California housing inventory disappears into the sunset: Large metro areas of California are witnessing declines of 50 to 70 percent of houses for sale from last year.

Since 2009 all cash buyers have purchased roughly one third of all Southern California home sales. This is a significant number and unlike the early 2000s, many of these buyers are looking to hold onto properties as rentals. A good portion of buying has come from larger hedge funds and an increase of foreign money has caused competition on an already low selection of homes to become more pronounced. The latest inventory report for California is telling in many ways. Many of the larger metro areas in California are seeing annual inventory drops of 50 to 70 percent. Those looking to buy are facing added competition from a variety of unlikely sources. Last year in February we set a record with the number of homes sold to absentee buyers (29.9 percent). Where is all the inventory going in California?

Inventory disappearing

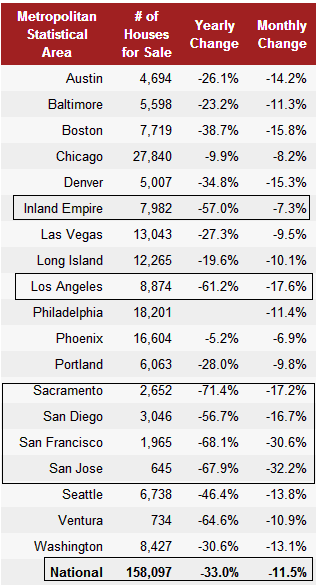

One of the more telling stories is the large decline in housing inventory available for sale. The trend is apparent nationwide but more pronounced in California:

Source:Â Redfin

If you are out in the market to buy a home and are wondering why your selection is limited, look at the above. If you were looking to buy in Sacramento, you had a 71 percent drop in inventory from the previous year. San Francisco saw a major 68 percent decline. Los Angeles came in at 61 percent. These are all nearly twice as high as the nationwide inventory drop of 33 percent.

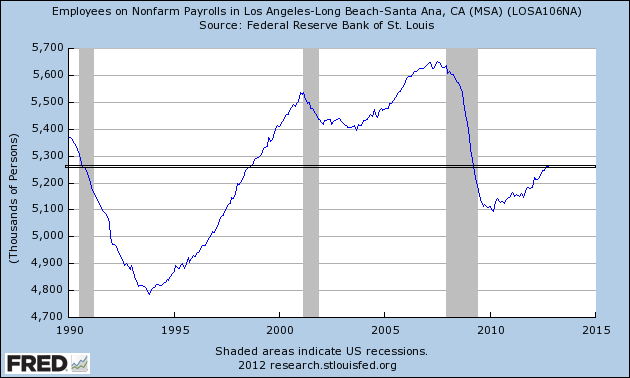

Is this growth coming from employment growth? We’ve been adding some of the jobs that have been lost:

We had more people working in the LA/OC area back in the early 1990s than we do today. The drop in inventory is a unique one and also one that reflects the management of shadow inventory from the banks.

The perception in the market is that inventory is running out and many people have the first California housing mania etched into their memory. Last year saw a big push from those sitting on the fence. This is why we are now experiencing this:

“(PSN) Real estate agent Alan Castillo recently listed a client’s fixer-upper in Granada Hills for $278,250.

It was only 1,600 square feet — but it drew 128 offers, most of them in cash.

The final selling price, after all of 10 days on the market? $377,872.

“I was very surprised,” said Castillo, the owner of Financing Realty Center Inc. in Granada Hills, who has been in the business for 20 years.

“I didn’t think I’d get that many offers. This was overwhelming.”

A fixer-upper listed in Granada Hills for $278,250 ended up selling for $377,872 after 128 offers came and sold in 10 days. Many areas of California are now seeing signs of a second housing bubble. We’ve documented many cases of flippers in hipster areas putting in a little HGTV work and then selling the home in a matter of days for hundreds of thousands of dollars more.

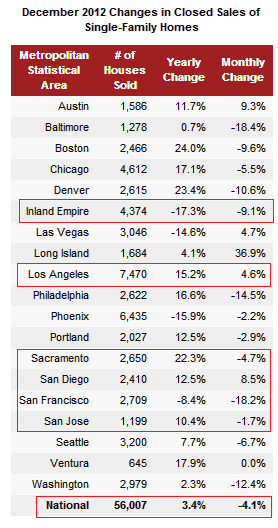

What is causing this market to inflate again? The culprits remain the same: incredibly low inventory, record low interest rates, bank management of shadow inventory, foreign money, hedge funds, and flippers. It is true that sales have increased but in reality, the surge in prices is coming more from the massive drop in inventory and low interest rate leverage:

For example, home sales in the Inland Empire fell by 14 percent year-over-year but inventory fell by 57 percent. San Francisco saw home sales drop by 8 percent year over year but inventory fell by over 60 percent. In other words the push up in prices is happening because of a massively small amount of inventory being combined with all the other forces of low rates, investors, and banks controlling distressed properties. In other words, the market is completely manipulated.

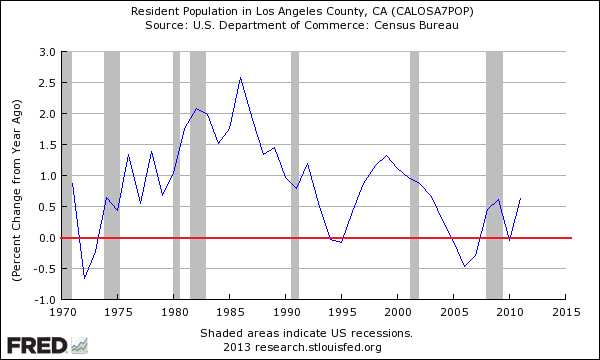

I’ve seen some people arguing that we had a surge in population but that is not a reason either:

In fact, Los Angeles County for example saw its first annual population decline since the 1990s prior to this recession hitting. This was the slowest growth in population dating back to the 1970s. Population growth is back but at a more modest pace. Certainly this is not the reason for the current major push.

The drop in inventory is incredible and is the largest I have ever seen. The increase in sales is not so dramatic but with scant inventory available, for those seeking to buy a home right now conditions are extremely competitive.

What is interesting that a leading indicator in future changes is when home sales begin to decline. Take a look at areas that are seeing annual sales drop:

Las Vegas:Â Â Â Â Â Â Â Â Â Â -14%

Inland Empire:Â Â -17%

Phoenix:Â Â Â Â Â Â Â Â Â Â Â Â Â -15%

These areas are massive hubs of speculation from investors. For Las Vegas and Phoenix roughly 40 to 50 percent of all sales over the last few years came from investors. What happens when prices get so high that they are no longer attractive as rentals or to flip? What happens when the large pool of uncommitted money takes off? Keep in mind that for investors, they need families to eventually buy or rent these places. At a certain point, you need the real economy to make up the slack and incomes need to rise in proportion. This drop in inventory is stunning since very few organic homes are coming on the market. In California, you have many underwater homeowners and also, many that took out HELOCs and home equity loans that wouldn’t be able to sell in this current market even after the current surge in home prices.

