California Housing Forecast for 2010: 5 Reasons why you Shouldn’t Buy a Home in California in 2010. 22 Percent unemployment and underemployment, home owned’ership, California Budget, Option ARMs, and Consumer Psychology.

Today’s data looking at the foreclosure filings for 2009 shows us that the housing market did not improve in 2009. In fact, it actually got worse even with all the government support and trillions to the banking sector. The stock market did go up but with nearly 4 million foreclosure filings in 2009, most Americans have seen their biggest asset decline in value. Also since the stock market low nearly 3 million Americans have lost their job which certainly isn’t a good thing for housing going forward. And keep in mind these foreclosure filings occurred while every imaginable bailout was given to the banks under the pretense that it was setup to help housing prices. Clearly it hasn’t. And why should it? Prices were in a bubble so all that additional money was a transfer to the banking sector. California had it even worse. In 2009 we had to patch up a $60 billion budget deficit and ended up going the way of Dumb and Dumber when we started issuing IOUs to people. Today we are going to examine 5 reasons why California housing is not going to recover in 2010 and why you shouldn’t buy a home this year.

Before looking at these reasons, you should always check on the track record of people. Given the 4 million foreclosure filings it is probably important to look at an article we posted back in July of 2009 predicting this number. In fact, the title is pretty self explanatory:

We were predicting between 3.5 and 4 million foreclosure filings for the year and reached the upper end of the target range. Keep in mind many people at the time were stating the recession was over back then.

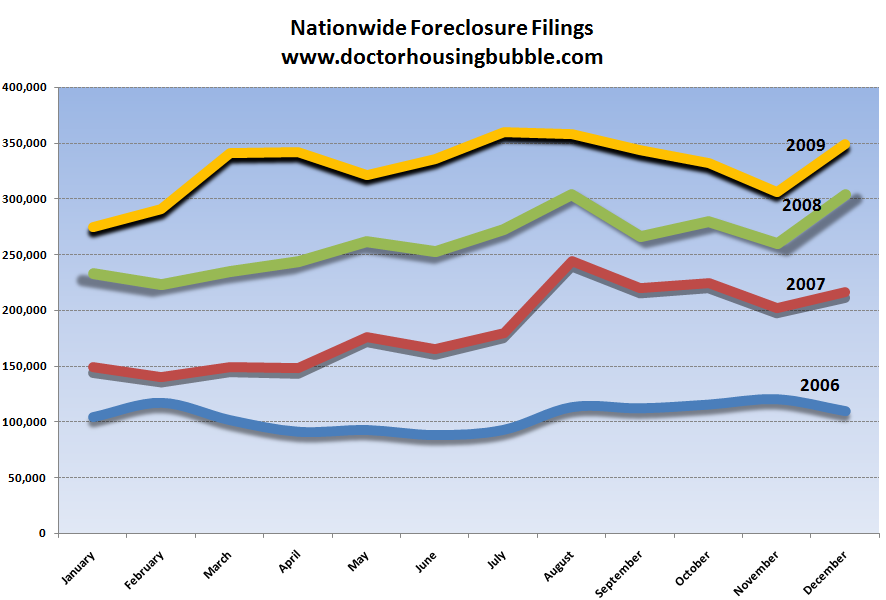

So let us look at the current chart of nationwide foreclosure filings:

Not only was 2009 the worst year ever on record with foreclosure filings, in December filings actually jumped yet again. This happening all the while Wall Street banks are dishing out record bonuses and going back to their casino antics. For good measure, S&P just went ahead and downgraded California (again) but at this point does anyone really listen to the ratings agencies? So let us examine the 5 reasons why California will see no housing recovery in 2010.

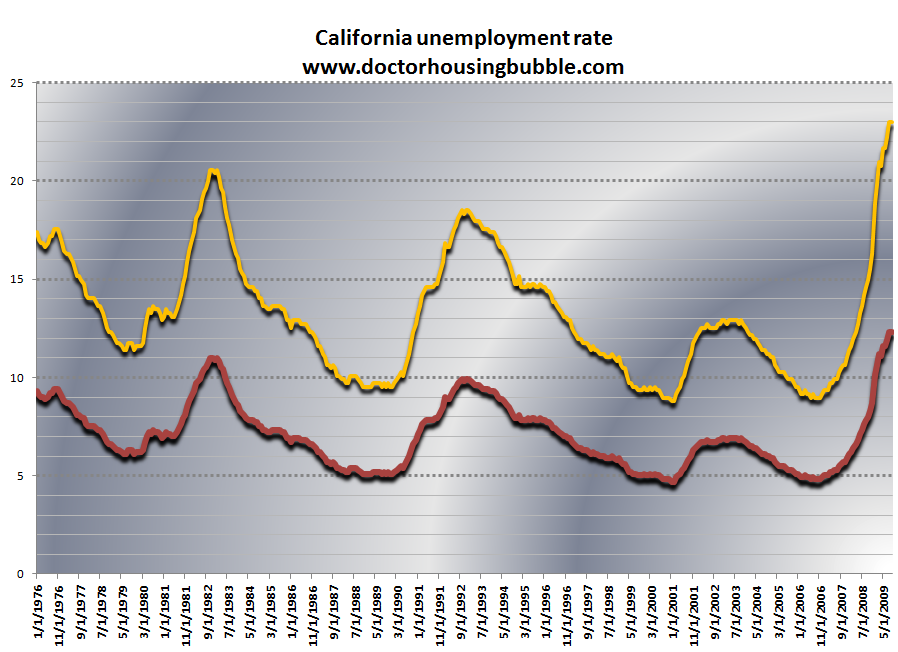

Reason #1 – Employment

Notice how so few people when talking about the recovery actually mention employment? Hard to mention employment when the unemployment and underemployment rate in California is at 22 percent. The recovery talk folks have yet to crack this crucial nut. Look, I’ll be the first one to say things are getting better but I have to see the employment situation improving. And I don’t mean by firing someone making $75,000 to $100,000 a year to suddenly taking a temporary Census job making $15 to $18 an hour. Is that enough to buy those bubble priced homes in California? Absolutely not. In the L.A. area you have 10 people competing for every 1 job opening:

“(OC Register) Job seekers in the Los Angeles area face one of the toughest markets in the country with 10.43 people competing for every advertised vacancy, according to the latest report from job search engine Juju.comâ€

Now doesn’t that sound like a recovery? What nonsense. In fact, when we actually look at real world action the data is totally different:

“(OC Register) The Orange County Sheriff’s Department cut off applications for its new civilian jail jobs just 36 hours after opening the positions last month.

