The CA bubble that isn’t from California: Canadians come face to face with the paradox of golden real estate handcuffs and a younger less affluent generation.

I really enjoy Canada. A beautiful country with great cities and fantastic food. Leave it to our neighbors to the north to show us how it is done for a real housing mania. For the first time in history we have experienced coordinated global housing bubbles courtesy of central banks following very similar policies. The addiction to debt isn’t only a U.S. born condition. While the recent U.S. market is dominated by low supply and massive investor buying, Canada continues to see rising home prices even right through the global Great Recession. The Canadians interestingly enough also face similar dilemmas between older and younger generations. Many young professionals are fully priced out of the real estate market even when they are working at relatively good careers. Many battle it out in the condo markets were even in this market prices are inflated. Canada has an incredibly heavy reliance on real estate, more so than the United States and their household debt ratios make the U.S. look like a frugal uncle. One fascinating story highlights a similar story to what many baby boomers here in the U.S. are facing with their offspring. They face the reality that they are house rich but cash poor.

Canada’s inflated real estate market

Home prices in Canada are inflated. Global cities like Vancouver and Toronto face massive investor buying that largely makes it tough for local families to buy. Many pre-bubble buyers are caught in a golden castle but unable to unlock the money until they sell, a similar condition to many baby boomers here in California.

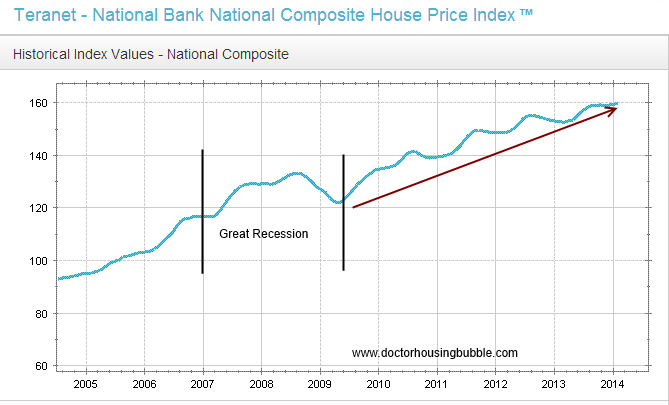

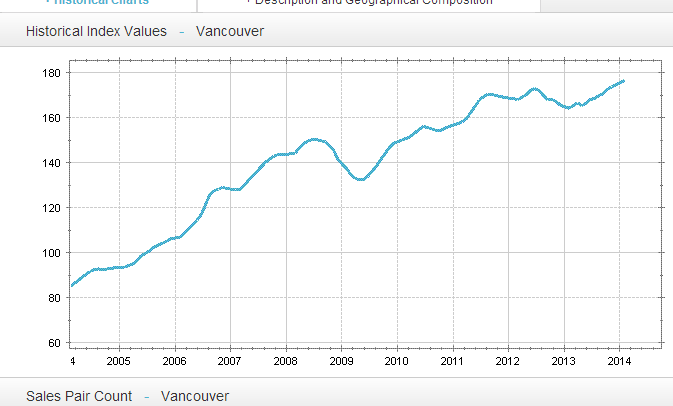

It is important to note that there was no correction in home values even during the Great Recession in Canada:

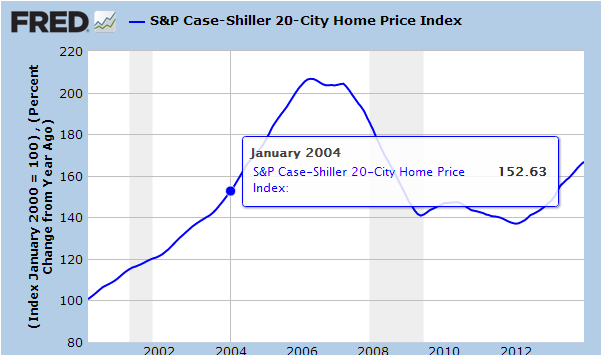

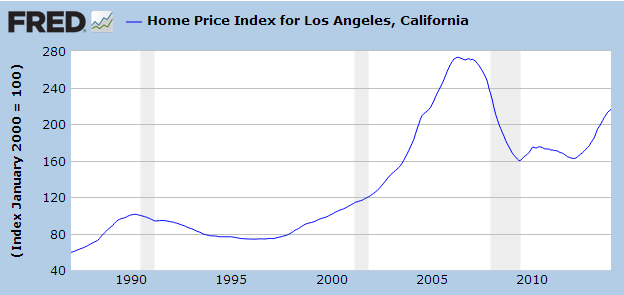

Canada home values have increased by close to 80 percent in the last decade. For the U.S. over this same period of 1994 to 2004 home prices are up (adjusting for inflation) by a modest 10 percent even after the 2013 mania:

The housing market in Canada has been split in many areas between mass produced cheaper condos versus single family homes:

“(CBC) One market is facing too much supply, while another appears to be heating up,” the bank said. “The GTA housing market is a tale of several markets with divergent conditions.”

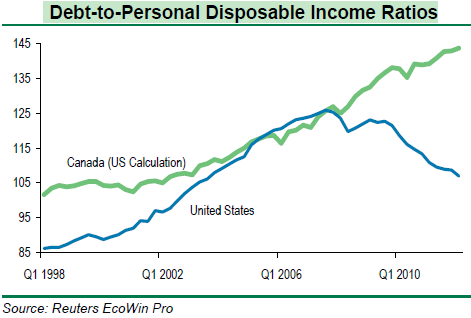

There are certainly changes in the wind but bubbles can go on for much longer than you think. How are Canadians keeping this thing going? For one, they are going into massive debt and putting the consumer hungry Americans to shame:

The above chart is very important. The U.S. hit an apex in terms of how much household debt would tip an economy over. Debt-to-personal income in the U.S. hit a peak of roughly 125 percent during 2007 at the height of the housing bubble. You can see the correction that followed in the U.S. and many have felt on a personal level. Yet Canadian’s continue to pile on debt beyond their actual incomes. As of more recent data, they are closer to a 150 percent ratio. Which leads us to those golden real estate handcuffs in Canada. A great piece on the Great Fool blog highlights this generational divide:

“(Greater Fool) Cheryl and Paul are 57 and 60 and live in a Mississauga house they figure is worth $900,000. They’ve spent the last 14 years paying down the mortgage and have about $80,000 yet to go. She’s been at home since the last kid left the nest six years ago. He sells real estate, made $126,000 last year and has no pension. Between them they have $37,000 in TFSAs, $160,000 in RRSPs and about forty grand in a high-yield savings account.

“How we doing?†Cheryl asked, hopefully. I paused to collect my thoughts. “Oh,†she said. “That bad?â€

Of course she knew the answer. The Boomer couple has just over $1 million in net worth, but 80% of it’s in one asset. Paul has no pension. Worse, as a commissioned salesguy, he has no business to sell. And he’s just as good as his last deal – which means any housing correction will not only sideswipe his income, but also his family’s net worth. It’s double jeopardy. And then there’s the nature of their liquid investments – the bulk of which sits in high-cost mutual funds inside an RRSP, meaning the money’s fully taxable.â€

This is an interesting situation very similar to our struggle for housing for younger professionals today in many high priced metro areas. The couple in the story above is massively house rich. 80 percent of their net worth is tied up in housing. Their retirement accounts are paltry assuming they will be living off this amount for 15, 20, or even 30 years. The house does not throw off any income. The only way to unlock the money is to sell. A home equity loan essentially means resetting the clock on additional debt. Downsizing or moving to a cheaper area is the only way to leverage that massive gain in housing. But how many people actually move? In the U.S. we pointed out that most people are home bodies that would rather eat cat food in their million dollar home versus selling and using the money to live a decent retirement.

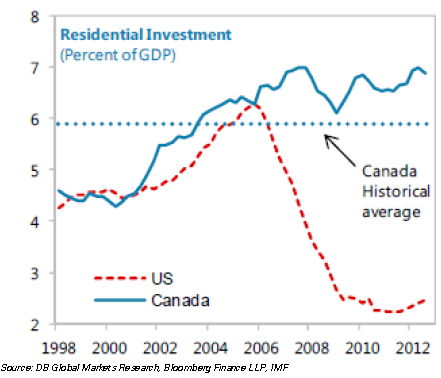

Canada’s economy is too focused on residential investment:

Canada has been investing too much into real estate going back to 2002. You can see the correction for the U.S. but is there something else going on here? The article highlights a reality that many even in the U.S. will face when they are house rich and cash poor:

“But it’s a house. No dividends or interest. Just property taxes, maintenance, insurance and eight hundred grand of locked-in equity which must be released, or these folks are going to run out of money before they run out of time.

