Cash buyers reach record level of all home purchases at over 42 percent: 80 percent of all sales over past year in Irvine went to buyers from China?

So you still want to make the argument that cash buying is a small portion of the market? The latest sales data shows that cash buyers made up a record 42.7 percent of all sales in the first quarter of 2014. The latest National Association of Realtors report shows all cash purchases at 33 percent for the last month of data. RealtyTrac also follows auction sales that many times, do not show up on the MLS and as we all know institutional investors at times are buying blocks of homes directly from banks. I would assume this would account for a good portion of the difference between RealtyTrac data and that from the NAR. Either way, both are showing an incredibly high number of cash purchases. Overall, investors are chasing lower priced properties. Markets like Nevada, Arizona, and Florida have cash buyers making up the majority of all home purchases. In one of the reports this morning, a research company mentioned that in prime Irvine California, something like 80 percent of sales are going to Chinese foreign buyers. That is not a small amount of the buying pool. This is definitely not your traditional housing market.

All cash buying reaches record level on low overall sales volume

I always found it amazing how some people downplayed the influence of investors in the real estate market. Many were saying that this was simply a tiny portion of the market. “Nothing to see here†was the argument in the first few years. There is clearly something going on here. RealtyTrac’s data shows that 42.7 percent of all home sales in Q1 of 2014 went to cash buyers, an all-time record. This is the core group of buyers in today’s housing market.

What we can take away from the report is this: (1) traditional buyers are being priced out even with low mortgage rates (2) cash buying although high as a percentage, is dropping in actual purchases (3) foreign buying is focused like a hawk on certain areas.

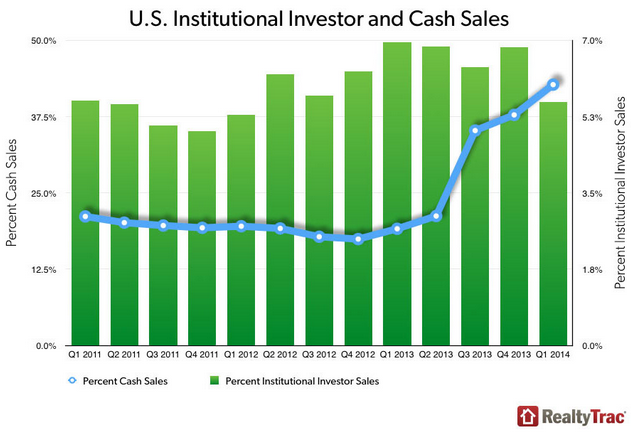

Let us look at the cash buyer data:

You can see that the big spike occurred in 2013 and has yet to subside. You will also notice that institutional buyers, those buying large blocks of homes, are starting to pullback especially in places like California. The cash buyer of today is largely buying investment homes, flips, or foreigners targeting certain cities.

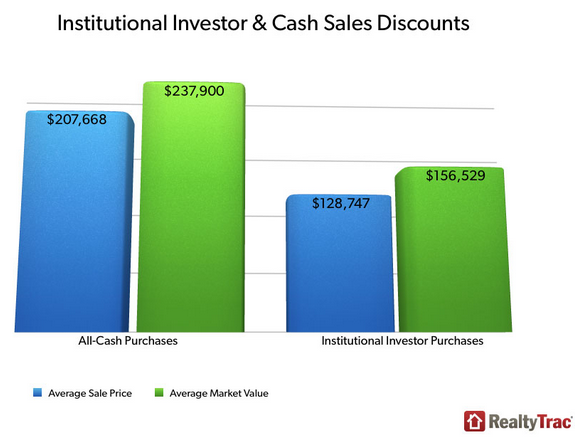

The majority are not buying high priced properties:

You can see that the average price paid by all cash buyers is $207,668 and for institutional investors it was $128,747. Makes sense given the massive amount of buying in places like Arizona, Nevada, and Florida.

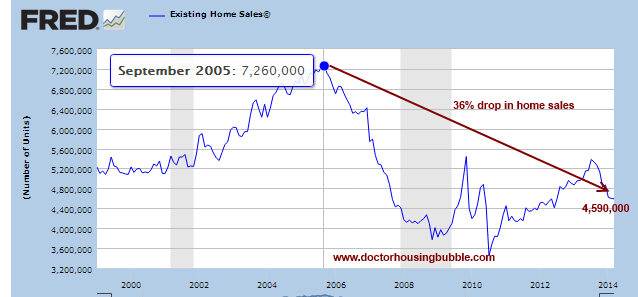

It is important to remember however that this is a percentage of all home sales. And existing home sales are pathetically weak:

This is why you see mortgage applications hitting levels last seen in 2000. The public is largely priced out. In overvalued California, 1 out of 3 families can actually afford to purchase a home at today’s prices.

What we do know is that foreign buyers are targeting certain markets.

80 percent of sales in Irvine going to foreign buyers from China?

Most of the reports over the last few days have been “shocked†at the record number of cash buyers in the market. Nothing surprising here. This has been the juice of the housing recovery going back to 2008. Latin Americans are heavily purchasing in places like Miami while buyers from China are heavily focused in on California. What did stand out to me was a quote from Meyers Research regarding the Irvine housing market:

“(CNN Money) Miami, New York, Boston and coastal California cities are attracting a lot of foreign buyers who are paying in all cash, according to Jeff Meyers, founder of Meyers Research.

In Miami, Latin Americans are putting down deposits of 50% or more on apartments in the early stages of development, enabling builders to self-finance the rest of the building or leverage bank loans at attractive rates. The buyer then pays the balance in cash at the time of occupancy.

In California, Chinese nationals and immigrants are “parking their cash in single-family homes,” said Meyers.

In Irvine, Calif., for example, 80% of sales over the past year were to Chinese buyers, he said.â€

This is a massive amount of targeted home purchasing in one city. I’ve had a few contacts that sell homes in the Orange County market telling me that 7 out of 10 purchases were going to Chinese buyers, all with cash offers. These reports would come in every few months or so but interesting to see this coincide with the report above. We already know that over 30 percent of all purchases in California are going to investors but 80 percent in one city? That would certainly change the dynamics of the market. Irvine is no small city with 230,000+ people living in the city.

The traditional home buyer is flat on his back. There is no surprise that California is largely becoming a renter state. When a poorly built condo in Irvine with mega-HOA dues is going for $500,000 you have to question what is truly going on. The above data helps to show us the true face of the market. The traditional buyer is done in high priced metro areas. Cash is king. The only problem is, most Americans don’t have the cash to play and many need to leverage to the hilt with ARMs or get from parents just to get into the game if they have any aspiration of competing in this market. But as it turns out, many of the younger buyers of today are so broke they are living with parents unable to even pay rent for a place, let alone venture out to compete with all cash buyers in inflated markets. This isn’t the housing market of mom and dad.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

137 Responses to “Cash buyers reach record level of all home purchases at over 42 percent: 80 percent of all sales over past year in Irvine went to buyers from China?”

Housing to Tank Hard in 2014!!!!!

Nope. Try again!

Beware the Ides of March, 2015!

