China’s real estate bubble overflowing into targeted US cities – Hong Kong imposes 15 percent tax on property purchases made by foreigners. The push for housing near quality universities.

The amount of money flowing in from global markets is incredibly strong. To be more specific buyers from China are big players in many prime areas especially in California. Access to high quality universities and prime neighborhoods is simply another factor that will keep prices inflated more than people may think. Canadians have firsthand experience in this global real estate market push. If you think our real estate bubble was amazing you simply have no idea what is going on in China at the current moment. This past weekend, the Hong Kong government put on a 15 percent tax on property purchases made by foreigners. There is no question that the market is overheating and the government is readily admitting it and even going to these extremes. Put this into perspective with US real estate in 2007 when the Fed was still reticent to admit that we were experiencing a heated real estate market. At this point it is too late and places where this hot money is flowing like a few Canadian cities will feel a pull back once the current trend stalls or even reverses.

China and Japan real estate markets

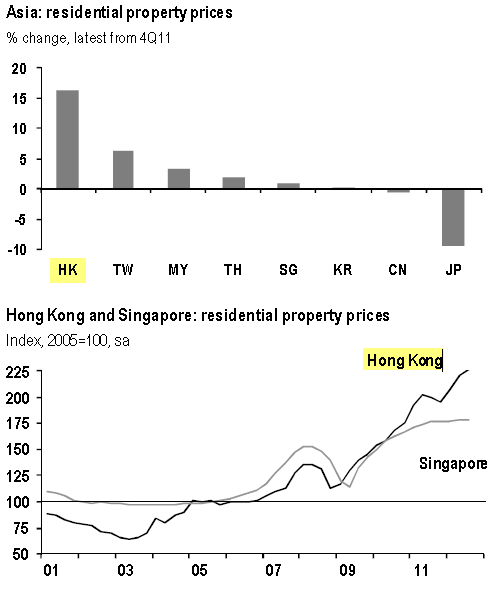

Not all markets in Asia are following a similar pattern. I was talking with someone very familiar with Asian real estate and it is clear that the press throws all Asian markets into one pot. That is clearly not the case. Take a look at housing values over the last year:

Housing prices in Hong Kong are up more than 15 percent in the last year. Price in Singapore are also on a fast pace upwards. You’ll notice in the chart that the financial crisis merely set in a temporary lull and prices are now way above record levels. But look at Japan and the trend hitting their property markets. Keep in mind that China and Japan are the second and third largest economies in the world behind the United States. This does and will have a significant impact on what is going to occur moving forward.

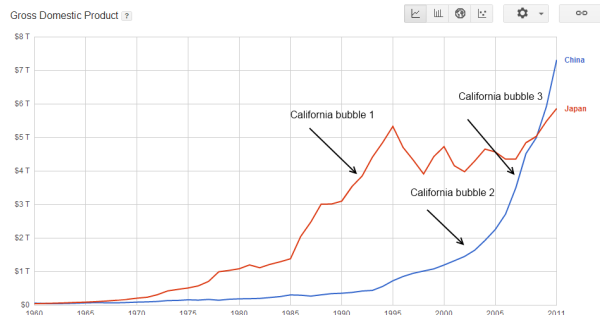

In California it is very common to see foreign buyers from China purchasing in prime locations. This has picked up recently and tying that in with what is going on overseas, our prices might look affordable in the grand scheme of things. A mania to us might be a hedge for hot money abroad. It is interesting for California since in the late 1980s the boom in Japan pushed up real estate prices primarily in the commercial side of things. We can include this foreign money flows for two of the last three bubbles:

The first bubble in the late 1980s came with the rise of the Japanese real estate boom. In the 1990s certain areas in the Bay Area saw prices soar courtesy of the technology boom. Today, we are seeing strong foreign buying from China. This is another reason why you have places like the Inland Empire looking attractive to local Californians in terms of price while other areas never even corrected. Compared to prime big cities and locations in China, many of the cities in California but also Canada look like excellent options to diversify a global portfolio. There is also a demand for more tangible assets:

“(BusinessWeek) Last year the average price of a foreign-purchased U.S. home was more than $400,000, which is double the national average—so the search for good value might only extend so far. That high figure becomes even more impressive when one considers that buyers from abroad often lack credit scores and access to mortgages, and frequently opt to pay the whole price upfront. “[S]ales transactions can often be completed quickly as many Chinese purchasers prefer all-cash deals,†Pamela Liebman, president and chief executive officer of the Corcoran Group, a New York real estate firm, writes in an e-mail. Liebman also says that her company has serviced more Chinese clients this year than at any time in the past, and that their interest is not just in residential real estate but in commercial property as well. Sixty-two percent of purchases by foreign buyers last year were in cash, according to the NAR. Zhao says many of the deals are for very large homes, capable of supporting several generations under one roof, which is a preference for affluent families.â€

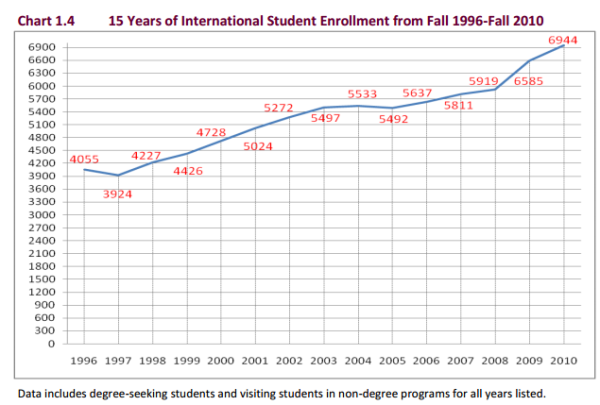

62 percent of foreign purchases were for all cash and the average price was $400,000. Given that the median price of a US home is about $170,000 and a high number of buyers finance their purchase, foreign money is being very specific as to where they want to land and when it does land it goes in with all cash. Fed or no Fed, low rates or high rates, if the boom continues abroad expect pocket areas to be held high as long as this trend continues. The education component is very important. Take a look at international figures from a top college in SoCal, USC:

13 percent of the students at USC are international students. They represent 70 countries. This is a trend that is hitting many top institutions across the country. As higher education pushes many domestic students into debt, many top institutions seem to increase their tuition year over year. Housing and education go hand and hand and the global demand is very clear in many markets, especially in prime SoCal areas.

What are your thoughts on this ongoing trend?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

43 Responses to “China’s real estate bubble overflowing into targeted US cities – Hong Kong imposes 15 percent tax on property purchases made by foreigners. The push for housing near quality universities.”

China in general have huge amount of dollars and as the value of dollar is plummeting, anything else than paper money is better than pieces of paper.

That drives the price up, 30% loss in short term (in value of a house) is meaningless when the expectation is that dollar will fall endlessy.

Also a nice place to retire if Chinese political winds turn. That can happen very fast and property abroad is a life saver at that point.

Love it or hate it, the dollar really isn’t doing bad at all. In fact, I think we will see the dollar go higher, (as asinine as that is), at least in the short term.

When the EU breaks up the dollar will soar. The only thing that would kill the dollar is the demise of the petro-dollar. Hint, that is why we are in the ME and promoting the “Arab Spring”. If you ever want to see how fast a ME leader can get kicked out the door, just have them mention they want to price oil in a currency or commodity other than the US dollar. Russia and China are trying to change the petro-dollar but as long as the US in the ME, no go. By the way, we are never leaving the ME. We just move around.

Even if the U.S. went full green, 100% sustainable energy, all of a sudden, they would still be in the Middle East because the country that controls the oil spigot, controls all the other pieces on the board that are oil intensive (i.e. the big competition).

Part of that money that goes to buy oil in SA, comes back to the US in the form of cash for Treasuries, investment in U.S. companies etc…

The DXY is a measure of currencies against the USD. Mostly the Euro. So when it goes up, it is going up against the Euro. But more importantly, it does not mean your purchasing power is increasing. Better to measure the USD against something tangible and fungible, like oil or food.

The European Union is not going to break up. It is constant propaganda from mainstream media to scare investors into investing in USA. The Euro is worth about $.70 to $1 USD. Euro has the largest GDP in the world. Its debt is 80% ratio to its GDP. USA is 100% to GDP and in 2nd place in GDP. EU trades heavily with Russia, China, and USA. Its banksters print money out of thin air just like USA and its servant politicians implement austerity. The difference is that there the citizens protest in the streets on austerity. Here in USA we just take it in the chin with cuts in retirement and health benefits, wage freezes or reductions, and union destruction.

