Is California the new Japan? – 5 charts showing nonfarm payrolls at 1998 levels, underemployment of 23 percent, 685,000 homes at least 90 days delinquent, a massive zombie real estate sector, and a decreasing homeownership rate.

California is facing a long and painfully drawn out foreclosure and budget crisis. From talking with average people it is apparent that psychologically, people have a hard time imaging a decade where things move horizontally. In terms of housing prices California is inching closer to a lost decade. We’ve already reached it if we include inflation adjustments but we are getting closer to seeing a nominal realignment. Thinking about it on a longer term basis shows us that California is likely to experience a Japan like economy for the next decade. There are few caveats but in terms of zombie banks, careful attempts trying to manage distressed inventory, and long-term underemployment it seems like the last few years have shown this is our future. Some seem to think there is no shadow inventory but there is a large amount on the balance sheet of banks. This isn’t some economic fairytale. We also have a large number of foreclosures out in the open for the taking. When we connect all the dots it is hard to envision home price growth even looking deep into the future. Some states did not have massive home price inflation so it is likely that their level to correction is much lower. Let us look at a few charts and see where things are going.

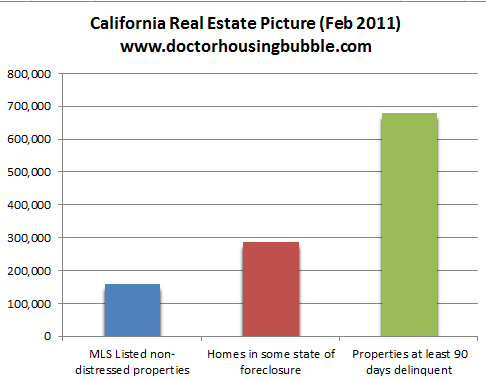

Chart 1 – The California real estate numbers

The MLS currently lists about 159,000 non-distressed properties. California currently has 285,000 homes in some state of active foreclosure. It is hard to see how many of these are listed but we find that at least 100,000 of these are listed:

So we already know that at least 185,000 homes are in foreclosure but do not show up on the MLS. This number by itself eclipses the non-distressed MLS inventory. But what is even more troubling is that we know that close to 13 percent of all nationwide mortgages are delinquent (in foreclosure or at least 90 days behind on payments). So the total pool of distressed homes is up to 678,000 and the public is only able to view 100,000 homes that are currently for sale in the state. In other words the shadow inventory is immense.

How did we calculate the above number? We took the total mortgage pool of California and used the below metrics:

“(Mortgage Orb) LPS reports that the total U.S. loan delinquency rate was 8.83% in December – a 2.1% decline month-over-month and a 17.9% decline year-over-year. Furthermore, the U.S. foreclosure presale inventory rate was 4.15% in December – a 1.7% increase in the month-over-month and a 9.3% increase in the year-over-year foreclosure presale inventory rate.â€

We are obviously being generous since we are using a nationwide rate to a state that is over filled to the brim with toxic mortgages including the option ARM. It has come out from various sources that banks are trying to leak the properties out into the market in a controlled fashion. We have also seen this year that many banks are willing to take an axe to prices to move inventory. There is no guarantee that the Federal Reserve will be able to control global events (i.e., oil, the US dollar, etc) so the power of quantitative easing might run its course. Japan took a similar approach to their banking sector and their end result was two decades of stagnant growth. What also resulted were real estate prices that went sideways for two decades. It is hard for someone in California imaging that their home purchase in 2002 will have the same market value as it will in 2022. Yet home prices are now back to 2002 and here we are in 2011.

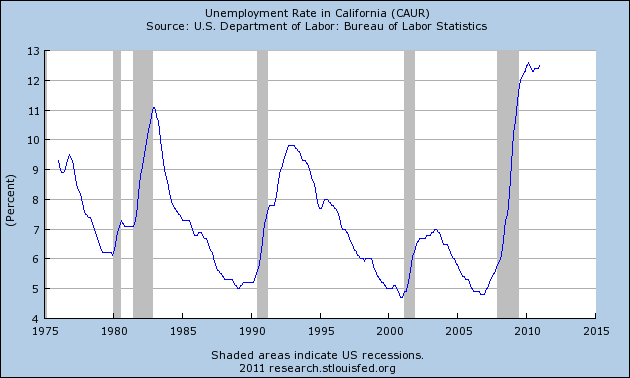

Chart 2 – Unemployment rate

The California unemployment rate is still solidly above 12 percent and if we include the underemployment rate we are up over 23 percent. Who will buy all those homes that need to be sold? Income growth is anemic to nonexistent if you have no job. Japan has a very low headline rate of unemployment. The current unemployment rate is 5.1 percent. Yet the reality is much grimmer. Over one-third of their working population works in a contract environment. They would be classified as our “working but looking for full-time employment†and many of these people have limited benefits and no security of work beyond their contract. Playing with the numbers. California has a large pool of these workers. As healthcare costs soar and technological innovation makes some positions obsolete, many employers will simply opt for part-time employment. I have a few colleagues that work in engineering and biomedical industries and for the past two years they have been working on a contract basis.

