Real Homes of Genius – Cerritos California and 30 percent short sale price reductions. Can demographics save a city from the housing correction?

Last month the economy added over 150,000 jobs yet the unemployment rate remained steady nationwide. How can that be? The economy needs to add approximately 150,000 jobs a month just to keep up with population growth and people entering the workforce. It has been so long that we’ve seen a six-figure private sector inspired employment month that some have forgotten the actual bigger picture. Yet this was nationwide and California still faces a 23 percent unemployment and underemployment rate. Some are confusing nationwide trends with local movements. It is amazing that even though California home prices are off by 45 percent from their peak you still have people thinking that the market hasn’t corrected or is poised for a jump again. Do they not see the 23 percent unemployment and underemployment rate? Do they realize the state budget will be a mess for years? Maybe they forgot that close to $5 trillion in real estate equity has been wiped off the books since the first quarter of 2007. Today I want to look at a market that some people think is immune simply because of demographics. Today we will examine Cerritos California.

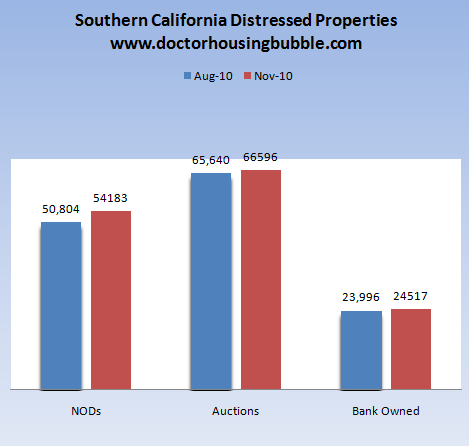

Math is math and incomes can only support so much. Sure, some areas can hold out longer than others but that doesn’t mean the eventual reality won’t catch up in certain markets. It does and it is. First, all the talk about the foreclosure paperwork mess stunting foreclosures has done very little here in Southern California:

In fact, we’ve added 5,000 more properties to the NOD, scheduled for auctions, and foreclosure pipeline since the paperwork fiasco broke. It doesn’t look like this has stopped banks here in Southern California from moving on taking homes back. After all, you have a litany of folks who have made no payments for 12 to 18 months (or even more in some cases).

Today we salute you Cerritos with our Real Homes of Genius Award.

Demographics the key to high prices?

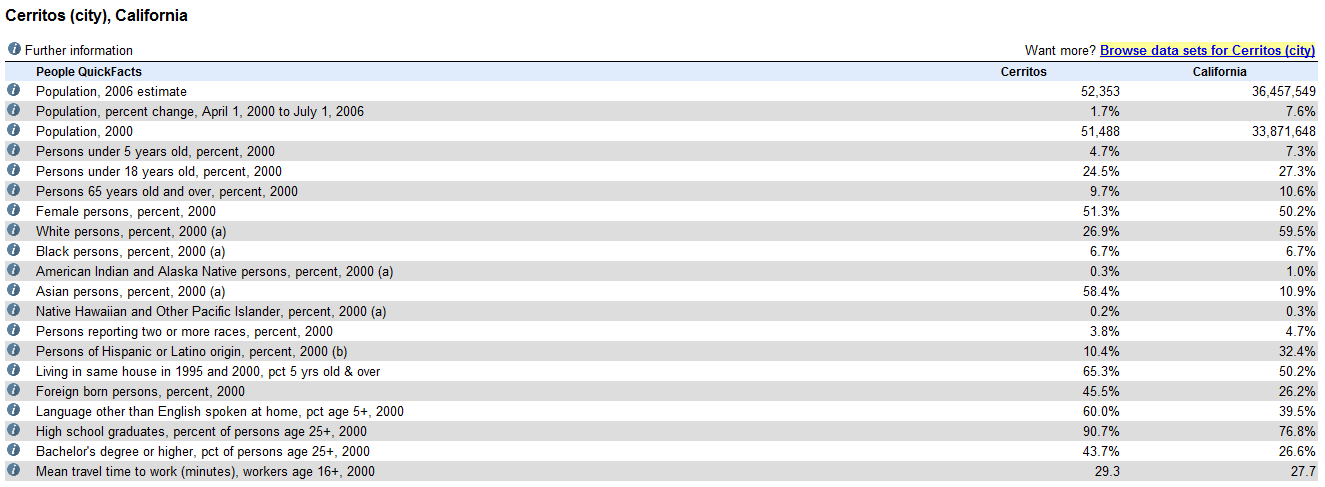

There have been plenty of comments about markets with large Asian populations as being immune from the housing correction. Cerritos California is a city with roughly 60 percent of the population being Asian from Census data:

Source:Â Census

It is true that Cerritos has done better than neighboring cities like Lakewood, Bellflower, or Artesia. But is it completely immune?  Let us take the pulse of the city right now.

