Chasing the market lower syndrome or how to lose $176,000 in seven months – Case Shiller hits a new post-bubble bottom – Finding the bottom in home prices in California. Woodland Hills has 483 properties in the shadow inventory while 200 non-distressed properties are for sale.

The Case Shiller data released today was rather significant since we have now achieved a new post-bubble low for home prices. So much for hitting a bottom. Clearly the economic conditions around the country are putting things into dramatic focus and many people are unable to stay afloat. The paltry demand for housing is coming for lower priced homes by a population that has seen their household income fall for well over a decade. The shadow inventory is still large and as expected is serving as a large drag on many markets. We also find out that the Federal Reserve made an astonishing $7.7 trillion in shadow loans to their colleagues in the financial sector. Keep moving along folks, nothing to see here! Even in mid-tier Los Angeles markets many were too quick to jump in as we will highlight today.

Case Shiller reaches new low

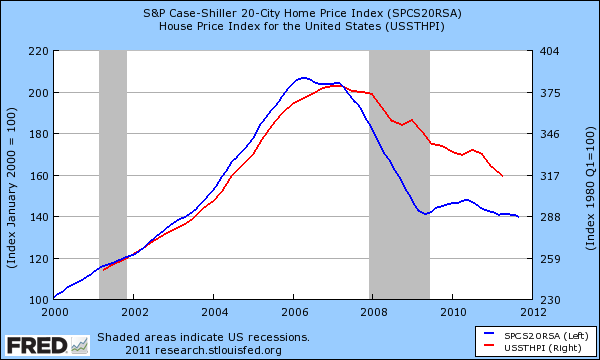

As previously mentioned the Case Shiller made a new post-bubble low today:

The market continues to make new lows for a variety of reasons but the most important one is the fundamentally weak economy. People tend to forget that all housing price gains for the last decade were largely illusionary. You had artificially low interest rates and no due diligence making up for a stagnant income base. That is obviously unsustainable and many European countries are finding this out the hard way. You cannot go into massive debt and create a sustainable economy contrary to what many believe. Sure, it felt like this was a new paradigm since the bubble ran strong for a decade but many have a hard time accepting this post-bubble market.

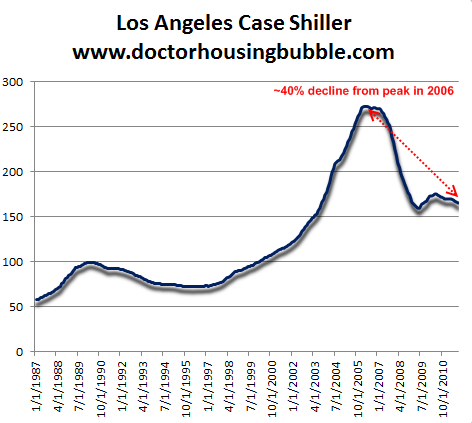

According to the Case Shiller Index nationwide home prices are down by 33 percent from their peak. Contrary to what some are saying, bubble markets have popped harder and will continue to drop quicker than nationwide prices. Take the overall Los Angeles market:

Looking at the Case Shiller data on Los Angeles which also includes pricey Orange County, home prices are down 40 percent from their peak and are down almost 5 percent year-over-year.

In other words, simply being in California is not going to keep prices inflated just because people enjoy the nice climate (last I checked Greece also has a nice climate). Yet a line of thinking continues that some markets are immune to this bubble bursting. As we have pointed out even housing in Beverly Hills is facing a correction.

But let us examine a mid-tier market here in Los Angeles County that certainly is not Beverly Hills, Woodland Hills.

