California’s dwindling middle class: California is gaining more renter households, a drop in homeownership, and housing affordability continues to be a problem.

The housing wealth effect is in full motion. There are many people in the market that see the rise in home equity and are now out buying bigger ticket items and also, upgrading their homes. You also have the flipper brigade being cheered on by house lusting cable television watchers. The Kardashians for the teens, the flipping shows for the Taco Tuesday adults. In California, a large group of “professionals†in the industry are disconnected from what it takes to build a quality home. Most have no sense of value and this is evident by the 1 or barely 2 toilet homes selling for ridiculous prices. On Main Street most people are brainwashed into now thinking real estate is a no brainer. You can only win, says the guy with veneers and pinstripe suit. The bread and circus is out in full fashion. Granite countertops, hardwood floors, and recessed lighting bamboozles the public from actually looking deeper into the bones of a property. If you look beyond all of this noise, the regular buyer is being screwed. Many can’t compete and are leaving the state. We have 2.3 million adults living at home with parents because they financially can’t even afford a rental let alone a home to purchase. A good portion of these folks are the BMW, latte drinking, iPhone crazed, and weekend partiers that want the L.A. nightlife but return after their escapades conclude to their parent’s home. Although inventory has risen this year and the mania has slowed down, the fever is still hot. For California’s shrinking middle class, you are seeing a state with a small section of growing affluence and a larger section of those struggling to hold on.

The shrinking homeownership rate

Historical amnesia is a trend to behold in California. I’ve seen the booms and busts come and go with regular fashion like an upcoming El Niño. Many of the people that lost their homes to foreclosure were too full of ego and pride to speak up in the state so now we have a new group of gamblers trying their hand at the good old California housing boom and bust game. You never saw “The Biggest Foreclosure†or “The Dumbest Flipper†on cable shows because people don’t like to highlight their failures. But we know in California that hundreds of thousands of families lost their homes in epic fashion. Real estate is not a riskless play. Many got caught up in the mania but others were flat out greedy and simply did not have the stronger hands that Wall Street is afforded when the house comes crumbling down.

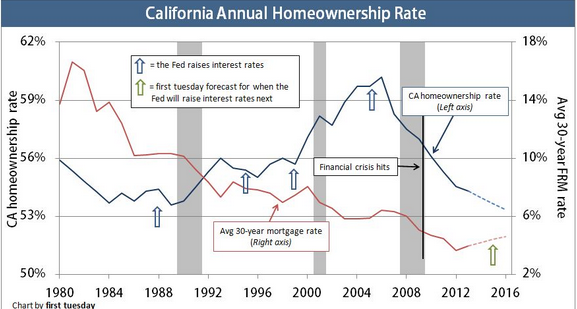

Just talking with people, the market is prime for ARMs, interest only loans, and other leverage bets. If we had access to these loans again, the market would go full on crazy at this point. Yet we don’t. What is interesting is the modest restrictions placed since the bust are now being criticized for halting lending and stunting this run away delusion train. And that is why the homeownership rate is near generational lows:

So why are home prices so high? Investors hungry for yield have been buying up properties since 2008. Banks have controlled supply for over half a decade courtesy of rewriting accounting rules and standards. That of course is the past. What of the present? Do prices make sense today? People make moves at the margins. The lower sales volume is still pushing prices higher. If you want to play in the game today, expect to pay. In California a large portion of housing wealth is also driven by stock market wealth. Just look at the Bay Area.

If this seems like a no brainer, why is the homeownership rate going down? Because the typical household is not exactly tearing it up on the income side. A state with more than 38 million people is going to have a large number of wealthy households. But that was the case a decade ago as well. Today you have many more being priced out to the point of merely affording a rental or living at home.

California affordability issues

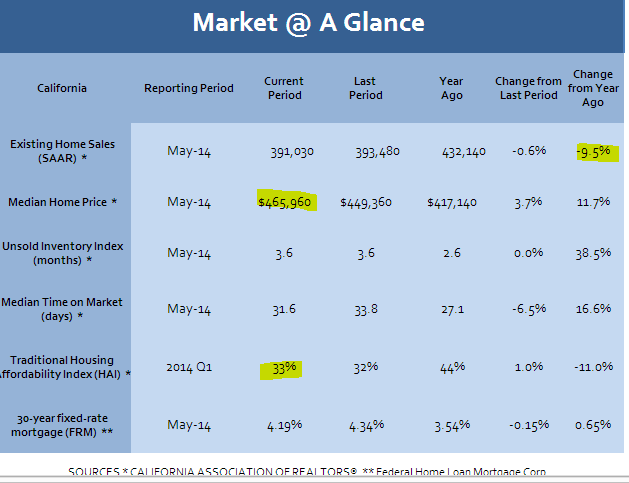

Even though inventory is up and price increases have moderated this year, you still have only 1 out of 3 Californians being able to afford a typical California home:

Of course those with higher incomes, think they belong in higher priced zip codes even if it means living in a piece of crap and having to share one bathroom with the entire family while forking over $750,000 or more. People forget how quickly time passes. Many also easily forget that you will have that mortgage payment for 30 years. I know a good number of boomers holding onto housing lotto tickets but scrimping by to have the SoCal lifestyle. Even a paid off home does not throw off cash short of a reverse mortgage. And good luck trying to convince the Fancy Feast eating crowd that slapping on a mortgage for cash is a good idea or god forbid, liquidating and freeing up some cash (although they are entirely fine with locking in for 30 years with a bank).

Investors have been pumping up the housing market for half a decade. They continue to do so. Today however, we have the stretching households using ARMs and other maximum leverage products to squeeze into properties. A perfect time to enter the game when the stock market is at a new peak and in some cities, housing values are near or making new peaks.

SoCal has a sizable number of swindlers, cranks, and con artists moon lighting as professionals. You usually don’t see the hustle until the lights go on. This happened with the army of “professionals†that thought they were the next Trump because they attended one of those revival seminars which serve as a replacement for some sort of religious structure. The religion in SoCal is real estate and people are back to worshipping at it’s alter. Sure, the homeownership rate is down, more adults are living at home, and incomes are not even keeping pace with inflation. In the end though, you simply have to believe blindly that home prices will continue to go up. Interestingly enough a good number of Californians have decided that they will try their hand at making it into the middle class in other states. For now, the cacophony of easy wealth down the real estate road is being preached again even though the stats show that it is becoming harder for regular households to own.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

117 Responses to “California’s dwindling middle class: California is gaining more renter households, a drop in homeownership, and housing affordability continues to be a problem.”

