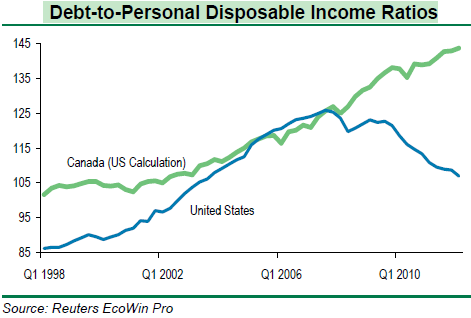

Canadian housing bubble goes into full mania mode – Canadian debt-to-personal income ratio near 145% while US at peak of the housing bubble was at 125%.

As global real estate bubbles burst at differing intervals, those still engaged in the depths of mania fever find every convenient argument to justify the existence of the current inflated economic structure. We can debate the nature of the current US housing market but with the median nationwide home price at $151,600 from the most recent Zillow housing report and the median household income at roughly $50,000 prices look to be leveling out especially with the absurdly low interest rates. As we know, housing markets are regional so applying this nationwide trough to frothy markets may not be the best way to measure investment value. However, when we look at the Canadian housing market we realize how insane things have gotten. I’m amazed by how many of the debt rehab or home flipping shows have migrated to the Canadian market. Of course they rarely mention this thinking the American audience will mindlessly assume they are in some other US city to prime the consumption pump. Yet when we look at the metrics, Canada is poised for a deep and profound correction.

The Canadian debt mania

I love how many of those that deny the real estate bubble in Canada point out random facts that were being used during the pinnacle of our own housing bubble. Of course things are different but deep down underneath the hood, the Canadian real estate market is driven by massive speculation and prices that are disconnected from underlying fundamentals (i.e., a bubble). Ultimately people are buying thinking there will be another sucker a few months away. They even parade these people on nationwide television. And for those that claim somehow the balance sheet of Canadians is better I present to you exhibit number one:

Source:Â Barclays

I agree with many of those saying things in Canada are very different. Canada is taking this bubble to an entirely new dimension. You can see that in the US, we hit our deleveraging moment of truth in 2007 but Canada has pushed on forward. To argue that households are taking on manageable debt is nonsense. The US at the peak had nearly a 125% debt-to-disposable income ratio while Canada is now inching closer to 145%!

As we discussed in a previous article, some areas in Canada are wedded to foreign buyers and the slowdown in places like China will have an impact. Yet this is one small piece of the pie. I also agree that like in the US, most of the buying however is occurring by domestic households and as the previous chart highlights, many are going into massive debt to support this lifestyle.

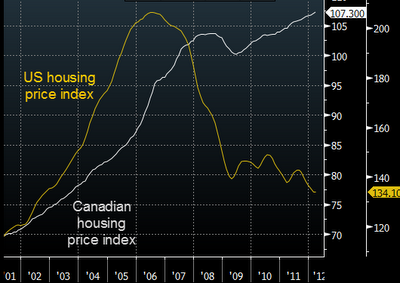

Canada continues to face an epic housing bubble and it will pop. How bad will it be when the bubble pops? Hard to say but look at this chart:

And the market is slowing down:

“(CBC) Price declines in Vancouver dragged the national average home price lower in July, even as most markets saw slight increases compared to the same month a year ago.

The Canadian Real Estate Association said Wednesday the national average price for homes sold in July 2012 was $353,147, down two per cent from the same month a year earlier.â€

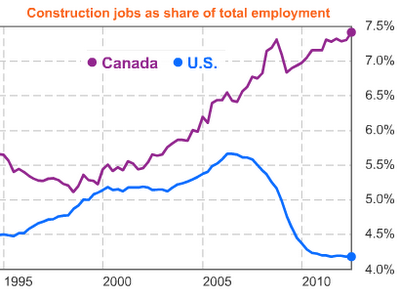

Is this the top? The longer this mania goes the more painful the unwinding will be. Similar to the US housing bubble that coincided with very good employment figures, Canada is relying very heavily on real estate as a part of their economic growth:

