30 years of booms and busts for California real estate: What does 2014 have in store for California real estate?

For the first time in nearly two years the California housing market showed some brief signs of cooling. The median price dipped and sales slowed down. The mortgage rate turbulence of the summer is likely to show up in late fall since the process of buying a home with escrow takes a bit of time to register in the current data. Although this is a current trend in terms of sales and prices we’ve also discussed why it is unlikely that California baby boomers will suddenly unload properties in mass. These owners may have equity trapped in their home but the only way to unlock it is via selling the place or going with a reverse mortgage which is like raiding the bank before handing something over to your heirs. California real estate has been in a perpetual cycle of booms and busts for nearly 30 years. That is why it is interesting to see the 2014 forecast put out by the California Association of Realtors (C.A.R.). The forecast is modest yet past history tells us a different story.

California housing forecast – 2014

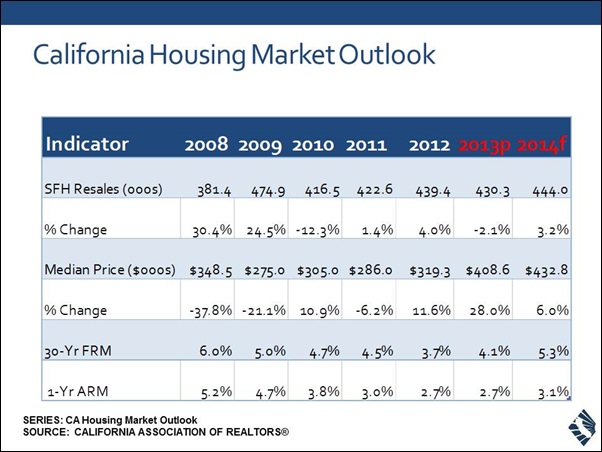

The C.A.R. released their forecast this month. Let us take a look at it:

This is an interesting forecast. The median price went up 28 percent in 2013 (the current median price is at $428,000 according to C.A.R. data so does this mean they are forecasting a dip by the end of the year before heading back up in 2014?). This forecast was only released this month. What should stick out to you is how erratic prices go up and down in California. Let us sum it up:

Annual price change (median price California):

2008:Â Â Â Â -37.8%

2009:Â Â Â Â -21.1%

2010:Â Â Â Â 10.9%

2011:Â Â Â Â -6.2%

2012:Â Â Â Â 11.6%

2013:Â Â Â Â 28% (IP)

2014:Â Â Â Â 6% (estimate)

What is telling with the C.A.R. forecast is that they are only estimating a modest price increase in 2014 even though sales are estimated to be at the highest level since 2009. Another thing that also stands out is the forecasted mortgage rate of 5.3 percent. This is nearly 100 basis points higher than where we stand today. Surely that would have some impact on price.

Given these kinds of cyclical behaviors in California real estate, it is unlikely that we will have a calm year coming off of what happened this year. The nature of California real estate seems to be euphoria, mania, and panic. Modest and calm are absent. The investor market is showing some serious signs of froth and if this group pulls back, the flow of the market can change dramatically.

Booms and busts for 30 years

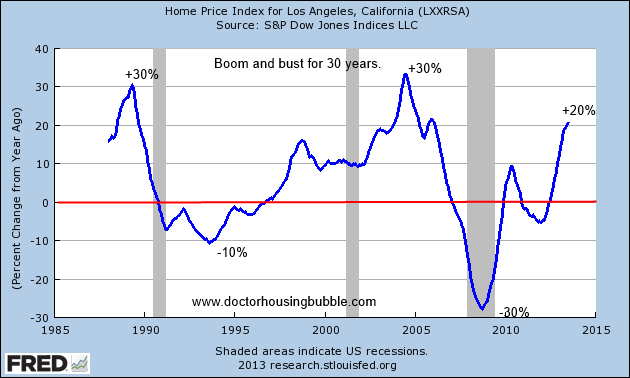

It is interesting to see speculation that somehow California real estate will suddenly become a calm market. When was it calm in the last 30 years? Just look at the LA/OC Case Shiller data:

Does the above look like a calm market? The chart above is looking at annual changes to the Case Shiller Index for Los Angeles and Orange counties. To the contrary, since 2000 the peaks and valleys have become more extreme. Clearly we are in the uptrend here but the rate is unsustainable. The C.A.R. has a forecast of lower prices by the end of this year yet rising throughout 2014. If rates go to 5.3 percent it is likely that prices will move lower, not higher given how much leverage is being utilized in the current market. You don’t think rates impact the market?