As I said last thread the word of the day is “bifurcated”. Irvine, Newport Beach, the Westside, Manhattan Beach, etc. The Oligarchs, rentiers and foreign invaders have economically conquered these areas. If Housing Bulls want to argue for these areas I won’t protest. However the credit bubble, job destruction, tax policies, etc that enable their largesse are DESTROYING the purchasing power of everyone who can’t afford “Prime” CA RE. Personally I’d rather have a colonoscopy than live around arrogant immigrants who made their fortunes on the backs of slave labor with the endorsement of the CPC. They and their Limousine Liberal/Crony Capitalist Conservative neighbors can die in a fire. I’m happy to wait out the crash and buy in non-prime So Cal and politely give them the finger when I drive through their neighborhoods on the way to the thankfully still public beaches. Yes, working people still exist and no matter your wishes you still have to see the unwashed masses from time to time.

I would argue that “colonoscopy” is the word of the day. I am ready for the debate if you are…

The word is “bifuckcastrated”.

You win…

LOLs What? and Joe…

I can’t tell you how much I hate the rentier class right now. We have an overcapacity of EVERYTHING and if the Oligarchy would allow for real price discovery and needed deflation the economy would quickly come back to life. Instead we get this slow motion clusterfuck where modest working people are sacrificed on the pyre of the uber wealthy. These sociopaths are grinding the whole economy to a halt just to benefit banking power. As a poster on zero hedge is fond of saying “Roll the gulitiones”

I would love it if someone could explain Americans to me.

The jobs market has been lousy and in a near depression for over seven years now. Wages for most Americans in the private sector have been falling for well over a decade… Large numbers of Americans young and old are moving back to their parents home out of financial necessity, and what is the top priority for Washington and the US Chamber of commerce?

Amnesty for illegal aliens, and a huge increase in work visas for foreign workers and guest workers.

Now we find out that Americans can’t even compete with Chinese buyers for real estate in parts of California.

I understand why big business wants cheap labor, and wants to depress wages further by flooding the labor markets with a lot more supply. I understand that it’s great for the real estate industry to bring in vast numbers of wealthy foreign buyers to pay what Americans can’t or won’t pay, but what I don’t understand is why Americans can’t see this, or won’t stand up against this to protect their own interests?

Are Americans sheep, or are they in a coma?

If someone can figure out why Americans put up with this please tell me.

“I can’t tell you how much I hate the rentier class right now.”

Let me get a little philosophical on you. You can tell me to shut the F up if you care to but here goes.

I know someone who bought at the perfect time(2011) a monster house on a huge property off of the 101 just south of San Jose for under a million (Yes, they paid cash). The property is easily worth 1.5 to 2 million now. They should be happy but they complain to me that they use to travel and now they spend all their time fixing the monster house. They feel trapped.

I rent houses and have had to move 4 times in the past 6 years. It sucks to move but I have experienced a lot of new neighborhoods in Santa Cruz county. There are many pluses and negatives to owning a home. I have been at peace with the housing market for couple of years now and accept that it is what it is. I do the math, find the best standard of living opportunity available for my needs/wants and I enjoy where I am. It helps that I no longer live in LA.

I know I sound like a RE shill but it really is that simple. House does NOT equal happiness.

Greg, Greg, Greg…

Why do we import doers? Because everyone wants to be a “facilitator” and not a doer. I remember when everyone use to want to be an actor now everyone wants to be a producer/director. It is the world we live in.

Why do we encourage Chinese to overpay for “Merican” assets? How else are we going to get our green pieces of paper back from China? Same thing happened with Japan. We sell for crazy price and then the asset crashes and we buy back for pennies on the dollar. Oldest trick in the book.

What are “Mericans”? They are over weight, over eating, over consuming, over sleeping, over gaming, over spending, over watching TV, etc. and the envy of the world. Why everyone wants to be like us is absolutely beyond me. Did you know that Mexico is the second most obese nation in the world? Wow! Even third world countries are fighting to catch us.

What’s, words of wisdom, “House does NOT equal happiness.” You are right. Being a farm advisor in the Emerald Triangle, I know that happiness is the land; good soil, sun, and the right amount of moisture, to raise a good crop that benefits the suffering and sick people of California. I do enjoy living in a tent under the redwood trees in part of Big Basin when I come down to visit Mountain man. Got to go, Forest Lady is calling.

Re: What?

A house is nothing. A home is everything. To truly make a house a home ownership is required. Landscaping to your pleasure. Adding a room to extend your family. You can’t do this as a renter. I spent a couple of my teenage years homeless with my POS dad. Sucked… Been dreaming of a place of my own since the 90’s. Unfortunately I started making $ right when Housing Bubble 1 took off. Just missed a place in 2012. Worked out for the best as I put it into an investment that got me a nice return so my down payment is much larger now.

Anyway… I will be very happy when me and my girlfriend get our place. My lady and our home will definitely give me happiness 🙂

Conservatism and crony capitalism are antithetical concepts. Republicans may be crony capitals, but not conservatives.

I don’t care what the textbook definition of conservative is. I go by the behavior and voting patterns of those who claim the label and the vast majority of “conservative” voters support crony capitalism and are statists. Wake up.

http://www.redfin.com/CA/Hacienda-Heights/16227-Soriano-Dr-91745/home/7835810

The pictures only show the good parts. The house needs a lot of upgrades. The retaining wall at the back yard of the house is failing…may require lots of money to fix it. 75% of the floor is carpet and there is no hard wood floor underneath the carpet. The rooms are small. The ceiling needs repair.

This comment is like deja vu all over again…

That may be the first exterior shot of a home for sale taken at night I have ever seen.

buddy just sold a place to all cash asian buyer in Irvine, 5% higher than next highest bid, had been listed for 2 mos.

It’s time for the federal gov to step in and so something to protect the Americans. For example limit a certain numbers of buyers from foreign countries in a city. In San Gabriel Valley or a.k.s. highly Chinese populated areas, currently a house with 3/2, 1,200 sf, easily cost more than 600K. Two years ago, it was worth about 450K. The jump was simply to the Chinese buyers who elevated like 50-90K above the listing price and they paid all cash. This needs to be stopped!

“It’s time for the federal gov to step in and so something to protect the Americans.”

Yes I believe we need to protect the indigenous casino owners from the Chinese patrons. They keep spending “their hard earned money” at their ancient ancestors’ (Merican Indians) gambling casinos. We must put a stop to this NOW!!!

You want the Fed gov’t to do something? LMAO!!! They, along with the Fed and the Big Banks are the ones that had a hand in creating this problem in the first place. How bout letting free markets return ? Let prices fall, and let these house horney Asian buyers take a financial bath along with the rest who bought too high. If the Gov’t could do anything, they might end all the shenanigans the banks play (like limiting the on market inventory … i.e. they are limiting supply) and the local govt’s play to put an artificial floor under housing. Of course the FED should stop w/ZIRP too to keep interest rates artificially low but that is another matter. The corruption runs through to the top and until more Americans wake up and realize they are being played by these chumps, the more they will continue to be fleeced and manipulated by these ‘managed markets’. But I guess its easy to blame the Foreigners. Feel free though to bitch about the Gov’t not enforcing existing Immigration Law and trying to push through Amnesty — both policies are screwing the American citizens.

Keeping interest rates low help American buyers, they need the loans. Once interest rates rise it may give the market pause but cash buyers will still be there buying. Cash buyers will continue to buy if interest rates rise and the more they rise the better deals they will be able work in their favor.

