California’s war against the middle class: Massive income inequality pushes a growth in crowded rental households and lack of income growth.

One of the memes that continues to spew out of the mouth of the Taco Tuesday crowd is that owning a home is the ultimate goal in life because that is how they grew up. You buy a home that stretches your budget to the extreme, work on the beer belly during the weekends, and slave away for 30 years hoping no curve ball comes during that time. And you wonder why mobile Millennials are saying “no way†to that vision. They also assume the past is going to reflect the future. Even in San Francisco with a well educated tech crowd, many are going down the renting path because owning a home is financially insane. What many fail to factor in is that California’s population is going to become much more wrinkly and old while our younger workforce is getting paid much less in inflation adjusted terms. So it should come as no shock that 2.3 million grown adults are now living back home with mom and dad. We also have a roommate trend where people crowd into homes like sardines to split the rent. In many gentrifying hipster zip codes the neighborhood looks like a car lot because of the number of people living in one house. If we are throwing labels around like the “war on drugs†then there is a war on the middle class in California.

The war on the middle class in California

First, housing matters because it is the biggest expense of the vast majority of households. Some seem to think it is logical to buy a $700,000 piece of crap and lock in expenses leveraged with a massive mortgage. Yet this is a simpleton analysis. Leverage cuts bought ways. Just ask the 1,000,000+ California households that lost their homes through the foreclosure process in the last decade. You also have selling and buying costs, maintenance, infinite taxes, and insurance. Also, your home is not an investment! Just ask the Purina Dog Chow eating boomers in paid off homes. Even a mortgage free home still carries annual taxes, insurance, and maintenance. There is no income check coming in from simply owning a home. The only way to get cash flow is by selling. Look, buying throughout most of the US makes financial sense. In California? It doesn’t right now and even if people wanted to buy, their incomes would be stretched like a rubber band just to squeeze in.

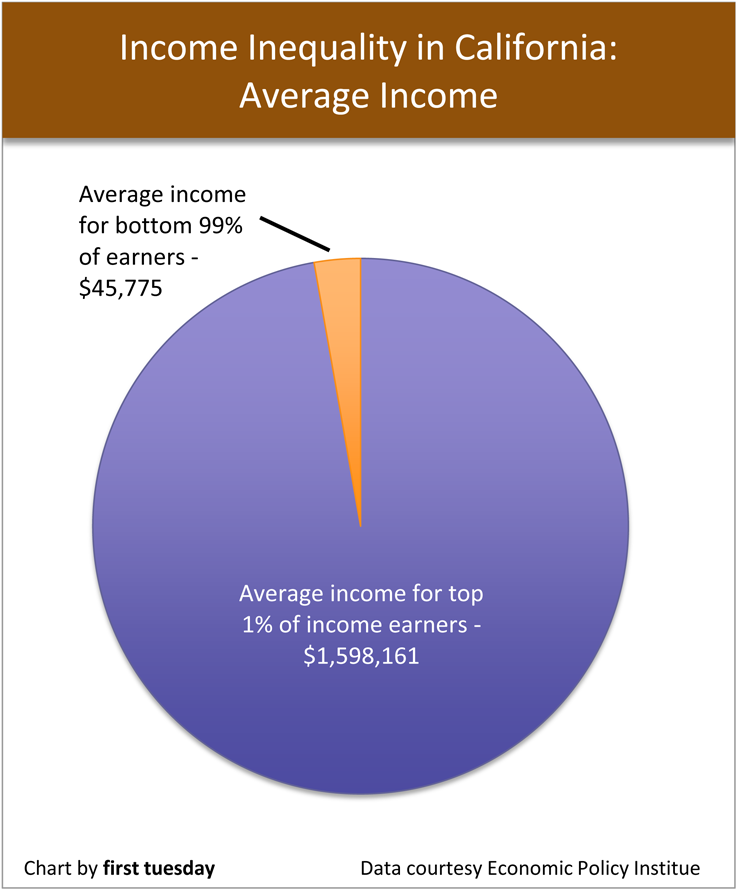

What is certain is that most in California do not earn high incomes:

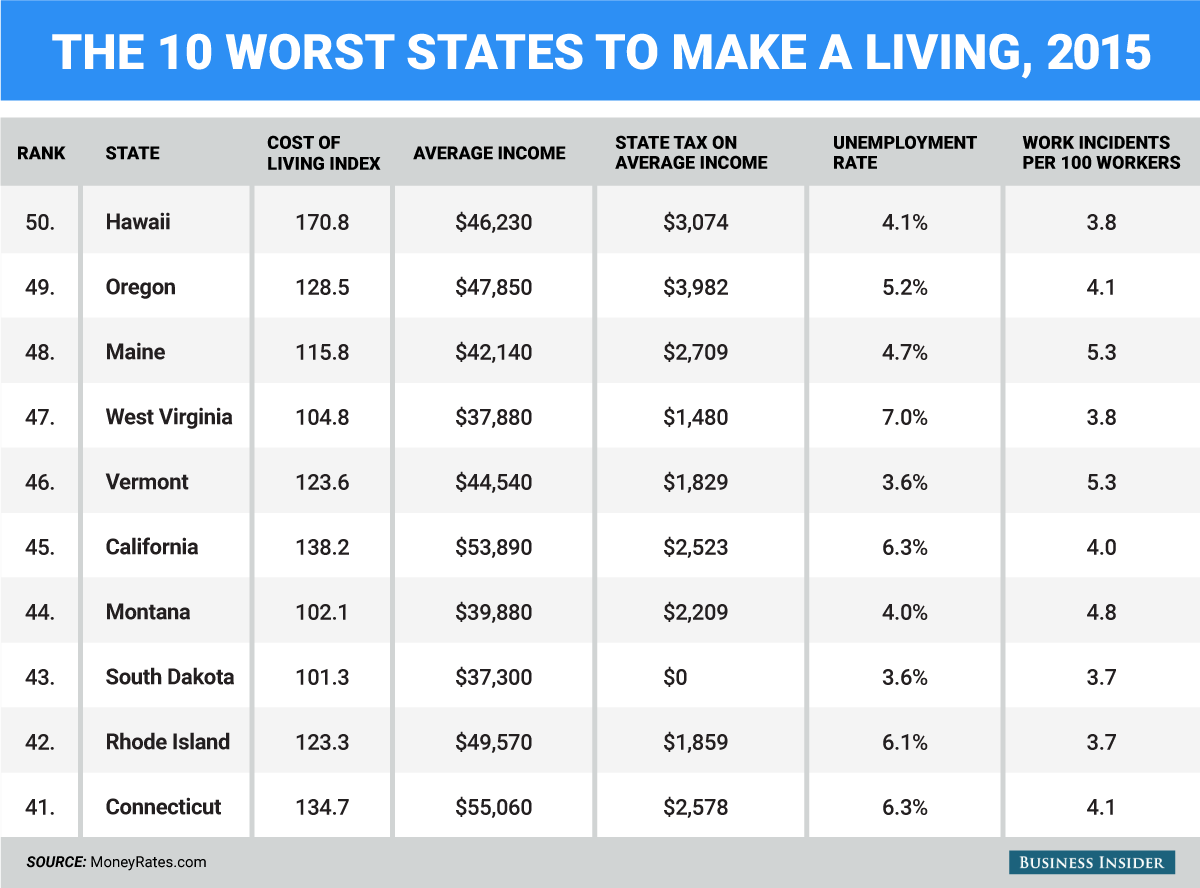

So the average income of the bottom 99% of earners is $45,775 while the top 1% have an average income of $1,598,161. Yet home prices are expensive even in inland areas that basically look like Arizona or Nevada. California has been labeled as one of the toughest states to get by on:

