California renter apocalypse: Why the rise in housing values is a reflection of a disappearing middle class. California rents up 5.7 percent last year.

The rise in rents and home prices is adding additional pressure to the bottom line of most California families. Home prices have been rising steadily for a few years largely driven by low inventory, little construction thanks to NIMBYism, and foreign money flowing into certain markets. But even areas that don’t have foreign demand are seeing prices jump all the while household incomes are stagnant. Yet that growth has hit a wall in 2016, largely because of financial turmoil. We’ve seen a big jump in the financial markets from 2009. Those big investor bets on real estate are paying off as rents continue to move up. For a place like California where net homeownership has fallen in the last decade, a growing list of new renter households is a good thing so long as you own a rental. The problem of course is that household incomes are not moving up and more money is being siphoned off into an unproductive asset class, a house. Let us look at the changing dynamics in California households.

More renters

Many people would like to buy but simply cannot because their wages do not justify current prices for glorious crap shacks. In San Francisco even high paid tech workers can’t afford to pay $1.2 million for your typical Barbie house in a rundown neighborhood. So with little inventory investors and foreign money shift the price momentum. With the stock market moving up nonstop from 2009 there was plenty of wealth injected back into real estate. The last few months are showing cracks in that foundation.

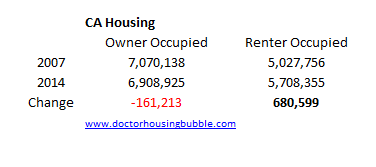

It is still easy to get a mortgage if you have the income to back it up. You now see the resurrection of no money down mortgages. In the end however the number of renter households is up in a big way in California and homeownership is down:

Source:Â Census

So what we see is that since 2007 we’ve added more than 680,000 renter households but have lost 161,000 owner occupied households. At the same time the population is increasing. When it comes to raw numbers, people are opting to rent for whatever reason. Also, just because the population increases doesn’t mean people are adding new renter households. You have 2.3 million grown adults living at home with mom and dad enjoying Taco Tuesdays in their old room filled with Nirvana and Dr. Dre posters.

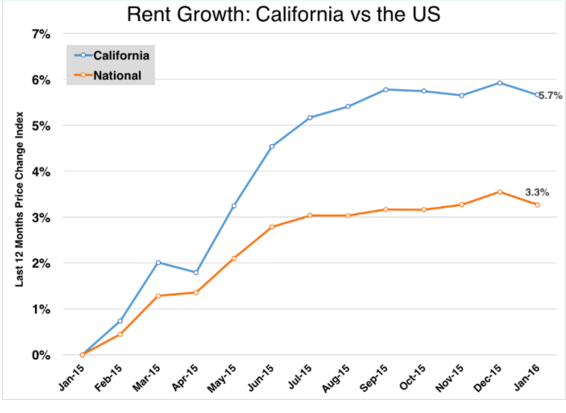

And yes, with little construction and unable to buy, many are renting and rents have jumped up in a big way in 2015:

Source:Â Apartmentlist.com

This has slowed down dramatically in 2016. It is hard to envision this pace going on if a reversal in the economy hits (which it always does as the business cycle does its usual thing).

Homeownership rate in a steep decline

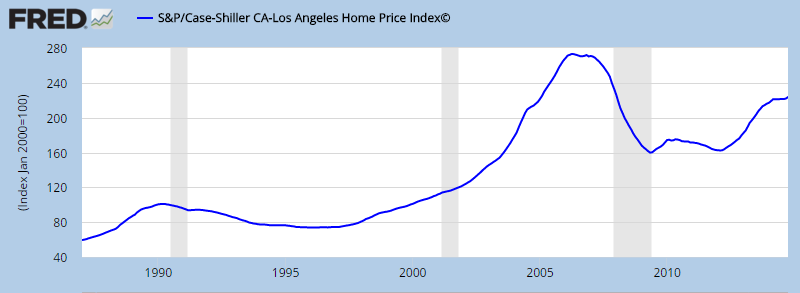

In the LA/OC area home prices are up 37 percent in the last three years:

Of course there are no accompanying income gains. If you look at the stock market, the unemployment rate, and real estate values you would expect the public to be happy this 2016 election year. To the contrary, outlier momentum is massive because people realize the system is rigged and are trying to fight back. Watch the Big Short for a trip down memory lane and you’ll realize nothing has really changed since then. The house humping pundits think they found some new secret here. It is timing like buying Apple or Amazon stock at the right time. What I’ve seen is that many that bought no longer can afford their property in a matter of 3 years! Some shop at the dollar store while the new buyers are either foreign money or dual income DINKs (which will take a big hit to their income once those kids start popping out). $2,000 a month per kid daycare in the Bay Area is common.