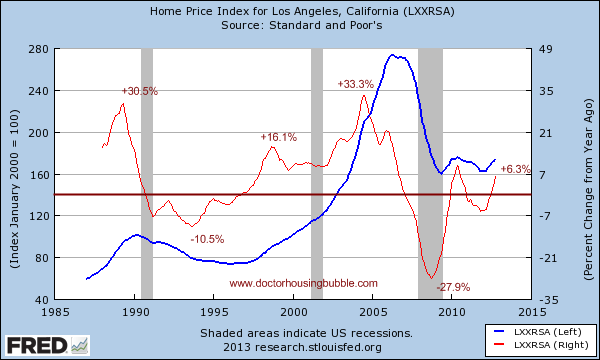

Home prices are still off by 36 percent from the peak in the LA/OC area:

If you are looking to buy, gear up for low inventory, bidding wars, flippers, and investors. Any stories from prospective buyers dealing with low inventory?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

103 Responses to “California housing inventory disappears into the sunset: Large metro areas of California are witnessing declines of 50 to 70 percent of houses for sale from last year.”

Hello Doc. I am one of those active buyers, seeking my first home purchase in Western LA area (Beverlywood to Baldwin Hills region. I must say it is interesting out there these days. The homes that have nice floor plans, organic sale (meaning not a flipper with cheap remodel) in a nice area, with no freeway or high traffic streets are getting 3-10 offers the day after the first open house. Of course, these are properties that the listing agent priced according to comparable sales rather than pie-in-the-sky prices. Same properties are usually bid up about 5% over asking but then end up closing for somewhere around asking or a little lower. The reason that they are closing for less than the bid up price is usually due to some credits (needed for minor repairs) or appraisal coming in lower than list price, then these houses do seem to get into a reasonable final closing price. In this regard, I think appraisers are doing the buyer a favor be being a ‘reality check’ for the buyer and seller. I also hear that the investor-flippers are tougher to negotiate with than the ‘organic seller’ who needs to sell to move, or retire, etc. As a potential buyer I do perceive that homes that have been on the market more than 1 month are lacking something and of the many homes on the market for more than about 1-2 months when I have gone to inspect the homes, it is usually not surprising they have not sold fast (noisy street nearby, or cell tower next door, or trashy neighborhood, or cheap Home Depot remodel-flipper, etc.

My broker says that this high competition on good homes started early in 2012 and shows no signs of slowing down yet.

I just bought a home near downtown Sacramento. The house was on the market for about a week; only one other buyer made an offer on it during that time. Sacramento area inventory is quite low and any house that is reasonably priced sells quickly (overpriced houses sit on the market for weeks). However, the downtown area seems to have relatively few investors and cash buyers. Investors are instead concentrating on the suburban sprawl areas around Sacramento where hundreds of homes were built during that last boom. In the under 250K price range competition is fierce. My co-worker (a first time home buyer) has been house hunting in the Sacramento suburbs for several months. She routinely puts in offers on multiple houses each weekend, but sellers prefer cash buyers who offer above asking price and can close quickly.

Is it not logical that as house prices continue to increase, more houses will then come on the market, especially those that have been underwater, and it will then put a ceiling to the prices? Will the number of qualified or cash buyers decrease and then cause house prices to fall? Is there simply a large influx of foreign money coming in to USA to snap up houses?

In a normal downturn, without the market manipulation endlessly derided on these pages, what happens to prices? They drop because homeowners are forced to sell – because of the usual array of factors like changes in job, financial or family circumstances, etc. Folks who don’t have to sell at a loss will often just stick it out. That’s what’s happening now.

In the downturn of the ’90s a large fraction of the aerospace jobs (the backbone of the upper middle class in the area) left southern CA and many were forced to leave. The big ’94 quake just put the icing on the capitulation cake. We don’t have the same sort of big external events focusing on SoCal this time. Certainly the financial crisis caused job loss here as everywhere else, but the majority of high paying jobs stayed, while in the ’90s disproportionately high fraction of them left never to return. In brief, inventory is now low because most folks have jobs, have decided to wait for higher prices before selling and can afford to do so. No amount of complaining about low interest rates and manipulated markets will change that.

I own a home and don’t feel like I need to sell any time soon. The same is true of everyone I work with and I imagine the same is true of millions of others with steady jobs in the LA area. Unless there is a cataclysmic disruption in SoCal employment like there was in the ’90s or until prices rise enough to encourage organic sales I suspect this will remain the case.

“…without the market manipulation endlessly derided on these pages…”

This is a classic tell – couple this statement with your one on the prior post complaining about alleged negative comments and we begin to have a pattern.

“No amount of complaining about low interest rates and manipulated markets will change that.”

These are not complaints, they are facts.

“I own a home and don’t feel like I need to sell any time soon.”

That’s nice – but why then do you feel a desperate need to convince others of the correctness of your decision to buy? Congrats, you’ve been outed.

Dmac,

I’m glad you caught onto this troll.

They stated in a comment on the previous post by the Doc the following:

“Look, I know this blog and comment section is basically a support group for those of us who have waited endlessly for prices to drop and really want to feel justified in our decision. But I hope this doesn’t mean we have to slam everyone who chose otherwise and accuse them of being fools (or even worse *realtors*). If we go that route then this just becomes a self-reinforcing echo chamber devoid of real information. I for one care about making accurate predictions about the future of home prices – even if that knowledge proves that we’ve all been fools for staying on the sidelines this long.”

Then this commenter now states “I own a home and don’t feel like I need to sell any time soon.”

Ok, this is starting to get annoying. Seriously, these people feel so confident about things that they have to stoop to these tactics?

Is there really some sort of propaganda campaign going on or are there simply a lot of individuals who are mocking any negative ideas of the market?

Outed as what, precisely? I’ve lived in the same house for 20+ years, chose not to participate in the bubble mania and now have cause to wonder if I took the uber-bearish message of this and other sites too much to heart and missed some good opportunities over the last couple of years. While I haven’t bought a 2nd home, I’ve been looking for a good deal for several years and am constantly trying to update my estimates of future pricing and availability to aid in whatever decision I make. If this means I’m outed as someone who is trying not to let bubble orthodoxy dictate my beliefs, but instead be open to whatever information appears to conform most to observed facts then so be it.

Joe – some of us experienced this kind of trolling on RE blogs during the last bubble – many of the posters were exposed as RE hucksters trying desperately to keep the inflated Hindenburg going, no matter how inane their efforts seemed at the time. Their MO was always the same – happy with their current home that they recently bought, it’s value has already gone up 25% in two months, anyone being negative about the market will be left behind if they don’t buy now, etc.

Apolitical Scientist — don’t fret…it’s just your greed and desires getting the better of whatever latent goodness and/or transcendence you were born with.

Money: the more you crave it – the cheaper you are.

Apolitical, you’ve been outcasted!!!! How dare you be positive in any way here! Shame on you! You must be a bankster! You must be the head of the Federal Reserve! You must be a real estate agent!

