California is no place for the young home buyer: Homeownership rate for young buyers takes biggest hit in California. Domestic migration out, international migration in.

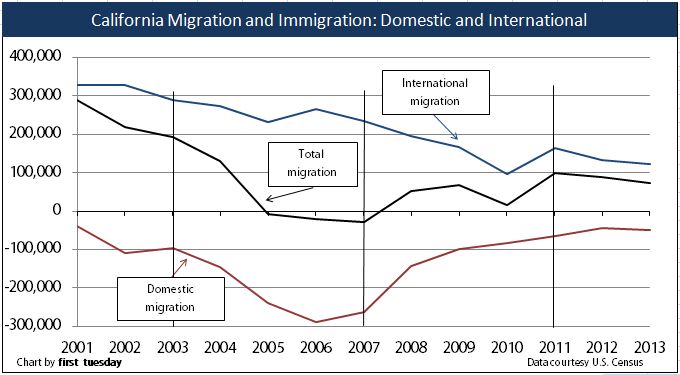

California is slowly splitting up into two clear distinct market segments. A smaller segment of wealthy individuals with access to capital and debt and another larger segment of financially struggling households. People might think that the trend of Californians moving out of the state is fairly new but this trend has been going on for over a decade. The state gaining the most from this domestic out migration is Texas. Surveys looking at reasons for people moving out include lower housing costs and a lower cost of living. Yet the population is increasing. The big reason for the increase is international migration. As we have recently noted there is a heavy focus in prime California markets for foreign investors, largely from China. Young families have little chance of competing in many California markets. Because of this it is no surprise that you have 2,300,000+ adults living at home with their parents. This group is not the future home buyer, not at these prices. Most are at home because they have lower paying jobs, no jobs, or heavy levels of student debt. Many are unable to even rent, let alone buy a home. So when we look at Census data, it is no surprise that the homeownership rate for young Californians has taken the biggest hit since the housing market peaked in 2007. Is California a place for the young home buyer?

Falling homeownership rate for young in California and nation

The lower homeownership rate for young Americans is not only an issue hitting California. This trend is occurring all over the country. One big reason for this is student loan debt. The Federal Reserve just came out with their household debt figures this week and highlighted that total student debt is now up to $1.1 trillion. This is now the second biggest household debt sector behind mortgage debt. That is simply one aspect of the issue here. As we noted in a previous post, many younger potential buyers are also confronting a world of lower wages. Those 2+ million adults living at home in California are largely at home because of financial hardship. It is naïve to think that these younger adults are living at home because they want to reconnect with family. To the contrary, if we brought back no-doc no-income loans the market would spiral out of control once again as house horny buyers dive into incredible levels of debt. Since you have to document income in today’s market, the first-time buyer market has dried up in the California drought but large money investors from Wall Street and abroad have taken up the slack.

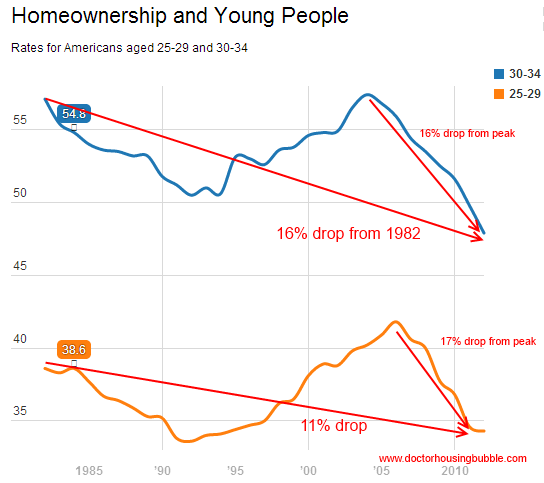

The homeownership rate for young Americans has taken a big hit over the last generation:

Source: Census data

I think the above chart is very telling. What it shows is that for the last generation, any gains in homeownership for younger Americans has been completely wiped out. The peak that was reached in the 2005-07 housing market was largely due to toxic mortgages and a predatory financial system. The end result of course is a graveyard of 7,000,000+ foreclosures (many purchased after the crash for rock bottom prices by large Wall Street investors with easy debt access from member Fed banks).

Student debt is merely one issue. If these young buyers had student debt but also high paying jobs, buying a home would be no issue. In California we see this trend as well:

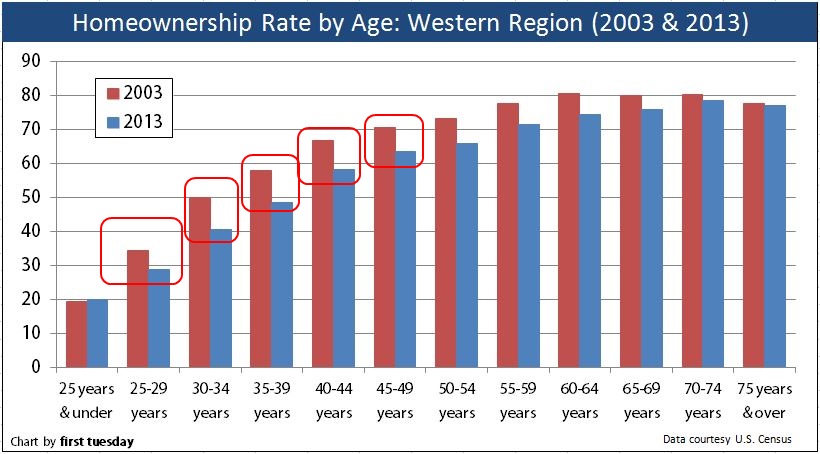

Source: First Tuesday

The homeownership rate took a big hit across all age groups but the brunt of this was felt by those in the 25 to 54 year old range. There was little escape here even for baby boomers. What is interesting is that the homeownership rate went up for those 25 and younger. This is largely due to big down payment gifts from parents and wealthy young buyers (this is also a very small percentage of all homeowners in the state by the way). The largest group of homeowners is from the baby boomer and older group.

California is getting older

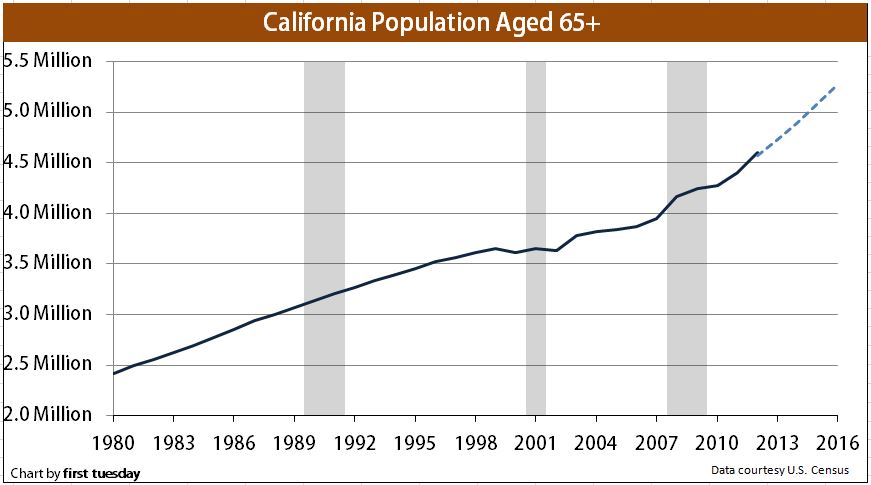

These dynamics are shifting how California will look. For example, California is quickly becoming an older state:

At the same time, domestic Californians are heading for the exits:

If it wasn’t for international migration, California’s population would actually be decreasing for well over a decade. In some markets a large portion of the recent price increases have come from international buyers. Young buyers are fully out competed here in combination with older households that may also have equity. Older home owners might live in a high priced home, but you have to sell or tap that equity out to generate income.

For example, let us take a look at a newer listing in Culver City:

11820 Juniette St, Culver City

Beds: 3

Baths: 1

Square feet: 1,036

I’ll first let the ad speak for itself:

“Location, Location, Location! This extraordinary area is called Del Rey and is next door to Culver City and The Playa Vista Development. Centrally located near Marina 90 FWY & 405 FWY. Just a short 12 minute bike ride to Playa Del Rey Beach & 4 minutes to Marina Del Rey Shopping Center.â€

“This neighborhood also has a community garden to enjoy. Property needs a little TLC but has strong and solid bones.â€

Solid calcium enriched bones baby! This home can also squat 600lbs on any given weekend. I always enjoy looking at the Google maps version of the street since it gives you a better feel of the area:

What is the current price tag for this home? $689,000. This place was built in 1953, you know, when Dwight D. Eisenhower was President. A 3 bedroom and 1 bath home at 1,036 square feet is a starter home. Now tell me, how many young buyers do you think have enough to support a $689,000 home? No surprise that adjustable rate mortgage (ARM) usage hit a six-year high in the latest sales report for SoCal.

