California Housing Bottom Callers and the Foreclosure Clones of 2008: Notice of Default Wave Part Two Gearing up for Q4 of 2009 and 2010. U-6 Unemployment and Underemployment Rate for California now at 21 Percent.

People are back to their bottom calling bunker positions here in California. Some believe the Alt-A and option ARM wave will be a non-event. I’m not sure if this has to do with the summer sun or the 50 percent stock market rally since March. In the last two months, I have gotten e-mails from folks in prime locations like Pasadena, Menlo Park, Culver City, and other areas and many largely believe that the game is now over. Move along. There is nothing left to see. I am fascinated by this not in my back yard view of economics especially when it comes to housing. They largely see the claim that housing will be in deeper pain for a few more years as some kind of “gloom and doom” call. I have news for them. California flew off a cliff with the $26 billion budget deficit. Gloom is already here for the 11.6 percent who are unemployed (21 percent if we use the U-6 measurement) and in many areas housing prices are off by 50 percent from their peak. I hate to tell them but the crash already happened for 90 percent of the state.

Many of these people are absolutely disconnected from the reality on the ground. Did they not hear about the Great Western Forum being filled up with thousands of people, many turned away seeking healthcare?

“INGLEWOOD – Judging by the images being broadcast worldwide, of rows of people waiting to be treated by doctors and nurses dressed in scrubs and working inside a vast arena, the sights looked a bit like a scene from the classic television show “M.A.S.H.”

But this was no war zone on the Asian peninsula. It was the floor of the Great Western Forum, where at least 2,000 people had come in the hopes of getting free medical services from a small army of licensed, volunteer health professionals.”

It always helps to look back since it can demonstrate how wrong psychology can get in these volatile markets. Back in March of 2008 we started seeing a flurry of bottom callers. At that time, the state unemployment rate was 6.2 percent and the median California home came in at $383,000. All evidence was pointing to a first wave implosion yet this is the sentiment that was permeating through the media:

“Alan Nevin, chief economist for the California Building Industry Association and San Diego-based MarketPointe Realty Advisors, predicted foreclosure sales could account for as many as 15,000 out of 25,000 total sales this year. But at some point, the foreclosures will drop off, he Nevin said.

“Anybody who’s going to walk away from a house or condo has already done it,” Nevin said. “Now it’s just a matter of the pig going through the snake.”

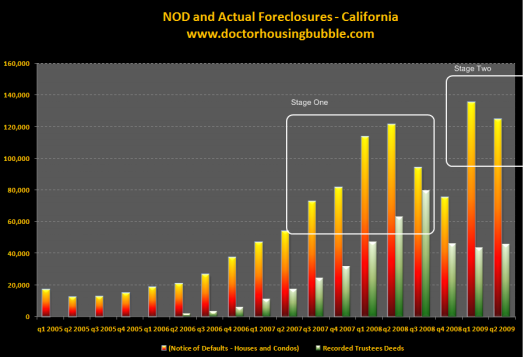

That prediction was massively off base. It turned out that for the second half of the year, foreclosure re-sales in many months made up over half of all sales. In fact, in September of 2008 only six months from the prediction over 50 percent of all homes sold in the state were foreclosure re-sales. And foreclosure sales took off at that point:

The idea that anyone who was going to walk away had already done so in March of 2008 flew in the face of all the data we were seeing. He wasn’t the only one off base:

“Remember, all of this foreclosure pain we’ve seen so far has come amid an economic backdrop that, until recently, wasn’t that bad outside of real estate,” DataQuick analyst Andrew LePage said.

He recommended that buyers and sellers pay attention to areas with unusually low sales counts where post-foreclosures sales dominate.

“The median price could pop back up once we see a more normal level of sales activity across all neighborhoods and home types,” LePage said.”

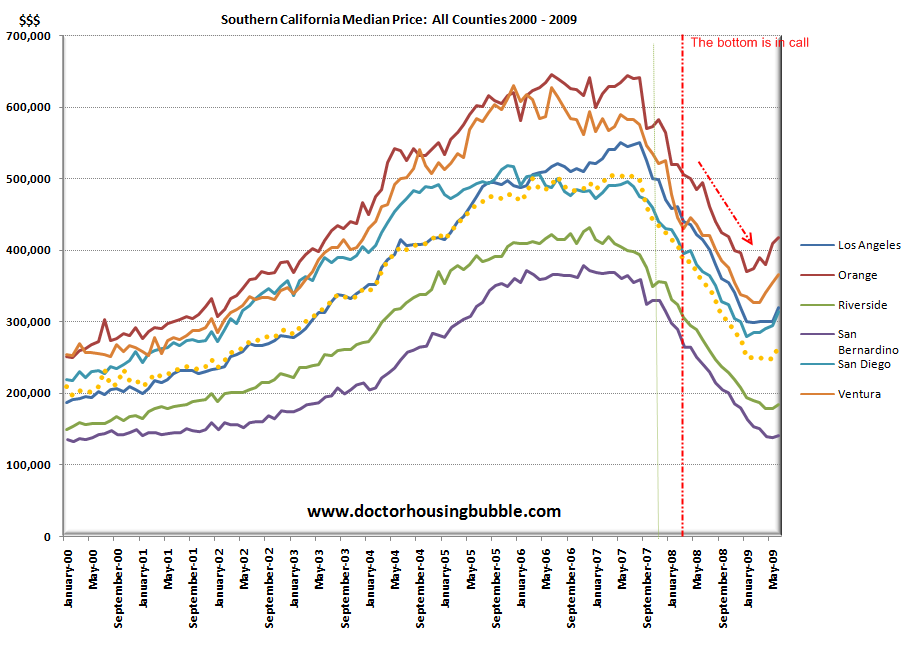

The median price completely popped alright but not exactly to the upside. Using LePage’s own data, let us see how well that call played out:

The median SoCal home price was $385,000 in March of 2008. The bottom hit in April of 2009 at $247,000 for the entire region. From that bottom call, the entire market fell 35 percent in one year. And the San Diego market? The March 2008 median price was $430,000. The bottom came for San Diego in January of 2009 at $280,000. These aren’t tiny mistakes. Looking back on this it seems obvious. But it didn’t at that time. Keep in mind that Lehman Brothers hadn’t taken its dirt nap, Fannie Mae and Freddie Mac were still waiting for their nationalization (aka conservatorship), and the stock market didn’t face its epic crash.

