The inflection point of all cash buyers in Southern California: Drop in all cash buying and FHA insured loans.

There has been little information on the makeup of the all cash buyer in Southern California. Sure, we know that for the last few years hedge funds have been swooping in on markets in Arizona and Nevada but also in the Inland Empire of Southern California. The markets went into a short panic this week at the hint that the Fed would slow down their MBS QE program. This is a big deal for markets in California where home prices are already at bubble levels and people are stepping over one another to get into open houses. Logic is now set aside. It is a fever. The headlines read that sales have hit a 7 year high in SoCal and that the median price is the highest in 5 years. So we are out of the woods right? Well much of this is built on record low rates and we see that the Fed will need to be in this game for years to come otherwise the market will retreat. Most are now buying with the belief that prices will continue to go up. When this is the default mindset, you know we are reaching a tipping point of sorts. Some data was released on the all cash buyers for SoCal. Let us look at this data.

All cash buyers – paying more for less

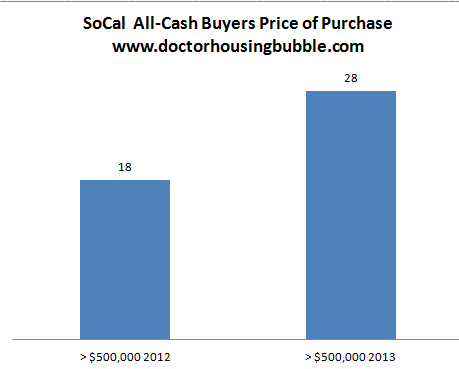

One interesting point is that all cash buying is still very high (roughly 31 percent of the market). This has fallen from the peak of 36 percent back in February of this year. Yet all cash buyers are now willing to pay more as well:

Of the all cash purchases, 28 percent were for homes that cost more than $500,000. Compare this to last year when the percentage was 18 percent. What was interesting about this segment of the market is that 44 percent were absentee buyers meaning investors. Given flipping activity I imagine anyone paying $500,000 or more is looking to buy for appreciation. It is hard to get a good rental yield at these high price levels.

Rents are nowhere close to rising at the speed that home prices are. Foreclosure resales were only 10 percent of the market. In other words, the foreclosure sale portion of the market is now closer to more normal historical levels. The rise in home prices in SoCal is reaching levels last seen during the bubble. Again, the gains are coming from everything but income growth. The growth is coming because of:

-low inventory

-record low rates

-momentum from manic buying

Low rates can only stay this way with the Fed becoming more aggressive. There has already been inflation in wealthy class assets as those with access to low rates pursue things like prime properties, stocks, and other key investment classes. This is also why Wall Street has had such a big appetite in rental properties. The Fed has made it very clear that it will punish investors that keep money in CDs or money market accounts. You either dive into the stock market or get back into the real estate game.

Jumbo loans coming back and FHA loans

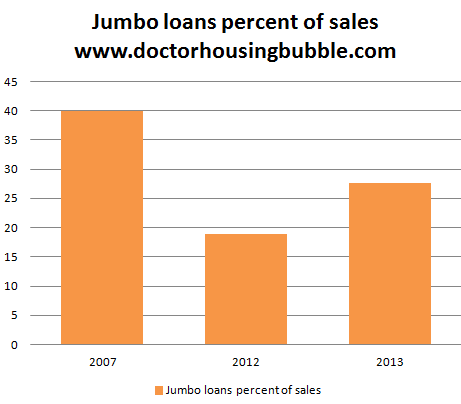

Jumbo loans are back in a big way:

*Of all SoCal purchases

To squeeze in, non-cash buyers need to finance their purchases and many are going with jumbo loans that now make up 27 percent of all sales (up from 18 percent last year). It is an interesting dynamic. But what is interesting is that since the year began, two major things have occurred:

-all cash buying is trending lower for SoCal

-FHA insured buyers trending lower for SoCal

For all cash buyers, the yields are looking weak and this was the case last year. We have those latecomers diving in right now. For FHA insured loans, the big jump in costs happened in the last few months, in particular in June.

