The California housing market will stagnate in 2016: Affordability, Millennials, and slow down in overall economy.

The California housing market ended 2015 just like the stock market. Losing momentum and looking overpriced. In California a runoff of tech wealth has flooded into areas like San Francisco driving prices into the stratosphere. People now seem to feel that real estate is untouchable and that the Fed somehow cares about some crap shack in SoCal. The Fed has bigger fish to fry. Foreign money has pushed prices up in certain cities but this money can be fickle. Will this money continue to flow in? The housing market in California looks due for a correction simply based on underlying fundamentals. Most of the arguments for prices remaining high across the region seem myopically focused on the notion that foreigners and investors are somehow dumb when valuing assets. I’ve spoken with a handful of investors, both local and from abroad and they are keenly focused on value. There are a few challenges facing the California housing market and it is safe to say that things will limp along into 2016.

Housing in 2016

It is interesting to hear predictions on housing especially in 2015. Most of the housing bulls seem certain that “others†will continue to buy even though they themselves are not buying. If housing were such a sure bet from here on out, why not plunk down some cash and buy? In California buying for cash flow is a losing proposition. But over the last few years people bought to flip or to speculate on additional appreciation. That has been the play for hot money. But with price gains hitting a wall, will this continue? Also, a 20 percent down payment on a crap shack can be $140,000 to $200,000 depending on the area you are looking at and this doesn’t count the 30 year giant monthly nut.

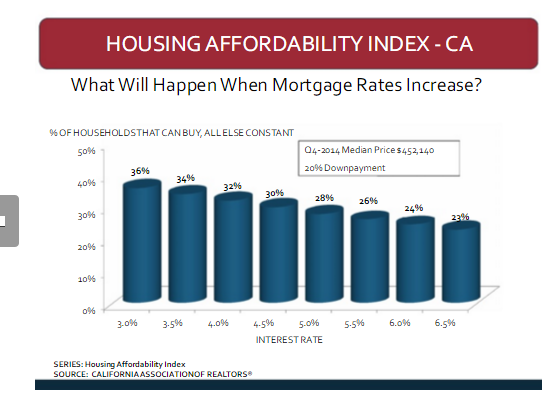

First, housing in California is incredibly unaffordable to most families:

At current interest rates, only about 32 percent of households can afford to purchase a house. And over the last few years the blind rhetoric that the Fed would never raise rates was broken. The Fed just raised rates. Now what? The idea that the Fed is looking out for housing alone is nonsense. They are focused on bigger challenges like keeping the stock and bond markets flowing and making sure the employment situation doesn’t fall off a cliff. Having ridiculously priced real estate in many regions isn’t exactly a good thing. This is more of an outcome of NIMBYism and hot money doing what hot money does.

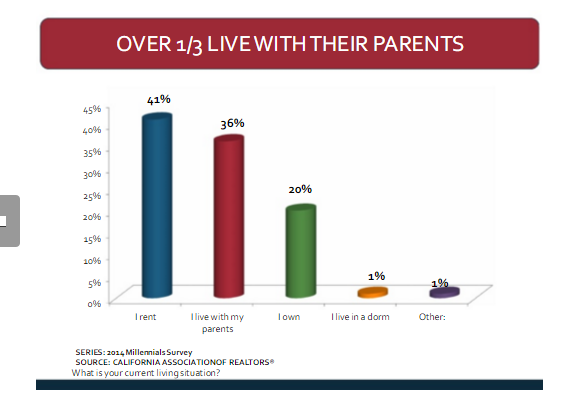

Another argument we get is regarding pent up demand for Millennials:

Most Millennials rent but an incredibly high number live with their parents.

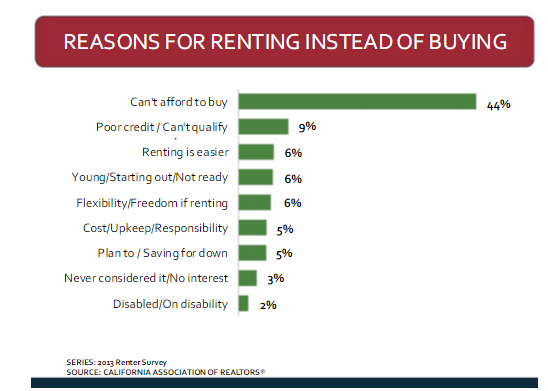

Those that rent are surely rolling in money and are just waiting to buy right? Not exactly:

Nearly half of those renting flat out can’t buy. They can’t afford to. Sure you’ll hear about anecdotes from house humping cheerleaders but data says otherwise. Then why did prices go up? Because of foreign buyers and investors. Can you compete with an all cash buyer in San Francisco for a million dollar crap shack? Do you even want to? In reality the number of renters looking to buy is in the single digits. And these are for renters. Do many want to buy? I’m sure they do but I’m sure many people would love to have a Tesla or a private jet. Those living at home are even more broke since the bulk can’t even afford a sky high rental.

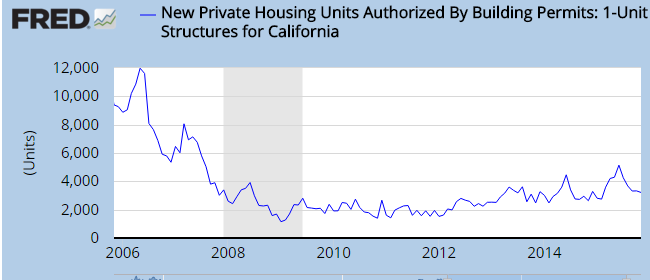

What about new construction? California is building a few new homes and developments but not many:

What is telling of the price gains is how widespread they are. We aren’t just talking about San Francisco or Santa Monica. You are seeing practically every zip code in Los Angeles up by large margins over the last few years. Yet incomes are stagnant. The notion is every area is gentrifying. That is simply not the case. Of course the stock market has been in a major bull run since 2009. We will see how real these gains are when the next slowdown in the economy hits. People do realize that recessions tend to be cyclical occurrences right? But of course, in financial amnesia California real estate never goes down, the sun always shines (except for El Niño years), and traffic is never an issue.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

166 Responses to “The California housing market will stagnate in 2016: Affordability, Millennials, and slow down in overall economy.”

Affordability will not drop from 36% to 23% if interest rate goes from 3 to 6.5 for the simple fact that home prices will drop significantly. Also, FED will not raise rates unless economy improves, which mean median income is up, affordability is up. The question is, if economy does not improve and rates stay low, what will happen? Nothing, until the next recession hits then FED will not have any arsenal left. If financial system proceeds responsibly, then low rates will be fine. But if systemic wrecklessness occurs, then only option is bailout, like how IMF saved the Greek economy. Perhaps the future is bailout every 10-12 years. Public might be ok with that as long as they’re preoccupied with their iPhones and selfies.

Jason: You’re wildly misunderstanding the point he was making by bringing up the effect higher rates will have on affordability at current prices: he is making a case for price drops in housing.

The FED did a small (.25%) rate hike just this month. They’re talking about doing more over the next several months to a year.

Uh prolonged periods of low rates are always bad from a historical perspective: it leaves your central bank without maneuvering room for the next recession and can introduce severe market distortions by the flood of cheap money and blow more bubbles or booms. Like a housing or stock boom or bubble for instance. We’ve had very low rates (ZIRP since 2009) for a long time and historically speaking are about due for another recession (they tend to happen every 10 yr).

Smartphones and selfies won’t distract people from another mass financial system bail out. Tech didn’t do that last time. People just don’t have good choices of politicians to choose from plus were bamboozled by astro turfed grass roots movements like the Tea Party and OWS which funneled peoples’ frustrations into useless activities.

If interest rates go down, foreigners with suitcases full of cash will have even more of an advantage as prices will go down, and financing will be harder for Americans to get.

I don’t know how bad things will have to get before we ban ownership of real estate by non citizens.

But our currency goes up relative to theirs so it’s harder for them to afford our real estate.