The share of construction jobs in relation to overall employment is nearly twice as high as it is in the US. This massive growth coincided hand and hand with the housing bubble. It becomes a chicken and egg type argument. Is the economy healthy because of real estate or is real estate healthy because of the economy? A similar scenario unfolded in the US. Yes, Canada is not the US but given the household debt figures and the mania in real estate, when the contraction comes you wonder if people will take solace in their neighbors down south who are in year five of the great unwinding. We do have some experience in regards to flushing out trillions of dollars in real estate wealth. From some of the comments many have drank the real estate Kool-Aid and the only thing that will change that is when the punch bowl is taken away.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

60 Responses to “Canadian housing bubble goes into full mania mode – Canadian debt-to-personal income ratio near 145% while US at peak of the housing bubble was at 125%.”

It really is different this time, they aren’t buidling anymore land, rich foreigners as far as the eye can see, we don’t have subprime loans……blah, blah, blah.

Now would be an excellent time to get your short positions in order. Seriously, does anybody have any info on shorting Canadien housing related stocks, REITs, etc?

I was wondering the same. My gut says REITS, banks, maybe some Canadian version of Home Depot in Vancouver, material suppliers, etc. but the amount of research needed to do it right makes it a tough play.

Waiting for dips in the China index ETFS (in it for the long haul – 25 years+). Bears get excited when China’s economy slows to 8%. I say 8% is still pretty darn good. Waiting for the food shortages to play out in Brazil next year; watching those ETFs also. Brazil has something like 12% of the world’s freshwater for growing things, so again a super long play will be worth it, in my amateur opinion, since the American bread basket is doomed over the upcoming decades, secondary to drought.

I think you’ll get burned shorting REITs. Go check what REITs did in the U.S.

There are a couple 3rd party mortage insurers worth looking at – Genworth comes to mind. However it is trading a pretty darn low multiples. Home Capital Group is another.

Not many consumer durable or discretionaries that are pure play Canadian. Most are U.S. companies ala Home Depot and Lowes.

Thanks WS. I was thinking more along the lines of those REITS that are centered around mortgage backed securities, though as i said, the amount of reading and research i’d have to do, makes it unattractive to begin with, especially if the conclusion is that it isn’t a good idea.

It’s probably better to stick with American REITS and mREITS until the interest rates start rising or the SEC starts negatively focusing on their leverage multiples. I’m finding it rather difficult to find a good investment lately – everything i bought late last year, and the first half of this year has bubbled up between 10 and 30%, and I like to invest for the long haul…

My father – in – law worked for decades in the seed industry, and the new prototypes for Corn, Wheat and Soybeans are going to use much less water than those currently in production. Additionally, sooner or later the ethanol requirement is going to be phased out, leading to millions of additional acreage for cattle feedstocks and other forms of consumption. You may be proved correct in the long run, but I wouldn’t bet against the US AG industry, they’re the world leaders for very valid reasons.

Why not think about shorting US companies that make significant sales in Canada? Companies making vehicles seem to be a good starting point for research:

Of the $230.3 billion in American exports to Canada in 2006, the following product categories had the highest values.

Vehicle parts & accessories … US$23.6 billion (10.3% of Canada from U.S. imports, down 1.5% from 2005)

Passenger cars … $13.1 billion (5.7%, up 8.1%)

Trucks, buses & special purpose vehicles … $11.8 billion (5.1%, up 16.6%)

Industrial machines … $7.5 billion (3.2%, up 9.4%)

Engines & parts … $6.4 billion (2.8%, up 3.3%)

Of course, on the flip side why not go long on companies that sell consumer goods at lowest possible price — like Costco (13.5% of their stores are in Canada) or Walmart. Both these companies seem to have done rather well when the US real estate market tanked. Loblaw Companies would be a pure Canada play.

Canada is going to get rocked. You hear the same rationalizations being made up there that you heard here in the States in ’06/’07. “Soft landing”?? Yeah right. Crash landing.

Our friends Down Under are also tee’d up for disaster. What an amazing crash it will be. Is any continent going to avoid the wreckage? Doubtful.

Look at Iceland. They had a total collapse. What did they do? Did they bow to the demands of the creditors in Europe to bail out their banks? Did the Iclandic taxpayer end up paying for THEIR banks’ risky behaviour?