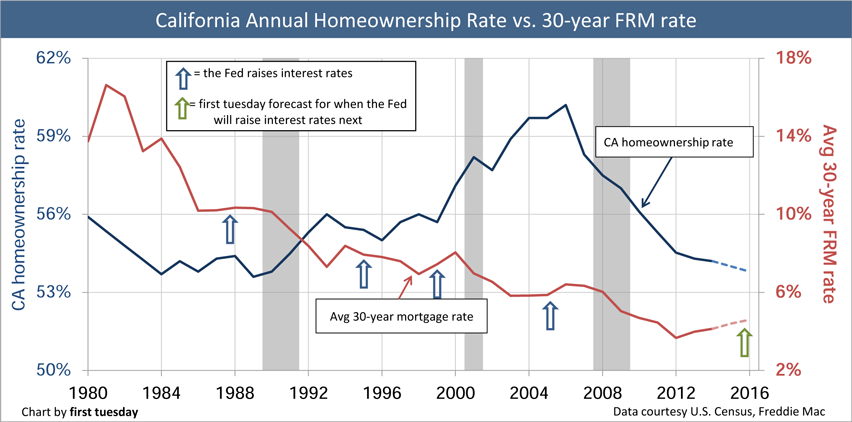

If this was such a simple decision then the homeownership rate would be soaring. Yet the homeownership rate is doing this:

In the end a $700,000 crap shack is still a crap shack. That $1.2 million piece of junk in San Francisco is still junk. And you better make sure you can carry that housing nut for 30 years. For tech workers, mobility is key so renting serves more as an option on housing versus renting the place from the bank for 30 years. Make no mistake, in most of the US buying a home makes total sense. In California, the massive drop in the homeownership rate shows a different story.  And that story is the middle class is disappearing.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

101 Responses to “California renter apocalypse: Why the rise in housing values is a reflection of a disappearing middle class. California rents up 5.7 percent last year.”

Sacramento is third highest rental market in country. Gotta love fake capitalism. My income stays the same but I’m expected to pay more for rent and to qualify just to have the option to rent an overpriced home or apt. Get this new trend, they are now requiring 70% to as much as 80% of the three times your income to rent ration. Or, if your rent is 1500.00 a month, your income better be higher than 5500 per month or your a deadbeat. They might even throw in a 70 dollar a month water charge just for fun. I am thinking the rental agencies are just trying to see how high they can go before people stop renting.

It is pretty amazing to think that 1,500 is the best we can do with income like that. But the truth is 1,500 used to buy a lot not too long ago. So the metrics are fine. The issue is due to the increases what 1,500 buys now is pathetic. Might be time to start thinking of moving to Idahoe.

“Might be time to start thinking of moving to Idaho.”

Nothing wrong with that Jim. Some parts of Idaho are absolutely beautiful: Sun Valley, McCall, Coeur D’Alene, Sandpoint – definitely way more beautiful than Sacramento.

The problem is, how you make a living in Idaho?

Agreed flyover COurdelane is beautiful even though I don’t know how to spell it. It sure would be nice to own a quality home there than a crapshake in Sactown. If I had to buy a home that is what I would do. But for now I’ll just rent and that is working fine.

It’s spelled Coeur d’ Alene (that is how you spell it), and yes it’s beautiful, but there aren’t a lot of ways to make a good living there. I grew up right near Coeur d’ Alene. Sure, some people make a good living in Idaho, but there is no tech industry, and it is hard to make a good living. CDA is mostly a service industry/tourist economy anymore.

Idaho doesn’t invest in their education system. If they did, then I suspect they could attract some tech industry throughout the state. Who wouldn’t want to live there (barring some of the bigots and aryan types). It’s a gorgeous natural wonder land, and there’s lots to do…but there’s no industry anymore.

But ask most Idahoans, they don’t want you to move there. I’d go back if there was anything there…trust me, I want to leave the Bay, I want to be able to not have to live in the same house as my landlord even though I make 55-60K a year.

In my opinion, I have been thinking rental agencies/landlords including apartment complexes are looking at percentages rather than what you make. I guess they figure the rent cost is justified based on what jobs are out there and maybe they assume the rentals are mostly for two people instead of one? Finding someone to share the rent seems to be where things are going based on what I have seen.

I guess if rentals stay idle longer than normal maybe that might justify correcting prices, but for now I think agencies/landlords possibly are looking at how people change their perception about living in these times.

That’s nuts. Sacatomatoes isnt that great. Were so deep into bubblesville is even isntnisin isintniwent isnrtmisentnisent isentnt isent even funny.

“Fake capitalism”. Yes, it could also be called “crony capitalism” or “rentier capitalism”. It involves an absence of true free market competition. Of course big “capitalists” do like to rig the system in their favor – in the case of housing, it is government not allowing the market to convert abundant rural (or other non-urban) land to urban use, in response to demand. There is no other single factor that explains whether or not a housing market will be affordable, and no other single better way to “rig” it in favor of incumbent wealth.

Sacramento is a big government town with little private industry and no major corporate headquarters. Almost everyone in Sacramento is dependent on big government: state workers, lobbyists, politicians, and welfare recipients. Sacramento is like Washington DC where taxes from elsewhere inflate the rental and housing markets.

Greater Sacramento:

Intel

Hewlet Packard

But, otherwise, you’re on target.

Silicon Valley has over flowed into the Stockton-Sacramento corridor.

Travis AFB is also a ‘kicker.’

Yep and my zipcode is full of state workers living in McMansions. Didn’t know they paid state workers that well lol

The average income in Sacramento region is like $36,000… average crap run down apartment cost is $1170 per month. So 39% of the average income goes to rent. And not even a luxury apartment. How depressing.

I was entertaining a job offer in Sacramento until I saw rent prices. Some areas are Bay Area prices! Even in run-of-the-mill suburbia, 1 bedrooms are going for $1600/month plus the ticky tack fees for everything you mentioned. It is completely mind-boggling.