I want to focus on these types of calls because they fail to back up their arguments with cold hard data. They use market sentiment that spans a couple of months. For example, I see some using the slight increase in the median price as the sign of a bottom. Well, as we have discussed if you have an area with homes that once sold for $600,000 now selling for $400,000 but the county median price is $300,000 then overall, it looks like prices are going up. Yet just saying prices are going up because people get a warm and fuzzy feeling owning a home is the same bubble logic exploited by housing porn TV shows. Did you ever notice that there was no detailed balance sheet on those shows except PRICE and EXPENSE plastered on the screen with a gigantic font? Sure, everyone knew you can buy a home for $200,000 and add $50,000 in cosmetic fixes and then sell it for $500,000. Even Elmo can’t teach math like this! This mentality still exists in some areas.

I’m simply amazed how people think we are at a bottom especially here in California. But this time unlike early in 2008, this group is a minority. Even back in March of 2008, I backed up my assertion with data:

“(March 2008) In the first quarter of 2008, we had 110,392 homes with notice of defaults out. Given the default rates on these we came out with the following estimate:

(110,392 individual homes with NODs for Q1 of 2008) x 68% will not go current = 75,066

Clearly we are nowhere near a bottom and all signs are pointing to more challenging times ahead. But wait! What’s that? It’s A Bird, It’s A Plane, It’s Super Wal-Mart Voucher Checks!”

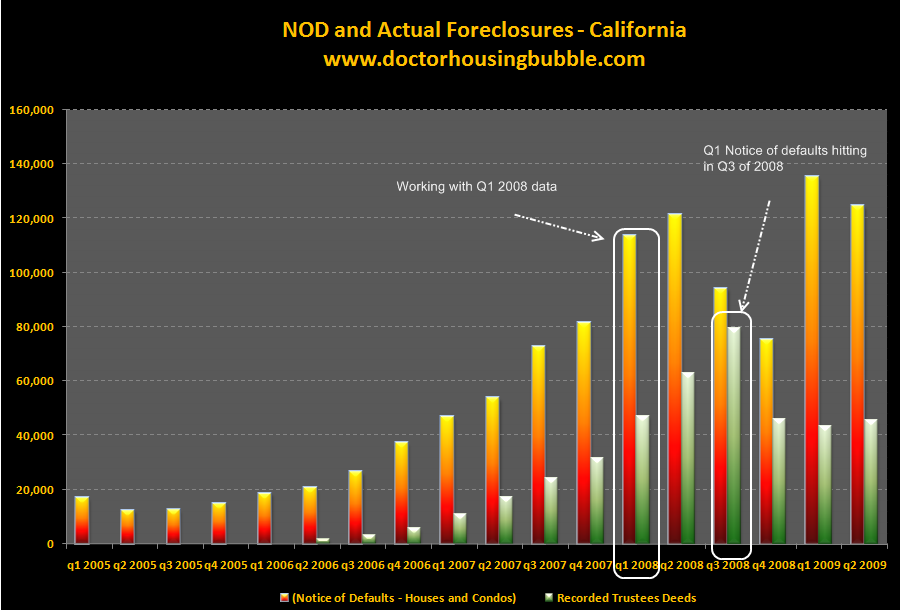

To show you how we predicted this, let us look at the graph carefully:

All we had at the time was the Q1 2008 notice of default data. 110,392 homes were sent a NOD in Q1 of 2008. We predicted that of these homes 75,066 would go into foreclosure. Since the NOD process is the first step, these homes will enter foreclosure at least one full quarter later (i.e., start of Q3 of 2008). What happened in Q3 of 2008? 79,511 homes had trustee deeds recorded (only off by 5 percent in our prediction from early in the year).

So referring back to the chart above, Q1 and Q2 of 2009 saw the two highest quarters of notice of defaults. Why are we to assume the same pattern won’t happen again? Some say loan modifications. So far, the few loan modifications that are occurring are absolute jokes and re-default rates are through the roof. If anything, those with Alt-A and option ARM loans are even more likely to walk. And this argument of a “renting utility” or emotional arguments like keeping your kids in a good school or finding a place to set your roots are irrelevant. If you are paying $2,000 and your payment is going up after recast to $4,000 the basic math is enough to push you out. Plus, have you noticed that there are many more cheap rentals on the market?

I think most of us would love to drive around in a Ferrari but most of our household incomes probably can’t support it. Many are debt zombies living in McMansions and driving leased cars with a negative net worth. All hat and no cattle. I can tell you as a property owner and someone who leases in California, if you need a home to feel rooted you have bought into the happy housing elixir. Owning a home at a price you and your family can afford is a good thing but to mortgage yourself with exotic loans for that is financial self destruction. It is about price and income. You cannot twist that basic reality. Some still think you can buy an $800,000 home with a household income of $150,000. In fact, this homeownership belief is being questioned:

“(WSJ) The New American Dream: Renting

A man is not a whole and complete man,” wrote Walt Whitman, “unless he owns a house and the ground it stands on.” America’s lesser bards sang of “my old Kentucky Home” and “Home Sweet Home,” leading no less than that great critic Herbert Hoover to declaim that their ballads “were not written about tenements or apartments…they never sing about a pile of rent receipts.” To own a home is to be American. To rent is to be something less.”

Some people have decided to look at this scientifically with empirical evidence:

“(Mortgage Media Mag) The new research was led by Paola Sapienza (Kellogg School of Management at Northwestern University) and Luigi Zingales (University of Chicago Booth School of Business) – co-authors of the quarterly Chicago Booth/Kellogg School Financial Trust Index – as well as Luigi Guiso (European University Institute). With data collected from surveys conducted within the last six months as part of the Financial Trust Index, this paper is the first to examine the economic and moral implications of strategic default in the current recession.