Nope, they told their banks and Europeans creditors to take a hike. They arrested the banksers and politicians that made the mess. That was a few years ago.

Did Europe refuse to lend to Iceland anymore? Nope, it’s been business as usual and this time, Iceland won’t let it happen again and their economy is booming.

Anyone remember the FRENCH revolution? Maybe that’ll happen again, North American style but WE will be much more humane, we will invent laser guillotines. No blood splattering the front row seats, the laser cauterizes the wound.

I can dream.

Andy; the Iranians have the right idea….they recently executed several senior bank officials for fraud. If we trotted out half a dozen of ours for public hanging or firing squad, you can bet that there wouldn’t be nearly as much corruption as we have now. Come to think of it, round up a few lobbyists and politicians too. Nothing like the threat of beheading to make the rest behave.

Good comments about Iceland. They were the only country that did the right thing. Our pain has been prolonged by the polititians peddling for votes from the “victums”

Many of our west coast markets are fueled by canadian investors. Vegas, Phoenix, Hawaii. We shall see what happens when that source of funds dry up

@Ian

I’m skeptical. My guess is that those executed for “corruption” in Iran, and, many times, China, are just those caught playing the game wrong, and getting on the bad side of those who do the executing. As if the executioners are as clean as a whistle.

You’d have gotten along real well with my old pal Adolph. He was a dreamer too.

Didn’t they get the memo, i thought they spoke english up there? What took them so long? Funny these cycles I see coming, but the timing is so much slower than I think it should be. Ours here in so-cal went 3+ years longer than I thought it could….i was screaming in the dark.

Dr. Bubble, what is your prescription for how to fix the mess we are in? You have very insightful explanations for what is occuring but I don’t see a solution myself other than what the government is doing now. How do you propose the housing credit debt problems be resolved. What would your step by step plan look like? How would it realistically play out?

Canada’s housing market is Vancouver’s housing market (that’s where most of the speculative funds from Asia enter the internal speculative pool), and Vancouver’s housing market is China’s housing market. When the last domino falls, so will the first 2. China’s in their 16th month of volume slowdown and few months in a price and credit contraction. All of the sudden, the West Coast RE market dries up. No new money is thrown into the pot to keep the game going. Casino goes bust.

While Vancouver is a very important, and active real estate market, the largest is in Toronto.

Presently in the GTA (Greater Toronto Area), there are almost 300 high rise condo towers under construction. This is the most in any city in North America or Europe. Many of these units are presold to overseas buyers, but most are bought by ‘locals’.

With over 100,000 folks moving to the GTA each year, many ‘experts’ feel the present level of high rise condo construction is at a sustainable level, and prices have eased somewhat over the past few months.

If the bubble bursts, it will be much gentler than in the U.S.

I have seen so many stories on the weakness in the Chinese economy, from so many varied sources, that I’m inclined to believe they are accurate. This probably means the top for Vancouver is at hand. Probably Toronto too.

As far as Alberta (Edmonton and Calgary), look for a big drop there too fairly soon, maybe in about a year. All that tar sands oil is a very temporary phenomenon, in my opinion. In order to produce tar sands oil at a profit, you need the perfect storm of overpriced oil and under priced natural gas. The reason is that they burn natural gas to make steam, that is injected into the ground to soften the tar oil, which they sell.

Currently, oil is selling for about 34 times the price of nat. gas, but on a btu equivalent basis it should be about 7:1. On any sort of economic weakness, which is coming, this ratio will contract toward 7:1, and the Province of Alberta will be a huge ghost town.

Tar sand has a pretty terrible EROEI. I’ve read articles that say natural gas fracking is in a credit bubble, being fueled by cheap, easy credit and hype, while the business is not fundamentally economical. I’ve seen charts where natural gas fracking production has peaked in the US already. The faster they convert coal and gas into windmills for electric cars, the better.

Yeah, a lot of the hype about Canada is that it is a resource giant, and that it partially true. But most of the high quality oil fields are played out, and only the dregs, like tar sands, are left.

Canada is also a world leader in lumber production. But they have pretty much stopped building houses here in the USA. What happens when they quit building them in Canada and China? Might see a little Canadian lumber price weakness, I suspect………..