Sheriff’s officials were hoping to get 500 applications for the next class of 50 correctional services assistants, said spokesman John McDonald. They got the 500 applications in less than two days.

“It surprised a lot of us here,” McDonald said.

The newly-created positions are for civilian employees who will assist sworn personnel in the jails.

Pay ranges from $37,211 a year during training to a maximum of $56,992. They also get county health and pension benefits.

The jobs that were offered last month were the first ones open to all applicants. The department’s first class of 23 men and women was drawn from internal candidates. They graduated Dec. 29.â€

Does that pay range look like enough to buy the median OC home of $432,250? The facts show us a very different story and it isn’t exactly screaming for you to buy a home.

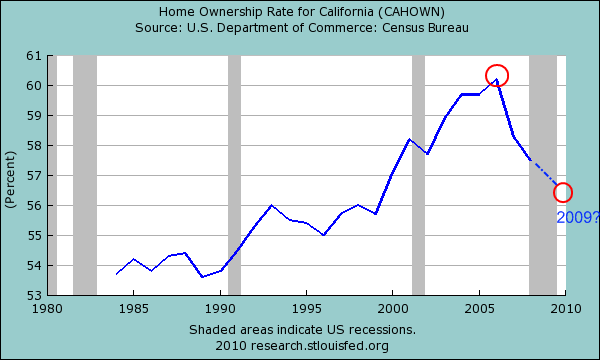

Reason #2 – California Home Ownership

People forget that California has always had a large renting population. Even at the peak of this massive housing bubble, California had a homeownership rate of 60 percent. Since that time, it has steadily declined. The above chart only goes up until 2008 so we know that when 2009 data is released that this rate will show an even wider decline given the massive number of foreclosures. Also, with Alt-A and option ARM challenges in 2010 this number is going to go lower much quicker.

But more importantly, why would anyone rush to buy a home right now? Every economic indicator is pointing to continued weakness in employment and the housing numbers. Buying right now is merely speculating and home prices are still in bubbles in many California cities. From what I have been seeing many people that have been patiently saving want to jump into higher priced areas with massive shadow inventory. This is no different than the person who took on an Alt-A or option ARM expecting prices to go further up. I mean if you were expecting home prices to decline in these areas in the next one to two years then why in the world would you buy right now? Because you need to set your roots? A nagging spouse? Your realtor has the inside scoop? You need to feel the “pride†of homeownership? All indicators tell us pricing pressure is to the downside. That is not an economic reason to buy a home but an emotional decision. Go ahead and buy, people don’t really care but don’t try to justify the financial numbers because they will not work in your favor.

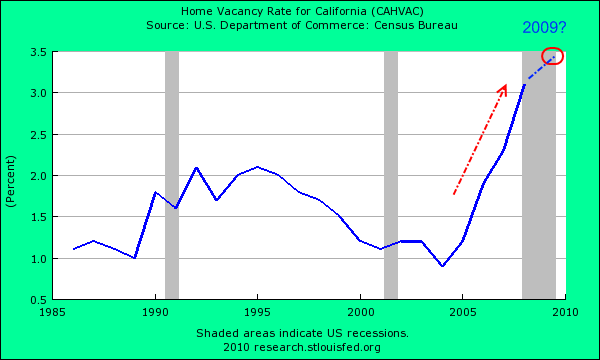

Pricing pressure is now assured because of the massive rental market and jump in vacancies:

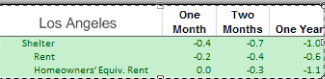

This is the highest vacancy rate on record for California so rents have dropped in the last year. I remember during the bubble people saying, “my landlord keeps hiking that rent so I should buy.â€Â Now, if your landlord hikes the rent just find another rental of the thousands that are out there. Heck, many of the all cash speculators are buying homes to rent out before we have another bubble! Good luck with that one. In fact housing prices have fallen both for rents and home prices in L.A.:

So the rush to buy flies in the face of the above data.

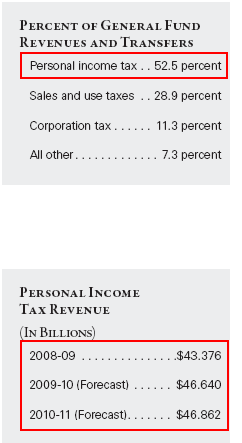

Reason #3 – The California Budget

Now do the quick math with the recent budget proposal. If California is still near peak unemployment and over half the general fund revenues come from personal income tax, then how can things be getting better if your largest source of money is constrained? It can’t. That is the bottom line. That is why the new budget proposal includes additional cuts (aka more jobs gone) to an already weak work force. Yet this is good for housing? Try doing the math on that one.

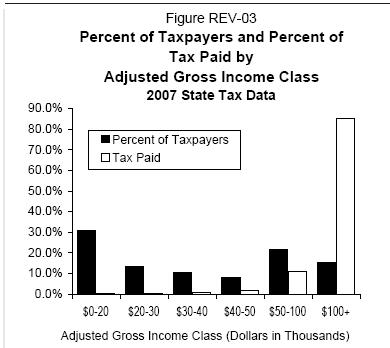

And here is even more interesting data:

Those making over $100,000 a year pay 84 percent of the income tax revenues. Keep in mind however that sales tax is up to 28.9 percent and this tends to hit everyone more regressively. Obviously someone making $50,000 a year buying a flat screen is feeling the pinch more than someone making $500,000 a year buying the same television. And very few actually fall in this category of high income earners. Basically less than 20% of taxpayers pay 84% of all personal income taxes. So as long as the stock market casino keeps going up, then California should expect higher income taxes but keep in mind many pay only 15% for capital gains (and let us be honest, the entire stock market is running like a casino).

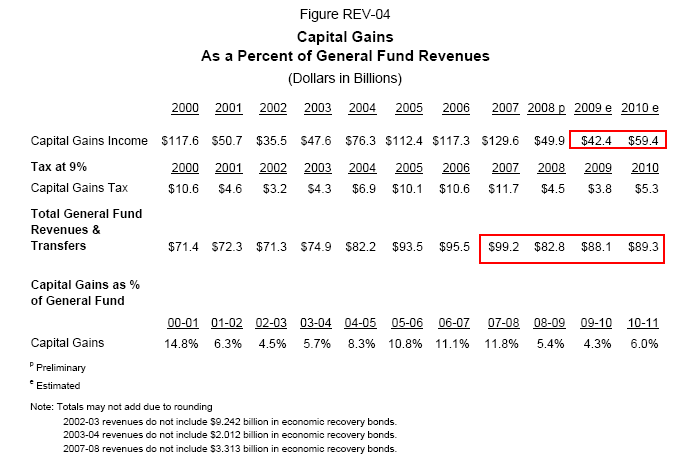

What about selling your home? You can keep up to $250,000 (individually) or $500,000 (married) in gains tax free if you lived in your home for two years but good luck in this market. The bottom line is the state is basically depending on casino like income from massively volatile sources of revenue. And don’t kid yourself, there are many people living off cap gains in California:

Just take a look at 2007. Some $129 billion in capital gains were made by Californians paying out $11 billion in taxes. In 2008 this number collapsed to $49.9 billion pulling in a tax of only $4.5 billion. But you have to think of what these gains came from. High flying bubble crony companies like Goldman Sachs that actually bet against you, the average American that home prices would collapse for example. These are the people getting bailed out by the U.S. Treasury and Federal Reserve. The state is betting on revenues going up but nothing like the bubble days. In fact, no projection has a revenue stream that looks like 2007.