Think about California’s heavy reliance on real estate. Do you really need a broker or an agent when you can do all the research yourself online? These were the high paying sectors of the economy during the boom. There is already pressure here with people selling their own home or using discounted brokers. Plus, if all loans are backed by Freddie Mac and Fannie Mae why don’t we just go straight to them? Like travel agents, technology is pushing one of the big sectors of California out or at least chopping into its income potential.

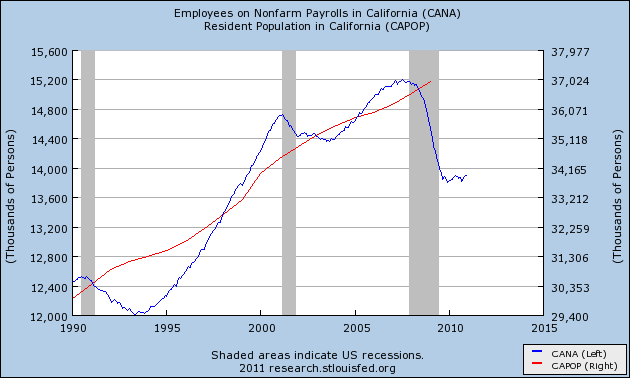

Chart 3 – Population and nonfarm employment

This is an interesting chart. We have the same number of workers on nonfarm payrolls as we did in 1998 yet our population has increased by over 4 million during this time. This is probably in one area where we differ from Japan. Japan’s population growth is solidly trending lower. It is too early to say where California is heading although recent indications show immigration and population growth slowing down. If population growth slows, where will the new demand from housing come? Some builders are already betting that things will turn around.

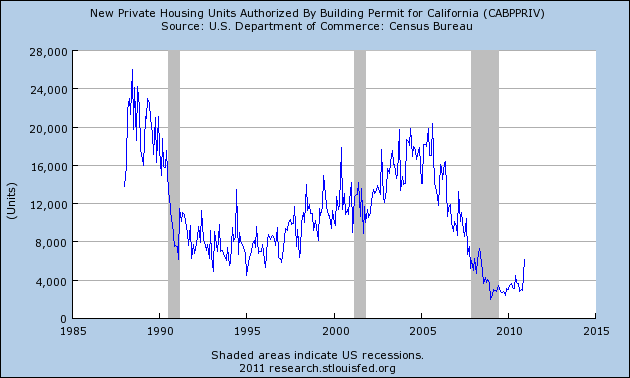

Chart 4 – Home building permits

As you can see home building permits perked up starting in 2010. But you have to remember what was going on then. It seemed like everything was going well as people were sucked back into the market with tax breaks and other mortgage rate gimmicks. That push is now largely gone.

Think of it this way. Last month of all the homes sold in California 13,790 were foreclosure resales. So even to clean out the current foreclosure inventory would take over 7 months and that is assuming no new foreclosures enter the market! Well take a look at the earlier chart. 678,000 homes in California are at least 90 days delinquent and of that pool 285,000 are already in the foreclosure process. This doesn’t even address the natural sales process of people moving to new jobs, divorces, or other life circumstances.

