United States of Cash Sales: A feudal changing of the guard. 58 percent of all real-estate-owned sales went to cash buyers out flanking traditional buyers with no access to pools of cash.

The old adage that cash is king seems to be the new mantra for real estate in a post housing crash world. Investors continue to dominate the housing market out maneuvering house horny buyers that simply want a place to call home. Beer budgets, champagne tastes, love of debt. Of course, as some of you astute readers know, the typical holding time for a first home buyer is in the range of 7 to 10 years. Not that this matters much for many since first time home buying is near record lows especially in expensive states like California that are undergoing a renting renaissance. Actually, this is more like a new middle ages in housing were big money from all over the world is crowding out regular home buyers. Yet big money is fickle. It moves around quickly. We are already seeing inventory creep up because prices are becoming less attractive to investors. Of course the crowd is always late to the party. Those that time the market get a large amount of attention while the 7,000,000 that underwent foreclosure since 2005 seem to be relegated to the appendix of “real estate never goes down†history. Some new interesting data on all that cash buying. 58 percent of all recent REO sales went to cash buyers (compared to 40 percent of all sales going to cash buyers). REOs are better deals and usually are priced more attractively which ironically, is what income strapped households actually need. Then again, this isn’t your typical housing market.

REOs provide better deals and are going to cash buyers

Some think that investors will continue to buy aimlessly and mindlessly as if they had no interest in protecting their wealth. While foreign money might make a big impact in key areas, the U.S. is a very large country. I know, shocking. For some in places like California, they have little idea of the world beyond their immediate bubble. It is important for some to own no matter the costs. People forget that the epic housing bubble we just lived through was because people lusted after housing so much, they started treating it as religious dogma. Today, you have this mantra creeping back in but those investors are keen at looking at prices. That is why most of their attention has been on REOs.

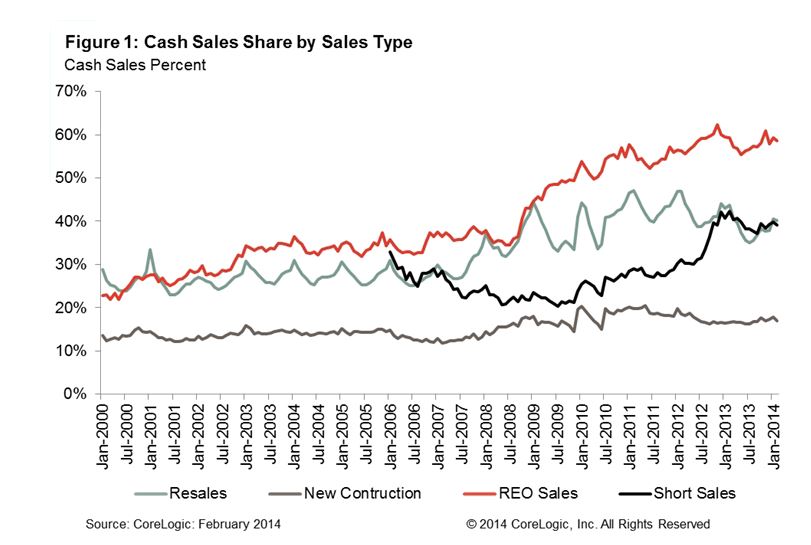

Take a look at cash sales based on actual property status:

Source: CoreLogic

This is a really interesting chart. In more traditional times, cash sales make up about 20 to 30 percent of all REO deals. Since REOs were a small part of all sales, this usually was a tiny amount of overall sales. Of course all that changed with the epic housing crash. REO sales were suddenly a big part of the market. You’ll notice in 2008 that investors started targeting REOs as their preference in purchases.

As inventory shrank and it was harder to find deals, REOs became the prime place to ferret out good properties. Of course, most regular buyers are confined to what they see on the MLS or other websites. Many of the better deals were done in bulk or through auctions where a cashier check was required. Good luck on that one where most Americans are flat out cash strapped and need debt for every little need in life (i.e., autos, college, housing, etc).

You’ll also notice that short sales suddenly picked up recently for cash buyers. Short sales take longer to usher through but when good deals are in short supply, you have to go to your next best option. New home sales are largely higher priced and targeted for buyers that plan on staying put for some time (not a big target for investors here).

It is important to note that the chart above is a representation of all sales, which overall have been going down. It highlights that the traditional buyer is largely absent in this housing recovery.

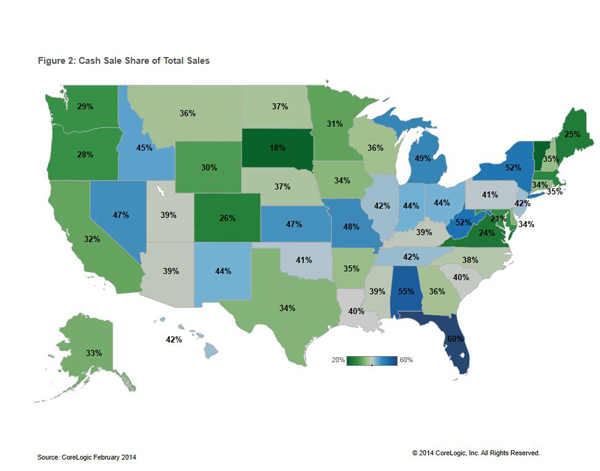

Take a look at state data:

Places like Nevada, Arizona, and Florida are completely dominated by cash buyers. Interesting to see that many other states are cracking the 40 percent mark. The point is clear and that is cash buying is a big part of the recent push up in housing prices across the nation. This is a multi-year trend that is reversing. The impact is yet to be seen.

Inventory slowly creeping back

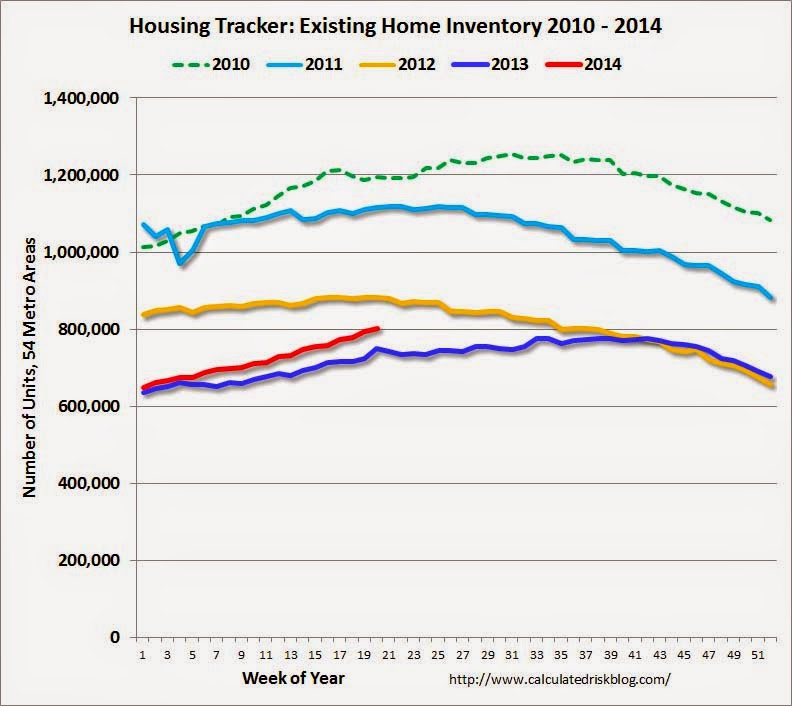

Sales are weak and mortgage applications are at levels last seen in 2000. As investors pull back, inventory of course is increasing:

Not a big jump but this is the first time since 2010 that we actually see inventory starting the year ahead compared to the previous year. This is being driven simply by sky high prices and the pullback with investor buying. Investors want deals and those are harder to find in the current market. Even in California, only the best of the best areas are still seeing big house horny demand. Other areas are seeing inventory buildup. If you plan on renting a place out, you better hope local area incomes can support your market price.

