California NIMBYism has created another housing bubble built on volatile wealth: California home prices disconnected from nationwide trends in the 1980s.

California has a severe housing affordability problem and much of it is brought on by its own laws and regulation. The state suffers from a deep and profound form of NIMBYism. While it is clear that there is a rental crisis and buying a home is out of reach for many younger families, the status quo continues to march on because of entrenched NIMBYism. It is hard for some to imagine California home prices tracking nationwide trends but they did for an entire generation between 1940 and 1980. Then, thanks to wild speculation, regulations, and the introduction of mania inducing mortgages, California started marching to a different beat. The tech market and Hollywood like marketing of the perpetual sun made this a destination of choice. Now typically when demand arises supply is there to meet the need but not so much in California. But those who got in early were too busy protecting their plot of land with local building regulations, zoning restrictions, and things like Prop 13 that basically rewarded those who “got here first†yet provide little economic benefit moving forward. It also creates a dangerous boom and bust system where things are fine as long as the stock market is rolling along. Let us look at some figures here.

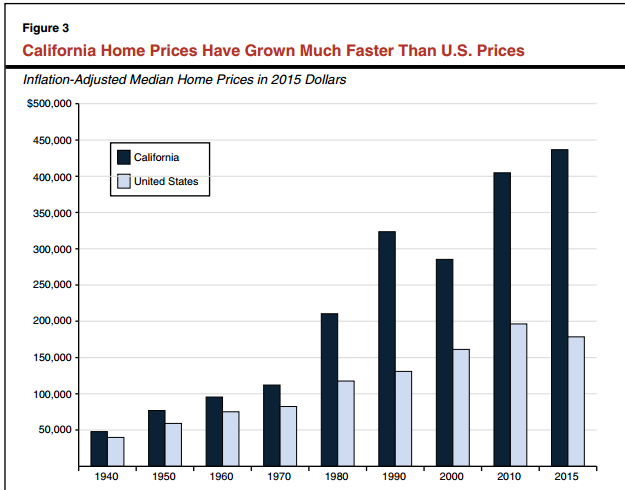

When did California housing detach from nationwide trends?

California housing prices carried a slight premium over nationwide trends but the differential wasn’t so pronounced as it is today. You need to remember that nationwide figures also include states like Texas, Ohio, and Oklahoma for example where home prices are very affordable. Even with that said, California was tracking nationwide home price changes for an entire generation.

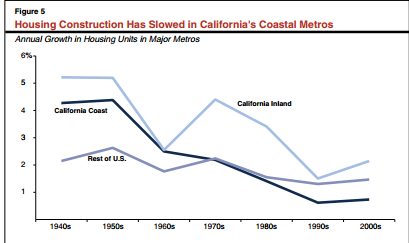

From the 1940s to the early 1980s California home prices tracked nationwide prices:

Source:Â LAO

The above chart shows inflation adjusted prices to better highlight the dramatic change. As of 2015, the differential from nationwide home prices and California home prices is near a peak once again What happened in the 1980s was the introduction of funky mortgages and Wall Street playing the same game we are seeing today. California has seen a share of booms and busts. The peaks and valleys are only magnified by the not in my backyard mentality.

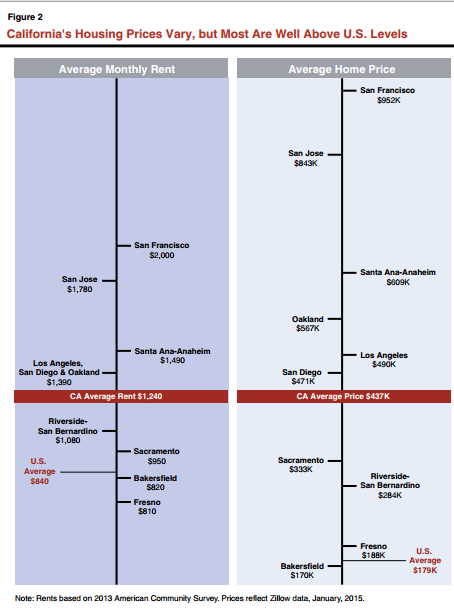

Even in California alone, the difference between Inland areas and those close to the coast is dramatic:

You have places like San Francisco where the median home price is well over $1 million to places like Bakersfield where home prices track nationwide trends. But what is certain is that the closer to the coast that you get, the more NIMBYism you are going to find.

Take a look at building growth:

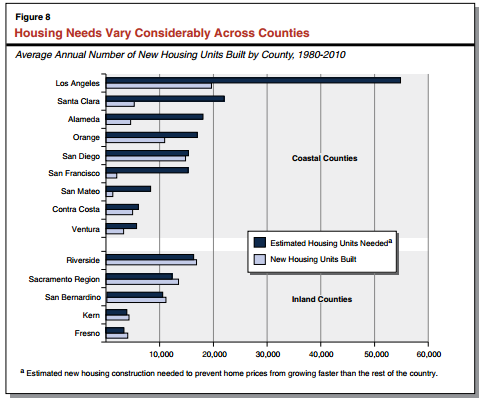

Housing units were being added nicely up until the 1980s and then things stopped. California’s Inland continues to add units near or above the nationwide trend. The coast is barely adding units. And the need is great:

The coastal communities are in significant need of housing units. When we say coastal we mean 15 to even 25 miles inland and not beach front Malibu. And it would be rather simple by adding high density housing. Look at a place like New York. But people want an anti-drought prone yard and grand-fathered in tax rates from the Carter administration while younger families are hammered on rents and mortgage payments on inflated homes. Increasingly, many of those able to buy are foreigners so they crowd out regular buyers on the already low amount of units available.

Even the LAO realizes that high home prices are tough on California households and the state’s economy as more money is simply siphoned away into housing payments. Here are the main reasons for resistance to high density housing on the coast:

-Community resistance to new housing

-Environmental reviews can be used to stop or limit housing development

-Local finance structure favors nonresidential development

-Limited vacant land to develop upon

And the irony is that some of these residents have “liberal†ideology so long as the ideology keeps people gentrified out of their market. We are “inclusive†so long as it doesn’t include you being my neighbor. It is true and you can simply look at San Francisco as to what is happening to their residents. NIMBYism is a big issue but as of now, the market is being driven by hot Wall Street money, house humping investors, foreign money, and households leveraging every nickel to get into a glorified crap shack.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

105 Responses to “California NIMBYism has created another housing bubble built on volatile wealth: California home prices disconnected from nationwide trends in the 1980s.”

It’s true that California’s inland counties such as Sacramento continue to add units near or above the nationwide trend. Even with drastic draconian water restrictions, new housing subdivisions continue to be built in the Sacramento area with prices starting at around $340K such as this one:

http://www.zillow.com/community/windsong/2101236009_zpid/

Meanwhile since the housing crash, Sacramento has many older subdivisions that are full of run down rental houses–many of them Section 8 rentals where English is rarely spoken. Below is a link to one such house that is being auctioned off with a starting bid of $80K in South Sacramento that had sold for $296K in 2005:

http://www.zillow.com/homes/for_sale/25855279_zpid/38.479353,-121.481355,38.468013,-121.502384_rect/15_zm/1_fr/

New home building is just starting to get back on track. It doesn’t mean the homes are affordable, but compared to Bay area prices they are a good deal. Which will attract those super commuters to the areas like Elk Grove who have bay area salaries. Plus those homes are close to hwy corridors and trains. This should cause the new home prices to increase as those Bay area transplants buy more homes.

There is a reason that those older homes are so cheap. Its in the meadowview area of south Sacramento. One of the most dangerous areas not named Oak Park. Of course there will be cheap housing, cheap rentals there. Look at a crime map and you will see how housing prices is based on safety of neighborhoods. And thanks to the rise of rentals in the area (One of the top areas of rent hikes in the nation) everyone is force to go east and south of Sacramento to afford housing. Then whats left is high prices (for the median income of the area). Its not like LA or SF high prices, but there are not a lot of tech jobs or movie execs in the area and its not near the ocean.

Some issues with living in the San Joaquin Valley is the EXTREME HEAT!

I used to talk with some people at hotels who said that in the summer a lot of their units were full by inlanders trying to get out of the heat.