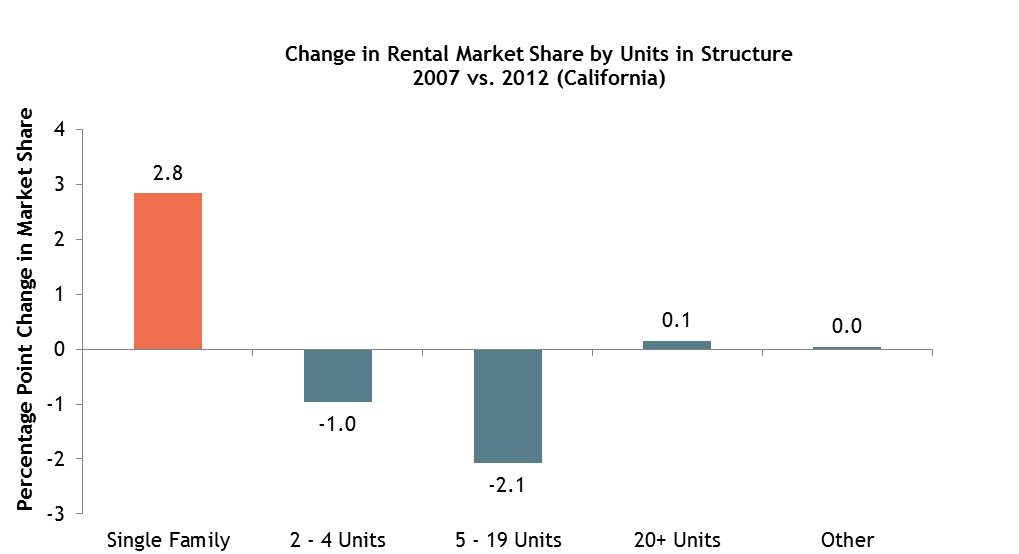

Our tax burden, income, and cost of living all combine to make the state very difficult for the middle class. Yet some want to pretend their crap shack is the diamond in the rough. In the end given the massive liabilities facing the state, the tax burden is only going to increase and with more households becoming renters, voting will shift. In California over the last half decade, a large amount of properties bought went to big investors to turn into rentals. We see this in the pool of single family homes that have become rentals:

This is a big change in terms of single family homes become rental units. You also see the pressure on multi-unit properties given our lack of affordable home building. Why would renters vote to keep Prop 13 in for example? Why would the upcoming young workforce with major problems affording rentals keep this locked in? The only argument that seems to go around is from the Taco Tuesday crowd saying “well when you join the club, you are going to enjoy this lotto ticket as well.â€Â That works when homeownership is increasing, not declining. Plus, no one feels sorry when grandma can sell her crap shack for $700,000 to some large faceless hedge fund or foreign buyer.

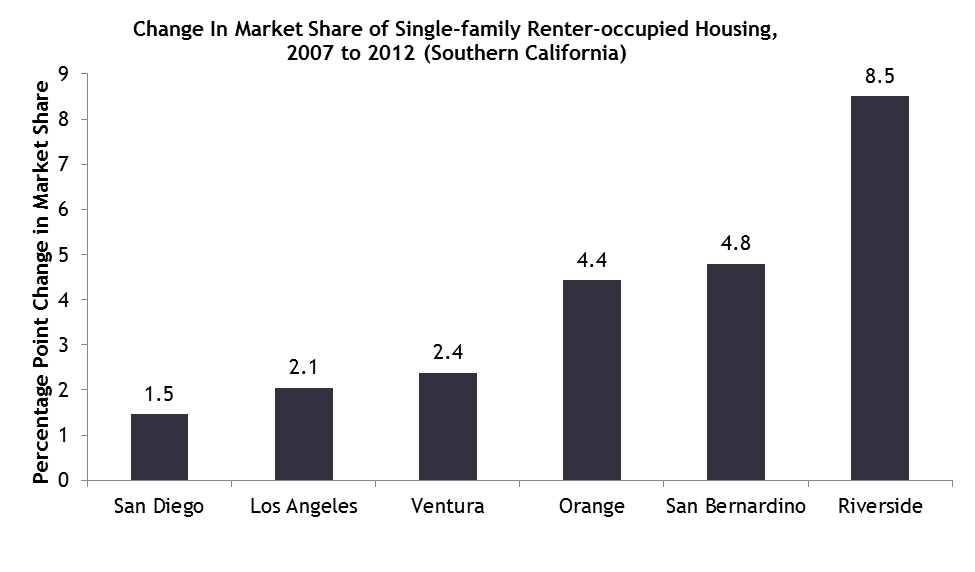

In SoCal, the proof is clear to see. There is a big jump in rental households:

The biggest jump has happened in the Inland Empire. And keep in mind all of this is happening on the back of a raging stock market, booming home values, and higher property taxes. The state is flush right now. Yet somehow, the homeownership rate is plummeting. How sane are things? Take a look at this 280 square foot shack in Venice with an asking price of $1.3 million:

The place has no kitchen. Of course this place needs a rehab as in “tear me down.â€Â Now maybe they go commercial to sell $50 tacos to the new hipster crowd and the numbers pencil out. But the middle class in California is being pushed inland or out-of-state. This really hasn’t been a recovery for the middle class in California. Those that think buying is a simple decision right now fail to look at history and conveniently ignore the headwinds coming down the road. I’ve even gotten a few e-mails saying how the potential El Niño this year is going to push home values up! Yes, even “bad†weather is good for home values now. Rain or shine, lack of income, crowded spaces, crap shacks galore, high taxes, and ridiculous home prices seem to be all part of the plan to push home values even higher. I’m sure this is why inventory is soaring and prices have hit a trough as reality sets in.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

116 Responses to “California’s war against the middle class: Massive income inequality pushes a growth in crowded rental households and lack of income growth.”

But Doc… “fabulous wealth” on “easy street” is just a prime LA or NY property away…

“Owning a primary residence in a decent area should be the goal of everybody on this board. Over the long term, the numbers make sense. Quit trying to cloud this argument!”

It’s quite interesting to be “advised” by touts whose “experience” consists of the last couple recent years. In some cases the same advisors who were the contrarians of relatively recent yore. The born again speculator crowd.

I’d bet that the readership of this website is much more diverse than the ‘left out’ crowd. Some of us have been around and involved in real estate long enough to know that it’s not as simple as buy now or be priced out forever.

Nobody except for the extreme fringe is claiming that long term buy and hold of a primary is a reasonable goal for most. The devil is in the details of timing and future unknowns.

Correction:

Nobody except for the extreme fringe is claiming that long term buy and hold of a primary is NOT a reasonable goal for most.

