House Party like its 2006: Cash-out refinance volume has grown astronomically bringing back the home ATM.

So much for learning from history. Once again Americans are tapping into their inflated home equity as if it were an ATM. Of course we heard from housing cheerleaders that everything is different this time and that people were being very cautious with buying crap shacks. That lasted only a few short years! Now people are leveraging record low rates courtesy of the Fed and are using their homes like ATMs. This massive growth has caused the FHA to pause and try to incorporate some breaks on this behavior. Here in California, people are remodeling and tapping out equity to create that “new†$100,000 bathroom to add the final touch on the crap shack. Without a doubt, what people are doing is setting up a limited economic buffer so when the next correction hits, they will once again face difficult choices. As a reminder, most of the foreclosures that happened in the last housing crisis came at the hands of traditional mortgages, not the No-Doc No-Income market boogie man.Â

Start extracting that juicy inflated money

People are deep in debt. Student loan debt is out of control. Credit card debt is solidly over $1 trillion. Auto debt is over $1 trillion. And taking on a HELOC or a home equity loan is basically like getting a cheaper credit card attached to your property. You still have to pay it back but all you are doing is extracting that inflated home equity and reducing any buffer you have should an economic change of climate take place.

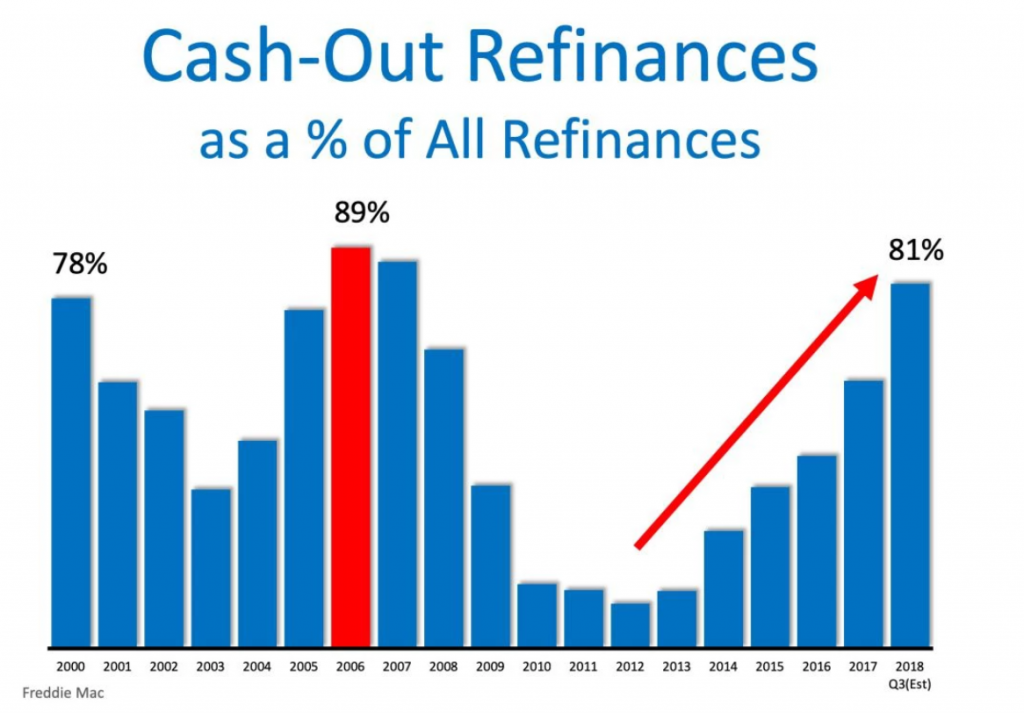

Even the FHA Commissioner has called the rise in cash-out refinances “astronomical†– this chart should highlight why:

“(Housing Wire} Subsequent years saw cash-out volume fall, hitting a low in 2013, HUD said. But now, volume is climbing again, rising 250% from 2013 to 2018.

In its annual Report to Congress issued last fall, the FHA said cash-out refinances represented 64% of all FHA-insured refinance transactions – up nearly 39% from the year before. It attributed the trend to gains in home prices and the decline of other forms of refinance activity.

On a call with reporters upon the report’s release, FHA Commissioner Brian Montgomery noted that cash-out refinance volume was growing “astronomically.† Â

And with lower rates hitting this year, more people are tapping into their home equity. You also have people buying crap shacks with maximum leverage. The market has started turning and this summer was largely a slow one with inventory rising and price reductions becoming more common place.

The fact that the FHA is trying to limit cash-out refinances at least reflects that they are trying to curtail this behavior because they too remember what happened last time. However, people are now in a massively tight position and so many products in our economy are juiced to the gills on debt:

-College costs (student debt)

-Cars (auto debt)

-Consumption (credit cards)

-Housing (mortgages and home equity loans/HELOCs)

Our economy is so leveraged it is beyond belief. The fact that cash-out refinancing is so high should give pause to many. But of course, the housing cheerleaders continue to believe that everyone is buying with massive down payments and have mega reserves to weather an economic contraction. When have we heard this story before?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

432 Responses to “House Party like its 2006: Cash-out refinance volume has grown astronomically bringing back the home ATM.”

Yes, this year is similar to the years 2006 and 2000. Those were not the years in which crashes and recessions started. Next year appears to be a good one for both real estate and stocks. This year’s, super low interest rates are delaying a recession and real estate crash for at least a year. At the moment, there is nothing to fear but fear itself.

This time is different Gary

Gary,

You’ve predicted that stocks would bottom out next year and now you are saying it’s going to be a good year. Lol

No one can predict what’s going to happen.

I predict stocks will go up, down, or sideways…or we will be hit by a giant comet.

Or there’s fearing the following year, when the gains from the next “good” year get wiped out and then some.

The home ATM can be a great thing if used correctly. If you are cashing out equity to buy Escalades or go on vacations, that’s just stupid. Doing a cash out refi to free money up to buy another house is a good thing, especially here in expensive parts of CA.

I know several people who have done this. They accumulated boat loads of equity in a starter home. They do a cash out refi to free up a hefty down payment (200K plus) on a move up home. And still rent out the starter home to cover the new mortgage. Welcome to CA, this is your competition! Or you can live in a cheap apartment in a shady part of town in hopes of a crash.

That is buying houses on leverage. Very bad on a down market. Also the rented starter home will be a millstone when the renters lose their jobs and become deadbeats. If you try to get them out and anger them, they will put holes in your walls.

The boogie man is back!!!!

The problem is not with cash out refinancing. The problem is in the use of the cash.

For example, let’s assume someone has 5 million dollar worth of real estate, some of it income producing. Let’s assume that the total debt is $300,000 and the income is 300,000 per year. The owner does a cash out refinance to lower the interest and invest the additional $200,000 in other RE investments producing 12% return, by paying 3.5% in interest. I don’t see any problem with that – lots of equity and cash flow and very small leverage.

Of course, the author is right if you have someone with 100,000 income refinancing his house worth $800,000 where he already owes 500,000. The additional $100,000 is to be used for traveling or expensive cars (depreciation instead of investment). Not much equity, one source of cash flow which can disappear in a recession and the cash out used for spending not investment.

Most of the cash out falls in the second category and that is the sad part.

Damn it, I was hoping the market reverses course and goes up due to lower rates!! Isn’t that the trick? You just keep lowering rates to inflate the housing market? Why isn’t it working anymore?!?! I need house prices to go up so I can use my house as an ATM.

https://www.cnbc.com/amp/2019/08/29/july-pending-home-sales-reverse-course-falling-2point5percent-despite-low-rates.html

I wonder how many people are out there like me who are waiting for the housing market to crash so they can buy a house. Living in SoCal there is just no way we can afford to own, even making twice the average income in our city. Maybe all the people like me moved to Vegas and Austin.

Don’t forget Idaho???

Don’t forget Winona.

Kingsman, Barstow, San Bernadino.

Don’t forget Idaho??? Almost any place beside CA

???

We are like you, Becca. Been here four years, make a very healthy income and rent. It’s so frustrating. We are saving money but can’t and won’t pay these prices for a home with the risk of significant downside if/when the market corrects. I am hoping we move somewhere realistic in the next couple of years because I am sick and tired of California. You guys can have it. I’d rather live in a midwest city with cold winters and a nice house to call my own than live here and make my landlord richer by the year. Our last kid has three years before graduating high school though so for now we trudge along.