Foreigners are only coming here with suitcases of money, so that they can park their cash in a safe place, and get most of their money out. If interest rates go up, their overall cash retention goes down significantly. Joe American won’t care too much, because his monthly payments will be the same either for a $1million house at 3%, or a $500,000 house at 7% . Joe China, or Joe Flipper will be out of luck if interest rates go up, as their quick return will be much lower, since a higher % of their money will have gone to interest, and not the house.

Amen! But the only way there will be a tax on foreign buying will be when citizens start to revolt. Look at San Marino school district. The majority of kids going there are now freakin Asian! Chinese paying hundreds of thousands above asking price so they can send their kids here! Insane and ridiculous. When will this insanity end? Certainly not with Hillary as President!

I agree, in the short term it make housing more expensive but if there is a good dropped in pricing it could be good. In LA?OC and so forth people could afford the houses better when the interest rates were higher. The low interest rates have encouraged high prices just like they do in London. England has almost 0 interest rates. The only countries where zero interest rates don’t make the housing more expensive are aging more like Japan and Germany. Japan’s population is declining so prices of housing can’t be driven up since their is less people to buy.

If we continue to have an administration that believes in unicorns and glitter like the current one does, they will raise interest rates and a lot more. These children in the White House are narcissists. They don’t give a shite about anyone but themselves. Mark my words. I said it when Obie was elected based on his personality profile. It is my profession and his type does not concern itself with honesty. Honesty to his type is like unicorns and glitter to the rest of the world.

You must mean good old GW Bush who thought the housing market was in great shape. Please.

Obama and Hillary have helped the 1% to more of the peasants money. Were you surprised? I wasn’t.

Great insight doc. People tend to have short term memory. What goes up must come down. There are those who thought that gas price will never come down. It did this year. It is still high but people think it is cheap because they are conditioned to think that way.

Tons of people are well aware that prices are too high though. You can tell because they cite prices as the reason for still living with their parents rather than moving out…

Its only in the mainstream media and RE ads that prices are presented as reasonable.

or you could say what goes down must come up. like home values in the better zip codes in SoCal, which are now beyond peak ’06 levels. You could have bought a home in one of those zips at the worst possible inflated value of all time in ’06 and here you would be, 10 years later, with the home worth more, having paid off 10 years of principle, having locked in a historically low interest rate. not bad, not bad at all.

best of luck to all the market timers out there.

Hedge funds and other big investors are market timers who make their own luck. Their massive RE purchases were enabled by record low borrowing rates, greatly lowered prices, and having exclusive access to RE portfolios of financial institutions looking to liquidate. Now, those same investors are cashing out on their RE portfolios to take advantage of the massive price appreciations. Classic market timing.

yes, hedge fund market timers are always right, those guys never take losses.

more to the point, virtually all of the homes in my neighborhood that change hands are owner occupied with kids coming in. I suspect this is true of most of the upper middle class neighborhoods in good school districts. this is the 2nd such neighborhood I have lived in in SoCal and no one is talking about how they are renting from a hedge-fund owner. it’s really not happening and not a factor in these neighborhoods. it’s people with money and/or great earnings. sorry.

There is no 100% foolproof way to time the market. At least they weren’t buying at the height of the bubble, losing out on the opportunity costs, and hoping that they can get crumbs from government and Fed bail outs during their artificial asset inflation programs.

During the last downturn, many buyers chose to strategically default because they refused to pay for an underwater property. It doesn’t matter how much they earned as long as giving the keys back made financial sense.

“or you could say what goes down must come up. like home values in the better zip codes in SoCal, which are now beyond peak ’06 levels.”

Or you could say what goes up and down. Unless buy now or be priced out forever.

“10 years later, with the home worth more”

So are all of the replacements with higher transaction costs.

“having paid off 10 years of principle”

With the typical borrower at 30 year terms, far more has been paid to service the debt than principal pay down.

“having locked in a historically low interest rate”

Actually, the historically low rates came at the end of 2012, not 2006. Many of the 2006 mortgage holders refinanced in the last ten years. Some of them multiple times. Care to guess how many re-extended terms out to 30 and aren’t making up for the difference on a monthly basis? I best most. Therefore, even more toward debt service and less toward principal.

Not great, not great at all.

brought to you by the biggest market manipulation in the history of RE.

yep, not bad not bad at all.

BTW my X bought in 2005, she just sold that house for a $30K loss and i’d be willing to bet she doesn’t agree with your assessment.

It seems the big problem right now is inventory especially in the entry level units…there is nothing out there in the $750k or less category in LA in houses or condos that looks nice.

Here is an example:

Starter family (my friends) just bought a 1,095,000 house with $1560 sq ft! That is over $700 / sq ft; up north in San Jose. Listed at 1.045 and got it through a bidding war and sold at 1.095. My friend and his wife make probably 150-170k together and have an infant. The ONLY way they were able to get this was the entire down (I assume around 25-30%) was from the parents.

Both of gone through up’s and down’s in terms of careers and I very much think this was a pretty big mistake; not only overpaying obscenely but affordability they are 1 lay off away from default.

I wonder if said house is one of our beautiful old Victorians with good California redwood bones or some 1970s POS made of papier-mache? We have an abundance of both.

Dan stated, “…they are 1 lay off away from default.â€

Other than generally ridiculous prices, that’s a big reason why I’m not buying now. Anything decent I can “afford†requires both my and my wife’s income to qualify and to make payments. If one of us lost a job, we’d be screwed (unless we wanted to exhaust our savings/retirement, which we would not).

I’m perfectly content waiting this out for a few years. A few years is about all we have, though, since our little one will start school and we obviously want to live in a good school district. Private school, I feel, is a waste of money, since you could probably apply the money you’d pay for private school to a mortgage for a house in a good district and be way ahead of the game.

It is so hard to be patient (we been waiting for 2 years), my wife is a lot more financially conservative than I but even she is feeling the pressure to buy before we have a second child. If our rent wasn’t such a great deal, we might have already jumped ship. We submitted offers earlier this year but all with 10-12% reduction off list price, eventually we will get to someone that really needs to get out and score a deal.

Keep fighting the good fight. You win by having a wife who manages finances well, a true partner from that perspective. Eventually, you will have enough saved to do whatever you want. We succumbed to the time push as well (have 3 kids) and bought a house for more than we wanted. Not perfect, but a good situation…we can afford the house, have enough space, etc.

You needed to buy in 2010 or, wait until 2020 or so. Buy when the tide is low!

Hang on your hats, folks. China’s stock market plunges 7% today, wiping out several points on the global markets with it:

http://www.bloomberg.com/news/articles/2016-01-03/yen-rises-as-investors-monitor-saudi-tension-stocks-signal-drop

Housing TO Tank Hard SOON!

Go, Jim!

I totally agree Jim!!!!

The worse things get for China, the more money will be come into US real estate. If you were sitting on a nice sum of money and the central bank was aggressively devaluing it daily, what would you do? Get the money out of the country any way possible. We need to put a steep tax on home purchases by non-citizens, I don’t care where they come from.

That’s exactly what will TANK everything. Panic money leaving China will run everything up until the market overheats and cracks. Then housing prices will crash hard.

Yeah – but the Chinese stock market isn’t really a big source of investment, like it is here for the private citizen, therefore a decrease has less of an effect.

A Few points with CA economics in regards to housing capacity

Still sticking to my model that shows 82% of the working population are priced out of housing once you exclude cash buyers and those making 3X median income

– Renting inflation has zapped the capacity of the young to save for even a 3% down payment in this cycle.

– Ownership from young buyers coming from certain high tech sectors which don’t have large working population

– Sales have really gone no where since Mid 2013 and 2015 YoY Data that has shown strength was only due to the low bar since 2014 sales were all negative year over year

– Limited expansion of newly single family homes here in CA. Massive uptick in luxury apartments

– Still the housing debt bubble is still with us as limited inventory conversion for CA owners. If you base off the affordability index a owner would need at least 28%-33% equity to sell and move up ( conservative estimate)

– A lot low end priced homes already bought with cash by investors and rented out

2016 Housing Prediction and Bloomberg Financial Interview On Housing

http://loganmohtashami.com/2015/12/28/2016-housing-economic-predictions/

Please stop spamming this blog by advertising your website

ZZZZZZZzzzzzzzzzzzzzz…

You have to give Logan Mohtashami a little credit- at least this time, his post is somewhat related to the article topic. And for once, I can actually sort of understand the information he’s trying to convey. I’m still not a fan of the self-promotion, but at least it’s a little more tolerable now.