Negative Equity

The study of the Massachusetts housing market during the 1990-91 recession found that very few people who could afford their mortgage chose to walk away from their homes. Consistent with the earlier paper, this new research shows that homeowners refrain from defaulting as long as negative equity does not exceed 10 percent of the value of the home.

After that level, however, the researchers found that homeowners start to default at an increasing pace, and walk away massively after decreases of 15 percent and more. In fact, 17 percent of households would default, even if they can afford to pay their mortgage, when the equity shortfall reaches 50 percent of the value of the house.”

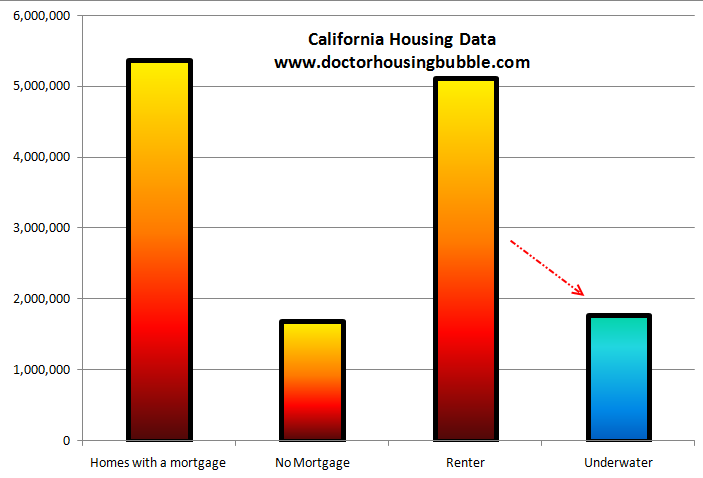

It appears that being underwater does matter. And what state is massively underwater? You got it, California:

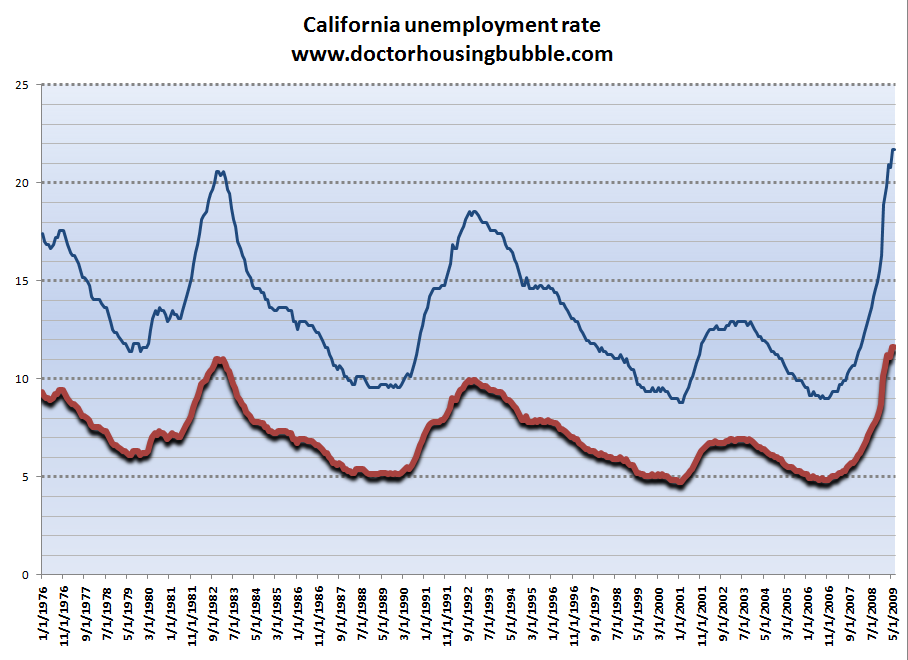

I would argue that the reasons for walking away are even stronger in 2009 than they were in 2008. First, the unemployment rate is nearly twice as high as the 6.2 percent rate when I made the March 2008 prediction. The unemployment rate for the state is now at 11.6 percent while the U-6 rate is now up to 21 percent by my estimates:

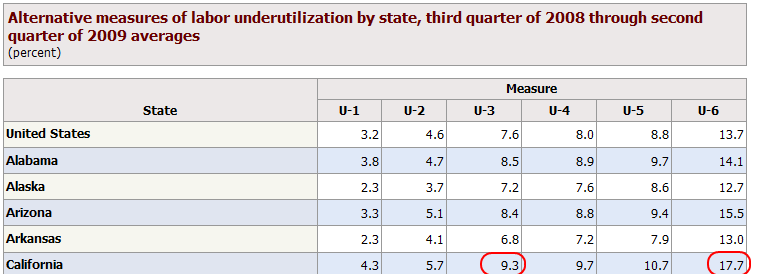

Keep in mind that the U-6 figure doesn’t include the thousands of furloughed workers. And the BLS now offers average figures on U-6:

The above BLS data includes Q3 and Q4 of 2008 for California when the unemployment rate was as low as 7.6% in August, 7.8% in September, and 8% in October. We didn’t get into the double-digits until January of 2009. So using ratios for the current data and the nationwide figures, we arrive at the 21 percent current U-6 rate for the state. Is this so hard to believe? The official data has the unemployment and underemployment rate at 17.7 percent and this is using six months of lower unemployment data averaged out. Just wait until we do the Q1 through Q4 estimate for 2009. The BLS U-6 state data will be out in Q1 of 2010 (we’ll also have one in Q4 of 2009) and will reflect this 20 percent unemployment and underemployment figure. Nationwide the unemployment rate is 9.4 percent with the U-6 rate over 16 percent. California heavily relied on housing and the finance industry for jobs and with that market imploding, it has taken down a lot of jobs with it.

So for those bottom callers, I would ask what big industry is going to make up for the lost jobs? Assuming job growth increases in the state, why would this justify current prices in mid-tier markets? The data is rather clear and the Alt-A and option ARM wave will cause problems. As I detailed in a previous article housing has a treacherous path ahead because prime loans are now defaulting in high numbers as well. This is obvious like it was back in March of 2008 but some would rather ignore logic and facts.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

46 Responses to “California Housing Bottom Callers and the Foreclosure Clones of 2008: Notice of Default Wave Part Two Gearing up for Q4 of 2009 and 2010. U-6 Unemployment and Underemployment Rate for California now at 21 Percent.”

