California’s disappearing middle class: Is the California dream viable for middle class families? The growing disparity between rich and poor.

There once was a time that California provided ample opportunity for middle class families. While this might be the case in some small areas, the statistics show us that it is increasingly more difficult for middle class families to get by in the state. The massive amount of investor buying is merely a sympton of a growing disparity hitting many parts of the country. Money has been devalued due to massive levels of debt and big investors would rather have tangible assets versus holding onto cash. This is a big reason that for the last few years investors have aggressively deployed money into the housing market where in 2013, half of all sales are coming from “cash†buyers. While the economy appears to be improving it is clearly not a uniform recovery. If you use the stock market and home values as a barometer you would think everything is going great. Yet that is not really the case especially if you are middle class. Let us take a look at a few signs that highlight the continuing challenges for middle class families in California.

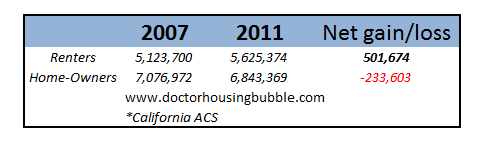

A land of renters

While the recession officially ended in 2009, since that point most of the boom in housing has come from hungry investors. In fact, California has had a net gain of 500,000+ renters while losing over 230,000 homeowners:

This trend has hit hard and we will see more data this month when the Census releases additional annual figures. Part of the above loss has come from households going through foreclosure. It is highly doubtful that in sought after areas of California a person with a foreclosure is going to stand a chance bidding against a liquid cash investor. There has been this discussion that somehow young Americans are poised to take the housing market to the next level.

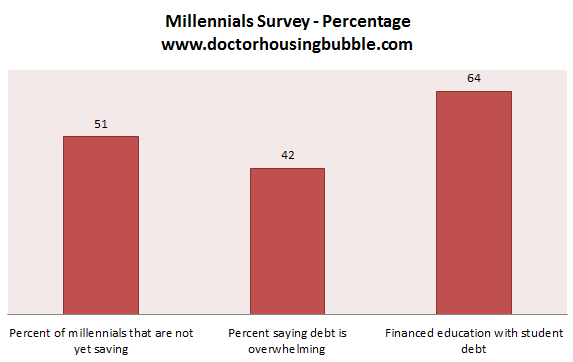

Young savings rate

First, Millennials are not exactly in a solid financial position. Recent data does not look positive for this group:

Half of Millennials have yet to start saving. 42 percent say they are overwhelmed with debt (which is good news if they plan on taking the largest form of debt, a mortgage right?). And something that is very unique to this group, 64 percent financed their college degrees which many baby boomers did not (or if they did, it was a trivial amount during a time of real growing incomes).

This kind of evidence suggests that this upcoming generation will have it financially tougher than that of baby boomers that witnessed one of the hottest stock and real estate markets ever. It is also no surprise that many younger Americans are living at home in spite of what we are told about the economy:

“(Salon) America’s young people have been hit so hard by the crappy economy that they can’t even get out the door. A fresh study from Pew Research reveals that 36 percent of Millennials —young adults ages 18 to 31 — are still living under their parents’ roofs (this includes college students who come home for breaks). Not since the 1960s have so many young people resorted to couch surfing with mom and dad, a record 21.6 million young adults last year.

This is a gigantic sign that something is going horribly wrong in our economy—something that will cost everybody.â€

This is important to grasp since there seems to be an implication that younger Americans and Millennials are flush with cash and ready to buy homes in droves. In reality, many are going to have a tough time renting. Many are already saddled with massive debt and given the sky high prices of California real estate, is this group really primed to buy up all the future housing that will come online? Hard to say since the market is currently dominated by investors. If we think of middle class life as including homeownership, many Millennials are going to face an uphill battle here.

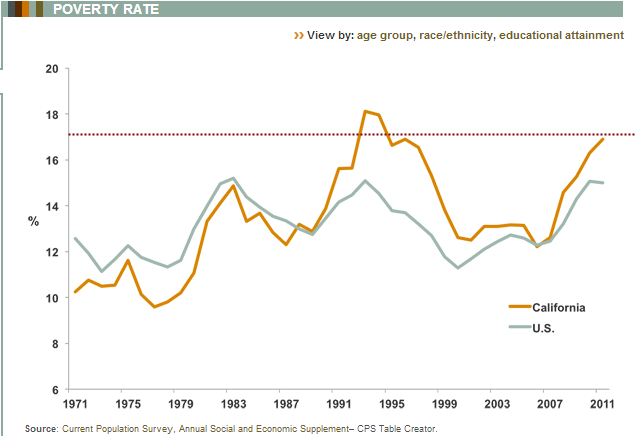

Poverty rate

First, it is important to define “middle class†since people put out nonsense that middle class means $250,000 of income a year. By definition, middle class is the median household income. In the US, this means about $52,000 and in California this means $57,000. This is simply data from the US Census. In fact, only 6 percent of California households make more than $200,000 (26 percent make more than $100,000). Since rising prices across many items eat into stagnant incomes, it is no surprise that the poverty rate in the state has increased even during this recovery:

The poverty rate continues to increase where we now have 3 million Californians on food stamps. Many of these people have fallen off the middle class ladder and are now struggling to get by. Rising real estate values and a rising stock market don’t necessarily trickle down to most middle class families.

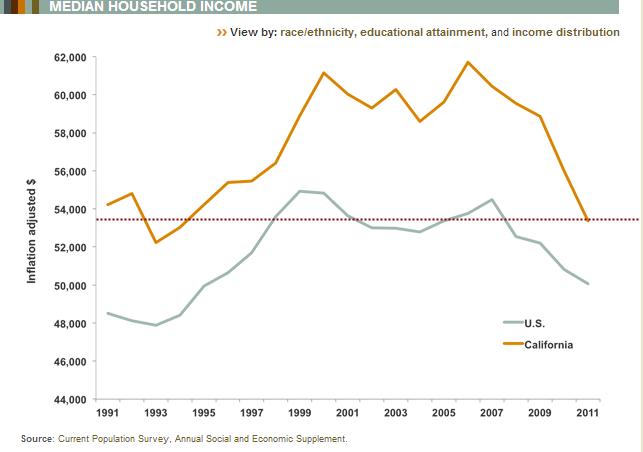

California income

Income is one of the best indicators of a truly robust economy where wealth growth is being shared by most of the population. That is not happening this time around:

Adjusting for inflation, California households are back to levels last seen in the mid-1990s. This isn’t only a California trend but a nationwide one. What compounds this issue in California is the price of real estate. For example, in many parts of the country a starter home can go for $150,000 to $175,000 so even at $50,000 or $60,000 a year a household can get in and float this mortgage because of artificially low rates. Is that even feasible in California? Not likely but there are areas in the Inland Empire and Central Valley where prices may be inline but these prices have been pushed up courtesy of all the investor demand. For example, the median price of a home sold in San Bernardino County last year was $165,000 but now it is up to $205,000 even though incomes in the area have gone absolutely nowhere.

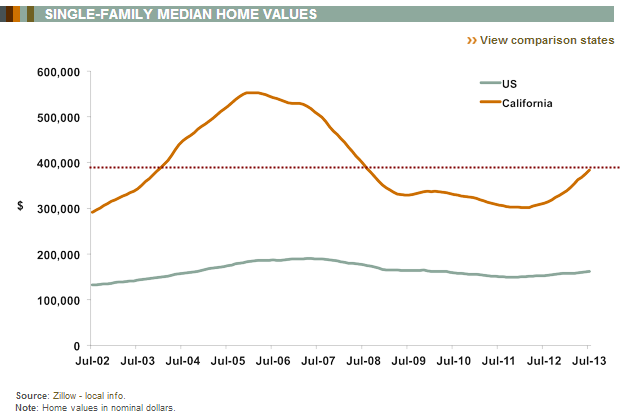

Home values

So you have to ask what is driving home prices up in the state?

