The four corners of the California housing market – Household formation, price dynamics, home sales, and the illusive foreign buyer.

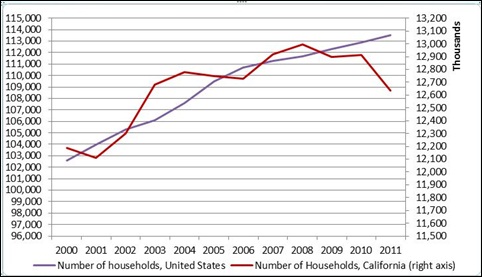

California has bucked the trend in terms of household formation. Nationwide the number of households actually grew at a much slower pace during the recession but in California, the number of households actually fell. Some are arguing that this is somehow a symbol of pent up demand. That is very unlikely. You have a split occurring. In California, you have those that can buy and also afford the higher rents in the state and those that cannot. Nationwide this issue isn’t as prevalent. Home sales have moved up but not to a blistering level that a historically low interest rate would spur on. We should look at a few key things that have occurred in this controlled market.

Household formation

As we initially stated, household formation nationwide did increase throughout the recession but not in California:

Source:Â CAR, Census

The simple perspective is to say California has pent up demand. I think the reality is a bit more complicated. California is still an unaffordable state for many. Sure, low interest rates and low inventory have pulled people off the sidelines. So why did household formation trend in a different direction in California? As we have stated, nationwide home prices measured with household incomes look affordable in many states but in many areas of California they are still inflated. California still has one of the highest unemployment rates in the country so you have a split between households that can buy or rent in key areas and those that simply cannot and actually need to consolidate households if they wish to live here. Population growth didn’t stop during this time in California so something else went on.

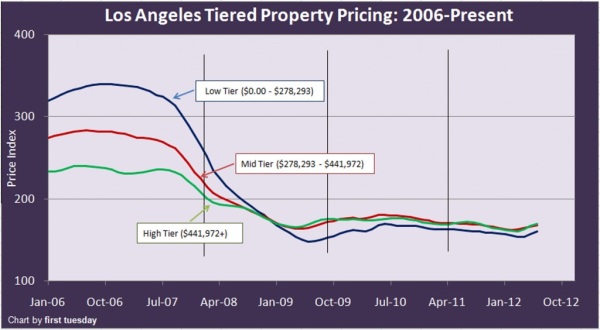

Tiered prices

Los Angeles is the most populated county in the state and while reading the headlines you might think that prices are now rising at a rate that will “price you out†you need to look at the actual data:

At best we are moving sideways from 2009 after a dramatic fall from the peak. The low interest rates are masking a deeper change. FHA insured loans are providing an unhealthy amount of 30x leverage for those coming in with low 3.5 percent down payments. Why is the Case Shiller moving up slowly or even sideways in many parts of the state while median home prices in other measures are going up? The mix of home sales has changed. Since banks are managing distressed inventory the few homes on market are causing some people to jump out and compete with lower inventory. Make no mistake, this is a fully controlled market. Ben Bernanke even alluded to more asset backed purchases if he felt the economy needed this. The Fed already holds nearly $3 trillion in questionable “assets†so would the Fed take on more? Probably. Yet this is uncharted territory for our entire economy.

One thing is certain however and that is all this bailing out of banks and low interest rates hasn’t boosted the household income figure. This is why I think household formation has fallen so hard in California. The state has a larger portion of renters and with high rents many simply could not afford the price and have consolidated households. Many that once owned are now moving into available rental space.