“Keeping interest rates low help American buyers, they need the loans. Once interest rates rise it may give the market pause but cash buyers will still be there buying. Cash buyers will continue to buy if interest rates rise and the more they rise the better deals they will be able work in their favor.”

Ha ha! That is the funniest joke I have read on this site… What? You are serious??? No… that is not possible. No one could believe that!!! Your pulling my leg! Right?

WHAT…. I never said in the long run keeping interest rates low helps the average American. I was only stating what will happen next in the progression. Of course higher interest rates will have a price affect on housing bringing prices down. Lower housing prices and higher interest rates will be a tug a war for a while as far as affordability but meanwhile the cash buyers will still be there to scoop up the deals. Cash buyers would love to see a hike in interest rates so they can further profit on their all cash deals with lower housing prices.

You obviously do not understand “cash” buyers nor economics nor finance nor…

What? I don’t see anything in your posts that you understand anything other than what you regurgitate from the latest article. Anyone can copy and paste. Statistics are only as good as the ability to understand them and their complexes and shortfalls. I am one that does not appreciate your rants and dialogue on this blog. Call me crazy!

Beam me up Scotty, there is no intelligent life here…

What? I must have struck a nerve. I did not know that your were the defender of this blog post. You are righteous to think that your opinion is the only one that is credible. I think you have some real problems and it’s deeper than anything that could be worked out on this blog. I am glad that I do not know you personally, you seem overbearing and controlling.

Nope…

That’s assuming it’s not by current design to sop up that hot money with RE. I know it sounds conspiratorial but I just can’t shake this nagging feeling that this is what those at the helm of our financial system want.

Think about how perfect it would be to exchange monetary units (dollars) for cheap foreign labor and finished goods, bring those units back in exchange for expensive (relative to labor) assets, then cut the asset market off at its knees. This is a really simple explanation but the point is that those units made a round trip and preserved the discount for American entities. Of course, those units being the de facto global reserve currency makes this possible.

Unfortunately everything comes at some cost and in this case it would be those American entities seeking one of those assets in play during this phase.

I could be wrong but can’t help but wonder about this…

“but the higher levels of cash sales may also come from the aging of the baby boom generation, with more trade-down and retirement buyers paying cash with decades of equity accumulation,†said Lawrence Yun, chief economist for the NAR.â€

So it is the old white folks that are buying with cash and not the Chinese. Take that you racists. Your parents are the ones that are pricing you out of the market. Stop blaming us.

Mr. Reee – did you just learn the ctrl c ctrl v command? Pretty cool huh?

There is no doubt this is true. But if you look at areas like Irvine and the San Gabriel Valley I don’t think this is what is happening in the vast majority of cases. Also they may be selling to these cash buyers. Big reflexive loop

Wait. The rich are parking their cash outside China like people fleeing a sinking ship. Has anyone thought about what this says about the underlying structural issues in China? Shouldn’t that be seen as a threat to the global economy?

We are safe as long as the band continues to play…

Chinese need a place to park their USD. Think about it. What are they going to do, keep buying US gov’t bonds at abysmal rates? Or exchange their USD for real property?

This is happening in other parts of the world. Asians did favor New York over soCal. It is such a problem in London there is talk of limiting foreign buyers. Should Irvine slap a heavy tax on foreign buyers?

89% of prime RE, or 89% of all sales?

@Joe, in Irvine all real estate sales are prime. Irvine is immaculate. 2/3 to 3/4 of SoCal is garbage/ghetto/barrio.

The Chinese nationals are not buying in low end SoCal areas: i.e. Paramount, Lynwood, South Gate, south central LA, Van Nuys, North Hollywood, Cudahy, Bell, Hawaiian Gardens, Compton, Gardena, Hawthorne, Inglewood, Panorama City.

The Chinese nationals are not buying in many medium tier areas: i.e. Torrance, Burbank, Glendale, Culver City, Echo Park.

The Chinese nationals are buying in Irvine and the San Gabriel Valley. I’ve seen some activity in down town Los Angeles (DTLA) and K-Town (Korea Town), but very little in the the super prime areas.

So what is your point Doctor? We know that rich “Red” Chinese will continue to buy up all available “prime” properties and we know that Black Rock will sop up the rest. This is why How-zing will go up fo-eh-vah, right?

Stop telling these lies about rich Red Chinese. There is no such thing. It is all the old white people as Mr. Yun has stated many times. We come here on H-1B Visas to work. We are not like the Mexicans who come here illegally to take away your agricultural jobs in Ventura that the meth young people say they would like to have.

Mr Reee – quick drinking so much coffee and smoking so many cigarettes. They are making you way too jittery!

Now tell me who is going to pick all the rice grown in Cali that is sent back to RED China if we don’t let the Mexicans slip quietly in the back door? Your peoples will starve because they can’t eat plastic Fisher Price toys infused with lead! So the next time you see one of these “illegal Mexicans”, tell him/her thank you for not letting my people starve…

Enjoy your I-phone dessert! They are a little crunchy this time of year…

WHAT, you write nonsense. I think that your Northern California toke on things is influenced too much by Raymond Shrimp Boy and his Tong merchandise. We in SoCal are completely different than the SF Tong. You seem to be obsessed with the mythical “Red Chinese”. There is no such thing. It is your old white people in the bay area that drive up the prices.

Mr. Reee – I have some homework for you. Look at my prior comments going back a couple of months and you will understand where I am coming from. The “Red” in Chinese is actually a dig at another commenter. Perspective is important and I think you should get some before you start casting stones.

“In overvalued California, 1 out of 3 families can actually afford to purchase a home at today’s prices.”

The primary issue with this data is that, imo, it conceals the deeper problem. Odds are fairly decent that the 1/3 is composed of a pretty high number of people who already are homeowners, whether or not they have equity. So it’s unlikely that the bulk of this 1/3 is actually in the market for a median home.

I doubt the data exists in this way, but even sketched out as a Fermi estimate, it would be really interesting to see that data broken down into what fraction of current non-owners could afford to buy a median home in the current market.

I doubt the data exists in this way, but even sketched out as a Fermi estimate, it would be really interesting to see that data broken down into what fraction of current non-owners could afford to buy a median home in the current market.

How about a percenatge of home owners that could actually afford the home they are living in today if they had to buy it at todays prices!

“How about a percenatge of home owners that could actually afford the home they are living in today if they had to buy it at todays prices!”

I’m sure it’s small, so doesn’t that simply validate the meme that they “bought before they were priced out?”

We bought a brand new home in 2003. Tract home, we upgraded it, end of cul de sac, gorgeous lot. Really nice home. We moved out of that area in 2005 and sold it at the height of the last bubble.

The dude who bought it was a pest control spray man. $589,000 he “paid” for it. According to the RE docs, 100% financing, sub prime loan. Well last year it foreclosed, after 2 yrs with no payments. Foreclosed in August 2013.

It is still empty and has not been listed for sale. US Bank trust owns it now.

This is a gorgeous home on a great lot. Why is it sitting empty?

@Calgirl wrote: “It is still empty and has not been listed for sale. US Bank trust owns it now. This is a gorgeous home on a great lot. Why is it sitting empty?”

A Couple of things here:

One, banks can hold on to foreclosures for a maximum of 10 years.