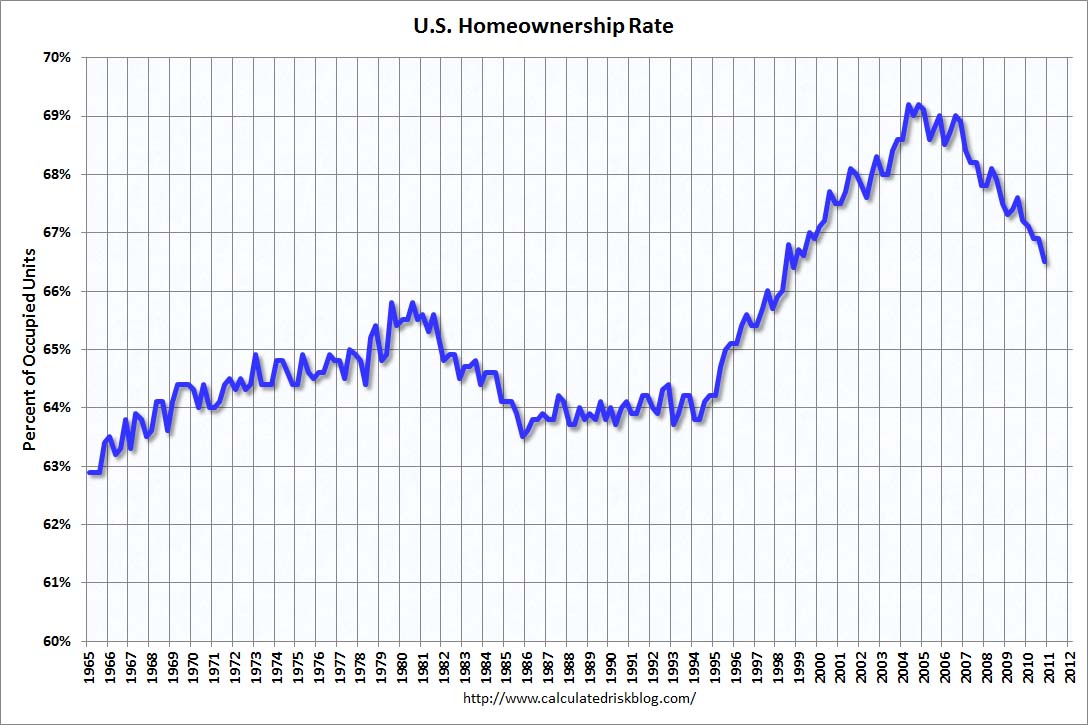

Chart 5 – Homeownership rate

Source:Â Calculated Risk

All those gains in homeownership have been wiped out like dust in the wind all thanks to the once in a generation housing bubble. Now we are left confronting the reality that we have spent over a decade basically spending money we did not have. The wealth has been transferred to Wall Street investment banks and all you need to do is pull up one of their financial statements. They don’t even bother hiding it from the public. There seems to be anger at so many things except the number one culprit and that is the vampire like nature of investment banks to strip out true wealth from the economy.

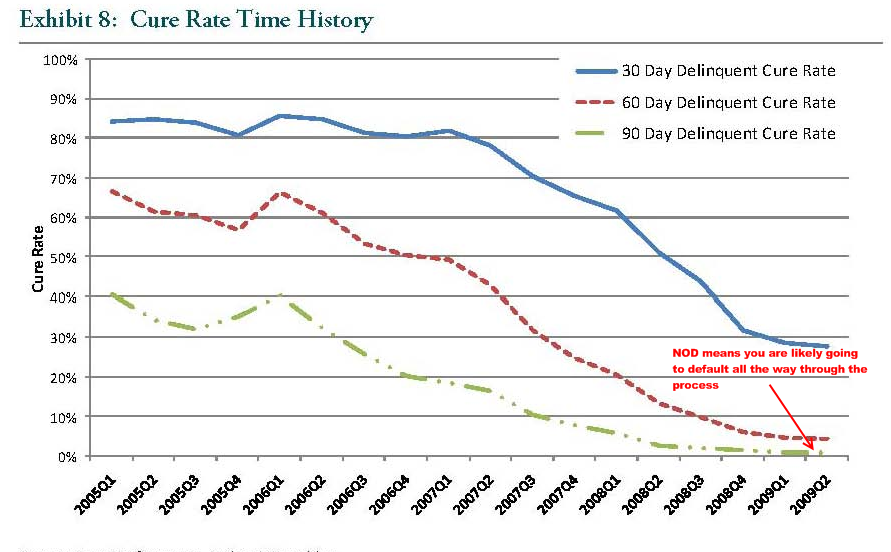

The homeownership rate only went up as an illusion. Those gains are completely gone. But the bonuses and taxpayer bailouts to these bankers is a very real thing. We have yet to venture out and do the one sane thing that even Paul Volcker advocated for which included the separation of investment banking and commercial banking. Can you believe that nothing has changed since this crisis has started? Well Japan did the same thing during their bailouts and look how far it took them. And for people that think most of the shadow inventory will cure look at this:

Some of the most strategic defaulters are those with higher mortgages. Rewarding these enormous moral hazards is should be no shock that many in the population are acting out in similar ways. What needs to be pushed is the breaking up of the too big to fail banks or we should gear up for another crisis shortly. If things work out like the banks and the Fed are hoping, 2021 will look a lot like it does today.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

48 Responses to “Is California the new Japan? – 5 charts showing nonfarm payrolls at 1998 levels, underemployment of 23 percent, 685,000 homes at least 90 days delinquent, a massive zombie real estate sector, and a decreasing homeownership rate.”