Second, China is switching trading in US Dollars with their own currency with many trading partners.

http://bullionbullscanada.com/intl-commentary/26020-renminbi-relentlessly-replacing-dollar-as-reserve-currency

Since we’re getting into some international RE talk, and comparing HK/Japan to the US, how about this:

Despite all that you’ve read about the “lost decade” and tumbling RE prices in Japan the income:home price ratio in Japan is still ~5.5 while in Tokyo it is ~7.5 Keep in mind the homes (apartments) in Tokyo are often tiny shoebox condos with no land so there’s no land value. New apartments sell for more than used apartments without land values holding it up.

Hong Kong and Shanghai? ~30 for Shanghai and ~12.5 for Hong Kong. Compare that to ~3.0 for the US (which often includes land). Even major metro cities like LA and SF don’t approach the levels of unaffordable real estate you’ll find in other international cities.

The 3x income:home rule hasn’t held up in those cities for a long time. It’s no wonder foreign buyers (Asian and European) often look at RE prices in LA/SF/NY and think they’re getting a bargain, especially with a declining US Dollar.

Excellent article! The point that really resonated with me was when you wrote “Patterns like this are short-term….These bubbles will burst because any housing market is going to be supported over the long-term by local households and what they can afford. These short-term speculative bubbles simply become landing grounds for hot money”. You are 100% correct. The hot money came to my city – Toronto, Canada…home prices are at absolutely ridiculous levels. Even people who have above average incomes will have a difficult time buying a decent house downtown. It now looks like the ‘hot money’ also wants to be able to make money on their real estate purchases, so their purchasing in sky-high markets like Toronto have decreased and they have moved on to the nicer areas in the United States. Now let’s see how long it takes for house prices in Toronto to drop. Unlike the USA, our economy didn’t decline as much and we didn’t lose as many jobs percentage wise. Prices will certainly drop in Toronto, the only questions are will it be a hard or soft landing and how long will it last? Local households are tapped-out. They’ve borrowed way too much already, so where will the demand come from? I don’t think we need to worry about increasing interest rates in the near future. Torontonians should pray that they don’t lose their jobs because that would be the straw that breaks the camel’s back and make it extemely difficult to hand on to their highly leveraged home.EJ

Defintely. Irvine as mention is one of these places for foreign cash buyers. An Article shown Orange County picking up 11,000 asians between july 2010 to July 2011. La county over 10,000 and Santa Clara over 10,000 and King County in Wa 7,400. Now La has a much bigger base of asians than Orange County so it would naturally grow more in total numbers. Granted, a lot of Asians are coming to OC from LA county and are not foreign cash buyers and Orange County south of Irvine has seen more hispanic growth than Asia which reinforces the asian foreign cash buyer in places like Irvine.

You are mixing up racial data with foreign/domestic buyers. There is no comparison with respect to the point mentioned in this article, other than the cultural flavor of the neighborhood.

Sadly, over the 5 years I’ve been reading this blog it appears the message has morphed from “Don’t buy now!” to “Don’t buy ever”. With all the dollars we’ve loaned to China looking for a way to repatriate, this could go on for a long time.

I don’t agree. Certainly it was don’t buy now in 2007-2009. But after that, the message that I got is that “Some people shouldn’t buy ever” There was a constant drum beat of complaints about government market distortions pushing people who shouldn’t buy into homes and propping up prices.

That doesn’t mean that *you* shouldn’t buy. If you can afford it, can get a good down payment and lock in a 30 yr fixed at an easily affordable rate, then go for it. Prices have been plateaued for a while.

http://www.calculatedriskblog.com/2012/07/case-shiller-house-prices-increased-22.html

Just don’t believe it is an investment that is going to make you rich, and you will be okay. What it will likely do over the long there is increase in value 1% over inflation, but cost you %2 of its value per year in carrying costs for property tax / insurance/ maintenance. If a mutual fund had that sort of annual cost, nobody would buy it.