I don’t blame younger people for having a good time, spending on car and gadgets and clothes, and living with Mom and Dad (hopefully paying some of their parents bills and saving a bit on the side). What’s the alternative, vs these house prices? Epic scary depressing debt, and house prices which melt my mind. Yes, it means you have society looking down on you, (living with your parents) but young people should look down on all the bailouts and stimulus pumped into the market.

A lot of parents can’t comprehend the challenges for younger people and house prices, given their own experiences and expectations that house prices only go up in the long term. I just wish more younger people had parents they can get along with in these times, parents who still have an understanding of value for money concepts, and value one another – do good by each other.

Keep your eye on the financial markets too. Lending is tightening up behind the scenes. The dynamic of contraction works behind the scenes, and, though it may not seem so now, my bet is trying to reflate, paradoxically strengthen the deflationary impulse

It seems to me banks have been spreading the pain, getting other investors to take some of their action, and cleaning up their books. What happens when banks are stronger? My view is they will not be so nice with other market participants. There is nothing “for bears” in forbearance.

____

It has been calm for so long – a storm must be brewing

25 Jun 2014

…Tougher capital controls also restrict bank activities. Banks’ balance sheets allocated to marketmaking are 25% of pre-2008 levels. Since the financial crisis, the US corporate bond universe has doubled in size, but dealer inventory is four times smaller. The problem is that less capacity for liquidity makes volatility spikes much more likely, especially if investors all rush for the – smaller – exit at the same time.

Grown children all over the worth live with their parents without society breaking down. Get a hold of yourself. This is not a horror story but for some a way of life. Just because American thinks this is terrible doesn’t make it terrible. Hysteria over nothing. Times are changing. Things are always changing. That is the way the world works. Separate households for each family member is a new invention of the 20th C so cool it. We will survive.

You’re right, our standard of living is declining down to match levels experienced elsewhere in the world. I don’t think anyone is in a panic over it, but that doesn’t have to preclude calling attention to the issue. Once this effect of globalism reaches a critical point, it will then become a mainstream story and most will act shocked like a frog in boiling water.

I had to kill some time before a business opened up and went to the Corp. fast food crap box next door. Overheard a group of retirees shooting the shite after morning services.

8 for 8, each one recounted how 1 of their now 50ish kids had a LIFE FAIL and was back on their doorstep.

Multi-generational does not work in America, because everyone needs a car to do even the most basic of necessities.

“The dynamic of contraction works behind the scenes, and, though it may not seem so now, my bet is trying to reflate, paradoxically strengthen the deflationary impulse”

The miss guided belief that “more money” in a system increases consumption came from a babysitting experiment where x amount of tokens where passed out to the participating parents. Initially, the parents horded the tokens because they had a very limited supply. They were each then given more tokens and the hording loosened up which encouraged the parents to use the tokens more freely.

There are a couple of problems with this story. First, is that the parents were all handed an equal amount of tokens to start. This is actually one of the prerequisites for the theory of supply and demand model to work. This never happened in QE. The next problem is that loosing up only happens when there is high demand for a fix amount of the “tokens†and the amount of “tokens†are increased. I would argue that we have little demand for more “tokens†and that is why M4 (no longer reported) is not growing as the M0/M1 grows.

The result of QE has been a wealth transfer to the few (those closest to the distribution of the new “tokens”) from the many (furthest from the distribution of the new “tokensâ€) and there has been no significant growth in economic activity. Actually, the debunked theory of supply and demand would tell you that this would happen if you paid attention. So, my question is, was this intentional or was this the result of the misguided? Either way, sooner or later the young boy in the crowd will cry out “the emperor has no clothesâ€â€¦

It was the greatest theft in the history of mankind…and was intentional as intentional can be…

Of course FASB 157 is still non existent in a fed prop job that has transferred money higher up the ladder and left many people chasing a top again…sugar highs fade fast…

I’m definitely moving out of state to buy a house, unless there is a massive drop down in the next year, which it looks like is probably not happening (there are too many variables to be able to predict accurately enough, but there are no clear signs that a correction of significant size is on the one year horizon). We are tired of swimming upstream. I have a portable job so any state could work. I’d rather not leave the state where I was born, raised, educated, etc. but home prices are just too ridiculous. If I’m signing up on a 30 year loan, I want value. That’s not available right now. I search for homes in other states and there is a massive glut of homes in very desirable areas in very nice locales. I see even beach front homes on the East Coast in the 700s. I could easily afford one. But in these uncertain times, I am looking for homes on larger lots (1/2 acre and up) but in a much less risky (to me financially) band, say 300-500K, which will minimize my risks going forward. Sorry boomers (I am one), I don’t want your 3/2 crapshacks at 1.0MM that should be selling in the 200-300K range max. Good luck finding a bag holder, it won’t be me.

What’s even more sad is that you’d likely find no dearth of short-sighted CA pollyannas who’d tell you that you won’t be missed. Isn’t it ironic?

You are right, Tired. Why people feel the need to kick people on the way out the door is pretty sad. My family is here, but it is getting smaller (death and some moving away). I have fewer reasons to stay. The weather? I’m not looking forward to going back to shoveling snow, but maybe I can create jobs too (let neighborhood kids do it) with the extra thousands that won’t be going to pay off a massive mortgage on an overpriced crapshack. I never thought I’d be priced out, having gone to the UC for college and law school…I thought I’d be guaranteed to be a survivor. But I haven’t seen anything that I would want to call “home” here that is in line with my fundamentals. Plenty out of state though. Now begins the next adventure, exploring new states. RTP in NC is definitely on the list (love OBX but they do get weather as we are seeing right now with Arthur).

If everyone really wanted to live there, everyone would live there now. Elitism can now be purchased on credit.

“If everyone really wanted to live there, everyone would live there now.”

There’s still the unenlightened who haven’t yet heard the good word and gospel about the promised land. Fortunately we have missionaries doing the Lord’s work – there’s even a few preachers right here on this blog fighting the satanic force of math and numbers.

Tired – you really need to stop using the “m” word and the “n” word. Your use of these vile/offensive words is making it very difficult for us rainbow/unicorn sect to read your comments…

The Raleigh-Durham area of NC is nice. It has the Research Triangle so there are lots of better paying jobs and a lot of upscale homes for them. Look on Zillow or Realtor.com and see what $300K buys. Pay special attention to the property taxes. You can view them on Zillow.

