A Tale of Two California Markets – Culver City and California City. Culver City prices back near peak levels with flippers out in full force. California City seeing prices back to levels last seen in the 1990s.

Desirable areas in Los Angeles County are finding bidding wars and many places are selling for prices last seen during the peak of the bubble. A fierce competition between flippers, foreign money, and households with healthy incomes leveraging low mortgage rates are pushing prices higher. A few readers were sending over some of the recent action taking place in Culver City. A few recounted their tales of open houses and the sense of urgency to purchase a property. The flood of easy money has certainly had an impact on mid-tier and prime locations. Only a two hour drive up north, in California City you can find homes selling for rock bottom prices. This is a trend bearing out in income statistics. It is becoming harder for the middle class to find affordable housing in California. Some have mentioned in zombie like fashion that some areas are becoming fortresses while other areas are left struggling. Let us take a look at some recent data.

Culver City – Bubble Prices Back

The median price of a Culver City home is $635,000 for the 90230 zip code and $703,000 for the 90232 zip code. One recent sale caught my attention because it is fresh and the current sale price is very near to what it sold during the previous mania:

4348 Globe Ave Culver City, CA 90230

Beds:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 2

Baths:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 1

Square feet:Â Â Â Â Â Â 1,036

Year Built:Â Â Â Â Â Â Â Â Â Â Â 1950

This home looks to have the HGTV upgrades that seem to be very popular in SoCal:

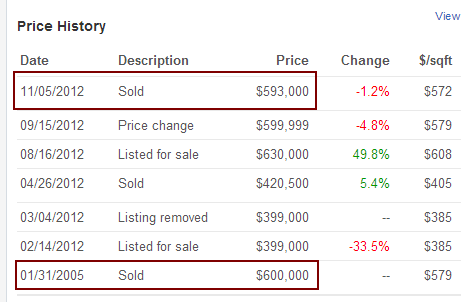

The listing history however shows us the impact flippers are having on the market. This home sold in 2006 for $600,000:

It was listed on the market earlier this year for $399,000. It sold for $420,500 in April meaning some eager flippers were fighting for this place in Culver City. A good deal was to be had here. After some HGTV remodeling the home was listed back on the market in August for $630,000. No action. Then in September, they dropped it down to $599,999 to show up on the radar for those that have alerts set up to go off when a “$500k†home shows up. It looks like it worked because early this month, a measly $6,999 reduction was all it took to get this place sold. So run the numbers:

Sale price:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $593,000

Bought for:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $420,500

Gain of $172,500. In a matter of a few months a remodel made this home go up in value by the median price of a US home. These flippers even accounting for the cost of the remodel and sales commission likely made out nicely.

Another example of a home shows the overall environment in places like Culver City:

4367 Tuller Ave Culver City, CA 90230

Beds:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 3

Baths:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 1

Square feet:Â Â Â Â Â Â 1,124

Year Built:Â Â Â Â Â Â Â Â Â Â Â 1946

This is a recent sale as well. Here is the history on this place:

Listed for sale:Â Â August, 20 2012 at $529,000

Sold:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â October, 10 2012 for $565,000

When you see pricing like this it signifies that there was plenty of interest on the list price and likely caused the price to be pushed up. This is the kind of action that is occurring in Culver City. Are incomes higher? No. But what you have is flippers, foreign money, and maximum leverage via low interest rates creating a scenario where homes are reaching peak prices. Yet only a few hours away in California City, the busted housing bubble is still very much alive.

California City

California City has a population of 14,120 and is located in Kern County. People in some areas of LA and Orange County clearly do not look too far inland when they ask “but where are the cheap California homes?â€Â Not too far away. In fact, you can find some areas where the popped housing bubble is clearly in action:

9901 Pebble Beach Dr UNIT R California City, CA 93505

Beds:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 3

Baths:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 2

Type:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Condo

Year Built:Â Â Â Â Â Â Â Â Â Â Â 1989

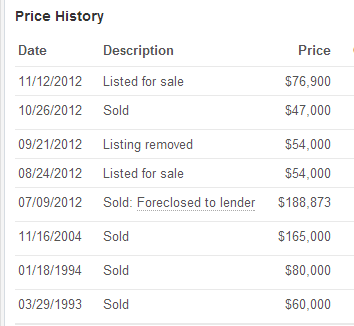

So how much is this condo selling for? How about $77,900. Maybe you want an actual single family home? How about this?