California is now dominated by investors, foreign buyers, and those leveraging every penny to buy to chase their house horny dreams of granite countertops topped off with a little hardwood floors. For the 2.3 million adults living at home, I’m sure renting a home seems like a dream at this point.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

144 Responses to “California is no place for the young home buyer: Homeownership rate for young buyers takes biggest hit in California. Domestic migration out, international migration in.”

Could we be headed for a Swiss model, where most people are renters?

What does Tiger Woods “Swiss Model” ex-wife Elin Nordegren have to do with housing?

Oh I get it! Housing will beat you with a club and take all your money in the end! Is that the right answer?

What? You should just be quite sometimes… Really, stop commenting on everything. Restraint is harder for some than others, I know you can do it. Not everything is in reference to a TMZ headline. I’m surprised you did not link this comment to the Swedish bikini team while at it?!

Nope…

We couldn’t be more divergent from the Swiss model where the people rule by referendum, are required to be armed, and immigration is severely restricted and controlled

Even buyers are renters with big down and then interest only loans. The down is the privilege to pass on the rent (interest only loan) to your progeny. Unless of course, you can somehow save up 700K+ Euros to pay off the principal in addition to the high interest only monthly.

I can’t see that model working here in a place like Stanton or Rubidoux, but maybe in the mid-tier areas on the outskirts of the prime areas (Costa Mesa, Irvine, Huntington Beach).

Yes, the classical ‘westside’ listing (over $600 per sqft).

From the looks of the map, a passing car on the freeway could throw a bottle out the window and land in the backyard!

LA Times 5/14/14 article says college grads under 40 years of age who have college debt have only $8,700 median net worth. Kids are graduating college with an average $29,000 of debt. Is it any wonder why more kids are living at home, delaying household formation, not buying entry level houses?

This housing market is being propped up by artificial interest rates, Quantitative Easing, and now the banks are loosening credit standards again because business is bad. It’s a house of cards.

http://www.latimes.com/business/la-fi-young-people-with-student-debt-have-median-net-worth-of-only-8700-20140514-story.html

There not loosening standards much. And Dodd/Frank pretty much rules out a return of NINJA loans. I think the banks are just trying to get a few more muppets (this time well heeled knife catchers of the few properties they haven’t unloaded to the specuvestors) into the ponzi before the music stops. The game’s basically over and they know it, hence the mortgage industry layoffs.

Jim Taylor’s tagline should be “Housing IS tanking hard in 2014!” The market for non-luxury homes IS crashed. The nominal price numbers will be the LAST indicator to confirm this.

Mr. ZerO, go ahead and let me know what tangible assets you own before you profess anything to anybody?

Yes, NZ, please do let us know about your personal circumstances so that we may deflect the debate to be about you instead of the topic at hand. Perhaps if we can create a diversion by calling into question your credibility, we’ll no longer feel the pressure to respond to your argument.

The inference here is that you can’t possibly have a valid point about this subject unless you’re a member of the class. Don’t forget to end a non-question with a question mark?

Until a house is paid for or close to, I’d consider a house liability, not an asset. But I think many people do not agree or act as if they don’t.

Tangible asset? You mean the one that keeps breaking down, leaking and has a 4% annual carry cost and costs 10% to transact?

RE:TiredoftheBS

Ouch… I felt that ass kicking right right through the intertubes! 😉

Well done! But let’s just keep ignoring him shall we? It’ll irritate him more LOL

And for the record my assets include 1% ownership of a Direct Marketing LLC with 2 active retail products, cash and my sole propreitorship IT services business. All trumped by my beautiful girlfriend who I love more than life itself 🙂 Probably wouldn’t have achieved any of them if I had listened to the housing shills during Bubble 1.0 and I don’t intend to start now. Hopefully when Bubble 2.0 finishes popping I’ll find the right one to buy for me and my sweetie.

I hope you are right NZ, I am watching the market in Camarillo, and I feel like with each new listing I am more and more perplexed, by who is listing them for this much, then even more perplexed when they go pending and I think to myself, who can afford to buy these places for that amount of money and get that little house for their money?

I am hoping and praying that something at some point will bring housing down to an affordable level where regular people can buy a regular house and still have money to do stuff with…

Someday…

Yes, Mr. ZerO,

Everyone knows that “tangible assets” = inteligence, besides, little “r”obert has a few dozen more stucco boxes to unload before the music stops and he has to go back to his handyman gig full time. Who knows, he might even be able to help secure a loan with those “tangible assets” of yours. Weeeeeeeeeeee!

“Until a house is paid for or close to, I’d consider a house liability, not an asset. But I think many people do not agree or act as if they don’t.”

Actually it is both. Any asset purchased with credit has a liability component to it. Most people have no idea what an asset is never mind the difference between tangible and intangible as we have seen demonstrated by the biggest blowhards on this blog.

The reality is that Assets or Liabilities in isolation tell you absolutely nothing. You need both and most will not admit to the “other side” of the balance sheet when they are boasting their “wealth” position. Anyone who looks at balance sheets will tell you that it is the equity from the Assets – Liabilities = Owner Equity equation that is important. That is why being “asset rich” is the most meaningless statement. Being equity rich is truly rich. Most of the “rich” we see are asset rich and equity poor.

There were 8 sales in my 5 mile radius since last weekend from 810k to 1.1m, so what house of cards are you dealing, because none are falling down in my neck of the woods?

Once again I’m fool enough to take the bait…

Anyway in my hunk of whitebread Ventura County there are some sales, but very few. In the neighborhoods I monitor there were 9 sales last year between $550-660K. This year there has been 1 closed sale ($560K), a couple are currently pending with asking prices in the low $6’s and 2 have fallen out of escrow and are back on the market. 6 are currently for sale at prices ranging from $600-680K and they are pretty much just sitting. 3 of these have been on the market for months and have now had multiple price reductions.

I’m not saying the market is completely dead, but at the very least sellers appear to have misread demand and price. This isn’t my opinion it’s just raw data and it belies the rosy “full steam ahead” talk others seem to purvey.

I’ve been keeping a close eye on residential real estate sales in the NorCal area for the last 6 months and I’ve noticed the bifurcation in action.

In the SF Bay Area homes are still selling pretty darn fast…less than 3 weeks on the market before an offer is accepted. But get several counties away or 150 miles out and the homes tend to languish on the market. My take is that investors are only going after the prime areas and the rest is selling based on the actual buyers that reside in the area.

Robert, you seem to be one of the more reasonable minds on this thread and I like what you said about buying when doom and gloom abounds and selling when things are rosy. To my novice eyes, things appear to be rosy right now — Massive asset inflation over the past 3-5 years, stock market at all time highs. Where in the cycle do you feel we are now?

I agree, no house of cards in my area either. This market has a ways to go. I rent a condo to a young newly married couple. One of them lived at home while in college and this is her first place on her own. Her husband is from Australia and owned a 3/2 home with a garage and a yard for the American equivalent of 350,000 in Melbourne. They have 100,000 for a down payment but are depressed at what a crappy house you get for under 500,000 in Orange County. They are moving out and moving back with her parents to save more. They are unique that they have a big down payment at their young ages of 26 and 28. I had 8 very qualified applicants but chose to give these guys a chance. I don’t see rents going down anytime soon. It surprised me how many monied professionals wanted my remodeled condo. It’s available again in a month so it should be interesting how much interest I’ll get again. I’m raising the rent.

Apolitical Scientist wrote: Anyway in my hunk of whitebread Ventura County there are some sales, but very few. In the neighborhoods I monitor there were 9 sales last year between $550-660K.

——

Does that have any bearing on the figures I’m reading in this May 5, 2014 article for one Realtor group? (below). I’m reading Government articles bemoaning weak credit growth for mortgages, when it could be solved with lower house prices. I would take a mortgage if the prices were more affordable. Need to get some proper inventory coming back onto the market, rather than a trickle meeting cash-buyers.