You are making too big a thing of this. Government unionized workers are around 30% of all workers in CA. There is NO WAY they are going to put up with no raises for 3 or 4 years.

First, “There is a budget crisis. We have to lay off teachers.”

Second – picket lines are set up with cute little kids for the TV cameras. Her picket sign says:

“I like my teacher. She needs a raise.” Public outcry” We can’t cut the schools”

Third- “We don’t want to raise taxes, but the people have spoken”.

Fourth- Taxes are raised.

Repeat as necessary.

Maybe we can look forward to political commercials featuring a brooding CA firefighter standing in front of a burning circus tent, efforts hindered because of budget cuts. Cut to kids crying, pointing and shouting, “Help Mr. Fireman, everybody! He’s sad!”

That fireman will still make $120K per year and retire with 80% of his salary at 50.

What do you mean by “this” in your first sentence?

Says who? They’ve already put up with furlough days and increased class sizes. Also total government employment (including federal) is closer to 15.5 of the state’s workforce. Keeping these people employed (which is where a lot of the non tax cut stimulus money went) clearly hasn’t done anything to help home prices.

Wendy Gruel released the LA city worker’s database – it shows 75 firefighters made over $200K in 2010. Simply ridiculous. We need to destroy these unions, kill the pensions and get these salaries back in line with reality. Especially since the bulk of them work all of 2 or 3 days a week for this insane amount of money.

And enough with the bullsh*t about dangerous jobs, if they don’t like it they can hit the road! Most of the high salaries are for the redundant deputy/assistant fire chiefs, battalion chiefs, etc. who are chauffered around from one event to another.

Ron, I work for a special district (at will govt worker 22 years) and I have gone without a cost of living (cola) raise for 3 three years. One- third of my pay goes to retirement, and last year I was asked to take 80 hours mandatory time off (unpaid time off), and the county is set to cut 500 jobs in July. It’s real man, believe me.

What did you do with your time off? Go surfing? Personally I’d never complain about that. Most good surfspots I know of are populated mid-day, mid-week, with firefighters and the like. The ones that dont surf, are busy a their second job as contractors or the like. They have the time and energy cuzz holding a hose, or driving and polishing a rig isnt very tough.

Ron…thousands of California teachers HAVE been laid off over the last three years. K-12 has been cut 30% in funding. The state is near dead last in per pupil spending. The results are commensurate with the lack of support.

Yet a coach at UC Berkeley continues to ‘earn’ $2.1 + million/yr. CHP’s by the dozen hauling in $200k+/yr. A tiny JC College president earning the same as the Governor. It’s positively obscene what is going on.

I don’t know where you get your statistics from ToraBora? California is not last or near the bottom of per student spending, as of 2008 it ranks 23! Oh, it makes for a nice bumper sticker or picket sign when the state Legislature meets. But there is no correlation between per-pupil expenditures and how well students are educated. Go down the list and compare state expenditures to student test scores. High spending states provide less bang for the buck-no results!

Utah and Idaho consistently rank last in per student spending, yet rank at the upper end of scholastic achievement. So don’t tell us that you need more money – doesn’t wash in the real world.

I’ ve found several references to state k-12 spending ….some as low as 47th in the country to, as you found, 23rd. Regardless it is obvious that we don’t have the money to spend more. We are in agreement there?

As far as spending the same, we have to cut out the wasteful spending throughout state government. It’s absurb that a small college president gets paid as much as the Governor! We are in agreement there?

And lastly….other than cutting wasteful spending…how does spending less on meat and potatoes education benefit students? There is the rub I’m sure. We may HAVE to spend less but do not expect to get the same result.

As far as your reference to the low spending states with good education results….those states lack the *cough cough* ethnic diversity our state has.

Oh, we are well on the way to being the new Japan. We keep assuming we are different but in reality from the world perspective we just aren’t that big anymore. Europe+Russia is a larger market. India and Japan are huge markets. Middle east is another huge market. China as well.

Currently the Chinese are making legal and structural law changes to file bogus patents to seal off markets and steal more technology. Fooking jobs are out the window and free trade has killed our technical and manufacturing edge.

But don’t worry. I’m sure China means well.

Sorry for this off topic ramble…

Saw this house out in Murrieta/Temecula area and it’s a multiforclosure special. I can see it getting back to the 1992 price possibly this summer. Looks like an OK house. Yeah, the location probably stinks but if I’m buying cash and can handle the drive and/or lower income….