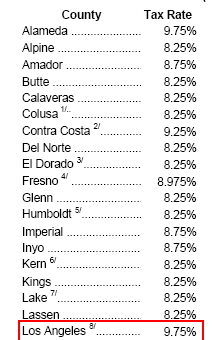

And keep in mind this collapse in tax revenues is coming while tax rates have gone up:

During the holidays I laughed when I look at my sales tax figure on a shopping receipt. So we pay one of the highest state income taxes plus one of the highest sales taxes. On the flip side, we have one of the lowest property tax rates that also helped launch this bubble (Texas has a 2.7 to 3 percent property tax rate and look at their housing market).

So California has two ways to balance the budget. Raise taxes even higher (which we have done) or more cuts (more unemployment). Either option is bad for the housing market.

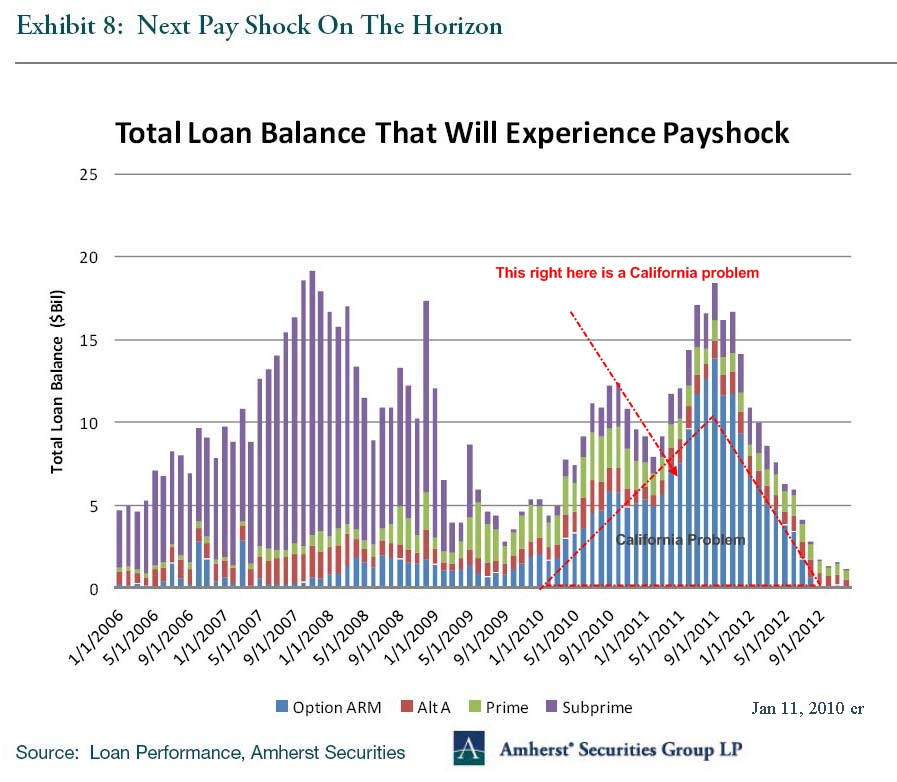

Reason #4 – Option ARMs

A few of you have sent in this updated option ARM chart that just came out a few days ago (updated). The bottom line is that triangle of pain is pretty much a California problem. California holds nearly 60 percent of outstanding option ARMs. The chart hasn’t changed much in the last year because the last option ARMs were made in 2007 (they have now been officially banned in California). These are going to hit in mid to upper priced areas thus adding more inventory to markets where prices have been more stubborn in coming down. But as we have mentioned before, home sales in these markets even at lower prices will pull the median price up (assuming sales volume at the low end drops or stays at current rates). For example, say a Culver City home that has an option ARM, forecloses and then sells for $450,000 from a peak of say $650,000. Still a higher price than the region but the city median is over that. So the city will see a median price drop if enough of these sales occur but the overall region will jump up because the median for SoCal is $285,000. Any home sales over $285,000 is going to help the median go higher.

And many people have already told me they are going to walk away this year. Every week I get a few e-mails like this. If they are telling me this you can imagine how many others are out there. Those with option ARMs are so underwater in California that it is probably a lost cause. The only question that remains is what damage will result from these homes.

Reason #5 – Consumer Psychology

People are getting more comfortable walking away. In fact, a few years ago this was the Scarlet Letter but now, people will look at you and say, “why in the world would you keep making a payment on an underwater home?â€Â The moral argument is weak. Our government and crony Wall Street with weak leadership have shown the country the gambling road ahead. To ask people to pay while they roll around in their massive ill-gotten bonuses is the height of hypocrisy. I have even heard from people that this bubble crash was completely deliberate. How so? Some think that Wall Street allowed Americans to fund their gambling ways; now with a massive panic and crash in prices only those with money (Wall Street) can buy up fire sale homes at rock bottom prices. Now this is a stretch but someone telling me a home in Compton would sell for $500,000 was hard to believe only a decade ago. Some looking to buy in the Inland Empire have e-mailed me telling me that for some properties, only all cash buyers are being considered. So much for helping that young family looking for a moderate priced home.

In the end, people are tired of the gaming. Some want to jump into the shark tank and go against all economic data. Go ahead. Systems like this don’t usually last long. After the Great Depression we had serious real reform. Over two years into this crash we have yet to see anything significantly change.

The California psychology is very different. I expect a more hesitant buyer going forward. With no expectations of massive home appreciation less will choose to buy. Some will decide to wait until the market stabilizes. Those with adequate income and jobs are even hesitant because of pay cuts or hours being tentative. For the above reasons I see no reason to buy a home in 2010 in mid to upper priced areas in California. At the lower end you may find some good deals but you are competing with all cash buyers and banks love cash as we can see from them sucking the taxpayer dry with trillions in bailouts.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

56 Responses to “California Housing Forecast for 2010: 5 Reasons why you Shouldn’t Buy a Home in California in 2010. 22 Percent unemployment and underemployment, home owned’ership, California Budget, Option ARMs, and Consumer Psychology.”