Some of that money from the East percolates into the California markets and when it dries up it will be another blow to Comrade Jerry’s ‘budget’. They will raid PERS…it’s inevitable. They’ll MAKE PERS buy Jerry bonds. Kick the can down the road.

This as been a long time coming.

same argument every 3 months for the last 3 years.

same misreporting every 3 months for the last 3 years.

same failed progonostication. make 1000 arrests in the U.S, and then you can begin to compare. think about it.

Steve – go check the monthly sales volumes in Vancouver. Worst months in the last 10 years. Highest inventory in the last 10 years and growing (currently about 12 months). The peak has already past for Vancouver – probably 9 months ago.

Good Morning DHB’ers

Here’s an update on our purchase. The house needs everything, but is $45,000 cheaper than our last offer on another home, and hopefully when we hit them over the head with our repair and replace quotes, they will come down in their price (not asking for even 30%of our bills) to get the deal closed.We love the neighborhood and the house is a great final one-story home.

It amazes us a seller compares a home in dire need of HVAC, Roof, Inners, Chimney Work, Pool fixing, Tree removal, etc… with a home that was well maintained and was updated nicely, and feels they are “giving it away”. We’ve sold perfect homes and were just grateful for the sale.

Friday the inspection contingency will be off and it will finally show pending, not back-up offers accepted. It has been years of letting the bubble pop and slowly leak, to 4 years of actively looking. We are elated. Having no mortgage at our ages is important to us.

Everybody have a great day, and keep posting. You’re all terrific!

Where did you end up buying?

SAM – East Ventura County where we were looking.

@Mad,

So glad to hear that the purchase is going well! Please keep those updates coming!

Paula

Thank you for the congrats. Much appreciated. Our friends are beating us up for price and price tag of repairs. They all bought 22+ years ago, and have no clue what is going on. Yeah, they have seen us struggle, but for some reason they aren’t being supportive. They should walk in all our shoes. They would roll up in a ball and die. This housing market has been a ride through hell for all us intelligent buyers.

Mad As Heck….

So glad you have found your home! It’s good to get settled and leave this mess behind you. No one seems to know what direction housing will take in the near future. Hopefully, the the repairs will not be overwhelming and it will all be worth the wait.

I’m still hoping my home will come along soon. I’m tired too. I’m ready for this roller coaster to end anytime for me, as well. It looks like I will be “forced” to buy a new home whether I want to or not rather than take my chances on a held back, foreclosure or bank owned in terrible condition after months of neglate. That is if… I could even put an offer in on it with the other 30 waiting in line and the connections through friends of friends.

The Realtors have been terrible in Las Vegas and it seems they like the fact all our economy is being bought up by “International Investors” and prices are on the rise…LOL. They’ve been told to adjust and they are. They don’t seem to have the time for Americans here anymore. So much for the home as a place to live. It is now an investment bank with interest for the elite.

Good luck with your move….I’m truly glad your home journey is finally at any end. It does give me some hope…

Hot LV

OMG, can I relate. We gave up on this deal, and an hour later the phone rang. Don’t give up. I have a ton of advice for you. awaitingwipeout@verizon.net. My family and great friends live there. Let’s talk email. I am interested in your search.

I’ve noticed similar comparables posted when I look at houses. They post anything within a mile or so radius (and there is not much) and claim it as a comparable house. I look at the descriptions of the houses and think “These aren’t anything alike. It’s like a car dealer saying “You may want to look at this Maybach if your considering the Chrysler 300”. Huh?

wydeeyed

I have friends that drive cheap want to be MBZ and have the attitude they are driving a Maybach. Real money drive a Maybach.But real people like Jay Leno drive everything else.

wydeeyed

In our area (east Ventura County) there is so little on the market right now, they can and do play apple and orange games, and the buyers are screwed. I count my lucky stars we lost the last bidding war. In the end, with the final adjustment for an inspection credit -may or may not get) we’ll put minimum $45,000 in our pockets to fix up a home, losing that “wow” factor yard bidding war. Best case is $55,000.