This brings us to Jason. Their kid. He’s 28. A member of Gen Y which, at 27% of the population is almost as big as the Boomers (32%). Jason rents in Toronto, makes $52,000 as a IT guy, rides a bicycle and the TTC, likes being urban, has no debt and puts money monthly into a TFSA with $18,000 in it. That makes him typical, too.â€

This story is all too familiar to people in high priced Southern California. The vast majority of people in SoCal that bought pre-bubble have locked in some solid games. Yet how do you unlock those? Heck, the advice is to stretch to the limit (meaning forego the retirement accounts or other alternatives) and double-down on housing. We have seen the resurgence of adjustable rate mortgages (ARMs) to stretch the budget even further. So all the money goes into this one asset. But then what? The truth is most will want to move up with that equity they build up (the average hold time in housing is seven years across the U.S.). So many simply kept resetting the clock up on the property ladder. Age doesn’t care about your new 2,000 square foot house with granite countertops and if you have a mortgage, you’ll need to continue generating income to pay the bills.

The story above also highlights the story of one of their “kids†at 28 that has a job in IT and makes $52,000 a year. How in the world is an $800,000 home even feasible for their son? Even a $400,000 condo would be a stretch. Should he save for a down payment? If he starts now he might be able to buy in his forties. But then a home will cost $1.2 million according to some analysts based on future projections (simply using the current trajectory in Canadian home values).

The young in Canada seem to be facing similar predicaments to those in the United States:

“Incredibly, almost 45% of all young people between 20 and 29 live at home. The jobless rate for the cohort is about 14%. Student debt averages $37,000 after a four-year degree. Underemployment is endemic.

And this is the big hope for so many Boomers – that the ‘next generation’ will pony up and bail them out? Good luck with that.â€

Living at home and massive student debt! A story near and dear to our hearts. As much as some Canadians would like to believe they are different from their neighbors to the south we are very much alike in our addiction to debt. We also apparently have a large portion of youth living at home. I can imagine this is more pronounced in high priced areas. Just look at the L.A. region in SoCal versus Vancouver in terms of prices:

Going back to 2004 home prices in L.A. adjusting for inflation are up 30 percent. A pretty big jump considering household incomes have not gone up in tandem. But just look at Vancouver:

Home prices are up 110 percent during this similar period! Vancouver makes SoCal look like an affordable paradise. It is interesting to know that Canadians are basically facing similar demographic challenges and have a massive amount of young people living at home. They beat us in hockey and they certainly beat us in going into massive debt.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

151 Responses to “The CA bubble that isn’t from California: Canadians come face to face with the paradox of golden real estate handcuffs and a younger less affluent generation.”

Most of the dynamics we had before our bubble burst, they are now going through. Canada will burst as well. Those HGTV shows are ridiculous.

Papa, check out where STL is on this upward mobility ranking.

http://www.bloomberg.com/visual-data/best-and-worst/least-upwardly-mobile-for-fast-food-workers-us-cities

Maybe things aren’t so bad in “flyover” country after all. There seems to be a lot of stats pointing to your hometown as a relatively decent alternative to the coasts.

Sounds nice and stress free.

But then you’re stuck in St. Louis (and I grew up there).

Outside of Clayton, Webster Groves, and Kirkwood, no thanks…

Spent most of my time in St Charles County, Downtown STL, Westport and Creve Coeur

Funny you should mention the HGTV shows.

I am Canadian but have been living in the USA for about 15 years now. I saw the effects of the first bubble. Especially where I live, which is Florida.

What is funny is when I chat with people here in Florida, they all ask the same question: are all Canadians rich? They watch many of those programs which are filmed in places like Toronto and they all assume that Canadians have money coming out of the wazoo.

Oh Canada!

But to step back South from America’s hat for a moment, what has happened the past few years specifically is theft by Quantitative Easing. The banksters print themselves money and buy valuable things, including the government and justice system. The money “trickles down” on the little people, devaluaing the currency by the time they get any. Taxation of income and basic essentials (mostly gas/workers) completes the cycle of wealth transfer from the increasingly poor majority to the bankster minority, preventing the printed surplus from hyperinflating the serfs into stampeding.

http://www.globaldeflationnews.com/anatomy-of-a-bubble-how-the-federal-reserve-and-the-u-s-congress-have-created-a-debt-crisis-of-historic-proportion/

I will start by reminding you of the words of one of the founders of the Austrian School, Ludwig von Mises:

“There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of voluntary abandonment of further credit expansion, or later as the final and total catastrophe of the currency involved.â€

The final chart reminds me of forgotten meme on this blog: “bubbles always burst past the mean.” Never happened with 1998-2006 RE bubble. Well, never yet.

Although the article doesn’t say all bubbles burst to below the mean, the author is predicting a Jim Tayloresque mean blow-out sometime in the next year or two.

aw jeez, another quote from a relic of Weimar. Listen, please, get this straight. Our currency, the world’s currency, by the way, cannot “collapse”, as long as we can pay our own debts by printing more money. Good lord, it’s so tiresome listening to this end of the world stuff. Your guns and gold and rice and beans will only fall in value.

I quite agree, but what will happen if the almighty dollar should somehow be replaced, as the world’s currency of choice? Let us hope that day never comes. Yup, borrowing money, then printing up more money to pay the debt is about as good as it can ever get.

That only works because of the strong economy in the states, and yes it is the strongest economy in the world, despite what some would have you believe. Biggest problem is one of inequality, even the Pope knows that! Watch the US economy skyrocket, if the minimum wage ever gets passed. Why, I wonder does the Tea Party hate it so much? Could it be that they want the economy to falter, for political reasons?

“That only works because of the strong economy in the states, and yes it is the strongest economy in the world, despite what some would have you believe.â€

That only works because of the strong military in the states, and yes it is the strongest military in the world, despite what some would have you believe.

There, I fixed it for you…

“I quite agree, but what will happen if the almighty dollar should somehow be replaced, as the world’s currency of choice? Let us hope that day never comes.”

Not in your or my lifetime.

“Listen, please, get this straight. Our currency, the world’s currency, by the way, cannot “collapseâ€, as long as we can pay our own debts by printing more money.”

Ah my friend, that’s not yours to decide, but your debtors. At some point they won’t accept dollars as payments: Your printed paper will be worth zero at point.

Also, printing “more money” when there’s hyperinflation going is only going to make situation worse as “debt” has to be renewed all the time and interest will raise according to inflation. Say hello to 100 000% interest rate.

Dollar as a currency doesn’t have any value outside buying oil and everybody knows that outside of US. Maybe you people haven’t realized it yet.

FED dumping 4 trillions of those to their ultrarich friends doesn’t help at trust issues at all.

Guns, preferably with ammunition, are ALWAYS worth something. Sell them for cash, barter them, shoot and eat a squirrel for brunch…… guns deliver, no matter how much the Huffington Post mocks them.

They are also good for keeping hungry people at a distance when rice and beans are scarce.

Think it can’t happen here?

Do some research on what really went down with looting after Hurricane Sandy.

Or pull up some video of the Korean storeowners during the King riots.

“Do some research on what really went down with looting after Hurricane Sandy.

Or pull up some video of the Korean storeowners during the King riots.”

Do you live in some god forsaken ghetto?

Yes. I live in what was just a few decades ago one of America’s most prosperous cities, earning the nickname “Smugtown USA” because it was such a bastion of middle class America. It is now America’s 5th poorest city and has one of the highest per capita murder rates in the nation.

And just because the LA area didn’t respond to the Northridge quake in the same way they did to the Rodney King acquittal doesn’t mean things will go down quite as peacefully as they did then. Cut off trains and trucks for a week in LA and you’ll see how quickly shit get’s out of hand (no food). The comment another person put up about potable water is apt too.

Your obviously political statement about guns, gold, seeds, etc. shows your complete ignorance of what desperate people are capable of doing in desperate times. If you weren’t around then you might not know that the LAPD retreated when the King riots began, leaving the civilian populous to fend for themselves (again, see video of the Korean storeowners on their roof’s armed to the teeth). As far as Hurricane Sandy, entire streets worth of stores were looted, but the media covered it up to maintain the image that things weren’t as bad as they seemed.

Don’t go beating on your neighbor’s door begging for help when that quake hits, be a man and do some preparation ahead of time. A $300 shotgun and $25 worth of shells will still be there 5-10 years from now when you need it. Seems like a wise investment to me.