The median home price in Los Angeles County is up 30 percent year over year. Mix of home sales or not, how is this even sustainable? Of course it isn’t and we already got a quick taste as to what will happen when the Fed pulls back. People fail to realize that the Fed is carrying something like $3.3 trillion in their balance sheet. This is what you call uncharted territory. When have you seen such large investor demand in rental real estate nationwide for multiple years? There has never been this much all cash buying in any real estate market in the US.

The market is overheating in SoCal. But like most bubbles, the apex is very hard to predict. The fact that FHA has gotten so much more expensive, rates trending up, and all cash buyers are pulling back will add some pressure on prices. Then again, many are willing to overpay so there is still a potential for more manic momentum.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

66 Responses to “The inflection point of all cash buyers in Southern California: Drop in all cash buying and FHA insured loans.”

Hard assets like real estate in the biggest economy in the world are probably looking a lot safer than many other choices.

You got that right. Real estate is a tangible asset, you can live in it or rent it out…unless you like living in your car or on the street everybody needs shelter. The gold bugs got slaughtered the last few weeks. I imagine stocks will be under more pressure as time goes on.

The US financial outlook is iffy, but right now they are by far the healthiest horse in the glue factory. This is likely another reason we are seeing all these foreigners flocking here to buy up real estate.

I was thinking about the contrast between stocks and the housing market this morning before this post came out. Stocks are just as “real” as housing–there are patents, products, and people that comprise the value of a brand.

Just like stocks, housing can be overvalued. For the former, it’s when the P/E ratio is exorbitant. For the latter, it’s when housing costs are out of reach for the regular Joe.

Unfortunately, for high housing costs, the government is trying to “solve” the problem, which only makes it worse: FHA, Fannie/Freddie, et al. It’s the same as we see in college tuition rates–finance the entire industry, and–shocker!–the cost of product goes up. The natural brakes that low demand would put on pricing are released.

I look at LA, my hometown, and I really wonder how that market is ever going to be able to support itself. What’s median household income today? What multiple is needed to buy the median home price? 5x, 6x? That’s nuts. What happens when interest rates rise and make the market even more unaffordable? The “smart” international money is already moving away from the U.S. and into Europe.

I run my own business and have a ton of international clients from everywhere–Europe, India, China, Indonesia, Vietnam, etc… Here’s the shocking truth: they are just as capable as those of us state-side. They are talented, work harder, and are just as innovative. If that’s the case going forward, how can So. Cal. salaries ever be competitive in an international marketplace?

I seriously believe the writing is on the wall, and if there’s ever a GOP administration ever again, a lot of the blue-state benefits (deductibility of state taxes and mortgage interest, sweetheart conforming loan limits) are going to be on the chopping block and really put a crimp on the housing market. It’s a slow death spiral ever since the departure of the aerospace industry.

On a global scale, it makes sense. Central banks are almost all going into dangerous and completely uncharted waters. Govts are getting more and more intrusive regarding taxation and financial control. So taking some money out of paper assets and buying something as fundamental as residential real estate makes a lot of sense right now. It won’t go to zero and it is one of the most basic requirements of man.

Interest rates on a 30 year conventional mortgage have quietly crept up to 4.25% on Friday. Compare this to the 3.25% at the beginning of May. This means that interest rates on a 30 year mortgage have gone up 33% in two months.

I suspect there will be many buyers who prequalified at 3.25% who will no longer be able to leverage out at 4.25%. A 33% jump in interest rates will cause a number of sales in escrow to fail as well.

Check it out: (Fair use quote to whet your appetite) >> That leaves best-execution at a stomach-churning 4.625% today. PLEASE UNDERSTAND, this is real. <<

http://www.mortgagenewsdaily.com/consumer_rates/313878.aspx

Interest rates are going above 20% again, like they did in the 1980’s under Volcker. This will crash stocks, bonds, housing and commodities.

Good Luck!!!