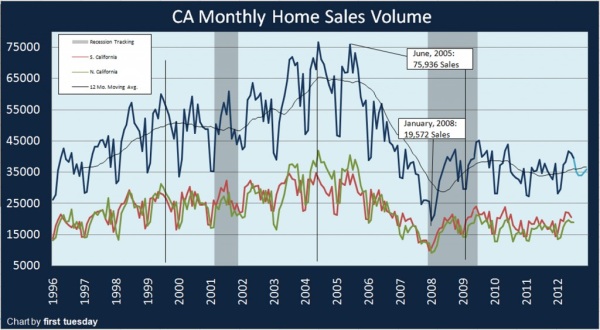

Home sales

In July 39,000 homes sold in California. It is important to put this into context. From 1998 to 2007 the 12 month average of home sales was above 45,000.  From 2000 to 2007 it was above 50,000. The highest month of sales brought in 75,000 and the lowest month of sales was at 19,000:

Even in boom and bust home sales are seasonal. The spring and summer are the strong months followed by slower fall and winter. There is no reason to expect this will be different this time around. California has the added challenge of the dismal state budget and there will be a big ballot initiative this fall. The high unemployment rate is also a big challenge that needs to be faced. When 20 percent of your workforce is either unemployed or underemployed you will face challenges ahead.

Foreign buyer

Another argument I have seen is that of foreign money flooding the housing market and this will somehow keep prices moving up. First, home prices did tank and foreign money was around in 2008 just like it is right now. Next, foreign money is targeting only key markets and not the entire US. Do you see foreign money flooding Michigan or Ohio? So this should be rather obvious. Also, when people say foreign money (as in markets even in other countries like Vancouver) what is really discussed is money flowing from China. Similar things occurred when Japan had their boom and money was flooding into California.

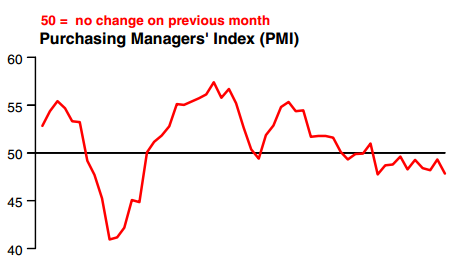

Some tend to think that China is going to save California. Yet China is now facing a slowdown brought on by a dip in global consumer demand:

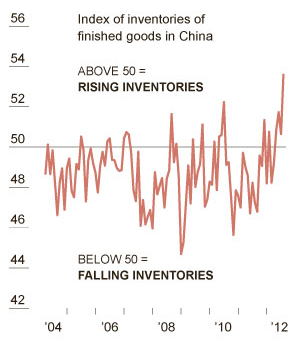

China has seen a contraction in PMI for 10 straight months and inventories are building up:

It is also important to note how small this piece of the market is but ironically, it is other countries that are bigger players here. Foreign buying is a tiny piece of the pie:

“(LA Times) Foreign clients bought $41 billion worth of stateside houses and apartments during the 12-month period that ended in March 2011, according to the latest tally by the National Assn. of Realtors. That’s roughly the same as the previous year…

More recent data square with the association’s findings. According to DataQuick, nearly 55% of all U.S. residential real estate sales to foreigners from May to November last year were in Florida, and more than 17% were in Arizona. Nearly 6% were in California, and close to 5% were in Nevada, another state hit hard by the housing downturn.â€

Apparently California isn’t the biggest draw of foreign cash contrary to those anecdotal stories. Our friends in Canada are accounting for one-fourth of the foreign US purchases. China and India account for 9 percent. $41 billion is a tiny piece of the $1.07 trillion in domestic housing action.

Inventories in China tell an even bigger story regarding the global slowdown. Will this impact foreign money flowing into global housing markets? Ben Bernanke had a somber speech this last week and his rhetoric reflected an understanding that the global economy is still in a very fragile state. Why else would he state that the Fed is ready to step in and purchase more asset backed securities? California will always be a multi-faceted market but the echoes of “buy now or be priced out forever†are getting louder each day.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

46 Responses to “The four corners of the California housing market – Household formation, price dynamics, home sales, and the illusive foreign buyer.”

More info here http://economistsoutlook.blogs.realtor.org/2012/08/01/what-is-california%E2%80%99s-pent-up-demand/

What a useless article. Pent up demand? How many miles would the average American had driven over the past year if gas prices were $2.75? Does that mean that there is pent up demand for miles driven in a car? How many Candy Corns would have Americans eaten if they were a penny a pound? Pent up demand on Candy Corns anyone? Price affects the quantity sold if you look at a basic demand curve. Am I the only one who sees this?