The funny thing, is that many that champion real estate in the current market are largely advocating this for others. The line of thinking is the same: “I bought in 2004, 2005, 2006 and look where prices are today in 2007!†Today it is more like I bought in 2011 or 2012 but would they pay the current market price of their home? Many would not. They got a good deal and that is great. But what about now? Was there only one bus that left the station? What about the fact that only 1 out of 3 Californians can actually afford to buy? What if Prop 13 changes, which now seems more likely? What will the impact be of becoming a state with a heavier renting population? The fact that sales are slowing down dramatically and prices are stalling out suggests something is in the offing. The housing market is a massive ship and trends once started, take years to unfold. So far we’ve had a good run with low interest rates, massive investor buying, and constrained inventory. Is this trend going to hold?

SoCal example: REO sales small portion of market

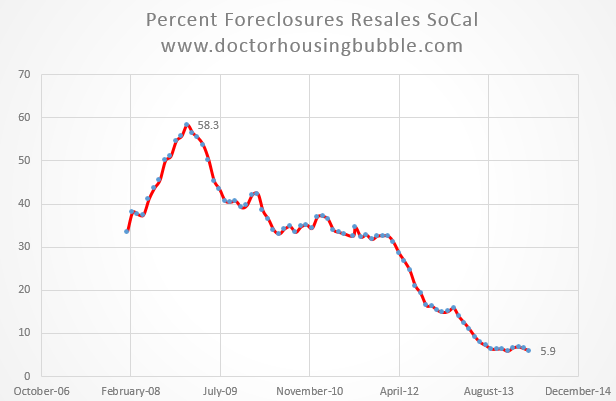

The reason that investors are pulling back is there are fewer deals to be had. Take a look at SoCal sales and the percentage being made up by foreclosures:

Not a large number of foreclosure resales. So investors will likely have to pay current market prices if they want to play and many sellers are high as a kite with their asking prices hoping some newly baptized sucker is ready to bite. The rental investor buyers are massively pulling back. Cap rates are pathetic. You still have foreign money flowing into places like San Francisco but what options are left for those in the area or in other areas where the vast majority of people live?

A personal residence is not an investment. If you own a rental, it is throwing income to you. If you live in a place you have the following expenses: principal, interest, insurance, taxes, HOAs, and maintenance. Some of these never go away even with the mortgage paid off. This is why we have the odd phenomenon of folks living in prime areas of SoCal in a home valued at $1 million shopping at the 99 Cents Store or Wal-Mart for food and hoping Prop 13 stays in place because they suddenly wouldn’t be able to afford their annual tax bill (which of course, is no issue for the new neighbor). These are your golden sarcophagus dwelling boomers that are probably staying put especially with many of their offspring coming back home.

Cash buying is slowing down and the premium for buying is much higher now:

“Buyers paying cash last month accounted for 26.7 percent of Southland home sales, down from 29.8 percent the month before and down from 34.4 percent in April last year. The peak was 36.9 percent in February 2013. Since 1988 the monthly average for cash buyers is 16.5 percent of all sales. Cash buyers paid a median $380,000 last month, up 26.7 percent from a year earlier.â€

The median price last month was $404,000 for SoCal. Fewer deals, lower cash buyer volume, and rising inventories. With fewer REOs out there, the good deals are harder to find for investors and you have house horny buyers now leveraging up with low down payments and the use of ARMs is back to a six year high (14.1 percent for April 2014 versus 7.9 percent in April 2013). Good luck paying $600,000 or $700,000 for some poorly built home and trying to convince yourself you have found the next Malibu. As the storm of investors slowly ebbs back, we are truly going to find out what areas the new feudal lords deem as prime and areas were aspirations are bigger than their wallets. SoCal is the land of the all hat and no cattle lifestyle.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

110 Responses to “United States of Cash Sales: A feudal changing of the guard. 58 percent of all real-estate-owned sales went to cash buyers out flanking traditional buyers with no access to pools of cash.”

The world’s economy is like a dirty laundry and the U.S. is the cleanest shirt in the load. So money will funnel here cause there’s no where else to dump it. A guy on CNBC just argued that we are entering another recession. Of course the crew of TV talking heads didn’t believe him, but they also couldn’t disprove him.

“A guy on CNBC just argued that we are entering another recession.”

What is the likelihood that this guy will be invited back?

For 99% of us the last recession never ended. For 80% of us it’s been one big recession since 2000.

I have no idea what you are talking about!

Existing home sales are up. This means that we are in “recovery”.

http://finance.yahoo.com/news/u-existing-home-sales-rebound-inventory-increases-140042558–sector.html

Unemployment is falling. This means that we are in “recovery”.

http://news.yahoo.com/unemployment-rates-below-6-pct-25-us-states-145324567–finance.html;_ylt=AwrSyCX5bn9TSWkAuFfQtDMD

Car Jacking is up in the Motor city. This means that the impact of the weather on the “recovery” is over.

http://news.yahoo.com/detroit-motorists-under-siege-carjack-city-043049027–finance.html

The Bureau of Labor Statistics announcement that unemployment has dropped from 6.7 percent in March to 6.3 percent in April was partly attributed to some 800,000 workers dropping out of the labor force last month, reducing the labor participation rate to 62.8 percent, a new low for the Obama administration.

Read more at http://www.wnd.com/2014/05/real-jobless-rate-hits-12-4/#omYiZjxsVHYcHT1w.99

So when someone tries to tell you that the unemployment rate in the United States is about 7 percent, you should just laugh. One-fifth of the families in the entire country do not have a single member with a job. That is absolutely astonishing. How can a family survive if nobody is making any money? There is a reason why government dependence has reached epidemic levels in the United States. Without enough jobs, tens of millions of additional Americans have been forced to reach out to the government for help. The number of Americans getting money or benefits from the federal government each month exceeds the number of full-time workers in the private sector by more than 60 million.

http://www.infowars.com/the-real-unemployment-rate-in-20-of-american-families-everyone-is-unemployed/

Of course they didn’t disprove him as many of those talking heads have little to no experience in economics or finance.

Oxnard is the next Malibu with tacos and Mariachi music .

Are you sure about that? I live and invest in this area, but I have no delusions about this area becoming North Malibu. The variety of Mexican food however, is amazing and delicious.

Got some of my best deals on REOs, tried hanging out at the courthouse, but the regulars seemed to get all the good ones.

Oxnard is Compton by the sea.

Oxnard is Acapulco de Juarez.

Housing to Tank Hard in 2014!!!@

Mortgage apps at all time lows. Wages declining. Q1 GDP .1% Likely to be revised down.

Jim! Real estate is going keep going up up up, despite the fact that a vast majority of residents can’t afford it and wages are stagnant! The voodoo of the markets will make sure prices always climb! Median SoCal home price will be $900,000,000 in 10 years! Buy now or be priced out forever!!

Exactly!!!

the Federal Reserve just laundered 147 billion dollars through the Bank of Belgium between the month says I believe it was September and November of 2013. Cicek weights to 29% of Belgium’s GDP for 2013. Why suddenly with Belgian purchase 147 billion dollars worth of US Treasuries representing 29% of their GDP in just a couple of months? The answer is they didn’t but in cahoots with the Federal Reserve a purchased the US Treasuries thanks to the Federal Reserve giving them the money to do so to make it look as if people still want are US Treasury bonds. Its all smoke and mirrors. They will do anything to keep the ship afloat. That’s why we have such a large cash investor class purchasing the foreclosures. It was designed that way to reinflate the housing market to keep the bubble blowing up. Its all manipulated. We have no idea what they’re going to do, other than have faith they will do whatever it takes to keep the countries using the US dollar to keep our way of life going at the expense of everyone else in the world. And that something you can bank on. Our money is backed by our blood sweat and tears. It’s backed by war its back by our labor it’s backed by our ability to get into debt.