Volcker raised interest rates to kill inflation, and it worked. The stock market soared after that. We’re facing deflation.

4.6% is for a conventional 30 year. VA/FHA was still at 4.25%.

The average 30 year mortgage interest rate (going back 100 years) is between 8% and 9%. When mortgage interest rates go back to their historic levels, home selling prices is SoCal will no longer be catatonic.

My observations are the same as the good Dr. described, the cash buyer is still there, but it is a different type of investor. The cash flow investor has moved on, with bidding wars and higher prices, it no longer makes sense to buy and rent.

I was thinking about that this morning, too. It’s just like the stock market…gotta buy low/early on a dip and know there’s going to be appreciation. I wouldn’t do it nowadays.

We recently sold our home in San Diego and move to a bigger home, since our family is growing.

Even with a 400K down-payment to buy a 600K home we have not found a home we like in the past 3 months. We keep getting outbid. Not sure if FHA, CONV or ALL-CASH.

Our offers are extremely clean. Inventory remains low.

May be after summer it will cool down a bit.

I just left San Diego after 13 years. It’s hard to find a good spot with good schools and not on the Miramar flight path. We were in Carmel Valley and had a daily airshow with Ospreys and CH-53s shaking our house. RSF and Del Mar have it, too. Carlsbad is nice and the schools are better than SDUSD…I always called it the best-managed city in Southern California.

It’s very naive to think that all real estate cash buyers have the mindset of pure profit. In this precarious economic environment, I guarantee you, a large percentage of cash buyers have the mindset of “I’m going to pour a portion of my assets into real estate accepting the fact that it has the potential of losing 15%, but the stock market has a potential of losing 30%. If I leave my assets in money market, it is 100% going to lose value, or buying power.” All decisions will be rational to one, but irrational to another.

As if the Fed outlawed black jack, where educated technical card counting skills can work to one’s advantage; and leaves only Roulette, a game of pure luck, as the only game for investors of all risk levels to play.

I think one thing to keep in mind here is that a house is not an equity. It is a large, energy, tax and resource consuming entity that can’t be parked in to a bank account.

For most buyers, even the investor types, the house has to be either occupied by the owner or the renter. Otherwise, it just bleeds maintenance and tax costs.

This will be the limiting step, not how long they are willing to hold on to the house.

Robert Shiller (of the Case-Shiller index) had a great quote on CNBC a few months ago…housing’s a terrible investment. Over the long-run, it is just-about break-even, after maintenance, taxes, updating styling, etc… I didn’t expect that opinion from him.

And, when the “investor” wants/needs to sell the house there has to be a buyer who can afford to buy it. You may be able to buy a lot of house with interest rates at 3.5%, but that same monthly nut will buy much less with interest rates at 6%. Unless the fundamentals take a dramatic turn for the better, I suspect there will be a lot of investors with an expensive house to sell and no buyer with the job/credit/down payment/income required to meet that monthly nut.

@KR

Robert Shiller also owns 2 homes….

KR, Shiller is correct that housing is a bad investment on a national level. That pile of bricks, wood and dywall in Iowa is likely worth what it was 30 years ago. Ask any of the boomers who have owned desirable CA real estate for the last 30 or 40 years how their investment worked out for them.

And remember Shiller is talking about “investment.” No matter what you still need a place to live. Either sign up for a 30 yr mortgage or pay a rent check for the rest of your life. Housing is a basic human need, this will never change. When you remove the investment point of view, it makes sense to own most of the time.

It’s certainly a valid point of view, but living in the world today where Governments have recently written “bail-in” language into legislation and knowing that there just isn’t enough printed money to make every depositor whole, owning a physical asset like a home or apartment makes a lot of sense. Especially if you lock in to a low interest rate, so long as those don’t get revalued after some type of economic calamity, you would rather have a house than watching the money in your bank account disappear.