There’s always work, everywhere, and usually a niche. When I obsess about my tiny retirement town in Idaho, people online will say “it’s a beautiful place with no jobs,” but what they really mean is that there are no corporate jobs. My sister owns a vacation rental there, and literally cannot find a taker for a $50/month gardener/handyman position. 2-3 hours work/month involved, easy money, and no one wants it. I talked to a property manager who said it’s a problem up there, because they’re a few miles from a ski resort with a lot of vacation rentals, but the “there are no jobs” crowd apparently refuses to do simple labor to pay their $150/month room rent, or $500/month house rent/mortgage. Is working at Target somehow more prestigious?

If I didn’t have kids who need to be socialized and prepared for the bigger world, I’d be up there like I was fired out of a cannon.

“My sister owns a vacation rental there, and literally cannot find a taker for a $50/month gardener/handyman position. 2-3 hours work/month involved… Is working at Target somehow more prestigious?â€

No, Target is not more prestigious, but if one were able to work full time at Target (say, at $9 an hour), that’s $1,440 every 4 weeks, pre-tax. Going to work every day at Target is much more reliable and involves much less headache and hustling than trying to cobble together odd jobs from people who want to pay you $50/ month for a few hours of work. I mean, really, who is going to do anything for $50?

Someone who pays $150/month to rent a room in a virtual paradise of a small town, 50 miles and a snowy mountain pass away from the nearest Target (which is NOT located in paradise). There are no corporate jobs in many flyover areas, which is the reason many people give for not moving there. To each his own, but I think a simpler, independent life is far more enticing. There are other jobs there too, of course, none of which involve benefits, but then there’s the commute – 5 minutes on foot or 30 seconds by car.

(Also my gardener, who gets $40-50/month from hundreds of clients. Needless to say he doesn’t do much labor any more.)

Responder,

I live in a small town (30k people) and the lowest paid reliable landscaper or carpenter I can find is $38/hour. The lowest paid reliable plumber I can find is $75/hour and the lowest paid reliable electrician is $100/hour. The landscaper makes over $100,000 per year after all the expenses. He can barely speak English, but he is a reliable and hardworking man. He works long hours.

For these prices, they don’t even have time to sleep (more than 2000 hours per year). Nobody says even “Hi” without $100 minimum charge.

These are people close to skiing, fishing, hiking and all the open outdoors have to offer. No traffic at any time of the day and clean air year round.

There are corporate jobs, but not as many as in LA area. However, there are 30k people not 30 million people.

Where the heck in Idaho is a room $150/month? When I was in community college in CDA in 2005-2007 I paid 350-400/month for a room which included all utilities. This was nearly ten years ago. Unless he’s living in a tool shed outback, this guy is not paying $150/month for rent.

I lived my entire youth in Idaho, and there is no where that you can get around everywhere on foot in Idaho in 5 minutes, especially a little mountain town. Everything is spread out in Idaho. Maybe in downtown Sandpoint, or CDA you can get around to the shops and restaurants, but you can’t get from home, to the grocery, the to shops, and to all the clients you would need to get by for the month.

I mean seriously, this is an unrealistic view of the world. Idaho is less expensive, but it’s not that much less expensive!!

Anybody have any predictions as to what the renter endgame is?

I can almost understand purchased values forever increasing given all the fake money floating around.

But rentals?. That requires real cash money on the barrel head which many households simply don’t have enough of.

It’s a bit of a stretch, but are New Deli India style slums in our future? How many pounds of sugar can one pack into 5 pound bag? Somethings just gotta give.

“Anybody have any predictions as to what the renter endgame is?â€

I don’t think there really is an end game. I think rents are more or less market-priced. If rents are too high and no one is renting, then rents will be adjusted downward. It wouldn’t make sense to have a substantial proportion of rental units sitting vacant if no one can pay for them.

“It’s a bit of a stretch, but are New Deli India style slums in our future?â€

Ever been to the skid row area in L.A.? They’re practically already here in many parts of the country.

The game of Monopoly was created to teach the children what the end game is. The only problem is most people don’t realize that it isn’t just a game. It was created to teach three important lessons. Lesson 1 is that the majority of players will lose everything as the land becomes monopolized. Lesson 2 is that even the winner loses once no one is left to rent his shacks or ride his railroads; it’s truly game over. Lesson 3 is that if the bank runs out of money you can look around for scrap paper to create more money to keep the game going. (That is right in the instructions and is exactly what we’ve been doing for quite a while now.)

So everyone already knows what the end game is but we are all so caught up in the mass delusion we refuse to admit that we’re all going to lose. If we just work a little harder and up our game we can all be real estate flipping millionaires, right? No we can’t. Eventually the price level goes too far beyond what the real economy can support and we have to switch to using scrap paper to keep things going. Well that only holds off the tears for a while. Eventually everyone has to move on. And then you get Detroit. (There is nothing new under the sun.)

IPFreely,

That is a good explanation. The system is designed to transfer the maximum amount of wealth and then collapse.

Every single dollar in the economy is created through debt. However, the interest to pay on debt is not created. That is real wealth transfered to the money “creators” (money changers) – from the middle class to the 0.0001% at the top of Wall Street and DC.