12351 Glen Creek Rd (Cerritos, CA)

Beds:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 3

Baths:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 2

Sq. Feet:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 1,677

Year build:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 1977

This is a decent starter home for a working professional couple. According to some, this kind of home should be completely immune from any price correction because of foreign money or demographics. Well let us take a look at what is going on with this place:

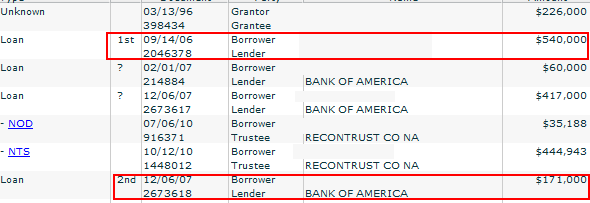

Looking at public data it looks like the last sale was in 1996 for $226,000. This home appears to have been a home equity machine. By September of 2006 this place had a loan of $540,000 secured on it. One year passes and a second mortgage is taken out for $171,000 bringing the total outstanding mortgage debt to $711,000! The home equity withdrawal phenomenon cut across all financial, demographic, and economic boundaries. This home is now a short-sale in an area where supposedly things are different according to some. Real Homes of Genius can be found all across Southern California. So what is the current sale price?

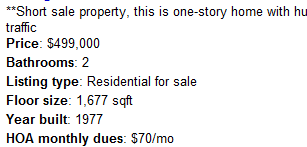

The place is listed for sale at $499,000 or nearly a 30 percent discount from the peak balance of mortgage debt in 2007. 30 percent doesn’t sound like a minor correction to me. Here is some more interesting data for Cerritos:

MLS foreclosures listed:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 4

MLS short sale listings:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 14

Shadow inventory (NODs, auctions, REOs):Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 173

I find it interesting that the 4 foreclosures listed on the MLS all seem to be home equity withdrawal foreclosures. That is, these homes took on additional mortgages as opposed to someone buying at the peak. You think the above short sale is a rare example? Let us do another then:

10826 DROXFORD ST, Cerritos, CA 90703

Beds:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 3

Baths:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 1

Sq. Feet:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 1,560

Built:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 1967

Here we have another nice starter home listed. The home was put on the MLS back in May and nothing has been biting. Let us look at the pricing history:

Price Reduced: 07/31/10 — $499,900 to $449,900

Price Reduced: 10/24/10 — $449,900 to $399,990

Why would you reduce the price if the market was so immune to price drops? This home had a bubble sale price as well:

Last sale:Â Â Â Â Â Â Â Â May 2005 -Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $590,000

Here we have another 32 percent discount. Notice how short sales and foreclosures are having a roughly 30 percent discount from peak prices?

Today we salute you Cerritos with our Real Homes of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

29 Responses to “Real Homes of Genius – Cerritos California and 30 percent short sale price reductions. Can demographics save a city from the housing correction?”

The first house mentioned might be 30% off peak, but it is still more than twice the 1996 price. Adjusted for inflation, this house should be between $300,000 and $320,000, and not $499,000. Everything is relative.

The 1996 price seems to be very affordable by Los Angeles area standards, but not by national standards. $226,000 is still too much to pay, even today, if you use national prices for a comp.

I’d be interested to see the foreclosure-to-actual homes listed ratio for this area as well. Are the banks keeping as many homes in shadow inventory here as up in West Los Angeles?

And just how would “Foreign money” be keeping this area going? Are there investors from Japan using the exchange advantage of the yen to invest in property? Or do people think that families from India, Korea and other Asian countries are subsidizing their extended family member’s mortgages?

As someone who grew up around there, and knows that there’s a strong chance of the area losing some major aerospace jobs soon, I simply can’t see how their local economy is supposed to be magically insulated from the fiscal carnage around it. The generally higher level of education around there may be helping (less doctors are coming up with pink slips than contractors) but there’s not a lot of new jobs available, and with a lot of teachers getting laid off, there’s surely a number of families losing the second income they need to keep (or buy) in that area.

It’s just rumor and hearsay, but I heard that a lot of Korean and Chinese money is buying RE in some areas. They want access to our education system, investment opps, suburban lifestyle, etc. Some probably get their green card via the millionaires clause in the immigration law.