If I were looking southeast and were portable I’d probably choose Ashland for the scenery and lower summer humidity (and bugs). There are a lot of higher end properties there, but you can find something pretty nice if you have 400-500k to spend.

RTC is quite nice overall, and Richmond might be worth a look as well.

I like NC but it’s a long term liability. Their oil/gas business rules over the place where one day you can wake up and have a fracking well sitting pretty close to your house and they don’t even have to disclose what chemicals they are using (indeed i believe it’s a criminal offense, or the like, to disclose what chemicals are being used there). Secondly the Outer Banks are doomed in the long run with sea level creeping up. Biggert-Waters is clamping down on subsidizing coastal property so guess who might have to pay for that junk when a full moon storm surge rolls in 30 years from now? But i suppose if you’re used to CA state taxes then maybe that won’t be so much of a sticker shock.

The good Doctor makes great observations in the growing wedge between the “have’s” and the “have not’s”. So many structural issues in our fair state it isn’t even funny.

F$%#

Exactly!

As a prospective first-time buyer I’m appalled by what I’ve seen in the past year for bay area CA.

In the past 6 months alone “starter home” list prices have climbed on the bottom end from about 250 to 350k. These are in war-zone neighborhoods guaranteed never to recover on the schooling and public safety front.

Meanwhile, median rent in the same area has skyrocketed 20% in the same period, gas has skyrocketed 40 cents and is due to rise higher due to local enviro-nazis punishing humans for living, and wages have been flat.

The only reason I bother to stick around is my apt by law can’t be raised more than 5% a year and my job is well positioned to ride-out the inevitable second plunge when we get this era’s next Volker.

$250K-$350K starter homes in the Bay Area – WHERE?!? Stockton??? I can’t imagine even the WORST hoods in Oakland and East Palo Alto have homes that cheap at this point. Are you talking 1.5-2 hours away each direction (3+ hours in rush hour) from SF and prime Silicon Valley job centers???

There were townhomes in the DMZ between oakland and san jose selling for that much (250-300) between 2011 and late 2013. Similar homes in dublin/pleasanton/livermore.

These would be 2bdrm’s sufficient for a young couple or family.

Now the inventory is 1/2 of what it was and similar listings are 100k higher for far worse.

The insanity is starting to spread to areas like tracy and mountain house, where listings are double what they were the same time last year and easily 20% above inflated zestimate figures.

just talked to 3 students moving back to home in southern cal at Golden gate park…

the bay area is the center of hot money courtesy of fed policy….IPO’s fuel market momo… most make no money outside of Go pro….

incredibly mispriced risk is what this is all about….it will end badly…signed homeowner in the city whom knows the prices are insane….anyone buying now is crazy….I would never buy my place at this price…

I heard Brentwood was hit real bad by the housing bubble burst. I’m talking about the city of Brentwood east of San Francisco, not the westside neighborhood in Los Angeles.

Lots of new McMansions were going up in Brentwood when the bubble burst. Many of these McMansions were abandoned by builders, then looted of pipes and appliances by hoodlums.

I saw some YouTube videos a couple of years ago, showing all gutted McMansions. Empty streets of Spielbergian suburban cul-de-sacs.

Perhaps houses are still cheap in Brentwood?

There are homes in that range in Vallejo in the east bay, particularly in neighborhoods that would seem to be less desirable. Seems to be some newish town home development at the north end that’s higher priced, but you can certainly find listings under/around 250k there.

I live in Brentwood, renting. I’ve been priced out for buying for about 6 months. Not at peak prices, but very close. Example: an older downtown home sold at 175k, flipped 4 months later at 375k. This is 2 bed 1 bath, OLD home. Modern homes are listed at 450k-550k…new construction has been going on for 6+ months. I missed my oppertunity. I’m a teacher and disheartened that I can’t afford to buy a home anymore.

Housing to Tank Hard in 2014!!!!

Hell yeah, Jim Talyor is back, cutting through the crap and delivering. Preach on Jim!

Now all we need is blert back with his quasi-informative, quasi-bullshit babble posts…

Housing to go up 30% in 2014!!!

You must work for Zillow: Zestimate forecast for 12 months in my area is 12%.

It’s over 3 1/2 months since the Ides of March. And 2014 is over 50% over.

Am still waiting for the tank.

I’m still waiting for my 30% increase. But it WILL HAPPEN!!!!

Oh YEAH! You are correct I still have 50% more time left. But I don’t think I will need all of it.

Inventory up. Mortgage apps down. Prices still up. Sales down. The avalanche is just beginning.

R.E. Prices for the most part trail inventory trends by roughly 6 months. At least that’s how it happened in the past, but given the market manipulation and shennanegans of late who the hell knows what the future holds.

However, looking at the last great bubble and its pop, inventory built up tremendously in 2006 and 2007 and as sales fell apart, this glut preceded the price stall of 2007 and start of the precipitous price drop of late 2007/2008. Jim’s a glass half full kinda guy for a reason on this one – the end of 2014 should show if the inventory buildup and dearth of sales leads to price capitulation on the part of sellers overall (specific micromarkets and hoods be damned).

Be sure to come back next year with a new user name. You’ll need it.

I don’t know when its going to all come apart but I do know it has to at some point. No organic growth of real jobs (not fast food service sector crap) or income. Its all a house of cards. The only question is when.

As I mentioned before, I have monstrously bad luck at financial windfalls. I am selling in the fall. My neighbor, who moved in less than a year ago is now selling. The bank that sat on a foreclosure for 5 years just got around to listing.

I can guarantee you, that with my luck, which is worse than Biblical Job, the crash will happen the day before I close escrow.

We’re all pulling for you Job!

How can this stop if the Chinese investors are taking over?

Live in San Diego, work at a top biotech, own a small property in a resort location, but rent locally (SD). I’ve bantered at purchasing for the past four years, but each time, resulted in a war with cash or mad buyers. That aside, I’ve pumped 30% of my gross income into the market since 2006, and have tripled my wealth…

So what is my next play? I have bullion in my safe, I have cash on hand, I have 60% of my wealth in the market, and my only property is 50% paid off, but on a 3.5% loan and is negligible from a monthly burden perspective.