This is being driven by investors, low interest rates, and a controlled level of inventory on the market (although inventory is slowly increasing). So it is hard to see how this is a benefit to the larger middle class in the state compared to investors and those locked into high priced areas already. I’m sure many of you know people and families that bought many years ago in target markets that if they were to buy today, would stand no chance of purchasing in their neighborhood. In fact, you can have one neighbor paying $10,000 a year in taxes while next door, someone is paying $2,000 even though they are deriving the same benefits from the government and local services. There are many nuts and bolts in California that create an environment where boom and bust are ingrained in the real estate market. So to think there will be no bust after this boom flies in the face of history.

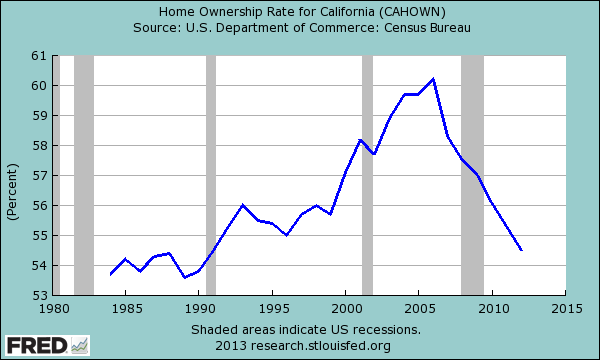

California homeownership rate

One clear result of all of this is that the homeownership rate has fallen dramatically in the state:

The current rate of ownership in California is now back to where it was in the early 1990s. What use is it having low rates when this kind of market actually favors investors that come in with cash or other forms of financing and crowd out regular buyers? The big winners are the larger investors and banks. All of this data is showing a more bifurcated market where inequality is increasing dramatically. This is simply a fact. You even have foreign money flooding back into California in more desirable areas. Of course, much of this money is contingent on a booming stock market since the big investors derive their net worth from financial instruments more than real estate.

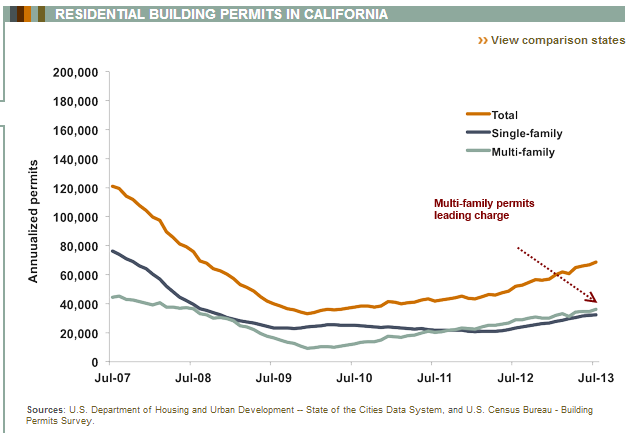

Multi-family permits

Big money understands this trend and that is why if we look at permits, you’ll notice that more multi-family permits are being issued in California compared to single-family permits:

Multi-family units are largely rental housing. Given that many younger Californians are simply unable to pay current prices, it is more likely that they will rent before they can buy. The middle class is shrinking in California and we are seeing a growing class mired in poverty. Some might be in their own little cocoon willfully ignorant of what is happening but the data is pretty clear. This real estate market is being driven by big money, not by a resurgence in the California middle class.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

108 Responses to “California’s disappearing middle class: Is the California dream viable for middle class families? The growing disparity between rich and poor.”

Hm, big banks and Fed conspire to blow up big phony housing bubble, then big banks and hedge funds end up owning all the real estate and turn Americans into impoverished renters. All a coincidence, I am sure.

It is interesting that we have seen for the first time funds investing in single family homes-American Homes 4 Rent and Blackrock. They desperately need low rates to make their new businesses work

I think it is Blackstone.

Daniel- it is blackstone and also a new public company American Homes 4 Rent-The story was covered here

http://www.doctorhousingbubble.com/american-homes-4-rent-net-loss-investment-property-wells-fargo/

I noted from American Homes 4 Rent public filing: At June 30, 2013, we owned approximately 17,949 single-family properties, approximately 9,882, or 55%, of which were leased.â€

We wish them luck in renting out the remaining 8,067 homes in a timely and profitable fashion.

Filing link is in this blog post:

http://smaulgld.com/the-recovery-is-worse-than-the-recession/

Actually, no they don’t. They already have purchased enough to make it work and those loans are locked in for the life of the home until it’s paid off.

Excellent post, Dr. HB. The Mellennials are supposed to be the next generation of housing buyers, but they are strapped with college debt and stagnant job creation and wage growth. Psychologically, they don’t even want to be home owners — it doesn’t suit their lifestyle. They see value in other things (mobility, technology, etc.).

It makes no sense that this last jump in house prices can continue — the fundamentals do not support it. Baby boomers are retiring at a rate of 10,000 per day. Who is going to buy their over-sized, over-priced houses that cost a fortune to maintain (taxes, maintenance, energy, etc.)?

We are already seeing a sharp cooling in sales activities after the recent spike in mortgage rates. Watch what happens over the next quarter or two, as prices flatten and then start falling again.

I think that many older people, in their 60s, will just sell to their kids, or stay in the house with their grown children living with them.

I know this is not worth much, but most people in their 60s that I know really don’t have much beyond their house. Many have no pension or little income for retirement. The future retirement for the people that are 60+ is a subject I have learned not to bring up when with friends. I have to wonder how this is all going to work out. Not to mention what the younger people will do when they are that age. Don’t want to doom and gloom, lived through the 50s and have personally witnessed how things have changed for the middle class.

@HearVoices

I think many of those baby boomers will just end up supporting themselves through retirement by renting out extra bedrooms in their house. Ultimately this is really the only way to turn a house into income. I’m a twenty-something myself, and I don’t think I know anyone who lives alone. They’re either married or living with roommates. In the early twentieth century, people stayed in their parents home until they got married. For a few decades in the mid to late twentieth century, the pattern was parents -> living by yourself -> marriage. Now that pattern is parents -> roommates -> marriage. And then sometimes you live with roommates even after you’re married!

@Miriam, big banks and hedge funds do not want to holding properties in the mid-tier areas. They are (slowly) liquidating foreclosures in the mid-tier areas. They are in the process of unloading (in a controlled metered fashion) their mid-tier mortgages from 2004 to 2008 to all cash buyers or buyers with impeccable credit (+20% cash down payment and FICO scores of +750).

The reason being when interest rates were at 3.25% in May, the banks could get full face value for their foreclosed mortgage, i.e. $800K in a mid-tier area. When interest rates go back up to 6% (the historical average is 8% to 9%) these $800K mid-tier homes will plunge in price down to $575K. Banks and hedge funds do not want to be holding these mid-tier properties when that happens. They will be insolvent and/or bankrupt.

The goal of the Federal Reserve and the Fed’s member banks is to clear out the 2004 to 2008 inventory and get these properties off of their balance sheets and on to the balance sheets of cash buyers or the impeccable credit buyers. The buyers with impeccable credit are not going to default just because a change in interest rates causes them to go underwater. They will continue to pay all the way to the bitter end.

ernst blofeld,

I agree with your point that hedge funds and bankers do not want to be single family home landlords forever, but the point is that (i) the middle class missed out on what should have been a historical housing bust/ buying opportunity in 2008 because (ii) these leeches have access to preferential access to financing, giving them an advantage plus the ability to buy these properties and unload them at a profit to cash buyer bagholders.