Nobody is getting priced out. Most are going to be underwater when interest rates rise. If you are a buyer do not expect appreciation. If you are an owner do not expect to sell for what you paid. The bill will get paid with inflated money. Half the folks will not pay for this folly….they pay no taxes.

Agree 100%. Anybody who think the home appreciation train left the station need to put the pipe down. Prices will likely be bouncing along the bottom for years to come, there are just too many headwinds to say otherwise. Is that overpriced POS 500K box really going to be worth 700K soon? Who is going to buy it? Rich Chinese, investors, government workers, illegal aliens, the under 30 crowd that is overwhelming dirt poor…

It will be very interesting to see what happens after the election. I think the controlled inventory we are seeing is highly politcally motivated. Every incumbent candidate wants to tout a healthy housing market with rising prices. With rigged interest rates and controlled supply one can create artificial bottoms in the short term…what will happen after November? Should be very interesting.

I agree that home appreciation in the next 5 years will be pretty boring and in most places will be flat at best. BUT, we’ve hit a point where unless rents fall, home prices have bottomed. I can rent my home for my current PITI no problem and I bought in 2011.

And if i wanted to sell and go rent.. I’d be pay more to rent the same house in my area. So, sure, i have maintenance and normal chores and stresses of home ownership.. BUT I can also refinance and lower my costs if things go south.. and i’m currently paying down my $350K mortgage at a rate of $7000 a year.. while collecting about $4000+ a year in tax deductions.

You wouldn’t happen to be some guy who used to post here who used the name “Kevin” or “Caliowner.” That poor guy bought last year and had the worst case of buyer’s remorse ever. Like I said before, be thankful that the Fed bailed your ass out…for now. Don’t think an uptick in interest rates or more supply won’t change the rent vs. own equation.

@RecentBUyer

I am not going to waste my time with the rental parity argument but I would like to make a couple of comments on your statement “we’ve hit a point where unless rents fall, home prices have bottomed”. First, there have been many times historically where rent was as high if not higher than PITI. The barrier to home ownership has historically been the 20 – 25% minimum down payment. Second, when you say price do you mean real or nominal? I agree it is possible that we are at a bottom in nominal price but the Fed is in the process of currency devaluation. So, if someone pays $500,000.00 for a house in 2012 and then sells in for $500,000.00 7 years later, would you consider that to be a breakeven transaction in the current environment? The only benefit of the devalued currency is that the seller would be less likely underwater. We just need to pray that we do not get real inflation which will impact interest rates and home values…

Don’t waste your voice on “RecentBuyer” or “GenY” or “Kevin” or “RentHigher” or “NotaSucker” or “CaliOwner” – it is all the same person. Always talking about rental parity and justifying the Woodland Hills purchase in 2011. Same syntax and grammar in all the posts. I’ll give Kevin credit for sticking to it on the rental parity argument.

recentbuyer: your $4000 tax deduction goes straight back to the government in property taxes, that’s not exactly an advantage over renting…

“Half the folks will not pay for this folly….they pay no taxes”

LOL when someone uses that argument it exposes how partisan and uninformed they truly are. that 50% pay no tax figure is from cherry picked data from 2009….remember then? the bailout of the banks and all kinds of new TAX CREDITS that paints a distorted view of who paid taxes for that YEAR ONLY.

and as so many seem to overlook, 2/3 of US corporations pay no income tax AND 68% of foreign corporations pay no tax.

but lets whine about some family of 4 making $25K year who’s paying no INCOME tax but a whole list of other taxes.

i must hand it to the PTB, their brainwashing tactics are amazing to behold and the sheep just fall right in line.

Unlike 20 or 30 years ago, mortgages are not transferable. Used to be, if you managed to lock in a great loan rate, you had a leg up in the selling dept., as the buyer could pay you your equity in cash and take over your loan.