QE has devalued the dollar, therefore, understandable why the market is up (both stock and realestate), but the predictions of bullion explosion over the past 3 years has not materialized, PE ratios of stocks are at an all time high (at least those I’ve followed for 15 years), and realestate in CA clearly doesn’t make sense… or does it?

I wish Jim was right… I wish he was right 3 years ago, 2 years ago, but…

I was MIDDLE CLASS, and if I cash out now, leave the state, buy a home for cash, and take a job at Walmart, I’d probably be in a better position than I am now… Middle Class??? Hardly…

Look at Walla Walla, WA; nice weather, character, beautiful homes, lots of restaurants, wineries (over 130), vineyards, 3 colleges and 4 hospitals. For $500,000 you look at mansions, literally. Maybe you don’t have the “diversity” from SoCal but you do have any ethnic restaurants. The large number of wineries, restaurants and history is turning the town into a tourist attraction.

However, if you like the smog and traffic, the “diversity” (culture), then SoCal is for you.

Diversity is WAY overrated, unless by ‘diversity’ you mean highly communicable diseases that we in the civilized world once mastered and eradicated, now being spread rampantly stateside by our wonderful border hoppers. Measles, chicken pox, H1N1 swine flu, drug resistant scabies and lice, whooping cough, MRSA, Dengue fever, TB, plague…and on and on. How’s THAT for diversity?

It has begun Jim Taylor.

Waypoint Real Estate Group is trying to “quietly†unload half its inventory of 4,000 homes in California to another company. It also manages another 7,000 homes that an affiliated REIT owns. Och-Ziff Capital Management Group and Oaktree Capital Management have already started selling their homes. Other firms, including Blackstone Group and American Homes 4 Rent have pulled back from buying homes as prices have soared

@KingLG – Is Blackstone kicking out the tenants and selling these as vacant homes? or are these simply ‘asset plays’; meaning if Blackstone or American Homes (or whomever) sells 4,000 homes (with tenants in place and rent stream) to another firm how does that affect home prices for you and me?

@QE abyss, worry not about these private equity firms. The Chinese will bail them out 100X over. The Chinese have so much gold they have developed chronic arthritis from the sheer weight of the gold they are carrying.

Who do you think inflated housing prices in the past 2years?! The sheep with their 500 fico score? Institutions and cash buyers hungry for a yield and a quick profit. When asset values peak the selling begins and demand falls. When demand falls ………………..

You can fill in the rest.

I think one of the biggest misconceptions about the “hedge fund†mass purchase of overbuilt housing is that they actually repaired and rented the unfinished/foreclosed homes. Many of these homes are still vacant and in disrepair to this day. The purpose was never to provide housing. The purpose was to provide an investment to sell to pension/401k fund managers. It would take a lot of hard work to make these houses habitable and to find reliable renters. Why do all that work when your ultimate plan was to securitize, market and collect a fee? The problem is that there really is not a lot left to squeeze out of this sponge, so now we are in the process of shifting deck chairs on the Titanic as the massive ship starts to list…

The fact that we have seen rising rents over the past year or so should have been a dead give-away that these homes never made it to the rental market. Of course rising rents makes the investment look even more attractive. However we all know that rents would tumble if all of these rentals actually made it to market which would make the investment look less attractive. Coincidence? I think not…

Recently i bought in ABC school district area which incorporate Cerritos, Artesia, part of Norwalk ( which is call college park adjacent to Cerritos college (So. Cal). Currently a corner lot house has 30 offers (selling for 450.00).

From my experience, if the area has excellent schooling Asian buyers will come. A friend of mine just bought a modest home in worst area of high end Cerritos for $675.000k. 2 years ago that house was bought for $500.000k. Still there are short supplies despite all the sheep she·nan·i·gans. There are still houses in great conditions in decent area available. It took over a year to purchase my home without giving up I landed almost turkey home in the college park area for 400k. Remember you got to be in it to win.

I meant to say i landed an almost turn key home in the area lol.

Good news, if that’s what is occurring behind the scenes.

From what I see on the Redfin and at open houses, it’s more like prices have plateaued and sales have slowed, rather than tanked.

I think it’s because flippers imagine they can raise prices by as much as $300,000 (in some cases) from what they paid just a year or two ago.

the butter on that bread is getting a little rancid..

What is the problem with one or two toilets if only one or two people live in the home? Eat quality food and drink so you don’t have to go to the toilet all the time. Watch the chili and the beer.

People pay for the lath and plaster(pre WWII) homes, not the cheap plaster board that costs less than 50% of the lath and plaster. There is a world of difference in the construction. Lath and plaster can stop a bullet, not the cheap plaster board.

What do you think bullet proof drywall is for?

That is a big selling point in San Marino. Drive By “proof” lath & plaster.

when the whinnies and losers raise up against the 1% in California, then the rich will appreciate their lath and plaster(redwood 1″ planks and chicken wire and stucco on the outside) and the poor fools with their plaster board moderns will be sad.

I just found this site through Zerohedge. I love that site for a laugh, but it is kind of absurd. I was surprised to find such good articles and consistently lucid comments. Looking forward to following discussions here for a long time.

Banks absolutely do not care about what they’re lending to whom and for what house. They just want to make deals go through while paying lip service to the new regulations. They’re there to make money, and the attitude of loan officers is to just force things work so they can meeet short term sales goals. There is no meaningful tightening of lending as far as I can tell. They’re the ones lending a million dollars for these tiny crudboxes in “hot” zip codes no (well minimal) questions asked. They’re lending absurd amounts to people with credit that wasn’t ruined in the last meltdown for way overvalued houses–obviously new rules have been put in place, but if housing falls and the economy takes a corresponding dive (or vice versa), the new buyers’ jobs are going to be in jeopardy and their houses will be worth significantly less than what they paid for them.

about questions asked… I bought here on the SF peninsula 6 months ago and found it a different experience from buying in 2000. example – we used mostly cash and had to provide a paper trail as to where is came from + income sources where verified. My last yrs tax return was off by a few bucks and I had to provide a written explanation as to why… seems very different than 2000 in my recollection.

I’ve heard that some banks are doing this, but I think this depends on where you go. I’m blessedly unaware of how getting a loan is these days, because on my budget and neighborhood, I could afford a tiny stucco box in a worse part, or a condo in significantly worse shape than my apartment.

