $2K/month – feels weird to pay that much. A lot of the other places I looked at were asking for $1700-$2K/month in bad neighborhoods with verifiable net income of 3X rent. I don’t know too many people living in the ghetto with net income of $6K but apparently these landlords have the expectation that there are.

I’ve seen enough in CA after 31 years. Sold my home and will close the end of the month. Destination Idaho. I sold in 7 days, standard sale. I had 12 views and 6 offers and took the one $ 7k over asking. Buyer is 100% VA with $20k cash over appraisal.

Anyway, while interviewing 2 of the major moving companies for bids, I asked if their outgoings are outpacing their incomings. Both said the CA outgoings the past 2 months are the talk of the moving industry !

It can’t just be me who knows the tax man will be coming with a vengeance. Can’t do anything about Obama, but I can sure do something about Jerry Brown and his public union thugs. I’ll snowbird out of Idaho in the winter, but not to CA. I feel sorry for my CA friends who are also fed up, but cannot leave due to family reasons.

You sounded pretty reasonable until you called working people thugs. The destruction of our economy began with Enron, a corporation committing fraud against the state of California, continued with Bush II’s unfunded wars and finished up with banks conning the govt out of regulating them. It is a fact that America’s most prosperous period coincided with the greatest number of union jobs.

i have reviewed a few graphs showing short sales rising as forclosures falling. I believe that the forclosure numbers are falling as the values rise, the note holders are reaching thier net shorts with overbidding and estimated values running upwards of 10-30%. remember you cant have a supply issue without demand. if demand is minlipulated the values are faux. do not be fooled.

The Homeowner’s Bill of Rights (HOBR) is just another stall tactic to draw out foreclosure. Politicians are actually doing a disservice to borrowers in foreclosure by passing this legislation.

Many states that are pro-borrower are changing their foreclosure process from non-judicial to judicial. While California is a mostly non-judicial state, we will see an increase in judicial foreclosures due to HOBR.

I think this is just another way to transfer wealth from the middle class and poor to the uber rich. Is that what the past what the past 30 years has been all about. Historically one of the ways the middle class could save for retirement was paying off a mortgage along with appreciation on their homes. Incomes are down nationwide I left CA in 2006 and returned in 2011 thinking I could buy a place as housing falls. It soon became apparent that I was wrong. Tons of evidently bogus listings dwindled to nothing and rentals were so high it was beyond my fixed income. So I moved again to Portland. After six months I caved in a bought a new condo. I know I paid too much and will probably watch the value go down but I desperately needed a place to take advantage of the low interest rates (that when up while I was looking). I notice that many of the RE agents here are being told lies or are telling me lies. When it comes to money no one tells the truth. The US housing market is a huge mess with the money going to Wall Street and other countries. It’s the same old story – the rich get richer and the rest of us – well you know. I will say it is a great deal more pleasant in Portland than CA. Public transportation is quite good. The people are quite friendly, the weather is not as bad as I expected. And Number One reason – no one talks about movies here – evidently the celebrity worship of Southern CA has not caught on here – yet. I don’t know how long it will take to return the housing market to normal conditions. Probably never. This has just been so profitable to the banks and the uber rich for them to give it up.

Wife and I have been looking for a house in La Canada Flintridge for the last 6 months. We were out bid by investors on two occasions. We’re still looking. But the sad reality is that since February, many new listings are asking above their 2006/2007 purchase prices. Are you kidding me? 1 year into the “recovery” we’re exceeding the last bubble highs? It’s insane. One good thing, maybe, this will force more inventories on the market due to less under water owners. Bad news is that if you miss one or two buying opportunities like we did, you may find yourself quickly priced out.

From Calculated Risk… the 2 bottoms of the housing market are here… for what its worth

http://www.calculatedriskblog.com/2013/03/housing-two-bottoms.html

Still paying $1/square foot/month in my rent controlled Warner Center apartment. Still avoiding purchasing a home because the government is artifically propping up the real estate prices. Saving up every penny. Hard to say where to put it. Real estate is too risky due to rampant market interventions. Stock market is very risky due to high frequency trading and the impact of Obamacare on individuals and companies. I got a promo from my stock trading company talking about which bonds are the best bet. Maybe that’s a clue that it is getting close to time to short the bond market. That will certainly change things in this country. Where are you people putting your money? I am all out of ideas.

gold

Why did this home jump 50% in 2 months? From 400 to 600k was this a foreclosure I could have bought in December for 400k?

Here is the address….

93 COSTA BRAVA, irvine, ca

Wecome to the Fascist States of Amerika!

This is the new normal, the one that everyone voted for. You love it don’t you!

http://www.alternet.org/economy/billionaire-speculators-greed-makes-life-hard-renters-and-would-be-homebuyers

Wow, this article really hit home as I am newly and currently a Florida resident for the time being. I can attest to the fact that the number of foreclosures and short-sales hitting the market here is unreal. Having just recently purchased a home here, I can also confirm that ‘all-cash buyers’ can swoop in and take a house of the market within literally five minutes of it being listed. This happened several times to us. I’m talking first-hand experience unfortunately. Money is cheap, as was stated here, and those with money are taking advantage of it. Who wouldn’t, right?

I too feel for the families in Florida and California not to mention all over the country facing these issues. Is the current climate setup for this to happen again? Let’s hope not. It is a great time to buy for new home owners and first time home buyers. I also agree with Kymmie that the number of short-sales and foreclosures is insane right now.

Leave a Reply