California’s Financial Depression: Unemployment and Underemployment rate at Great Depression Levels. 23 Percent Unemployment for Biggest State in the Nation. California Will not see Housing Peak until 2030.

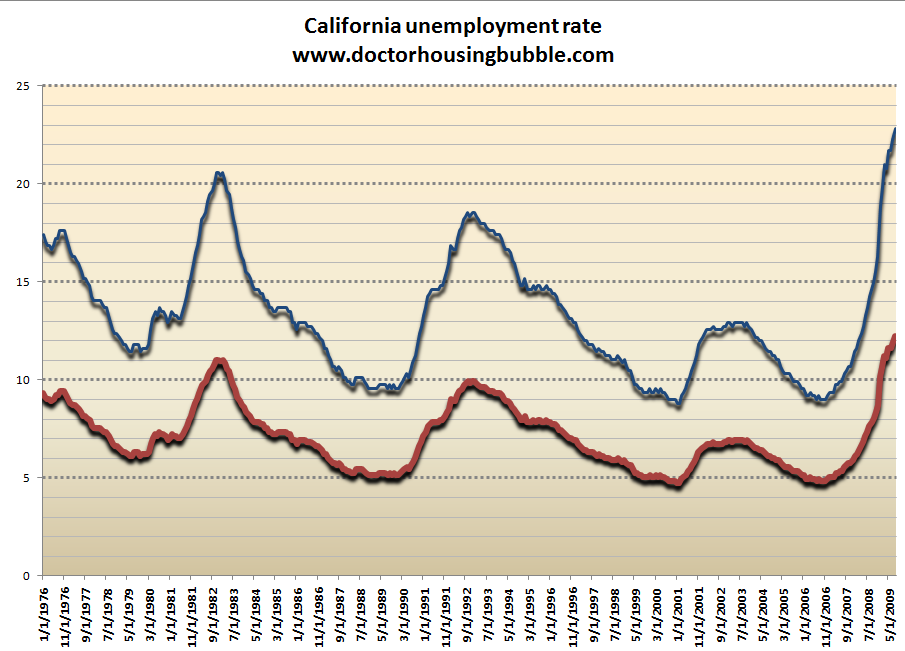

California has now reached Great Depression unemployment levels. Many are now calling the end of the recession but there is no sign that California is inching closer to prosperity. Last month the unemployment rate shot up to a post-World War II high of 12.2 percent. This is only the official headline number. The unemployment and underemployment rate is up to 23 percent putting California into its own mini depression. The great housing bubble is still beating down on the state economy. Alt-A and option ARM products are staring us squarely in the eyes for 2010. Many of the banks and lenders were probably assuming that somehow by this point in the cycle that the economy in California would be bottoming out. It is not. What this means is housing will take another leg down.

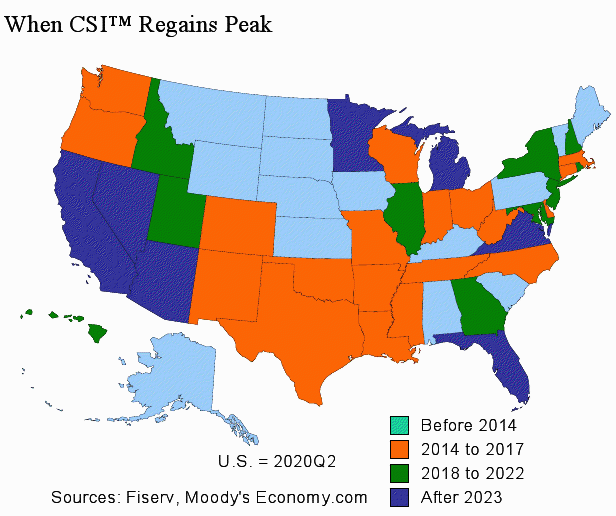

When will California see peak housing prices again? According to Moody’s, not until 2030:

If that is the case you probably shouldn’t hold your breath on going back to the bubble halcyon days. Let us first look at the unemployment rate:

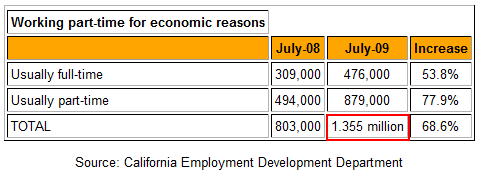

The only data that we have for California is the official headline number. However, we are also able to access U-6 data from the BLS for previous quarters to arrive at our current U-6 figure. Officially 2,248,000 Californians are out of work completely. That is where the 12.2 percent figure is derived from. But how many are working part-time for economic reasons?