“2014 could be a challenging year, especially if transaction volume growth continues to slow throughout the prime selling season,â€

The company reported a net loss of $46 million, compared with a loss of $74 million in the same period last year.

http://www.latimes.com/business/realestate/la-fi-mo-big-brokerage-predicts-slow-home-sales-20140505-story.html

—

“I agree, no house of cards in my area either. This market has a ways to go. I rent a condo to a young newly married couple. One of them lived at home while in college and this is her first place on her own. Her husband is from Australia and owned a 3/2 home with a garage and a yard for the American equivalent of 350,000 in Melbourne. They have 100,000 for a down payment but are depressed at what a crappy house you get for under 500,000 in Orange County. They are moving out and moving back with her parents to save more. They are unique that they have a big down payment at their young ages of 26 and 28. I had 8 very qualified applicants but chose to give these guys a chance. I don’t see rents going down anytime soon. It surprised me how many monied professionals wanted my remodeled condo. It’s available again in a month so it should be interesting how much interest I’ll get again. I’m raising the rent.â€

And?

“Please save your stories for your family and friends I am sure they would enjoy them more than this audience. You are off subject and your comments are not endearing. Try to control yourself from needing to comment on every post. It’s getting a little old, with that said I don’t know where you add any value by poking holes in others arguments without ever stating a sustenance response. I understand you have a lot of passion but look at what you write and think for a minute, does this add anything that may have been missed or needs to be expanded upon. Write your own opinions on the matter, don’t just use this blog to shoot ideas down without ever offering anything from your own source of knowledge on the subject. Try to add something not just shoot comments down. I know that you think you are helping with your stupid quips but it is very non-productive. It is easier to be negative, be resourceful and offer something insightful.â€

I am not claiming to add value but I see no real in depth economic, finance, or policy information coming from your simpleton comments either…

BoE,

The relevance I see is that while sales in this market segment have dropped considerably, prices have not yet done so. The price drops I’ve seen have been on the order of $10-25K while the run up in asking price in the last year has been more like $50-70K. It’s difficult to predict with any accuracy, but I suspect some of these houses would need to remain unsold for a whole season before sellers might capitulate and prices start to fall below the 2013 levels.

Note that these are move up homes (~2500 sqft, 3 car garage, etc.) in a “nice, but not really prime” area of Southern California so this only reflects a small subset of the overall market. The article to which you linked refers to demand from first time buyers, few of whom would likely be looking at these properties. So the market for starter homes may indeed be even softer than the data I present indicate.

There’s this intern in one of the places I sometimes work who has 240k in student loan debt whilst his girlfriend has 100k in student loan debt. This guy talks tough…..about Bengazi; and makes it pretty clear to all of us he is a Republican through and through…..

But then he spends a lot of time lamenting on student loan forgiveness. Every time I see him, he’s yearning for a bailout. His parents live in Beverly Hills. For some reason they don’t ‘want’ to bail him out. He rents an apartment in Beverly Hills. He has a nice car worthy of his zip code. But he’s only making like 30 bucks on hour at work. WTF? The dude tried to give me a stock investing tip the other day too. WTF?

Anyway, I think I’m going to move to Charlotte, NC. Still a big city feel. Still lots of pretty girls.

Doesn’t surprise me — Republicans say they want free markets, no regulation, lower taxes, but when they get in trouble, they scream and cry about getting bailouts, they want big government to step in, they want to use other people’s money to cover. Selfish babies. Makes me sick.

Democrats are no different.

I knew a woman who was a far-left Democrat. She had a bulletin board with all her former campaign buttons. Democratic politicians going back three decades. Always complained about the rich, and how they didn’t pay enough taxes. Always complained that she didn’t get enough help from the government.

But when she decided to move to Florida, she exclaimed with glee, “Yaaaa! No more state income tax!”

Democrats want all the benefits, but they want someone else to pay for them.

Damn Demopublicans!!!

Housing to Tank Hard in 2014!!!@

Love this Taylor guy always the same thing housing tanking in 2014′, year sure and the Cubs are going to the World series right?

Don’t listen to the shills. So keep it up! 🙂

Jim’s got a book deal in the works: ‘Called It!!!@, By Jim Taylor’.

In my case the job situation is still very bad. We are two spouses with advanced degrees. As usual one wins and the other struggles. I may not have college debt but most of my peers do. Some of us younger folks don’t just face an unstable future in that there might be job loss and reduced earnings, but my salary can easily drop to zero. So many recent grads still have poor earnings on a real level compared to different cohorts, poor earnings on a historical level (inflation adjusted), and loads of debt.

Leaf Crusher the question you need to answer, do you and your spouse have loads of debt and has your salary drop to zero yet?

Look, you can’t worry about the next guy in any time of your life, you should only worry what has actually affected you as to income earning etc.

I have been in this game for a long time, if you can and are young enough with some fiancés try to learn where the hot jobs are and move if you have to.

This country has opportunity, not at every corner anymore, but skilled people are needed, you need to find the place where they are needed and moved there if you are able? Waiting for change forget it, we are early in this century the change is happening right now, the powers to be think 20 years in advance, research what the world will need energy,tech,medical that is where you need to be.

Robert thanks for the reply. I do appreciate your optimism. My comment was going for anecdotal evidence that things in the labor force are still quite amiss. That is part of the change I see in the economy.

I am in a high tech sector, but that is part of the problem. Like many people I have a specialized degree. I have NO debts, but have prevented my salary from hitting zero only by unemployment benefits in the recent past. I understand life is not perfect and realize my labor will be worth something in the future, but I do not feel unique in this problem. Especially when it takes two high powered incomes to buy the roof over your head.

Besides the excessive debt part, many Americans have invested in specialized degrees. People have outstripped many of the HOT jobs you talk about that require these degrees and we see that in declining wages. At the same time companies are importing workers to reduce their costs. All together this makes the labor market inefficient and that contributes to a reduced interest in investing in SoCal housing.

Great advice, Robert

The old days are gone and we need to adapt

I am taking bets that little “r” and “bill” are one in the same. Any takers?

“nick” also with much better odds…

If I magically woke up one day and found myself in college, I’d work either towards water rights law (lawyer), architectural engineering with an emphasis on energy efficiency, or pimping. Some pimps make like 30k/month in Texas.

Stock Market on its way to 17,000 remember gang don’t buy in at 7,500??? Now houses are not going up and sales are going down forever (not).

Look folks very simple, what goes up goes down, and vice of versa, it is when you buy at the right time that makes you successful. One size fits all doesn’t fly in making money, it is what fits for you, one persons success is another’s ones failure always going to be that way in a Capitalist country.

i understand that you want to save all of us from making the terrible decision not to buy a house in california yesterday but you wouldn’t be commenting on this site if you

1. didn’t have doubts about this market yourself

b. weren’t a real estate broker, bored out of his mind due to the low volume of sales

so tell us how you really feel or who you really are, because while i actually agree with you that house prices will probably still go up from here (the most risk-free/efficient way to levitate the stock market is to do it with little/no volume and oh ~ that’s exactly what has been happening in the recent past) the fact remains if you don’t have the $ to buy a house at these inflated prices, you aren’t going to just dig yourself in to a debt-grave to ‘get in’ at such an uncertain time

everything is inflated and we might be sheeple for thinking someone good will come along to fix it

but once china’s real estate bubble pops, it’ll be hard for bankers to hock our credit-fueled capitalism elsewhere

look at what being #1 cost china: air you can’t breathe, water you can’t drink, and food you can’t eat. who’s next in line? nobody.

shhhhhhhh. 🙂

Read what I post, I’m not telling you to buy, if you can’t afford something then turn away, but if you can buy research and you will find bargains with sellers in trouble.

Buy when things look worse and the dome and gloom is amoung you, never buy during rosy times very simple lesson.

Now Robert’s ghost go play with the other posters who have no idea of a plan in their life?

But Robert, when about when times are ambiguous? Neither rosy nor tanking, but, as I think we’re at now, it can go either way. Housing may go up some more before it goes down. But when will it go down? Next month? Next year? In a few years?

Sharp price increases seem to have plateaued, but it’s not clear that prices will soon tank.

@robert wrote: “…Stock Market on its way to 17,000…” Old adage: “Sell in May, go away”. Whether the DOW hits 17K matters very little to me. Recessions happen every 5 years. Last “R” ended in 2009. That means the next recession is due right now. I was long stocks from 2009 until early this year. I made a lot of money but it’s now time to short the crap out of the stock market.

