The End of the 6% Commission: Examining the National Association of Realtors and why Agents and Lenders are Going the way of the Travel Agent.

The real estate business will never be the same because the rules of engagement have now been altered by the collapsing economy. I made this argument many years ago and faced a strong amount of resistance. My argument was that real estate agents and lenders/brokers are overpaid while Wall Street assumed the role of head money cartel funding the dealers while the Fed actually grew the homegrown credit. The entire system was corrupt to the core and these pillars all caused the housing bubble; the users, the pushers, the credit, and the Wall Street delusion. I stand by that claim and I think most Americans are seeing through the crap the real estate industry complex has been shoveling. In fact, on a recent NPR show they had a former Countrywide employee actually saying something to the effect of, “hey, we didn’t force people to sign.” These people were delusional and much of our problems stem from this incestuous rewarding of financial deviants for juggling a decade long bezzle.

There is enough blame to go around but the magnitude of blame for certain groups is certainly not equal. I hold some of these “so-called” professionals to a higher standard because they are professionals (supposedly). If you asked your cousin Johnny to operate on your foot and it gets massively infected with gangrene that is your fault. But if you go to a medical doctor and the same thing happens, there is a certain shared responsibility at this point. The same thing happened with real estate agents and lenders. You were better off doing your own thing than listening to these people but many people fell for the suit and tie theatre and actually believed that most of these people knew what they were talking about. They clearly didn’t. The National Association of Realtors used to have an “anti-bubble” page which miraculously is no longer up. Since the link is now inactive, thankfully another blogger over at Bubble Meter was smart enough to copy and paste some of the text back in November of 2005. Let us look at some of their sage advice shall we?

“Has there ever been a national housing price bubble?

No, not since good recordkeeping began in 1968. There was a national decline in the 1930s during the Great Depression; however, home prices were not a prime concern in that era. The greatest issues were essentials such as food, clothing, employment and shelter of any kind. Declining home prices were a natural result of a general economic collapse caused by the stock market crash in 1929.”

Bwahahaha! Home prices were of little concern during the Great Depression? That’s news to me. Pass me the housing crack pipe please. What they fail to mention is that there were many regional housing bubbles in our history including a 1920s Florida housing boom and bust. Plus these blind mice were unable to see the biggest housing bubble while they were standing in it at the apex! And incredibly, this was the first ever national housing bubble that just burst and the National Association of Realtors flat out missed the biggest economic event of our lifetime and it had a nucleus in their industry, housing. Talk about missing the boat. This almost reads like a poorly written comedic piece:

“Should we be concerned that home prices are rising faster than family income?

No. There are three components to housing affordability: home prices, income, and financing costs – the latter are historically low. During the last four-and-a-half years of record home sales, there has been a shortage of homes available for sale. As a result, home prices during this period have risen faster than family income. However, in much of the 1980s and 1990s, the reverse was true – incomes rose faster than home prices. On a national basis, according to the Housing Affordability Index published by the National Association of Realtors, a median income family who purchases a median-priced existing home is spending a little over 20 percent of gross income for the mortgage principal and interest payment. In the early 1990s, a typical mortgage payment was in the low 20s as a percent of income, and in the early 1980s it was as high as 36 percent. Overall housing affordability remains favorable in historic terms.”

Excellent point oh mighty NAR! Keep in mind with the value of hindsight, this statement was made at the pinnacle of the housing bubble. Since they used their own data to state the above, you have to wonder what that says about them? In fact, I just imagine a group of mortgage flunkies coming up with the toxic pay option ARM because of trying to keep that monthly affordability index low. Options ARMs were nothing more than the music to keep the Ponzi scheme going a little further. I’ll give you one other piece of juicy information before moving on to the meat of this article:

“What are the prospects of a housing bubble?

There is virtually no risk of a national housing price bubble, based on the fundamental demand for housing and predictable economic factors. It is possible for local bubbles to surface under the right circumstances, but that also is unlikely in the current environment. There are tight supplies of homes available for sale in most of the country, and labor markets have been improving. In other words, the two conditions necessary for price softness do not exist in most of the country. The strong underlying demand for homes results from the simple fact that the population is growing faster than the supply of homes. In addition, it is highly unlikely that the cost of construction will decline. In fact, construction material shortages are expected to continue and the cost of building and development is trending up. Baby boomers remain in their peak earning years. Echo boomers – the children of the baby boom generation – are just entering the period of life in which people typically buy their first home. The echo boom is the second largest generation in U.S. history. Considering the median age of a first-time buyer is 32, echo-boomers will be a big factor over the next decade. In addition, immigration has been strong for many years. Census data shows that immigrants eventually achieve homeownership rates higher than do native born Americans – this also will be a strong factor in housing demand in the future. Also, minority ownership rates have been trending up. All this means the demand for housing is historically high and is one of the reasons 2005 will be the fifth consecutive year of record home sales. Even in an economic downturn, the demand remains.”

Bwahahahaha! Discredited! How many times can you be wrong in one paragraph? Anyways, it is pretty clear why that “anti-bubble” Q & A page was taken down. Yet I would even agree that certain organizations have artificially inflated prices higher. These are the same groups that have stated that they wanted to help homeowners buy homes. Yet with the caveat that they still get their cut. Nothing sickens me more than this and Wall Street of course is the most guilty where you had the architects of these toxic products still receiving bonuses for creating a situation that has put our country in the biggest economic peril since the Great Depression. Just look at what is happening with banks asking for a measly 10 percent down with a 30-year fixed mortgage.

The fact we are debating bonuses is absurd. If we had any sense we need to raid their accounts and take back every damn cent they made and throw them in prison. If you robbed a bank and got away with $50,000 you’d probably be in jail for many decades. On Wall Street you can rob the taxpayer of billions and not only do you get rewarded, you get to walk away with a minor verbal lashing but a gorgeous golden parachute. Pathetic.

Why is the 6 Percent Commission Finished?