Source:Â OC Register

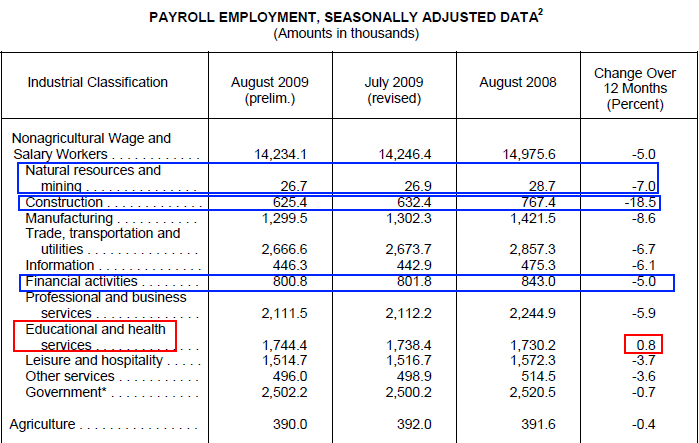

Add these two groups together and you will find that 3,603,000 California are either fully unemployed or are working part-time for economic reasons. These are levels reminiscent of the Great Depression. If you factor in those who are discouraged and have left the work force it is readily easy to see why the U-6 figure would be at 23 percent. Yet those in the housing industry are quick to say this is a housing bottom. This notion is simply misguided. They are focusing completely on the buying and selling side of the equation. What many fail to understand is that much of the bubble was also related to the selling, flipping, manufacturing, and finance side of real estate. Those industries are still bleeding jobs:

This makes perfect sense. If 50 percent of homes being sold in the last year are foreclosure resales in the state, these are homes that are already built and chances are will only turn out one transaction. Meaning? These are one and done sales. In more normal markets you will typically see someone sell a home and then, purchase another. Each sale in effect created two transactions. That does not occur with first time buyers and investors who have been lured into the market with gimmicks like the $8,000 tax credit.

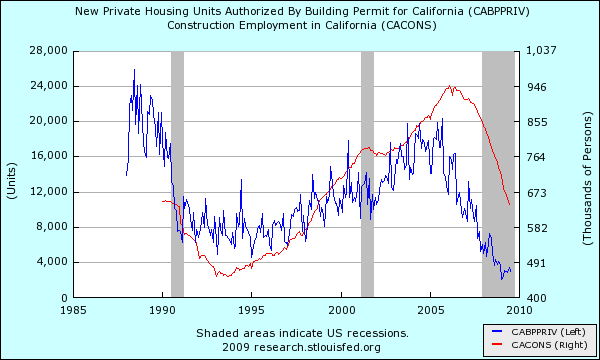

Take a look at this chart showing new permits and construction employment:

We are now working the years of bubble excess out of the market. California is still seeing record amounts of foreclosure activity. So even though sales got a temporary boost, employment in these sectors is still at a bottom. And keep in mind that we have hundreds of thousands of mortgages in the Alt-A and option ARM category that will go bad from 2010 to 2012.

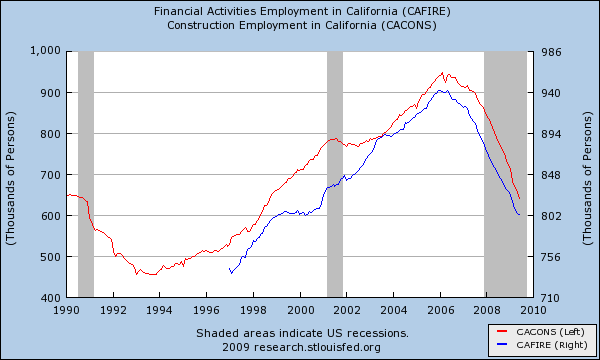

If you want to look even closer, let us look at jobs in the financial sector:

The trend is very clear here. We are losing jobs in sectors directly linked to housing. Many times, these were the same people buying the mid to upper tier market homes. So you are losing customers as the months roll along.