Jumping in too early in Woodland Hills

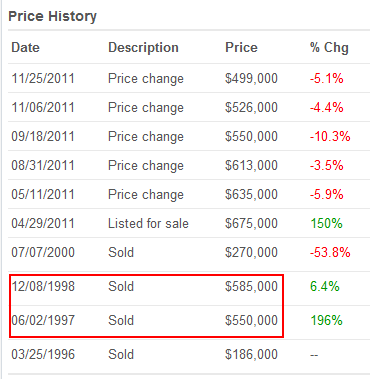

You have to look at the entire scope of what is going on. Housing does not operate in a vacuum. I wanted to highlight how quickly things can change even in this market. Take this short sale in Woodland Hills for example:

5219 BAZA AVENUEÂ Woodland Hills, CA 91364

3 bedroom, 3 bathroom, 0 partial bath, 3,476 square feet, SFR

Nothing extraordinary about the city or property but here is a perfect example of markets that have yet to hit a bottom. This home has been on the market for well over 200 days. But the real action is in the pricing history:

Does this pricing action demonstrate a market that is full of pent up and repressed demand? This also shows how disconnected some markets in Los Angeles have become. How can you go from $675,000 in April to $499,000 today? In no other states do you see pervasive manic pricing like this. This is like going to a car dealership on Monday and getting quoted $40,000 and then heading back on Friday and getting a price of $20,000. The price reduction alone is the median price of a home in the United States!

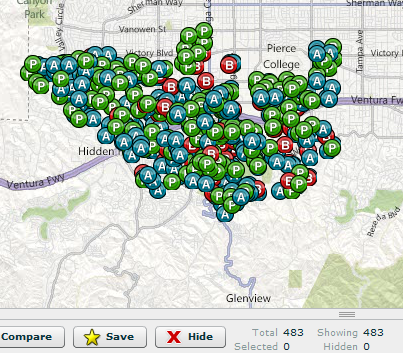

These markets are incredibly inflated and that is why the above 3 bedrooms and 3 baths home in Woodland Hills is now reflecting a price last seen in the 1990s. But of course this is only a handful of properties right? Let us look at the shadow inventory in Woodland Hills:

If we exclude distressed properties, Woodland Hills has roughly 200 non-distressed properties listed on the MLS while 483 are in some stage of foreclosure! In other words, the bottom is far from being reached in some California cities.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

45 Responses to “Chasing the market lower syndrome or how to lose $176,000 in seven months – Case Shiller hits a new post-bubble bottom – Finding the bottom in home prices in California. Woodland Hills has 483 properties in the shadow inventory while 200 non-distressed properties are for sale.”

I think the really odd thing is the tax assessment on this property. It appears that it is based on the 2000 price of $270,000. How the hell did the property go from $186,000 to $585,000 then back to $270,000 in a 4 year timeframe? Maybe this was a 1994 Northridge quake red tag but how do you get to down to $270,000. I smell something strange with this property…

Seriously, it’s as if the 1998 buyer did a total raze/scrape-off of the prior house, then the new house project died, and they had to sell off the empty lot in 2000…? It happens.

Regardless, DrHB is right–the real story is the post-Bubble race to the bottom in just the last 6 months… D’OH!

It’s been awhile but as i recall, there was a small problem with real estate fraud going on in some of hte communities in the Valley. Woodland Hills was a hot bed of flipping and increasing prices in a scam. The OREA even ran a special class for appraisers to be on the look out for this activity and don’t get caught in this tangle.

year 2000 also included a reaction to 17 years of a secular bull market compounding…..while 2011 includes a secular bear market of 11 years unwinding compoundings…not to think of these 6 percent commission brokeragings added at each buy and sell being trying to be recouped..? or an extra 42 percent added to price for nothing house related.?just some form of sellers “helper” royality…..

I live in Woodland Hills, my poor neighbors on both sides. One side bought in 06 for 1.7M and now Zillow has his house at 886K. That’s a downward slide of 900K in 5 years.

The other neighbor bought for 1.3M in ’07 the house is now in the high $800’s. Nearly a half-million dollar loss in 4 years… Bad timing all the way around for those trying to buy into the American dream, I mean nightmare…

And interesting angle toward that just popped into my head. In the late 70’s to early 80’s, mortgage rates shot up to the high teens and low twenties range. From the standpoint of the buyer, the interest paid over the life of the loan would be about 3-4 times more than principal they borrowed. If we look at the situation of your neighbor, signing a loan for 1.7 M with the value falling to around 800 G, the amount paid for the first mortgage, assuming a either an adequate (20%) down payment was made in cash or via a second, then the amount paid into the first mortgage would be around 3.6 M assuming 6% rate from 2006, which is pretty close to 4 times the current buying price.