I think many will now agree that those in the financial and real estate industry were over paid for what they did. In fact, I would suggest that they shouldn’t make a damn cent because the products they were pushing were toxic and self-serving in only making them a nice commission or bonus. It was a pointless spectacle of greed and little did these people care about the sustainability of our nation’s economy. If there is a silver lining here is the snake oil salesmen are being exposed for what they truly are. Titans of industry? Please. Nothing highlighted this disdain for actual work when we saw how Congress bashed and shamed the auto industry while Hank Paulson was giving TARP money to his crony capitalist in the banking industry with no major oversight. At that point, we knew exactly what our leaders thought about those that work with their hands.

Back to the NAR, they are now pushing for legislation that would actually make housing prices more expensive:

“Late last year, NAR presented Congress with its core principles for stabilizing the housing market to launch an economic recovery. In the current legislation, NAR strongly supports the provisions to reinstate the 2008 FHA, Fannie Mae and Freddie Mac loan limit increases through 2009. NAR also strongly supports eliminating the repayment requirement on the first-time home buyer tax credit. “This is critical to stimulating home sales and shrinking the housing inventory, which will in turn help stabilize home values,” McMillan said.

Although Realtors® support these provisions, a number of enhancements are needed to make them more effective. In a letter sent to Congress earlier this week, NAR encouraged Congress to make the loan limit increases permanent so that secure, affordable, safe financing is available for American families regardless of where they live. NAR is also pressing to expand the tax credit to all home buyers and extend the expiration date to December 31, 2009.”

Did you get that? The NAR is actually pushing to make permanent loan limit increases in the face of a national implosion of home prices. And by the way, the most important thing in buying a home is affordability! The loan limit increase is a wet perverse dream of these people since they are tunnel vision focused on only the 6 percent cut of a larger loan. Why would you be wanting higher loan limits when unemployment is soaring, wages are being cut, and hours are falling? This in fact will raise prices or at least keep them higher. If you truly believe in a “free-market” what is currently going on is a washing out of years of a corrupt and broken system. The most important variable in home prices is your income (wages from your job) in a healthy housing market. Of course the NAR is only concerned about people buying homes even if they don’t have a job to service the mortgage. What do they care? These loans can be shoveled off on Fannie Mae and Freddie Mac which are now nationalized which means we are on the hook for them. But they’ll get that 6% cut and that is what truly matters.

Yet the internet has redeemed my faith in people from going off the cynic’s cliff. For the first time this year more people get their information from the internet than from newspapers:

And that is why mainstream sources of media are cutting back and seeing ad revenues fall off a cliff. Guess what? They are competing against thousands of independent contractors that are experts in very niche markets. For example, why would you trust a journalist who by default has to cover hundreds of stories when you can have an expert on basketball, football, California housing, Wall Street, commodities, economics, farming, or any other niche tell you even more detailed information? Many bloggers don’t have the filter since we are not representing anyone aside from our passion to write and get the information out. And it is a labor of love for most but this above chart tells me that people are now much more savvy in where they get their information. With the NAR Q&A from 2005, is there any doubt? On the whole, the media was like a reed in the wind. A few outsiders were screaming but it was merely background noise. Yet the media is still missing the game. They cry foul regarding a few million in yes, horrible programs but you tell me when have they ranted about the trillions being swindled by the Federal Reserve? That is the biggest damn story and they still don’t cover it! The only time I saw this on mainstream TV addressed was in the Republican debates when Ron Paul talked about it but he was marginalized.Â

Now that people are suspicious, the entire idea of the 6% commission is going to collapse in a few years. It already is but the entire model is going to change. I know many want to believe that this won’t happen but it will. Trends change. If you are not part of the trend of course you are going to fight to keep the system from changing even if it hurts home buyers and sellers more than it helps. Here are a few reasons why this is over:

(a) Zillow – Zillow has come an amazingly long way since it was launched on February 8, 2006. It was funny that in the early days, many old school real estate folk thought that this was much to do about nothing. Zillow provides tons of information regarding homes across the entire United States. You are able to see previous sales and in 2007, Zillow teamed up with Mircrosoft to provide Bird’s Eye View a feature in Zillow. The database has 70 million homes.

Now why is this tool useful? First, in the past a buyer had no easy way to see the previous sale price of a home without going to the county clerk’s office. Now, all it takes is a few seconds. It was always to the advantage of realtors to hide this number because with recent appraisals, this was a method of doing a comp check and you basically took the 3 most recent sales and went from there. To call this scientific is to make a mountain out of a mole hill. You can see how information is power. Now, people have the ability to look at a home price and many bought at the peak so a buyer is now more reluctant to buy because they have seen in action that yes, real estate does fall and sometimes spectacularly.

Now you don’t need a degree to learn how to do a comp. I talked about this long ago and you should read the article if you are interested but here is a quick method. Pick a few random homes around the home you are looking at. Take a look at previous sales prices. Get square footage averages. Factor in the S&P Case-Shiller drops for the MSA. Factor that in and bam! You now have a good estimate of the current market value. Send 6% commission to Dr. Housing Bubble, thanks.

And the paperwork is absurd. You want us to believe that they were looking out for buyers? The fact that the market is imploding should tell you something. If we standardize the forms and make it transparent, there is no need for complicated forms. If anything, an entrepreneur real estate lawyer can create an online form for a flat fee and make beacoup dough. The forms are complicated for the nice commission. If we are now for change let us change the damn forms.

(b) Redfin and ZipReatly – many sites are popping up with discount agents. These are fantastic because they introduce true competition into the marketplace. The NAR has artificially caused prices to stay even higher and their recent press-release of pushing for permanent loan cap increases is only self-serving and in the worst interest of future buyers. Sellers are also hurt because you have a smaller pool of buyers because of these restrictions. Prices need to hit equilibrium levels and although you think your Real Home of Genius is worth $500,000, you’re probably only going to get $250,000 in the market.