So, this ends up being a loss to average Americans who now have to choose between being renters or paying full value for a home.

It is a windfall for the one percent.

Those $800Kers (my “so-so” neighborhood in Marin is full of them) really should plunge to $250/$300K at most – -they are 3BR, 2BA crackerbox tract houses built in the 50s on 6,000 SF lots. Most should be torn down as they were not well-built. Yet they still sell for 800-900K. Where are the salaries to support that kind of pricing for those houses? I think those who buy now are really going to be kicking themselves for years and years for falling into the latest bubble blown by the Fed. As for me, I am debt-free with plenty for a down, but choose to rent – I don’t want to be a bag holder, ruining my financial future just to own one of these cracker boxes. My “problem” is having family and friends here, and the easy climate. I wish I could handle living away from the coast, but being born and raised near it, I just can’t do it (and neither can my wife). So we will rent until the cows come home unless sanity ever comes back and we can afford to buy a nice home on our budget. At this point, without a major crash (everyone gets burned in some fashion), I can’t see it happening for decades. I mean, such would require capitulation (or being asleep at the swithc) of some sort by the 1%, and I don’t EVER see that happening.

BAR, in same boat as you in LA. My outlook is that the FED and 1% have no more bullets. Operation Twist brought interest rates down to historical lows but it looks more and more likely the FED has lost the bond market. The only thing the FED can do is more QE (which I feel, undoubtedly, they will do again despite this taper talk). All one has to do is read articles like this one and realize, like in the boom of six years ago, none of these prices make any sense.

Yeah, that’s one option. However, they could also simply inflate your savings away. Reduce the real cost of the national debt, save the balance sheet of the banks, and allow congress to continue spending.

That or they could allow deflation to kick in, and let savers like yourself be victorious and put all their buddies on the street.

One thing that could be of concern is as poverty increases so does the increase in federal aid for infants. As poor require assistance they will probably use child credits or welfare options to offset their total expenses. On top of that Section 8 vouchers will likely grow faster. I am curious if investors will cave into this crowd if they run out of decent renters? Do investors mind having 3 or 4 generation families living in a 2 bed 1 bath home?

Doubling up is already happening in the overpriced rental market. A couple with children and an income less than the median ($57,000/yr) cannot afford a decent rental, let alone purchase of a home. Remember, HALF of all households live on LESS than the median. I live in a complex in coastal OC that is becoming quite crowded because families are doubling up (2 families in a 2 bedroom apt). Heck, the one bedroom near me has a family of five. For reference, a 1bdrm is approx $1500/mo and a 2bdrm is $1800-2000/mo in South/Coastal OC. These are in bike riding distance of the new employment in this area…. jobs added here during our so-called “recovery” are housekeeping for numerous upscale hotels (St. Regis, Ritz or Montage) or Retail/Fastfood. This is in SOUTH OC which is perceived as very wealthy. R.I.P. middle class.

This is exactly the problem with job creation. As the costs of everything go up including rent companies willing to hire are not looking for “living wage” jobs” to cover remedial work or blue collar jobs. All the competition for companies to keep prices affordable at the expense of the worker is going to eventually bite them in the #@$.

You are right. That is the future of SoCal. Multiple families in residences built for only one and the cities do not enforce the occupancy limits because that would be racist. Things are changing. When immigration reform passes, each one can bring in at least four people. 40 million new voters will soon be coming. Don’t worry, we will tax the rich in NoCal, e.g. Frisco.

Great work! California led the nation in many ways post WWII.

They have in the last 20-30 years, however begun a reversal with expanding the welfare state for citizens and non citizens alike, overly generous pay and benefits for an ever increasing number of public workers and more regulations than other states can even think of.

Add to that increasing sales, taxes, property taxes (despite prop 13- as home prices rise) and income taxes and you get two types of people who can afford to live in CA-ultra wealthy and public workers.

LOL. Public workers and the 1% are the only ones who can afford to live in Los Angeles? How much do you think teachers and DMV employees make? Pull your head out of the sand. We’re not making that much and those of us who need college to apply for our jobs have student debt on top of exorbitant rents. Don’t ever put government workers in the same category as Jeff Bezos, Mark Zuckerberg and hedge fund managers. We government workers went to college to educate your children, put out the fires threatening your home and keep your streets safe and we make a lot, lot less than the millionaires and billionaires.

I have watched many family and friends leave SoCal for more economic places to live… New Mexico, Oregon and Arizona come to mind. People who are seeking a lower cost of living with too terrible weather. Most of my SoCal friends would rather be in the southwest and endure hot weather than places like Montana or Colorado with cold weather. It would be interesting to see some comprehensive comparisons between cost of living in for example Oregon versus SoCal or Taos NM versus SoCal. Aside from the cost of the home itself I would not presume a big difference in sales taxes, property taxes, food, gas, utilities, etc.

Almost everything except utilities are cheaper everywhere else than CA.

The difference is opportunity. In SoCal the vast resources make opportunity at clawing your way out of poverty and middle class a lot more viable than from AZ or NM.

Yeah maybe if you’re an immigrant, but not if you’re a white picket fence suburban all-American boy. In that case, either you have a power degree and power career in L.A., or if not you moved here for a job and are living sub-standard.

Average quality of life is higher “in flyover country”

I meant to say ‘with not too terrible weather’ in my prior post

The poverty rate was the lowest during Nixon’s time. Oh, we long for the good old days. Where is Nixon when we need him. It has only been down hill for this nation, after Nixon left us. We so miss him.

Once Nixon took the US off of what was left of the gold standard, we got a totally free floating dollar. In the 1950s, a $10,000 a year salary was big money. A teacher, who made $4,000, made enough to feed and house a family of four. Today, a 1950 dollar is equal to ten dollars.

Today, according the the IRS, 48% of working age people make $30,000 or less. A starting teacher in North Carolina makes $30,000 a year. If that teacher is unmarried and has one child, he/she qualifies for food stamps. With the death of blue collar jobs and factory towns, it wasn’t long before it took two wage earners to keep a family of four afloat. By the 1990s, it took two working people plus credit cards. In the 2000s it took two working people, credit cards and HELOCs. Today it takes the Government, with over half the nation surviving on some kind of government subsidy or government paycheck.

Don’t pine for Nixon.

As I was a young adult in the Nixon years, I witnessed every step of his destruction of our economy. It was the Nixon administration that departed from the gold standard and launched a tsunami of inflation that has not abated since. It was Nixon who gave us the Section 8 housing program. It was during the Nixon regime and the aftermath of is fall that the oil embargo occurred and the stock market fell 50%. Well I remember taking my mother’s big Olds to wait in line for gas, still dressed in my nightgown under my coat, at 7 in the morning during the oil embargo.

Nixon was one of the worst economic stewards this country ever had, even though he has been surpassed since, I admit. We are still feeling the effects of his policies.

Please keep in mind that for a certain class Nixon’s economic policies were fabulous. It was the beginning of the greatest robbery in history and consequent boom for the 1%. Fiat currency, together with high leverage and inflation, handed all the wealth to the financial class. The actual producers of goods and services have fallen down a very large black hole, never to be seen again. Historians will ask how it was that the great mass of people never saw what was happening until the very end.

If we still backed the worlds reserve currency with gold, every nation with gold would be manipulating our money. Viewed under this light, Nixon becomes brilliant.