In the last 60 years, the unemployment level has had the highest correlation to residential real estate prices in CA, compared to any other factor. But what if mortgage interest rates rise? Or property taxes are increased by raising “fees”, as well as other govt related add-ons. The state of CA is busted and has one of the highest unemployment levels in the country. Oh, and it’s darned expensive to live here, too. DONT BUY IN 2010. Things are not good.

I am one of the “idiots” who just bought but the way I see it I can’t lose. I bought a house in the Inland Empire for $160K(built in 2005, 1900sq.ft.)….I make over $100K at my day job plus I have a side business that bring in another $40k…I got a rate of 5.5% and had to come out of pocket a lil over $7,000 but I’ll get that plus a lil extra back from the tax rebate…..I’m 30 years old with no kids so if in a year or two I find that it doesn’t work out then I have no problem walking away…I discussed this with my parents (who live on the east coast) several times beforehand and they agreed it was a no-brainer but if I missed something then someone please enlighten me…even if it is too late now.

And FYI…Ideally I would have liked to bought something in the Pasadena area….but the prices are still delusional.

Agreed about the ‘hesitant buyer’. Having waited out the boom/bust market over the past 5 years.. I’m willing to wait a few more years to purchase. Rents (on great apartments in great areas) are falling, but house prices remain stubbornly high. What’s the hurry. Low rates? 8K tax credit? Commercials from the NAR? LOL. Its amazing how many of my co-workers who purchased houses over the past few years used ARM loans and are paying over 50% of their take-home to cover their mortgages. Now with the equity faucet all dried up, these same brain-iacs are considering walking away from their loans. Simply amazing and yes.. reckless.

California is at the beginning (although some might say it started much sooner) of a decades long decline. Because this recession is a long one to be sure, because many industries went under for good, because we’re so bankrupt, and because our choices of how to handle our bankruptcy (massive cuts to higher education), will put the final nail in this states coffin. When we don’t even have an educated workforce to offer, what will we have?

Although if you don’t mind living in a state that is starting a long decline, we have nice weather, the mountains (when they aren’t burning down) and the beach :). Many 3rd world countries also have nice beaches though, and they are cheaper.

Don’t buy real estate on either coasts.

Great post Doc, but I have to take issue with the quote from the OC Register about 10 people competing for every job. I find it highly unlikely that each job seeker is applying for only one job. If 10 people all apply for 10 different jobs, that could be construed as 10 people competing for every job even though each of them can really only accept one job. Therefore, this would be the equivalent of one applicant per job. I think that ratio is quite skewed.

On another note, with an ever increasing number of people with solid employment and income walking away from their homes, thus removing themselves as potential home buyers for the next few years, is the market for rent to own homes going to increase? The way I see it, several people walked from their homes because they saw the same house they paid $500k for selling for $250k and they just didn’t want to throw their money away any longer. So they walked away and rented a home just as nice as theirs for half the money. A person in this situation is probably still interested in being a home owner but now has to wait 3-7 years to buy again. This seems like a great opportunity for a landlord to rent a home at an increased price for the commitment to sell at a fixed price at some point in the future. This way, the landlord increases his rental income immediately, has increased confidence that the home will be well cared for, lowers the risk of an extended vacancy, and is protected from a further fall in real estate prices. Even if prices lower to a point at which the renter/buyer decides not to exercise their option to purchase at the strike date, the landlord has benefitted from an increased rent and lower vacancy period over the period of the purchase option. Am I off base here?

Good article except for reason #2, Calif Home Ownership %. You mention that rents are going down in that discussion, which would obviously affect housing prices over the longer term. However, you don’t explain the connection between home ownership % and housing prices.

Looked at from an investment perspective, the average prices of homes should depend loosely on capitalization rate and rents. Rents are a function of the population size, number of homes, average number of people per home, and desirability of the property, among other factors.

Maybe having a lower home ownership% would lower housing prices by lowering the cap rate, or increasing the number of people per home, but rents should not be affected.

Let me get this straight, you bought a $160K house (must be a dump but that’s a different story) and borrowed against it while you make 140K / year? You ought to get the smart allock award of the year my friend… unfucking believable folks.

Believe me, I HATE that I have no choice but to buy, and within the next handful of months. Hubby lost his job a year ago and cannot even get a callback let alone an interview (he’s told he is overqualified for everything), and now the money we had saved for just such an emergency is about gone. My job is in no peril, but I only make 67k per year…and that doesn’t cover our eye-popping rent on this house. It’s far cheaper for me to buy than rent another house. I currently pay $2,450 a month for a 3+2 with a 10k yard, two garages in a great part of Granada Hills North. Renting another house makes no sense, as all that are large enough to accomodate us and our 3 kids are renting over 2k per month, and that’s no improvement. I have 20% down to buy…but prices in the valley on the lower end are being pushed UP, not down. The market is psychotic here, clogged with people like me being beaten out of low-end homes by cash investors and flippers. I have been priced out of every area (except those too dangerous to consider) in the Valley. I may have to actually buy in Palmdale – I work in Hollywood – which is a worst-case scenario.

The point is, some of us HAVE to buy right now. We’re not happy about it, but that’s the reality when a 2-income family becomes a single income family, and the job that was lost was the much higher paying one, with no prospects for us to be 2-income again in the forseeable future. Recession? Hardly. It’s far worse. For those of us living it and paying attention to what’s happening not just in the USA but globally, this is no Recession – not unless the word has taken on an all-new meaning.

William. You missed the point that DHB mention that you might find some good deals in the Inland Empire. You might however compete with cash buyer though. I think you did the right thing especially if rent is close to your buying cost.

Comment by CAE

January 14th, 2010 at 6:48 pm

In the last 60 years, the unemployment level has had the highest correlation to residential real estate prices in CA, compared to any other factor. But what if mortgage interest rates rise? Or property taxes are increased by raising “feesâ€, as well as other govt related add-ons.

>>

___________

(1) Interest rates go = sticker price of the property goes down. Figure 110% drop in the sticker pricer for every 1% rise in the interest rate. (Works the other way too – 1% drop in interest = 10% rise in price.)

>>

That monthly payment MUST reflect the amount that households can pay. And it doesn’t matter how the total monthly cost is divided up amonth the parts which make it up: principal, interest, taxes and insurance.

>>

Since interest rates will pribably get back into that 6 1/2% range in the next 18 months or so, figure you will lose $16000 from what you paid.