If you believe housing values are going to plummet further, then you would have to believe that there is some secret / misunderstood euphoria and/or malfeasance going on in the market causing it to be overpriced. Government subsidies notwithstanding, it is hard to imagine what that would be. People are really cynical in the last few years. I think if there was something truly rotten there would be lots of people screaming about it. The worst I can think of is the fiscal cliff causing a recession, or the end of the mortgage interest deduction in a Romney presidency. It sounds to me though like he just plans to end the deduction for wealthy people through a capping of itemized deductions. If that is the case, you probably only need to worry about steep price declines in the wealthy end of the market.

The funny thing about china real estate investors is that they are purchasing everying in sight in Las Vegas right now -many times sight unseen which has increased pices 30% in 6 months in some areas! its insane.

well at least we know the shadow invnetory is there alive and well thanks to zillow

No More secrets -Zillow allows you free access to your neighbors foreclosure

http://caliscreaming.com/2012/10/31/where-is-the-shadow-inventory-ask-you-neighbor/

Oh yeah, and I forgot to mention unlike claifornia where there is a rental shortage in many areas- in Vegas there is over 7000 rentals availble right now – mainly due to these Chinese and Canadian(but that is another story) investors.

Our higher education must be pretty good. Seems like wealthy foreigners still value it very highly. Having spent time in Brazil and India, the main thing I noticed in both places was that they do have some pretty good schools, but not many. So the demand is higher than the supply. End result is that if they have money, the parents send the kids to the US.

I remember talking to some very wealthy Brazillians who had two kids in school at Stanford University. They were blown away at how big and robust it was. The UC’s as well. Most countries just do not have the educational infrastructure to compare to the US.

How correct you are, sir

China is the hammer and we all look like nails.

After the Fukushima fiasco, I would think Japanese money

would want to invest elsewhere in real estate.

I ain’t no financial whiz so what I say and think is mostly fizzle.

Internationals have cash to buy a frat house so the kiddies can go to USC. Attending a state college must be at least that important to them. That is how I read this article. Then it must be time to raise the tuition on out of state students. They have cash. The money is there.

If USC isn’t supporting itself. Then they need to look at it.

I find it interesting that 2-3 years ago, we bears were all busily denying any stories of “rich chindians” sustaining CA prices. Now, that prices are obviously rising, we suddenly embrace them?

You’re right, the Dr. in particular has now changed his tune on this issue. This is another sign of capitulation on this board and the good Dr.:

“Fed or no Fed, low rates or high rates, if the boom continues abroad expect pocket areas to be held high as long as this trend continues.”

What? Now Fed actions nor interest rates swings will make a difference?

My personal anecdote? My landlord is Korean and she just raised my rent 10%.

What do I thinks about this trend?

I think it’s the bill coming due. Factor this in as part of the cost of ownership for all of that cheaper priced junk from China that we financed our lifestyles with.

Another example of inflationary law that what you pump into one place ultimately finds somewhere to go.

You can’t count on Chinese money coming in and propping things up forever. Vancouver seems to have peaked, with one measure showing prices there 11% off the peak price for the average house.

I remember in the 90’s a lot of Japanese kids came over to study. But this is a tiny fraction of the total student population.

At some point, the cost of a house or a college education will have to reflect the average salaries in the area, or the salary a graduate could reasonably expect to earn. This is the problem, because there just aren’t that many new, cutting edge, industries developing that pay top wages.

It is going to take some pretty severe monetary inflation just to keep American wages from tanking.

Two new neighbors, Korean and Japanese, with no visible means of support. hmm.

Used to be the Hi-tech H1B- green card morphs were buying houses for their parents to come over.

The important concept to understand about our “trade” with China is that we do not pay for their goods. We give them “money” but this money is immediately used to buy US government debt of various shapes and sizes. So, we end up the goods and they end up with debt created out of very thin air. Fabulous system, until it is not. Of course the Chinese know this, that is the oligarchy, like here. But the average Chinese worker, like his American counterpart, does not. I can assure you that GS and Timmy understand how this works. And, they are into real assets. Wait until all that US debt implodes, it will be like nothing the world has ever seen. If I were a wealthy Chinese, I would be looking at Singapore real estate rather California. Read a little history of the Chinese Exclusion Act.

