Velocity of home price increases and leverage for Los Angeles and surrounding markets – Where are the California Real Estate Agents?

One of the best measures we currently have for tracking real home price changes is the Case Shiller Index. The reason this measure is one of the best is that it examines real changes on repeat home sales. So you are really measuring the real price change for the same property, or as close to it as you can. The median price can show massive price movements down or up given what period of a boom or bust we are in. The median price is useful in more stable housing markets but for over a decade we have had anything but that. It is important to understand the difference in these measures because we are now seeing a large usage of the median home price in the press and this in turn creates a self-fulfilling prophecy. The same can be said when bubbles burst. I want to explore the Case Shiller closer for the Los Angeles market over the last few decades to track these changes and spot where we are in the current cycle.

Case Shiller Los Angeles

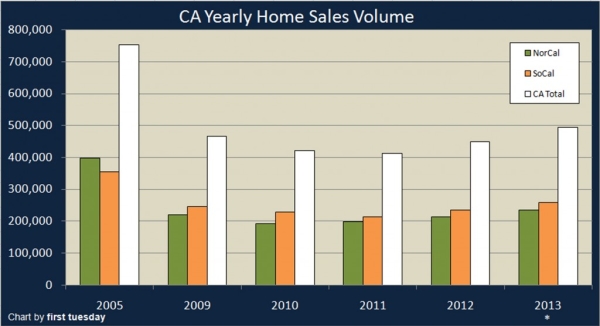

I wanted to map out the Case Shiller changes for Los Angeles on an annual basis. What is fascinating is that in the late 1980s and early 1990s, Los Angeles had a big boom and bust as well. In regards to an actual percent increase, we nearly approached the same peak as we did this time but the fall was much softer. Take a look at some of the peaks and valleys going back to 1987:

The dip in the 1990s was modest partly because real household incomes were still going up and we also had a solid boom in the technology sector. This made up for some major cutbacks in the aerospace industry. You can also see the larger 2000 peak and this was much more pronounced because it came on the back of already higher prices which started in the mid-1990s. So these annual gains were much more significant since they compounded.

Looking at the blue line above, home prices for the Los Angeles region are now back to levels last seen in 2003. However a larger part of the recent increase has to do with very limited inventory, some of the lowest we have seen in over a decade coupled with very low interest rates. Take a look at this chart examining what kind of leverage has been added to the typical buyer:

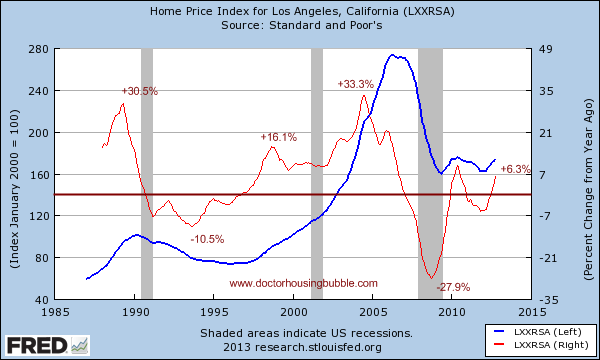

Back in the early 1990s the 30 year fixed rate mortgage hovered close to 9 percent. At that level, a buyer with an average income was able to afford closer to $110,000 to $120,000 in a mortgage. Today, we are inching closer to $228,000 with rates in the low 3 percent range. We discussed this in a previous post showing that Japan in spite of low rates has seen zero real growth in real estate values for nearly 30 years.

What is interesting about the chart above is what happens in a few years. You see what happens once rates begin to move up in 2015 as many are predicting. At this point, even a slight movement up will disrupt the market (i.e., if rates go from 3 to 6 percent). The amount people can take on decreases with the proportionate rise of interest rates. So right now, even more modest predictions do not see rates dipping much further from here and subsequently, in a couple of years, rates are very likely to go up.

With housing booming, where are the good paying jobs?

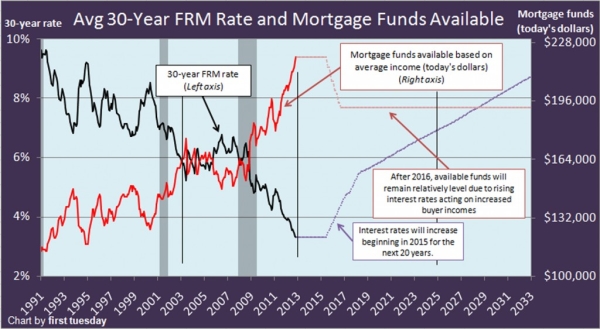

Even with the 2012 boom in home prices in California and other parts of the country, one area that is not seeing job growth is with real estate agents:

We have the same number of active real estate agent licenses as we did back in 2003. As many of you know, this is a feast or famine profession. You have probably 20 percent of agents taking on the lion’s share of sales volume. Many people have a license but never actively participate. Many have only a handful of sales each year. But this decline is sizable. From about 270,000 or so down to 180,000 today.