It’s “Fo-ev-ah”.

How-zing to go up 30% in 2014 and 2015 and 2016 and…

Wow!

At that rate prices will double in fewer than 30 months. Guess I’d best buy now or be priced out!

You may laugh and I am not willing to actually predict this but I can kind of see a “train wreck” housing scenario in the near future (end of June beginning of July).

Unless something changes before this occurs, once inventory levels reach the 2012 line on Calculated Risk’s chart, prices should stop increasing and might actually decline. I note that although Dataquick’s sales prices are still up year on year, they are not increasing sequentially any more. We will see what they do tomorrow.

Normally, moderating prices would not be a big problem and, over time, might actually be a good thing and a sign that things were getting back to normal. Under the circumstances, however, the market is now so dependent on investors that a fall in prices, or even a dramatic slow down in price increases, might cause investors to think that the house buying party is over. If that occurs, my sense is that regular buyers are not going to be in a position to take up the slack (the MBA says purchase apps are still down 12% year on year) and, seeing prices fall again, regular buyers might not want to take up the slack even if they could.

If this occurs, the psychology of “buy now or be priced out forever” might become something more like “sell now or wait years for prices to come back to this level.” But even if that doesn’t occur, it is hard for me to see investors coming back into the single family house market in large numbers once the tide starts running the wrong way. Apartments are just easier to manage than houses for the rental market and, unless there is significant price advantage, it is hard for houses to compete with apartments in that market. Given the transactional costs associated with selling a house, I think many of these 2013-14 vintage investors are going to bitterly regret their decision to buy. Once the tide turns, and for many years afterwards, I think investors are going to be net sellers. And then the baby boomers are going to start looking to sell and move into retirement housing in bigger numbers. Once that process starts, it might be a very long time before the situation turns back around.

“You may laugh and I am not willing to actually predict this but I can kind of SEE a “train wreck†housing scenario in the near future (end of June beginning of July).”

LOL

Seer definition “a person who prophesies future events”

So, if you are using the “I see” or “I can’t see” equivalents, then you ARE predicting!

I absolutely agree. The only reason housing didn’y tank harder in 2009 was the investors came in to support and move prices up a bit before the next leg down. I totally underestimated how powerful they would be in both percent increase and length of move. But 2014 will be the year the investors decide to cash in their profits and that will snowball down just like you said and we will see lower lows than in 2009.

Even if housing prices decrease, will there be inventory? How many current owners in semi-prime to prime areas will need to sell? How many will simply stay put and hold onto their Prop 13 benefits?

Low prices are useless to buyer if there’s scant inventory.

Hey Jim, I think the jury is still out regarding whether the buyers you mentioned are “investors” or “speculators.”

Tired – it’s “specuvestors”…

Look at that red 2014 inventory line. Is almost looking exponential…

It is also know as the hockey stick recovery. Up is good right!!!

” SoCal is the land of the all hat and no cattle lifestyle.” and some of the people are as dumb as a post or as smart as a box of rocks, just like some of the people in Dallas.

Big Tex… You said it all (Dallas), you have a problem with people who have money, I got mine thru unbelievable chance taking, where I bought $1 dollar down homes in Simi CA years ago. Second mortgage people were being driven to their knees by first mortgage cause folks defaulted, they had no money into the deal they just walked.

I bought them and waited and waited and waited, because I have faith that housing is still the dream, I took the chance of my life at 22.

Please don’t rip on all people who have or made money, just because a person is poor doesn’t make them a better person, all it makes them is less money in the bank?

sounds like a late show infomercial to me…

“I trolled mine thru unbelievable shilling, where I shilled $1 dollar down trolls in Simi CA years ago. Second mortgage shills were being trolled to their knees by first shill cause folks trolled, they had no money into the shill they just trolled.”

Troll on brother!!!

Robert, can you elaborate on how you made your money in RE? Sounds like you did well and it was kind of unconventional. Congrats

Pete

$1 unbelievable chance taking. Must have been scary risking all of those singles.

Hey!!! I just realized that CA Appraiser and pete are one in the same! Wow! Learn something new everyday!

The problem is the very underwater folks. When do they stop paying because they are buried 30 to 60% in negative equity. At some point they have to say to themselves nobody is going to save me, unless the gov’t does a massive cover up and takes to them back to break even.

It is a perplexing concern even a pro RE advocate like me is wrestling with, even though most knew they were during the wrong thing signing these liar loans, I’m worried for them.

@robert wrote: “When do they stop paying because they are buried 30 to 60% in negative equity…”

The correct answer is: As long as PITI is within the ballpark of rent equivalent there is no reason to stop paying irrespective of one’s negative equity position. Negative equity is not a reason to walk away from a mortgage. However if rent equivalents plunge in price that changes everything.

stop paying? Do you know how many people I know who stopped paying about 5 years ago and the banks still have not foreclosed? Believe me this is manipulation through and through and the homeowner and borrower is being blamed for everything. ” It was it mostly subprime borrowers”, that’s just a big story line. Don’t forget its all BS and its all bad for you! Hat tip: to George Carlin.

People stop paying because they can no longer afford to pay. I doubt most of these non-payers are looking at equivalent rents or even equity position in most cases. They default for the same reason they default on any other kind of debt such as revolving credit or installment auto – the income isn’t there for whatever reason.

“It is a perplexing concern even a pro RE advocate like me is wrestling with, even though most knew they were during the wrong thing signing these liar loans, I’m worried for them.”

WTF?

http://www.bankofengland.co.uk/publications/Documents/quarterlybulletin/2014/qb14q1prereleasemoneycreation.pdf

It’s a tad off topic… but the above Bank of England white paper re-states my contentions posted here going back to December 2013, inre money creation in modern society.

They turned my paragraphs into a 14 page pdf.

Most of the key points are contained at the top of page 1 — which are a complete rehash of my postings.

blert, with QE, there are TWO sides to the lending equation. No matter how much QE BoE has done (not sure about FED), and its FLS scheme of £hundreds of billions to make credit easier to ge.. credit growth (demand for credit) is feeble – anemic (at least in the UK).

It’s partly a response from people (deliberate from younger renting generation) as resistance to the policies to try and get us to load up on jumbo mortgage debt to buy massively overvalued rubbish houses.

All this cash-buyer business is all well and good, but I can’t see it turning much of a profit for banks. Banks make their money on mortgages, and there’s not much mortgage lending going on! Why? For me it’s the crazy high prices, and pitiful supply in semi-to-prime areas. If I were a banker I’d want…… a situation where I could write loads of new mortgages, for all those homes owned outright are dead money for banks.

——–

Bernanke’s Worst Nightmare: Rising Real Interest Rates

May 28, 2013

…What seems to be lost in the monetary debate is that this persistent drop in inflation defies the primary purpose of quantitative easing, which is designed to lower real interest rates. In fact, with nominal yields rising in the face of falling inflation and thus raising real interest rates, the US economy is now closer to a deflationary death spiral than at any time during the Fed’s unprecedented policy designed to prevent just such an outcome.

Though he wouldn’t admit it, Bernanke met his match in 2011. The consumer balked at attempts to stimulate aggregate demand via inflationary policy of negative real interest rates, and ever since, has been raising real interest rates by reducing inflation through lower aggregate demand. This is perhaps the most unappreciated yet significant market development since the financial crisis.