Mortgage applications and refinance activity falls hard

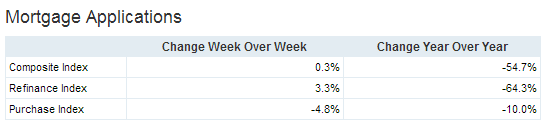

The higher rates in 2013 did impact the market. Take a look at refinance activity and purchase activity:

The refinance index is down a whopping 64 percent from last year. The purchase index is down 10 percent showing some softening in the overall mortgage market. Higher rates and higher prices are unlikely to be the case. This is probably why the median price actually dropped last month. We’ve been on a good run for a couple of years. If history is any guide, we’ll bounce around at the top a bit before correcting. By how much is the question. Of course never have we had roughly 30 percent of all California home purchases going to investors so this is a different beast. The lack of inventory and investor market is still the driving force here. Will this trend continue into 2014?

I think it is telling that the C.A.R. is actually being conservative in their 2014 forecast for California real estate. One thing is certain and that is California real estate is never a dull experience when it comes to price action. Now looking at the C.A.R. forecast, what are your thoughts on California real estate for 2014?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

33 Responses to “30 years of booms and busts for California real estate: What does 2014 have in store for California real estate?”

A 20% chop in prices would be healthy for all.

Papa – as somebody who will be selling in a few months, a 20% drop would be a bummer, dude.

PapaNow, just need prices to hold up a little longer.. Just mailed in my PMI removal request to my mortgage holder this week. Considering I’m about $8K away from it falling off from the original 2011 appraisal figure. Comps in my neighborhood are up 24% alone this year… so any appraisal using recent comps, would easily put me on track for PMI removal. Currently have a sub-4% rate and no PMI after 2 1/2 years. I wasn’t expecting that when we purchased with a 5% rate and $200 a month PMI in 2011.

Guessing out thought you were going to be able to buy a house in Newport Beach for $200 grand.

Central bank hot money is blowing real estate bubbles around the world. London prices up 10% in one month. Shanghai up 12% in one week. Here we go again !

http://www.zerohedge.com/news/2013-10-21/what-comes-after-bubble-london-home-prices-rise-10-one-month-shanghai-12-one-week

That’s beyond insanity…

“The nature of California real estate seems to be euphoria, mania, and panic. Modest and calm are absent.” Just like the people who live here. How can you predict the future in this environment? Throw the darts.

Money is only getting more and more scared by what’s coming out of govts mouths. Equities and real estate will be where it flows for a while. But only the higher qualities as it’s a parking lot for cash that can’t stay in a bank or govt debt.

I just went to a real estate seminar this past weekend. I have a back round in new home sales and large scale apt management and thought I could offer some guidance to my daughter who wants to get into real estate. I am a day trader now but I was blown away by what is happening in real estate now! I had no idea these banks are selling groups of homes for ten cents on the dollar to hedge funds and other banks.

Lets say Joe is in foreclosure with a loan balance of 300,000. The house is worth today for a quick sale is 100,000 no fixing up, straight out flip. The bank sells to a hedge fund or another bank for the todays flip price of 10 cents on the dollar. The hedge funds gets this home for 10,000. The bank then gets a kick back from the federal government for having that loan (bail out money that the tax payers are giving to these banks) and then they get an additional 80% of the total loan value , 300,000. The bank pockets 10,000 plus 240,000 for a grand total of 250,000. We are taking these homes away from the original owner for 10,000 and giving them to hedge funds to sell and realize massive profits. The owner in foreclosure has no chance of getting any kind of deal like this. They are told to suck it and move out.