And we are already seeing some gas running out of the California buying spree. Here is recent California sales data:

July 2009 Sales:Â Â Â Â Â Â Â Â Â Â Â 45,079

August 2009 Sales:Â Â Â Â Â Â 39,811

This includes resale homes and condos. This is a drop of 11.7 percent. This is incredible especially the amount of homes being sold at lower prices. But again, you are selling homes in a state that is in a financial depression. And for perspective on those sales figures, the August peak was reached in 2005 with sales at a stunning 73,285. The average August sales figure for the state going back to 1988 is 49,467. So even with a 50 percent price drop in the state, the $8,000 tax credit, and real estate pundits cheerleading home sales the market still can’t make a 21 year average. Now we enter the fall and winter selling seasons that are slower and exhaustion is creeping into the markets. Add the Alt-A and option ARMs into the mix for 2010 and you can understand why we are starring at a second leg down. For last month, the median price dropped to $249,000 but keep in mind, when you see many of those mid to upper tier markets taking hits you might see the median price creep up even though prices are falling.

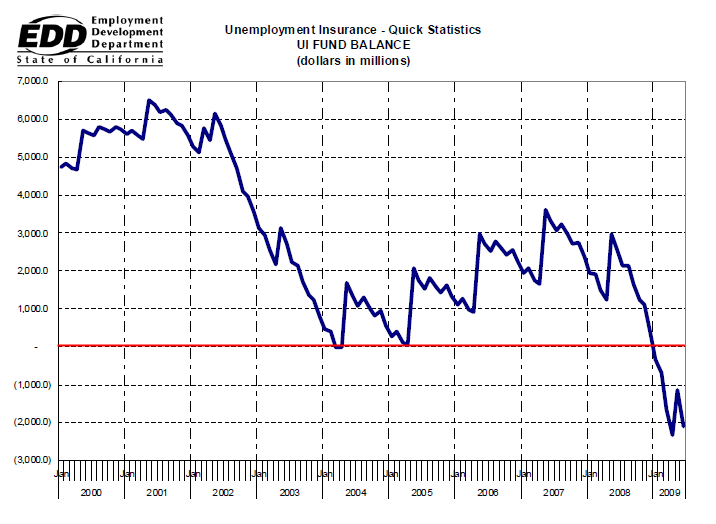

But a simple thing anyone should understand is that anyone that is unemployed or underemployed is not in the mood to buy a home. The state is borrowing money from the Federal government to pay out unemployment insurance since it has gone broke in its fund:

And if you think this trend is reversing, it isn’t. A senior job fair in Irvine pulled in 700 people. The parking lot was over filled.

“(OC Register) Seniors seeking jobs increased 40 percent this year, the Pew Research Center reports. Sixty-eight percent of research participants said they work because they want to, and job satisfaction was cited even when jobs were “dumbed-downed”.

But that leaves 32 percent of seniors who work because they have to. Sandie Monnier, 62, said she has been out of work for more than a year and her unemployment benefits expire soon.

“I will probably work until I am 70,” she said. “I’ve lost my 401-k.”

While the Census Bureau’s poverty rate for seniors was revised this week from 10 percent to nearly 18 percent, Pew’s data say adults 65 and over have already downsized their lifestyles and are dealing with the recession better than any other age group.

Peter Chiarle, a general contractor, says he’s doing all right since his construction company closed it doors. But he is not ready to retire.

“I’ve built thousands of homes and worked my way up through the trades. Plumbing, electrical, you name it. But I’m not finding jobs that require construction skills,” Chiarle said.â€

This is impacting all age groups. So the Pollyanna talk from the housing and financial industry is unwarranted. The only reason we are seeing minor moves up is due to the U.S. Treasury and Federal Reserve juicing up the market with easy credit and every other imaginable gimmick. Let us run down a brief list:

-HOPE Now

-Stimulus Bill (~$700 billion)

-Tax Rebate #1 (~$168 billion)

-Â TARP (~$700 billion)

-Â Banking Bailouts and Backstops (~$12 trillion)

-Â Cash for clunkers (~$3 billion)

-Â Home tax credit (~$15 billion)

Yet unemployment is at record levels and foreclosures are still sky high. If you haven’t caught on after two years, the pretext of the bailouts was to help the American public especially the homeowner but all this money was laundered into bailing out the crony Wall Street financial industry.