These new sites are what Travelocity, Expedia, and Priceline are to the travel agent industry a few years ago. Now really, is it that hard to find a home and price it? Come on! When I got my real estate license earlier in the decade I studied while watching my favorite TV show and working out at the same time (calculus it was not). In fact, having Zillow and these other sites is really all you need to make an informed and smart decision. I see brokers and agents as nothing more than a car salesman. Nothing wrong with the profession but they are massively over paid; and look how that is going for the auto industry as well.

I know many in the industry will try to argue that the commission is split between an agent and their broker. Usually 60/40 for newcomers but the ratios can be different. Even with that, let us look at a $500,000 home in California:

$500,000 x 6% = $30,000

$15,000 bucks for a few hours of work is insane. And yes, I realize that you found the buyer or seller but so what? Some people make $15,000 a year and you’re telling me finding a shack to sell is “worth” $15,000? Please. That is why the market is issuing its final verdict. And good riddance. I am happy to see this collapse in California because so many young professionals, singles and couples, and prudent Americans are looking to buy a home and the only way they were able to do so is by committing financial suicide. If you really care about “affordability” how about we give $10,000 of that $15,000 to cut down the cost for the buyer? We have as much luck with that as Paris Hilton becoming a medical doctor.

The Market is Changing for the Better

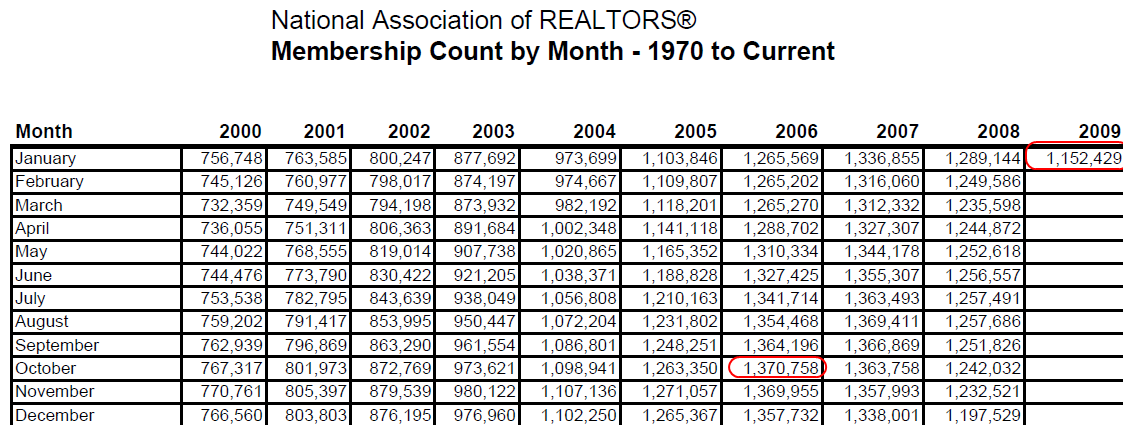

But there are some better changes in the marketplace. NAR membership is declining from the peak reached in October of 2006:

From the peak, membership has fallen by 218,000 according to the above monthly data sheet released by the NAR. That is a significant drop and represents a decline of 16%. So without a doubt, there is a trend happening here.

Every once in awhile I come across a fantastic internet nugget. Sometimes these articles/blogs/links are buried from years ago because no one really seemed to care about them during the time. Today’s find was a report submitted to the Federal Trade Commission/U.S. Department of Justice back in November of 2005. Keep in mind this was posted at the same time the NAR came out with their anti-bubble piece. The report was submitted by David Barry discussing competition policy and the real estate industry. An absolute fascinating read but I’ll break down important points in the document:

Let us first look at the breakdown of pay for agents:

Wow. To say that this group has the “lowest productivity of any job in America” is pretty strong. The author actually states that the real estate brokerage profession “should be ashamed of its dismal performance” and this was at the height of the bubble. 1.1 million agents in America come out averaging 6 home sales per year. They work about 40 hours per sales which amounts to 12% of the work year or five hours per week. And you wonder why I had such a frustration at the skewering of the auto industry from Wall Street and lenders. Hypocrites. At least these people put in their 40 hours.

Some people are telling me “this doom and gloom is tough, tell me what industries are hiring” so I’ll give you a few:

(a) Some reports state that the Internal Revenue Service issued a “shocking call” for “hundreds of new IRS officers, reflecting the need for more government cash. Here is the site. If you are laid off from the financial industry and have a good head on your shoulders, here you go. Starting wages are at $45,000 and go up but hey, those six-figure jobs were bubble jobs anyways.

(b)Â The SEC is now hiring as well and will be thanks to the massive corruption.

(c)Â Bankruptcy lawyer, restructuring specialist, loan “modders”, engineers, health care professionals, and other fields are still hiring.

But back to the topic, the paper is pretty damning and hopefully now that we are going with public floggings, the NAR should be up on the block as well. Let us look at NAR membership over time:

The author goes on to say the following:

“On Nov. 15, 1972, NAR orchestrated a price fixing conspiracy between all Realtor associations at its national convention in Honolulu. This price fixing agreement – still active – is engraved into the bylaws of all 1,453 Realtor associations. The agreement, called the DR formula works as follows: a broker decides to join the local Realtors association. She will be told that dues are $427 a year for each agent, and she’ll be called the Designated Realtor (the DR). Under the DR formula, she will be billed for all agents in her office. If there are ten including her, she’ll be billed $4,270 – ten times the amount for a single agent. If she protests that only she wants to join the Realtors association, they will tell her, sorry, but that’s the DR formula – that Designated Realtors are charged for every agent in the office. Brokers always pass on Realtor association dues to their agents.

Before the DR price fix, NAR sold memberships to 31% of real estate agents; within a single year it shot to 95%. I accuse NAR of the crime of price fixing and urge public prosecutors to commence criminal proceedings against NAR and its affiliated Realtor associations.”