Same. Not paying for these ridiculous prices. I’d pay 30-40% less compared to today’s prices. Why make someone else rich by buying his/her house? They cash out with a 200k profit and move to another state while you are holding the bags for the next 30years? I’d rather shoot myself.

Same here. I made $400k last year but by the standards of the current CA real estate market I’m lower middle class and stretching to afford a fixer (unless I move to the middle of nowhere), which is absurd. So we rent and lately watch places around us not move and get pulled from the market, price cuts, get lots of spam and flyers from agents, etc. We are watching and waiting to see if we’ll be able to make a move here or finally just give up and exit the state in another year or two.

The large number of renters who are “waiting” for prices to drop 5% or 10% or 20% or X% before they buy, almost ensures that prices won’t end up dropping very much. There’s a built-in level of would-be-buyers essentially creating a price floor.

JiAtLaw,

Dude that is pure BS. With a $400K income you could afford a $1M house without thinking twice. Median home prices in SoCal is $600K. Come on, enough of this nonsense. If you don’t want to buy, don’t buy. But calling yourself some sort of victim is insane makes you sound insane.

I was going to call the same BS on Jim. A 400K income means your take home gross is 33K per month. You mean to tell me you won’t feel comfortable spending 4 or 5K per month on housing? First world problems amigo…

A cat once burned will never jump on a hot stove again… nor will it jump on a cold one!

My advice, don’t refinance unless one is reducing their rate or their term.

But of course as the good “Doc” eloquently details it’s a rat race, on D.E.P. ( debt enhancing products) over the cliff edge. Maybe the reasons we see the posts waning is because it’s a cyclical and history does in fact rhyme.

Good blue print increase debt by printing money, trigger asset deflation, assume ownership of assets at pennies on the dollar. Er EH rinse repeat.

I know we have it good comparatively and I don’t want to sound like some of the well documented trolls here. Why can’t we figure out how to preserve our wealth and our ecosystem.

Good to hear from ya “Doc” thank you for your insights.

Prices really haven’t started to drop yet in the south Bay Area or Santa Cruz County. Any idea when this will happen? Will the dropping interest rates make prices start rising again?

I purchased the cheapest house in south orange county 2 years ago JUST IN CASE the prices never go down. If they keep going up fine. If they stagnate for 10 years, fine. If they go down also fine. I got some left over room in my budget and I’ll get another one if they really ever go significantly down.

I purchased because I calculated how much I spent in the last 5 years on rent and wow. I spent like 50k on rent during that time and only because I rented a room at some point and a very cheap 1 bedroom. If I continued renting I would spend another 50 in just 2 years. And its not even a house. If I waited Id be down 100k by now and the prices are still the same or worse so I’d have to wait another 2 and be down 200k to save 200k on the purchase price? LOL

Id say people who are not sure at least get like the cheapest condo you can afford to hedge the bet. and calculate how much you spent on rent while waiting for a good price

A lot of people do the math wrong. They just see rent vs mortgage and appreciation but there’s more to it. Numbers vary but the costs of owning that you don’t recapture are:

– Purchase costs (closing, title, etc)

– Repairs & Maintenance

– HOA if applicable

– Insurance

– Interest on the mortgage

– Sale costs (realtor fees, title, etc)

– Time spent dealing with the transaction, repairs/maintenance, insurance, and HOA

– Lost income from the downpayment that could have been invested elsewhere

Hopefully the appreciation minus all of the above is still higher than total rent paid and it all works out in the end!

Youre right. They shouldnt look at it in terms of rent vs mortgage payment. They should look at it as rent vs monthly interest only. Interest is the part of payment you will never get back just like rent. The rest of the mortgage payment are basically your savings so it would be unfair to include.

Math Nerd,

You are right on all of the above, however you forgot the MeloRoos which can be substantial in some parts in SoCal (sometimes more than $1,000/mo). Not all properties have those, but many do.

Buyers should be aware of those. They are kind of capital improvement taxes which in most of the country are captured in the price of the house. Buyers should always compare apples with apples and oranges with oranges. I built a house 20 years ago in King County, WA. Capital improvement taxes were required at the time of permit issue and they were $30,000 in dollars from 20 yrs ago. Some municipalities in SoCal allow these taxes to be passed on to the buyers via MelloRoos and they pay them for a long time; they are not capitalized at the time of construction. This way they help the developers with a better cash flow and a more attractive price on their homes. The buyers step into a trap.

Here is the best buy VS rent calculator I have seen.

https://michaelbluejay.com/house/rentvsbuy.html#mdt

Of course, I do not think this is a good time to buy a home unless there are some extenuating personal reasons to do so. But I guess you could say that 2011-2015 were good for anyone to purchase.

QE Abyss,

That is an an excellent rent vs buy calculator. I would recommend using that one or create your own in a spreadsheet.

Always buy at or below rental parity. Many areas in CA are already at rental parity or below. I would forget the premium coastal areas, completely unrealistic… but the very nice areas 5-12 miles from the ocean in Orange County are either right at rental parity or about 10-15% above.

Don’t make the mistake Millennial is going to make.. waiting it out and letting it pass him by. Once you get rental parity… jump on it and never look back.

I was laughing so hard at this! Thank you polish guy.

One of those morons who has never seen a rental parity calc and doesn’t know what opportunity costs are.

He probably thinks that his mortgage is paying himself. Wait until he sees how much interest he pays to the banks….the interest alone is much higher than the rent.

It’s because of silly people like this that we have boom and bust times. Dummies always buy at the top because they think “if I don’t buy now I will be priced out foreverâ€.

Some folks never learn. Will make those of us rich who wait on the sidelines until we get a nice crash.

The first 4-5 years of a mortgage is almost entirely interest, so your logic doesn’t add up. And if prices go down (which they will), now you’re upside down. Not a good place to be.

I just refinanced into a 15 year so it doesnt really apply to me anymore but even if the payment was mostly interest what does it change exactly? I was paying more in rent than the interest portion of my mortgage day 1. I was throwing away my money regardless. If prices go down by 50% tomorrow ill be very happy. Ill get a place in laguna beach and rent my existing crapshack.

Somebody failed basic math here. With today’s super low rates, the amount of principal paid up front is significant.

On a 30 yr loan, the first payment is about 1/3 principal.

On a 15 yr loan, the first payment is about 2/3 principal.

When rates were double digit, what you are saying was true. Most Americans can’t save a dime, paying off big chunks of principal is nothing more than forced savings. As long as rates are low, everybody here can forget about the big tank. I’m sure Jim “Tank Hard” Taylor is currently enjoying his recent purchase.

The only way I call it. I am not a facebook guy but i hear things. Some of these people crying about the cost of living are at some of the best steakhouses every week. And i do realize there is other expenses but I hate the freakout of people why the can’t afford. Now that interest rates have dropped why not put a little bucks in to the principal and make your payment a little lower?

My heart goes out to people who had a downpayment sitting in the bank for years, but decided to wait for a housing price crash by renting.

Couldn’t agree more! Saving, waiting and not buying has been the best thing for me. My net worth increased over the last few years tremendously thanks to not buying high and smart investments. I could not imagine how it must feel to tie your hard earned money to an overinflated house just to see it crash again? I would feel sry for these buyers who bought at the top but that wouldn’t be honest. Without losers in the market you can’t win. I am waiting for foreclosures to ramp up and buy in when the market is down again. Some experts (like me) believe the market will see a 50-70% discount in house prices. That seems very conservative and realistic. Wait and see 🙂 whatever you do, don’t catch the falling knife. Buying RE at the top is the biggest financial mistake one can make. It’s similar to gambling and putting it all on red every turn. It’s just a matter of time until you lose it all.

I mostly agree with you Millennial. Just one thing, the BIGGEST financial mistake you’ll EVER make is marrying the wrong person, compounded only by having children with said spousal error. In the later the mistake will cost you the rest of your life, weddings, birthdays of grandchildren and the constant sniping smearing you’ll receive. ALL with your poor offspring caught in the middle. ALL of this during and after handing over half your assets and likely a continuing stream of income in the form of child support, education and in the very worst case scenario, “spousal support” after the fact. THAT is way worse than buying high in the housing market which will seem like a cake walk after the fact you marry the wrong person. I’m a woman and I’ve always made very good money, in my business I’ve seen this repeatedly and it always makes me shutter!