Ordinary Folks are DECENT, NAIVE, COMPLIANT and REASONABLE HUMAN BEINGS.

They were never “trained” to be Contrarians ..That’s the problem.

We need to CHANGE HOW OUR CHILDREN THINK …

i.e. What to buy , When to buy, What to Pay, Who to do business with …

…. and How to WALK AWAY FROM THE “SO-CALLED OPPORTUNITIES”.

There’s been Five Generations “brain washed” in the Consumerism that is

destroying their FREEDOM and their ability to THINK INDEPENDENTLY.

24 HOURS of CONSTANT DRUMMING INTO THEIR HEADS ABOUT WHAT

“THEY DON’T HAVE” … So now they want what they can get which is NOT MUCH.

Instant gratification that leads to DEBT and BURDENS that break their backs.

TIME TO “RE-TEACH” OUR CHILDREN … ” THAT EVERYTHING IS NEGOTIABLE.”

*** AND JUST WALK AWAY IF THE DEAL STINKS.***

Congress will always pass a CONSUMER “protection act” that does nothing of the sort, but it will never in your lifetime pass a CITIZEN protection act.

I’ve been involved in California real estate since 1991 and have only seen 6 years of NOT BEING UPSIDE DOWN.

that’s the fact jack!

Never surprises me to see the occasional

Real Estate Industry “Troll” sulking in the dark.

This stuff below is NOT FACTUALLY CORRECT,

this stuff below is Propaganda

=========================

interesting – July 13, 2015 at 6:11 pm

” I’ve been involved in California real estate since 1991

and have only seen 6 years of NOT BEING UPSIDE DOWN.

that’s the fact jack ”

==========================

One of you has their grammar confused.

Was recently in the Leimert Park area for a family gathering that a friend was having. Was looking around and thinking about gentrification. The neighborhoods are so ghetto. Parking sucks, all sorts of unsavory activities abound, it just sucks. It’s desperation to move into an area like South Central, while putting all of one’s eggs into that basket, and hope for the area to evolve into something nice one day. Even if I knew for sure an area was going to turn, it’s just not worth paying the price of all the years putting up with the ghetto bullshit being fraught with frustration.

If you live in Cali, shut up! or move from this un-american state otherwise you deserve EVERYTHING you get if you stay.

… Regrettably everything and every place has or is a “game” …

We can’t run away from “every-where”.

But we can learn to “learn the rules of the game(s)”, what to do, what to avoid,

what to ask and how to discover the “LIE” in the stories we are being told.

More importantly — once we learn the rules .. which rules to ignore and which rules to break … and finally how to leverage those rules to our advantage.

…. WHO IS WATCHING ANYWAY ??? ..

… Why do some people get ahead and some people fall behind.

Doesn’t matter where you live … you still have to COMPETE … or AVOID LOSING.

SO – Learn all the Rules ..FIRST .. before you “jump into their game”.

My wife an I checked out of the Hotel California 7 months ago for this very reason. Sold a 1500 sq ft crap shack in Torrance at $500/sq ft and bought a very nice 2000 sq ft rancher in Austin, TX for, wait for it, $100/sq ft. Less than replacement cost. Could rent it out for $400/mo cash flow positive tomorrow if I wanted. I will be buying more as time and money permit. Oh, and in case you are wondering, Austin aint a bad place to be right now.

Uh, wasn’t half of Austin under flood water recently? Enjoy those mosquitoes!

Quick search of several Austin houses and I didn’t come across one at $100 sq. ft. $184 – $200 is more like it. What neighborhood are you in?

id rather live in Scottsdale than Austin

I’m sure this is why inventory is soaring and prices have hit a trough as reality sets in.

Now unless the Doc has gone Perma-Bull, I’m going to assume he meant prices have hit a plateau. We’re a long way from a fucking trough. The correction coming in so many malinvestments is going to be huge. The misallocation of capital you see everywhere is one domino fall away from from a cascading correction. And there’s so many dominoes set to fall. The first looks to be the rate raise in 2 months. It looks like the FED has decided the shit storm is coming no matter what, so better to tip the first domino themselves then guess which one will begin the economic contagion.

I now wonder if in some ways what we’re seeing is analogous to the period from 1987-1994. Greenspan used his first “put” in response to the ’87 stock market crash. Who knows what a true correction the the over heated economy of the mid to late 80’s would have looked like. Instead more time was bought for the S&L’s to lever up and implode and by the time the Berlin Wall fell not only could the US no longer afford insane defense spending but the pretense was gone as well. So we got the recession we should have had in ’87 pushed back to the 90’s. You could say that the entirety of Bush 41’s presidency was a Greenspan engineered dead cat bounce. Looks like Obama’s might be as well only on a grander scale. Definitely makes the next recession look foreboding…

All these properties are being bid up with easy money whether from loans, stock dividends, IPOs, salaries at companies that will be cutting labor to the bone in the next recession. There is NOTHING about this environment that says these prices can hold. By historical averages we’re about a year overdue for a recession coming out of a “normal’ bull run. The last few years have seen Central Bank financial engineering go full retard WORLDWIDE. If those chickens come home to roost in even a 1.5% raise in interest rates we’re looking at 18% haircuts JUST to keep the monthly nut the same. Now imagine what will be happening in the economy if mortgage rates are at 5%. Either the FED will be in damage control mode using higher rates to combat the real inflation they publicly deny, or they will have completely lost control of the bond market. These market based corrections are all but inevitable. As the Dr says in the article, reality is setting in

If mortgage interest rates hit 5%, which should happen in the next 12 months, then prices are going to fall off a cliff. This market is gasping to maintain prices at 4% rates. 5% rates and prices will drop 15% to 20% within 6 months. Watch.

Then Housing Will Tank HARD!

I gave this some thought and I thought the same thing that housing prices will drop. I do not think they will if there is still a lot of liquidity and people can still borrow at a higher interest rates. What it means is they will still buy a house but since the monthly mortgage buys 20% less house then they will buy a smaller house.

Instead of a 4 bd 2000 sq ft house they buy a 1500 sq ft 3bd. If they were going to buy a 3 bd then now they will buy a 1200 sq ft 2 bd condo. If they were going to buy a 1200 sq ft condo then now they will purchase a 1 bd 800 sq ft condo………etc

New homes that are McMansions were typically the move up type of home. The second home someone buys. Lets say right now they are $400k, 4 bd, 3 car garage, 3000 sq foot. These move-up houses probably will not be built so big when interest rates go up. They will be 4 bd, 2500 sq ft with a 2 car garage that sell for $350k.

Thus higher interest rates that comes with liquidity (easy to borrow) then the 3 bd and small 4 bd houses may not stay on the market long.

So in essence everyone moves down the housing food chain but housing prices do not collapse. For housing prices to drop then money (debt) has to get tight (now liquidity).

If I recall rising interest rates in 1977 through 1980 did not decrease the price of housing. Prices kept going up because Savings and Loans were creating lots of money via fractional reserve trickery. Volker reduced liquidity and juiced interest rates to control inflation.

http://www.apimagazine.com.au/blog/2011/10/how-do-interest-rates-really-affect-the-housing-market/

History shows that whenever the availability or cost of finance was pushed upwards, out of the reach of prospective first homebuyers, rents rose as more people competed for rental properties and this was accompanied by a gradual shift from home ownership to rentals. In other words, the increasing rental returns of housing attracted more investors.