>>

(2) I notice you said “walk away” and no “Sell it.” If you would go to sell it , keep in mind that the realtor is going to sink their claws into 6% of the sale price. If you sold for what you paid, that means the realtor snabbles $9600. And then there are the closing costs, title, deed prep etc so figure another $2000. If you tried to sell it next week, you wouuld have to come up with $11600. You are ALREADY underwater – unless you can find someone to pay $6000 or so more than you did.

>>

SO interest rates go up – pretty certain according to comments from the Fed and FOMC – and go up even 1%. Now the price of the property drops to $144,000. (Sure won’t hold steady since incomes are not rising to pay you 10% more!) Here is the math:

>>

Paid $160,000

Down $7000

Mortgage $153000

>>

Interest rates go up 1%

>>

Value now $144000

>

Versus

>>

Realtor costs $8640

Closing cost $2000

Bank owed $153000

>

TOTAL OWED AT CLOSING = $163640

>

Underwater by $23640

>

Say rates don’t go up before you go to sell and you sell for what you bought at -$160,000. Do the math. Bank owed $153000, realtor gets $9600, closing costs $2000 = $164600 owed at closing – buyer paying $160000 = you have to come up with $4600.

>>

So here are the consequences when you need or want to move:

>

(1) rates are the same and price the same: You have to kick in another $4600 to sell it.

>

(2) rates go up, price goes down (sort of like gravity in the consistency of the rule). You have 2 choices:

>

(a) You have to come up with another $23460 at closing

>

(b) You walk away.

>>

No good option that either doesn’t mean you take a hit one way or another.

Too many holes in the dike, only so many Dutch boy’s fingers. When this busts, head for the hills and not Beverly.

California prices will drop for the same reason they went up – herd mentality. Everyone wanted to get in at any price, now they simply MUST get away from this destable real estate! I say, take advantage of it and buy.

The fact is that population is growing and the supply of housing is not. People want to live in Cal and this will drive prices. Look how high they remain even in less desirable L.A. suburbs.

Any of you watch the Rose Parade? See how sunny and clear it was? Think it was about 80 degrees on christmas. Bet a lot of people in the country started thinking about a move.

are you SURE it is cheaper to buy than to rent a house? I seriously doubt it if you run the actual numbers and include property taxes, the “loss” of your down payment for other investments, the maintenance you will have to do on the house you buy that you would not have to do if you rent, and the insurance you wil have to pay for that you do not if you rent.

Comment by TakeFive

” Look how high they remain even in less desirable L.A. suburbs. ”

My God, are you not paying attention?

Do you think, there may be an itty bitty possibility that statement is true

because of the trillions our Gooberment is spending trying to keep them up?

You may be exited prices are strong with the 8500 tax credit and the 1.5 trillion in mortgage backed securities and the foreclosure moratorium, but I think it is impossible to interpret market signals with all this Bologna going on.

You are right, California is very desirable and that is why it has always been more expensive than most parts of the country and it always will be but by 3 or 4 times? I don’t think so.

TakeFive–

Supply of housing is dwindling? Everyone wants to live in California? What are you, a member of the NAR? This is the same garbage that fueled the bubble in the first place. Get lost.

To Takefive:

Yeah, so explain to us why Florida real estate is in the middle of a half off sale with all the boomers going into “retirement”, and the market is still ugly down there and getting uglier. It’s not as though there isn’t a long history of migration to the Sunshine State by the nearly dead. A sunny day still won’t make for a decent down payment, or move your MacMansion up north.

and, to Marcy

wow, that is some screwed up logic you’re displaying there, that you “HAVE to buy right now”. But it helps explain the wacky psychology that fueled this bubble and keeps it pumped up. Just stunning.

TakeFive –

Actually, the population of the U.S. is seeing the light – in 2009 more people moved out of California than moved into California. The only reason why the population grew at all is because of immigration – most of whom are illegal and are working at slave wages – hardly enough to be able to afford a $500,000 home – or even a $300,000 home.

And the supply of homes is growing, not decreasing. Prices are dropping in the “less desirable” neighborhoods as well as the more desirable neighborhoods. Case in point – just this morning I was notified that a property I’ve been watching in North Hills (2000 sq. ft. townhouse, built in the ’90s, it’s been on the market for almost a year now) reduced its asking price from $275K to $267K. Does that seem like property is in short supply? Supply is so short that a near-new construction townhouse priced lower than the median asking price has been on the market for over a year? The fact is that demand is low and supply is high.

And yes, some people watched the Rose Parade and said “it sure would be nice to have that weather”. Then they looked into a move and discovered that instead of being living in a brand-new 2500 sq. ft 4 bed/3 ba home on 1/2 an acre with access to stellar public schools, their income in California would allow them to afford a pre-1950 1000 sq ft. 1 bd/1 ba apartment in a crime-ridden neighborhood, where their children would have to go to a public school with fences and metal detectors. Move cancelled.

You are moaning that you can’t support your family on 67K a year? You need to look at your budget. $2,000 rent is a third of your income. That’s totally doable. Where does the rest of your money go? You have no emergency fund but you have enough for a down payment? I make $65K, also have 3 kids, no down payment, no emergency fund, live in Garden Grove. It aint’ no picnic, but everyone’s fed, clothed and educated.

either he pays the fed’s on 4/15 or pays a mortgage payment. why walk away assuming you have FHA loan at 5.5% you can rent that home and breakeven, plus get year end tax benefits.

Quote of the day folks:

“And yes, some people watched the Rose Parade and said “it sure would be nice to have that weatherâ€. Then they looked into a move and discovered that instead of being living in a brand-new 2500 sq. ft 4 bed/3 ba home on 1/2 an acre with access to stellar public schools, their income in California would allow them to afford a pre-1950 1000 sq ft. 1 bd/1 ba apartment in a crime-ridden neighborhood, where their children would have to go to a public school with fences and metal detectors. Move cancelled.”

Marcy –

Your reasoning as to why you HAVE to buy a house right now is ridiculous.

If you’re willing to buy in Palmdale, why not rent in Palmdale? You’re willing to part with a 20% down payment, probably at least $40,000, in order to purchase a house that will only drop in value. You said that your husband is out of work and has no prospects. Why not save your money (you said that your reserves are almost depleted), and rent in Palmdale, where you can get a nice 3 bedroom, 2 bath house in a gated community for about $1,300. If you buy now, you will lose your downpayment and be underwater on your loan within a year or two. Then you’ll be wishing you had that $40k back.