Two, mark-to-market was suspended in 2007. If mark-to-market were still in place, the banks would have been forced to adjust its balance sheet to reflect market values. They would have then unloaded the property.

Three, the Federal Reserve implemented ZIRP so banks can borrow at 0% interest. With real world inflation running at 5% to 7%, this is basically gifting the banks money to keep foreclosures off of the market.

Housing to Tank Hard in 2014!!

The way the market has gotten off to a slow start this year, it sure look like housing will tank. Only 1 out of 3 families can afford a house in Southern Cal now. Seems like common sense. Investors are pulling out with these high prices. It should be interesting.

Impostor! How do I know? Not enough exclamation points!!! You need at least three…

I’d don’t come here for info any more; just for the entertainment.

“I always found it amazing how some people downplayed the influence of investors in the real estate market…buyers from China are heavily focused in on California.”

HeeHee. Doc, you’re too kind, well aware that many of your DHB blog’s most proliferate posters are of the “gold bar carrying Chinese buyer is a crock” school of bemusement.

Like unicorns, these were postulated as mythical figments of our collective housing bull imaginations, naively invented out of thin air to justify demand-side juice that really wasn’t there.

Remember classics like,

“There really aren’t that many millionaires in China”

or

“Why would Chinese want their kids to go to crappy SoCal schools when there’s Ivy League schools like Dartmouth”?

or

“There may be rich Chinese, but the government has strict controls about repatriating money outside of China.”

Play on, haters, play on!

Or you could look at it as…

The volume of sales is still falling. Inventory is increasing. Zero first time buyers. No traditional buyers, fewer institutional buyers. Foreign buyers are all that is left.

In previous years you had all of the above.

“Play on, haters, play on!”

I thought we all agreed that we were going to replace “haters” with “racist child predator nazi fascist commie pinko murderers”. Oh I forgot “psychopath”. Or did we all agree to drop psychopath because it might offend the .01%? Who took the meeting minutes?

Many of the loudest voices here genuinely don’t like SoCal.

DFresh – so do we keep “psychopath” or do we drop it? Your call.

No worries, the 0.01% don’t have feelings to hurt. As “people,” they have more in common with GE than with you or me.

DFresh – It is my understanding that GE is a corporation which by definition is a person (supreme court decision) and most people have feelings. So GE may have more feelings then the .01%. So I think we are okay with corporations I was just a little worried about the .01%…

So, psychopath is in then! Good!

Just think about it, with 1.4 billion people in China, say 1% of that are rich or have money to buy foreign properties and for example 10% of that 1 % wants to actually buy in SoCal and move to L.A, you now have over 13M that you have to compete against. As a regular working joe even with household income over 6 figure, you would have no chance to compete and actually buy in desirable area. Then again maybe it’s a good thing, personally I would not want to live in a city full of FOB immigrants.

Great read as always. Dr you have good eye on reality thats for sure.

Its not right to blame a certain demographic for the recent sales data, America as a whole is made up of foreigners at some point in its past. The market is what it is at any given time, you should always be looking for opportunity out there.

YES the prices are way up there and affordability has dropped off a cliff due to Fed intervention giving us a false market in the first place. If the Fed spent as much money bailing out the banks and spent the same money on job creation and rebuilding our decades old infustructure things might be a little different.

“If the Fed spent as much money bailing out the banks and spent the same money on job creation and rebuilding our decades old infustructure things might be a little different.”

Really? You believe that the Fed can “spend” our way to growth? The Fed does not spend the federal government spends, local government spends, the public spends, the fed manipulates interest rates.

My favorite quote from ZH is “I’ve fallen down and I can’t print myself up”…

Blaming foreigners for rising real estate prices is just as misguided as those protesters in SF harassing tech workers for rising rents.

If you want cheaper housing, you need to build more. Simply stated, for the last 5 years we haven’t been building enough housing, especially in areas where people WANT to live. Building tracts of homes in LV, PHX and Stockton may make housing starts look strong, but if people want to live in metro areas, then that’s where you need to build.

Of course that means relaxing zoning restrictions, spending money on mass-transit and reducing the NIMBY mentality that homeowners often carry.

Until that happens, housing will become more and more unaffordable as homes get passed down instead of resold. Fewer housing starts, fewer new home sales, lower overall volume, and higher prices.

But there has been a ton of new construction over the past 10 years, it’s just at a price that’s not affordable to most. Look at downtown LA, 1000’s of new units came onto the market in an era when median salaries were down. Is this a prime area like Santa Monica or Malibu? Are any of those units affordable to working people? Nope.

Over the past 20 years, former industrial zones in cities were converted to housing. Out went the abandoned factories and warehouses and up went residential. Did prices ever come down? Nope. Even in the Bay Area where there are some environmental restrictions, developers were very successful in building new housing all over.

LAer: “Look at downtown LA, 1000′s of new units came onto the market in an era when median salaries were down” … “Over the past 20 years, former industrial zones in cities were converted to housing. Out went the abandoned factories and warehouses and up went residential”

Yeah, and as a result of those two factors, the median for downtown LA dipped to about $300k in 2012.

Has there been SOME new development? Of course, but it’s barely kept up with replacement rate.

Before 1990, the LA MSA was adding about 2500 new SFH every month. Even in the boom building years in the mid 2000s that number was only about 1200. Since 2008, about 500/month.

Do a quick search on Redfin for homes. You’ll see that most of the tract homes in LA County were built in the 50s and 70s with few built in the 90s. Anything with a 2000+ build date are small developments, probably mixed-use.

The biggest project on the Westside in recent history is Playa Vista with about 3000 phase 1 units and 2500 phase 2 units. That took about 25 years for that to get going and it needed to be built on methane deposits.

Build more = “house prices will become more affordable.” ROFL !! Chronic nonsense. That won’t change anything when there’s forever more stimulus QE (USA/China/UK).

Why people think they can build homes faster than government encouraged property speculators can speculate on them is beyond me.

“Build more = “house prices will become more affordable.†ROFL !! Chronic nonsense. That won’t change anything when there’s forever more stimulus QE ”

Explain why QE makes LA/NYC/SF unaffordable but doesn’t have nearly the same affect on Ohio, Iowa, Montana, or Houston.

Houston despite being a metropolitan city has very lax zoning laws, allowing developers to build to satisfy demand. In the flyover states, developers can buy 100s of acres and within 2 years build tract housing less than 30 min from major employment zones. IF you can accomplish satisfy demand like that, the housing/income ratio should hover at around or less than 3:1.

MB I don’t know those markets whatsoever. Also I question incomes standing up – even though things are booming in Houston for energy jobs.

I just read a bit in the Financial Times from April 2014 (1 paragraph under fair-use policy):

“During the past 12 months, prices in the Houston metropolitan area have risen 11 per cent – and are up 29 per cent on what they were in 2006, before the US housing crisis and global downturn began, according to Savills.”

And there are a few other news-stories recent weeks of Houston runaway house price inflation. They could build the houses, but I think the developers would want to hold market to hostage to high and higher prices, and many buyers will push and fall over each other to pay it – unless credit becomes more expensive, or some slowdown happens, and sentiment reverses.

This too.