Homes are selling quickly again. You lost.

Lisa, Millennial has often posted about the importance of choosing a spouse wisely.

Are you sure YOU aren’t Millennial? Because you sound just like him.

Lisa, you are correct 100%. I can’t imagine if I had a wife who would want me to buy an overpriced crapshack at the worst time in history.

Thank god! I married a wife who understands that buying real estate in California is all about timing! That’s key….. if you married a shitty partner you will regret that for the rest of your life. Take your time and dont rush into marriage. I would do exactly what I did in the past. I drove a beater car and dated her. She obviously wasn’t looking for a guy who brags with an expensive car. I could have easily bought or leased a BMW or Mercedes but didn’t. I like to save money, invest and wait patiently for buying opportunities. I needed to make sure my wife is on the same page before getting serious. No idea how I got so smart. 🙂

Lisa sounds just like some guy crying at the bar.

Almost sounds like a replay. Same old song and dance…

Oh wait thats just the 70s echoing through Aerosmith. This time it different.

The game has changed and there is no sky and there is no limit to where home prices will rise.

Watching in Amazement for over a decade Doc. Keep up the good work.

Homes over one million will correct 18% lower, except coastal areas which will stay flat for many years. Homes under a million will drop 25% then stay flat for 5 years.

There will be no crash. Just an 18-35% drop across the board.

Jed, you may be correct. At least in Orange Co., it is hard to imagine a crash greater than 25%. That sounds like a lot, but since it costs more to rent than to own here, there is little to gain by waiting. Also, part of that decline has already occurred. Price are probably already down 5% from the 2017 top. There is probably only another 20% to go.

If the Chinese decide that they no longer want California real estate or suddenly need to liquidate their holdings because of the political climate in China and/or the US, OC real estate is going to drop a lot more than 25%.

California insurance companies are increasingly wary of insuring home against fire, making it harder to obtain mortgages:

https://www.cbsnews.com/news/wildfires-california-homeowners-insurance-hard-to-find-due-to-magnitude-of-massive-wildfires/

An estimated 350,000 California home and business owners are unable to get property and casualty insurance after last year’s devastating wildfires.

As the threat of mega-fires grows across the state, California’s insurance commissioner predicts the situation will get worse.

Consumers say insurers are “holding us hostage,” noting that people can’t get a mortgage without home insurance.

Seems like people never learn! It doesn’t matter if there aren’t enough housing units in California! If you can’t afford to buy or rent, you can’t afford it! The real question for those hanging their dreams on sky-high real estate is, when the music strops, who’s going to buy your home for those ridiculous prices?

Haven’t you heard? There are millions of Chinese millionaires touring your neighborhoods ready to buy the million dollar crap shack! Oh wait, that was another RE cheerleader lie that failed miserably. Nevermind.

https://www.delreyurban.com/property-blog/foreign-investments-in-u-s-housing-market-plummets/

So who else wants to buy the top of the bubble? Millennials!!!!!

THIS is the year when millennials will go out and buy in droves!! For real this time!

Nope, we heard that lie for the last 5 years and it looks like student debt and low wages are still a thing? Or maybe millennials are smarter than previous generations and don’t believe the RE cheerleader lie that if you don’t buy now you will be priced out forever?

Who else is left that wants to buy the 2007 (eh 2019) house at overinflated values just to see it crash during the next downturn?

Well said, one more thing to add to that list is the fact that Millennials do not blindly trust our government, banksters, etc. like the majority of the baby boomer generation does. Baby Boomers blindly trust with the thought process of, they woulddnt do that, why not? cause they arent supposed to…….ahh ok gotya! lol. I think there will be some change across the world once the baby boomer generation dies off and all the people left living are smart enough to realize that uncle sam is fucking us all up the ass with a red white and blue dildo that shoots stars! High student loan debt, shitty low wage jobs, insanely high rent and home prices. The whole thing is a crap shoot. Remember to obey and blindly trust the government like a good little sheep.

The economy is only going to go up up and up, so the cycle that you all are expecting to happen won’t happen any time soon under natural causes. HOWEVER, the china shoe about to drop will make a huge dent in the market. When THAT will happen who knows

I am hoping for a black swan or some dramatic event. I want nothing more than this f-ing economy to be destroyed. I am going to throw a big party when we get an economic collapse. Can’t wait to buy my first house. Until then I will live with my parents. Hahahah not paying some f-ing landlord. Crash baby crash!!!!

Hoping, let me guess, you’re a democrat. What do you think happens to people when an economy is “destroyed”? And when this does happen, you’re not going to be caught up in it?

This is the official Democrat Party line. SAD

H –

A Black Swan is something generally thought to be impossible that suddenly becomes reality. Unless you are plugged in to the Divine will, you’ll never know when a Black Swan event will happen. Depending on a Black Swan is an oxymoron. Earthquakes and hurricanes aren’t Black Swans because we all know they will happen eventually.

If you can’t find success in the best economic climate in a half century (now), then your chances are pretty slim if the economy goes to hell. I doubt anyone you know will feel much like partying then, and you’ll have bigger things to worry about than getting some discounted real estate. You sound like the Joker from Dark Knight: some men just want to watch the world burn.

These cash out refinances will probably end in foreclosure, which means they could end up in the hands of private equity firms meaning one less owned by private individuals and drives up the price of housing.

Hoping all I have to say for your comment is stupid beyond belief .As far as low interest rates bailing out housing don~t see it N SLO county I have watched that market for over a year 90% of the houses sold have been under list anywhere from 2-5% not a major move but an initial corrective move the stock market anyones guess but the volatility is so high that any move higher will likely be short lived and corrected.

Reading a lot of fantasy land here it will be different this time, no afraid not ,the correction will come and likely more severe than 2009-2011 not doom and gloom just reality we have spent too many years developing financial weapons of mass destruction and a fed that is working in conjunction with other central banks to keep interest rates low and negative throughout Europe not a good scenario .While this manipulation of paper assets go on, infrastructure improvements are ignored and the main street economy is not good for the majority. 50% min. drop leveraging at this time is insane!

I cashed out my primary home last year and used the money to buy a rental with the cash. The interest on a rental property is about 1.5% higher than on a primary home. And I was also in a better position to buy, since with my cash offers, I was able to buy at a discount, with sellers willing to take less with the guaranteed closing vs going with a mortgage buyer. I know someone who did a cash refi as well and used the money to pay off some business loans on which he was paying a really high interest rate.

Right now every bank in the universe if offering you money at 3.5% on a mortgage. If you have any debts with interest higher than 4% (to take into account closing costs on the refi) , you’d have to be an idiot not to take that offer.

Sry to hear you bought investment property last year. Bad timing….. and timing is everything in the real estate market – as they say.

During the upcoming downturn and when we have real buying opportunity, buying a rental isn’t a bad idea. I am planning on doing that. I got zero debt but lots of cash.

Millie my good friend,

I’ve been buying rentals for close to a decade. And I will continue to buy for the next decade. Think of it like dollar cost averaging for stocks. Over the long run, you buy high, you buy low, but in the end they all end up being profitable. It’s impossible to time tops or bottoms, only fools try.

Also remember Millie, with rentals you don’t buy for appreciation, you buy for cash flow. Appreciation is a nice bonus if it happens, but should never be part of the calculation.

I assume that’s in Spokane-istan? You want to show us a rental parity calc for your rental you purchased in 2017? You know why RE cheerleaders in California NEVER show a rental parity calc for rentals in Cali? Cause it would be a good laugh for all those that have a brain and understand basic math.

I love dollar cost avg. in stocks and crypto! never heard that for rentals 🙂

Maybe because buying REAL ESTATE at the top is never a good idea. No matter how hard you RE shills try. If buying RE at the top would make sense we wouldn’t need an army of RE shills to convince us to buy now 🙂

Have you ever heard of a stock bubble blog where stock shills try to tell you dollar cost avg is a good idea? Nope, cause it’s not needed. We all know it makes sense to dollar cost avg into stocks. For REAL estate, those that bought high are trying hard to convince others to share the pain. And of course the realtards, lenders and those who want to cash out at the top.