Will the Chinese money ever run out? If China starts crashing it seems to me that there will be a veritable flood of gold bars into Canada as the rich Chinese try to save their @sses and buy up everything in the Offshore Chinese Colony of British Columbia. Prices can be expected to zoom upward the more problems they have in China.

@BigBill

Precisely what I’ve thought. There may be an escalation of Chinese families escaping from a broken economy and to a safe haven where there is some sort of rule of law (oh boy, now that could start a debate) that will protect their money.

Vancouer is currently a biggest problem for the Canadian RE. Just check the Vancouver Housing Market: Developments in 2012 and you will see how bad it really is.

Smart people saw it coming long ago, but constant negation from the REBGV and its director Eugene Klein in combination with low interest rates for mortgages “helped” the bubble to survive a bit more. I would not blame Asian money or any other segment of population, because there is no real evidence about it. It is an urban myth, which was dissolved by many RE experts.

I don´t believe there will be such a big price drop followed by foreclosures like it did happen in US. Remember that our banks are not in problems. They can be but I believe in their ability to renegotiate the mortgages with the state. Minister of finances Flaherty has already started the necessary reforms so let´s hope he will continue to do his job and protect the Canadian citizens from the possible RE crisis.

“renegotiating mortgages with the state”?

Last time I checked, accounting standards still had debits and credits. What happens to the lost income and book values when the government writes down debt?

Vaporized?

When bankers and politicians collaborate, there is no lower bound for depravity.

Canadian mortgage are recourse. That’ll be a problem. But I think the bubble is in BC. Mostly. Canada has more natural resources per person than anywhere on the planet. In a world with 7B people, this has to be a gigantic macro advantage. They will need a correction in their markets, but Canada is going to experience solid, long term growth for a long time.

A realtor friend of mine here in Phoenix gets 75% of his yearly business from Canadian cash buyers between October and March.

In our new NAR world of suspended facts and downright lying, I can conclude that a bursting Canadian Real Estate bubble will lead to massive Phoenix homebuying, and that now is the best time to buy 20 “investment properties” (I call them “dis-investment properties”) in Phoenix, ’cause you know, God only made so much sand, I mean land.

@Laura

“Flaherty has already started the necessary reforms so let´s hope he will continue to do his job and protect the Canadian citizens from the possible RE crisis.”

Really? If he wanted to “protect” his citizens from this situation, maybe he should have intervened in markets so that a modest little home in Vancouver didn’t run up in cost that only a King’s ransom could buy. As in America, I heard of hardly anyone bemoaning the fact that home prices were escalating rapidly for a decade, inflating the largest cost that most middle class families confronted every month dramatically. (And, all the while, the government telling me that inflation was barely negligible. Yeah, right, tell that to my rent check) Nope, just celebration after celebration as many thought that debt servitude was a way to riches. Now that prices are returning to long term trend, or, normal, politician after politician after pundit after economist after zillions of Americans are crying and whining for the market to be “fixed”, which, I suppose, means that prices should return to bubble levels. But, we all see where that got us, right? How do you think that’s going to work out this time?

Do you really think a two bedroom “bungalow” in Vancouver should be worth seven figures? Why?

Vancouver is going to get wacked as will Toronto to a lesser extent.

We do have a much higher percentage of people that own their home outright than the US and no interest rate deduction.

About 15 years ago we went through a significant housing correction and the government let it run its course. Hopefully they do not interfere this time, we see how badly that worked out in the US.

This video on the canadian bubble just about sums it all up…

http://youtu.be/UK-vWGuK83M

I am going to start shorting REITS with heavy exposure to this….

this is a cant lose short opportunity, right?

Be wary of shorting REITs. If the market crashes/drops, REITs (which are generally cash flow positive distributing entities) will likely increase in value due to an increase in the number of renters (which should drive up average rents). Most REITs own holding building outright for an extended period of time (I.e. they don’t speculate so it

Shouldn’t impact their cash flows)

Some may speculate, so do you research before you short. Remember, when you short your leases are theoretically infinite (if the REITs keep going

Up),

I concur. Don’t short REITs. they are actually probably one of the better investments.