Rising real interest rates is Bernanke’s worst nightmare. Everything he has worked for in academia and implemented in monetary practice is imploding before his very eyes. Contrary to his assertion in 2002, aggregate demand in the real economy has in fact met the limit of monetary policy, rendering QE’s impact ineffective and obsolete.

continues: http://www.minyanville.com/business-news/the-economy/articles/Bernanke2527s-Worst-Nightmare-Rising-Real-Interest/5/28/2013/id/50031?page=1

This matter was addressed back in December — on this blog.

My postings at that time would appear to be the basis for the Bank of England’s white paper, for many concepts and word phrases are direct lifts.

1) The utter failure of MMT and its peers on the origin of money in modern societies…

2) The existence of multiple engines of money creation…

3) The dominance of commercial lending as the fount of modern monies…

4) The ability of the sovereign to create monies by debt issuance…

5) The fact that the multiplier concept is totally wrong…

6) The irrelevance of consequential money creation…

7) The fact that the central bank tops up the liquidity engine in RESPONSE to lending…

8) And more generally, that the entire logical train of MMT is off the rails…

9) So much so that this white paper has been ginned up to set the facts straight.

The good doctor has a readership larger than he might imagine.

Further, in this age of cut & paste, information transmission is hyper-rapid.

&&&

This sequence reminds me of when I opined about how to resolve the banking crisis — March 7, 2009, on a very brainy blog.

Its readership included high powered analysts with SocGen.

Within days, that blog thread jumped to #1 in Google — out of 500,000+ — later out of 2,500,000+ references.

And, within days the powers that be adopted — after a fashion — a number of my themes.

1) RMBS have to be rolled up ASAP by way of refinancing properties with vigor whenever this can be done.

2) The used of a Government Bank to do so. (Existing government banks were expanded in function to provide the requisite liquidity.)

3) A wind down of Freddie and Fannie was recommended. This step is now, haltingly, underway.

4) Cross subsidization of the (mortgage) banks was recommended. (done)

5) At the same time the (mortgage) banks were to eat their losses, straight up. (no good bank/ bad bank)

6) Termination of the Syn-CDO market.( it evaporated — it’s very notable that these 60 month instruments are now soon to expire/ wind down. (the system ducked a bullet with Syn-CDOs)

7) That it was urgent that America and Mexico join hands to develop (Mexican) oil strata nearby the Rio Grande. (this is finally under way – – it’s a revolution in politics!)

8) The equities markets turned on a dime shortly thereafter. The powers that be finally had a workable roadmap for unwinding the ball of paper that they’d created. Refinancing all of the RMBS has taken them off of the front pages. The process also reliquified (European) daughter (ie domestic American branches) banks to a startling degree. Refinancing was spurred on by jamming interest rates to the floor.

%%%

This white paper is the first instance of officialdom getting wise on how modern monies are created. At all times prior, MMT has been used.

So, there is hope.

blert – It sounded to me that the money creation argument came straight out of Steve Keen’s “Debunking Economics”. However I have not heard a word about the it’s the private debt stupid arguement…

blert wrote: “My postings at that time would appear to be the basis for the Bank of England’s white paper, for many concepts and word phrases are direct lifts.”

I’d be quite proud of myself if that is the case – and I can easily believe it is true.

I make no claim to know the structures com-prop is often held under for most efficient purposes, but do know main banks have loved the the resi-and-comprop debt, vs the very meager lending for business enterprises and industry. Banks… it’s all been about property lending (mostly). For-ev-ah goes up in value.

__________

SOBER LOOK

TUESDAY, NOVEMBER 12, 2013

Need a corporate loan? Forget your bank – tap the shadow banking system instead

Here is a simple question: what percentage of US banks’ balance sheets is taken up by loans to businesses? The answer may surprise some. It’s just under 11.5%, down from about 16% some 10 years back. Banks began preferring real estate loans (particularly commercial real estate) to corporate credit in the early part of last decade. That didn’t work out so well (see post). Since the financial crisis, banks’ deleveraging sent the number to new lows. The percentage began to rise in 2011 but has stalled again this year.

(continues with chart) http://soberlook.com/2013/11/need-corporate-loan-forget-your-bank.html

Hey…

Don’t use my pseudonym.

Thanks.

?

Strangely, Keen has been out on the Web — big time — for Y E A R S and yet the Bank of England never issued a white paper adopting any of his concepts.

Yet, within weeks of our ‘post-offs’ the BoE drafts a white paper that re-writes the fundamentals of economics.

It’s an experience that I’ve had on numerous occasions, some so shocking that I hesitate to claim my due.

&&&

Example #1 ( of many )

I opine on the technical deficiencies of the F-22 INRE its PSA air supply.

Eight weeks later I read that the USAF has — overnight — adopted ALL of my technical remedies. (!)

The USAF had been tangling with the matter for Y E A R S on the QT. At this time the entire fleet has been retrofitted per my missive.

Why? I cut through the bunk and went straight to the heart of the chemistry. I pointed out which laws of chemistry were at issue — and why all prior efforts could NEVER work.

Then I offered a solution — which was simple Simon. Poof. The problem was solved.

AFTER my missive, the problem looks trite. Before, it looked hopeless.

This is what can happen if you’re willing to completely forego any credit — even a pat on the back.

blert – you need to get a handle on your handle! I can generally tell by the fact that I need to reread your posts a number of times before getting a inkling of the point you are trying to make that there is some handle hijacking going on. I know something is fishy when a post with your handle is clear and concise…

On the other topic, I find it absolutely ludicrous to believe that world central bankers are trolling southern California housing bubble sites for economic insights. No offence to the Doctor or the shills who frequently comment but that is really a stretch. I think the average “is it a good time to buy” or “I made millions from CA RE” would bore world central bankers to tears and they have much bigger fish to fry. My guess is that they would be more likely to hear money creation theories from the folks who do it for a living verses from the likes of us. Again, no offence intended but this is in the realm of tin foil hat people…

C’mon What, You know the best deadpan humor is the kind where you laugh nervously wondering if the perpetrator could just possibly be serious. Then you shake your head recognizing the absurdity of it all and acknowledge the master’s skill. blert is clearly one such.

ap – I am an admitted borderline retard/realtard. You would know this if you read my comments…

What really scares this borderline retard/realtard is that he actually might believe it! I have read this guys comments for years and have noticed a growing delusional slant. I would truly bow down to his greatness if it has been a joke all these years.

That’s great blert but I am still confused on the “Real Estate is almost NEVER held inside a corporation, certainly not operating corporations.†statement.

I work in corporate finance and I have NEVER seen a balance sheet on a fortune 500 company that did Not have Land and Buildings on it.

I am concerned that the publicly traded corporation like Public Storage (ticker symbol psa) would have a balance sheet shows significant land and building assets but you are telling be that these assets are not owned/held by the corporation nor the stock holders rather by limited partnerships outside of the corporation. I believe this would be considered fraud and would love to learn how it is not fraud to represent asset holdings that are not held by the corporation i.e. the shareholders.

Are you telling me that Disney Corporation (DIS) does not hold land assets on their balance sheet because I am seeing land on their balance sheet as well?

http://finance.yahoo.com/q/bs?s=DIS

Or are you telling me that the land that the theme park is on is actually held by limited partnerships as well? I must have been misinformed that the DisneyLand property is currently protected by Prop 13 and the tax assessment on the land is laughable.

?

You’re cross-confusing firms that have unique (operating) properties that CAN’T be financed any other way than by the corporation with (passive/ investment) properties that are routinely financed by banks and other financials.

Disneyland

Steel mills

Auto plants

Lumber mills

Dedicated factories, generally

^^^ These are entirely outside the investment space of commodity real estate — which is what is being discussed.

It must have been a struggle to get through college: Public Storage is an ACTIVE real estate investor that is DENIED the sugar. What you see on its balance sheet is the minor fraction of real estate controlled by its many, many, partnerships.