Old Glory said: >>> that there just isn’t enough printed money to make every depositor whole, owning a physical asset like a home or apartment makes a lot of sense……. you would rather have a house than watching the money in your bank account disappear. <<< Yes but there are TRILLIONS in over-valued assets to exchange to the bank depositors, in lieu of what they're owed, at super-low prices. Let's see who wins. The leveraged debtors who are proud of their hyperinflated valued properties, or the savers….. which include just about all the most powerful people in the world. The people who matter. The people who are way more involved in liquid wealth, that ridiculously exposed to hyperinflated property prices.

I want to ask a fairly obvious question.

Does anyone know what percentage are true cash buyers versus those who promise cash and take the risk of securing a loan?

My point is, one of my very-well-heeled friends bought a $600,000 house in Highland Park with an “all cash offer.” He turned around and with a decent sized downpayment portion, secured a loan for the house. The only difference was he took the risk of having to bring all the cash to the seller if he wasn’t able to secure a loan.

I think a lot of the “all cash” offers work like this with intelligent buyers with bullet-proof creditworthiness securing downstream financing. Good investors would be insane not to take advantage of the low interest rates.

Why does this make a huge difference? Because when the interest rate in downstream financing takes a hike up, a lot of these “all cash” buyers will no longer be interested in buying even if there was no large sell-off panic due to high rates.

I put a back-up offer on a short sale two years ago, but was beat out by an all cash offer. A few weeks later, we were contacted & told that the all-cash purchase “fell apart,” so I got moved to the top of the list. Then they told me that the bank had agreed to $20K less than my offer, so I needed to reduce my offer by $20K. Then it worked out that there was an additional refund I’d be due at the close of escrow, reducing the cost by another $16K. I say, shenanigans.

Side note: I was put at the top of the non-pocket-listed people because “I was clean.” I’d never heard this term before, and it was really my offer that was clean (pre-approved & downpayment in the bank, though I like to think that my personal grooming habits contributed in some way).

In this type of market, I would bet that most all cash offers are not “true” all cash offers. Real estate is a high leverage play usually and people with cash know how to play the game. Realtors undoubtedly have coached their buyers into how to write an offer that has a chance of being accepted in a multiple offer situation. If you have 30,40 or 50% down the banks would love to float you a loan. This market has become the most manipulated real estate market in history and is nothing more than musical chairs and the music has begun to slow down. Look for the hot money to exit and play the next rotation. Precious metals maybe? Perception is changing and latecomers to the party will be left without a chair.

http://Www.westsideremeltdown.blogspot.com

http://Www.santamonicameltdownthe90402.blogspot.com

I tried to buy in norcal from spring 2011 to spring 2012 and gave up after being ignored in favor of cash bids from flippers and speculators several times. I did have 20% to put down, was preapproved for a much bigger loan than I needed, etc. but none of that mattered. From what I was told a down payment bigger than 20% does no good in this market so I didn’t bother though I could have done 40%. Am now on the sidelines and hoping some of theses speculators and flippers get badly burned. May look into buying again next year if things change and that seems likely, I get the sense that an inflection point in near in norcal too.

Exactly. In our family, my Wife helped our Daughter (along with her Husband) buy a house for “cash” before she sold her old one. Prices for her old one jumped about $50K during the delay, and she is now in escrow. When it closes, she’ll finance and buy my Wife out. Hopefully, this game of interest rate roulette doesn’t end in tears.

Although we talk about the 20% down payment guy having more skin in the game/less likely to default as well as the possibility that the cash buyers are investors that will flee when things go bad, less is made of the fact that the ones that can afford to pay for cash could also just sit on their houses for a long time as all cash buyer are s more likely have money so can have longer hold times. They may just wait it out bc they can. if america is the best turd of the bunch (i mean even germany is slowing down, china is teetering and they exaggerate nums to begin with and the emerging markets are too), the probabilities increase more.