You will have higher electrical bills unless you can get solar.

The commute to SV or SF will be a strain.

Subsidence issues.

Bubble, bubble, housing trouble in 2016. I am surprised it has not burst yet.

Wow, the survey data shows way lower rent than that of the Zillow/new rental value. The housing price / actual rent data is insane in LA.

Think about this. I can buy a house in another state that would be about the same I paid for a house in Coastal SD 20 years ago, and the house is nicer, newer (by 20 years), 4x the yard with better weather, much lower taxes (both property and state) and just a much better quality of life. I haven’t done it but it makes me wonder why people are spending so much in Cali and getting so little for their money. I guess its good, makes the rest of the country seem sane by comparison, and maybe its best we’re left alone by the loons that cover the (formerly) golden state.

Junior: where did you move?

Flyover, in the previous thread you said, “Do you think that if I am “right wing†I have any sympathy for Bush and Cheyny and their Patriot Act?”

The Patriot Act was drafted in 1994/95, by the Clinton administration. More specifically, by the Janet Reno Justice Dept. The FBI was the force behind the bill.

It was not called the Patriot Act. It was called the Omnibus Counterterrorism Act.

It was opposed by various civil liberties groups, most notably the ACLU and the NRA. (Yes, the National Rifle Association.) Because of their lobbying, its more egregious elements were removed. It was passed in 1995, being fast-tracked after the Oklahoma City Bombing.

https://en.wikipedia.org/wiki/Omnibus_Counterterrorism_Act_of_1995

http://www.orwelltoday.com/anti_terrorism.shtml

http://www.nytimes.com/1995/04/21/us/terror-oklahoma-congress-anti-terrorism-bill-blast-turns-snail-into-race-horse.html

After 9/11, Bush said, “I want to pass something to fight terrorism.” The Justice Dept immediately got out the deleted elements from the 1995 Act, renamed those elements the Patriot Act, and gave it to Bush.

The Patriot Act, was created by the Clinton Administration, then passed in two parts, but Clinton and Bush.

The FBI was the main force behind the bill. It pushed for it in 1995. Then waited in the wings for a chance to pass the remaining parts.

Joe Biden — yes, THAT Joe Biden — was the man who drafted the language for the Patriot Act: http://www.washingtonsblog.com/2011/12/joe-biden-drafted-the-core-of-the-patriot-act-in-1995-before-the-oklahoma-city-bombing.html

SOL,

Thank you for the extra details. Regardless if it was passed by Bush and Clinton I still don’t like it. It erodes the freedom we enjoyed in this country and it’s unconstitutional.

If they have an R or a D after their name I don’t care. Bush, Clinton, McCain, Obama and Cheyney are a bunch of globalists from CFR and Trilateral Commission who represent the interests of the 0.0001% from the top at the expense of everyone else.

As long as people elect politicians based on R or D after their name the distruction of the middle class will continue unabated. The ones from the middle class will be left finger pointing to the Democrats or RINOs who is at fault for their demise. Before they do the finger pointing, they should rather look in the mirror and point the finger to themselves – they vote for D or R after the politician’s name or whoever “PROMISES” more freesbies (not that they will remember ) to deliver after elections.

Nobody is looking to vote outsiders or based on character. When they hear that they laugh but then they don’t enjoy when they are lied to.

I think that the manipulators we have in power are a reflection of our society and culture as whole.

Thanks for the info

Wow.

Talk about revisionist history! You take some key facts, twist with words and abracadabra, you have your own version of history.

The SF peninsula is built out. High density housing here happens by tearing down existing structures. Redwood City is an excellent example – they are undergoing a massive building spree in and around their downtown by adding several new multi story, residential and office structures. Next store in San Carlos there is a new ‘transit village’ being built which is literally going to sit on a strip of empty lots adjacent to Cal Train. Not exactly a desirable location… but drives home the point that there are no more apricot orchards to build on as was the case in the 50’s, 60’s and 70’s. Building high density housing here is not simple. Not to mention the great number of high paying jobs available here – all new inventory will be scooped up immediately.

BAR – I know what you’re saying. But – next time you’re flying in to the bay area, take a look down and notice all of the undeveloped land in the center of the peninsula and out towards the ocean, around Concord, and east and west of San Jose. Obviously this land is all protected but that’s the Doc’s point.

They are trying to return the bay to what it was or something close to it before the onslaught of progress.

BayArea – I’m in north San Jose and they’re building apartment or condo blocks friggin everywhere here.

Same here in Glendora, Covina and La Verne areas. I’ve been posting parallels between what is going on now versus what occurred less than 10 years ago for some time now. Here, yet, is another: “I already have 20k in equity because I bought during phase I and now they are in phase II.” (good grief) Heard this a few times in the past month. But nothing to see here. This time, after all, is different.

Jim will be right!!!

I’m in your area Bonzo and I see the 3 story townhouse trend as well. They all seem to be made by the same developer. They have a recently completed track in South El Monte as well. Once again we’ve gone FAR beyond the fundamental issues that will plague CA real estate for the foreseeable future. This is a mania where the few that can still buy are paying significantly over rental parity. There is no reason for this other than sentiment. The qualified buyer population is DECREASING as this new inventory is coming on line. And the recession hasn’t even started yet!

I have seen asking prices in Upland and Rancho continue to drop over the last year. Lots of inventory sitting. The worm is turning, albeit quite slowly. The desperation of the FED is on full display after the September failure. The slowdown we’re seeing everywhere will be trickling down to logistics managers and other members of the local economy soon. No one is going to be jumping into half a million dollar mortgages with abandon once the next cycle takes hold.

Similarly to 2010 I expect home credits and ultra low rates to be in place as they try and put a floor under prices. For those of us who missed out on the last trough it will be best to act quickly. If there’s anything I learned from the bust is that with the oligarchy in charge of our fiat currency the only thing we can count on is volatility. I don’t think the reasonable among us can be blamed for thinking we had more time to buy. It was the shortest downturn ever. But we will have no excuse if we aren’t prepared this time. Keep your fiat dry and your credit score high 🙂

As always California wealth effect with hot money, low supply and foreign wealth as created a distortion in Median Prices to Median Income. At the BNY Mellon Stock Conference last year I had a presentation talk showing that 82% of the working population is priced out of Housing here in CA, once you exclude cash buyers and those making 3X median income 190K

It’s not just CA home prices, it’s new home prices as well.

We had a big miss in the recent new home sales numbers, the trend of lower revisions started month ago when I noticed multiple months of lower revisions

Even in 2015, the new home sale market struggling to get to 500K sales with inventory now at 5.8 months. This with rates ranging between 3.625% – 4.125%

A few key charts here to show the issues with the new home sales market and as always the expensive California market

“New Home Sales Miss Was Forecast Months Ago”

http://loganmohtashami.com/2015/10/26/new-home-sales-miss-was-forecast-months-ago/

NIMBYism to a certain degree exists almost everywhere, but California is the epicenter of the culture. It is not only responsible for some excessive building regulations and costs, but is largely responsible for

NIMBY and Prop 13 are two peas in a pod. It reminds me of a discussion with a well meaning commenter here about how Santa Monica has changed much to the chagrin of long term residents. The problem is that change is inevitable and the choice is to either adjust with it or resist it. Natural law does not provide for any guarantees that the environment will remain to our liking even if “we were here first.” Resistance in this regard has a cost that is not normally expressed as its own line item on balance sheets.

It shouldn’t be any surprise that timing of the disconnect with national home prices coincides with Prop 13. The climate and international status didn’t begin in 1980.

Prop 13 is a subsidy from the young to the old, from the have nots to the haves, from new entrants to the entrenched. Prop 13 has failed to mitigate runaway spending in Sacramento. Prop 13 has created imbalances in the equitable burden of payment for public services. Prop 13 has created distortions in the housing market by providing mechanical incentives and disincentives for the disposition of property. As Prop 13 introduces non-elastic limits which disallow adjustments in kind for changing conditions on the ground, Sacramento makes up for it by increasing fees and taxes in other areas, and taking on additional public debt.

It’s a hot button topic because there is a benefitted class with a subsidy at stake to lose. The suggestion that the free punch will run out is met with emotional anguish as bets and assumptions have been firmly placed on its continuance.