Now that is a pretty strong statement. Without a doubt however, membership in the NAR did spike up in the early 1970s. Now having membership is important but what most do not know is that when you sign with an agent, you actually sign a non-solicitation rule. It should actually be called a non-competition rule. For example, if I have a car and I’m selling it for $30,000 and you find a similar car for $22,000, why shouldn’t you be able to break rank at the last minute? Sure I’ll be miffed but that is my fault for not being competitive. This is not the case in the real estate industry. Say you sign on with an agent and find one that is willing to work for 2% instead of 6%. Why shouldn’t you be able to move along? That is the nature of competition in a free market system. Either way, I know the argument from the real estate industry but it matters very little, the fact that membership is declining and with new technologies it is a dinosaur of an industry and has actually weakened our economic prosperity in the world marketplace. Really, do you think flipping houses to one another is the pinnacle of success? It was the height of our folly giving the corrupt crony capitalistic Wall Street the spoils of our nation. Now we must pay the price. It is time to punish these industries. The people saying we shouldn’t look back are those that stand to have dirt under their rugs and crud in their nails.

Much of the power comes from the MLS or the Multiple Listing Service. The reason they protect this so much is because they realize this is the last thing they have protecting them. See, even if I wanted to go out there and build a plane, I wouldn’t be able to do so because I am not an aerospace engineer. And neither can you without the proper training. Buying and selling a home? If you have been a reader long enough on Dr. Housing Bubble you already know the process and you have learned this for free, no previous experience required. That is the difference. The MLS isn’t such a big deal anymore since places like Zillow make it irrelevant since sellers can now go around the service if they like. Zillow now has sufficient traffic to justify this. Yet the MLS in 2005 still had power over some regions:

Look at Southern California. No MLS without membership purchase. Sure did our market well! You’ll love this picture from the Great Depression of a Ripley’s Believe it or Not cartoon:

Do we copyright the word doctor, lawyer, engineer, chemist, or musician? You would have to be pretty insecure to copyright your job title. Do you really need any other reasons why the 6% commission is gone and rightfully so?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

35 Responses to “The End of the 6% Commission: Examining the National Association of Realtors and why Agents and Lenders are Going the way of the Travel Agent.”

Comrades, I’ve got two words for you, FSBO and Craig’s List (ok, more than two). And don’t get me started on NAR…

~

While I agree in principal with your thesis, I am concerned about the transactional and legal issues. Realtors might be a thin line of defense against fraud, they’re better than none. Who would take over this function? This is an animal of a much different stripe than say, buying an airline ticket online. There is one other interesting dimension to this story. The majority of realtors are women and how they’ve affected and been affected by this is a story in and of itself. Let’s face it, this is one of the highest paying professions dominated by women (administrative, education, homemaker, etc.)

The internet has revolutionized the way people find property. It used to be that Realtors held all the cards. Not anymore. There seems to be more and more talk about restructuring sales agents commission. On the Westside of Los Angeles, those commissions are considerable and have been a big part of the housing problem. Many are just plain fed up. Are they really worth adding 6% to the sales price? The Westside doesn’t think so.

http://www.westsideremeltdown.blogspot.com

http://www.santamonicameltdownthe90402.blogspot.com

we have alot of purchases now here in central coast california and on EVERY bank owned sale the realtors are making OVER 6% commission.

So just what are you saying blutown? The fact that most realtors are women (even if true) should excuse them for their shoddy monopolistic and fraudulent practices? I hope I’m reading you wrong. As I’m sure you are aware this recession/depression is hurting everyone, but I’m by far willing to bet that the vast mojority of those currently laid off nationwide are of the male sex. I’m not in the mood for any more focusing on the pain of the women – it sort of reminds me of the old feminist canard that the “real” victims of war are female when, even among the noncombatent groups , males are more likely to die. In any case, a laid off female nurse I can feel sorry for, or female Doctor for that matter. But a bloody realtor, esp after learning what I have in this post from our good blogger?

@blutown: there is an alternative to realtors or real estate agents: they’re called real estate attorneys. In most states you can have an attorney handle your real estate transaction for a fraction of the cost of a realtor. True, the attorney is not going out and showing you overpriced houses or pretending to show off your overpriced house, but do you really need to pay 6% for that “privilege?” Most of the time, you just need someone to make sure the paperwork is kosher and file the appropriate forms with the county recorder’s office. The rest you can do for yourself (despite the FUD the realtors like to spread about this.) Really, it’s not that hard to create your own real estate offer letter.

Dr HB, you hit another homer out of the park!! I concur on all points! The web age is the planet’s glimmer of hope for information flow, transparency, and if we are lucky, a revolution to eliminate the crony capitalist corruption that runs the USA!!

Why would you overpay for any service, especially on a really large transaction like a home. A lot of people these days couldn’t pay 6% if they wanted to, because they don’t have enough equity.

Dear Dr HB, you forget to mention the 30 year mortgage (always taxpayer subsidized) in your rant. Americans (including you) seem to consider the 30ym some kind of god given right. Why should borrowers be able to make an extremely long 30 year bet on interest rates, then be able to break the contract and walkaway leaving the bank holding the bag if the move away/move up/move down/default? Why should the borrower be granted given this government mandated gift? If the borrower was just required to pay short term interest rates on the banks share of the principle (say 80% of house price max) then when interest rates sink to 1% as they are now then every borrower could afford a McMansion. This would also force the borrow to consider what max interest rate he could afford before taking on a mortgage (say 8 or 10% interest). This would also give the fed much more leverage when setting interest rates, ie: interest rates of >1% would lead to massive reduction in housing costs, interest rates >8% would suck up any excess cash in the system in cases of bubbles. By forcing the 30 year fixed mortgage model on the US, Roosevelt and the new dealers removed the link between interest rates and housing costs.

@clarence

~

My apologies if you misread me. I am not saying that women should be treated any differently than men. However, if you look at the main characters in this Greek tragedy of a meltdown, it is mostly white men and they have borne the brunt of the job losses as you rightly point out. There has been very little discussion in the media about the role women have played and how their lives are being affected. I am curious to hear more because their unique perspective (venus vs. mars you know). BTW, there are a number of women realtors in my family, some of whom are the primary bread winners.