Mr. Landlord,

If you bought RE in WA state, what are you doing about the new law where you are forced to accept Section 8 from people with an income less than the rent?

It looks like the socialists in WA, OR and CA are worse than the communists. They act like they own your place in order to buy votes from the millions coming illegally from Central and S. America. This is worse than nationalization. At least under nationalization they have to maintain the property, pay property taxes and insurance.

Flyover,

All my properties are in Idaho. I live in Washington (no state income tax) but all my investments are in Idaho where (for the time being anyway) the laws are very much in favor of landlords over renters. But sadly, progressivism is a cancer that spreads and eventually even Idaho will impose idiotic laws like that. When that happens, I’m out of the landlording business.

Flyover, landlords are now sadly not permitted to categorically discriminate against Section 8 voucher tenants in ANY state- it’s an HUD rule written into law. Your best defense against Section 8 is to screen, screen, screen, so if you do get stuck with a Section 8 tenant, it will be some nice, quiet elderly person or disabled person.

With regards to Section 8 I would be careful to make sure the primary tenant does not have a chain of family trash kids or others that try to stay as permanent residents as they are usually the downfall for renting to Section 8 recipients.

Homerun, that is why the landlord must screen rigorously. Screen, and set conditions. For one thing, you must limit the number of people who can occupy the place, and prohibit short term occupancy or subletting in any way, such as Airbnb.

Of course, it goes without saying that it’s much easier to enforce conditions when you have nice places in nice areas, where you have many prospective tenants who are waiting to take over when you have to evict someone. But nothing beats screening out trouble to beginning with, and it’s a lot easier to be selective about your tenants when you are offering a pristine place for a bargain rent relative to the area, than it is when your place is substandard and overpriced. I remember looking at places in super-prime neighborhoods here in Chicago where the landlord clearly thought that just because the place was in Lincoln Park, that he was justified in charging nosebleed rent for a place that was borderline unfit for human habitation. That is asking for a bad tenant. If the only people looking to rent your place are people with vouchers, you need to ask yourself what you’re doing wrong.

Laura, New York City rent control laws give tenants the right to sublet. A landlord cannot prohibit subletting.

As we become a nation of renters, expect ever more onerous rent control laws.

I believe that RE prices are going to go down in Communists states due to mismanagement and increase in value in conservative states where the property owner rights are still respected.

The communists in power in socialist states like CA, OR, IL, NY and WA will act like they own all the real estate – for landlords forcing them what to charge and do with their private property and for homeowners to use them as sitting ducks for confiscatory property taxes which will be raised a lot to cover their own pensions and those of union bosses who give them the votes and money for political campaigns.

Because of this, in the coming years you will witness massive reallocation of capital from blue states to red states. It is already happening in the case of NY, Chicago, SF, etc. and it is just going to go from bad to worse. The red states where you see more respect for property will stand as beneficiaries of this capital flight. I know lots of people with serious money flying away from the insanity in communist states (blue) and relocating their capital and investment in red states.

In the last 3 years ID had the fastest increase in RE prices in the nation, faster than any communist state. This is not just my opinion. Numbers don’t lie.

I want it too crash so I can buy for good price.

Beautiful news. Music to my ears

https://www.ocregister.com/2019/08/31/more-proof-that-southern-california-home-price-gains-are-evaporating/

Evaporating price gains. Love it

EPIC !!!

Absolutely EPIC Millennial !! No price declines… but slower increases !!!

BRUTAL !!

“Los Angeles County saw the smallest increase since 2012’s fourth quarter, a 3.8% year-over-year gain vs. a 5.8% increase the previous quarter and an 8.4% rise a year earlier. Gains ran an average of 7.4% in the past five years.

In Orange County, it was the smallest increase since 2012’s third quarter, a 2.6% year-over-year gain vs. a 4% increase the previous quarter and a 6.5% rise a year earlier. Gains have averaged 5.7% in the past five years.

For the Inland Empire, it was the smallest increase since 2012’s fourth quarter, a 4.2% year-over-year gain vs. a 5.6% increase the previous quarter and an 8.1% rise a year earlier. Gains have averaged 7.5% in the past five years.”

Exactly! Epic! My words!

During the “strong economyâ€, the real estate market shows signs of weakness like a cancer patient.

Higher inventory

Price reductions left and right

Open house after open house

No more bidding wars

Longer market time

Historic low pending sales

Asian money stopped flowing into the RE market

Remind you, this is while we have historic low unemployment 🙂

This will be an epic crash 🙂 I feel sorry for those who bought recently. Smart people will buy when it crashed. You will be able to buy RE 50-70% below today’s prices.

Millennial,

How much you want to bet there are year over year price increases again from 2019 to 2020?

So EPIC, absolutely EPIC crash man !!!

Tank in sight, why in such a hurry.

Sometimes I think you perma bulls stress too much.

Right now is the time to save and invest – make money in good times and buy real estate during crashes. This has been working for decades. Every ten years on average we get a massive real estate crash. It’s called business cycle, or boom and bust cycle.

I don’t understand why you fight reality so much? The only explanation I have is that you are overleveraged in real estate or an agent who needs commission checks.

Millennial,

Sweet deflection, at least you admit I’m right.

Bottom line we have year over year increases and it looks like another year over year increase for 2020. Glad we got that settled, since you have fantasy land all over this blog.

Permabull? Far from it, I have timed the market several times before, I am the one giving you the dose of reality.

There will be a 15-25% drop in the prime areas you want to live in at some point. Give the current state maybe that is 2024 or 2025. How much will the market have gone up since you started posting about a 60-70% drop three years ago? What a great question.

The problem is you are going to miss the boat. You are going to be here clamoring every day about your 50-70% drop when we are far below rental parity in 2024 or 2025.

Welcome to your reality. I have seen it all before here. You will not be the first and you will certainly not be the only one who misses the boat hanging on to fantasy.

Bawahahahahahahahahahahah

Tank in sight, you are the new clown here. Tells us timing the market doesn’t work, so buy now. But tells us now that he timed the market perfectly. Lol. Sure buddy! We all believe you!

If you would be familiar with California RE boom And bust cycles you would know 50% haircuts in prices are common. Not even a conservative estimate. Just look at the sales history of some houses… anyone with a half brain can do it.

The truth is, you were telling everyone how there is no inventory. Prices can only go higher. How come you never mention we already see price cuts left and right? That was just 1-1.5 years ago when you told us the no-inventory-lie! What happened? I haven’t heard you say this in a looooong time now.

Now your pitch is, the next drop will only 15-25% in 5 years. As if you would know!

As always I will do the opposite of what RE cheerleaders tell me. That has proven to be the best strategy:

Save in good times, let the RE shills tell us their BS and get the deals once we see the crash. Couldn’t be simpler. Until then, I enjoy renting for 1400 freakin bucks ROFL.

Btw, my wife and I work and make good money, (I have a six figure tech job) debt free and over 800 credit score. I could easily buy now in a desirable area. But why waste your money if you can wait and buy half off? None of the RE shills has ever answered that question 🙂

Tankinsifht,

15-25% drop in 2025? How are you projecting what happens in 2025?

That would mean 15ish year bull market. I don’t think you have gotten the memo yet.

Why not make this 2040?

People have bad memory. Remember when people were saying it’s a great time to buy in 2007?

Great data from a great, well known website

https://www.zerohedge.com/personal-finance/fitch-confirms-lower-interest-rates-have-yet-spark-home-buyer-demand

Home buying has slowed down significantly- not even lower rates could help to sucker in the last buyers before the massive crash.

My thoughts go out to the RE cheerleaders who have over leveraged themselves by buying overpriced crapshacks at the top. Only a miracle can save them now.

That is the same website that predicted recession every year since 2012. They will get it right eventually but you missed out on alot of big gain

What???? Lost on gains?! I made an absolut killing the last few years. To start, by renting a cheap apartment I have several thousand per month to save and invest. The stock market made me a ton of money. Not to mention the crypto bubble in 2017.

Talk to anyone who has experience in the real estate market and they will tell you timing is everything. The RE moves like a cruise ship, once it sets course it follows that direction for years. You gotta love those people who think it’s always a good time to buy RE. Some people learn the hard way….