This is an all out travesty of justice. The banks must be stopped.

Not enough: The bank owns the hedge fund too so it sells the mortgage to itself, pocketing most of the loan from taxpayers money as “loss” and gets to keep the house, now worth 10 000 in books but 10 times of that in real life. That’s why the house ex-owner can’t have it with 10 grand.

So the hedge fund (=bank) profits again 90 000 when they sell it, increasing total profit to 370 000 (10k internal shuffle). Out of 300 000 loan. With taxpayer’s money.

Richard Florida wrote an excellent real estate article on the winning and losing communities in the US. He’s not an Inland Empire fan:

http://www.theatlantic.com/magazine/archive/2013/10/the-boom-towns-and-ghost-towns-of-the-new-economy/309460/

I have one more thin to add to the other comment I just posted. In markets that are non-judicial states(California) meaning the foreclosure process is quicker and the banks sell those homes for more than 10 cents on the dollar. They may sell those homes as high as 50-80 cents on the dollar and actually make a profit on the total loan balance. So this is what the bank is making on your foreclosure. Same example Joe house is in foreclosure.

300,000 loan balance

100,000 todays flip price

80,000 80% of todays flip price is what the hedge fund pays and the bank pockets.

240,000 the bank gets kick back from government(FDIC loss share)our tax dollars!

The bank walks away from this deal with 80,000 + 240,000 for a total of 320,000!

That is 20,000 more than the original loan balance.

The hedge fund is happy to get this home at this discount and will now rent this home to you for top dollar!

Joe has no chance to save his own home from foreclosure for the reduced price of 80,000!

Americans are paying for the programs that kick out Joe from his home and give the goodies to banks and hedge funds!

Does anyone see a problem with this or is it only me?

“The hedge fund is happy to get this home at this discount and will now rent this home to you for top dollar!”

This is where it all falls apart. The market will not support higher rents and current rents are being inflated by the shadow inventory, investors able to hold empty properties with endless supply of FED bucks, any and all other mal-investemt effects of the Bernanke Mega Bubble. It works until it doesn’t. The doesn’t part is going to come even sooner as Yellin thinks turbo QE will make things better, when in fact it will only hasten the crash.

HOUSING BUBBLE 2.0 WAS CREATED FOR ONR REASON AND ONE REASON ONLY. TO CLEANSE THE BANKS BALANCE SHEETS AS MUCH AS POSSIBLE.

Mission accomplished. Now the toxic paper is held by THE bad bank, the FED, as well as Fannie/Freddie/FHA. Prepare for another housing bust that wipes out the specuvestors, but unlike last time leaves the banks unscathed.

@NihilistZerO wrote: “…The market will not support higher rents and current rents are being inflated by the shadow inventory…”

This is correct.

Assuming interest rates remain flat, for the C.A.R. numbers to hit the projections of a 6% price increase, they would need some combination of 6% wage increases, all cash buyers or profession investors (Wall Street hedge funds). This is highly unlikely because when interest rates went from 3.25% in May to 4.5% in July, the real estate market flat-lined.

What this interest rate change really implies is:

1.) Professional investors (hedge funds) are not buying in the pricey metro areas.

2.) All cash foreigners are a very small part of the market.

3.) Most of the buyers in the pricey metro areas are regular people with constrained wages.

4.) The huge run-up in real estate prices during the past 2 years was heavily driven by the interest rates plunging to all-time lows.

Good points. Can we take it one step further though and say QE was created to lower interest rates to (1) create a housing bubble to get bad loans off insolvent banks’ books; (2) keep our insolvent federal, state and local govts afloat by keeping borrowing costs/interest payments low; and (3) regardless of which party we vote for (if any), delay an economic crash and therefore keep a lot of politicians in office who otherwise would not be there.

@FTB

(4) Property taxes, Mello-Roos, and soon future government assessments, are based on selling price of a property so QE reinflating the real estate bubble means more $$$ for the (broken) state and local municipalities.