When the middle class can not borrow anymore, it is game over. Obamacare is the biggest wealth transfer mechanism from the young and middle class to the insurance companies owned by the 0.0001% of the banking cabal. It doesn’t leave any money to save for downpayment or pay back for student loans, thence no money for downpayment and no ability to borrow. It does not have anything to do with health and everything to do with wealth transfer and control. This wealth transfer affects everyone regardless if you understand the mechanism or not. It affects buyers and sellers of real estate in equal measure because the wealth transfer is indiscriminate. Directly or indirectly everybody gets affected. It is the most regressive form of taxation.

Blert explained this phenomena many times on this blog and I agree with him. The commercial banks are by far the main source of increase in money supply via lending and mortgages. When potential borrowers can’t borrow or afraid to borrow given the economic uncertainty, the money supply doesn’t increase to accomodate higher economic activity. The 0.25% increase in interest by the fed is sucking from the economy aproximately 800 billion dollars per year. It is a collapse by design, as always.

When that happens wealth doesn’t dissapear; it gets transferred. Money disapear, but money are not wealth – they just measure wealth and are an instrument of wealth transfer.

In my opinion the only problem with the market is if the landlords marks down the rent fee by 10% and then all units become full again it maybe that is the bottom which may reaffirms that rents will likely head up again. Income is the metric they are looking I bet and if they figure the average wage can afford their rent then it is forgone conclusion rents will remain where they are or go up.

There are some very well written and interesting articles on line about monopoly. Very good reading.

Dude you don’t have to go to skid row to see slums. Half of the city is a slum

The ‘endgame’ is literally the removal of the entire planet’s ‘wealth’, then let the feces hit the fan and watch as the masses destroy each other for scraps. The ‘housing’ element is just one piece of the pie. You know the end is close, because they keep ramping up the fear, both real and imagined. Anyone that appears to be happy is either stupid, faking, or part of the problem. (or any combination thereof)

Mynamemeansnothing,

I agree with you say, but not the last part about happiness. I am happy and I am not faking it. True happiness does not have anything to do with how many millions or billions you have and it does not have anything to do with the circumstances. I read about lots of billionaires who live miserable lives and some of them committed suicide because of depression. See, they look for happiness in the wrong places and pursued material possessions as an end in itself.

You are right about the end game, though.

The money shunt from Beijing can’t carry on forever.

At the margin, amazing events have occurred.

http://www.zerohedge.com/news/2016-02-05/these-vancouver-homes-sold-millions-2011-and-have-been-vacant-and-rotting-heres-why

The author of the piece conflates wealth parking with money laundering.

For, obviously, the funds were ALREADY laundered to effect the purchase.

The total unconcern about maintaining these properties is entirely consistent with Red Chinese real estate “investors” back in the home land.

If one were to peel off enough layers, it’s a pretty good bet that these troubled homes were purchased by criminals who have subsequently been taken out of circulation.

The Communist authorities were never informed about these hidden assets during their trials. ( As such trials are very brief in Red China — even today. )

The Communists are NOW trying to tie up loose ends with American and Canadian authorities — to discover what values might be recovered.

As it is, the Red Chinese have created a simulacrum of a capitalist economy.

Bank lending over there is not determined from the ground up — but by edict from Beijing.

The result is detailed by David Stockman.

http://davidstockmanscontracorner.com/red-ponzi-ticking/

Stockman lays out shocking economic insanities — epic in scope.

The Big Men in Beijing see the folly, too.

So many are rushing out to establish bolt holes in the West — North America in particular.

http://davidstockmanscontracorner.com/socgen-claims-china-is-only-months-away-from-burning-through-its-currency-reserves/

Once the insane cash// liquidity is removed you discover that most all of Red China’s enterprises are insolvent — and massively so.

The Communists have set the table for a civil war// revolution… and now, have figured that much out.

The end game is everyone a poor rice farmer wearing a g-string duh!

End game is revolution.

If you got the H1B’s coming over in droves, get ready for a New Delhi style slums coming in a neighborhood near you.

Strictly speaking H1bs have to go home.

The ONLY way an H1b can stay on is if they get a fat follow on contract.

That’s rare — and is confined to geniuses.

&&&&&&

BUT

You’re correct as far as the relatives of said geniuses.

Once even ONE Indian is made a citizen — the rest of the fam comes pouring through the gap.

Like the others… NONE of these immigrants is in least bit interested in becoming Americans — culturally.

Inter-marriage is TOTALLY taboo for all of them. ( Chinese, Indians: Sikhs, Hindus )

First of all, rent price indexes are far less reliable than home sale price indexes and are more prone to miss key trend reversals until long after the fact. The infrastructure for recording rental transactions is practically non-existent. What little is in place to record these transactions don’t generally account for renewals or any other agreements between landlords and tenants.

Secondly, and I’ll keep banging on it because it’s a significantly relevant truth to the housing bubble story, West Side Los Angeles asking rents continue to drop. Albeit a small cohort, there are also indications of some new rent contracts pricing below previous contracts. This began to occur to a noticeable extent around Q2 2015.

I was living in a 1 bedroom apt in Santa Monica (10th St and SM Blvd) – it was an 11 unit building with a mix of 1 and 2 bedroom units and several tenants were working at google when the financial crisis hit in 2009. At that time, I noticed that rental rates for 1 bedroom apartments went down by only a couple hundred bucks per month, roughly $1600 per month to $1400 per month), which is not much if you ask me. I dont see how in any impending economic conditions that current rental rates on the Westside would decrease by more than a couple hundred per month for a typical 1 bedroom.

