Housing inventory disappears in California for the fall: Number of homes for sale reverses steady increase from February lows. Where did the housing inventory go?

For most of the year, housing inventory was steadily increasing across the nation. In California, it appeared that inventory hit a bottom in February of this year. At that point, there were 109,000 homes available for sale. The latest figures going out to October showed 127,000 homes available for sale and this was down from 134,000 reached in August. There has also been a steady decline of homes available for rent. The cash investor crowd is still out buying in large numbers. The drop in inventory is typical for the fall and winter selling seasons in normal markets. However this drop in inventory is likely being brought on by other factors including the jump in interest rates and also, the perception that the market may be softening. The number of listings with price cuts was 17 percent earlier this year. Today it is up to 28 percent. Where did the inventory go?

California housing inventory

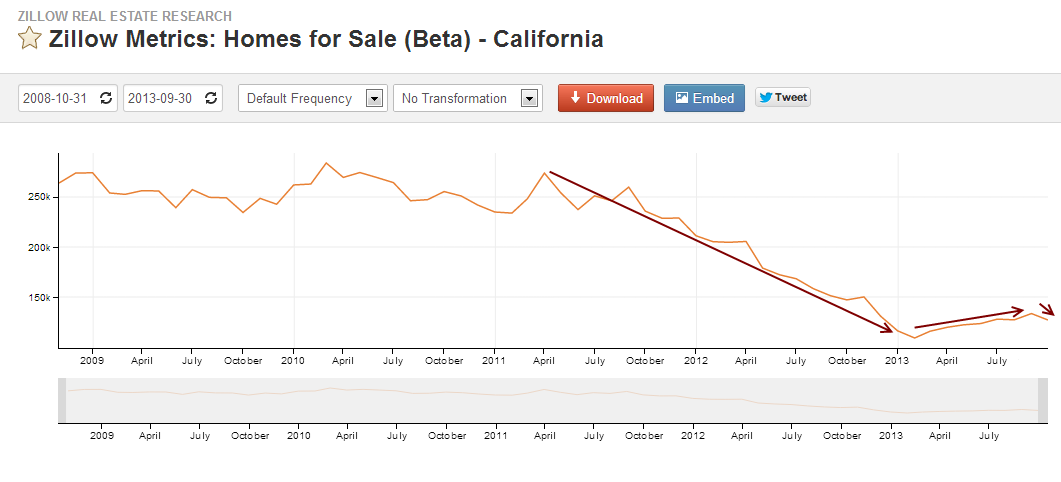

Starting in 2011 housing inventory went into a deep decline in California:

Source: Quandl, Zillow

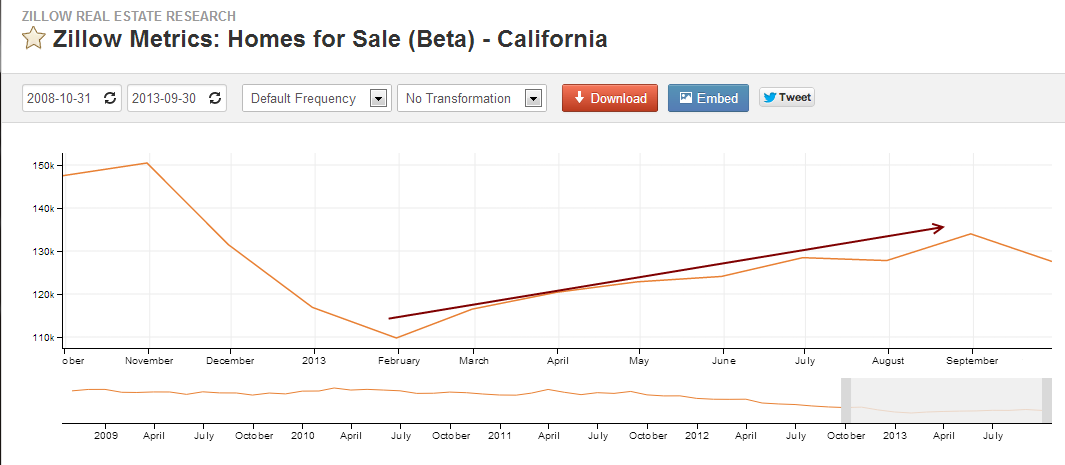

This was over a 50 percent drop in total inventory over a short period time. So it is no coincidence that home prices over this short period also increased dramatically in conjunction with low interest rates brought on by the Federal Reserve. However, housing inventory hit a temporary bottom in February of this year:

As mentioned, inventory bottomed in February at 109,000 homes. It ended up going to 134,000 over the summer but has now moved lower to 127,000. This trend is not only impacting California but the rest of the nation as well. Inventory was moving up steadily but the impact of higher rates does seem to be softening the market.

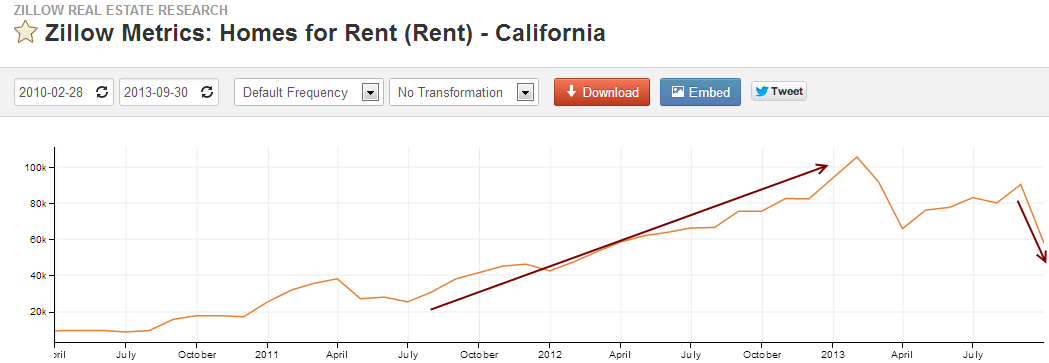

In California, many investors bought single family homes for the purpose of renting. You can see the steady increase of rentals starting in 2011 (oldest data available):

However, over the summer the number of homes available for rent in the state has declined sharply. The fact that only one out of three households can afford a California home is partly due to this but also, a slight decline in sales for the state. Being out bid by investors and also, simply being unable to buy have increased the number of renting households.

National trends align with California

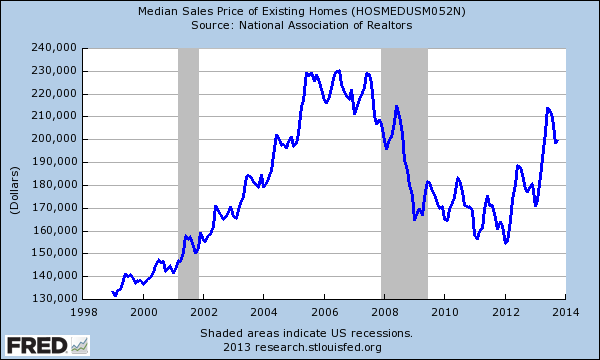

Nationwide, prices have softened a bit:

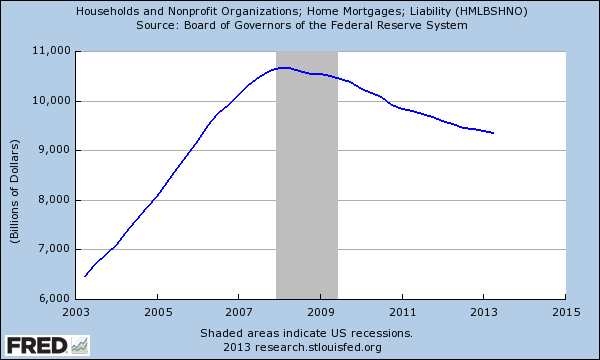

The cash crowd has been a dominant force nationwide as well with over 30 percent of sales still going to this group. Given the massive rally you would expect mortgage balances to be soaring for regular households but they are not:

Alternative financing for investors does not show up here. The housing market seems to be at a lull trying to decide where it will go. Home prices in California are up 25 percent over the year and clearly this is an unsustainable pace. The California housing market is addicted to a boom and bust cycle. We are in a boom of sorts so to think we’ll have a steady market following the latest boom simply goes against recent history of the market.