I guess I meant more that the bank doesn’t care what condition the house itself is in. I don’t know how you could change the appraisal process, but as long as appraisals are based on recent sales, there is absolutely no protection against inflated pricing. As long as your future neighbors paid close to a million for a crummy house no bigger than a 3 car garage recently, the bank is willing to lend a ton of money on the crummy place you made an offer on, as long as your other credentials check out. The whole appraisal process seems like a dangerous experiment in begging the question. Why’s this shoebox “worth” almost a million? Because the shoebox next to it is sold for almost a million. But why is THAT shoebox “worth” almost a million? Because the shoebox across the street sold for almost a million. I realize that this is how prices are set, but when the market isn’t rational, the results aren’t good. No one will pay $15 for a moldy loaf of supermarket bread, but put some “distressed” hardwood on the bottom, throw in some matching stainless steel appliances, and slap some fancy sans serif street number on the front and now people are fighting over it.

This time around buying a home was the hardest thing in my life due to cash buyers/new bank laws. It’s not getting EZ any time soon.

This market is all about speculation. No one who is financially prudent–regardless of their degree of wealth–should set foot in it. If your area of concerns extends past your nearest and dearest in any way, you can only find this situation deeply shameful.

we have to set foot in it, like it or not. Renting is setting foot in it, buying is setting foot in it. Do you live in a tent somewhere? If you keep your head, only pay what you can afford for rent or mortgage, you can live sanely in California. But, as the Doctor always points out, it won’t be in a mcMansion with a Caddy out front.

I was referring specifically to the market for purchasing houses in Southern California.

Not looking for any kind of sympathy but there are some California natives like myself that simply missed the boat. I have friends that bought during the 90’s and are comfortably living in their homes. I was too busy doing other things and now find myself unable to buy even though I make a decent middle class salary. I remember after the ’94 Northridge earthquake there was a huge Exodus of Southern Californians that moved to either Washington or Colorado. Things seem different now and it’s hard to imagine there will ever be a time to buy a decent home again at a fair price.

That ship has now sailed. But everyone somehow thinks it’s going to sink. Just as the rest of the country seriously thinks CA may break off and fall into the ocean.

One only needs to look at places like livermore in person.. just drive out there.. to understand that california’s regulations have stifled the supply of housing to the state.

Livermore is an hour from the major cities in light traffic, surrounded for miles in all directions by unused farmland, and the prices are in the 700’s.

If one were to take the georgia or texas law books and drop them into california the housing market would be corrected, affordable, and look better in under a decade.

Just ride the bart from fremont to richmond and look out your window at the falluja-esque landscape: the building codes have done NOTHING to preserve or enhance the beauty of the area and everything to make it more expensive for no reason.

You are right Dan. Come on over to Texas and I will make you some really good Chili and I only use meat from free range, grass fed, and happy steers. We are not a bunch of posers like those people in Newport, we are genuine down home friendly folk. Come on over Dan, Texas will always be waiting for you. For some, Texas is a state of mind, a refuge to go to when life has you down.

I like the idea of free-range, grass fed beef from happy steers, but I don’t like the idea of Texas,… except maybe, Austin…

Hate to hear you sound so down Dan. You might have missed that boat, but maybe there’s another smaller craft you can get into. Be happy at least you didn’t get wiped out like a lot of others who bought in the 90s. All is not necessarily lost, keep your chin up and there might be a break in there someplace for you. Keep saving, keep looking around.

For what it’s worth, the stats show that the current monthly mortgage payment takes a smaller percentage of median income in the LA/LB/SNA MSA than it did for most of the 90s.

http://www.jchs.harvard.edu/sites/jchs.harvard.edu/files/sonhr14-appendix-tables.xlsx

Assuming your post isn’t some weasley attempt to advocate for the “buying is always better” crowd, we’re all moving down the highway and you’re coveting some of the other cars based on their outside appearance.

As for the ship sailing metaphor, ships come and go all the time, hang out at the port and you’ll see it’s true. So what if you missed the last ship, catch the next one.

@ TiredoftheBS

The ‘ship has sailed’ is not a good analogy, because you are not spending money on rent waiting for the next ship and the time between ships does not leave room for inflation to creep in.

if home prices today drop 10% you will be back to early 2013 prices. If prices ‘crash’ (defined as 20% or more drop) you are back to 2011-2012 prices. If prices ‘crash’ 25%-30% you are back to 2010 prices in many areas.

Tell me what ship will arrive? 10% decrease? 20% decrease? 30% decrease? [Beyond a 30% drop, you then need to go back to roughly year 2001 prices].

Will some of the ready, willing and able buyers sitting on the fence on this blog tell us … what price reduction from today’s prices do you need to buy?

The ‘ship has sailed’ is not a good analogy, because you are not paying rent waiting for the next ship, nor is inflation creeping in.

In any case, assuming another ship will arrive, meaning a price reduction, what are you hoping for?

A 10% price reduction will take you back to early 2013 prices.

A 20% price reduction will take you back to 2011-2012 prices.

A real crash (over 20% reduction) will take you back to 2010 prices. A 30%+ reduction will take you to 2002 prices.

For the ready, willing and able buyers on this blog, what price reduction will trigger you to buy?

Ship is a metaphor for opportunity by most colloquial standards. Perhaps you believe that ship is a metaphor for shelter.

As everyone knows I have Titanic on the brain so when I hear “Ship” I can only think of one outcome…

Realistically my opinion of the ‘correct correction’ will vary on the property. But if I had to give an average for my market (Oregon) it would be about 15% if you assume rates don’t move much, and more if you assume mortgage rates will rise with any significance.

Keep in mind that a) a not insignificant percent of buyers are still reliant on mortgages

b) most of those buyers shop on monthly payment, not sticker price

c) rates on 30 yr. mortgages at the start of 2002 were over 7%.

A lot of the runup in valuation over that span is arguably attributable to the transfer of savings on interest rates into higher spending on principal. For every 1% in interest rates you need sales price to drop by about 8% for the monthly payment to stay flat.

Not so, be careful of the ship you get on. Don’t be Shanghaied. I have had experience. Make sure the ship is well constructed and meets all the current safety requirements. You don’t want to be the captain of the RMS Titanic. It was the first mate’s fault, as I told St. Peter, but the ship had a lot of faults, according to the inquiry. Better to be safe than sorry.