_____________________

Soaring home prices put a dent in Houston’s reputation for affordability

Johnny Hanson

Prices of houses, like this one going up southeast of downtown, are up 9.4 percent overall from 2013. Inside Loop 610, they rose 12 percent, and between the Loop to Beltway 8 they’re up nearly 20 percent.

By Erin Mulvaney

April 30, 2014 | Updated: May 4, 2014 11:06pm

http://www.houstonchronicle.com/business/real-estate/article/Soaring-home-prices-put-a-dent-in-Houston-s-5443379.php#/0.

_____________________

Houston’s median household income is about 60k. Houston’s experiencing a huge housing boom right now too, median prices up almost 10% to… almost 200k. Almost exactly 3x median income, like everybody talks about. Of course what happens when they start edging past that magical 3x number?

Of course, they BUILD!! Houston has more housing starts than anywhere else in then nation and had more SFH housing starts than the ENTIRE STATE OF CALIFORNIA 3 of the last 4 years.

They see the rising housing prices and are kicking in construction into high gear and will start hitting nearly 50k housing start per year.

To make it even more eye-opening, realize that Houston MSA is about 6M people while LA MSA is 18M.

Would you like to revise your statement about building not affecting affordability?

If you’re waiting for housing to become 3x income in LA, you’d better find a way to start building a LOT more units in Los Angeles. Every year that passes and LA doesn’t build enough to keep up replacement rate let alone population growth you’ll see housing prices AND rents become less and less affordable.

Los Angeles MSA is around 13M, not 18M. Adding Ventura, Riverside, and San Berdoo counties makes it 18 M.

Regardless, let’s see how much stomach locals have to build “quickly” in and around Houston if that MSA ever reaches 13M. No easy feat.

@MB, California has one of the most generous welfare packages in the U.S. Hawaii has the best welfare benefits of all 50 states. Coincidentally, Hawaii has some of the highest home prices as well. Texas has one of the worst welfare packages in the U.S.

California has 12% of the U.S. population but 34% of the nation’s welfare recipients live in California.

“Regardless, let’s see how much stomach locals have to build “quickly†in and around Houston if that MSA ever reaches 13M. No easy feat”

You’re right, GSA is 18M.

and again you’re right, as Houston’s population grows, it will get harder and harder to build near employment centers without creating additional quality of life issues such as crime/pollution/traffic/bureaucracy, etc.

AND that is why it’s silly to compare housing affordability in an international metropolitan city (NYC, LA, SF, HKG, LHR, NRT, CDG) etc to housing in flyover states or smaller cities.

Housing in Los Angeles will boom, and it will tank, but it’s unlikely it will reach the level of affordability that some people pining for.

The chinese housing bubble is popping as we speak. A lot of chinese wealth is going down the toilet.

Remember all the unemployment discussions a few posts ago?

http://www.shadowstats.com/alternate_data/unemployment-charts

Take that gloom and doomers! The shadowstat chart is up baby! Up is good right???

Hey What? I presume you are joKing? Lol

Doc, great post! I am concerned about the huge amounts of capital flowing into the US and other countries from China, Russia, etc pushing up housing prices while domestic income is stagnant. http://confoundedinterest.wordpress.com/2014/05/10/the-great-wall-of-irvine-80-of-home-sales-were-to-chinese-investors/

all these high price homes are paying high property taxes do you really believe that your government wants to lower those taxes?

While they might collect less via property taxes if home prices fall, it could be made up in many other areas of a dramatically improved economy, which lower home prices would bring.

The reason the Chinese buyers are cash buying is the damn banker’s have push thru a buy your American citizenship bill a few years ago. Invest $5oo,ooo dolars or more and get fast tracked to American citizenship. Invest in a business or housing and get a green card. Who benefits the most? The bankers with all their foreclosed inventory.

Close, but no cigar…

The visa program requires that the investing alien kick in $ 500,000 AND launch/ expand a business.

(Personal) Housing does not count.

“The EB-5 category requires an investment of $1 million (or $500,000 in a high unemployment or rural area) in a commercial enterprise that will employ 10 full-time US workers. Although the investor’s role cannot be completely passive, he or she does not have to be involved in any way in the day-to-day management of the business unless he or she wants to do so. It is critically important that the investor be able to document the lawful source of investment funds, whether his or her own or funds given to him or her as a gift. The permanent residence obtained by the investor is conditional for two years and can be made permanent upon satisfying USCIS at the end of the two years that the investment proceeds have not been withdrawn and the requisite jobs have been created.”

http://www.eb5immigration.com/

Documenting that the monies are legal is going to be brutally difficult for many Red Chinese with flight capital. Crooked monies are the only monies that they can touch.

@ Dfresh,

“Their maybe rich Chinese but the government has has strict controls repatriating money out of China”.

Best joke/lie I heard today. Drive through Valley Blvd. in the cities of Alhambra, Monterey Park, and San Gabriel. Drive through San Marino, Pasadena, Walnut any city along the 10 freeway in the San Grabriel Valley. Look in the yellow pages in the banks section. There are probably more East/West Banks in these cities than liquor stores in South Central.

So why are there so many banks catering to the Chinese community? It’s an open secret that these banks accept and hide money from the Chinese government. Its kinda like the Cayman Island or the Swiss banks for wealthy American to avoid paying their share of lawful taxes.

Yes, these banks may exist and they may have Mandarin-speaking tellers and customers, but read the fine print ‘cuz they only accept deposits of gold bars.

What is this? Double garble-speak?

To “repatriate money” is to bring currency back home that had been invested overseas.

That’s NOT the phenomena that Beijing finds illegal. Their capital control laws prohibit the EXPORT of Red Chinese liquidity to the exterior world. Such capital controls are as common as dust in the Third World — and the Second World.

(Red China is a Second World nation, BTW.)

Other typical laws prohibit the export of capital goods — ESPECIALLY to include personal wealth generating goods such as hand and power tools.

I knew of some tradesmen that went to Red China to build out bowling lanes — in the sticks — at the height of their mania, going back 25-years. He was shocked to find that he’d lost all of his personal tools upon entering the country. This Second and Third World tick is almost NEVER mentioned in the First World.

$$$

As for hiding money from the Red Chinese government: ’tis to laugh.

They can find out anything they want by cyber attacks. America has no bank secrecy laws.

The VAST, VAST bulk of the East-West Chinese banks you’re staring at are tied into TAIWAN. Duh.

While ZeroHedge spouts off about Red China’s US Treasury position…

Keep in mind that Japan used to be number 1 and is still a close number 2.

Taiwan used to be number 2 and is still a close 3 or 4.

Taiwan also has a fantastic stock pile of gold in the Federal Reserve Bank of New York. It’s so vast that Taiwan may still have more gold than Red China. (!)

That’s what years of accumulation will do.

Lastly, Red China is NOT lending America money.

Her accumulation of US Treasury paper is a DIRECT consequence of running a mercantilist trade policy. She has NO VOLITION on the matter.

She’s also in no position to become an international reserve currency. EVER.

It would take a total political revolution for this situation to change.

Moscow is in the exact same boat.

The ONLY nation in a position to emit International Money (besides America) is JAPAN.

The Euro is a fraud and a mess. The British pound is tapped out; it’s an ex-reserve currency.

ZeroHedge jokes and jibes DO NOT make for profound economic insight, no matter how cute they may be.