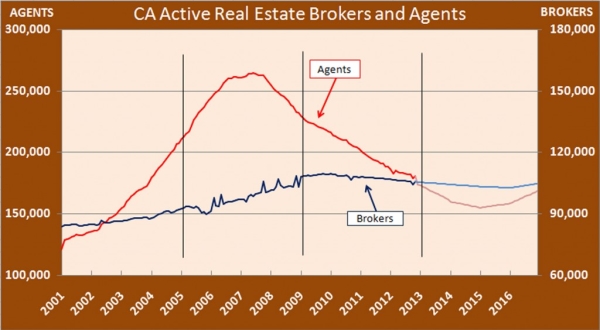

What is interesting about this current part of the cycle is that a larger portion of the money is being made by investors and flippers. Sales volume is the name of the game for real estate agents. You make money when you buy and sell. If we look at actual sales volume, we can understand why this trend is occurring:

While home sale volume is high relative to say 2007 or 2008, we are far below a peak year like we saw in 2005. In 2005 we were approaching 800,000 sale transactions in California. Last year, it was around 430,000.

Are we on a sustainable path in terms of seeing prices increase? Hard to say. We probably have a bit more gas in the low interest rate gas tank and with low inventory on the market, those that want to buy have to compete with hedge funds, flippers, FHA insured loan buyers, and your regular family trying to buy. The interesting thing is that psychology is very much in mania mode. Like in the 2000s, a good number of people knew we were in a bubble but after seeing the gains in the market, many decided they were going to jump contrary to understanding the numbers. Today, many understand that low rates are artificial, incomes are not going up, and a big part of the low inventory is based on how the banks are processing and leaking out distressed properties. Understanding and action are always two different things however. We don’t need to dig into the archives of housing history to understand that.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

99 Responses to “Velocity of home price increases and leverage for Los Angeles and surrounding markets – Where are the California Real Estate Agents?”

Sure looks like a manipulated bounce. The key is future mortgage rates because the inventory is going to stay low for a long time.

But who thinks rents are going down anytime soon? So, even if you buy now at rent parity and rates go up, you will still be paying a rent equivalent but payments will be towards ownership rather than just rent payments. Bottom line, everyone needs a place to live.

“But who thinks rents are going down anytime soon?”

What is this supposed to infer? Define anytime soon.

Who cares about rent parity today if tomorrow you’re forced to sell and take a haircut.

This whole “everyone needs a place to live” line is getting stale. We already know that x comes before y. It also comes before z.

It’s logic…If you accept the premise that one either rents or pays a mortgage in order to have shelter. If the monthly price is the same, then would one rather being paying off a mortgage towards ownership or paying for a place to live, month-to-month?

If one cannot make this monthly payment, then they will be out of shelter either way.

You’re missing the point, CAE. No one is arguing that it’s a lesser choice to build equity in a true parity scenario. In order to make an honest financial analysis, one must consider aggregate cost in both cases over a longer term.

In other words, it’s not as simple as you make it out to be.

Of course, hindsight is 20/20, so the best we can do is to discover and work with the information available today in order to project potential scenarios. That’s why I read this blog.

Again, we already know this. The point is that we’re analyzing information that goes beyond that.

You didn’t answer the question on where rents are headed nor did you address the possibility of equity gains being negated when selling.

Joe, you have to understand the latest and greatest manipulative tactics that the REIC is now using in their comments on bubble blogs. Here is the method.

1. Start with a seemingly “bearish” statement but give yourself it a “who knows what will happen” out. This will give yourself a non committal appearance of legitimacy. It is usually along the lines of “If interest rates rise, who knows what will happen”

2. End with statements that will instill fear and doubt into those still sitting on the sidelines such as CAE’s comment of “Who thinks rents will be going down any time soon”, and the old rent parity trick.

3. Use lots of half truths and come across in a much more sly (with kid gloves) manner than the Realturds of the past (2005-2007)

“But who thinks rents are going down anytime soon?”

Me.

It’s simple logic: Big investors have bought millions of houses and they are not going to sit on them: They are put out as rentals or sold for profit and either of those will happen in two years: There’s a running cost all of the time and the price won’t climb faster than running costs cumulate, while capital just sits. That’s eventually unacceptable.

By your logic these houses have vanished permanently from the market ( limiting the supply, thus raising the rents), but that’s quite far from the truth: Speculators can’t afford to wait forever, they are not banks.

Ya mean speculators like “speculate”?

Who knew. It’s simply amazing that so many, so quickly buy into a ‘hot money” phenomenon continuing permanently.

Thomas

You are absolutely correct. Investors don’t change the inventory they just shift it from

a rental. Miami is swarming with investors. From hedge funds to the Colombian maid I just sold my condo to. There are 3 unrented investor condos in the building I just moved out of. Each month takese a big hit out of their supposed easy ROI.

Many of these investors will soon learn its mot so easy to be Donald Trump and cash out.

I believe that Clear as Mud has outed you effectively – either respond to the follow – up questions or admit the obvious.

ClearAsMud,

Thank you for the insight. What you posted makes perfect sense and I should have known better.

Your handle is very fitting!

Haven’t people been saying interest rates are going to go up for four or five years now? Why do you think they will go up in 2015?