“Can we take it one step further though and say QE was created to lower interest rates to (1) create a housing bubble to get bad loans off insolvent banks’ books; (2) keep our insolvent federal, state and local govts afloat by keeping borrowing costs/interest payments low; and (3) regardless of which party we vote for (if any), delay an economic crash and therefore keep a lot of politicians in office who otherwise would not be there.”

A more gentle interpretation is probably in order:

1) Making extra capital available so that buyers can be found for ownerless properties. This will avert a crisis of dilapidated unoccupied houses leading to substantial real value destruction.

2) Inflation is also good for borrowers. The principal is reduced in real value. I’m not sure that low interest rates does much except encourage even more livung beyond one’s means. The Federal government is in a class by itself though on this. It prints the fiat currency. It can’t actually go bankrupt unless it wants to.

3) Yes, they were certainly trying to reduce the severity of the economic damage. Much here depends on whether you think that the apocalypse is inevitable or avoidable. I’m in the latter camp. Don’t damage the economy so much short term that so much value is destroyed that it takes forever to recover the lost ground. Use the value to push the economy faster than it otherwise might have.

Nonetheless, the Fed has been pushing so much liquidity into the market for so long, that i agree with many that some level of inflation is inevitable when people finally forget about the last crash, an effect not unlike the spring thaw. The last crash was particularly acute though, so I expect people to continue to be cautious for a quite a while. All and all, sanity is good compared to what we went through 1995-2007.

Yes, but it’s obvious that FED exists solely to make its owners ultrarich: they don’t giv a damn about state economy anymore: “Grab the money and run” is the politics as long as dollar as a currency exists.

It’s obvious tha FED is trying to profit as much as it can before it dies and they are not doing anything harming profits to keep it alive.

The FED is trying to profit? To what end?

If the FED wants to profit, it can just print money. Profit is meaningless to the FED. It is a money supply buffer. To some degree its purpose is to not profit, but rather soak up excess liquidity when there is too much, and provide some when there is too little.

May you live in interesting times…I have to pull the trigger next spring whether I want to or not. Rental price for the size place I need in L.A. is unsustainable for another year without danger to my long-term retirement plans so gotta do the best I can with what I have. I can put a bit over $100k down so I’ll have to see what that gets me next year and I’ll report back. Per everybody’s estimate, I make more money than most people ($125 to $225k year) but still won’t risk it all getting a jumbo loan. Modesty, along with honesty, is the best policy for me. Looking in North San Diego county area with pre-approval

It sounds like a rationalization of a purchase decision to me. I’ve been there and it takes one to know one. Just be honest with yourself. Northern SD County is as foam whipped as anywhere. Certainly if you keep it for 30 years you’ll be ahead but you don’t have to buy because rents are going up. You might be able to sell that story to your family though…..

Maybe Fenster, but the $4000 month rental on the Westside is making me and my investments mighty rent-poor. I’m an older person, so don’t have twenty years to put more money away. I will be buying my final house which I hope to live in the next 20 years til I drop in the dirt. Yes, NSD county is frothy too, but some areas are very obviously less manipulated that others. I’m hoping to get pre-approval from 4 places (one my current bank in Beverly Hills, 3 other local-owner banks) and speak to asset managers at those banks to see if they are interested in my chunks of money, my joining and giving to their small community, and if they know of any assets they may have in trouble that might interest me. Can’t hurt to try it…

P.S. Fenster, I’m a widow with kids grown so there’s nobody’s permission to get nor anybody I need to impress or convince. Just me deciding to end business in the big city and dial down the money going out so I can last another 20 years if I’m so lucky.

God strike me down. I twice agree with the C.A.R — 5.3% mortgage rates and 6% yoy real estate gains. Why gains? The new fundamentals will still be in play:

* restrained inventory

* global demand

* fear of “missing out” on “historically low” interest rates will cause a melt-up of demand in the face of rising rates

CAR is a propaganda machine.

6% might be right if investors continue to play the game, but in some areas I think an excess of rental properties on the market is slowing them down.