Dan,

I lost 20% of my home value in the Bay Area when I bought in 1989 and sold in 1993. I realized that I needed to understand what happened. I found that California operates on an 11 year cycle (plus or minus 2 years. After I realized that, I took my wife to La Jolla in 1997 and found a 2000 sqft home with an ocean view for less than 300K. I didn’t buy because I could not convince my wife that it was a good deal (she remembered the debacle in 1993). But the point is that the cycle is likely to follow the same path despite the current easy money and new mania. Someone actually has to pay these gigantic mortgages.

I do wish that someone would have advised me that if it is cheaper to rent, then rent, if it is cheaper to buy then buy. Unfortunately, it always feels wrong at the moment.

I now live in Tucson and only one of my nephews and nieces has followed my advice to buy if it is cheaper to buy. So go figure.

Cheers, Chris

11 year cycle? Prior to the latest bubble it was a 14 year cycle actually, except when it wasn’t. It’s only a cycle in years until it’s not.

Given the previous 2 peaks were 1989 (with a dead cat bounce in 1991) and 2006/2007, that’s 16-18 years peak to peak. And at this point given all of the unprecedented market manipulation, all bets are off.

Finally after years on this site everyone is getting a clue. Averages, median, local income, interest rates, and all of the countless charts you try to use to predict the future are about as accurate as dice.

SoCal cities that have nice weather or culture will always be in demand. People with wealth move to these areas which make the local income a pointless number to look at. If someone comes into financial wealth they usually don’t talk about moving to North Dakota. They move to the state with Disney Land, palm trees, and movie stars.

As for the middle class going away…is this really the first time everyone is hearing this? I have heard this for 20-30 years. Surprise! Really?! That info should have been taken as what do I need to do and earn to be upper class. Get a college degree in a field that pays. Medical doctor, dentist, lawyer, engineer, IT, etc. Many useless degrees are a one way ticket to Target and Starbucks. Luckily in Pasadena they are both I the same building.

Back to home ownership … Yes it’s now for the upper class. They are paying a great deal for the land. Many will remodel or rebuild. Most everyone already knows that many 1mm homes have a land value of $950,000 and physical home is probably worth about $50,000 (if that.) But without that 950,000 piece of land you can’t build your $250,000 new home. In other states you can put a $250,000 home on a $10k piece of land. (Like Texas.). That’s why people see more value. Homes cost about $80-160 sq ft to build. Lumber, wire, drywall, lights, and paint are the same price almost everywhere, and labor is actually cheaper in SoCal with some cash under the table workforce.

So there you have it. Location, location, location. If you can’t stand the heat get out of the kitchen. If you can’t afford the meal, go to a cheaper restaurant.

Personally, I am willing to pay the price of renting in SoCal. I find value in it. But if I had 3 kids and a wife to support I would consider a cheaper area as my priorities would be different.

To all of the naysayers I make you this deal…. I will relocate from SoCal if you find me a place that is a lot cheaper and that has SoCal weather within 5 degrees and 5% humidity on a monthly average basis. Texas, too hot an humid. Arizona not an dry. Washington and Oregon to much rain. Midwest humid and snow. East coast miserable snow and expensive up north, rain mid section, and humid and hot in the south. The one place I have found that is almost as nice as CA is Denver area of Colorado. But it has cold winters and snow.

CA > *

Atlanta.

A major city with a booming culture and some of the cheapest costs of living for a major metropolitan area in the entire US.

You can buy in buckhead for california prices and live the night life, drive 40 minutes south and buy free and clear for 40k, or get a 3k sq foot mcmansion in a good school district for between 200 and 300 to the northwest.

Winters are pretty mild and summers are hot but it doesn’t matter because most of the houses are under 30 years old and energy costs in the region are dirt cheap.

I think he stipulated something about humidity which would rule out Georgia.

Portugal has a lovely climate.

Hotlanta? Huh

#always

almost forgot…

#PayNoAttentionToThatManBehindTheCurtain

“Washington and Oregon to much rain.”

It is true that Texax and Florida have humid heat. However, in regard to WA you are dead wrong. 3/4 of Washington is as dry as CA. The rain is ONLY on a narrow strip on the coast because it stops in the Cascades. 3 hours from Seattle, east, it is like on the moon. Then, as you drive towards other mountain ranges, you get just the right amount of rain. Who wants to live in a place which looks like Mars!!!????

Other than that, I agree with you that for most people is not pleasant in humid heat. Your mistake is extrapolating the Seattle weather to the whole state. I used to live in SoCal for years, till I’ve got tired of smog and traffic bumper to bumper. I have only one life and I don’t want to spend it on the freeway – it does not matter where you live. For me that is no quality of life. On top of that, for that “privilege” I have to sell myself and family in slavery to the banks for quality of life far worse than what WA has to offer. WA does not have income tax, lower sales tax than CA and very low property taxes (unlike TX).

People in CA suffer the consequences of their own decisions and they complain about them.

You are free to decide, but you are not free to choose the consequences. They come as a package.

seen 3 housing downturns in S. Calif under more favorable wage growth direction…

it will happen again and I would say much sooner than many think….

you are watching the final charade being played out…time and history are not on the side of America anymore….

All it would take to grow the US again is for enough people to eat a pink-slip from “free trade” for them to re-introduce the tried and true tools of domestic growth as utilized by Alexander Hamilton to bring the US from agricultural back-water to world power in a couple generations:

Import tariffs and subsidies.

@Sean1, you are so right! In SoCal, home prices will go up 50% a year, every year forever!!!!! Local incomes do not matter. Jobs do not matter. There are 100 million Red Chinese communists drooling at the chance to buy that $2.5 million dollar tear down in San Marino. These Chinese communists have over $10 million dollars each! So money is no object. Start cranking up those San Gabriel Valley home prices now because they are going to the MOOOONNNNNNNN!!!!!!!!

Come on ernst blofeld, 50%???

30% makes way more sense to me!!!!

Let’s not get crazy now. 😉

“That info should have been taken as what do I need to do and earn to be upper class. Get a college degree in a field that pays. Medical doctor, dentist, lawyer, engineer, IT, etc.”

I’m going to be kind and pretend you didn’t say everyone should take steps to be upper class. I see that statement, but I’m going to walk on by.

Your advice about getting a college degree that pays and your specific advice on professions needs to be corrected. The gap between rich and poor continues to grow, and those formally solid professions don’t always pay what they used to. Meanwhile, the cost of an education has grown excessively, endangering the ROI on these so-called valuable degrees.