Now, most buyers don’t have the cash to pay much down, and even if they did, loans aren’t transferable. So if interest rates rise, so will monthly payments for the prospective buyers, even with flat home prices.

Far more likely, in my opinion, we are in a zero interest rate trap and rates won’t rise for a decade or more. This means that savings will not earn a decent low risk return, and capital will continue to be misallocated. You can plainly see this in most cities, where they build new strip malls a block away from existing ones with lots of vacant space.

Since it is Romney or Obama for the next four years, either of whom will grow the size of the Federal Government by leaps and bounds, look for even more downward pressure on interest rates, as the government struggles with more and more debt to auction and roll over. Since government consumes wealth, and never creates any, look for the country to get poorer over the next four years, regardless of the election outcome.

How hard would it be to pass a new law making all loans transferable.. or assumable?

I think it would be pretty damn easy… I can see that happening before housing drops 50% again.

Or is it dead on arrival due to politicians being in big banks pockets feeling what’s good? Is this a stacked deck or what? Free enterprise thawrted or what? Or is it unregulated free enterprise as long as you are too big to fail and you control everything?

Most loans from 2001 to 2008 were securitized and chopped up into tranches. Theoretically, the senior tranche could override the junior tranche but the litigation that would ensure means that this is an all or nothing approach. This is why most attempts at loan modifications fail. Fundamentally, all parties in the tranches must agree to any changes in the loan, which is highly unlikely.

I completely agree. Most seem to gloss over the fact that we are deficit spending over a trillion dollars a year. We can never get out of this hole…

I read the other day that our Federal Government is borrowing money just to make the interest payments on the money we have borrowed. How can this end well?

OMG… the debt! First of all, government debt is completely unlike family debt. Please, introduce me to a family who can pay with the currency it creates, without limit.

Second, as a legacy of the commodity-backed currency that preceded Nixon closing the gold window in ’71, the U.S. central bank (“the Fed”) issues a dollar of debt for each dollar of currency it issues. That means unless the current account (exports – imports) intervenes, U.S. government “debt” is exactly equal to the financial assets in the non-government sector. Reduce that “debt” and you suck financial resources (dollars) out of the private sector.

What’s needed is a *much* bigger government debt. Otherwise, we’ll be stuck in a deflationary spiral where vulture capitalists will pick apart the economy and privatize all those public goods like infrastructure, parking (the Parthenon, for Greece!), and make them into a series of toll booths that impoverish the population until they are, in effect, in debt peonage.

“But if you print all those dollars, then it’s bound to be inflationary” (say the semi-economists). Yeah, everywhere except in reality.

We already issued more than enough dollars to be “inflationary” in 2007, when, as its recent audit discloses, the Fed issued $16 – $29 trillion to cure what ailed the financial markets, bailing out the same guys who caused our current lesser depression. That was five years ago. Where’s the inflation?

The truth is that paying off debts and bets does not demand goods and services, so it is not (obviously) inflationary. I’ve even heard the semi-economists say “Well bond yields and the CPI are low because the Fed is managing inflation.” Except Quantitative Easing is designed to prop prices UP…in other words to *encourage* inflation. The problem we have now is deflation.

To give you an idea of how big $16 – $29 trillion is, that’s more than a single year’s GDP for the country. For only $9 trillion, they could have paid off everyone’s mortgage.

Notice, BTW, that with this kind of (sovereign, fiat) currency, taxes do NOT fund government. In fact who could pay taxes, returning the money to its source unless the government first spent the money? Why would the government need taxes since it can make money without limit?

And no, neither does borrowing from the Chinese fund the government. Again, in the U.S. (but not the eurozone) government can make as much money as it needs at will, and the amount issued is limited only by the productive capacity of the economy. Taxes make the money valuable, but they do not fund the government.

…and leaving productive people and plants idle is far more expensive than employing them for government-sponsored work.

Actual economist Steve Keen suggests crediting every household with $50K that must first be used to pay down debt. The other obvious solution to our current woes: A job guaranteed by the government.