7354 Catalpa Ave California City, CA 93505

Beds:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 3

Baths:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 2

Square feet:Â Â Â Â Â Â 1,616

Year Built:Â Â Â Â Â Â Â Â Â Â Â 1990

The price on this home? This place is selling for $76,900. The price on this home is back to the early 1990s:

Those that think the bubble popping did not impact California real estate are simply not looking hard enough. The Central Valley and Inland Empire for example have been hit hard and prices are still at affordable levels. Yet looking at more select areas you see that the bubble never popped. Flippers are back. Prices are back near peak levels. And bidding wars are back. For those buying in these high activity locations be prepared for the familiar smell of mania.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

49 Responses to “A Tale of Two California Markets – Culver City and California City. Culver City prices back near peak levels with flippers out in full force. California City seeing prices back to levels last seen in the 1990s.”

Prices above peak in this Encinitas neighborhood:

http://encinitasundercover.blogspot.com/2012/11/the-bubble-is-back-encinitas.html

While I agree with DHB’s general argument using California City as any kind of example is a bit questionable. Cal City was founded as a fever dream of real estate boosterism in the middle of the Mojave Desert and has always hovered at the ragged edge of unlivability. Even during the peak of the bubble only the city center had houses on most of the streets. These days it’s nearly a ghost town. Go a half mile in any direction and all you find are blocks and blocks of cheerily named streets devoid of anything but creosote, cactus and rattlesnakes. Saying California City is only 2 hours north of LA is like saying Auschwitz is only 2 hours east of Prague.

Don’t be so hard on DrHBB. I am sure he would have used a more appropriate comparison of someplace in between DTLA and the arse end of the universe that is CA City but he can’t because no such dimension of reality exists in SoCal where a true mark to market value is out of captivity and out free in the wild.

It is truly a captive market, Eastvale, Riverside Co., is in a price spike now. Even the pervasive stench of Dairy cows can’t keep the banks and the FED from lifting all the turds that are floating in this market today. Ben Bernake thinks you should be great full for only paying $450,000 to smell cow shite for 30 years.

Your California bubble mentality is spreading to Colorado.

I met a woman yesterday at an open house here in the Berkeley neighborhood of Denver. She lives in Newport Beach , CA and was looking at the house because her brother said she buy in Denver. This is insane. The duplex side she was looking at is priced right at the market at $560K so “investment gains” are many years away.

Whelp, just goes to show whut the Walfart shoppers are doing when they’re not pushing, shoving, beating up and grapping packages from other Walfart shoppers at the Mall

Enlightening, hilarious contrast. Thanks!

LA = close to everywhere! California City, Desert Dump, environment like Death Valley!

Actually Death Valley is quite beautiful with the sand dunes, mountain ranges and other geologic formations. Cal City is just a flat dry sage brush wind blown piece of dirt. It’s only value is that it is closer to the eastern Sierra.

You neglected to mention the hilarious fact the Globe house literally backs up to the 405 and the Tuller house is one block over from the 405. I looked at the Tuller house and wanted to throw up. Total and complete tear down with a backyard that looks like a bomb hit it. We’ve been spying CC houses for over 2 years and this is a new kind of crazy. Open houses on Sunday, all offers due by Wed a.m. Multiple bids, $40-50K over asking. Practically ZERO inventory. At these prices, you’d think everyone would be selling again! And you’re correct, no increase in household incomes. If we could just barely afford something 2 years ago, we certainly can’t now. With skyrocketing rents, it looks like we’ll be hunkering down in our 2bd, 1bath for the long haul.

