The lost generation and merging of credit bubbles – College graduates go into massive debt and enter a low wage job market. Median starting salary for the class of 2010 is $27,000. Student loan debt soaring while wages decline and delay a generation from buying homes.

The student loan problem connects very closely to the future success or issues housing will face in the next decade. A large part of the housing machine is based on stable and predictable home price appreciation over long periods of time. This equilibrium is broken thanks to the recent housing bubble but also many younger professionals are now carrying student loan burdens that sometimes rival the size of a mortgage. This is unprecedented in history but we seem to be saying this often during this decade of incredible debt bubbles. The stories of boomerang college graduates heading back home unable to find jobs is now somewhat known by most since the Great Recession started. What is under reported however is that each subsequent class of college graduates is producing a new class of worker that is in massive amounts of debt because of their education and will need to put off buying a home. Debt is debt and ultimately student loan debt is crushing many young professionals. The fact that many are unable to reap the rewards of their education in the job market is sending repercussions deep into the housing market especially the new home buyer segment. The data on recent college graduates is rather sobering.

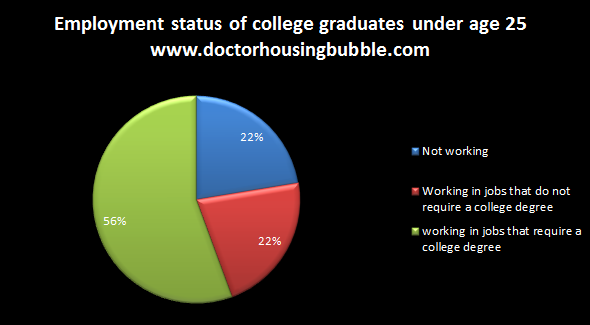

Employment status of the class of 2010

Source:Â John J. Heldrich Center for Workforce Development at Rutgers University

I found the above data reported this week rather startling. Of the class of 2010 22 percent are not working. Ironically in the survey many reported that they were going on to graduate school and going further into student loan debt. I’m all for higher education and owning a home if purchased correctly. This is the absolute nucleus of the issue here. The only reason housing ever increased to the levels that it did was first, Wall Street juiced the market and turned it into a casino and second the government was there to backstop the entire mess. The same is happening with higher education being privatized by sub-prime non-profits that simply push out degrees that are one step above junk mail. You might as well go online and stream free courses for some of these institutions. This only can happen because of Wall Street turning education into another sector to be exploited but also massive government loans that have also infiltrated the private and state college systems chasing tuition up.

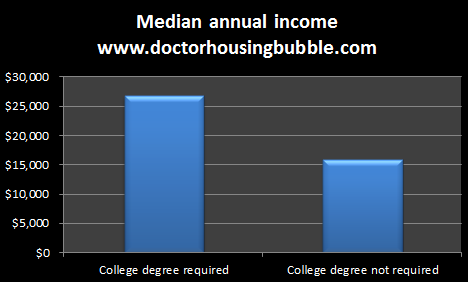

What is more disturbing is you also have 22 percent of 2010 college graduates working in jobs that don’t require a college degree. In other words since the Great Recession hit in 2007 how many people have become underemployed? These are workers who look as fully employed Americans on monthly job reports yet their income is massively lower as we will show. The class of 2010 is facing some harsh times even though the recession is “officially†over. 56 percent are working in fields where a college degree is required which is low. And the salary for those working in fields where a college degree is required isn’t exactly flying off the charts:

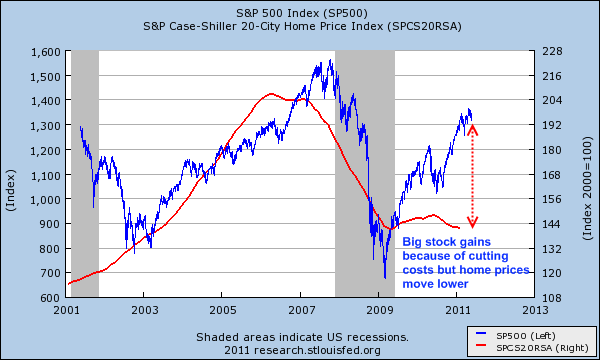

The median starting salary for those that graduated in 2009 and 2010 is $27,000 per year. This is down from $30,000 for those who entered into the employment world between 2006 and 2008. So the Great Recession is being solved by cutting wages for the many and increasing profits for the very few. In past recoveries there were real sizeable income gains for middle class Americans and the growth was distributed. That is no longer the case. Yet this may be good for short-term stock market gains for those who hold sizeable amounts of stock, but what about the future buyers of homes? This is why we are seeing the stock market rally and home prices move lower. I haven’t seen a chart putting home prices and stock prices together recently but let us try:

Now this is a fascinating trend. In the early 2000s you see the technology bubble bursting dragging stock values down but money flowing to the next bubble in housing. After that you have a near synergy between home prices and stock values. In the bottom of 2009 stock values suddenly rebound furiously thanks to the Federal Reserve and trillions of dollars in bailouts to banks but also big cost cutting measures. Interestingly enough all these “housing bailouts†have done nothing for home prices. Why? Because people need to pay for homes via their earned income. As the recent graduates are finding out, firms are getting away with paying much lower wages or offshoring jobs. What this also means is that home values must adjust lower if new home buyers are going to buy new homes with their adjusted lower wages.

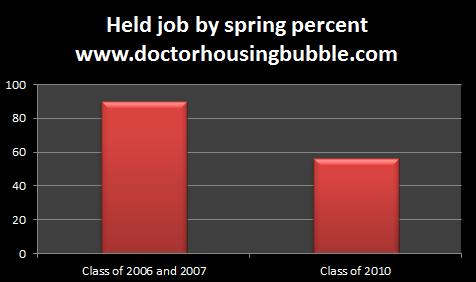

Keep in mind many recent college graduates are moving back home. Take a look at the percent of those holding jobs by spring:

The class of 2006 and 2007 had 90 percent of graduates with at least one job held by the spring quarter versus 56 percent from the class of 2010. Does this mean the class of 2006 and 2007 is simply better or more intelligent? Of course not. It is a matter of timing. Yet a Catch-22 enters these deep economic recessions because to get a job, many employers want to find those with experience. With many people looking for work without experience, recent college graduates have a tougher time entering their own fields and thus have to take jobs outside of their profession. As the economic crisis lingers, once the market rebounds (and I mean the market for middle class Americans) many of these workers will have experience in fields unrelated to their jobs. This is why an older longitudinal study on the Great Depression showed that many individuals simply did not recover economically from the struggles faced during the crisis. The longer individuals have to work at lower paying jobs outside of their field or remain unemployed or underemployed the longer it takes to build real wealth. Yet we have a new variable unlike that of the Great Depression in massive amounts of student loan debt. Are recent graduates looking to buy homes anytime soon? We’ve been in this mess for four solid years now. Are we seeing wages go up? To the contrary as graduates of 2010 are facing wages that have actually gone down.

