Rental World: California adds more than 500,000 renters while the homeownership rate declines amidst a boom. California food stamp users jump from 2.2 million in 2008 to nearly 4 million today.

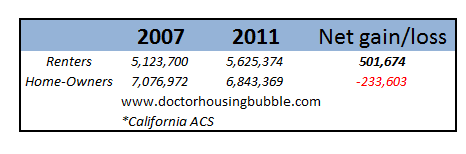

The California housing market is providing us with two different pictures. First, home prices have surged and inventory is still very low (although increasing from the spring low). However, the homeownership rate continues to decline from the peak reached in 2006 of 60.2 percent. Today the California homeownership rate is 54.5 percent. How big of a difference is this? Since 2007 California has added a net of 500,000 renter households while losing a net of 233,000 homeowners. Yet the market continues to boom in the face of a declining homeownership rate. As we look at the market today we start seeing a slowdown in the speed in which flips are being accepted and inventory is rising. With higher interest rates and the fall season just before us, will the market thaw or continue to accelerate?

Taking account

It might be useful to take into account what has occurred in the last few years in regards to the status of occupied-housing in California:

California has added a significant number of renters over this period. Many of these people lost their homes via foreclosure and simply shifted to renting their place of occupancy. What is interesting is the number of renters being added has only increased. The above data is from the Census ACS that came out in September of 2012 (the full 2012 data should be out in fall of 2013). The above figures were calculated when California had a 55.3 homeownership rate (the latest figure is 54.5 percent):

One of the big reasons for this shift has certainly come from investors purchasing homes for rent. In more typical markets, a home is sold and then another one is usually bought (two transactions are generated). In the recent market with many foreclosures, you had someone losing their home and then someone buying it from the bank (which was a one-and-done transaction if it then became a rental). This was likely the case in many areas including the Sacramento area and also the Inland Empire. I know of a few people that bought in Los Angeles and Orange County for these purposes but their rental yields were extremely low.

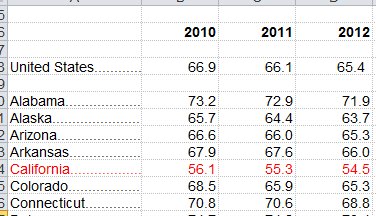

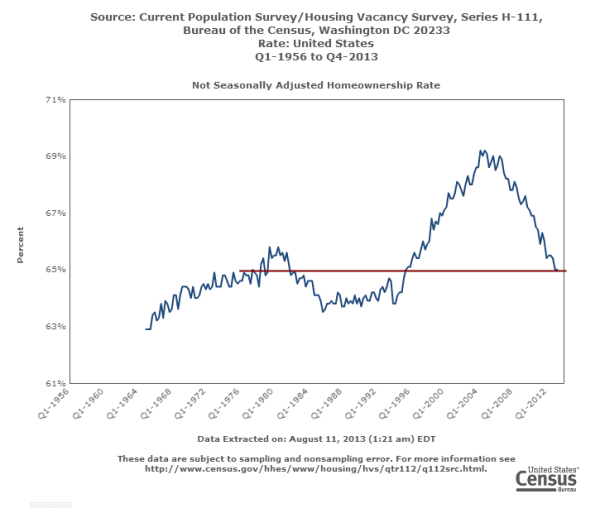

This trend to a lower homeownership rate is not only specific to California. It is a nationwide trend:

The homeownership rate today is back to where it was in the mid-1990s or if you go further back, to what it was in the late 1970s. In California home prices are in a manic like acceleration upwards. The median home price in the state is up a record 28.5 percent over the year:

Median price:

May 2012Â Â Â Â Â Â Â Â Â Â Â $274,000

May 2013:Â Â Â Â Â Â Â Â Â Â $352,000

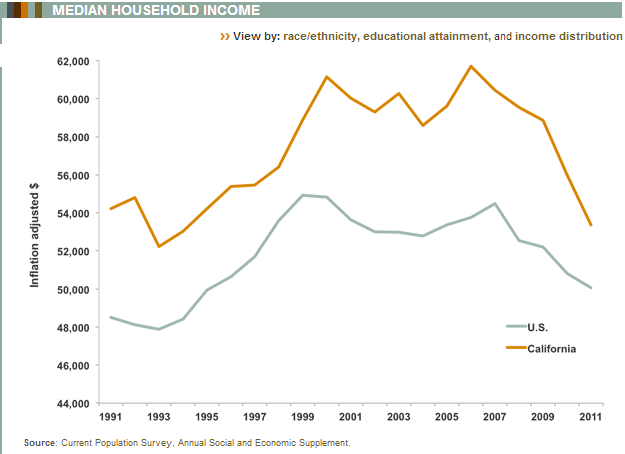

Home prices went up by $78,000 across the state while incomes look like this:

To put it another way, a California family would do better by simply sitting in their home generating “equity†instead of working. This is starting to sound very familiar since many of the ancillary businesses are now starting to rev up and once again have become very real estate dependent. For example, banks are living high on the hog with low rates and a continual stream of refinances. Fees and leverage allowed for record profits once again. We are even seeing a few of our favorite loans cropping up once again as well.