Comment by Partyboy

January 15th, 2010 at 2:42 am

Great post Doc, but I have to take issue with the quote from the OC Register about 10 people competing for every job. I find it highly unlikely that each job seeker is applying for only one job. If 10 people all apply for 10 different jobs, that could be construed as 10 people competing for every job even though each of them can really only accept one job. Therefore, this would be the equivalent of one applicant per job. I think that ratio is quite skewed.

>

__

>

No you are wrong,

>

That is not how the ratio of job seekers :: job openings is calculated. It comes fromt the JOLTS data – part of the BLS. It takes all the available job openings and compare it to how many people are seeking work or a different job (see definition of ‘unemployed” and “under-employed” as in ‘want fulltime have only gotten part-time.) The data about how many job openings there are in a given month is gathered by a specific business survey for the purpose of the JOLTS data.

>>

And yes there really can be 10 job seekers for every job opening in a specific geographical area. Nationally it is around 6.23 or 6.73 this past month (can’t remeber the specific fraction but it is well over 6 per opening.) As some areas will have fewer than 6 per opening (think Montana or other place where unemployment is low but no one in their right mind would live), then some areas will have more job seekers per opening.

>>

So you statement is wrong about how the 10 per opening was arrived at and given the level of unemployment, under-employment and discouraged workers in CA, that would sound about right for that area.

Comment by TakeFive

January 15th, 2010 at 10:58 am

The fact is that population is growing and the supply of housing is not.

>

___

>>

Utter totalt NONSENSE and premise that is so full of holes it could pas for swiss cheese.

>

Doesn’t matter how many people there are. What matter is how many have an income to pay the purchase price.

>

You can’t sell the Hope Diamond at auction in a football stadium packed to standing room only if everyone there doesn’t have the income to pay for it.

>>

And in case you hadn’t noticed, CA has been losing population or barely staying even the past couple years. And it definitely has gone negative on the number of middle-income households – those have been DECREASING as they leave the state, not increasing.

>>

Sunshine, 80 degree days? Try smog, horrible traffic jams, endless driving to get anywhere, high crime rates, non-English speaking population, totally non-functioning state government, looney meddling busybody laws and legislation regulating everything people do, nasty vindicitive society that locks up more people per capita than anywhere else in the world, horribly high housing costs compared to the rest of the US……yeah right. Companies are going to move to California and run a business when they can’t afford to pay enough so that even their middle managers can afford a house……..

Marcy if you just ‘have to buy” then by all means buy. It is a personal decision. It’s like my cousin who just “had to buy” an expensive $900 purse. But by all means, if the market goes against you, don’t blame anyone else but yourself.

Any financial decision made out of fear is probably the wrong one.

Marcy,

That was probably the oddest arguement for having to buy that I’ve ever seen. Nowhere in that entire post did you give a reason why you haveto buy now. Explain how a member of the family losing their job somehow makes buying a home a prudent financial decision?

Gov’s solution to housing inventory problem:

http://www.latimes.com/business/nationworld/wire/sns-ap-us-urban-neighborhoods-michigan,0,7526693.story

I see where this administration is going; artificially inflate demand and structurally remove supply to restore the market. It’s kinda like a cash for clunkers for homes. These guys are playing with fire…

William,

Buying in the Inland Empire is unlikely to be a bad idea as buying costs around the same as renting which no reasonable person can argue against.

This article was about the mid to high end which is still wildly expensive. In my area a decent house sells for around 20 times median income (or 12 times income for a median priced property)

Even if prices drop by 30% in you area it is a big “who cares” when your rental options are priced similarly.

My Brother-In-Law bought a house in the eastern San Gabriel Valley a year and a half ago. During his house hunting, he put in bids on about 5 houses that were in some stage of foreclosure. He didn’t win any of them. He finally wound up buying a house from an old woman who owned her house outright who was moving out of the area. He paid about the same for that house as his bids on the financially troubled properties. Most of the properties he lost on were bought by investors from abroad. He had a very big down payment, so I don’t think that financing was the problem that caused him to lose the bids. More like some kind of cronyism? Maybe so.

There are a lot of US dollars abroad, particularly in Asia (in one country in particular which shall remain nameless), that need to be invested in something that is being sold for dollars. US goods are mostly priced out of those markets, t-bills are paying next to nothing and the financial equities markets may draw too much scrutiny, so buying houses in areas that Asians might want to live in is where that money is currently going. So as long as there is fear that our government is going to debase the currency, there will be seemingly economically foolish investing in choice California Real Estate. Those folks really don’t want to live or invest in Hesperia or 29 Palms, so you’ve seen those prices come down.

So I guess it really doesn’t matter that we can’t afford these houses as long as there is someone who can afford it who wants to park money in them.

Reason #6: Continuing higher gas prices in 2010 will be body blow after body blow to the economy that is already in critical condition.

One way the price of housing can go up with rising interest rates:

Chinese dump the dollar and start trading the bonds for property – ouch!

AnnS,

Thanks for the info on how the ratio is calculated. Just for fun, I looked up Irvine, Ca on monster.com and it showed 3706 job postings. So to match with the number from the OC Register, there would have to be 37,000 people applying for these jobs. Does that sound likely to you? I’m not saying it’s not true, but it’s seems exaggerated to me. Actually, I believe there are that many people looking for those jobs, but not 37,000 qualified people.

The problem, in my opinion, is that there is an excess of unemployable people, not a shortage of jobs. If you look on any job board, you will find a plethora of good jobs available. The issue is that the unemployment numbers reflect people who WANT jobs and can’t find them instead of people who are QUALIFIED for jobs and can’t find them. I know this is not always the case, but there is an excess of lazy, underachieving people out there who are bitching about not being able to find a job which will pay a good salary for someone with a high school diploma and no useful skill sets. Not a reflection on the economy as much as it is a reflection on the quality of people in the labor pool.

Comment by Brionna

January 15th, 2010 at 2:30 pm

You are moaning that you can’t support your family on 67K a year? You need to look at your budget. $2,000 rent is a third of your income.

>

___

Read what was written. Marcy says their rent is $2450 – NOT $2000. That is 23% more than what you write.

>>

Income $67000 a year or $5583 a mont. Rent at $2450. That means 44% of gross income is going to rent and that is NOT affordable. (And $2000 would be a strech as that is 36% of gross income and with kids in the house, more goes to food, cloting etc than if only 2 adults)

>

All she can afford is $1400 – 1700 a month in rent or PITI (principal, interest, taxes and insurance.) The lower end is better because of the kids – costs more to have kids in the house than just 2 adults. $1400 is around a $200,000 mortgage and $1700 is around $250,000 mortgage (including taxes and insurance on both.)

>

5 people in the household. $67,000 income. And that is 259% Federal Poverty Level for a household of 5. Time to move to a cheaper neighborhood – they are living above their means with that $2450 rent.