I would only add one point to this well thought out article…

The only way house values will begin rising back to bubble prices is if Uncle Ben shifts from dropping money from helicopters to carpet bombing us with the fiat garbage.

.

I would hazard a guess that the study on walking away is massively biased since it was conducted recently. Home”owners” are still conditioned to think that their properties will rise by 10-25% a year so being even 50% underwater is not a big deal (hence only 17% walking away).

As reality takes hold, we will see that number increase dramatically. The 1990-1991 recession was of a different nature and did not involve a massive housing bubble. As people finally (maybe) realize that house prices were two times too high, they will also realize that walking away is the best way to deal with their marble-countered albatross.

Yep, as soon as the average Joe figures that out – they’ll run away, not walk. Meanwhile, back at the ranch, those of us who aren’t underwater are going to take it on the chin, again, and yet again as these homes flood the market.

I’d like to see some type of focus by Congress on those homeowners who are doing OK and giving them support to get through this, because that’s the last bastion of defense before a complete collapse of that sector of the economy.

If anyone “deserves” a handout, its the people who are doing it right even now in this hurricane that is about ready to come onshore.

I think the author makes a good point by emphasizing the importance of employment loss and the very stark chances of any kind of short term recovery, regardless of how much money is printed. The housing industry, especially in California, is not coming back any time soon, nor is the military industrial complex of Southern California. It will be difficult to make payments on a $250,000 house, much less a $600,00 house, on WPA type work.

It would be on interest if a study could be done by statistical sampling of the sources of income for the residents of the “safe” neighborhoods to see just how secure their income really is.

It’s good to see someone finally calling these economists out by name. It’s almost nauseating to watch the news at this point due to the dripping naivety. It’s going to be sadly entertaining to go back and read some of these current forecasts a year from now. How the bulk majority of economists, atleast the ones in the media, have been optimistic to the point of insanity is beyond me.

I gather that “The Power of Positive Thinking” is required reading for economists and ‘market experts’ nowadays, along with the mandatory rose-colored glasses. After all, we have a new President that can fix anything!

Alas, as our host continually reminds us, this is a mess that was many years in the making, and the current attempts to mitigate the damage are likely to hurt us badly in the years to come.

To focus the conversation, let me ask “What’s the motivating question?” The question is one of trying to forecast the short-term (18 months) and near-term (say, the next 4 years) development of the housing market and its interaction with the broader economy.Then let’s ask “So, what the problem?” The problem is that there is such dramatic (and emotional) disagreement about those forecasts. One might think, in this modern age, with all the progress in Economics, and the availability of data and technology, that the range of reasonable opinions would be narrow – but it is not. There is everything from “Flee fools! Do you not see the apocalypse is at hand!” to “We’ve already reached the bottom, you crazy gloom-and-doomer, and it’s blue skies from here on!”So, why the difference? There are three reasons1. I think the claim Dr. HB is making here is that there is a decent case for an accusation of reality-denial based self-delusion on the part of the sunshine crowd. The case is a strong one – it is unjustifiable to ignore things like the large and quickly growing numbers of Notices of Default which indicate those who are failing to make full payments on their mortgages. One cannot reasonably disregard important negative-indicators like the high rate of underemployment, the percentage of homeowners who are underwater, the poor business and consumer climate, the vast number of vacant properties, and, especially, the enormous number of outstanding “ticking-time-bomb” mortgages – most of which will likely fail.2. There is a question of credibility. Bottom callers employing various methodologies have been dramatically wrong for the last several years now. Why should we believe the results of those who employ the same methodologies today? One would, at the very least, be interested in identifying what is was that they got wrong, or what they ignored that they should have taken into account. And what was that? Among other things – an acknowledgment that the housing price correction cannot be complete until those prices return to a balance with other economic fundamentals – for instance – returning to safe ratios as compared to the distribution of income. Especially when banks won’t give out loans with a price-to-income ratio higher than 4 it cannot make sense to assert that population-wide ratios of 6 or above are sustainable and won’t experience further declines.3. Some of what will happen to the market depends on unchangeable realities, for example, a man who earns $70K a year cannot both pay his other bills and handle his Option-ARM mortgage when his minimum payment jumps from $2K to $4K per month. But some things which may happen are not “inevitable” in that sense because people have some room for maneuver and can make choices according to their own values and motivations – and here, predictions are much more shaky and there is more room for debate. Let’s say a family with a secure household income of $100,000 that puts 20% down and buys a $400,000 house at the peak of the market with a 30-year-fixed-interest, low-rate mortgage could continue to safely make their payments indefinitely. But when that house’s value falls 50%, the family faces some choices. They could stay, make their payments, and keep their credit scores, or they could strategically walk away, “ruthlessly default”, or send the home keys to the bank as jingle mail. One of the prime motivators for such a decision would be, “What else could I be getting for my monthly payment?” And the answer, in a declining market – is “Much more home than you’re living in now – so long as the hit to your credit score doesn’t forestall your ability to sign a lease.”Now, I don’t know how much the psychological-value of home-ownership and the financial value of a good credit-score is actually worth to people. I would guess there’s a fairly broad distribution of attitudes out there, but logic dictates that, at some point for everyone will this choice, the benefits of leaving will outweigh the costs – and so long as we remain in a declining market – those benefits are getting larger and larger in comparison to the costs, and more and more people will change their minds.Finally, there is a big social-norms factor here. What behavior people think is acceptable, and what moral and other attitudes they have towards debt and their duties to the banks, rely substantially on what they imagine other people think about it. If people start to perceive that strategic defaulting is common instead of rare, and thought to be “smart” instead of “crooked and devious”, and that debt is less of a “sacred obligation” than a “contract in which society has allocated the risk of decline to the bank” then they will be more likely to do it themselves. We can’t know, exactly, what people will choose, but we can come to conclusions as to what larger numbers of them are more likely to choose if current trends continue – and we can make good, evidence-based arguments as to why those negative trends will continue which have the advantage of being proven accurate for the last several years.