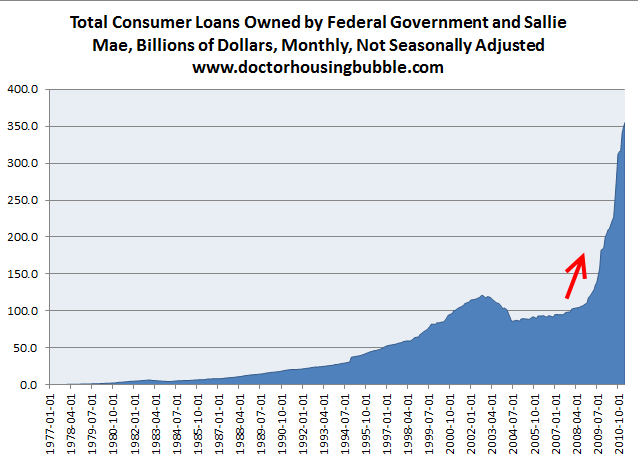

While wages are going down student loan debt is doing the exact opposite:

What we have is a merging of massive debt bubbles. The housing bubble, higher education bubble, automotive bubble, and credit card bubble. Many bubbles like housing have burst and are held by a thread by low down payment programs like FHA insured loans. Yet higher education costs have inflated higher than any other sector and quality schools are being heavily impacted while shadowy institutions come up with salespeople to pitch their program and merely siphon off student loans and aid from incoming students by promising absurd job opportunities. The message falls on open ears as the realities of the job market are painful. Somehow I doubt they are telling students that they will likely earn $27,000 if they are part of the few that get jobs on graduation. As we recently noted some for-profit schools were claiming individuals would earn $150,000 to $250,000 a year as barbers. If that is the case we would all be working at Supercuts and driving around in European imported cars.

We know housing was in a bubble even though the majority denied it to the very painful end. We all know higher education is in a bubble yet just like housing there is a near religion around college without distinguishing between excellent schools, programs with value, and absolute junk institutions that are vampires for financial aid. Like I’ve said countless times, a college education is fantastic and will help many grow and become better overall individuals. Yet why does it now cost $50,000 a year for most private colleges, the equivalent of a median household income for an entire year? Even worse, why does it cost on average $20,000 a year for a paper mill for-profit where lower income individuals are sucked in and no measurable results in terms of career, education, or knowledge are created? The only wealth is in the stock profits for these organizations:

These institutions are like the shadowy mortgage brokers pushing people into option ARMs or other subprime junk during the housing bubble. Think this is only a tiny portion of the problem?

“(Pew) Students at for-profit institutions represent only 9% of all college students, but receive roughly 25% of all Federal Pell Grants and loans, and are responsible for 44% of all student loan defaults.â€

An easy first step is to stop all federal loans and grants to for-profits until the above is addressed. There are many larger issues at hand of course in higher education but why not start in the most obvious place? For-profits represent 9 percent of all college students but take in 25 percent of all Pell grants and loans? They are also responsible for 44 percent of student loan defaults? Does it sound like a good idea to keep pushing money here?

Without a doubt you have hundreds of good institutions in the country. We also have many good homes around the country. The issue at hand is that it has been inflated thanks to the Wall Street financial machine that seeks continuous bubbles and uses the government as a dumping ground for bad bets. This mix is what is causing all the bubbles. The government has been involved in housing since the Great Depression and never have we seen nationwide bubbles like this (only after the culture of de-regulation took a massive hold). At this point Wall Street and the government are tied at the hip. What a shocker that we now have bubbles popping up on a continuous basis. The bottom line is that nothing is changing and many are going to school and coming out ill prepared and massively in debt. We are locking out an entire generation of college graduates from purchasing homes. Plus, there is no walking away from student loan debt unlike a toxic mortgage. Who are all these home sellers planning to unload homes to? The U.S. sells over 5,000,000 homes a year. The math is simple and new buyers are a necessary lubricant for the market. With these low wages, expect lower priced homes.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

71 Responses to “The lost generation and merging of credit bubbles – College graduates go into massive debt and enter a low wage job market. Median starting salary for the class of 2010 is $27,000. Student loan debt soaring while wages decline and delay a generation from buying homes.”

I might be completely off the mark on this one, but on a ten year repayment schedule ($28k average debt including 4k of credit cards, 6% interest on loans), your monthly payment calculates out to about $310. For a 20 year plan, that’s $200/month.

27k/year works out to $13/hr which is what, $750 per paycheck after taxes, health care, etc? Toss in cheap rent w/roommates ($600/m) and it means your monthly take-home budget with your debt obligation is 600/month, give or take. Good luck saving for a house with that.

I am a 34 yr old 1999 college grad and this is an ongoing discussion between my friends, all of whom have professional careers.

Amongst my core group of 10 friends are 3 CPAs, 2 marketing execs, a Harvard MBA, and an attorney. And we all married working professionals, many with MAs, MBAs, PHDs. Some of us own homes, some of us have children. But what we all have in common is we worked very hard, applying for fellowships & scholarships, working our way through college, taking those $27K yr jobs, driving the same cars for 10 years, taking on multiple roommates to save money, etc- to achieve the lives we now have.

Now, many of us have siblings in the 28-30 yr old range. They are part of this Lost generation or entitlement generation. Whatever you want to call it. And they all are either unemployed, underemployed, living with mom and dad or some off of mom and dad. And yes, I know a Art History major who has been unemployed for 2 years.

We can’t wrap our heads around this. Especially since we experienced the same parenting. Or did we?

I understand the economy and job markets have changed, but this generation grew up with cell phones, the internet and ‘helicopter’ parents. The ones who hover over their children to ensure all is well in their world. Now that they graduated into a crappy job market and become ‘boomerang’ children (returning home) parents asume that role again and pity their child. We’re told our siblings “are late bloomers” “trying really hard” and “they’re friends are in the same position.”

I really have no clue how this generation will get out debt, create a career and buy a home. They feel so close in age, yet so far behind. I’m as baffled as the rest of you.

I was born at the peak of the baby boom, and have siblings 4 to 6 years older. I got married before completing college, which was a huge mistake, but the people in the second half of the baby boom seem not to have done as well as the people in the first half of the baby boom. As the baby boom progressed, a higher and higher percentage decided to attend college, which made competition for college slots and for post-college jobs tougher and tougher. By the time I graduated (three years late, in the early 80s) the job market for college graduates was already MUCH worse than it had been for my elder siblings. Part of the problem was the Jimmy Carter malaise era.