Watching the stock market this morning, I see the sell offs and corrections happening for the new tax year. Look for a big housing dump as commercial and real estate dump properties at the “peak” of market. I can see prices jumping up a bit, then flattening and dropping by the end of the year. If Hillary gets elected like we think she will, look for more selloffs and stagnate job growth. Happy New year!!!

Hillary getting elected won’t have any impact on the economy and any changes in the stock market with her election will probably be transient too.

Statistically in the US recessions happen about every 10 yr so we’re due for at least 1 no matter who gets elected.

Economically speaking Hillary is Third Way or Center Right, IOW pro banker and Wall St, in terms of what policies she would push for. So expect more of Obama-esque economic policy decisions. Socially she seems to be Center Left, or at least saying she is, so maybe you’ll see more money put into the hands of the middle class by her instead of just the rich but any real changes will have to go through Congress which is locked up by Republicans so nothing will change much with her elected most likely.

I just don’t see Hillary getting elected. Too old, waaay too much baggage. Bernie is even more fossil like. I’m surprised the Dems couldn’t find someone younger and more dynamic to toe the marxist party line they’re pushing nowadays, but they’ve bred an idiocracy to support them at the ballot box so there’s not a lot of intellectual power there and maybe all the master planners are either dinosaurs or so ugly that they don’t want to put them in front of any cameras. Truly strange times we live in.

Yeah, it’s really weird that the current crop is the best that either party can muster- odd ducks and duds all around. Not that I really care much who gets elected- my life wont change (for the better) either way. Maybe I should give politics a go lol.

Hills has about as much chance as a colored guy, huh?

Ya seriously. It seems politics are for ugly people with diva mentalities. At least republicans are presentable but man have you seen some of the democrat women? No wonder they are so mad most of the time.

Having lived through at least two previous housing busts in So. California and one in Denver, I can safely say they are inevitable! I was in the position of being able to wait out the multi-year recoveries, but in every instance there were many who got hurt badly! The next correction will be no different …

Ehhhh the whole “entry level” thing always seemed to me to be nonsense in order to get people to overpay for tiny and/or crappy homes in crappy areas in order to get them started on the “housing investment ladder”. Which is BS.

More decently prices homes with decent neighborhoods and infrastructure should be the end goal here for society at large. The trick is crafting the laws necessary to make it happen and getting them through the appropriate state and federal legislatures intacts.

“More decently prices homes with decent neighborhoods and infrastructure should be the end goal here for society at large. The trick is crafting the laws necessary to make it happen and getting them through the appropriate state and federal legislatures intacts.”

What laws are you referring to exactly? You feel that laws should be crafted to enable you to purchase your dream house at a price you dictate? That is the problem with this county, people feel entitled. No one is entitled to own a home. Owning a home is a privilege.

Hunan: I said decent, not dream home. Respond to what I said not what you think I said.

As for the exact law changes necessary that is a harder one but I’d look at what Germany has done. They explicitly try to keep home prices from rising period and have strong renter rights there too.

Also having a place to live is a necessity not a privilege. And having affordable living areas is good for society and the economy as a whole. These bubbles are slowly destroying the economic well being of most Americans.

I agree that owning real estate is a privilege and not a right. According to this principle, do you oppose the ongoing subsidies from the Fed and government that lower overall affordability by artificially keeping inventory low while concentrating purchasing power in the hands of investors?

You definitely hit the nail on the head, Hunan. I am not sure if it is a big city mentality or that many people here in SoCal have a sense of entitlement. You just need to observe the way they drive their car. They think it is in their God-given right to cut people off because they are the only ones in a hurry and no one else.

Great post! I never undestod the starter house concept myself. So you buy a cheap lousy house and then if prices go up you win right? Wrong. Your goes up but so does the higher priced home in a good area. Doesn’t really help. I guess your closer than someone who didn’t buy at all, but you still didn’t get the house you wanted. Conversley if the market drops you are locked into crap and can’t switch to something good that is now affordable like a renter can.

there are plenty of decently priced homes in decent neighborhoods in this country. 90+% of this country probably fits that description. if you cannot afford what you want in SoCal, hey it’s a big country, get packing.

Helps if you can take your job with you.

I second what Martin said. There’s a big reason why prices are lower. Too bad that reason doesn’t apply to California.

The starter home provides a much needed experience besides a stepping stone to a better home. For most people the starter home is a learning experience. Many mistakes will be made when buying and maintaining your first home. People will ascertain their needs and wants for their next home. Better to experience this on a smaller scale on a generally cheaper home before moving on to a larger more expensive property which requires more maintenance. Previous generations have gone the starter home route and moved on to bigger better properties. Problem is that a starter home in LA is costing 500K+.

“Problem is that a starter home in LA is costing 500K+.”

And that is a BIG problem for most young couples. It shows that the market in SoCal is in stratosphere and bound for a major crash. Why should a young couple pay half a million for a house where bullets are flying through the walls at night? Just to say that they enjoy the SoCal lifestyle? What lifestyle? The ghetto lifestyle? The next to the freeway lifestyle? Or that of sitting in the car for 2 hours each way to and from work and breath all that smog? If that works for you, fine. Just do not counsel the young couples to tie a millstone around their neck.

“The starter home provides a much needed experience…â€

No, it doesn’t. My starter home (condo) was a foreclosure that required a ton of work, which we had to do ourselves since we didn’t have the money at the time to pay someone to do it. Numerous weekends of my life wasted, doing stuff I don’t enjoy doing, just for the sake of having a place to live for a reasonable price. I refuse to ever waste my life doing that again. Some people call it sweat equity- I call it hell.

“For most people the starter home is a learning experience. Many mistakes will be made when buying and maintaining your first home.â€

It’s not rocket science. Buying something you can afford, getting a good, legitimate home inspection, and fixing stuff when it breaks, is all pretty remedial stuff and is all stuff that can easily be done by anyone with half a brain.

“Problem is that a starter home in LA is costing 500K+.â€

I agree with you there- L.A. housing is out of control (pretty much the premise of this blog).

Responder, you prove my point. You learned that you don’t like working on your home yourself. So next time you will buy a place that doesn’t need work or hire someone else to do it. You learned something from your 1st home which you will carry over to your next.

Home improvement is always hell, it seems. The saying that hell is other people applies to the guy I work for…. His kitchen is half torn apart and full of Croatian guys much of the time lately.

Hunan, I respectfully disagree that I proved your point. I didn’t learn anything that I (or most people) didn’t already know- that sweat equity sucks. It’s not like I chose to fix up the house thinking I might like doing it; I chose to fix it up myself because there wasn’t another option for me at the time.

Housing to crash hard in 2015!! Oh wait..

Housing TO Tank Hard in 2016!

Well, it looks like it’s started on the West side of Los Angeles. I looked at 40 homes sold in Brentwood and Palisades during the last 3 months – . 90% are going under asking price, and the average discount is about $200,000. This is from data I pulled from sales off of Redfin. Some of this may be seasonal, but that’s a bit much to account for all that.

I’m not sure if we’re in a bubble but money is cheap now. If the Fed takes a gradual approach to the rate and the 10 year price doesn’t tank then housing will stagnate for years to come.

Bubbles virtually never pop in a orderly slow fashion and years of stagnate prices is just a round a bout way of saying slow crash due to inflation.

Dear Jim,

I’ve arrived.

Sincerely,

Your Year

Is it too early for post of the year, Mr. 2016?

Nice! Love it! 2016 the year it Tanks HARD!!!

Keep the dream alive Jim. Your record of predictions that have come true speaks for itself.