How do you even measure someone who is walking away. If someone doesn’t max out their credit cards and raid all their retirement savings before losing their house does that mean they walked away? The last phone call I got from the bank asked me why I hadn’t done that. I can only laugh at them at this point. Here is another funny one. The guy tells me I’m not eligible for the making home affordable because my first mortgage without considering HOA, 2nd mortgage, Insurance, and taxes is already under 31%. Last I checked the whole PITI is supposed to be under 31%. Another problem I don’t think has been very closely followed are all the people like me who have 2nd mortgage that have $70,000 balloon payments coming up in the next 3-5 years. I don’t see housing recovering enough for any of them to refinance by then.

The bottom callers are scumbags from the REIC. Nobody with half a brain thinks that we are at the bottom now. It’s all wishful thinking and BS from the NAR and the mortgage and banking industries and probably current homeowners PRAYING for a bottom and bounce. Fu** ’em all. Most of these people don’t even deserve to live.

I have started pointing anyone who doesn’t believe that the housing market in SoCal is that messed up still to hotpads.com (click on foreclosures, and type in Los Angeles, CA for location).

My parents in Connecticut had no idea it was that bad. Neither did my otherwise well-educated roommate in Los Angeles.

A solid visual makes all the difference.

ChipChick:

I hesitate to ask what you think Congress should or could do to artificially prop up the market for those “who are doing it right”…..sorry.

Should Congress pass a law to instruct judges to adjust the amount of a mortgage lower to reflect the present conditions, perhaps allowing some to stay in their homes and reduce the amount of foreclosures in the market and perhaps that would somewhat stabilize the market for the other owners “doing it right?”… maybe…I understand the sentiment and feel for those losing their homes, very emotional and sad …but how many times? What if it is adjusted, then the market drops another 10%? How many times would this be limited to? See my point? And wouldn’t allowing judges to adjust the value lower do the same as a foreclosure: lower the value of all in that neighborhood? Golly, then we would be seeing homeowners wanting to sue the courts for lowering the value of what they perceive the market “should” be…..

You cannot turn back the rain nor hold back the tide, dear.

If by “doing it right” you mean you can afford to pay the mortgage, still have positive, but dwindling equity….then pay the mortgage and hope for the best. Or try to sell now, and move to a place that has lost it’s value and get a better deal…..use the market forces to your advantage while you still can.

If you mean you purchased your house before the 2006 bubble, and can afford the mortgage on what you perceive as a sane price and payment level, are you asking Congress to use taxpayer dollars (or in reality burdening taxpayers with more debt) to prop up those that didn’t, and hold back the foreclosure tide to stabilize your equity? Geez, we GAVE $12 Trillion to the bankers to cover their bad bets, and what are they doing with it? “Unfreezing” the credit market?

We KNEW that wouldn’t work: credit is given to those actually “employed”, and over 6 Million jobs have vanished this year….like Dr Housing Bubble (and other reasonable folk) asks: where will these new jobs come from?? It’s not a difficult concept to grasp.

No, these bankers are using it to BET on the NYSE, shorting it, going long, and we’ll have to pay to clean it up again while they still hold onto the toxic mortgages using criminal accounting to overvalue those mortgage holdings. While passing out bonuses like candy at Halloween.

This is the new bubble, this giveaway to Wall Street, and it WILL POP just like the other bubbles, RIGHT on top of the 2011 peak of home defaults and negative equity…think about that. Watch the NYSE come a tumblin’ down soon. There are NO consumers! Improving your bottom line through layoffs and cutbacks only lasts so long…….somewhere, somehow, jobs must be created for an economy to recover…and I do not see ANY area that will happen in, except DOD spending, which is based on what? Tax revenue (dwindling to record lows) or more debt…..

Hint: If you are “doing it right” (and I believe you are), you should have been able to salt away at least 10% of your post-tax income in savings……if the houses in your community fall below the price you paid, use research (like this site) to gauge the bottom (I say late 2011 at the earliest) and be ready to pounce on a better house in your location for way less than you paid for the one you are in, use your savings for a downpayment, and walk away from your potential negative equity burden (if it turns that way the next two years)…..use the market, don’t try to fight the fundamentals of it.

Fundamentals say housing historically needs 15 years to recover….15. And that was when we didn’t have such crushing debt, nor shipped our manufacturing jobs (pre-NAFTA and the like) overseas.

Expat: I would hazard a guess you are 100% correct…..

Of course, the “plan” may be for starting WWIII, and then all bets are off……

Here’s a concern that I haven’t seen discussed… Budget cuts for California and its cities are going to effectively reduce police force levels. Many home buyers consider the safety rating of a neighborhood when shopping. The question here is what effect sparser police patrols and higher response times is going to have in the “better” (i.e. higher-priced) areas.

The data is clear, What however is not clear is why the banks are holding off on releasing REO inventory and foreclosure in the first place. Is it just a stall on their part? or part of something bigger? Once the federal government changed the accounting rules for banks, it is not much of a negative for them to hold REO on their books. It is clear that if the feds and the banks would get out of the way and let nature take its course we would be facing another crash. The question is when and if they will get out of the way? Any thoughts?

Farang,

I’m not in trouble, to the contrary I bought a beat up old farm and have been rehabbing it myself on my own dime. The price was well below market at the time but not in foreclosure, and I’ve got a comfortable equity cushion but if the trend continues, I will be underwater.

But I have land. I can grow and raise my own food, can food, split wood to heat my home, live mostly off the grid. I can even feed others. So even underwater I’m far better off than those who have nothing to work with. This was by my planning only, and I sold my city home just before the bubble burst to get to this place. I made sacrafices to get to this point, BIG ones. I flew against convention doing so as a woman, and I work hard to keep it. But I don’t live lavishly or have huge debt.

What I’m referring to is an admission on the part of our Congress, that those left standing in all this need to be given priority. We all know what happens with the poor individuals who lose jobs, homes, etc. Heck, I might be one myself (if the taxes get too high) but the sheer fact is that there are a LOT of people who are doing that is right NOW, with no acknowledgment of the fact.