So as California is experiencing its own depression we have a group of people trying to sucker people back into buying homes. The rhetoric seems eerily familiar to the bubble days. “If you don’t buy you’ll be priced out!†or “you’ll miss the next move up!†and people jump on this. Many are going to be shocked as 2010 rolls around. Anyone can logically understand that an economy with depression like unemployment is not a good place for a housing market.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

50 Responses to “California’s Financial Depression: Unemployment and Underemployment rate at Great Depression Levels. 23 Percent Unemployment for Biggest State in the Nation. California Will not see Housing Peak until 2030.”

Most people do not care about the data presented on this web. They just compare today’s prices with peak prices and think that housing is a bargain. 10% off sound good. 20% off sounds even better. 30% off sounds great. But, 30% off of what? They never ask this question.

Hi Doctor

I live in Cerritos CA 90703 and house prices are shooting up again. Check this out

18402 De Bie Ave, Cerritos CA 90703

2 br | 1 ba | 988 sqft | Single-Family Home SOLD for 500K

Normally home were selling 300-400/sq feet in this city. Why someone decided to pay 500/Sq feet.

Is it possible that these banks are buying back to create panic or Someone really think that this house is worth 500k. I have 40% down and very stable job and still I can not buy house in this city. I am telling mysself that I should be able to buy 1400-1500 Sq feet decent home for 500K.

Thanks

12.2% unemployment and the housing market had an uptick this summer. Just think what it would have been without all the massive govt intervention! Foreclosure moratoria. tax credits, etc… NOD’s are way higher than foreclosures. Someone should investigate this more closely.

This fall may begin another strong leg down in the market.

Here is an interesting statistic from th e LA Times – “In California last year, the number of strategic defaults was 68 times higher than it was in 2005.” See: http://www.latimes.com/classified/realestate/news/la-fi-harney20-2009sep20,0,2560658.story

People are now walking away from mortgages when they are upside-down even though they have the money to pay them. This will just push the prices lower, and this has nothing to do with unemployment, since these people have money.

California Unemployment Situation in Heat Map form:

here is a map of California Unemployment in August 2009 (BLS data)

http://www.localetrends.com/st/ca_california_unemployment.php?MAP_TYPE=curr_ue

versus California Unemployment Levels 1 year ago

http://www.localetrends.com/st/ca_california_unemployment.php?MAP_TYPE=m12_ue

JS, if you really have 40% down, I find it hard to believe you cannot find a good deal on a house in Cerritos, of all places.

“Accidental Landlords” are renting at a loss when it may be smarter to sell at a lhttp://www.time.com/time/business/article/0,8599,1920627,00.html?iid=tsmoduleoss: Rent.com has added homes for rent now, to accomodate these accidental landlords.

Don’t worry, come early 2010 when the tax credits expire, the loan-mods fail, the low-end investors and first-time home-buyers supply gets exhausted, more resets/recasts/strategic defaults happen, and the fall and winter off-season Case-Shiller numbers become come available – the truth will out.

Home Prices = Incomes x Expectations.

Incomes, we know with increasing unemployment, are going down. All that’s left is expectations – which with incessant boosterism can defy reality for a short period – but not forever.

I agree with Nick, prices in the mid to upper tiers are still out of sync with reality. This is especially true when you consider that people with above average incomes must currently settle for significantly below-average housing options. The important thing to remember is that it’s still too early to expect prices to go down in this market segment. Starting in 2008, I recall reading many rational and plausible assessments of housing price deflation in certain parts of the market not occurring until late 2009 and 2010 – maybe even 2011. The fabled Credit-Suisse chart is old hat and other good predictors exist, but the fact remains that many houses bought in 2004 had five-year teaser terms. It’s now 2009 and the people who bought into the hype are just now beginning to be called on their bluff. And then there’s the HELOC abusers. Many of the organic house sales occurring in this market are people signing up to be debt zombies and future foreclosures. People looking to buy in the mid upper tiers need to know that the smartest thing to do right now is to find a rental hand ignore the real estate market altogether until next year or later. Really, buying a house can wait for the vast majority of people. If you know of people who are trying to buy now, do them a favor and respectfully offer them the right information so they can reach their own conclusion.

With option ARM’s coming up to reset dates, it would be interesting to measure the payment amount of the average negAm payment vs. what the new payment will be with the payment based on the now quite low indexes? And also what the new debt balance is based on the years of NegAm payments?

I’m guessing this wont be a pretty picture. But data also suggests that being upside down on a mortgage is the best predictor of defaults rather than simply the ability of the borrower to pay.