Yet the change in California is symbolic of a bigger trend nationwide. Fewer and fewer people will be able to live what they think of as a middle class lifestyle in more expensive regions. And the legions of poor are also growing. In 2008, California had 2,220,127 people of food assistance. Today it is closer to 4,000,000 (a jump of 80 percent in roughly four years). This is in the same state that saw an overall median price jump of 28.5 percent.

The unsold inventory index is down to around 2.9 months which indicates tight conditions for anyone looking to buy. While the talk is heating up, the facts show that hundreds of thousands of Californians have now become renters versus homeowners. A few open houses seemed a bit calmer this month but only by a little.

What are you seeing in your local real estate market?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

53 Responses to “Rental World: California adds more than 500,000 renters while the homeownership rate declines amidst a boom. California food stamp users jump from 2.2 million in 2008 to nearly 4 million today.”

And of the 4,000,000 on food stamps; 400,000 of those are in San Bernardino County. Don’t even get me started on this garbage!!

Now don’t get me wrong, the Western Valley of San Bern County is quite nice. This is the Rancho, Upland, Chino Hills area. Much of Ontario is solid as well, and FONTANA was just ranked 15th safest city in the nation and 4th in CA by the FBI crime bureau. Being familiar, I can attest to that. It may be dusty and some parts in the middle a little white trashy, but north and south Fontana are all new and quite nice.

But it’s the rest of SB county that is a shame. Stop off at Stater Bros in Rialto, SB, Colton, Pomona, or Victorville and watch the check stands. Ghetto people piling up the frozen dinners and soda’s, then whipping out the ol “State of CA gold card” to pay for it all. Then take $20 from their cash side and buy booze. This is COMMON.

If I was in charge of the food stamps, I would make it illegal to buy anything in the aisles of a store. Why? That’s where the boxed and frozen junk is. What is on the ‘racetrack’ (outside wall) of the store? Fruits, veggies, meat, milk, cheese, eggs. Healthy things people who are getting free money should be forced to eat.

I don’t get the COL out here, and how the system manages to work. Now granted it’s been 12 years since I’ve been in the Midwest, so I have forgotten the daily in’s and out’s of life there, but I remember conservative finances well. And the math in CA just doesn’t add up. It has to be multiple people paying rent or mortgage payments, there is just no other way to survive out here for all these blue collar and service industry people living in ANY suburb or L.A. proper. There are just too many fees and taxes people are forced to pay that takes away from discretionary income.

Yeah. The midwestern states are full of decent white (non-ghetto) people who live within their means and eat healthy fruits and vegetables that they cook themselves from scratch after getting home from work.

Conservative finances always go with conservative politics, everybody knows that. Oh wait. Turns out to be a fact that the red states receive more federal money from the pot than they pay into it, and blue states pay in more than they receive. Which doesn’t defeat your argument, because that really is so unfair to the non-ghetto people in California.

Source on red states receiving more federal aid money?

DCRP,

Here you go:

http://www.slate.com/blogs/the_reckoning/2012/10/25/blue_state_red_face_guess_who_benefits_more_from_your_taxes.html

(Where is your “reply” button, if you’re challenging me to reply…?)

Did you actually click through to Slate’s “source”? It just linked the Tax Foundation’s website, not the data itself which was conspicuously absent. Also, neither the article nor the (absent) data demonstrated that the aid received by a state exceeded the taxes paid. It DID say that there were a high percentage of non-payers in certain states, but that doesn’t mean that the total federal tax revenue collected by the federal government from that state was less than the aid received. There were no data on income distributions in those states nor total revenues collected. Did you actually read the article?

DCRP,

Look. You can love it or leave it. You can hate what I read and what I believe. You can even come up with your own research or just believe what PapNow believes, which would be much the easiest thing: ghetto people are a drag on “the economy” and midwestern people have conservative fiscal habits, the former bad the latter good.

Yes I read the article. Here’s its last paragraph:

“So spare me all that red state angst about the federal deficits and national debt. When you stop spending New Jersey’s money, Tex, and produce a plan to replace it with your own revenue stream, then you’ve earned an opinion in the matter.”

Although I disagree with the article in that I recognize you can go ahead and have any opinion you like at whatever stage of understanding you happen to be. I mean I can’t stop you.

And once again I wonder, why are you the only person in the comments with no reply button? You’re stomping around demanding ’em. This will be my last to you. You’re on your own from here.