Troll Mike M was obviously not in LA during the riots…

“Yes. I live in what was just a few decades ago one of America’s most prosperous cities, earning the nickname “Smugtown USA†because it was such a bastion of middle class America. It is now America’s 5th poorest city and has one of the highest per capita murder rates in the nation.”

Well, then, why don’t you move? Or, do you enjoy the paranoia and fear? (And, the rice and bean recipes?)

Sure, I remember the Rodney King riots. Who doesn’t? Hey, more power to those little Koreans defending their businesses. But I’ll bet a lot of them moved to somewhere else after that little event. They’re smart. Not like some white people who relish their guns, and seem to look for a place to use them. I mean, good lord, it’s a big country. Too bad you’re stuck in a place where you have to cower behind bars on your windows, waiting for the savages to attack. jeez. I lived in NYC for twenty years, and I even drove a cab for nine months (in the seventies!), but, never thought it necessary or even wise to carry a gun. Like it would do me any good 99% of the time anyway. Probably wind up getting shot with it.

And, really, stop with the Sandy stuff. The media would be all over looting and such if it happened. Sells papers and air time. Ever hear of the NY Post? They would love to print stuff like that if it happened.

Have fun. Don’t shoot yourself. (You do know that most murders are committed by people who know the victim, don’t you? and, then there’s that nasty suicide problem among gun owners………..)

@What?

“Troll Mike M was obviously not in LA during the riots…â€

You know, you really come off as an ass most of the time around here. Just sayin’.

Troll, indeed.

“more power to those little Koreans” Nice; is that kind of comment acceptable bigotry on Huffington Post?

“They’re smart. Not like some white people who relish their guns, and seem to look for a place to use them.” Ah, more of the Commie inspired Alinsky tactics. Divert attention and then attack the personality….. because you can’t win the argument.

“I mean, good lord, it’s a big country.” Yup. I spend my free time traveling it on my motorcycle.

“Too bad you’re stuck in a place where you have to cower behind bars on your windows, waiting for the savages to attack. jeez.” I’ve been to war, I’ve spent a career as a ghetto fireman (making about 1/2 of what they make out there). Owning a gun isn’t a sign of ‘cowering in fear’ it’s common sense and unlike in SoCal bars on windows are illegal here. I’ll leave when I’m done here.

“I lived in NYC for twenty years, and I even drove a cab for nine months (in the seventies!), but, never thought it necessary or even wise to carry a gun.” That’s your choice. Don’t tell me what to do and I won’t tell you. Or are you unable to keep from demanding others live as you see fit?

“Like it would do me any good 99% of the time anyway. Probably wind up getting shot with it.” Meh. If you don’t understand that it’s that 1% when it’s needed that you wish you had it than I guess you will be dropping you health coverage, auto insurance, homeowners, etc. You’d be a fool to invest money in those, right?

“And, really, stop with the Sandy stuff. The media would be all over looting and such if it happened. Sells papers and air time. Ever hear of the NY Post? They would love to print stuff like that if it happened.”

Let’s see…. Huffington Post, ABC, CBS, NJ.com, Christian Science Monitor, Daily Mail UK, even Gothamist ran stories on it but doing a Google search is hard to do. Granted, the majority of them only did stories that resulted in arrests because they think that the people are all good and kind. I’m sure you doubt the annual murder totals in Chicago too because the national media refuses to report on that.

“Have fun. Don’t shoot yourself. (You do know that most murders are committed by people who know the victim, don’t you? and, then there’s that nasty suicide problem among gun owners………..)”. I know all about guns, I carried one for 6 years during that stint in the Marines. From your reply you know very little about them other than what MSNBC tells you.

Make sure you know how to shut off the gas supply, anchor your shelving and other things to the walls, have cabinet door locks installed and keep plenty of fresh water/canned food on hand. Your kindhearted neighbors will be expecting you to chip in for the good of mankind if that next quake hits onshore. I would say the Boy Scout motto to you but you probably hate them because the media told you they aren’t friendly enough to gays. Oh screw it….. ‘Be Prepared’.

Mike M: “and, then there’s that nasty suicide problem among gun owners………..)<<

Huh? What "problem"? You sound as though you believe that suicide is a "problem" that just "happens" if you own a gun.

Suicide doesn't just happen. It's a choice. If a person really wants to kill themselves, they'll find a way, with or without a gun.

There's been a surprising amount of suicide in Santa Monica over the past 20+ years I've leaved here. Mostly jumpers.

Back in the 1990s, a guy jumped out of the Huntley Hotel on 2nd Street. I was around the corner and heard a loud BANG. I later learned it was a body hitting a pavement.

Another young man jumped out of the building I live in a few years ago. He died.

There was another guy who jumped off the roof of a downtown parking lot a few years back.

An Asian woman jumped off another building downtown. She survived. She was on drugs, so maybe that wasn't a suicide attempt.

A high school kid jumped off some building a few years ago. He died.

And they occasionally find bodies along the PCH, at the bottom of the bluffs. Sometimes suicide is suspected. Sometimes homeless-killing-homeless.

If you think guns cause suicide, perhaps we should also ban tall buildings.

He is a parrot. He hasn’t said anything genuine yet and probably can’t. Wait, he was a cabbie in NY. But it was in the 70’s so that isn’t even original. “Eh dere Edith…. dem gun’s dere might make da Meathead off hisself. Good ting he’s too much of a peacenik to use em.”

I agree with you about suicides, having been to more than a few at work. Hanging, along with pills, trump shootings in my experience. Gun assaults and homicides in my statistcally violent city also are almost exclusively gang turf/drug dealing or domestic related.

http://www.hsph.harvard.edu/news/magazine/guns-suicide-the-hidden-toll/

“Suicide is the 10th-leading cause of death in the U.S.; in 2010, 38,364 people killed themselves. In more than half of these cases, they used firearms. Indeed, more people in this country kill themselves with guns than with all other intentional means combined, including hanging, poisoning or overdose, jumping, or cutting.”

20,000 people out of 310+million off’ed themselves via firearm and 40,000 out of that 310+ million went out like that. Yes, it is such and epidemic. Such a tragedy that we need to remove the Rights of millions. How many failed attempts did the great and glorious Ivy League study fail to account for? How do you quantify that which can’t be known?

If you drove a cab in the 70’s I will assume you are a baby boomer. Your generation has done more to destroy this once great nation than any other in our history. The sooner the dirt nap comes for the majority of you the quicker we can unscrew all of your Commie inspired ideology. There has never been a more spoiled, know-it-all, we want it now but never want to pay for it, do as I say and not as I do generation. Maybe suicides would be lower if your generation hadn’t done everything it could to destroy America.

I reverse an earlier statement. Please shoot yourself.

Nah, I want to be around when your 80 and Gen X & Y are in total control so we can strip all of you of everything you’ve demanded and never paid for your whole lives.

Your entire generation, one based on hating your hardworking parents, then stealing from the children you didn’t want to keep you from having ‘fun’, living a lifetime of dismantling a nation other’s spent centuries building….. it’s going to be awesome.

Off to the home with you Grandpa. Sure…. we will visit soon….. oh, the lady you demanded be allowed into America to ‘better her life’ doesn’t understand English well enough to keep your Depend’s changed…. I’m sorry, but I have my free healthcare now and am ‘free to not work’ so you’ll have to figure it out because we are all going skiing this week. Ciao!

You are the one who is cowering in fear, because you know that train is a comin’. If only you had bought a gun way back when some young smartass suggested it on a housing bubble blog…… you could end it all with one pull of the trigger.

You first, Cabby Mike. Rent a gun and eat a bullet. It will be far more pleasant than the inevitable that is coming for you, I assure you. Hopefully you boomers will get what you deserve – put out to pasture in appropriate conditions (read: FEMA/Obamacare death camps) that will make Auschwitz look like Club Med. Hard work will set you free, too bad the vast majority of you godless free lovin hippy assholes never did a real day of hard work in your entire worthless lives.

“Voluntary abandonment” lol we can dream. … what I am very confused about is when our housing bubble crashed Americans debt to income ratio was that about 125 percent. At that time Canada s debt to income ratio was 145 percent. Yes they never had the housing crash that we had. How can that be? Their banks are in bed with our banks are in bed with other international banks. They don’t just sell debt to Americans. Why did their housing bubble stay inflated and continue to inflate when here and in Spain and Italy in Portugal et al crashed like a rock.?

I believe Canadian mortgages are locked into rates for 5 years, which means you can’t securitize them like you can American ones. I might have that wrong or they might have changed their lending laws/norms.