Do you have some examples of recurring proclamations for increasing rates over the past four or five years?

My recollection is that it’s only been a more recent trend in the blogosphere and independent journalism realm.

You are so correct in questioning this. Becareful of people who make future predictions.

Gael is implying a future prediction in the premise of his question. You’re right, we should be careful of those who make predictions.

Didn’t the fed hint that they may stop buying on the open market as soon as this year’s end and not 2015?

For investors locked in at the low interest rate, they’ve set up a business with steady rents and a positive positive cash flow income.

When interest rates go up, the investor already locked in his costs, so there is little pressure to sell the income producing asset.

Inventory is likely to remain low for the foreseeable future.

Unless rents go down.

Having owned and rented out my former place for a few years (and not by choice), let me tell you that the maintenance costs of keeping up a rental can rapidly eat away at whatever profits you may be counting on. Couple that reality with the fact that other related taxes (i.e. property, sewer, water, etc.) never go down but only go up over time, and landlords often find themselves in deep crapola unless rents keep on an upward trajectory. Simply put, there is only one fixed cost you can count on – all of the others are purely guesstimates. BTW, you better live nearby your rental unit and be fairly handy with home repairs, or look out below when those costs come into play.

well said…better know how to fix it?

On a separate note, the chart of LA Case Schiller prices need to be indexed against inflation. That will give a more accurate view of how reasonable current prices are.

Once indexed for inflation, it will show current LA home prices are a bit on the high side, but within reasonable levels.

You must be only considering price inflation. In terms of the average Joes’ wages, what sort of price to income ratio would you define as reasonable?

Last time I checked, wage inflation has been stagnant and most of us just had our payroll taxes increased.

Based on government statistics (ECI), wage has been growing.

http://www.bls.gov/web/eci/echistrynaics.pdf

If you want to get less technical, the average Joe is not expected to buy a house, so don’t use them as a basis for home purchase argument. The people who buy homes are either wealthier people who can afford the asset amortization payments, or disciplined people who can manage their finances. That excludes a lot of people in the United States. Those excluded, good or bad, will have to rent.

To answer your question though, in my personal opinion, the price to income ratio should be between 3 x to 5 x income, depending on various factors like interest rates, government intervention, upward mobility, home price trajectory etc …

Lastly, if you’re worried about the tax increase affecting your ability to buy a home, you fall into the category of ‘shouldn’t buy a home’. The tax increase is tiny, relative to the annual amortization payment for a home. If that tiny tax change affects you significantly, then you’re a high risk default candidate. For your own financial good, you are better off just renting.

It’s not wage inflation, aka, price deflation that’s the problem, it’s price inflation, or, more accurately, price rigging that is the problem. The price inflationary forces that are at work are not some systemic effect beyond that the players are part of the system. Hedge funds being pumped full of money that was provided to them at negative real interest rates from the coffers of tax payers, to buy up real estate that is artificially being held from the market and buy up rental units that are pushing their prices up exponentially beyond any imagined amount of wage increases on properties that are sheer extractive profit; are ruining the economy. More accurately, they are setting up the next house of cards, although it is now not a house made of cards, but more like a house of razor blades. They will fall, and when they fall they will cut and slice and we will all bleed and there will be unimmaginable suffering as we have to walk through the rubble of razor-blades left behind by the ponzi-scheme that the wealthy run called the United States of Scam.

Pug, I do appreciate your response but it’s rather uninteresting to split hairs over the definition of the average Joe.

“Lastly, if you’re worried about the tax increase affecting your ability to buy a home, you fall into the category of ‘shouldn’t buy a home’. The tax increase is tiny, relative to the annual amortization payment for a home. If that tiny tax change affects you significantly, then you’re a high risk default candidate. For your own financial good, you are better off just renting.”

I suppose the same argument could be made for someone worried about inflation.

@ joe,

I’m not worried about inflation. My comment on inflation was that the LA price changes need to be indexed against inflation. Once you do that, it will show the LA home market prices are within reason (a bit high, but very much within reason). Factor in declining interest rates, people who purchase now are getting a pretty good deal (relative to history).

You can independently verify that with PITI calculations using historical interest rates, home prices and index it against wage inflation.

Doc, it’s great to see that you’ve been really hitting the trail on the postings the past few months.

I might vary slightly on some of your conclusions but the points raised are of profound importance to critical thinkers.

A lot of what drives markets are physiological in nature but we can still gleam useful correlations that tend to repeat over time. I could be wrong but it seems to me that the general public is still a bit cynical about housing. That last downturn was very severe in scope and it appears that we’re still in some stage of the same cycle.

I get a kick out of the folks who try so hard to justify what most instinctively feel doesn’t make sense. You can take the volume of something and divide it up in to many pieces and shuffle it around every which way from Sunday, but at the end of the day, you still have the same volume of that thing in existence.

The actors in control want us to throw in the towel and leverage up. My personal view is that leverage is fine as long as you’re able to dispose of levered assets at any point in time. I’d bet that most low-down buyers today would be up a creek if some major life event comes up tomorrow and they have to sell.