“People are buying schools”

This Berkely lecture explains a lot about the California and US housing situation:

http://bullnotbull.blogspot.com/2009/12/elizabeth-warren-coming-collapse-of.html

What about inflation? If unprecedented deficit spending (if?) causes inflation to skyrocket, isn’t owning a home the place to be? The actual value of the mortgage plummets along with the value of all that cash the renters have in their banks. In fact, isn’t a long period of hyper-inflation the one thing that can make all these bank balance sheets become solvent again? Isn’t a long period of hyper-inflation just the thing for those who are underwater? Seems the USG has many incentives to allow it to happen…don’t you want to be in the market before this starts?

Marcy, I think AnnS has a point. $67K/yr even with children as a deduction, leaves little for rent and expenses. If you consider that most of your mortgage will be interest payments the first years, you’ll get that as a tax deduction as well. So calculate that in. But when it’s all done, I suspect your housing costs need to be in the $1700/month range to be “affordable” for you.

First off, Dr. Housing Bubble — enjoy your blog. You are calling it right on the money. My story: Bought a foreclosuse this past summer in a low-end area near Alhambra. Safe area, but lots of dogs and idiot neighbors playing their music. I hope to ge out of here in 2011 or 2012, when prices in the mid-range level of LA are hopefully more affordable. Paid cash for the house, beating out a host of folks interested in a house that was, at the time of purchase, at least 30% below market.

It seems rather certain to me that the mid and high range homes are going to fall big-time, courtesy of all the factors you list in this article. I’m confident I will realize some profit on this home — we’ve already transformed the place from an eyesore to one of the nicest places on the block. I’ll probably get less than I hope for, but we’d need a real catastrophe (or I should say ANOTHER one) for me to lose money.

I make $60K a year, slave wages by LA standards. But guess what, I have ZERO debt, no mortgage, own my cars outright, pay my SINGLE credit card off every month. Have no personal lones, Wouldn’t dream of taking a HELOC.

Somewhere along the line, the hucksters convinced people that leveraging your ass off it good. But the thing is, it’s leverage if your CitiBank — otherwise all you have is plain old debt.

Moral of the story. If you live within your means and don’t buy Rolex watches, Vuitton bags, German sportscars and overpriced McMansions, you may actually be able to save a little of your paycheck. And you may actually sleep well at night.

Always fun to read the Doctor’s posts. I understand the warning to not puchase in 2010.

At the moment, I have more qualified buyers than I have homes to put them in.

While there is an un- and under-employed rate of 22% in our region, that still leaves 78% that are working at stable, secure jobs with decent salaries. Most longtime homeowners in Socal are used to riding the value wave up and down. They’ve seen the boom and bust cycles. If you’re planning to flip your house, the Doctor is correct–do not buy. However, if you find a house and plan on staying and raising a family, hanging out at the block parties and enjoying your neighbors and neighborhood, then you shouldn’t be worried about how much further housing prices will drop, nor how long it will take for the overall market to recover. As long as you can comfortably afford the home, and the maintenance and taxes that come along with it, that should be the basis of your decision. Yes, there are some areas in Socal that will still come down (read the Westside), so you will need to do the research on your area of interest and see if it makes sense. The Feds have hinted that interest rates will start rising by the end of the year, and any increase in rates will wipe out any drop in price you might have been waiting for. Your friendly lender can do the math for you.

There is no crystal ball to predict how the market will ultimately fare. However, this much I know, I wouldn’t bet against the federal government and Wall Street. The banks are getting stronger everyday, and paying back TARP money as fast as they can. As their balance sheets get stronger, the incentive for them to dump their “shadow inventory” lessens. The stronger they become, the longer they can hold the bad assets. And make no mistake, the Obama administration will not do anything to jeopardize this market in the midst of mid-year elections. If that means continuing to drip the shadow inventory onto the market, then that’s what they will do. This band-aid is going to be ripped off slowly. I’m hearing that some banks are quitely selling off chunks of inventory to private investors in bulk again. The White House and Wall Street hold all the cards, and will determine what happens with any shadow inventory that exists. I guarantee they will not allow the real estate market to collaspe. They will find a way by writing a policy or drafting another program to prevent it from happening.

I actually have more than a 20% down, and yes – it’s cheaper from a payment perspective for me to buy than rent. I’ve been searching for rentals along with homes for sale. With my down, I can easily get my mortgage payments well under $1,000 per month. I cannot rent a house (yes, it has to be a house not an apartment or condo because we have pets) for under $2,000…and that’s just the mortgage, not counting the rest of the bills. Those have to be paid too. So, a 2k rent is impossible. Buying makes sense – for me. I’d far rather wait until the current feeding frenzy is over, but that is unlikely to happen.

Er, how about “I can’t pay $2,450 per month rent, plus all the other bills because our 2-income family has become a single income for the forseeable future.” I don’t make enough to pay for it all. We HAVE to move. Staying is not an option – there simply isn’t enough money. I DO have an excellent down payment for a house. Enough that I can have a mortgage (plus homeowner insurance plus property tax) well under $1,000 per month.

That leaves enough to pay everything else until – someday – when we are a dual income family again. For my situation, buying makes sense. My situation isn’t everyone’s, and I surely wish things were different for me. But, we play the hand we’re dealt.

You didn’t read, or I didn’t explain clearly. We HAD an emergency fund. It is now gone – a year of unemployment will do that. That should tell you how prepared we were – most are lucky if they have enough to cover 3 months. We had a full year. $2,450 rent can’t be covered by my salary alone, not with a family and needing to have little things like water, power, heat, food. Rents of houses have *not* dropped. $2,000 is the cheapest I have been able to find in an area I don’t have to carry a gun, or have my car insurance go through the roof because of the crime rate. Hopefully that explains a bit better. I still have my down payment fund, and I am NOT going to toss that away on rent, “trusting in the lord” that hubby can get a job soon when he can’t even get a callback.

Palmdale, believe me, is a LAST resort. We also can’t do a gated community (my dogs, though they are Canine Good Citizens are on the “bad dog” list). If I’m going to invest a chunk of savings, it won’t be on rent. Once we move, we stay. That is why it is important to me to have a halfway decent neighborhood. We are not wanna-be flippers or investors. We have been saving and waiting to buy a house for years – I’d planned on doing it in 2011 or 2012, having tracked this market for the past 3 years. The best-laid plans of mice and men… Just means my timetable was accelerated.

Socal Realtor you write: “78% that are working at stable, secure jobs with decent salaries”

__

And from what universe do you pull out the data to claim that all of the 78% still employed are making ‘decent salaries’? What a farcial statement completely detached from reality and blithely made in the face of all data.