If you are out in the market, you may find the selection of housing better than it was early in 2013 but the number of new inventory coming online may be limited. Take a look at Pasadena for example:

Source:Â Movoto

Inventory shot up by 50 percent from the lows in February but has recently softened up. The two major factors driving this recent decline are higher rates and a weaker market. 28 percent of homes now have a price reduction in California. Back in spring and summer before the hike in interest rates people had to beg on their knees just to overbid on a property. That doesn’t seem to be the case and sellers with golden handcuffs are probably riding this out hoping for higher prices in 2014.

The cash crowd is going to find it more difficult to make money flipping and finding good yields on rentals and we are seeing some slow down in cash buying although it is still very high (in SoCal it is still 27.5 percent of all buyers). Hearing from those in the market and talking to contacts in the industry, the market has definitely softened and many are planning to wait this fall and winter out for the hope of higher prices in 2014.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

50 Responses to “Housing inventory disappears in California for the fall: Number of homes for sale reverses steady increase from February lows. Where did the housing inventory go?”

Darn Totting straight. Housing tanking hard in 2014!

It looks like the banks started taking houses off the market soon after rates rose in May.

Your thoughts?

Of course banks pulled inventory when interest rates went up.

Per Federal law, banks can hold on to foreclosures for up to ten years. Factor in the Federal Reserve keeping the Federal Funds rate at zero percent. Banks can then float their foreclosures until the ten year holding period expires.

So we will not see any type of unmanipulated housing inventory until at least the year 2016.

Who’s to say that the rules of the game won’t be changed prior to 2016? That’s the very genesis of what is being pointed out as what’s wrong with the system. If the home team looks to be losing, just change the rules until they win.

This post reminds me of a running joke we have at the office. Every time someone says something about the future we respond “why are you acting like we are going to be here…â€

Why are you acting like market forces have anything to do with the current housing “market� I think we know that there are government/banking forces moving levers in hopes to keep this party going.

At the end of the day there is only so much money available for housing. Eventually this will impact housing. I think the only caveat is that “markets†can be irrational longer than you can remain solvent…

agreed!

Since 2009, the real estate investment groups all over CA have been crowing about buying SFR’s for their rental income as this was one of the rare times when a house bought in CA could cash flow as a rental. And, flipping was a good way to lose your shirt. in 2012 big investor groups started buying SFR’s for rentals as well.

The prices and interest rates have risen enough now that buying as a rental that will cash flow is tougher. Notice the pricey areas of CA have been steadily climbing, and these do not cash flow as rentals. I’ve seen people bidding all cash on $1.5M homes in Silicon Valley. This is money looking for a place to hang out while the storm hits. A loss of trust in the system coupled with a desire to park cash where it stands a chance against govt intervention and appropriation.

“…a desire to park cash where it stands a chance against govt intervention…”

But, isn’t buying a home with guaranteed resale value (e.g., Silicon Valley) as case of money looking for safety provided by government intervention? We know for a fact that government will do whatever it takes to prop up housing prices. Owners with houses in the most desirable areas will benefit the most from keeping the system afloat–from the government keeping a pool of worthy and unworthy buyers in circulation for them.

My point being that the safest place for your money in modern America is anyplace with a federal backstop.

Unless you have some sort of a crystal ball, we do not “know for a fact that government will do whatever it takes to prop up housing prices.”

Recent historical events might suggest it to be the case, but that does not make it a fact.

While we’re on the subject of speculation, I’ll posit the possibility that the government may be corralling the heard right where they want them. Think about it for a moment. How tempting would it be to have all of those repatriated dollars from overseas come back into a physical object that can’t be easily transported back out of the country. The trick is dropping the curtain at the right time so that the price level falls before enough folks can sell off in time.

I could be wrong as it’s simply a suspicion.