Is having a loan versus a rent payment really worth that risk? This is where you’ll find the dividing line between the rational and the emotional players.

Joe … where is your analysis? I just see a lot of talk and criticism. It’s easy to throw peanuts from the peanut gallery.

Make a specific bearish statement about the housing market, and I’ll show you analysis (or show you how you can analyze yourself), based on public data, that will dispute your bearish comments.

That’s a direct challenge to your all talk with unseen ‘critical thinker’ analysis.

I won’t get into the realm of making predictions because I believe that the only real predictor is what plays out over time. The best I can do for myself is to use historical data to make educated guesses about the future.

Where are the agents? That’s easy!!! In prison. See Mortgagefraudblog.com, mortgagefraudblogger and many more.

I don’t think mortgage rates are ever going up. Only possibly down. Inventory is low (and will stay that way) and prices are going up, throw in higher interest rates and that would be checkmate. The whole economy would collapse. No one would have any confidence in housing after two collapses. Never going to happen.

Care to let us in on where to get that crystal ball?

My crystal ball is called common sense. You should have been around me in 2005 when I was telling everybody that housing was going to colapse.

The FED has come out and stated this many times. In fact, they have pushed interest rates to nearly 200 year lows. I think now is a great time to buy, but there is plenty of time.

Tricia, it would be interesting if you could provide proof of your claims of prior warnings about the housing implosion (why you felt the need to even mention that is telling). As for your assertion that there will never be another one, the bottom line is that Math doesn’t care about your feelings or has any empathy for individuals, it always comes calling at the end of the day, because Math is relentless – and those who refuse to learn from history are doomed to repeat it.

By 2016, the national debt will be at least $20 trillion. If interest rates start going up to tame high inflation, payments on the interest on the national debt will skyrocket to $1 trillion a year by 2020. We are living in crazy times.

At the end of Sept 2012 ou cash and close home materalized. Three months later, after 10’s of $1,000’s we just moved our furniture in. Happy as can be. A home around the corner recently lists (bigger floor plan/no pool) for $129K more than we paid. Granted, it’s redone, but painted cabinets, new windows but old sliders. The price blew our minds. The K-6 school playground is accross the street, whereas we are in a sweet spot fom the school traffic and noise.

Housing is insanely overpriced. This reinflation of the bubble is surreal.

Congradulaions. Glad you like the new home. Enjoy yourself!

Gael Wins!

Thanks. We were priced out 6 yrs solid and it took 4 years to find this gem but man does it feel like a money pit. The interior is now pretty and practical (and safe), but the yard costs are daunting. Thank God we’re savers.

Since we live with a non-self inflicted medical issue, we needed a place to be, modest and paid off. In reality, we overpaid by $100K (salary scales vs housing cost) but our rents were bleeding our money. Now we bleed into a forever home. Our quality of life changed 180%. In the end it’s about the quality of your life.

It may be true that you “overpaid”, but your piece of mind is what counts. You can always hire some kid to mow the grass. I used to mow an acre lawn in Georgia in the middle of July for $15 when I was a kid. I loved the money and I liked making the nieghborhood look great too.

I personally can’t wait to get a house, so I can put up a fence and have some privacy for once. I haven’t lived in a house since 1998. I love to garden and can only do so when I rent a property that will allow me too. I also don’t have to worry about some knucklehead contractor coming into my place unannounced.

Enjoy yourself!

Gael

We sold our pevious home in June of 2002, right when prices started jumping $20K a month. A decade of our lives lost, so I know your grief. Trust me, we’ve lived in your hell.

The pool needs a redo, and the concrete work is a must. The pool deck was damaged in the 1994 quake and they left it. We figure $40K minimum to bring up the yards, but after our journey of a lost decade, we have reconciled it. Apt life and storage sucked.

You seem like a wonderful person. We get beaten up verbally for our purchase and remodel. It was a decade of living frugal and leaving our housing proceeds alone. We paid our dues. It’s nice to be happy finally. I wish the same for you.

Thank you very much. It’s easy for people to be nasty on these forums and in the real world. Kindness goes a long way.

I don’t believe anyone’s being “nasty” on these forums regarding those who bought their homes because they were tired of renting and just wanted a decent home to live in – what brings out the snark is when some of those same individuals post that it’s now or never if you’re going to buy, prices are only going up, interest rates will never be this low again, and blah, blah, blah. They sound a lot like folks who are trying very hard to convince others because they’re harboring doubts about their recent purchase.

Gael Wins!

I read your acknowledgment of my best wishes to you. I meant it.

Life is too short not to have a place to call “home”.

T

he Dollar Tree has Impatient seeds and I can cover some ground this spring

for under $20. Shade areas, here comes my purple thumb,,,LOL

Jeff, at our current rate of indebtedness, we’ll reach 20 trillion in 2014, but i have a suspicion it could happen in 2013. Our deficit is currently 1.6 trillion a year but we’ve been averaging 1.9 trillion a year, go figure.