Interest rates don’t reduce the demand for housing – they just move it around

The message is clear. Rising interest rates don’t reduce the demand for housing, but shift the demand for housing from those areas where new households buy homes to those where aspirational first homebuyers are forced to rent from investors. This doesn’t result in a reduction of the number of cards in the housing finance deck; it’s merely a shuffling of the cards leaving investors holding trumps.

Interest rate hikes ultimately benefit investors

Interest payments are an allowable expense to be offset against income that housing investors earn, but there’s far more to it than that. Rising interest rates lead to more renters and this allows investors to recoup any increased repayments by way of rent rises whenever leases expire. Although there’s a time lag, it works both ways in that it takes months before any reductions in interest rates lead to a lowering in rental demand.

One more note on what may affect housing prices.

http://www.ritholtz.com/blog/2015/07/how-sensitive-is-housing-demand-to-down-payment-requirements-and-mortgage-rates/

Taken together, our findings suggest that the strength of housing demand is strongly affected by fundamentals (household wealth and income) and also the quantity of available financing (especially for first-time home buyers). The price of available financing (that is, the mortgage rate) may play a less important role than commonly thought, although we emphasize that our stylized setting omits certain factors, such as payment-to-income constraints, that may in reality affect households’ ability to qualify for loans.

@ru482

Those years of rising prices and rising interest rates also coincided with rising incomes and a vibrant middle class. Today, middle class incomes are stagnant. Current liquidity favors the well-connected, not organic buyers. Thus, the fall of individual ownership to the lowest level in decades and the rise of RE investment groups.

Prices are not based on fundamental but on cheap debt. Those investment groups borrowed billions to build up a portfolio of rentals. Already, the rate of acquisition has decreased because even returns on rentals won’t cover current prices.

The market is demanding higher Interest rates. Everyone except Wall Street speculators. I’d love to be able to buy CDs again and live off the interest. Don’t know if this will ever happen again the way the fed manipulating the free market economy

Sorry Ru82….but if you make it more expensive to pay a mortgage at a certain loan amount, LESS people are going to buy that house…which is what you said, and they’ll have to look at something cheaper. But if LESS people can buy a house, there is LESS demand for that house…at THAT price level. And what happens when demand for a $700k crapshack goes down? The price has to go down.

Incomes matter. If they didn’t, we could have 15% interest rates…but you wouldn’t simply argue that everyone will go buy a 500 sq ft house….would you?

The impact of higher rates will be unevenly felt. It’s the bubble areas such as SoCal that has no capacity left to take on higher monthly nuts. That’s why the area’s touts have been in the mode of self deluding on the idea that incomes don’t matter.

It almost seems that the FED wants the market to find it’s price discovery first before the SHTF. Maybe that way the FED doesn’t look bad if they have to raise rates. – all imo

When are the Chinese going to sell their fucking unoccupied houses in SoCal? I wish their stock market crashes, depression style, so they can offload their shit here in SoCal.

Waiting for prices to correct itself to 2009-2012 levels before I consider to buy.

Waiting for prices to correct itself to 2009-2012 levels before I consider to buy.

This is actually quite sensible. I thought we were near a bottom after the uptick that coincided with the Housing Tax Credits faded. If not for the insane FED intervention we’d likely still be trending along the 2012 monthly nut pricing. In other words prices would be a bit higher if interest rates had fallen some or lower if they rose. instead the FED introduced a whole new wave of volatility to the market so theat inventory could be moved from the banks to private equity that institutional buying created the momentum that fueled Housing Bubble 2.0. WIth that momentum gone in the past year it’s only a matter of time until we return to the moderately organic market of 2011-2012.

Juiced markets never stay flat when the punch bowl is removed. The correction has begun…

IIRC, I read Colony and Blackstone (deep pocket SFH REO holders) had to buy and hold 5 years, before they could sell their properties. That I what sucked up a lot of the inventory. 1,000’s and 1,00’s of homes and they got them for rock bottom prices, fixed them up, and are charging high rents. We have a few in our neighborhood.

Yeah, housing is way too high. We bought a cash & close in 2012, and we over paid as well. There were 9 offers, but most were FHA, and the roof would not have passed inspection. The first $10K check was for the new roof, and we and a connection. Most wanted $12K-$14K.

Another $60K more, and we could move in. We’re now doing the exterior. We figure in the real world, this house should have cost $250K. We paid just south of $400K. 2,000 sq ft one story ranch (1967), with a pool (a money sinkhole -not sexy). The inverse effect of the insanely low cost of money, the limiting of inventory, are screwing up everyone’s life. We had to rent for years before we found this joint, after selling our former residence .

I feel for all of you. We wound up in a semi-marginal neighborhood. I wish people were thrilled we’re fix’in up the curb appeal, instead of being nasty mean jealous a-holes. We’re helping the neighborhood.

Excuse my lack of editing. My keyboard has a communication issue tonight, and I am rushed and tired.No, I’m not an idiot.

getting close to a half mil for a nearly 50yo house in a middling neighborhood? Damn you have to be pretty optimistic! And thats with the loan I assume? Holy Cow!

You will be waiting a long time, perhaps forever.

Real Estate is America today is one big scam.

Instead of being a shelter, it’s investment, buy and flip, etc.

What a joke

Well Said!

Hello Doc

Its been a while since we have seen a ‘real homes of genius’…

curious if this fits the bill:

sold for $374K one year ago. Now after a flip it is offered at $674K. small lot in a lousy ‘mid-city’ LA LA LAnd neighborhood…

http://www.trulia.com/property/3131125760-2351-S-Cochran-Ave-Los-Angeles-CA-90016

Nice lipstick, but it still screams crap shack. Mediocre to awful schools to boot! And what’s up with the gravel in the backyard? Odd. At least put in a few drought-tolerant plants.

maybe if you never left your house, or looked outside, this residence might be sufficient. but seriously, not worth what you are asking, maybe I can say that because I’m not a Los Angeles drone.

I personally can’t wait for China to tumble and fall, or at least the SF Tech boom to bust a bit. Maybe those hipsters might let loose their empty second (or third) homes up here in Tahoe so us upper-middle class Tahoe local families can purchase a home.

Irvine–> inventory at 1001 houses…for the first time since the bubble busted….we will see who bends over first…owners need to still pay their taxes and hoas and reparation costs…i pay just my cheap rent:-)

The numbers presented for average or median incomes are all wrong. Wikipedia has the actual I.R.S.-sourced numbers and most of the nation earns $13.00 an hour or less.

$24,960.00 a year is the most that 60% of the country will ever earn. If that alone is not enough to justify change I don’t know what will be enough because these people will never achieve the American Dream.

social security admin says little over 50% of wage-earners in the US earns $30,000 or less

“I’ve even gotten a few e-mails saying how the potential El Niño this year is going to push home values up!”

YES! I heard the same recently from a SoCal broker friend; “El Nino is coming, good business ahead” she said, eyes raised skyward.