It carries a PROMOTED INTEREST in the BACK-END of the deals. Even when wildly successful, this promoted interest is still less than that of the limited partners.

This particular structure was taken up because of the re-launch of the IRA in the Reagan era. Overwhelmingly Public Storage was going after (tax) ‘qualified monies.’ By statute and rules, such monies can’t use leverage/ bank financing without imperilling their tax status.

The limited partner’s share of the massive Public Storage portfolio does not show up on the corporate balance sheet.

Public Storage CAN’T take advantage of any of the tax advantages of being a passive real estate investor: just too many transactions. Again, this is what did in Carleton Sheets. He never intended to go public with his formulas. He entered the talk circuit as an emergency measure to pay off his re-calculated tax liabilities. He makes no bones about it.

BTW, Public Storage ran its own internal construction arm. Anyone doing that has no chance of attaining passive investor status.

?

Lastly…

My billionaire client was THE landlord to the Fortune 500 in the Islands. His breakthrough lessee was Xerox. It put him in clover. They rented his property for thirty-years.

NONE of the F 500 owned real estate there. Every last one was a renter.

But that’s not unusual. Most of the plain vanilla real estate space used by the Fortune 500 is under a commercial lease.

I can tell by your postings that you’re not at all aware of how corporate America views holding real estate.

1) Shopping malls — every space is leased.

2) Grocery malls — Safeway on over — they are leasing in almost every case.

To restate the obvious: when the tax advantages are considered — they rule the deal.

Operating corporations never want to hold real estate inside the corporation unless they have to/ no tax savings are to be had in any structure.

Duh!

Your inspection of 10-Ks notwithstanding, you’re not seeing the totality of the picture.

With your latest postings, your gadfly status is assured.

“I can tell by your postings that you’re not at all aware of how corporate America views holding real estate.”

I am very aware of the fact that most corporations lease property, buildings, cars, machinery, desks, laptops, etc. However to make a blanket statement like “Real Estate is almost NEVER held inside a corporation, certainly not operating corporations.†can easily be proven wrong by the evidence. Not sure how you are able to clasify me as gadfly when your history on this site proves you have earned this space many years ahead of any attempt on my part…

@What?

“With your latest postings, your gadfly status is assured.”

Priceless!

Polo – I am always open for any real dialog. The problem is that this site has always had a heavy shill influence along with “is it a good time to buy” crowd which really makes some of the dialog tiring after years of following. As I have said time and time again, I would pick blert’s rants over shill BS any day. I rarely agree with the guy but he at least brings something different. I really see no need to continue stating my case with supporting evidence because there will be a new clown posting shill BS all over again next week. That is the ultimate goal of the shills is to tire out the opposing view. So, I choose to mock the shills as it is much easier than arguing what the definition of is is…

So troll on brother!!!

Blert: What? might be a ‘gadfly’ but only because you’re intentionally obfuscating the issue as it relates to Prop 13.

Prop 13 as it’s currently written allows corporations or LLCs to game the system because they can divide into shares.

It doesn’t matter if Widget INC which operates in a building at 123 Widget Dr leases it from Widget Properties LLC or RE Investor LLC. When that building gets sold, Widget Properties LLC or RE Investor LLC can structure the sale in smaller shares so that a new tax assessment won’t get triggered.

I’m sure you’re aware it happens often and is rarely in the public spotlight.

Now you may argue that it may drive businesses out of CA, but don’t argue that the existing loophole doesn’t exist or that many businesses haven’t been exploiting it for decades.

MB

As a percentage of the marketplace, the highly structured deal makings that you posit are insignificant.

LLCs don’t provide ANYTHING that is not already customary with a TRUST structure.

I’m not going to drag out all of the case law — and the textbooks that have been drafted over the last century about how trusts are the way to go.

Just take a tip from the Kennedy clan. Their ownership of the Merchandise Mart was by way of a TRUST.

I can see by even a quick scan that the legal profession is having a field day with LLCs.

What I can’t find is any reference detailing how an LLC can be folded into another business entity without killing its Prop 13 shield.

The only scheme permitted turns on handing the assets down the family line.

Well, trusts do that perfectly well. A trust, once set up, does not automatically trigger a $800 per annum fee to Sacramento. One attorney is pitching the idea that EVERY single passive real estate property ought to be its own LLC. (!) Such is hype.

Lastly, Prop 13 protections are so far down the road that no commercial real estate deal dwells on it.

The valuation is automatically reset upon purchase.

Sacramento has LONG figured out how to tap commercial properties by way of other provisions in the tax code that have never penetrated your consciousness. (The $800 per annum fee is merely the tip of the iceberg.)

The brutal reality is that re-locatable businesses are fleeing, ALREADY, and in size.

Whatever scheme you conjure up will merely turn an orderly retreat into a fulsome rout. And with each departure, you will savage the tax base.

Lest we all forget, Jerry is ramping Sales Taxes something fierce.

The man knows no internal (fiscal) restraints.

blert wrote: “My postings at that time would appear to be the basis for the Bank of England’s white paper, for many concepts and word phrases are direct lifts.â€

Let me get this straight. You’re inferring that some folks at the BoE read your comments on DHB and essentially plagiarized you in one of their publications?

Is anyone buying this? I mean, really. This has got to be tongue-in-cheek.

I just went back and re-read some of the comments in this thread. Yes, apparently blert does suggest that various PTB are reading his comments on the Internet and adopting his suggestions in kind. Wow.

Tired – You know what, I kinda want to change my handle to just “Tired”. You wont be offended, would you? BTW, I think you may have recently changed your handle as well…

I got my tin foil hat at the ready, how about you?

Whatever makes you happy. Yes, my handle was Anon before some douche starting using it.

I would love to get everyone’a thoughts regarding monopolistic actions recently taken by many private equity firms. I believe in some areas they have enough market share to qualify as a monopoly and in others area an oligopoly (black stone, black rock, colony capital, oak tree, and others).

Sorry Erin, what was the question again?

The under 30 crowd is really going to feel the shift in std of living as they age. The sweetheart union deals are going away fast and globalization is edging them out of corporate employment as well.

Unless they work for the govt. Govt still pays good, secure salaries, with all sort of health & pension benefits.

A few months ago, the Santa Monica Daily Press reported on the highest paid city workers. The highest was a police sergeant who earned over $250,000 the previous year due to all the overtime he put in. And that didn’t include his benefits package.

Who’d have thought a generation ago that cops would be in the top 10%.

I know they say govts are in financial trouble, but I think that govt union benefits will be among the last things cut. They’ll first try massive tax increases, selling bonds, defaulting on bondholders, federal bailouts, and service cutbacks, before they touch govt union benefits.

L.A. schools aren’t educating anyone. L.A. city streets resemble moon craters. But teachers and city road crews are still getting their salaries and benefits.

Most of the states I’ve lived in have already cut into public employee benefits, primarily via pension contributions and/or insurance premiums.

That said, the changes typically are often tiered based on when you started. The reason being that it’s easier to reduce benefits for new employees than for existing employees, both for contractual reasons and as pragmatic politics.

I don’t have the exact dates handy, but in Oregon the PERS system has titanium rates if you started before 1996, gold rates if you started between 1996-2003, and much more middling benefits if you started later.

But in the near-term the cuts don’t really do a lot to salvage the overall pension system, as the employees who will be retiring and withdrawing from the fund over the next 20-25 years are largely those who still have the Tier 1 benefits.

The OR legislature has half-heartedly made some bipartisan movement toward trying to cut payouts to Tier 1, but it has significant political opposition that could derail it, and may not hold up in court, particularly since Oregon isn’t yet as broke as NJ or other states that have pushed the issue.