Short term (2 years) I agree housing is headed lower. But disagree with the map showing 2023 as the year of full recovery in CA. One thing they ignore is the impact of immigration. In the next decade, 15,000,000. people will legally immigate to the U.S. About 40percent of all new immigrants move to Cal. Immigrants have much higher birth rates, and much larger families.That means by 2019, Ca. will have to house another 6-8 million households. (These people have to live somewhere.)

In Calif., at least, this massive increase in population will quickly offset any long term downward trend.

To Robert Cramer: It doesn’t matter how many “immigrants” move to California or anywhere else. If a person can’t afford to buy a house, they won’t be buying a house. Demand alone props up housing values only in the world of liar’s loans, unless all of these “immigrants” you routinely refer to are extremely wealthy.

Robert. It dose not matter the population growth as much as income growth. The year 2023 is releasable if you considered a slow expansion of income. Immigrant of all people (especially from south of the border) are not going to make mega bucks to buy a houses they cannot afford. Just because they “need to live somewhere” does not mean that they will be able to buy. Rent is always an option and rental apartment building will likely to grow. If you look at other places in the world that are much, much more condense in population and short of land, you will see that even them have some sort of balance between income and houses prices.

The notion that California will continue to see a massive infulx of immigrants is misguided – especially if a dollar collapse occurs which I expect in the next 6-24 months. Why would immigrants come to a state or a nation in a depression with a government that is as corrupt or more so than that in their home country? Americans are the ones who are going to want to immigrate out if Wall St. maintains control over our lives and economy. Problem is no-one is going to want them. For myself, I’m fortunate to have some Canadian friends that will help me get out of here if we descend into total chaos!

Immigrants come to this country to get jobs. There will be fewer and fewer immigrants as unemployment increases. Data shows that this is already happening. Also, it is not unheard of to see impoverished immigrants living 10 or more in a 1 bedroom. They sleep next to each other on the floor, like sardines. This might be hard to believe for people who are obsessed with granite counter-tops and stainless-steel appliances, but such over-crowding does occur in poor parts of LA.

Robert,

Yeah, I see those immigrants from mexico coming in and filling up those 500k+ developments we’ve been slamming up over the past decade for sure.

Most people can’t understand the amount that the credit bubble has distorted our views of financial reality. All you need to look at to understand where house prices are going is this chart:

http://market-ticker.denninger.net/uploads/KeyCharts/TheoreticalDebtPresent20.png

Cheers,

prat

I’m not sure as many immigrants aim straight for California these days. It seems the ones that are coming are moving to other areas and cities. However, with the lack of work available in these cities and the poor living conditions, I’m not sure we’ll see the same impact as in recent years

Immigration boomed in 1910 to 1930. Immigration was nothing during the 1930’s.

So when does the MSM realize, that the real story is the Depression in California. I guess when those tied to the real estate industry are all broke and they cant squeeze any more advertising money out of them.

Still a few knife-catchers buying on the Westside though.

http://www.westsideremeltdown.blogspot.com

Population growth is not a garauntee of price increases. There are many examples of this around the world. Easy credit and rising wages/employment are the needed factors to get residential home price increases. Govt incentives thrown in for good measure help as well.

I was told by an ex Countrywide, now BofA employee, that house prices won’t drop more because of all the immigrants coming to L.A. and the demand for housing. I looked at him, incredulous and asked him to please tell me how many of these people can afford a house / condo at the current levels? He had no answer!!!!!

Actually, he was a nice guy and said that he HAD to make these loans during the boom years because that was the mentality at Countrywide, which again was no surprise.

Comment by worm

September 20th, 2009 at 1:49 pm

Immigration boomed in 1910 to 1930. Immigration was nothing during the 1930’s.

___

Wrong info.

Immigration was greatly restricted immediately after WWI (and for those who don’t know that ended in Nov. 1918.)

>>

Immigration was very restricted in the 1920s.

>>

The immigration boom was between 1880 and 1914.

>>

House prices flew upwards in the 1920s – nice bubble going on in credit, stocks and all sorts of things.

>>

Immigration actually increased under the allowed quotas in the 1930s – all those nasty dictators and revolutions going on in places like Italy and Germany.

>>>

House prices fell in the 1930s when the economy went south.

You should not trust any data from Moody’s. Moody’s gave toxic mortgage backed securities a triple A rating.

