California real estate foreclosure math – Notice of defaults decline while actual foreclosures increase. Why are notices of default falling while those falling behind on their mortgage are still at record levels? The 550,000+ California properties in distressed limbo.

I’m surprised how quickly people are ready to believe housing industry math even though this is the same industry that championed toxic loans and saw no future problems by giving loans to anyone with a pulse. So keep that in mind as new data is being held up like a trophy as if things have suddenly improved. The new data that came out showed that notice of defaults for Q2 of 2010 declined dramatically in the last quarter for California. Great news right? Well this would be fantastic news if we also saw in conjunction those that are 30+ days late on their mortgage falling as well. Yet that rate is still at peak levels. By the way, actual recorded foreclosures actually increased from Q1 of 2010 to Q2 of 2010 but this was buried deep in the ministry of housing propaganda’s desk. So let us examine the actual California foreclosure math to see exactly where we stand today.

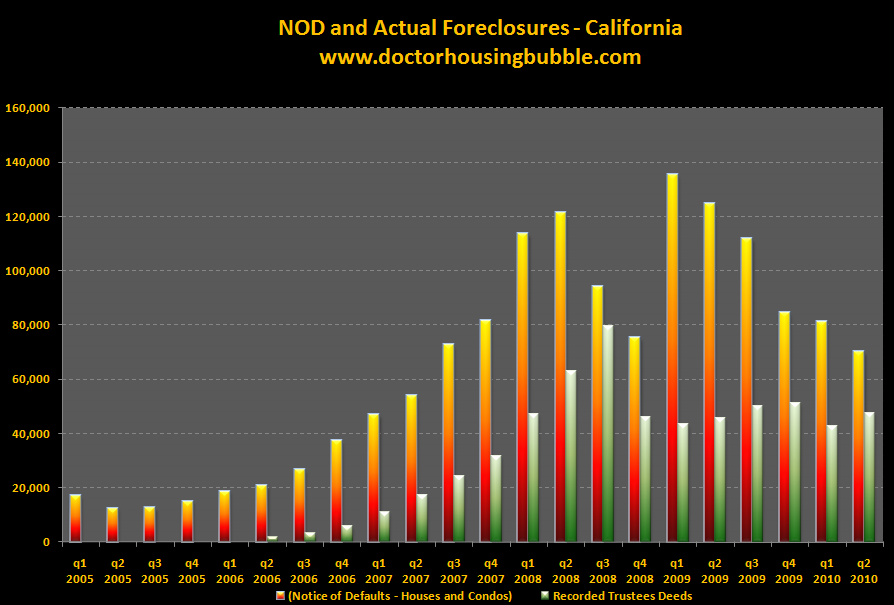

For better or worse, actual foreclosures are still elevated:

Actual recorded foreclosures show up as recorded trustee deeds went up by over 11 percent from Q1 of 2010 to Q2 of 2010. This jump of course occurred because of a variety of reasons including a crappy economy but also the abject failure of HAMP which merely bought a few more months for many homeowners. Notice of defaults fell by over 13 percent over the quarter. I would only take this as good news if actual late payments on loans were also falling at this rate but they are not. We are still near record territory for actual loans that are distressed in the state. Then we hear about areas like Los Angeles that will now fine banks for homes that are left to disrepair. Banks being the patron saint of taxpayer money, are now going to have even less of an incentive to file a notice of default. Let the sucker borrower mow the lawn. The amount of time for a foreclosure has gone to record levels because banks are simply ignoring late payers. They are overwhelmed or simply don’t care (both are not good reasons). So the decline in NODs is probably a bigger reflection of this trend as opposed to the actual market suddenly turning some proverbial corner.

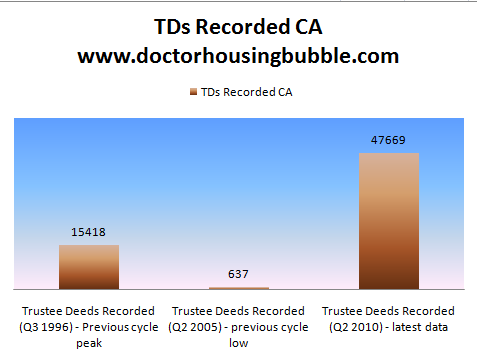

Keep in mind that the housing market still sucks. I’m not sure how else to put it especially for California. Things are so bad, that people actually think 47,000+ recorded foreclosures in Q2 of 2010 is some sign of progress. Let us put this into context for you:

In the aftermath of the last California housing bubble, the apex of recorded trustee deeds occurred in Q3 of 1996. At that time, 15,418 foreclosures were actually recorded. In Q2 of 2010 we actually recorded some 47,669 foreclosures. So we are foreclosing at a rate of 3 times what was being experienced at the peak point of the last real estate crisis. Yet this is somehow good? For absurdity purposes, look at how low things got in Q2 of 2005 at the height of insanity. Only 637 foreclosures were recorded during the entire quarter! This is absolute insanity. I mean think of how out of sync things had to be. People always lose homes for a variety of reasons including divorce, loss of job, or medical illnesses. Did life suddenly come to a pause in this quarter? Actually, anyone and everyone could qualify for a loan so it is surprising that we even had 637 foreclosures.