It will definite going to tank. Investors are buying off from each other and driving up the price since post 2008. I was outbidded several times post 2008 and finally gave up searching. Now, I see many houses are sitting on the market for months to years without any buyer. Unless wages are catching up soon, there won’t be much millionaires out there. The stock market is hyperinflated. It takes few big time investors pull their money out, the panic will begin.

Just like pre-2008, liar loans allowed people without money to make money. I see a lot of realtors are hurting right now because there are not enough buyers out there. Most buyers that I have seen are investors, foreign and domestic. Let’s sit back and watch the meltdown unfold.

Runaway inflation is just around the corner, too.

Just like it was in 2009, 2010, 2011 …

2016 is the year for sure!

We have run away inflation; utilities, medical, housing, college, pretty much any required service or product has gone through the roof. Sure DVD players are cheap, but how many time stop you buy those.

In terms of housing price inflation, we’ve already come around that corner more than once.

Looks like your new years resolution may come true-

Global Stocks Sink on China, U.S. Growth Concerns – January 4, 2016 — 2:31 PM PST

Stocks were pummeled on the first trading day of the year, sending the Dow Jones Industrial Average down as much as 467 points before recouping some of those losses as a selloff in Chinese equities spread amid anxiety over the outlook for global growth.

While the U.S. blue-chip index had almost halved its decline by the end of Monday trading, the Dow still capped its worst start to a year since 2008. Banks and health care shares led the Standard & Poor’s 500 Index to a 1.5 percent slump, and a gauge of global equities posted its worst inaugural session in at least three decades. Emerging-market shares slid the most since August as evidence of slowing manufacturing in China triggered a selloff that halted trading in Shanghai. As riskier assets were shunned, bonds found favor and the yen rallied. Oil ended lower after rising earlier in the session.

http://bloom.bg/1YZloRu

What’s interesting to note in terms of Los Angeles housing prices is that lifestyle often comes into the conversation – as in LA has an unmatched lifestyle. Yes, it does not get cold in LA and there is a beach. But it does get insanely hot and it’s difficult with crowds, parking fees and traffic to even get to the beach unless you plan out the trip in advance. Quick jaunts to the beach end up being a lot of hassle.

This being said, many cities around the country are focusing on lifestyle. All these walkable downtown areas in places like Sacramento, Milwaukee, Philly, and in many second and third tier cities take away a lot of the reason to go to LA. There’s bars and high-end food, clubs, music venues in a lot of places now. And most of these places are much cheaper than LA, SF, NYC or Seattle. I don’t think future generations will see these large cities as much of a draw as time goes on since you can get 90% of the activities at 20% of the cost somewhere else.

Only Los Angeles delivers Los Angeles. You don’t get it anywhere else. I love LA !

Only hubris delivers hubris!

Many people gladly take the trade off of some cold and rainy days as opposed to the bad air pollution.

Location doesn’t mean as much as it used to. Some types of employment, particularly tech, are spreading to even smaller communities as more companies realize that someone living in a beautiful old $150k Victorian in a quaint small town in flyover country is more than willing to accept a $70k telecommuting salary to pay their $700 mortgage, with the alternative being paying a local $100k+ to go into the LA office and do exactly the same job. That local employee is also more likely to jump ship and move to some other trendy tech hub, considering s/he is probably a renter.

Those jobs have peaked, losing steam and about to reverse…

the economy is not good and in fact the ISM print the other day was worse than 2009…

The fed bubble is bursting….and again it will not be pretty..

Expect bad things to happen…dislocation is around the corner…Housing has peaked…

Location doesn’t mean as much as it used to? What? Sorry to disagree but I think the opposite is true. Location means more than ever, as clearly evidenced by the ever-growing disparity between SoCal home values and other primo areas vs. fly-over country. Higher premiums than ever are being assigned to the most desireable areas. Location means more than ever.

“clearly evidenced by the ever-growing disparity between SoCal home values and other primo areas vs. fly-over country”

Price is one thing. Value is another.

I agree about location. I work from home, so does my SO. We could make $20-$30K more each a year if we were willing to go into an office everyday in San Francisco, but we already tried that and it didn’t make sense financially. After taxes the extra money would just go to living expenses.

We were spending $1200/month total on transportation costs including bridge tolls, gas, pub trans, car maintenance, and parking since our companies didn’t offer parking. We didn’t make enough to comfortably save and live in the city, so we had to live as close as we could which was still expensive. Commuting and working took up so much time that we were always eating out instead of eating at home. This was a major hit to our budget every month. Our complex charged us for everything – parking, $35 fees for this and that. And on and on and on. In the end it just wasn’t worth it.

Good point. I left LA after 20+ years. I no longer saw the appeal. Yes you have the beach, museums, restaurants, music venues, etc. But it was nearly impossible to enjoy any of those things because of traffic and overcrowding. Just looking for parking can give someone a nervous breakdown. Not to mention the insane cost of living. It appeared to me that LA was becoming more like Tijuana then a worldwide destination city. Homeless people are everywhere, the city is dirty, crime is rampant, more people speaking Spanish than English.

Museums? Their is no culture in LA, unless you count the Whiskey in the 80s

life long resident…

Left so cal almost a decade ago, same feeling. If I’m paying 1st world prices I want a first world lifestyle, not a third world experience. Takes way too much money and regardless you’ll be spending a quarter of your life in traffic. Aint no way to live!

SoCal is a trashy place. It has been like that since the 80s and is getting worst by the day. San Diego used to be a nice city. Now it is the second most populated city in California. Homelessness and poverty are on the rise in the U.S. and worldwide. Income gap between the rich and the poor is getting wider and wider. I was just in downtown Phoenix and San Diego last month and I saw lots of transients and panhandlers than the previous year. Who on earth can afford a 2-3K monthly rent living on a menial wage? Let’s be real.

“If I’m paying 1st world prices I want a first world lifestyle, not a third world experience.”

Ding.

The prices don’t justify the value received.

Isn’t the LA lifestyle a little overblown? I read in one of the LA papers that in order to truly live the LA lifestyle, you need somewhere around $300k/yr. While it may seem like everyone is rich in parts of LA, statistically, there aren’t that many making that coin! The average picture is get up early, drive at least an hour, sit in your cubicle for 8 or 9 hours, get back in the car drive an hour, and sit inside the walls of your house with the TV blaring, go to bed, and do it all over again! The average resident gets up on the weekend and either goes to a second job, or contemplates going to the beach or the mountains, then says naw, I have to go to the store, but always wonders where the weekend went and why they didn’t get to the fun stuff! That is the real reality of almost any city in America!

You either over pay in rent or over pay for a house. The house/the banks and The Federal Reserve always wins folks.

Only if you live in socal, NYC, Seattle, or one or two other niche locations.

Your predictions are reiterations of the past 5 years in data gathering. NAR along with Toll Bros and Lennar are driving the inventory message. Inventory is down because homes are purchased high on the incline. A large portion of homes were unfinished during and after the crash of 2008, as inventories were low then. Homes don’t crumble to the ground nor have a 10 year shelf life, they stay in circulation, occupancy drives down inventory, occupancy today is not based on sound fundamentals. It’s now 2016 and those who bought in the 3rd quarter of 2015 are speculating that their employer will keep them, that their Index fund will continue to grow, and that they can eventually refinance out of the PMI when they get over the 80/20 hump. The vast majority of the US population is earning what they earned 10 years ago. The window from 2010-2015 is over. Irrational Exuberance is where we sit today in housing, Double digit growth and P/E ratios are fictitious based on what we are seeing in many sectors of Wall Street. There was no where to go but up, and the up was not based on fundamentals but rather, limited alternatives. Now we face the same situation all over again. What will happen is that the markets will not fall, but death spiral dragging down peoples “portfolios”, what follows is the employment market seizing up, followed by student loan defaults then the auto loan defaults. Housing will be collateral damage. The gap of the wealthy and middle class will widen but the transition from middle to low will not provide a sustainable continuous supply of cash to the rich thus everything across the table will be effected. These are the facts and they are undisputed. No one has the balls to make a real prediction.