I find it obscene, too, Papa. “EBT Accepted Here” is plastered on every fast-food window as well.

Like every other program that comes out of D.C., you just have to follow the money:

“One after another, Democrats and Republicans all said exactly the same thing. ‘You have to get the anti-hunger groups on your side (to change SNAP policies to replace junk food for healthier choices). Until they are willing to support this, it’s not going to happen. Period.'”

“For example, ConAgra Foods, makers of everything from Slim Jims to Chef Boyardee, has made a $10 million commitment to Feeding America (anti-hunger group), which also lists General Mills, Kellogg’s, Kraft and PepsiCo among its donors in its annual report. The sponsors of FRAC’s fundraising gala dinner, held in June in Washington, included PepsiCo, Land O’Lakes, Yum! Brands, Nestle, the American Beverage Association, and the Snack Food Association.”

http://www.pressherald.com/opinion/competing-interests-fuel-food-stamp-debate_2013-08-11.html?pagenum=1

Heck with all the left-right arguments around here. Now we get to the nitty gritty of the culture wars: Foodie Chauvinism. Don’t you be dissin’ my Lean Cuisines!

your posts get more negative re: California every day, why are you still here?

Here’s an article in the 8/11 Los Angeles Times about the real estate tax loop-holes both the Republicans and Democrats are considering eliminating in order raise revenue in the fall, including the mortgage interest tax deduction. Currently you can deduct interest on mortgages up to $1.1 million, which is a wonderful benefit for the wealthy. Hard to imagine they won’t lower it, probably to the level of jumbo loans ($625K). What do you think that will do to property values in So. California?

Worth reading —

http://www.latimes.com/business/realestate/la-fi-harney-20130811,0,177141.story

People who have no homes, kitchens, pots or pans and are working 2-3 jobs don’t really have the luxury to be a master chef every night. Aside from that…Have you seen what school lunches look like? It’s all about supporting the fast food industry…

I live in Rancho Cucamonga but work in San Bernardino. I do stop in a few of the Stater Bros markerts in San Bernardino from time to time and I see exactly what you are talking about. It really annoys the hell out of me to see the person in front of me using an EBT card to pay for their junk food while playing around with their fancy smart phone. I see booze too but I assume they have to buy that with their own money. THEN, as an added bonus, I’ve seen on more than one occasion the very same EBT card users walk out to their Cadillac Escalade or Lincoln Navigator with the fancy 20+ inch wheels and drive off. Ah yes… the California dream… to live off of government handouts.

Todd S., as has been pointed out in this stream, sure there are “poor” people who take advantage of these programs…but corporate interests are the ones that keep these programs in place with their lobbying dollars because ultimately, the corporations benefit above every other entity. Who cleans up the mess in terms of obesity, diabetes, etc? It’s Joe and Jane taxpayer, while the corporations hide their profits overseas. Like I said in prior post…follow the money

Keep in mind food stamps is not a benefit for the poor, it’s a subsidy for the food producers. It was created to absorbe surplus production during the 1960s and 1970s, but it has remained in place long after it was needed. ConAgra, Cargill, and ADM don’t care what food stamp recipients buy. It’s all made from their produce.

Can’t agree more. Just went by Walmart superstore around 5pm today on a Sat evening and there was hardly any soul. The is a a super store and there were only 4 checkout counters open and there were no lines. Compare that to the end of the month when EBT is loaded and you cannot find any room along the food aisle. I can understand why the food industry and the retailers would support the food stamp program. This not to say that I am against EBT. Just an observation.

Papa, sorry to burst your bubble but the claim that Fontana is the “15th safest” was from businessinsider.com they mention that they derived that number using the FBI stats however, if you look at the FBI stats it’s not true at all. I would take anything from businessinsider with a grain of salt and no offense but Fontana is a ghetto and I would never live there if I could help it. I know you’re bias because you live there but I have property next door and stop by often enough to know Fontana is still a ghetto.

Sure troll, I’ll bite. Fontana has ZERO ghetto in it. Are you elitest or something? I find your comment insulting and beyond the pale.

Let’s examine Fontana’s three zip codes. I see absolutely no ghetto here. As I said, there is some white trash in the middle, particularly the eastern 1/2, but no graffiti, drive by’s, or bums that would constitute “the ghetto” like I drive through on the 105 freeway every day. In fact, if people in CA would not be so concerned with faking the funk, and lived within 2.5X their income, most of SoCal would look like Fontana. And yes it is a very safe place to live, kids fill the streets on their bikes and razors every night.