Feb 02, 2011 Price Changed $193,500 — MRMLS #T10132466

Jan 13, 2011 Relisted (Active) — — MRMLS #T10132466

Jan 10, 2011 Pending — — MRMLS #T10132466

Dec 30, 2010 Listed (Active) $215,000 — MRMLS #T10132466

Mar 18, 2010 Sold (Public Records)

This home was foreclosedForeclosure is a process that transfers the right of home ownership from the homeowner to the bank or lender. A home goes into foreclosure when the owner stops paying his mortgage loan payments. and bank-ownedShort for “real estate owned,” REOs are foreclosed homes owned by banks and lenders.. $285,818 — Public Records

Jul 16, 2008 Sold (Public Records) $255,000 -31.4%/yr Public Records

Nov 30, 2007 Sold (Public Records)

This home was foreclosedForeclosure is a process that transfers the right of home ownership from the homeowner to the bank or lender. A home goes into foreclosure when the owner stops paying his mortgage loan payments. and bank-ownedShort for “real estate owned,” REOs are foreclosed homes owned by banks and lenders.. $265,000 — Public Records

Jan 12, 2007 Sold (Public Records) $450,000 13.5%/yr Public Records

Apr 03, 1998 Sold (Public Records) $148,000 -0.1%/yr Public Records

Feb 03, 1998 Sold (Public Records)

This home was foreclosedForeclosure is a process that transfers the right of home ownership from the homeowner to the bank or lender. A home goes into foreclosure when the owner stops paying his mortgage loan payments. and bank-ownedShort for “real estate owned,” REOs are foreclosed homes owned by banks and lenders.. $134,000 — Public Records

Jun 26, 1992 Sold (Public Records) $149,000 — Public Records

In many ways the comparison with Japan is apt, but there are some differences. Japan has a lot of elderly and a lot of savers. As a result, they have a hard time growing their way out of the situation – old people spend much less than young families.

The difference between Japan and the United States is that the Japanese population is much more resilient in the face of debt-induced stagnation than the United States is. People who have ample savings and few debts are much better able to weather stagnation and unemployment than are compulsive consumers buried in debt, and a lot less likely to make demands on social services that are increasingly difficult to fund.

The savings rate in Japan is what is saving the place from total collapse and descent into disorder and poverty. The United States, on the other hand, is moving inexorably toward complete breakdown as the load increases on our frayed social safety nets. As a result, we will borrow more non-existent money and fuel commodities inflation, while becoming poorer and poorer, and our social safety nets will become increasingly fragile as there are fewer people to support them and more people needing assistance and support.

Well stated.

If you are up to your eyeballs in debt, you can’t spend yourself or your country “out of the situation.” Under these conditions, any spending just increases debt – it does not create wealth.

I wish New York would get the California flu. Home sellers here are still delusional.

Aimlow Joe was here.

http://www.aimlow.com

Worldwide confidence in the U.S.( and California which is 12% of the U.S.) is so well respected due to the fact that America, in her sovereignty and largeness, has never defaulted on a loan, surrendered in a foreign war nor constitutionally collapsed in government since the 18th century. Perhaps Britain is the only other example of such stability, which would justify her still substantial influence. I, like all of you reading this site, enjoy and learn but it is important to remember as Disraeli/Twain famously said…”there are lies, damn lies and statistics.

What I do know is I’ve been working in Southern California real estate for 20 years in a family real estate business established over 70 years ago. The vibrancy, creativity and diversity of the region is far greater than multiple charts that span maybe a decade or two. Information is all good and digest it at will…just give thought to what you are digesting.

By the way, we bought our house in 2002, had an appraisal two months ago, and the appraisal was 35% above the 2002 purchase price. We are just one family but we are also reality. And if wall street banks are so wealthy then shame on us for not buying their publicly traded stock……..we would all be rich, if only we took the risk.

I think you overlooked an important point. California gene pool has been flooded with third world thinkers, that have limited skills and income. My best guess is that they take mroe out of California then they put back into it.

With the majority of States looking to drive their gene pool of illegals out, they seem to be talking about heading to California. My wife is a legal resident, but she talks to lots of illegals and their stories should scare the crap out of California…. the biggest increase of residents coming inot California will not come from the South, but from the Eastern part of the USA. They are very poor, hungery and being driven to move. Many of those who stayed know someone to live with in California, and they rent by the Sq Ft, in small quantities…. I’m betting this push will drive California truely back into being a thrid world Country all it’s own.

Purchased in 2002 and appraisal shows it’s worth 35% more? Well WHOOP DE DOO! That’s 8-9 years depending on when in 2002 it was bought, so basically a 3.5% gain per year over that period. Considering how much the dollar has lost in value over that period, you haven’t come close to so much as matching the rate of inflation, real or even official. And that’s not even considering the money spent on (post deduction) interest for the mortgage, property tax, etc. 35% over let’s say 8.5 years, LOL!!!