As for the new houses being built in California, most of what we’ve seen are 2 story monstrous McMansions with master showers big enough to fit a polygamist and his 5 wives, at the same time!!! So much for water savings!

They’re just not building what people actually need or want. They’re building what will get them the most profit!

“They’re just not building what people actually need or want. They’re building what will get them the most profit!”

Eddie89,

Did you read and think what wrote before posting?

First sentence – what about if people need or want a nice house in a good neighborhood for $100,000? Should the builder provide it? Or should the government provide it? What about losses in order to come up with “what people need or want”. Should the builder cut corners and produce a poor quality product in order to come up with “what people need and want”? The builders know what the people “need and want”. That brings us to the second sentence:

“They are building what will get them the most profit”. Isn’t that what all the market participants are seeking? If you would be the CEO or president of a company what would you do as part of your fiduciary responsibility towards the shareholders assets? Would you tell them that you will do the best you can to bring the lowest possible profits to the company? …or will you try to produce a loss year after year?

No wonder you can not get ahead in life with that approach. Your thinking will make you successful ONLY if you work for the government or non profit. If the private sector would operate based on your mentality, there will be no wealth for the government and non-profits to distribute/use. Money are not wealth and the only wealth is produced in the private sector. Government can produce money but you can not eat money or get warm with money.

Without profit there is no private sector and nothing gets produced. That is the reason the communist block collapsed – state companies did not pursue the “most profit”. Without profit and private production any possible system you devise will collapse.

We ceased to have a true private system and free market in 1913 when the FED was created. Since then all we get is more and more centralization in the hands of few crony “capitalist”. It is the lack of truly free markets and centralized manipulation of markets by the politicians and the FED (Wall Street) that is killing the hope of the young couples to buy a house, not the private sector pursuing the “most profit”.

If the banking cartel would be allowed to fail for their manipulations and speculations regardless how big to fail they are, then you would not see so much speculation. The speculation in RE takes place because our “elected” politicians back the banking cartel with your taxes and mine to stop them from failing.

Most people are idiots. Builders build houses that they think they can sell for the highest margin possible, it’s like bottled water or soda. If Californians were really interested in more affordable housing they would make the entitlement process for residential projects easier, but in fact, we have consistently made building new homes in this state more and more difficult, so the only conclusion you can draw from that is that collectively, we actually want homes prices to keep increasing. The only way to reduce the price of housing is to enact laws to lower barriers to entry for new construction. When people complain about the high cost of housing in this state, the response to them should be, well, when you don’t want to build more supply, prices go up. It’s not rocket science. You can’t be a state full of NIMBYs and then complain about the high cost of housing, in other words, you can’t have your cake and eat it too, you have to decide what your public policy priorities are, and as a state, we have decided that we want to protect existing home owners v. future ones, i.e., that we want sky high home prices. This shouldn’t be a shocker, if you already own a home, this is great news for you, if you don’t, you come to boards like these and bitch. This is how it is with everything, there are winners and losers for every public policy decision. People just need to accept this in their hearts rather than wish for some fantasy world where it rains donuts every day.

What would help is a loosening of square footage restrictions. I lived in rooming houses for less than $200 a month, in rooms that were decent, not grandiose, bedroom size. This was in the 80s. I believe those same places are available back there for $200-$300 odd. We need things like rooming houses being allowed to operate on the up and up, sro hotels,and so on. What this country needs is a good $50 a week flophouse.

As Britney Spears would say: oops I did it again…

The Federal government “conveniently” screwed up ten years worth of new construction housing data. This is a key data point in which to gauge the health of the housing market.

http://www.thefiscaltimes.com/2016/01/04/Oops-Feds-Screwed-10-Years-Housing-Data

The National Association of Realtors did the same thing a few years ago in which they admitted that they lied. I mean made a mistake on how many houses were sold during the times housing was in a bear market.

Once again this proves my point that the whole market is rigged and none of us little peons have a chance. For those who think otherwise, keep dreaming.

“Once again this proves my point that the whole market is rigged and none of us little peons have a chance. For those who think otherwise, keep dreaming.â€

As I’ve pointed out numerous times, most people know the market is rigged. Where I think you are misguided is your mindset that there will never be a chance to buy a reasonably-priced house. As history has shown in multiple previous housing downturns, these opportunities do arise. You just have to save your pennies and by ready for when the opportunity presents itself.

Success happens when preparation meets opportunity. There will be opportunity- you just have to be patient, and be prepared.

“In financial amnesia California real estate never goes down, the sun always shines (except for El Niño years), and traffic is never an issue.”

I’ve been here all my life and I really don’t get it. Most large cities in Calif. are overcrowded, expensive, dirty and overrun with the homeless. Other people live in the suburbs and drive miles thru the muck to work. Some have daily commutes lasting hours. Our daughter lives and works in Los Angeles and in some ways its a cesspool.

I just got back from Montreal Canada which is a totally clean city next to anything we have her. The quality of life here sucks in many regards but people will pay anything to live here. Go figure…

I totally agree with you that many areas of So Cal suck. However, there is a ton of stuff to do (even if its crowded at times), and the weather is nice relatively speaking (winter is fantastic, summer is a little too hot for my taste). Unfortunately, after the last month or so of “cold†weather here in So Cal, the wife and I have concluded that we are definitely not cold weather people. So we’re kind of stuck here unless somewhere in the contiguous U.S. with a milder climate and cheaper housing exists (which I do not know of).

I can hitch hike to socal and make a living. I can’t do that in bumfuck nowhere unless I’m prepared to live like the unibomber.

CoreLogic posts latest on housing, from MarketWatch;

excerpt

…U.S. home prices rose 0.5% in November, representing a 6.3% gain from the same month in 2014, CoreLogic said Tuesday.

The changes varied widely among states and metro areas, ranging from a 10.4% annual price increase in Colorado to a 3% decline in Mississippi. Prices rose in all but three of the markets tracked by CoreLogic.

Some regional “fissures†are emerging, CoreLogic said, such as a slowdown in such formerly high-flying markets as Texas and California. Demand has been sturdy in other areas. But as that demand continues to outstrip supply, it may be pushing prices high enough to quell demand…….

http://www.marketwatch.com/story/how-state-by-state-house-prices-grew-in-november-2016-01-05

You forgot this gem from the same article:

“CoreLogic forecasts that prices will rise 5.4% from November 2015 to November 2016.”

The RE is in a insane state right now. I and my spouse make almost 250k but are still renting. We do not trust that the employment environment in the near future. The math really does not add up. The flawed model that is promoted in the RE world that you can buy something 4x your total gross income. In reality , you net pay is really far off. Your mortgage comes out of net pay not gross. This is where the illusion lies.

For example , a home with $1m price tag need 200k down. The opportunity cost on the 200k can help me subsidize my rental instead of becoming a consumer of this 200k plus 800k mortgage payout. The RE agents are putting a spin on tax benefits on the interest paid on the mortgage. Most folks believe in the myth that 1/3rd of the interest paid will be tax refund , this is complete non sense. It is based on the tax bracket. If the tax bracket is on 30% or more then there is some benefit. Currently the standard deduction is $12500 for married couples filing jointly, so in case you itemize for mortgage purposes, then the standard deduction is the baseline opportunity cost for itemizing. Many people dont even understand this properly and just live in hearsay stories.

Net-Net, for the last 3 years we had barely 2-3% salary increase which translates a $100-125 a month in net pay.

“The opportunity cost on the 200k can help me subsidize my rental instead of becoming a consumer of this 200k plus 800k mortgage payout.â€

Yeah, but what can you do with your $200k that will be of any substantive benefit at the moment? A CD at 2%? S&P 500 that’s about 100 points down from its all-time high? Gamble on individual stocks? Gamble on futures? Risky bonds? At the moment, I don’t know of anything sane you can do with $200K other than save it in a CD, or maybe invest in a rental (although I have a rental, and cannot wait to get rid of it). Not only are the options seemingly limited for investing currently unless you’re an expert stock broker, but your rent will go up and up over time, whereas your home ownership costs will increase only negligibly.