When the exchange rate flip flopped I stopped my nearly monthly drives across the border so I don’t have the same amount if contact with my Canadian friends as I did in the late 90’s/early-mid 2000’s.

Toronto has seen a massive boom over the last 10 years while across Lake Ontario in western NY our cities are dying at ever increasing rates. Toronto is an international city on par with NY, London and Paris and much more so than places like Boston and San Francisco. Toronto and the GTA (greater Toronto area) IS Canada to most non-Canadians.

Big difference my Canadian Caknucklehead friend pointed out, at least versus California, is that all mortgages are recourse in Canada-land and the banks have a history of coming after homedebtors that default.

You want to know what is DIFFERENT?

Oil hit $147 in 2008 – it’s never under $100 even in a shitty economy – because we are out of CHEAP OIL.

http://www.csmonitor.com/Environment/Energy-Voices/2013/0412/The-decline-of-the-world-s-major-oil-fields

High energy prices = less consumption because everything including the fuel in your tank costs more = layoffs = less tax revenue = government cutbacks, layoffs and debt increases = less consumption = more layoffs = less taxes ===== economic death spiral.

Here is what is different – Bernanke and other central bankers + the leaders of global governments know full well that we have reached THE END OF GROWTH. They know we are FUCKED no matter what they do.

Like when Spain pillaged south american gold and lived large – when the gold ran out they were FUCKED.

The cheap oil is gone – nothing can replace it – NOTHING.

So what would you do if you KNEW that the world was fucked?

Of course you’d do absolutely ANYTHING to delay the unavoidable collapse – anyting that would allow you to continue to enjoy your awesome life – because what comes after is going to make Mad Max look appealing.

You’d do shit that you would in the past never DREAMED of doing:

Print trillions? Fuck it – we are doomed anyway

Ignore massive corruption in govt and banks? Fuck it – we are doomed anyway

Lie about economic data? Fuck it – we are doomed anyway

Students using loans to pay rent and buy iphones? Fuck it – we are doomed anyway

Healthy people on disability in droves? Fuck it – we are doomed anyway

And on and on and on……

Remember when Bernanke gave his farewell he said “I know a lot of people are pissed off at me – but when they realize at some point why I did what I did – they will understand”

Translate: “We are fucked – there is nothing that we can do to fix or soft land this fucker – so we do ANYTHING – I repeat ANYTHING – that keeps the system running for another year – another month – another day – another – minute – another second – because when this fucker blows most if not all of us DIE’

Remember this – industrial farming requires gas and oil inputs for pesticides and fertilizers. If they are not CHEAP industrial farming ends. Industrial farmed soil is DEAD. It would take 3+ years of intensive organic inputs to grow a crop in this DEAD SOIL.

We have 7.2 billion people to feed – these starving hordes will eat everything that moves or grows – they will rape this fucker to death – including gorging on each other’s entrails.

They will tear down every mother fucking tree that stands and use them for cooking and keeping warm

And what about the thousands of spent nuke fuel rod ponds – how to you maintain that shit when there is total chaos all around? No cooling and the fuckers blow sky fucking high — just one of these is many thousands times worse than fukushima and chernobyl combined.

Like I said – WE ARE FUCKED. Bernanke knows it – Obama knows it – Merkel knows it – Yellen knows it – they all know it.

That is why THIS TIME IS DIFFERENT. And that is why policy makers are engaging in seemingly suicidal/insance policies.

We are ALREADY DEAD.

Soooo… let me get this straight… this time is different because we are fucked? Hmmm… So how can I make a buck off of the carnage?

Thanks for a better f-bomb drinking game than even the late, great, Scarface!

Seriously, can it be that simple of a zero sum game? World War O instead of World War Z? Well, maybe. But, there will be more inputs to your model besides disappearance of cheap oil; potable water being even more critical, IMO. How about a rise of super viruses? Like that one, too.

Yes, the giant-brained rats that humans are, we’ll probably continue our voracious natural resource binge into our own Easter Island-style oblivion. But, there’s still plenty of time for several more lovely SoCal boom-bust RE cycles for us all to obsess over in the mean-time.

America, Fuck Yeah!

TTIRID: “Like I said – WE ARE FUCKED. Bernanke knows it – Obama knows it – Merkel knows it – Yellen knows it – they all know it.

That is why THIS TIME IS DIFFERENT. And that is why policy makers are engaging in seemingly suicidal/insance policies.

We are ALREADY DEAD.”

Governments & policy makers have been engaging in suicidal/insane policies since they first existed with few exceptions and those civilizations were ultimately toast too. Different times, different policy makers, different insane suicidal policies. Once we’re born we’re doomed to die anyway so might as well enjoy living, even as a zombie.

exactly! The only thing that will keep this party going is to keep this party going. Meanwhile they’re working on the soft kill spraying the skies with toxic aluminum and barium poisoning the water poisoning the food supply with pesticides and genetically modified organisms not found in the natural cloning process, pushing pharmaceutical drugs with toxic side effects, and that’s not even counting the enjoyable substances like tobacco and alcohol, cancers gone crazy, the soft kill.

Once we got to stocking up on guns for the zombie apocalypse here in crazytown I knew it was only a matter of time before Chemtrails came trotting along…

April Brent Crude went below $100 yesterday

A key difference between Canada and the U.S. is that there is no tax deduction for carrying a mortgage, so most buyers look to pay off their home within the first 15 years. Just like Southern California, there is a lot of Chinese money absorbing inventory in Canada. I think that the So Cal market faces greater headwinds despite Canadians’ historical penchant for being over-levered on personal debt; economically speaking, Canada has its act much more together than the folks in Sacramento and LA City Hall…and ultimately, that determines how sustainable high housing costs will be.

What?

In other words, you can get away with high housing costs if the private sector is generating incomes that can reasonably support such prices. See: Silicon Valley. From an anecdotal perspective, those in Canada in the private sector can better afford homes than those in the private sector in Southern California, generally speaking. Average household income is $53k in So Cal, so you pretty much have to spend 9x to 10x income to buy a property that you hopefully can pay off in 30 years. Canadians tend to buy with a 15-year window in mind–and no rationalizing the purchase in terms of getting a federal tax deduction since no such deduction exists up there–and at a lower multiple than what So. Cal. offers. That’s the basis for my conclusion.

I work in Silicon Valley and at a Dot Com. The idea that there is so much money here is a little over blown. Housing for the average manager/director level is tough and many live in the outskirts. I worked for a Canadian tech company for 7 years ending in 2009. They actually pay significantly lower salaries than in Silicon Valley. I doubled my pay by changing jobs and moving from LA to SC while my rent stayed the same. Not sure where you are getting your antidotal information from…

@KR wrote: “…Just like Southern California, there is a lot of Chinese money…”

Yes! Millions and millions of Chinese investors flying in on their magical Unicorns to open houses carrying baskets filled with solid gold bricks.

Now, after you recover from your magic mushrooms…

Estimates are that more than 70% of the rich Chinese have already left China so the capital flight from the Middle Kingdom is over. The areas in SoCal where “allegedly” hordes of gold laden Chinese buyers plopped down is the San Gabriel Valley, and Irvine. The 310 area code is largely devoid of signs of Chinese buyers carrying wheel barrows of gold bullion. Ditto too the 818 and 323 area codes.

Add the 562 area code as another SoCal region where the sign of the uber rich Chinese with suitcases of gold is mostly non-existent.

Well, they’re real in the Greater Toronto area. They were real when I was selling my place in Carmel Valley. They were real as sellers for about half the properties I’ve looked at in the South Bay. I don’t know where you guys are going with your observations–I pointed out about a month or two ago that 64% of all native millionaires have already cashed out of China–obviously, I think Chinese money is/was bubblicious. The home was a great place to stash the cash, so to speak…won’t stay there forever, I’d imagine.

“But it’s a house. No dividends or interest. Just property taxes, maintenance, insurance and eight hundred grand of locked-in equity which must be released, or these folks are going to run out of money before they run out of time.”

Which, come to think of it, is even worse than gold, because the precious metal doesn’t require storage (well, not if you dig a hole in the back yard) and maintenance costs. Just no dividends and interest.

This is going to take so long to stabilize, for the water to find it’s level. Millions of these homes will be left to estate sales, because the Boomers will be stuck, and the kids will just cash in for whatever they can get, because they either can’t afford them, or don’t want them. I’ll give it 25 years, at least. Funny how some thought that the greatest asset bubble in history was just going to be a blip on the radar, and it was going to business as usual in a few years. Sorry, but, the air is coming out of this balloon, one way or another.