~

One World Comrades!

Don’t believe everything you read, Clarence.

Real Estate commissions are negotiable. By law. The Federal Trade Commission can offer clarification on this. If you don’t want to pay a 6% commission (3%, by the way, going to each Realtor), then negotiate for less. For the good Dr. to represent commissions as set in stone is inaccurate. And it would be illegal if he was still practicing Real Estate.

FSBO’s (For Sale By Owners) receive less traffic than homes sold through a Realtor.

Like other independent contractors, Realtors are subject to the same costs of doing business. Not the least of which is advertising a client’s home on MLS, newspapers, etc.

Pricing one’s house based on Zillow is a inaccurate and lazy way to do it. It requires a bit more….there’s no other word for it…”work.”

Let me get this straight, you’re upset that a realtor makes 6% (which they don’t, I’ll explain later)… so where is the outrage and anger over the 33% that a lawyer gets ???? If a lawyer sold a $500,000 house their fee would be $165,000 !!!

They are the sleaziest “industry” of all, making realtors look like saints.

When I sold homes I would work almost every day from 8:30 am till 10 pm. I worked seven days a week for years, no – for decades. When I took a day off, once in a while, I felt guilty because I wasn’t working and providing for my family. Over the years I worked on Christmas Eve, New Years Eve, Valentines day… you name it. I worked for 25 years with no benefits, no retirement, no nothing.

A good realtor is worth 6% (of which they “split” half of the 6% to the other realtor in the sale which happens about 97% of the time. From whats left the realtor then pays their broker a portion of the remaining 2.5 or 3%…from that subtract all the up front costs of advertising and marketing. To that add fees to the Association of realtors, direct costs for lockbox’s, signs and sign installation, gas, maintenance and wear and tear on their car, etc,etc,etc)

Do it yourself or get a “bad” realtor and you’ll end up with less. Its true,how lucky do you feel ?

Broker John in California.

You hit the point.

Why in the world realtors get a percentage of the sale anyway. Same papers for a $100k house or for a $1 million house so why can’t we pay the same amount.

Cheers!

Realtors are sleazy, but people basically are honest. Direct sales by owner are much preferred to the housing equivalent of a used car salesman that supposedly is looking out for you.

Thats why people HATE shopping for cars, but don’t really mind buying a car from another person directly. They don’t get the runaround, and people will tell you whats wrong with the car before you buy it.

When I was looking for houses I gave an offer to a realtor for a house I liked, and was berated in e-mail about my offer being too low, i was treated like a child, she sent me various documents showing how great the house was, that comps in the area were high. How about just sending over the offer and shutting the hell up? I told her to stick it and bought another house.

For the first time this year more people get their information from the internet than from newspapers…

And that is why mainstream sources of media are cutting back and seeing ad revenues fall off a cliff.

Although it’s really more complicated than that.

While the good Doctor appears to do most of his own journalism, most of the blogosphere doesn’t. Most bloggers link to articles on other sites — mostly run by newspapers — and then comment on them. This is an essentially parasitic model, and it’s not clear to me where bloggers are going to get their basic journalism from when the newspapers all go under.

great post Dr. HB as usual.

60 Minutes did a piece on this a few months back and I think you could actually see steam come out of the ears of the realtor that they interviewed…hilarious!

60 Minutes—“So you think buyers should pay a 6% commission to you no matter what the price of the home…even though housing prices have doubled and tripled over the last few years?”

Realtor–(obviously steamed by the question) “We provide a service that’s worth the commission…blah, blah blah”

Here’s a link..pretty hilarious.

http://www.cbsnews.com/video/watch/?id=2791945n%3fsource=search_video

I mean seriously…do you think that these realtors should be getting paid $300,000/year for driving people around and showing them a shack!?

And for that matter should all these mortgage brokers and stock brokers be making hudreds of thousands and millions of dollars? They do the work of a used car salesman and should be paid about the same. 50-60k or so. I mean seriously, why do think all these banks are bankrupt? I wouldn’t buy a dollar of any of their stocks knowing how they do business and what they pay their employees. How these guys ripped off their stockholders was criminal, but hey…CNBC and Ben Stein said financials were a great buy so people bought because it was easier than trying to figure out how these businesses run and why their stock would have any value.

Real estate agents should be extinct. Real estate is a commodity. Standardize it.

I don’t think this article goes far enough. I say get rid of the attorney, the relators, revamp the home mortgage process, and have all public records of ownership and liens in a system that anyone can get access to and easily afford to acess such information (Zillow is good but needs to have access to the Westlaw property records to take it to the next level). The reason home buying is not like buying plain tickets online is because theree is so much waste and inefficiencies in the home buying process. If anything buying a house should be as simple as buying a car. There are a lof of people who like the inefficiences and obstacles in the current home buying processes.

I am female, and I agree with you. Just because most real estate agents are female is not an excuse to keep the profession going even though it is clearly becoming obsolete (except, perhaps, for commercial properties and residential situations where the owner can’t do a FSBO, i.e., they are living far away from the property and cannot show it, etc..).

I have no idea if the majority of layoff victims are male–they are hitting so many industries and so many levels that it’s impossible to tell without the actual numbers–but to claim that it’s inherently “worse” for a woman to get laid off than a man is ludicrous. If we must talk about who has it “worse,” we draw the line between someone with a family and responsibilities and, say, a single 22-year-old still living with their parents. Gender is irrelevant; the latter is better off.

(I’ve never agreed, WRT war or otherwise, that “the people left behind” suffer more than the person who died. HUH?????)

See, even if I wanted to go out there and build a plane, I wouldn’t be able to do so because I am not an aerospace engineer. And neither can you without the proper training.

Actually in engineering there are no licensing requirements except to sign off work for code compliance. And even then the person that actually did the work most likely does not have a license. You can design your own airplane get it licensed and fly it if you have the time and the money.

Also the comment about getting a real estate attorney to deal with the paper work is a good one I think. I know an attorney’s that specialized in selling small businesses. I can’t see how that would be much different than selling a house, if anything a home sale might be even more cut and dry.