I think down the road a bit, there will be something you can do with $200k to prospectively make money and subsidize rent in a meaningful capacity. However, at the moment, I don’t know of anything unless you have some insider trading information or something.

I agree with everything else you stated. I’m also waiting to buy (a primary residence) until a downturn in real estate prices occurs.

“but your rent will go up and up over time, whereas your home ownership costs will increase only negligibly”

My experience has been otherwise, Responder. Not sure how long you’ve been and landlord/property owner but rents move both ways over the years. Additionally, all of your maintenance, repair, and replacement costs are subject to the same inflationary/deflationary forces as other consumption items such as rent. Unless one stays in one home until they die (a rare scenario), those same forces compound transaction costs to replace or dispose.

By the way, asking rents appear to have peaked and reductions abound in the west side L.A. market. It’s a significant turning point indicator in this cycle.

As to the opportunity costs — if the OP believes there’s a particular amount of risk premia involved in a house purchase, then an alternative investment that he believes has upside to the same would be fair game. Additionally, some assets are more or less liquid which also offers to opportunity cost, owing to the reason why people are sitting on the sidelines with cash. There seems to be an implicit assumption that the alternative would have to be ‘safe’, but that wouldn’t be so if the OP feels that buying a house is also not safe.

Easy.

Roth IRA $5500/annually over the last five year would be $22,000. But if you just stuck it in an index fund you’d probably have around $50,000. That’s money that’s tax free when you draw in retirement – huge plus for later years of retirement when your income is really low.

So let’s then say that they’d be left with roughly $180,000. Seems they are young so an index fund would present a good risk/reward. That $180,000 would be worth north of $400,000 with cap gains taxes taken out if they’d invested that over the last 5 years.

I’d rather have that financial profile than a house any day.

LAer:

It’s easy to say that you could have turned $180K into $400K over the past 5 years. Although you’re probably reaching quite a bit there. Actual returns probably would have been closer to 50% (not 100+% as you suggest) in an S&P 500 index fund, for instance. You would have had to buy in 6 years ago if you wanted a 100% return. But this isn’t five or six years ago. This is today, where, even with the slumping market, the Dow Jones is less than 1,800 points down from its all time high.

It’s obviously a total guess, but I think that many or most investments (housing, stocks, futures) are a risky venture at this point in time. There doesn’t seem to be much upside in the near term (say, 5-10 years), but there does appear to be a substantial downside. Oil may be an exception to this, but you can’t sanely put all your eggs into one basket (oil).

I’m not suggesting investing $200K into housing is a wise think to do at the moment. I’m merely stating that there’s not much in the alternative that you can do with that $200K currently that doesn’t involve a lot of risk. I’d love to hear a realistic investment suggestion, though, since (coincidentally) that’s just about what I have saved for a down payment sitting around making a paltry 2% in CDs.

Is it ever possible to get around risk:reward? I think that’s why we’re here, because you can’t have it both ways. Buying a house for consumption purposes has taken on far too much risk in markets such as SoCal.

“This is today, where, even with the slumping market, the Dow Jones is less than 1,800 points down from its all time high.”

He could short the Dow or S&P at this point and if the bottom falls out, he also makes money on the way down. If the position moves against him, his asset is liquid enough to hit a stop near his choosing. Can’t do either of those things with a house.

I think the (annual earnings)x rule is factoring for net take home.

One of the details often glossed over by real estate interests is that the tax advantages are very much case by case, subject to change and with low rates the subsidy isn’t as effective. It doesn’t seem like too many people consider the effectiveness net of the standard deduction, and in some cases the standard deduction is actually better!

I’d much rather borrow at a lower cost basis with higher rate to earn a better net effective subsidy versus the opposite scenario that current buyers are facing.

“I’d much rather borrow at a lower cost basis with higher rate to earn a better net effective subsidy versus the opposite scenario that current buyers are facing.â€

Same here. And if you borrow at a high rate, there’s always the possibility of refi’ing down the road to lower the payment (as others have noted here before). Not so if you borrowed at rock bottom rates with a high purchase price.

Seems the California legislature plans to put a $2 billion bond measure on the state ballot, the money to be used to build low-income housing for the homeless:

http://www.sfgate.com/news/article/California-lawmakers-propose-2-billion-plan-to-6735788.php

California would spend more than $2 billion on permanent housing to help the nation’s largest homeless population, under a proposal outlined by state senators on Monday.

The housing bond would be enough to help local governments construct more than 10,000 housing units, primarily for those with mental illness, when it’s combined with other federal and local money, estimated Senate President Pro Tem Kevin de Leon, D-Los Angeles….

Damn…some of you regulars press your agenda of a bubble as if “The Big One” is just about here. Kind of like watching the news. Some of you strictly just want to scare people. Easy to lay false claims of up-coming disasters when you’re playing on the sidelines.

things…

1)The next real bubble is student debt…that gate is ready to burst.

2)For those of you claiming that LA/SoCal is awful. I’m willing to bet 1/2 of you transplanted here from another “desirable” part on the country.

3)The market is due to slightly correct itself. Bubble? No. But if rates shoot up rapidly all bets are off in the housing market. And no one knows if or when or how that will happen.

4) Go see Robert Campbell speak. He does the timing letter quarterly. He is a credible source to scare you on global/domestic economics, specifically the housing market.

So this time, like so many times before, is different?

How many houses are you buying regardless of the largest debt levels in several decades pushing real estate prices to historical highs?

NONE

BTW, I don’t think it’s about low interest rates anymore but the inevitable end to the expansion period, as weak as it has been, during this business cycle. Corporate earnings are suffering from domestic and global economic stagnation, junk bonds are defaulting in greater numbers, and crashing commodity prices reflect the lack of industrial demand. All during still the longest period suppressed interest rates.

It is awful. I lived in LA for 15 years, my wife live there her whole life, my son was born there, and nearly all of my family and friends live there, but we moved to Portland over a year ago. When we look out our new neighborhood, the schools, the community, the walkability, the waterfalls…and even the weather, we’re very thankful that we ripped the bandaid off and left LA. We just went to LA for the holidays, and we couldn’t wait to get back.

You all need to leave that mess!

Blue Jay Way:

There’s no agenda that I’m aware of. Wishful thinking? Maybe. Agenda? Probably not. I don’t think many (if any) people are simply trying to scare others. My perception is that a majority of people here (“regulars†or otherwise) are here to commiserate about ridiculously high prices and to try to share/discuss information regarding housing prices in general.

Regarding your point #3, that is an interesting assumption that we are not in a bubble. On multiple previous occasions when house prices have increased considerably over a short period, a significant downturn followed- not merely a slight correction. I would call those bubbles. And the current pricing pattern seems similar to previous bubbles.

What’s so scary about lower prices for housing? It’s a good thing for those who haven’t imprudently tied their fortunes to prices only moving one direction.

The transplant argument is bogus. Most people move to SoCal with little to no idea of the realities involved in living here.

Pretty much making a profit on a home is all but gone. Even if what seems a good buy at $1m today will most likely not fetch $!.2 million tomorrow. You buy a home not a house to live in it at least 10 years and maybe you break even or lose the commission.

People can only go so much, pay will not offset the difference we are in a mode of when our parents sold for maybe break even at best. CA. yes is always a wild card, but really this price crazy market was good for TV ratings on Million dollar shows, the realty is more than settle down now, the overwhelming population just can’t afford such houses and even if they could, who wants 1500 sq. ft. for $1.2 million makes no sense, in any market in the future.

Grantham just made another bold call. He thinks the US market is “ripe for a major decline†in 2016. He says it could spark the worst crisis since the Great Depression. The Financial Times explains:

The famously bearish and often prescient money manager said this could trigger a “very different†type of crisis, because many governments had become considerably more indebted and much of the liabilities had shifted to the balance sheets of central banks.