And if that rent fell to half what would that tell us ?

I live in the same exact neighborhood, well okay, I am North of Wilshire but South of Montana. in 2008 rents WERE around 1600 for an average one bedroom.

Then, Google and Yahoo moved in and now, those same 1600 a month apartments are renting for 2200, and they are only on the market a few days

One anecdote from a previous cycle doesn’t account to much for seeing where things are potentially headed in this cycle. I’m not making predictions, but rather reporting current and aggregated data which suggests the current popular prediction is outdated.

Day care in the Bay Area. People don’t have kids in The City unless they are on welfare. In fact, if you have children in The City, you are look down upon as being very strange, like you belong in Utah or Texas. A couple that works in high Tec does have the income to purchase a $1.2 mil cozy little house.

While SF has a lower ratio of kids than most American cities, there are still plenty of children whose parents are not on welfare, especially the Asian ones who have completely taken over most schools from K-12. Their extended family take care of dycare for sure, but if you go to the entire West side (Richmond, Sunset, Lakeshore, Ingleside, Midtown Terrace, etc,) or take the MUNI in mid-afternoon anywhere, you’ll see a “sea” of Oriental kids all over the place. There’s a completely ignored Asian side to SF that has nothing to do with the techies, yuppies, gays and all those Millenial singles we keep only hearing about.

Asians themselves are already 33% of the population, and that’s not counting the thousands of illegals an overstaying students:

https://en.wikipedia.org/wiki/San_Francisco#Race.2C_ethnicity.2C_and_languages

Totally! Daycare is = to 1 month rent. Public schools suck so much, I am not even sue what to do. I can pay or for daughter day care or for son’s private school. Now choose what kid gets better future…

All I have to say is that Asian values are not The City’s values of Market and Castro streets. Asians don’t vote in the numbers like we do. We still control The City government.

You’re probably not from California originally, and that’s why you think the schools are bad. Just because most schools here are majority non-white does not make them bad schools. I grew up in a shit-town, my high school was mostly cholo and Asian gangbangers, but many kids went to Berkeley, Stanford, Harvard, etc. Even average public schools in LA send a bunch of kids to UCLA. Most large cities have magnet public schools. I have friends who did this and ended up at CalTech and MIT. Public schools are fine if you can get over the racial part.

LAer: “You’re probably not from California originally, and that’s why you think the schools are bad. …Public schools are fine if you can get over the racial part.â€

Just look at the Great Schools ratings and you can see that many school are pretty bad. These ratings are based significantly on standard test scores. Many public schools aren’t fine- you even said it yourself with regard to the school you attended: “my high school was mostly cholo and Asian gangbangersâ€. Yeah, that sounds like a place I want to send my kid, with all the up-and-coming lowlifes. No thanks. Just because a few kids from your school made it into a decent college doesn’t mean that the school wasn’t awful and that it was a beneficial place to be. Race has nothing to do with a school being awful (well, who am I kidding- it probably does). But technically, I really don’t care what race someone is, or what race of people my kid goes to school with. I do care, however, what the rating of the school is that my kid attends, and my kid will (thankfully) not be attending a school with a Great Schools rating less than an 8 or 9 (out of 10), and will not be attending school comprised mostly of cholo and Asian gangbangers.

The Bay area and Silicon valley is full or 30+ year olds living with roomies and making 100K. paying 2K for a room is common.

People who are not making 100K and have kids live better. I’ve seen couples not married where the chick gets the low income housing… welfare checks stays a home and works as nanny for people she knows charging who knows how much per kid and then the boyfriend moves in…. is all cherry.

I hope you’re not talking like that’s a bad thing.

It’s a BAD thing. you have grown @ss adults living like college people.

you have people claiming to be single parents to qualify the government limits for low income housing and every other help. People are lying and opting out of having a stable household… get it. it’s all bad.

I’m ready to to home to Hawaii and sleep on a green sand beach with a monk seal. High tech and the Iinterrnet are ceasing to exist.

In had hopes, I had high hopes.

It was all a lie.

Meanwhile, you can paint with mud. Even back home, I’ve done it. Using hala fruit. Natural paintbrushes.

@Alex. I just don’t understand. If you don’t have family or a baller Job moving up in the corporate or making at least 80K… why are you still living in San Jose ???

I you make minimum wage, you can do that in Hawaii or the other 48 states…illuminate me.

http://www.lao.ca.gov/reports/2015/finance/housing-costs/housing-costs.aspx

California’s high housing costs causes and consequences… Don’t kid yourself….California is a desireable place to live..

I doubt anyone would disagree that California is a desirable place to live, with the caveat, ‘if you can afford the California Dream’! I think part of the reason there isn’t a larger mass exodus out of the State is the weather and the Dream hype/hope! People appear to be willing to put up with a lot of expense, uncertainty, and are potentially willing to risk their future financial security to stay in place! Just read the other day that the average Joe homeowner, has more than 80% of their net worth tied up in their home, and without that, has roughly $50k. There are a lot of people who have bet everything on their homes being golden!