Beat me to it. No thanx. Prefer to spend my days without noise-cancelling headphones on. (Assuming they could even cancel the 405 …)

Won’t cancel the toxins you’ll breath. And what professional jobs make the incomes that qualify to buy these redone tract homes?

Cal City is barren desert, miserable most of the time.

I only go there to ride dirt bikes. Looks like I could sell the RV and just buy a house out there.

Same here. Store the bikes there, and pray nobody broke-in and takes them while we are at work.

I read Eastvale had a high average income folks form La or Orange moved out there to get a bigger house for cheaper price.

I believe those prices for CC is justified because CC is becoming the next great neighborhood for the upper middle/middle class. Much of the new population are families who cannot afford to buy within the main LA areas such as West LA, SM, MDR, Brentwood, and Mid-Wilshire areas. CC is still considered to be a part of the “West Side” so they feel to be a part of the “LA” culture that is exclusive of the suburbs. The amenities and location is very ideal because of its easy access to the coastal areas, 405/10, new Expo line and outdoor amenities such as Baldwin Park and downtown CC area. In addition, a second wave of commercial development is coming through on the Washington blvd corridor towards MDR where a bunch of new restaurants are creating a dining destination like downtown CC. A third wave will be coming towards the end of 2013 next to the new CC Expo line. There are already a bunch of new developments by the new station.

Also the public elementary and middle public schools of CCUSD are among the best within Los Angeles. If anyone has noticed, the API scores of these scores are trending to the 900’s. I predict within 5 years, a majority of the schools will hit 900. Obviously, high school is another story which I won’t go into.

If you add all this up, CC has a perfect balance of amenities, city/urban characteristics, adjacencies, and “coolness†to justify the prices. I would bet on CC more than any other neighborhoods in LA

How many houses did you sell this month?

CC school system is hardly ‘among the best.’ Ask any family with kids if they’d have a hard time deciding between San Marino, La Canada, South Pasadena, Cerritos, the coastal cities (like Manhattan Beach, Palos Verdes, etc) versus Culver City. There would be no contest. Culver City is a decent school district because it doesn’t suck hard like most of the other neighborhoods in LA, but nowhere near the same class as the other cities listed.

Downtown CC has been undergoing a revitalization, but if people are going to get into a car, why not just drive on over to SM, marina del rey, etc? it’s minutes away. The revitalization, if anything, may increase land prices just around the DT area where walking distance to shops/amenities becomes a factor, but I definitely would not want to walk around on the Jefferson side of the city. There are pockets of nice streets/homes in Culver City, but there are more areas where I would not want to live.

“CC is still considered to be a part of the “West Side†so they feel to be a part of the “LA†culture that is exclusive of the suburbs”

Well… I think this sums up the point. It makes people feel good about themselves because of the locale, but it’s still not Santa Monica, Marina Del Rey or like it’s Westside neighborhoods. It’s a front, and that’s why prices are not justified

It’s damn good for its location in LA. Obviously not as good as San Marino, La Canada, South Pasadena and Cerritos. But that is why i say it is a good alternative to having to move out to the burbs and have an hour commute to work.

I do agree that south of Jefferson is terrible and their is no way to gentrify those areas. Even with the newly renovated Westfield will help that area.

My point is that CC is not like SM, MDR, and West LA. It is a great alternative to those areas without having to move to the burbs.

Mr. Palmer, CC is g.h.e.t.t.o, just like it was 10-15 years ago. I agree, parts of CC has undergone a makeover, but 60-70% of CC is still lower income, 6-8 multi-family unit homes of thugs and juveniles, and thats not going to change. Just look at the crime history here for proof:

http://projects.latimes.com/mapping-la/neighborhoods/neighborhood/palms/crime/

Also, simply drive around CC, yes, you might see a street or two of nice suburban homes, but you’re always minimum of two blocks away from shady neighborhoods, which is, unfortunately, 90% of LA county.

Give me a neighborhood, which has a 1/2 mile radius of all nice, clean, homes without metal bars in the windows, and i’ll agree that it’s a worthwhile area to purchase a home.