I don’t know offhand how much the economy changed from 1999 to 2005 (i.e. the time when you graduated vs. the time your sibling graduated) but if you don’t get an appropriate job for your education as you exit college, it DOES seem to do lasting harm to your career path.

The boomers who graduated from college in the mid-60s did very well for themselves, even if they had the proverbial art-history degree.

Are most of your friends and their spouses firstborn children? Firstborn children are supposedly more career-driven than their younger siblings, and that has been true both for my siblings and for my own offspring.

Excellent point about inflation and ultimately that average $27K salary plays a pivotal role in home prices too. My friends and I have seen firsthand how the debt and job market crises creates the boomerang kid who already has this entitlement mentality (scoffing at jobs that don’t require a college degree) and co-dependent behavior (relying on family members for money). Add that together and you’ve got a mental roadblock preventing this generation from paying off massive levels of debt and allowing them to afford a home. And you are correct – it is beyond what generations prior have faced or could ever imagine.

@Laura

We’ve hypothesized about the first born child theory. In fact there is a book called “The Pecking Order†that explores this theory. However, I know many second and third born children who have excelled beyond most people’s expectations. In fact, my Harvard MBA friend is the second born.

I think it comes down to peer group influence. The baby boomers all got behind the importance of a college education – even if it comes with a hefty price tag, encouraging their children to get one. This “Lost Generation” is also part of a group mentality – and when we hear parental excuses like “their friends are in the same position” it creates acceptance of this boomerang, live off mom and dad lifestyle.

Timing does play a critical part. Graduating into a poor job market is the problem, but living off mom and dad or unemployment doesn’t have to be the solution. Many of our siblings scoff at the idea of a temporary retail job or seasonal work. As much as the economy and job market is a challenge right now, these are college educated adults making the decision to live their life the way they want.

I’ve seen so many shocked responses to the $27K median salary. Maybe because in SoCal that doesn’t do much for ya. But, that’s about where it was 10 years ago – most of my friends started at $27-$30K. But you know what? None of us make that anymore. We worked our way up. You have to start somewhere.

SoCal–

Adjusted for inflation, $27,000 today (2011) is the equivalent of $21,260 ten years prior (2001); today’s graduate therefore pays more for an education that, at least initially, is worth less. I believe the focus of the Doctor’s argument is empirical indebtedness, not the merits of hard work and its miscarriage by the current generation. That aside, I am inclined to agree living with mom and dad is a condition more often than not incompatible with upward mobility.

Thanks again Dr. for pointing out the pie in the sky dreams these knuckleheads are having us believe. I saw the creator of “Dirty Jobs” saying that in some of those areas there is a labor shortage. No one wants to do those jobs, we’ll collect unemployment or sit in coffee houses musing over our student debt, wondering how we are gonna make our first million with our Phd in Elizabethan Literature. Don’t worry the barista has a degree in psychology, and will listen to your sob story. Leave those jobs for the illegals, cause god forbid an American should get his hands dirty, let alone the looks he might get should he dare tell anyone he is a mechanic or plumber. We delegitemized a massive amount of the work force, made them take wages below the poverty line, and wonder what is happening to our middle class.

The people trying to hold on to middle class dreams of the 50’s to 90’s are in la la land. It’s over! Stock up on soup, and canned beef stew. That’s were you should put your money if you need investment advice.

I don’t think the problem is that Americans aren’t willing to get their hands dirty. Of course it’s anecdotal, but I would rather have an active job than a desk job and work with several people who share the same sentiment. Cubicle jobs are pretty terrible on your body. A plumber or mechanic job, now, that’s a different story, but the problem is that most “dirty” jobs simply don’t pay enough.

And it’s an even bigger deal to a college grad who is facing debt repayments. The immigrants you mention don’t have Uncle Sam looming over them with tens (or hundreds) of thousands of dollars worth of debt, from which not even bankruptcy will absolve them of. Starting out on a $9/hr post hole digging gig just ain’t gonna pay the bills, any way you look at it, so they patiently wait for those openings (which aren’t there) that will at least allow them to have a meager lifestyle.

It’s sad, but that’s how it is.

And by the way, exactly the same sort of labor shortage you mention has been happening in China for three years now.

I’ve recently hypothesized that a large contributing factor to my generation’s (i’m 27) disinterest in blue collar jobs is that our parents constantly raised us to have “options” and to “follow our dreams.” What I’m finding out now is that I did not know what my dreams were at 25, let alone 17 when you make important life decisions, my options were too broad. I went to “business school” because I wanted to be in business. Seriously, wtf was that. I wish my parents had pushed me into a field that maybe I didn’t want to go into, but at least I would have had a certain narrow goal that I could achieve.

I agree about the student loan bubble. University in the United States is literally a four-year party (or 5 or 6). That’s what most of us do and it’s terrible and I wish I could change it.

http://goodmenproject.com/newsroom/mike-rowe-of-dirty-jobs-pushes-pr-campaign-for-blue-collar-men/

This is the link if you doubt me.

“I saw the creator of “Dirty Jobs†saying that in some of those areas there is a labor shortage. No one wants to do those jobs, we’ll collect unemployment or sit in coffee houses musing over our student debt, wondering how we are gonna make our first million with our Phd in Elizabethan Literature. Don’t worry the barista has a degree in psychology, and will listen to your sob story.”

Yes. Spend an hour on Facebook, you’ll find endless posts written by 20-40 something’s emoting about relationships and unsatisfactory jobs, or no job at all. This group won’t consider taking any job they deem beneath their skill or dignity level, they’ll become “movie extras” believing they’ll be the next Kardashian or Situation, or “continue my education” to delay the inevitable. They’re not appreciated, deserve better, life is unfair.

@ We don’t Make those drinks:

Who taught them to be that way?

I think there is some truth to your statement, but you should understand where it comes from. At 31, I fit squarely in the middle of the group you are talking about. From the day we were born, we were spoon fed the “you are a beautiful snowflake,” line. Soccer moms picked us up from our “you are special,” private schools, which offer customized education (and not socialization, which is what public schools are about), like Waldorf, and took us to practice every day. “Reach for your dreams,” they said, “you can do anything you want if you put your mind to it!”

So we did. We took their advice. And now we get beaten down for it by our elders such as yourself.

While this parenting tactic may be good for the ego, unfortunately, it isn’t in line with reality. You can’t do anything you want. You are not special. Life is hard. No one cares about you. You will have to struggle to get by. Your standard of living will probably be lower than what you grew up with. <= I think every person between the ages of 20-40 will have to come to grips with this at some point, with the fact that this, not what the fairy tale they were taught as children, is reality. For me, it happened when I was 25. I'm lucky. Some others are not.