“I doubt anyone would disagree that California is a desirable place to live”

JNS,

I would argue that most of CA is not a desirable place to live for many reasons, housing cost being only one of them. There is a horrible traffic most time of the day, there is massive air pollution, especially in the Summer, there is massive poverty, lots of gang activity, massive taxation and very high cost of living. These do not make a place very desirable.

You can mitigate these factors to a certain extent if you have over 5 million dollars to live close enough to the ocean to feel the breeze, in a safe area, not be in debt and afford some streams of income in case of a downturn and lost of a job (that way you are not forced to sell on a loss just to get out).

You still deal with traffic, but not too much pollution and poverty and gang activity.

So yes, few select areas are nice but most of CA presents zero attraction to me. And, yes I can afford to live in most of CA and buy in cash. In conclusion, it is way overpriced in most areas. Due to amount of leverage in CA RE, in case of a deleverage in the US financial sector (about 50% of US economy), CA RE can be in a serious trouble regardless of the low supply. Lots of people without money for those astronomical prices does not mean demand. India, China and Brazil also have lots of people and that does not translate in demand. CA population increased by 10 million in a decade but only by 150,000 taxpayers. Is that demand? You decide.

Flyover I’m gonna agree. I’m ready to say fuk this shit and go home. Unless things have radically changed since I was last there, and that place has more inertia than a 3000-lb ball of osmium, I can still live totally cheap there. And I can make a living.

I was born in California but left when I was five. Lord knows, I’ve tried but its not Home.

There is much more to CA then LA and SF. I live in rural San Diego county where the houses all have at least one acre of land and min. 2000 sq ft for average of 500K. The scenery is beautiful, weather & air quality is great, little traffic, quiet, no crime, but the down side is that there are zero jobs and you have to drive at least 20-30 min to get anywhere.

Feeling good,

Very good information. It shows that building cost increased significantly and it shows why. Even land, which is the biggest driver in cost increased due to a combination of many factors.

When I was saying that I stopped building any more single family homes because there is no profit, nobody believed me. I still build custom homes, because the risk is on the homeowner. There is still profit in multi family housing. We’ll see for how long.

Remodels are still profitable because the risk is on the homeowner.

LA is great if your non-white. Enjoy!

I wonder if the CA Bullet Train will have people sitting on the roofs and hanging on to the sides like the trains in Mexico.

A look at the future of the CA Bullet train:

http://static.fjcdn.com/pictures/Indian_dcd5fe_761415.jpg

Efficiency!

The tech stocks are crashing. That is already slowing the bay area housing market. Up there, the wealth is just fake tech stock wealth that is disappearing rapidly. The private equity money is running away from the bay area.

At the same time, wealth in Los Angeles is real. The high end zip codes are smoking hot. Prices are racing ahead in places like Manhattan Beach, Santa Monica, and Newport Beach.

During a time when economic growth is predicated on cheap borrowed money and financial engineering, I doubt that the wealth in L.A. (fyi Newport Beach is in Orange County) is any more genuine than it is in San Francisco, China, London, or Europe. When the tide goes only then do you find out who’s been swimming naked (paraphrasing Buffett).

Note that prices of high end markets in New York city and Hong Kong are falling already.

I’ve lived in Newport Beach for some years and God damn that pisses me off. Los Angeles and Newport Beach, the OC in general are MILES apart.

No one back home mixes up moiliili and kapahulu although they’re cheek by jowl, and the mainlanders just say Honolulu and they’re right because it’s all Honolulu county.

Many live in Orange County and work in Los Angeles county. It is the same metro area.

@jt, you have both confirmed and contradicted yourself.

Wealth on the westside is directly tied to the stock market.

When the stock market goes up, people take out margin loans using their stock market portfolios as collateral. This creates the illusion of massive wealth in Santa Monica, Manhattan Beach, Newport Beach, Beverly Hills, San Gabriel, Marina del Rey, etc.

If the stock market tanks, then we know what will happen on the westside when the margin calls start coming in…

Here is the difference. In the bay area, many are using un-exercised employee and investor stock options as collateral for mortgage money. When the market goes south, those options are worthless. Down goes the bay area real estate.

In Los Angeles, the use of un-exercised stock options is much less. Therefore, the wealth is more stable. Furthermore, as people lose faith in the financial markets, financial assets are sold and much of the money will find its way into real estate. High end zip codes in Los Angeles will benefit.

So, a decline in sales and price is considered smoking hot? Manhattan Beach and Santa Monica are showing this is the last set of YoY numbers from CoreLogic.

Note that it’s a lot luxury rental addition have only been built

50% of the working population in Los Angeles are dual renters in one household too

Speaking of the Big Short, check this out here.

http://www.passiveincomeadvisors.com/the-big-short-part-i/

I enjoyed reading your experience. Looking forward to Part 2, plus would love to hear your thoughts on the current market.

The author noted the problem but did’t propose a solution. The problem being investors and cash buyers pushing up single family home prices. Eliminate the tax benefits of investors, and non-residing owners to purchase single family houses will allow single family home prices to be determined by the people, and families that want to purchase the house to live in.

wp.me/p42WQA-7c

It’s all about jobs. Idaho and parts North and East are attractive and cheaper but you have to work. The Internet helps some people who work online but most of us can’t and won’t. California used to have a dozen auto assembly plants and aerospace companies everywhere. They’re all largely gone. This is high tech’s moment in the sun. We’ll see what comes next.