It reminded me of Wang Lung in the Good Earth standing on barren, locust ridden fields pleading to the Gods for rain and fertile soil. I suppose they’re hoping SoCal Real Estate experiences a rebirth; a sea of open houses displaying womb-shaped musical instruments and plenty of bowls of ripe, fertile, plump fruit as bold, adventurous warriors (oops, buyers) engage in fierce bidding wars as rain pours down from the Heavens…

I guess Millinneals stuck in PT and/or low wage jobs w/unpaid student loans, a lack of stable, living wage FT employment, a shrinking middle class, and the largest welfare/homeless population in the US that keeps growing is irrelevant. CALIFORNIA JUST NEEDS RAIN DAMMIT.

… we have California “WINE” .. who needs Rain ?

You mean Whine….

Wang Lung… yes, the character that bought bought bought real estate every chance he had.

@eden

Yes, he bought his land with stolen loot…very much like ZIRP robbing a generation of savers. And then he wasted his fortune away on booze and girls….much like the many equity-rich took out HELOCs on frivolous luxuries.

Yes! The same Wang Lung who disrespected a hardworking faithful wife by taking a prostitute mistress. The same Wang Lung who built on empire on stolen property and greed. The same Wang Lung who raised indulgent children who fight over Daddy’s money. The same Wang Lung who eventually realizes the many mistakes he made in his personal life because of his obsession with status/wealth. The same Wang Lung who at the end of his life begged entitled sons not to sell land he sacrificed for; they just smile behind his back.

Yes, same guy.

Wow. I havn’t read Pearl Buck’s THE GOOD EARTH in something like thirty-five years now, but your post brought back the whole thing. I have no idea how authentic a portrait of the life of a Chinese peasant is, but it hardly matters: she forcefully conveyed the agonizing struggle to save a silver coin here, another there, to buy the only really valuable thing in the world, “the good earth”, each acre another bit of security against poverty, starvation, death. There are few pieces of literature that convey so well what it’s like to live and struggle – work like a dog – to build up some kind of barrier against a miserable fate, a fate that will overtake you and your family, your children, everything you love and value if you forget, if you weaken even for one day, one hour, one minute….in other words, the world that the overwhelming majority of humanity experienced throughout history, as much so in Europe as in China.

Seduced by the surface glitter of technology and glib sales talk we’ve forgotten this older world, the world of our grandfathers and their ancestors stretching back time immemorial! I am afraid that we may be reminded of certain harsh truths in the future. The world Pearl Buck wrote about is far closer than any of us think, despite all our virtual crap, and bullshit self-deluding nonsense about how computewrs will fix everything. Unlike some, though, I don’t lookj forward to the day of reckoning.

From Wiki:

The film stars Paul Muni as Wang Lung. For her role as his wife O-Lan, Luise Rainer won an Academy Award for Best Actress. The film also won the Academy Award for Best Cinematography for Karl Freund. It was nominated for Best Director, Best Film Editing and Best Picture. Its world premiere was at the elegant Carthay Circle Theatre in Los Angeles.

I had the pleasure (and I don’t use that word often anymore) of meeting Luise Rainer (who I understand is still alive) in Switzerland some 35 years ago in a little village south of Lugano where she lived with her husband. She made a trip up to our school of architecture once a term with her Oscar film in hand for a showing for us students. Then she told of her experience and what that film meant to her. Until that moment I had no idea who this lady was.

The only word I can use to describe her is elegant. Sadly our coarse world does not know or experience this sort of elegance anymore.

Just thought I would share a moment in time.

Thank you for your thoughtful response, and to the others as well. The Good Earth is a masterpiece. It warms my heart that its characters and timeless lessons still strike a chord in some folks; in a culture fixated on vapid celebrities and a bar that keeps getting lowered it gives me a tiny glimmer of hope. Lucky you to have met her!

I think a lot of what you are saying is going to be dated. There was an article on the tiny house in the Register. Two gals renting an old home in Orange for 1,500 and only 425 sq feet. There is a Tiny House show even if the Tiny House was a little bigger 800 sq feet you could go back to the size of homes in the 1950’s with two kids. They usually had bunk beds in those days. In our family we had a bunk bed in a 2 bedroom mobile home. If Tiny Homes become more hip and some cities zone for them then the high price of housing drops. Back east you can buy them for over 100,000. Maybe in LA/OC if they are pre-fab or 3-d printed they could sell for 300,000. Local Motors is coming up with the first big release of 3-printed cars next year. I predict in 5 years you will see 3-printed housing where the tiny house or conventional.

The issue with “oh, we grew up in 800 square feet, it’s totally possible” is that an 800-sf single-family home on a quarter-acre lot has far more room that the base square footage would suggest. You usually had a basement and an attic and a garage, all of which served as storage; and you could build sheds on your land to hold more stuff.

The kind of beehives they’re building in California these days don’t have that; they’re just apartments that are labeled “townhouse condos” and sold for $450k. When they say “800 square feet”, they mean that they measured rooms to the inch and then rounded up bit to get there, counting the under-the-bar-counter space, the inbetween-fridge-and-counter space, the corner in the closet behind the water heater…

This Santa Monica condo is listed at 1,115 sq ft — BUT the realtor told me that that included the two outdoor patios: https://www.redfin.com/CA/Santa-Monica/1912-Broadway-90404/unit-311/home/12546243

The interior of the condo is only a little about 900 sq ft.

Why the 1,115 sq ft listing? The realtor told me, “That’s just the way the builder listed it.” (It’s a relatively new building.)

If you’re single and lead a simple life, a tiny home would work well. I live in a 400 sq. ft. guest house and I have everything I need in it. Add to it a paid off car, a cell phone and a laptop and call it a life.

Don’t worry folks it’s about get even worst!

I had to share my story…

I live in Simi Valley and was doing errands today when I was struck by a nunber of “Open House” signs. I started to stop by one of them to see what the ruckus was about. Mind you, the median price of a starter POS home in SV is about $450k right now.

I follow the first one I see and it leads me to…..a trailer park. No joke, their showing homes in trailer parks. I asked the realator, he said their is so little inventory that this was the only thing selling this weekend. Very interesting to see the lack of inventory in this market.

It does look like there is quite a bit of inventory available in Simi. A neighbor of mine listed his house for 609K and it sold in 4 days. I guess it really depends if it is priced right and somebody is willing to pay the price. Rent for a house similar to mine might be 300-400 less a month, but for me personally I would pay that extra money to own my house (at least make payments on it)

Even near the end of a bubble…there are still suckers. Suckers that don’t want to get left behind…suckers that think prices will go up forever. Just because there are suckers doesn’t mean prices won’t correct.

I do have to say it’s funny seeing everyone confidently predicting how there’ll be this HUGE crash ANY day now, and prices will TOTALLY drop. People, prices barely dropped back when banks had standing armies of foreclosure agents; what makes you think they’ll drop any time soon? Anyone who couldn’t afford to sit and wait lost their house six years ago. Property owners now can pay for their places, and they can happily hold on until they find someone willing to give them at least their listing price.

Because history only began to be made six years ago? We have decades beyond that of evidence which portends the pattern. Dense alright.

One of the attractions of California real estate for Chinese investors is that they can sell at will.

As such, it is both a financial safe haven and a potential bug-out landing spot.