Of course creative mortgage financing has roots in California. Increasing real debt has been the only way to make up for the imbalances whilst keeping the party going for those that came early and late arrivals alike, but eventually people get tired. This is at the very essence of the skepticism around inflated house prices.

If it is to be the case that “everyone wants to live here” then “I was here first” is only going to last for so long as a palatable justification to the increasing non-entrenched masses for maintaining the status quo.

Good posting Hotel California.

Hotel CA,

“Prop 13 is a subsidy from the young to the old, from the have nots to the haves, from new entrants to the entrenched. Prop 13 has failed to mitigate runaway spending in Sacramento. Prop 13 has created imbalances in the equitable burden of payment for public services. Prop 13 has created distortions in the housing market by providing mechanical incentives and disincentives for the disposition of property. As Prop 13 introduces non-elastic limits which disallow adjustments in kind for changing conditions on the ground, Sacramento makes up for it by increasing fees and taxes in other areas, and taking on additional public debt.”

In the paragraph above replace the words “Prop 13” with “Obamacare” and “Sacramento” with “WA DC” and see if it is correct. In both cases you have wealth redistribution from the middle class to the rich. Obamacare is the most regressive form of taxation and a wealth transfer from the middle class to the insurance companies owned by the banking cabal who put our president in power. It is true that a little bit of that regressive taxation goes to deadbeats but most goes to the Wal Street. It is a tax because that is the ONLY legal leg to stand on according to the SCOTUS (a wobbly leg at best).

The liberal elite when they do this they count on their constituents not being able to understand what they are doing and those who understand don’t vote for them anyway unless they are part of the gang who shares the spoils.

That is a really good argument for single-payer insurance.

For those who don’t want a “government bureaucracy” making these decisions:

Which would you like to have decide whether or not you get a needed treatment: A government bureaucrat who dispassionately looks at the circumstances, or a employee who company makes more money when the treatment is denied?

The very people who criticize Obama care for enriching insurance companies are the same people who fought against a public option that would have gotten insurance companies out of health care. Insurance companies can’t compete with a not for profit entity.

Martin:

“If you’re not part of the solution you’re part of the problem” is typical Left-Wing cant. People who are sooo sure they have all the answers typically don’t think of unintended consequences. That happens with political extremists of all stripes. Putting the genie back into the bottle is tricky and we do have to consider the low end rentals in non-bubble markets when we start taxing landlords. Sure the high end rentals are a big cash cow for long term owners who pay taxes based on what was relatively cheap real estate and charge phenomenal rents to hapless tech workers who need a place to crash. But that doesn’t describe rentals in Bakersfield or Tulare does it?

I pay a little more than half the taxes of my newest neighbors and more than twice the taxes of the few who owned when Prop 13 was passed. I understand the rationale why those people feel that it is fair to have your taxes go up predictably over the years.

Joe R, the Tulare and Bakersfield property values as they relate to Prop 13 subsidies don’t have the same spread differential as they do in Santa Monica or San Jose. A re-assessment to current market rates would not have the same proportional impact. Furthermore, longer held properties have a larger profit margin as a buffer.

Agree that unwinding it could be very disruptive, so we either get it done earlier with a methodical approach or wait until the dam bursts.

Unpredictability is a fact of life and later stage participants are being coerced to indemnify an entrenched minority. It won’t stand.

we just moved out of a house in the bay area. rent went from $3500 to almost $6,000. daughter inherited from her parents – original owners from the 50’s. a real crap shack, minimal, cheapest repairs, fixtures, etc.

the next door neighbor built a new house a few years ago – maybe 5-7 years. Property taxes on his is ~$40,000 a year.

the crap shack we rented paid $1,500. a year.

So much for grandma not getting kicked out of her house….

Why don’t we amend prop 13 to exclude rental properties? Anyone know why rental properties were allowed to be included at the time of prop 13?

Responding to Brian:

Howard Jarvis and Paul Gann were both involved in real estate. Jarvis was at the time employed by the Los Angeles Apartment Owners Association as a lobbyist. It is doubtful that they would have sponsored a measure that didn’t benefit themselves. Prop. 13 also applies to all commercial real estate, which is why so much commercial property in California is on leased land. It is one of the few bright spots in the California tax codes for business. Be careful what you wish for. Repealing Prop. 13 on rental property would send a shock wave through the apartment rental industry in our state, especially in the poor districts of California.

Joe R

You arE part of the problem. Your proclamations of disaster thwart change, which we desperately need.

Amen Brother!

When do we do something about it?

The absolute worst thing about Proposition 13, save all the other wrongs for later, is that increases are capped at an artificially low rate of 2% when inflation has averaged just above 3%. This was the worst giveaway of taxpayer revenue ever. I would even be fine with YOY controls at or above inflation. But below inflation and coupled with the fact that you can inherit this tax subsidy like some sort of royal title is a complete joke and taxpayer rip off. Lower sales tax and phase out 13 over 5 years.

Inflation is 3%? Your U.S. government says that the inflation rate for the United States is 0.0% (unchanged) through the 12 months ended September 2015.

http://www.usinflationcalculator.com/inflation/current-inflation-rates/

Tens of millions of seniors will see no annual cost-of-living adjustment in their Social Security checks in 2016. It is only the third time in 40 years — all of them during the Obama administration — that the Social Security Administration has not increased its payments. The raises are tied to the consumer price index (CPI) which has been flat because of lower gasoline prices.

Seems to me to be futile trying to do much else about it aside from presenting others with this particular point of view. A monster was set in motion and eventual readjustment will likely be painful for the more entrenched property owners. My guess is the state’s financial burden will become so overwhelming that change will come about in a spectacular fashion as the result of a desperate legislative act. It might not be presented as an honest revocation, but rather through an obfuscation. Perhaps even to be decided by the judiciary. However it happens, it’s forthcoming.

Good post Hotel.

Prop 13 is ludicrous and completely unfair. I’m pretty sure all other states base property taxes on the current assessed value of property, how it should be. Anybody who claims Prop 13 doesn’t affect home prices in certain areas simply doesn’t get it or doesn’t want to. Homes will be kept in a family for generations while paying a fraction of their “fair share.” I currently benefit from Prop 13 but would vote to overturn it given a chance.

Hotel: we need to go further back than Prop 13 and question the entire concept of property taxes. Especially when home debtors are on the hook for whatever bonded indebtedness is assigned to them by voters whenever a ballot measure funding a new project comes up. {BTW I love how I was still paying for a Valley police station funding bond long after it was never built or the schools I never put a kid in}.

Targeting a specific group is really punishment for having risked their capital and future earnings on a crap shack just to live in. Property taxes in and of themselves are the same thing.

Would people feel the same way if there was a property tax for the renters on their unit. One could always call it a use tax and be subject to the same bond issue payments as home debtors.

I appreciate your arguments on this, but many here act as if some poor slob that bought a house years ago is some sort of criminal.

Potential buyers are not rich [well proven on this site]. They’re not made of money and yet will fall in line and be saddled with property taxes for the rest of their lives, Prop 13 or no Prop 13.

I suspect most were like me: I bought houses to live in, secure a locked in payment every month rather than be subjected to rent increases and the whims of a landlord every year. I bought to pay it off and have a roof over my head that no one could take from me when I was no longer able to work. Prop 13 was never a consideration.

Maybe that’s old fashioned. But the character assassination on here of people who simply bought a house to live in, to get some sense of security and stayed put is way off base.

We should be questioning the entire concept of property taxes in the first place. I think they’re a much greater distortion on the market than the side effects of Prop 13.

The whole system is screwed up. Prop 13 is just one wart on an ugly hog.

Best to ya, Hotel. Enjoy your posts.

DweezilSFV,

Excellent comment!

There is no point to have property taxes. If there is no income or the income is very small why should someone be kicked out of his house in old age because he doesn’t have the money to pay for those huge promisses made by the government union bosses. His only fault is that he lives under the FED who printed too much money and the house now is “worth” too much. Actually the house is worth less because it is older and most likely poorly maintained because the government sucks all the money through taxation and poor old man or grandma do not have any money left for maintenance.