Tricia. Interest rates have to go up, if not we are going to have a pension crisis. Pensions and Savings rely on compounding. Without compounding and high level of inflation, you’ll eventually go broke. Thats why poor people remain poor and rich people get wealthier. Except that Rich people are finding it difficult to make money these days, because there are very few places that allow you to compound over true inflation. As long as the government continues to fund these deficits and buy its own bonds, expect inflation to continue. It wont be long before Oil is over $100.00 a barrel again and we are paying closer to $5.00 per gallon for gas.

As far as housing, the prices are artificial. No jobs are being created, even though thats a lagging indicator, Obama Care will put a squash to it. No employer wants to be forced into paying more. They’ll take on more part time help, or find ways around it. Detroit is a shadow of what is going to happen nationally. The people in Detroit never saw it coming, and the rest of the country is just as complacent.

“””w ithout compounding and high level of inflation, you’ll eventually go broke.”””

What I meant to say is without compounding, and with the current high level of inflation, people will eventually end up broke as their savings are eroded. This is government theft pure and simple. To anyone that understand fractional reserve banking and fiat money, inflation is directly related to over printing of money. The theft of your savings.

Frankly, I could careless if the FED “prints” a quadrillion dollars and burys it under the White House lawn. It will do absoulutly nothing to inflation if you and I can’t get our hands on it. Plain and simple.

Physical dollars and coins haven’t really “flooded” into circulation, so I’m having trouble seeing the Wiermark Germany scenario. No burning of money to stay warm in the winters here.

Not to mention the FED issues things call bonds, which people all over the world have been buying. This buying has created a lot of demand for them which has pushed interest rates to historical lows.

Why is this a bad thing? I thought you doom and gloomers said that the US currency was going to ZERO by now? What happend with that? Are you still waiting? If so, please send me all of your dollars considering you deem them worthless. I can’t use my silver bars at the local 7-11 to get a Slurpee…nope they want those fiat dollars. Please feel free to clean out your account and send your cash my way. I will gladly except them.

Thankssss a bunch!

The demand for over 60% of treasury bonds is coming from . . . . the federal reserve. They are purchasing them with ones and zeros from a computer terminal. That is why treasury bonds have such low yields – artifical as opposed to real world demand for them. China and Japan have cut their purchases to less than 20% of what they were just a few years ago. Wall Street Journal article out about thisl

@Gail wins!

Frankly, I could careless if the FED “prints†a quadrillion dollars and burys it under the White House lawn. It will do absoulutly nothing to inflation if you and I can’t get our hands on it. Plain and simple.

Why is this a bad thing? I thought you doom and gloomers said that the US currency was going to ZERO by now? What happend with that? Are you still waiting? If so, please send me all of your dollars considering you deem them worthless. I can’t use my silver bars at the local 7-11 to get a Slurpee…nope they want those fiat dollars. Please feel free to clean out your account and send your cash my way. I will gladly except them.

You are making far too much sense for most of the posters on this site.

As the poster below stated, we’re now the majority buyer of our own bonds. Does that make any sense to you?

@Gael Wins! All I can suggest is for you to watch a great educational video series titled ‘Money As Debt’. You can find it http://www.youtube.com/TheeLynnChase You will understand a lot more about about money, banking, and the fractional reserve banking system. You would think we would understand money since it is so important to us but sadly they do not teach it in school. To quote Henry Ford “It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning.” It is Americans lack of knowledge and understanding about this important representation of all goods and services and who controls it is powerful. Power corrupts, absolute power corrupts absolutely.

First you were complaining about the Chinese and other owning too much of our debt.

Now your complaining about us owning too much of our debt?

Which one is it?

And no, I’m not going on Youtube to “learn” any valuable misinformation…..oopps…I mean information on our monitary system.

Again, feel free to send me your “fiat” dollars. I will gladly take them.

“Based on government statistics (ECI)”

And you’ve got the problem right there: government statistic is a lie. And they know it. We should also know it.

Buying a home in this era is a nightmare. We bought in the late 90s, sold in ’07, and cashed out a bundle. Have been renting ever since, great houses, pricey rent (in neighborhoods we would buy in if we were to buy again), but very little risk (short-term). Tons of flexibility (limiting our financial risk to the lease we sign) and landlords on the hook for any fixes or replacements (we have seen a replaced dishwasher, new fridge, plumbing issues like a slab leak in the bathroom, roofing issues, fences knocked down by storms, etc., all taken care of by the landlord). And not one price increase in 5 years. With the money we got out of selling, we can pay for the kids’ college so they have no loans. And there’s still 100s of thousands left over. People can say what they want about buying now, but it still looks way overpriced. And I think rates will be kept artificially low, like Japan, until the cows come home (i.e., maybe another 20-30 years, if that is even possible to fathom). So buy if you want to, but the “rental parity†argument is a total scam – they never factor in replacing the roof, slab leaks, pin hole plumbing issues, appliances conking out, old plumbing and electrical issues, etc. Or the possibility of being taxed to the max, increases in insurance, HOAs doubling, infrastructure bonds being added to your tax bill like Mello-Roos, etc. Unless you plan on staying a long time, and you are relatively sure that your income will be going up quite a bit over the years ahead (so you can pay all of the inflated prices to come for health care, federal tax increases, soaring college costs, food price increases, etc., it’s a no-brainer to rent in the school district you want your kids in and forego the endless risks of owning in this uncertain economy.