Given that central banks were able to create money to recapitalize themselves, this “could be a crisis we could weather,†Mr Grantham said. “If not, then we’re talking the 1930s, where you have a chain-link of government defaults.â€

https://www.caseyresearch.com/articles/one-of-the-worlds-most-respected-investors-predicts-2016-stock-crash

Anybody whose been investing in the past 2 decades or more knows we are in deep kimchi. Stock market wildly overvalued, real estate the same, the economy sucking wind and we’re just a hair above 0% interest rates. Oh yeah, this will end well!

Meanwhile Jeremy Siegel is calling for a 10% increase in the stock market in part driven by Chinese investors looking to shelter their money. It would make sense for the property boom to continue for at least the next year.

“Jeremy Siegel: A 2016 Outlook for Stocks”

https://www.youtube.com/watch?v=3wKKpaZwuQM

Oil down to insane prices, China doesn’t have a clue of stock market controls, housing overvalued nationwide, stagnant pay, many homeowners again thinking about walking from homes they can’t sell, retail and small business failing at a rapid rate, mega malls in America losing millions of dollars every month, online buying killing retail, only Costco has cars in their parking lot, Every thing is coming up roses???

Yep, and throw in some credit card and student debt to the mix.

Let’s say RE will crash this year. At what point to buyers start buying?

When the heard all start buying again, what happens then? Bidding wars leaving normal folk w/ less than 20 down on the sidelines till market goes up again and we are back at 2016 sitting on the sidelines talking about when TANKING HARD begins.

Lather, rinse, repeat. A million variables but one thing certain, the transfer of wealth will only continue.

Yeah, I wasn’t in the position to buy after the last crash, because, like you say, less than 20% offers were tough to get through. I’ve been saving cash since then and waiting for the next dip.

“Let’s say RE will crash this year. At what point to buyers start buying?”

Depends on their needs, level of risk tolerance and purchasing power. Some will buy when the price drops 5%, some at 15% drop and some at 50%.

There are no two buyers alike.

Yes, you understand how things work, if housing does Tank Hard, I’ll be in line ahead of you.

To answer your question about when I will be a buyer, 10-12 times annual gross rent is something that I would consider a good deal.

In my opinion it’s unclear what buyers will do . However, I think the FED is partly the reason what everyone is waiting on to make a decision. Usually when you see announcements come out from them like what happened in fall of 2012 that was a big trigger for what happened up till 2014. I think buyers just want a crash with reasonable rates so they can buy in again

Completely depends on the relative alternatives. Rents are beginning to roll over, that will have an impact. If returns on other investments with a similar risk:reward ratio inch up, that will have an impact. Unorthodox demand came into RE over the past several years due to barrel scraping of yield.

Here is your chance to pick up a house in Ca. very cheap of course you will have to wear a gas mask 24/7 where(?) PorterRanch area of the SFV. methane gas problem has evacuated thousands and home values now in the tank.

I can remember many years ago when it was developed, it had many concerns major fault line was one, many homes that cracked soon after occupancy but the buyers flocked to them and million dollars ( of course like all city and builder developments all is good now and in the future. ) paid for these terriable built homes. Now gas leak, old saying “you can fool me once but fool twice” just kidding folks don’t buy a home theirs very bad investment for years to come.

Several attorney are already working on class action lawsuits for Porter Ranch homeowners. Presumably, their claims will include loss of property value.

Feel bad for the Porter Ranch folks. Their homes will now be worthless for many years and the leach attorneys will scour the earth to find them and get them to be a part of the class action lawsuit. All gains from class action lawsuit will go to attorneys first and they will disperse pennies on the dollar to the home owners, the true victims in all of it.

I probably talk too much about our move to Portland last year (I’m a long time reader of this blog,) but, man, it was a better idea than I realized. Prior to our move up north, we were renting a house in the Porter Ranch area. Whew!

Global Stock Market to Tank Hard in 2016?

Housing to follow and Tank Hard too in 2016?

I moved from the bay area to San Diego because it was nicer and less expensive. I was tired of paying 2K for an apartment in Mountain View. Now I pay $1300 but it still is too expensive. I loved San Diego when I lived there in 2003-2006 but now its a big dump with horrible traffic. Now I plan to move to a cheaper place like northern Arizona or Florida with lower taxes and lower housing costs.

I find it interesting when looking at sites like Zillow and you notice homes that are for sale usually see their prices inching up while being sold or planning to be sold. However, other homes next door are showing dips. Also same thing with new developments the estimates appear to show increases while other homes seem to stagnate around them. I am curious how these estimates are generated when a home is sold or off the market?

OK my two cents. I bought my plain old track home in north OC back in 1994 and it was a fixer big time. In 2006 we would walk the neighborhood and see how high the homes are and felt it was a good time to sell but where to move? In 2011 I bought a house in WA state for a good price and now it has almost doubled. My house in OC will be on the market in a few weeks and I’ll make 4 time what i paid 22 years ago. I’ll move to WA and pay off that house and be free and clear with money in the bank (not that I would ever keep money in a bank). The trick is this took 22 yrs. I hate to say it but buy low and sell high. Now is selling time and soon it will be buying time. Also my mortgage payment has always been lower than my rent would be and you need to live somewhere. The tax write off is interest paid for the year so it just depends on your tax bracket.

It will be a 18 to 24 month window for a great deal. Just cover your ears and look at the numbers. Thinking 40% to 50% haircut in most areas would be the buy trigger. As soon as the tax credits for homebuying hit, then peak bottom will be reached. Get your popcorn ready.

Chart the history of the bedroom communities of major metropolitan areas first. The crash starts there first and works its way inwards. The first clues would be asking price reductions, N.O.D.’S start ramping, building permit reductions in those areas.

Sorry Iceman – but there may be no cometh. We waited after the last crash in 2008 in North San Diego County for a major dip. Yes, there were deals; but, not to the extent that we had expected. We ended up buying in 2013 and are glad we did. We are in it for the long term; and, rents here have jacked up, so as to to make our monthly payment reasonable in comparison. Bottomline, I agree with Nimesh…the market is rigged and each person should get in when it makes sense and they can do so.

2-3 years later, rents are beginning to roll over. Let’s see how the comparisons get adjusted moving forward.

“We ended up buying in 2013 and are glad we did. We are in it for the long term; and, rents here have jacked up, so as to to make our monthly payment reasonable in comparison. Bottomline, I agree with Nimesh…the market is rigged and each person should get in when it makes sense and they can do so.”

In other words, “buy now or be priced out forever” — just as from 2002 through 2006. And the market was so rigged that price downturns in the 1990’s and 2000’s could never happen again.

The stock market is CRASHING. Suck that I have a shlt load of $$$ in stocks, but maybe it’ll balance out when properties fall down back to what it should be. 35% cheaper!

Just HOLD on the stock and wait it out. No need to sell unless you can profit from the sale.

I wonder if the debt gets called in from China if all the speculators out here liquidate house to pay leveraged debt on the stock market.

I like many others lost my Condo in 2006 in San Bernardino county. I’m now married and my wife has never owned a house. We currently rent happily in Long Beach which is convenient to where we work.

We are hoping to start a family soon so we began looking at houses. We have been saving a lot of money and building a very nice nest egg.

Trying to decide if we should purchase in Orange County (Fullerton area) to centrally locate us between work and families.

My gut instinct is telling me to keep renting and saving and see if we can get a better opportunity in a couple years if prices do decline. It’s just so tempting to follow the stereotypical life pattern in get married, buy a house and start a family.

After being burnt in 2006 I am beyond scared of making another HUGE mistake with real estate.

Any insight/advice/thoughts much appreciated!

We live inland (Temecula) and bought in 2011…low market. Our plan is to sell in a few months, make a good chunk of money, and then rent until we feel comfortable buying again because we’d like our next house to be long-term where our kids grow up. I work in real estate and housing prices seem to have reached a plateau so I don’t like the idea of buying right now, especially with all that’s happening in foreign markets and the talk of another recession on the way. The goal is to buy low and sell high, right? So is this a good “plan” that we have? I don’t see prices coming down to what they were in 2011, but I don’t want to buy when it’s high…and right now it seems high.