On home values, “they” can adjust down the principal for the “good payers” to compensate for the cratering market based on area stats without the fee’s of a refinance or a loss of equity. My property has fallen off 25% so far, and continues downward. It would be less costly for the banks to address the losses NOW than in the future when its all tied up in procedures and the courts if these properties in good standing go to foreclosure later. They should allow the homeowner to work with the county to reduce the land taxes on the same properties year round, not just from Jan 1 – Mar 30 annually.

There are things they can do. But they won’t do because there is no reward in this system unless you are looking out for only your own self interest, as the lending instituations and Congress are. “they” don’t care, which includes our elected officials, who incidently work for US and are accountable to US.

That’s what I’m talking about.

I’m curious how many ‘buyers’ are out there just waiting on the sidelines for the bottom. I am one of them. I’m assuming a good portion of readers to these blogs are as well. So I guess i’m asking about the Demand for housing right now.

While I can’t speak for anyone else, I know i’m extremely anxious to get in the Real Estate game. If it weren’t for blogs like this, i think maybe my greed might’ve gotten the better of me. So thank you, Dr. Housing Bubble, for continually making rational arguments as to the true state of the housing market and taking the emotion out of it. I am curious though…what about the others on the sidelines? Are they just knife-catchers in waiting?

Or are there enough people out there who have been saving for the past 2 years to be able to put down a decent down payment, and be able to secure a loan, and help stabilize the market? Again, maybe it’s just the greed in me, but i kind of feel there are more of us out here than anyone wants to aknowledge.

Yea Boy, all ya need is land! Cape Coral Florida is like #2 right now in the Nation for foreclosures. The loss of tax income has put a hurt on the local Govt. Yesterday’s paper says they’re contemplating an 85% property Tax increase!

And tell the investors of those securities that are backed by those mortgages you want to write down that you’re not gonna be paying them the amount you agreed to pay them, you know, those investors like CHINA! or how about the Government Pension Plans! You know those investors who are actually the real holders of those Notes, even though the Mortgage Servicing Companies SAY they own them, they don’t.

Wall St and Washington Ave. created this mess, they ought to pay for it.

Dr. HB, if you thought bottom callers were in the minority, please consider the following from Zillow dateline August 18, 2009: “But homeowners are more optimistic than ever about the future values of their homes, with 81 percent of homeowners believing their own homes’ values will not decline in the next six months – the highest percentage on record since the first quarterly Homeowner Confidence Survey, which was fielded in the second quarter of 2008. Meanwhile, only 19 percent of homeowners believe their own home will decrease in value over the next six months.”

Oh, and about that supply/demand thing, consider this from the same article: “When asked about future plans to sell, 29 percent of homeowners said they would be at least “somewhat likely” to put their homes on the market in the next 12 months if they saw signs of a real estate market turnaround, creating “shadow inventory” that could slow a recovery.”

Gotta love the United States of Delusion! Be brave Comrades!

Rule #2

Never listen to those folks who are interested in getting your money one way or another. Your ears may be widely satisfied by sweet words but your money drains into someone else’s pocket. Listen to these folks’ advice whose interest has nothing to do with your money or business.

I have been on the sideline for the past 6 years (2003? anyone?) but fighting with my wife on a regular basis who does not understand the rule even when I tell her to think about “Why?”. Well? What to do?

All the lessons of the Great Depression have had to be relearned in this Not-So-Great Depression. One thing we have missed is that the holding companies of Commercial Banks, Investment Banks and Insurance companies are perceived to be ‘too big to fail’ when the truth is they are too big to succeed. The nature of things is that complexity does not grow linearly but exponentially–the only way these creatures survive is if they have a stooge at Treasury writing them counter-party checks when they bet wrong. Investment? What a sham. Our human-survival subroutine has a fatal run-time error and we have just about consumed all of the processor’s resources. Almost time for a reboot. Better save your work in a safe place, if you catch my drift.

Green Shoots? How about 90 cargo ships floating around in Hong Kong waters because they have no cargo to haul…The only thing being transported is China hoarding tangibles instead of t-bills…

Housing bottom? You don’t jump out of a window on the 5th floor because it’s much lower than the 10th floor. The bottom is when it stops going down. You will know it in retrospect. If you can predict the future, just buy a lottery ticket–much simpler than picking the point at which a knife stops falling, and the odds are about the same you can do either.

@Susie Q

Looks like there is blood in the streets with the the little red forclosures. There are so many you can’t even see the cameo trash cans and window bars. Bet there’s a ship in LA harbor with a load of granite counter tops they can’t offload. Planet of the Alt-Apes is so scary I may have to hide beneath the seats or go out for more milk-duds.

Oh, and China is printing money faster than US because they try to keep their currency pegged to USD. If they don’t trash their currency as much as we do, their’s rises and they might not enjoy as much ill-gained trading advantage. How did that most-favored nation think work out?

Captian,

I’m one of those also sitting on the side line. I did my homework during the housing frenzy and backpeddled after figuring out the market was in a natural

housing cycle. And everyone and their great grandmothers were real estate agents with less than five years experiance. I believe people like us need to stay educated and aware of both economic and housing trends, and not give in to the NAR and media hype.In my opinion, web sites like this one are the best thing we can rely on for true concrete information on these trends. Hopefully there are more of us sitting tight and laughing at those who give in to their greed and ignorance of this whole mess.

Hang in there buddy, the best is yet to come…

We are going to see a massive switch in buyer psychology this Fall, as it becomes very apparent that Westside foreclosures are accellerating. Keep your eyes on Google Maps. Combined with job loss, tight credit, prices still fundamentally out of whack and the MSM, we are about 3 weeks away from the end of the summer selling season (Labor Day) . Soon it will be trendy for Westsider’s to talk about how much money they pulled out of their house and the total debt they are walking away from.

A harsh reality is about to wake people up….Hence the name

http://www.westsideremeltdown.blogspot.com

Those of you who post longer comments, please

use paragraphs. Thanks.