The first thing people have to do is separate pensions for law enforcement/public safety and civilian government employees. Cops and fire fighters generally have way better pensions and get to retire much earlier. And they get paid a much higher salary than they really should which contributes to the higher pension payouts. And don’t forget the overtime that they get as well. They always blow through their overtime budget and come back to ask for more. They are the ones who have caused most of the budget problems for municipalities.

All this while crime has gone down significantly in the last generation. The job is just easier now relative to the risk. And this goes for fire fighters as well since building codes are so much stricter than 40 years ago so they don’t really have to battle the blazes that their predecessors once did.

On the flip side I would argue that teachers have it harder now than teachers of 40 years ago yet just about everyone shits on them. To be a good teacher you have to put in the long hours but you don’t get the overtime.

Part of our society’s problem is that we we value cops much more than teachers.

So, please, if we are gonna pick in government employees let’s start with cops and fire fighters. Let’s work on fixing their “compensation packages” first. That is where you will get the most bang for your buck in terms of reducing government costs.

@ Owl…police and firefighters have tremendously positive public “brands” that straddle the two parties well. Their endorsements of candidates are very influential at the local and state levels. They get their candidates in and the candidates in turn do their bidding.

Teachers are vilified due to their intransigent unions, who refuse to adapt to the times in terms of merit pay and merit terminations.

In CA, we’re bound by law to funnel more and more money to education but there’s no will to make trans-formative change. Instead, charter schools are creating change incrementally.

Government jobs are affirmative action jobs and are a secure Democratic Party voting block. Now we are a one party state, and now the intracide fighting will begin on how to divide the shrinking pie with the private jobs and businesses leaving the state. We have a growing welfare state in California.

The under 30 crowd? Heck! I’d say most of the under 50 crowd have already come to terms with those facts.

Ive talked to several long time govt union employees and they tell me that the sweetheart deals are going away. I was in line at Safeway yesterday and the guy in front of me had retired from them a year ago. He said he’s glad he’s out as the job had turned to garbage. And he was talking to a manager there who said much bigger changes were coming in the next two years.

Hasn’t the historical long term affordability rates stayed below 30% in California?

I’d so, this current situation, while unfortunate, is no worse than its been before. If I recall correctly, affordability was under 10% in many parts before the housing market crashed. Seems like this bubble might have a bit of steam left in it.

The US wants to be Russia soooo bad.

All the signs are there of quickly becoming a Mafia State. Interest free pallets of cash for the ultra-wealthy, “settlements” (read: legalized racketeering) for banks, heavy weaponization of local police forces, and corporations speaking for the citizenry because we’re too stupid to make sound decisions.

There is no reasonable way to debate this and correct the path through voting and discourse. The US Empire is well on the decent into eventual chaos and a messy revolt.

Sam Zell just came out with an interesting statement the other day….home ownership in the US is going to be under 50% in the next 10 years.

The trend is your “friend,” as they say! Certainly, the macro forces at work for the past 30+ years that have lead to this inevitable decline in home ownership show no signs of abating. The more interesting questions include: 1) what will this mean in terms of price-support gvmt policies?; 2) what will this mean in terms of public initiatives to remove certain tax advantages of ownership?

CA appraiser…the carnage in CA real Estate years ago ten fold. To get folks to move away from the SFV of LA county to Ventura County banks and builders offered people to buy homes from 18k to 28k for a dollar down no income verification.

Of course many of these families ran into problems they turned to second mortage money and many investors took them on hoping they would not walk away. What were the investors thinking, if these folks coudn’t afford the first what made them think they pay the second especially with no money down.

Of course the first mortage foreclosed and the second mortage investor was left holding the bag. I went to many of these homes really a value 4 to 5 bedrooms etc. Blocks on end empty, I went to the best lots and then called the bank, all 5 homes sold for around $23k ea. I offered the bank 100k for all 5 homes at 15k down.

The risk was a freeway was being proposed to connect Simi Valley with LA county, if it went thru I make a lot of money if it fails I’ m also walking away 15k poorer and credit issues. I sit on the homes empty, to rent them well lets say the renters in that valley would destroy the houses and cost me more to evict them etc.

After many fingernail biting and sleepless nights the state approves the freeway prpject and Simi Valley takes off.

I sell all 5 houses in 45 days for a avg of $59,500 each all by owner. I took that profit and bought one apt building in N Holywood 12 unit and a luxury foreclose home in Thousand Oaks CA. From then on I wheeled on dealed on many properties in LA and Ventura County.

In today’s markert as you know things are very iffy, but as I profess, if you can do it and buy if the deal is right for you then do it, worrying why Johhnie down the street can’t buy has nothing to do with me. In America today there is less of a opportunity but opportunties still exist.

on top of which, the Federal Reserve is the one that created the program for large institutional banks to buy a large volumes of homes at auctions etc they have specific rules. 1, they have to hold the houses for a minimum of 5 years as rental properties 2. they have an option to renew for an additional five years 3. at which point they must sell the properties, so think about that what will happen in 10 years? Banks use a long time frame of decades to produce the results that they want. They have been trying to take over the real estate market for at least a decade. They have paid legislators to pass bills that allowed depositor banks to be one adn the same with brokerage banks it was all planned.

my dad is a small business owner in gardena, ca. and he bought the land in 1975 for $30,000. he made a lot of money in the 80’s boom, remodeled in 89 with concrete blocks and now the building is conservatively worth $2,000,000. he can lease out the whole building and retire but he is a workaholic and he says he will die in 6 months if he retires. he does lease out part of the building to a smog check guy. at his age he only speaks to customers, does the paperwork and watches videos on his laptop all day. his trusty employee does all the work. of course it’s all in a living trust so his three kids don’t have to worry about retirement.

Meat Loaf (the singer) has said that he’s made more money in California real estate than in rock & roll.

The context was an interview in which he slammed the record companies. He said if you sign a recording contract, it’s a given that they’ll steal from you, not giving you all the royalties you’ve earned.

This interview appeared before the 2007 bubble burst.

Landlord…Most world class entertainers and athletes make most their money from investing,endorsements, and a good accounting firm.

It always reminds me of Steve Young the 40 million contract? like he says, you think I like doing ESPN NFL and freeze my ? off. I got only 800k total and had to pay taxes on that, the whole contract was based on annuities and the league profits which there were none.

The great Roger Staubach made only $28k playing for the rather cheap Cowboys (they had a provision in every contract, discuss your real pay and you are history in the league). He made all his money in commercial real estate, he used his name and fame, otherwise he also is up at 1 am doing sports center?

Robert wrote: Blocks on end empty, I went to the best lots and then called the bank, all 5 homes sold for around $23k ea. I offered the bank 100k for all 5 homes at 15k down…………. In today’s markert as you know things are very iffy, but as I profess, if you can do it and buy if the deal is right for you then do it, worrying why Johhnie down the street can’t buy has nothing to do with me. In America today there is less of a opportunity but opportunties still exist.

_______________

It’s strange there was a situation back then, with an abundance of opportunity for those not already over-leveraged in debt, to pick up value in housing at value.

Where was all this world’s money that never runs out? And that will always pay higher prices, in SoCal, the world’s number 1 location, where many older owners have great pride of how wealthy it’s made them via property.

Now non-owners are supposed to hunt and chase for possible 15% off ‘true value’ deal, if we kiss people’s hands and polish people’s shoes along the way to get to that deal. I’m waiting for the deals to begin coming to me, at value I consider true to me.

I think many people should worry why Johnnie can’t buy. They should worry about why mortgage demand is down. Cash buyers no use to banks overall. They’ll want to write many new mortgages in the future and there is an obvious implication to that.

Prices are topped out (in my opinion), and perhaps there isn’t unlimited money out there to pay ever high prices. Values are set by buyers. What happens if there is a big drop down from this point, to level other new buyers willing to pay?