We have our own consumption problem yet we remain and are the pusher not the addicts. Predictions of the US dollar being replaced anytime soon as the worlds reserve currency are dreams and fantasies. Like the heroin addict dreams of the day he,s clean.

It’s a global community and we all go up and down together. When we are down they will all be most generaly worse off than we are. So what’s lost ?

Richard, it sounds like what you may be really missing is the gold standard, which prevented the politicians from spending more money than they took in, and it also prevented central banks from printing money out of thin air. Back then, our dollar remained strong, and the strong dollar prevented input costs (commodities) from rising beyond what the middle class could afford. Yeah, i was too young to remember those days, but I do know that it was none other than Nixon who helped put the nail in the coffin of the gold standard, which in turn put the nail in the coffin of the middle class.

The economic malaise that festered under Nixon is usually pinned on Carter by most Republicans.

And the same give credit to Reagan for fully utilizing the 100% FIAT monetary system put into place by Nixon. Carter was criticized by Republicans for running an average 54 billion dollar deficit annually while Reagan was celebrated as a God for running annual average deficits of 240 billion dollars with little to no criticism from his party. In real dollars, Reagans average annual deficits were higher than Obamas current deficit. (A OK if you are a God, I guess.)

One thing is true about Reagan, he had imagination and the will to spend whatever it took to fulfill that imagination.

Under President Barack Obama, the national debt has grown by more than $6 trillion, the largest increase under any president in U.S. history. The National Debt has now increased more during President Obama’s three years and two months in office than it did during 8 years of the George W. Bush presidency. The National Debt also now exceeds 100% of the nation’s Gross Domestic Product, the total value of goods and services.

Remember, when speaking of the relative “prosperity” of the Nixon years, it is easy to confuse cause with effect.

During the early 70s, we were just coming off the “high” of the Post WW2 era of 1945 through 1970, the peak of our country’s prosperity and and productivity. People did not know it at that time, but that fabled Golden Age of high wages and year-over-year real growth with low inflation was being steadily undercut at its very peak. It was already written in stone, for example, that millions of jobs would move offshore during the next few decades- what do you think our diplomacy and wars in SE Asia and our meddling in Latin America were really all about.

Interesting story that illustrates my point: my mother worked as a bookkeeper for a small metal-plating company in St. Louis in the 60s, the type of company there were thousands of at that time, and which was one of the massive, complex network of suppliers and sub-suppliers and vendors and contractors that make up a healthy manufacturing economy. It was bought by a larger concern, M&T Chemical, and that outfit was swallowed up by another, and the St. Louis operation was shuttered, along with hundreds of other little manufacturers in that city and other midwestern burgs, at that time. We could see something was happening and it didn’t auger well for these cities, but we couldn’t tell exactly what. Well, two of the officers from my mother’s old company set out to form their own metal plating company, with my mother on board as the company treasurer & secretary, and tried to get taken public by. They could not get underwritten, because, they were told, operations like theirs were moving rapidly offshore to places where labor was much cheaper, and there was no way they would be able to compete with local well-paid labor.

In less than ten years, by the mid-seventies, a trickle had become a flood of jobs leaving the country, especially when Japanese autos, with their superior engineering, made great inroads into our market.

Nixon’s policies were instrumental in making it possible for American companies to exploit 3rd world slave labor havens. In fact, I maintain that that is what the “detente” in China, considered to be Nixon’s greatest diplomatic achievement, was all about. It was, I have always maintained, what the Vietnamese war and our other incursions into SE Asia and Latin American were all about, and from the time the lines went down at the end of WW2 to the time when we began to see the fruits of our leaders’ labors in the mid-70s forward, they were busily at work undercutting the fabled middle-class expansion and nationwide prosperity of that era.

There is a tremendous wealth inequality in the USA. The top 10% of households have 90% of the entire wealth in USA! The bottom 80% have 15% of the wealth. The top 400 households have 50% of the wealth! Yikes. sources wikipedia.

How did we get to this severe wealth inequality?

Dilution of currency by coming off the gold standard in early 1970’s…then wage suppression, union busting, change from profit sharing to 401K…massive push on credit card use…government lie/propaganda that there is very little inflation…quietly allowing the massive migration of cheap labor from the South…slowly exporting millions of manufacturing jobs to China…deregulating banks to gamble with our saved money…and lastly having 90% of us politically fight each other while the 10% watch and count their wealth.

Robotics and automation here on our own soil have taken 10 times more jobs away than China has. China has taken 3 million to 10 million jobs from the USA depending on the source. Robots have taken 30 million. Anyone who has ever worked in a factory, medical facility, or farm can vouch for that. Palletizing, sorting, and inspection are all automated now. Operating rooms are more automated and precise, farming has less hands, feeders, and detasslers than before as well.

Tesla builds cars in NorCal but not on a line of humans, but a line of robots with a few humans to maintain all of them.

Robotics and automation here on our own soil have taken 10 times more jobs away than China has? Where did you come up with that gem?

So with all of the supposed robotics and automation, why do the undocumented workers (aka illegals) keep coming here? How are they surviving? Don’t they all just come here to work?

Robotic data?

http://www.nytimes.com/2012/08/19/business/new-wave-of-adept-robots-is-changing-global-industry.html?_r=2&pagewanted=all&

Illegal immigrants? I’ve seen some of the work they do, and they can have it. I’d ponder starving to death than doing remedial, physical, disgusting, hot climate, slave type labor.

Please, all of the millions of undocumented immigrants (aka illegals) are out doing slave type labor in the fields? NOT! Some of them may be doing that, but the vast majority are either doing the work that American citizens WILL do (at lower wages or they get paid under the table so that employment taxes are not paid) and/or they are receiving some type of tax payer funded benefits (like welfare, section 8 housing, education, health) or both! THAT’S BECAUSE NO ONE IS CHECKING ON THEIR IMMIGRATION STATUS! Neither political party will stop the flood of undocumented immigrants (aka illegals)–in fact, they are encouraging more with their comprehensive immigration overhaul! Borders are not enforced–borders are wide open in many sections. Many undocumented immigrants (aka illegals) come into the country and then just overstay their visas because NO ONE IS CHECKING UP ON THEM! Cities across the country are now “sanctuary” cities like LA, San Jose, San Francisco, etc., where undocumented immigrants (aka illegals) can live and work without fear of deportation. Many states (like California) now offer undocumented immigrants (aka illegals) in-state tuition at public colleges and universities. Meanwhile, American citizens from other states must pay a premium. The leftists who control universities like UCLA have even banned the use of the word “illegal” because it’s “racist.”

Wake up PapaNow and you will see the country known as the United States has been disappearing before your eyes.

No where in the article that PapaNow cited does it say that: “Robotics and automation here on our own soil have taken 10 times more jobs away than China has. China has taken 3 million to 10 million jobs from the USA depending on the source. Robots have taken 30 million.”

It’s another made up lie! HA!

Right on Matt,

There are none so blind as those that will not see!

Apparently wikipedia can’t do math. If the top 10% own 90% of the wealth and the bottom 80% own 15%, then I assume the people in the 80th-90th percentile own (-5%)?

But of course, if wikipedia says something, then it must be true.

While I cannot comment on the validity of those particular numbers, I can comment on the math. The math itself is not as strange as it may appear. Anyone with a negative net worth will have a negative share of the nation’s wealth.

How do they determine someone’s share of national wealth? Well national wealth is simply the sum of the net worth of every individual living in the country. If you have a negative net worth, ie your debts exceed your assets, you do have a negative share of the nation’s wealth.