This is something we should truly be concerned about. Emphasis should be given here and the solution should be available soon. Thanks for sharing this. By the way, I know a great Kentucky home that might interest you too. Thanks

Well, now I know where some of those foreclosures are going. I had a conversation with a Chinese real estate lawyer the other day and he mentioned that several Chinese investment groups are buying up several foreclosures at one time from the banks with their cheap U.S. dollars and just sitting on them. The prerequisite for buying the properties is that they are located in a desirable school district and usually under 600K. That’s why it is exceedingly difficult to buy a presentable house in Arcadia, Temple City, San Gabriel, Walnut, Diamond Bar, etc. in this depressed market. It’s quite difficult to compete with these cash buyers. He also stated that there are waiting lists for families in large Chinese cities to move to cities in the above mentioned areas just for the schools and cultural similarities. Their Yuan has increased in value during the past year whereas if they buy a house here for 600K, that they are actually paying about 490K in U.S. dollars. Just amazing……………

Chipchick writes,

“There are things they can do. But they won’t do because there is no reward in this system unless you are looking out for only your own self interest”

If I understand your argument correctly, the half of mortgage-holders currently under or approaching the water line and “dead to you” and should get swept away by the next tide. But YOU deserve a handout because you did everything right and you can can your own vegetables, or something.

I’m kinda libertarian myself, so I understand where you’re coming from. People should stand on their own two feet, etc. But you want it both ways. You are the alpha and omega of the political system and it has wronged you by not recognizing that you are “deserving” and “worthy” of help in the form of lower taxes and stabilized home values. I’m in awe of your solipsism.

D!,

This foreigners buying up CA theory is just unfounded and stirs up xenophobia. what about immigration laws? I just don’t see how all these Chinese folks are going to immigrate (move their family) to the US? and if they are wealthy enough to be an immigrant investor (1mm dollar club) I just don’t see them buying a 600k house.

I live in the Sacramento area and among the people that I know, many (about half of my acquaintances) are either unemployed or underemployed.

Also, I keep tabs on the rental market and it is starting to be flooded by Baby Boomers, many are low income, underemployed families, and many singles are disabled.

One apartment complex that has all studios never had waiting list and was crying for tenants now has a long waiting list.

I have a friend who was looking for a rental house out in Yreka and they were ALL rented.

The market up here is now being flooded by renters, period.

D1, their yuan will deflate too. They have a similar bubble going on right now. The bare facts are that the US Fed should NOT have propped up the credit markets because its just prolonged the agony for everyone.

Land is only as good as the tax base. I’m fortunate that I live in a rural area that is reasonable on taxes. If that gets out of hand, I’ll be moving on somewhere else.

In the meantime, I’m selfishly hoping that everything goes bust and things right themselves to a more respectable price and that will force down the tax base by law.

Wiz, My husband and I have been on the sidelines for about 8 years. Each of us working professional (currently employed), no debt, excellent credit, plenty of savings for a 20% down payment. – BUT Prices in the decent areas of the OC are just too high! We are renting in old town Orange where very few houses on the market this summer have sold. The prices are absolutely unreasonable – No Thanks!! We are willing to be renters for another decade, if necessary ( even at are ages – 36 & 40). If your wife likes her lifestyle – she needs to keep waiting – being underwater in a “home” for many years would not be worth it!

Sometimes I fill I am getting insane and sometimes I feel like the only sane person in a madman house. What all those people buying right now are thinking is beyond me?

http://www.latimes.com/business/la-fi-home-sales19-2009aug19,0,5419938.story?page=2

Sales up, prices up!? WTF? Does the cheapest cookie cutter in Torrance for $550K seams like the bottom!? When this army of idiots will stop challenging my sanity?

Thanks to the Dr. HB to meet some of the sane people in LA like me that are about to loose their mind.

No WindyCity, you misunderstand. I don’t need the bail out, but a lot of others do. Why reward those who screw up? That’s what is happening and guess what you and I are paying for it. So, yes, I continue to pay my mortgage and also the rising taxes and other things because my neighbor drank the Kool Aid. The system is all bassackwards and its now penalizing those who have lived up to the terms of their mortgage. To help with the coming flood of people walking because they are +15% underwater, they need to act NOW.

Unfortunately, that is not going to happen. Its also happening with small business owners who are going to be asked to shoulder MORE taxes to bail the gov’t out of the extreme debt load.

Guess how many are going to stay in business????

And Windycity, your jealousy does not become you. This is not about me, but about the example of what SOME have done to avert disaster.

I think that everyone betting on spectacular failure on the side of China is just lost american guy concentrated on his belly button. Germany and France are out of the recession officially. They got in the resection 1 year later than us and are out now. China has for the second quarter 11% increase in GDP! Car sales are 70% up from same first half of last year! That much about how the world is worst s**t than us. And you thinks this is some mockery with the numbers on Chinese side think again, situation is the same in South Korea, Indonesia, Brazil, India, Singapore, Hong Kong, Taiwan…we are so alone in this hole gentlemen. And the reason is simple at the time of the easy credit years they were serving to produce the toys of the American consumer hamster. Now when this hamster is very tired (today’s data from retailers show sales down and down again) they are turning to feed their own domestic consumer hamster in order for their wheels to keep turning. And it works because their hamsters is young, not tired and under pile of debt. There is no reason to believe that this will not work for them for a while , since it was working for us for so long even not producing the goods and this guys are the producers…Here is great article in Economist

http://www.economist.com/displayStory.cfm?story_id=14209825

We are so alone.

Yeah, the formatting on my comment makes it very difficult to read. I used to “” html paragraph tags, but it didn’t work for some reason. I’m not sure what else to do to make it function on this site’s comment feature.

Cash flows get crimped due to delinquencies, property values and foreclosures causing the global economy to limp through difficult times.

Financing of properties is going through a huge restructuring process and the pricing should readjust to the new trends affordable by people. This transition is causing a lot of industries and job sectors to be totally wiped out.

Due to various disconnects in the industrial chain, job markets in various segments are drown, property owners are sunk in debts and lenders are sceptical to lend and bail out people from the difficult situation. The income to afford to repay loans is declining highly.

Only when the restructuring gets stable and the pricing reconciles and reaches an acceptable and affordable level, the industry is expected to recover. With the housing market in great trouble, moderately-priced apartments have become the core buy.