If someone lived in his house for 40 years and the property taxes are $14,000 and he has a pension of $15,000 why should he be kicked to the curb at his old age. Prop 13 is not the answer – it is a windfall for the rich.

Property taxes should be eliminated because in the best case scenario they are a very REGRESSIVE form of taxation and wealth redistribution. The schools, fire stations and police can be financed by income tax and/or sales tax.

I don’t agree with Prop 13 for the obvious reasons which were explained many times on this forum, but I don’t agree with property taxes in the first place, at the very least for residential areas.

When the day comes when we live in a Utopian society where robots manage our emergency response issues then property taxes could probably be considered something to be removed. Back to reality… not sure what cities could do if they lived completely on sales taxes or fees. No owner could ever be evicted unless from bank foreclosure or something else.

Doc: ‘But those who got in early were too busy protecting their plot of land with local building regulations, zoning restrictions, and things like Prop 13 that basically rewarded those who “got here first†yet provide little economic benefit moving forward.’

Good entry (and one I will have to re-read a few times). All of that for certain. Prop 13 needs to be overturned. It’s such a joke. In a way their must be growing temptation for an even bigger NIMBY to change the rules; Gov authority who want to increase their tax take, and banks who will want to get more debt on all these super high value properties, which others control/own. It’s a wider mad bubble though of global speculation.

The balance of taxation has been shifted. Workers and businesses are picking up the tab via taxes on labour and productivity. This means that many working home-owners and especially renters are already effectively compensating for their own land use and then paying additional tax on top of that to compensate for the land use of unproductive others. (Including those on cushty Prop 13, they awarded themselves as ‘first’ long ago)

________________

Chartered Accountant: I feel very strongly that we need to argue forcefully and without kid gloves against idiocy and ignorance. There is some irony here. People tip up and spout ignorant prejudice about house prices and their $Mad Gainz$, and when you ask them to explain it, not defend it, explain it, it comes back to them being first or their clever ‘$Mad Gainz’ on housing as the justification, or sometimes open season for their ad hominem attacks and plain as the nose on your face bile.

As I’ve stated plainly before, for me, this is the place where destructive idiocy “You can’t go wrong with property/houses”, and “it’s always the right time to buy” (etc) is called out as nonsense.

I am just past forty, the generation coming up behind me are getting crucified by this nonsense and out in the world very few are calling it nonsense. On the internet we get to call it nonsense, armed with evidence and reason, to demonstrate it is nonsense.

Firstly, to my mind, if it is worth posting about, it is worth arguing about, and if it is worth arguing about, then people who post ought to have argument to support their posting. Do we propose a social space where all voices are honored equally, in defiance of their mastery of reason and evidence?

For those of us deprived of homes by the voice of reason tw@ts expecting us to ‘admire’ their housing $Gainz$, or rent from them forever, this is the f**king front line, and I fight, and I give it my best shot.

Doc: And the irony is that some of these residents have “liberal†ideology so long as the ideology keeps people gentrified out of their market. We are “inclusive†so long as it doesn’t include you being my neighbor. It is true and you can simply look at San Francisco as to what is happening to their residents. NIMBYism is a big issue but as of now, the market is being driven by hot Wall Street money, house humping investors, foreign money, and households leveraging every nickel to get into a glorified crap shack.

____________

Change is coming soon in my opinion. Basically it is an increasingly stupid system. It relies on ever fewer people people paying ever higher prices to “get credit into the economy”. Doesn’t that make it an unsustainable system? Stupid may well be, in line with Forrest Gump’s mother’s suggestion, as stupid does, but “If something cannot go on forever, it will stop” – (Herbert Stein).

People are now used to prices moving up so quickly as if this was some law of nature. According to so many smug older owners, a graduate couple can go to LA in 2015 and easily replicate the older owners blistering real-estate material gains if the graduates rolls up their sleeves and spits saliva into the palms of his hands and works hard, despite house price growth that has well outstripped wages for decades after the older owners (Prop 13) initial house purchase. Maybe this graduates just has to work even harder than older owners’ own “Herculean efforts”. How many hours in a week again? 168? OK work that and find a way to double those hours. Should be no problem.

____________

What annoys many young people is that older home-owners and real-estate investors are literally lottery winners. Being given $half million/$2 million+ for nothing via decades of house price inflation, 0.5% and QE, can most definitely be classed as a lottery win.

And are not even cashing it in !!

They also have a belief that they are somehow deserving of it – which is ********.

____________

Many a younger voter is annoyed that they work hard and sacrifice much and yet what little they can save, after excessively high rents born of a captive market, is outpaced by house prices fuelled by speculators who have borrowed in order to gamble on a basic human necessity.

The young are more likely to be on the losing side of this equation than most. What did they think was going to happen?

What exactly did these mega-fortune value older home owners and leveraged landlords/real estate investors think the endgame was?

That younger generations would be forever content to have less and less and less? That no-one would ever get angry to work hard and yet be denied the opportunity to have a secure home of their own? Or did they think that it would never occur to the priced out to vote in their own best interests? Or that politicians would never think to appeal to them?

Yes, Galaxy Brian, couldn’t have stated it better. Younger generations are mad as hell. Every day I wake up with an increased desire to punch smug old home owners in CA who believe their good fortune was deserved.

http://www.reddit.com/r/lostgeneration gives a pretty good picture of how young people feel.

Reddit’s a pretty good discussion site. It even gets quoted in the news (like on the radio) once in a while.

Galaxy,

In your previous posts I think you misunderstood my point.

I don’t encourage anyone to flip property because most of the time they will lose money especially after all the buying and selling cost and caring cost. The amount of risk taken for the most part doesn’t justify the net return.

I would definetely not encourage someone to buy at currrent astronomical prices and I agree with you that prices in highly levareged areas like SoCal are way higher than they should be based on economic fundamentals. The higher the levarage you see in an area the higher the correction will be. That is basicaly stating the obvious. If most homes in an area are paid off, then that area will be relatively stable in a major RE correction (lower percent dcrease).

For those who followed me on this blog, they know that my leaning is to be a bear rather than a bull.

What I was trying to say is how human psychology comes into play in every type of market and that the rich don’t have a monopoly on “greed”. I was also explaining the “fear” factor.

The “fear” and the “greed” factor are the two emotions moving the market. Every human being if they are honest with themselves they can recognize these two emotions coming into play at all times. These two emotions come into play with every single human being regardless if they are poor or rich.

When those rioters in Baltimore were breaking into stores to loot, were they guided by fear or greed? They were taking something they were not entitled to it.

Yes, I exposed myself as being a human being and I always have mixed emotions. Sometimes I buy something because I am afraid of inflation and sometimes I sell because I am afraid of deflation. It is a constant pull back and forth not only in the markets but also in myself. I am just watching the TPTB and try to assess the best course of action based on their moves. When I buy something someone might say that I am greedy although the motivation might be protection of government theft via inflation (another form of taxation without representation).

I know people don’t want to here this but we need a moratorium on new housing starts in California. There are too many people here and not enough water. That’s it. The State should sue Federal Government to pay for new dams and desalinization plants. Why should the Federal Government pay for it? It’s the Federal Government’s job to protect the border. If they are going to allow millions of people to illegally enter the country, then it’s an unfair burden on our State because millions of them choose to settle in our state. We don’t have enough water, period. The Feds need to cough up the money to build new water infrastructure because THEY are the ones who created the problem. Until we take care of the problems that overpopulation has created, there needs to be a moratorium on ALL new housing starts.

Well, finally someone mentions the elephant in the room – overpopulation. I agree – building moratorium in California please!

Ventura County,

The citizens of Texas and AZ were saying the same thing as you do. When they were asking for more federal money to help with the flood of millions of refugees from the south, the liberals were complaining that the red states of TX and AZ are getting more money from the FED than they pay in taxes. Of course, they seem not to notice (on purpose) that they were not the citizens of those states creating a humanitarian crisis but the liberal in DC (White House).

They were not the cowboys from ranches applying for welfare but the future voters the liberals were importing from the south.

On the one hand you have liberals like in Sierra Club screaming about the overpopulation and destruction of natural resources, and on the other hand they vote twice for a liberal who overwhelms the system with millions of illegals who have the highest natality. That is the pinacle of hypocrisy.