I see no ghetto in these three links.

http://www.redfin.com/homes-for-sale#!market=socal&num_baths=1.25&num_beds=3®ion_id=38276®ion_type=2&v=8

http://www.redfin.com/homes-for-sale#!market=socal&num_baths=1.25&num_beds=3®ion_id=38277®ion_type=2&v=8

http://www.redfin.com/homes-for-sale#!market=socal&num_baths=1.25&num_beds=3®ion_id=38275®ion_type=2&v=8

California has become a third world country. I feel like being in India during the good old days. Just consider yourself lucky if you are a part of the ruling class(top 5%).

Homeownership is dropping because employment is worse and the low interest rates are only good for those that have jobs and great credit

This housing bubblet is not as deep and wide as the last one

You said – “Homeownership is dropping because employment is worse and the low interest rates are only good for those that have jobs and great credit”.

You forgot it’s only good for those that bought in 2011 and refi’d to 3.5% in 2013, and those who bought pre-2004 and refi’d to 3.5% in 2013

If the housing bubble is not as bad in comparison to 2003-2007 then this new housing recovery should be extended out to 2030+ or longer. Home values would have to remain relatively flat and/or decline with slow growth while a majority of the populace catch up on savings.

@Homerun wrote: “… this new housing recovery…”

Housing recovery? What housing recovery?

1.) Pushing the interest rates from 5% in 2011 to 3.25% in May 2013 means that home selling prices can go up by 20% but the monthly payment does not change.

2.) The surge in FHA buyers with their 3.5% down payment creates maximum leverage.

3.) The Federal Reserve keeping the overnight rates at close to zero percent interest (ZIRP) means that member banks can use this ZIRP money to keep non-performing mortgages off of the market for up to 10 years (inventory manipulation).

4.) ZIRP money causes investors to chase after yield (i.e. real estate)

Q: Has there been a “housing recovery”?

A: No. It’s yet another bubble engineered by the Federal Reserve, and it is all connected to artificially low interest rates.

and most of the “housing recovery” has been accounted for.

I was being facetious. That is what the FED and media wants us to believe we are in a recovery. I don’t believe it and I agree with your points.

Homerun, you are right-on!! 😉

Don’t suppose there’s any sign of a rent-price-crash looming?

Thought this may be of interest to you, Dr.HousingBubble:

http://www.reuters.com/article/2013/08/11/us-usa-homes-flips-insight-idUSBRE97A05W20130811

Yes, the article provides more anecdotes that the $300-$500k market has been flipped out and now the financiers and flippers are moving up well into the seven figures markets. Good for them. Higher risk higher reward. For the Sarah Gilberts of the world too lazy to scour around on their own…let them benefit from the “services” of these flippers.

One perspective highlighted in the article is that what is partially fueling this high-end flipping is that Prop 65 lottery winners are really dying off or down-sizing.

More evidence that nothing will ever be done about Prop 65…its sunsetting will be the white light that these lucky boomers see in their final moments. Since most of them have no other savings to speak of, they’ll take the money and limp versus bequeath their lottery win to their offspring. Sorry, kids!

Good read. Thanks for sharing the link.

Doctor, what do you think will happen in the great state of California when we have more renters on food stamps than homeowners? Do you think that prop 13 will survive? Do you think that there will be any problem with voters voting in more “tax the rich†initiatives? What happens if we have more renters than homeowners nation wide? Maybe this is why the Federal government is trying to come up with creative ways to find new voting homeowners…

What really puzzles me is that we are hearing talk from the lame duck Obama administration of closing the only financing vehicle for housing (GSE’s). This is after the most intrusive government interaction in the housing market that I am aware of (QE infinity). Does anyone really think that we can close the GSE’s? Does anyone really think that the Fed and taper? I am not sure what is real and what is for show anymore…

Whoops! I meant the fed CAN taper!!!

Taper talk mostly MOPE… with germ of truth…

I think the reason for the ‘taper talk’ is to control perceptions, to continue to cause investors and hedge funds to doubt the possibility of continued QE and hold off on placing gold bullish bets or bond bearish bets (since ‘if we can taper, surely there is no risk of bond market crash, right?’).

However, there is no way the Fed can discontinue ANY of their bond buying, that I can see.

OTOH, they *could* stop absorbing the MBS from the TBTF banks, and therefore trim back on *total* monthly QE. This is the germ of truth that they will then point to as saying ‘see, we can do this.’ They can pull back from these IF they are willing to bet that they have created enough upward momentum in housing such that the bad MBS will stop getting worse… after all, the whole reason for buying these MBS was to take the worst debt off the balance sheets and replace it with good collateral. From the outside, it looks to be working. But I think something is rotten in Denmark. The shadow inventory is actually huge. The nonpayment portion of MBS that is unacknowledged and not even in the official foreclosure pipeline is significant.