APOLOGY – from BrainOfEngland

Oops – I accidentally made 2 posts with a handle of blert.

Apologies. I was intended to reply to blert (then robert) and in error changed my own username in the Name field.

Stop using my pseudonym.

Thanks.

“I think many people should worry why Johnnie can’t buy.”

Agreed. It’s short-sighted to think one lives in a vacuum, disconnected from the shared reality of interconnected systems.

This forms the basis for unchecked greed – thinking that we’re immune from the consequences of our successes.

“Prices are topped out (in my opinion), and perhaps there isn’t unlimited money out there to pay ever high prices.”

This does not sound like blert to me but I’ll bite. With your belief in “hyperinflation” as being our soon to be destination (if we re not already there in your mind), how can we have either “prices topping out” or cease having the “unlimited money out there”? Would it not be the case that hyperinflation would set in (whatever that means) and then the growing supply of dollars (whatever that means) would frantically chase a fixed amount of goods and services before too much purchasing power is lost? Does this not have to happen before we top out in a hyperinflation scenario prior to the collapse of the monetary system? Or are you saying that we are already at this stage of hyperinflation and the monetary system is about to collapse?

blert…. back then you still had your mega locations which the rich and famous overpaid. Simi Valley was a remote poor access bedroom community, consider a extremely poor investment, chance takers only need apply.

I got very lucky because of the state speeding the freeway project. That said, to me it was still So Cal. which by its sheer size even back then you always have somebody moving in from another state .

As far as Johnnie, I just want people to be made aware, sometimes when you hang around with sick people you tend to be sick yourself. I want to think what is best for me and not be influence by the bad decisions of someone else. That is not say bury your head and don’t look up, but I believe there will be a next good deal around the corner, that suits my financial situation.

Overall this economy, job outlook,grossly underwater and small business climate which is still very poor, we are headed for a major showdown and even I’m beginning to wonder if the gov’t has no bullets left for the gunfight. take care

take care

Brain – it all makes sense now.

I thought for a moment that blert had decided to become succinct for a change and robert had picked up some grammar skills.

I guess you really can’t have it all!

It looks that you read this blog for so long that you start sounding pessimistic. That is what you said: “if you hang with sick people for too long you get sick, too”

Now, the question is: are you still optimistic or pessimistic ? Did you get the bug from this blog?

robby is safe and sound. As you know, sociopaths live in a tiny world inside their head and are unaffected by the world around them…

the reason the banks and second mortgage companies give people loans knowing that they can’t pay them back is because, that doesn’t matter. They take the note the security agreement and sell it on the 2nd market they still retain a percentage of profit they get all of their cash upfront and pass along the debt to some other schmuck who then pass the debt along to some other schmuck who then pass it along to some other schmuck mean while using the house as the underlying values and hypothecating it repeatedly. This is a way to pull real cash out of thin air and pass the risk to some other schmuck. This is done with virtually every commodity in the world. We currently have about a quadrillion dollars an outstanding derivatives debt but right now banks do not need to do create these security instruments for borrowers that will never pay it back because they’re getting free money from the federal reserve. You know that free money the taxpayers will have to pay back for generations to come on the back of their great great grandchildren who will live in a feudal world. Free money at billions per month at zero interest. Why lend money?

Excellent Lynn…The banks have very little to lose on the seconds, people were buying up the seconds for monthly income, the bank as should the investor know the first always controls the situation. When the homeowner defaults the second stands there and hopes and prays the homeowner catches up they almost never do and the second loses and the bank forecloses, they wins again when they sell it to another homeowner or investor who now holds the new first.

Lynn I must say Ive read most of the comments on here and you are probably the only one that knows whats *really* going on!! 😉

As you say its all manipulated and its smoke and mirrors based on absolute bull!!

If the American people do one thing this century, WE need to abolish the privately owned federal reserve!

regards to you :0)

I see the “investor” label thrown around a lot in the Dr’s articles, so just wanted to clarify what constitutes an all-cash investor – they are frequently amateur flippers working with a hard money lender (high interest, short term), so they can make those all-cash offers. These are not people with money, which means they are not smart with money, or they would not be paying these prices at a time when the market is stagnating. Of course the end result is the same, in that the average buyer can’t compete.

Amateur hour began when flippers took all the profits they could out of the market, and then started selling their knowledge instead of flipping. It will end when prices are obviously dropping and even the amateurs get scared.

John D you make some good points. I for one always paid close to cash or cash when I got in a financial position later in life. It is true like you said, doesn’t mean you are the smartest person because you have cash, you still can get caught.

Many very well off people never deal in cash so if things go awry they have their cash in hand, they really don’t give a hoot about credit ratings. I just don’t like house payments, but I also have a lot of cash into my properties, if it becomes a cataclysmic event then I will see you all in the soup line, I hope it is not water down Campbell?

Fig. 1 – http://www.redfin.com/CA/Los-Angeles/2125-Vallejo-St-90031/home/6945511

Someone please explain why data aggregators like core logic refuse to offer services to the average consumer / homebuyer? For example, homebuyer wants to buy an AVM for a property they are considering bidding on, and the service request is rejected because they are only available for institutional investors, lenders and realtors. This is significant, because these reports are normally repackaged and manipulated at inflated values and presented to the homebuyer as justification for the inflated asking price. Only after the deal closes or years down the road when attempting to refinance will the homeowner get to see a ‘real’ AVM. Guess what? 85% of the time this is where homebuyers realize they got screwed because they were misled into believing the true market value. Short sales should ONLY be available to the average homebuyer who is highly liquid and qualified, but I digress…. The point is there is no hope at getting a fair deal to help out the middle class family.

Steve when common sense comes into play then the powers to be reject it on their face value. Fair deal for the middle class, as you probably know banks,fed,major corps world wide view the middle class as a forgone conclusion, that it is really is the lower middle and they have no interest in helping such folks in the 21 century.

True market value in controlled by the vested interest of that item, property, what ever. I just saw a Vase mind you painted by some guy in France, whoever valued it at $3m dollars, I would love to meet, because it looks a kid of 12 did it?

Same with housing, why anybody anywhere is buying San Jose 1957 shoebox homes for $1.2m and up is beyond my comprehension. The loan and bank officers just love to put a value on these so called great zip codes. It is (hi tech?) you know, the homes certainly don’t reflect hi tech and neither should those locations.

So is there hope for most of the Americans wanting a piece of the dream, it looks like Wash DC politicians from both sides have no idea of bread, milk, or egg prices, so you really think they are looking for fair deals for the masses, it is a rough start to the 21st century Steve hold on, it may get real rough.

Okay the gloom and doom site has truly jumped the shark with this one…

http://www.zerohedge.com/news/2014-05-21/27-huge-red-flags-us-economy

“27 Huge Red Flags For The U.S. Economy”

“#1 Despite endless assurances from the Obama administration that we are in an “economic recovery”, the number one concern for U.S. voters is “Unemployment/Jobs” according to a recent Gallup survey.”

And?

“#2 Historically, sales for construction equipment manufacturer Caterpillar have been a pretty good indicator of where the global economy is heading next. Unfortunately, sales were down 13 percent last month and have now experienced year over year declines for 17 months in a row.”

Hello, Weather, duh!

“#3 During the first quarter of 2014, profits at office supply giant Staples fell by 43.5 percent.”

Ahhhhh maybe we have finally gone paperless and office supplies have gone the way of the buggy whip!

“#4 Foot traffic at Wal-Mart stores fell by 1.4 percent during the first quarter of 2014. Analysts seem puzzled as to why Wal-Mart is “underperforming”.”