I know it is not PC to say it but I gave up on being PC long time ago. I just say what I see – the truth.

There’s plenty of water for the people, even if California’s population doubled.

50% of all our water goes for the environment. 40% for farmers. 10% for the people.

The reason we don’t have more damns and desalination plants is NOT because we can’t afford them. It’s because the enviro-wackos keep blocking attempts to build them. Even if the feds gave us money to build damns and desalination plants, the enviro-wackos would go to court to prevent us from building those damns.

Plus, we don’t need the fed’s money. All we need do is divert the money we already paid for “high speed rail” and use that for the damns.

BTW, we’re dumping fresh water into the Pacific in order to “save” the Delta Smelt fish from “extinction” (although this fish is plentiful in China, according to KFI’s John and Ken Show): http://www.reuters.com/article/2014/03/14/us-usa-california-water-idUSBREA2C1MB20140314

Thank you, enviro-wackos!

Because when you need solid biology news, John & Ken are your go-to guys!

The problem with that suggestion is that the current status quo requires continued “growth” in the form of new entrants. Sure, limit population growth and be prepared for some difficult readjustments in kind. Primarily it would take the form of even higher taxes. Someone has to pay. The entrenched are currently being subsidized by the new entrants.

The water problem is really a failure to plan. We’ve known since the mid 20th century that California was drought-prone and that population would continue to grow. There is one county that met the challenge: Orange County. Lots of reservoirs, extensive infrastructure for watering with re-claimed water and the country’s original Toilet-to-tap system running in Huntington Beach.

Don’t forget the reliance on water pumped into aquifers. Underground storage is extremely cheap and efficient since evaporative loss isn’t a factor. That’s where toilet to tap is stored.

Anyone that thinks Los Angeles has a lack of land is kidding themselves. There are vast areas in Los Angeles county that are industrial and in need of repair. Dilapidated strip malls are prime locations for mixed use condo shopping.

The issue is politics. Someone is not making redevelopment easy. There money is there to buy the homes, demand is strong, so why does is land sit vacant or in disrepair?

Somebody owns that strip mall or that industrial building and are either using it or trying to sell it. Most empty, dilapidated industrials are sitting there because potential buyer/developers who want to change the building’s use/zoning has to present highly-detailed proposals of what they want to the cities. These proposals themselves cost a lot of money and take a lot of time to create. So that piece of land you are eye-balling had better be in a desirable area where what you are proposing makes sense and is going to make you a lot of money.

Industrial specifically is hurting because the manufacturing sector is dying and the information sector doesn’t need that much space. And those pieces of land are not usually attractive living locations. So you see churches and breweries and Crossfits moving into the old industrial parks.

“The issue is politics. Someone is not making redevelopment easy. There money is there to buy the homes, demand is strong, so why does is land sit vacant or in disrepair?”

Sean101,

The answer is easy; constrain the supply and prices go up. That helps both – the politicians for taxing higher property values and the bankers for more security on their assests. Happy bankers contribute more generously to politician’s campaign.

Sean101..It is all about the banks and municipalities how they loan money against their sold products. If they financed a area of 5 miles of large homes avg. $1millon dollars and up than 5 miles away a developer wants to put homes from the $250’s you can be assured he gets turned down. They can’t have so called great buys just a short drive down the road doesn’t work that way for them. they must keep values up and up on 30 year loans and cash buyers who expect the prices to at least hold steady or gain within a few years.

If the folks who can afford such homes get a diet of maybe homes around the corner will devaluate your investment the word gets out and these over priced turkeys will never sell. It is all about the perception that no matter how obscene, a home in a certain zip code will always be worth money because the banks ,local gov’t and never your friend real estate brokerage houses will rigged the game for values to remain very high.

If I owned through inheritance lets say prime acreage with utilities in and paid for many years ago in millions of dollars coastal area and decided I want to help the avg. family buy houses for $500k, how far do you think I will get in my process of building these homes? I probably will have to look under my hood every morning before I start the car up understand, the game is not for the avg. Joe to live nice and a good price, the powers to be don’t care unless you buy in very fringe areas with poor pay in other words. drive to buy?

robert: If I … want to help the avg. family buy houses for $500k, how far do you think I will get in my process of building these homes? I probably will have to look under my hood every morning before I start the car up

Even if you succeeded in selling homes at below-market rates, your plan would fail to help “average families.” Greed is universal. All those “average families” would buy at $500,000, then flip those homes for $1 million within a year.

Besides, how would you select your lucky home buyers? A lotto drawing? You put up houses at way below market rate, and you’ll have a flood of offers.

Imagine if some billionaire bought 20 houses on Malibu beachfront, then sold them at $500,000 each. The problem isn’t that nearby houses would sink in value — it’s that when it came time to resell (or a quick flip), those lucky buyers would sell high.

Prime property will remain expensive, even if a nice guy sells his house at below market rates. His buyer (lotto winner) will see to it.

All the reason why comparable values is a joke when homes have to be built to mirror others around them.

I think another issue causing high prices and low sale inventory is vacation rentals, I.E. AirBnB, etc.

Just did a quick search on AirBnB alone and there are 300+ in San Diego (where I am) and San Francisco shows 300+ rentals.

I’m certain that prior to the internet era, there weren’t this many vacation rental homes.

Prior to the internet, you had to list your rental with an agency, who MAILED out information to prospective renters. Not the most effective. The internet has changed a lot of things and created a lot of sectors that didn’t exist before. Yay internet.

House Price Bubble: It is effectively a longitudinal series for the long boom in asset prices as the financial system stops fulfilling any purpose aside enriching bankers who discuss risk management by saying “You’ll be gone, I’ll be gone”, (h/t John Kay).

https://www.youtube.com/watch?v=1kOAS0yzUIQ

It’s the story of how the financial system failed and how it embedded a ludicrous faith in property in the boomers, leveraged landlords, speculators and flippers.

I can understand “controlled growth”, considering the water situation in California. Our infrastructure has not been expanded or updated to meet the increase in population.

See Chris in OC and my posts above. Water is a political not a technological problem. Orange County proves that. I’ve posted in previous Dr Housing Bubble topics about the long term history of CA rainfall patterns but here it is again for those of you who missed it:

http://ocwatersheds.com/rainrecords/rainfalldata/historic_data

About four or five dry years for every 2 wet years going back over a century.

Here’s the LA data going waaaay back:

http://www.laalmanac.com/weather/we13.htm

Nothing new under the California sun!

Very good analysis, Dr

But urban land markets are complex, and it is not as simple as “potential supply of housing units” ZONED for. They have been through several cycles in the UK now, of “planning” for “increased housing supply”, focusing mainly on upzoning. The results every time have been a dismal failure.

I believe that it is “spare rural land allowed to be built on” that is THE deciding factor about affordability and price stability. If you look at the international data for urban density and affordability, it is obvious that there are some very low density, but affordable cities, and some very high density, unaffordable ones. In fact ALL HIGH density cities are UNaffordable and volatile! ALL the affordable cities (i.e. median multiple of 3) have densities on the low side.

There are “low density unaffordable” cities but every time, there is some kind of growth BOUNDARY as well as the mandates against density. It does not seem to matter what the densities allowed inside the boundary, the housing units will be expensive. The only options are whether they are going to be large-lot, expensive housing, or high density, expensive housing.

There are a few enlightened urban economists who have argued correctly for decades, that “site value is elastic to allowed density” (when there is not the option values of freely-converted rural land).

Going along with this, is the fact that the housing markets within growth boundaries are distorted in the direction that site owners regard their investment as something like gold or bullion and they do not care about actual redevelopment. The rezoning itself, when it happens, makes the site value go up! If they sell, they capture the gain and the redeveloper has to pay this value upfront and carry the risk of much higher costs during the work in progress stage. Hence “supply” ends up falling dramatically short of the expectations of the planners. Typically, the actual supply of new units over a decade under rezoning, might only be 5% of the theoretical “newly-allowed supply”, regardless of the demand pressures. The demand pressures only push the prices up and encourage site owners to “hold” in anticipation of yet more capital gains!