Do they really believe they have ‘done enough’ for RE that they can stop propping it? Well, most ‘hot’ areas have the new buyers who rely on purchase loans chasing the market up and failing. The successful buyers have been cash-paying flippers or wannabe renters. It may take a year or so, but that bubble is deflating already. The flips will fail, and the properties are priced above cash flow break even, so good luck to the new landlords.

And don’t look now, but the bulk-buying (off-market, low-balling) hedge funds who were early in the market have been absent for a year or two, and are now actually prepping to spin off REITs consisting of SFRs that have barely a year or two of ‘history’ as to cost and cash flow. Good luck buying those! Same old *#@$ that wrecked us in the 2000’s.

And at the same time, Obama himself now steals the Republican position and says he wants to shut down Fannie and Freddie ‘so the taxpayer does not have to take any more losses.’ LOL…. well, if the private sector he now champions takes over the pricing of loans, riddle me this: which way will rates go if properly priced for risk of default, to ensure that the private sector does not lose money either? And how much of a drag will THAT be on the market, right at the time that the pseudo-cash flipper buyers look to unload? (They were ‘deep pocket’ borrowers, not true cash buyers, in many cases, according to socal housing blogging I follow.)

So sure, let’s watch as they taper the MBS and RE rolls over next year and takes a nose dive in the hot markets (like socal, where the MBS are most at financial risk).

Meanwhile let’s also watch as they buy even larger amounts of Treasury debt, especially as China continues their process of NOT rolling over all the short term debt they own, and cash out instead? Who you gonna call?

Larry Summers, of course… our next Fed chief. Even the NYTimes is now writing fluff pieces to prepare everyone for the pronouncement of his annointment as the next Fed head… the dark horse (by economist’ consensus) just a few weeks ago is now the presumptive winner. Mr. QE continuation, but also, and more importantly, a true friend of the TBTF banks and Wall Street. Party on, Garth!

add: ‘MOPE’ ™ is Jim Sinclair’s acronym for ‘management of perception expectations,’ which is a large part of what central banking, ‘official’ data manipulation, and government pronouncements are all about these days. Where is the honest broker? Oh, yeah, Paul Volcker was shoved out of Oval room influence by… (drum roll)… Larry Summers!

In my opinion if FNF were dissolved what would probably be an outcome for all other private lenders? I would venture to guess that properties would fall, but by how much? I would expect more QE or maybe a new QE plan that covers low income housing lending for people with less cash or lower credit scores. Perhaps it would be the government or HUD that picks this up with QE support? New subsidized housing loans.

However, if FNF become privatized this would probably be business as usual and growth to the moon for all owners? Flipping would certainly continue and more homes would eventually enter the market causing the whole system to keep cranking higher until interest rates go higher along with QE taper, which should lead to a flattening or decline in pricing due to supply. Oh and refinances would probably continue.

Well I hate to say I told you so but I said this was the plan as far back as 2009. The banks did this purposefully and intentionally. They had legislation enacted that allowed them to to this. It’s no accident. It was Done to transfer the wealth i. e. The underlying assets. There is currently a quadrillion dollars in outstanding derivatives debt. The only way to pay it, or back up that debt with enough assets is to inflate the value of the underlying assets. There are not enough assets on the planet to back that debt. A loaf of bread would need to cost $1, 000.00. Or more. No the FED can not taper. If we had reality in the market it would mean systemic economic collapse. Of we don’t keep the fantasy going we are screwed. Problem is if we keep it going we are also screwed through the widening gap of haves and have nots with the suckers, I mean us taxpayers subsidizing the theft from both sides. Wealthy corporations and the poor. Like a candle being burned from both ends. Or a giant tapeworm eating itself. The more the Fed prints the banks don’t need to lend. Since money is debt, without debt there is no money. Currently the banks are being paid more to let it sit and collect interest at the FED. They have 1.8 trillion dollars parked there and we suckers, er taxpayers, pay the interest on that money. If that money were to make its way into the economy we will have sky rocketing inflation. It’s a real conundrum.

What’s sick is that foreign banks are parking their money in our Federal Reserve and we the taxpayers get to foot the bill.

The irony of all this market manipulation is that it was started to avoid a global collapse and the violence that comes with it.

Brilliant again.

QE or no QE? That is the question. What would the outcome have been if QE didn’t happen back in 2012? Seems oddly suspicious that there was house flipping going on BEFORE the FED proposed this. The QE in my view has come 4 years after one Presidential cycle and now we are going into the second half. It’s too staged to not be something that could have just happened because of the economic environment. Why all of a sudden is the media making it feel like its 2005-06 all over again?

In my opinion now we are about one year since the QE was created and coming up on a FED decision to Taper or no taper. I’ll bet it will be a crap shoot on what is going to happen, but I guess they may just kick the can down the road or possibly propose some reduction in QE maybe in the beginning of 2014 while saying everything is just fine . I think the FED is trying to make point that they see CONFIDENCE in the overall markets including housing. If everyone is happy the economy would be able to move on it’s own. QE just makes it harder for us to believe the BS.