I had thought the 6% commission was a thing of the past, for most agents I know here in Chicago never get more than 3%, which they split with any other agents involved in the sale. For “big ticket” properties costing $1M or more, 2% is more likely, and the marketing expenses tend to be quite large on expensive properties and must be paid out of that commission.

I found out long ago that commissions are infinitely negotiable. 6% has been considered excessive here for a long time. You may have to pay more to get the kind of marketing effort you want, or for a really experienced and reputable agent, and I would absolutely engage one of those to sell my property- that is one transaction I would never attempt on my own- too many traps.

DHB is touching on an important issue here: which automations of information flow can have the best uses for Just Regular People. Travel agents is the perfect example.

~

When we bought our place in 2001, we told the “buyer’s agent” that all we wanted her for was to search her databases for houses with our terms-structure (square footage, age, energy source, location, price, etc.). Then we went out and did drive bys. We ended up buying the house that was second on our ranked list of these hits.

~

In other words, if there’d been an open database of houses on the market, we could have done all the searching ourselves. Today, online resources are much more extensive. The different between RealTorz and editors is, RealTorz didn’t have to know anything to have their job. In other words, if one is writing a book about ontogenic variation in marine amniotes, you hire an editor who has a background in that. If you are buying a house, the only way the RealTor will know anything about the house is if they’ve resold it like six times.

~

Which, by the way, was the case with our buyer’s agent and a certain house we really liked. But when she said this would be the fourth time she sold it (in 8 years!), we figured buyer’s remorse was likely to come with the house.

~

Just a cautionary word on the proliferation of Internet experts.

~

One of the founding conditions of “newspapers” was that with the proliferation of printed information in the 19th century (and the proliferation of mass literacy in the 18th), it became useful to have professional “gatekeepers” who could sift through and sort the oats-n-wheat from the plop. Information sparrows. This is how the business press, the professional presses (engineering, medical, etc.), arose. If all you care about is the oats, you entrust watching that news to Oat Picker Weekly, and pay them for that info gatekeeping. If wheat is your thing, you go with the Daily Triticum. Specialized readerships.

~

The role of editors since Erasmus (15th-16th centuries) has been to perform that function (originally out of an effort to organize far-flung editors working on religious texts). The old-timey newspaper editor was expected to know enough to be the traffic cop for floods of information.

~

In the late 19th century, journalism was professionalized, and then corporatized in the 20th. Editors became the people charged with making sure newspaper content made advertisers happy. Doc, that tendency only strengthens on the Web, where measures of “eyeballs” and “traffic” and “unique visitors” are automated, and Websmiths can be sorely tempted to follow the numbers uber alles.

~

I am all over the information dispersal of the Internet, but as with Wikipedia, it requires a huge amount of caveat lector. When I have to personally fact-check every damn thing I read, it puts a serious crimp in being a polymath and a highly general/associative reader.

~

I know of no meta-web-site that rates other web sites for their veracity, or assesses their partiality out of evolved critical perspective. On the Internet, everybody is an expert, even (especially) when they’re hooting out their downspouts. This is why even Wikipedia’s founders are moving in the direction of information clusters with more informed content gatekeepers, rather than the free-for-all they created.

~

I feel compelled to not that during my years as a young journalist I worked for the chain of newspapers that Noam Chomsky featured at the end of “Manufacturing Consent” as an example of all that was going wrong with journalism. He was prescient, and right, about that…even though in my view he shoots wide on many other things.

~

rose

PS–sorry for what is likely to be a spate of typos in upcoming comments. I’ve got new reading glasses with some fabulous complicated new lens technology. They’re great, but I’m still figuring out where to look, when. My proofreading is weak at present. ;D

~

rose

The real problem is that nobody knows what anything to do with the real estate biz is worth because there are so many false price signals.

First the fed. The fed determines interest rates based on “crystal balls” and political sentiment, interest rates should be market determined, that is to say a saver if they want to become a lender should go into the market and be able to lend to whomever they want at whatever terms they mutually desire. This is the crux of the issue, every other market signal is derived from this transaction. The collective direction of interest rates, terms and conditions would emminate from this simple market transaction and result in a reality based market for assets. The only government intervention should be to make sure that both sides understand the agreement and follow through on their ends.

No leverage, no subsidies government or otherwise should cloud the the signals put up by the market. Would realtors get 6 percent? If their value added was such it justified their salaries I would say yes, but 6 percent of what would the price be of real estate? Nobody can answer these questions because there are so many layers of distortion between what a person can pay and what a person can sell real estate for, no body knows. Right now with all the government backing fannie and freddie, loan guarrantees etc. I think the price of real estate and realtors income would probably collapse were it not for these artificial signals.

The term “real estate bubble” denotes a price distortion. With a price distortion you have a value distortion and subsequent pathologies arising from this fundamental problem.

We have no idea what to do about this problem or what individual players responsibilities should be or were until we address the problems of the market.

Trying to determine a realtors compensation by tea leaves is futile you need better clarity determined by “clear eyed” participants in order to do that competently.

Really great post, Doc! God riddance to the 6%. Just hoping for the day that prices truly come back in line with incomes… but not anytime soon as long as those in the REIC have anything to say about it.

Another point is that the percentage commission helps fuel the bubble–if the commision were basically flat, there would only be the incentive to make more transactions–like online stock brokers. It’s not the perfect solution, but if you create an incentive to bubble, it will bubble. Like Reagan being an actor–the only thing he wanted was to be popular, so he said and did all the things to make him popular, in spite of the fact the he sent us down the road to perdition.