They want access to our education system? Ha ha ha ha ha….yeah right. Poor deluded fools.

Maybe they do want access to our educational system… I guess they haven’t gotten them memo about the sorry state of American education.

Aimlow Joe was here.

http://www.aimlow.com

gael & AimlowJoe, for practical purposes, you can replace ‘educational system’ with American universities. Going through primary and secondary school in the US (particularly California) is just a means to increase the chances of getting into a top ranked university in the states.

Why would a foreigner with a boatload of money worry about what public school district they own a home in?

If they really had that much money wouldn’t they be better off sending their kids to a New England Prep School such as Andover or Exeter?

Susan, RealyTrac has the rate at 1 in 412 homes foreclosed:

http://www.realtytrac.com/trendcenter/ca/cerritos-trend.html

In comparison, Beverly Hills is about 1/500, Santa Monica is 1/1000 and south pasadena is 1/900.

JK, there are not that many korean/chinese home buyers from overseas. However, their presence in the market may have enough of an effect to slow down the slide in the housing markets in higher asian-concentrated neighborhoods/cities since those areas tend to have less defaults than other areas. This could be due to the cultural tendency of asians to save money and make less financially risky decisions than the overall population.

Koreans do not need to buy housing to enjoy the benefits of our higher ed. All they need is to score very in graduate entrance exams and join science related programs where competition from natives barely exists.

“I’d be interested to see the foreclosure-to-actual homes listed ratio for this area as well. Are the banks keeping as many homes in shadow inventory here as up in West Los Angeles?”

It certainly appears to be in line with shadow inventory in other “better” areas, at least in terms of what the good Dr. HB has reported previously. The number have usually been around 10%, at most, or bank owned/REO/short sales are on the market versus 90% “in limbo”. For Cerritos, Dr. HB mentioned 4 REO + 14 short sale versus 173 properties off the market:

MLS foreclosures listed: 4

MLS short sale listings: 14

Shadow inventory (NODs, auctions, REOs): 173

That’s generally been the % breakdown in parts of Pasadena and west LA, Santa Monica, south bay etc.

And the good news just keeps on coming:

REGIONAL AND STATE EMPLOYMENT AND UNEMPLOYMENT — SEPTEMBER 2010

Regional and state unemployment rates were little changed in September.

Twenty-nine states and the District of Columbia posted unemployment

rate decreases from a year earlier, 16 states reported increases, and

5 states had no change.

The national jobless rate was unchanged in September at 9.6 percent and also little different from a year earlier (9.8 percent).

In September, nonfarm payroll employment decreased in 34 states and

increased in 16 states and the District of Columbia.

The largest over-the-month employment decreases were in

California (-63,500), New York (-37,600), Massachusetts (-20,900), and

New Jersey (-20,200).

The West reported the highest regional unemployment rate in September,

10.9 percent, while the Northeast recorded the lowest rate, 8.6 per-

cent.

The largest over-the-month statistically significant job losses occurred in California (-63,500) and New York (-37,600).

California ……………….| 13,872,100 | 13,808,600 | -63,500

In September, Nevada’s unemployment rate held at 14.4 percent, again

the highest among the states.

The states with the next highest rates were Michigan, 13.0 percent, and California, 12.4 percent.

At least Michigan has someone to keep them company.

Construction

July Aug. Sept.

2010 2010 2010p

546.9 541.3 528.0

Financial activities

July Aug. Sept.

785.7 779.8 776.4

BUT THE GOOD NEWS IS:

The largest over-the-year percentage increases in employment

were reported in the District of Columbia (+3.3 percent)

39

In broken Japanese, that’s “san-kyu.”

It’s not like all Asians live in super-nice areas either. On my mom’s pretty-nice street of small tract homes, prices went up to 600k+ and I think they’re closer to 400k now.

If past performance is any indicator of the future, further drops are in store. Prices fell from the late 80s to the mid 90s by around 2/3.

39, “San Kyu” is actually “Thank you”. In Japanese there is no “Th” so “Thank you” is pronounced like “san kyu”.

It would seem to me, that a big part of the problem with California, is and has been the exhorbitantly high cost of housing.

to me, this factor alone looks like a huge job killer when it comes to offering affordable housing in nice neighborhoods.

I can’t imagine a company considering locating significant facilities there and trying to convince average employees to try to find starter homes for anything under a half million dollars.

Both of the homes that are shown are indeed, nice looking, decent, average looking, starter type homes.

At 1600 square feet, 3 beds, and 1 or 2 baths, it’s sort of hard to call them anything but.