Somebody just copied wrong. Actual Wikipedia data (from 2007) is:

Top 10%: 73% of wealth

Top 1%: 35%

Bottom 80%: 15% (as previously quoted)

So still plenty of inequality and no need to resort to negative wealth.

Matt,

Tremendous post.

The Fed is succeeding in its mission to grow the wealth inequality in this country, and it will continue this mission for as long as it is allowed. Creating a housing bubble, popping it, then pumping money to its Wall Street friends to buy up property so the People can rent from them – all part of the plan. Printing 85B a month allows those closest to the spigot to profit immensely.

“and lastly having 90% of us politically fight each other while the 10% watch and count their wealth.”

The 10% also owns both parties so political fight is basically irrelevant. Or who do you vote: Owners won’t change.

The only thing that matters is the sun shines 330 or more days a year. Absolutely nothing else matters. We can all live under freeway overpasses but by-golly we’re in Cali-for-ney and life’s great!

I sense some sarcasm in your post.

For all the complaining, I do think SoCal is pretty great. Sunshine and beach are nice to have. For my birthday earlier this year we enjoyed ocean views while we ate lunch 2 tables over from Leonard Nimoy, cruised along PCH in a convertible with the top down, and then walked along the beach during sunset. It was 75 degrees and there were dolphins.

OK now something a little closer to realityville…

I never thought the problem was CA or jobs, per se, but the problem is too many people and not enough to go around. And the heavy regulations don’t make things easier. My theory? Get rid of minimum wage. Unemployment will become 0% overnight. There are “jobs” in CA, and quite frankly many good high paying ones. There’s just way more people than good jobs.

What that means for Joe Sixpack is this is an eliteist area. A lot of companies want a presence here, but it’s expensive. So only the best people are invited in, and the highest salaries. Hence the abundance of high COL neighborhoods. The rest is table scraps, that’s why people move out east where their skill set is more in line with the COL of less desirable areas.

I myself am not rich or high paid, just stating the truth…

Papa, I’ve been watching your posts for awhile and notice you sure give a lot of advice but what weight does that really carry considering you’ve stated that you make over $100k yet you barely got into a house in Fontana and even then you’re barely making it. I think you really should take a backseat to giving advice and spouting off ideas.

Who do you think you are? “Blah” about says it. I have an 800 FICO, no debt, and can spout off all the “proper living” ideas I want to. It’s all the dreamers and sleep deprived debt slaves that need to hear what I have to say and have learned. And it wasn’t easy but I wouldn’t go back to that heart-attack-waiting-to-happen lifestyle even if I was paid more.

Keep chearleading CA, YoBlah. Give us more to laught at. It’s people like you that make this state suck so bad.

Sorry Papa, you’ve already divulged much about yourself in past posts. 1) you were ridden with credit card debt 2) you had to borrow a down payment from your parents and or in laws to get a house in Fontana 3) you’re barely making it

Don’t pretend that you got where you are on your own. You didn’t even consider jumping into the market until I had to personally lay out the terms for you and I remember your eyes opened. Everyone has an opinion and that is great, but I think your credibility on conventional wisdom is questionable and that you shouldn’t be giving out advice on how better to manage things when your own house isn’t in order.

Hey Papa, look a stroll down memory lane http://www.doctorhousingbubble.com/renting-the-california-dream-typical-southern-california-mortgage-payment-down-54-percent-rental-market/

First of all, psycho stalker dude! creepy…

Second, that was a year ago. Debt free now.

Please spare me. You’ve been spouting off your entire life story for the past 2 years it’s not like anyone has to stalk you to know that info. That was me that gave you the advice and I’m sure you didn’t suddenly go from one day having massive credit card debt crying about not being able to buy a house to one year suddenly having the house you couldn’t afford and then paying off credit cards unless you listened to my advice, paid off your debt using your 401k advancement and had been given support for a down payment and or got some lucky windfall. The latter , btw, which you’ve already admitted to in one of the other posts but I’m not going to even bother looking it up. Either way you didn’t suddenly get out of your mess due to financial wisdom and responsible saving we all know that so pleas stop kidding yourself and others. What kind of grown man needs gift from parents to buy a home in Fontana, anyway? Either way, back to the point – you’re full of it and pretend you are successful completely forgetting what a financial mess you were. I find it hilarious and amusing that you’re giving advice to others on what should be done to run the country and others’ lives. Humility and humbleness are clearly not part of your character.

Without minimum wage, we might find an equilibrium between wages and labor but I feel that the rate would be so low that it wouldn’t really improve consumption or wealth distribution.

The issue facing the LA area is this: no real growth industries. Growth industries that employ a broad array of workers drive up wages across industries and worker categories. So what does the average person do if they can’t see wage gains? They use assets, such as housing, to try to make up the difference. This is why you get all this house flipping and gains in property value. In other parts of the world with no employment or wage gains you see this a lot – Europe especially.

Prior to about 10 years ago, you could come to California and “make it”. Lots of people did. I don’t buy the “only the best are invited” argument about California – I see plenty of mediocre and poor talents when I look around. I think that argument is a bit of a challenge that HR and business people tell potential staff as a bit of psychology to disorient their sense of self-esteem.

Our company, and Aerospace in SoCal in general, are exporting jobs to Texas and other states at an alarming rate. They have made it clear to stay here, you need a top degree and top security clearance. If that’s not elite, I don’t know what is. The work on the floor is being done in TX for 1/2 the wage but the few top engineering jobs are in CA. But since the COL in TX is much cheaper, $20/hr is a decent job over there.

Money is steadily rotating out of paper assets into tangible assets. And realestate is probably to most time honored tangible asset available. So this trend has legs and will continue for some time.

We’re moving, quickly, to a country where 30% to 40% of the population own their home and the rest rent. As rent pays the wealthy to own real estate.

@CAE wrote: “…Money is steadily rotating out of paper assets into tangible assets…”

That is the strategy of the Federal Reserves’ ZIRP (zero interest rate policy). Since the Fed controls the overnight rates (aka Federal Funds Rate), the Fed sets this rate at close to zero (ZIRP, the current rate is 0.09%).

This effectively pulls down savings account, money market and certificate of deposit interest rates down to zero as well. Since official inflation is at 2% (and unofficial inflation is at least 5%) savers are being kicked in the teeth by the Fed’s ZIRP. Savers have a choice: continue to lose 2% to 5% per year due to inflation by keeping money in CDs, MMs or savings accounts or chase after yield by chasing after Real Estate Bubble 3.0.

all true, until investors etc. revolt and the FED loses the bond market (which I believe is beginning now).

What do you think will happen then Gordon? I gotta admit, everytime i think there is no way our wreckless leaders can keep the car onte road there is some new creative scam that seems to calm everything down until the next bubble. I really thought this past financial collapse was the biggie then i saw how they recovered it and felt stupid yet again. Unlike te 1%’ers, i can’t afford to risk any of my money since i just don’t have that much, this savers inthe middle are in a pickel, do we chase yield (i.e. increase risk) or stay where we ar and lose some ground guaranteed. Perhaps my question is rhetorical for noone knows te answer but its good to hear ideas/perspectives. Thanks all.

Rico,

the best advice I can give you is to read Bill Fleckenstein http://money.msn.com/bill-fleckenstein/ and Mark Hanson http://mhanson.com/blog . Bill always goes into detail about the FED money-printing policies that we believe has already caused significant inflation and will create even more with every passing day, not to mention another financial bubble. Mark is a real estate expert who has nailed every real estate trend over the past ten years. Go through their articles and decide whether whatever they espouse makes sense. Hope that helps.