There is still a large contingent that thinks housing is all of a sudden gearing up for housing boom 2.0. Keep in mind that we are only tasting a tiny respite thanks to the Federal Reserve flushing over a trillion dollars down the toilet to buy mortgage backed securities and has also artificially kept the interest rate low. Add to this the expensive and horrible policy blunder of the home buyer tax credit and the market was juiced on easy money steroids. What more can we do? Give homes away? As absurd as that sounds, not really because the big gimmick is that banks need to keep homes valued at bubble levels and have home borrower suckers making their payments to keep the massive debt current. Banks need an army of debt slaves. So what if you stop paying on a $500,000 loan even though the home is valued at $250,000? The bank still pretends the loan is valued at that level and this is where the gigantic gap appears:

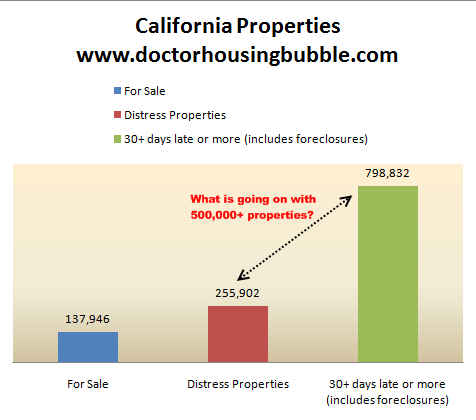

Source:Â MLS, MBA

This is where the excitement over the drop in NODs is basically hot air. Currently on the MLS California has 137,000+ homes for sale. This is what the public can see. This does include some distressed properties but not many. If we look at distressed properties including those currently in foreclosure, we find that the market has 255,000+ homes. Some of these appear on the MLS, most clearly do not. Yet the next column is where the sham is really happening. Nearly 800,000 loans are 1 payment behind or even worse, already in foreclosure. Naively some think that many of these won’t enter into foreclosure. Actually, recent data shows otherwise. Of loans that get behind one payment roughly 90 percent enter into foreclosure. But let us be generous and say that only 80 percent will go into foreclosure.  We are talking about 640,000 properties here. So much for the drop in NODs (it was a drop of roughly 11,000 from Q1 to Q2 of 2010).