Where would government get the money? The same place the Bureau of Weights and Measures gets the inches.

Adam Erin offers “solutions” that are so simple and straightforward. How could we be so foolish to ignore his enlightened prescriptions that will rescue our flagging economy?

Need money? Borrow it into existence and pass it out like candy. Jobs? No problem, direct from .gov to those in need – Shazam! Adam says inflation doesn’t exist anymore, and even if somehow prices rise for the little people, well we’ll just create more credit to pay those higher costs.

Adam, since you’re obviously astute and probably did well in your math classes at school, please answer one simple question regarding the dramatically larger debt you propose. How exactly do we service the ever (exponentially) increasing interest on the debt? What will a barrel of oil cost when you and Dr. Krugman are finished playing this fun little game?

Adam,

I think our belief systems are so far apart that we could never have a fruitful discussion. I will say that I agree that all money supply originates in our system with debt. I also agree that the fed is and has been fighting deflation for the past five plus years. And that is where we part ways. My guess is that we have different opinions of the purpose of an economic system. I believe the purpose of an economic systems is to efficiently allocate scarce resources. I do not believe that government has the political ability to stop the economic boom bust cycle. What government will listen to the teaching of John Maynard Keynes and cut fiscal stimulus during a boom? What government will stop increasing money supply durring a boom? The government has now become unable to stimulate a withering economy because there are no more arrows in the quiver. Japan is the model we are following and we already know what we will look like over the next ten years. I prefer Japan over Zimbabwe…

100% agree – well said. We’re in the midst of a very slow “reset” of our standard of living due to the combination of very low interest rates (ie. forced savings at near 0% interest rates) and hidden inflation due to the depreciation of the US $ thanks to all of the money printing.

But that’s not a secret, as we’re in the middle of it right now – you just won’t read about it in the mainstream media. Everyone knows that food prices, for example, are contributing to reduced disposable income levels for the average American – except for the official “core inflation” readings, which suggests apparently that nothing is going on. Amazing how that doesn’t include food. But, more telling, if you measure inflation the way we used to measure it before 1982 then you would see that we are running at a 8-12% rate (I believe it’s around 11% at the moment). Dr. HB has published that chart numerous times. So the average person in the US is slowly loosing their purchasing power, is making less (inflation adjusted) than they were in 2007, and is losing ground in their savings account (interest rates are WAY below inflation rates). All of this will likely continue for years, as it did in Japan. Bottom line is that we’re slowly creeping towards a lower standard of living and it will continue for years. As an individual, the only thing you can do is try to stay ahead by either finding a higher paying job or finding investments that pay more than 0.1%! I personally do the latter in an effort to keep my family ahead of the curve…

Good luck to everyone,

Investor J

http://www.meetup.com/FIBICashFlowInvestors/

http://www.meetup.com/investing-363/

Interesting comment. I’ve been on side lines this cycle. What happened to a deal subject to the loan of record? Did that greed for a fat commission screw up a nice way to sell in an otherwise dead market? Example this is about only way to sell a mountain home in the past.

And don’t forget about peak oil.

My understanding is that production has been flat since 2005. Obviously, the cheap energy prices that defined last century and its crazy growth and prosperity are a thing of the past. If you don’t believe me, then why are they tearing up mountaintops, fracking, filling middle eastern oil wells with ocean water, and piping tar sand up north?

The energy return on energy investment (EROEI) on what energy is now available to us ain’t nothing like it used to be. Sure coal is still up there, but it has secondary costs not built into the market, like the cost of the American breadbasket turning into a desert, like it was before, during the Medieval Warm Period. The latest technology, which hasn’t been put into action yet, where CO2, mercury, etc. are condensed out of coal flumes, ends up reducing a plant’s efficiency by 25%.

The saving grace is that wind energy, and marine related energy projects will eventually achieve decent EROEI’s, but the cheap energy party is still over, considering overpopulation is straining energy resources.