Most of the workers had to choose compromising on the wages forever as they feel that even at the end of this recession period, they may not earn as much as what they used to earn initially during their fruitful days. Another important point remains that since people have cut down on spending, many businesses simply may not have the scope to recover soon and hence, they may not hire new employees. For example, construction, hospitality and manufacturing industries depend on demand of the customers for their growth.

Read More: http://www.housingnewslive.com/articles/housing-bottom.php

@Wiz:

My hubby and I have been on the sideline too. Since 2001. We’re staying put in our rent controlled apt until prices become more reasonable. In the meantime we’ve had two fabulous kids, and can say that what we are looking for in a home has changed as a result. I’m so glad we didn’t buy earlier as we would not have been able to afford to send our kids to school if we were also burdened with an outrageous mortgage. Renting allows us to be more flexible and gives us more wiggle room should one of us lose a job. Taking on debt in this economy that one doesn’t need to is a mistake. I hope your wife will realize that waiting a bit longer will be well worth it. Good luck!

When……..

The Chinese are not buying California….. just in pocket cities or areas. I know, because I live in the middle of it! You have to remember, China is nowhere in debt like us. The populous SAVES MONEY, unlike us. The GNP in China is like ours used to be in the 1960’s! Along with some other countries, they will be the new MIDDLE CLASS buying things that we won’t thanks to the massive wall street corruption private fed reserve. Sure, their yuan might dip, but nothing like our ailing dollar. We’ll will have to earn our way out of this mess while people from other parts of the world will be buying up the for goodies for a while. We need manufacturing and productivity to be able to afford a decent house in a decent area. we have been slowly going backwards for over 40 years……….We have been victims of corporate profit and banker interest. Now there is nothing left but debt and a cheap dollar. WHAT’S THAT GOING TO BUY?

‘Most of the workers had to choose compromising on the wages forever as they feel that even at the end of this recession period, they may not earn as much as what they used to earn initially during their fruitful days.’

Exactly right, Real Estate Info. Hence the deflation we are experiencing in jobs and salaries/wages. My city has lost so many jobs that morning rush hour isn’t so rushed anymore. (I work in one of the top 10 dying cities). I thought it was just my imagination but on the commute to work, there really is a marked difference in the number of cars on the street. Even a co-worker mentioned it.

PARAGRAPH GUY

Just to let you know I always use paragraphs but for some reason when I post it all gets lumped together.

@Dan,

France, Germany and China are all such heavily government-manipulated economies they almost make US look like a capitalistic nation instead of an Obamanation. You think their banks aren’t so full of toxic paper they smell? They don’t have real-estate bubbles caving in? They’re probably not as screwed up as we are, but not shining examples of economic juggernauts either, although now the Euro gives them a more complex means of disguising fiat government stimulus shenanigans. Plus their currency is pegged to all the other EU states and their zombie central banks. Housing bubble in Spain? Think all EU states will pull their weight? We will see. China? Market goes up 80% in 6 months, down 20% in two weeks…they are anything but stable

I’m not sure “lesser Bards” is a good way to describe the authors of the two songs you mentioned. First of all, “Old Kentucky Home” is a minstrel song about slaves uprooted from Kentucky. Stephen Foster was a songwriter, not a poet. Some people get the two confused nowadays. See http://www.mudcat.org for lyrics.

Home Sweet Home was written in England by an American expatriate. The lyrics are more about roots than about real estate.

“Words by John Howard Payne, music by Henry Rowley Bishop.

Again from Mudcat:

The home that Payne wrote of was a little cottage in East

Hampton, Long Island. The song was first heard in London in his

play “Clari” in 1823. The air had appeared in an early

collection of Bishop’s as a Sicilian tune. The theme of the song

and the beauty of the melody have given it world-wide fame.”

How many songs with lyrics by Walt Whitman have you heard lately?

PS My Mom loved Whitman and had us read a poem by him at her funeral.

Least we forget that California has been on a 90 foreclosure moratorium since the middle of June.

http://abclocal.go.com/kfsn/story?section=news/state&id=6866754

All the phony numbers from the bean counters proclaiming the bottom is in should should have some nice spikes come fall/winter (unless they work their magic with numbers and/or extend the duration)

Me and my husband are renters. We almost commit to buy a house back in early 2008. Thank God we didn’t. We rent a brand new 4-bedroom condos in Monterey Park and lease out 2 other bedrooms. The builder of this 15-condos complex is a Taiwanese who hope to make a big buck during the heat. However, I’m still amazed by these Chinese people who are still buying these 600k condos. Since last Oct I moved in, they have been sold 6 condos already. The neighbor next to me bought the condos in “CASH”. I can’t believe why do people are buying a 600k condos in “Monterey Park” now!!! Three of my best girlfriends they all own a house or condo. They are my college friends who only start working for 2-5 years.

I guess the reason these Chinese people are still buying at this moment is because either they’re lack of information due to language barrier (I listen Chinese radio everyday that they broadcast wrongful information about the market) or because of peer pressure I guess.

Me and my husband will continue waiting till the housing price becomes reasonable or else we will just move to Texas.

I need some help. I’m newly married and my husband wants to jump into the market now. With all the reading on this Blog and the discussion of the devaluing of the dollar, I’m afraid to jump into the market now.

We did find a home we really love. It’s in the Inland Empire around one of its lakes. When first sold it was around 194,000, sold again for $240,000, then jumped up to $600,000, then to $800,000! It is currently on the market for less than half its last sale price. I might add the area has beautiful custom homes, amazing views of the lake, easy access to the freeway and urban creature comforts.

The home we’re making an offer on I feel could fall more, but the Inland Empire took the hardest hit and it makes me dizzy to think I could get a home that was formally $800,000 for less than half of that value. Also, we plan to grow old in the house and pass it on to the kids. Any thoughts about further falls in the Inland Empire (don’t worry I know this isn’t investment advice!).

Also, just to let you know, the bank is not releasing homes for sale to artificially create a scarcity of homes on the market with the intent of creating bidding wars on properties- and people are falling for it. They say entry level homes may have as many as 40 competing offers! Although I hear homes in the mid- to upper middle income range are less active. I wonder how long the banks can keep this up.

Leave a Reply