Sorry Robert. We don’t live in a capitalist country. Prices are being set by the government. I’ll bet you don’t know that all prices for health care procedures are set by the government. In the housing market, government is propping up housing prices to bail out the banks. In the labor market, foreign work visas are being issued to suppress wages. Command pricing and private ownership are the definition of fascism. That is the political/economic environment we are living in.

To RM:

Yikes! You’ve let out the big secret!

Prices ARE being set by the government. Command pricing and private ownership ARE the definition of fascism until government seizes all the wealth away from the rich and the poor and doles bits and pieces of it out to the masses like an allowance while ingratiating themselves with the rest, just like the Soviet Union. Then we have communism. You’ll know we’re there when the D.C. suburbs are covered with dachas.

DJMiller the dachas are here already. Your not looking for them in the right place.

Politburo members had them outside Moscow because traveling farther was difficult. Both physically and politically.

Our boys on the Hill have them in places like Puerto Rico, or fancier than that place for many of them. Easier to hide when you can jump on a Lear Jet or G5 on “FACT FINDING” missions.

Boy I must have gotten deeper in little r’s ass than I thought, look at all the rapid fire posts 🙂

Anyway… How many of you guys factor in safety in a SHTF scenario when looking at housing? I’m not thinking we’re going “Mad Max” but in a down economy with a police force that will likely focus on protecting the rich, I think planning for rough times is prudent. In the event of social unrest central LA, OC, etc will prove less than desirable…

Thoughts anyone?

shhhhh about you know what…

Buy a tent and canned goods… don’t forget the Swiss army knife…

That’s what I did. Living in Big Basin with Forest Lady.

zerO….You are so easy, nobody wants to respond to Robert ? For the record like I said before I have no ego issues, I post to educate because I have been thru the wars of buying and selling.

Take from ones wins and loses and learn to further yourself, chopping me down, how does that further your fiancial picture in life or the discussion of housing bubbles?

Last comment I’ll ever leave you…

Your grammar is poor, your arguments trite and devoid of empirical evidence and as a troll you evoke laughter not anger. You are so sensitive I made you drop multiple messages in one thread about me. You changed your handle because we teased you.

In short… You are a weak sauce troll if I ever saw one 😉

“a police force protecting the rich” that says it all why do I respond to this guy, my wife says because you found a outlet for a while, I think I found something more then housing bubble concerns.

Good one. There are some good commenters here, but you have to wade through the doomsday preppers and goldbugs.

Well, I was at ground-zero when the RK riots broke out. Saw some Mad Max sh!t. If you had seen up-close what I did then you would have written of SoCal for good. Then, you know what? Americans got back at what they’re good at…being optimistic and consumers/proprietors again. Now reports are that South Central is now undergoing some gentrification (near U$C, at least).

You’ll never get rich with a doom and gloom mentality. Sure stocks and housing crash (and will crash again). We’ve been sucker-punched big-time the last 15 years with booms and busts (stocks and housing). However, if you would have just “robertized,” you would have made out great. Go figure.

So you lived on Florence and Normandie in 1992?

On April 29th I was driving a fellow West LA CC student back to her mom’s place when we encountered dumpster in the middle of Venice Blvd ablaze. Mind you, it was getting late and we hadn’t heard about the RK decision or rioting while we were driving.

There was a car stopped right before the dumpster inferno, and a black man pulling out a blonde woman by her hair and she was screaming, “help me! help me!” There were around a dozen black people encircling the situation and cheering on the perp. I had to make a split-decision about whether to exit my car and endanger my own life as well as my female passenger’s, or leave the scene and go look for help.

I put the car in reverse and bolted. Driving on the wrong side of the street now, I saw a cop car speeding toward the melee. I think about that woman about a dozen times a year since. I know now that being a hero is not for everyone. I chose not to be hero that day.

So, still not knowing what the f was going on, I had to make my way down to USC where this girl lived. It was a strange f’ing scene. People running everywhere, fires, etc. I broke every traffic rule under the sun to drop her off and get back onto the 10. When I saw the multiple fires to the North and the South, I put 2 and 2 together and realized this was RK-related.

About that R.K. day, I had driven hundreds of miles from the central coast to attend a meeting in Beverly Hills about a book I had written. At one point a security guard busted up the meeting and told us we had to evacuate. Every building was evacuated in the city, and all of L.A. dumped onto the street at the same time. I had an older car and I knew at some point the engine would start smoking. I think it took something like five hours to get from Beverly Hills to Woodland Hills. Ha. What a day!

The fuel cost situation worries me. http://www.resilience.org/stories/2014-04-13/did-crude-oil-production-actually-peak-in-2005 Lots of commuting going on in SoCal. What you spend on gas (and the embedded fuel costs in everything else you buy) is no longer available for debt service. Not to worry about China buying treasuries, the Fed, via Belgium, will sop them up: http://usawatchdog.com/fed-laundering-treasury-purchases-in-belgium-to-disguise-whats-happening-paul-craig-roberts/

Hey that is good news! We have another name to add to the enemies list! So now it is rich “Red” Chinese, Russian Mob, “Illegal” Mexicans, and “mysterious” Belgians… I want to coin a new term – CRMB’s (pronounced crumbs)…

Conventional oil is going away. Look at capital expenditures for Exxon, Shell, Chevron, BP, etc. for the last five or so years: aggressively growing to unheard of proportions; then compare that to their production: flat to mildly declining in the selfsame time frame. That’s why folks are obsessed with that Keystone XL and fracking stuff.

Just remember what the Korean business owners did to protect their business’s during the King riots

Speak softly and carry a big stick

How could you not forget. Some of them were wearing their own uniforms. They were the ones that stopped the riot.

NZ-

I absolutely think about this. I am a little obsessive in fact. Kind of end up scaring the wife every once in a while. I am in the SGV area, actually pretty close to the areas you’ve mentioned looking at in the past.

I’m currently in escrow on a high elevation home, a fixer, with a great 270 degree view on a cul de sac that sets about 200 ft back from the street. I think it’s essential to know your neighbors and be prepared for just about anything. Sitting on too much cash at this point and I need to diversify some of it. We live in a strange bizarro world where up is down and down is up. I am beyond the point of trying to figure out any of the “markets.”

To AK’s post up a ways. Get me some of what you’re smoking, 4% carry cost, 10% transactional cost? You’re looney bro. I’ve owned multiple properties. 2% annual carry cost is conservative, and transactional cost for me is 2% including title/escrow (i’m RE licensed).

The fact is that California’s population is increasing because of migration into the state from other countries. Is this trend going to stop? Probably not since this is a pretty nice place to live and there are a lot of really high end jobs here. I know that a lot of people would like to see a crash in the prime areas but it just dosnt seem likely considering the global demand. Given the high demand and high rental prices it not going to be possible for a lot of people to stay here. It seems that California is now losing locals not because of high housing prices but instead because of the high price to rent here.

“Probably not since this is a pretty nice place to live and there are a lot of really high end jobs here.”

Until it is not and there are no more…

In the last decade, the middle class taxpayers from CA are leaving while 10mil. more welfare recipients from other countries are moving in. The future doesn’t look to rosy for CA.

Excuse me. Chinese ex-pats who purchased Irvine McTownhomes with wheelbarrows of gold bars deserve their SNAP cards…so clever!

JT, you made this comment yesterday: “Population keeps rising in SoCal. That means more demand.â€

This is a totally wrong statement. If the supply is one house, if you have a billion penniless people who desire that house greatly, the price is zero, not a million. A high number of penniless people do not constitute demand. It is better to have 2 millionaire competing on a house than 30 million people with no money.

I hope that the explanation is clear enough for you to realize that a large number of people would not constitute DEMAND. Otherwise, India with over 1 billion people would be very rich indeed. Also, Switzerland, with a fraction of India population would be very poor because of low demand.

Flyover, that’s a point very well made. I don’t understand how people can’t grasp it, and keep going on about population growth = demand = rising prices for-ev-ah.

I love the insight given on Doc’s blogs, including that U-haul test (and the replies) to some indications corporate companies (and individuals) relocating to lower-cost areas.

http://www.doctorhousingbubble.com/cash-buyers-california-investor-buying-underwater-homeowners/#comment-496955

***When opportunity is cut off in one direction, people will move in another. Where there is freedom to move, the process is practically as automatic as that which inclines plants towards sunshine. It is all part of the mechanism through which individuals actively seek their happiness and societies maintain their balance.***

Can’t vouch for the accuracy of the source I’m using, but it’s saying that 1953 Juniette St shack last sold in Oct 2004 for $500,000.