Jeff Beckman

You are right, China is sending us more real goods and services than we send to them. The trade gap with China is a real benefit to us. They give us real stuff and we give them US dollars, something they desire to save. If they didn’t want to save US dollars they would import more from us until the trade gap approached zero.

How would the US debt implode? Do you think the US federal government won’t be able to pay its debts? That it will run out of dollars? How is this possible?

@Rumble

Yes, we do technically give China US dollars. However, they give them right back to us via the purchase of US debt. That way we get the products and the money. Same with petrodollars, we get the oil and ME gets dollars to buy US debt and support the dollar. When this Ponzi scheme runs dry, the dollar will crash. It maybe ten years, ten days or ten minutes. But, it will happen. The Chinese do not want our dollars, they want to sell product so their 100s of millions of workers have something to do. This is also all tied in to the disappearance of the middle class. The West does not need a middle class anymore. The Chinese, et al, do the work of the old middle class.

The Western world has a tremendous over supply of workers. This shows up in the worker participation rates even more so than the unemployment rates. (parts of Spain, Andalusia, have 50% unemployment and Greece is totally ruined) Wait until after Tuesday, not long, and you will see how the game is really going to be played out.

The long and the short of it is that you cannot run an economy based on debt upon debt. How will the currency collapse? There any number of ways. If interest rates move up, if the holders of US paper sell, if there is a deflationary crash or hyperinflation. These calamities have all happened to other countries. This is not some conspiracy theory. It is a fact. There are a small group of people who greatly benefit from this system. I will leave it for you to guess who they are.

“Do you think the US federal government won’t be able to pay its debts?”

It can’t do it even now.

“That it will run out of dollars? How is this possible?”

I’m afraid you can’t pay your debts with running your printing press faster, i.e. with paper. (Or like it is now, virtual money.)

Nice and comfortable assumption but it won’t fly very far: Eventually debtor wants hard currency or tangible goods and US has neither. Current value of a dollar is totally meaningless in that context.

The downside of fiat money: There’s nothing to back it up and when it tanks, only zero is the lower limit.

Agreed so far you’re the only one with reasoned argue that I can see

Speaking of the petrodollar, I hope you’all have not been bombarded by this vid on the petrodollar.

http://www.youtube.com/watch?v=P02vjiEZyUs

That being said, I am actively looking to by my first home. I am no longer interested in waiting to see what happens. Bank interest rates are giving near zero return, the stock market to me is scarier than real estate. I simply try to keep ‘eyes wide open’ that house values may stay flat for 10 years but plan to live in a house that I buy for the rest of my life. This beats giving a landlord 10 years or 20 years of rent.

@Jeff Beckman

“Yes, we do technically give China US dollars. However, they give them right back to us via the purchase of US debt. That way we get the products and the money. Same with petrodollars, we get the oil and ME gets dollars to buy US debt and support the dollar. When this Ponzi scheme runs dry, the dollar will crash. It maybe ten years, ten days or ten minutes. But, it will happen. The Chinese do not want our dollars,”

They do want our dollars, they are saving them via purchasing US debt. If they didn’t want them they could easily buy stuff with them. They trade pieces of paper with green ink on them for pieces of paper with red ink on them. Is there something magical about the green ink?

They are simply moving dollars from their federal reserve checking account to their federal reserve savings account. If you are going to save dollars might as well get some interest on it right?

“The Western world has a tremendous over supply of workers.”

What? We have run out of things to do? Our roads, airports, bridges, schools, hospitals do not need any work done on them? All the books, music and art have been created? All diseases cured, all scientific research done? All our children educated to the best levels possible? I don’t know I see an almost unlimited amount of work to be done. The tremendous oversupply of workers is a result of poor economic polices.

“The long and the short of it is that you cannot run an economy based on debt upon debt. ”

But for the fact the we have been doing that for decades and now have the largest economy and the greatest accumulation of wealth in the history of the world…..

Would it make you feel better if we called the federal debt net financial assets of the private sector?

Federal government debt is not like household debt! Federal government deficits are the only way the private sector can net save!

http://youtu.be/ba8XdDqZ-Jg

I remember when the Japanese were buying everything in site in USA. I bought three condos in Hawaii for $30k each and sold them to Japanese ‘investors’ for $80 each three months later. They were flush with money ….until they weren’t. As far as I am concerned the “Aliens” can have all the wooden boxes they want. I wonder if NAR checks the source of that overseas cash money?