It’s striking how much things can change while remaining the same…

Except that the guy who bought with a 13% interest rate 30 years ago could have refinanced to a nice low rate many times between now and then. The guy who bought at the peak is just SOL. His rate isn’t going down.

True, but Califnornia being a no-recourse state has generated conditions which have allowed many peak buyers to live rent-free for typically 18-30 months while the foreclosure gears turn. If you’re talking about a 500,000 home, that can easily add up to $50,000-$100,000 in non-payments. A couple years of lousy credit and apartment dwelling isn’t such a stiff trade-off.

And all this is before Greece defaults and the Euro breaks up. When that happens,

(not if, but when) panic may grab the financial markets worldwide.

I remember when Countrywide went belly up. People lined up around the block to get their money.

You haven’t seen anything yet.!

Greece represents 2% of the the Euro Zone GDP. Also if the Euro is in danger of breaking up, why is it still worth 33% more than the US Dollar today. If you are so sure the Euro will break up then short the Euro and you will become filthy rich.

I worry about what is happening here in USA. There is massive austerity occuring with wages slashed, benefits cut, food stamps approaching 50 million people, and inflation running at 10% a year per pre-Clinton era inflation formula. House prices will continue to go down.

Matt,

Didn’t we already go over this? The value of the Euro in relation to the USD has nothing to do with the strength of the European economy rather the policies of the Fed versus the policies of the ECB. Do you disagree? I already spoke to the percent of GDP fallacy as well. What percent of the US GDP was Lehmann? What effect did the failure of Lehmann have on the US economy? What am I missing?

Matt: the Euro’s launching rate was $1.17 not $1.

@What?

Currency exchange is a barometer of the economic strength between two nations. The Euro Zone GDP ratio to its debt is much better than USA GDP to debt ratio and there are other factors such as inflation and trade to consider too of course. Also the policies of the central banks of currency devalution are part of it as well too. However it is simple economics 101. The persistent commentaries by our mainstream media of the impending implosion of the Euro is fallacy and purely disinformation to force the sheeple to continue to invest in US Dollars is what bothers me. If it were true, the Euro would be worth pennies to the US Dollar now.

http://www.livestrong.com/article/121415-determines-strength-dollar/

Lehman was assassinated by JP Morgan. Read this great commentary:

http://www.bullionbullscanada.com/index.php?option=com_content&view=article&id=12242:did-jp-morgan-assassinate-lehman-brothers&catid=47:us-commentary&Itemid=132

@Matt,

The majority of the current devaluation of the USD relative to the EUR is related to the actions of the Fed versus the actions of the ECB. The unemployment numbers in the troubled EU partners are higher than Detroit. I am not convinced that the Euro zone is a stronger economy than the US. I believe that they are both in trouble the only difference is that the Fed is doing a better job at devaluing the currency than the ECB. I agree that things are much worse in the US economy than what is being reported in the MSM but I disagree that things are much better in the EU than is being reported in the MSM. Many of the supposedly solvent EU countries (i.e. Germany) invested heavily in US MBS’s/EU partner bonds and are in much worse shape than is being reported. I believe it is more likely that an EU country will default in the next year or two then the US. I am not convinced that the Germans are willing to bail out Greece, Spain, Portugal, Ireland, Italy, etc. I am very convinced that the US government will bail out California, Illinois, New York, etc.

I do agree that the perception of US treasuries as a safe haven is most likely misplaced. Regardless, I believe the market signals this to be the case because it seems that every time the market is spooked the treasury yield drops. I think something that should be included in your evaluation of the EU versus the US is the treasury rates. I think this shows not that one economy is better than the other rather the difference in Fed policy of buying up US treasuries to manipulate interest rates and increase money supply.

@What?

First, what is your source of USA’s unemployment rate? The 9% government number is a fabrication. The amount of people employed in USA is at the same level as in 1982! The unemployment rate is about 20% in USA on top of the underemployed, part-time employees, 2 million in prison, 50 million of food stamps, and half million in military. To make matters even worse, American workers get 2 weeks off a year while Europeans get mandatory 6 weeks off and work mostly 32 work weeks. Productivity in Europe is far less than USA and still they have the highest GDP in the world. However, I do agree that ECB is also devalueing the Euro so that USA does not become an exporter nation. It is a race to the bottom.