Obviously, I’m not concerned about being popular by criticizing FDR and RPR, but my point is those guys did the popular thing, and they may have truly believed the junk they served up, but in the end their policies caused irreparable harm. This is such a damning mess, it may not be solved in my lifetime. If we can at least avoid the catastrophic wars that always seem to occur in the throes of Kontradieff winter, at least we may once again be blessed in the next generation’s lifetime. BHO is again playing the popular game, but in the end I hope his folks do the right thing rather than another round of hide-the-sausage, but it looks like more pork will be on the menu for 2009…

Comrades,

~

My apologies one more time for the sidebar about the effect this meltdown is having on women in the workplace. See this chart:

http://www.nytimes.com/imagepages/2009/02/06/business/06women.graf01.ready.html

If current trends continue, women employees will outnumber men. That would be unprecedented and one more fascinating (at least to me) aspect of structural change we are currently experiencing. I’ll leave it to others to decide if this is a good or bad thing.

Have job losses begun to hit the Westside? January housing numbers will be horrendous. Early indications from Melissa Data show prime areas from Beverly Hills to Venice have dropped 60-80% in total sales volume, during January, measured YOY.

2009 is off to a roaring start…

http://www.westsideremeltdown.blogspot.com

http://www.santamonicameltdownthe90402.blogspot.com

CAR forms are so easy to obtain and understand, so you don’t really need a realtor’s help there. In fact, if you can’t understand a CAR form you probably shouldn’t buy a house as you won’t understand your title policy or home insurance either. What I did was to offer a 2% commission to the procuring broker and listed it as FSBO. Sure, it wasn’t on the MLS, but it was everywhere else and people came knocking. Plus, I rather enjoyed the self starters who didn’t want a broker in the way. They were honest people and they knew enough about homebuying to see that I was providing complete and clear documentation. In the end, a broker brought the highest offer, which was about 3% higher than the highest non-broker offer, so I took it.

To the broker who said that lawyers would take 33%, that is just ludicrous. This is not contingency based litigation it is contract work and you can get your deal documented by a capable attorney for a few thousand $.

Who would take over?- lawyers. Let people sell their own houses and have a lawyer handle the transaction. We made a deal with the owner directly and had a lawyer take care of everything else. The fee? $2300. No headaches. No games. No last minute switches at the closing.

It’s time for the real estate “profession” to disappear. Seriously- 50k for opening the front door and screeching about granite counter tops. These people have no skill. They shouldn’t make a dime.

Wow…I generally enjoy reading your posts…even though I am a licensed and active Real Estate agent…Realtor even…but good Dr…especially as a former licensee…a little rough there…and yet seems like there’s a lot of folks that are very bitter at Real Estate agents right now. I guess my question is…are Realtors really responsible for the real estate bubble and implossion? I have never “sold” a home yet where I “sold” the home…I always tell my buyer clients that there is nothing I’m going to be able to tell them to sell them…seriously…who’s going to convince someone to make that large of a decision? I’m convinced all I can do is facilitate the process. They make the decision, I give them all the facts…at the end of the day…with or without me…they were going to purchase property. And not one of them that have had to sell because they couldn’t afford the home any longer blamed me for losing the home.

And the 6%? I actually kinda got a good chuckle outta that one because I would LOVE to make 6%! And anyway, the “sellers” in this market, where 80% of the listings are distressed (short sale or REOs), the bank is paying for the commission. I have many times cut my commission for friends to as low as I could to protect their equity position and allow them to walk away with the most money possible while keeping the deal together.

I’m all for revolutionizing the industry, but here’s the biggest problem that I see that needs to be addressed…when selling Real Estate…you need representation. It really is like going into court and representing yourself. I have seen so many deals that sellers and buyers would not have been able to keep together if they were dealing directly with one another…it’s harder then you might think…when it’s your home…it’s personal. And yet…it’s not personal…it’s business. But when a buyer comes in with a laundry list of repairs they want to make to your beautiful home…it’s hard to not be offended. Keeping the deal together is very underated I believe.

Anyway, this is not a market for the fainthearted…it’s hard. It’s hard work. Deals fall apart over and over despite best efforts. And the agents closing 6 deals on average a year? Really? I had 4 times that many fall apart last year and the year before and I estimate from personal experience and exposure to the community that most agents are closing between 0 – 2 deals a year with an average paycheck in this market of about $4,000 take home (which all taxes and expenses need to be taken out of).

I could go on and on…but I’ll wrap it up with this…I have not met a FSBO yet that didn’t overprice their home. And what I always get a kick out of is the Real Esate agents (well…they have their license and think they know what their doing 😉 ) are the worst offenders…why? Cause their home is special. And in this market where your competition is banks…how are you going to sell your property again? As you pointed out…buyers have access to information…believe me…they know their stuff now…do you really think they’re going to want to deal with a seller directly? A buyer doesn’t pay a dime of a Realtor’s commission…why would they forgoe representation to purchase an overpriced property? And if they did…guess what they’re going to ask for…hmmm…could it be 6% reduction in your price? And when that roof that leaks suddenly appears that you “forgot” to disclose (which, by the way, is mandatory in California)…who’s going to be drug into court…the “6% agent” or the “I’m not paying 6% but am going to take 10% less than an agent would net me Seller?” And if you think I’m just being “one of those agents” by saying that…look into it…this is a lawsuit happy enviornment right now…folks are very unhappy that their homes are worth less than what they paid for them. That’s why Realtors carry E&O insurance…errors and ommissions…kinda like malpractice insurance for doctors…do FSBOs carry this? (cringing here)

On behalf of the entire profession I apologize to everyone who’s had a terrible experience…I know they exist and I’m not trying to make light of that…but I have met a lot of wonderful, caring, hard working professionals that care dearly for their clients well being and do everything legally possible to protect them and get them the most for their money.

Gosh, wish I only worked 5 hours a week to sell 6 houses in one year.

I work 7 days a week — rarely take Saturdays and holidays off because that’s when I show property to clients who can’t take off during the normal work week, or Sundays off because that’s when I hold open houses. During the day, it’s research, calling for appointments, etc. The good realtors never have an idle moment.

Many of my clients are internet savvy, but I provide additional information othat they are not able to get on the internet information providers. If they want to subscribe to RealtyTrac to find out which homes are in distress, that’s fine. But more often than not, I have to explain that just because they’re on RealtyTrac (or Trulia and other sites who draw from it), that doesn’t mean the house is for sale.