I suppose it could be a move up for a young couple coming from a condo, apt, or smaller box, or possibly a downsize for a boomer.

So the craziness is what bank or used house salesman thinks $400K or $500K constitutes a starter home price?

Ok, Ok, Ok – thiese homes are discounted about 30% from their peak price (their insane, buy-it-if-you’re-a-retard prices).

Semantics, semantics, semantics. Tell it like it is Dr. HB. These houses are a RIP OFF at their current prices. A RIP OFF! They are both priced about 3 times their reasonable, sane, fair market prices, but sadly, people cannot get over the greed of the housing bubble.

You know, it used to be that if you lived in a 1/2 million dollar house, you were a rich guy! Now if you buy one of these homes for a 1/2 million dollars, you’re a moron!

And I love your very first line – “Last month the economy added over 150,000 job.” Yeah right. Actually, this is probably true, but these jobs are most likely temporary jobs working in malls for the Christmas season, and working in Starbucks to accomodate the holiday shoppers. These jobs are not permanent nor significant. Most likely on Jan 1, 2011, these jobs will be toast!

Big Banana:

I believe that if these houses were on the market at 1/3rd of their list price they would sell in a week. They would be great buys at that price – perhaps even steals. I do agree with you that they are over priced and were over priced in 1996, but in a community where nearly half the population has a bachelors degree and is stable these homes are not the cracker boxes shown as RHGs in the west side bubble mania.

One of the greatest problems with the whole housing, FIRE mess is it exposes that we as a nation have given up on the premise that our system, the one that changed the world. We have resorted to financial gimickry as a way of life. All the great minds that should have been leading us into the future have diverted their talents into sucking the very life blood of the masses to sustain their oppulent perversions. We are in danger of showing the world that our system has failed and that China has the better system–that is the great danger in all of this. That we are the zombie nation now and that we are spiraling out of control in all areas. Without the worldwide belief that we are the great productive, innovative nation that changed the world, no one will believe in us and we will have to buy our own bonds and have the government make all the loans and bail out all the businesses. Can you believe this is how we wasted our birthright?

Dr. B, funny you mention areas being over priced with large Asian populations, my parents live in Alhambra and prices seem to be in a bubble there. Prices dipped after the initial bust but they seem to keep trying to get back to thier peek prices of 2006. I think they’re about 10% off peek but in my mind at least 20% over priced.

…but I heard that a lot of Korean and Chinese money is buying RE…

Oh, really..? I’ve heard its not the Korean/Chinese, but the space people

who want to blend in before the big takeover..

I have heard this BS from realtors for years.

Can anybody produce just ONE verifiable example of these money flows?

Hi Doc:

I believe the Asian areas like Cerritos are more resistant to decline because they tend to be higher educated and the city more than likely has a much lower collective loan to value ratio than say, Chino Hills.

Also, just a little heads up on that first example. It took me a minute to figure out from that document list; but here’s what happened.

The borrower took out a $540k first in Sep ’06, then pulled a $60k second about a year later in Feb. ’07 from BofA which was probably a line of credit, which was then refinanced in Dec ’07, and here’s where the tricky part is, using a new $417k first and a $170k second. The total of which is $587k; which is why you have an NOD and then a Notice of Sale on the $417 first and not the $540k loan which was paid off in the Dec ’07 refi.

If you look closely, the document numbers on the $417 loan and the $170 second, they are consecutive which shows they were recorded under the same title order; meaning the same refi escrow.

The owner was probably trying to take advantage of the $417k conforming loan limit in effect at that time to get a lower interest rate and put the rest of the debt into the $170k second so the blended rate of the first and second would be lower.

These bubble-resistant areas just take longer to correct but real income levels forced in front of the underwriters’ noses by full doc qualifying requirements will push sales prices inexorably lower. Like you say, only a rise in incomes can stop this correction.

Thanks Doc.

Thanks Thomas for the exaplanation, and of course thanks Dr. H B for another great article.

You are both absolutely correct that while it takes longer, the more affluent areas – ALL of them – eventually fall in such a downturn with % losses very similar and inline with their subprime, low income, ghetto etc. neighbors.

There was a great study done of the 90’s downturn by someone at Anderson at UCLA (before they become a mouthpiece for the NAR/CAR as in that recent nonsensical 50%+ growth in prices in 5-10 years projection from last week). In the analysis of the 90’s SoCal downturn, they found that home prices/values in the most affluent zip codes (based on average and median household incomes) did in fact fall by the same percentage off from the late 80’s peak as the least affluent/ghetto zip codes, it merely took longer, usually around 2-3 years.