Globalization and digitization also means even hands-on professions like medicine can be performed from anywhere. Engineering can move to Romania. Tele-medicine can be practiced in Thailand.

Teresa

My suggestion was not college major selection advice, but to state that if you want a home you are going to need to pay with some sweat. That means picking a career that pays. I am in IT, I know hie globalization pushes my salary down, but it’s a lot better then my friends with a degree in English literature.

But yes, everyone who wants the more expensive things in life should take steps to earn them. Otherwise, it’s not going to happen. And I the US you are much better off poor then you are in many other countries.

Are you suggesting left wing liberals (Obama and Clinton) should put into place more home affordability acts? So the poor can buy a home and pass their liar incomes off on Fannie Mae so tax payers can bail them out?

Life isn’t fair. But it’s not the 1% buying all of these homes in LA. It’s probably more like the top 25% in prime areas. Inland empire can be the top half. The bottom half can rent. Owning a home is not a entitlement it is an earned privileged.

Sean…As a former CA. Resident all you said has a place in a decision to leave or stay or move. I traveled many places small towns, big towns, states that have culture differences etc.

When a person has choices in life it makes it much easier, when you have crazy money you can even live in several places and countries. For the overwhelming population in this country they have little or no choice, that is why they play the lottery in record numbers.

My wife and I made our decision to move out of CA. Because of quality of life, we can live anywhere we want, but traffic and merry go round of state in total disary was not appealing after 33 years.

We tried Denver for 7 years great experience buy not for us long term so we bought a condo in lower downtown, in case we decided to return we has a place to return to, we sold it 5 years later not netinterested in ever

We now live in a environment ( 2 homes in the same state) that is peaceful, wonderful dry climate, red mountains, rivers, and still great shopping and restaurants. That said,this is also a life for the well healed, many CA. folks want out for our same above reasons quality of life issues for their kids especially, with little future.

For these people opprtun

Sorry I timed our, opportunities still happen in border states of CA. But that also is shrinking, I say unless you have crazy money or must stay, then their is no choice, otherwise leave and build a new life in the West, Ca. isn’t going to get better?

Robert…where do you live now?

This too shall change. Don’t know when. When I first came to CA houses were cheap even compared to Detroit. 1972. Now look.Since then I have left CA many times and always come back. I moved to Boulder twice, bought homes and hated it here. It’s a 9 month (wicked last winter) winter and I don’t ski anymore so what is the point. The heating bills are terrifying. In summer in spite of poems lauding the cool mountain air it’s hot as blazes up to an beyond 105 degrees so the cooling bills are even more frightening. Spring and Fall barely exist. GRowing season is just a few months. The food is bland, the people friendly sometimes. It’s an athlete’s paradise for a few months a year. Running through a foot of snow and pedaling in 100 degree plus weather is suicide. It’s a nice bland little city and no decent big city nearby. I am still searching for interesting things to do in Denver but they don’t have cattle drives down main streets in the last 20 years so I guess that is progress. So be careful. If a house is your only value go anywhere, Buffalo, Detroit is very cheap now. But CA is still paradise and few mosquitoes. All those other places are havens for mosquitoes – it rains in summer and all year round. Go if you must but stay is you take advantage of the CA climate, beaches and traffic (hahaha). Even in Boulder we have traffic jams. This little city has grown so fast without careful planning that the traffic jams and roads here have been blocked for over a year now. Nothing compared to L. A. but unexpected and annoying. Healthcare is quite limited. Only only one highly rated hospital in the area, Jewish Hospital in Denver but no one ever heard of it here. Kaiser is a nightmare here and the rest is so so. But as I said Nice people for the most part.

Zillow is playing games again.

The owners informed me a few weeks ago they are going to sell the rental house I live in. They “offered” it to me for $389,000 – I politely declined their “offer”. It needs at least $30,000 of work put into it. No back yard ever installed, just a concrete patio and bark. Entire thing floods every winter, with a foot of standing water eating away at the foundation. Flooring was a DIY job, horrendous, all of it needs to be ripped out. Holes in the great room ceiling, needs to be patched, retextured and painted. Lots of work to do, but as a rental, it suited me fine, especially at the cheap rent which they’ve never raised in my tenancy.

So 2 weeks ago I checked Zillow, said value was $407,000 which is a joke. Price per sq ft higher than 2006-7 bubble prices.

Today I check Zillow and its now $356,000. $51,000 difference in 2 wks? And it says $1450 INCREASE in past month? WTH?

eAppraisal says $298,000.

Have not heard a peep out of the owners on when they plan to list it.

Redfin has a new game. Some houses on their maps are marked as HOT Ii.e., they have an orange HOT tag above it). A HOT tag apparently means “This house is expected to sell in X days! Take a tour soon!”

X varies. Sometimes 3 days, sometimes 11 days. I don’t know how they “estimate” such a thing.

Is it even an honest “estimate”? Getting a HOT tag for your home listing might get more people to look at it, and perhaps pressure them to bid higher. So every realtor and seller and flipper will want a HOT tag for their house. How does Redfin decide which house gets one?

Is Redfin’s new HOT tag another sign of desperation?

I love Redfin because they are breaking the realtor cartel. You can list your home with Redfin and they take1.5 and give the other realtor their 2.5. 4% commission is a move in the right direction especially for homes 700,000 and up. They are on salary not commission. The job should be a salary job, it never warrants the commissions that they get here in California when someone goes to sell a run of the mill crap shack. Please no special marketing or effort is done on behalf of the seller. Buyers look online at the homes they want to see and ask a realtor…middle man, gate keeper to show it and spend ten minutes writing an offer and not more than a days worth of work to close the deal. Bye bye realtors your reign in bullshit will be coming to an end.

Probably some marketing gimmick from redfin by which they are charging desperate listing agents some fee to attempt to make their listing(s) stand out from the rest by labeling them as “hot” in orange. Google, eBay and others use similar tactics, upselling the sellers with features such as making their listing(s) more prominent, top of search results, etc.

@calgirl wrote: “…Today I check Zillow and its now $356,000. $51,000 difference in 2 wks? And it says $1450 INCREASE in past month? WTH?..”

These are just numbers. Most Americans fail at anything more complicated than 1 + 2 = ?

Most Americans cannot compute simple interest.