The dividend a house provides is either rental income or the utility of having shelter (not having to pay rent).

That’s a pretty big dividend.

“The dividend a house provides is either rental income or the utility of having shelter”

Eaten totally by various taxes, renovation evey now and then and value depreciation: No dividends. Space and comfort it might give but as a investment it’s very bad.

Same amount of capital invested to various places would bring income to pay the shelter without tying all the capital into single object.

High risk, low profit.

“Eaten totally by various taxes, renovation evey now and then and value depreciation”

True for some RE purchases no doubt, but there are many many more examples of the dividends far outweighing taxes/renovations/depreciation.

You know I have been noticing more trolls/shills as of late. I also had an old landlord (RE agent) ask me if I was interested in looking to purchase a new home. I am starting to wonder if all this troll/shill activity is a sign that things are already starting to fall apart. Could this be a last ditch act of desperation? Maybe it is all in my mind…

I see you calling people shills and trolls an awful lot. All this despite contributing very little of substance in any of your posts. What’s your definition of a shill?

I enjoy reading the discourse and civil arguments on this site.

Of course you will probably call me a shill too.

No Alex you are a clown. Remember that this is a “HOUSING BUBBLE” site. It is not a shocker that RE agents/shill/trolls frequent here when there is no work for these bozos. I really couldn’t care less if a clown thinks I do not add to the discussion. I have been commenting on this site for many years and you are the first to state that I don’t add to the conversation. I am always open to intelligent discussion but “you gotta live somewhere” and “life is short” are NOT valid arguments against the fact that we are in the throes of a housing bubble. I do call people out who are obviously trying to sell us something. Quite frankly I am tired of arguing the point that the sky is up, the ground is down and we live somewhere in between. You can enjoy the land of make believe with the clowns, shills and trolls…

DEFINITELY no shortage of trolls, shills, and clowns among the peanut gallery here on Dr. HB…

What would be the purpose of RE shills coming on to this board? If you truly believe there are shills on this board that believe they can somehow affect the market and their bottom line, you’re delusional.

Granted I’m not on this board everyday, but the only shills I’ve seen on this board are the ones that post a quick one-liner and then a link back to their blog.

Given how restrictive posting is here I’m surprised the moderators let that sort of thing through.

I’m not saying that the RE shills and trolls can affect fuckall. All they can do is spew their bullshit pro RE rah rah mantra in the vain hopes of somehow convincing their own selves as to the validity of said bullshit they are spewing.

For the rest of us it’s just the same old tired bullshit we’ve heard for the majority of the past decade plus. The weaksauce arguments and “points” the bulls have been making of late and continue to make even now are the same ones we heard back in 2007 when the RE flight had already stalled out and was just beginning its glide into the turn and nosedive of bubble popping.

If anything, despite ALL of the massive intervention to keep the market sustained and afloat and the asset bubble somewhat re-inflated, the charts are sure as sin looking EXACTLY like the tail end of the bull trap. See: phases of an asset bubble.

Off topic article from ZeroHedge: http://www.zerohedge.com/news/2014-03-11/fannie-freddie-crash-after-bill-unwinding-gses-passes-hurdle

My comment there: “I disagree timmah. This will happen as it was the plan all along. When the greater fool lemmings who bought between mid 2012 and now default gubemnet and the Big 4 banks don’t want to be anywhere near this stuff. the last 5 years was all about transfering the housing loans and inventory to lemmings and specuvestors. QE and ZIRP are over in 2015 and the echo bubble will likely be fully popped.”

The biggest takeaway from comparing Canada’s home prices is that you can’t predict home prices based on a chart or a ratio.

Imagine it’s 1992 and you’re thinking about buying a home in Vancouver. You do the math and find out that the median income / home price ratios is 6.0. Wow, greater than 2.5? That means it must be a bubble right? Right?!?

Fast forward 20 years later, and not only has the ‘bubble’ never popped, the ratio is 11.0 now.

Clearly, the rate of increases ‘feels’ unsustainable, but predicting that it’s going to fall by xx% by xx/xx/xxxx date is a fool’s exercise.

…Therefore you should always be buying – yesterday, today, tomorrow, the future. Right MB? Right?!?

No.

Treating homes like stocks and trying to time an entry and exit point is more often than not an exercise in futility.

IMO, rather than spending time researching the big macro picture (ratios, interest rates, employment, etc) someone looking for a home to live in should spend their time researching individual neighborhoods and homes.

Find a neighborhood that has good long-term prospects. Perhaps a neighborhood that is about to gentrify, or a metro station is beginning construction. The land ends up being more valuable than the home, so look past pretty baubles like appliances or flooring.

Focus on that neighborhood and wait. Know it inside out, and wait. Wait until you see a home that has potential, flaws that can be fixed with time.

I’d even suggest getting a realtor’s license. The barriers to getting one are slim, and you can use it to save a few % on your home purchase. With the internet these days who really needs a realtor?

IMO, spending time doing the above is time better spent than trying to figure out the future of housing.

I love the cool refreshing taste of koooooool-Aid. It is cool, sweet and artificial!!! Hey, this batch seems to have an off taste… Bottoms up!!!

“trying to time an entry and exit point is more often than not an exercise in futility.”

“Find a neighborhood that has good long-term prospects. Perhaps a neighborhood that is about to gentrify, or a metro station is beginning construction. The land ends up being more valuable than the home, so look past pretty baubles like appliances or flooring.”

Timing

“Focus on that neighborhood and wait. Know it inside out, and wait. Wait until you see a home that has potential, flaws that can be fixed with time.”

Timing

How is this not contradictory?

If I may, MB…

As DRB has pointed out….due to market conditions we are all FORCED into being speculators when deciding to purchase RE these past years.

What MB is proposing is a particular sort of “timing” different from the AM radio ad speculator’s handboook, which is largely based on interest rates, inventory conditions and price momentum.

Rather, MB is proposing the type of “timing” that used to be “common sense” when deciding on buying a property….you know, “location, location, location.”

Two completely different versions of timing and therefore not contradictory.

“location, location, location†is straight out of “the AM radio ad speculator’s handbookâ€â€¦

MB – I don’t completely disagree with what you are saying but we do need to accept the fact that the US housing bubble did pop. Those ratios, especially debt coverage related did in fact work but it took a few years longer than anyone expected (tech bubble was similar). The burst was catastrophic to the point where even stupid low interest rates couldn’t save it and it would have taken the financial system with it were it not for an “everything and the kitchen sink” effort. Realize that effort is not remotely done and we will have a rigged market to support pricing for some time still – probably another 5 years – so a decade in full. Maybe longer.

It most certainly is a contraction as the use of timing is both denounced and advocated in the same message.

Your response simply confirms my point that timing is an input for different scenarios.

“How is this not contradictory?”

I’m suggesting that a buyer looking for a place to live, buy the right house as opposed to buy at the right time.

A flipper or speculative investor NEEDS to time the market. If the housing market starts stagnating or dropping, the flipper will take a huge loss.

A homebuyer that’s looking for a primary residence should be less concerned about the overall housing market, but more concerned that they find a home that they can comfortably afford in the neighborhood they want to settle down.

“How is this not contradictory?”

I’m suggesting that a buyer looking for a place to live, buy the right house as opposed to buy at the right time.

A flipper or speculative investor NEEDS to time the market. If the housing market starts stagnating or dropping, the flipper will take a huge loss.

A homebuyer that’s looking for a primary residence should be less concerned about the overall housing market, but more concerned that they find a home that they can comfortably afford in the neighborhood they want to settle down.

Paper gains are not realized until you sell, but either are paper losses. If the buyer is happy about their fixed monthly expenses what does it matter if housing prices are falling or rising around them?

If one want a “good deal” on a home, I think time is better spent getting a RE license to save commission, and then submit lowball offers on good homes and trying to negotiate a lower selling price rather than waiting for the market to reach a certain point before jumping in.

Most people are buying individual uniquie homes, not investing in RE futures.

Slim said: “we do need to accept the fact that the US housing bubble did pop”

Yes it did. Sitting here now in 2014 I can take a look at the C/S chart and see the popped housing bubble in 2009. When someone tells me they own a home purchased between 2005 – 2008, I immediately feel badly for them without knowing the details of their purchase. I assume they must have taken a huge hit.

However take a look at the LA housing bubble that peaked in the early 90s before popping in the mid-90s. If someone tells you they bought a home in 1990 and still own it do you feel sorry them? That was ONLY 20 years ago. The 2000s bubble far dwarfed that one.