“Dr Doom” Nouriel Roubini is predicting that the next economic crisis will be a supply side one, unlike the demand side crash of 2008. China trade wars or a Persian Gulf oil cutoff will change the supply of goods, not the demand fo goods that the 2008 massive crash caused. This might cause stagflation as in the 70s instead of deflation. So stagflation causes what in the housing market?

http://marketwatch.com/story/the-fed-cant-rescue-us-from-the-coming-supply-shock-recession-2019-08-22?mod=hp_minor_pos21

https://www.quora.com/What-are-the-best-asset-classes-to-be-invested-in-during-stagflation

Mr landlord I would have to agree ” you`d have to be an idiot” short term thinking and leveraging at the top of the market your choice too much of group think, things are different this time, which is probably true it will be much worse than ever over the next 2-5yrs

R E C E S S I O N

Historic data shows that purchasing real estate right before a recession destroys wealth.

Well prices are not dropping in Sacramento, California. I want a place close to downtown for easy commute and more room. But no way am I paying 800k for a crapshack in Land Park, downtown, midtown or East Sacramento. I also am not commuting 3 hours each way to afford a real home. It is a bubble.

Sacguy, if don’t want to pay $800K for a crap shack in East Sac but you want to be close to downtown, you can always buy a house in South Sac where housing prices start at $150k. Of course you’ll need to have bars on the windows, security doors, a guard dog, and carry a concealed weapon. You’ll experience all the joys of living in a diverse neighborhood!

The big interest rate fall sure brought the anger out here. Dead ahead is more housing appreciation. I understand you find that distressing.

Just keep repeating the Recession word if that makes you feel better. Or, if you want, if it makes you feel better, go ahead and post that prices will fall 50% or 70%. If the freefall in interest rates are too stressful, you can always predict prices will fall 100% on this blog. Just imagine if someone gives you money to take their house for free. Now, that should make renters feel better. Whatever you need to do.

Exactly right jt. The panic is palpable amongst the permabears.

Poor JT, the market is changing fast and all he can do is deny and make up stories. Hint: just because you live in a fantasy world and tell yourself the RE market will keep going up doesn’t mean it will. Denial usually ends in tears. The sooner you accept reality the sooner you can allow yourself to adjust and prepare for the crash.

The lower interest rates haven’t helped at all. We see longer market times and price reductions left and right. As we know, this wasn’t supposed to happen during a strong economy. Experts call it market cycles. It’s normal.

Older millennials are driving home prices higher again

https://www.cnbc.com/2019/09/03/older-millennials-are-driving-home-prices-higher-again.html

““A growing number of millennials are expressing an interest in buying homes, reinforcing the theory that this cohort is continuing to engage within the housing market,†said Frank Martell, president and CEO of CoreLogic. “But, with so few homes available for sale, the imbalance has created an affordability crisis that is getting worse every day. Demand exceeds supply and we’re unsure of when the two will balance out.â€â€

Rofl!! In other words…. millennials ain’t buying!! Nice try

The last few years we heard the Asians are buying. That myth has been debunked and now RE shills are trying again with millennials! Keep trying 🙂 when do people realize there aren’t enough suckers out there to buy your overpriced crapshack?

““A growing number of millennials are expressing an interest in buying homes, reinforcing the theory that this cohort is continuing to engage within the housing market,†said Frank Martell, president and CEO of CoreLogic. “But, with so few homes available for sale, the imbalance has created an affordability crisis that is getting worse every day. Demand exceeds supply and we’re unsure of when the two will balance out.â€â€

Rofl!! In other words…. BROKE millennials ain’t buying!! That is right. Millennials who don’t have any money because they screwed up in life aren’t buying. The ones that screwed up need a 70% price crash because that is the only way they can afford to buy.

Milli: millennials ain’t buying!! Nice try

Most of the people I see at Open Houses are millennial couples with young children or babies or a pregnant wife. And the houses are sold, eventually. Someone’s buying.

Do you bring your wife to Open Houses? Wonder how she feels, seeing her peers buying nice homes and starting families. While she lives in a sketchy area, sneaking into the neighbor’s pool, listening to her husband talk about an elusive crash for years on end.

It’s hilarious…..now our poor RE shills are back to “this will be the year when millennials buy in drovesâ€. Haven’t made a sale in a while and hope a buyer will show up eventually at your open house?

It used to be: “Asian millionaires are touring your neighborhoods ready to buyâ€

That changed rather quickly. Now RE cheerleaders are putting their hope in millennials.

The reality is that buyers sentiment has shifted. Millennials are not that silly as their previous generations. They learned from their mistakes. Last time we had 7 Mio foreclosures because silly people believed the lie “Buy now or be priced out foreverâ€

Millennials don’t buy at the top no matter how hard RE shills want them to.

Obviously, there are exceptions. You need a few dummies who buy the top and foreclose later. One of the biggest mistakes one can make is marrying the wrong partner. Son of landlord knows this. He was out of luck and is single now.

Luckily, my wife understands that buying at the top is financial suicide. Therefore, we make a killing and save tons of money by not buying high. Once the market corrects (usually 50-70% in California) you will have rental parity. Then it will makes sense to buy a house. By that time i can buy in all cash or simple buy investment properties and a nice house.

That’s how winning looks like 🙂

Losing looks like this: you buy at the top, have buyers remorse and try to convince people on a housing bubble blog that buying at the top is somehow not that bad. Rofl

Looks like JT and “Mr Landlord” didn’t save their commission checks during the bubble years…LOL

Don’t worry, housing Bubble 3.0 will come in 2034….just hold OK

What happens if some experts are right and we are in a stagnation period for many years. Nothing goes up or down more than 10%? I always see some homes priced way out of range and they get some massive drops and people start screaming “crash”. Here in the inland empire, many homes have not reached 2006 levels yet but some have, given the area.

I think rates are going to determine if and when a crash occurs. What happens if the fed lower rates to let’s say 2.75% on a 30 and 2.0% on a 15? This would be historic lows and would prevent a crash for the time being.

For those that are wait- what happens if a crash doesn’t happen for another 5 years and then it’s about 25-30% (realistic) drop? I also do not think many here have actually owned a home and can factor in the benefit that does add up on paper?

-the home is yours to fix or change

-you have your own garage of 3-4 car garage (vs apartment)

-not having to worry about being kicked out cause rent is going up or landlord is selling

*I am not saying by at these prices I am just throwing some thoughts out there as your purchase price matters with how much it will go up or down in a recession. A 200k home is not going to lose 50% of its value but a 1.5 million dollar home can (maybe)

Experts are expecting a recession and housing bust. It makes sense after artificial low interest rates. Every bubble ends at some point. We are overdue for a nice recession.

Poor millie believes “experts”. LOL No wonder he lives with his mom.

Could not agree more. I believe in experts and data. I def don’t believe in cheap sales pitches by RE shills. They have proven to be wrong for a decade now.

I myself am a RE expert.

Unfortunately, I don’t live with my mom. That’d be great! I can only encourage any adult living in California to live with their parents, save big and buy when we get a nice crash in real estate prices.

Jordan, I believe the Fed can delay a crash for years by dropping interest rates lower and lower. However, I don’t know what the Fed will do.

In any case, if home prices start falling both low and high priced homes will drop equally in value. The reason: Once homes become cheaper, people will stop buying the small, junky ones and start buying the nicer ones which they will then be able to afford. There will then be no buyers $200,000 ones and,therefore, their prices will also decline rapidly.

Many people have misconceptions about the interest rate the Fed sets. The Fed only sets the FFR (Federal Funds Rate) which is basically the overnight rate for banks. Bills (<52w in duration), notes, and bonds are all set by the open market either at auction time on issue or cash and futures markets for existing issues. The exception to this was QE where the Fed basically printed money to purchase bonds directly in the open markets (driving down yields).

I could see us buying when the market dumps 30%. Until then, we are going to live rent-free @hotel mommy for a few more years. We are not going to rent and for sure stay the hell away from buying. Don’t waste your money people – prices are still way too high!

We are looking forward to a recession. We want our kids to move out and buy real estate but at the moment prices are just ridiculously overinflated. A decent house at 700k today should be 350k in reality. Until we see realistic prices again I am happy to have my adult kids at home. It seemed much easier to buy a house 30 years ago. We have to make the best out of this crisis and hopefully it ends soon with a meaningful recession.