If you’ve got cash sitting somewhere, it may be the easiest thing to take from you. Like a Bail-in. But if it’s in real estate or equities, hard assets.etc….it’s tougher to get at.

CAE

Is there a black market that exists for property transactions in this country? The same government in control of banking and investment operations is just as in control of issuing and recording land deeds.

How can we state with any certainty that governments won’t levy property holdings and transactions any more or less than any other area under their purview?

I have to agree with the comment by “what?” (interesting name ;)). There really is only so much money that is available, and basic economics tells us that it will impact prices.

Also supply. In a couple of years, a lot of properties from dead or dying people are going to hit the market. I can see it happening in N CA already. There are literally 100’s of homes within a mile or 2 of me owned by aging empty nesters. I see this everywhere.

Yep, my parents sold their house and moved to Virginia…my Aunt in Hayward is retiring at the end of the year and they are moving to Virginia (all those gold communities between DC and Richmond). No reason for someone in their mid-60’s to stay in the area.

A lot of properties from dead or dying people are going to hit the market in a couple of years? What a crazy thing to say? Or maybe LAer knows something that the rest of us don’t know? Perhaps the current regime in Washington DC will have their Obamacare death panels fully functioning by then to get rid of older folks?

You are a real vulture, waiting for all those old people to drop dead so you and your friends can buy cheap from probate. Well, that will not happen, because those old folks will give the house to their grand kids, like my grand father promises me.

Don’t mistake “local incomes” with “available money.” Believe me, local incomes don’t matter for desirable CA real estate and there’s plenty of money…

America is considered a safe haven across the globe as a place to park (and/or launder) money, and U.S. real estate is embraced because it is an inflation hedge and is a roof for any number of wealthy foreigners to park their brood. Finally, a $500,000 “investment” (per EB5) in real estate will get anyone in the world to the front of the line for a coveted green card.

x10000. Unfortunately I think you are spot on.

Has not “desirable CA real estate” markets experienced price level resets during every bust cycle?

At the very least, it would suggest that income to price level correlations in surrounding markets informed changes in these exceptional areas by some amount.

But yeah, this time is different.

That’s what I’ve been saying as well, Joe. Seems like people are forgetting that Cali is not a boom only state or boom plus small increases or boom plus flat state when it comes to real estate; its a boom n bust state. See the last bubble less than a decade ago for proof. The argument back will logically be that this time is different. We will be peppered with things like mark to market being suspended, QE infinity, banks controlling supply of foreclosed homes, globalization/increase in global upper and middle classes, money has to find a place to go and the US is the safest haven, Chinese n institutional demand making traditional fundamentals like US income/employment not mattering, etc. We can then say either that some of that stuff above can change on a dime or a random blak swan event can occur causing real estate to plummet or at the end of the day, its really fundamentals of US citizens that matter most. Neither side can really “prove” their point, unfortunately. Personally, I’m still on the side that its all a fragile house of cards and cletis is about to turn a fan on. I certainly wouldn’t be betting testicles that we’re near a crash either though. Just so hard to weigh all the factors together and then adding a date to your prediction after weighing those factors is nuts.

I will say that as a new homeowner, I’m starting to see more pluses to renting every day. 😉 My house is from 2005 and I can already see big $$$ in my future with new windows, new hot water heater, etc. and that’s after I replaced pool equipment and HVAC upon moving in. Regardless of what happens today or tomorrow in housing, IMO, there is no way millenials will want or afford home ownership like previous generations. Best hope the 1% has lots n lots of babies or at some point SFHs will go down for that reason alone.

Wow, FTB, replacement of HVAC on an eight year old house? I guess they don’t build things like they used to.

Joe-not sure if its my crappy luck, former owner abuse or the fact that goodman used to build garbage ACs. I have a large home for Cali, kinda more standard for Texas, with two sep AC units. Both were Goodmans, which I heard are getting better now, but were not quite that good back in the early 2000s. The previous homeowner had already replaced the AC coil on one of the units. When I had my inspection, we realized the other AC unit (the more important one’s) AC coil was toast as well as some other issues. A new coil would have been $2,000+ as its a sizeable unit. Instead of spending that amount of money to basically patch a crappy, dying unit, I figured it was smart to buy a new, more energy efficient variable speed unit from a better company so going forward maybe I could also reduce my AC bills. So basically in under 10 years, both units needed significant money.