It is such a strange and unsettling thing: this temporary spike in some real estate prices in the middle of massive unemployment in this state. It makes no intuitive sense. Who is coming up with this money to buy these overpriced houses? Some rich people? The same kind of people who play the slot machines? Are banks and/or Real Estate agents playing with the numbers–prices being inflated on the books, to try to spur panic buying?

There is some answer. It is certainly not that there is this great economic recovery going on. I realize that there still are people who are comfortably solvent. I have no significant financial worries, and yet I cannot imagine paying $1.5 million for some of the mediocrities currently priced that high on the Westside or in the SFV. Of course, maybe the answer is that anything I buy, I fully intend to pay off in full; while many of these buyers are simply gambling that there will be another boom, and if there isn’t, they’ll just walk away, like the last crop.Do they really contemplate paying $8,000 a month on their mortgage for the next 30 years? I have this distinct feeling that in three years there are going to be entire neighborhoods full of unkept, seedy-looking houses. And then all the people like Sheila Bair, who keep talking about how it is important to keep home prices high, to protect the value of others’ houses, are going to look very stupid.

Not to mention that California’s infrastructure is in the toilet. We’ve been living on the overcapacity of previous generations. Now that the water, sewer, soil, and other chicks are coming home to roost, gadzillions of dollars are needed to rebuild everything from bridges and aqueducts and roads and drinking water plants to water mains and electrical/telcoms pathways and schools and hospitals and prisons and power plants and fruit bats and breakfast cereals.

~

And this will come from where now that Wall St. has looted the nation (just as Reagan’s Rangers planned it and so many voters abetted it)?

~

Have fun in Canada, that bitter cold fool’s paradise to da nort’. A lot of the people I know who think “fleeing north” is going to give them the California Dream of an escape to more privilege seem to overlook something essential: wherever you go, there you are. DHB’s tonic of realism has been the same from the beginning: the only way out is through.

~

rose

Hi DHB, thanks for another great post.

For your reading enjoyment, please see “Unemployed homeowners could get financial assistance”

http://www.usatoday.com/money/economy/housing/2009-09-17-homeowner-aid-unemployed-obama_N.htm

The feds aren’t going to be happy until they print everyone into prosperity. I am not against helping homeowners BTW, I would rather see the money go to them than the Crony Capitalists at AIG and Goldman. But we are just postponing the inevitable.

the bill has begun to come due:

http://www.nytimes.com/2009/09/19/business/economy/19bailout.html?partner=rss&emc=rss

As the government continues to attempt to prop up housing and the zombie banks, where’s the money going to come from?

At some point, interest rates are going to rise, and that is going to agent orange the housing market’s green shoots. Unless we blithely continue on to destroy the dollar, which will delay the further housing meltdown by a bit…

Thanks for all the response to my post. Not all immigrants are poor Mexicans.

About 50% of immigrants are Asian, and they have a very strong savings and buying a house cultural bias. In San Francisco/ Fremont/San Jose area, a very large portion of the buyers are Indian(high tech). Asian families will often band together to buy a house, live together in multi generational families,or loan money to relatives.

As far as coming here for jobs, if you legally immigarate to the U.S., you can bring over your elderly parents, who can collect Social Security (without having worked here). They can contribute their two Social Securtiy checks to the mortgage payment.

I have been reading this blog for a long time and I agree with the data that everything points to values going down, but things in my area (90277) are going up from where they were a year ago.

Bottom line is SFR’s are selling for more than they were a year ago and their is less supply on the market.

Robert Cramer must be a member of the NAR.

I want to mention an article that I just read, “The Great American Bubble Machine,” by Matt Taibbi, in Rolling Stone a couple of months ago. The expose clarifies the thievery that Goldman has been doing for years. And people here ask me not to talk about violence…if you can read this article and not become infuriated, then you are not human.

Mark my words, if our crappy government continues to refuse to do something about the scum, there are people who will take matters into their own hands. I’m not saying that I am one of those people; I don’t even own a gun. But I read a lot of blogs, and people are pissed. They have every right to be pissed. You can’t loot a nation, take people’s jobs away, rob them of their pensions, and send them to live in the streets, and expect no blowback.

“there is less supply on the market”. Bingo. With less supply you can prop up housing prices, at least in the short term. Those who are saving and waiting, will be in a much better situation to survive in 2010 when the boom is lowered forcefully on the credit markets, Round #2. You are going to need that cash and need to be nimble. But don’t expect the banks to do anything as it will be worse than before as whatever liquidity they have will be tied up in Round #2.