Further, by their webpage, ZH is an SVR front agitprop operation. It NEVER takes an anti-Putin line on ANYTHING.

That’s more than strained when you think on it.

blert, thank you for posting. Every time I learn something new.

“Her accumulation of US Treasury paper is a DIRECT consequence of running a mercantilist trade policy.” This is the most important statement in this rant…

Where is Mr. Reee when you need him…

never read such a crock. You fancy yourself as the expert on international finance but you are dead wrong here.

“SVR front agitprop operation”

This is not the first time I’ve read such a claim about ZH. I’ve been paying careful attention and am not so sure about your assertion. That’s a big claim to make without offering proof.

By the way, in paying careful attention, I have read posts critical of Putin and Russia.

Quick! What monies you may still have or what the hell; beg, borrow or steal because you are losing monies by not being “invested” in the stock market. It is called “opportunity costs”, and you are losing big time. Costs means that you pay!!! History tells us that you will average 8% return! Act now!!! Jim Kramer genius, prophet, oracle of wall street is giving you free advice that normally costs thousands if not millions. Act now or miss the opportunity of a lifetime fo-eh-vah!!!!

http://www.cnbc.com/id/101659659?__source=yahoo%7Cfinance%7Cheadline%7Cheadline%7Cstory&par=yahoo&doc=101659659%7CCramer:%20Common%20financial

fine print please do not read as you may go blind…

(our legal team requires that we state that past performance is not a guarantee of future performance and that you can lose monies…)

The guy in the pic looks like he’s just seen his portfolio wiped out. “Opportunity” does cost, if you buy in at excessive high prices, with just unicornology and rainbowolgy telling you what is value.

Yet feeling defeated by so many years of being defeated, including by QE and all the other bailouts, after early caution in to the housing boom.

Can only hope its all a massive Pump-and-Dump operation. Mortgage lending divisions reporting deteriorating-to-low profitability, at some point needing to improve their margins. Low demand on mortgage side. Cash buyers hopefully settling and improving bank balance sheets….. then let the whole thing go, and write volumes of mortgages to younger people, at seriously crash prices. Supply flooding onto the market in a panic, as owners try and sell before it falls further. The owners tales of woe in the crash will be drowned out by the joy of younger people buying and upsizing at much better prices, at profitable margins for the lenders. Far better it is to buy at a low price with a higher rate mortgage, than at a very high price with a low rate teaser rate mortgage.

When Cramer says ‘all in’, that’s the signal to start reducing your positions.

Damn it!!! That means I sold too early… I am one of those stupid in-westors (what ever happened to the in-westor guy?) that sells into a bull market. Talk about opportunity costing… Maybe next time! I hope this clown lives long enough for me to be a Cramerica contrarian next go around…

You are all losing money because that is what the Plan is. It’s called Trickle UP and it has been happening since dear ole Ronnie and his keepers hit the White House. If you want to really understand what has been going on and is going on and will be going on for some time to come read Thomas Piketty’s new book. This young French economist used data never before available until it was compiled on computers. Now we now the history, and why the inequality in the US is just about the worst in the world. Buy it on Amazon for as little as $13. Read it because it is great research and he actually proves how the rich have taken over this country and possibly the world. It isn’t just CA. It is everywhere. And still the brain dead public keeps electing these clowns who are hell bound to hurt the middle class. Wake up. And also read the book.

I’ve read a summary review: http://qz.com/193098/everything-wrong-with-capitalism-as-explained-by-balzac-house-and-the-aristocats/

In all of those inequality periods of the past, something has eventually come along to change the inequality dynamic.

It’s true, we have inequality, especially in the house price dynamic which has steadily become worse for years. Yet I believe the trickle-up days are numbered, whereas too many are making decisions (to buy at ever higher stupid prices) on the assumption trickle-up can always continue, and want to be part of it, in this crack-up boom of ultra-high prices being achieved.

It’s already topping out, and real wealth can turn on the pretenders, with opportunity for new mass wealth creation after allowing a crash. I’ve been following people in power in UK, and I note a few have quietly been selling up into the frenzy, and downsizing, whilst pocketing millions in the sales proceeds.

Also including the Duke of Westminster (his associated property holding company)… until very recently the UK’s wealthiest property-owner (land/property) – aristocratic wealth from generations:

Trickle up is over, and the years of such inequality as outlined by Thomas Piketty’s new book in previous ages, compared to our own, is set to give way to a new age of opportunity, as the squeeze gets applied and buyers fall away at these prices, and pretend wealth is found out. Debt is not wealth.

____

Grosvenor Estates sale marks top of London property market

Controlled by the Duke of Westminster, Grosvenor Estates, which owns swathes of mansion blocks in Belgravia and Mayfair, has sold off £240m of its London portfolio, a further sign that the prime property market in the Capital is starting to cool.

29 Apr 2014

http://www.telegraph.co.uk/finance/newsbysector/constructionandproperty/10795978/Grosvenor-Estates-sale-marks-top-of-London-property-market.html

Bobi as you probably know there is no true middle class in a capitalist society, there is poor to low middle and then a stop over in the middle to upper or rich, and then back down to low middle or poor.

The folks caught in the so called middle are always trying to reach the next step of upper but usually misstep and drop down to lower or poor.

Anytime in life you are in the middle of a crowd or traffic jam, economics, you want to escape, the route to escape in always in question, but few want to stay in the middle waiting to see what happens?

So, you come unbidden to proffer economic advice from a European perspective…

The crowd that’s had essentially ZERO employment growth for a generation.

And your saint is a Parisian who scarcely leaves town — and his context is France — a nation run by Enarques.

Do yourself and the punditry a huge favor: read the back posts here-in.

There is some (slight) chance that you might be de-programmed.

As you write, you read as if you’re a product of ‘higher education.’

In the UK, where many young are priced out similar to SoCal, this was reported by a highly reputable source a few days ago: “cash-only purchases amount to a ‘historically large’ share of about one-third of property sales.”

money, flooding everywhere it seems, if it really is unleveraged money, and…

“Low borrowing is good news for the sustainability of the recovery, but bad news for banks’ profitability,†said Martin Beck, senior economic adviser to the Ernst & Young Item Club. “Banks will need to continue exerting tight controls on costs and innovate further to close the gap with pre-crisis rates of profitability.â€

Whilst main banks “have sold assets and cut jobs to bolster earnings and meet tougher capital rules.”

Those seeking to borrow going to non-bank other financial institutions lenders.

[Apart from a Government scheme called “Help To Buy” in conjunction with the banks, being lapped up by air-head younger people who still think housing only goes up, as they race to pay stupid prices.]

And BoMad (Bank of Mom and Dad] handing over fortunes in savings (and possible equity released from their own homes that have hyperinflated in value over the years) to enable their their kids to buy, at silly prices, because HPI is all they’ve ever known, and “renting is dead money.” Deleveraging and some similarities to the US position.

It’s absolutely disgusting to me that foreign Asian immigrants are allowed to buy up the majority of an American city like that, absolutely disgusting.

And no, the argument doesn’t fly that it’s a global economy and highest bidder wins no matter where they are from.

These Asians multiplied like rabits it’s in their country and their top % of 5 billion is a whole lot of people in the rich buyer pool… And their fortunes are mainly from polluting factories and sweat shop/slave labor in china… So why should we let them same harbor their money here and screw over the American born and raised family with artificial prices???