That’s why I call major bs on the folks on this board who allocate $200 month in maintenance. Number one, unless you are purchasing new construction, most folks invest some money immediately after purchase or soon thereafter to ‘clean’ up the house a little or maybe make it their own. I notice these initial costs are never included when the real estate thumpers compare renting vs owning. I also find it contradictory for these same folks to say use a 10 year hold time AND claim such low maintenance. Maybe things don’t need fixing the first few years, but houses in so cal are already old, so to not expect more significant home repair bills in years 6-10 is wishful thinking. Lastly, I haven’t seen the 5-6% fee included in the calculations that the seller pays to real estate folks when selling. All in all, I’m not saying home ownership is good or bad; I’m just saying home ownership is more expensive than many people think (especially those that have always rented) and more expensive than LB and others are claiming on this blog.

I can understand how rising prices and rising interest rates would cause buyers to be skittish and sales to slow down. But shouldn’t those factors increase inventory, not decrease it ? – why would inventory fall as a result of higher rates ? If prices are too high, then there should be more sellers, not less.

In an actual free marketplace, I believe that what you suggest would be the case. What we are observing could be evidence that the exuberance from the last bubble still hasn’t yet shaken out (i.e. golden handcuffs, shadow inventory).

People can only pay so much per month in mortgage, so if the rates go up, then the prices must drop, so that the house can sell. Low interest rates fueled the housing bubble from 2001-2006, because people can pay 5-6 their income when the mortgage rate is 4%. If rates go back up to 10%, then sustainable housing prices will be 3x average income.

Is there any way to see how many houses the banks have.?

So? CA homes are still, on average, much below all-time highs, especially factoring in abt 20% inflation. Markets go up and down. Thank goodness cash is what is driving sales. And, those who do borrow, must be more solvent than times past, sounds pretty healthy to me.

Those all-time highs were reached during the most fraudulent bubble in human history, one that should have brought down the entire financial system with it, but didn’t due to a corrupt and sold-out government. In other words, using that top as your historic metric is foolish. In some places, though, prices did approach those tops this year, again due to a different type of fraud known as quantatative easing and any number of anti-forclosure laws and well-known foul play by the banks. Despite all that, the “second” top has already come in and the slow decline has begun – just look at any graph (except the lagging Case/Schiller) that plot prices and you’ll see the makings of a bubble top once again. The question is not whether prices will tank. The ONLY question remaining is whether the government has the ability to prop the prices up in perpetuity or whether the game must end some day. I think the latter is the safer bet, but who knows.

Those of us in a ‘hot’ neighborhood like Silver Lake, in Los Angeles, understand that micro bubbles can occur, even when the larger market might be doing something completely different. I’ve been keeping track of some of my favorite houses, which sold for exorbitant prices during the boom. Some of them have been sold again recently at 25% to 45% higher than boom prices. When we purchased on my street 11 years ago, most of the homes were going for around 400-500k. The last four homes to sell on this street recently have all gone for over a million bucks. And we’re on the ‘poor’ hill. My real estate friends tell me that most of the sales are still all-cash offers, usually foreign investors with some trust fund babies thrown in. We’re seeing crazy and frenzied multiple bidding situations, which leave the last bubble look tame by comparison. Most nice houses are sold within hours of their first open house (the flipped house up the street – 1,200 sf, had three bids way over the $1.2 million asking price within an hour of going on the market).

I honestly don’t know how any young couple can afford a home in Los Angeles, or in any desirable part of California. Our parents and grandparents had it good, when California real estate could be had for a few dollars per acre. Heck, my house sold for $250k just in 1995, and now it’s worth nearly four times that amount. It’s been upgraded and landscaped, but … geez, this is insane. I can’t sell it and move anywhere in L.A. – to realize a profit, I’d have to move out of state. Or out of the country. Our dreams of staying in Silver Lake and buying a larger house are kaput.