You are right, and smart!

Renting is not living the American Dream–own a home is the American Dream

Well that settles it, then – we’re buying tomorrow! BTW, I’d like to subscribe to your newsletter.

Yeah, as a kid, I never fantasized about becoming a millionaire, having a trophy wife with big knockers, and renting a 1/1 dump in Orlando for $850 a month.

Well….at least I got 2 out of the 3.

Not

too

shabby

Remember what Carlin said about the American Dream…you have to be asleep to believe in it. Times have changed, friend, the middle-class is in its death throes…

Carlin was also a comedian. I guess you didn’t laugh………

Renting in this era is a nightmare also.

1) Rising rents

2) Slum lords

3) Filthy methhead nieghbors

4) No freedom to do whatever you want with the place

5) Not being able to lock into a price and let inflation take care of the rest

Anyone else want to add to this list?

Gael, how is renting in this “era” different from any other in the past?

I’ve been renting in coastal cities of SoCal for 12 years, currently renting a 3/2 SFH with big grassy yard, view, fruit trees, in San Clemente.

1) not once did I have to deal with a rent increase

2) where do you rent?

3) see #2

4) true, I haven’t done any major remodeling – but we always paint to our liking, we now have our own vegetable garden, I don’t mind investing up to 1 months rent per year into the place I live, even replacing the carpet is worth it if you like the place

5) I’m sorry, how do you lock into a price when you buy? Ever heard of maintenance? Property tax increases?

Right now we’ve discovered termites – I fell sorry for the landlord and I’m very glad I’m just renting. Tenting alone will not cut it, they will have to replace some of the wood beams!

BTW: The same floorplan house across the street just got sold, except their lot is smaller and they have no view. $625k versus my $2500 a month no strings attached!

Been renting 3/2 SFH for the last 4 years in East Bay Area after walking away from our $300K underwater home that we “owned”.

1. Landlord loves that we pay rent on time and take care of the palce so has reduced our rent since we’ve ben here.

2. No

3. Again no, rentals exist in nice neighborhoods too.

4. We’ve painted and landscaped. Yes would like to remodel baths and kitchen but not hugely important in scheme of things. Owner has had to replace A/C unit, H2O heater, paid for the tree trimming, sprinkler maintenance, covers the gardners and soon will be replacing a side fence.

5. See above, plus property taxes. You never truly “own”.

To be honest we may consider buying this place, owner has offered to sell, but the point is that renting is a fine lifestyle and the freedom and peace of mind of not being a debtslave to a huge mortgage is gratfying. Owning is fine too, if it’s within or below your means, but I personally can’t understand the obsession and financial abyss folks sink into just to ‘live the dream’. We got sucked in but got out and are happier for it. To each their own I suppose.

Everyone is different. If I like orange and you like purple, does that make me a bad guy.

I don’t stress about that crap. Cars need maitenence, but shit, I still have to drive it. I have to pay insurance on it too. I also pay all sorts of shit to operate it. Either way, I still have to drive.

You can complain about your living situation until your blue in the face, but I’m sure you still have to deal with whatever it is at the end of the day.

Gael,

Have you ever lived in SoCal? Ever owned a home here or rented here? I’m referring to spending significant time beyond coming here on vacation or knowing people who live in the area.

There is a unique reality on the ground here that helps to form the perspective of this blog.

I’m not trying to give you a hard time. It just seems that your responses to comments are from a somewhat different regional perspective than what some of us have.

Just for full disclosure, I have lived in other parts of the nation which includes owning and renting outside of SoCal. I’ve been in SoCal for over a decade.

Gael, you’re in the classic stage of projection, due to a severe case of buyer’s remorse. You should stop posting unless you wish to beclown yourself further on this subject. OTOH, you probably are just another RE troll.

I think these are learned mantras designed to make us strongly believe we must own, to be happy.

I’ll add to the list, Gael. Where I live (San Peeedro, CA), you can BUY a house and live next to filthy methheads. While you make your mortgage payments and find ways to protect your kids from his pit bulls, you can rest easy knowing he’ll never struggle to make his monthly payment because it’s a PAID OFF HOUSE he inherited from his old-country Slav mom. Most likely, the dude never moved out (became an adult) in his twenties or thirties, and there he putrifies: “Homeowner”!!! Sure feels good to rent.

Gail,

For some areas and personal situations owning makes sense. It happens that for myself it just does not pan out. I live in south pasadena and rent a 1920 remodeled spanish mission. My landlord is great, fixes things promptly and has not raised rent once in 6 years. We have a nice yard and live in a great area with shops, restaurants and good schools. It is safe for my wife to walk to dog by herself at night. These things are not always a given depending on where you live in LA. The rent is 1600. Cost of similar housing in our area is near 600k $/sqft. There are not any sfr properties in south pasadena that meet our criteria for less than 550k. For my calculations buy vs rent parity is just not meet. Not to mention, a small price decline will change these calculations significantly (a 15% decline will cause breakeven in 10 years vs 2). If i find a place that is works i would buy it but it just is not out there right now.