Wal-Mart? Really? I thought that when more “shoppers” where at Wal-Mart it meant that “shoppers” were trading down and is a tell tell sign of recession. Now you are telling me when there are less “shoppers” are at Wal-Mart it is a tell tell sign of a recession…

“#5 It is being projected that Sears will soon close hundreds more stores and will eventually go out of business altogether…”

And this is a bad thing? Have you been in a Sears lately?

“#6 The labor force participation rate for Americans from the age of 25 to the age of 29 has fallen to an all-time record low.”

Hey maybe most college kids are on the 10 year plan. That way you get the most out of this college debt tsunami thingy.

“#7 According to official government numbers, everyone is unemployed in 20 percent of all American families.”

Oh, now you all of a sudden believe in the government numbers?

“#8 As families struggle to pay their bills, many of them are increasingly turning to debt in order to make ends meet. Earlier this month we learned that total U.S. household debt has increased for three quarters in a row. And as I noted in one recent article, total consumer credit in the United States has increased by 22 percent over the past three years, and 56 percent of all Americans have “subprime credit” at this point.”

More debt means more money, which means more economic activity, which means we are on our way to recover!

“#9 Interest rates on student loans are scheduled to increase substantially on July 1st…”

Does anyone really believe this will ever happen?

“#10 U.S. industrial production fell by 0.6 percent in April. This should not be happening if the economy truly was “recovering”.”

See #2

“#11 Manufacturing job openings in the United States have declined for four months in a row.”

See #10

“#12 Existing home sales have fallen for seven of the last eight months and seem to be repeating a pattern that we witnessed back in 2007 prior to the last financial crash.”

See #11

“#13 In the real estate bubble market of Phoenix, sales in April were down 12 percent year over year, and active inventory was up 49 percent year over year. In other words, there are tons of homes on the market, but sales are going down.”

See #12

“#14 The homeownership rate in the United States has dropped to the lowest level in 19 years.”

See #13

“#15 Trading revenue at big banks all over the western world is way down…”

Hmmmm… and this is a bad thing?

“#16 Jan Loeys, JPMorgan’s head of global asset allocation, is warning that the Federal Reserve is creating a huge financial bubble which could “push us into a credit crisis”…”

Never heard of the guy. Has he ever been on CNBC? I only listen to CNBC for financial advice…

“#17 Peter Boockvar, the chief market analyst at the Lindsey Group, is warning that the U.S. stock market could experience a 20 percent decline once quantitative easing completely ends.”

See #16

“#18 A lot of other big names are telling CNBC that they expect a significant stock market “correction” very soon as well…”

Hey, does this mean that I should be long now?

“#19 The number of Americans enrolled in the Social Security disability program exceeds the entire population of the nation of Greece and has just hit another brand new record high.”

That is very fitting given that Democracy was invented by the Greeks. We have now come full circle…

“#20 Poverty continues to grow all over the country, and right now there are 49 million Americans that are dealing with food insecurity.”

It is called dieting. Call me when we are no longer the most obese nation in the world and the second most advanced nation Mexico finally passes us as the most obese nation…

“#21 According to Pew Charitable Trusts, tax revenue in 26 U.S. states is still lower than it was back in 2008 even though tax rates have gone up in many areas since then.”

See #…. I lost track… It is the weather!!!

“#22 Barack Obama is doing his best to keep his promise to destroy the U.S. coal industry…”

Wait a minute! #23 says that global warming is a problem and #22 says that the environmentalist is the problem. Typical…

“#23 Climatologists are now saying that the state of Texas is going through the worst period of drought that it has experienced in 500 years.”

See #22

“#24 It is being reported that “dozens of Texas communities” are less than 90 days away from being completely out of water.”

Because they are in a desert! Hello!

“#25 It is being projected that the drought in California will cost the agricultural industry 1.7 billion dollars and that approximately 14,500 agricultural workers will lose their jobs.”

1.7 billion? That is supposed to scare me? Wake me when we hit 1.7 trillion.

“#26 Due in part to the drought, the price of meat rose at the fastest pace in more than 10 years last month.”

See #20

“#27 According to recent surveys, only about a quarter of all Americans believe that the country is heading in the right direction.”

According to recent surveys the other 75% believe they have been visited by aliens and I don’t mean the ones with a Spanish accent…

Is that blert? Looks like one of those comments that just goes on forever in different directions.

Seriously though, I think that was a guest post from Economic Collapse Blog, not a Tyler Durden post. Some of their guest posters are a bit over the top and you gotta take those with a grain of salt. ZH reminds me of drug stores like CVS or Walgreen’s in how nearly each aisle has truly useful items amongst bins and shelves of junk. It’s still worth shopping there for the important items you really need.

ZH is really hit or miss these days for some reason. Then they redeem themselves with articles like the this:

Italy to add Hookers and Blow to the GDP next year.

Now that is the Jump the Shark point for the EU I think.

Hey at least they are measuring “goods” and “services”!!! The last US GDP proposed calculation adjustment had to do with including speculative gains. Are speculative gains a “good” or a “service”? So, which change to GDP makes more sense?

BTW what happens when there is a net speculative loss? Oh yea, we change the calculation to include bankers jumping from buildings as part of GDP…

Somebody please explain to me why this guy is still talking???

http://www.zerohedge.com/news/2014-05-22/marc-faber-system-very-vulnerable-brace-general-asset-deflation

“Marc Faber: “The System Is Very Vulnerable,” Brace For A “General Asset Deflation””

Just stop!!! Please stop!!! We all agree that we should brace for the blah blah blah blah…

So… what is Harry Dent up to these days???

So how does the saying go again? Oh yea! Even a broken clock is right twice a day…

the actual saying has a “for-EV-ah” at the end, as I recall.

Somebody please remind me the topic of this post again…

After the winter thaw…New home sales and resales show improvement not great but a starting point.

Hey, I have a great idea for the next comic book super hero!!!

Da tah da!!!

I am Economic Man!

What are my super powers you ask?

I am all knowing and all seeing.

I make rational decisions.

And most of all, I seek the greatest utility!

I am Economic Man here to save the day!

Da tah da!!!

“Definition of ‘Economic Man ‘

First coined in the late 19th century, the term ‘Economic Man’ has developed to refer to a hypothetical individual who acts rationally and with complete knowledge, but entirely out of self-interest and the quest to maximize personal utility. Economic Man is an imaginary figure who is able to satisfy economic models that push for consumer equilibrium. All of Economic Man’s choices are based on the fulfillment of his or her “utility function”, meaning the ability to maximize any situation that involves choice.”

http://www.investopedia.com/terms/e/economic-man.asp

Anyone doubt after reading this post (What?) is under 21 or maybe 18?

Keep the complements coming!

Troll on brother!!!

Interesting new article at WSJ about asian buyers – more of them seeking mortgage financing as affluent move into the market following the rich all-cash buyers, but the real news for me at least is further down the article where it claims most of the financed buyers are seeking adjustable rate because they don’t expect to hold property more than five years.

http://online.wsj.com/news/articles/SB10001424052702304547704579562012938354846?mg=reno64-wsj

itwasntme…..That article is very telling, good read and important to know.

Imagine being one of those Chinese guys and watching over the next few years as your Chinese real estate drops AND your American real estate drops too. I can’t imagine being upside-down in 2 countries at once.

Interesting to see that the superrich wave of Chinese has crested and now it’s just the affluent trying to get in on the action.

A few months ago someone posted a link to a PDF copy of a book that “exposed” the banking industry (yeah I couldn’t think of another term)…does anyone have or remember that link?

So what does anyone think of articles like this? Perhaps the number of all cash transactions are going up because of older baby boomers cashing out and buying down for their remaining year? With the baby boomer bubble getting older, this will most likely accelerate for the next few years.

http://finance.yahoo.com/news/cash-deals-homes-reach-record-040005429.html

Leave a Reply