6% commission? Geez, that’s almost a thing of the past. And please remember that this is split between agencies who split it with the realtors. The average realtor probably gets 2%, and from that, he pays for the cost of advertising, lock boxes, etc. That doesn’t include the cost of time devoted to arranging for and staying at the property during inspections, cleaning, staging. Some realtors even do our own staging if the property needs it. Recently a widow moved out for medical reasons. She couldn’t afford to have the hardwood floors refinished, or pay for cleaning. I paid for these services myself because unless they’re done, the house showed poorly. I also staged it. And no…I’m not getting 6%. More like 1% after expenses.

Yes, if the owner wants to sell himself, there are all kinds of resources. Hope the owner is prepared to give up his own free time to make himself available everytime someone wants to see the property. And whatever the seller does, please do your due diligence and disclose, disclose, disclose pertinent information and facts about your property.

Just how much is YOUR time worth? Can you afford not to be paid for the time you spend working for your clients? Driving around showing property is a small piece of the work we do. We spend hundreds of hours working, but our efforts don’t necessarily result in a sale.

Until I became a realtor, like you I had no appreciation for the work they do (because I didn’t see what they were doing for me whenever I bought or sold a house — and that’s quite a few properties). I once tried to do a FSBO and spent a lot of time and money advertising; but ended up hiring a realtor who sold my house in a much shorter period of time.

And when I moved out of town, my realtor took care of the property, checked it frequently to make sure my house and yard looked presentable, and that the property was secure. She called me frequently with an update. I had peace of mind knowing I had someone I could rely on.

Guess people will always find something to complain about regardless of the profession. Government workers? Overpaid. Teachers? Not effective. Care home personnel? Not caring enough. Restaurant servers? Surly. Police officers? Brutal. Doctors? Mis-diagnose. Bloggers? Blowhards.

Awesome. I really enjoyed this post. You nailed it.

>>>Realtors and why Agents and Lenders are Going the way of the Travel Agent<<<

— They’re already there – they just won’t admit it. I always love these types of discussions, the weak agents chiming in trying to defend an income figure that has been falling for 2 years.

The days of showing 3 homes on a Sunday and having a contract by Wednesday are over, waaay over .. now agents have to “earn” a living, not just be order takers.

Most buyers and sellers have already been doing their homework. They know how long the home has been on the market, they know it’s been relisted, (not “just listed”) buyers and sellers know the tax base, they can study every house in a 3 square mile area and tell the agent how many times the Poodle dog down the street goes out – basically doing 75% of the agents work. — what today’s agent/Realtor won’t do, is just admit it.

You have savvy agents from Florida to Minnesota that are using flat fee’s, and heavily discounted commissions – why not.? business is off 50%. You have listing agents using flat fee’s to get the business, and the smart ones, are using a big discounted commission to keep the business ..

How many buyers or sellers are going to pay a $15,000 commission to buy or sell a $250,000 home when most of the work has been done by the consumer.? — and in today’s market, most agents certainly can’t use the phrase: “all my knowledge counts for something” anymore, not when 70% of the Realtors in today’s market are living in a home with a pile of negative equity –or– getting ready to lose one via a foreclosure …. so much for knowledge.

Agents and Realtors are the shadow and the direct reflection of today’s car dealers … 9 years ago car dealers would claim they would never take less than a 10% commission, then came the internet … 9 years later, they will battle for a 2% commission on a $15,000 truck — so goes today’s realtor.

–

I’m a real estate agent in CT and appreciate much of your blog. I was talking about the risk of a housing bubble starting Dec 2005. I’m a proponent of transparent and efficient markets. Residential real estate has a long way to go. I think zillow has a credible model. I’ve tracked and used it since its launch, and have advocated it to anyone in the market from Buyers and Sellers, to Agents and Brokers. Both because I participated in launching a similar model in the commercial RE space in 2001 which helped me understand the potential of the site, and because I think it will be a great tool and resource for all parties in any real estate transaction. The sales database is still not large enough to be a credible source of actionable data, but it is getting better everyday. It has increased transparency and provided access to some sales data and this has been a great service.

From my perspective, the better informed a consumer at the start of a home buying or selling process, the more efficient and productive the process. And the more informed a consumer, the better chance they have of knowing what is feasible and what they want. This allows me as an agent to better assist them achieve their goals. Anyone can unlock a door and say this is the living room. Less know the fundamental elements of value in residential real estate generally and then as it relates to a specific geographic area (e.g. a Town, neighborhood, street). Less have spent the time to understand how value changes in different parts of a town or street and why. Less know the inventory because they are in the market every day. Less know or spend the time to figure out what is happening with the adjacent plot or local school that may impact future property values in the area. Less have been in thousands of homes in the town and can provide fresh and relevant sales comps based on familiarity with the sale comp properties rather than simple data similarities derived from the an online database. Less track inventory by price ranges to gauge the overhang and plot bid strategies based on this. Less have insight into the general construction and design features and their impact on value and the ability of a family to enjoy a property. Less can direct a Buyer to additional resources to get one familiar with the area, properties, schools, taxes, services and other issues relevant to a home buyer and home owner.

I could go on, but basically a more transparent and efficient residential real estate market benefits all involved (although the entrenched Brokerage companies may not agree for a while). They reduces costs for Sellers and Buyers and Agents. It drives out agents unable to provide value-added service to property consumers and demands more from those remaining. Agents that are intimately familiar with the local market, proficient project managers and professional can save a buyer or seller a significant amount of money and stress in numerous ways. For example, in the market I work, it is not uncommon to see that an out of town agent has assisted a Buyer purchase a property and paid way too much. Those are the breaks of knowing the market generally. General knowledge, data driven basic comps get one only so far. Some may be satisfied with 85%; others may prefer better results.

Hi, the whole thing is going fine here and

ofcourse every one is sharing facts, that’s genuinely excellent, keep up writing.

Leave a Reply