Hello Auntie

Dont hold your breath for a 50% haircut – unless the following.

prices begin to retrograde in 2020 then it will take 3 – 5 years for the bottom to hit. And for a 50% haircut your children need to be looking at dumpy regions like Fontucky or other places in the Inland Empire. And don’t forget, ‘inland empire’ is not a location, it is a miserable state of mind.

I see a common theme here, all the bears want a bad recession so they can buy after the big crash. News to bears, the vast majority of people are too scared to buy a home during a really nasty recession. They may not have a job or are holding on for dear life. Just like last time: the people with cash, connections and large down payments get the houses. And you need all cash to get the really sweet deals.

Lord B. I agree with you on that one. I takes nerves of steel to buy when is “blood on the streets”. Usually, under those conditions, buying a house is the last thing on people’s minds. Every day you hear that the dow dropped another 1,000 points, more millions lost jobs, foreclosures grow exponentially, and all people are afraid of catching the falling knife.

In 2010, I had lots of cash in the bank and I still had to go through a good tug of war between my emotions and logical part of the brain deciding if I should buy RE or not (as investment). I was twisting in bed at night. I am glad that my analytical part of the brain won, but from experience I can tell it is not easy.

This, coming from me – all my family, friends and relatives think I have nerves of steel. The reality is that most people, statistically speaking, can not do what I did financially or emotionally.

Blankmind, you must be new to the real estate cycles. I know dozens of people who bought sweet deals during 2009-2013. You are either clueless or full of bs.

Noooooo Aunt Sara! SocalJim and Mr Landlord Benz payments aint gonna pay for themselves!!!! The REIC will die if no one buy or rent!!!! Please show them some compassion

About Nouriel Roubini from Wikipedia:

In September 2006, he foresaw the end of the real estate bubble: “When supply increases, prices fall: that’s been the trend for 110 years, since 1890. But since 1997, real home prices have increased by about 90 percent. There is no economic fundamental—real income, migration, interest rates, demographics—that can explain this. It means there was a speculative bubble. And now that bubble is bursting.”

Now this economist who worked closely with the Clinton and Obama administrations is predicting a repeat of the economic downturn of the ’70s with rising inflation and economic stagnation. No one has yet commented on my previous post about Dr Roubini’s recent article. This type of recession will lead to rising prices of real assets like precious metals and real estate just like in the Carter years (I bought my first house in the last months of the Carter administration).

I’m not convinced about a return of stagflation, and a Japan-like permanent regime of deflation and low interest rates seems possible to me. But people should think about this and not assume

About Nouriel Roubini from Wikipedia:

In September 2006, he foresaw the end of the real estate bubble: “When supply increases, prices fall: that’s been the trend for 110 years, since 1890. But since 1997, real home prices have increased by about 90 percent. There is no economic fundamental—real income, migration, interest rates, demographics—that can explain this. It means there was a speculative bubble. And now that bubble is bursting.”

Now this economist who worked closely with the Clinton and Obama administrations is predicting a repeat of the economic downturn of the ’70s with rising inflation and economic stagnation. No one has yet commented on my previous post about Dr Roubini’s recent article. This type of recession will lead to rising prices of real assets like precious metals and real estate just like in the Carter years (I bought my first house in the last months of the Carter administration).

I’m not convinced about a return of stagflation, and a Japan-like permanent regime of deflation and low interest rates seems possible to me. But people should think about this and not assume like in 2006 that Roubini has gone off the deep end.

A period of stagflation is certainly in the cards at some point in the 100 year interest rate cycle.

The hard part is predicting when, it could start in 3, 5, 10 or even 20 years. It’s easy to right about it, but hard to predict exactly when it will happen.

You definitely want to own real estate in that period.

NOW is the BEST time to buy!!!!

-REIC Shill

qt (Troll Boy),

Not sure how you get that out of my comment, but whatever floats your boat !

It’s funny when you bring the realities of prices here…and the history of SoCal median prices…. and talk about a normal correction during a recession… you are called a REIC bull here, hilarious.

Core Logic posts YoY increases for August of 3.6%

https://www.calculatedriskblog.com/

Home prices continue to increase on an annual basis with the CoreLogic HPI Forecast indicating annual price growth will increase by 5.4% by July 2020. On a month-over-month basis, the forecast calls for home prices to increase by 0.4% from July 2019 to August 2019. The CoreLogic HPI Forecast is a projection of home prices calculated using the CoreLogic HPI and other economic variables. Values are derived from state-level forecasts by weighting indices according to the number of owner-occupied households for each state.

“Sales of new and existing homes this July were up from a year ago, supported by low mortgage rates and rising family income,†said Dr. Frank Nothaft, chief economist at CoreLogic.

“With the for-sale inventory remaining low in many markets, the pick-up in buying has nudged price growth up. If low interest rates and rising income continue, then we expect home-price growth will strengthen over the coming year.â€

Read more at https://www.calculatedriskblog.com/#O0Jl4rD3tHyBemAd.99

I think many people are forgetting about people out there with money. I believe if prices fall a little bit more over the next year or two that those people will start buying up the homes for rentals.

Exactly! Like me! When prices fall 50-70% I will go out and buy.

People forget how leveraged some investors are. They are up to their ears in RE debt. Once the music stop they have to unload fast or are being trapped underwater for at least a decade. Liquidity will dry up fast and cash will be king.

Smart people unload in time and sit on cash until the crash. ….happens every ten years

Milli, you will be buying when prices rise 50% – 70% … cause it will take you a long time before you make enough money to scrape together a down payment. How did you get in such a bad spot?

JT, I couldn’t agree more. I will buy when the housing market corrects. Experts like me expect 50-70% discounts. Until then, renting makes more financial sense. It’s just simple math. Some people (like me) are what they call smart buyers. We buy based on numbers and what makes sense financially.

I could easily buy now if I wanted to:

Six figure income & working wife

Massive cash balance

No debt, over 800 credit score

If I would have bought at the Top like JT and landlord I would be throwing away my money. Someone would have to explain why this is a good idea? I haven’t seen an answer yet. Why not wait and buy half off?

Cash out refinancing is a dumb thing to do but it’s not going to cause a crash in the housing market. In this housing cycle, households and their income have largely been sidelined. “Investors†have dominated the market and set the prices. And investors have aggressively push rents to generate yield. The higher rents supported by a false narrative that there is a housing shortage have attracted new rental construction. In a well-functioning market this should cause rents and house prices to fall but, unlike 20 years ago, ownership of new and existing larger apartment complexes is more concentrated so these owners have market power. Even as “to Lease†signs go up all over the San Fernando Valley, where I live, rents continue to increase. That’s not market failure but a reflection of market power. My assumption is that many smaller investors who have been rental price followers, especially those who go into the market over the last 3 or so years, will not be able to withstand the financial burden of prolonged vacancies and loss of rental income. Some have already started to unwind their housing positions, many others will need to do so over the next few years. Sadly, the price adjustment will be slow. Banks don’t want prices to collapse again but house price appreciation will be negligible for 10 years while the banks and the wealthy investors protect their position society.

so big bank takes little bank until the majority of the population work at walmart for slave wages only to be able to rent a shitty apartment. Home ownership in the US could potentially be a thing of the past and left only for the banksters, the elite, and high income people such as doctors and lawyers or what not, Your average blue collar joe millennial, will slave his life away. Chasing pennies to the grave rather than the dollar to the grave.

Garfunkel (nice name btw)

You sound like the people in 2005-2007 saying: buy now or be priced out forever!

If you go back in time and read the blogs from 2005-2007 RE shills back then and today haven’t learned much.

Its just greed to think what goes up must go up forever. It’s a clear sign that we are at the peak right now.

All the people here waiting and hoping for a depression didn’t learn any lessons from 2009-10. During that time, on paper it looked like home prices plummeted. But they didn’t really. In the aggregate prices fell, 25 or 30%. Which sounds like a lot. But in reality homes that you wanted to live in barely budged. Maybe 10 or 15%.

The 25-30 was an average that included 60%+ drops for houses in far flung ghost town suburbs or in the ghetto. But the reason they were that cheap was because nobody wanted to live there. People only bought there out of pure desperation. And for every 60% off home that nobody wanted, there was a 10% drop in the ultra desirable ares.