I am angry that you don’t believe exactly what I believe! Angry!

http://media.salon.com/2012/07/exclamationkeyboardrect2.jpg

That may contribute to the reason for low inventory however in brief, the reason has nothing to dov with anything “organic” so to compare the market to anything organic or free is moot. The reason for the low inventory is because of the investor program offered by the Federal Reserve you can read more information about the investor housing program at the Federal Reserve website it is for institutional qualified investors only they must hold the properties purchased in bulk for a minimum 5 years to be used as rentals they can extend this for an additional 5 years before they’re allowed to sell the property back on to the market. further brokerage banks like Goldman Sachs JP Morgan Chase and the usual Banksters,are going to securitize the rent rolls yes I’m sure this will end well securitizing rent rolls if they couldn’t securitize mortgage backed securities successfully what do you think that’ll happen when they’re securitizing just the signatures on leases without being backed by any assetof course the reality is that’s what they did with the mortgage back securities in reality we’re just Hawking are borrowers signatures on a note they could care less about the underlying asset it’s might as well have been a coffee table. Henry Ford said it is probably well enough that people do not understand the financial system for if they under stood there would be rioting in the streets before the morning.

Punctuation?

I think it is partly that some sellers are holding back, but that doesn’t explain why the sudden drop in inventory. I very much doubt there’s been collusion between buyers, and if so, then why wait until now when there are signs of improvements. When things were really bad, you can understand many would be reluctant to sell. Of course, there were many distressed sales, and that may have eased now but the delay time is long. You also have to ask why California has been particularly hit? One answer may be that it had a very high rate of foreclosures, and since foreclosures have dominated sales since the crash, any reduction in their numbers will effect inventory. There’s been government attempts to delay foreclosures, moratoria, states opting for judicial process, and now institutional investors buying wholesale on the court house steps. Since a recovery has been a primary objective, with low rates being the MO, low inventory has been the booster. Whether by design or coincidence, another trapeze artist has just been airlifted onto the shoulders of the straining human pyramid. I don’t see another bubble happening so soon, but it looks a little like the situation we had with the tax credits.

Refinancing during this interest rate bubble is further locking in home”owners” for the long-term, further reducing the “inventory” of sellers.*

*”Data from mortgage giant Freddie Mac showed that in the second quarter of this year (2012), 23% of homeowners who refinanced reduced their principal balance during the process, and 59% maintained the same loan amount.

The percentage of borrowers keeping about the same loan amount was the highest in the 27 years of tracking.”

http://usatoday30.usatoday.com/money/personalfinance/columnist/story/2012/09/26/your-money-people-are-refinancing—again-and-again/57846292/1

I live in Chicago. In 2010 and in 2011 I would search for properties and see a huge inventory of homes and a huge inventory of bank owned properties. Then in the Spring of 2012 and throughout the year the inventory for distressed properties suddenly vanished.

How long can banks manipulate the market? Plus how can I find the shadow inventory for my area? If someone can direct me to a resource in which I can find the shadow inventory for my area it would be greatly appreciated.

Zillow now has the option to see pre-foreclosure and foreclosure homes. In my area, I scoured the online county records for notices of default and of foreclosure sale. There are thousands of them, which let me know that there is definitely a shadow inventory.

HI Sadie

What you have have found is some database with all the foreclosures in it, but good luck getting from that database to being able to get an offer accepted on one of those homes….

Sadie

Ca Homeowners Bill Of Rights effective 2013 – Mods or possible lawsuits

Former subscriber to Foreclosure Radar- Mods are king. (we were a cash buyer so the auctions were an option for us). Most 95% turned into modifications.

We had our cashier checks in hand many times, only to be disappointed.

I have the shadow inventory lists! It’s right where I left it next to the Colonel’s chicken recipe, JFK’s assasination files, and the holy grail!

Yawn. Typical over the top (r)realtor tactics.

http://www.nakedcapitalism.com/2012/07/realtytrac-corelogic-confirm-housing-bear-thesis-85-90-of-reo-being-held-off-market-meaning-tight-inventories-are-bogus.html

After residing in Portland for over a half year now, I see similar market manipulation going on, but not of course on the same scale as in CA. Inventory is being artificially repressed, not only because of the factors you cited above but also because the OR legislature passed a recent law forbidding any bank from foreclosing on any property that’s finally being foreclosed on by an additional 6 months.

Dmac,

I have lived in Oregon for over 45 years, now living on the oregon coast. I am a buyer and currently own 4 rental houses, and always looking to buy more. Have several realtors sending me info daily. I have noticed many of the houses i’m seeing have no furniture, i see they are not going short or are listed as REO. I think it’s more than obvious what’s going on here.

Tillamook Tim – good to hear from you, haven’t seen any postings from you in ages. Can’t say I’ve seen too many empty homes around here in terms of what you described, but we have a friend who’s been an RE agent in Portland for over 20 years, and he’s definitely noticed something quite strange going in regarding the foreclosure process. Last time around (circa 2007 – 8), he did the usual MO for foreclosures, usually conducting the filings and paperwork required literally on the courthouse steps after they cleared the judge’s dockets. This time around, he’s yet to see any REO or any other foreclosure listings at all, albeit one or two that he gets to peek at for a grand total or 30 minutes, before it’s yanked off – line immediately. He later learns that the same listing just sold to an all – cash investor that neither he or his other agents have ever heard about previously. Additionally, there are never competing bids for these properties, primarily because no one had a chance to look at them for more than a few minutes – definitely something rotten going on this time.

My landlord decided to move back into the house I am renting so I started looking for a house to buy. After looking at houses in less than a week (three total), I made an offer the first day it was up for sale along with three other people. The owner accepted my offer as I had the largest down payment. The house was pending by the next day, a two day sale. I was lucky, I had been looking for only 5 days and purchased a house. There are people out their that have been looking forever and keep getting outbid. Luckly, no all cash buyers showed up.

Just curious, why would the seller care about your amount of down? All other things being equal, if it were between a higher bid low-down FHA and a lower bid 20% down conventional, I’d take the higher bid.

It’s my understanding after selling an inherited house and then buying another house that the offer with the higher down payment has a better chance of actually going thru the process to close the deal. So it’s a safer bet, the FHA loan requirements can bog down and crush an otherwise good deal.

I think they wanted to make sure the loan would be funded.

Congradulations Tricia. Just wait for all the skeptics to appear and just ignore them.

The sock puppets are abundant these days.

JFC, what color is the sky in your world?

One day reality will collide with your world, and I’ll hear your screams “Help me, I have nothing…” I’ll quietly whisper “No, this is atonement for your sins…”

“Many areas of California are now seeing signs of a second housing bubble.”

Huh? There’s a lot of data in this article but that particular conclusion came from left field. How about publishing some direct evidence that supports the assertion before making that claim?

“one that reflects the management of shadow inventory from the banks.”

How much shadow inventory is there? Is it meaningful? Core Logic put it at 2.6 million. The United States has 130 million homes. That equates to 2%. Whatever the banks are managing, it isn’t meaningful in the market place.

With all due respect, your website has a lot of good information. However, when unsupported conclusions are made, it only reduces the value of the information provided.

Core Logic is a respected source to be sure, but it’s regarded to be on the low end of shadow inventory measurements, due to their primary reliance on credit scored being the end – all. Other estimates put the inventory at over 9 Million homes –

http://money.usnews.com/money/personal-finance/articles/2012/04/10/how-shadow-inventory-hurts-the-housing-market

Dmac,

Your article doesn’t say anything about your 9 million shadow inventory. Please cite where you’re getting that number from.

If anything, your article agrees with my number. It cites 2.1 million projected shadow inventory, and I cited 2.5 million.