It really is amazing how f-ed up everything is. It all feels upside down and illogical and i study this stuff ad naseum and im really confused as to whats next. Clearly the home price increases cant continue at these levels, but when do they go down and how much of a floor is established due to then stuck underwater folks who can afford to wait is just a nightmare to predict. Add in globalization on a ridiculous scale, uprisings in foreign countries where richie richers may be like ca or fl sound better than my crazy home country, political repurcussions for O and dems in midterm elections and bernackes legacy, banks liking profits and feeling either too big to fail so maybe get govt safety lines or cyprus style bail ins if they lose on bad mortgage loans, etc., good luck knowing that bottom. Imagine if to protect housing being crushed, they tie it to immigration.

…..and then again, it could crash soon with zero global demand and increased supply bc builder sentiment is now finally super high. My biggest advice is no one is an expert. Experts are annointed after the fact and are often one trick ponies (they got one lucky guess essentially and/or inside (illegal often) info. Also every mouthpiece on cnbc, etc is giving advice based on which side of the trade they sit on. Just only buy what you can afford if you do or rent. Try not to stress about your personal decision or be angry if this is all bs. The world is a different place then even a few years ago. Good guys lost. Banks and half percenters won. We just gotta make do.

Well I have been watching redfin for several months in Hollister which is an hour south-east from San Jose, and prices went crazy right before the PMI became permanent on the fha loans. There were many houses sold in March that were relisted for up to 100k more in May. Listings were pending very quickly, within hours. Now for the last 4 days there is absolutely nothing pending and two houses have returned from pending to the market. Unemployment here is the highest in the entire state. My friend who is a Realtor says almost all her buyers were investors or FHA with only 3%. Not sure what to make of this but I am hoping it means prices will come down with the rate hikes and more expensive FHA. I am also hoping some of those nasty flippers who bought in March and are now trying to gouge real families will get screwed. Homes here are still below 2006 prices but are way out of line for local incomes. There has to be a better system than the corrupt one we’ve got. Try not to be angry? I think the problem with Americans is we aren’t angry enough, we have sat by complacently while our government has become completely corrupt, the elites have become above the law, and the middle class has been destroyed.

Well put Ann Vasquez! We are without a productive economy, over regulated and taxed being profitability for the average business person, so these “modern day carpetbaggers” keep trying to squeeze a buck anyway they can with the help of Uncle president and his equally corrupt senate, house, and the Fed.

The middle is angry, but have been angry and dwindling in numbers for years. In today’s two party system, gop supports the rich and dems support the poor and rich. The talk is always about the middle, but no policy supports it, nor would i hold my breath waiting for them. Maybe someone starts a middle class superpac that gains traction over the internet that can push causes, but otherwise, how do you see the middle advancing its policies?

Exactamundo Ann. Extend and pretend will continue to crush the middle class as this same old song keeps playing.

Without a real crash (and each QE/Tax credit extension puts it off a little longer), the market and middle class will keep treading water in this bubbly toxic RE waste until the pain is realized and/or the middle class is destroyed and forced into serfdom to landlords rather than banknotes.

Cash buyers are still pretty active in the Westwood and Beverly Hills areas. I’ve seen several $700k-$1m properties close within 2-3 weeks of the pending date, and most of them are above asking price.

Using California to deduce the state of the housing market is like using a hot-house orchid to deduce the nature of plant life on this planet. In the first place, the state was the creation of an industrial corporation formed by four merchants from Sacramento who were given title to most of the state for their clever use of contractual slave-labor imported from China to construct the western portion of the transcontinental railroad; they had to monetize this windfall somehow! In the second place, the state’s population is largely self-selecting on a set of criteria such as weather (the old and infirm), leisure (the idle rich), avoidance of process-servers (the film industry), and their servants (immigrants). This is the kind of schizophrenic mix that elects Richard Nixon, Ronald Reagan, and then goes for the restitution of the monarchy (figuratively speaking) with the descendant (Jerry Brown) of the ancien régime (Edmund Brown). But you can’t escape the fact that it’s a place built by railroad and hydraulic engineers on a coastal desert which is probably why the locals believe that trees grow to the sky!

Love your theory!!! You are right on!

they do grow to the sky: http://en.wikipedia.org/wiki/List_of_largest_giant_sequoias

and only in California

the most beautiful place on earth (if you took away all the stupid people)

And brownies with ice cream are the healthiest food, if you take away the fat and sugar.