Someone else is using dg now too? I’ve been posting from time to time on this blog as DG since 2008. I agree with what the other DG said, but I would take it a step further. Given everything that’s going on how long is it until we have some kind of revolution of rich vs. poor. When investors buy up all the properties then rent them back at prices the poor can’t afford without living 20 people to a 3 bedroom house maybe? Eventually this will end badly for everyone and I don’t just mean financially or economically. This can only go so far for so long without it ending in bloodshed.

You mean, when do people say “F it” and start living by their own set of rules? Someday pretty soon. We can’t defy economic gravity for too much longer.

The problem is with people who are struggling to make ends meet really does lower someone’s self esteem. Unable to provide for themselves or others. Always a struggle. On the other hand the immigrants who come across the border probably have a different view here than the person who has been here for years unable to keep up. It’s really just a matter of looking at yourself as a tool for others to maintain someone else lifestyle or stop following the urban sprawl. Time to leave and make a living somewhere else.

Ain’t gonna happen. Nobody can agree on who the ‘enemy’ is. Most folks know it’s the 0.1%, but who is that? Where are they? This wealthy redistribution and inequality is crazy and both the Dems and Repubs are contributing to it.

I wish I had an answer. But I don’t know what it is. Just look at the “Occupy” movement. That went nowhere as there was no specific message or action, just a bunch of people fed up about a number of different issues.

The wealthy are too distributed and ownership is too difficult to track. Besides, it’s all global now. If you’re in the 0.1% and sense trouble, just go to one of your other homes in another country. you’ve got assets at multiple institutions in multiple countries. How the heck will somebody like that every see their day of reckoning?

A massive problem is illegal immigration and the fact that the 1% have gamed the system to not enforce our laws with a simple employment verification system. The 1% have a steady stream of cheap, exploitable labor that can be replaced very easily with another illegal willing to work for a wage 4-5 times greater than they made in their native country. This wage depression from the bottom brings down everyone else’s wages except the employer and smacks of feudalism.

Not sure how the Dr. came up with 50% of the sales being cash, as this link from Data Quick would not indicate that. In fact if you read the California link info, last month appeared to be a pretty strong month for the state. It will be interesting going forward to see how the numbers finish out this year. http://www.dqnews.com/Articles/2013/News/California/Southern-CA/RRSCA130814.aspx

“Absentee buyers – mostly investors and some second-home purchasers – bought 27.4 percent of the Southland homes sold last month, which is the lowest share for any month this year. Last month’s level was down from 28.6 percent in June and down slightly from 27.5 percent a year earlier. The absentee share has ratcheted down gradually each month this year since hitting a record 32.4 percent in January. The monthly average since 2000, when the absentee data begin, is 18.3 percent. Last month’s absentee buyers paid a median $312,000, up 34.5 percent from a year earlier.

After hitting a peak earlier this year, the share of homes flipped has generally trended a bit lower, but rose modestly in July. Last month 6.0 percent of all Southland homes sold on the open market had previously sold in the prior six months. That’s up from a flipping rate of 5.6 percent in June and up from 4.5 percent a year ago. (The figures exclude homes resold after being purchased at public foreclosure auction sales on the courthouse steps).

Buyers paying with cash accounted for 29.4 percent of last month’s home sales, down from 30.5 percent the month before and down from 31.8 percent a year earlier. The cash share of purchases has declined each month since hitting an all-time peak of 36.9 percent this February. Since 1988 the monthly average for cash buyers is 16.2 percent of all sales. Cash buyers paid a median $328,000 last month, up 39.6 percent from a year ago”.

Re: how many home sales go for cash:

http://blogs.wsj.com/developments/2013/08/15/report-half-of-all-homes-are-being-purchased-with-cash/

On the flip side there are still clueless buyers out there. Real estate is local as the old saying goes. I’m in the suburban Sacramento area. On Sunday I went to look at some brand new “courtyard” homes in Lincoln. Miles away from anything. A bit pricey at $300k +… Anyway, While I was in the sales office a family was talking to one of the sales agents. The sales agent asked “are you looking to buy today”? The man said:

“Yes we’re moving here from San Jose and we want to get in before “things get out of hand”.

I nearly laughed out loud. The market in Sacramento has all but died since FHA changed its PMI rules and interest rates went up. The investors stopped buying here 6+ months ago. Inventory is growing day by day and daily price reductions are the norm here now.

This poor guy most likely will pay whatever the sales agent tells him he needs to pay. I went home and checked comps on these tiny little houses in the middle of nowhere. Exact same floorplans built over the past 3 yrs are selling $60,000+ LESS than the new home price. This guy was also saying they will need an FHA loan as they had a foreclosure in the Bay Area a few years ago. So I ran the numbers: the house he wanted to buy would cost him $2340 a month to carry including P + I, taxes, mello roos, HOA and insurance. The average rent in that neighborhood for that house is $1800. AND he will have instant negative equity.

The sales agent was literally foaming at the mouth and was laying out the red carpet for this family. I felt bad for them. They are not local and obviously don’t know they could negotiate tens of thousands of dollars off the price of these built, empty homes.

Also part of the reason CA real estate is so expensive. I know so many New Yorkers who come out to CA thinking that $1 million for a 1/1 condo is cheap. A lot of sellers hold out for out-of-area folks who don’t do their research.

I agree with you CG, and i’ve been of the same camp for the last few years saving up cash – the depressing part is that logocal or not, people keep paying the prices and this leverage is rewarded. I’m an excellent saver but even though i’ve saved more than six figures in just 2 years my purchasing power has only gone up marginally as home buyers that go into hock are rewarded. I’m wondering if its time to throw in the towel and just buy since i’m no longer convinced we will see “normal” interest rates anytime soon (and i believe thebonly way real estate will potentially drop is with normal interest rates (i.e. go up more than +2 or 3%). Its depressing to see prices continue to climb while increased povery abound and savings in the bank are negative after inflation – its actually quite infuriating.

Just a dumb thought RICO, but if you have managed to save up over $100,000(6 figures) in just two years, shouldn’t you be extremely thankful about the country you live in, not complaining about the affordability of housing? Try to do that in some Euro countries with 65+% tax. I suspect if you can save 50k per year(that’s saving over $4000 per month), you would be able to afford a million dollar house within a couple of years(unless you are living rent free.)

KC, I definitely am very thankful for what I have, yes I work very hard to earn my money and to save but I know its not always as simple as having a good work ethic. Despite that, I am furious (as I think most Americans should be) with the elite in our country and with the banks that we have continued to bail out time after time after time during our country’s brief history. I don’t want to contribute to more fiat money creation by living in debt and I was originally thinking I would be able to buy a house without a mortgage, but I’m just not sure its going to be possible unless I’m willing to live in extreme climates away from the city. Yes I make good money now, but I don’t want to be in the “rat-race” for too long and thus I am saving furiously now so that I can move on to something a little slower-paced sooner rather than later – even if it means I don’t have a 2500sf house in the hills. My point isn’t that we gauge how relatively well off one is vs another. My point is that we the people keep allowing banks to manipulate our economy by living in debt and accepting whatever line they feed us. Even something as silly as swiping credit cards for convenience – whether you carry a balance or not, every time you swipe that card, you just gave a bank money. i.e., we have given banks the ability to generate money “on our currency”, and we don’t question this, yet there are real implications to the behaviors that we allow ourselves to be cornered into.

I realize I’ve changed topics a bit here, but in case you didn’t notice – I despise banks.