Or, they will simply be bankrupt.

Immigration, availability of land and crowding families into one home were all things I heard in 2005 in order to rationalize sfr’s increasing in price. I’ve studied the data for CA home prices since 1950. In every instance where unemployment rises over 7%, prices stagnate and/or drop…even in the best areas of CA. We are well beyond this level and rising to historic highs. I would not bet on a rising trend until I could see Y-O-Y increases.

After reading this, I recall an old lady neighbor I had growing up, buying a custom house for 10K in 1941 in a choice area (Glendale) that sold new for about 38K in 1928. That’s almost a 75% drop! And it took 13 years!

Just released 9/21, Equifax reports that delinquencies are at record highs (7.58%). There was actually some good news in the report that should be taken note of. Household debt has been reduce by $300B and the savings rate is up to 5% (still pitiful by historic standards). http://www.reuters.com/article/newsOne/idUSTRE58K29E20090921

My interpretation on the trend is:

1) it’s a lot easier to make the minimum monthly payment on credit cards (often times only $15). Some may actually be forced to make payments as credit limits get reduced.

2) underwater homeowners have rationalized that it doesn’t make sense to put money into a losing cause like making a payment on the underwater mortgage.

3) credit card companies are much more aggressive in collections than mortgage holders so maybe people are just taking care of the squeaky wheel 1st.

4) the high delinquency rate on mortgages will drive down home prices which in turn will drive down the assets on bank’s books. At some point as has been discussed at great length on this blog, the dam will burst.

5) if unemployment continues to grow, expect delinquencies to go up and a reversal of the saving rate.

6) either way, we will not “consume” our way out of this recession. Unless we discover the next growth industry such as renewable energy and green industries, we will stagnate for many years.

One reason housing prices are not dropping as fast as fundamentals would indicate is that the government is now in the business of selling toxic loans – no money down, teaser rates, high leverage, etc. Yes, toxic loans are back, and the taxpayer is backing it.

Lost bid #10. A 3/2 in San Jose, 1440 sq. ft. decent schools (but not primo), 6,000 sq. ft lot and a bit of freeway noise..

I bid $535k with FHA loan and lost to someone at the same price who put 50% down.

Someone flashed a quarter of a million dollars of a modest family home with modest curb appeal.

It came on the market Monday with bids accepted until Sunday. It got 26 offers.

Sorry, Dr. Housing Bubble, but the facts on the ground today don’t offer much support to collapsing prices.

Anyone have a scenario where don’t have to go to WW III to get this thing fixed? I can’t think of a Kudlow happy ending here. I think the only scenario is to keep bluffing and prop up the house of cards as long as possible. Since it will probably alter civilization as we know it, it might be a good time to go for broke, run up the credit cards, HELOC until the cows come home and party with the young girls/boys, as the case may be…it’s like that War Games movie where every scenario ends in inhalation.

I showed Denninger’s debt to GDP chart to another blogger, and this was his reply:

“Ah, Doug, Look at that chart again.

He’s doing “Real” GDP growth (after inflation,) and “Nominal” Debt growth (before inflation.)“

Since we had many posts about immigration, here is a relevant link titled, “Asians hit worst by decline in housing market. Homeownership in ’08 dropped to lowest level in six years, Census says” http://www.msnbc.msn.com/id/32959437/ns/business-reinventing_america/

Nickhandle,

That article might be true, but where? Just go down to Temple City and watch a cracker box sell for 500K in one week! If the house in in one of those corporate-packaged areas like Corona or Valencia, that might be the case.

D1,

I am sure you are right on a micro level, but probably not on a macro level. Here is another article, “Number of Foreign-Born U.S. Residents Drops

Construction, Manufacturing Job Cuts and Enforcement Cited in Loss of Hispanic Immigrants” http://www.washingtonpost.com/wp-dyn/content/article/2009/09/21/AR2009092103251.html?hpid=moreheadlines

I think housing market has still to fall because America is losing on Jobs and interest rates have gone higher. There are very little chances of housing reviving. On top of it, the government efforts are not helping as well.

Recently read an article on a similar premise.

http://www.housingnewslive.com/us-housing-news-articles.php

Ends in “inhalation”? =D Hahaha, maybe that is the key to all of our problems, Sabin Figaro. I’m going to give you the benefit of the doubt and credit it to a classy replacement of “annihilation”.