Maybe punitive land taxes, especially on “under-developed sites” would be a solution, but basic political understanding of the subject has not progressed this far yet, even in the UK after 6 decades of urban “planning”! Simply “allowing more sprawl”, as in Flatlands USA, is the only thing that has always worked and continues to do so while it still exists.

Yes, thus you have the mass Inland Empire/Temecula/North San Diego County development of the 2000s.

Costa Mesa is less than 1 mile to Newport and Huntington Beaches. The “Costa Mesa Westside Plan” dictates only SFR or Townhomes to be built within this designated area. So only infill projects that replace “downscale apartment units” get through the developer friendly Planning Commission. And then they are quickly approved by the City Council. There have been over 2200 units approved/ built ( i.e. mostly high-density live/work units) recently in the high $600-900k range to attract mainly “Costa Mesa’s Cool” action sports employees from Hurley, Volcom, RVCA, and it’s working because VANS & Element Skate Co recently moved their corporate offices too. CM has a lot to offer because it’s beach-close with great ocean-breezes, 3 freeways running through it, awesome shopping malls with IKEA, South Coast Plaza, The LAB and Camp, plus 2 In-N Out Burgers, and a brand new Halal Guys…. I guess the secret is out!!!

I agree CM is da bomb. Spent many years there. Being able to hop on my bike and essentially coast down to the Pen was bomb.

But a hell of a lot of people would not be able to live there if their parents hadn’t bought in the 1960s or if those old trailer parks weren’t grandfathered in.

What about those high density “doghouses” out on the Pen? Those would never get approval now.

Or CM’s funky old boat yards. Or a bunch of old stuff that the non-rich use to live in, work out of, and get by.

You want $200 an hour plumbers? Because this is how you get $200 an hour plumbers.

Google: The Boathouse Collective to see how CM Westside has started to change for the better. Also, maybe visit a new website: http://www.iheartcostamesa.com that blogs about the area too.

The storage yards near El Ranchito restaurant are gone now. Three-story townhomes called the Brickyard recently replaced them…just under $700k and up!

The trailer park on the corner of Placentia & 15th St in NB (on CM border) is closing to make way for about eighty $1.3 million dollar homes next year…. just one block south of the habitual carcinogeic-fumes violator “Hixson Metal Finishing” shop!!! Better lawyer-up for future cancer deaths. And, Kobe Bryant just bought the old “Road and Track” magazine building on Monrovia Ave (NB) for $5.8 million for his new “Kobe Inc.HQ”

Also, The controversial “Banning Ranch” project (located in the old oil fields near the Newport Shores canals) was expected to build 1375 homes, and a hotel, but the CA Coastal Commish recently told them to revamp their housing numbers much lower to 1175ish.

BTW, the CM City Council is very developer friendly b/c. both the Mayor & Mayor Pro Tem are both RE developers. And, both of them recently tore their own houses down to build modern-style $2.5 million dollar homes for themselves on the Mesa Verde Golf Course!!!

So they both have a vested interest in slowly transforming the Westside into the “Bestside”

Also, they have been encouraging sketchy motel owners to demolish their crappy buildings & replace them with luxury apartments. The CM Motor Inn on Harbor/Wilson (directly adjacent to the CM Golf Course) is the first to take the City’s density/variances offer. There’s actually another protest tonight at that motel to focus attention on the need for more “affordable housing” (e.g a minimum $80k income required for their newly designated “affordable units” LOL)

Well, I hope I caught you up to speed w/ your old stomping grounds….

BTW unless it’s changed south coast plaza is strictly Meh. Fashion/Fascist Island is where it’s at.

Bet those sk8 companies got perks, like no taxes or something, otherwise why not set up in Anaslime, Garbage Grove, or hell, Ontario, where it’s much cheaper? Yeah I remember the Vans shop a short walk from where I lived, and I just bought a pair of Vans (made in Viet Nam) that I have to break in, but does anyone care if their HQ is in Chino or somewhere? Perks. It’s gotta be about the perks.

You want to see a horror, visit downtown Huntington Beach. It’s become a Disney theme park, where tourists from the Midwest stare in astonishment at the Surfer statue…. OMG he’s got no shorts! And a cop every 100 yards. It used to be a town of old oil worker shacks, repurposed banks, and funky coffee shops with acoustic jams. The yups applied the scorched-earth policy to Wimpi’s and I will never forgive them.

Huh, I always thought it was Anacrime, not Anaslime. Guess I was wrong. Oh, and is it still Stabba Ana? 🙂

The peninsula is NOT built out. Not even close. Drive up the 280 instead of the 101 from San Jose to San Francisco and you will see miles and miles of completely open land. The good Doctor wrote a piece on the crazy land use policies 10 or more years ago (he briefly summarizes them in this post) and how so much land can’t be built on, can’t be used. It’s nice to have all this wonderful pastoral land to hike on and look at I guess. There are probably snail darters or geckos that are grateful, but by and large the government has locked up land with regulations and outright purchase or confiscation. Fully 50% of this state is owned by the federal government. Most of it inland but a fair amount on the coast. That makes it crazy to try and accommodate residents as we grow. The birthrate in California resembles Europe with insufficient numbers to maintain the population but the incredible influx of Latin migrants is completely blowing out that number. We don’t have sufficient housing, we’re not adding enough and if you find land to built or expand on the restrictions, permits and NIMBY neighbours will make it nearly impossible. In the 60’s and 70’s you could buy a nice house for close to your annual salary. Today it’s more like 10x and it’s getting worse. We are competing with Singapore, Hong Kong and London and look like a good deal with nicer weather. It’s not going to get appreciably better.

Don’t go crazy but buy what you can afford, take in roommates and live on Mac ‘n Cheese until your situation improves. Don’t overextend and hunker down. If you can’t stand it Dallas is actually a pretty nice city even if the weather and diversity isn’t perfect.

My neighborhood of south Torrance/south Redondo Beach is at a development standstill like most of the beach cities. Zoning to allow 2-on-a-lots in one south Torrance neighborhood was quietly revoked last year because the local schools are full. People don’t want the San Franciso-ization of infilling more and more densely – yes NIMBY. Traffic looks to have doubled in the last 20 years – in my eye. Infrastructure is hard to keep up with – old water mains are busting right and left (http://www.dailybreeze.com/environment-and-nature/20140806/torrance-hit-with-three-water-main-breaks-in-one-day), the street cracks are filled with tar, then slurry-covered, which doesn’t last long. Etc.

No new apartment buildings have been built in many years. The numbers? Torrance population is about 150,000 and grows to about 500,000 during the week with in-bound commuters working here. That’s a lot of people who live in Carson, Gardena, Long Beach, Lakewood, and beyond who ostensibly would like to live here because the schools are better and it’s safe. Those good schools again – attracts all the families, even if they have to rent whatever they can find to get their kids in to a Torrance or Redondo Beach school.

Developers are wrangling locals for years at every corner, trying to get permission to build their attached townhome/retail/”mixed-use” projects, and tearing down real crapshacks to put up 2-and-3-on-a-lots (mostly 90278 where it is zoned). See the current 2015 list for RB here: (http://www.redondo.org/civica/filebank/blobdload.asp?BlobID=29673)

North Redondo Beach (90278) was destroyed by zoning that allows 2 and 3-on-a-lots – no street parking, no lawns, no greenery, not many parks. It’s gross and no one in South Redondo or Torrance wants that to happen to their town. NIMBY for sure.

I don’t see much changing in the future. The NIMBY’s fighting for the fabric of their neighborhoods, tooth-and-nail. And I don’t see that as a problem. The alternative of building more and more densely-packed multi-family housing is just too awful to consider.

Keep your houses!

“And the irony is that some of these residents have “liberal†ideology so long as the ideology keeps people gentrified out of their market. We are “inclusive†so long as it doesn’t include you being my neighbor. ”

Doc, no wonder you put this statement at the end. It is a perfect conclusion for “liberal” ideology.

The liberals in Washington DC, this year were accusing those citizens in Murrieta, CA of racism for not wanting to be overwhelmed with immigrants, but none of them would want to see them on their lawns in their cities. Same like Germany with the flood of immigrants; they were accusing the Greeks of racism for not accepting more immigrants and refugees till their backyard was invaded. Now they act the same.

Please stop it with “the liberals”; it’s getting absurd. We get it, you don’t like “liberals” – what ever that means.