Money and power are two things that relentlessly consolidate. The middle class era was a historical aberration. Look at the history of all world civilizations and you will see that the typical society is comprised of a small, wealthy, powerful ownership class and a massive underclass. Deviations from this model have occurred (such as the American middle class era) but will always “correct” toward the elite vs. underclass society.

I do not feel very bad for much of the dying middle class as they have had a major hand in their own demise. Instead of living within their means and saving and investing as much as possible, they chased every form of material thing to the detriment of their financial security. Leased new luxury cars, granite countertops, hardwood floors, stainless appliances, exotic financing, Ipod/Iphone/Ipad for everyone, flat screens in every room, eating out often, $4 coffee at Starbucks, $150 for one concert ticket, on and on and on. The Great American Consumer, just keep spending, for God’s sake whatever you do don’t save and invest.

There are plenty of places in California that housing is somewhat affordable, but not Coastal California. It is a tale of two Californias – coast vs. inland. Long term, the values of coastal property is only going up. Sure there will be pullbacks from time to time, but overall the value is just going to go up. It is near the top of the list nationally and internationally as far as desireability. If you are not a playa with serious income or assets you are not getting into that market, not now, not ever. There are other places for people who cannot earn big dough, plenty of other places.

The gap between the haves and have-nots is only going to widen. And the number of have-nots is going to continue to grow.

Well said.

Falconator,

I ask because I do not know the answer: how do you explain that during the housing bust of the 1990s house prices in wealthy areas declined at a higher percentage than all other areas in Southern California?

The NAR would probably strongly object with you since they need ANYONE to flip these expensive homes to if they are not meeting their sale quotas.

Overspending wasn’t the demise of the middle class. It was the lack of egalitarianism, community, sharing, morals, ethics, and a sense of purpose in life that finished it off.

I think you are right. I mean my entire goal now is to just buy a house for cash using student loans, work for a lower pay that doesn’t trigger any payments on it, and just get out of the area to a cheaper state and continue borrowing until I can buy a rental unit and live off passive income. In other words: get above the line by any means so I don’t fall into the lower class. I had to dump idealism at the door and most of what I thought were my principles because I see the coming desperation and strife and I want to get ahead of it, get out before it drags me down with it.

But then what ? I don’t trust anyone in my neighborhood, I don’t talk to anyone. We all work and then come home and hide away. I am surrounded by a foreign culture that I don’t understand (India folks working in tech, mostly harmless I guess but it’s hard to communicate and we have little in common other than work). I am disillusioned with technology despite having always believed in it; human nature twists it into sloth or greed, not higher productivity.

The area is so flooded with people… there is no choice but to leave long term. The math doesn’t add up, the higher wage vs. other states is all eaten up by higher rent. I make more money writing pointless essays for classes than I net working in technology after taxes. It all doesn’t make any sense anymore but I’ve been forced to adapt to the reality that now exists: the country may eat itself alive before it becomes productive again. It has to get worse, much worse, before it can get better. My only hope is to ride it out in relative comfort, to get out of the metro.

Falconator,

Let me make one correciton ‘ ownership class’ should be crony class.

On to my point. Look what happens when the under class has enough of the cron class and their nonsense.

Some of the modern events where the “ownership” class ended up on the wrong end of a weapon or guillotine.

French Revolution

US Revolution

October Revolution

Chinese Civil War

Rise of Nazi Germany

Cambodian Genocide

Arab Spring.

What’s next?

Of course most of these incidents don’t have a happy ending and many innocents were swept away, but your ownership class usually received the worst of it.

^correciton^correction^

Winston – I do not know “what’s next” but my bet is that it is not going to be a violent armed uprising in the U.S. where the masses seize the assets of the wealthy elite and then execute them (much as many would like to see this happen…) The apathy in America continues on its upward trajectory as the dumbed-down masses pay far more attention to the Lindsey Lohan saga, what will Kim Kardashian name her baby or when will the Iphone957 be released. A significant percentage of America is relatively lazy, fat, out of touch, and easily distracted – not the sort of attributes you need to fire up a revolution. They are simply not going to get off their couches and take up arms.

The true battle lines in this country are drawn between the dying middle class and the lower class. For those in the middle class who squandered their opportunity to amass some wealth because they couldn’t bear the thought of living without the very latest electronic gadgets, cars, home improvements, vacations, etc etc, they now stare into the abyss of the lower class. The wealthy will outperform regardless of who is in office and I firmly believe that in the highly unlikely event of a true revolution in this country the wealthy elite will either be insulated or will have relocated out of the fray.

As for coastal CA real estate 1) crashing and 2) staying crashed, I would not hold my breath. The one constant I have found over the past 22 years of analyzing the San Diego real estate market is a lack of understanding by many people of the increasing amount of serious money that is both being made and being imported into San Diego. You want coastal RE, you are not competing locally, you are competing against regional, national and global moolah.

How do you define coastal RE? How far inland?

For instance, in L.A., is all of Pacific Palisades, Santa Monica, and Venice coastal? What about as far inland as Mar Vista or Culver City?

Bravo Falconator, extremely well put. too much apathy, and too much big brother (police-state) for any revolutionary winds to ever pick up in this country again.

Papa Now – that is an interesting point about getting rid of the minimum wage. You are probably right – unemployment would most likely disappear. Minimum wage, along with a long list of other government regulations have strangled business in the U.S.

Bay Area Renter – I feel just like you. I live in a California coastal area which is almost very similar to what you describe. You can maybe find a fixer upper for $550K. It’s insane. A decent home is $750K or more. Oh, the price to own a piece of Commie-fornia! Can you imagine all the taxes you would pay on a $750 house? And as CalGirl says – many newer homes came with these newfound schemes of adding on “Mello-Roos” taxes and homeowner association fees. It’s all robbery, nothing less!

CalGirl – I had a good laugh when you said the guy from San Jose wanted to buy “before things get out of hand.” Wow, I feel sorry for the man. It’s almost beyond comprehension how the powers-that-be have reinflated the housing bubble during a depression. It is absoulte insanity!

And finally – here are the words of Fabian Calvo. He says there is going to be a cataclysmic collapse in the housing market. Fabian is no dummy, and he lives in California, I believe (so he is familiar with the real estate here). Fabian’s thoughts mirror my thoughs exactly. This whole real estate circus really ticks me off big time, and I think current home prices are ABSOLUTLELY UNSUSTAINABLE.

http://usawatchdog.com/cataclysmic-collapse-in-housing-on-the-horizon-fabian-calvo/

Mexico, which is surprisingly expensive to live in, has a minimum wage of about $5/day. Per hour, it’s pretty close to 0 and they have fuckloads of unemployment. Not sure if that’s really the solution.

One thing that folks may not have considered is that global trade rebalancing means that US will increasingly become savers while China become spenders, at least until the trend ends.

Savers save a higher portion of their income. That means a larger portion of their income is available for paying mortgages. Which means higher real estate prices, and increasing ratio of real estate price to income. High real estate prices are common in Asian cities where consumption to GDP ratio is high. Just saying.

Typo. ” in Asian cities where consumption to GDP ratio is high” should be “in Asian cities where consumption to GDP ratio is LOW”.

Just want to give a shout out and thumbs up to Miriam. She is 100% accurate.

I have heard so many times about the sure ultimate collapse of California’s economy (starting with housing), that I’m starting to wonder if it is some sort of religion for the disaffected. I do think that prices in coastal California have been boosted by foreign investment, and that such investment is probably cyclical. (I was posting on the subject on a couple of blogs starting just after the initial crash.) But if you are like me, and can sit tight without too much of a problem, this place is not too bad. And by every definition, I’m middle class. Only a few years to retirement, when I can dramatically cut my auto expenses, and a paid-off mortgage help make it possible. I may keep working past my “official” retirement age since I am in good health and my job is not too stressful.