All you people are putting your lives on hold for years, living in run down apartments or living with your parents to save maybe $100K. It’s sad and pathetic. Renting long term is financial suicide. Don’t do it kidz.

And as someone else mentioned above, with all of you waiting on the sideline, at the slightest drop in prices, you are all going to be competing against each other. All this pent up demand will drive up prices right back up quickly.

Only way Millie’s fantasy 70% off happens is an extraordinary event like a war (real war not the BS trade war) with China or whatever. And in that case, buying a house will be the least of your worries. Absent something like that, home prices will do what they have done for the past 100 years….keep increasing.

I’ve been tracking the price of our old house in Santa Barbara out of morbid curiosity.

It was a 1960’s tract house along with about 700 other houses in the neighborhood ranging from 1K to 1.5K square feet. Great schools and extremely low crime neighborhood with a 10 minute walk to the beach.

1987- 200K – sold

1994- 260K – sold

2006 – 800K – neighborhood houses

2011 – 420K – Our Millennial was right! sold!

2018 – 950K – neighborhood houses

2019 – 900K – Currently offered neighborhood houses. Our Millennial might be right but there’s a long way to go.

In retrospect we should have held in 1994 and nearly tripled our money in 2006 or 2018.

Our Crystal Ball broke in the 1994 Northridge quake.

I forgot to add some data on this neighborhood that I remember

1966 – 28K – House built

1972-1978 – Rental

1979 – 130K – Sold!

1987 – 200K – Sold!

This shows the increase in housing during the 1970’s and 80’s. and the growth of CA housing prices during this time. 1970’s were boom years. 1980s/90’s were mostly flat.

Landlord, I disagree slightly with you statements.

It really depends on the circumstances.

You live in Spokane. House prices aren’t as overinflated in Spokane-istan as they are in California.

Take me for instance, I am a smart guy, make well over six figures, no debt, over 800 credit score, massive cash war-chest. I can easily see that there is no rental parity in California. So why heavily overpay for a house that’s likely to lose value during the next downturn.

And please don’t tell us you believe there won’t be one. I know some RE shills make it sound like you are a doom and gloomer when you mention the R word. The reality is though that recessions are part of the business cycles. It’s normal and healthy. Most people with a college education know this. And People in California know this because it happens (on avg) every ten years. In California we call it the boom and bust cycles.

Nobody has ever said renting your whole life is the goal……even if you do…..later on in your life you inherit the houses your parents bought for cheap.

A massive, painful housing correction is coming. Don’t deny it, keep your powder dry and buy when prices are lower. Or don’t, and tell yourself, prices will only go up. The choice is really up to you. Just don’t cry later that nobody has warned you.

I hope it helps and I do agree with your financial suicide description. Buying at the top of the bubble in California is something you will deeply regret. You can never catch up with someone who bought low. Buying high is almost like financial suicide in a way.

I have given many strategies to come out ahead during California bubble times:

Rent cheap and save/invest

Live with your parents

Live with your in-laws

If you are single, maybe live in a van. Some smart six figure tech employees do that

Or rent a tiny house or live in a trailer park

Once the correction is here, buy 50-70% off, a nice beautiful house. These strategies are genius and I don’t even charge money for it. Make the best of it and good luck!

Mr. Landlord, you have won me offer. You are correct about the prices in the most desirable areas dropping only half as much as the less desirable ones. However, if the crash does occur, the greatest investment profits will be made by those who buy homes in the least desirable areas.

Millie can’t win either way since he can’t afford to buy in a desirable area and will lose a lot of money buying in a undesirable area. It appears to me that the small, undesirable home are still rising in price so Millie can’t buy now even if you are correct about the longterm trend.

“However, if the crash does occur, the greatest investment profits will be made by those who buy homes in the least desirable areas.”

Yep. People made out like bandits buying homes in Riverside for under $100K in 2009-2010. Same homes are now $250-300K today, plus 10 years worth of rental income. You’re talking 1000% cash on cash return. That’s how you do real estate investing right.

Home prices in the most desirable areas drop only half as much as those less desirable ones. However, if the crash does occur, the greatest investment profits will be made by those who buy homes in the least desirable areas.

Millie can’t win by buying now since he can’t afford to buy in a desirable area and will lose a lot of money if he buys in the currently, very overpriced undesirable areas. Even now, those small, undesirable homes are still rising in price. Millie has to wait and hope for a crash, but it may never occur. If the Fed keeps dropping interest rates, the crash may be delayed many, many years in the future when home prices may be much higher.

Gary, exactly. You don’t win buy buying high. Anyone who has a Puls can buy high.

The trick is to wait, be patient and disciplined. Then buy when the market crashes.

One thing you got wrong though is: interest rates won’t go up in the next years. Have you seen what happened in Japan or Europe? They have negative yielding ten year bonds. Mortgage rates are close to zero there. Still, you can’t push asset prices into sky. Prices will decline. Here in the US we will see a massive crash and you will be able to buy RE 50-70% lower.

Millies in Seattle were high fiving each other at the “crash” that happened in the city. A crash of….wait for it….3% !!! LOL. Meanwhile, rents continue to increase, with August being the 8th straight month of rents going up in the city. Which is weird because all the perma bears were sure prices were going to crash 50% after all the new apartments came online. Weird how they were wrong yet again, huh?

https://mynorthwest.com/1497628/seattle-renters-report-august-2019/

I keep telling you people renting long term is financial suicide.

Agree with you Mr. Landlord, long-term renting is bad for finances. But so is overpaying for assets that are grossly inflated due to policies (ever-growing fiscal deficits plus near zero interest rates because the markets “need” it) aimed at maintaining baby boomer wealth by stealing from future generations. That’s why a lot of us frustrated renters are here on this forum, hoping for a crash that would bring prices back to where they make sense.

SD,

The fallacy by renters is thinking houses are over inflated. Perma bears always think the great crash is coming. Which is why they never buy and continually miss out. Had someone bought at the absolute peak of the the 2000s bubble, say in 2006 or 2007 (depending where you were), today you’d have 12-13 years of principal paydown and a house worth more than what you paid. That’s the absolute worst case scenario and still, you’d be exponentially better off than having rented all this time.

As for blaming Boomers, come on dude not this nonsense again. Take some responsibility for your lives and stop blaming others for your failings. You could have bought cheap real estate 5 years ago. You chose not to. Cuz hey man, millenals are like too cool for owning real estate bruh, we are mobile and we need to be within 1/4 mile of 27 Asian-Somali fusion restaurants. We love your 500 sq ft apartments!! We don’t need those environmentally unfriendly single family homes or a car needed to drive to them. Sound familiar?

You chose to be special snowflakes. Now you get to live with your choices. Not my fault. Not a boomer’s fault. Not Trump’s fault. Not the Fed’s fault. Nobody’s fault but YOUR own. So stop whining, man up, act like an adult and maybe you can right that ship.

I am not a millennial and I am not blaming anyone for my situation. Just stating that IMHO current monetary and fiscal policies are aimed at inflating assets as long as possible, which hurts working people and robs future generations. I did not have the savings in 2010 to buy responsibly. Now I am in good position to buy but not seeing the value – paying $1.1M for house I can rent for $3.5K is financial illiteracy and is indicative of inflated valuation. If that same house was $850K, it would be a barely Ok deal. I can’t speak for the whole country , but in SoCal the home valuations DON”T MAKE ECONOMIC SENSE. And now over-$1M market is dead and prices are slowly coming down (fact!). Once the stock market blows up (which the increased volatility and Walstreet crackheads begging for rate cuts is indicative of), the whole house of cards is coming down. I hope you can cash out by then.

Negative mortgage interest rates, here we come.

https://finance.yahoo.com/news/americans-are-trying-to-get-denmarks-negative-mortgages-143832101.html

Negative mortgage interest rates, here we come:

https://finance.yahoo.com/news/americans-are-trying-to-get-denmarks-negative-mortgages-143832101.html

I’d buy if we get a crash and negative mortgage rates! Until then, hotel mommy is your friend! Gotta have some advantage over boomers. Lol

I kinda feel bad for the perma bears. So wrong for so long. It has to start getting to you guys.

The recession has been cancelled. Mortgage rates are at 3%. Home prices are accelerating.

You guys lost out again.

Who do you believe?