Check out some of the malls in Beijing. Many empty storefronts in their mega-malls right along Wanfujing Street. Some floors of these massive stores are completely empty of shoppers. When you walk thru them the dozens of salespeople almost beg you to buy something…anything. It’s sad.

The Chinese are methodically getting away from US debt. They are focusing on hard assets. The Chinese are building the worlds biggest oil refinery in Saudi Arabia at this time and should come on-line in about a year. The Russians and the Chinese are clearly working towards a system the circumvents the US Petro-dollar. And it’s not all that far away.

Sovereign default is far more common that hyperinflation. But, whatever will help keep the banksters whole, will be what happens.

$400,000 for a big house in California?

Dirt cheap. In Singapore HDB apartments that sold for S$5000 in the ’50s now crack S$1 million at auction. ( 1 USD = 1.22 SGD ). In China sellers want 1200 times the monthly rent for an apartment: massive real estate bubble there). In Australia a starter home on a small lot costs A$400,000 – $500,000. A small studio condo in Australia is priced at over $300,000. The US dollar is low right now and US real estate from a foreign perspective is a screaming BUY.

You are missing the whole point. Wealthy Asians do not buy $400,000 houses in dumpy California neighborhoods. Wealthy people want to be where there are other wealthy people and they feel secure. That is why there is such a premium for real estate in places like Singapore, London, Monaco and even Sydney. In Kansas, you can buy a “hugh” house for $100,000.

And, by the way, the Chineses are also buying gold like crazy. And, mines like African Barrick Gold.

Not entirely accurate. In the late ’80s a Japanese billionnaire bought about 5% of the SFR’s in Santa Rosa, CA as an investment. Lower middle class area. Decided to sell in the late 1990’s. Caused a huge uproar in the community as he had been charging rent far below market rate for years.( I think mostly to avoid tenant hassles.) This was well documented.

USC is a private research university & not a state school. It’s located in a bad neighborhood. There was a gang shooting right at the center of campus on Halloween and two Chinese students were shot and killed a little distance away from the campus a few months ago. I don’t think that the Chinese are keen on buying property in this area right now. UCLA would be a much better pick in regards to location, but their engineering school isn’t nearly as highly rated. Engineering is a popular choice of major for the Chinese and also Indian students.

Did anyone associated with this blog take introductory economics at university? It’s not a bubble if real productivity growth is behind it! China is experiencing one of the largest rural-to-urban migrations in the history of the planet and it is backed by growth in real wages that is backed up by worldwide demand for the country’s output, unlike the US where real wages have been falling for 40 years or more while housing appreciated over the same period at unheard of rates, somewhat counterintuitively, as they say. The Chinese can afford to allocate more income to housing because their income is rising relative to imports and exports. The US, by contrast, is an import vacuum cleaner and an export bust. As long as the most traded item on the planet, oil, was denominated in US dollars, the pot didn’t boil over but that’s over: the Chinese are going directly to oil exporters and cutting the dollar out of the loop. Housing is a low-skill and no-skill sector of the economy with output that is nonexportable which means it’s just a drag on the currency. The US is the worldwide consumer of last resort with a maxed out credit card while China is the workhouse of the world.

Adam Smyth

Lets have a bit of perspective, the US has 5% of the worlds population and currently produces 20% of the worlds manufactured goods. That’s pretty efficient. And that is despite our politicians best efforts to defund education and run our economy with a 10 billion dollar a day output gap.

We export a trillion dollars of stuff a year.

“China is the workhouse of the world”

Did you ever see a Chinese made airliner? If you did, would you fly on it?

Can the Chinese even grow enough food to feed themselves?

“The US is the worldwide consumer of last resort with a maxed out credit card while China is the workhouse of the world.”

All our exports are paid for, no credit card needed. If the Chinese didn’t want to save our dollars, they would not export more to us then we do to them. They would rather have the dollars than the stuff and we would rather have the stuff than the dollars.

There is nothing stopping us from producing all the economic output our economy can and consuming it and consuming whatever economic output other countries want to send to us.