Doc: The coastal communities are in significant need of housing units. When we say coastal we mean 15 to even 25 miles inland and not beach front Malibu. And it would be rather simple by adding high density housing. Look at a place like New York. But people want an anti-drought prone yard and grand-fathered in tax rates from the Carter administration while younger families are hammered on rents and mortgage payments on inflated homes. Increasingly, many of those able to buy are foreigners so they crowd out regular buyers on the already low amount of units available.

There are so many conflicts, vested-interests and malinvestments (including too few sellers selling at very high values for selfish gains, for imo they expect even higher gains) that you’d need to network a few super-computers to process them all, to get very clear answer. There is hidden order in chaos, but you need super-computers to see it.

I accept the need for significant number of new housing units (in that area), and the explanations of why there is resistance to it (including Nimby-ism). Also despite being a non-owner, I do have some sensitivity to those owners/councils who are concerned with certain types of new building structure changing the dynamic of an area.

However I suspect there is much by way of unproductive use real estate, including homes with empty bedrooms. And some of these crap shacks just need tearing down and smart modern housing built in its place (perhaps not over-doing it for density), but which enhances the cultural vibe. Whilst house prices are out of whack with earnings that is not in and of itself evidence that there is unmet demand for housing. As always with a question that might be considered an economic question there are so many interlinked parts that an observation of a correlation is just another puzzle.

I also come back to some of your other entries Doc. Things change and change again. I don’t fully know the answers, other than things will be different, and cause a shake out, if and when the next recession hits. And everything is connected to everything else, with trigger points being possible slow down and repatriation of investment (including in real estate) from those in other nations, or fewer visitors / holidaymakers, or many such risks. Such events may show the demand/need for housing is not quite as clear as it appears to be at the moment. It’s a price thing for the moment; such high prices. Surely some developers would love to build if the land prices stacked up, and confidence in enough mortgage applicants seeking to buy – but it appears a significant risk at the moment.

_____

Doc: You would think with low interest rates that the public would be at it in terms of mortgage applications but they are not: [..]Mortgage applications remain at levels last seen back in 2000. In other words, people are not applying for mortgages needed to buy homes. Sales remain weak because the public is shut out of this game. […]Why are builders not out building homes in this hot market? Newer homes typically go to your more traditional buying crowd and carry a premium, a premium that many income constrained households just cannot pay. That is very clear. What we have is a lack of affordable housing based on current financial conditions of US households. The market is largely manipulated and we all know this.

17 Jun, 2014 http://www.doctorhousingbubble.com/cash-buying-real-estate-who-needs-a-mortgage-application/

_____

Doc: Beyond the coast, California has plenty of land to build but we see building permits at near all-time lows. Is California built out? […]The difference between the massive run-up in price from 2013 versus say that which occurred in 2005, 2006, and 2007 is that builders are betting on this price rise as an anomaly. For example during the boom days we were seeing privately owned housing start permits hitting a range of 12,000 to 14,000 as measured by the US Department of Commerce. Today it is near the 3,000 range. This is a big difference. […]Privately owned housing starts have fallen 78 percent since 2005. Are we not adding more people? Didn’t home prices surge by 20 to 30 percent in California in various markets? The problem with the current boom is that it is based on manipulated supply, artificially low rates, and massive demand from investors. Take one or two of these items away and the market slows down. […The problem with having a boom and bust market in California is that it forces a winner versus loser situation on families merely looking for homes. Instead of having housing as a small part of the economy and focusing on more important job creating sectors in places like California, housing has become the modern day gold rush. People try to get rich quick and see real estate as the perfect vehicle.

31 Jan, 2014 http://www.doctorhousingbubble.com/california-home-builders-building-out-california-real-estate/

Wow, I thought Orange County was bad. I tried looking for a place in Cerritos, CA and they are MORE than some of the places I looked in Garbage Grove.

It’s the schools.

Cypress has the Number 1 HS in the state and Cerritos has Number 4, hence all the Koreans and the higher housing prices. (Because you know – top HS = more chance of getting into Harvard…)

“Because you know – top HS = more chance of getting into Harvard…â€

I would love for my kid to get into Harvard one day. However, an additional important aspect of school (to me anyway) is not having to attend with gang members, low-IQ people of all types, non-English speakers, etc. Therefore, if you have a kid(s) and you care about him/her, it is generally necessary to select a home in a good school district. Those homes are more expensive unfortunately, as others have mentioned. Just one of the many costs associated with having kids.

While everyone is worried about who is in their backyard – prices rose another 5% YOY. From LAT a few days ago….

————————————————

….Solid sales pushed up U.S. home prices at a steady pace in August from a year earlier, a sign that the housing market is improving despite a slowdown in the overall economy.

The Standard & Poor’s/Case-Shiller 20-city home price index rose 5.1% in the 12 months ending in August, That’s up from a 4.9% pace in July.

Home prices have risen at a 5% pace for most of this year, which economists see as more sustainable than last year’s double-digit gains. Three years of solid hiring and historically low mortgage rates have enabled more Americans to buy homes. That’s lifted sales of existing homes nearly 9% in the past year.

San Francisco and Denver both reported annual price gains of 10.7%, the largest of any city. Portland, Oregon’s annual gain of 9.4% was the third largest.

On a month-over-month basis, the 20-city price index climbed 0.4% in August from July. Eighteen of 20 cities said prices increased. Prices slipped 0.1% in San Francisco.

Sales of existing homes jumped 4.7% in September to a seasonally adjusted annual rate of 5.55 million. That’s a reassuring sign that the housing sector has so far been insulated from weaker growth overseas that is slowing growth in the U.S. manufacturing and energy sectors.

Yet overall the housing market’s health is mixed. New home sales plunged in September to their lowest level since November 2014 and remain far below their long-run average.

The construction of new homes rose at a healthy pace in September and is up 12% so far this year compared with 2014. But the bulk of the growth has been fueled by condominiums and apartment buildings. Single-family home construction was flat in September.

That reflects a greater preference for renting rather than home-buying since the Great Recession, which has pushed the percentage of Americans who own homes to a 48-year low of 63.4%.

More single-family home building is needed to boost overall supplies, hold down price gains and give potential buyers more choices.

The number of existing homes for sales has fallen 3.1% in the past 12 months. In September, the number of available homes was equal to just 4.8 months’ of sales, below the six months that is typical of a balanced market.

——————————————————-

if the avg household income in Garden Grove is 65k, how are people affording these $550k run downed shacks that require an additional $100k in renovations to get it move in ready?

What’s the secret? Because I’ve been rejected for a mortgage twice. I’m self-employed and my reported earnings are 55k after deductions.

So far, I barely qualify for a $200k loan….. Unless I pick up a co-signer…….

While some are busy paying attention to trailing house price data – leading indicators continue to mount.

Mobile home flips. I recall this as being one of the features that marked the top of the previous SoCal housing bubble around 2005.

https://www.redfin.com/CA/Redondo-Beach/2345-190th-St-90278/unit-56/home/57007371

HC – that’s pretty funny. Notice the black Mercedes G SUV in the front? Those start at $115k. I suppose it may be the realtor’s rather than the owner’s, but it’s still funny.

There a Mercedes G500 parked what I guess could be called a driveway? I would hope that’s the photographers car.

Land lease $650/month. For now.

When did California housing detach from nationwide trends?

Look, when it became the place to be and be seen. Many year ago we couldn’t sell a BMW, then all of sudden ( basically same design’s, same dash, and interiors) they were the must have car, today still enough buyers who want one in their life and prices that have increased ten fold, doesn’t matter to them, even though it is mainstream now to own one with leasing?

So that in mind when will CA. began a steady fall, with so many people in the world about 7 billion and the 3% who can afford such living which means upwards of 21 million ( about 1% of those folks 2 million actually will consider CA.) they think CA. is the place to be, there is enough to support the crazy prices for many a year.

I believe the derailment of such insane pricing in NY city and CA. will be the financial collapse of Wall street for NY, and a catastrophic EQ for CA. which nobody should wish for.

3% of 7B is 210M, but who’s counting… still, that probably only strengthens your point.