My wife and I made about $275k this past year but still are hesitant to buy a 700k overpriced piece of crap in an area manipulated by these foreigners!

The government needs to step in now!!

Sean…Of course you know except for the American Indian we are all of foreign origin in this nation. How and why do you say foreigners manipulate anything, it is called free enterprise. If you were raised in lets say China, you could conclude that America is a imperialist country of poor moral values who shouldn’t have there military with bases all over the globe?

For the most part Sean people are people the World Over, except for brutal regimes which the free World does little about, human nature is to do the best for yourself or family by any legal means for a better life, it is not a Asian thing?

The Chinese are our bankers. When was the last time our government did anything to punish bankers?

There’s no one to blame but our government. They have been consistently overspending. Now we are paying for it. They are printing money like crazy (still) and the Chinese who are sitting on a ton of US currency that no one wants are simply moving their worthless paper into something with intrinsic value. Real estate. You can’t blame them. It is the bitter sweet payback for getting f’cked by us devaluing the dollar. Still, housing will not tank, but the dollar will and is already showing great signs of it by the inflation of the housing prices. It’s not that housing has gotten more expensive (yes, in dollar numbers it is higher), it’s just that your purchasing power has dropped and will continue to do so until all the QE is finally in circulation. The money hits the big boys first (the rich). They are the ones buying real estate and stocks right now. The last ones to see a wage adjustment for inflation are the middle class and below.

$275k used to be a fairly decent salary. In today’s market it is not going to buy you much, as you know. But it’s going to buy you even less in a year from now, although wages won’t go up for a long time.

You post like a troll.

5,000,000 Chinese?

Absurd.

Don’t defame the reputation of this blog with silliness.

BTW, did you ever hear of the one-child policy?

Thought not.

5,000,000 should read 5,000,000,000 … my bad.

“Don’t defame the reputation of this blog with silliness.”

I am not sure what to make of this… Do you actually believe questions like “so doctor housing bubble, I was thinking about buying a 6 sf cardboard box on a heating grate downtown for $1,000,000.00. Do you think it is a good time to buy?” This is essentially the question debated at this point on this blog. We are so past this discussion that there really is nothing serious left to discuss. We have now degraded to the point where we blame the “Red” Chinese and “Illegal” Mexicans for our decline when it was corporate governance that got us here. We were invaded from within and the invaders were smart enough to create a smoke screen of Chinese/Russian/Mexican enemies to blame for the aftermath. What real discussion is left at this point? Is it a good time to buy? “Illegal” Mexicans are “stealing” all the jobs. “Red” Chinese are buying up all the prime real estate. REALLY? That is what we are talking about?

Just how effective is that one child policy?

Some 20-25 years ago, I attended a dinner party with a speaker from Red China. A refugee. I asked him about the effectiveness of the one child policy.

He said it was only enforced, to any extent, in the cities. That in the rural country, where most people live, the policy was too difficult to enforce, and widely ignored.

Granted, this is an anecdote, and an old one at that. But the guy came from China, FWIW.

Son…

The One-Child policy was — IIRC — never applied to the sticks.

Yet, as Red China has urbanized, the policy has gained compass.

Couple of days ago a neighbor ask me did I know that the house a block away closed at 965k, he is new to the area who was thrilled. I hated to tell him that the couple paid $1.2m for the home in 06′, and that many sellers are taking a bath they are so grossly underwater.

Also, I’m sure that whoever bought that house probably figured they got a good buy at 960k. if they think they can flip it for $1.2m in a short period of time, well I hope they bought it to live here for a long time, but who knows what these folks like many are thinking?

If it wasnt clear to anyone before, it should be now….foreign money is pouring into US real estate because it is scared of the future. 40% cash buyers! Unheard of in the US. it was hovering around 30% last year. This trend is gaining momentum, not waning.

Used to be they bought US treasuries, but now it’s real estate. Parking that much money into a fairly non-liquid market means fear. This is not trivial.

Something really bad, this way comes.

They can’t buy treasuries because the Fed is cornering the market…

Yes there is. And we will all be affected, except for the

Elite that are manipulating the system.

This was beaten to death FOUR MONTHS AGO on this very blog.

BTW, the apparent rise in cash buying is a fake out.

1) The leverage buyer is being shoved out of the bidding.

2) It’s now common for mortgages to be laid on AFTER the escrow.

3) There’s a general panic in Red China (by the elites) to get a ‘lifeboat’ in California — ASAP.

4) Because of Red China’s capital control laws, many of those bidding have been lining up their ducks for some months now. (One has to use various subterfuges to get serious money outside of Red China.)

5) The Red Chinese panic is real. There has been a changing of the guard. Many of the players have found that their chair has been removed. They are left dancing — and the music has stopped!

(Red China completely replaces the top tier of leaders every five years. This makes Red China more politically dynamic than America — in that respect. America hasn’t even figured out that the game has changed.)

40% seems like a lot on its face, however, the total volume of transactions is at record lows. The real story is that first time homebuyer is hardly anywhere to be found and the rest either have low to negative equity and/or they lack confidence in the market.

Got to love this board? Nobody is more American then my family, many military and two academy grads Air and Naval. That said, all fought for the rights of people, hard working people of all race,reglion,creed,gender whatever.

But on this site you have many who blame Hindu’s, Orientals, Black, and God knows who else for the reason they are struggling and can’t buy a home or have a decent job.

All I know is many families, that immigrated to America stick together, they work day and night in small business many open 7 days a week as family members take shifts from each other, they pool there money.

Nobody gives them a house for free or car or TV or anything else they pay for it with US dollars and help out economy.

Our there bad people in America yes and they come from all walks of life including you guessed it, Anglo EU from such sweet and incent countries ???

So get off the “I so bad off” because of other people who may be a little different, because that you or a cousin or best friend may be only in a bad way because circumstances not created by others from far away nations, but look to Wash DC and who you voted for???

In honer of mothers day I have a story to tell. I live by the beach and there are quite a few vacation rentals in the neighborhood. Every so often I see a bright yellow Hummer parked in front of a vacation rental and I assumed that it was the owners vehicle. Well I saw the owner of the bright yellow Hummer and it was two Mexican cleaning ladies. I chuckled and thought to myself that is how we roll on SC West side cuz. Things are never quite what they seem…

Good one! Remember, “Don’t believe anything you hear, and only half of what you see”.

Please save your stories for your family and friends I am sure they would enjoy them more than this audience. You are off subject and your comments are not endearing. Try to control yourself from needing to comment on every post. It’s getting a little old, with that said I don’t know where you add any value by poking holes in others arguments without ever stating a sustenance response. I understand you have a lot of passion but look at what you write and think for a minute, does this add anything that may have been missed or needs to be expanded upon. Write your own opinions on the matter, don’t just use this blog to shoot ideas down without ever offering anything from your own source of knowledge on the subject. Try to add something not just shoot comments down. I know that you think you are helping with your stupid quips but it is very non-productive. It is easier to be negative, be resourceful and offer something insightful.

My comment was meant for “what?” Sorry for the confusion. Come on man, pull it together. I have faith that you can write thoughtful responses.

Nope…

Keep being complacent homeowners, investors, flippers etc…. this is just one way Piketty’s build-up of severe inequality and malinvestment changes dynamic.