I’ve seen plenty of Chinese-made computer parts and there’s nothing that can touch them in terms of quality or price. They’ve just entered the airframe business but I can tell they are fast learners and wouldn’t have a second thought about flying on one. The market is voting with their wallets on the dollar. The transition from one world leader to another is never seamless as two world wars in the last century demonstrate.

“Lets have a bit of perspective, the US has 5% of the worlds population and currently produces 20% of the worlds manufactured goods.”

You mean that US owned companies (located outside of the US) either buy them somewhere (just middlemen) or are actually manufacturing them outside of the US. Like in China.

Otherwise I won’t buy this statement without a reliable source.

“Producing” is generally accounted by company, not by country and to me it looks like you are trying to attribute all goods made by US companies globally as US products. That is not the case.

Thomas

From wikipedia:

As of 2012, the country remains the world’s largest manufacturer, representing a fifth of the global manufacturing output.[23] Of the world’s 500 largest companies, 133 are headquartered in the United States. This is twice the total of any other country.[24]

^ Vargo, Frank (March 11, 2011). “U.S. Manufacturing Remains World’s Largest”. Shopfloor. Retrieved March 28, 2012.

^ a b “Global 500 2010: Countries”. CNN.

Foreign investments made in the United States total almost $2.4 trillion, which is more than twice that of any other country.[28] American investments in foreign countries total over $3.3 trillion, which is almost twice that of any other country.[29

Interesting choice of words. “China’s real estate bubble overflowing into targeted US citiesâ€. And TARGETED they are…

One of the most significant motivations driving home sales is the privacy aspect of home ownership. The freedom to be lord and master over one’s private domain, free of the prying eyes and threat of the landlord and government and having some control over that government (yes, even if it is an illusion). That is what is presently driving the hot money from China and other nations. To escape that repression and seek individual freedom.

Unfortunately this is to be a very short lived “overheating†of US real estate pockets. The repression they seek to escape, which already is responsible for the

the intentional deflationary global ‘austerity’ and herd thinning, will soon pop these localized bubbles and depress US real estate prices as never before seen. The technology is here, your home is no longer your castle. It will soon be your private prison cell that you pay to maintain while you live in lock down.

This new game will give you some understanding of what is presently happening…

“If You Want Your Kids To Grow Up To Be Like The President Of The United States Of America — Then Get Them DroneGod!™

A Learning Game For All Ages — And Its Just In Time For Christmas…â€

http://www.boxthefox.com/articles/DroneGod!%E2%84%A2.html

Deception is the strongest political force on the planet.

I just want to catch the bubble on the upswing and sell my place ahead of the pop. Getting out of CA while the inmates are running the asylum is plus under any economic scenario. If the Chinese want to pay taxes for a train to nowhere in a central valley whose economic base has been gutted to protect a non-indigenous fish then they’re welcome to. I’ll be somewhere where the climate isn’t so nice but where the people and their elected officials have a nodding acquaintance with reality.

The huge $3T+ of Chinese US Treasury debt has shrunk as they buy real-estate and gold. The amount that China investors put into US Hotels chain ownership is nothing less than staggering.

The gold in the Shanghai exchange now surpasses the world’s production. Well over 50% of the gold is being imported to China Shanghai exchange while the US shuns the metal. Since Shanghai metal exchange officially opened and several regional centers open. The North American one will be in Canada, not the US.

As the Federal Reserve Note is the world’s Reserve Currency for trade today, the new gold backed currency will begin to replace the USD now. Since the Treasury and Federal Reserve worked with two “too big to fail banks” to electronically smash gold / silver, huge amounts, larger than WWII times, were transferred to Shanghai and other foreign Central Banks.

The Mid-East, Russia, Canada, and Germany will soon began the replacement of the Federal Reserve Notes as the US Debt continues to soar.

Many expect gold to then go up multiple times in value. So, a US $400,000 property will not seem that much to the new foreign currency.

Yes, Housing is in a bubble as is Wall Street stock. The $13T US Debt plus the next two years $4.5 Trillion of Unfunded Liabilities will trump everything. Last quarter, the interest alone on the US Deficit spending surpassed all military spending.

Your chart needs to show the US Debt next to housing prices to show a better relationship between money debt printing and housing prices.

Leave a Reply