Have fun watching your kids grow up in the back yard of your stock portfolio.

Oh my God, the kids don’t have a back yard that the parents have trouble sleeping at night over making the mortgage on, they’ll be ruined! Plenty of rental houses with back yards out there.

Have fun leveraging your home equity to the hilt to buy on vacations, new cars, and other frivolous luxuries.

*sarcasm off*

Texas is number one on that list of best places to make a living(e.g. Austin’s hi tec). In regards to the inventory going up in SoCal, it is the Chinese raising cash due to their 1929 learning lesson. Remember the Japanese real estate investors in the past, they paid too much and of course realized the loss when they sold when their stock market crashed.

Living at home with Mom and Dad in their basement is possible only because they suffered through the thirty year mortgage.

So home ownership is bad and renting is good? Based on what kind of logic?

The person that rents is still paying off a mortgage and pays all of the same tax on property as the person that “buys.” It is just that the “owner” is one step removed from the genius that would prefer to rent instead of own.

The only reason that there is a bubble on anything is that there is more demand than availability. If there weren’t so many restrictions and limiting factors on building in the California market, there would never be a bubble.

Woody

@Oran Woody

Wrong on every count

“Living at home with Mom and Dad in their basement is possible only because they suffered through the thirty year mortgage.”

Mom and Dad didn’t have to suffer paying outrageous prices. Many owners couldn’t even afford to buy their own house at today’s prices.

“So home ownership is bad and renting is good? Based on what kind of logic?

The person that rents is still paying off a mortgage and pays all of the same tax on property as the person that ‘buys.’ It is just that the ‘owner’ is one step removed from the genius that would prefer to rent instead of own.”

You don’t own anything until you pay off your loan. Quite a few people learned that when they were foreclosed on, walked away from their underwater mortgages, or took out HELOCs. It makes sense to rent in overpriced regions.

“The only reason that there is a bubble on anything is that there is more demand than availability. If there weren’t so many restrictions and limiting factors on building in the California market, there would never be a bubble.”

Inventory is historically normal. The issue is that there are not enough qualified buyers for overpriced RE; the majority of locals can’t afford to buy in Sol Cal. The bubble has and always will be in the pricing.

You forgot your other talking points:

So Cal is becoming an international community.

Rich folks want to buy out So Cal.

This time is different.

You are correct that I could not buy my own house, especially after the builder enlarged it and sold it for $2.1 million. That’s $21,000/yr in property taxes (to start) PLUS paying the mortgage.

That means we’re back to the Doctor’s pie chart that shows 1% make $1.6 million incomes in California. They can afford my house. Not me.

My parents moved to this same city in 1957, moved a house onto the empty lot and built it and remodeled the house over the years. Pure sweat equity. They scrimped and saved like you can’t believe. They did without much more than I ever realized.

So, no, they couldn’t “afford” their house either. By sheer guts they made the payments for that 30 years, wore rags and didn’t go on vacation or by fancy cars or eat out.

Every generation has not been able to “afford” their house.

The problem is that you can’t necessarily live where you’d like to live. There are places you can afford and there are dream houses.

You buy what you can afford and work until you can get the dream house.

Problem now is that young people come out of college owing as much as a house in student loans and then can’t get a job that pays enough to pay off the student loans alone, much less a house and the down payment.

So they’re back home in the house that mom and dad bought with high school diplomas.

You’re getting it twisted. The mainstream skeptical voices here are not claiming that renting always makes sense and buying never does. The point is that it doesn’t always make sense to buy and it doesn’t always not make sense to rent.

Doc, the problem with your logic is that the Fed, like China, is going to do whatever it takes to prop up inflated asset prices. Since 2008, the Fed has embarked on a massive campaign to ensure that all assets, housing in particular, go up and up and up! So you are not dealing with a rational, free market driven by the laws of economics–so stop trying to analyze it that way. Anybody who doubts the government’s skill is unamerican and will be investigated by Obama’s Committee of Un-American Activities.

The only problem with this view is that there is only so much higher a house can be worth to an “Average” person or family on their current wages today. At some point these people who cannot afford may just leave. Perhaps with the cost of living going up everywhere these people may find sanctuary in other cities/states.

Over the long haul, the dollar will be devalued, making all who hold real assets whole. My rule in the purchase of Real Estate has always been to calculate the CAP Rate on it. Even if it will be my principal residence. Who knows, I might loose my source of income someday and need to rent it out to keep from losing it. If it calcs out to equal the average corporate bond yield, it passes muster. If not, I pass on it.

Been at this a long time now, and the “rule” has served me well.

This factor is why we can’t as a country be allowed to ease lending standards. California housing has had growth in the past with exotic loan debt structure. Now, we have to make sure to get it as vanilla as possible

My counter response to Mark Zandi, Laurie Goodman and others who believe we need to ease lending standards to fix the housing market

http://loganmohtashami.com/2015/04/09/tight-lending-and-other-urban-legends/

May you live in interesting times…..we will see what happens to values going forward. While there are always dips in the road, the long term trend in my lifetime has always been higher.

So if the market does pull back 20%, I sure hope everyone buys, as it is nice to eventually pay a home off, so you don’t have to live on cat chow like the oldsters that rent.

thanks Jim for giving us an example of normalcy bias, i have a few boomer friends where that’s all they know is that it always comes back.

well when i ask which one of their kids can afford the house they live in ALL OF THEM say “i can’t afford to buy the house i live in on my current income” one couldn’t even afford what the news taxes would add up to.

so at SOME POINT incomes will matter once again. It’s only a matter of when.

most likely after the next earthquake cycle gets about half way thru it’s cycle.

How exactly is “Taco Tuesday crowd” defined? I know what TT is but the attendees are extremely diverse.

I am not surprised to see Riverside leading the surge in renter-occupied housing. I owned my house for 25 years in the 92506 zip code, with the highest median income in the city, mostly professionals….bought it brand new. I saw the value go to $660k then $289k in 2010 after the bubble burst. Then the investors swept in, turning a 4 bedroom, 2.75 bath home into 5 bedrooms by recreating the ‘ family room ‘. This was going on throughout my formerly nice clean single family neighborhood. Then the home burglaries, car burglaries, multiple vehicles on driveways and lawns, car vandalisms , 2 a.m. police sirens, etc. accelerated. You get the picture.

I feel lucky to have gotten completely out of the State in early 2013 at $375k. Couldn’t be happier, cause I would have spent $20k just ripping out the lawn had I stayed.

With the next downturn, which will come, pay attention to the changing dynamics of your neighborhood. If you see even one Mexican food truck parked in a neighborhood driveway, it’s time to get out of Dodge fast.

Mexican food truck parked in a neighborhood driveway, it’s time to get out of Dodge fast.”

Not sure about that. It makes Taco Tuesdays convenient, fresh and delicious.

Black stone is starting to sell off part of its portfolio

http://finance.yahoo.com/news/blackstone-selling-1-300-atlanta-090102828.html

Who’s the Taco Tuesday crowd agian – is that hipsters who buy crapshacks they can’t afford and then pretend that Taco Tuesday’s are really cool way to save money while they’re really just poor people with a big mortgage? Do I have that right?