Well Bermuda a few things to remember in all of this…. plenty of recent large bubble examples and past deflationary examples to draw from.

1) Prices are still declining… see Japan… Tokyo real estate declined for around 20 years and did a complete retrace. See similar in great depression. Deflation tends to come in two flavors; fast and chaotic or slow and grinding. We are in slow grind.

2) Cash out your house now and take advantage of the inflated price due to low rates.

3) I cashed in my chips at the last market peak or nearly so. I also got some returns from the recent run up. I play the long game.

4) If you were really familiar with history you’d recognize various ages occur in civilizations. We might be getting near the end of a major expansion and technological revolution. Change might be slower from here out.

5) We are starting to face some kinds of natural resource strains. remember your smaller children and pets are eddible.

6) Just because I might understand the game doesn’t mean I agree with it or enjoy it. I am getting adept at staying ahead of the banksters and recognizing their signature on events.

7) California has a lot of nice spots. So does Florida. Florida meltdown is our future. I don’t expect values to hit zero as the over building isn’t as bad and we have more industry. However, suspect we will see more market headwinds.

8) Demographics are not favorable for the future. We have a rising of less productive minority populations. We have a an aging population. The debt burden also does not look attractive.

9) The debt makes the US/California an unattractive business location. No matter what short term commitment congress/state gov might create; the rich are unlikely to trust a place like california not to tax/regulate/fine/fee them to death. We used to have a lot of great foundries in Silicon valley but they are moving away. Hasn’t been a new foundry in 10+years or more.

10) Not sure how the party with China ends. California has a lot of Import/Export money. Trade takes a dive and port towns take a dive.

11) Military spending benefits California but is likely to tail off.

All deflationary.

As I understand the laws about certain kinds of debts; a lot of the state and municipal stuff requires you to raise taxes till you can pay it.

Good times ahead.

When you cashed-out, did it feel good to pay your govt the capital gains tax?

What % above the 2006 price is your house currently appraised at? You remember 2006, when the RE Industry was saying “buy now or be priced out forever”?

Hey Doc,

So when is the bottom going to happen?

I go out looking and I’m still simply shocked at the prices, still way too high.

Maybe the question should be “Is California the New Hiroshima? (or Nagasaki)” See the story and the accompanying picture below. Maybe the devastation from the housing meltdown will be more like Hiroshima or Nagasaki.

http://www.philstockworld.com/2011/02/03/housing-armageddon-12-facts-which-show-that-we-are-in-the-midst-of-the-worst-housing-collapse-in-u-s-history/

burmuda,

you have been in the real state bus for 70 years and you have one house. tell me you have more real state then that.

Why would someone need more than one house?

Yes, I do. Residential and commercial. I’m only in my forties, the business has been around for 70 years.

I love the “third world populating California” rant. This was argued when California first became a state in 1850. Racist fear is silly. Shall Cali only have blonde Prussians move in, or maybe “the right kind of people”. No one ever mentions that in the last 10 years the most influential companies and minds have moved to or resided in “minority infested” California. Apple, Facebook, Intel, Chevron, Ratheon, Blue Shield, Yahoo, numerous nobel laureates, numerous automotive design teams, Google, Dreamworks, Warner Brothers…and so and so forth.

“Currently the Chinese are making legal and structural law changes to file bogus patents to seal off markets and steal more technology”

I don’t doubt that but how does that differs from what US has done several decades?

In your system is perfectly OK to patent anything not yet patented in US and f**k the rest of the world. Just to kill foreign competition and steal technology legally.

From this side of the pond there’s no difference and I can guess that China has only translated US patent laws into Chinese, no need to change anything.

What I’m really wondering is why China does this now and not 10 years ago.

Dude, the epic amount of fraud and theft with China is stagering. They put out a policy statement on how they are going to become a technology power house within the next decade.

The system for patents is now first to file(French) vs first to invent (US system). The patent language is also very broad. So, at this time a bunch of guys in China are busy brainstorming “ideas” and filing “patents”. They don’t actually have a way of building the widget. Just file on the idea. Additionally if you propose a project and show them any IP, lookout, a local firm will probably pop up with a “patent” that blocks your market entry.

If you want to defend against this, your going to be going against the home town court system and have to expose more of your technology. Good luck with that. About as dishonorable as the French system.

These guys are calling re-innovation or reinvention with changes to make it Chinese technology. All those asshole bidness guys that sent their factories over there are going to loose their shirts AND I think they deserve it.