>

Unemployment cuts across all wage levels and all incomes. The fact that they are employed does NOT mean they are even making the California median household income of $61,154 or the California median family income of $69,659. The bottom 93.5% of CA households can have an income from minimum wage to $200,000.

>

The fact that they still have a job at the local gas station does not make it a ‘decent income’ nor enable them to buy a house. DItto those such as Marcy who posts here and whose household is down to 1 income. She is still working but the household income is slashed.

>>

And the advice about ‘go ahead and buy if you are planning on staying put’ is BAD advice. The best laid plans go awry. They have to move because of a new job. They have to move because unexpectedly they have another child and need the space. They have to move because they lose their job and can’t afford the payments, They have to move because of a divorce. They have to move because of family affairs and return closer to their family. Pick a reason. They happen every day.

>

The average length of residence is around 7 years. And one should always plan for the ‘just in case’ situtation. one would have to be dumb as a post and thick as a rick to assume that it would be ‘okay’ to buy because they ‘plan’ on the future going a certain way – and ignore the fact that if the future does not work, they are screwed from taking your advice because of the falling real estate market which will only fall more when interest rates return to normal.

>

And this is just complete and utter hogwash when you write ” The Feds have hinted that interest rates will start rising by the end of the year, and any increase in rates will wipe out any drop in price you might have been waiting for. ” Bladerdash. What in fact happens is for every 1% change in interest rates, prices move by 10%. Interest goes up 1%, price falls by 10%. Interest goes down 1%, price goes up 10%. How much households can pay is tied to INCOME and the TOTAL COST per month.

>

You obviously have not lived through wide interest rate swings so let me teach you some history. Interest rates went up up up in the early 80s and house prices fell fell fell. ANd this happened because people can only pay so much a month and it doesn’t matter how it is divided between interest and principal because the total can NOT exceed their ability to pay. In the late 80s and early 90s, interest rate began to go down (and down by whole percentage poitns, not 1/4s or 1/2s) and prices went back up (and the monthly payment would end up about the same.)

Socal Realtor–

We have your guarantee that the White House and Wall Street won’t allow the housing market to collapse? Very comforting. And how is your argument any different from that of TakeFive? Low inventory? I suppose none should be surprised that a realtor would sell his or her soul for that potential 6%. Sweet dreams, thief.

Read that Cal is going to request a US bailout by March, then Illinois, Florida, Nevada, Arizona. Somebody else. 2010 looks like green shoots to me. I don’t know if that means housing prices go up or down. Seems like Citi did great being too big to fail. Maybe Cal will too. Maybe not.

David Gorman says:

“What about inflation? If unprecedented deficit spending (if?) causes inflation to skyrocket, isn’t owning a home the place to be? The actual value of the mortgage plummets along with the value of all that cash the renters have in their banks. In fact, isn’t a long period of hyper-inflation the one thing that can make all these bank balance sheets become solvent again? Isn’t a long period of hyper-inflation just the thing for those who are underwater? Seems the USG has many incentives to allow it to happen…don’t you want to be in the market before this starts?”

Absolutely not. If hyper-inflation hits (which I don’t believe it will) real estate will collapse through the floor like nothing you can imagine. Hyper-inflation = everyone using their money to buy food. Not owning shelter or flipping homes. How do I know this? I know someone that lived in Russia in the early 90’s when they went through hyper-inflation. If you do research on hyper-inflation and the effect it had on housing prices in the past you will know this.

Realtors have no souls.

The most out of touch comment from the trolls is Socal Realtor- “if you can afford it buy it”. Who the hell can afford to lose lots of money in Santa Monica, Torrance, RPV , Newport Beach if the prices in such are barely down with 10% from the peak of the madness? Who? The potential on the down side in the whole west side is at minimum 20%, which most likely will happen this year. Who is that? If the prices do not go down they have no way up either, so we can discard the speculative motive. Who?

SoCal Realtor –

I hear you, but believe that higher interest rates and lower house prices are good for the buyer for two main reasons:

– your downpayment goes further. For example, if the $600K house I am looking at now drops to $550 I can put down $110 instead of $120K for the downpayment. That’s real money saved and can cover closing costs, etc.

– you can refinance when interest rates drop again and sell your house at a price more comparable to what you paid. If you buy at a higher price and a low interest rate you likely won’t see those interest rates again, and/or you will not be able to sell at the price you purchased the home if prices continue to decline and/or interest rates continue to rise.

Overall dealing with a high interest rate is much easier than dealing with a high price.

And the one reason TO buy?

If your money becomes worthless through hyperinflation or devaluation, at least you have a house. Hopefully with some land to grow food. If you have cash.

Comment by Amy

January 18th, 2010 at 12:15 pm

SoCal Realtor –

I hear you, but believe that higher interest rates and lower house prices are good for the buyer for two main reasons:

————–

Third reason – lower property tax basis.

————

Hopefully this comment will make it through moderation!

I largely concur with SoCal Realtor. I know two couples “that are working at stable, secure jobs with decent salaries†of $100K+ combined and they have repeatedly been shut out from buying by competition from other buyers.

I mean these guys race to the fax machine to get their signed offers in, and still loose. One guy’s agent told him to overbid by $30K if he wanted chance. Well faithful blog readers (including me) would insist this is nonsense, but those are the facts on the ground.

Another buyer I know has been waiting for the last 2 years for Pasadena prices to drop. They’re easing the tinyest bit, but not dropping any significant amount. Plus, there’s not a lot of desirable properities currently available. This is another buyer that is WELL qualified.

Those of you waiting for prices to drop back to 1990 or 2000 are going to be renting for a very long time. Simple fact is the DESIRE for property has not gone away. The means of aqusition has gotten more difficult, but demand has not gone away.

AnnS, you’re withering wit reminds me of Jeane Kirkpatrick taking on the UN: they never even knew what hit them. Whenever I read something posted that is particularly thoughtless, I eagerly scroll down to see the evisceration that’s sure to be on the way; it might take a few comments, but it’s always there, right on target. Dr Housing is a regular read because you’re a regular delight.

Buy buy buy! What are you waiting for? It can’t get any cheaper and even if it did, interest rates will go up. I bought a bank owned and even though I lost $100,000 or more in equity (as I bought it in 2007) I am still happy that I am in a house rather then renting from a lousy landlord. You are in a house and that is the American Dream and as long as you can afford it you should stay there. For sure your equity will eventually go back up especially from today’s prices. Don’t wait – buy now if you can.

Naomi, switch to decaf. But thanks anyway for the hilarity.

Leave a Reply