These numbers on Zillow, Redfin, Realtor.com, etc. don’t really mean anything and possess no meaningful value.

The weather is nice here, there is lots to do. People are still buying 600,000 starter homes. Boomers are hanging on to their houses and not selling out for cheaper retirement destinations.Lots of people on this blog want to buy here despite what they get for their money. They may be frustrated with the prices to rent or buy here…but they are still here.

I think it is just as stupid to rent here, you could own a home almost anywhere else in the country for what you pay to rent here. Save money renting and you can put that extra money towards other investments. I never see that happening and what investment is safe to dump your extra money in now?

If you are going to stay somewhere that long you can just wait for the next bust and buy but I find even when we are in a bust phase those people don’t buy when opportunity knocks, they stay in rentals and complain about prices. Rental life sucks. It is different out here, people will do almost anything to continue living here.

Blah, blah, blah. You get on me for adding no value and this is the best you have to offer?

Good point.

“It is different out here, people will do almost anything to continue living here.”

That sounds…. familiar…

Good catch.

Everyone wants to live here and this place is different.

These Internet sites like Zillow, Trulia etc, are half the real estate problem, never ever make a buying decision based on there estimates of value or future forecast. These are the folks who tell you about a rain storm that already happen 3 weeks ago?

Check county records for actual closed prices, history of home that is for sale, goggle earth ( out of state propetty) if available to see block of homes in neighborhood. If you can get the owners name and search for there history.

Check sales as far back as one year, many homes may take longer then 6 months or more to sell. Every home,every offer on a home is dependent on the buyers, what a house next door sold for and the one down the street could be a entirely different secnario terms,sellers motivation, sellers personal circumstances in life etc.

Zillow and the rest have no idea of the condition of homes, good or bad lots, trends, HOA issues, neighbors from hell rtc. There one size fits all should lend itself to suspicion, you can’t be passive in RE buying and selling, going on the computer because you think the work has been done for you is recipe for buying and selling disaster.

I agree, you cant rely on the zillow and redfins of the world for estimating home price. Best thing in my opinion is IF you are going to buy a home, get out and see as many homes as possible that are on the market in the specific areas you are looking. After viewing 10 or 20 homes that are priced to sell then you have a better feel for what is realistic, that along with as many comparable sales you can find within 6 prior months will help you determine the realistic from the ripoff. When I was house hunting I noticed that some of the homes that were listed by out of town agents who were unfamiliar with an area had under priced the home but not by a large enough factor for me to want to purchase if I didnt like the home itself.

I, last month, posted the Bureau of Labor Statistics non-farm payroll report, which every month like clockwork reports a net gain in jobs of approx plus 215,000 per month. Then, I posted a report from the real employment situation on the closing of the south’s largest casino in May, a Harrah’s in Tunica, MS and the loss of 1,300 jobs (since it’s hospitality where they say the bulk of these job gains are coming from.)

So, for June, just reported from BLS a gain of 288,000 jobs. Really? What a remarkable achievement for a govt. that doesn’t even discuss the monster issues (“free trade” etc.) facing the job market much less do anything about it. I then concluded that by the end of the administration’s 2nd term, they will say 10 million jobs net gained in the 4 years (12 months x 200k, then x 4)!

So, I now post another casino closure, this one the Showboat in A.C. with a loss of 2,100 jobs. Remember that federal and state governments are still taxing the tips of all employees in the gaming industry. Why? Taxed into serfdom for the working class and printed into stawk mawkit nirvana for the upper class. This is a disgrace.

http://online.wsj.com/articles/caesars-to-close-showboat-in-atlantic-city-1403877635

Tom posted: “So, I now post another casino closure, this one the Showboat in A.C. with a loss of 2,100 jobs. Remember that federal and state governments are still taxing the tips of all employees in the gaming industry. Why? Taxed into serfdom for the working class and printed into stawk mawkit nirvana for the upper class. This is a disgrace.”

_____

I got this in my inbox from Digg a few weeks ago, if it cheers you up – but I was questioning how companies call follow – and also I tend to find it’s equity rich homeowners pushing for wage inflation… they want that solution rather than the prospect of their homes falling in value. No crash, and such generous ‘wage increases’ just sucked up into more rentiers increasing their positions, and probably more house price inflation.

_____

In October of last year, the union for the employees working at Resorts World Casino, one of the most successful casinos in the country [PDF], struck a deal that effectively doubled the salaries for 1,400 of the roughly 1,700 employees. The employees went from making $10-$12/hour to $20 or more, plus benefits, essentially overnight. This transformation is rare, so we asked five of the employees what their lives were like before the contract and how they changed after they began receiving a fair wage for their work.

continues: http://gothamist.com/2014/06/05/living_wage_casino_workers.php

The stock market is at all time highs while welfare recipients are also at all time highs. Meanwhile, the so-called Middle Class has disappeared; it’s relic of times gone by. If you see a “Middle Class Sheeple” grab him and turn him/her over to the Smithsonian for a $2,000 reward. They are looking for one of these rare animals for their collection.

Look for them in the “homo-eradicus-bifucastradedus” exhibit hall.

I think my new favorite word is “rehypothecation” (is a professional financial market practice, where counterparty reuses a security pledged as a collateral for its own use.)

I have no idea what all that means but I like the way it rolls off the tongue!!!

You pledged your allegiance to “bifucastraded” awhile back, so we’re not taking this news lying down, What?.

Southern California … beware :

“Bubble Bubble .toil and Trouble”

… whoever buys now will lose all their money later …

Paul, you have to believe most houses especially in Ca. will take a drop of more than 40% am I correct? I don’t see that happening in CA. again or another place of substance.

There is the exception in a country this size, but CA. RE is huge and if the market again collapsed especially in the range of 40 to 50% the ramifications would be worse then 2007-2009.

Lending laws, bank playing games, mortgage companies are so regulated now and watch liked a enemy of the state, I think normal up and downs can take place but cataclysmic don’t think so unless of course, old mother nature acts up, then all bets are off, lets pray CA. never has the big one ever?

We moved out of Orange County, CA in 2008. We’re struggling to maintain a middle class existence there on a six figure income. Moved to Little Rock, AR and the lower cost of living has left us a ton of discretionary income. Feel like we’re rich by comparison.

Teresa, Sean1 has some pretty fair points he said, “Owning a home is not a entitlement” this statement is as true as it gets.

Leave a Reply