The stawks are UP on the “good” Greece news. The show must go on!!!

This isn’t ZH, full of perma-bears, oh wait… Carry on

The only way to bring back affordable housing (good for the economy) is to see prices drop drastically to be in the vicinity of income levels. This would require raising interest rates (considerably over time), which would be hell shock for the economy in the interim. But we’re in too deep now.

In the UK in the past few days, there was The Budget. To use all the very formal nomenclature…. Chancellor of the Exchequer, The Right Honourable George Osborne, Member of Parliament, at Her Majesty’s Treasury (HM Treasury)… has announced measures which are quite a squeeze on property investors. Taxy taxy, taxy taxy. Can hardly believe it. However he’s telegraphed the changes to occur from 2017. Nevertheless it’s going to spook a lot of property investors. The smarter ones will be making haste to sell up (and hopefully accepting lower prices) – and of course, knowing what’s coming with taxes, it is likely there will be a cooling of buyers. And property investors now own 1 in 5 UK homes. As of this month they own $1.55 TRILLION dollars worth of UK homes (not outright, that’s just the homes value at this point – and many will have heavy mortgages.. some own 10+ properties).

World is interconnected; Doc focuses on California housing focused real estate (mostly) but I just thought should advise of this tax change. It may have many implications in other markets. Or soon to be repeated in many other areas.

Chicago-feel sorry for SoCal, live in a 900sqft/ 2br townhome that hasn’t increased in price in 15 yrs. Neighbor went to a nursing home 2 months ago and his son was cleaning it out to give($0) back to association because it won’t sell. Anyone want one-you could buy and commute and still be $$ up.

Not surprised that Oregon is #2 (after the obvious Hawaii) on the worst states to make a living in. Still haven’t sold the rural OR house we’re selling which is within 25 Mi. of a major university. Prices there are way lower than Socal but not much is moving. I can get renters, but not for Socal rents.

Portland apparently hasn’t received that message. We moved here in January, and we plan on renting another year or two, but the market is outrageously bubbly at the moment.

Go 100+ miles south of Portland and head for the woods. My Brother used to live there (raised his kids there) but the job scene was bad so he moved to the north plains for a better job with lower taxes and good retirement benefits. We’ve got the old family places (one house each and one we own together).

Not much building has gone on in the last 7 years or so in CA, people still coming here, weather is good, it will rain, grew up in this state and have traveled around the country. There is no place like CA. Prefer the northern gold country area, very nice.

People are going everywhere, been all over the world and there’s no place like anywhere else. None of that exempts any place from the effects of its problems.

https://www.equitykey.com

This will end well.

OMG. Kali, especially is ripe for this. Watch it grow then be sold as EBS {Equity Backed Securities} rubber stamped AAA by Moodys.

Scary.

Went to an open house over the weekend in my neighborhood. 11 yo house – Nice floorplan, horrible condition – needed a total remodel except the kitchen. BAD location. Looking right onto a block of section 8 apartments. No back yard landscaping at all. Outer suburbs of Sacramento. WAY WAY overpriced! I nearly laughed when I picked up the flyer. Realtard gave me the song and dance about how if I thought it was overpriced, there’s PLENTY of people that are willing to pay asking on this dump. I said well good luck to them.

I was there listening to his BS for 45 mins. No other visitors lol

Happy to stay a renter for $1,000 less a month, right up the street, in a nicer house.. until this madness ends.

Froth – don’t be a fool. You should put your life savings into this dump! It’s the American dream to own a home. That back yard is a place you can have a BBQ. Spend the next 30 years fixing up the home and dumping every last dollar into the money pit. This will be good for your employer who knows you need the money and will work you harder. If you rent you are only going to have needless savings and peace of mind. Who wants that? I suggest you put in a bid of 100K over ask to make sure you get it. As long as you can make that payment the rest of your life you can put on 25% charge cards. What is my logic flawed? 🙂

“California’s war against the middle class”

I really, really don’t get this headline. California — the state — has little to do with the current real estate market conditions. This is like blaming Florida for hurricanes or Oklahoma for tornadoes. These are all caused by factors external to the state. Let’s take them one by one:

Foreign capital — no state has jurisdiction over immigration policies. California has no legal power to control or limit foreigners from bidding up prices.

QE, ZIRP — low mortgage rates boost home prices due to increased leverage. California has no input into Fed policies.

Income inequality — this is mostly caused by federal policies that encourage closing domestic factories, outsourcing, and failed federal “trickle down” experiments.

And so why are the LA and SF real estate bubbles California’s fault again?

All this speculation is terrific, but should I sell my paid-off SoCal crap shack ($300/mo property taxes, $120/mo utilities + it needs a new $7000 roof and a new block wall, otherwise livable) to a greater fool willing to part with a million bucks, and head for Arizona, buy a bigger, better house there for half the cash and live off the banked profit?

Or do you think when TSHTF they come after 30% or more of my cash savings ala Cypress?

I would sell and invest your $1M from the sale in a 2%+ CD. Then rent for a while until prices deflate a bit, and buy again (with cash leftover in your pocket). Since your house is paid off, though, that’s a bit more of a potential risk, since monthly rent is something you wouldn’t otherwise have to spend in your current place. If you pay rent long enough, your savings could obviously evaporate over time. However, I suspect that your income from investing the $1M plus your property tax and maintenance expenses that you now pay, would pretty much be a wash if you selected a reasonably priced rental.

I agree with you- the Cypress money grab is a scary prospect, and not something that the U.S. government is above doing.

http://www.forbes.com/sites/steveforbes/2013/03/25/can-a-cyprus-like-seizure-of-your-money-happen-here/

Thanks for response, Responder. Problem is, here in 90277 rents for crap shacks like mine are $2500/mo are minimums. I’m in escrow for a beautiful brand new 2100 SF Arizona house with a 1200 SF garage that will cost me about $2200/mo for the mortgage which I can pay. Plan is to sell to a greater fool and retire, then move. Risk is that my current crap shack will collapse before I can sell. Bigger plan is to get out of california soonest.

US major banks are flush with cash, in my opinion. Flush = overflowing.

_____

The big banks have vastly more deposits, on which the banks pay close to nothing to savers, than they did two decades ago.

Source = Fortune 2013

http://fortune.com/2013/06/03/jamie-dimons-5-billion-bet-against-bonds/

This past weekend my wife and I found ourselves in south San Jose, Blossom Hill neighborhood. This is the neighborhood I went to high school in. My parents bought the home in the early 70’s for $32k.

These are modest homes but they are now going for $700k to $950k. My parents housed seven of us total and we did not have many luxuries. Absolute dead center middle class.

The middle class disappeared in San Jose. There is no such thing there anymore.

32K in 1972 adjusted for inflation (CPI) would be $182K in 2015.

900K in 2015 adjusted for inflation (CPI) would be $158K in 1972.

Yes, housing is overpriced in many areas. Still I don’t see a solution.

Patience…and wait for the crash.

“This is the biggest boom we’ve ever had. So a very plausible scenario is that home-price increases continue for a couple more years, and then we might have a recession and they continue down into negative territory and languish for a decade.” – Robert Shiller in 2007 on CNN

I know quite a few people working at large banks and from what I have heard, most of the large banks are cutting their mortgage processing and mortgage refinance groups. TD Bank and Bank of America have both drastically cut their mortgage departments. You have to wonder what they see coming down the pike.