So please, if you want to speak in stereotypes and insult the work ethic of the 20-40 crowd, at least understand where it comes from. They learned it from their parents.

I’m in my mid forties. There are probably more attention wh*res in my age group than yours. Look at me, pay attention to my thoughts and feelings! I deserve fine things!

Every generation thinks their parents are to blame for their struggles. Again, you are not a unique Snowflake. Growing up in the 70’s-80’s, my generation’s parents in general were a pretty narcissistic lot. Lots of drinking, lots of pharmaceuticals. Lots of divorce, broken homes. Dad is leaving, he met a soul mate. Mom met a new guy at work. Latchkey kids. Somehow our futures were not doomed because of childhood experiences. Part of adulthood is the acceptance that we control our destinies; we are not planets in an eternal orbit of Parent Sun. Someone fretting because they attended a private school and had nurturing, supportive parents is tough to sympathize with…I am sorry.

You wrote…”You can’t do anything you want. You are not special. Life is hard. No one cares about you. You will have to struggle to get by. Your standard of living will probably be lower than what you grew up with.”

Sounds like you get it, and that’s great. You’ll be fine, and life can be great. The past is gone. Cinderella doesn’t wear a glass slipper, the Golden Goose doesn’t lay golden eggs.

I tried hard not to raise Snowflakes. My son is joining the Marines when he graduates HS. His choice; scares me, but I support it because its his life and his choice, not mine.

I have a largely immigrant work force that works there asses off for very good pay. Wages and benefits for someone working full time is over 80k per year. Great medical coverage and a good pension. There are NO HIGH SCHOOL graduates willing to put in the time to learn the trade. I was making 50k at 20 years old (1980) and 100k at 25, but I had to work my ASSSSSSSS off. Then I started my own business and guess what? I still work my ASSSSSSS off. There is no easy life folks. Luck happens to people that work their ASSSSS off.

Yes, there is a bubble in education at the undergraduate level.

The bubble is most likely not at the graduate level in the science/technology/engineering/mathematics areas. Many of the Ph.D.s are earned by foreign students in these areas. Graduate students in many of these programs do not accumulate debt and are given deals where they work for the university in exchange for free tuition and a modest salary.

When I was applying for colleges at the undergrad level I turned down many of the best schools in order to attend URI because they offered me free tuition with a Centennial scholarship.

To be honest I feel better about my situation after reading the numbers for median starting salary. I am only making a little less than the median salary.

California can no longer afford to educate local citizens. Foreigners pay more in tuition and are thus t’d-up for the new tech jobs I suppose.

Overpopulation/unemployed, illegal immigrants, food shortages, oil shortages, supporting our retired parents and grandparents yet they collect pensions+SSec.+medicare, step-parents taking any inheritance you may have had coming (disallowed in Europe), parents not taking care of their adult offspring, distruction by cheap drugs and alcohol (indirectly a cop’s livelihood), corporate investment and profits staying offshore, funding disasters, funding foreigners’ wars – throw it all on the back of taxpayers. Another 410,000 jobless claims today. What else did I miss? Housing surely to continue to fall.

So the next bubble to pop is in colleges. It used to be a way to better yourself, not an education casino for the wealthy. Business doesn’t have to hire domestically anymore. That’s why our housing industry is so weak. Good jobs that support current housing are disappearing overseas every day.

Just look at the areas of Santa Monica, Malibu, Pacific Palisades, Venice, Marina del Rey and Mar Vista. All are continuing to slide after 4 years now.

http://www.westsideremeltdown.blogspot.com

http://www.santamonicameltdownthe90402.blogspot.com

I’ve been saying for years that not everyone should go to college. Yet whenever I voice this opinion, people look at me like I’m crazy. Just like homeownership, college is not for everyone. The dropout rate for some colleges is over 50%. Forcing young people to go to college when they lack the capacity to complete it only results in putting people into debt with nothing to show for it. Pursuing a useless degree that has no market value results in the same thing.

Increasingly it seems like we live in a fascist society.Where does the governemnt stop and the lobbyist/corporation begin?

This whole deregulation mantra just continues on-does not matter which party is in power. Perhaps we have to hit bottom, before the populace stops believing in all these slogans and demand we act in our self interest and not the corporation/lobbyists. One can only dream. But history is filled with nations that have decayed and never recovered.

De-regulation? I think you have it backwards. Govt regulation, red-tape etc is biggest as it has ever been. Its massive progression is what has gotten us in this mess. Wake-up.

You can’t put a value on a college education. Whatever it costs it is well worth it.

How about $10,000,000 up front with 5% fixed interest rate to work for $25,000 per year with 3% increases matching inflation until death? Do the math yourself, it’s called negative NPV and should be answered with “No” in decision making.

At some point it doesn’t make sense and we are at that point. Salaries are not increasing while at the same time spiraling costs are leaving people with unpayable debt burdens. The shame of it is that these institutions have been spending like mad to ‘keep up with the Joneses’ on all kinds of things which do not directly relate to education quality or efficiency. Conveying knowledge through blackboards and lectures requires only some space and human capital, we don’t need Ritz Carlton dorms and fitness facilities. There is no reason for this at all but government support and students/parents not doing the math have facilitated this ridiculous bubble.

The other sad fact is that most students come out with very low transferable skill other than some basic PC and communication skills. People are spending massive money and devoting years of their lives here for an education that in most cases a hard working diligent person could get through reading the text books and working problems/assignments. You don’t get the collaborative peer environment or liquor filled spring breaks but at what loss/cost and can that be supplemented elsewhere far cheaper.

BTW – this comes from someone gainfully employed with MBA from a top school. Only at PhD level or serious independent study with collaborative faculty and resources can you truly leverage what a serious institution has to offer. Much of the information even through graduate level is straight out of the books. Largely this is about tradition, a modern ‘union card’, and hopefully an alumni network to drive recruiting/hiring. A union card which costs more than the job itself pays is a poor investment.

I think a lot of students (or their parents) would be startled to know where the actual tuition money is going.

My brother works for an expensive private university and some of the perks he has told me about are almost unbelievable. If he works there for a certain number of years he can go to school for free, or send any of his children their (or a choice of other schools) for free even if he leaves. They will pay a certain amount of money per month toward a mortgage up to a certain amount. I don’t know if I have all the details right because this is second hand.