I’m UK based, and only looked it up, for I recognized ‘Del Ray’ as being where a UK friend told me about last year… they went for their ‘holiday’ from UK to Santa Monica (later drove to San Diego) staying in places booked via VRBO (owner listing on VRBO said they bought in 2008 – exclusively let out to holidaymakers as per many others on there) + Airbnb, and they went to Marina Del Ray for a few hours and to have some food.

They’re in their early 30s, renting in the UK… totally unable to afford a place to buy in UK because of the bubble, and nearly all UK politicians all looking for “recovery” in house prices (= going up in value even more preposterously than values already are).

The situation for young people in UK is almost completely the same as SoCal. The asking price of that shack is not much different than a standard brick nasty little semi-detached house in rainy Manchester. Also the squeeze is biting for many people in the UK, so expect fewer UK people taking ‘holidays’ from UK to California. All the money is going into servicing debt… that’s why supermarket discount wars are starting here. Too many people have been malinvesting into property at high prices because “it’s not earning anything in the bank” and feeling that property (at any price) is safer than “having it in the bank” but it seems to be topping out now. Europe wide too… we’ll see how many people continue to bling it up on holidays in California. That might help sway things a little on bringing supply to market. The banks need to get the market crashed, and lend in volume to younger people. All that property owned outright is dead money.

Nice to have your perspective here, Brain. While we do have plenty of unique differences, there are so many interconnected parallels between the UK and the US – especially in the modern financial system. I won’t be surprised when some version of “help to buy” makes its way to the states, just like a bastardized remake of a British sitcom.

As a side note, Del Rey is technically a neighborhood in the City of LA, situated to the east of Marina del Rey and sharing some borders with the westerly tentacles of Culver City. MdR is not part of the City of LA. There’s also Playa del Rey, not to be confused with Playa Vista. It’s easy to get them all bunched together since they occupy the same region, but there are distinctions – especially in regard to the RE market. Del Rey is sort of a later entrant in terms of desirability.

Ah Tired of the BS, thanks for that good guidance on Del Ray – good to learn – for I’ve only got a hazy grasp of subtle differences between some areas.

I see you know all about the UK scheme (which on a daily basis sends me into some rage) that’s helped reflate UK house prices even more; “Help-To-Buy”, with Government fronting up some of buyer’s deposit, to help them afford what the silly high price a newbuild developer wants to sell at. If that scheme comes to the US, I hope there is more of a challenge to it, than there has been in the UK.

In my view the scheme has caused a wider effect in hyper-sentiment, as other market participants paying more for mid-to-higher end homes.

It’s like a modern day twist on Hanzel & Gretel…… “And a 100% mortgage famine swept the land”… but the media kept saying “you can’t go wrong with property – and look at the population growth, as that must mean HPI for-ev-ah” so the young took on jumbo mortgages with deposit paid for by Gubbermint (Goverment), as a 2nd mortgage you can worry about paying back 5 years later.

Yet with no happy ending, no running way, just H&G slaving away for years to pay the fat bankers debt.

Hanzel & Gretel / Help-To-Buy Pic (and in the pic, imagine the Witch being a devious smiling politician, and imagine a $600,000 “For Sale” sign beside a smiling Realtor in the background)

http://m1.behance.net/rendition/modules/13711357/disp/52fb7d26847665f8d0958171c7b13560.jpg

Interesting program, that “Help to Buy”. I have a background in mortgage lending, and ultimately, it seems like it has the same impact as FHA financing. FHA allows for 3.5% down even with somewhat shaky credit, and the only reason the loan is possible is because the gov’t insures the loan against loss. We have our own “help-to-buy” in the form of direct gov’t backing of mortgage loans that has undoubtedly led to homes being more expensive than they otherwise would be.

As is all too common with gov’t programs, there’s good intentions but lots of unintended consequences as well.

I think Del Rey is the scuzziest area west of the 405, north of LAX. I wouldn’t want to live there.

So is that house in Del Rey or Culver City? I know a sliver of CC extends west of the 405 into Del Rey. Culver West, it’s called? Not the nicest part of CC.

@Son of a landlord, a sizeable chunk of the Del Rey neighborhood is serviced by the Culver City post office. Officially this Del Rey area is “Los Angeles, CA 90230” but residents frequently put “Culver City, CA 90230” Torrance and Beverly Hills Post Office service areas of west Carson and Los Angeles where residents put the wrong city on it.

The Mar Vista Gardens Housing project is in Del Rey but serviced by the Culver City post office.

Yes, Del Rey is a really crappy area, and yes Del Rey is west of the 405 (Westside!!!!).

English is the 2nd or 3rd language in the Del Rey neighborhood.

Good take Leaf Crusher, hang in there you both are educated and it will all work out, America is still the greatest place on earth!

The house on the hill on the north side of town can never be owned by the hard working young stiff.

The homestead was bought or built by the occupant’s grandfather and because of other real estate investments grand dad left a legacy of wealth for generations down the line.

If your grandpa didn’t leave your dad a pile and he didn’t leave you a pile you cannot live on the hilltop in California.

Sure, you can start a business, become a doctor (depending your specialization), a corporate attorney or win the lotto but otherwise you are consigned to living in the flatland.

That is just the way it is.

The good doc picking on sweet ‘lil Culver City again. Obviously, this house+lot plunked down onto 99% of any other part of Merica would probably garner a $95k price-tag. But, that’s not nearly the point.

Has the good doc forgotten about bifurcation, cuz CC has done bifurcated, son! It’s gentrified. Game over. Whatever your cognitive dissonance with regards to your 1995 mental image of Culver City and a $689k print on a 3/1 POS, get over it!

Anyone here with the means would house hump that crapshack if the price were $400k, with full knowledge, again, that it’s a piece of sh!t. Why? Because we know it would be a good deal at $400k (rental parity, yada yada).

Culver City has converted to the land of the 10%, prop 13 median income skewers be darned. It’s not for the middle class anymore, it’s prime real estate.

I’d sooner live in Sherman Oaks, Studio City, or Pasadena than in Culver City.

Parts of CC are nice, especially immediately south of Sony Studios.

But the vibes in the wee hours don’t feel completely safe to me, especially on the fringes of CC. On the eastern end, and west of the 405, and the northern end that runs along Venice Blvd. I’ve seen bars on the windows in those areas.

The portion immediately south of Sony is nice. The portion north of Sony,

Gahahahahahh!!d

What makes everyone think this younger generation even wants to buy homes and start families? They are actually quite liberated and intelligent about most social constructs. Rewriting rules and lifestyles. Not everyone wants or even cares about the fifties version of the American dream anymore.

Hear hear!

One consequence of having an older California is an entrenched, prop 13 for life voting constituency, which will battle it out with the renting class over their sacred golden sarcophagus protection plan.

Official inflation beginning to rise without a concomitant rise in bond rates.

http://www.investing.com/analysis/on-falling-rates-and-rising-inflation-212853

http://bpp.mit.edu/usa/

I don’t think the American public wants another war so something will have to give. I believe Yellen would like to reduce her central planning regime. Some asset depreciation and slower growth might relieve some of the stress. I don’t think the Fed really cares about peoples housing in bubbly areas as much as stable prices and healthy banks. A downturn in housing really won’t kill the banks since: 1) They have prepared; 2) Current low housing sales volumes have shifted their business model from one solely tied to housing to other sectors; 3) Banks knew when the ReFi boom happened that slower mortgage profits would follow and they have cut overhead.

@Dr HB— You know the end is near when Ditech gets resurrected from the grave to do 125% LTV loans. http://www.zerohedge.com/news/2014-05-15/subprime-20-125-ltv-loans-are-coming-back

I’ll give the bulls this, if lending goes full retard then 2014=2006 not 2007. I SERIOUSLY doubt that will happen though. Political suicide for the GOP to pass legislation that would undo Dodd/Frank mortgage protections.

Thanks to the good old Doc for his periodic anti-news establishment truth out. Probablity is high that we are at the end of a debt super cycle so don’t expect past performance to rhyhme with current events. Our foreparents and I have consumed more then is sustainable. Weak wage growth, household formation, employment & incomes etc. all portend the ageless lesson; “things that can’t go on, don’t”.