Second, I don’t believe that European Banks hold that much MBS bonds otherwise they would have collapsed by now. Our real estate market has lost about $7 trillion in value. European banks hold government bonds where a lot of it is tied to CDS market. The CDS market is being attacked by Wall Street gamblers and causing European countries bond interest rates to skyrocket. That is a whole other story.

@Matt

My point is really pretty simple. The exchange rate between the EUR and USD is not an economic barometer of the economic strength between the EU and the US. The same is true with the interest rates on US treasuries versus the individual EU country’s bond rates. Both of these are being manipulated by governments. There is no econ 101 at this point.

My other point is that percentage of GDP is not a strong argument that Greece’s default will not have a significant impact on the EU. I think the real reason that Lehmann’s failure led to a freeze up in the financial sector was not size of Lehmann, rather the fear that others investment firms would soon follow suit. I believe that a Greek default would lead to fears of an Irish, Portuguese, Spanish, Italian, etc. default. This fear would make it difficult for these countries to turn over their debt which would lead to a default. None of these countries can print euros to pay their debt.

pre clinton inflation numbers included house price inflation..that not being counted raped savers for 30 years of purchace power and dollar value, what..? exactly..do you think this pages story is all about.

“If we exclude distressed properties, Woodland Hills has roughly 200 non-distressed properties listed on the MLS while 483 are in some stage of foreclosure!”

Anybody thinking about buying now needs to print this statement out and tape it to their fridge door. Sooner or later it will sink in that we are far from a normal, healthy market with all the distressed properties clogging up the pipeline. I’m thinking at least two more years of pain for loan owners.

Lordy, ain’t that the truth, although I think more than 2 years. Probably more like 5 or 6. I my own case, I desperately need a bigger house. But there is no way I can sell near break even. So we are remodeling the basement. (was unfinished, just concrete walls, floor)

I’m acting as my own general contractor. Less than $10,000 will add a 3/4 bath, bedroom, storage room and family room.

If I was a contractor, this is what I’d be gearing up to do. There will be no need for new home construction in this country for many years.

With permit? w/OUT permit? Nudge-nudge, wink-wink… Hopefully the former, as the latter can bite you hard when sell time finally arrives. ;’)

Back on-topic, building-out/adding-on is definitely an adaptation to circumstances being widely seen in all markets. It’s the only work most GenCons are seeing.

Enzo–I’m going the ‘with permit’ route. However, in my city, the inspectors are very friendly and reasonable.

I have heard a lot of horror stories about the ‘inspector from hell’ in the next township. If that were my area, I wouldn’t bother get a permit.

Back on topic. I won’t be able to sell at breakeven for years, barring some sort of hyper inflation event, which will destroy the economic landscape. So I think the low cost way to add living space will be the way to go for a lot of families.

As other posters have mentioned on other threads, the thing that really drives the real estate market during booms is ‘move up’ buyers. Some burger flipper buys a trailer. The trailer seller buys a starter home. The starter home seller buys one step up, etc. That whole mechanism is completely broken, and will remain broken until the ‘underwater’ situation clears. That is many years of high inflation down the road.

Another good article – thank you, Doctor!

Can someone shed a light on those shadow loans by the FED? I recall seeing how the FED loaned enormous amount to overseas banks…

For the Inland Empire, I can report rising vacancies for landlords. Rents are being lowered aggressively by some. With fewer people owning, there should be more tenants. But the opposite is true. Hopefully, doctor HB will shed a light on this phenomenon.

…With fewer people owning, there should be more tenants….

You would think so.

In Orange County (Irvine) I have noticed a trend for familys to double up into a single household.. Ditto for singles and everything in between. How to I know? I have helped some of those folks (who are friends) move!

I am a property manager for a private group owning 50 SFRs for rent in the inland empire and I have found I can keep rents stable, but, with increased demand I no longer need to offer a “move in special”, and I am getting many more calls. Out of 50, I have only one vacancy a month, and it fills up fast. This is a *great* occupancy rate.