That is why not everyone is buying. Plus there is very low inventory, not much to choose from and bidding wars. The good deals are snagged by all cash investors, leaving use regular folk to fight over the scraps.

So buying worked for you, that does not mean it will always be great for people who have different circumstances and live somewhere else.

Well, you win some you loose some. If your naturally an angry and negative person, then any little thing is going set you off.

Sorry to hear others misfortunes, but things happen. Life isn’t perfect.

No, I haven’t lived in Cali, but I’ve been there. I know why people are willing to pay big bucks to live out there. It’s truely a nice place.

If things out there are so bad, why stay? Why constantly complain about the situation? Why do you all blame people that have nothing to do with the housing market?

I used to be just like you all. Always pointing the finger. Blaming my own misfortunes on others. It’s easy, it’s human. At the same time, it was an utter and complete waste of time.

Glad we bought in the early 1960s and stayed put in Pasadena.

You certainly have it made. Don’t you think that if a young person buys something today, that in 40 years from now, they’ll be able to say the same thing your saying today. Aren’t the problems of the 60’s similar to the ones today?

Don’t you like paying the 1960’s rate of a mortgage than what it would cost today? Inflation ain’t so bad afterall!

Okay, now I know for sure – Gael must be a realtor!

Huh?

Nope, I know more about real estate than they do. The fear, doom, and gloom are passing. People are just plain getting tired of being scared all the time.

The US Mint has sold less Silver and Gold Eagles in 2012 than in 2011. The time to sell your “hoard” was then. Good luck trying to sell now to your fellow doom and gloomers!

SELL IT WHILE ITS HOT, HOLD IT WHEN IT’S NOT!

I think we’re in an artificially priced market. In other words, housing has gone up at a faster rate than inflation and wages have not followed. I think overall the person who bought 50 years ago in the 1960’s got a way better value than one would get 50 years from now, buying today.

Time and money are just like the tides of the oceans. They go in and out. Sometimes there’s a tsunami, and some times the tide is low. It’s never perfect and it always changes. But, for those of us that love the beach, we keep coming back.

I am in my early 30’s. I was in Orlando for the housing bubble/bust. I now live in Western PA. I love it here and I’m not leaving. No, it’s not So Cal 70 degrees every day, but I learned to make it fun and enjoyable.

In the winter, I ski. In the spring, I can garden and enjoy the air. In the summer I can boat on the lakes and rivers. In the fall, I can enjoy the leaves and all the festivities.

I don’t care to ever have to sit in traffic for an hour each way every day. Burning gas and burning time. I don’t have to listen to the aweful radio for very long anymore. Do they play music? LOL.

Jobs will also come and go. When asked where was my favorite place I ever lived, I always change the question slightly. I say Atlanta in the 90’s was my favorite place to be. Atlanta was growing and the jobs were everywhere. Asked if I would go back now, I would say why? No jobs and overcrowded.

Gael Wins,

Atlanta in the late 90’s is where I moved after my divorce (remarried to the same guy again-2nd marriage to each other), and I loved Atlanta. Managed Shopping Centers in Buckhead. God’s Country (trees are awesome) and lots of smart people there. especially the triangle area.

Atlanta in the 90’s was a magical time. I was in Middle School and High School at that time. I know it sounds weird coming from a young dude, but people were just plain happy. I’ll give you some examples.

Western Mass: Friends bikes were stolen

East Cobb: I gave my bike to the younger kids in the nieghborhood.

Western Mass: Slum housing from the 1920’s = $100,000

East Cobb: Newer homes twice the size and land = $100,000

Western Mass: Schools mostly worried about drugs and gun violence to bother teaching

East Cobb: We had opportunities to learn different things and were allowed to succeed.

Western Mass: Everyone was always fearful of their nieghbors.

East Cobb: Never locked our doors, people stayed out of others business, and were generally friendly.

Western Mass: People put on waiting lists for shite jobs.

East Cobb: All you needed was a pulse to get a decent job.

Things have changed everywhere now. There is no where to run and no where to hide. So, I just enjoy myself whereever I am.

Atlanta now is not what it was in the 90’s in my opinion.

I’m glad you found peace where you are. Think of rebuilding your house as a good thing. Your putting your own time and energy fixing the place you love. That’s hard to do renting.

I will buy a house soon. I’m not in any real rush and take my time.

Probably lots of realtor jobs there, if that’s something you would like to do. I’ve been considering Atlanta and they have much more inventory than So Cal and you can live in a mansion for a 1/4 of the price. Or you could live in the same home you can afford in PA (assuming you are in a relatively high priced market), for half the price in Atlanta.

For me being in CA, it’s very tempting. Could pay for a house that’s better than mine with cash in Atlanta or pay it off in three to five years if I pay the same amount I do now for mortgage in CA.

Why does you life completely revolve around housing. I choose to live in an area because that’s where I want to be, not because of housing inventory and other useless nonsense.

I’m glad I don’t live a shallow life.