“what do you think will happen in the great state of California when we have more renters on food stamps than homeowners? Do you think that prop 13 will survive? Do you think that there will be any problem with voters voting in more “tax the rich†initiatives? What happens if we have more renters than homeowners nation wide?”

If people would always vote their interests, our country would be very different.

Why do people vote against an estate tax even though they would more than likely never hit that threshold?

Why can’t we increase capital gains tax even though the majority of Americans wouldn’t be subject to it?

Why isn’t our tax rate even more progressive?

Whatever the reason, Americans generally have resisted targeting taxes against the rich.

The first thing the folks who hate Prop. 13 will do is repeal it for commercial real estate. There are too many older voters who own a house, and always come out to vote. The older voters may not care if businesses leave California in droves as they are retired, and living mainly on Social Security.

I believe that they won’t include rental residential real estate in the tax increase as the landlords would threaten big rent increases, scaring the tenants. I don’t know what would happen if it did pass. Especially in the rent-controlled liberal enclaves. But I may be over-estimating the sanity of the California political left.

As the population of CA ages and the state and local govt become more onerous, CA will start to resemble FL much more than the 10th largest economy in the world. It’s just the way things devolve when they get too big and too old.

The producers will get tired of fending off the govt and the senior voters and just start to leave the whole mess behind.

MB,

The rich are used as the patsies and demons to get at the real tax revenue generators–the middle class. The middle class makes nowhere the money the rich do, but there are so many more in the middle class the sum total tax revenue from them dwarfs anything potentially collectible in the upper income levels.

That’s why the progressive income tax code is so valuable to liberals and RINO’s. Politicians can go around and demonize individuals and income groups on a selected basis rewarding some while penalizing others. If income taxes are raised on upper income groups, tax rates by default on the middle class also rise proportionately if not modified by political whim.

The progressive income tax is why 47% of taxpayers pay no Federal income tax. Its why a family of four with an income of nearly $45k per year pays Zero income tax while a single individual making $45k already owes over $5,000 in income tax.

Obamacre government subsidies end at a little over $40k virtually assuring those below that income will have low cost to free healthcare. By $50k individuals pay the full premium price for Obamacare and pay the same premium cost as someone making $600k or $6 million.

Borrowing and using a slightly modified famous quotation, “Its the middle class stupid”.

If every few years you got the flu and now you had a strep throat it would be incorrect and possibly dangerous to think that you just had a bad case of the flu this year. Over the last hundred years there have been numerous recessions but only two depressions, the depression of 1929-1941 and the depression that began in 2007. The symptoms of strep throat and scarlet fever may be similar to that of the flu or common cold. However, causes of the former are the streptococcus bacteria while influenza is viral. Hence, strep throat and scarlet fever require antibiotics which are useless against viruses. Likewise, believing that the depression that started in 2007 is just a severe recession is quite dangerous to both investors and policy makers. As long as many policy makers appear not to realize the distinctions between recessions and depressions, investors ignore those distinctions at their peril.

The effects of the 2007 depression are much less severe than the 1929-41 depression because of safety-net benefits now provided. Consider the horrendous, though not uncommon situation of a household in 1932 comprised of elderly grandparents being supported by their working-age children with young children of their own, when the breadwinners became unemployed. The 1932 family would be destitute. Today the grandparents would have social security and Medicare benefits. Their working-age children could now collect unemployment benefits for up to 99 weeks. Additionally, the entire family could also be eligible for food stamps, Medicaid, rent subsidies, heating fuel subsidies, free school lunches and other benefits. The 1932 family might also have had a bank account in one of the many banks that failed and lost their savings. Today, Federal Deposit Insurance protects such bank accounts. You might say we are now in a depression with benefits.

The difference between a depression and a severe recession are not just semantic. Recessions occur when the Federal Reserve raises interest rates in an effort to slow down an overheated economy. Most importantly, recessions end when the Fed lowers interest rates. In a recession the pent-up demand for housing and durable goods means that monetary policy alone can cure the recession. Just as antibiotics can be effective against bacterial infections but not against viruses, monetary policy alone cannot end a depression. Furthermore, modest fiscal stimulus and the automatic stabilizers that can hasten the end of recessions cannot end a depression. There can be ups and downs in the unemployment rate during a depression. However, the unemployment rate remains elevated. It was 14.5% in 1940 and 9.7% in 1941.

If we are in a recession, economic activity will fully resume just from the monetary and fiscal stimulus that has already occurred. Ultimately interest rates will rise. However, if we are in a depression, even one with safety-net benefits that mitigate the hardships, interest rates will remain relatively low for decades as was the case in Japan and the USA of the 1930s, where only World War II ended the depression. The ideal investment for an extended period of low interest rates is agency mREITs.