I also agree that a lot of the money spent on education these days doesn’t really go toward education, but toward extra expenses that really have nothing to do with the education. Almost every college campus these days has built a huge fitness center to attract students. While the health of students is important, at public universities these are often built at taxpayer expense plus student expense, to the detriment of many local business owners that would serve the student population. In my hometown, I know that the public university ended up building a fitness center that put a few of the local gyms out of business.

Hi Clyde –

I’m not sure that is true for a large % of college graduates unless you took a “trade major” (Pharm, Eng. Computer Science, etc) I got the typical useless BS in psych back in 1977 from a large East Coast University and never used a drop of it since learning critical thinking was not a requirement for graduation – regurgitation was the model then as I hear it is now. I learned all of that important stuff the hard way after graduation. I didn’t use the “networking” model of mooching a job off one of my fellow graduates or graduate contacts etc either.

If you guys have not read this it is worth a look:

http://www.youtube.com/watch?v=VpZtX32sKVE&

By the way – the Plumber I hired the other day to fix something was $95/hr. You do the math.

Lifeguards in Orange County Ca. start at $70K and some make close to n$200K, per the OC Register. Sheesh.

$95.00 per hour for a plumber no college degree is good but, I hired a pool man to fix a leak in my pool the other day $300 to find the leak and $50 to repair it H.S. grad. Probably owns his own home – I would think.

I too have a degree in Psych & when I graduated the jobs were non-existent. Tried to get help from my grad school as well as an agency for the visually impared & got nothing more than the runaround. What I found out a year or so later was that healthcare providers were moving towards social workers as therapists because they were hcharging half of what a psychotherapist gets paid per hour. Forget about psychietrists. Outside of dispencing meds & in hospital care, there roll is almost gone in the medical system.

As for the youtube video you linked to, watch it closely there are obvious miss truths within. Not mentioned is how the banks & universities developed a too close relationship with loans & the like increasing student debt levels. also pation to how the video pushes the purchase of silver & going to college online to get a degree. after blasting college as a scam.

Bubblespeak.

Honestly, I don’t get it?

Even a decade or two ago, the word from the elders was like this …

Ivy League (plus MIT, Stanford, Duke, Univ of Chicago, Johns Hopkins, Oxbridge, London School of Economics), if you want to be a big law attorney, management consultant, or Wall St banker.

State U for engineering, accounting, health care (nursing, pharmacy), etc. Practical degree, less costly.

Then, if none of the above fits you, go into a trade and either become a plumber, electrician, or auto mechanic. You can still take classes on the side & get a BA in the long run if you later want to transition into an office role or white collar stint.

In none of the above, did I hear borrowing $150-200K per year for a useless undergrad degree?

Someone please explain to me this religion?

There is an old saying: ‘the time it takes to do a job expands to fit the time allotted to do it. Along that same line, remember the movie ‘Field of Dreams’? Kevin Costner said, If you build it [ballpark], they will come.”

These colleges and Universities are already built. It isn’t like we can just shut them down. There are huge vested interests in keeping them open. This represents a huge percentage of our economy.

Speaking of bubbles, have you seen the price of college text books? Holy higher education, a used book for a community college class, entry level, costs almost hundred federal reserve notes. What a scam. You pay a fortune for tuition, fees, and books, making administrators, professors, and publishers wealthy, so you can get an assistant manager position at a burger flipping joint, lol.

This is a little revisionist. In the 80’s and 90’s, the attitude I saw was that you just needed a degree, it didn’t matter so much what degree, and you could get a job. I knew plenty of people that ended up with good jobs having nothing to do with their major, esp. liberal arts majors.

The rationale for the last couple of decades for many employers was that having a college degree meant you at least could show up on time, and had the basic thinking, language, and literacy skills necessary to do a decent job in the workplace in a non-technical, non-engineering position. So you ended up with people graduating with sociology degrees getting jobs in insurance companies, English majors working at petroleum companies, art history majors ending up in marketing, geography majors working in museums, or communications majors being able to b.s. their way into just about any kind of company (these are all real examples of people I know, from regular old state colleges and not ivy-league schools).

These people could think and write, and hey, you learn any job by doing it anyway, right? But employers weren’t hiring high school grads and training them, they hired people with degrees, for whatever reason. I assume because they would be a better fit into the company culture of other people with degrees (and sure, you could argue that willingness to put up the b.s. in college will mean you are more willing to put up with the b.s. in the workplace), and because a college grad would be more likely to be mature and more professional than a kid fresh out of high school.

I think this sort of thing gave rise to the notion that you just needed a degree (any degree) to get any job, because in my experience, that was true. But in recent years, I’ve seen a move away from this attitude by employers, to seeing them expect more specific degrees for a particular position. If you had a Communications degree and were a good b.s.-er, you could no longer wrangle your way into any firm. If you had an English BA, you could no longer get hired for a technical writing gig in an industry for which you had no prior experience. To get into an entry-level gig in the marketing department, you have to have a marketing degree instead of any liberal arts degree. If you want a job in a museum, you better have a Museum Studies or Library Science degree. Every firm and industry wants people who have trained, and have degrees in, EXACTLY what the job is, preferably advanced degrees.

I think this is generally a bad thing, because first of all, few people know exactly what they want to do for the rest of their lives when they are 18 and just starting college. And secondly, it was a way to get diverse thinking into companies, whereas now everybody in each department comes from the same general school of thought (even if they went to different actual schools). But I think this had something to do with rising college costs, because for awhile there, all you needed was any degree and you could worm your way into a decent middle-class job.

Go back even further, and the corporations used to give IQ or aptitude tests to applicants. High scorers could end up with a lifetime job, sans college. Had a childhood friend get on with the phone company that way.

They can’t give tests like that anymore, due to disparate impact. Hence they screen by degrees.

Regulation has pushed the Health care Industry away from the Free Market and towards Politicians to control which perverts the market. More industries will become the next Housing or Education Bubble with more regulation and more will become Debt Slaves to the system. Regulate only what needs to be regulated which are Monopolies.

When I graduated from high school in 1983 the job market was similar to what it is today. I took a $4 per hour job cleaning windows while taking classes at night. There were many evenings I spent sitting in a class learning algebra and calculus while sitting in filthy, stinking work clothes in a state of exhaustion. I worked my way up the ladder taking more dangerous and difficult work while continuing my studies. I lived in a cheap basement suite and spent nothing for five years. Today I’ve experienced great success but the path I took has been closed off by illegal immigrants. When you’re young, all you have to offer is a strong back but somehow we’ve come to think that college kids know everything. Much of this student debt pays for living expenses when previous generations worked their way through school. Millions of illegals have cheapened the honest work that used to provide the first step up the ladder of success. For this you can blame corrupt politicians that encourage the illegal migration of foreign peasants all in the name of identity-politics pandering.