Cheap energy gone (which hurts the economy), overpopulation, globalization, running out of fresh water, climate change, etc.. all point to chronic slowing of large, developed, energy intensive, consumer based, economies. I would expect interest rates to remain low for a long, long time, unless faith in the US’s ability of its taxpayers to pay the bills is laid by the lee, and we see a spike in treasuries ala Greece or Italy, etc., as DHB has alluded to on previous posts (if i’m interpreting his writing correctly).

Seeing as how long term growth ain’t look’n so good, I can understand why large institutions might want to get into the renting business.

As far as assumable mortgages go: Most of the interest is paid in the first part of the mortgage, so getting banks to agree to reinstate this idea is like asking them to take a large pay cut on lending money. Assumable mortgages were gold for the leveraged RE investor back in the day.

Doctor , you forgot to mention the new congressional scam to boost prices:

Buy a $500,000 House, get a US visa. That is the new program our elites in Congress have devised to boost the housing market. I am not making this thing up. If you don’t believe me here it is:

http://online.wsj.com/article/SB10001424052970203752604576641421449460968.html

Basically Government says, If Americans won’t buy our overpriced real estate, we will darn well get people who will. Never mind that there are plenty of people who would pay $500,000 dollars for the visa alone.

Imagine bringing in new immigrants with the promise of a visa just to out bid Americans in their home buying quest!

This is the policy that created the $8000, tax credit real estate bubble back in 2009-2010.

Sad but true.

That’s a crackpot proposal that’s unlikely to go anywhere. Current status: “the bill was introduced on Oct. 20, 2011, when it was also assigned to a congressional committee. No further action has taken place” (http://www.theepochtimes.com/n2/united-states/foreigners-buying-up-america-again-278013.html)

“Crack pot proposal”, yes. Likely to go nowhere… I am not so sure about that.

The $8,000 tax credit to buy single family properties was also a crack pot proposal, and they passed it twice.

Is this how we fix our dwindling middle class? By insourcing? At $500,000 I understand that they are above our perceived idea of middle class, but this is what this policy is aimed to rectify right? There is something past immoral going on when we continue to outsource our jobs, indebt our young, knowing that there are no jobs for them, and continue to create policies that are contrived to keep the financial industry afloat. To even come up with that bipartisan visa policy speaks volumes about our two party system. It’s only rhetoric that separates them. To bring in new “citizens” to replace our decimated middle class is just another degree on the thermometer of my growing discontent. Can there be anything positive about it we’re missing? Great find Greg.

And this was on NPR. The more headlines and reporting the better.

http://www.npr.org/2012/09/03/160396937/are-todays-millennials-the-screwed-generation

While I usually agree with your POV on just about everything, you comment above “. . . but the echoes of ‘buy now or be priced out forever’ are getting louder each day” seems counterintuitive.

Rising inflation with interest rates in tow will keep downward pressure on prices in the short-to-near term–especially with soft demand (i.e. people buy payments/what they can afford; interest rates go up, principal portion goes down, payment amount remains unchanged). Not to mention the market tastes are thought to be changing and McMansion’s are seemingly growing out of fashion in all but the high-end.

And there’s the growing threat of Prop 13 being changed/modified/amended by the political gutter snipe in Sacramento.

So, pray tell, what am I missing?

What you seem to be missing is ignorant poorly informed buyers. They don’t believe the truth, they actually believe that realtors know something more than themselves and these same realtors are cheerleading the pack. It’s true and I experienced it in San Diego with realtors telling me to up my offer. I just said, sorry but I won’t play that game and have you no memories of our great crash? There is the market is completely controlled. Gone is a agreement between buyer and seller. Gone are counter offers. I just left California after loving the state for over 40 years. It’s just one big traffic jam all over southern Cal. I’m in Boulder now on my way to Portland and then I shall see how the comparisons add up.

Bobi6- you are the smart one ! We too have been in LA for over 40 years,grew up here, live on the Westside and will never buy here again, does not make financial sense. Buyers should beware and get educated, but we live in a land of sheep, they all follow. Most buyers in our wealthy neighborhood are cash buyers and not from around here. So right, LA is one big traffic jam with non english speaking people, not a pretty place like it used to be. Looking forward to retiring elsewhere !