Bubbles will come and go. It’s part of our financial system these days. There will probably be a bubble down the line that dwarfs this one and when it’s scaled, the 2009 bubble will just be a small blip.

MB – You really need to keep to selling/investing in your RE niche because you have no idea what you are talking about.

“Bubbles will come and go. It’s part of our financial system these days. There will probably be a bubble down the line that dwarfs this one and when it’s scaled, the 2009 bubble will just be a small blip.”

These days? WTF??? BOOM BUST IS A LAW OF NATURE THAT HAS BEEN ARROUND LONGER THAN THE CONCEPT OF MONEY, BARTER, EXCHANGE, ETC YOU BOZO!!! Tell me a time in human existence where boom and bust was not a part of “finance”?

BTW I am in finance…

MB is suggesting you perform something similar to microeconomics vs. macroeconomics…instead of “macrotiming” (interest rates, inventory, zip/city/state/national numbers et al.) you should be “microtiming” by focusing just on a particular neighborhood, street, house. Be a stalker.

Loved that contradiction, though – “Attempting to time the market is an exercise in futility. Instead, you should time the market.”

“However take a look at the LA housing bubble that peaked in the early 90s before popping in the mid-90s. If someone tells you they bought a home in 1990 and still own it do you feel sorry them? That was ONLY 20 years ago. The 2000s bubble far dwarfed that one.”

EXACTLY! Even better, just take a look at the Japanese property/housing/land bubble of the late 80’s which popped around 1990. That was almost 25 years ago and look where they are now. Oh wait, that’s right…they’ve been suffering from the results of that massive RE/stock credit/debt bubble and subsequent deflation battle for 2.5 decades and have property values that are STILL 50-75% below peak “values”.

25 years on and they are only getting $.50 on the dollar on that million dollar Tokyo suburb shoebox…and $.25 on the dollar for most of the country (and that was before the Fukushima earthquake/tidal wave/nuke plant meltdown)…

MB- You are the one that said “these daysâ€. That is your words not mine!

“If you’re truly involved in finance, you should understand the proliferation of credit is going to lead more frequent boom and bust cycles.â€

I would argue that the existence of money, debt and banking exaggerates the impact of boom and bust. I do not agree with frequency impacted by the increase in credit. There have been many times in the past where we had banking crisis after banking crisis when we had much lower debt to GDP ratios. I would argue that we have actually exchanged frequency with size by Fed manipulation. Our crises appear to be less frequent with larger and larger size. I would argue that the next crisis will be even larger than the last.

“tech & private equity†I think you are in the throes of the bubble if that is your line of work. You are most likely so deep in the forest you will never see the trees until the forest is burned to the ground…

I couldn’t care less about your personal B/S, I am trying to understand your motivation behind your comments which generally sound like a salesman trying to con someone into taking your bait…

“The biggest takeaway from comparing Canada’s home prices is that you can’t predict home prices based on a chart or a ratio.”

“Imagine it’s 1992 and you’re thinking about buying a home in Vancouver. You do the math and find out that the median income / home price ratios is 6.0. Wow, greater than 2.5? That means it must be a bubble right? Right?!?”

It’s interesting that your example begins with 1992. Ten years later in 2002, it was at 6.0. Conveniently skipped over that reset beginning in 1995.

I thought the housing cheerleader meme was to look at rent parity because local incomes don’t matter? So let’s look at rents in relation to home prices in Vancouver and “do the math.” From what I can tell based on a cursory search of the Interwebs is that home prices there started to decouple from rents around 2002 and are now separated by more than 3x.

“Clearly, the rate of increases ‘feels’ unsustainable, but predicting that it’s going to fall by xx% by xx/xx/xxxx date is a fool’s exercise.”

Yes, “clearly” something doesn’t seem right. To bring up “xx% by xx/xx/xxxx date” seems like a distracting exaggeration. Most people are simply trying not to get burned financially. Given that, would you suggest that someone looking to buy in Vancouver today can safely ignore the past and present data?

“It’s interesting that your example begins with 1992. Ten years later in 2002, it was at 6.0. Conveniently skipped over that reset beginning in 1995.”

I chose 1992 because it was the earliest date from the chart I saw. I chose the earliest date because some people believe there’s some law that says price:income ratio should 3.0 and given enough time it will revert to that ratio. Since you also did your research, did it ever come close to that ratio in the last couple decades? If someone were waiting for that magic ratio as a sign to buy, how long would they be waiting? .. and how much longer?

Investors looking to purchase investment properties to rent out absolutely need to consider rental parity.

If someone is looking to buy a home in Vancouver, I wouldn’t make a blanket statement to them and tell them NOT to buy. I’d say the same thing I posted upthread. Buy a home you can afford that you want to live in long-term.

Let’s be clear. I am not predicting that housing prices in Vancouver are going to keep rising. I’m not even predicting that they will stagnate. I’m saying: Nobody knows what the housing market is going to do.

Anon, you’ve obviously looked a income:ratio chart and price:rent chart for Vancouver. Without the benefit of hindsight, at what point in the last 20 years would you have felt it was safe to purchase RE in Vancouver based on those charts and why?

MB, you asked “Without the benefit of hindsight, at what point in the last 20 years would you have felt it was safe to purchase RE in Vancouver based on those charts and why?”

It depends on each individual situation. There’s no one size fits all answer. That said, it has become increasingly less safe since 2002.

“If the buyer is happy about their fixed monthly expenses what does it matter if housing prices are falling or rising around them?”

This is where you and I mostly differ. From the perspective of a career oriented person with enough working years ahead, mobility is increasingly more of an unavoidable reality of modern life. Life is becoming more complicated which demands flexibility and agility to stay above the fray. We’re in the Information Age where a lot of inputs that weren’t even available a few years ago are now used to make decisions. Employers and the financial system’s beneficiaries are exploiting this. Given all of that, in the context of mortgaging a house, the risk of exposure to having to unexpectedly sell in a down market is greater when you can’t plan like you used to.

I believe it’s a disservice to folks to suggest that they hinge their financial future on a simple methodology of where a monthly payment fits with today’s circumstances. To hedge risk is more complicated than that. People are free to stick their heads in the sand to their own peril. Who knows, maybe they get lucky and don’t have to worry about anything and everything I stated is meaningless. Personally, I’ll stick with my gut intuition.

What do you do for a living?

This question is at you MB…

Of course bubbles have always been in existence, did I ever say it was a modern problem?

If you’re truly involved in finance, you should understand the proliferation of credit is going to lead more frequent boom and bust cycles.

My line of work deals with tech & private equity. Are you going ask me my net worth? if I own or rent? my shoe size?

Beware the Ides of March……………

et tu brute

4 days and counting…

3 days and counting…

Come on guys/gals you can only comment on this thread in Shakespearean quotes…

2 days and counting…

Remember, kiddies, it’s ALWAYS a grrrrrrreat time to buy…OR sell…a property. At least if you’re a realtor/agent.

I sent this link to a friend of mine living in one of the burbs of Vancouver and here is what he said.

…Since independent houses in Vancouver are unaffordable for its own residents, the market is getting flooded with lots of new apartments and condos. I’m not sure if it is a ‘bubble’ as it should have burst during the last recession. But surprisingly held itself and is continuing to increase…

Perhaps this (condo/apt living) is indeed the future in some urban markets that had heretofore resisted increasing density.

The SFH (even in more and more inner suburbs) may be a relic of the Post WWII age that is approaching the end of its days, perhaps except for those who are already bought-in, or the few who have the money for a luxury good.

From an economic standpoint it’s largely decoupled from income in many market. From an environmental standpoint it has a high carbon footprint.

Prices of homes will go down now. In the budget last week, the Canadian government announced an immediate end to the immigrant investor program – under which people with a net worth of $1.6-million lend the government $800,000 interest-free for five years in exchange for permanent residency – and cleared out a backlog of tens of thousands of applicants, many of whom are from China.

The government said many of the people who use the program have only “tenuous†ties to Canada, and even some Chinese-Canadians in Vancouver – where many mainland and Hong Kong investors live – have the impression that some of the investor immigrants buy houses and cars and bring their families over, then return to China and Asia to do most of their business.

I’m sorry, Lee, unless these “Chinese” are carrying gold-plated luggage inscribed with, “Chinese RE speculator,” they do not actually exist and have no effect on any real estate dynamic in play. Try again.

Even if these mythical Chinese (aka “rainbow unicorns”) existed, their influence would have to impact the entire country of Canada in order for their purchasing activity to be relevant. Vancouver? Meh. Nobody really wants to buy there.