I would like the see the statistics broked down by degree program. Fully half of the kids in college are in “non technical” type of degree programs such as philosophy, exercise psysiology, sports management, history, women’s studies, etc.

My daughter graduated in 2008 from a good second tier state university with a degree in finance. She and all of her friends that graduated at the same time with technical degrees are reasonably well employed. They are not making the salaries that kids that graduated a few years earlier were paid, but they also didn’t get wrapped up in the condo debt debaucle like many did.

People that major in degree programs that do not lead to employment prospects tend to skew the numbers.

It is simple, the baby boomers saw the success of there piers that went to college and came to the conclusion, college is the reason for their success. Then came to the conclusion if there kid went to college they would be successful, so they put their children on a path to college. What they did not facture is, many of the people that went to college at that time came from wealthy families and had many more benefits then just college. Now that so many are going to college there is just a simple supply and demand problem. More college educated people than ever, fighting for the same positions. So the value of an education has been depleted do to supply.

Also there are plenty of creative whatever classes in college, except for, creative how to make money classes. Academics find money dirty and beneath them.

1. Find a bunch of fools with a desire to compete. 2.Pit them against each other. 3.Find suckers with money to invest (or better yet print your own). 4.Promise the world to all involved. 5.Loan the money (or sell some weapons) to both sides in group one. 5.Collect big fat commissions and pay protection money to powers that be. 6.Get out of Dodge.

Sounds like you are describing the UFC?

I just received a Bachelor’s of Science in Math & Computer Science from a legitimate university (not ITT Tech, Phoenix or a “career school”). $27k? If someone offered me that much, I’d pass out. I can’t even get work for minimum wage.

I guess I’m “lucky” in that I’m an older student, in my 30s, and I already own a home. The house is not underwater, but I know I will never be able to sell it and move because of my massive student loan debt.

I will never forgive myself for returning to school. This was the biggest mistake I ever made. I thought I was doing something good for myself and my family, especially since I went for a STEM degree that is allegedly “in demand.” What I found out is that it’s not true that only graduates with “useless” majors like women’s studies or art history cannot get jobs; science degrees aren’t worth anything, either. I may as well have just gotten a degree in theatre or film; it sure would have been easier, and probably cheaper because I would have gotten done a lot faster.

BTW, don’t believe the hype in the news about how “Google is hiring 6,000 new workers this year” and similar claptrap. What those news articles never mention is that Google receives literally HUNDREDS OF THOUSANDS OF RESUMES for those 6,000 jobs, and the same scenario repeats at all high-tech firms — Facebook, Yahoo, all of them. Trying to get into a a hot high-tech company is like trying to get on “American Idol.”

dude, learn to program SAS well and you’re employed. Do a search and look it up, volumes of data to analyze and very few who have the math/ stat backgound to do it well.

I agree 100%. I have seen intelligent individuals learn SAS in half a year, break into the industry starting at $65K/yr and make $100K+ after only 2 to 3 years of experience. My father was one of them.

“The house is not underwater, but I know I will never be able to sell it and move because of my massive student loan debt.”

That doesn’t make sense. You can’t sell your house because of student loan debt? Huh?

This is one my the best articles you have written. I can not believe I have not seen the S&P500 chart next to the Case Shiller chart, but that brings up a good point and shows exactly where all that bail out money went.

Also, the pie graph that shows the percentage of students getting jobs that do not require a college degrees is very distressing. It would be interesting to see a break down of which colleges have the highest “non college degree jobs.” Clearly, based on the default rates, the for profit schools will be extremely high, but I would be interested to see where the likes of the USC a UCLA graduating classes end up.

My grandfather was a miner in Montana and taught music at night for extra money. He went to the ‘commodity store’ for free peanut butter and flour, bread etc during the depression. But he and his wife (she was a beautician) saved enough money to leave Montana and bought a house in Santa Monica for $17K in 1955. when he got to LA he was employed as a carpenter making coffins. The kicker is that house was North of Montana Avenue where tear-downs are now worth $1.5 million. Shocks me how the blue collar workers in the 50’s could afford a house in Santa Monica. I think that was the case up until the 70’s… Can you find a blue collar worker who can afford a house in Santa Monica these days….let alone Northern Santa Monica…(not unless they own the business).

27K really? — I graduated with an accounting degree in 1981 — took a state job for 31K – I made about 10% less than my private industry counter parts. Bought a house for 100K — which would now be 500K — bought a 3-series BMW for 15K — just paid 55K for a new one.

How can they survive in this day and age on 27K. 27K and in debt. My total 4 year college tuition at a private school was 18K, I made $14 a hour working at the local grocer, had more money than sense.

America’s day has come and gone. I mean wow, I guess I should count my blessings. What the hell are these kids going to do?

The kids will riot.

In spain they have already started.

Riot for what? More “free” education and healthcare? More taxation and “fair” wages? Soon, the productive citizens like me will be leaving this country for good.

I love how all the baby boomer call my generation the entitlement generation while looking the lens of an anomaly in the U.S. economy: upward growth, a strong manufacturing base and very little globalization. They chide us and say we are lazy or won’t take minimum wage jobs while at the same time encouraging us to be over-achievers and go to college. What’s that? We actually want jobs where we can use our education? Shame on us. College tuition has gone up almost 900% post Reagan and a student loan is almost always necessary. How in the world can you pay for tuition, etc. with the current cost of education. I had two jobs during college (6 years ago) and it barely covered food, let along rent and groceries. Boomers, please wake up. Now about the statements that we should have chosen a science degree. My company placed an add for a grunt engineering position and we received almost 700 applications from well qualified individuals. The point is that science/engineering jobs are not needed either. If they are, guess what, employers such as mine can offer pennies and people will fight over them. The market is even worse for MBA and those with business degrees. My HR friends at some of the banks have told me that on a weekly basis security guards have to tell “eager beaver” job seekers not to hand deliver resumes to their offices. It’s no longer 1969 Boomers – wake the F up!

Agreed, I think it’s obligatory almost to the point of being comical for the older generation to say about the generation that follows.

The younger generation could just as easily point out that it’s the older generation that has enabled such entitlement, just as they have installed societal systems that discourage independence through social welfare. Meanwhile societal responsibilities (owning a home, supporting a family) are now only obtainable through massive accumulation of debt or credit (mortgage, school loans), so that the wealth of the previous generation, accumulated through debt, can be maintained on the backs of the younger generation. This puts responsibilities so far out of financial reach that it leads the younger generation to avoid the responsibilities of adulthood for as long as possible.

It’s no longer 1969 Boomers – wake the F up!

HUH???