________

James Dale Davidson (1992) “The Great Reckoning”

A casual look at the Commerce Department data on home prices in the twentieth century would belie this conclusion, in part because US statistics are formatted to start with 1929 as a base year. For example, at the Department of Commerce the price index for private homes in twenty-two major US cities shows a fall from 100 in 1929 to 75.7 in 1933. This is a drop of 24.3%. It is hardly trivial, but it is more frightening when put into context.

The depression-era drop in US housing prices (understated in government statistics) wiped out the total gain during the inflationary boom dating back to World War I. In 1914, the index stood at 78.1 – higher than in 1933.

Similarly, the index of the average value of farm real estate per acre in the United States (1967 = 100) rose from 28 in 1914 to a high of 48 in the early twenties. It then tumbled to a low of 19 in 1933. The total gain in farm land from the inflationary boom was wiped out in the depression. At the bottom, land was worth 33 percent less than it had been before the boom began.

The twenties were a period of a tremendous building boom. A higher percentage of the total economy was devoted to housing construction than at any time in American history. From 1921 to 1930, approximately $61 billion (in 1929 dollars) was invested in the construction of new private homes. Another $4 to $5 billion was spent on additions and alterations to existing homes. In spite of the huge investment in new and improved housing, total nonfarm residential wealth in the United States tumbled from $108.4 billion in 1929 to just $81.3 billion as its low in 1935. This was 12 percent below the comparable figure for 1920.

________

The fourth migration was only incidentally a migration of Okies and movie stars to California. It was more significantly the move to suburbia. It took place throughout America, and is dated by the demographers as having begun in 1929. The first stirrings of this migration, however, were evident earlier.

An intelligent observer could have spotted the growth of the suburbs by the middle twenties. By 1929, the Connecticut suburbs of New York were already so jammed with commuters who had grown rich in the bull market that choice properties were selling for as much as a million dollars.

As Jim Grant points out, this was actually the top of the market for that type of suburban property. The million-dollar houses in Greenwich of 1929 “changed hands for as little as $75,000 in the 1930s.†Suburbia began with a migration of the rich.

A DHB MD shout out to all the house horny moms out there! Can I get a woot woot!

good article on the declining middle class and home ownership from Charles Hugh Smith

http://www.oftwominds.com/blogmay14/fixed-costsMC5-14.html

QE, what Charles Hugh Smith is saying in writing is just common sense. When I came to this country penniless decades ago I didn’t even speak English. It was a mater of learning, observing and intuition. Today I have millions and almost no debt. Today I can afford a standard of living higher than most americans. But I did not get to this point by instant gratification. There were decades of hard work, saving, investing and living frugal.

Not many people have the discipline, the drive and desire to postpone gratification in order to succeed. They want it and they want it now. They sell themselves in slavery just to show that they are accomplished. I have people working for me with less than 10% of my income and they drive more expensive cars than me to impress people who care less. Of course they get the cars with payments. This is not just my observation. You may get this opinion from many people who come to this country. The debtors sell themselves into slavery to the bank, loose their freedom completely just to impress others how accomplished they are.

Easy, pardner! You may be new to this country, so let me ‘splain it to you…we Mericans kinda got used to 70+ percent of our GDP coming from zombie-like consumer spending. It’s built into our culture as well as our economy.

Human beings are wired to try to impress other people and gain positive reputations among peers. In a capitalistic economy, that translates into a natural proclivity for zombie-like consumer spending.

Get with the program!

They have moved their most profitable and valuable assets into non-banking corporations and moved their exposure to Credit Default Swaps into government insured sectors. They know when the dollar is to be devalued so they can make money on both its rise and decline. They created the Federal Reserve system in 1913. It gave the banks the right to charge us interest on money they created out of nothing which transfers all wealth from us to them.

Good grief…

Who is ‘they’?

As for the US dollar rising… that never happens.

It’s a one-way bet. Fiat currencies get debased into oblivion.

If you haven’t figured that out… read some (any) financial history and get back to us.

“Who is ‘they’?”

I thought we all knew what “they” means! They are alien beings! Come on blert, I thought you knew everything. Some weekend reading material to catch you up if you so desire…

http://www.aliens-everything-you-want-to-know.com/DifferentTypesofAlienBeings.html

There is a third way to cancel debts. The Babylonians had a mathematical formula that told them when it was time to cancel debts to restore the economy. We could have worldwide Debt Cancellation as an alternative to economic collapse, mass starvation and wars. But that isn’t happening.

We are all slaves, even those of you who think you earn too much to be a slave. The culmination of these greedy elite, is upon us and everyone will feel the pain.

Embrace nihilism, you say?

Suffering under a terrible government is not equal to out right slavery… but it can get close. But, you’re stretching your term too far.

Please, please, please…

Is there any way to get posters to stop throwing up utterly silly ideas about reverting to some Biblical solution?

As if America — and the rest of the planet — still lives in a subsistence economy — which is what ancient Babylon was.

BTW, the number one debtor in trouble back then was the Crown — the sovereign — the Big Man.

As for debt forgiveness, we ALREADY have it provided under the Federal bankruptcy statutes. The ancients didn’t.

As for Babylonian math — ’tis to laugh.

“As for Babylonian math — ’tis to laugh.”

I agree! Let’s go back to the Roman numeral system! It was waaaay better!!!!

Tsk tsk Blert. U r nothing more than the walking dead, believing himself to be more wise than all the sheep. You lack the bigger picture. May I lend you a flashlight, as you se to be stumbling in the dark

Yes you may, slave.

Post away.

BTW, cutting edge nihilism is sophomoric.

***

?

Roman numerals are too dated…

I’ll stay with hexadecimal.

Below is a copy of a paragraph from a NY Times article about housing in suburbia:

“In no place is that more true than California, synonymous with the suburban good life and long a magnet for restless newcomers with big dreams. When taking into account the cost of living, including housing, child care and medical expenses, California has the highest poverty rate in the nation, according to a measure introduced by the Census Bureau in 2011 that considers both government benefits and living costs in different parts of the country. By that measure, roughly nine million people — nearly a quarter of the state’s residents — live in poverty.”

This is what debt produces to people who go into debt slavery – POVERTY. So much for the so called “inflation hedge”

What are the sales now in Irvine? Is it true, that foreign investors are moving to other states, and California is now cooling?

Its not that big of a deal

At some pt born american citizens will just repossess this foreign real estate

California is now pretty full, they should definitely stop all immigration for a while, 10 years or so, and work on removing illegals as well

I don’t get it.. how do these Chinese buyers in California have so much money? Pay is terrible in China, USD-wise, and even small and medium business owners there make about an average worker salary here. When you see/meet these people, they seem like ordinary average folks… I don’t get it?

I wonder if all these “cash” buyers actually use cash they have in some account or if they are not just only borrowing against other assets they may have. It would make sense to think that getting houses that appear “cheap” evaluated for a mortgage might be burdended with a higher insecurity factor by a surveyor and thus be les-than-ideal collateral so it might well make sense to use another property of known and uncontested value that has been paid off in previous years as the mortgage collateral. This also allows you to arrange the mortgage in advance and thus approach the new property in a favorable negotiation position as a so-called cash buyer.

Leave a Reply