The US also tracks all the stolen software which the government over there seems to do nothing about. Not to mention all the massive subsidies that amount to tarifs.

They have been doing this kind of industrial espionage for a long time however now it has a legal and government structure to attack everyone. You can read about it on some of the other blogs.

We haven’t lost in Iraq or Afganistan yet. Course we lack the old European genocidal tendancies that would be more of an easy out Thomas. Now, we “lost” Vietnam but in more of a “why continue to trouble ourselves” moment. In the long game we “won” and the evil socialist regime failed first. Similar points about Iraq or Afganistan.Not really winning over there. Just giving the terrorist some targets and helping all the people that need an easy path to Allah a hand, and in their own back yard. Might go ugly at some point over here but not likely to amount to much.

Our problem here is we allowed a credit bubble and over leverage and allowed a system that isn’t resiliant to deflation. Too much allegedly TBTF crap. That and competing with bizzare mercantalist power one after the other (Japan and now China).

The great thing about all of this. In 15 years China will be beyond a dead force and we will still be chugging right along. Our questions are what to do with our protectorate states (Iraq, Saudi Arabia, Israel, England, Ireland).

You EU guys, well, good luck with that currency. Everybody over there seems to be pushing the hyperinflate button. See how long that mess lasts. Ah… just remembering how many people ran and traded their dear sweet dollars to me on the cheap for Euro’s.

America has devolved into a nation of gamers. Something for nothing. If you’re reading this website, then your not a gamer. You need to do your homework and study game theory to get ready for the next bubble. Good luck.

“Worldwide confidence”

US dollar isn’t worth much two seconds after you can buy oil with any other major currency and not even worth of toiletpaper if you can’t buy oil with it. Just like Zimbabwean dollar was in 2008: Worth is measured by pounds of note paper and markings on the note are irrelevant.

” is so well respected due to the fact that America, in her sovereignty and largeness, has never defaulted on a loan”

No, you just make the currency it’s on, worth nothing. Not even toilet paper. Knowingly. In my terms it’s the same as defaulting.

“surrendered in a foreign war”

You’ve lost several foreign wars and you are too stupid (? arrogant? Who knows ) to surrender: You just take your toys and go home. Examples: Vietnam, Afghanistan, Iraq.

“†is so well respected due to the fact that America, in her sovereignty and largeness, has never defaulted on a loan—

This is also an actual lie. When French wanted to change their dollars (presumably backed by gold when aquired) into gold, you defaulted and refused to pay.

That was in 1971.

In reality, the US has been going sideways since 2000. Just look at the stock market. Real estate was a bubble investment from 2002 to 2007. So it’s deleveraging. This takes time to unwind due to so many govt interventions. But it’s happening nonetheless.

The latest bubble is in sovereign debt. Which looks to be about rolling over now.

Be interesting to get a handle on the baby boom component of California real estate. As this age group comprises 25% of the US population (likely less in California but still a major component of affluent communities) and many may need to rely for some part of their retirement funding the equity in their homes, the impact on the housing market as they attempt to realize that equity might be significant.

Reverse mortgages may mitigate some of the pressure to sell but not all of it as staying in a large expensive home will just be beyond the means of many especially if SS pensions are means tested, capped or even rely on bogus CPI numbers for COLAs.

Also, retirees want to move to states without or lower income and sales taxes.

The only thing good about this whole mortgage/foreclosure crisis is that it does redistribute wealth away from some of the old time home buyers now more in favor of new blood coming into the market. Young people had no chance of buying a home. People who buy a home now, will be because they can afford a home and not looking for it to be their investment nest egg. Sorry old timers as much as you want to bash people who walked away from their loans it was more a case of haves against have-nots. Have-nots revolted by walking away when the rules they had to play with were too high. They wanted a piece of what long term home owners had and they had no chance to acquire. If you ask most people all they want is to own a home that they can afford but with the high prices in the California market, they had to do crazy things for basic home ownership. Despite the good advice to be a renter this is not how most family’s want to live. Yes, you can point your fingers at the strategic million dollar home defaulter but most were regular working people who want to have a home for their family. Banks preyed on this basic need.

= 12 m twelve million empty houses in states.

. . . other nations have no mortage de duction tax breaks. . oft pay cash.

Seems so complicated with all the charts and terms. In simple terms, the US got too fat and now is overburdened by it. We can no longer move about like we used to. The rest of the slim world now also wants to be fat, because it tastes good!

The US should take this opportunity to slim down while the rest of the world packs it on. (Exactly what Japan is doing now) In 1 to 2 generations, when the rest of the world can barely get out of their seats from their excessive size, we can start selling them everything they need while they continue to engorge themselves.