Does the weather trump prices and crowding? At the moment maybe yes. What does the future hold in store? This state has changed so much since 30 or 40 years ago it’s actually shocking.

We had a metric fuckton of manufacturing here in CA. Electronics is gone. An engineer fiddles out a circuit using SPICE, they send the Gerber files off to a board house who sends the work off to China, you get a few trial boardsand test em, specify some changes, and it goes into production. Cheaper to change out a board than to repair. Oh yes, and the engineer is in India.

Culver City, CA

Sat, 2 PM, Sunny

Sunny74°F|°C

Precip: 0%

Humidity: 15%

Wind: 6 mph

4 PM9 PM2 AM7 AM12 PM

SAT

Sunny

75°

53°

SUN

Sunny

81°

58°

MON

Sunny

83°

56°

TUE

Sunny

82°

56°

WED

Sunny

81°

55°

THU

Sunny

80°

57°

FRI

Partly Cloudy

75°

56°

SAT

Mostly Sunny

76°

55°

SUN

Sunny

76°

55°

MON

Mostly Sunny

79°

54°

More on weather.com

Feedback

You’re right. L.A. weather sucks. Sunny and hot all week long? Disgusting.

Yet another reason I contemplate Seattle. It’s in the 40s this week, and drizzly to boot. I love gray, drizzly weather and cool temps.

Although I did wish I was back in NYC this past week, what with all that beautiful snow. I always enjoyed shoveling snow, the more the merrier.

Either NYC or Seattle beats L.A. for weather this time of year.

Agreed. Weather was a major reason we left L.A. I can’t stand 80 degrees plus, although even Portland was too hot last year.

Yes, the weather is nice. However, LA is COMPLETELY dependent on having water and food brought in from hundreds of miles away. Trying to support millions of people in LA is unsustainable and the city is a disaster waiting to happen.

Where is El Nino? All the experts said this was going to be the mother of all El Ninos.

One thing is for sure. Having a super bowl party enjoying 80 degree weather near the beach is awesome. The super bowl is in Santa Clara which will also see beautiful weather, those kids living in the amongst the frozen tundra just might start having some California dreams.

It rained in N Cal but just a normal amount, nothing like the last El Nino or even I think 2004/2005 when it rained all the time even in the Coachella Valley. If we’re lucky it might come down in March or April, but this one feels like a bust.

The weather in Silicon Valley was beyond awesome on SuperBowl Sunday. It felt like a typical Spring day (April to early May). I thought it was cold up here compared to LA (since I used to live there) but it feels just like LA but the air is not as polluted.

It was cold and rainy the week before, now this nonsense is starting up again? If it was so objectively great all of the time here, there would be no need for these absurdly shallow and hyperbolic promotional posts, much like the area they represent.

I went to this Open House in Woodland Hills today: https://www.redfin.com/CA/Los-Angeles/21213-Golondrina-St-91364/home/4217170

Very hard to find parking, up there in the hilly sections. Lots of No Parking signs. I think I parked illegally, as did all the other buyers.

LOTS of house-horny buyers, jamming their cars along those narrow hilly streets. The neighbors must hate us. Couples with children. Even a gay couple.

Or if not buyers, at the least lots of lookiloos.

I went mostly as a lookiloo, since it’s been a while that I’ve been to an Open House. It’s a nice house, but I don’t care for a house on a hill. And I don’t like the markup — sold for $530k in 2009, now asking for $810k.

The realtor said the family had intended to stay for 10 years, but were now growing and needed the extra space. I wondered if the family wasn’t also trying to cash out before the next crash?

Getting out of Santa Monica was crowded as usual. Traffic gridlock trying to get from the 10 onto the 405 — and on a Saturday morning! I returned via Topanga and the PCH. More gridlock coming onto Ocean Avenue in Santa Monica. Crowded with tourists and beach-goers, as usual.

Whenever I drive in L.A., I muse about moving to Seattle. That’s one of the things that’s kept me from pulling the trigger on buying a house in Pasadena or Woodland Hills. Do I really want to stay in L.A.? That, and the fear of buying near the top of another bubble.

Jim keeps predicting a HARD TANK. But people are coming out for these Open Houses, despite the huge markups. I wonder, how many serious buyers, how many lookiloos?

Big investors with inside connections backed out of the market due to high prices a year or so ago and are looking to cash out. Retail buyers are seemingly always last to the party.

The traffic is just as bad in Seattle and the housing prices are just as insane as SoCal.

Yep. Walked by an open house in my hood on Saturday. About 10 people were milling around outside waiting for the 450k flip that is now 879k to open.

Very very ratty house now with Home Depot puke throughout! No garage! 1970s house in a hood from 1930s. Garage is now part of the square footage. Very boxy looking. The only thing good about it is it is on a canyon but you need to leave the house and walk into back yard to see the view.

Herds appear sizable right up to the edge of a cliff.

http://healthland.time.com/2013/05/09/why-kindness-can-make-us-happier-healthier/

Hope everyone is enjoying there weekend.

My guy and I are selling our house in Denver and moving a few hours west to the middle of nowhere. We’re renting a house for 6 mo to a year, they want over $4000 UP FRONT to get in the door! First months rent, last months rent, plus deposit. Renting doesn’t mean more affordable either! That amount is more than HALF of the six months rent.