Thanks apolitical scientist…210 million probably couldn’t comprehend the number, but most likely my math especially was poor. Hence, playing sports in school we had many a tutors which meant missing classes and paid the price as my English teacher express to me on many occasions, the teachers were more than right, you can’t cheat book learning, the easy way out always haunts you ?

It’s simply an opinion of “when” regarding the assertion about a “place to be and be seen” but what is historically factual is that Prop 13 was approved in 1978 and rolled back beginning assessments to 1976 values with negative real annual caps, just in time for the 1980 disconnect.

Hollywood among others were promoting this place “to be and be seen” long before 1980, along with the weather and beaches.

“3% who can afford such living which means upwards of 21 million”

Define “afford.”

define afford?…Well the 3% has a worth of over 10 million, which means show us houses up to $5m. Don’t know what you are saying Hotel, if you are not in the 10% of worth than you can look at all the houses you want and dream, for the most part in better to top zip codes in CA. you can’t “afford” to buy.

There are plenty of nice homes in the Inland Empire, parts of Ventura County, fringe locations of LA county afforable by CA. standards. But you know the locations that are off limits has been that way forever, a home on the coast for $4m is not going down to 999k?

I don’t know, Robert, I found the post to read in a confusing way and after re-reading I’m still not exactly sure what it is putting forth.

I just think it’s extremely abstract to claim an affordability factor for a cohort of 21 million potential buyers on the basis of income rank alone as “afford” means different things to different people.

Yes, you can live in Bubbaville for a lot less. If you are a philistine you can live in the less expensive areas such as Fontana or Kentucky. But in The City here, you either pay the freight or you are our of here, as I tell my tenants.

Regarding hypocrisy, everybody is a hypocrite, but not everybody is self aware to see themselves. When it comes to money, I am like a Republican , but I still speak like a Marin county liberal to fit in.

Just because one dislikes your art or your hippy culture doesn’t make them a philistine. Everyone has their own interests; they are not an automatic philistine based on the offense of not liking what you like.

As for “you can live in Bubbaville for a lot less†and “in the city here, you either pay the freight or you are our (sic) of here…â€: No shit, Sherlock! In other news, grass is green.

I’ve always found it funny that Bay Aryans spend a lot of time/energy talking about how much they hate SoCal, but folks down here rarely even think about NoCal. Must be because we’re such ignorant philistines.

Jerry Garcia, the demigod of Bay Area Hippie culture, started out as a banjo player wit a yen for Bluegrass. I guess he couldn’t cut it as a Bluegrass player so he did that awful Jam Band music the Bay Area loves to death. When he got older and famous he played Bluegrass with big name Bluegrassers. Some were Hippies like him and some maybe not. Dave Grisman is a Bay Area Hippie mandolin player and Ricky Scaggs is a Kentucky Christian Conservative mandolin player, but both are pretty hot players, so where’s the culture vs Philistine? By the way, Bluegrass comes from KY not SF!

Hi Ira… Fontana or Kentucky or maybe Syria? Look, most people on sites like these are just asking the Why not question. They want a nice house, affordable price in a location that the standard feature isn’t a land line to 911.

Of course you can find to live cheaper most likely not better or safe. The land is endless in places like CA., you drive and wonder, can’t they build houses for the majority of folks who don’t want to leave, a nice stake not a Mc Mansion, nicely built, and the why not comes into it, it doesn’t look like it Ira, two class system makes the natives restless in a country this rich and wasteful at the same time. Fontana or Kentucky, if that is what a person wants fine,but give them more choices than that okay. take care

After watching home values in SoCal beach communities rise in price from 5 to 7 times since the late 1990s, the only thing dumber than not owning a beach close home is not owning two beach close homes in SoCal.

Because there’s nothing smarter than being house poor to the power of two.

Third-quarThe economic recovery is helping fuel a new population boom in Florida and in turn is putting new pressures on the inventory of single-family homes available for rent in the state’s southwestern communities. According to the Fort Myers News-Press, rent on an average single-family home in the region is now around $1,540, or up nearly $300 from a year earlier.

ter rent increase: 23.6%

Third-quarter rent increase: 14%

The economic recovery is helping fuel a new population boom in Florida and in turn is putting new pressures on the inventory of single-family homes available for rent in the state’s southwestern communities. According to the Fort Myers News-Press, rent on an average single-family home in the region is now around $1,540, or up nearly $300 from a year earlier.

Oil prices may be down on global markets, but the energy sector is still strong in North Texas. The region also has growing medical, financial and technology businesses, which bring even more job-hunters into the region.

Florida and Texas are jumping too. A lower based but since they are cheaper they will catched up in 10 to 15 years.

I see that a lot of luxury condos and apartments are being built in Downtown LA and now even a proposed mega project in Historic South Central. Where are this people coming from? If there any “white flight” or “wealthy flight” city? I know of a couple of people saying that the inland empire is not as rich anymore? I do see a lot of out of state plates in cars in downtown and Echo Park, from Teneese to New York. South LA still seems affordable. Traffic seems to be getting worse by the years. So moving closer to your work place makes sense. I know LAX has a high minimum wage, so does a lot of good paying jobs in the West LA, Long Beach, Downtown LA and Rancho Dominguez/Carson area.

@SouthCalifornia. I have lived in LA my whole life and am astonished at the development in DTLA over the past decade. I recall DownTown News wrote an article many years back stating that approximo 3,000 people per year are moving INTO DTLA. Lately, I have watched as my wife’s daughter and her recent college-grad friends want to live in DTLA. These are college grads who are making $50K – $70K per year and dont mind spending $1500 – $2000 per month on rent in DTLA.

Perhaps we are seriously underestimating how many well paying jobs are cropping up in DTLA and more hi-rise office towers being built.

There are over 90 developments slated for DownTown LA these days….

http://www.ladowntownnews.com/development/downtown-development-updates-on-projects/article_6886af8a-fb4a-11e4-80e3-f76f86390038.html

I would not say there is any ‘flight’ from anywhere but over 3million kids graduate college every year in US

http://www.ask.com/education/many-people-graduate-college-year-8b0ccf821050d39e

It only takes a small percentage of well paid college grads to contribute to the 3,000 people per year moving into downtown LA statistic.

Another interesting article on the boom of residential developments for DTLA

http://www.ladowntownnews.com/news/the-rising-price-of-downtown-living/article_916184de-e54c-11e4-be4e-a766501fbe40.html

It will be many, many years if ever for S. LA to gentrify. There are too many people there entrenched in their crapshacks and low-income subsidized housing. The old timers who have accumulated equity can’t afford to sell and buy anything else, most have no interest in moving anyway. There is a general lack care and pride taken in S. LA neighborhoods. I personally know someone sitting on 400k+ in equity who treats their homes like garbage and it shows. Most of these S. LA residents have little if any knowledge of the real estate market nor do they care. Unfortunately many S. LA residents are more then content living in poorly maintained and poorly served communities.

@Hunan – I dont think he meant the actual South LA… there are major developments in the South part of DownTown LA, called SouthPark

http://www.ladowntownnews.com/news/south-park-bid-earns-international-award/article_ca682f20-743b-11e5-b53d-fb9d4163ba8b.html

These are the areas that were once a no mans land of development between roughly Olympic Blvd and the 10 freeway. Old warehouses and skidrow apartment buildings are slated for new developments.

There are a couple of developments for South LA but like you say it would probably be decades before they would be considered nice places to live. One development is USC’s Biotech Corridor right in the heart of South LA.

https://news.usc.edu/76533/usc-summit-marks-rebirth-of-biotech-era-in-los-angeles/

Doc, this post is spot on, as usual.

I moved here three years ago to work in the Maritime industry as an engineer. I do well for myself, making close to 100k with a great job and benefits. I’m early 30s, single, and have been looking to “settle down” into a nice house and take the next step in my life for some time (not that I’ve had any luck with San Diego dating scene, but that is a different story). I travel often for work, and I have reached the conclusion that the American dream is dead for me here in California and I think most of my generation has also reached that same conclusion. There is no way, despite making around 100k annually, that I would ever consider buying a home costing upwards of 400k+, even using my VA benefits I still wouldn’t do it. A bad purchase is a bad purchase is a bad purchase and cost is EVERYTHING.