Unfortunate for those living in the US during this era. Lucky for those living in other rising economies. LUCKY FOR ALL OF US THE WORLD IS A SMALL PLACE. PULL UP YOUR TENT AND CHOSE THE ECONOMY YOU WANT TO GET FAT IN. YOUR SKILLS ARE NEEDED ALL OVER THE WORLD.

I have a lot of fears about what CA is becoming, or actually, what it is returning to. The job situation is bad. I know PhD’s and other top-level people out of work. Doctors struggling to keep practices open. The level of street violence has gone back to what it was back in the early 90’s – no statistical data but as a lifelong Californian, it just feels the same way it did back in the early 90’s. I remember how the last 2 recessions completely destroyed people, many of whom never really recovered. This one is way worse. High value jobs are leaving the state and the US for that matter. It just gets worse and worse everyday. Just when they tell you it’s a recovery, another one of my friends gets laid off. I don’t know, I just don’t know.

Anyone here who has not yet seen Wall Street: Money Never Sleeps yet needs to see it soon. I saw it last night and was amazed at the way it nails the financial meltdown of the last few years right to the wall. I really enjoyed seeing a mass media presentation that socked it to the banks, and I think you would too. I read some online reviews afterward where people were complaining about the quality of the filmmaking. As I reflected on it, I realized that they were right to a certain extent, but that I had not noticed it so much in the wake of my enjoyment of the content involving the exposure of the banking schemes.

Well, I’m glad you are highlighting the shadow inventory. My house was for sale for 12 months, before I finally got it approved and finalized for a short sale under the hafa program (this month). The bank never issued a notice of default on the property.

I put 100k down and the house lost 200k in value. I’m happy they have programs that you can basically walkaway. I’m a happy walker. I had a lot of from debt student loans that basically made the loan unaffordable once it adjusted not to mention that every month we have a furlough threat that may happen this summer after the state budget cuts (i work for a state agency).

My friends are still trying to hold on to their properties and get loan modifications without a principal adjustment. I think if people bought at the peak of the housing frenzy they should walk and take advantage of the tax forgiveness and other short sale programs before it’s too late. I got my bailout just like the banks.

I’ve read a couple of articles recently saying that banks such as JP Morgan are modifying loans to make them easier for people to make their payments and avoid foreclosure. Any thoughts from anyone on the impact of that on the number of foreclosures that will be out there, and/or prices?

Once again, thank you DHB and rest of the loyal readers…… By 2015, New World Currency will come out…… There still be a dollar but devalued 60% to 70% at the point…. & the name of the new currency is H***

Have a nice weekend people……

People forget that there is a growth industry here.

A few weeks ago, a panel van pulled into the driveway of an empty, long foreclosed house. Some very professional looking people got out and spent about an hour in the house. Later, when we saw open doors, we called the Sheriffs to file a report.

“There’s nothing we can do”, the sheriff said. “This is a victimless crime.”

“How so?”, I asked.

“We can’t find out who owns this property”, came the reply.

Several thousand dollars for just a few minutes work. “Need a new AC unit? Water Heater? Piece of cake.”

Like I say. This is a growth industry.

There’s also those that just move into empty housing. They use lanterns and pack water in to flush toilets. The fun is barely beginning.

Japan is not a proper model for California. Japan is not multicultural, like California. The Japanese are polite, obey the laws, conform to whatever norms there are and adapt to the place in life that they are given.

California without the money to pay the enormous security apparatus and the bread & circuses to keep the unemployable diverted will be more like Mali or Somalia than Japan, much more!

I see blame for all the usual suspects: lazy overpaid government workers, Mexican illegals, etc etc.

The real problem in California (and the US in general) is FIRE: Finance, Insurance, and Real Estate.

It is the confluence of FIRE which drives up housing and commercial real estate prices.

This in turn drives up cost of living of which housing is the single largest component.

Which in turn decreases labor competitiveness and drives away jobs.

The difference between California education and Idaho education is simple: the wages in Idaho are more commensurate with the cost of living.

The influence of FIRE is also pervasive in siphoning off money in other ways: refinancing for example is a wonderful scam for banksters.

It isn’t that refinancing is always a scam, but it is that most people just don’t get that switching into a lower payment halfway through a loan means you’ve given hundreds of thousands of dollars in interest payments away for free.

Other scams: home improvement – the idea that sinking more money into a negative equity house will somehow fix the problem.

Throw the criminal banksters in jail. Re-evaluate criminal FIRE proceeds in court. Kill all mortgage subsidies and all other housing distortions.

Until this first step is taken, all the rest is meaningless.

Leave a Reply