Pug –

My mistake, I was conflating two different sources and numbers into one –

http://www.forbes.com/sites/afontevecchia/2012/06/26/10-million-underwater-mortgages-and-shadow-inventory-worth-246b-mean-housing-trouble/

I was incorrect in stating the 9MM number as strictly shadow inventory – the 10MM number sourced here is regarding mortgages currently underwater only.

To add to that response, the laws recently enacted (which I discussed in another post below) in many states are further complicating an accurate rendering of shadow inventories in many locales:

http://www.thefiscaltimes.com/Articles/2012/06/30/Housing-Crisis-Anti-Foreclosure-Laws-May-Backfire.aspx#page2

Are prices going up?

Are incomes going up?

If you think yes/no…it’s a bubble.

patsfaninpittsburgh,

And how are you accounting for the significantly lower cash payment due to lowering interest rates? How does that affect your definition of a bubble?

Also, please define bubble. Perhaps we just have different definitions.

I think of bubble as an over inflated price, which is un-supported by technicals. In this case, the housing prices are very much supported by technicals (low interest rates).

Wages are up (in spite of all the un-supported rhetoric … see gov’t BLS data). Cost of housing loans are down. Given the relative ease of home payments (relative to current incomes), bidders are bidding up home prices. Also, if a buyer can’t stay at their current homes, they can rent it out and be on positive cash flow. So with all this, how are we in a bubble?

@pugtv:

Actually it seems like you are the one with the rhetoric:

http://advisorperspectives.com/dshort/commentaries/Median-Household-Income-Update.php

Median income is down from the peak in nominal terms and in real terms, we are back to levels last seen in the 1990s. You pointed out BLS data that factors in compensation in a previous post but by most accounts, the best measures of household income comes from the Census ACS. You can even look at Social Security data. They all cross check. No serious economist or financial expert will use BLS data as a sign of household income growth.

You mention the monthly payment. I doubt any are discounting that but surely you can see that the reason home prices have gone up is from leverage by the Fed and the little inventory. Trying to say incomes are going up (see above) is weak.

Distressed inventory is very real. Over 5 million homes are in foreclosure or are inching closer to it with missed payments. Ironically you seem bent on asking for data but provide very weak data to support for your arguments.

Data that supports your cause is okay but anything that refutes it is rhetoric.

Sarah,

I’m glad to see someone who can somewhat justify their logic based on real data. So let’s dive into it.

First of all, your article shows that nominal median household income is up, with a blip in 2008 due to the effects related to the bubble. So to my point, wages are up. Specifically, relative to 2000 (because a lot of people like to quote accordingly), it’s up.

Second of all, as you pointed out, real wages are down. But if you’re going to use real wages as a comparison point, you need to use real housing prices as a point of comparison. Further, you need to factor in declining interest rates to determine housing affordability over time. Is housing cheaper now than before relative to incomes? The answer is yes … but you’ll have to work that out for yourself.

With respect to your 5 million homes that are or inching towards foreclosure, I counter that with Core Logic’s 2 million to 2.5 million shadow inventory. It’s a manageable number, and that won’t have a significant impact on prices.

Lastly, I’ll say this. I think rhetoric is people citing BS without any real information behind it. Yours has information behind it, so I won’t call it rhetoric. However, I’m not clear what your conclusion is. Do you have one? I’m saying housing prices today are at reasonable levels (based on current interest rates, home prices, wages and comparable rents). What are you saying?

Take a look at the median income. Just look at nominal. You can adjust the hell of it and twist it into anything. Take your paycheck out from 2000 and see if your pay is the same as in 2000.

http://www.davemanuel.com/median-household-income.php

Pug, let’s take a look at your recent response to Sarah’s points –

“Further, you need to factor in declining interest rates to determine housing affordability over time. Is housing cheaper now than before relative to incomes? The answer is yes … but you’ll have to work that out for yourself.”

No, that’s your job, not hers. She made a counter – point to one of your arguments, now you’re asking her to do your own work to substantiate one of your points. Try again.

“…I counter that with Core Logic’s 2 million to 2.5 million shadow inventory. It’s a manageable number, and that won’t have a significant impact on prices.”

“It’s a manageable number,” according to whom? You? Once again, please try underpinning your own argument with some actual substance.

“I think rhetoric is people citing BS without any real information behind it.”

Sounds like a bad case of projection.

pugtv

Do you read this blog?

DHB has scores of posts on income and housing values. Why is that so hard to look at?

My guess is people bid up houses in 203/4/5/6. That wasn’t a bubble?

Also, what’s up with monthly payments? I pay cash for homes I purchase. Last month I had to spend $25K to replace drainage/sewer lines. Another $5K in the spring for sidewalks and lanscape.

You look at these things in your calculations?

Here’s the point

Understand what you can afford

Use data to determine correct value.

If the value is there, stay on budget, stay disciplined.

Why some areas fall for the same stupid things is simply beyond belief.

@ pastfan

“Do you read this blog?”

One in a long while.

“DHB has scores of posts on income and housing values. Why is that so hard to look at?”

I don’t dispute his data … just the particular conclusion on housing price bubble, which had zero support to it.

“My guess is people bid up houses in 203/4/5/6. That wasn’t a bubble?”

I told a lot of people that was a bubble and to stay away from housing back then. I sold my home in 2005. I’m saying this time prices aren’t in bubble territory. If it goes back up dramatically, then that is a different story.

Eg. Cash Shiller index for LA was 274 in Sep 2006. As of Oct 2012, the index is at 175. Prices have come down 36% since. Sep 2006 was a bubble. Oct 2012 (latest data) is far from it.

“Also, what’s up with monthly payments? I pay cash for homes I purchase. Last month I had to spend $25K to replace drainage/sewer lines. Another $5K in the spring for sidewalks and lanscape. You look at these things in your calculations?”

I don’t look at it as an upfront cash full payment. I look at it as an amortization. Also, I do factor in other peripheral costs. Besides taxes, HOA (representative of other housing costs) costs as well.

“Here’s the point. Understand what you can afford. Use data to determine correct value. If the value is there, stay on budget, stay disciplined. Why some areas fall for the same stupid things is simply beyond belief.”

No argument there.

@ Dmac,

“No, that’s your job, not hers. She made a counter – point to one of your arguments, now you’re asking her to do your own work to substantiate one of your points. Try again.”

I’ve done it in the past, and have my answer. Sarah hasn’t. Nothing like doing your own math to open your eyes. Try a different criticism.

“It’s a manageable number,†according to whom? You? Once again, please try underpinning your own argument with some actual substance.

2.5 million and declining every month of 130 million homes is tiny. That’s 2% of the total home market. Keep it in the books and sell the inventory over a few years. My bad for giving you too much credit to understand that. Sorry.

“I think rhetoric is people citing BS without any real information behind it.

Sounds like a bad case of projection.”

No real criticism / comment here so you send a pointless cheap shot? Too bad … expected more from you.

@ptv

A bubble can be defined as a person’s inability to correlate consequences with actions; stupid is what stupid does, in your language. Someone makin’ 50K, buying a 500K house with 3.5% (via FHA loan) down is stupid. It is abundantly clear that you have NO concept of finance or economics.

With crap like “…bubble as an over inflated price…”, “…supported by technicals [sic] (low interest rates)…”, “… they can rent it out and be on positive cash flow…”, are you drunk off of the unicorn piss, high off of the unicorn farts?; WTF is wrong with you?