Markets continue to be massively irrational in this area.

Dr. HB has pointed out here, ad infinitum, that real wages are stagnant. That is a response to your inflation argument.

Some on here would respond that there are plenty of wealthy Chinese and the like waiting in the wings to keep the housing price curve in an upward trend, so wages don’t matter in a place such as SoCal.

Now that sales have been consistently declining over the past few months, I ask – where are the wealthy Chinese buyers at?

Mostly in the SGV and other cities with strong Asian concentrations. It’s really a niche market more than a sweeping generalization for all of housing. Just depends on where you live, and you will see the other side of the story.

I work just north of LA in the Pasadena/Glendale areas, and I’ve been noticing more homes for sale since September, and they seem to sell in under a month. If you live in these areas, the grass is certainly greener.

This isn’t to say it’s time to celebrate, but it is to say that it’s hard to generalize every single neighborhood to be a ‘softening’ market or a bull market at that. Focus on the area you care about if you are interested as a buyer. If you are just here to be a bear, then relax and enjoy. There’s plenty of you here to socialize with 😀

Tell ya what, next time you encounter some sort of bullshit, just relax and enjoy.

Take a look at all the buyers in San Marino. Chinese are buying up all million dollar homes site unseen here and account for 90% of all sales. House prices are going through the roof here. Nice flip for this seller. http://www.realtor.com/realestateandhomes-detail/719-Winston-Ave_San-Marino_CA_91108_M26358-64429?row=7

Scary article on HELOCs….they’re baaaackk. The human race’s stupidity and addiction to debt is scary. Sucks that we all are tied to each other’s financial decisions. I really can’t figure out what inning we’re in anymore. Just when it feels like the 8th, it starts feeling like the 5th. Our fed has gone mad (or shows you how broke the banks truly still are) and its become apparent that they want/need the bubble. Scariest thing written this weekend was another floater in the media about paying US savers a neg interest rate at banks (aka paying the bank to loan money to them). If that does somehow happen and there is no massive pushback causing the policy to be discarded, I give up. At that point, it will mean ‘they’ have officially won forever. Game over.

http://www.bloomberg.com/news/2013-11-25/faucets-at-1-000-abound-as-home-equity-spigot-opens-mortgages.html

I think we may see the re-emergence of subprime soon enough. More debt is the only play left in the book that doesn’t change the current system even more drastically than it already has been. On a global scale, people just don’t have confidence as before and an increasing distrust of the system along with its players emerged as a result of the last bust. Therefore, the honeypot of cheap leverage has to be made even bigger and evermore flowing to keep our eyes distracted from the man behind the curtain.

Right now HELOC programs have only slightly loosened. The main driving force behind this is gained equity due to (faux) appreciation in many markets. That being said, this is only a fraction of the lending market, so I think this article is a bit of an exageration or highly optimistic for the near future re HELOC’s.

As far as the comment for sub-prime, it never really ceased lending. Just went from private lending to govt insured under the guise of FHA and VA. Both programs will insure loans to borrowers in the low 500 fico range. Of course they need to qualify based on income/employment, but, credit scores are not a main decline feature these days.

There have been a few “sub-prime” lenders spring up in the past 6-12 months, that are comparable to hard money lenders. I am talking 8-11% rates w/ 2 pt costs.

Just my .02 from someone who sees LOTS of mortgage programs come across the desk.

Here is a partial explanation. As home prices rise, homeowners start to come up from being underwater and place their homes on the market for sale- when they do there are more homes for sale and prices drop causing fewer homes to be listed.

Fuller explanation here: http://smaulgld.com/real-estates-underwaterdown-side-sticky-catch-22/

Actually the more pertinent post on your web site is http://smaulgld.com/the-feds-no-exit-dilemma-podcast-11-22-13/.

What a minute… you mean to tell me we don’t get French benefits?

No you don’t get French benefits and most of the numbers that are reported are… ahem… “adjustedâ€â€¦

You mean it isn’t the leaning tower of pizza?