Right on, articulately put!

much of cash buyers are from Asia. We buy and rent the house out. We buy for relatives back home. California is great. If they want to move and live in California, they get great government benefits here as well. Benefits in Texas are not so good.

I am not sure u will find renters. That is the whole problem with lots of people becoming investors at once.

If this post is real, plllllleeeaase go to cali and not texas. They do have better govt benefits and the weather is better for you and your relatives. Too many bugs and its too hot for you in texas. Please spread to all your friends as well.

I am not going to get into a debate as to whether or not it is a good time to purchase a home. This post is for those who have complained you cant find a good home in LA for under $500K. Here is a listing in a neighborhood I live in, which is 15 minutes from the beach or downtown LA in a strong Neighborhood Association. 1,500 sqft on 7000 sqft land, corner property well kept. You will not find any houses of this size, so close to Culver City and the Westside for less money. In other words this as about as close to LaCienega you can get for under $500K that is not in bad neighborhood.

http://www.trulia.com/property/3122041163-5601-Sunlight-Pl-Los-Angeles-CA-90016

I’m not in the real estate industry, simply trying to stop the ‘under $500K’ whiners.

Since when is that a good house for half a million bucks? To me, that shows me just how out if whack things are in this state. I wouldn’t want to live there for half that price, which is why family has decided to leave the state (and our family) in a few months.

@GH

My post was targeted to those who wish to own a home in a decent area in LA for under a half million, not whether or not it is a good time to buy and not where you can get the most amount of home for your dollar.

Gotcha.

A corner lot is not a positive, it is a negative, because you get traffic from twice as many directions.

Market dips and the owners who buy at this price in this neighborhood will be underwater fast. Shitty school district so be prepared to spend extra money to send your kids to a private school. This home is not a deal. It’s a trap.

Ha, I toured this at their open house last week. Big, nice lot but super dated and the back half of the house had setteled about 6 inches, so there is a HUGE crack in the master bedroom wall that extends down and through the patio and foundation.

$485k, dated, in dire need of updates and structurally unsound. Ya real value for your 500k there. Me and the wife laughed out loud.

@ Brian

Curious if that is an area you are considering purchasing in that area? well, of course, if the house fails inspections then dont buy it. Dated houses in this area sell for under $450K-$500K (3bd, 2ba). Updated houses sell for $500K – $550K. Hope this helps.

Have seen that sort of thing myself over the last couple of years, been to three open houses that claimed the residence needed TLC (which I’m fine with if the price reflects that as I enjoy DIY projects) but had failed foundations, earth movement, serious cracking, etc…had to restrain myself from pimpslapping the lying realtor

The home seems nice, but Baldwin Hills isn’t what I’d consider a ‘decent’ neighborhood.

@ Ed I agree that Baldwin Hills is a little questionable but in relation to where? Questionable to Santa Monica (where I grew up, yes). I bought a house in Baldwin Hills from an old Jewish lady who lived here for 60 years and didnt have any problems… when I purchased the home it still had no fence across the driveway and no security screen door on the front of the house. Come to think if it, her security was no different than a house in a decent part of Santa Monica. In any case, the area bound by Jefferson on the North, LaCienega on the West and LaBrea on the East is more ‘decent’ than many people realize.

If the immigration bill passes in the Senate and an immigration bill passes in the House, members of the House and Senate will sit down and write a compromise bill that Obama will sign. When this happens wages will drop even further, making housing even more unaffordable. Real Estate is in a long term downward spiral that is being led by a reduction in wages for American citizens. This is a depression that has its roots in the 1990’s. To fix the problems it will take a mass undoing of many laws and treaties. I do not see an economic turnaround in sight.

I am curious, in your opinion, how having people already living and working in this country effects wages negatively after passing an immigration reform bill? Havent many if these folks already undercut wages by working off the books at low rates? Arent they already in housing in america? Im not saying i want an immigration bill, im just trying to see your link between cause and effect.