Value is relative term. If you look at RE in Hong Kong, Tokyo, China, even Australia, you will see the price there is much higher than that of US. Plus, Canadian and Australian dollars are significantly higher than 10 years ago compared to USD. If investing still means anything to anyone, this is the right time to sell those RE in those countries, and buy RE in US. Buy low and sell high? Now someone will argue that RE in US can go lower. Does that mean RE in those countries will go higher? Or we all go lower ? Remember capital flows. I personally believe RE in US will move higher from here. But that’s just me thinking.

What people may not know is that home prices in Vancouver declined by 21% in 2008 and people weren’t panicking. I think a correction in home prices Is long overdue and the days where people lined up overnight to buy condos ended about a year ago. At the end of the day Vancouver will always be a desirable place to live with limited land/development opportunities and prices will always be high. Toronto on the other hand has seen an orgy of investors gobble up thousands of units. The skyline is dotted with construction cranes as thousands and thousands more units go up (I believe there are 25k units under construction right now). Expect an oversupply of inventory and more drastic price declines.

I wouldn’t be so sure about that. I’m a Vancouverite, and I’ve been paying close attention to the general economy. Vancouver is turning into a service economy. COmpanies are closing up shop due to operating costs. There are few head offices of the sort that you find in calgary or toronto, for instance.

Vancouver has a fantastic setting, but what makes a city is the people. Between a poor economy and a flood of refugees and immigrants (many of whom are heavily involved in crime), I think you’ll find that it won’t be a nice place to live in 20 years. I already hear rumblings of discontent from Asians about the flood of arab, muslim and black immigrants/refugees into the city. (If you think Chinese people like living with blacks, you are nuts).

Interestingly as this issue plays out, US retailers such as Nordstrom, Bloomingdale’s in conjunction with The Bay & especially Target with there purchase of Zellers are gaining a serious foothold in the canadian market. Many others want to come, but there’s not enough space for them, or so they claim.

For you Vancouverites on the blog, how many of you know of a baseball player from Burnaby BC named Jasen Bay? He plays LF for the New York Mets.

“It seems like the whole world is saying: ‘Canadian Real Estate is in a Bubble That Will Burst’. We say: ‘Perhaps, but perhaps not.’ We also say that a general consensus is generally wrong, and ‘conventional wisdom’ is an oxymoron. Our point is that there may be forces at work that aren’t being seen. The real driving force might not be in Canada. It may be global forces that are driving Canadian real estate prices. Global economic forces are massive relative to Canada’s small population”

http://www.cliffkule.com/2012/05/is-there-housing-bubble-in-canada-or.html

The good news is the “Rental Bubble” is finally paying off for renters. Rents are falling as too-many-to-count rental units flood the market. I guess everyone read those ads about all the money you can make “Being a Landlord.” All those “international investors” from another planet better need lots of right-offs.

Soon we will see “Flip That rental” on TV right after the Jerry Springer show.

Although I do not believe in the Chinese or any other outside group of rich people coming in a buying all the high-end properties in ‘good’ neighborhoods, I found this article to interesting.

It is saying that 25% of luxury goods consumed in the WORLD are from Chinese.

http://ca.finance.yahoo.com/news/chinese-25-worlds-luxury-buys-093900420.html

You prognosticators are so obtuse. Housing is just that…a place to hang your hat, not an investment. If you use the shelter over your head as an investment vehicle instead of a burrow, you deserve to be left out in the rain. Gold , silver and oil, along with potable commodities are the means to gaining wealth, rolling the dice on the place you lay your head is pure greed.

@Jim – Disinformation – obviously not from Vancouver.

Question though… there are quite a few people in Vancouver currently locked out of the housing market because of high prices, so if there is a price correction, won’t developers simply focus on a different income bracket that has been locked out all these years?

This city has strong population growth – about 40 000 new residents per year – so would that not keep fueling our real estate economy as well? Or is it still doomsday?

I have observed in this city that development permits have risen to almost pre recession levels; towers going up left and right and more being planned, and pre-sales going very well, so obviously the developers have confidence in this city. Of course they could retreat very quickly if need be, but the size of some of these projects – Metrotown, Brentwood, Richmond, etc., – are pretty ambitious for a city in decline.