Had 40 showings in two days and got only four offers, two were NO MONEY DOWN loans. Yes, I think we are at or near the top of the market, again. When the second shoe drops things are going to be a lot worse than the first.

Nothing significant will happen in either rent prices or home prices until the pink slips start flowing on a nationwide level and loosen up inventory. Job loss, equity loss, repo, divorce…people’s lives literally need to spiral out of control and get wrecked in order for a healthy market correction. I think the slide will really start when our next President gets started, no matter who it is Bernie, Hillary, Rubio, Cruz…Trump (yeah right). Her/his first order of business, like Obama’s was, is going to have to be fix the Sh*t sandwich.

Obama didn’t fix anything. The national debt has increased under Obama by 8 trillion dollars to 19 trillion dollars which is more than all presidents combined. The Fed has kept interest rates near zero since 2006 and has printed money. The stock and housing markets are in a bubble again. The too-big-fail banks are bigger than ever and not one banker has ever gone to jail.

“The national debt has increased under Obama by 8 trillion dollars to 19 trillion dollars which is more than all presidents combined.â€

I’m no Obama supporter, and I agree with much of your post. However, your assertion is untrue based on the numbers you provided. If the national debt was 11 trillion when Obama took office, and under Obama the number has increased 8 trillion to 19 trillion, then the national debt has clearly not increased more under Obama than all previous presidents combined.

I didn’t bother to check the accuracy of the information you provided; my post is based solely on the numbers provided by you.

I’m pretty tired of this Faux News trope so I try to correct it when I can. It is 100% crystal clear that most of the increase in the national debt during Obama’s term is a result of just a few factors, none of which he had any control over, (1) two unfunded wars that were off the books, Afghanistan and Iraq, it was actually Obama that insisted on bringing those wars on the books, (2) the Bush era tax cuts, you can see the chart on that, those tax cuts contributed to billions in deficits and trillions in overall additional debt (how can you cut taxes if you have a deficit???), (3) the Great Recession, which most conservatives like to forget, started under GWB, not Obama, Obama had to clean that up, and you can criticize how he has done that all you want, but by any reasonable measure it was a gargantuan task, if you think you could have done better, why didn’t you run for president, (4) TARP and the Fannie/Freddie bailouts (also under GWB, I guess you forgot that too) and (5) Medicare Part D, the largest unfunded new social benefit in recent history, was also under GWB. Look, I’m not saying Obama hasn’t also been a big spender, but conservatives act like when a new president takes over, the national finances are tabula rasa. Well, no, GWB’s liabilities carried forward and had far reaching consequences on our national finances and still do, and it wasn’t as if Obama could just snap his fingers and magically make those items above go away. If you’re going to criticize Obama, you should be fair about it, this idea that his policies increased the debt by 8 trillion is simply a false statement any way you look at it, it’s just dishonest and unconvincing on it’s face, you just have to care to actually look at the numbers. It is one of the reasons people are so sure that opposition to Obama is in large part just due to animus, not facts.

The sad thing with each economic crisis is that for every new crash/recovery we can expect traffic jams to increase.

Don’t give up hope Jim Taylor housing will tank hard! It just might take a little longer than you thought. Of course it will take a little longer in the desirable areas..but on the real I am noticing an uptick in homes listing for default again and builders are slowly coming out again. So keep saving, have faith our time will come. Don’t be a quitter and run off to Idaho, your one of my favorite responders on this sight always have been.

“It just might take a little longer than you thought.”

Haha. He’s been calling a TANK since 2012.

Probably the only homes that will be available after the crash will be McShacks, Motor Homes, your own car, or somewhere in a National Park.

Rent up more than 5 percent last year? Well thank God China is making rubber bands cheaper than last year! Although that rubber band now only lasts one month instead of the 5 weeks it lasted last year!

That is exactly what is going on, consumer goods, made cheaper and cheaper every year hide and offset inflation in the things you actually need to live.

The meaning of money underwent a radical change with zero interest rates.

I am afraid this year will only bring a lull in housing prices and when the Fed begins negative interest rates within the next year or two, one has to wonder how high housing prices might go with 2 percent or 1 .5 percent 30 year rates.

Fake banks use fake money to enslave the populace.

They own the real estate. They don’t have to make a profit. They are not in business.

They don’t have to lower the price of the real estate they acquired through foreclosure.

They were “bailed out” when they ended up controlling all the real estate in 2008.

Why should they sell the real estate at a price commensurate with “market conditions” when they can just print up a whole lot of money and give it to themselves?

SanityClaus,

Those are the most cogent arguments against buying a house. Thanks.

“Those are the most cogent arguments against buying a house. Thanks.â€

Not sure if your post was sarcastic or not, but assuming it was not: even if you don’t buy a house, you still have to rent. It’s not like those same arguments don’t apply to you if you rent, since rental prices are more or less proportional to real estate (purchase) prices.

The big matzo ball hanging over your head is the landlord who decides he wants to put his kid in the house because he doesn’t like what he sees as options for the kid, his wife and all the kidlettes.

This happened to us getting tossed out of our rental after 5 years and being forced to look for a place before the holidays in a tight market.

If you have the mortgage and make your payments no one can drop by one day and drop the hammer on you. That is worth more than a little.

Every comment on this page was enjoyable to read. Every commenter and reader should pat themselves on the back. Very good job Dr HB

Leave a Reply