Also, many americans dont give too shts about folks wages here in the states or they would be buying more american made products and using more american workers. In LA at least, where people could afford whatever they want, its foreign cars, foreign luxury clothing, mexicans doing landscaping and home construction, etc. People shop at walmart instead of mom n pop shops to save a few bucks.

Big business was all – in for the Amnesty Bill that was passed back in the 80’s, and they’re all – in for this bill as well. There’s only one reason why – they don’t want to pay minimum wage and the related benefits for their lower – level workers. It’s purely self – interest.

The immigration bill will allow massive new amounts of people in on foreign work visas. This is the same thing that happened with the American Competitiveness and Workforce Improvement Act of 1998 – dumping boatloads of cheap foreign labor on an already depressed labor market. On top of that, under Obama Care, it will be $3,000/year cheaper to hire someone on a foreign visa because companies will not have to provide their insurance. The bill is detrimental to our economy.

I have one word for those who were suckered into the real estate market by Ben, ROTATION. Greatest bond sell-off in history is taking place before your eyes. Might be a little difficult for your ALL CASH Chinese buyers since the banks in China a closed today. And, for those who think interest rates do not affect the price of real estate, welcome to the real world.

This. The oh shit reckoning is upon us.

Maybe I’m missing something that one of you could help with..

Why not build a house in CA rather than buy? After doing the math and talking to a few construction companies it seems that you can build the same house for much less than buying a preexisting one of similar stature. That is my plan for the near future but I’m really looking for any insight.

D Land costs are high in the pricey areas of California

The only way that would pencil out is if you happened to get a very cheap lot (think inheritance). Here’s an example of a local (to me) house in an “ok” area that is listed as a tear-down:

http://www.redfin.com/CA/Redondo-Beach/2411-Graham-Ave-90278/home/6683415

You can venture outside of LA, but then you’ll also be on the hook for water/power/engineering etc. Malibu always has a few affordable land listings, but you’ll probably burn through 5x the purchase price before you even get a wall up.

I’m looking above Hollywood in the higher up Beachwood Canyon area. I’ve seen a few lots going between 40k – 100k. I’ve been saving for about 2 years now; I’m 27 and my plan has always been to get a pre-fab home. Maybe this area is cheap because there are hidden costs of excavating on steep hills and hooking up to water/ sewage / electrical?

The pre-fab homes I’m looking at run anywhere from 180k – 230k. I know their style isn’t for everyone but I enjoy them. This would be my residence, not a flip. I need a place to live and waiting / saving is causing me anxiety since prices are shooting up and the buying power in my money is falling.

Anyways, thanks for the comments.

My only thought is that if something is still vacant over a few boom/bust cycles it’s probably more trouble than it’s worth.. not to mention there may be HOA / neighborhood restrictions on using prefab housing.

Don’t worry about prices going up, it’s going to slow down at some point and you may be glad to have that cash on hand.

D, you don’t have to feel anxious because what goes up must come down. Patience pays off in the long run. That is all.

Rates just hit 5%!! Quicken Loans

If we hit 5% this fast. I do not think 10% mortgage rates by end of 2015 is unrealistic. This will crush housing. Investors that have flipped already nice work. Those that try to do it now or recently bought. Unload now, or forever be stuck.

Can’t wait for the fireworks later this week! Woohooo!

bluto

June 24, 2013 at 8:39 pm

Have seen that sort of thing myself over the last couple of years, been to three open houses that claimed the residence needed TLC (which I’m fine with if the price reflects that as I enjoy DIY projects) but had failed foundations, earth movement, serious cracking, etc…had to restrain myself from pimpslapping the lying realtor

I’m still laughing as I write this. Best post of the year. And while the phrase is abhorrent it all seems to be the new normal. I was also amused to read that the taxes listed on the property for 2012 were on a value in the mid-sixties. QE is wrong given the description of the back half of the house settling. You can’t buy it for under 500K. The true cost is what it will take to make it whole. Apparently well above 500K.

Leave a Reply