This is still artificial means. It’s going to be a double edge sword.

Doc

Thanks for the report on foreign home purchasers. I was struck by two things. Florida leading in the purchases by foreigners. Canadians as foreign purchasers. I live in a Baby Boomer community in the IE. I have Canadian snow bird neighbors who winter here in homes they own. There are many more in the suburban community I live in. Here’s my take. More money is going to Florida because Florida is more affordable and California is for the most part still significantly overpriced. The money is going to where it has more purchasing power. In the face of stagnant incomes, unemployment and lots of shadow inventory California should experience declining home prices toward actual value. Cal may stay higher than the national median because of population and desirability similar to NY city but I think it will come down from it’s current high.

I live in Diamond Bar, Ca. This and surrounding area are 60% Chinese. The Chinese seem to be the only folks willing to pay high prices to live in this area. The Chinese are keeping the property values high. I have stories of Chinese in the US going back to China because the economy is so bad here. Now that the economy in China is bad, there will be a decrease of Chinese buying in these area. In fact, I have noticed a decrease in the number of houses for sale. Housing prices here are in the $800,000’s.

Good point is cheaper than California but Miami always been overprice. I also thought that Florida is the state with the most diverse Hispanic population unlike California and Texas where the largest group is from Mexico. So, I thought that the foreign money is coming into Florida from buyers in Latin America.

La-Orange are the high price coastal county rents and they have several immigrant families that will rent an apartment which also causes the rents to be high in poorer communities. The inland Empire I believe has lower rents than places like Seattle Washington.

I think we need to be careful about how we distinguish between currency devaluation and inflation. I would argue that we currently have a check on inflation by the inability of workers to command a higher nominal salary/pay. The slack in the labor market along with globalization enables employers to replace workers with cheeper labor which holds down the nominal price of labor. Food and fuel appear to be increasing in price due to the fact that we are bidding for these commodities on the world market with dollars that are in the process of being devalued. The real concern of a devaluing currency without inflation is that we start to crowd out other expenses like housing and services. This is the main reason I believe that housing is not at a bottom nor will see a bottom any time soon. We are trying to devalue our way out of the current crisis but the devaluation impacts the economy as a whole in a negative way. Add to the mix a trillion dollar a year deficit tacked on to the national debt that can only be sustained if interest stays abnormally low. Basic econ tells us that anticipated inflation is a component of interest. If this is the case, than we better pray that we never see real inflation ever again.

Things are quite different in those States where they actually allow developers to just get on with building houses. Housing has remained affordable regardless of what was going on in California, household discretionary spending is higher and that boosts the local economy. There is far smaller amounts of money involved in “underwater” mortgages and deleveraging is far less painful. Artificially low interest rates are genuine stimulus under these conditions. And note that in-migration, birth rates, and construction of housing are all still healthy – the ability to “just build houses” in response to demand, actually keeps house PRICES, and the rest of the local economy, stable. Cyclical fluctuations are far more volatile and damaging where all the response to “demand” takes place in price rather than quantity.

If you want to know where California is headed, study the housing market cycles in the UK since their 1947 Town and Country Planning Act. Every cyclical phase involved a bigger price spike and a weaker “supply” response. There is actually now no evidence at all of any “supply” response – the rates of construction are LOWER now in the “bubble” phase, than they were in the “bust” phase 50 years ago when population was far lower and the housing stock was “younger” on average. This is because the time taken to get a new development through the regulatory process to completion is longer than the length of the cycle itself. They even hold negotiations for years, over who will get what share of “planning gain”, which is understood to be in the order of thousands of percent – the land vendor, the developer, local special interests, local government, central government agencies, designers and architects, consultants and lawyers. And the advocates of urban growth constraint often deny that they cause housing unaffordability and cyclical volatility……!