Your showing me the crime map of Palms, not CC. CC is south of this. Have you driven around the neighborhoods of CC north of Jefferson? It is pristine and nice. I don’t think you’ve spent enough time there. Obviously not as nice as MDR, SM, Brentwood, and South Bay. But for it’s location to West LA, it’s pretty good.

Go f* yourself, real estate broker shill.

“… CC is becoming the next great neighborhood for the upper middle/middle class…”

Sorry dude, but Culver City is not part of the west side. CC is the DMZ that acts as a buffer zone between the L.A. ghettos/barrios and the “real” west side areas. No one who can afford to live in Manhattan Beach, Playa Del Ray, Westwood, Brentwood, Pacific Palisades, Santa Monica, Westchester, El Segundo, etc. is going to pick Culver City over those areas.

Culver City is adjacent to/borders acknowledged L.A. ghettos/barrios. In addition, CC has a distinct ghetto element. Go to Jefferson, Washington and Culver Boulevards to see this.

I agree it is a buffer, but that’s why i said it’s an upcoming neighborhood. Silver Lake, Echo Park, and Atwater all border terrible areas.

Obviously, CC is not Manhattan Beach, Playa Del Ray, Westwood, Brentwood, Pacific Palisades, Santa Monica, Westchester and El Segundo. That’s my point. It is an alternative to them because those cities are way out of price for CC people.

Drive around north of Jefferson between downtown CC and Overland. They have great neighborhoods.

LA times mapping considers CC as part of west-side.

http://projects.latimes.com/mapping-la/neighborhoods/region/westside/

“No one who can afford to live in Manhattan Beach, Playa Del Ray, Westwood, Brentwood, Pacific Palisades, Santa Monica, Westchester, El Segundo, etc. is going to pick Culver City over those areas.”

I did.

Anybody else think, in a few years we will look back on 2012 and think, dang, it was all so obvious at the time, why didn’t I ______?

Short Treasuries and move to Chile?

(*rimshot*) 😀

Drop the interest rate to 3.4% and look at the magic that starts to happen. Throw in lack of inventory and Shazam, you’ve got a hot market. I know a few people that have bought recently and it was all about rent parity. This could go on a while as I doubt the inventory will grow very fast and the rates could get a little lower. AMAZING.

All markets are now rigged. Welcome to the NEW NORMAL.

http://www.zillow.com/homedetails/13357-E-Avenue-W11-Pearblossom-CA-93553/20261748_zpid/

look what 200k buys

I feel sick and angry. My husband and I sold our house last August, to a nice family. It was a normal, fair sale. After our inspection, we fixed what needed to be fixed and even made a reference book of vendors, in case the new owners wanted to change anything . We thought we would be able to size down a bit and live closer to where I work, train and go to church. What we have experienced in these short three months has been anything but fun. Realtors come across as arrogant and know-it-all-smug. I have to bite my tongue, but sometimes I voice my frustration. What to do now?

The problem w cal city is that there is no high speed rail to there and LA. Fix that and cal city will grow.

LOL can be done, can be done, I am trying to start a petition for a 80 billion dollar bond measure for this much needed high speed rail. We really can’t afford not to, it’s our future. It will only use 1/4th of the energy generated by Hoover Dam per day to run which can easily by generated by merely one or two new nuclear power plants located along the San Andreas.

Well, the retard Florida Governor here declined to take several billion from the Federalies to build a high speed rail a few years back that would have taken people from Daytona Beach, to Orlando, and then onto Tampa. Don’t get me wrong, California highways suck, but I-4 through O-town ain’t no picnic either.

Let’s see, you can call me a socialist here, but wouldn’t it be a hell of a lot easier to have built the damn thing at near zero interest and cut the travel time between these cities?

Wouldn’t it have been better for people like me to have found a job as an engineer working on this project than taking my 90 weeks of unemployment?

Sorry, but commuter rail–high speed or otherwise–is a non-starter in sprawled-out states such as CA and FL. Even in super high-density areas like NYC and Philly, peeps use rail only reluctantly, being UNable to afford a car and/or parking fees.