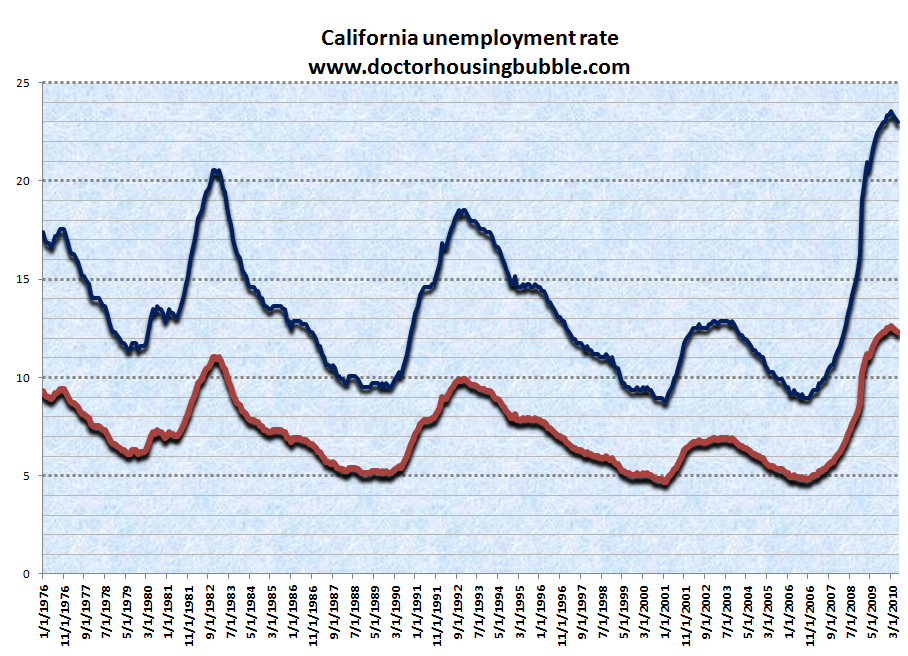

I’m highly suspicious of the data because the actual real economy, you know the thing people use to pay their mortgage with, is actually still in a big mess. California is flying off a budget cliff even though people pretend all is well. We still have no budget for the next fiscal year and the gap of $19 billion still lingers (even as we give tax credits to those to buy homes!). So we are in for some serious financial issues going forward. Not much has changed. If I saw wages increase by 50 percent in one year and all of a sudden high paying jobs were available for many unemployed Californian then maybe we can jump on the recovery bandwagon and justify high home prices. But this is the reality:

Source:Â BLS

In other words, the drop with NODs is largely based on funny math. Banks are not moving on homes which is something that is already documented. Extend and pretend programs also took some of these homes out of the NOD landscape. But this is largely a distraction because the housing market is still in a giant toilet bowl. I vividly remember talking about the massive rise in housing inventory in 2007 right before the market imploded. People were laser focused on price and ignoring the major headwinds. Home prices peaked at the moment we were heading for a rollercoaster price decline. We are in a similar position today. Ignore the data at your own peril.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

18 Responses to “California real estate foreclosure math – Notice of defaults decline while actual foreclosures increase. Why are notices of default falling while those falling behind on their mortgage are still at record levels? The 550,000+ California properties in distressed limbo.”

thanks for your wonderful work Dr. HB. I am listening to cnbc, and it is amazing that people are talking up markets with this backdrop, and the banks should be bankrupt. I still don’t know why the press doesn’t report on this more.

How are data companies finding out about the late payments if Banks are not filing NOD? Are they getting the data from the three credit reporting bureaus?

It’s amazing how little things have changed in the past few years. It seems all, or most of your posts say the same sort of thing, median incomes/salaries are not large enough to support the median cost of housing, and each area has a similar kind of discrepency, The numbers just don’t add up, they never will until housing prices drop. Even Patrick, at Patrick.net has had the same warnings “Housing Crash Continues — It’s Still A Terrible Time To Buy” and he lists 10 reasons.

http://patrick.net/housing/crash.html?ref=drhousingbubble.blogspot.com

His message has been the same for about four or five years, as has yours, Doc.

We keep waiting for this thing to straighten out, and it keeps being the same..

Every little trick and bailout only temporarily delays the enivitable day of reckoning

You see avs, MSM=Main Street Media is some what connect to Wallstreet Crooks and GOV so there won’t be no news on this….. I mean once upon on time…CBS did a segment…I think was 60sec….. what is coming ahead 2009, 2010, 2011, 2012 & beyond….. Alt A and ARMS Loan…..tsunami……Like I say and people who knows….we are in big trouble and just getting worse…… So again, kiss my ass to Wallstreet and their friends….

Foreclosures here in Brevard County Florida are on the rise as well as short sales. Values continue to decline here also. NO HELP for millions loosing their homes….big banks are showing record profits even with all the foreclosures…what is wrong with that picture.

Mainstreet media operates under the KISS rule-keep it simple, stupid. There are no reporters on tv- just attractive women and good looking men, reading a script

(check their backgrounds- NONE of them have experience as a real reporter, digging out facts on their own for a story.)

Walter Cronkite could never get a job on TV today.

I have heard a number of acquaintances talk at length about how long it’s been since they’ve actually paid their mortgage and most of them have not had any communication from their lender at all! I doubt that this group is an anomaly. They are living rent free and loving it. Some of them have rental properties, so they are collecting the rent and pocketing the money just waiting for the bank to take some action. I have been hearing these stories from the same people for over a year! I’m starting to think that maybe I”m the sucker since I pay my monthly rent and do not have a house I can’t afford…

As was mentioned, you will not find any “real” news or hard numbers reported by the MSM. The people who pull their puppet strings want good, optimistic, rose colored glasses reports given to the uneducated masses. If you scare the heard enough, big problems will result. People might actually stop the consumer spending binge, stop buying overpriced real estate or heaven forbid…they might pull their money out of the Wall St. casino. The biggest fear of the MSM is people finally wising up and taking a stand against our corrupt leaders and government. This is the way the game has been played for a very long time.

When you go see a movie, the speakers are on the sides and in the back.

There are no speakers behind the screen.

Yet, when the actors mouths move, your brain disregards the input from your ears and makes you think that the sound is coming from their mouths.