Landlord: there won’t be a recession again ever again. It’s been cancelled

Smart buyer: what they said last time. I am keeping the powder dry. You go ahead and buy your rental “investment†at the top of the bubble.

Landlord: you will rent forever

Smart buyer: sure, what they (realtards) keep saying. Patience and discipline usually win though. Let’s wait and see 🙂

Where’s the crash?

Consider this Santa Monica townhouse: https://www.redfin.com/CA/Santa-Monica/1252-Euclid-St-90404/unit-105/home/8114604

Listed 5 days ago and already an accepted offer.

* 2011 … sold for $990,000.

* 2019 … listed for $1,529,000.

If it got its asking price, that’s a $539,000 markup since 2011.

Renting long term is financial suicide.

Landlord,

Replace “renting†with buying at the top and I would agree that: buying overinflated assets will collapse soon and is financial suicide.

I met a realtard lately….he quickly understood I am a smart guy and get the market. So he didn’t bother trying to give me the cheap sales pitch “interest rates are still lowâ€

Instead, he told me that he sold his house recently and rents now. Smart realtard one should say. He is now waiting for the crash. He looks pretty very old. Probably in his 50’s. He told me he has seen this multiple times. For those who don’t know or are new to the RE game. It’s called cycles. Nothing goes up forever. A downturn after a steep run up is just normal.

A friend of mine just sold her Oregon home for a $36,000 loss after holding it for 13 years. Yet when I looked at what it would have cost her to rent vs. what it did cost her to own during that time period, she still came out ahead owning–even after selling the home for a loss. The main reason was that rents in her city increased at least 60% during those 13 years while her house payment remained the same. Eventually, the monthly cost of owning her home became much less than the cost of renting a similar home.

I agree with Mr Landlord.

“Long Term Renting is Financial Suicide”

I’d also like to add:

Short term home ownership is even worse financial suicide.

8 Million people walked away from their homes in 2008-2011 with foreclosures. (Quote from The Good Dr.) Finally, now after 60% increase in rent from 2008-today, they can buy a house again during this bubble. Hopefully not to walk away again.

These people panicked and sold. The sad part is if they would have held for 3-4 years(easier said than done but don’t commit to buy a house if you don’t have the cash to ride out a downturn. Just like Our Millennial), they would now be showing at least a 10% capital gain on that house,

AND if they bought in 2006 at the peak, they would have ALMOST paid off a 15 year loan (2021) and been able to live rent free for the rest of their lives. Can you imagine NEVER having a rent or house payment for the rest of your life??? And never having to endure a rent increase ever again?

These are the people who bought in 2006 at the last peak and will not have to worry about paying Mr Landlord ever again.

Buy and hold no matter what time and you will do well.

Buy low and sell high is also great advice, but like with many things in life, don’t wait too long. Some early Millennials had a historic great opportunity in 2008-2011 but based on history, housing prices had never crashed 50% in over 70 years before that. It could end up like the 80’s and 90’s where housing prices were flat for decades and inflation ate away at the value.

IMHO, Our Millennial will likely have to wait at least another year for the crash and it may be a flattening and not a crash. How long have you been waiting? 7 years? That’s almost half the life on the journey to a rent-free freedom. If you would have been old enough to buy at the last peak in 2006, you would have had no rent for the rest of your life in 2021. (How old are you?). Do the math.

Yes, waiting a few more years or decades is no issue at all. As long as you don’t buy the top you will be fine. In California especially, you want to buy when the market is down 50-70%

Right now I feel like I am cheating the market. I call it house hacking. Don’t mind to continue doing this. The market will tell you the buy signal. Once we have panic and increased foreclosures.

So lame to base a market projection on 1 sale, lmao ZERO CREDABILITY, Keep trying Realturd cheerleaders, you remind me of Kevin Bacon in Animal House

https://www.youtube.com/watch?v=zDAmPIq29ro

Can’t wait for a recession!!!!!!! Lower prices!!!!! Am gonna buy when the housing market collapses!!!!

The US is headed the same direction as Japan. Zero to negative interest rates and crashing asset markets.

Looks like the bear market has ended and we are entering a downturn. We’ll wait with buying. We saw what happened last time!

Bear market has ended and we’re entering a downturn? That’s a new spin on things.

Haha bidding wars are something from the past. Sry realtards.

Slowdown then crash? I sure hope so!

https://on.mktw.net/32qyVdV

It’s been hot! Luckily I rent cheap not too far from the beach. We still get an ocean breeze and don’t need an AC. The best part is that I don’t pay for HOA’s but have friends in the neighboring community who have a nice community pool. we have the key code. Some people over there have seen me very often and think I live there. Lol. I call this house hacking. Save and invest your money and wait until the foreclosures ramp up again. Then come in and buy at the bottom. Meanwhile enjoy the pool but without paying any HOA.

Aside from being super ghetto, I call that trespassing. You may buy a house one day but unfortunately you’ll never have any class.

That just motivates me to share more strategies. This is called street smart! I should write a blog. Wait, I am already kinda doing this here 🙂

Millie is stealing and bragging about it. Tells you all you need to know about his character. He is typical of millenials, no morality, thinks only of himself, would walk over his dying mother to get something for free.

SAD!

Oh please SoCalguy,

The RE market is the most manipulated market. You can bait and switch (fake asking prices) and get away with it. You can lie about other offers without having to prove it. You can lie about everything and get away without consequences. Real estate agents and lenders/banksters are the most dishonest people. And you tell me taking advantage of a community pool next door is somehow bad? Give me a break.

Sry I had to laugh hard at this 🙂 landlord 😀

Rofl, I am stealing by using a pool without paying for HOA’s? Dude, this is called house hacking. You are just upset you don’t have a pool nearby in your Spokane-istan! Always welcome to join me at the pool next door and have a beer. It’s on me!

Milli, perhaps a homeless bum will break into your apartment someday. Use the shower, eat in your kitchen, sleep in your bed. Homeless breaking into apartments and houses to use amenities are not uncommon in Santa Monica’s sketchier areas. I’ve read of several incidents over the past year.

Should you ever walk in on a homeless bum using your shower, I’m sure you’ll understand that he was only “house hacking” your apartment. Perhaps you’ll even hand him a towel?

Milli, I googled “house hacking.” The term does NOT mean what you say it does.

All the search results described “house hacking” as thus: https://www.coachcarson.com/house-hacking-guide/

A house hack basically means that you buy a small multi-unit real estate property, live in one unit, and rent out the others. The property for house hacking could be a duplex, a triplex, a fourplex, or even other creative property uses like garage apartments or mobile homes, which I’ll cover later. The income from the rental units can pay for some or all or expenses while you live there. Then once you move out, the property could also become a great long-term rental investment.

“House hacking” means you BUY rental property and use the rent to pay for your expenses. It does not mean trespassing.

BTW, you are trespassing. It doesn’t matter if a resident gave you to code key. If only the HOA has authority to allow you to use the pool, and you don’t have their authority, you are trespassing.

You are also breaking and entering. A non-authorized use of a key qualifies as breaking and entering.

What I define as House hacking is a sum of strategies to come out ahead and live a qualty life by not overpaying. There are many strategies I have outlined.

I should probably write a book.

The most important:

Save during good times and don’t spend money on rent or an overpriced mortgage.

If you have parents or in-laws in the area, live with them and cut some kind of deal:

Mom and dad don’t charge rent and help with child care. Adult millennials will help with financial advice, installing apps on phones, retirement planning and help with house remodeling advice.

It must feel really shitty if you massively overpaid for real estate and see it crash soon?

Robert shiller:“It would suggest declining home prices in the near future,†Shiller, who teaches at Yale University, told Bloomberg Television on Thursday. “I wouldn’t be at all surprised if house prices started falling.â€

Well, no shiat Sherlock. Of course prices will crash. Have you ever seen a bubble that doesn’t pop eventually?

https://www.ccn.com/us-housing-market-crash/amp/

Not just Amazon, but all tech companies…..poor Millie!!

“As if highly paid Amazon employees needed another helping hand, some lenders are making it easier for the company’s new tech hires to qualify for home loans. Some mortgage originators now agree to consider Amazon employees’ potential future earnings from restricted stock units — which can make up the majority of their compensation package — as income for the purposes of qualifying for home loans.