As I have said before, if people want to have an old fashion family(not PC I understand), move to Texas. That is what our Gov. Perry has been saying and that is why Toyota and many others are coming. I understand that the lefties would rather live in a $700k shack than come to the promised land. That is fine, we would feel uncomfortable around them as well. It is great how Obama has brought everybody together. It is 84 in Dallas with 30% humidity while you lefties in Santa Monica are getting a preview of the afterlife, 100 degrees with no A/C.

“Promised land”? Bwahhaha! Have you seen the prices in Austin? Yeah, still cheaper than CA (for now), but so is the pay, and more people moving every day than there is available housing. And traffic is probably WORSE than L.A., now.

i agree,wish everyone that moved to California in the last thirty years would move to Texas.Toyota is a great example,wonder what you give up to get them to move,need to up it up more. thank you keep up the good work.

Yes, Toyota just wanted to move their “family” away from the gays in Torrance. Thanks, Tex!

Hello Doc

I went to hear Bruce Norris speak today in Long Beach. He is a SFH investor, claiming to have been involved in over 2,000 SFH sales in the past 30 years from Bakersfield to San Diego.

Here is his take on the SFH market today.

– through 2014 and 2015 SFH market will remain good and prices will increase, here is why:

– more than 50% of all venture capital is coming into California.

– the lenders are lowering their credit scores to stay in business and this will spur first time buyers;

– underwater homeowners in California has been dropping steadily, esp. since interest rates dipped down below 4% range and people refinanced.

– No more NINJA loans means the wave of buyers since the crash are staying put or moving up, not walking away.

– the affordability index for California fluctuates from 60% (good) down to 17% (bad) over the past 50 years. The only time housing in California has crashed is when the affordability index dropped to the +/-17% range. Right now it is at 25%. and there is no solid connection between crashes and interest rates.

– he does not see a problem with interest rates hurting home prices until the IR hits aprox. 6% or higher.

-lately in SanBerdo and Riverside, there has been a surge in land purchases, probably due to the lenders recently lowering their credit standards and builders seeing a new surge coming for first time homeowners.

-during the crash, aprox 60% of all home sales were the lenders and today it is less than 25% indicating no pending crash.

In conclusion he says if you want to sell your SFH at the top of the market it will probably be sometime in 2016 or after but not in the next 18 months.

He also acknowledged that many zip codes in LA and SF are higher than peak prices and said there was no problem with this and it does not mean another crash is around the corner.

Long term he said that in the 1980’s the young couple was forming a household in their early 20’s and now (GenYrs) it is not until their early 30’s. Ultimately these GenYrs will want to own homes so house prices could be stable for quite some time.

What say you, Doc?

“- he does not see a problem with interest rates hurting home prices until the IR hits aprox. 6% or higher.”

So existing debtors can keep paying down their debts on their mortgages, not be forced sellers… that’s fine.

House prices are set by buyers, and NOT owners, and NOT sellers. Have you had a look to see how mortgage applications have plummeted? The house prices are too high. We’ll see how long investor/cash-buyer money holds up, setting values.

There will always be some who need to sell (often outright owners), who into a market change are much better placed to accept lower prices in order to sell, and all house prices are set at the margin.

“In conclusion he says if you want to sell your SFH at the top of the market it will probably be sometime in 2016 or after but not in the next 18 months.”

Jim Taylor is spinning in his grave.

I’m about to go Chuck Norris on Bruce Norris! Housing WILL Tank Hard in 2014

@Jim Taylor: That’s your best one ever! I laughed heartily.

I think he’s assuming that they also have the funds–and job security– to pay for it.

Want and need are two very different things.. especially when the average starter home is over 500k.

Thank you of your comprehensive synopsis of your meeting. Quite interesting. We have not even started the pump and dump phase. Once easy loans are back and big investment groups start to sell because they have hit their numbers housing only then will be vulnerable to tank. To many big players in this market now for anything to tank now. They pretty much orchestrate the pump and then dump and do it again. If you know the game you can play. I agree housing will good for another two years. I’m not saying that you should buy, just that the investors have a longer time horizon before they start to sell. They won’t be happy till they bring as many new buyers into the market as they can, believe me they have a plan. They have to bring the masses in so they can sell. They will make that happen with new loan programs.

^ hopes they are still there. Sure Christie, wait until you start see evidence of big money leaving before you get out. They’ll make sure you know what’s going down so you won’t be left holding the bag. You should raise rent now too.

Not impressed…

What? What is your profession? You seem really knowelable.

I am a real estate shill who trolls housing sites and posts pro housing comments for NAR.

Re: *** lately in SanBerdo and Riverside, there has been a surge in land purchases, probably due to the lenders recently lowering their credit standards and builders seeing a new surge coming for first time homeowners. ***

__________________

A contact bought close to San Berdoo in 2012, at 65% below a price whoever owned it before paid in 2007, but he doesn’t pat himself on the back, and regularly points out some downsides. Recently he reckons similar homes to his are selling for 25% higher prices.

From his anecdotes I know of SanBerdos’s bankruptcy in 2012 and history of the air-force base and effects of its closure on local economy – to more recent events like a strong opposing action to a larger trailer park that opened recently on edge of San Bernardino . He was recently saying of the luxury upgrades on the commuter bus-services making them a real (and safer) alternative now for car-centric and car-proud majority (I’m using his words), if circumstances require alternative to car.

He reckons there’s some excitement over the proposals for a big spend and upgrade on the commuter rail-line, which could mean less than an hour to Union Station. Everyone with houses close to the stations along the line buzzing it will massively boost the value of their homes. (I’ve personally go no reference point for ANY OF THIS.. I’m not US based. Nor do I know if the high-speed rail-line is a serious proposition backed by money, or just dreamy talk. I expect regulars here to know much more than I do about such things.)

There’s complicated, and perverse, forces in play.

_____________________

November/ December 2013

Stay Put, Young Man

Americans used to be exceptional for how often they moved. But that once-powerful source of both efficiency and upward mobility is now in steep decline.

Moving from LA to San Bernardino would not have improved your chances of finding a job. …Yet a huge flow of migrants continues from LA. Why? Mainly because housing is cheaper.

http://www.washingtonmonthly.com/magazine/november_december_2013/features/stay_put_young_man047332.php?page=all

_____________________

I forgot one key factor from Bruce Norris

He said he was in DC a few weeks ago and was informed by some high level govt that the BlackRock and usual suspects who bought the hundreds of thousands of homes are not going to sell them. He said they have or will become REIT and BlackRock considers these swaths of home purchases as ‘an apartment building with 50,000 front doors’.

This Bruce Norris is just one market participant – with his own view.

Is he really privy to Blackstone’s real position. I don’t openly share with competitors my full commercial intentions. There is sleight of hand in markets. And he knows all the banksters/FEDs real plans? Or is he like some future super-computer, fully cognizant of all of the variables and complexity in markets, and long-wave markets especially of 100 years+, that can build up to trigger a non-linear market-changing event, even against the will of the authorities, but then unable to hold it back for the consequences of doing so make situation even worse.

Inflation and deflation are not polar opposites. The are brother and sister of the same species. Yin an Yang.

You certainly can not take your bearings in the market from the mass-media.

It bugs me that in the long-wave house price inflation decades, so much win for these older owners. Look at his bio… married at 17, started out filling cars with gas… to discovering the wonders of leverage. Versus position of so many younger associates I know, in their 30s, out-priced, renting, or living with Mom and Dad.

http://www.latimes.com/business/la-fi-himi-norris-20130908-story.html

All of the majors have indicated that they would like to exit within 5-7 years. This was a backdoor deal (.gov gives money to banks, banks loan to investors, investors buy out underwater homes) that is slowly unraveling with no precedent.

An apartment building with 50k doors? Good luck with that. More like the Winchester mystery house with 100,000 hallways.

I’m familiar with this guy. Bruce Norris’ business depends on maintaining the status quo of RE speculation. He’s a hard money lender, what else do ya really need to know? These “seminars” that folks like him participate in are designed to sell their products. If that also means hyping the market, then so be it. We’ll see if his tune changes in 2015 to it’ll be a great time to buy for another couple of years. Plant just a sliver of false doubt as if to give your message some credibility of reason, and don’t dig too deep of a hole just in case you fall into it later on. Clever enough, but it’s hard to bullshit a bullshitter.