For $499K that house looks like a steal if it doesn’t have structural/foundation issues… if you really need that much space 3500 sq feet is pretty enormous…. (expensive utilities).

But the area has great schools, very close to the beach/malibu/santa monica… safe quiet area.

This house DOES look like a steal. Woodland Hills is a fairly prestigious community, though not, I’m sure, in the same league with the really tony areas like Laguna Beach or someplace like that. You will pay this much even now in less-than-prime neighborhoods in the city of Chicago, for an 80-year-old 2500 sq ft house that needs a new kitchen and to be rewired.

Judging by comments on our local housing blogs, many City of Chicago homeowners and aspiring buyers have not yet gotten the message that the United States AND the G20 countries in general are in the throes of an epic economic shift that will roll for the next two decades out and that will most likely leave us all much poorer and completely unable to service loans that seemed very doable just a couple of years ago. Millions of jobs will be lost and so will many fortunes- even the fabled 1% will not escape unscathed.

Woodland Hills is indeed a lovely area – if we weren’t tied to work in Santa Monica it would definitely be on our radar. With Tarzana and Calabasas on either side its a nice part of the Valley with good schools, quiet leafy streets with decent access to westside and downtown.

However, due a weird temperature inversion in the western part of the SFV – Woodland Hills can get as hot as Hades during the summer. As in ‘read temperatures for Palm Springs rather than Downtown Los Angeles’ kind of hot.

So, anything you buy will need decent insulation and a very pokey HVAC system. Or, you need to be a heat-loving reptile

Yeah, it can get into the 100s pretty easily.. But rarely do those heat waves last more than a week at a time.. And it’s dry heat… far more pleasant than Texas or southern states heat.

I guarantee you 110 degrees in the San Fernando Valley is 1000x more comfortable than 85 degrees and high humidity in Texas.

Install some mist machines in the back patio… buy a house with a pool.. and you won’t mind the heat at all. (Temps drop quickly at night time.. so you almost never have to run the A/C at night.. especially if you have an attic whole house fan).

1637 was the peak of the tulip mania. You know, you can still get tulips pretty cheap. Better get used to a long Kondratiev winter, cause it’s a hard snow gonna fall.

Hey, let’s look at housing priced in that dirty, nasty, yellow metal… (hehehe)

Link: Gold Housing Ratio Falls to Historic Low

In gold terms, an average single family home in the United States can now be purchased for only 18% of its pre-bubble price in 2001. The term “pre-bubble” merits emphasis: the average house can be purchased at an 82% discount (in ounces of gold) not from the peak real estate values of 2006, but the much lower home prices of 2001, before the real estate bubble began.

yes but what about the median wage/gold ratio over the same time course?

Yar. Can there be any doubt that gold is not in bubble?

It does make me feel good about my 2010 house purchase!

LOL

You clearly do not understand Gold or where housing is headed.

There is a fundamental shift taking place. How you define wealth and what it is, is undergoing a shift. “Paper wealth” is dying.

You ‘feel good about a house purchase in 2010’??

I wish you luck.

I was probably a bit harsh. But here is some food for thought from Jesse’s Café Américain…

I am not sure if it will happen in gold or silver first, but the price management schemes that have been in place for a few decades now in the metals markets are reaching a tipping point. To paraphrase what Kyle Bass recently said, ‘There is $80 billion in open interest in gold futures and options, and there is $2.4 billion in deliverable gold at the exchange. The exchange is a fractional reserve system, and they plan for a one percent redemption. In the event of a greater demand for redemption, they assume that price will take care of it. The decision for a fiduciary is simple; take your bullion in gold out now.’

.

Where do you store your excess wealth? Choose wisely.

Appears those Central Bankers are keeping themselves very busy today rearranging the deck chairs on the Titanic.

Yes, very busy. Imagine, free marketeers acting in concert with communists to stabilize the global banking system. They can do pretty much whatever they want, with one exception: they haven’t figured out the ancient alchemist’s riddle—to turn base metal into gold.

Until they figure that one out, look forward to a lot more deck chair shuffling, perhaps with a bit of ‘musical chairs’ type music stoppage once in a while to throw some poor patsy under the bus.