In 1969 the so-called Boomers were at most 23 years old (born in 1946) and the vast majority were a lot younger – as in between 8 and 17 years old.

Those in the job market in 1969 were the 1950s – came of age around the Korean War generation — the people born in the mid- late 1930s and the early 1940s.

The majority of the ‘Boomers’ hit the job market beginning with the recessions of the early 1970s through the recessions of the early 1980s. (No jobs, lower wages than their just-a-b-ti-older aunts and uncles got…)

So your point is?

I don’t want to put words in his mouth but I assumed he was using 1969 to reference the ‘free love/drugs/etc’ late 1960s era as opposed to the job market itself. Late 1960s were no picnic either, hell even the 1950s, while economically profitable, had heavy cold war fears, middle class bomb shelter door to door salesmen, and in-school training to survive nuclear attacks (under the desk works ever time).

My assumption anyway.

True that Ann,

Folks are assuming that one generation would act differently than another, or that one party has all the answers and the other is trying to destroy the world. We are all running the same Human OS 2.011, which was designed to help us survive among natural predators, like lions, tigers and bears. For the last x millennia we have been adding patches to our OS, but the platform is dated–we seek individual survival in an interdependent world. All of these are symptoms of the same problem–our brains are too retarded to survive much longer in the ever-more complex world that is evolving. Housing, education, healthcare, Walmart–these are all symptoms of the basic problem–master-slave human configuration.

“So please, if you want to speak in stereotypes and insult the work ethic of the 20-40 crowd, at least understand where it comes from. They learned it from their parents.”

Well said.

If someone (especially parent generation) has the nerve to disagree, it just shows that they themselves live in a bubble and hasn’t faced realities yet, essentially living in a laa-laa-land. OK for them but it won’t change the reality.

Meanwhile Snooki and the Situation are laughing all the way to the bank. perhaps that is the future of America?

Good article. Working class taxpayers do not want their tax money going to fund college for other people’s children. They want the money to go to California’s K-12. Folks, right now we don’t have the money to fund both the state colleges and K-12.

Another ill side effect of the education bubble is that it has ruined college for people who actually enjoy studying. Before people call me a dork, remember that this economy has many tough, difficult jobs that require much training. To say nothing of innovating. Being a university graduate used to mean something, and now degrees are worthless. I for one can say that my education was spoiled by all the unintellectual goobers roving around the campus neck-deep in loans. I’m elitist, I know, but the reality is that there are a lot of dim people and not everyone can achieve all they want in life, and right now motivated and talented students are at risk of drowning in the pool of mediocrity. That would be a bad thing, because these people hold up society.

And I’m doing fine, so I guess the system is still working to an extent. But that’s only after I personally approached professors for mentorship and did independent research during school. The average bear guzzler had a snowball’s chance in hell.

Every keeps talking about no everyone should go to college, but we have the same percentage of our population today getting college degrees that we did 40-50 years ago. I’m not sure if more people are going to college today and dropping out today, but we aren’t getting a higher percentage of people educated. It’s presented as if demand is driving the cost, but that seems like a lie to me. I completely fail to understand with the same percentage of people achieving degrees why the cost has gotten so insane. I can only believe its because its so easy to get student loans. Get rid of student loans and it will fix the problem… people would have to work more and go to school, but the cost would come way down and society would be better for it. Excess lending does nothing but create bubbles and enslave people. The ones who get hurt the most are middle/middle upper income youth. Generally they don’t qualify for any grants so they are the ones who have to take out huge loans if they want to go to school. Stop giving out so many grants and loans and it would fix the problem and make the system a lot more fair.

Great post. If tuition had to be paid from earned income and not from an unlimited supply of gov’t backed cheap debt, the price would adjust quickly. Much like housing…

As a 30 year old 2004 graduate, virtually everybody I know is one of the living statistics presented here. I recall countless conversations during college with friends about having our children growing up with one another, camping trips, etc. But due to our student debt, out of about 25 close friends, only 4 of them own homes. Only 6 of them have felt financially comfortable to have children.

My wife and I have a son and now make about $90K between us. But with our $60K in student debt, $800 a month for daycare, having to save up 100% cash for our two cars in the first few years of marriage (we refuse to go into any more debt), the prospect of buying a home has barely even been on the radar.

Atleast half of my college graduate friends are working 2-3 part-time low paying jobs to support themselves. Most were told you have to do this your first couple years out of school. But once the recession hit, here they are now 7 years later entering their 30’s and still working $10 hour temp jobs that offer no health insurance.

Hearing the criticism here that these people are lazy, self-absorbed art history majors is quite sad. Until you’ve done everything “right”, got an “in-demand” STEM degree, worked 55 hours a week to make $28K, your wife and you living on the edge without health insurance having to pay over $1,000 a month in student loan payments, you truly do not understand what millions of young people are going through right now.

Most Gen Y’s I know have pitifully low expectations after 2-5 years in the workforce. Most have embarrassingly low salaries and are just thankful they even have a job as they’re blatantly aware a large group of their friends are flat out unemployed. Most live a level of frugality that is entirely foreign to their parents. Only 17% of Gen Y own a smart phone. Yet, the stereotype lives on.

Jeff-Unfortunately, it is not as simple as a gen-y vs. other generations issue. When a company outsources a job or group of jobs, they aren’t thinking, ‘I don’t like gen-y kids, let’s export a batch of jobs that would normally be filled by them.’ They are exporting AMERICAN jobs for their economic survival.

If joeBlow Widget maker can put product on Wal-Mart’s shelves for $1.00, and your employer can’t do it for less than $1.50, guess what? They are gonna start laying off boomers and gen Xers, and stop hiring gen Yers, and shipping jobs to BRIC nations.

The good news is that this process has pretty much run its course. The bad news is that the end game is a 20 year mirror of what the Japanese have been through since 1990.

If you can possibly start your own business , I’d consider it. That’s what I’m going to do.

Well to add too this, I’m 30, have two degrees, first one earned on my parents dime and a few small grants but it was a history degree showing me few options other than MORE education in a highly competitive and tight market, continue working retail for $12/hr OR go back to school for science which i was interested in but required me paying for everything this time around. Back to school I went, I started paying out of pocket initially but wanted to finish school ASAP instead of working and going to class. Enter in my student loans and credit cards. Over the course of both degrees (roughly 8 years, with some time off, international trips and living) I’ve amassed about $60k in debt. 40 of that is from tuition/books/directly related college expenses the other is from living. Not bad for someone who barely earned little over the course of 8 years.

Luckily immediately after my science degree I found an amazing job, office with a window, great salary, great benefits, and it’s doing exactly what I love to do. However, I feel weighed down by my debts but know that they’re manageable and that I will be able to buy a home within two years.