I get the impression that some posters here are really rooting for some kind of a collapse, for whatever reason.

I believe (and I may be wrong) but aren’t all mortgages in Canada insured? And isn’t the backstop insurer the Canadian Federal Government? The banks won’t lose a dime but the Canadian government, and by extension Canadian citizens, will be on the hook for all that money.

For what it’s worth I’ve tried to explain this to a few Canadians I know and their uptake rate on the news is only warm at best; they are still not convinced. The numbers Dr posts here are undeniable to me, there’s no argument to the contrary. Canada is in a major housing bubble and it will pop.

Doesn’t really answer my question though. From what I’ve seen, prices have held steady or dropped on new apartments, still with strong sales. I suppose that would be considered some of the bubble bursting. So if prices drop even more, a new home purchase is now in the range of people who previously couldn’t afford to own.

I’m not sure what people here mean by “bubble bursting”. To me it means a price correction. Is that a bad thing for consumers? We have a solid banking system and good employment, so what is the danger here?

It does not take a rocket scientist to see the trend in Canadian Real Estate has turned over and is cruising through the averages with little effort. Do Canadians not see what is happening in Europe along with their neighbors to the south? This slowdown has just begun and once the US double dips into recession Canada will not be far behind. The RE market is a leading indicator in my opinion and no amount of QE will stop the train. I have always said do what the Governments do, not what they say. In 2008 the Canadian Government and the Banks started tinkering with the mortgage market much like happened in the US and the end result was no RE crash in Canada and in fact the bubble continued to grow. Today is a different story, the market is rolling over and the Government and the Banks are tightening hoping to control the pace of deflation in the RE market. Time will be the teller of all truths but unfortunately small fortunes will be lost while owners wait to see if the market is indeed going to correct.

It is “monkey-see, monkey-do”.

Like the US, the Canadian Housing Bubble was created by the government through massive manipulation at the expense of non-homeowners, taxpayers, first-time buyers and the younger generation:

http://www.newworldparty.org/2011/04/housing-most-manipulated-market-in.html

Bubbles, such as the Dot Com, Oil and Real Estate bubbles, are extremely disruptive for any country. They usually make some people filthy rich and some people filthy poor: http://www.newworldparty.org/2011/11/bubbles-extreme-maker-and-breaker-of.html . Governments should do everything they can to prevent or suppress bubbles. Instead, the Canadian government did everything it can to create and fuel the Housing Bubble.

Bubbles have happened throughout history, dating back to the Tulip bubble in 1635. In the past 35 years, there have been multiple bubbles: Housing Bubble in 1989, Dot Com, Oil, Dubai, Housing Bubbles in Japan, US, Spain, Ireland, etc.

Canada’s Housing Bubble is the longest lasting bubble in Western history. No bubble in history has plateaued after hitting a peak. No bubble in history has not collapsed. Many Canadians are hoping that Canada will be the first country in the world to break history. Unlikely.

The young, who make up most of the first-time buyers, got screwed by this housing bubble…again.

http://www.newworldparty.org/2012/09/screwing-young-over-and-over-again.html

The best thing they could do, is sell ASAP before they become financially ruined.

There is an old saying: want to make a small fortune in RE? Start with a big one!

As a Builder/Developer in Southern Ontario for 28 years I have seen many booms and busts. This oncoming storm will be of Biblical Proportions! We should have taken the hit in 07/08 with our American relatives and would probably be seeing some light at the end of the tunnel by now, but we only blew our bubble larger.

As America’s largest trading partner, our symbiotic relationship has complimented each other and seems that now we are the second largest mortgage purchasers next to the Fed. Reserve. As Canadians continue to purchase in the “Sand States” to escape our winters, we are using the HELOC’S to finance the down payments for these second homes. This can’t end well if (when) Canadian RE values plunge!

The Chinese are the key! If they begin to deleverage then all global RE will correct to the mean before a truly global revival can occur! Remember the Japanese who bought Rockafeller Centre and Pebble Beach? Only to sell after the devaluations of 1990 at half what they paid. The Chinese are financing our inflation and giving us back their profits by purchasing our RE at market peaks.

Leave a Reply