That said, he has a good podcast where one can gain insight into RE investing trends and strategies. He tends to have interesting guests (even NAR/CAR shills) that if nothing else, give away tells on the future narrative for the agenda of hyping RE.

As for the points raised:

“more than 50% of all venture capital is coming into California.”

Not sure what to make of this without having further detail. Is there some conclusive data that correlates this to RE appreciation? It’s a broad point.

– the lenders are lowering their credit scores to stay in business and this will spur first time buyers;

Agree, although I think it goes beyond credit scores. Just check any of the credit repair forums like myfico or creditboards, house horny people with poor credit are finding ways to get financed. I believe that the finer details around down payment and reserve requirements are at issue. If we see zero down and NINJA or variants thereof come back, watch out below.

See point number one in this recent piece from Logan Mohtashami:

http://loganmohtashami.com/2014/05/05/why-the-financial-media-and-housing-pundits-got-it-wrong/

– underwater homeowners in California has been dropping steadily, esp. since interest rates dipped down below 4% range and people refinanced.

I’d like to know specifically how “underwater” is defined in this context. Is the takeaway from this supposed to be that because the paper value rises, people are going to start trading RE again? Maybe, although it’s not assured. I suspect there are other inputs to this equation being left out. Again, with the refinance activity, what is the takeaway? One could just as easily posit that refinanced folks will hold in place because the deal won’t get any better.

– No more NINJA loans means the wave of buyers since the crash are staying put or moving up, not walking away.

At best, this puts a floor in the market. Real growth doesn’t come from the same folks trading amongst each other.

– the affordability index for California fluctuates from 60% (good) down to 17% (bad) over the past 50 years. The only time housing in California has crashed is when the affordability index dropped to the +/-17% range. Right now it is at 25%. and there is no solid connection between crashes and interest rates.

Technical indicators are just that, simply indications and not foregone conclusions. Ask The Fed what their technicals were indicating when the Bernake stated “We’ve never had a decline in house prices on a nationwide basis. So, what I think what is more likely is that house prices will slow, maybe stabilize, might slow consumption spending a bit. I don’t think it’s gonna drive the economy too far from its full employment path, though.”

– he does not see a problem with interest rates hurting home prices until the IR hits aprox. 6% or higher.

Ok, why?

-lately in SanBerdo and Riverside, there has been a surge in land purchases, probably due to the lenders recently lowering their credit standards and builders seeing a new surge coming for first time homeowners.

Probably.

-during the crash, aprox 60% of all home sales were the lenders and today it is less than 25% indicating no pending crash.

Yikes, if this isn’t a candidate for correlation causation, I don’t know what is.

Isn’t it funny how bears become bulls the minute they pull the trigger?

Today’s “market” is like playing a made up game with a 4 year old that keeps changing the rules to make the game go their way. It is really funny how people make predictions using simplified supply and demand. When I studied economics every supply and demand statement was followed by the “all else held constant†disclaimer. How many times in life is everything else held constant while one thing changes in isolation? Ahhhh NEVER! Simpleton economics from people that can’t even balance their checkbook is really getting tiring. This is the dawning of the age of “Guessonomicsâ€â€¦

What? Before you write everything I say off just know that I have considerable experience in owning rental properties and several personal properties, yes I mean own, not mortgage. I am a single mom and have managed to keep out of the traditional workforce for 15 years. I am a day trader and have timed my exits well. I am not college educated and my writing is not up to par with blog writers but I do write from a place of experience and I have lived a very rich life that involves more than cash but time to do what I love and spend time with those I love. Just thought you should know who you are knocking down all the time. I feel like my experience is valuable. I’m not thinking it, I’m doing it. My life is not theoretical. I am by no means a market expert but I have learned to bob and weave pretty damn well. This won’t make a dent in your opinion of me but I’m an optimist and believe when people care they can make a difference.

blah blah blah…

Christine, a lot of non-owners, and hopeful upsizers, are also optimists. Optimistic that house prices will fall. It could be even banks and government are secretly optimistic, for it will allow massive credit growth, profits and taxable revenue on many new mortgages for the Government. For

My life isn’t theoretical either. I also “care” and “believe it makes a difference”. I care especially for younger people VS older vested-interests who’ve acquired too much property in the boom, pushed up values along the way, and are rentiers for their main income). Can you explain to me what you care about again? This? “I do write from a place of experience and I have lived a very rich life that involves more than cash but time to do what I love and spend time with those I love.” Swell. Solely your own gain via multiple properties/rental streams? A life That’s your vested interest.

I’m just on the other side of the equation, with experience too. One of my father’s sayings in the early 90s recession was… “If you’ve got no money, you’ve got few friends.” So I’m in liquid funds, whereas you have real estate exposure. The money is more or less a constant, where property values are set at the margin.

I can bob and weave with a liquid position. Point being if/when the crash comes, its going to be too late for many holding the real-estate. Other sellers-to-buyers decide values for you, with their bobbing and weaving, at lower prices.

Also no one is really ‘knocking you down’ – just being robust with their own positions – and you’ve strongly let rip in return, with your response about the prosperity being a property investor has brought you, and telling us how it’s lifted you to wealth.

I’m going to watch older owners cry and beg me to buy their houses, when the banks decide to call an end on this market, and look for credit growth by massive lending on crashed prime housing to younger people.

How about this ridiculous heat? A great example of how imperfect the weather in SoCal can be.

90’s at the beach and dry as a bone.

Ah, but the dusks are delightful…

DFresh….As a former golden stater, I can attest that dusk and nights are very nice in most of Cal. You can always cool off after a hot day, where I live now we love but summer nights are not like most of Cal where the temps drops fast after the sun goes down enjoy!

HOT in South Redondo. We have a particularly nice marine layer that stays about an hour longer than other beach cities and keeps it about ten degrees cooler than Hermosa & Manhattan Beach, but today it was nonexistent. I lived in the San Fernando Valley for two years and in Pasadena for six, so I’m not complaining about 90 degrees.

BS….We all have discuss the weather and it’s affects, all nonsense aside, the Western droughts of the past few years is a worry for all of us who live in the beautiful Western states, fast becoming Mothers Natures curse to us and our lifestyle.

The house featured in this article is a typical cheapo tract house of the 50s that cost $10,000- $15,000 to buy at that time, and is markedly inferior to the one my parents bought in the St. Louis area for $10,000 in 1956. Their place was built on the cheap, too, but it at least had exceptional architecture, with vaulted ceilings and an entire plate glass wall. This sad little place has nothing.

We have deteriorated steeply as an economy and a society when living in a 50 year old starter shanty is an upper-middle class privilege.

In a similar vein, I just saw an ad for an ABC TV show where people pit their babies against each other for college tuition money. The American populace has been reduced to putting their babies in a circus so those kids can be educated.

Easy to see what is going on here. High income and/or wealthy people are migrating into areas like LA/OC, SF, NYC, Boston, DC. People with lesser incomes are migrating to areas like Chicago, Detroit, Atlanta, Phoenix, LV. The problem here is many people complain about the home prices being too high are just living in the wrong area. Phoenix is very nice and that may be your best option is move there. If your income is not high, LA/OC, SF, and the rest of that list is very difficult place to buy a home since so many others make tons of money and they will outbid you. But, Phoenix has lower incomes, so the home prices are lower. Plus, Phoenix is a very nice place. Beautiful and affordable. Plus lots of great looking women. Can’t go wrong there.

Arizona spends a lot of money on there roads they are clean, well maintained thru out the state. Billboards are also at a minimum, overall for such a large town that is spread out, 8 out of 10.

I’m married long time but of course I sneak a peak, LA, Orange County, and Phoenix Scottsdale ,overall they have some nice looking women floating around at the malls.

ZerO…Don’t want to respond to my takes no problem, but I want everyone to know I never changed my handle ever! Please do your own thing to the poster or posters that seem to want to stir up the pot, then run away leaving me with the leftovers to defend your views.

I believe my style is evident to most, all I really want is for America to make a comeback, I know it is going to be a long road though, Wash DC and both parties have no idea of what they have done to our consistution and bill of rights.

They now believe the forefathers are out of touch for the 21st century, they are dead wrong. Ask yourself where are the next great leaders? I’m very concerned.

Landord….You are right prices have somewhat stabilize, but the big question is the direction. Many sales have a serious underlining problem these folks sold but most of the sellers took a bath. They needed to get out from under, what they are left with is no profit to repurchase another home.