They specifically compared Holmby Hills/Bel Air/Westwood, Santa Monica, Malibu, and Beverly Hills zip codes to Compton, South Central, Watts etc. We are nowhere near the end of the pain train. WOO WOO!

RE: The “Asian Salvation Factor”… if history is any guide, the collective Asian buy-in seems to occur at/near not only at the overall peak, but also at local maximums during the sawtooth-down-trends. Two decades later, I’m STILL having schadenfreude chuckles over the “genius” purchases of the Japanese in the mid-late 1980s, when the chicken-littles were warning us that “they” were “buying our country out from under us”… much sooner than later, the Japs lost their shorts… ROTF-LMAO at the “geniuses” in Tokyo.

OTOH, I *will* say that as crooked as our bank$ter system has been for the past 25 years, the NY-London Axis are boy scouts compared to Japan, and absolute saints compared to the ChiComs, so I’m sure there will be some Asian capital fleeing to The Peoples’ Republik of Kah-lee-foh-nya, if only for shelter/safety. Yet, I have NO hard numbers (who does?), and doubt it will “prop up” the powerful headwinds of deflation to any significant degree.

Remember:

EVERY job lost is DEFLATIONARY;

EVERY missed mortgage payment is DEFLATIONARY;

EVERY vacant storefront or office space is DEFLATIONARY;

EVERY bond downgrade–corp or gov–by even one level, is DEFLATIONARY;

When is the last time you heard the MSM report anything detailed on the largely under-the-table corporate and muni bond markets? Helicopter Ben has everyone distracted with the QE-goosing of the stock markets. The Real-tards® are lapping it up.

@Enzo

Echo’s from the other Sunshine State, FL

I’m here on business and there are so many beautiful new vacant commercial buildings here it is frightening–four on the small street this hotel is on. UE still a mess. Housing still drafting down. A lovely facade to a collapsing interior?? Microcosom to the rest of this stuff? It’s not San Andreas’ Fault…

Looking from an Europe prospective. And looking at the only sane Germany real estate market i would not pay more then 250k dollars tops. Thats about the top price. Would mean another 38% drop in the current price.

USA housing market is in a depression for years to come. Till levels reach like 3 to 4 yearly income. Seen it happen before in begin 80 ties. No way around it.

Plenty of cheap real estates within 60 miles of Berlin, at Brandenburg, Szczecin and Kostrzyn.

That first house is actually nice, and Cerritos seems like a great city. I can only dream of homes being 4x annual income – it’s ridiculous right now. We’re definitely in for a prolonged hurting that will take it’s toll on housing, employment and my entire generation.

I am a first grade public school teacher in the Cerritos area and I can tell you that the public schools really do make a difference to the home buyers. Home buyers of all races are looking for a school district where the average child has high IQ, and where there are very few disruptive and violent children.

When we give our children IQ tests, there are very clear differences between the Northeast Asian Children and the other children. Northeast asian children have IQs that are on average one standard deviation higher than the average of all the other children.

This is not a function of income, since routinely we have very low income Northeast asian children, both parents recent immigrants working jobs near minimum wage out scoring upper middle class children of other races on IQ tests. I would also point out that there seem to be plenty of little girls put up for adoption in China and shipped to the USA to be adopted by Americans of all races. In our school district the little chinese girls adopted by parents who are not asian seem to have the same IQ test scores as the Chinese girls raised by Chinese parents.

So what we see in my district is a very sharp gap between the Northeast Asian children and the average non Northeast asian child. You can just tell the difference when you come in to my classroom, or any classroom in the area. Again, the parents of the kids in my classroom are of a mix of races and nationalities. They are not snobby and they are not status seeking. They are just good honest hard working folk that want what they see as best for their children, and what they see as best for their children is a classroom filled with kids who arrive at school with very high IQs, very good behavior, very little propensity for violence. That means the Northeast asian demographics of Cerritos make it increasingly attractive to parents of all races.

I am pessimistic about all of California, but if I had to buy and hold for ten years I would certainly choose Cerritos right now over a neighboring community with different demographics

Cerritos is home to the Gretchen Whitney H.S., a free public high school that’s open only to high scorers on its entrance exam. It had 18 National Merit Scholars in 2009 versus eight at Beverly Hills H.S.

To all the above comments relating to Oriental education and overpriced real estate entitlement——- CAN U SPELL—- TOTAL ETHNOCENTRISM———

Leave a Reply