For example, it’s not enough for Chinese to be buying up inventory in the San Gabriel Valley and Irvine (again, watch for the gold-platted suitcases to be sure), for Chinese to have any real effect on SoCal real estate AT ALL they have to be doing it 1800’s Spanish Hacienda-style to be relevant.

Hoping their bubble bursts at some point because I would love to move there. The US has become a country that only caters to the wealthy and squeezes the middle class out of a decent lifestyle more and more. I no longer have any hope that this will ever change and at least with Canada they give their middle class affordable health care.

I had a Canadian friend who loved Canada’s free health care. Until she got sick. Then she changed her mind. She told me she’d been wrong to admire Canada’s health service.

She had to wait 2 years for some oral surgery. Canada eventually sent her to a California dentist to have it done.

Even then, it took over a year to complete the surgical process. Canada kept sending her to the U.S., and back to Canada, several times over the course of a year.

But if you’re friend had a bad car accident with several broken limbs she wouldn’t be facing 10’s of thousands of debt to go with her recovery. Better to be covered against catastrophe and wait or pay out of pocket for non life threatening stuff IMO. Hell, she could have flown to Mexico instead of Cali and got the oral work done for a few grand I’m sure…

I live in Toronto, Canada and you are correct about housing prices here and in the GTA (Greater Toronto Area which includes Mississauga). Housing prices here are absolutely ridiculously high. The $900,000 house you cite in your article is cheap compared to prices in the mid-town area where I live. In my area, $1million will not buy you much house…maybe a tiny semi with no parking.

Will Toronto real estate prices crash – doubtful – slowly decline, perhaps.

What would it take to drive down prices in Toronto

1. High Inventory – but there’s no inventory in Toronto and that keeps prices high. People (boomers) are living longer and longer. The first of the boomers are somewhere between age 65-70?? People are now in their homes until early 90’s. As long as they eat right and exercise, they can easily stay in their homes.

2. Higher Interest Rates – yes, rates have gone up a bit, but they are still extremely low relative to historical rates. Once mortgage rates start rising, this will cause some pain to those who have borrowed too much.

3. Downpayments – For a conventional mortgage in Canada, one needs to put down 20%. This is getting harder and harder to do as home prices continue upward. I’ve heard that approx. 65-70% of all outstanding mortgages are now insured (ie. high ratio mortgages). Canada has just increased the insurance premiums, so this will impact demand. However, this doesn’t impact people buying the $1mill+ homes in Toronto as mortgage insurance hasn’t been available on $1mill+ homes for several months now.

3. Pool of Qualified Buyers – Canada had a policy where if you wanted to immigrate to Canada, all you had to do was lend the gov’t $800,000 and your in. This led to a lot of immigration. People would buy a home at whatever price (because to the int’l buyer, prices in T.O. are still a lot cheaper than where they are from), park thier wife and kids here and then go back to where they came from and continue to make money and pay taxes there. Canada wasn’t getting much out of the deal and has announced plans to shut down this program. This will likely affect demand – especially in Vancouver. Toronto still has a lot of highly paid professionals in finance, education (universities), executives (Toronto has a lot of head offices), government workers and health care. Our health care system is providing shoddy service because all our taxes go to paying the huge salaries of doctors and in particular medical specialists. Even if the foreign buyer goes away, Toronto still has a large pool of highly paid workers. The question is when will the time come when all these people have bought Toronto homes – then who is left to buy? Will it be the Mississauga person who sells their $900,000 home and moves to Toronto and takes on additional mortgage debt? Unlikely. Will it be young people with rich parents who will give them a downpayment? There will be some but not the majority. At some point, everyone who wants a Toronto property will have one..but when does that occur?

4. Employment – we have lost jobs in Toronto but not to the extent of what happened in the US. There have been many high paying jobs that have been lost and will never re-appear, but as explained in #3 above, there still remains a lot of people who make very good incomes in Toronto.

Before we see prices drop in Toronto, we have to see prices stop rising. Torontonians (and those in the GTA) may feel smug about all the money they made on their homes, but they should keep in mind that their property taxes are based on what thier home is currently assessed at, not what they purchased it for. Torontonians – are you getting more services from your city today than 15 years ago? I know I’m not. This is an issue that city hall needs to account for. Where is all our property tax money going? Stop giving the police and firemen more and more money, while the rest of us struggle to maintain our lifestyles. I am very confused about Toronto real estate and don’t know when it will stop rising, but we have to be getting closer and closer to that point.

Confused in Toronto

“park thier wife and kids here and then go back to where they came from and continue to make money and pay taxes there”

What conclusion should we take away from this?

Is there empirical evidence which exists to back-up the claim that they “park thier wife and kids here?”

I’m questioning the motives of many of these foreign buyers, especially Chinese. A lot of statements made in these discussions infer that wealthy foreign purchasers are buying these places for family to live in. Perhaps that’s accurate, but where’s the evidence aside from anecdotes? I can’t help but wonder to what degree is the foreign purchasing simply speculative play that doesn’t have anything to do with real migration.

Anon – if you want empiracle evidence, ask yourself why the gov’t of Cda would stop the foreign investor program. If Cda was benefiting, then why wouldn’t we take a 5yr, interest free, $800,000 loan from foreigners all day long, walk the streets of Toronto and ride the subways. The amount of people who speak Mandarin/Cantonese is very big. Go to the private schools – the numbers of Chinese coming from China are big. Go to all the high end stores – Chanel, etc. – many Chinese buyers. Do some research on luxury retailers in China – their sales are declining because many wealthy Chinese have left China. They are now in cities like Vancouver, Toronto, NYC, various cities in Orange County and around LA, London (England). Anywhere where it’s safe, beautiful, high end schools, high end shopping, good gov’t benefits, etc.

You wonder about their motivation. I wonder about it too. Why are foreigners so desperate to get money out of their own country? Is it just simply for a better life for their families in a country with more social benefits? Is there an issue with how they made that money? Is there an issue with their currency? Look at the Russian ruble and how it’s tanked…I’m sure there are many happy Russians who purchased home in London, NYC, etc. ….Confused In Toronto

Confused….

Beijing prohibits any money transfers out of Red China that exceed $50,000 per annum.

Consequently, you are, on the whole, looking at illegal (by Communist capital control standards) escape monies.

Both Canada and Australia are being overwhelmed by this tide of flight capital.

Red China has created liquidity — via its dark banking system — that is epic by any standard. Beijing has created more liquidity that the entire rest of the planet… times two!

The desire of the Chinese to live with yet other ex-patriot Chinese is typical of humanity world-wide.

Americans living in Costa Rica like to live adjacently, too.

Consequently, entire Canadian and Australian neighborhoods have shifted — en masse — into Chinese ownership. This started thirty-years ago — and was noted by Barron’s magazine. Even that far back, Canadians were stunned as to how much the Hong Kong flight crowd was willing to pay — to get the right spot.

This is now being duplicated in San Francisco. Here and there, there are accounts of properties going for TWICE over the asking price — and in less than a week on the market. (!) Only one kind of buyer is that panicked. It’s politically incorrect to mention the ethnicity/ nationality of the new owner — so the MSM don’t.

In contrast, all of the California natives are more than willing to bump over to the next hill if it means that they can save a mere $750,000 — that is — the price spread is 100%.

These Chinese investors are more often than not investing illegally obtained bribes. The corruption at the top of Communist politics is legendary. It’s so bad that the regime has thousands of secret police chasing down Internet leads to stop the truth from coming out.

From time to time, a (corrupt) official is taken out and shot for said corruption. This is purely practical cynicism: the practice goes straight through to the top.

It’s so bad that some twenty-something girls have attained billionaire status because of their investment savvy. (AS IF) They are, of course, the blood kin of the top Communists — every time.

So the real estate purchases we’re seeing are but a trivial tip of the slush monies trying to escape the Communist system.

I’d estimate that at least $1,000,000,000 per month is trying to get out/ is available for residential property investment — per major real estate market. That’s a trivial fraction of the trade imbalance the West is running with Red China.

At the heart of all of this: the average Chang is being wildly under-paid back in China. If Chinese wages were take off, like they did in America a century ago, then most of the economic pressure seen today would fade very quickly.

(There’d be no relaxation of pressure on food prices, though.)

I’m across the lake in Rochester. I commented in reply to another person that I was under the impression that mortgages are only locked into rates for 5 years up there and then you refinance. Could you get comment on that? My info is out of date I’m sure as (mentioned back up the page) I don’t visit much since the exchange rate swapped to favor the Loonie.