You would think that if lower interest rates were going to work, they would have by now, but these guys don’t know the meaning of the word ‘quit’.

It reminds me of the Summer of 2007. The Fed announced they had solved the debt problem from the subprime loan mess. One year later, Bernake was running to Congress, with a gun. Stuck us up for $700 Million.

There are limits to what the Central Bankers can do.

“The persistent commentaries by our mainstream media of the impending implosion of the Euro is fallacy and purely disinformation to force the sheeple to continue to invest in US Dollars is what bothers me. If it were true, the Euro would be worth pennies to the US Dollar now.”

Unfortunately, it is true, most European big banks are as bankrupt as US banks are and the only reason keeping Euro up is that Euro countries are pouring taxpayers money in to them and situation in US and/or Japan is seen as even worse.

Euro banks have most of their loans in dollars, i.e. foreign currency, while US has everything on dollar and it’s widely expected around here that (=EU) that dollar will fall like a stone, saving European loan bubble while doing that.

That’s assumes that Euro holds longer than dollar, of course. If Euro falls first, European countries can’t pay back even a small fraction of their dollar loans and then the US is also in deep trouble, on top of current problems.

We are living interesting times. I that one is a safe bet to say.

Yes but it is U.S. dollars that bail out the world. The FED bails out Europe:

http://money.cnn.com/2011/11/30/news/economy/fed_ecb_dollar_liquidity/index.htm?iid=SF_E_River

–

“Euro banks have most of their loans in dollars, i.e. foreign currency, while US has everything on dollar and it’s widely expected around here that (=EU) that dollar will fall like a stone, saving European loan bubble while doing that.”

Well the FED is actively creating (hopefully short-lived or else it IS inflationary just like Ron Paul ways) U.S. dollars now to save Europe. One might even cynically say it is helping to bring the very situation described above about.

“That’s assumes that Euro holds longer than dollar, of course.”

See above.

It’s not that the U.S. does not have VERY VERY VERY deep problems perhaps deeper than Europe’s. It’s just that right now it’s on top. It’s not the first time since 2008 the FED has leant money to the whole wide world. Worse so much of this just ends up bank bailouts by the backdoor. Bernie Sanders has documented how this happens. Banks borrow at 0.58% (what we are lending to Europe for) and invest it at a higher rate than this. Thus they profit off these bailouts. It happened of course with U.S. banks as well.

Wondering why prices in Sierra Madre have barely budged in the three years i’ve lived here, its frustrating to see prices heading south in other desirable areas, why not here?

My opinion\educated guess is that a relatively larger number of homes in a very desirable mico-market like Sierra Madre have been owned for a long time. If this is true, you would tend to see less distress and more limited supply of for sale homes.

Can’t speak about Sierra Madre. Perhaps someone found the treasure there?

Seriously, the Doctor has covered other areas in LA where people thought the price would never come down. They did.

Up here in the SF Bay Area, we have the “glorious” area of Palo Alto. It’s next to Stanford, and the people living there are delusional enough to call themselves the top-tier. They aren’t. Second tier at best. The top tier is out of their price range, but they never mention that.

The locals had been in an orgy, shouting how prices were going up earlier in the year. It’s now down 10% YOY, and the fanbois have become quiet lately.

The point is, even what looks like an untouchable area is all too touchable. And this is with significant job growth in Silicon Valley.

Do you think it is possible that banks are manipulating the markets by not sending notices of default in certain neighborhoods while foreclosing in other neighborhoods? This way they could work through each neighborhood while artificially supporting neighborhoods they have not gotten to. I have no direct knowledge of this but it makes sense and would answer why certain neighborhoods were affect right away and over time new areas become affected. Why would it take 5 years for the housing crisis to finally impact the bay area? I know that prices South San Jose started to plummet about 2 years ago. It is almost like it moves like a fire versus like an earthquake.

“California Love” – Kali expecting to layoff 60,000 soon

http://money.cnn.com/2011/11/30/news/economy/jobs_challenger_adp/index.htm?hpt=hp_t1

43 to 7 vote for governments “right” to disappear innocents, …thus, the unpaid tax propertys of the detained and fema imprisioned can be taken and given to foreign holders of the debt……..cheap…………..

Leave a Reply