I’ll say it again for those in the cheap seats – housing is inversely related to interest rates. Interest rates go up, housing goes down. Rates go down, prices go up. Rent does NOT follow this – people have a cap on the monthly rental nut; rents cannot keep pace with housing prices on the upside – there is NO leverage in renting! Yes, it’s that simple.

I hear idiots chant “but don’t fight the [private] FED…” and “…it’s worked so well in the past…” Rates are at an all time low; they can’t get much lower. What they fail to understand (imagine that, these idiots fail another one of life’s little tests – Shocking!) are 1) debt and exponential functions, and 2) what cannot go on forever, will not go on forever. This Ponzi scheme will end sooner than later. Mark my words. Interest will rise due to lack of confidence in the dollar and housing prices will collapse as a consequence.

Finally, you claim real wages are not down, according to the BLS data. Tell me then, why does their CPI measure EXCLUDE things like food and energy? Can you point me to a living human that does NOT need food or energy? I didn’t think so; you really are galactically stupid.

I love these responses:

“Do you read this blog?â€

“One in a long while.”

For someone who’s just made quite a lot of criticisms regarding the information posted on this site, that strikes as a little more than passing strange.

“I told a lot of people that was a bubble and to stay away from housing back then. I sold my home in 2005.”

I’m sure you told lots of people all about the bubble and sold at it’s peak. No question, we’ll just take your word on that – no problem.

“I’ve done it in the past, and have my answer. Sarah hasn’t. Nothing like doing your own math to open your eyes. Try a different criticism.”

To which you post no proof of the numbers you allegedly ran to justify your conclusions. Again, we’ll just your word on that – sure thing.

@ Variance Doc,

“you really are galactically stupid.”

Let’s see … I have a Masters in Finance from a top 10 Finance institution in this country, and I’ve been right with respect to my call on the home market over the last 10 yrs … what are your credentials?

@ Dmac,

You keep asking for proof, and I’ve given some here and there. Yet, you’ve given nothing, except … a falsehood / lie / deception / mistake with your 9 million shadow inventory claim. Worse, I had to uncover your lie / mistake, to which you admitted.

And I’m supposed to take you seriously and prove anything to you? Riiiight …

I know someone who recently paid about 204% of what the flipper who they bought the property from paid for it only six months prior. This was with a low-down FHA in an average LA neighborhood. They ended up giving this flipper about an additional 4.5% more than asking to boot. The price came in at the very edge of the FHA jumbo limit for the LA market.

I wouldn’t want to be in this person’s shoes should they find their back up against the wall in a few years needing to sell.

I also know someone who has a nice lot in a gentrifying part of LA whom over-leveraged on a HELOC during the last boom. When everything came crashing down in ’07-’08, this person lost their primary income source and has since been in a multi-year long back and forth with the bank. This property has come within days of auction more times than I can remember. Each time, there’s some sort of bureaucratic process that kicks the can just a little bit further down the road.

I routinely come across postings on the myfico forums from people who are worried about closing on a low down FHA or no down USDA loan because lenders are looking at bank statements and some of these people have recent overdrafts. In some cases the posters are worried about BKs that are only a few years old. Do I even need to point out the obvious here?

Sure, these are simply anecdotes but my God, something doesn’t seem right.

It’s a frustrating market for a qualified buyer to say the least. I’m one of them. The factors contributing to this latest bubble are overwhelming and anything but normal. Even though I can afford a decent house, I’m leaning towards renting.

1. Record low home-starts in the last few years means there’s not a lot of new homes adding inventory in the market.

2. Many people have very little equity in their homes, making it tough to sell.

3. Record low interest rates + increasing rents have brought many homes down to rental parity or below. If you’re fortunate enough to have a property well below rental-parity, sometimes it makes more sense to rent it out than sell, even if you’re relocating. Even if you’re underwater, but PITI is less then equivalent rent it doesn’t make sense to walk-away or bring money to the table and sell.

1a. It’ll take a few years for builders to ramp up homes.

2a. It’ll take a few years for people to build up enough equity in their homes to sell (unless housing prices start increasing dramatically)

3a. I personally don’t see rents decreasing, but interest rates probably will increase sometime in the next couple years. For those that have already locked in low rates, it’ll take a lot for them to sell their low fixed mortgage. There will be very few move-up buyers should rates increase.

MB,

I generally agree with your view. Additionally, I think we’re in a new normal for the next few years, with low inventories as the norm.

When interest rates rise, there will be pressure to lower prices. However, this will be offset by continuing low inventories that will pressure prices to go back up. The net effect is price stability in the face of rising interest rates.

Low inventories will be the result of 2 factors. Home owners / investors already locked in at low rates won’t want to sell and would prefer to rent out for positive cash flow. Home owners who are underwater will stay in there homes and have less reason to sell (currently, 90% of underwater home owners are current on their loans and will continue to pay their mortgages).

I think the only way out of this inventory issue is to build more homes / apartments, within the relevant communities. That will take time.

“However, this will be offset by continuing low inventories that will pressure prices to go back up. The net effect is price stability in the face of rising interest rates.”

Facts to support this statement, please.

“Home owners who are underwater will stay in there homes and have less reason to sell (currently, 90% of underwater home owners are current on their loans and will continue to pay their mortgages).”

Please offer legitimate cites for this figure.

@ Dmac,

“However, this will be offset by continuing low inventories that will pressure prices to go back up. The net effect is price stability in the face of rising interest rates.â€

Facts to support this statement, please.

No facts here. This is my opinion. The whole comment is part of my initial statement saying “I think …. in the 1st paragraph”

“Home owners who are underwater will stay in there homes and have less reason to sell (currently, 90% of underwater home owners are current on their loans and will continue to pay their mortgages).â€

Please offer legitimate cites for this figure.

See the article below.

http://money.cnn.com/2012/05/24/real_estate/underwater-mortgages/index.htm

“Most underwater borrowers, however, do not lose their homes. Nine out of 10 underwater borrowers are current on their mortgage payments and continue to make payments on time, Zillow said.”

Why sell your underwater home when you can live for 12-24 mos for free without making any sort of mortgage payment and then use the fact that you’ve been living for free for 1-2 yearsapply for a loan mod as proof of financial distress to qualify yourself for a loan mod @ 2% for 5 years (which then rises up to 4% eventually) and have a large % of your prinicpal wacked off because banks were foreclosing on people using an automated system to streamline the process?

I’ve been telling my husband we need to stop thinking like credit score 800 and more like 620. Just jump in there and get messy with them all. If the bubble taught us anything it is that when enough people jump in and do stupid stuff they will all be helped out when it turns. We have acquired these crazy fears of not being able to pay our mortgage or losing valuable credit points. Remember back in the days when the bubble first burst people used to talk about moral hazard? We know now that if you just remove morals the hazard disappears.

http://ficoforums.myfico.com/t5/Mortgage-Loans/bd-p/loans

Bottom of the market was 2011. I closed/bought 5000 acres from 11-2009 to 1-2013. 13 months before the 2011 and 13 months after 2011. AKA 3 years of buying at the bottom 2010-2011-2012….. My goal is 2000 to 4000% returns by 2020.