Cheers from the south shore.

Justaguy….Cdns can lock in their mortgage rates for up to 10yrs now. In the ‘old’ days…ie. 15years ago, you could only lock in for up to 5yrs, but these days you can lock-in a rate for up to 10yrs. Which is another reason people feel comfortable taking out huge mortgages. Also, Cdns can’t deduct the interest rates on our mortgages. We have to pay everything with after-tax dollars. I can’t imagine how even more insane Toronto real estate would be if our interest rates were tax deductible. Also, another thing that we have to contend with in Toronto is double Land Transfer Tax. The closing costs on real estate here is utterly insane and yet it doesn’t seem to stop people. Where the heck are people getting all this money from? Yes, I know they are borrowing it, but still…I have no idea how an average family of 4 is making it. I think they are surviving as opposed to what they should be doing…thriving. Confused in Toronto

Gotcha. I thought it was 5 years back when then. I feel the closing cost/property taxes/etc. payment pain here in NY too. I pay more in property taxes on a $140,000 house here than friends in LA do on a $500,000 place in Redondo Beach. We NY’ers are mandated to have lawyers for closings, title search, tax stamp…. and on and on. Plus it takes 60 days minimum to close. Thanks for the info! Cheers.

In the I.E. Canadians are buying houses like crazy. No doubt due to the cheap prices in comparison to B.C. where many of them are from.

China has purchased large areas of oil deposits in Canada, and flocks of people from Hong Kong buy in Vancouver.

Just the recycling of money.

Is it “just the recycling of money” or the setting up of dominoes?

As long as the flood of foreign (mostly Chinese in Cali, SA and EU in Florida, and Russian in NYC) keeps flowing in they’ll probably be ok.

But where do these Russians, Europeans, SA’s and Chinese get those millions?

Nobody asks where the money comes from. Don’t ask, don’t tell. Ask me no questions and I tell you no lies. California is so different than Vancouver. California is truly the golden state. We Chinese prefer California for so many reasons. Hundreds of millions of Chinese want to come to the west coast, for a better life, of course.

Here is the latest from Mark Hanson, posted on Zero Hedge. I attach his closing comments but entire article is here

http://www.zerohedge.com/news/2014-03-12/mark-hanson-why-we-could-be-housing-bubble-right-now

“…In closing, I do think higher house prices are mostly always good. That’s of course unless the reason for the rise is “unfundamentalâ€. General consensus has once again returned to the overwhelming belief that “house prices always go up and 2007 to 2009 was a flukeâ€. That’s plain wrong and dangerous. I am not calling for another house price crash even though I think that housing is back in a bubble based on the monthly payment comparisons between now and 2006. What I am saying is that housing runs a real risk of price downside if the new-era investors — that have largely supported the entire sector and run up house prices beyond the reach of the average end-user through cheap and easy liquidity over the past three years — take their balls and bats and go home.

On the other hand, bubbles can deflate while house prices remain flat if the underlying fundamentals improve rapidly…strong employment, income gains etc. But fundamentally-driven housing markets take a lot time to develop, especially after so many years of running on unfundamental stimulus. Perhaps our economy can “grow into†today’s house prices over the next few years. Perhaps not.

As we saw in 2007 nobody can predict what house prices will do and the general consensus is usually the wrong one. Be careful out there. Buy a house because you need shelter and buy what you can truly afford using a 30-year fixed mortgage. Don’t buy because everybody else is unless you can clearly afford it — both financially and psychologically — especially if next chapter for this housing market is a consolidation of the past few years of gains.

“unfundamentalâ€. A new word to add to the vocabulary. You need to preface zerohedge with “the gloom and doom” site. I do agree with some of the posts and it is an ok place to visit but I wouldn’t want to live there…

“As we saw in 2007 nobody can predict what house prices will do and the general consensus is usually the wrong one. Be careful out there. Buy a house because you need shelter and buy what you can truly afford using a 30-year fixed mortgage. ”

I absolutely agree with this.

Who wouldn’t agree with it? It’s obvious and non-specific. What is useful is just about everything else Mark Hanson stated in that post.

This trend of advising people to only commit to what they can afford in these debates is suspect. The people who will spend beyond their means aren’t going to stop because some random person advises against it. It’s like telling people they should stay hydrated. Well, no shit Sherlock. It’s a non-committal statement in that it provides the author with a level of ambiguity to hide behind should a fallacy be exposed in the context of their claim.

It dismisses the premise that people stretched and are still stretching to “afford” a home. That’s the real issue. We already know people should be spending wisely, the suggestion is that they aren’t!

Oh my goodness, shut up Anon! Get a life, will ya?! Shit, lets not agree with anyone cuz Anon said so.

Ugh! – the problem with RE shills is that they all start with a statement like “only buy what you can afford” and the purpose of this statement is to give the impression that they have your best interest at heart. Once they get you to “trust†them, they turn around and enter your numbers in a flawed model that tells you can afford a house/payment that you really cannot afford. There is a financial incentive for the RE shills to not have your best interest at heart even though their roll is one that has a fiduciary responsibility to their clients. They are supposed to be the experts to help guide the client to make the best decision but this model is flawed by the very nature of their compensation. We know the higher amount you pay for the asset the higher their commission/fee.

My mother God rest her soul told me many years ago when scanners first showed up at the grocery stores that someday people would scan, bag and pay themselves and I told her she was out of her mind. She just smiled as if she knew that I would one day eat my words and guess what? I ate my words. I remember when you had to have a stock broker to buy and sell stocks. Well, now we have etrade accounts and the need for a stock broker is all but disappeared. I will make my mom’s next prediction in her spirit. There will come a time where the RE agent will go the way of the dinosaurs. Remember MB’s only valid comment “I’d even suggest getting a realtor’s license. The barriers to getting one are slim, and you can use it to save a few % on your home purchase. With the internet these days who really needs a realtor?†I completely agree that the barriers to getting a realtor’s license are slim aka any clown that can fog a mirror can be a real estate agent. I also believe that he is correct that who really needs a realtor especially when they do not have your best interest at heart.

“Oh my goodness, shut up Anon! Get a life, will ya?! Shit, lets not agree with anyone cuz Anon said so.”

What value are you adding to the discussion by resorting to a personal attack? If it bothers you so much, feel free to not read anything I write. Obviously I’m raising awareness to points that are making you uncomfortable. Perhaps we’re getting extremely close enough to the truth that it has you squirming. That gives me motivation to keep the comments coming. You’re welcome.

What, and if you don’t have a realtor’s license, you can hire a real estate attorney to handle your side of the transaction.

If you want to buy a house, tell the seller that you’re paying for your own attorney, so the seller’s realtor needn’t split the commission, and can thus lower their commission from 6% to 3%. Since the seller will now pay a lower commission, he can offer you the house at a lower price.

I hired an attorney for my last purchase. No realtors involved.

Thanks, good link though as was said zero hedge is over the top sometimes (often?) Some blogs did call 2007 correctly, thehousingbubbleblog and oftwominds for example, I followed them daily from about 2005 on and sold my place in spring 2007 thanks to what I learned…and completely agree with the ZH author on buying, it should for the right reason i.e. to live in the house for at least several years NOT to make money and should not require a financial stretch…those were the circumstances when I bought in a flat market in 1997 and it worked out well. Will maybe buy another place after this bubble pops if it looks like I won’t be wasting my time trying to compete with flippers and specuvestors though will definitely steer clear of any 2010-2014 flipper remodels that go back on the market (there are many and they are pretty much all the same around here in Sonoma Co….beige paint, cheap and cheesy fixtures, “bamboo” flooring, cut rate granite countertops and appliances, immature plants, LOTS of bark, etc.)

A really nice set of graphs on Canadian housing bubble.

http://www.torontocondobubble.com/p/canadas-housing-bubble.html

It turns out housing in Canada is overvalued pretty much everywhere, not just in Toronto and Vancouver

follow the money, sure its going to be expensive.look at down town los angeles 20 years ago you couldn’t give it away.now go look where their is no money and you’ll find a lot of good buys do that and the others that follow will make you rich.

…unless they DON’T follow and you the places with no money stay that way or get worse – like most of the rust belt, Detroit, etc. Many of those entire regions have been in decline for multiple decades.

REIt’s are back…

http://seekingalpha.com/article/2079573-morguard-corp-a-diverse-high-quality-real-estate-portfolio-that-sells-at-a-50-percent-discount

I have met many Chinese people over the years, they don’t care about California and quality of life, they just want to live there period.