Many, many, many people have disregarded the factual input from people like Dr.HB for a long time, now…

As long as FASB will allow the mortgage holder to keep the loan on the books at face value instead of market value, they have little incentive to pursue the mortgages that have gone into ‘late payment” status. I suspect many of these banks would be insolvent if they actually served NOD’s at 90 days late and followed them through to foreclosure.

Heard on NPR this morning–

Four Letters Ease Housing Fears For Some: Rent

http://www.npr.org/templates/story/story.php?storyId=128703796&sc=emaf

MSM hits the spot.

We got the bubbleheaded bleach-blonde, comes on at 5

She can tell you about the plane crash with a gleam in her eye

It’s interesting when people die, give us dirty laundry

Can we film the operation? Is the head dead yet?

You know the boys in the newsroom got a running bet

Get the widow on the set, we need dirty laundry

You don’t really need to find out what’s going on

You don’t really want to know just how far it’s gone

Just leave well enough alone, keep your dirty laundry

Kick ’em when they’re up, kick ’em when they’re down

Kick ’em when they’re up, kick ’em when they’re down

Kick ’em when they’re up, kick ’em when they’re down

Kick ’em when they’re stiff, kick ’em all around

Dirty little secrets, dirty little lies

We got our dirty little fingers in everybody’s pie

Love to cut you down to size, we love dirty laundry

We can do the innuendo, we can dance and sing

When it’s said and done, we haven’t told you a thing

We all know that crap is king, give us dirty laundry

————-

It’s better when you’ve accepted that they’re lying to you because then you can move forward; expressed more eloquently:

If there must be trouble, let it be in my day, that my child may have peace.

Thomas Paine

Check out these people, http://www.beforeclosed.com. This adds a whole new meaning to airing your dirty laundry in public. …

There are indeed valid points to made about the potential for collapse, but it may take many years still. In the late 80’s Ravi Batra made a tremendous case for the great depression of 1990, and it may have indeed contributed to the panic of 1987. There were a lot of jolts in the next few years but things basically went ahead until 2000 when the bottom fell out. While there is an unimaginable amount of debt, derivates, dollars, dreams; most of it is not real, but numbers stored in computer memory. The lives of 8 billion people won’t stop because the numbers don’t jive–they will collapse when the physical survival capabilities will no lonver support 8 billion, or whatever the current world population is.

Easter Island, Mayas, Rome, Angor Wat–these civilizations collapsed when the population did not have the physical means to support the lives of the masses. We are trading long term survival for short-term self glorification on all levels. 50-100 Million dolar homes…resources we must steal from other countries–we get their oil, cars, junk, exports of all kinds; they get IOU’s. We have been running multi-billion dollar trade deficits for decades. I think they are on to us…housing in CA is unsustainable. But is it this year, next or five years from now. We are in the twilight zone,

Dr. HB, I’d like to hear from you in more detail on how the banks are handling the lack of income from mortgages, and how that’s being hidden on their balance sheet. I’ve been looking at foreclosures for months now, and finally have started to see some that are reasonably priced and appraised fairly accurately (without a lot of bubble-thinking). Problem is, every time I make an offer (even at asking price!), the banks claim there’s multiple offers and counter with a request for an extra 10-15% over the appraisal in cash! Of course, the deal falls through and I’ll see the place sitting on the market with absolutely no activity for months. The banks don’t seem to have any incentive to actually sell the house, even when they’ve bothered to put it on the market! I just don’t see how this is working as a viable business plan for them.

@Micro – there’s a good and bad to this trend. I’ve spoken at length to some journalists and they are experts at writing and checking sources but not necessarily experts in whatever field they are covering. For example, business writers who have never worked in business or real estate journalists who have never been real estate agents. A lot of these people just take government or other data at face value and repeat it as the truth. The other type of “journalist” has worked in the field they are covering but seem to only want the fame that goes along with being on TV, so no real investigation into stories there. Thank god for bloggers.

Because the mainstream press is OWNED by the very same crime syndicate that massively benefited from the fraudulent run-up(s), and which has massively benefited from the fraudulent bailout(s). BOTH the Democorp and Republicorp parties are part of this syndicate. Additionally, the Democorp and Republicorp parties provide a “user interface” for higher-level syndicate members, and this user interface is the tool by which the syndicate royally shafts the sheeple, over and over and over again. W a k e u p.

Mortgage fraud in California?! Say it isn’t so!!! (sense the scarcasm)

http://www.reuters.com/article/idUSTRE67G1S620100817

Leave a Reply