I bought fairly recently, in Sept 2011, inventory was tight at that time and boy did I see some UGLY houses. Finally purchased a beautiful home in San Pedro, which is wonderful and very affordable, if you are only looking in the wealth magnet squeaky clean neighborhoods then you will be competing with big money. I love my house, I love being a homeowner. I have followed this market since 2005, and this blog for much of that time. When the market started going south, I knew it might be manipulated, I knew it might fall further but I set the wheels in motion May 2011 because I didn’t want to risk another bubble. Glad I did, regardless of what happens, I can afford my payment and if I ever can’t its going to take them along time to boot me out, a lot longer than a landlord would take.

Yes, there are some nice pockets of Pedro (especially in the “PV blend” areas), and if you’re retired/no kids and only want to shop on Western Ave. and around the Peninsula to Redondo, you might have something going on.

But having lived there myself, I’d never go back. All those Pedro “dawgs” livin’ large on their bloated longshoremen wages, with their monster trucks, blaring Harley’s, etc. Not to mention the noise and pollution from the harbor, the perennial “it’s-going-to-get-better-soon” downtown, terrible schools, special forces-attitude LAPD, gang crime (aggravated assaults way over national average), no decent restaurants, half-way house row, etc. make other South Bay areas much more appealing to put down roots for the long-haul for buying a home/raising a family.

Yes, some lovely old homes and cute pockets. Hope things have changed since I left last (’09).

Candace, my thoughts exactly. I wish I would have bought in Orlando in 2005, but no, I let fear and all sorts of nonsense cloud my judgement. Even if I forclosed on the house, I could have lived rent free for two years. It would have been better than having moved 4 times in the same town in 4 years like I did.

Moved into an apartment, turned to condo, got kicked out.

Moved into a house, buddy wanted to buy, couldn’t afford the full rent, so I left.

Moved into a rented condo, landlord forclosed on it and told me I had to leave in two weeks……….I should have squatted.

The rest is ancinet history.

I’m currently looking for a house and can’t wait to have my own place.

FED UP

So, I buy a house in Thousand Oaks 5 years ago. I paid $645,000 for a 4 bedroom 2 bath home with $200,000 down. The house now is worth $499,000. Like a fool I’ve made my payments on time and made peace with the fact that I bought at the wrong time. We’re not planning on moving any time soon and I can afford the payments.

Just the other day I was talking to one of my neighbors, I’ll call him Bob, who purchased their house about the same time we did, similar home 4 bdrm 2 bath and for the same price. Bob tells me, in a bragging kind of way, that his lender just reduced his mortgage principle, by $125,000. Bob tells me, he bought the house with no out-of-pocket money down, he borrowed the 10% down on a second mortgage. Just add to the bragging Bob tells me his second mortgage lender just settled the $64,500 second lien for $12,000.

What the fudge is going on! Bob, a good guy, employed, married 3 children, bought a home like mine for the same price in the same neighborhood with no money out of his pocket and now he has $31,500 equity, FREE equity! And I’m stuck with my home under water and $200,000 out of my pocket.

I decided to do a little research and found out these deals are going on all over the country. Banks are giving away money in the form of debt reductions. The only qualifications that you need to get a debt reduction is a home that’s upside down, market value not worth what you owe on mortgage balance and a hardship letter. Apparently there are hardship letters all over the web if you need one.

The only hardship Bob had was paying for his new car and the 5 credit cards the family had.

Boy, do I feel like an idiot, play by the rules and I get screwed

That pisses me off. My wife and I have saved up 100k and are waiting to see what happens. We just want a home.

David, I feel the same about a lot things, bank bailout, bankers getting huge bonus by screwing up everything, the laws don’t apply to the powerfuls, Jon “superman knows nothing ” Corzine, etc. yes, there are clearly problems with housing market, and a lot people are gaming the system. That’s why many people, people with jobs, with houses are really mad. Unfortunately, our elected officials don’t really care about the people who actually pay the bills. They only care about the unemployed, and the defaulted or those who choose to walk away. This is the sad reality. However, Having a house with a yard is great for the kids and family, and you have a sense of accomplishment. That’s the most important thing, that’s the part missing in all these discussions.

It pisses me off too. Bob takes risks and you don’t .you could have gotten the same low or no down but chose to have skin in the game instead. Bob could have lost it all playing that game but didn’t. The banks and govt should have encouraged for closures not discouraged them. If you have no equity you are are renter and should be treated similar to a renter. Bob should have been thrown out on his ass so someone else more responsible could get a chance to have a home. The lesson which was not learned is that you should have more ownership rights as your equity rises from either putting more down or paying your mortgage down. This applies to you as well . If you over pay and the market collapses you lose. Imagine how healthy the market would be if the rules were as I describe. Imagine mortgage insurance costing barley anything because if you have no skin in the game the banks take it back and kick you out right away when you default. No 2 years more like 2 months. Bob should be in a tiny apartment and you should be glad you are not bob. But the system keeps punishing the good responsible citizen. If bob continues to gamble he will eventually lose.

David, I am sorry. Your post makes me sad; what happened to you is unfair. You might want to check out this article…”Why U.S. might be ‘a nation of deadbeats’”…

http://finance.yahoo.com/news/why-u-might-nation-deadbeats-113026485.html

Another day, another financial Mulligan. Media hysterically reports on fiscal cliffs, debt cliffs…more money printed, more credit extended, stock market rallies. Never an end game. People boast about buying a house, proudly declaring if things don’t go their way, they’ll stop making payments, dare the bank to kick them out. I know many discouraged, good people who see deadbeats being rewarded. What happens if the majority decides to throw in the towel, game the system too? What then? Print more money? Surge the Dow to 30K on bad news? 100 bids on a 500K one bedroom “fixer” condo in Barstow?

Bob might not be telling nor understand the whole story. Usually the terms are they stretch the amortization over 40 years, but have a balloon payment due in year 30 which will in fact cover the the original mortgage. It really isnt forgiven, but merely postponed. Bob and folks I know who participated in such schemes, are banking (pun intended) on being dead , or the market/hyperinflation bouncing back by yr 30!!

The facts remains that the Federal Bank and our governmnet is still looking out for the banks who took our tax money and bailed themselves out…matter of fact, these banks are still being bailed out. Numerous lawsuits accusing banks of FRAUD on our loans had ended up with settlements rather than jury court trials that ended with banks paying less than what they would have paid.

Yea, they have HAMP, HARP programs to help refinance these upsidedown loans at 125% of market value value….why would anyone do that? Yes interest rates are low, and that is precisely how the Federal Bank is screwing us. Why would you pay 25% on a negative equity?…thats 125k on a California home?…

Loan Modification?…thats a joke. still not many are qualifying. No principal reduction either though banks promised they would…

FHA home financing? well, SUB PRIME lending is now legal…wasnt this what part of the problem was with the housing market debacle? Low downpayment and high payments?

Wonder why Shadow inventory had declined? The FDIC had been selling non performing notes to Hedge Funds and large portfolio investors, at the same time the Federal Reserve Bank had allowed banks to keep foreclosure inventory off their books. This means that banks can still meet the operating reserves requirements required by the Fed to remain in operation…these banks would have otherwise been closed down

BOTTOM LINE….THE FEDERAL RESERVE BANK AND GOVERNMENT ARE STILL LOOKING AFTER THESE BANKS WHO COMMITTED FRAUD IN ORDER TO GET RICH…AND ON OUR (TAX PAYERS) ACCOUNT. What surprises me though is that NO ONE IS DOING ANYTHING ABOUT IT. AND NO BANK EXECUTIVE HAD GONE TO JAIL….