The govt is doing just about every trick in the book to keep housing where it is. But it looks like we’re headed for another global recessionary event in the near future. So I doubt very much that the housing market will see any kind of a consistent price rise into next year.

I’ve been on top of the whole debt crisis since 2001. I studied and prepared for the crash but this whole housing situation is sickening. I sold my house and when heavy into precious metals back then and have been waiting to buy a house since the crash. I have a cheap ($125k) condo I purchased in 2009. 10 years later and I still refuse to pay these prices in Orange County.

My sister-in-law just listed her condo last Friday. She paid $239k in Feb 2011 and put $25k into updates. Looks great so her realtor wanted to list it for $260k but I convinced her to push for $275k. She was immediately flooded with traffic and offers with $295k being the highest that I’ve heard of so far. She showed the property to over 60 realtors in a 3-day span.

It was like a fresh piece of meat was being thrown to the vultures. People are bidding up properties and the central planners are setting up the economy for another HUGE crash. There has never been any recovery. No fix. No improvement. Yet, the sheep are being led to the slaughter house once again. Are people really this stupid?!?!

So let’s do the math now on your sister in law’s windfall sale. She bought for 239K a year and a half ago and sunk 25K into it. So she’s into the property for 264K. Let’s assume she paid off 5K in principal during the time…that put’s us at 259K into the deal.

Let’s say the property appraises and sells for 295K. Subtract about 7% percent for commisions, closing costs, repairs, moving, etc. She walks away with 275K. And don’t forget to pay capital gains taxes since she didn’t own for more than 2 years.

When all is said and done, she’ll likely have made about 12K for all her trouble. Not exactly getting rich in real estate. Numbers can be quite sobering. This is what happens when you have interest rate and inventory manipulation going on!

Long story short I say they are kicking the can until the next big cycle, which historically happens every 20 years or so. Not the fake housing boom, but the .com was real, any industrial boom is real. The next one will come from energy, not from Obama wannabe solar green energy, but some form plentiful and renewable energy that everything will need to be converted too. Will it be nuke fusion? Possible but who knows, if we knew now it would be happening.

You just lost me. The housing boom was fake but the .com was real? Papa, please help me understand what are you talking about? I work in SJ and work with many .com’ers that would like to know how the lost fake wealth of the .com differs from their lost fake wealth of the housing boom…

I never know what he’s talking about…

Then you need to continue your alternative media expansion Gillian. DHB is only one…MiSh, Karl Denninger, and Gerald Celente are some of my tops.

And What? I believe the .com boom was more real than the housing boom. Yes there is some residual wealth left from those that sold high, yet the internet boom provided infrastructure and technology that still exists to this day, and is only growing. Don’t confuse “irrational exuberance” with outright stupidity and fraud. There is a difference.

Papa,

I may not agree with you that often but you usually appear to be a bright guy so we must have a different understanding of the word “real”. Some of the companies in the .com era were infrastructure companies (i.e. JDS Uniphase) that help build our information pipelines but there were many companies (i.e. Snap.com) that “created†zeros and ones which became shelf-ware at best. I would argue we built a large amount of infrastructure during the housing boom as well. Both were asset bubbles fueled by cheap easy money. Both booms created infrastructure. Both booms had their share of stupidity and fraud. There was quite a bit of fraud in the IPO process in the .com era. There was quite a bit of stupidity in the .com era like people quitting their day job to become day traders. I really don’t see much of a difference other than the .com boom was not as big as the housing boom.

Hear about the 7.6 earthquake in Costa Rica today ? Nobody seems to mention that So Cal and all up & down the pacific coast has earthquake faults. If you did not live in Los Angeles in 1994 and experience a big quake, your real estate decisions may differ.

I lived in prime Santa Monica which got totally trashed. I remember condo & home owners completely caught off guard and walking away from their properties. There are many areas here in LA I would never own based on that, like Marina Del Rey which is all on landfill. People here have short memories about the chaos and the extensive damage to their uninsured homes and should remember LA will get hit again.

Illusive? You mean elusive?

Leave a Reply