Depressions occur after investment bubbles burst. In free-market capitalism, capital generates income for the owners of the capital which in turn is used to create additional capital. This is very good. Sometimes, it can be actually too good. As capital continues to accumulate, its owners find it more and more difficult to deploy it efficiently. The business sector generally must interact with the household sector by selling goods and services or lending to them. When capital accumulates too rapidly, the productive capacity of the business sector can outpace the ability of the household sector to absorb the increasing production.

The capitalists, or if you prefer, job creators use their increasing wealth and income to reinvest, thus increasing the productive capacity of the business they own. They also lend their accumulated wealth to other businesses as well as other entities after they have exhausted opportunities within the business they own. As they seek to deploy ever more capital, excess factories, housing and shopping centers are built and more and more dubious loans are made. This is overinvestment. As one banker described the events leading up to 2008 – First the banks lent all they could to those who could pay them back and then they started to lend to those could not pay them back. As cash poured into banks in ever increasing amounts, caution was thrown to the wind. For a while consumers can use credit to buy more goods and services than their incomes can sustain. Ultimately, the overinvestment results in a financial crisis that causes unemployment, reductions in factory utilization and bankruptcies all of which reduce the value of investments.

If the economy was suffering from accumulated chronic underinvestment, shifting income from the non-rich to the rich would make sense. Underinvestment would mean there was a shortage of shopping centers, hotels, housing and factories were operating at 100% of capacity but still not able to produce as many cars and other goods as people needed. It might not seem fair, but the quickest way to build up capital is to take income away from the middle class who have a high propensity to consume and give to the rich who have a propensity to save (and invest). Except for periods in the 1950s and 1960s and possibly the 1990s when tax rates on the rich just happened to be high enough to prevent overinvestment, the economy has generally suffered from periodic overinvestment cycles.

It is not just a coincidence that tax cuts for the rich have preceded both the 1929 and 2007 depressions. The Revenue acts of 1926 and 1928 worked exactly as the Republican Congresses that pushed them through promised. The dramatic reductions in taxes on the upper income brackets and estates of the wealthy did indeed result in increased savings and investment. However, overinvestment (by 1929 there were over 600 automobile manufacturing companies in the USA) caused the depression that made the rich, and most everyone else, ultimately much poorer.

Since 1969 there has been a tremendous shift in the tax burdens away from the rich and onto the middle class. Corporate income tax receipts, whose incidence falls entirely on the owners of corporations, were 4% of GDP then and are now less than 1%. During that same period, payroll tax rates as percent of GDP have increased dramatically. The overinvestment problem caused by the reduction in taxes on the wealthy is exacerbated by the increased tax burden on the middle class. While overinvestment creates more factories, housing and shopping centers; higher payroll taxes reduces the purchasing power of middle-class consumers.

…”

http://seekingalpha.com/article/1543642-a-depression-with-benefits-the-macro-case-for-mreits

Here is a story.

Broke guy lies about income and buys a California home around 2006 for $800K for interest only.

After a year or two of minimal payments stops making house payments and has others living in the home on Food Stamps.

The sympathetic government help this poor guy out after 4 years on non payments by reducing his principle balance by almost $200k to put it in like with market price. and he needs to pay a percentage of his “new” current income.

The CA market turns around and the home sold for $865K which puts a huge $265K profit in his pocket for gaming the system for 7 years.

This person continues to tell everyone in the office how buying a home was the smartest decision ever. Renting is for stupid losers.

That scenario is so amazingly sickening, but you know it happening in all areas.

When the president lies through his teeth with his latest “responsible homeowner ” plan, it makes me cringe. They aren’t even finished stealing from us, yet!

The flippers and specuvestors are definitely a factor, I tried to buy from mid 2011 to mid 2012 in northern Calif. and my offers were all ignored because I was competing 100% cash buyers…I had 20% down, a preaproved loan, great credit and job but none of that mattered. May try again after Bubble 2.0 pops but am continuing to rent in the meantime. I did own from 1997 to 2007, knew the pop was imminent thanks to a few blogs similar to this one and sold is spring 2007…FWIW a $10-15K “discount” from the going rate got me a buyer under contract in a week.

4M out of about 30M people on EBT? That’s right about the national average of 14%.

In case no one is watching, the wealthy are starting to get their money out of paper assets and into tangible assets like real estate and equities. Keeping money in debt or banks is getting sketchier by the year. Real estate can be a decent hedge against all kinds of govt failures.

I would just worry a little about the taxes our govt will start to create in order to fund themselves. Talk to anyone who’s dealt with the CA franchise tax board and you’ll understand how they can get. And they will probably be getting tougher in the years ahead as they are broker than ever.