The reason rail is so successful in Japan is: a) homogeneous, CLEAN, and well-behaved population; and b) BATC = Bad Ass Transit Cops, both ON the train cars, and in the station. If you’re a scruffy-looking tattooed thug, you’re not even getting on the train, and anyone misbehaving while underway can expect rough justice on the spot, and unfavorable treatment by the criminal courts afterward. BOO-ya!

Also in Japan, you can leave your beloved car/motorcycle/scooter parked at the station all day, all night, all weekend, and… NOTHING will happen to it. BATCs make SURE of that. Vehicle theft/vandalism is a HUGE unspoken problem at mass transit stations here in So-Fla, and elsewhere in CONUS.

Sorry, but the ACLU and related Lefties will NOT allow BATCs in Duh USA. Pity.

If you look at the ‘year built’ dates for the two CA City structures in the example, you will see that they were built a couple of years before the aerospace industry bust in southern CA, which I believed happened in the early 90’s. It happened in the years following the collapse of communism, in 1990. None the less, the place actually grew between 2000 and 2010, though only a few thousand.

The seeds of the current economic problems in the state were sown with the collapse of the Soviet Block. These are great jobs (aerospace) that are gone, pretty much for good. Another industry that has been in decline is oil production and exploration. It has been in decline even longer, since the 1980’s.

There’s one bright spot, computers and technology, but that is mainly confined to Northern CA.

So you have the ackward situation of a loss of the really high paying jobs, and lots of average, and low paying ones. Even long time industries, like the garment district in LA, are under tremendous pressure, as can be seen in the stories about the garment factory fire in Bangladesh.

Quite frankly, I’m amazed that the ‘coast premium’ extends all the way inland to the 405 border, or even beyond. Can’t see this lasting, though. Nothing has been addressed at the national level, in terms of the fiscal plight and reckless overspending and living beyond our means. If we go off the ‘fiscal cliff’ that would be the worst outcome. It would push the economy into a deep recession without addressing any of the underlying issues, such as the insolvency of the social security/medicare systems, or figuring out who is going to pay for us to be the world’s cop, to name just two.

I agree with basically almost everything you posted here, Jason – except for the fiscal cliff scenario you outlined. I used to think it was inconceivable, but now an across – the – board 10% automatic cut for everything under the sun doesn’t look so awful at this point. Make every single Federal program go under the knife, regardless of whatever pet political constituencies are favored at the moment. The system is beyond “reasonable compromise,” since that kind of backroom politicking only results in more can – kicking down the road. I honestly believe that going over the cliff will be the only way left to truly force congress and the WH to stop this madness from destroying what’s left of our economy. I even think the Pentagon could use some honest cutting of it’s bloated programs, just like any other. I hope Boehner calls Reid’s bluff and goes nuclear – and then start all of it over, and put Big Ben and his money – printing operation out of business while they’re at it.

Hard to say, Dmac. Let’s say we go off the ‘fiscal cliff’ (I don’t think we will, but just suppose). Given the current weakness of the economy, I would expect a horrible recession, maybe like the 1930’s. Consider that they can’t lower interest rates to stimulate the economy.

I my opinion, it would be far better to call for a 2nd constitutional convention and start over from scratch, with the debts, public and private, reset at some level that is payable. Also, the constitution should be rewritten to incorporate your idea of abolishing the money printing press. I know, I know, it won’t happen, lol. These morons are gonna kick the can down the road one more time, and we’ll go over the fiscal speed bump, lol.

They’re back! Everything old is new again! Snap up a house with low down payment, apply for HELOC…if the market soars you’re a genius, if not, squat until the sheriff comes…could take years! Rent for three years with mortgage money you didn’t pay, get back in the game with a new home loan, you savvy Boomerang Buyer, do it again!

**********

“Home Equity Loans Make Comeback Fueling U.S. Spending”

http://www.bloomberg.com/news/2012-11-26/home-equity-loans-make-comeback-fueling-u-s-spending-mortgages.html

Bloomberg, USA official propaganda paper, failed to mention that home equity loans totaled under $80 billion last year. At the peak of the U.S. housing bubble Americans were borrowing over $700 BILLION per year in HELOC’s. Thus what Bloomberg is REALLY telling us is that even AFTER rising 30% in one year, home equity loans are only about 10% of their former peak.