The government has no problem handing students massive loans for education, be it a more useful STEM degree or something in the social sciences/arts. They also have no problem giving massive bailouts. Since college graduates are the ones that will be stimulating the economy for years to come by purchasing homes, cars and other such goods why can there be no bailout for students? While I’m not saying I or any other student deserves a bailout, I made a choice to sign the loan papers, I think that there’s better use of taxpayers dollars.

Many are to blame, parents, the system, traditional ways of thought, etc… K-12 education has indoctrinated the “you must go to college” mantra. This needs to change, teacher friends of mine often say that most of their class does not need to go to college and would be better off learning a trade from a young age. If that trade does not serve them later in the life they will be able to make that decision to go back to school. Looking back on my history degree I probably would have been better off working for a few years, accumulating no debt, traveling and figuring out what I really wanted to do. The reason it takes some students 5+ years to make it through something that should take no more than 4 years is they just don’t know what to do or study. I have peers (including myself) that have graduated with a BS or BA with 24+ extra credits, unnecessary!

I visited my graduate school and tuition for the year has jumped from $27,000 to $54,000 per year from 1998 to today. I asked the dean what happened, and this doesn’t make sense with inflation. They said to me that it was out of their control, and mandated by the larger university. They are now trying to get alumni support because costs are unaffordable. The US has still not dealt with these unsustainable debt problems from the federal government, local governments, institutions, and individuals. Personally, my wife and I after 6 years of living the California dream are moving back to her parents house where we can hopefully pay off my debt, and here is the kicker I went to medical school. If that is the situation for me who makes a good income, not I banking income, but decent income what is happening to the rest of the economy.

America has lost its way, these institutions have made the same gamble that the financial world did. They levered themselves with ridiculous debt to grow, the presidents of universities were rewarded with new buildings, and the same charlatans that sold houses seem to have sold expansion with debt to the universities. They argued that like housing, housing prices never go down that your education is an investment. These idiots who run universities bought along as we still haven’t fixed our cultural stupidity regarding debt. Btw – my medical tuition went up from 30,000 to 50,000 in a matter of a few short years as well. Absolutely ridiculous……

The older folks here are just spewing cable TV talking points. Try visiting China or India and see the optimism there. All the jobs are out there and as a consequence , they are feeling mighty confident. I see no will on our side to balance the trade and bring jobs back. It can be done , if we give up the nonsense about free trade and all that-you wanna run govt like a business-well the first rule of business is you do something for a profit and if the current model of trade is bankrupting us-toss it aside and fix it with somehing new.

Although, having visited China and India often, I am beginning to even wonder if it is even possible anymore. perhaps the Europeans will show us the way as the protesters force their govts to bend? Iceland has already refused to pay bondholders for their private losses.

caboy-We have $15 trillion economy. Therefore, the $1.5 trillion in deficit spending the federal government has been doing the last 3 years amounts to 10% of our economy. So not only is the present system broken, it is not fixable. If they balance the budget, GDP contracts 10% immediately. Unemployment doubles.

If they lolly gag around and balance the budget slowly, over 10 years, lopping off $150 billion of red ink a year, they add another $7 or $8 trillion to the National Debt.

If they get rid of free trade, inflation skyrockets. Wages would go up too, probably, but that would most likely lead to massive bankruptcies.

The only way out is the Iceland way, a debt default. This will devastate older Americans, since their social security and Medicare benefits would have to be cut drastically, but that is gonna happen soon enough anyway.

@Jason

It seems reasonable, but at what point does the US default and who says so? We have been on this exponential course of debt and counterfeiting for four decades now and they seem to keep it going–even having Fed and CBanks buying at auctions when others are net sellers. It doesn’t make sense but it keeps going. I read where $4.5 T is now sitting in bank vaults. Why not 45T? 450T? 4Q? They are all just imaginary numbers as they will never be paid back.

I’m terrified of accruing student debt. I left high school early and went to junior college, then transferred to a State University. It was the 80s, I was 19, what can I say, I blew it off. 20 years of wage slave jobs growing slightly in prestige later I want to try to better my situation. It’s a crap job market for degree holders but it’s a super crap market for anyone without one, I don’t have high hopes for myself in this market. But when State uni is 7K a semester, UC (if I could even get in there) is 11K a semester- am I really going 30-50K in debt at the age of 45 for a liberal arts degree? For any degree? So, I can’t afford to go but I can’t afford to not have a degree in the current climate.

You know what I can afford? I can afford to go to school in Bangladesh. I’m so excited to know there’s a place where I can pay for a quality education with money I’ve saved and come out without having signed my soul away. I’ll be moving in 2013.

In the 5+ years of Dr HB, I think these are the BEST string of comments I have ever read. We search and search for answers to our country’s and world’s mess, and if you think , research, and discuss long enough, the answer lies within the INDIVIDUAL!!

I think many of you are getting off the point–the problem is the Manhattan Mob that rules by banking. They keep the entire world in debt. For many years large banks would go to the rulers of banana republics, have the government take out huge loans and give the leader a giant kickback. Then the country would default and the banks would take whatever means of production the country had. This keeps the country in perpetual poverty. We are just another ignorant third-world country that somehow thinks that since Manhattan is geographically within our borders that somehow we are all citizens of a common nation. We are not. The problem is that Manhattan rules every aspect of our lives by luring us into perpetual debt, and this is just one more method:

Banking, Housing, Education, Health care, Entertainment, Politics, The Military-Industrial complex–we have been duped and our now powerless to stop them.

Folks are living longer and longer so let’s try to normalize debt to longevity.

I am not sure what is more depressing – listening to folks who complain about being saddled with huge student loans, or listening to the automatons who obey the master and knuckle under to achieve their view of success. I think the latter.

Boomers (like me) in college in the 1970s were not concentrating on getting a job, it was more about Vietnam and hippies. I got a crap degree, found out I couldn’t get a job, went back for Engineering and that seemed to to work out. Even back then I was afraid of debt (learned that from my Dad), so I worked during college rather than use credit cards or loans (ok, I used a credit card a little when I had to…but paid it off usually every month). I always pay cash for cars (first one a used Pinto for $700). Even now my wife and I have only 1 car (ok, it is a Lexus, but it was used). And I do not have a cell phone right now. A bought 1/2 of my clothes from second hand stores over the years (although they do get new clothes quite often). We have mostly the same furniture since the “80’s (still in good shape), and a table from my Dad (from the ’70’s) that is just fine too. We buy the Entertainment book and eat 2 for 1. We paid off our house in ~15 years because my wife paid a little extra every month. We have over $1M saved by being financially responsible, and you can do the same thing.

Leave a Reply