The house across the street from me (San Bruno, CA) just sold for $640k. That’s a tiny three bedroom with no garage because the garage turned into a bedroom. So it’s pretty much the same as my house. I pay $1900 per month rent for the same house across the street. and these idiots signed up to pay $3500+ monthly. (tax is 8k per year that I don’t have to pay.)

Now, the price is very close to the high of the crazies (it sold for $720k, forclosure sale at $275k last month) and I’m thinking this house is cursed with strategic foreclosure in the future and my tax money is bailing the idiots out again.

(for some strange reason, the foreclosure sale disappeared from zillow. why? it was there before.)

Nickhandle,

I agree with with your article. My point is the fact that desirable properties are and will be bought up buy many Asians and Indians for years to come and the local folks will continue to move away to cheaper areas. I have this seen for many years. It just has accelerated in recent times. The sad thing is that while the locals are placated with watching silly ass TV shows and still buying material crap and toys or move to cheaper areas to buy more crap, some foreigners are diligently saving to buy in the good areas with the top public schools. Believe me, when these folks put 50% down or buy all cash, they are playing for keeps, even in these times! For the most part, they don’t care about local employment. Much of their money comes from outside sources. QUALITY WILL AND ALWAYS COST MORE MONEY RELATIVE TO THE ECONOMY. Another example: Go out and look for a mint condition ’55 Chevy convertible. They will still cost 50K up with cheap US dollars. In the end, there will just be the haves and have nots and not much middle.

There is a bifurcated market: crappy foreclosures that sell cheap and nice homes that are really expensive, with little in the middle. When something is priced in the ‘middle’ it gets snapped up very quickly with multiple offers. This is not a phenomenon limited to the west side of LA but all across the country.

However, do not be fooled by the mirage. The middle price range of $500k may be the bottom of pricing for middle to upper market homes on the west side. As the bubble continues to deflate, what you will get for $500k will get better and better. The greater fools are jumping in now with their hard earned cash and as they say, a fool and his money are easily parted. Higher priced homes will languish on the market in the $600’s and $700’s and $800’s. In order to sell they will need to lower their prices into the $500’s and lower $600’s because they will continue to languish at higher prices. In a few years, the home referred to above that just sold for $500k a few months ago will have to sell in the $300’s or $400’s to compete with the deals to be found in the $500’s.

Furthermore, $500k or $600 makes sense for a dual income household earning $150k, $200k, $250k a year, because it’s 2.5x to 3.5x income with a decent down payment. The $700, $800k+ homes are really screwed when there are multiple bids for homes in the $500’s. That’s what people want and that’s what they’re paying. That’s the market is with tightened lending standards, that’s the bottom of the middle-upper housing market, it’s in.

Now it’s just time to wait for the languishing homes to reduce their prices to the level where people can afford to pay. The bottom’s in people, give it time and be patient, there will be deals to come but it will take years for the market to normalize, especially out there in whacky CA.

Carol,

I am wondering if the banks are buying these homes to prop up prices??

Ron,

Great point, you are spot on. However, if you have ever travelled to Shanghi or Bejing, a well to do business man has to pay 500-700k up for a townhouse close to work. So a house with land over here close to work and friends is a steal. Although China has their problems, their GNP is 9% or more; way ahead of us. Many of us are in denial about this aspect that they can pay for houses here much like we used to when our middle class was healthy. Since they own most of our debt, they can obtain good deals on foreclosures in bulk with our banks that they have some of their money in. Although China will get hit by the recession/depression, they still have many buyers trying to dump the US dollar and buy our real estate. Their philosophy is to possibly lose a smaller percentage on choice real estate, than to lose big on holding worthless dollars. The Dr. is correct in that we are basically flat on our ass concerning employment and upside down mortgages for years, even decades. Without a productive manufacturing base, we will never have a sizable middle class again. Others will take our place as they are starting to do in ernest.

Our agent is telling us that there are very few homes in the $500s on MLS here in San Jose. With all this bidding, I believe it.

I bought a townhouse in Monterey County in 1979 for $60,000, sold it in 1992 for $130,000. Over the years, according to Zillow, the value of it went to $360,000, but now the value is $120,000, which is $10,00 less than I sold it for 18 yrs. ago. Now that’s what I call a “bubble.”

Leave a Reply