If interest rates go up 200 basis points there will be complete collapse.

Interest rates will not go up because the Fed controls it… Ben Bernanke has said he will keep it near 0 at least until mid 2015. Who knows what will happen to real estate, it may literally go through the roof where a 2 bedroom shanty in Anahiem will cost $1 million!

Just wait for the low tide…there will be so many bare bottoms.

I would have done the piece on Rancho Cucamonga instead of Cal City.

Most homes and cities directly off the 15 are quite nice. Yes there is cow poop to the west (Chino). Yes there is some ghetto in Ontario, Pomona, Montclair, San Berdoo. But you also have Claremont (most PhD’s per capita in US), Upland, Norco, Corona, even Fontana’s crime rate is BELOW the US average the last 10 years.

The I.E. is not a bad place anymore, it’s western valley has come up extremely the last 10 years. It’s eastern valley though is still suffering badly from the closure of military bases 20+ years ago.

@Jason Emery

“Quite frankly, I’m amazed that the ‘coast premium’ extends all the way inland to the 405 border, or even beyond. Can’t see this lasting, though. Nothing has been addressed at the national level, in terms of the fiscal plight and reckless overspending and living beyond our means.”

How are we living “beyond our means”? I see millions of people unemployed and a 10 billion dollar a day output gap. It looks like we are living well below our means. We have a lot of means just sitting idle and producing nothing at all.

John, thank you. Love your perspective

Here’s another comparison is south Inland Orange County not really overprice compared to a Culver City its showing hot sells in Rancho Santa Marg. There are no hip types or foreign investors, south inland oc appeals mainly to family type whites or in the case of the future Rancho MissioN Viejo some emptynestes since they are going to 55 and over. The only problem is if you work in LA instead of Irvine.

Rancho Santa Marg.

19

61

0.3

2.2

$456k

Foothill Ranch

7

21

0.3

2.1

$432k

Dove Canyon

4

9

0.4

5.0

$821k

Aliso Viejo

39

83

0.5

2.4

$514k

Lake Forest

37

68

0.5

2.3

$518k

County

Supply

Deals

Mon.

Yr. ago

Price

All of O.C.

3,534

3,013

1.2

3.1

$1.4m

Coolest

Supply

Deals

Mon.

Yr. ago

Price

Corona Del Mar

76

15

5.1

5.9

$3.0m

Laguna Beach

171

42

4.1

6.4

$4.5m

Newport Coast

67

18

3.7

5.8

$6.2m

Dana Point

148

41

3.6

4.5

$2.4m

Newport Beach

255

79

3.2

9.1

$2.9m

In Rancho Santa Margarita, 61 homes went into escrow in the 30 days ending on Nov. 21. The city had 19 homes for sale on that date. At that sales pace, it would take just nine days to sell off all the listings in the city, Thomas calculated.

Four other South County communities also were among the top five markets with the tightest supply of homes for sale: Foothiil Ranch, Dove Canyon, Aliso Viejo and Lake Forest, with sell-off times ranging from 10 to 17 days.

The coldest market in the county was Newport Beach.

Corona del Mar, Newport Coast and the rest of Newport Beach ranked among the top-five coldest markets in the Thomas report. The time needed to sell off all the listings in those

Supported price levels in real estate or any asset for that matter is based on psychology rather than intrinsic value. If people believe that a 2bd shanty in Anahiem is worth $500,000, then that is what it’s worth.

I remember just a bit more than a decade ago, when income levels were not that much different, someone at a party, usually a Doctor or Lawyer would mention a $500,000-$600,000 home purchase and everyone would acknowledge what an expensive and grand house he had just bought. Fast forward to today and most people associate this price level with the terms “cheap”, “on a budget” and “starter home”. Unbelievable how psychology works…nothing has really changed except people’s perceptions that this is the new normal.

Leave a Reply