I agree with Jenny 100% ! Im in my mid thirties, single male. I have chosen not to buy simply because I couldnt decide on what area I really wanted to live in. I too feel that prices are high right now. The year is still young and I would hate to buy something and have it depreciate in value within 6-12 months. Until we see the effects of raised interest rates I am holding off. My gut tells me that the FED will continue to raise interest rates and I am hoping to see the downward price adjustments as a result—once that happens I will buy.

I am a “Millennial” (24). I am getting myself in a financial situation to move to Los Angeles. I work as an accountant but am not the typical bore that one might imagine. A few of my friends have gotten big into playing landlord (other millennial’s). I looked into it but the returns are pretty low right now and I felt it just was not for me. Other than the select few friends who are landlords I do not know ANYONE planning on buying a house to live in on their own. Either they will have roommates or rent from someone else. Most of them live with their parents because they want to “pay off their debt.” I think its a funny trend because they all think they are so responsible but really they are wasting away their best years worried about $20-40k. What happens when you get a mortgage? That will be way bigger than student loan debt.

This whole thing is a generational issue. Its not that they couldn’t live on their own, its that they CHOOSE to pay off debt because that was pounded into their brains from somewhere. Just my 2 cents though..

It may not be that they really want or need to pay of their debt but they might be afraid of being on their own out of the safety nest that is their parents home. Too much coddling and “you’re my little princess/ shining star.” I just think most millenials are afraid of responsibility and real life. In Los Angeles they obviously cannot afford right now but I’m speaking generally and from my experience. We will be in a huge need for leaders in the next 20 years. My kids will be in public school and they will walk or take the bus to high school unless they buy a beater car with the paycheck they earned. That’s how you learn…

I bought when It was low in southern California, close to MX. I was happy with my purchase EXCEPT!!! People from MX purchased the unit upstairs. They use the home as a hotel and mail box. its a one bedroom and the entire extended family has the key so you can imagine the chaos. I can’t sleep at night. HOA has fined them, i’ve called police EVERYTHING. they don’t care. I am so tempted to sell BUT I can’t afford anything out there. I will be out of a home. Although I made money I still wish I didn’t have to go but I am tired of not sleeping well since 2008 any advise?

I’ve lived through three housing bubbles and recessions, and each time I had a strong gut feeling they were coming, there are just certain signs and symptoms. During each of those cycles, (just like this one) many economic and housing market experts kept assuring us with all their calculations and speculations that all was well and the economy and housing market was doing fine, and then, of course, reality hit. I have that same gut intuition all over again, only this time the bubble feels bigger and the fall will be harder. Many folks back then were in denial…..just as they are now. I fear its the same thing all over again.

P.S. Maybe my intuition is wrong this time…I hope it is….but I just can’t shake this sense of foreboding.

If Trump becomes president, maybe he’ll cut back on China and foreign trade. Then, maybe we’ll see foreign investors go elsewhere. I would love to see that happen.

Let’s get this country back to the Americans who want a home.

My husband is a storyboard artist at DreamWorks he makes around $8k a month after taxes. I’m trying to get to get the same kind of job. Together we would bring in maybe $14k a month. And we still can’t afford a 3 bedroom house on Pasadens, Glendale area. Being artists we don’t always stay on the same job so wet have to think about the days we are waiting for another show to start up. LA is not sustainable. We would be upper middle class anywhere else but here we are a step above lower class. I say screw all the cock roach infested 70 yr old houses is time to purchase land and build. And don’t say there is no land cuz over found plenty all under $100k and some were flat but most are sloped. You just have to look hard. A 2000 sq foot simple home can be built for around $200k to $250k easy.

Buying land and building new construction is probably the most cost effective strategy in California. New construction is poor and overpriced.

Couldn’t we make laws to prohibit foreign investors from buying homes in California? This is unfair to local California residents.

I like many others lost my Condo in 2006 in San Bernardino county. I’m now married and my wife has never owned a house. We currently rent happily in Long Beach which is convenient to where we work.

We are hoping to start a family soon so we began looking at houses. We have been saving a lot of money and building a very nice nest egg.

Trying to decide if we should purchase in Orange County (Fullerton area) to centrally locate us between work and families.

My gut instinct is telling me to keep renting and saving and see if we can get a better opportunity in a couple years if prices do decline. It’s just so tempting to follow the stereotypical life pattern in get married, buy a house and start a family.

After being burnt in 2006 I am beyond scared of making another HUGE mistake with real estate.

Any insight/advice/thoughts much appreciated!

I get what everyone here is talking about for the most part? I pretty much understand that “what comes up, must come down” etc.. What Im in need of is for someone, any one of you qualified future “market analysts” (so to speak ) to set me straight on what I (really) should do about the “present” and what not to do before the future comes on to quickly and I drown from my procrastinating, I’m kidding myself to think it won’t happen to me attitude. This is what I’m up against: I’m 48 yrs old, married, I have a 5 yr old daughter, no parents (passed), no job, a mortgage $150,000 and $35,000 in debt (misc) I live in N. Calif. SF Bay Area 3/3 Condo in a neighborhood that’s still considered up-scale not rich by all means, just real good. My husband is a self employed contractor and works on projects when they present themselves. we are BROKE! my questions are these..

With a $145,000 at most mortgage our monthly payments are MUCH lower than any rent for the size and location we have right now. Being that we are already struggling, I have to realistically think not much will change for us in the next year or two (maybe) but realistically, come on. With the talk I’m reading regarding “housing”, the economy, and what not, is this the only time I may have, in the up and coming months (how long?) to get ahead, as opposed to going completely under if I try and ride it out a year or two longer and if so, do we rent somewhere else and hold off until the market drops to possibly buy again and will this happen (inevitably) to the housing industry?

To Vonlist- My advice is you will not solve any problems financialky if you continue to stay in the Bay Area. It will not get better (unless you win a lottery). It’s simply an unrealistic existence. Get out while you still can. Best thing my husband and I ever did along with many of our friends. There are better places to live! And much more affordable! I always thought the Bay Area was so great, but after I moved away and then came back for a visit, I couldn’t believe I ever wanted to live there in the first place. People in California are so enslaved to the high cost of living and the crazy rat race, they’ve convinced themselves it’s just the greatest but are only deluding themselves. There is life after California and a heck of lot better one! Good luck!

Can you give me a hint on the direction your talking? What & where?🙀

My advice leave California.. Why spend ridiculous money on a house that might end up tanking in the water in the next 50 years, and don’t forget about the water crisis and energy crisis. You call that a good investment because you have beach front property?.. in Arizona.. you can get 5x the size of the house for 440,000 talking 4,000-5,000 square feet & newer property.. 2,000 sq fee 75000-150k… Time to move you deal with the heat but you learn to adapt to A/C and you save.. Vacation, and enjoy life.. rather then be a slave to your a job and stress that could ruin a marriage.. Divorce rate is high in California for a reason.

I wish you were all right. I live in LA and the prices jump up every single month. I see no decline and very little inventory.

Vonlist, yes get out of California. The market is distorted there more than anywhere. Look around the country and compare median incomes to median house prices. One of my relatives just bought a $736K home in southern Cal. Here in the midwest, it’s a $136K home. So they paid $600K for a tiny piece of sand. And the median income in THEIR area is $80K, in my area $60K.

People think population drives California prices. That hasn’t been true for decades.

Ultimately, the price of real estate correlates with the income of the people who live in it. When it doesn’t it WILL adjust accordingly.

It could take a while if you wait. This blog focuses on housing and author suggests the FED is going to raise rates. The FED is blabbering. If they raise rates, they know everything crashes. This is true overseas as well. Because no sovereign bonds or savings accounts are returning any interest, buyers are bubbling up housing. But when it stops, it will stop in a big rolling crash. Sell your house and if you can buy a home or land in a reasonable area. Even those might go down, but not like California.

Leave a Reply