Everybody keeps forgetting bubble 1.50, the famous Federal tax credit……we had in CA at the time our famous actor/govenour who come up with his own tax credit as well, so for some they had a double bubble going for sure.. (basically if you went FHA 3% down at that time you actually came out ahead of the game)not bad at all for a Fed and State freebee!! if you were a buyer back then you will probably remember the stampede to buy, multiple offers and going way over the asking price…Sound familiar to anyone?

A vast number of those people who bought a home in 2009/2010 which was another “Your going to miss it if you dont buy now” sales pitch were upside down between 5 and 10% almost immediatly in 2011. The good news is along comes QE3 and its happy days all over again!!!

MikeRE… 2011 still had over 50 percent of the active market distresses sales, much different now in 2013 where its less than 10 percent. Even on the wholesale side ( trustee sales) inventory is super tight and competition fierce. As the distressed market dries up, each sale is not just or two… But many multiples. Here in the IE there are a surprising number of listings in which the sale of the property is contingent upon the seller finding a suitable replacement property.

New home Entitlements in SoCal take years and construction financing is still not there in a meaningful way yet, so inventory shortages will continue.

I have been in the RE development business for 30 years now. I can not remember a time that it has been this difficult to get clients approved for a loan. This is why by the “flippers” / cash buyers always seem to get the “deals”.

IMO, the market will contine to rise… Albeit a slower pace, as the lending standards become less ridged. The pendulum has swung too far the other way. Stated income loans work fine when the buyer puts down 25 percent or more. The biggest problem was the “0” down programs and ez qual programs with instant piggyback seconds. Today’s FHA FNF loans are intensely scrutinized and meticulously underwritten.

Couple this with rising property values and the fact that interest rates over the last few years were at historic lows… It’s “bubble” won’t be popping any time soon.

In SoCal, most of the 3.5 percent down buyers over the last 4 years now have 20-30 percent equity, the the prospect for another oversupply of distressed properties is unlikely into the foreseeable future.

Each month more and more owners are becoming unburied in their homes and are now able to move… Up or down.

I think we are heading to a much more stabilized market with not so much fear of a bubble pop any time soon.

Interest rates staying low is well, an assumption. I think we are seeing first signs of bond vigalantes and inflation so rates will rise with GS pointing at 3% by end of year. This will crimp sales, lower conforming rate limits will be making comeback as private equity replaces govt. loan bordellos. Lending standards are no different than in 1994 coming out of a recession. Home prices being higher and incomes denting PTI and DTI ratios will make 94 look like a walk in park.

The only caveat is inflation. The fed has no idea what the next step is but they know inflation is about to roar because they fed it. People will be hurt after all is said and done. This is the reason pe, blackrock, hedge and ex sub prime lenders are now bulk purchasers. The only way housing can rise further is inflation, the price fixing and collusion have already taken place…So your price inflation will come true to the pain of the average citizen. This bubble could be worse than the last one so pray for inflation…

Feels like the hedges have invaded the board. Seem very confident in that statement? Maybe we should boycott all the hedges and sub lenders properties from being rented. Wonder what kind of return they would get if no rent?

Prices are definitely up in our neighborhood in North San Diego county.

Dr. Housing Bubble, I was wondering if you could comment on the fair number of closed sales in the last few months or even a little longer that I have noticed in Redfin closed sales #’s, by just looking in my own neighborhood, where the “foreclosure or short sale” price is “1996” low. Who gets these deals?

This is happening at the same time that ridiculously inflated prices are closing on smaller homes in similar condition and locations.

When we looked at homes a few years back when prices were low, our agent was so nice but so not even thinking of offering prices this low.

It has to be more than “inside real agent world,” doesn’t it? Is it Bank pres. relatives or foreigners who are friends with the current administration?

California is such a freak show.

If only Lex Luthor could be successful in that scheme he had in the first Superman movie. Just send it all into the ocean.

Truly hilarious and original, MM, despite the illogical reference and poor syntax. Go figure.

Hilarious.

“dwarfs anything potentially collectible in the upper income levels.”

False or a lie. Upper income levels pay practically no taxes and these people make tens of millions per year. If they really would pay 45% of that as tax, it would easily dwarf anything middle class pays even there’s only some % of high income people.

But of course tax evasion is the rule at that income level and these people pay less than 1% of their income as tax, often nothing at all. Far cry from 45% they _should_ be paying.

From that point of view it’s totally absurd to whine about low income people being freeloaders: They don’t have the money to pay tax while the rich people have money but evade taxes, just for personal profits and while there’s only a million or two of these, taxes evaded per person are several millions, resulting billions of tax evasion losses.

Taxes are for the poor, says Congress.

Leave a Reply