These

Yes, yes, and yes. It is rigged, rigged, and rigged. Until you start seeing corrupt people going to jail the fixed, rigged, system (in this case for housing) will continue to go on.

Corrupt people are not going to jail because not enough people care about doing anything about corruption; your just showing it on yourselves.

I’m a first time home buyer and have been submitted 20+ offers in the last year in South Orange County. My budget is $250,000 which is the most competitive price point in this area.

In December, a listing came on the market for $199,000 which was bank owned. I offered $210,000. Comps in the same neighborhood were going for about $215,000. I offered on it site unseen and the following day the bank countered my offer for $279,000.

Several days ago I offered on a property that was listed for $173,000 that was about 850 square feet. I offered $210,000. The winning bid was for $215,000 and the buyer had $100,000 down.

I recently went to an open house for a condo with my girlfriend. I didn’t think it would get much attention because it was in an undesirable location and the asking price was a little high. I had trouble finding parking and walked in the door only to find myself shoulder-to-shoulder with about 15-20 other people.

I’m seeing that around Sacramento also. Dumps selling in 2 days with multiple offers. I couldn’t buy a house here I actually wanted, if I tried. And we’re looking in the $400k range. Avg price of a house in Sacramento (median) is I believe about $160000.

We’re using VA financing and we’ve had agents tell us they are not interested unless we have $100000 down and conventional financing. I’m amazed…

We were pretty much sidelined having VA financing. After a year of looking, multiple declined offers, we knew a couple who was PCS’ing, offered on their house and we went into contract with them as a FSBO. If it wasn’t for that we would still be looking, offering and getting nothing! (we are in Vacaville, Ca.) A military friend of mine told us if you can to get FHA and VA approved, offer with FHA and once accepted, tell them you decided to go VA instead. Worked like a charm for them!

Well, if the place is undesireable and over-priced, what does that make you conclude?

The reality is you live in an area of the country dominated by idiots. Why join the club?

Here’s a better plan:

Know what you can pay.

Know what legit (DHB like) value metrics are.

Keep at it till an offer based on this is accepted.

Very good points. Do not let emotion rule the deal. The homes prices that make sense may already be gone and now it’s bag-holder time.

Incomes and wages do not support this run up whatsoever. It’s purely historically low interest rates and controlled inventory. The “pump” looks to be almost in full swing……not long after which the “dump: comes into play.

Thanks Pat’s Fan =)

I only told the story of the open house just to show how desperate buyers are right now. Fortunately, I live at home still and am very picky with what I offer on and am willing to wait as long as it takes.

Last February I offered on a condo that was a pre-foreclosure and going for 205,000. My offer was too late and the bank had already begun the foreclosure process and pulled the property off the market. They re-listed it about 10 months later for $309,000 and it sold within a few days.

I’ve done a lot of research regarding these investment firms that are packaging their rentals as REITs and are selling them guaranteeing a 5% yield. I would love to hear anyone’s thoughts on how a strong stock market would affect the demand for REITs.

If the 5% yield is no longer attractive if the stock market offers better returns, are the investment firms stuck holding the bag? What options does the investment firm have with the properties they own if the demand for their REIT diminishes?

The richest state in the richest nation in the world. 20% of the Fortune 500 companies are based in California, while only 12% of the nation’s population reside here. Idiots abound, fer sure, fer sure.

20% of Fortune 500 companies…..and 40% of the welfare cases.

LOL

Thanks for assuming the role of poster child for my origional point.

You deserve an Oscar for best portraying that roll so perfectly.

Buying seems to make sense if you have money or can get a VA loan with a low down with no mortgage insurance. FHA is getting so f ing ridiculous that it doesn’t make sense anymore.

Why buy a condo rather than save for a home? Investors will sell at some point when they feel safe in the stock market again. Being a landlord is a pain in the ass. Employment uncertainty is going to force more people into renting.

Can you factor in changing jobs , losing jobs and instability into your 30 year equation? People get cancer and they have spouses that become disabled or sick children. If you can pay cash for the condo or house you can sell it quick in current market conditions or for less if thins get worse. People are putting 3% down and getting ripped of with such high mortgage insurance it hardly seems worth it. The more uncertainty the less you should be borrowing. Renting is probably more expensive than owning in some circumstances but not all.

Housing is a mess right now and some people will come in with low down payments and win but many will not. Patrick.net. ” you either rent the house or you rent the money”.

@Patrick, I suspect that you, like many of the disgruntled posters here, are chasing after the small handful of desirable properties in the upper mid-tier areas. This would explain the so-called “bidding wars”. Here in SoCal, when you move outside of the desirable upper mid-tier areas, it is quite normal for properties to be on the market 6 months to a year with frequent price cuts by the listing agent until the unit finally sells. And the final selling price puts the monthly mortgage well below equivalent rent for the area.

It warms my heart to see how easily the Fed and the govt can re-manipulate the sheeple into a house buying frenzy, yet again. I’ve been attending real estate investing club meetings since the mid 1990’s and one thing that really hit me about this down turn since 2008 is that the club meetings actually grew in attendance rather then declined. I can tell you that was not the case back in the early 1990’s.

They’ve all been chomping at the bit to buy more houses and now are crying because the prices are going up too quickly now and they are also going up against hedge fund cash buyers.

This has all the earmarks of a dead cat bounce/pump and dump written all over it.

Lots of rhetoric and personal anecdotes but no hard facts …

I’m not convinced.

A reasonable price analysis will include the full value of renting over 30 yrs vs. the full value of ownership (at today’s home prices) over 30 yrs. Compare the two comprehensively / mathematically and see which is more expensive. The answer will tell you whether the housing prices are reasonable or not.

I’m convinced by math and real facts … not personal anecdotes and rhetoric.

How do you factor risk such as job loss, moving to stay employed, underemployment, spouse job loss, sick spouse, sick child, earthquakes.?

How does that get factored in? Renting can be expensive or cheap depending on circumstances. How many people in today’s world can buy a home in southern cal with little down and live happily ever after for the next 30 years without any bumps in the road? I’m not preaching I really do want to know how to factor in risk. Seems to me the ave joe needs to buy a modest home and put as much down as possible and pay the mortgage down in 15 years or less. If you really own a home then you don’t pay a mortgage and can better handle income fluctuations. I think most people who leverage themselves too much for shelter are going to get hammered. Good luck to you

Something that is not as expensive as an alternative does not mean it’s a reasonable price.

“Compare the two comprehensively / mathematically and see which is more expensive. The answer will tell you whether the housing prices are reasonable or not.”

And the underpinnings for that statement of fact is…? Nothing. Show your work, please.

“I’m convinced by math and real facts … not personal anecdotes and rhetoric…”

I agree wholeheartedly – and so far you’ve shown nothing (except for one number regarding BLS) in terms of any actual evidence for your macro statements of alleged “fact.”

“I’m not convinced.”

Given the paucity of your evidence – who cares whether or not you’re convinced of anything on this blog?