Also , so many got burned they are now gun shy on buying a house for at least a few years.This leaves another concern for the industry, banks want to raise rates of course but leave the fed fund at near 0, totally upsides down and against all principals of a so called stable economny

I just talked with one of my clients in the South Bay area who lives down the street from a house that just sold. The buyers paid $1.3 mil for a house in a circa 1950s subdivision. They moved in themselves with the help of their friends. My clients point: if they could pay that much for a house, wouldn’t they also be able to afford movers? Seems like many of the people that are buying these expensive homes are really stretching to do it. Crazy, if you ask me.

What a shame Blert no longer posts, I greatly enjoyed his commentary and perspective.

I wouldn’t have thought he was thin skinned, was there some other reason ?

We’ve got to petition the Doc to bring blert back. Hey, blert, what will it take?

Here’s a long-distance dedication, Blert lovah: “The Democratic party is the party of the wealthy.”

I see no reason for me to be obsessive, repetitive nor wax pedantic.

Events are largely following my previous conjectures.

%%%

The bizarre over production of automobiles, globally, is both striking and significant.

See ZeroHedge.

When combined with the Beijing contraction, one might reasonably conclude that we are at the top of another international expansion phase.

Ukraine is significant in many directions.

At the top of the list, it’s an opportunity for the Euro to fracture.

While the Euro is miles away from the insanity of SoCal real estate, it’s a ‘tell’ as to the un-reality of fiat gambits.

1) There is no such thing as THE Euro. Rather, there is a RIGID EXCHANGE RATE REGIME that permits the German Euro to trade at par with the French Euro, with the Spanish Euro, with the Greek Euro, etc.

2) These are ALL separate currencies. Paris backs the French Euro – and no others. Berlin backs the German Euro – and no others, etc.

3) This rigid exchange rate regime is identical in construct to many European schemes that have come and gone before. Such rigid schemes dovetail into the mercantilist train of thought. Floating exchange rates ruin the entire dynamic of mercantilism, a Parisian construct, if you recall.

4) In the end game, the rigid exchange rate scheme is undone by cheaters. The Greeks would be at the top of the standings, just based upon history. I can’t say why such is so. It just is.

5) The nations that end up being burned are those that extended credit – not those that took on debt. So the players in the hot seats are Red China and Germany. Merkel is rolling the can forward because to recognize the macro-embezzlement that has occurred would:

a) Immediately implode her party and de-throne her person.

b) Cause a cat fight across every European trade front – all at the same time.

c) Give a free hand to Putin to run with the ball.

d) Wreck export market penetrations all across the globe – starting with North America.

%%%

The separate Euros are made obvious because:

1) The have separate serial numbers and are issued regionally. X as a suffix means Germany. Y as a suffix means Greece.

2) The various nations issue unique Euro coins, all with national imagery.

3) The various (old) central banks have never stopped doing business the same old way – to include keeping track of which nation owes which.

4) By the treaty, the nations pledged in black letter ink to NOT stand behind each others currencies!

All of the above are suppressed by the mass media with somnolent propaganda.

[ somnolent propaganda = nothing to see here, move along, move along ]

No small amount of the panic buying from Red Chinese real estate buyers turns on their knowledge that the peak of (Beijing) liquidity is at hand. Hence, owning some hunk of California, free and clear, looks mighty sweet.

The Chinese tradition for such end-games is revolution.

Similarly, gold is the traditional get-out-of-Dodge currency. (I know of some Chinese-Vietnamese who got out soley because they could pay their way out in gold. — That’s thinking ahead. For those unaware, the vast bulk of the boat people (Vietnam) were ethnic Chinese. This triggered the 1979 Sino-Vietnam War.)

Convulsions overseas would soon bounce into local real estate transactions. So keep a weather eye.

“The bizarre over production of automobiles, globally, is both striking and significant.

See ZeroHedge.”

I thought you were the one that said to read ZH with a grain of salt and that they had their own agenda. Guess I was wrong… This reminded me of a story of the first mechanic Job I had as a youth. I worked for a Hungarian that had escaped the “Red” Russian takeover of his country. He told me about a communist cotter pin factor in his homeland that would work all week making cotter pins only to find that there was no demand for cotter pins so they would melt them down and start all over again

Interesting take on the Euro. My observation from a corporate finance perspective is that the breakup of the Euro would have a tremendous cost on intercompany transactions. The problem of transacting across currencies is that the original transaction happens at one translation rate and then the settlement happens at a different rate. Tiny shifts in translation rates over short periods of time can have millions of dollars impact. International corporations have huge gains and losses based on which direction the wind blows.

“For those unaware, the vast bulk of the boat people (Vietnam) were ethnic Chinese.â€

I actually work with a guy that came over on “the boat†in 1975 and he will be surprised to find out that after all these years he thought he was Vietnamese and a small portion French (most Vietnamese claim to have some French) that in reality he is Chinese. He will have to tell all the others that came over on the same boat that they are Chinese. This will be a shock to many Vietnamese that I know. I will spread the word and refer them to this post if they argue. Because we all know that you know more about this than the folks who were actually there…

Whoops my bad! I misunderstood boat people. You mean the “over 3000” Chinese evacuating Vietnam by boat and plane now not the boat people from 1975. I need to read zero hedge more often to keep up with your thinking…

http://www.zerohedge.com/news/2014-05-17/over-3000-chinese-evacuated-boat-plane-vietnams-anti-china-riots-escalate-taiwan-als

http://www.zerohedge.com/contributed/2014-05-16/momentum-stock-fiasco-already-pricked-san-francisco-housing-bubble

Silly gloom and doomers!!! Somebody forgot to tell them that How-zing and Stawks only go up… I kinda feel sorry for these guys because they are “leaving money on the table” and are paying “opportunity costs”…

Interesting article:

http://www.businessinsider.com/apple-stock-gold-or-bay-area-home-2014-5

“Of course hindsight is 20-20, and the information in this chart is an approximation, so take it with a grain of salt (not least of which, because it was put together by a real estate group).”

I say buy moar how-zing and stawkz now!!! Hiz-tory provez that deh will go up fo-eh-vah!!!

Moar? What’s wrong with “mo-wah”?

Dfresh, I like the way you think! Mo-wah it is!

Now the gloom and doomers are just making up stories…

http://www.zerohedge.com/news/2014-05-16/where-worlds-unsold-cars-go-die

Somebody just learned how to use Photoshop and can’t stop photoshopping cars in random places around the globe. Still mad that your gold “investment” didn’t pan out? Silly how-zing/stawk mah-ket bears. I am sitting pretty with all my monies in a SFR and I am rich b%$!@!!! Gotta go! I am gotta buy some dot con stawkz with my new etrader account on the interweb…

Christie above wrote;

” It’s available again in a month so it should be interesting how much interest I’ll get again. I’m raising the rent.—

I don’t know why this bothers me but it does. I am a free enterprise guy by nature but I am tiring of the greedy landlord. That $50 or $150 probably means just another meal out with your friends but to the tenant it means they will sacrifice such an outing.

Good luck with your investment.

Agreed, I rent out my previous slightly underwater house (out of state). I could probably get $100-200 more per month, but tenants are typically active military, I make it a point to show a mortgage statement and let them know I’m not seeking a profit off their hard earned income. Just staying afloat a few years until I can sell.

Likewise my current Socal landlord (prop 13 inheritor) rents to us well below market and has not increased rent. That motivates us to take excellent care of the place in return. Less greed and not squeezing every penny out of tenants can be a win-win for everyone involved.

Thank you for the excellent commentary and graphs. Even the less expensive areas of California are suddenly off limits, due to high demand, high taxes, high unemployment, and horrible salaries. Chico, Redding, and other areas in the northern central valley are very expensive compared to a decade ago. Even Reno, NV is expensive. The “R” in Reno means “R” for Rich. Reno assesses high taxes, including impact fees. In Reno ten years ago, you could buy a new house for $120,000. Today, that house is worth $240,000, this is over 5 times the median multiple, due to lousy salaries, and perhaps due to Reno’s 2008 voter approved Growth Management Act. Whereas the “R” in the booming Rio Rancho, New Mexico means “R” for Relief (from taxes, impact fees, cost of living, and regulations).

jim taylor is the man!!!!!!! housing will tank hard in 2014!!!!!!!