This rally in home prices will not last. We are due for a DEEEEEPPP recession in 2013 or 2014. Home owners will get crushed because wages are still way out of sync with home prices. LA and OC is still in a housing bubble.

“Home owners will get crushed because wages are still way out of sync with home prices.”

Wages go up by 2% to 3% per year. In spite of all the rhetoric, you can easily check that with the government BLS website.

Also, when interest rates go down, prices rise. This is where we’re at.

What is not clear to me, is what happens when interest rate rises significantly. A large population of home owners have locked in their low interest rate costs. They can make more money renting out their property. Why take a capital loss (sell) when they can make positive cash flows (rent)?

In my opinion, good or bad, I think we’re going to see low inventories for the next decade.

Another reason that contributed to the housing bust in the 90’s was the Northridge Earthquake ’94.

For those who are interested in gentrification of LA neighborhoods, here is a good article from LA Weekly “Hollywood’s Urban Cleansing” in summary, 12, 000 mostly Latino residents pushed out by city codes, high rent and hipsters.

http://www.laweekly.com/2013-01-03/news/hollywood-latino-population-drop-12878-diaspora-gentrification/

Keith Jurow explains why price per square foot comparisons

is better than C-S.

It’s also been a bear indicator, particularly in his home

region (New England-CT/Westchester Co., NY.)

His is this one importantly @1:40

http://finance.yahoo.com/blogs/daily-ticker/house-prices-nowhere-near-bottom-says-analyst-125114464.html

from this bundle:

http://www.multiurl.com/ga/TheManySignsOfShadowInventory

This might interest also:

http://www.multiurl.com/ga/Illusions_R_Us

ENEN

Have a nice day.

We are also do for a MONSTER EARTHQUAKE IN THE SOCAL AREA!!!!

JimmyZ

Who knows when. We took the bait and got a 10% deductible CEA policy.

Only 10% of homeowners have earthquake insurance, so the risk of it not paying out isn’t so bad. I figure, the more homes to fix, the worse the financial hit to the fund.What do you think?

In suburban Philadelphia (Drexel Hill) you can buy a very nice Tudor style stone house 4 b/r 3 bath for $200K, built in the 1930’s. Gorgeous hardwood floors throughout, very classy. The catch is the property taxes will run $11k per year (2012) and will go up every year forever. Also, you can expect to pay in an average winter, $5k in heating oil bills. Not to mention everything else like new roofing, plumbing, electrical, appliances, etc. Even if you own it free & clear, you’ll still be doling out $2400 month just for the privilege of living there.

I sold my house & live in a rental in Raleigh. 3 b/r 2 bath. I pay 1200 month. If the toilet breaks, I email my building management & a maintenance guy comes over the same day.

In most parts of the country, especially in the northeast, owning a house is a one way ticket to financial oblivion. I don’t miss it. It’s an endless money pit.

I hear a lot of ‘just wait until interest rates rise then home prices will drop’…. but wonder if the good Doc can post any track record on home prices and interest rates. My friend, a realturd in the LA area says there is not much correlation to show that home prices decrease when interest rates rise….. what say you?

Interest rates are not going to rise at least for the next four years since the Fed’s policy (which is Obama’s policy) of unlimited quantitative easing will last through the current administration.

Therefore, add four years to the current little bubble.

I’m beginning to wonder if interest rates will EVER rise again in any significant manner. Given what it would do to the national debt and federal budget deficit, I’m starting to lean toward the Japanese perpetual low interest rate scenario for the next 50 years of the US…

I think they will. When though? When the banksters are in the right position for this to happen.

OK, the ‘animal spirits’ as Mr. Schiller says are now let loose. But how does the population demographics fit in this picture? We are a aging baby boomer population with a smaller younger less able segment coming forward.

We have been looking into the Southern Calif. real estate market and it is crazy again. My wife discussed the possibility that we retire outside Southern Ca. and even look outside this Country. Its a world market now. How does this fit in the leveraging up we see in real estate particularly in Southern Calif.? How can it sustain itself without boom bust cycles that happen at a much greater frequency?

Well, many in the OC would love to see latinos pushed out of Anaheim and Santa Ana but Anaheim needs workers for the resort district and the only thing going for it on the westside is the Colony District and Santa Ana has the artist district but not much changed in demographics.

The changed in demographics in La while making it more extensive prevented La from being at least 60 percent hispanic today it slowed its growth rate. Hispanics moved into the Inland Empire which needs job development more. Personality, the Santa Ana California model is not that great, the OC Register shows the school district at 77 percent of the children on the free and reduce lunch program and 52 percent as ESL learners, Santa Ana has had that high of English learners going back into the 1990’s it been subject for about 30 years of immirgants coming from Mexico or a few from Central America. Some some single whites versus hispanic couples or single-mom hispanic women might not be all that bad.

The BOND Market is not in a BUBBLE. When it bursts within 2-3 years, rates will skyrocket. Bond prices has an inverse relationship with interest rates. Housing is doomed

This from the Pasadena Star-News today…

http://www.pasadenastarnews.com/ci_22362287/time-buy-southern-california-real-estate-if-you

Leave a Reply