The day my 1600 sq ft SoCal house is worth less than my Brother’s 2100 sq ft house in an equivalent neighborhood in Fargo will be a damn cold one. Like when the asteroid hits.

If that big earthquake happens (or some other major calamity happens), your 1600 sq ft SoCal house may become worthless!

Actually, real estate values in many parts of North Dakota have been exploding in value because of oil money.

Climate change is gonna be a bitch.

http://www.rollingstone.com/politics/news/why-the-city-of-miami-is-doomed-to-drown-20130620

http://ngm.nationalgeographic.com/2013/09/rising-seas/folger-text

speaking of coastal real estate, here is a recent study from USGS on potential for dislocation of hundreds of thousands of homes in SoCal if and when Alaska has its earthquake.

http://blogs.ocweekly.com/navelgazing/2013/09/tsunami_orange_county_long_bea.php

Here on the Westside, this would affect, parts of Malibu, SM, Venice, MDR, etc. In any case I think anyone at an elevation of 30 feet or more would not have to worry. (for example most of santa monica, north of the pier are higher than 30 feet from sea level, except the Gold Coast along PCH.

ND Real Estate in the Bakken went from “zero” to “something”, but Fargo is the other end of the state. Even so, Fargo is worth more than most other ND towns as it is the largest metro area in ND. Some relatives of my wife back in the late ’80s bought a house in rural ND for $500. See what Zillow thinks about ND RE values before you comment (they are a good substitute from hiring an appraiser).

We have had earthquakes, and property values didn’t drop. That’s why I carry earthquake insurance. How ’bout you?

Totally agree on the SoCal vs. Fargo thing. Even though the market goes up and down, real estate in beach cities will always be in high demand, simply because many people like living near the beach. It’s basic supply and demand: high demand for coastal property, low supply because there’s only so much space you can build in before you simply run out of coastline in proximity to LA. In contrast, inland desert areas in SoCal are always cheaper because more people prefer beach to desert if given the choice and it’ll be a long time before we run out of desert to build in.

Bottom line: there is no (and probably never again will be a) 2100sqft sfh in Malibu for $200K because everyone and their great aunt Mildred would jump on that.

Of Course!!!! Me included.

nice post

Ah Hell we did it to ourselves. Wanted stuff too cheap so they had to make stuff in (fill in the blank). Stopped the japanese American from cutting our grass, hired a illegal guy. Put the butcher out of business. So now a guy from Mexico does it cause he saw a flyer that these meat processors put up south of the border. They treat him like a human machine making the same cut for 12 hrs a day till he burns out. Now we are fat, sick and poor. Eating all that cheap meat. Hell we can eat all the shrimp we want for ten bucks. My dad legally immigrated here in 1960. Was a machinist, Cold War shit. Was lucky, the American dream was achievable and he did it. Now people are like the guy at the meat processor. Just keep working till you burn out. You’ll be swept away them. You and your American dream. We have no one to thank but our, short sighted, selves.

Wow, a very good post. Thanks.

I see a lot of truth to the perception argument, and it’s exactly why I know companies in CA have trouble retaining talent. It’s not always about environment, it’s about quality of life which includes the size of home you live in and what’s inside it. Commute matters too.

When you grow up in the Midwest, and houses are common, the word ‘apartment’ means an 18 y.o. slop house until you get your stuff together in a couple years. Same with ‘rent’. Yards are also large and good schools common. These simple things are a premium in CA. Now, on the other hand, when you grow up in Mexico or the Philippines, or rural China or war torn areas, then yes I can see ANYTHING in America being an upgrade. We do that for granted, however, perception is key.

In some ways, I am an elitest, and no I’ll never live in a horrible manner. But it’s because I’m American, not Californian, and I have the right to compare states and look down on a subpar way of life (“Middle class” California they call it.)

Yeah it’s a weird set of circumstances that led me to visit Nevada, specifically Reno. Exploring made me realize that there are other options than struggling in the Bay Area. They just keep importing more and more technical people who will work for less (or maybe just tolerate 12-14 hour days, I don’t have the long term stamina). We opened the gates to “equalizing” with the rest of the world and the result is better quality of life for them, but a lower standard of living in the local area. Once you leave that area of heavy global interaction, things become different culturally, financially. The pace is a bit slower, less hectic. Prices are less ridiculous (still inflated currently, but more likely to correct in proper fashion later as less investors are interested in the inner empire, it’s not hot or sexy like California). Also, in the technology sector there’s no reason for me not to live somewhere else and work at home, it’s mostly coding and testing anyway. Why live nearby in miserable conditions ?

Large corporations in California (like tech companies) DO NOT have trouble retaining talent. Google, Apple, Facebook, etc. have their pick of talent because talent flocks to them not only from around this country, but also from around the world. Tech companies in the SF Bay area have nearly an endless supply of talent. These large corporations pull strings with the big government elite for yet more cheaper talent and more profits by lobbying for “comprehensive immigration reform,” more more H-B1 visas, and more favorable tax treatment.

Meanwhile, small businesses in California struggle under oppressive taxes and ever more government regulations. They don’t have the clout of large corporations. Many small companies are closing and/or leaving California:

http://www.businessweek.com/articles/2013-07-03/why-are-californias-businesses-disappearing

http://www.foxnews.com/politics/2013/01/23/california-residents-businesses-consider-bailing-on-golden-state-over-taxes/

http://www.ocregister.com/articles/california-373219-public-state.html

http://hotair.com/archives/2012/04/30/california-by-the-numbers/

http://www.csub.edu/kej/documents/happening/2011-03-21_business.pdf

I just think that is messed up to allow foreigners from China and Russia or anywhere to own residential property in the US when they haven’t even resided in the US or particular state and paid state and federal tax for at least 5 years. They just buy homes and push the prices up because of “Demand” and price out the market all the tax paying Americans… it’s so infuriating.

It’s only Free market Capitalism when is convenient for the top rich people. But when they needed a bailout it was a collective effort to keep “us” going.

I really don’t see the benefits of urban cities as I rarely use the facilities or institutions in the area such as the bars or theatres or restaurants, etc.

Unless you were born into the city life you will probably have a different view what it is like to live amongst millions of people and block to block buildings and homes for miles.

I wonder if Earth could ever be like Coruscant in the long distant furture? Scary to even think it but who knows. Oceans and Ag land would seize to exist and environmentalists would be kicked off the planet by then.

So are large cities like Los Angeles, Las Vegas and San Francisco where drinkable water and food must be shipped in from hundreds of miles away unsustainable in the long run? If a major earthquake or some other calamity happens, how ugly it will get? But why worry? Rest easy and know that FEMA and big government will always be there to save the day just like they did in New Orleans after hurricane Katrina?

Illegal immigrants? I’ve seen some of the work they do, and they can have it. I’d ponder starving to death than doing remedial, physical, disgusting, hot climate, slave type labor.

Papa now, a lot of jobs done by illegal immigrants can also be done by automation and robots. Car Washes could be completely done by machines. Farm labor is predicted to be done by robots and not illegal immigrants or guest workers in 10 years. Maid and Janitorial work is predicted to be done more by robots. Home Health care has some robots and even fast food could reduce the number of workers by robots. In fact technological changed will mean only 500,000 of the illegal immigrant population of California could find a job by 2025. They might have better luck in Mexico then.

Leave a Reply