I like to pop onto this website and read and see what people are saying. This is the first time I have contributed anything.

I first started reading about the (coming) real estate crash in 1999. For a solid year I read about of things that pointed to an upcoming crash. As a result, I sold my 3 bed 3 bath house in Simi Valley for 235K (bought in 1994). We sold in April of 2000. I pocketed around 35K after all was said and done and sat on the sidelines. Prices never did drop and I tried climbing back into the market in 2003, only to get outbid on nine straight bids. I never bought the first house as an investment, but rather as a place to raise my young family and in the end I treated it as an investment and sold when I should not have. In 2006 the person that bought our house for 235K sold it for 605K! Trust me, if I still had it in 2005 I would have sold it because I felt in my heart that the real estate market was just plain bonkers.

We ended up buying my parent’s house in late 2004 as they moved to Arizona and paid cash for a house. I felt they gave us a good deal and we were happy to once again be home owners. I never felt comfortable renting a house and not having the stability of living long term uninterrupted I work for the fed govt. and took an overseas assignment to Toronto in 2007. Sold my house for 495K and made about 20K. That same house dipped all the way down to about 250K in 2009 and would probably sell for about 490K now.

We got back from Toronto in the summer of 2013 and ended up buying a house again in Simi Valley for 540K (4beds/3 baths-2100sqf) in a nice neighborhood. This time, I bought the house for what it means to me. It is not an investment, but a place to raise the family (even though 2 of our 4 kids are away at college). Did I pay too much? The house across the street, which is the same model sold for 750K in 2006 and the current neighbor bought it for 500K in 2001, so I paid 40K more 3.5 years later.

For me, I look at what it would cost to rent a similar house and i think it would be close to 2700-3100 a month. My mortgage is 3100 a month, so for us, this is fine (between the wife and I, our take home is 10K). This is just a personal decision that works best for the wife and I.

Will house prices tank? Maybe, maybe not. I waited 9 years the first time I started reading about the coming house market implosion but things were different then. Anyhow, I enjoy reading the articles on this site and just wanted to share my story.

You can’t kick yourself…just be happy with what you have. No point living in regret…just enjoy that family…and sounds like you’re doing a great job at that. 🙂

The takeaway is that changes come up before 30 years does, so timing matters. Unless of course, one doesn’t care about the financial impact of “ownership.” If that were the case, this blog wouldn’t exist.

Yeah, it’s a bit of a game of roulette in California, if you buy and then only stay in the house for 7 years.

You should be fine

You are buying it to live and you are at par with rent…

dont fret n regret..

I wonder how cities are going to cope if they see prices drop precipitously down and down and down? Those tax assessments will likely go down as a result. – all imo

This video from a top economist explains it all:

http://pro.strategicinvestment.com/NDPCOL4/PNDPR716/?h=true

Scary

eMan – if you’re going to post links to videos intended to sell crap to idiots, please warn us when you post it. Sheesh.

“Incomes matter. If they didn’t, we could have 15% interest rates…but you wouldn’t simply argue that everyone will go buy a 500 sq ft house….would you?”

Nathan118,

Incomes matter; it is true. But RUE has a point which I made before – it is called “lower standards of living” in very crowded cities like SoCal. I don’t think that NOMINAL prices will drop too much. Adjusted for inflation, yes, they will. Since salaries are not adjusted for inflation (the real one not the published CPI) due to globalization, what I see is a shrinking middle class, lower standards of living, crowding in housing and freeways, basically the SoCal will look more and more like Sao Paulo.

A higher standard of living will be found in Flyover country. That is the reason I moved out of SoCal and never regreted it. US has lots of space and very nice places at afordable prices. Those who insists on living in SoCal will suffer the consequences of their own decisions. It is their choice.

You are free to make a choice but not to chose the consequences – they come as a package.

You’re also proving my point. You flat out LEFT the state…which some people will do. How do prices remain high with rising interest rates, when people can’t afford the higher monthly nut, and people like you aren’t even there to buy a smaller house at the same monthly nut?

I agree Flyover. Income matters and we also need to remember people have to live somewhere. The plus 10% interest rates of the late 1970s did not stop people from buying houses. Also average income for a family is higher now than in 2007 so income is going up albeit slowly. Low interest rates have made up for the low income growth.

The American dream is to own a house. If the population was not increasing then I would agree that there will be less people able to buy a house that just became more expensive via higher monthly payments because of high mortgage rates. But even though the middle class income is stagnant in real terms there is an increase and more millionaires families YOY. I am guessing biotech companies are producing a lot of millionaires base the stock market values.

IMHO….it is all about loan liquidity and supply of new houses that will drive the price of housing. I am just using history as a guide. The past two housing bubble burst occurred because liquidity dried up which reduced demand which causes and oversupply. Higher interest rates in the past has not caused the price of housing to decrease much if at all. It may mean that fewer high priced houses will be built and this may hurt home-builders. Of course I can be wrong about my assumptions.

There are possible bubble areas where prices could drop (California) if demand drops (caused by high interest rates or liquidity) but I also live in Fly-Over country and you can get a nice house in a great school district for $100 sq ft. I just do not see that number dropping.

If foreign ownership of California homes drys up then that could cause a problem. I did read an article that stated more Chinese investors are looking to buy U.S. real estate because it is a safe investment compared to the Chinese stock market. I read that Chinese investors bought $28 billion dollars worth of U.S. housing last year. Divide that by $400k and that is 70k homes. I think the Chinese purchases alone is about 10% of normal housing growth needed per year to satisfy the U.S. population growth. I am guessing most of these purchase have been in California.

Well that might explain some of it ru82. Where I rent in orange county….stuff is listing at over $500 a square foot…and these are post WW2, 1950’s houses…not Beverly Hills. It’s insanity.

SF East Bay Area inventory changes over last year

Oakland

Inventory 1 year ago: 489

Inventory today: 889

Alameda

Inventory 1 year ago: 58

Inventory today: 119

Berkeley:

Inventory 1 year ago: 74

Inventory today: 122

Albany:

Inventory 1 year ago: 13

Inventory today: 36

San Leandro:

Inventory 1 year ago: 91

Inventory today: 190

Info from Movoto.com

Mmmm…..I like facts but I’m still trying to determine feelings relating to this new inventory data. Thanks, Bay AreaJh, for the Movoto.com source!

Now for selected cities on the western side of Los Angeles County (single family homes and condos combined):

Beverly Hills

Inventory 1 year ago: 199

Inventory today: 248

Burbank

Inventory 1 year ago: 125

Inventory today : 276

Culver City

Inventory 1 year ago: 60

Inventory today: 112

Inglewood

Inventory 1 year ago: 61

Inventory today: 126

Malibu

Inventory 1 year ago: 272

Inventory today: 284

Santa Monica

Inventory 1 year ago: 144

Inventory today: 227

West Hollywood

Inventory 1 year ago: 108

Inventory today : 148

Jim Taylor , you’re prediction of housing to tank hard fell short. 2017-2019 housing will tank hard.

Leave a Reply