I’ve been looking in Fresno, CA since January in the 150k range for a 3/2. A move in ready home in that rough price range would not last 3 days on the market because of cash and high down payment conventional buyers. But since the summer, even remodeled homes in that price range are sitting for 3 weeks now. There is still low inventory. This is not a sign of a market that is going to increase 6% anytime soon. Maybe the specuvestors have gotten their fill. Part of that has to do with rental properties sitting on the market for weeks and months. Land lords are having to lower rents. Nice properties at really fair, affordable prices are going quickly, but so many are vacant.

I recently quit and have one foot in, one foot out. In January I could get a decent flip in an okay neighborhood at 130k at $70 sq/ft. Now the same type of property is 170k and more like $120-$130 sq ft. Quality of listings are decreasing, prices increasing, but perhaps this latest stall is a sign in won’t anymore.

It’s a tale of two cities in California. There’s the rich coastal cities where homes prices are rapidly escalating due to high demand from wealthy and upper classes from around the world and then there’s the poorer inland areas with more modest price increases.

Marc Faber, publisher of The Gloom, Boom & Doom Report, told CNBC on Monday While there may be little inflation in the U.S., Marc Faber said there’s been incredible asset inflation. “We are the bubble. We have a colossal asset bubble in the world [and] a leverage or a debt bubble.”

Back in April 2012, Faber said the world will face “massive wealth destruction” in which “well to-do people will lose up to 50 percent of their total wealth.”

It is just a question of time until it goes pop. Now CBS Los Angeles is stating that the big fish monsters washing ashore off Catalina foretell earthquakes. An earthquake(overdue for one) will reduce inventory further. CBS Los Angeles,” ‘Sea Serpents’ Or Harbingers? Oarfish Washed Up Year Before Japan Quake”

John Williams, of Shadowstats, has been predicting for quite some time that the early stages of hyper inflation will arrive in 2014. One could argue that QE is a hyper inflation precursor.

I’m firmly in his camp, so I think that tangible items are going to go way up in price in 2014 and beyond. Houses are somewhat of a hybrid. Obviously lumber, bricks, and glass are tangible, but highly leveraged borrowers are more of a financial being. So I think houses will go way up, but not as fast as purely tangible stuff, like gold, gasoline, grape gravy, etc.

The main case for hyper inflation rests on the fact that the ANNUAL federal deficit is about $7 trillion. The govt. claims it is ONLY $1 trillion, but that is phony Enron accounting that excludes off budget items, interest on unfunded liabilities, etc. Williams derives the $7 trillion figure directly from information available to the public on the US Treasury website.

Not surprised it is a senior making these comments. Is there any younger futurists out there that can predict where we step or fall off next. Turn the page.

I have my doubts about California. My father once said during a visit to my Bay Area home that it was a beautiful place but it was for young people as then was. It is increasingly a place of young third world people with affluent pockets of European and Asians. Moreover its economy is increasingly reliant on high tech hucksters, from Netscape to Netflix, instead of Hewlett Packard and Intel. Social media fads like Facebook and Twitter are seen as real economic powerhouses based on IPO share prices fueled by ‘temporary emergency measures’ of a Central Bank. Biotech has picked the low hanging fruit and companies like Allergan rely on Botox sales to the 1% because there is nothing in the pipeline that people really need like an anti Alzheimers or even glaucoma cure. What happens when the stock market corrects and all the high flying but profitless software companies flat line again?

Southern Cal is having their techno boom like Northern Cal had. All things come to an end some time.

True.. Venture capital has it’s limits, and we’ve all seen this before.

“What happens when the stock market corrects and all the high flying but profitless software companies flat line again?”

The same thing that always happens! Traffic in the Bay Area will improve for a few years.

Some people move away. Most find new jobs.

The thing is, if you are going to invest in a startup, where are you going to do it? The most innovative place on Earth, or somewhere else? So, the greedy money flows back in and the startups start up all over again. It’s a living. It isn’t required that the system actually make a profit, so long as the investors keep piling in hoping for windfalls. They are selling stock, not products.

Leave a Reply