Every deal is different. But, if you can buy a house for less than it cost to build it on the same land or its PITI is the same as rental costs, it’s probably a decent deal.

The safe return on money is paying almost zero at this time. So at least “buying” a home leads towards ownership of something rather than renting it. A 30 year commitment requires some stability of income and a hope that prices don’t drop again. I am noticing a distinct change in attitude towards housing in CA at this time. Even this board is starting to sound like at least 50% bullish, if not more. Some good money can be made in the next 12+ months.

Are you looking for hard facts that we know for sure today will predict the future? They dont exist, so for now you’re just going to have guesses on what may happen.

It’s not our responsibility to convince you of anything although it seems as if you’re doing a great job of that all by yourself.

Snide commentary aside, your points are well noted and we don’t have to come to the table with an annotated bibliography to simply express an opinion on a comments forum.

@ Dmac,

And the underpinnings for that statement of fact is…? Nothing. Show your work, please.

Sorry Dmac, I can’t output a spreadsheet here. How about you do some work on your own? I’ve given you enough support for various things … some you’ve asked for and others you have not commented on … eg. Core Logic data shadow inventory, Case Schiller prices, 90% underwater mortgages that are current … I think I’ve given more data than you have. Perhaps you should start doing your own math analysis and searches so you don’t have to ask me.

“I agree wholeheartedly – and so far you’ve shown nothing (except for one number regarding BLS) in terms of any actual evidence for your macro statements of alleged “fact.â€

Again, I refer you to the statement above. I’ve given more than enough data and sources. What have you offered besides asking for more data?

“I’m not convinced.â€

Given the paucity of your evidence – who cares whether or not you’re convinced of anything on this blog?

Looks like you should look at yourself in the mirror for “paucity of data”.

You’re right about one thing … no one should care of what you think. It’s mutual, your opinion means little to me. I’ll stop responding to your further request for data, given that you offer none.

Pug –

That’s good advice; and here’s some more – next time you accuse others of engaging in “rhetoric,” try harder not to engage in it yourself. Additionally, this blog is for those who believe we’re in a housing bubble, specifically related to CA – it’s not up to the commenters here to disprove your disbelief on that assumption.

@ Dmac,

If you choose to engage yourself in group think, that’s your business. You don’t speak for others. If others choose to digest a counter point based on factual data, that is there business. No one appointed you President.

Flippers, multiple offers, wall to wall people at open houses, ah the sweet smell of a real estate bubble. Look what happened last time folks. History repeats itself over and over and over. Time to que up the song ” We won’t get fooled again” by The Who.

http://www.westsideremeltdown.blogspot.com

It sure looks like a frenzy in the making. But one big difference this time is that lending is not looking to get any easier. I’m still hearing a lot of issues with qualifying for a loan and a lot of people are bringing big cash down payments to the deals. If not all cash.

I’ve seen one deal where the appraisal looked like they pushed the edge pretty hard to get the number. But the lending side looks pretty conservative this time. So, I would expect this run up to be much shorter lived than the last round. 2003 to 2006 was the sweet spot. Without lender participation, I’m thinking this goes another 1 to 1.5 years.

“Without lender participation, I’m thinking this goes another 1 to 1.5 years.”

But that’s really the underlying question, isn’t it? Can the Fed continue to keep the market moving forever upward, in league with the lenders? I don’t know, but I thought at one time (not too distant) that this current run would’ve been over by now.

This market will continue until the Fed takes away the punch bowl. Keep in mind that they usually take the bowl away too late and everyone gets wasted.

I’m hearing of offers that require a lot of cash because the lenders are not backing the offers up. And the hedge funds don’t have a “lender” to worry about. This makes me think that despite the frenzy and hype that will be generated by all that’s now happening, the majority of the about-to-be-bag-holders just don’t have the cash to put into the deal.

Without the lenders joining the party, I don’t see how it will be a full-on bubble. Nor do I see how it will run more than a year or so. In the real world of cash, people run outta money.

“Won’t get fooled again” 🙂

Folks, this is the end of home ownership for Americans – except for the .1% This has been

situation has been engineered by the big money world wide. Let’s approach our congressman and see if we can do something. I saw this happen in my neighborhood. The house needed many repairs and the Wall Street ‘people’ who bought the house, brought in multiple limited English language people to fix up the house – probably immigrants from Latin America. This must be stopped. Our children’s future depends on it.

Is this a joke? I can’t stop laughing at how retarded of a comment this is. Do you believe in “Chem trails?” If you do, please walk off a cliff.

I think there’s a lot of truth in the OP’s comment. The banksters will keep at this, finding new ways to make bank. Nothing to do with believing in chemtrails. Just a real possible outcome based on what’s happening.

If a lot of investors are paying cash, won’t this stop soon because the banks aren’t benifitting for the long-term? I mean the banks don’t make money off of it, though they do get to escape the losses because the property was purchased.

I don’t know exactly where I’m going with this, but would love to hear thoughts on what will happen because of all these cash purchases.

Well, even with Patrick’s bad luck, it shows that there are even a few cheap condos in South County. South County isn’t what it use to be there are now some tough hispanic areas with some gangs not as bad as North/Central Orange County though.

Are there any numbers that show conclusively where the inventory has gone? If listings are down 60% in some areas, what percentage of missing homes are normal sales, and what are REOs? The only way I can see of finding that out is to look at the mix prior to the vacuum, taking into account trends such as falling foreclosure rates. If foreclosures were 40-60% of sales, and now comprise say 20%, and organic sales are more or less static, we know for sure something is amiss. The next piece of the puzzle is deciphering what percentage of homes never got to market because of trustee sales. I think the American buying public has a right to know. It’s just a few simple numbers, and they may be seriously distorting the market again. If the game is rigged and the playing field is not level, buyers need to made aware of it.

Transparency is clearly not the goal right now. You have to look hard to find out what all the ‘shadow stats’ mean but most of the official numbers are ‘inaccurate’ or at least don’t reflect a lot of the relevant information.

The average person who just wants a house to live in I would wager only sees the ‘recovery happening’ in the news and jumps in. They can only afford to do so with FHA leverage and low interest rates, and price be damned they are going to get that house (or at least one of them is). I wonder how many will be underwater in the next dip ?

Cash buyers will take a loss but can get out of the property at least; in that sense they don’t paralyze the market like people that bail (or just had no equity to begin with so they cannot sell to get out). If only we had a law forcing banks to allow short sales up to 10, 20% of the loan so inventory could get cleared.

I recently talked to a direct lender who is on the finance side and he was telling me about investors are forming these huge lump funds called superfunds that is about $500 million each and are buying out properties indiscriminately. They would hold on to these properties and release them a few at a time depending on what the consumer market needs. Don’t know how true this is but it certainly falls in line with the artificially low inventory and manipulated market.

I’ve been looking at homes since July 2012 and the situation gets worse every month. The foreign all cash offers is what kills me. They will always win the bidding war. I have looked at over 80 homes in the LA/San Gabriel Valley area and each house we look at will typically receive 5-10 offers at least. On house had more than 40 offers. That property was a fixer. Unless this mini bubble bursts, I feel like there is no stopping this frenzy and ridiculous trend. What goes up must come down. Greed will always screw you over if your short term memory doesn’t serve you well. I will sit this one out for now.

Leave a Reply