No it’s not the leaning tower of pizza and employment adjusted for population has not improved since the recession…

You mean Jimmy Dean was not an actor? No Jimmy Dean was a sausage and there has been no real improvement to the economy…

I remember an economics class in business school where the professor discussed how beliefs impacted economic activity. If the fed can create bubbles in the stock market and housing market there will be a perceived wealth effect. The average Joe would be more likely to take the family out for night at the Olive Garden if he believes he has some extra money even if it is only a perception. He can take home the same amount of devalued dollars as he did last year but if you tell him his house has gone up in value x devalued dollars; it’s celebration time!

The one funny note in this podcast is that the RE guy has to get his “if you can buy a property now go for it†in even though the things that are discussed make it sound like a really bad idea. RE folks can’t really help themselves… It’s kinda cute really…

Many investors avoided RE, S&P in 2009, too risky; money flowed into precious metals (safe haven). I recall checking out new MLS offerings every AM back in the day. Some decent fixer properties went for the price of a new car.

Now many investors can’t get enough RE (safe haven), S&P; precious metals taken to woodshed. Interesting times, just my humble thoughts, ramblings. Who knows?

I’ve been avoiding RE in SoCal since 2004. It still doesn’t make sense. Here’s the best part – I don’t have to buy if I don’t want to and I think a lot of folks are feeling the same way.

Lead story on cnbc is about Chinese buying up CA real estate….

http://www.cnbc.com/id/101225345

I saw that, too. I still wonder when Chinese money will go the way of Japanese money from the 80s…

I read the CNBC story. Where does the chinese miney come from? Drugs? Exploitation of their own people?

Hello! China is the second-largest economy in the world and nobody wants to live there who can afford not to.

Here’s the answer…

http://www.cnbc.com/id/101225781

That guarantees the top.

Wall Street as Landlords….what could go wrong??!

http://www.tomdispatch.com/blog/175777/tomdispatch%3A_laura_gottesdiener%2C_wall_street%27s_rental_empire

Understanding bubbles and getting before all the hot air still works in CA. Its all about cash flow management and leaving some for the next buyer.

Speaking of Pasadena, any thoughts on this place??

http://www.redfin.com/CA/Pasadena/1915-Kenneth-Way-91103/home/7182147

@ Pasadena Kid. Looks like a decent price for Pasadena BUT it looks like it is alongside the 210FWY. Have you ever lived that close to the 210fwy or any freeway for that matter? Very noisy and constant soot and dirt floating in the air (I lived on Villa Street near Fair Oaks even further away from the 210 than this house on Kenneth Way) and the noise, soot and dirt was terrible. Besides the house is pending and so at that price, the deal will likely not fall apart. You will often time finds homes that are near the freeway (or other busy street) or have lousy floor plans for less than other homes but think carefully about ‘love where you live’. Remember in order to find out how noisy it is near a busy freeway or street, go there when it is not rushhour. At rushhour all the cars are going slow and so you dont hear the sound as much times in early morning or late evening when the cars are moving fastest that you hear all the noise.

Hello Doc

The low inventory must explain these cases of strong flip activity as it continues unabated.

Case in point

This house, purchases for $380K in 2011 then sold recently for $577K.

http://www.trulia.com/homes/California/Los_Angeles/sold/22108853-2128-S-Cloverdale-Ave-Los-Angeles-CA-90016?ecampaign=con_day_propertysearchsold_bk&eurl=www.trulia.com%2Fhomes%2FCalifornia%2FLos_Angeles%2Fsold%2F22108853-2128-S-Cloverdale-Ave-Los-Angeles-CA-90016

here is another case:

Sold for $445K 1 year ago and resold this month for $750K

http://www.trulia.com/homes/California/Los_Angeles/sold/1899886-2489-S-Westgate-Ave-Los-Angeles-CA-90064

in any case, many of us thought this bubble would pop by now, but the low inventory and low interest rates have made for a new game. I doubt that anyone who purchased in 2010, 2011 and maybe even 2012 will see their home prices faulter by more than a few percent in the coming year.

Leave a Reply